By Ovi

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for oil producing countries. The charts are created from data provided by the EIA’s International Energy Statistics and are updated to September 2023. This is the latest and most detailed/complete World Oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few of these countries and the World.

World Oil Production and Projection

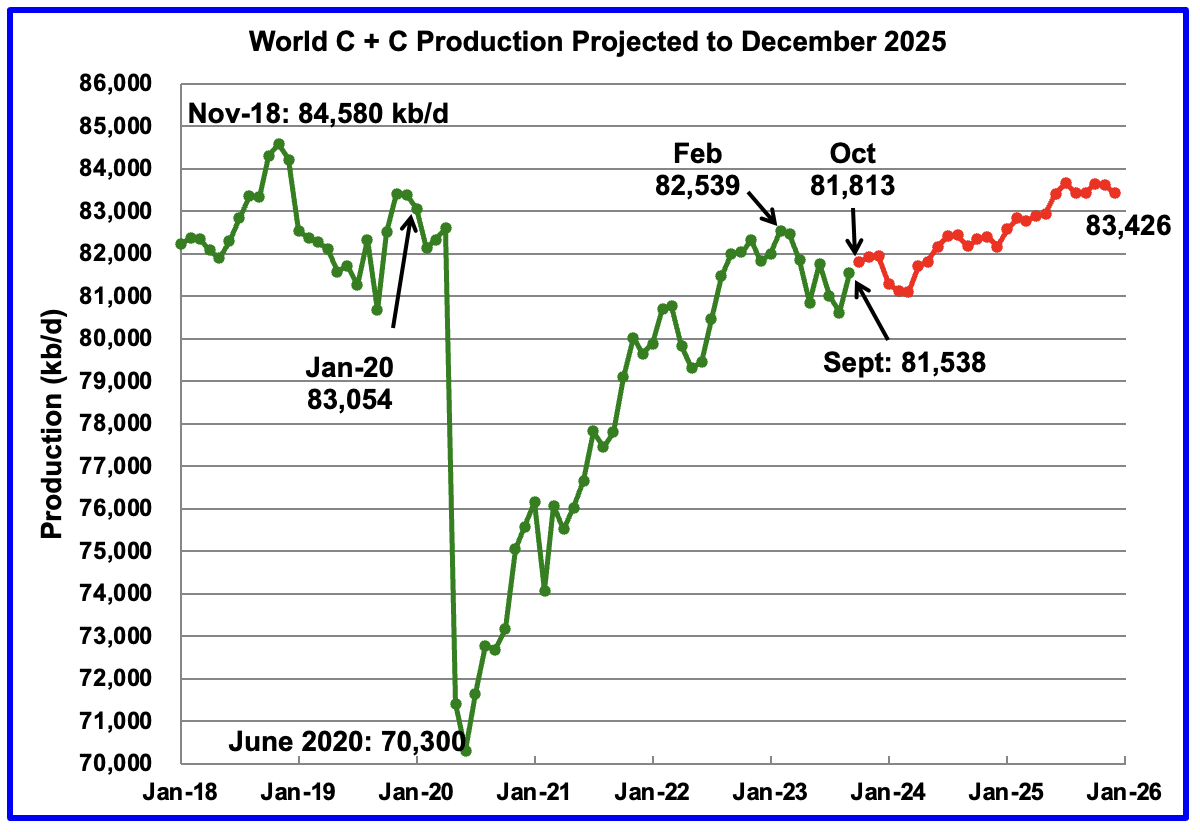

World oil production increased by 927 kb/d in September, green graph. The largest increase came from Saudi Arabia 500 kb/d while the US added 224 kb/d and Brazil 210 kb/d.

This chart also projects World C + C production out to December 2025. It uses the January 2024 STEO report along with the International Energy Statistics to make the projection. (Red markers).

The red graph forecasts that World crude production in December 2025 will be 83,426 kb/d and is 1,154 kb/d lower than the November 2018 peak. Note the large production decrease starting in January 2024. It could be the reflecting the latest OPEC + cut announced in November 2023.

From October 2023 to December 2025, production is estimated to increase by 1,613 kb/d or an average of 62 kb/d/mth.

Keep in mind that OPEC + has close to 3,000 kb/d of cuts in reserve if required.

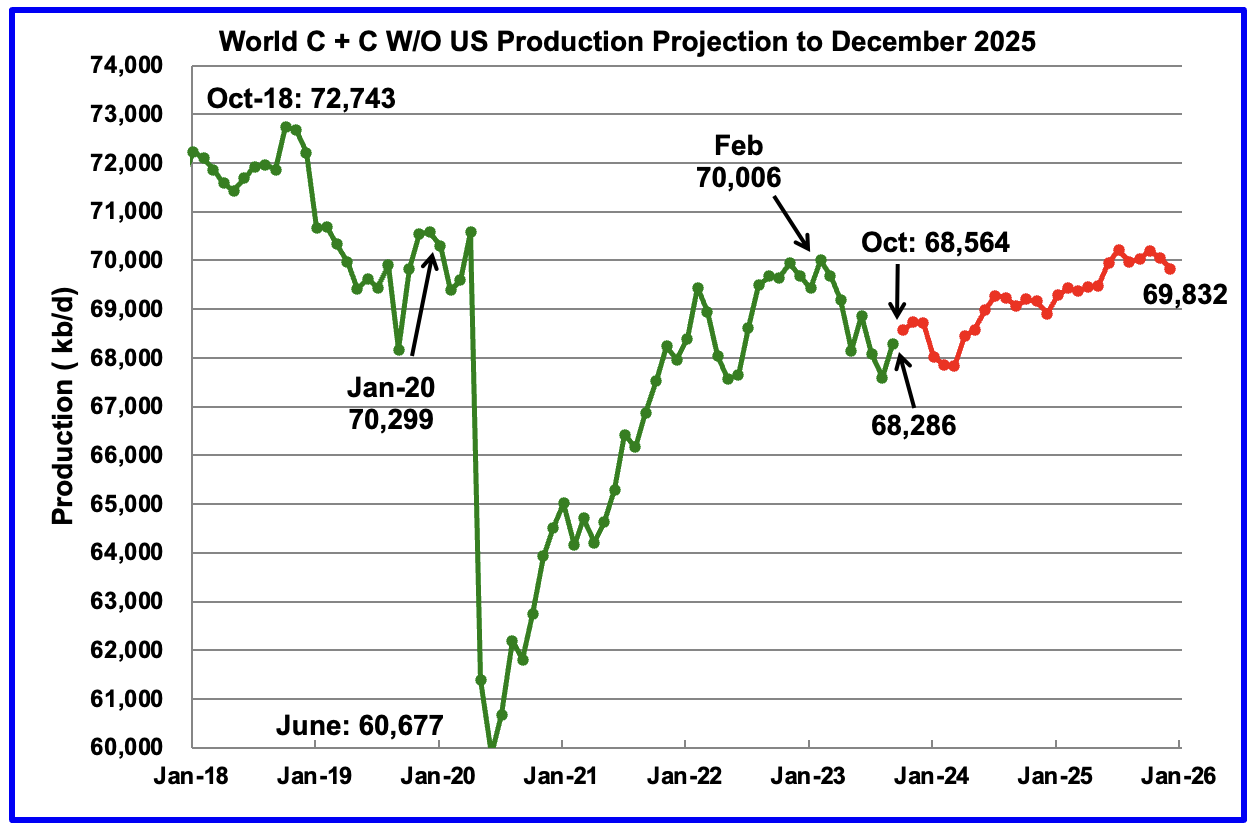

World without the US oil output in September increased by 688 kb/d to 68,286 kb/d. October is expected to add 378 kb/d.

Note that December 2025 output of 69,832 kb/d is lower than February 2023.

World oil production W/O the U.S. from October 2023 to December 2025 is forecast to increase by a total of 1,268 kb/d.

A Different Perspective on World Oil Production

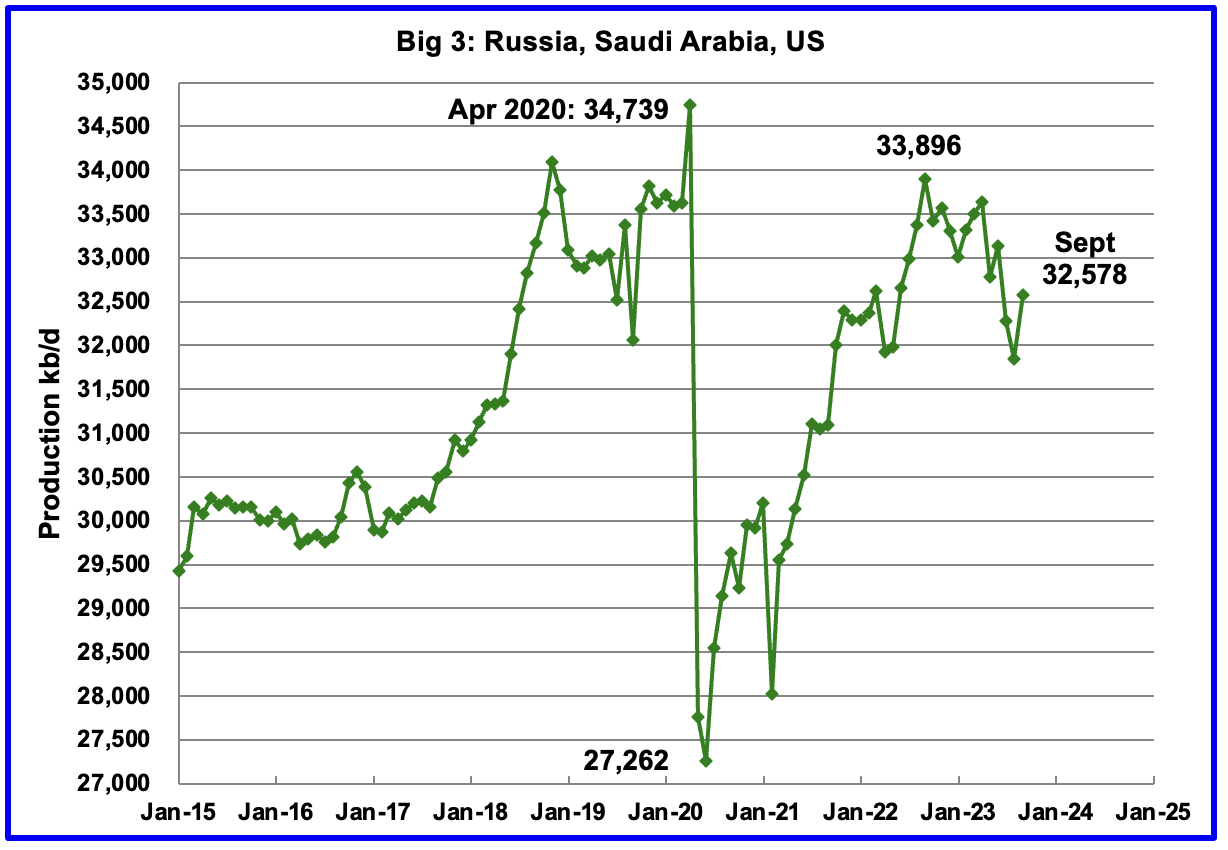

Instead of dividing the World oil producing countries into OPEC and Non-OPEC, this section divides the countries into two groups on the basis of their production capacity. The division will be The Big Three, US, Saudi Arabia and Russia, and the Rest, i.e. the World oil producers W/O the Big 3. The top producer in the Rest, currently Canada, produces less than half of the lowest producer in the Big Three.

Peak production in the Big 3 occurred in April 2020 with a rate of 34,739 kb/d. The peak was associated with a large production increase from Saudi Arabia. Post covid, production peaked at 33,896 kb/d in September 2022. The production drop since then is due to cutbacks within the OPEC + countries.

September production from the Big 3 increased by 730 kb/d to 32,578 kb/d.

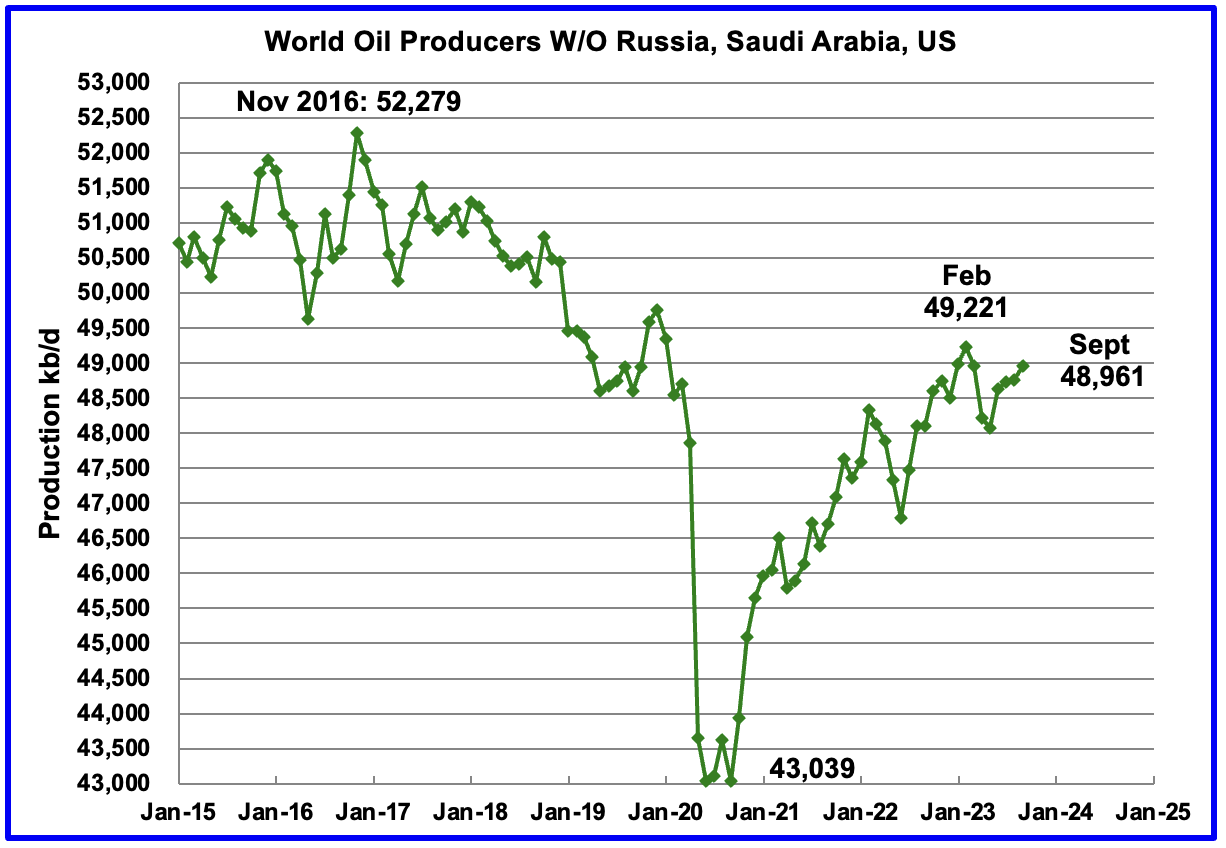

Production in the Rest has been slowly increasing since the low of September 2020, 43,039 kb/d. In February 2023 production rose to a post covid high 49,221 kb/d. Output in September was 48,961 kb/d, an increase of 235 kb/d over August.

Production is down 3,318 kb/d from November 2016.

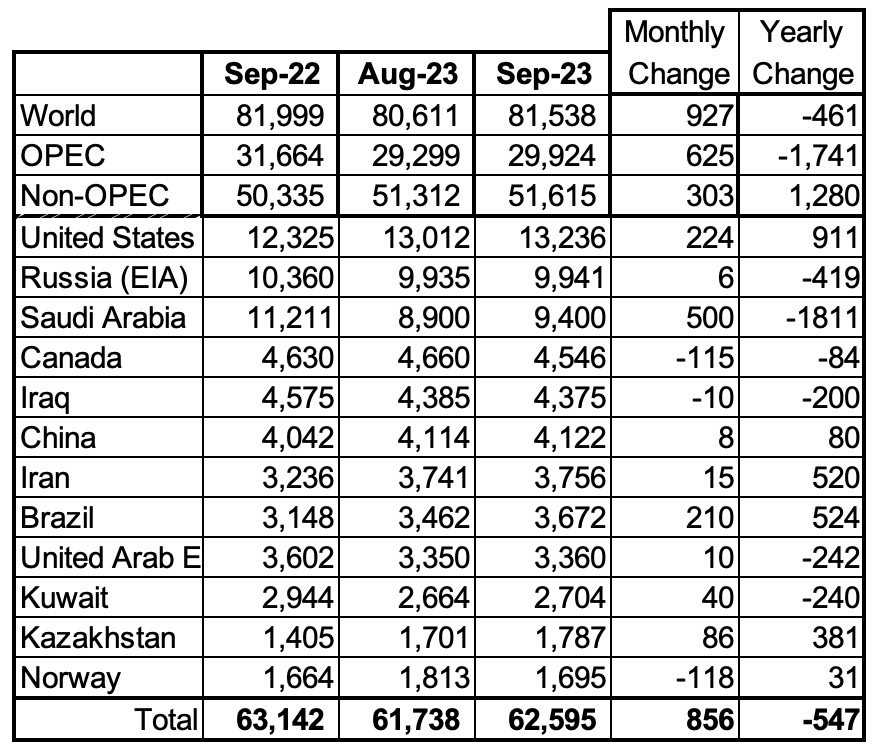

World Oil Production Ranked by Country

Above are listed the World’s 12th largest oil producers. In September 2023, these 12 countries produced 76.8% of the world’s oil. On a MoM basis, these 12 countries increased production by 856 kb/d while on a YOY basis, production dropped by 547 kb/d. On a YoY basis, the size of the Saudi Arabia drop is double the US increase.

Non-OPEC Oil Production Charts

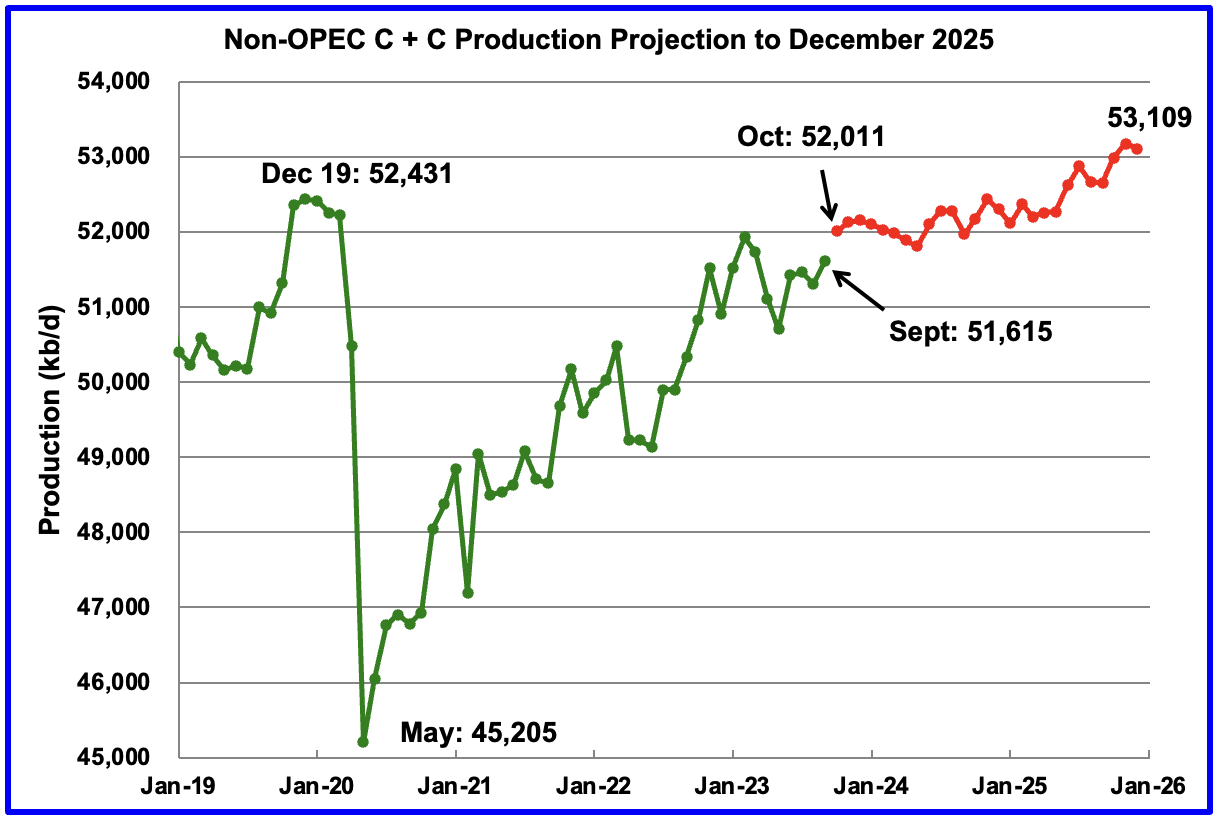

September Non-OPEC oil production rose by 303 kb/d to 51,615 kb/d. The largest increase came from the US.

Using data from the December 2023 STEO, a projection for Non-OPEC oil output was made for the period October 2023 to December 2025. (Red graph). Output is expected to reach 53,109 kb/d in December 2025, which is 678 kb/d higher than the December 2019 peak of 52,431 kb/d.

From October 2023 to December 2025, oil production in Non-OPEC countries is expected to increase by 1,098 kb/d. According to the STEO, the major contributors to the increase are expected to be the US and Canada.

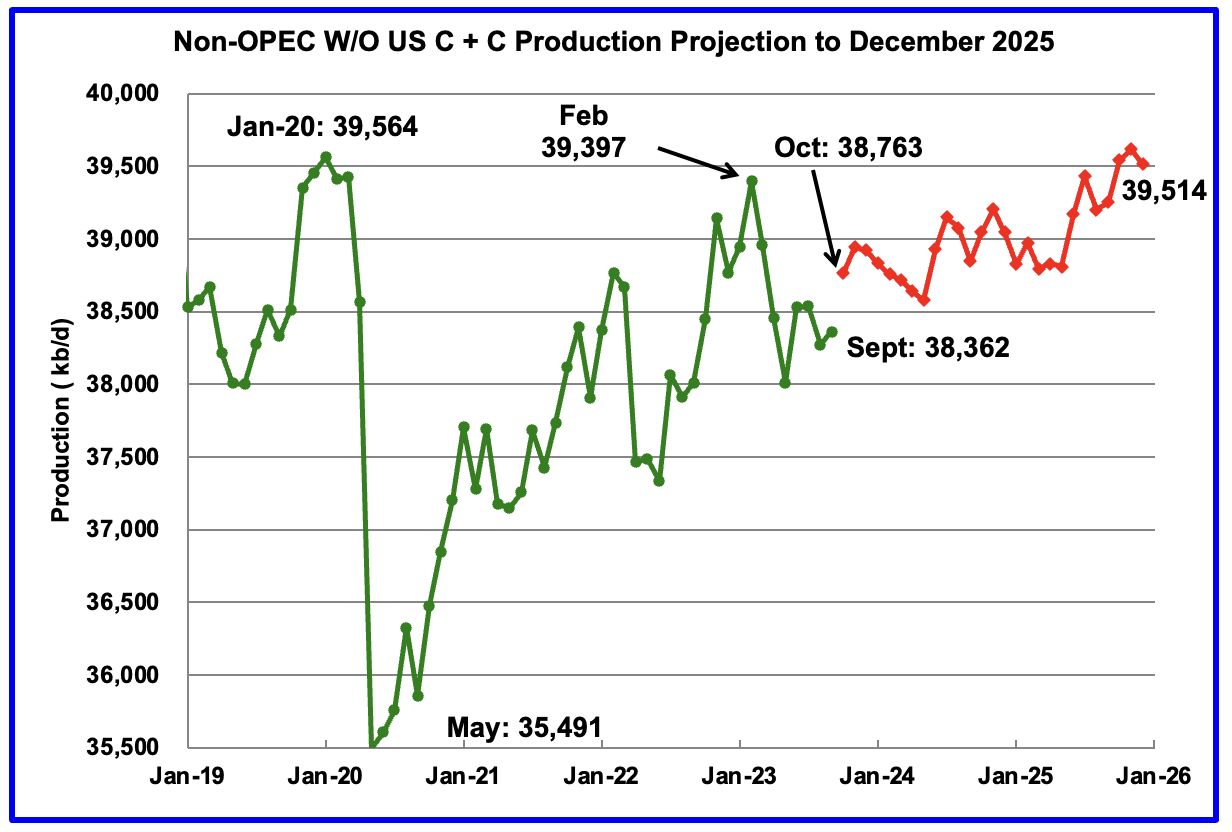

September Non-OPEC W/O US production increased by 91 kb/d to 38,362 kb/d. October production is projected to increase by 401 kb/d.

From October 2023 to December 2025, production in Non-OPEC countries W/O the US is expected to increase by 751 kb/d.

Note that December 2025 output is lower than the January 2020 high of 39,564 kb/d by 50 kb/d.

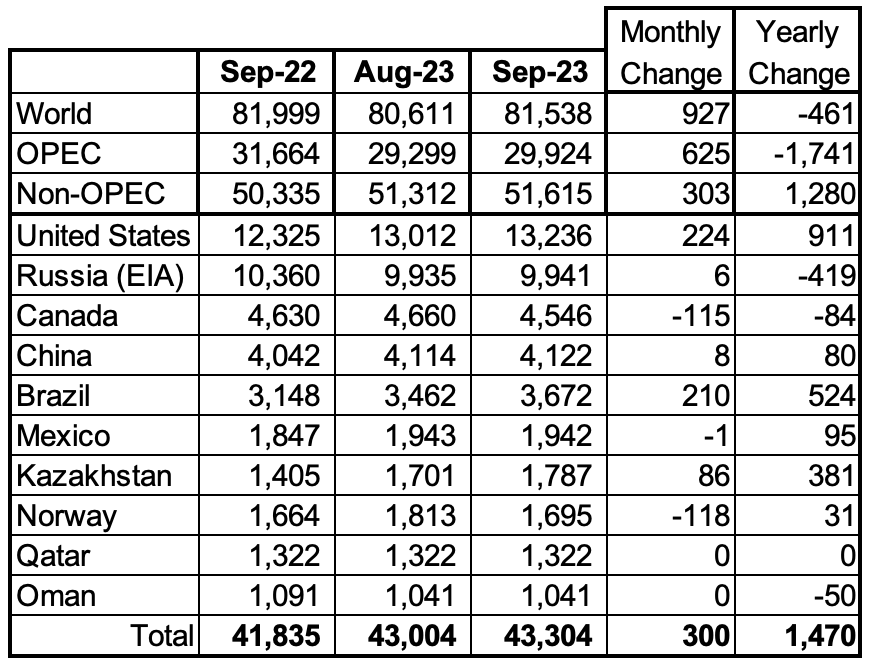

Non-OPEC Oil Production Ranked by Country

Listed above are the World’s 10 largest Non-OPEC producers. The criteria for inclusion in the table is that all of the countries produce more than 1,000 kb/d.

September’s production increase for these ten Non-OPEC countries was 300 kb/d while as a whole these Non-OPEC countries saw a production increase of 303 kb/d.

In September 2023, these 10 countries produced 83.9% of all Non-OPEC oil production.

OPEC’s C + C production increased by 625 kb/d MoM while YoY it decreased by 1,741 kb/d. World MoM production increased by 927 kb/d while YoY output decreased by 461 kb/d.

Non-OPEC Oil Production Charts

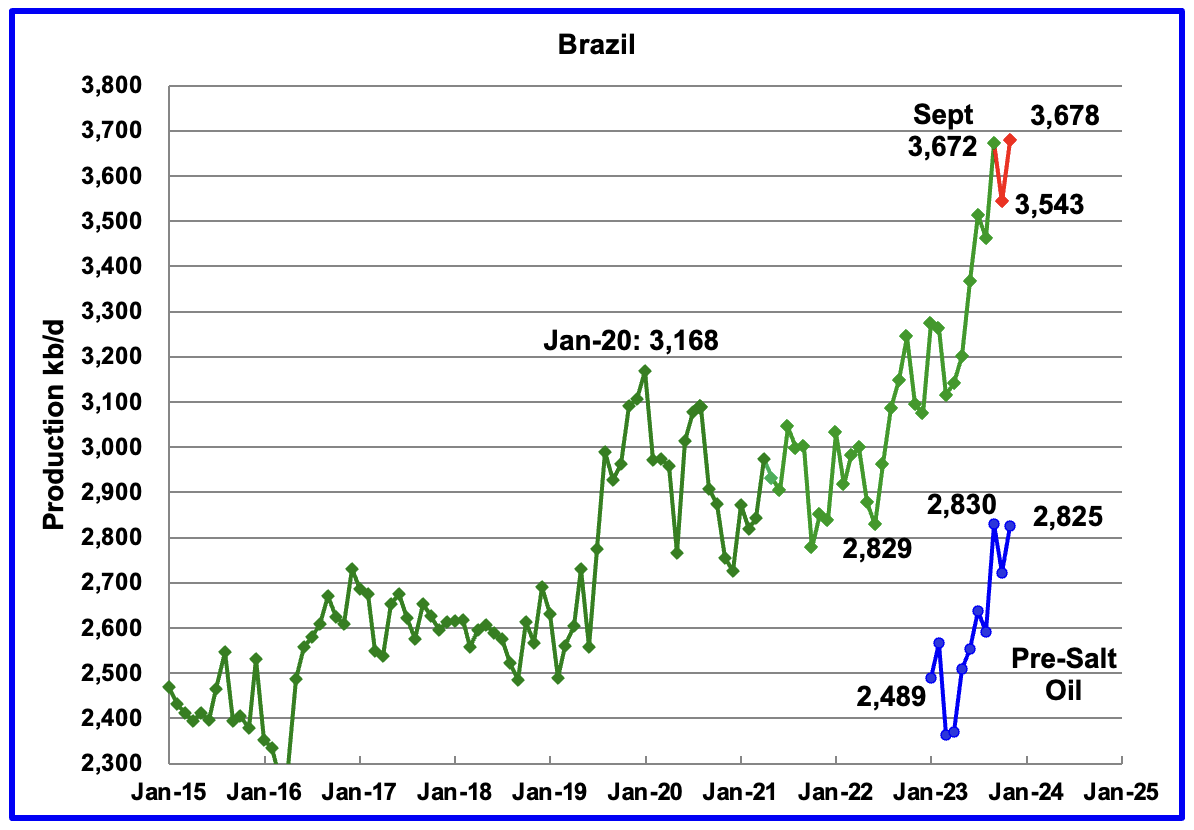

The EIA reported that Brazil’s production increased by 210 kb/d in September to 3,672 kb/d.

Brazil’s National Petroleum Association (BNPA) reported that output in October decreased by 129 kb/d to 3,543 kb/d followed by a 135 kb/d rebound in November to 3,678 kb/d.

From March 2023 to November 2023, production increased by 563 kb/d. A similar rise in production is not expected in 2024. For 2024 the MOMR is expecting a smaller increase, closer to 100 kb/d.

For 2024, the January MOMR states: “Crude oil output is expected to increase through production ramp-ups in the Buzios (Franco), Mero (Libra NW), Tupi (Lula), Peregrino and Itapu (Florim) fields. Oil project start-ups are expected at the Atlanta, Pampo-Enchova Cluster and Vida sites. However, increasing costs in the offshore market and inflation might also continue to delay projects and could temper growth in the short term.” However for 2025, an increase of close to 200 kb/d is expected.

Production from the off-shore “pre-salt” region has been added to the Brazil chart, blue markers. November oil production increased by 103 kb/d to 2,825 kb/d, which accounts for most of the 135 kb/d overall increase in Brazil’s November output. Much of Brazil’s 2023 production growth came from the highly productive pre-salt fields. From March 2023 to November 2023, production from the pre-salt fields increased by 462 kb/d.

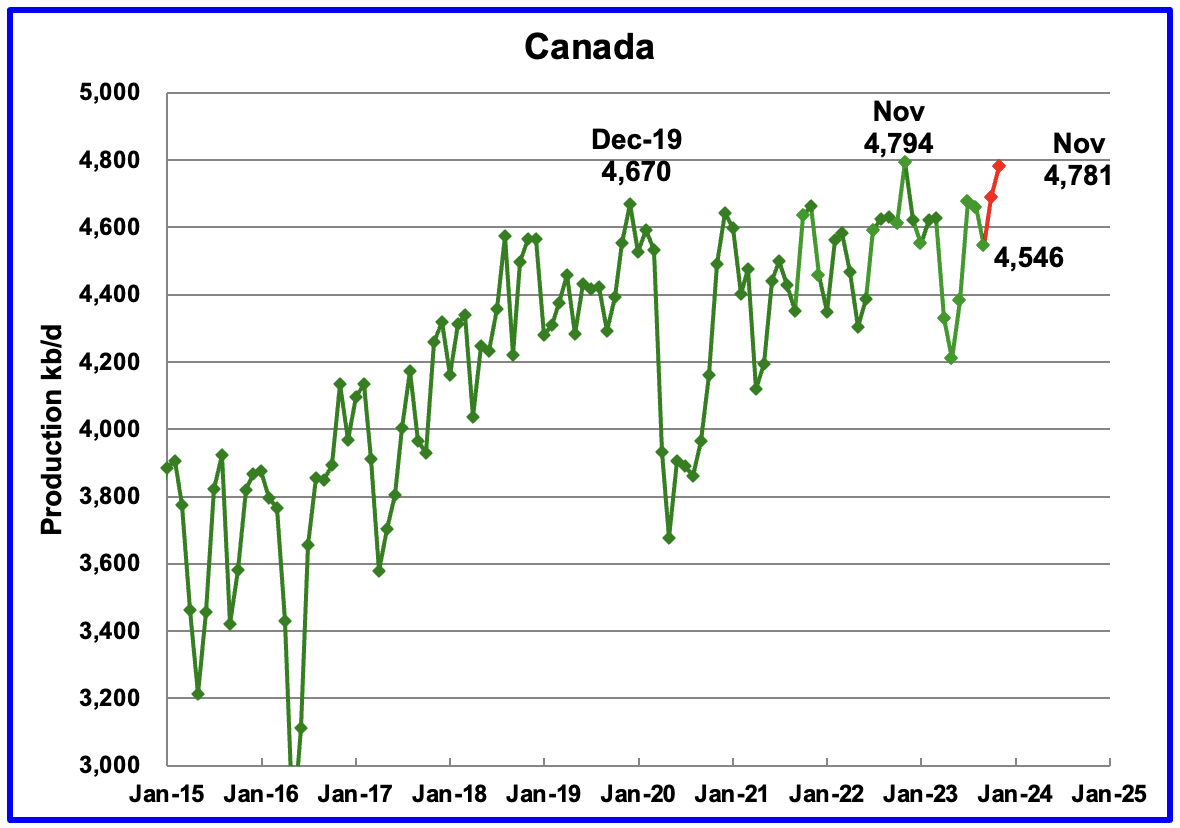

According to the EIA, Canada’s production decreased by 115 kb/d in September to 4,546 kb/d. The September drop was due to fires in Alberta during the 2023 summer.

The STEO is forecasting that Canadian production will rise by 142 kb/d in October along with an additional 93k/d increase in November, red markers.

According to this source, Alberta’s oil production rose to record in November that tops China’s production.

“Production is surging as oil-sands companies prepare for an expansion of the Trans Mountain pipeline — which runs from the province to Canada’s Pacific Coast — to start up this year, giving them 590,000 barrels of new export capacity.

Alberta’s oil-sands deposits represent the world’s third-largest crude reserve, and November’s production is more than all but four countries, edging out China’s average output in 2022 while trailing Iraq’s, according to data from BP Plc. Including output from Canada’s other provinces makes the country the world’s fourth-largest producer.”

In January 2024, the Canada Energy Regulator approved another variance request by the Trans Mountain Pipeline (TMX). Line fill of the TMX pipeline could start in March/April.

“Trans Mountain Corp is racing against the clock to complete the expansion project, which will boost the capacity of Canada’s only oil pipeline to the West Coast to 890,000 barrels per day from 300,000 bpd currently.”

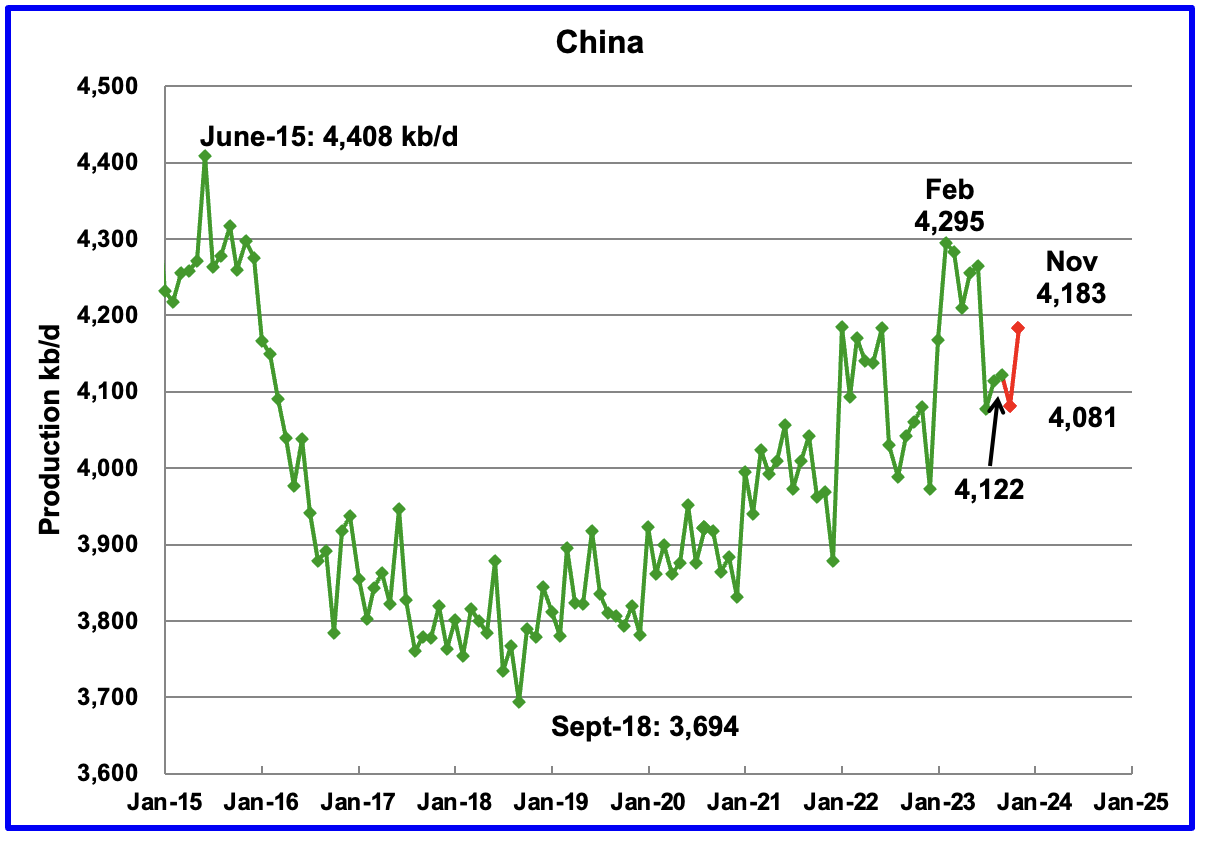

The EIA reported China’s oil output in September rose by 8 kb/d to 4,122 kb/d.

The China National Bureau of Statistics reported that output dropped in October to 4,081 kb/d and then rebounded in November by 102 kb/d to 4,183 kb/d.

Every January for the last four years, China’s production has taken a massive increase. In 2022 production jumped by 322 kb/d from December 2021 to February 2022. However according to the January MOMR: For 2024, Chinese liquids production is expected to remain steady at the 2023 level of 4.6 m/d.

While China’s production growth has risen steadily since 2018, it may be approaching its post pandemic high as inferred by the January MOMR.

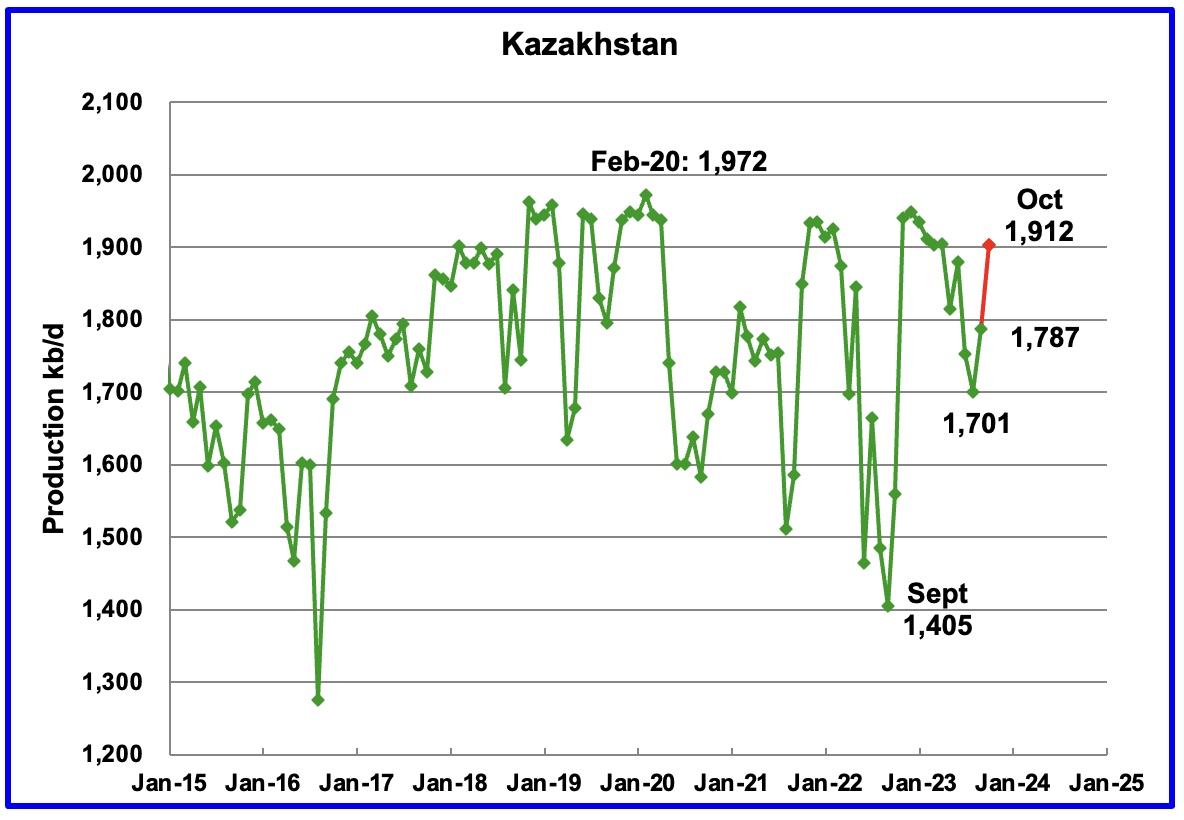

According to the EIA, Kazakhstan’s output increased by 86 kb/d in September to 1,787 kb/d.

The STEO is forecasting that production will continue to rise in October to 1,912 kb/d, red marker.

The January MOMR is reporting that “November Crude production dropped by 44 tb/d, m-o-m, to average 1.6 mb/d. NGL and condensate output rose by 17 tb/d, m-o-m, to average 0.4 mb/d.”

Mexico’s production in August and September was 1,943 kb/d an increase of 24 kb/d from July’s 1,919 kb/d.

According to Pemex, Mexico’s oil production dropped in October and November to 1,921 kb/d.

Mexico has recently revised its definition of condensate. This has resulted in the EIA adding an extra 63 kb/d, on average, to the Pemex report. The red markers include the additional 63 kb/d.

According to the January MOMR for 2024: “Pemex’s total crude production decline in mature areas like Ku-Maloob-Zaap and Integral Yaxche-Xanab is forecast to outweigh production ramp-ups in Area-1 and El Golpe-Puerto Ceiba, and from a few start-ups, namely TM-01, Paki and AE-0150-Uchukil.

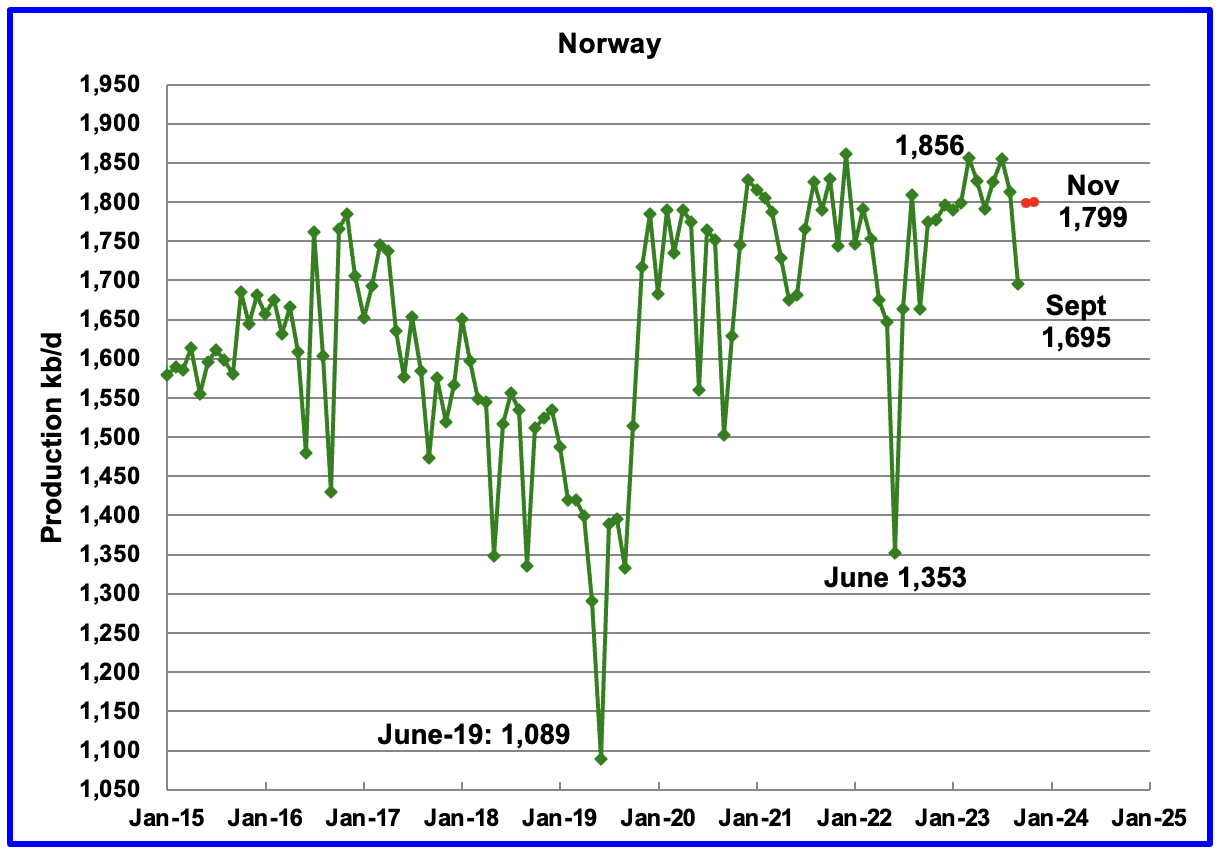

The EIA reported Norway’s September’s production dropped to 1,695 kb/d.

Separately, the Norway Petroleum Directorate (NPD) reported that October’s production increased to 1,798 kb/d and then added 1 kb/d in November 1,799 kb/d, red markers. The October rebound was due to repairs to the equipment failures experienced on a number of platforms in September.

According to the NPD : “Oil production in November was 3.1 percent lower than the NPD’s forecast and 0.9 percent lower than the forecast so far this year.”

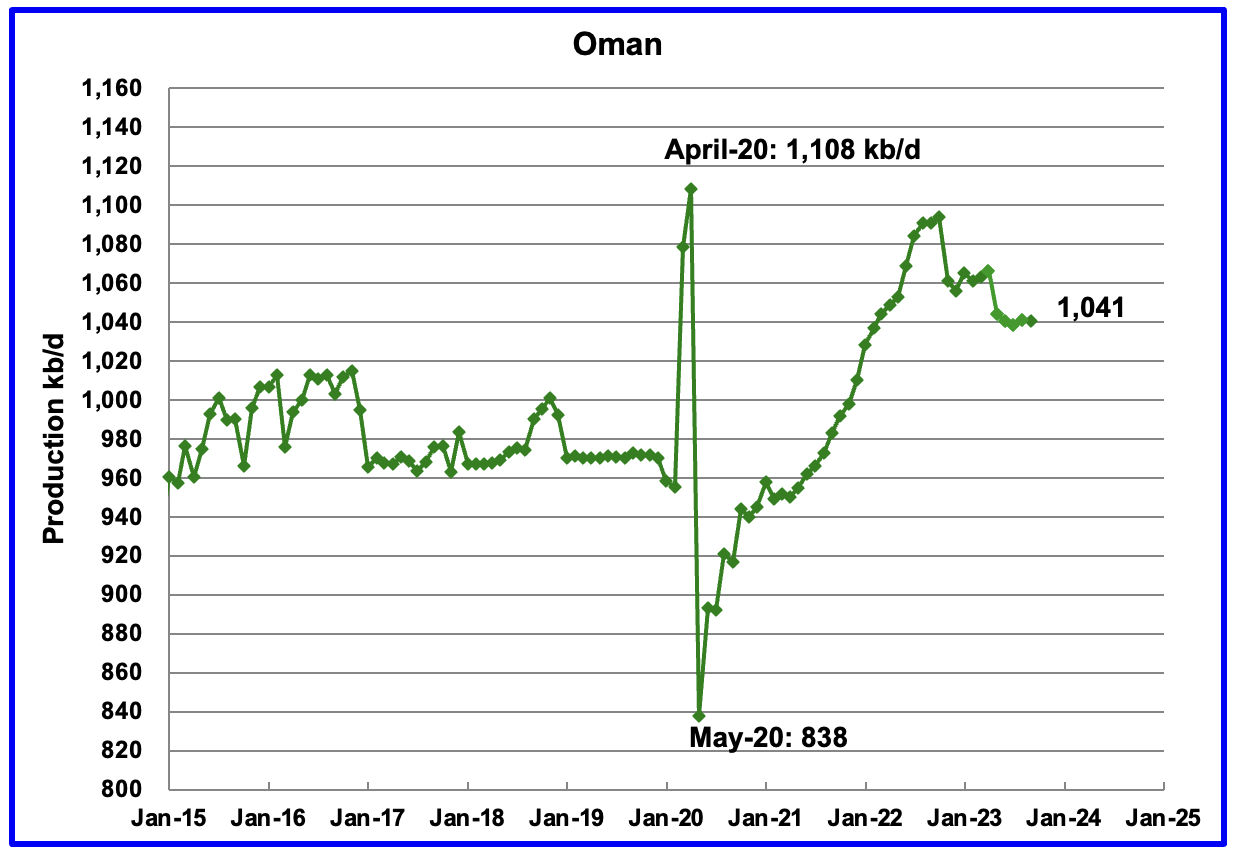

Oman’s production rose very consistently since the low of May 2020. However production began to drop in November 2022. According to the EIA, September’s output was unchanged at 1,041 kb/d.

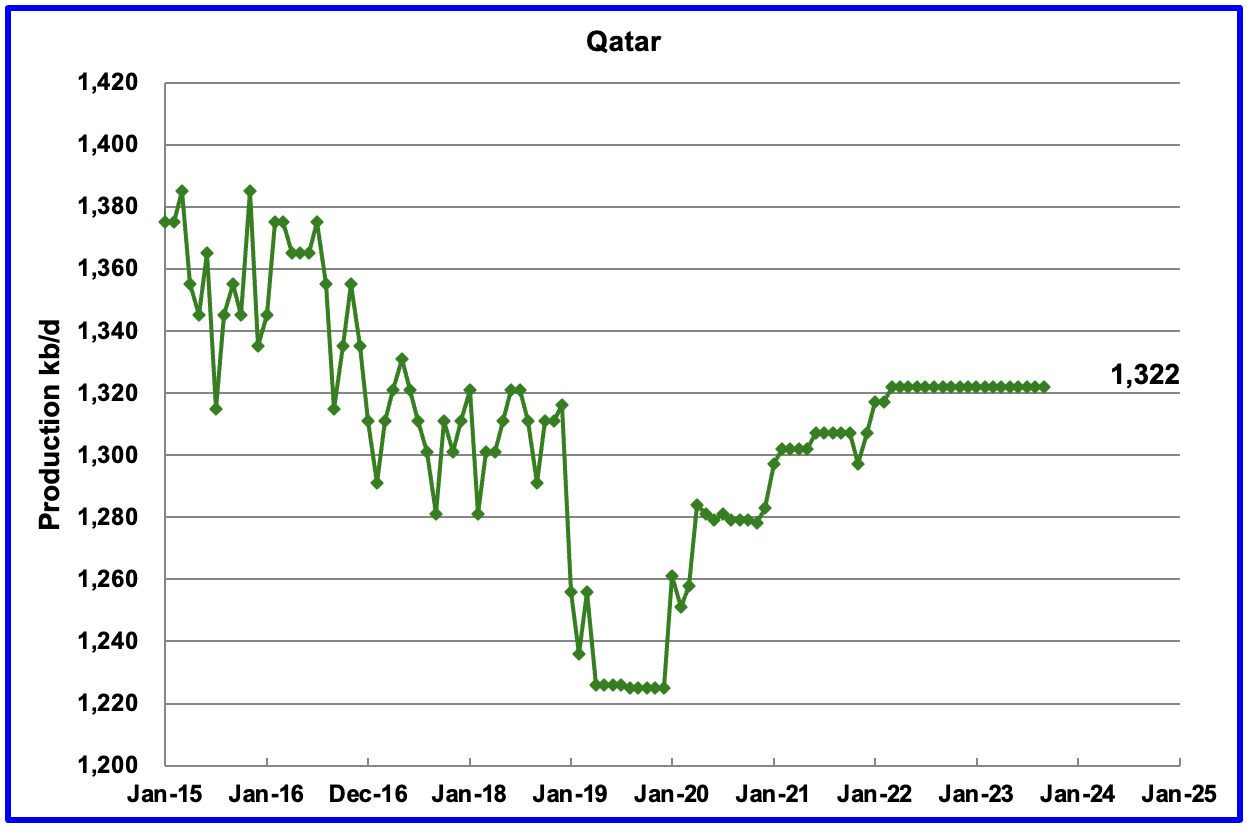

Qatar’s September’s output was unchanged at 1,322 kb/d, possibly due to lack of updated information.

The EIA reported Russia’s September C + C production rose by 6 kb/d to 9,941 kb/d. Using data from the January STEO report, Russian output is expected to increase to 10,076 kb/d by January 2024, orange markers. If the projection is correct, this indicates that there is no sign that Western sanctions are affecting Russian oil production at this time.

According to this source, Russian Crude Flows Exceed OPEC+ Target. (A very long article)

“(Bloomberg) — Russia’s seaborne crude shipments shrugged off attacks on shipping in the southern Red Sea to register gains in the latest week, as Moscow failed to match export cuts that it pledged to its OPEC+ allies.

About 3.43 million barrels a day of crude were shipped from Russian ports in the four weeks to Jan. 14, tanker-tracking data monitored by Bloomberg show. That was up by 94,000 barrels a day from the period to Jan. 7.

The more volatile weekly average rose by 166,000 barrels a day to 3.45 million. While that was 134,000 barrels below the average export level seen by Bloomberg during the benchmark months of May and June, it was still less than half the cut Moscow pledged to its OPEC+ partners for the first quarter of 2024.”

Using data from Argus Media reports, Russian crude production is shown from May 2023 to December 2023. For December, Argus reported that Russian crude production was 9,440 kb/d, a decrease of 60 kb/d from November, blue markers. Adding 8% to Argus’ November crude production provides a C + C production estimate of 10,195 kb/d, which is a proxy for the Pre-War Russian Ministry estimate, red markers.

Comparing the Argus crude data with the latest STEO projection indicates that the EIA estimate for Russian C + C is between the Argus estimates for Crude and C + C. Prior to the war, the Russian Ministry estimate was alway 404 kb/d higher than the EIA estimate for C + C. The current December Russia Proxy output is 119 kb/d higher that the EIA’s estimate.

The January IEA OMR reports that Russian crude production in December was 9,480 kb/d, very close to the Argus report. Note the trend difference between the EIA and Argus after October. Is this an indication EIA’s estimate for Russian C + C is too high?

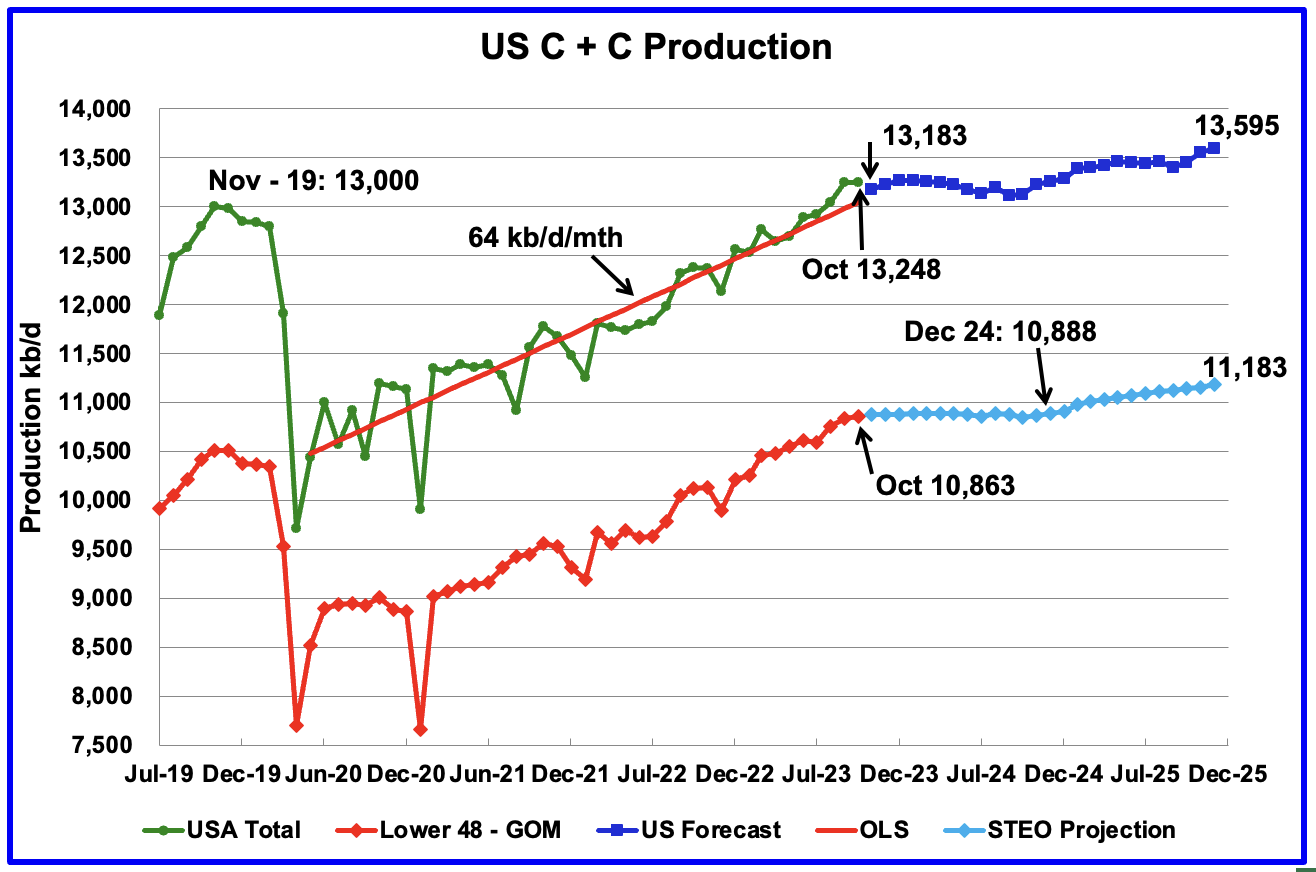

U.S. October oil production decreased by 4 kb/d to 13,248 kb/d. The decrease was primarily due to decreases in the GOM and North Dakota being partially offset by increases in Texas and New Mexico.

The dark blue graph, taken from the January 2023 STEO, is the forecast for U.S. oil production from November 2023 to December 2024. Output for December 2025 is expected to reach 13,595 kb/d.

The light blue graph is the STEO’s projection for output to December 2025 for the Onshore L48. For 2024, the STEO is showing essentially no growth in the L48 states. From October 2023 to December 2024, production growth is 25 kb/d. This is consistent with the DPR model which has been showing a slow growth production trend for the last few months. Not clear on the source of the 300 kb/d production increase for 2025.

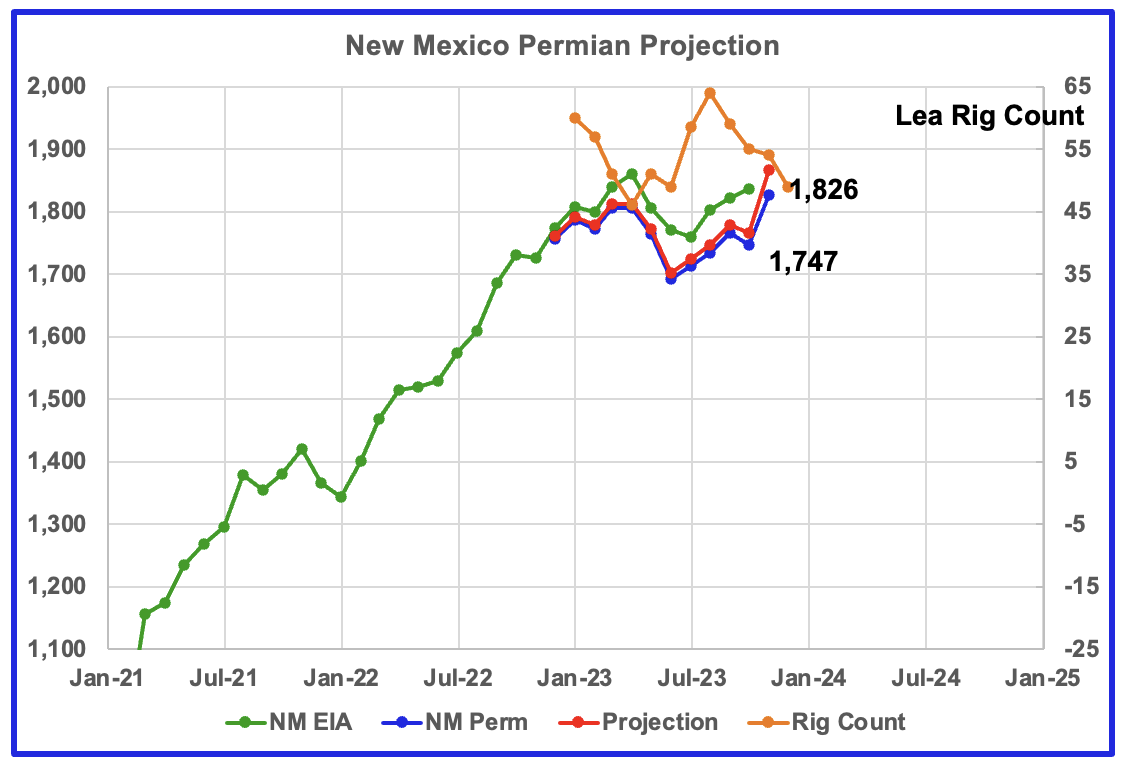

This chart reports on October oil production for New Mexico according to the EIA and November production from the New Mexico Oil Conservation Division (OCD). The blue graph is monthly data as published by the OCD and is the total oil production for the Lea and Eddy counties. The red graph is a projection for what the OCD could be reporting about a year from now for November 2023 production.

The raw data from the OCD is indicating an increase of 79 kb/d (Lea 59 kb/d, Eddy 20 kb/d) from October to November which translates to 101 kb/d in the projection.

Such a large increase in production was an unexpected surprise. The Lea county rig count has been added to the chart and it provides a possible clue to the surprise increase. Note that the rig count began to rise in June 2023. Allowing for an average delay time of four to six months to bring wells online, the November increase may be the first batch of those wells starting production. If correct, production increases in New Mexico could continue for a few more months.

This rig count chart has been added to show the rig count for the New Mexico Permian. While the rig count for Lea county started to increase in June, the opposite occurred with Eddy. However even though the rig count began to drop in Eddy county in June, production rose by 20 kb/d in November.

For the week ending January 19, Eddy added 2 rigs to 46 while Lea was unchanged at 44. Lea’s rig count is down 19 rigs from the 65 operating in the week ending August 18.

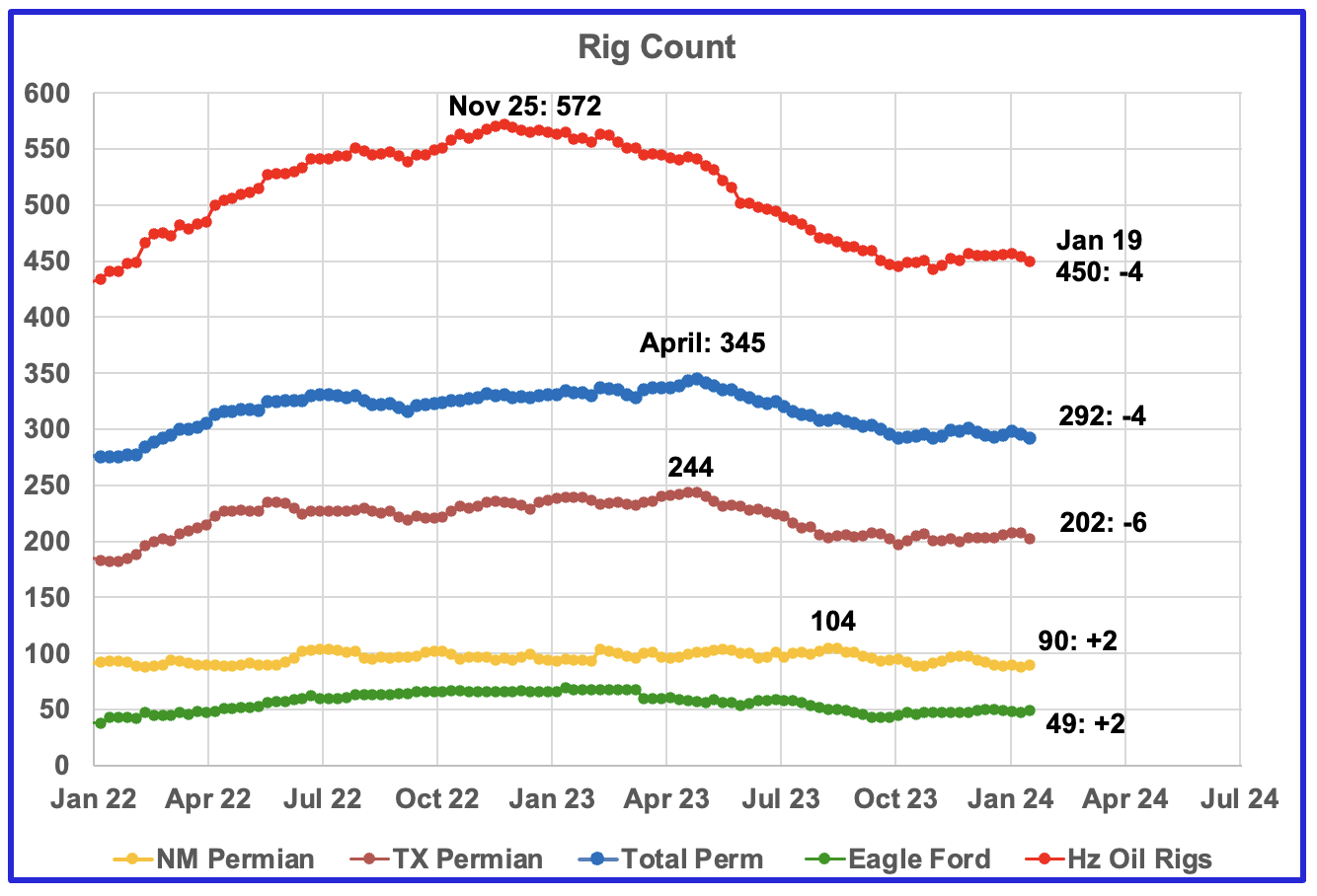

Rig report for week ending January 19

– US Hz oil rigs decreased by 4 to 450, the lowest count over the past ten weeks and down 118 since November 25, 2022. The rig count has been close to 450 since the beginning of October.

– Permian rigs were down 4 to 292. Texas Permian was down 6 at 202 while NM was up 2 to 90. In New Mexico, Lea county was unchanged at 44 while Eddy added 2 to 46.

– Eagle Ford added 2 to 49.

– NG Hz rigs added 3 to 109 (not shown)

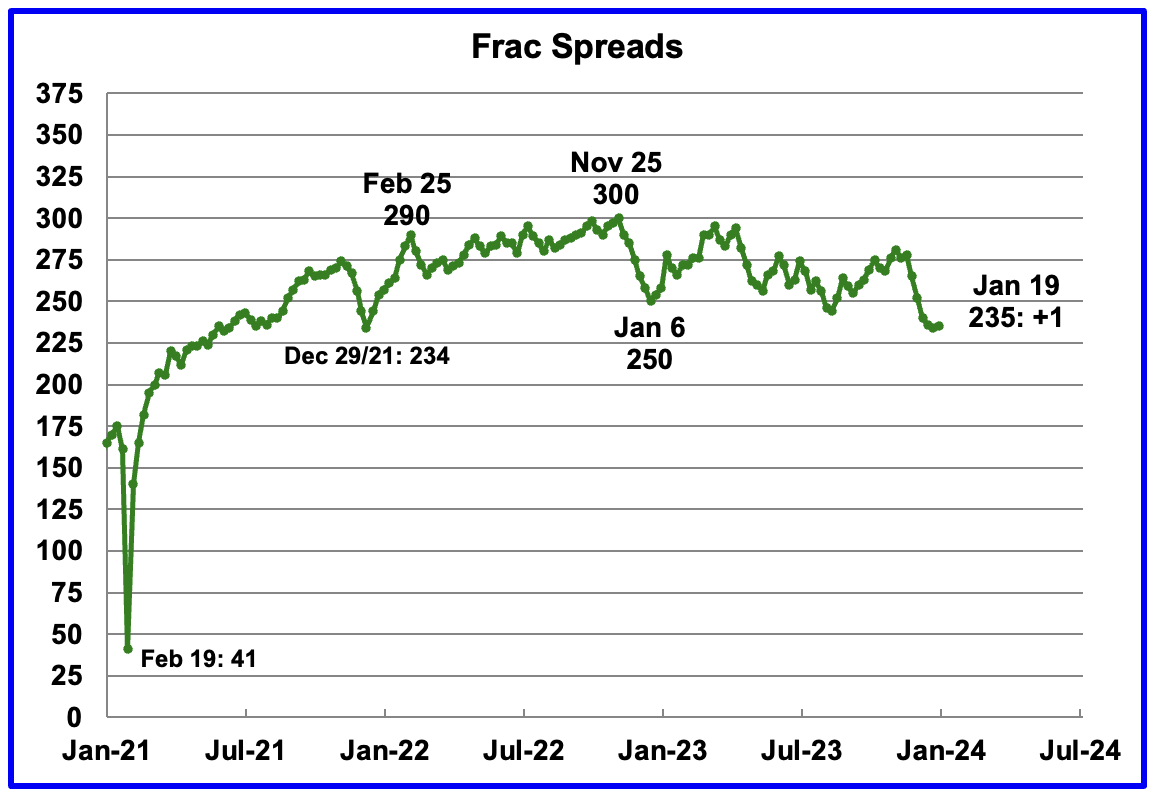

Frac Spread Count for Week ending January 19

The frac spread count was up 1 to 235 and up 1 from the previous low of 234 on December 29, 2021.

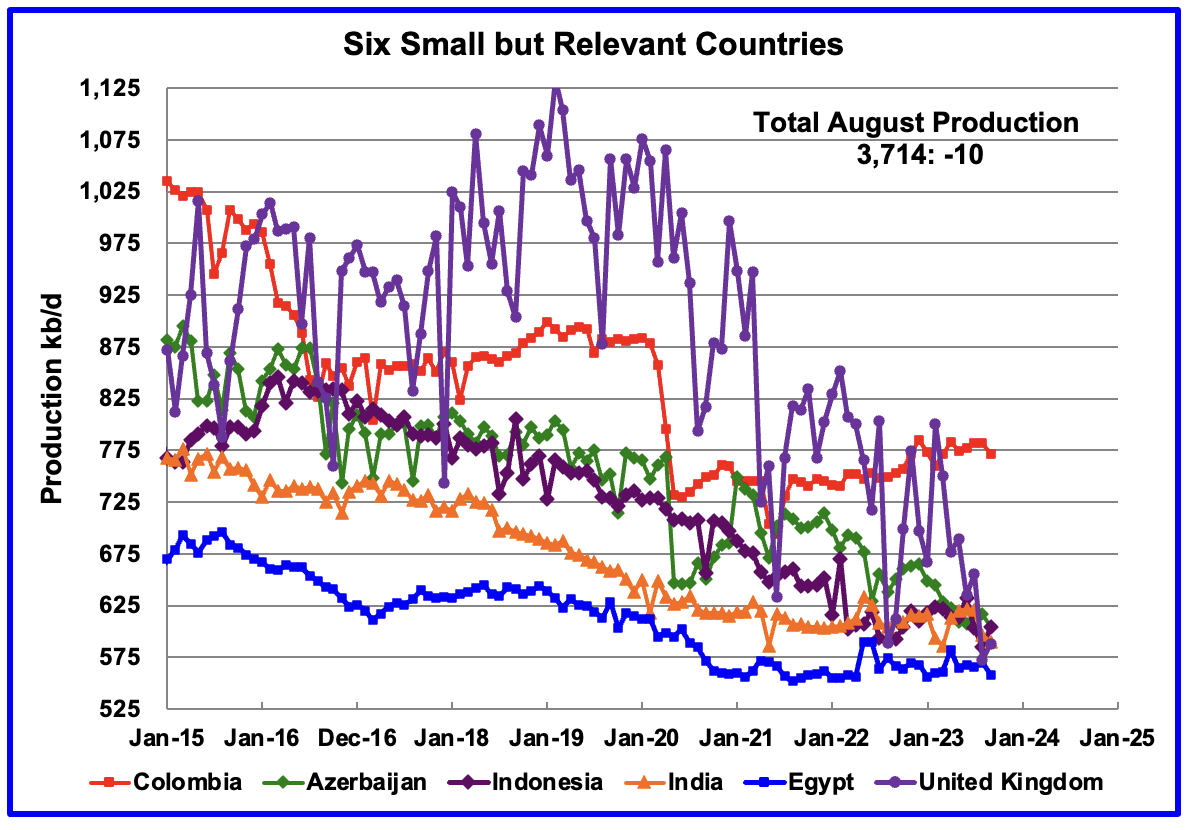

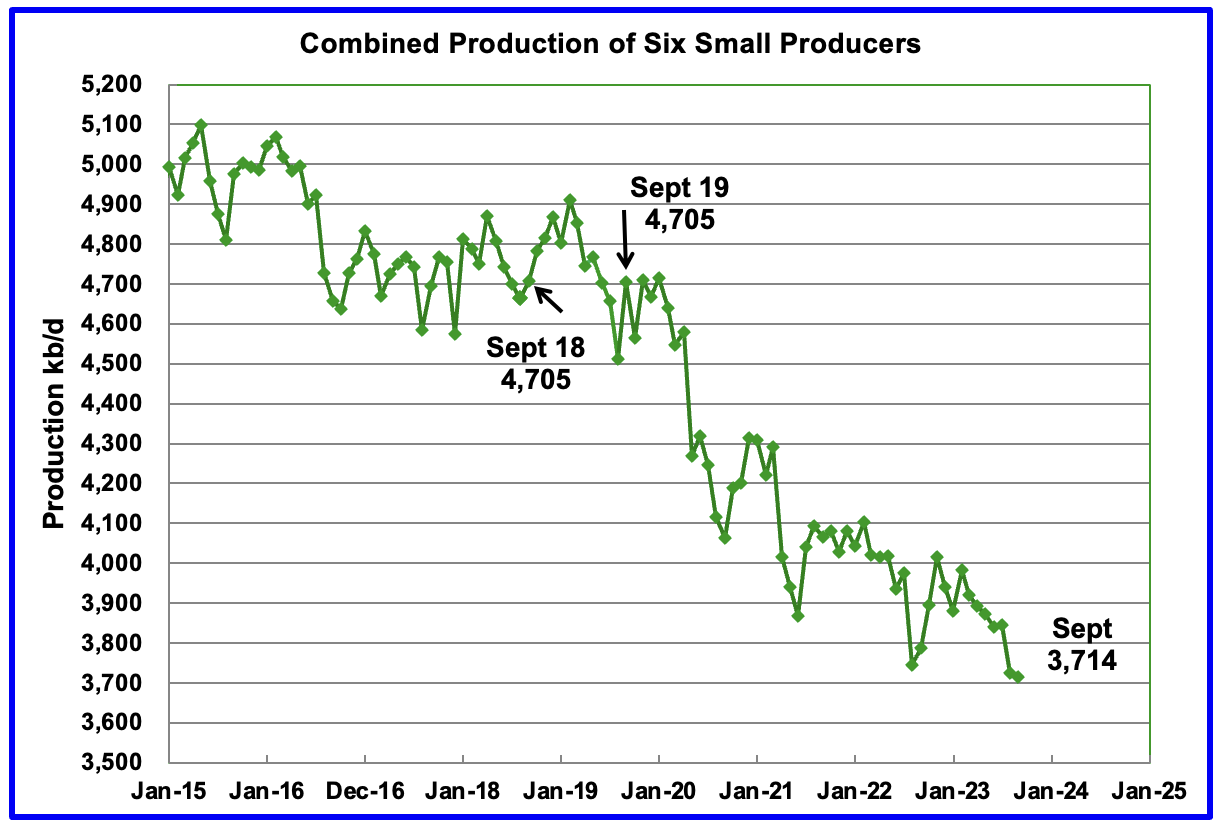

These six countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Note that the UK has been added to this list since its production has been below 1,000 kb/d since 2020 and fell to a new low of 573 kb/d in August. September added 15 kb/d.

Their combined September production was 3,714 kb/d, down 10 kb/d from August.

The overall output from the above six countries has been in a slow steady decline since 2014 and appears to have accelerated after 2019.

The decline from September 2018 or September 2019 to September 2023 is essentially 1,000 kb/d. This means that the combined average decline rate for these six countries is somewhere between 200 kb/yr and 250 kb/yr

As always, Great job Ovi!

Andra the Giant

Thanks. Much appreciated.

Ovi , stellar and efficient as usual . Kudos .

Hole In Head,

Great to see you back! Thought you might have some bad health or something…hope u r well.

What do you think of those US Navy Aegis Destroyers that are sinking drones, missiles, ships and anything else advesarial….with ease!!!!

They are detecting missiles about to be fired and destroying them before they can.

https://www.youtube.com/watch?v=58FB3orQz8E

only 62 of these!

The CEO of ARAMCO has been warning for over a year that we are about to see a world oil supply crunch. Now the CEO of Occidental is saying the same thing. Peak oil is upon us and the big guys are screaming the bad news. Is anyone paying any attention?

Occidental’s CEO Sees Oil Supply Crunch from 2025

Occidental’s CEO Sees Oil Supply Crunch from 2025

By Charles Kennedy – Jan 16, 2024, 11:00 AM CST

• The ratio of discovered resources versus demand has dropped in recent decades and is now at around 25%.

• Oxy CEO Hollub: “2025 and beyond is when the world is going to be short of oil.”.

• Oil industry executives have been warning that new resources, new investments, and new supply will be needed just to maintain the current supply levels as older fields mature.

The world would find itself short of oil from 2025 onwards as exploration for longer-producing crude reserves is set to lag demand growth, Vicki Hollub, chief executive of Occidental Petroleum, said at the Davos forum on Tuesday.

For most of the second half of the 20th century, oil companies were finding more crude than global consumption, around five times the demand volumes, Hollub said, as carried by Reuters.

The ratio of discovered resources versus demand has dropped in recent decades and is now at around 25%.

“In the near term, the markets are not balanced; supply, demand is not balanced,” Oxy’s CEO said.

China Issues Huge Batch Of Crude Oil Import Quotas

“2025 and beyond is when the world is going to be short of oil.”

According to the executive, the oil market will find itself moving from an oversupply in the near term to a long period of supply shortages.

Oil industry executives have been warning that new resources, new investments, and new supply will be needed just to maintain the current supply levels as older fields mature.

One of the most persistent warnings has come for years from Saudi Arabia, the world’s largest crude oil exporter, and its state oil giant Aramco.

The Kingdom and Aramco have repeatedly said that the focus of the energy sector and the debates on the energy transition should be on how to cut emissions, not on reducing oil and gas production.

Speaking at the Energy Intelligence Forum in October, Aramco’s chief executive Amin Nasser said that the Saudi oil giant is working on renewables, e-fuels, hydrogen, and carbon capture and storage (CCS). But the world will need oil and gas for decades and renewables won’t meet this need for decades, he added.

The additional oil and gas demand over the coming decade needs new upstream investments to offset the 5-7% annual decline rates, Nasser noted.

Ron

I think the CEO of Oxy is optimistic. Attached is a chart by Rystad of oil discoveries from 2015 to 2021. Using the posted GOR, below are a sample of recent years oil discoveries.

2018: 5.4 Gb

2019: 6.2 Gb

2020: 7.0 Gb

2021: 3.1 Gb

Considering the world uses 30 Gb each year, the only year when discoveries were close to 25% is 2020. 2021 is close to 10%.

I think the first chart in the post is more a reflection of demand than supply. Keeping in mind that OPEC plus has close to 3 Mb/d in reserve and demand will expand at 1 Mb/d/yr, I cannot see where 2025 will be the year when oil gets short. I still think that shortage, if it develops, will be closer to 2028 to 2030.

I think both CEOs are trying to talk up the future price of oil, exactly as you would expect, being producers. However the financial markets aren’t buying it. They see prices dropping into the 60s next year, and below 65 by 2027.

https://www.cmegroup.com/markets/energy/crude-oil/west-texas-intermediate-wti-crude-oil-calendar-swap-futures.html#venue=globex

Of course it’s impossible to predict future gyrations/ For one thing the timing of geopolitical shocks or recessions is unclear. But markets don’t see some sort of Hotelling style high price scenario with a dwindling fossil fuel resource leading to production price increasing with a discount rate equal to the cost of capital. More the opposite. Markets think prices are being propped up by Middle East war jitters, which are near term.

As for the lower discoveries, this is an incredibly old complaint, which paradoxically hasn’t held up. Where is the $200+ oil that Matt Savinar predicted? And why is the R/P ratio not declining.

“Discoveries” tends to be the wrong metric because reserve growth in existing oil fields is not considered a discovery and is actually backdated and given to the historical finding of the field.

The CME manages crude oil “futures” predictions based on current price fluctulations; those strip outs change every day and have nothing to do with how financial markets “view” the future of supply and demand. “Markets’ change every millisecond; go to, for instance, oilprice.com and watch WTI open on the NYMEX at $3 and close at -$3 later in the afternoon. The CME strip changes accordingly.

Of course the lack of major worldwide discoveries matter. They matter a lot, for a host of reasons.

Reserve additions in newly found structures, or traps, are generally added from new minor, tertiary pays found on the same trap, or IOR estimates, both rarely work out as predicted…EXACTLY like volumetrically estimating OOIP in the original new discovery and picking some stupid RR factor like 60%, never works. Whose guilty of all this horse shit? Resevoir engineers wishing to self-perpetuate their existence, or CEO’s selling the wares and ordering resevoir engineers to lie. Like 1,000 BO EUR’s from the Wolfcamp in 2018. How embarassing should THAT be?!

In the world we live in today, oil reserves are dung heap. By the time you book shale oil reserves, for instance, and the EIA recognizes them, they are totally depleted.

Worldwide R/P ratios have remained remarkably consistent over the years, in spite of falling new discoveries, because of all the stinking lying.

“Peak oilers,” an asinine term, get constant grief from people who refuse to accept reality, want to be different, and relevant on social media, and will resort to all kinds of dog dookey to prove themselves right, others wrong. It’s not happened yet, mostly because of other people’s money, and inspite of unprofitability, so therefore it will never happen, they think.

Don’t buy it. We’re getting closer every day.

In 2023, US production substantially outperformed predictions. In DEC2022, the EIA STEO predicted we would average 12.3 MM bopd in 2023 and exit at 12.5. Instead, we exited at 13.2+ MM bopd and averaged 12.9 MM popd. We had double the growth predicted. And at lower average oil prices than EIA had predicted. Just check the DEC2022 STEO.

Or look at PXD CEO statements at CERA Week in MAR2023. He said it would be another 2-2.5 years before we broke the old 2019 production record. In fact, we broke it in AUG2023, 5 month later, less than half a year!

That doesn’t mean it will go on forever. But those who want to talk down production now ought to consider how they failed to predict 2023 growth, of almost a million bopd per year, exit to exit.

Great post, Ovi. Please keep up the good work. This blog could not survive without you.

I’m just curious, but what is your personal opinion of the world energy situation for the next ten years or so? Do you think oil production will keep on rising? Or do you think the decline will set in and cause serious repercussions? Or do you think oil production will plunge, but renewables will replace falling oil production, and all will just be fine and dandy?

I am extremely pessimistic. But I could be wrong. We know that Dennis thinks renewables will save the day. I do not. What do you think?

Hey, just curious. It’s not that important, but I was just wondering. Oh, and anyone else with an opinion, please chime in.

Ron

Ron

Thanks

I am slowly drifting into the Peak Demand camp. I think that Peak Oil is history, 2018.

The problem is slowing demand rate growth. I think that demand will continue to grow till about 2028 to 2030. The question I can’t answer is whether it will get back to 84,580 kb/d. Assuming there are 3,000 kb/d in reserve by OPEC Plus today and add that to September 2023 production in the first chart, supply could be 81,538 kb/d plus 3,000 kb/d = 84,538 kb/d in 2028. Damn close to 2018.

Going forward I will be interested to see what the Post pandemic peak oil will be. My guess is slightly below November 2018. Then demand will start to slowly fall off. I don’t see a Seneca hill. For a while I thought that Ghawar was going to be a Seneca hill. I now think it will also be a slow decline.

So bottom line, I see a post pandemic peak close to 84,000 kb/d around 2028 to 2030 and then a slow decline in demand for oil.

Ovi, I don’t see a gradual decline in world supply. I believe we will hit 5% decline within 5 years, perhaps within three years. The article below is from 2015, 8.5 years ago:

Saudi Aramco Testing C02 to Get More Oil From Giant Ghawar Field

Saudi Arabian Oil Co. started injecting carbon dioxide to try and boost extraction rates from the world’s biggest oil field as the company steps up plans to recover more crude from its deposits.

Saudi Aramco, as the company is known, already started injection and will put 40 million standard cubic feet per day of CO2 into the Uthmaniyah area south of the Ghawar field, it said Thursday in an Arabic statement on its website. About 40 percent of what’s injected will be stored in the field.

“The project aims to enhance oil recovery beyond the more common method of water flooding, and is the largest of its kind in the Middle East,” it said. The project is part of the company’s efforts to reducing domestic carbon emissions and meeting environmental goals, it said.

Oil-rich nations across the Persian Gulf are seeking ways to continue output from fields that are at least half a century old. While the industry average is for producers to recover about 35 percent of fields’ total deposits, Saudi Aramco is developing technology that could double that rate, Ahmad al-Khowaiter, chief technology officer, said in March.

Injecting CO2 into Uthmaniyah will boost oil-recovery rates by 10 to 15 percentage points, Khowaiter said in March. The CO2 for the project will be captured at Hawiyah gas recovery plant and then piped 85-kilometers to the site. The project will be tested for three to five years before Aramco applies the technology to other fields, it said in Thursday’s statement.

“Saudi Aramco is carrying out extensive research to enable us to lower our carbon footprint while continuing to supply the energy the world needs,” said Amin H. Nasser, acting president and chief executive officer.

bloomberg

I think Saudi is starting to panic. I doubt that Saudi has more than one million bpd in reserves. And the rest of ARAMCO Plus has less than half that.

Ron

My gradual decline remark relates to slowing declining demand. Producers will produce enough to meet lower demand post 2030 without any problem. Could result in a fight for market share between countries.

With regard to Ghawar, I will go with SA’s claim that production is declining at 2% in spite of all of their efforts.

Hi everyone! A long time lurker who dares to post for the first time. To begin with, great work Ovi, Dennis and Ron!

On the peak oil demand debate, the assumption is that renewables will eventually decrease oil demand. However this isn’t happenning jus yet and to get there, industrial production (mainly using fosil fuels) would need to ramp up. Wouldn’t this show as a pronounced acceleration of oil demand before it gets subdued? If we asume the transition continues at the current speed, wouldn’t peak oil demand rather plateau and only decrease slowly?

“to get there, industrial production (mainly using fosil fuels) would need to ramp up. Wouldn’t this show as a pronounced acceleration of oil demand”

I don’t think anyone knows just how much energy will be consumed in the attempt. I doubt it would add to a ‘pronounced acceleration’ considering how lackadaisical the world is about the challenge, and just how very much energy is used in all kinds of other pursuits including air travel, marine transport, metal industry, computer industry, medical and military industrial complexes, agriculture, fossil fuel production, etc.

OIV —

A lot depends on China. Much of the increased demand for oil (and all for coal) since 2000 has come from China. But the government doesn’t like being dependent on imports, so they are trying to reduce demand from the transportation sector, though not from petrochemicals. They have succeeded yet, but if they do it will be hard to see what new demand could offset efficiency improvements and demographic change in rich countries.

Maybe India? Well maybe, but if the Chinese succeed inbuilding a big EV industry, they will start massive exports of cheap electric cars. They are already doing this with two wheelers, which are the vehicle of choice in densely packed Asian cities.

Here is my opinion, which is worth nothing.

https://www.oilystuff.com/forumstuff

Mike Shellman has identified the wholer world of oil growth is being supported from 4 counties in the USA and the wells there are getting gassier.

( I don’t remember which ones, read his work….I hope I haven’t misinterpreted )

That does not sound good at all. It seems really simple to me.

Andre The Giant

I have added a special section in the last US report on POB to track what is happening in those four counties.

In the current post, under the US report, there is a sudden spike in NM production above its previous high. The was an unexpected surprise and difficult to explain, except through a sudden increase in new wells coming online due to increased drilling. This increase may continue for a few more months and then the decline might begin in parallel with the decline in drilling that started in August 2023.

Attached is the oil and gas production chart for Lea county. This is raw data from the NM OCD. The first batch of Lea data was downloaded on Thursday and I thought there was a mistake. I checked again on Friday and production was higher again.

In November 2022, oil production was 1000 kb/d. In October 2023, production was 1,051 kb/d, up 51 kb over 11 months. Then all of a sudden November 2023 adds 59 kb/d. What happened?

Mike has his ear to the ground and has been watching the Lea rig count drop since August 2023. The drillers/friends he is talking to are probably telling him that things have changed for the worst in Lea county. Because of the delay from spudding to production, it may take a few more months before a sharp decline in production starts to show up in Lea county data.

Mr. Shellman is 100% correct. 4 Permian Basin Counties are the only shale counties growing non opec growth and that will come to an end very soon and perhaps this year.

I own stock in a couple of smaller Canadian oil companies (that I almost sold in late October) and they have been crushed over the past few months. I believe that the Permian is going to roll over this year so I think that companies with more conventional wells and oil sands will do better when the depletion really sets in.

I have no joy in watching this resource being sent overseas as fast as we can pull it out of the ground. I think we’ll wish that we kept it in the ground to ease our own transition to whatever comes afterwards.

Same situation here too. I have been watching the TMX debacle since 2013 and have come to the conclusion that Canadians are dumber than Americans on a per capita basis. The TMX project is now entering its eleventh year. The Alaskan pipeline, which is longer and in an isolated and harsh environment, was built in three years. Much of the TMX push back came from British Columbia in an attempt to lean green. But BC is anything but green. Their forestry management is atrocious, wood being their second biggest export. Clear cutting on 45 degree slopes is apparently a bad idea. Not to worry. Anther ice age will fix the soil erosion.

Victoria, the capital and a jewel of a city, dumped all their sewage straight into the ocean until 2020. That would put them about 100 years behind the rest of the west. Better yet, BC’s number uno export is… coal:)

Anyhow I greatly appreciate this site and all the effort that goes into it. Thanks muchly to everyone and respect to Mr Patterson.

If Art Berman is right, there might be a drop in demand for gasoline, not a drop in demand for oil, which is still going to be needed increasingly for diesel, jet kerosene, marine fuel, etc. If demand for EVs grows, won’t gasoline just keep getting cheaper, and all those used ICEs become hot items? Idaknow.

But then I’m a lay person who in spite of keeping track of oil issues since 2005 still feels like he knows nothing about the subject. It’s fucking complicated. My geology professor back in 2007 predicted peak in 2011-2013 and has since drifted off into retirement obscurity. It looks like he might have been off only by 5-7 years.

Two of my great-great grandfathers pumped the oil fields near Toledo, Ohio back in the period of 1895-1920.

“What oil fields around Toledo, Ohio?” you say.

Exactly. As goes Ohio . . .

Ron

I agree with you completely that, renewables, won’t some how save humanity.

A successful human endeavor must, in the end, produce enough revenue (wealth) to pay for itself. Governments giving subsidies, preferential treatment and legislative coercion isn’t a long term solution.

I would say that, in the moment, any power project should be the least expensive most reliable and minimally environmentally disruptive as possible. If those that feel that peak oil production is past, in the present or sometime in the near future then worrying about carbon dioxide is silly. Without abundant inexpensive steel, fertilizer, plastic and cement the world will not be a nice place live. Another thing that’s becoming common to have power companies telling its customers to start sweating in the summer and start shivering in the winter and in both cases DON’T charge your car. Just a side note….the US Government is scheduled to borrow $340 Billion this coming week. There are only 47 countries in the world with an annual GDP greater. Let the fact sink in, that it’s just this week.

” If those that feel that peak oil production is past, in the present or sometime in the near future then worrying about carbon dioxide is silly. Without abundant inexpensive steel, fertilizer, plastic and cement the world will not be a nice place live. ”

What if both propositions are true? Both peak production AND climate change mean the “world will not be a nice place to live [in]”. There is no way out.

And lets just keep pretending poor planning of transport isn’t the main reason for oil consumption.

When Ovi said “The problem is slowing demand rate growth”, I found myself thinking in an opposite way…

slowing demand growth is desirable and may help blunt the severe effects of the world economy running rapidly short on oil supply. As I see it- the greater the demand destruction we can achieve without experiencing outright depression…the better/luckier we will be.

Ron, I think the energy situation is going to be even more and more a mosaic of regional outcomes than it has been in the fossil energy growth phase. Some places will drop off the list of regions which have been able to purchase or could afford to purchase oil products and NG. And others will be off the import list for geopolitical reasons…including perhaps the US and/or places we are economically and politically partnered with since WW2.

I also agree with your notion that alternatives to fossil energy will come up short on replacing all of the fossil energy. Once again a mosaic of outcomes.- Some places, like those with great hydro or those who are building other forms of energy capture/generation quickly, and have the capital/credit to ramp up fast with their purchase of Chinese equipment, will have a better chance of partially blunting the loss of fossil energy.

I think that overall the big risk is that globally energy demand destruction is going to be much slower than supply declines. And by demand destruction I am not talking the kind that is voluntary or proactive, rather the kind that comes via loss of purchasing capability…the hard way.

Before Johan Sverdrup, Troll was the largest oil producer in Norway. Troll III switched from producing the oil rim with long reach horizontal wells and reinjecting the gas to producing the gas a few years ago. Since then oil production (multiply by 6 to give kbpd) has been falling fast and may reach zero in the next few years or so.

Ovi,

Great job.

Note that on the delay from spud to first flow, Mr. Shellman has said 6 months minimum, my guess is that he is right, he obviously knows more than me. There also could be a few DUCs that are nor wolls in process, though the numbers are likely small, about 100 to 200 perhaps. So rig counts give some indication, but DUC inventory also plays a role. My guess is the New Mexico estimate form the PSM probably tracks New Mexico Permian output pretty closely. Note how close the numbers are from Feb 2021 to Dec 2022. I think you will find the match is quite close, in fact a chart of the difference would be interesting perhaps (that is New Mexico 914 initial estimate minus the sum of output from the 4 New Mexico Permian counties from the NM OCD).

Dennis

Thanks

Something seismic happened in Lea county in November. Let’s see what the EIA reports at the end of January. Will they confirm this November production spike.

Attached is the chart you requested using Lea, Eddy and Chaves county. The difference wanders between ± 30 kb/d up to February 2023. After that the OCD lags due to delayed updates.

The chart in the attached article agrees that Spud to Sale time (STST) of 6 months is a good rule of thumb.

While the STST average is 6 months, to me that expands the STST range to 4 months on the low end for a number of wells. That is why I think additional new wells were coming online in November to account for the increase.

https://btuanalytics.com/crude-oil-pricing/are-permian-rig-counts-high-enough-to-drive-growth/#:~:text=The chart below shows average,5.5 months and 6.7 months.

Thanks Ovi,

Your chart seems to confirm that the PSM pertty accurate. I think if we looked at Jan 2015 to Dec 2022 we would find it matches quite closely.

I think Mr Shellman said 6 months minimum, he knows aot more than me, my guess is thar he is correct. I am not an expert on the realities of how oil is produced.

Ovi,

Aren’t you over-interpreting this single preliminary data point?

I noticed that the OCT data point from the NM office is in the opposite trend from the PSM report… So if you average the two, things don’t look that extraordinary…

Another thing to keep in mind is that weather in November got colder and with colder weather more C5 condenses on the lease, rather than in the NG plant. That fluffs a bit the lease volumes (“oil”) and leans the NGL volumes.

BTW, this is probably the reason EIA reports lower volumes for Russia than the Russian Ministry of Energy. EIA probably only estimates lease condensate, while the Ministry reports both lease and plant condensate. Also, the condy volumes for Russia have been going up the last couple of years. The last two months before the embargo (Jan/Feb of 2023) they reported 1.1 MMbd, which is more than your estimate of 8%…

Kdimitrov,

If you have access to Russian Ministry of energy data can you put it in a spreadsheet at Google Docs (or wherever) and post a link to the spreadsheet?

We no longer have access to this data from North America (Ovi and I cannot access the data if it is available where you live).

This would be much appreciated.

Dennis,

They embargoed production data for a year, starting March 2023.

For the data for Jan/Feb of 2023 (last available), I used this Oxford IES paper. It has other interesting tidbits there.

https://www.oxfordenergy.org/wpcms/wp-content/uploads/2023/07/Insight-132-Russian-oil-output-increases-in-2022-amid-unprecedented-Western-sanctions.pdf

Thank you Kdimitrov.

On demand and supply…right now the UK National Grid is supplied by

34% nat gas, 6% nuclear, 49% wind, 1-2% each hydro, biomass and coal.

They have tapped into less than 1% of their offshore wind resource thus far.

And they have announced plans to ramp up nuclear deployment over the next 25 years-

https://www.theguardian.com/environment/2024/jan/11/uk-government-sets-out-plans-for-biggest-nuclear-power-expansion-in-70-years

We’ll see what they can pull off. The race is on.

Hickory

Are you implying that if the UK is able to get to 10% or 20% or 50% of its wind potential then the UK will be a prosperous and therefore a wonderful place to run a business and raise a family? Then the UK could once again be a manufacturer like it was 150 years ago? Abundant cheap power, the stuff that prosperity is built.

Ervin,

I assert that a place like the UK will survive the loss of fossil fuels (depletion and geopolitical disruption) better if they take extraordinary measures to come up with replacement production such as wind, nuclear, deep geothermal, and energy storage capacity (I leave out PV for the UK since its a marginal endeavor in the cloudy clime).

Similar thinking applies to all countries that don’t have enough fossil fuel to last them indefinitely.

Relying on imported fossil fuel is a dangerous limb to be hanging on.

Hickory … “Relying on imported fossil fuel is a dangerous limb to be hanging on.”

Yet relying on imported, solar panels, wind turbines, inverters, nuclear fuel, geothermal pipes, other electronics, batteries, cables and ships to repair off shore turbines is somehow going to be more reliable than importing fossil fuels.

IMHO when they can’t import fossil fuels, they wont be able to import any of the things made from fossil fuels either. All the solar, wind, nuclear, geothermal suffers from entropy, it needs to be replaced over time. What happens to imports of food once they have racked up huge debt in new BRICS yuan, or whatever currency, and they can’t pay back? Will the Pound be worth anything?

The whole energy story is one of an entire system where different feedback loops affect everything. All the renewables and nuclear comes at huge cost, a real cost of energy to build it, that the UK will never be able to pay back, especially in a world where they can’t import fossil fuels, which is coming whether they plan for it or not.

You know commercial banks create all the money via lending. Even before the FED existed. Back when we had a gold standard or gold backed currency. The money supply wasn’t at all connected to the amount of gold banks had on hand. Money supply grew back then just as fast as it does today with a debt based monetary system. Banks make loans when they see an opportunity to make a profit on the loan.

When the energy supply is shrinking so will the money supply. Because commercial banks will see less opportunity to be repaid on loans that they create. There for they will make less loans.

This is in fact why we currently have a dollar shortage globally. Banks don’t want to make the loans. It’s not that they can’t it’s that they see reality and choose not too.

Even in China where the CCP tells the banks they have to lend it’s just not happening as desired. Banks don’t want to lend when they know they won’t get the money back.

Here is the US since 2008 if you were too big to fail. Banks have had no problems loaning money to we will just call it wall street because they believe at the end of the day they will get bailed out. So the loan is perceived as safe.

The FED put is 100% psychology. As long as the commercial banks are willing to create the money that the FED can’t actually create the illusion of FED liquidity will remain.

There aren’t any bank reserves invested in the US stock market. That leverage is created at commercial banks using collateral to make actual loans.

Collateralized loans is what drives the financial markets but it also drives the real economy.

When the energy supply shrinks the debt is going to be defaulted on. We will see the private debts go down first. But eventually government debts will also be defaulted on because it’s the money that commercial banks create that ultimately turn into taxpayer dollars to be collected by the government.

Without enough commercial bank loans property values fall and there for tax receipts.

I don’t see an inflationary way out. Just a deflationary way out. And it isn’t really a way out it just an outcome.

I think we will see some spikes up in oil prices that are followed by collapse in oil prices as scarcity sets in and banks decide not to make loans needed to sustain current economic activity.

HHH. The outcome you describe will result in governments being unable to sustain support payments for healthcare, pensions (social securities) and other support to the poor and old.

This seems like a more and more likely outcome as the can of fiscal balance has been kicked so far down road in many countries.

The result (increased energy and health care poverty) could be one of the mechanisms that forces population downsizing, and destabilization within countries.

Yes , But deficit spending will be blown out to levels beyond comprehension in an attempt to keep the status quo going.

Interest rates will be pinned in at zero. Central banks will do but won’t have to do yield curve control. Markets will set interest rates at zero for them. Because without the credit impulse from the commercial banks growth will be lower than expected. Which will create high demand for government bonds extending government’s ability to spend money into economy.

Government spending, if it takes what is basically savings and turns it into deposits into checking accounts can increase the velocity of money. For a period of time. Like in the aftermath of Covid. But that has a shelf life. And the only real end result is debt levels both private and government went up by a lot since 2020.

Right now everyone both governments, private citizens and businesses needs interest rates to go lower much lower so the enormous amount of debt can be rolled over. Not paid down. Just rolled over.

Stuff like UBI (universal basic income) will be tried. To keep the economy up. But ultimately the debts are unsustainable. And as seen, if you hand out money especially during a time when we are in a supply shock or scarcity . Prices can go up. They can go up to uncomfortable levels. They just can’t stay at those levels.

So I think we will be swinging back and forth between high priced oil and low priced oil. Which is no good if you’re an oil producer.

Look at the FED’s so called tightening. Higher interest rates and QT which is lower balance sheet and yet stocks are at all time highs because commercial banks currently have no problem lending to wall street.

Further proof that the amount of bank reserves or the size of the FED’s balance sheet doesn’t matter because banks don’t actually use bank reserves. They don’t need or use bank reserves to create loans and there for liquidity.

Heck between 1940 and 2007 the amount of bank reserves at the FED ranged between about $20-$40 billion. Yet the money supply grew for the most part exponentially over that time. Bank reserves don’t matter.

What matters is the risk level involved with commercial banks creating loans.

We get into and energy contraction. The money supply will contract regardless of what the FED does or doesn’t do because they don’t control the money supply. The FED put is 100% psychological.

The idea that there is an entity out there that’s all powerful when it comes to the economy and money supply is absurd. And will get exposed as being absurd when energy scarcity sets in.

My bet though is as bond yields roll over and head down it means financial conditions are tightening and money becomes harder to get. Stocks and oil both head lower as bond yields fall back to zero.

Look over in China. Bond yields are head down almost at all time lows. It’s because credit is becoming harder to get as they continue slipping into deflation.

I’m going to give you a little hint on how I believe things will play out in Asia in particular.

But also in Europe.

The collateral that underpins a lot of the Eurodollars in Asia is actually JGB’s or Japanese government bonds. Well it’s actually the shorter dated bills that are important to the Eurodollar market.

JGB’s are used as collateral to create dollars that allow global trade and finance to happen in that neck of the woods. US bills are also used but not exclusively.

The equivalent in Europe would be Italian government bills that underpin the majority of dollar denominated loans in Europe.

I think we will see a run on the collateral that backs a large part of the dollar denominated debts and it’s going to be an enormous deflationary problem. Outside the US.

A lack of energy will most definitely cause a dollar liquidity squeeze outside the US. And the biggest bulk of collateral being used that isn’t US bills comes from two countries that have a lot of debt but not many natural resources. That’s a problem for global dollar liquidity.

And there for it will be a problem for oil prices.

Central banks would make the collateral shortage worse by buying the short end of the curve trying to stop a run on collateral btw.

So I think the above is all inevitable regardless of what the central banks do.

HHH, what is your guess for the timing?

Timing is very hard to nail down. But I keep an eye on what the JGB’s bills are doing. When there is strain in the market the yields on the bills tend to spike down as there becomes huge demand for them as collateral. During a collateral shortage.

But what if that collateral was to get repriced though. Meaning what if it lost value say due insufficient energy. Or what if Eurodollar banks decide they no longer wanted to use that collateral and only US T-bills will do. Which in itself would reprice the value of JGB’s or Italian bills much lower and cause a collateral shortage.

Counterparty risk between banks will play a huge role. When deciding whether to except collateral or not. If the only collateral you have is deemed no longer sufficient. Then your ability to borrow money into existence for global finance and trade is greatly diminished.

Some US banks ran into this very problem back in March of 2023. The collateral that they held was insufficient to borrow their way to liquidity. So they became illiquid due to insufficient collateral.

Also keep in mind that in the Eurodollar market the same collateral is being used for anywhere between 15-25 different loans at the same time. What could possibly go wrong?

I also keep an eye on REPO failures. Meaning one of the parties involved in the REPO transaction decides to keep the collateral. Instead of returning it as was agreed upon.

REPO fails tend to spike during collateral shortages as collateral is at a premium and cash isn’t. Which again could make banks think twice about what collateral is sufficient or not sufficient.

Hideaway- “somehow going to be more reliable than importing fossil fuels”

Certainly- Compare a scenario 7 years from now where an importing country who relies almost entirely on imported fossil fuels loses half of the supply (or can’t afford it), versus the same country who had deployed large capacity alternative sources. The second would indeed have ‘more reliable’ availability of energy at its disposal.

As an importing country just sitting on your hands is not a strategy.

Regarding affordability of energy consider that the world has grown big on very cheap energy. The whole system, no what the particular components and sources, is going to get more and more expensive over time. Perhaps that wouldn’t be the case if fossil fuels were self-replenishing by magic forces deep in the earth. I think it is highly likely that populations of most countries will decline to come in line with the domestic/regional food and energy resources that they can muster. It won’t be voluntary downsizing. Mostly a process of forcing in the form of poverty, failed migrations, and in some cases armed conflict (within and/or without).

Hickory, it’s not ‘some country’, we are talking about the UK. Where you wrote ‘deploy’, it should be ‘buy from overseas and import’.

The cost of importing all the renewables and batteries would be multiples of importing just the oil, coal and gas over the same period.

IMHO ‘any’ country is much more likely to be able to import ‘some’ raw products for a long time after finished goods become too expensive or just not available.

“The cost of importing all the renewables and batteries would be multiples of importing just the oil, coal and gas over the same period. ”

I disagree. The cost of importing depleting fossil fuel energy is and will be much higher than spending money on replacement and efficiency mechanisms.

And importation of energy as a strategy in this increasingly destabilized world is a very insecure path to walk.

True for the UK, or Korea, Australia and most other countries.

Hideaway I’ll give you an example.

Iowa has very good wind resource, with about 60% of state electricity generated by wind on an annual basis currently.

As of 2022 they had installed wind capacity of 12 GW,

and the US government estimates they have a total wind resource of

as much as 570 GW! (which yes, may be triple what is practical to deploy).

And the retail price of residential electricity is 14 cents/kWhr

Compare this to Indiana which has 47% coal and only 6 % wind as electricity source, and yet has slightly higher retail electricity rate than Iowa.

Hickory, I don’t think one path is better than the other, I think both are disastrous.

Taking the UK as the example, the latest plan seems to be building one nuclear power plant about every year. Assuming something like Hinkley point C in the next decade. Assuming the current cost of around $40B for 3260Mw of capacity, the cost for 10 of these being ~$US400B, making the very big assumption the British pound does not fall dramatically as they try to borrow this much.

Assuming the cost of operation is similar to the US fleet of around $US32/Mwh in 2019 dollars (from WNA, last sensible year for numbers pre covid), giving a 60 year ‘life’ for the power plants, equals a spend of ~$US920B to generate ~17B Mwh of electricity over the next 70-80 years from 2034..

Assuming they spent the same dollars in coal at the current price (probably easier/much cheaper to buy the mines in USA, Australia, Indonesia, Canada etc). At current $US118/t of thermal coal of roughly 7Mwh/t, equals an energy equivalent, after allowing for only 40% efficiency, of around 21.8B Mwh of electricity generated. It could be run through existing plants from today, and new ones built from cashflow over the years at a fraction of NPP price.

The NPP has the distinct disadvantage of having a huge cost of money associated with it all paid up front over a decade or more before any return to pay for the interest…

For the UK, the real problem is Wind is making both Nuclear and Coal unprofitable to run. For 40% of the time Wind provides vast amounts of energy, but the coal or Nuclear still need to exist for the other 60% of the time. They can’t be turned off and on as quickly as needed, so excess power is available at that time and the wholesale price goes negative, destroying the economics of all 3. The UK system planned to be around 80Gw constant by 2050, a total of around 700Twh of supply, up from 320Twh at present because of EVs, heat pumps everywhere, etc.

If the plan is batteries to support wind, then covering just 5 days outage would need $US1.5T for this alone, assuming the cost gets to $300k/Mwh for full installation cost (cheaper than present and excluding any operating costs, maintenance costs and replacement costs after only 12-15 years).

BTW last time I looked Iowa wasn’t a country so not comparable to countries without natural resources of fossil fuels…

I agree about two points you make here

1-nuclear power is expensive to build. No company or cluster of companies in the world can fund the buildout of these stations on their own, without a large degree of government support in the form direct subsidies, tax breaks and loan guarantees, below market financing, insurance coverage, fuel chain support, waste handling.

2-‘both scenarios are disastrous’. Sure, since the human experiment is so very far overextended. There are no good options.

However, I assert that to just rely on depleting and imported fossil fuels is a worse disaster in very important ways compared to the alternative approach which involves making fierce efforts to deploy energy efficiency measures, other energy generation sources, along with proactive downsizing.

On that last matter, one way or another the consumption will come into line with the long term sustainable supply in the world and in a country. Better to make a few choices about how to get there rather than just have it happen to you with hands in your pockets and head in the sand.

The UK is certainly a fascinating place to look at. They may be farther along in their transition from fossil fuels than anywhere else, given their previous history of coal and oil production. They have all but eliminated coal use and their oil production is falling off a cliff. Still a fair amount of oil imports but less than a decade ago.

https://www.msn.com/en-us/news/world/venezuela-military-drills-start-as-uk-warship-sent/ar-AA1masXR

UK sent a warship to Guyana ( hottest oil prospect in South America ).

Didn’t realise the UK had interest in Guyana.

The UK is definitely an interesting case, their electricity consumption is one of the lowest in the developed world (per capita), lower than China.

In part, this is no doubt because of the ever increasing rate at which people are disconnecting their electricity (and gas) supply because they can no longer afford to pay it…

People sometimes speak of ‘peak demand’ like it is a sunshine and roses scenario where we just didn’t feel like using oil (going on trips, eating meat, buying big cars, etc.) any more, but the reality is more like the above, any peak or decline in demand we are seeing is not because we have switched to better substitutes so we can have everything we want without needing oil, but rather because people can no longer afford to pay for it. Oil is down from its recent highs, but still well over double (inflation adjusted) what it was in the good old days of the 50s and 60s.

The only way you could say that demand is peaking because we have better alternatives available, and not because we are just to poor to pay for it any more, would be if the price of oil went down to low levels (back to where it was in the 50s and 60s) and stayed there for a long time.

Some Guy. True. The hard truth is that most countries including the UK will find themselves unable to afford all the energy that they had become accustomed to over the past century. Even more so if they only rely on depleting and/or imported fossils fuels. Its going to be costly one way or another.

Stephen

When we burnt coal poor people could afford electricity.

Today we have one of the highest electric prices, million stay in cold houses and tens of thousands become so ill they end up in hospital.

We now import lots of oil and over 60% of our gas consumption.

When there is no wind at night 100% of the electricity comes from gas and some nuclear.

Silly me. Of course coal never made anyone sick.

https://en.wikipedia.org/wiki/Great_Smog_of_London

Stephen

An ignorant response from a rich person.

At that time coal was burnt in almost every home in very inefficient fire places. Once coal in homes was stopped there was no more smog

Charles, if you had read the link you would have seen that much of the coal burned was from power plants. Burning coal causes massive health problems regardless if it’s for power or heat. But I’m flattered that you think I’m rich!

We now import lots of oil and over 60% of our gas consumption.

What country do you live in? It’s sure as hell not the USA.

Ron

I was Replying to Stephen regarding his praise of how wonderful the U.K. renewable utopia is.

I notice California has a high electricity price.

Charles- Can’t go back in time.

“The United Kingdom holds 77 million tons (MMst) of proven coal reserves as of 2016, ranking 61st in the world and accounting for about 0% of the world’s total coal reserves of 1,139,471 million tons (MMst).

The United Kingdom has proven reserves equivalent to 1.9 times its annual consumption. This means it has about 2 years of Coal left (at current consumption levels and excluding unproven reserves).”

Maybe can dig under the sea-

““We think there are between three trillion and 23 trillion tonnes of coal buried under the North Sea,” explained Dermot Roddy, former professor of energy at Newcastle University. If we could extract just a few per cent of that coal it would be enough to power the UK for decades or centuries.”

Charles —

When we burnt coal poor people could afford electricity.

On the other hand anyone can buy an electric heated vest with a USB plug online for 20 pounds. staying warm was never cheaper

For the UK I would suggest, again, that you insulate your houses with something different than bricks, and use 2 or even 3 layers of glass in your windows.

And if indeed, which I would like to see numbers on, the UK per capita electricity use is comparatively low, I would suggest to prepare for less NG in the exact same way.

Laplander

To fit double glazing is easy if you have £10,000 plus. To properly insulate solid walls is difficult and expensive. Most people can’t afford to do that.

But I guess when you get Hinkley point C running, all will be well and electricity cheap. /S

Sorry, could not resist, it´s not the common man/womans fault but the bed is made anyway, so some preparations at least would be valuable.

To retrofit masonry buildings you might find this interesting if you live in the UK

https://www.academia.edu/10322361/POTENTIAL_FOR_RESEARCH_ON_HEMP_INSULATION_IN_THE_UK_CONSTRUCTION_SECTOR

Interesting, according to Stephens link there´s 5 million dwellings in the UK with mostly solid brick insulation (p 144)

I knew it was bad but that was even worse than expected. On the other hand, if you solve the moisture/condensation problem with an impearmeable wall, your business oportunity is golden.

U.S. Oil Production Flatlines

– US unconventional crude supply is expected to remain flat in February for the third straight month, declining by a mere 2,000 b/d to 9.68 million b/d as the country’s rig count is still yet to see a rebound.

– The EIA expected bigger month-on-month declines in 2024, but productivity gains in the Permian, Appalachia, and Haynesville have surprised to the upside.

– The Permian Basin remains the only major play to see its production increase, improving marginally to 5.974 million b/d next month, though oil producers are still yet to assess the damage wreaked by the cold snap on US upstream sites.

– North Dakota oil production dropped by as much as 700,000 b/d this week, whilst the US Gulf Coast’s refining capacity took a 15% drop with some 1.5 million b/d going offlin

Frugal

The first and third paragraph come the January DPR report.

Ovi,

Great as always, thanks!!!

May I suggest that you use a fixed color-scheme in the graphs? It will be easier to orient.

The green for the EIA is perfect; then fix one color for all STEO projections and another color for the preliminary data from local authorities, across all the country graphs.

Thanks, again!

Kdimitrov

Thanks

With regard to your request on the colour scheme, I am sorry but I won’t be able to accommodate it.

I create charts with two objectives

– Keep them simple so that the results and trends are obvious. I am trying to make sure that new visitors and lurkers can also understand the charts.

– Use high contrast colours to separate different data/graphs. Green, red and blue are the preferred basic colours.

I will tweak some charts by adding a legend. For instance, the Brazil charts will be updated to show the source of the data. Red for the Brazil Petroleum Association beyond the EIA’s data. Blue for Pre-salt.

North Dakota Oil Output To Be Lower For Another Month: State Regulator

It might be another month before crude oil production in North Dakota returns to normal, the state regulator said on Friday.

Extreme weather has eaten into crude oil production in North Dakota to the tune of hundreds of thousands of barrels so far—with the cold weather creating power outages and shutting down oil refineries. It has essentially cut crude oil production in North Dakota by half, cutting out 650,000 bpd from its typical 1.24 million bpd of oil production.

The North Dakota Pipeline Authority said on Friday that production was now down between 350,000 bpd to 400,000 bpd for oil, and 0.95 BCFD and 1.10 BCFD for gas—leaving about 30% still offline due to the extreme cold weather and operational challenges.

On top of production outages, oil spills and other incidents have been reported in Bakken oilfields, where windchills have fallen in recent days to -70F. But subzero temperatures are not over for oil country just yet, with the cold snap expected for another few days.

The cold temperatures didn’t just knock out oil and production in North Dakota. Frozen gas wells resulted in the lowest level of production in 11 months over this last weekend, Reuters estimates predicted. And while the cold weather is tightening oil and gas supplies, it is also creating an increase in demand as consumers try to stay warm.

The cold snap in the United States has collided with other supply-tightening factors, such as tensions in the Red Sea that have caused oil tankers to take the long way around.

The tightening supply and temporary oil and gas production curtailments will come as welcome relief for OPEC, which looks to be struggling to live up to its oil production cut promises for January.

By Julianne Geiger for Oilprice.com/i

Oil resources

Some people do not know the difference between reserves and resource.

What would Canadian oil reserves be at a consistent $120 barrel, which is cheap.

https://natural-resources.canada.ca/our-natural-resources/energy-sources-distribution/fossil-fuels/crude-oil/oil-resources/18085

Venezuela could easily produce 8 million barrels per day if the country did not have a totally corrupt government. Venezuela oil reserves are vast and its resources even greater.

https://pubs.usgs.gov/publication/fs20093028

Peak Oil in its proper sense is about unrestricted oil production in a region with a certain amount of resources. Such as the United States. The United States is a rare exception in the world. Most countries have undergone years of wars and sanctions where oil production has been stopped.

OPEC is another case where production and drilling has been curtailed for political and price reasons.

Today Peak Oil and s a guess as to what may happen to oil prices which no one knows. It’s a guess as to what may happen in every oil producing country. Peak oil could be 2018, (annual production) but this is looking unlikely. US, Canadian, Venezuela, Guyana and OPEC spare capacity will push world to new highs.

Charles,

If demand for crude grows, you may be correct, but for the past 4 years demand for crude oil has been relatively flat, if it grows as it did from 1983 to 2019 then oil prices may rise and supply may grow to levels that are higher than 2018, I expect by 2025 or 2026 we will see this effect if oil prices rise, otherwise we may see a plateau of roughly 82 Mb/d, if oil prices remain below $80/bo for Brent crude. I agree future oil prices, demand and supply are difficult to predict, we just do not know.

“Peak oil could be 2018, (annual production) but this is looking unlikely”

So far it’s still 2018, 1P reserves are only about 250 Gb, world currently consumes almost 30 Gb annually.

1P reserves run out in ~8 years, we will need to see 1P reserves increase by 15% each year just to keep them around 200 Gb…so far there’s nothing suggesting that is going to happen.

A future peak exceeding that of 2018 seems very unlikely, so I completely disagree with your willy nilly assessment…

More likely, we will see very large production cuts from a number of key producers (Russia, Saudi Arabia, US, etc).

Dennis Coyne,

Firstly EU car sales and gasoline

You are conflating periods in which there were major changes in the vehicle fleet composition and then trying to derive a decline curve and trend

There are lies, damned lies and statistics- Disraeli.

There are two distinct periods in the EU- and I mean all of the European OECD countries. In the period 2002 and 2016 the high-speed diesel for light vehicle improved in leaps and bounds and substantially affected gasoline car sales.

In 2012 diesel cars outsold gasoline cars by 54 to 42% of EU car sales. Emission limits on NOx and PM2.5 started to reverse this trend such that diesel cars sales declined to 13.6% of new car sales and gasoline (CV and HEV) climbed to 61.1%. In that period EU BEV.’s sales climbed to 14.6% of new car sales in 2023 (1.533 million units). Total BEV’ are still <5 million in 300 million on the road vehicles .The uptick in gasoline demand from 2015 is because gasoline car sales are growing and light vehicle diesel sales are declining. When we see the gasoline sales for 24 they are likely to show a small increase. I do not buy into you argument that gasoline demand has peaked and is falling.

Thus your EU gasoline graph needs qualification because without it is meaningless.

Second point

I have worked in the oil business for a long time. One thing I learned was the errors in gauging. You believe in the figures presented by the EIA, IEA, and consultants. I don't. There is no way that you can trust a lot of the data from countries that do not have the same standards as the west. Even some of west's statistics need a little care as you have found out with LTO. The data might not be in sync, and there might be deliberate misinformation. Don't believe everything you read. Be sceptical.No-one knows the ture extent of the Dark Tanker fleet.

I have said and will repeat my view on so -called spare capacity. No-one really knows and 5 mb/d would be about 6% of the global production (C+C). I very much doubt that figure. It might be the surge capacity which might be possible for a short-term fix.

As for new oil finds just remember that company X might have found a "new reserve but it will take time to develop. 5 years or more. LTO took time and there was an already established gathering system. The price pinch in 2009 was only solved when the Saudi's finally commissioned the AFK field gas plant. They we not prepared to produce the field until the gas plant was operational.

As Charles has noted some readers conflate reserves with resources. The US has a mighty large LTO resource. The reserves are much , much less and due to the nature of the methods of exploitation the recovery factors are much less than 10% of the OOIP. The Saudis do much better because their resources are better. They have championed pressure maintenance with water injection, and are now going to use carbon dioxide. Whether this will work is open to question and Aramco will wisely proceed with caution and evaluate both effectiveness and the economics of this process over a lengthy time period. It might work, it might not be economic. Only time will tell.

Carnot,

That is the reason I initially included both petrol and gasoil consumption in my initial chart.

Carnot, please, that quote is not by Disraeli. You look like a fool when you repeatedly misattribute it to him.

https://en.m.wikipedia.org/wiki/Lies,_damned_lies,_and_statistics

The phrase was popularized in the United States by Mark Twain (among others), who attributed it to the British prime minister Benjamin Disraeli. However, the phrase is not found in any of Disraeli’s works and the earliest known appearances were years after his death. Several other people have been listed as originators of the quote, and it is often attributed to Twain himself.

Who cares who actually wrote it.

It is the message that matters and accurate data is hard to find. Read the message

Why should I believe any of your other facts if you refuse to fact check? I understand why you are wrong so often now.

17 minute Joe Bloggs YouTube video. Lots of good information on the current state of Russia’s oil industry.

RUSSIA Shuts Down Oil & Gas Terminal & Port After Drone Attack as Ukraine Targets Russian Oil & Gas

Refining Crude Oil

Some people have been expressing opinions on what will happen with falling gasoline demand and the fuel mix balance.

Firstly, in the west the prospect of a significant contraction in gasoline demand is most unlikely in the next 5 years. In the EU the BEV fleet is still less than 5 million out of 300+ million light vehicles. WU BEV sales in 2023 showed growth but gasoline vehicle sales were over 4x that of BEs, and with all the recent negative publicity regarding BEV’s there are a lot of hurdles.

Crude oil comes in many different variants but can be classified as light, medium or heavy and sweet or sour dependent on the sulphur content. Different crudes yield different yields of the primary derivatives ; light distillate- naphtha, middle distillate – jet, diesel and gas oil, heavy distillate – atmospheric residue.

Contrary to what you might read on the internet there is very little direct blending of naphtha into gasoline.

Crude oil generally contains about 2-3% LPG which is recovered with the naphtha. Very roughly the naphtha fraction is about 15-25% and the middle distillates about between 30 and 40%. The atmospheric residue fraction cover material boiling above 365 deg C. The rough boiling point for the fration are as follows:

1. naphtha 35- 180 deg C

2. jet kerosine 180 – 240 deg C

3. diesel/ gas oil 240-365 deg C

4 atmospheric residue 365+ deg C

The atmospheric residue is typically distilled under vacuum tp yield

5. Vacuum gas oil 365-560 deg C

6. Vacuum residue 565+ deg C

Refineries have 4 main process steps:

A. Separation – distillation of streams

B. Upgrading to improve properties- reforming, isomerisation, alkylation

C. Conversion – cracking technologies to convert heavier molecules to more valuable smaller molecules

D. Treating- stabilising and sulphur reduction of finished products

Refineries cannot pick and choose what products they produce. The crude oil stream dictates the yield structure and the product mix. Gasoline is the most energy intensive fuel in the refinery and it is NEVER a single product. It can contain from 4-10 components depending on the refinery configuration and complexity. Most gasoline will contain a mix of streams such as :

1. FCC gasoline RON 91 35-45 %

2 .Reformate RON 96 25-30%

3. Isomerate RON 81 10-20%

4. Alkylate RON 94 10-15%

5. isopentane RON 93 <5%

Streams 3,4 and 5 might not always be available. RON is the Research Octane Number.

Sometimes gasoline might contain light naphtha but this has a very poor octane number of around RON 66 so must have additional high octane components. This could be ethanol or fuel ethers ( not US).

There are 3 main parameters for gasoline.

1. Octane

2. Density

3. Vapour pressure

The name of the game is to get the lowest cost of product with the lowest density – max volume.

The are few more points to mention about gasoline.

The naphtha fraction is typically split into light and heavy naphtha, but can be split into 3 streams. Light naphtha is used as steam cracker feed (petchems) whereas the heavy naphtha is routed to the reformer and/ or isomeriser to make reformate and isomerate for gasoline and aromatic precursors for petchems.

FCC gasoline is made from Vacuum Gas Oil in a fluid catalytic cracker, and FCC gasoline makes up the major component in the gasoline pool. The FCC also makes the precursors to alkylate, so in all about 50% of the gasoline is produced form vacuum gas oil distilled form the atmospheric reside.

If LTO is considered it is typically around 50 API gravity and will contain mainly light and middle distillates with very little atmospheric residue.This means there is little or no feed for the FCC( or hydrocracker).