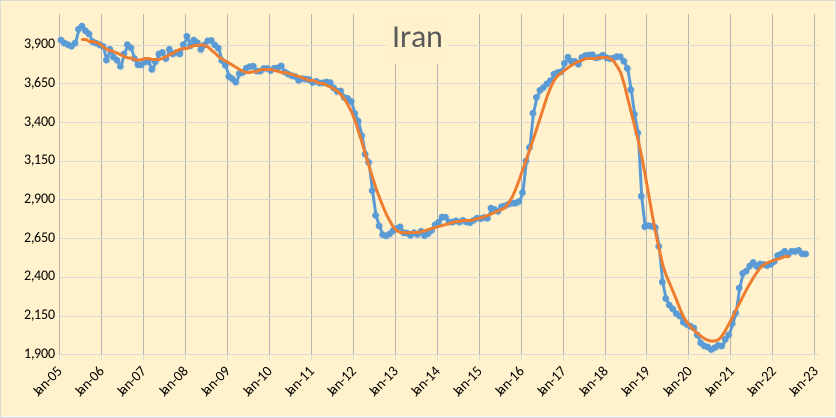

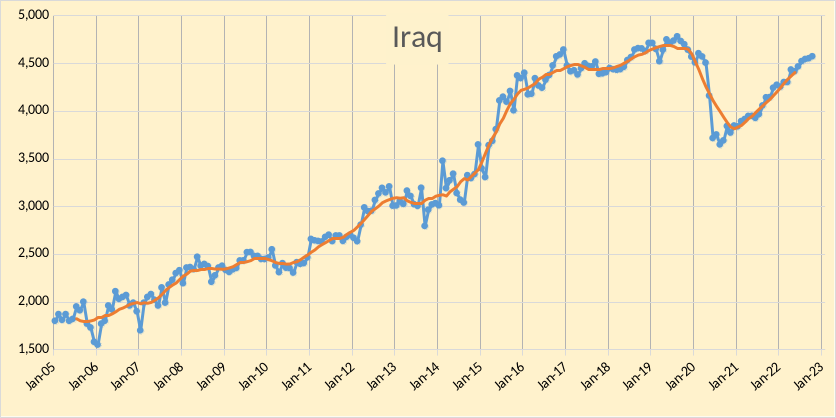

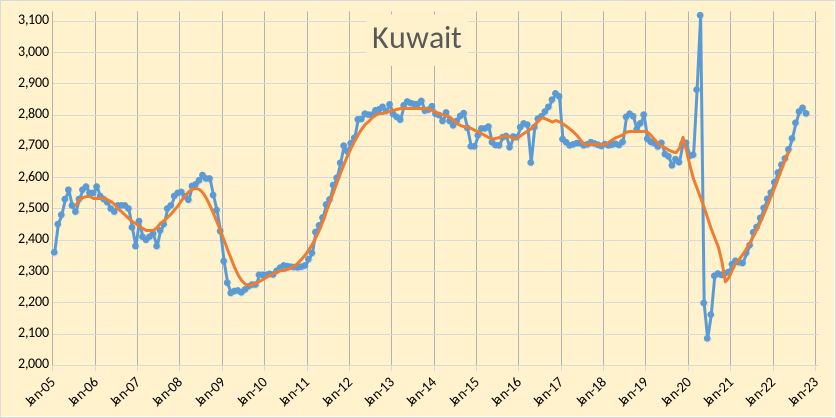

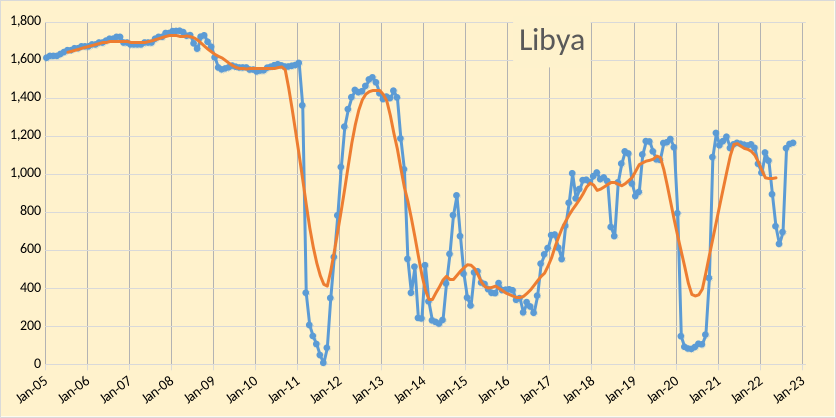

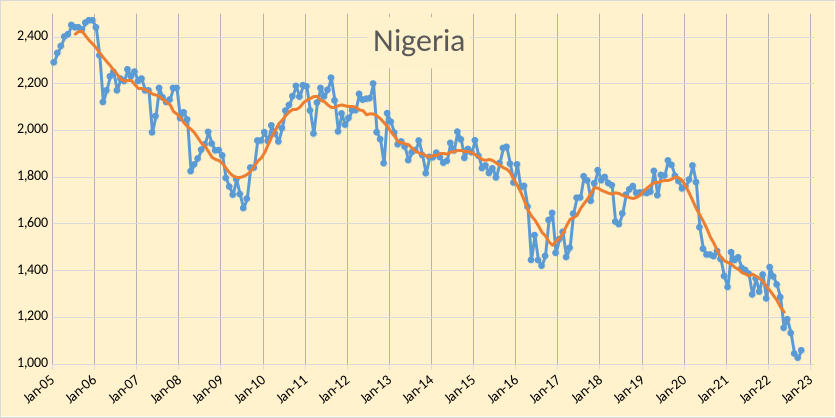

The OPEC Monthly Oil Market Report (MOMR) for November 2022 was published recently. The last month reported in most of the OPEC charts that follow is October 2022 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In most of the OPEC charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output. I also show a number of charts from the recent World Energy Outlook 2022, published by the IEA in October. I focus on a selection of charts from Chapter 7 of that report which covers oil.

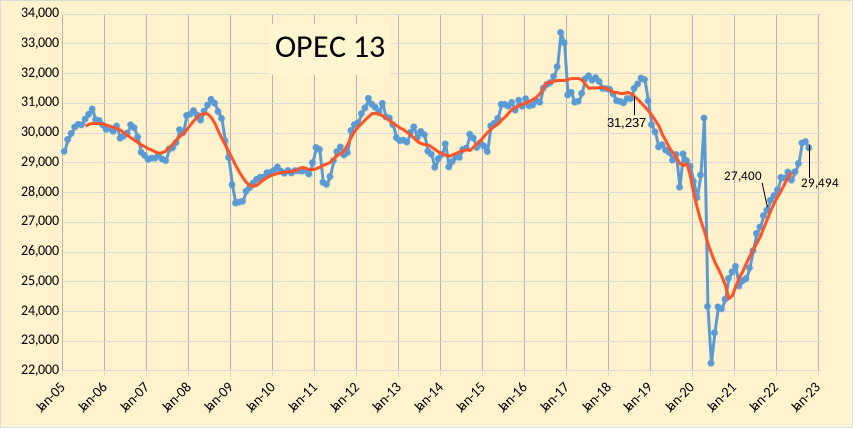

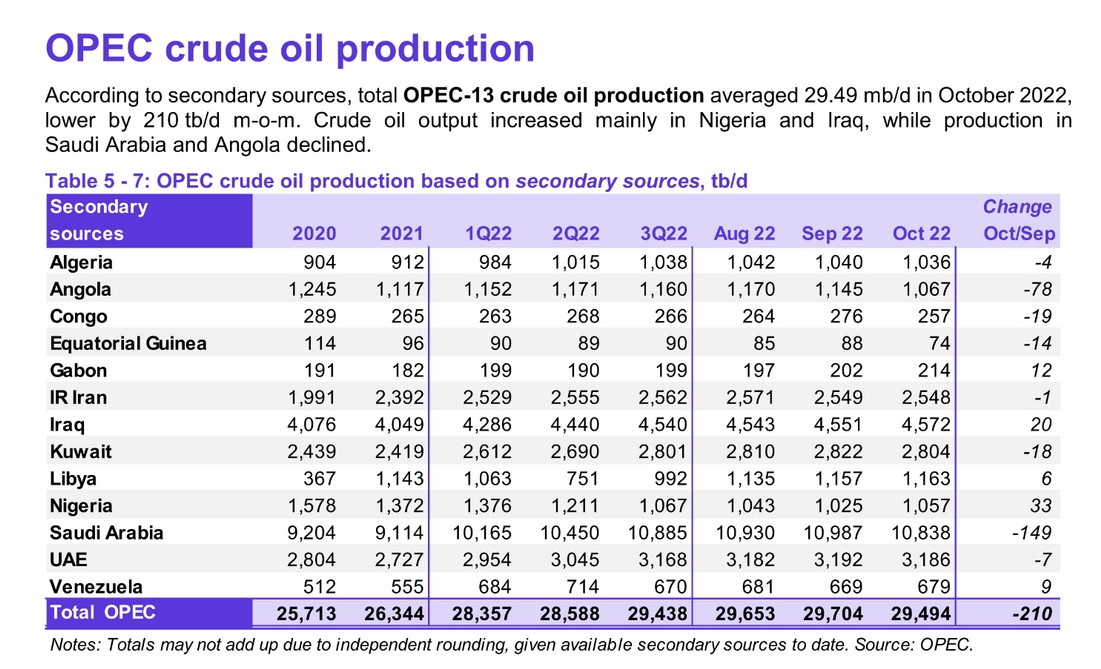

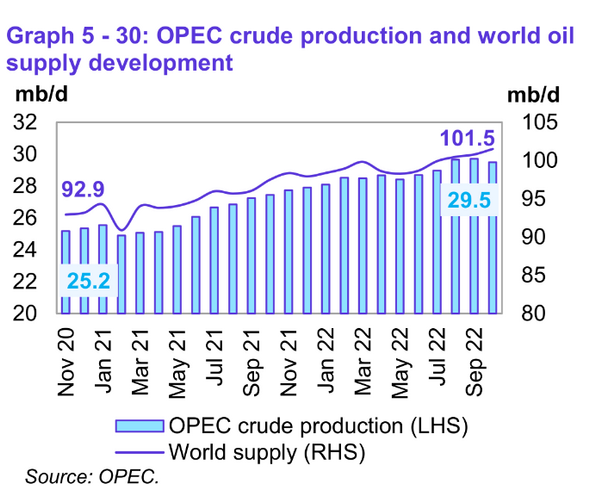

OPEC crude output was revised lower in September 2022 by 63 kb/d compared to last month’s report and August 2022 OPEC crude output was revised higher by 83 kb/d. OPEC output has increased by 2094 kb/d since Sept 2021, from 27400 kb/d to 29494 kb/d. When the World was at its centered twelve month average peak for C+C output in August 2018, OPEC crude output was 31237 kb/d (as shown on the chart), September OPEC crude output was 1743 kb/d below that level.

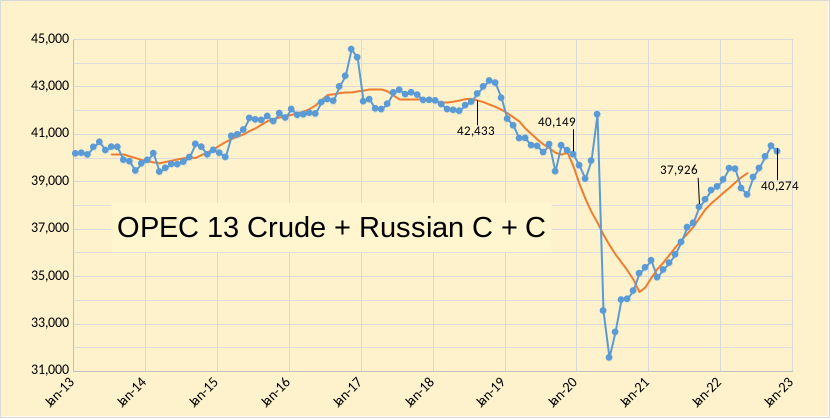

In the chart below we have Russian C + C and OPEC crude oil output. Output for OPEC13 crude and Russian C+C was 42433 kb/d in August 2018 when World C+C output was at its centered 12 month average peak, output for Russia and OPEC was 2159 kb/d below the August 2018 level at 40274 kb/d in October 2022. In the past 12 months OPEC and Russian output has increased by 2348 kb/d from 37926 kb/d in October 2021.

World Oil Suppy (including NGL) was 101.5 Mb/d in October 2022, 8.6 Mb/d higher than output in November 2020, about half of this increase was due to the 4.3 Mb/d increase in OPEC crude oil output from 25.2 to 29.5 Mb/d over the same 23 month period.

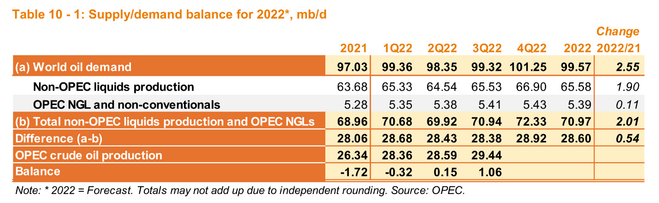

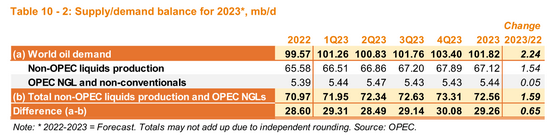

The demand estimate for 2022 was revised from 99.67 Mb/d last month to 99.57 Mb/d this month and 20224Q demand was revised lower by 390 kb/d, with the call on OPEC falling to 28.92 Mb/d for the fourth quarter of 2022, with October output at 29.49 Mb/d, it is clear why OPEC believes that a reduction in OPEC output is necessary. In 2023 the World oil demand forecast was reduced by 200 kb/d from last month’s OPEC report and the call on OPEC remains below the October 2022 output level until the fourth quarter of 2023, with the average level for the year being 230 kb/d below the October output level.

Note also that in the recent Oil Market Report from the IEA demand growth in 2022 is expected to be only 2.1 Mb/d and 1.6 Mb/d in 2023 vs OPEC’s estimate of 2.55 Mb/d in 2022 and 2.24 Mb/d in 2023. If the demand estimates by the IEA are correct, this suggests that OPEC cuts may need to 640 kb/d larger, if the OPEC estimates for non-OPEC supply are accurate.

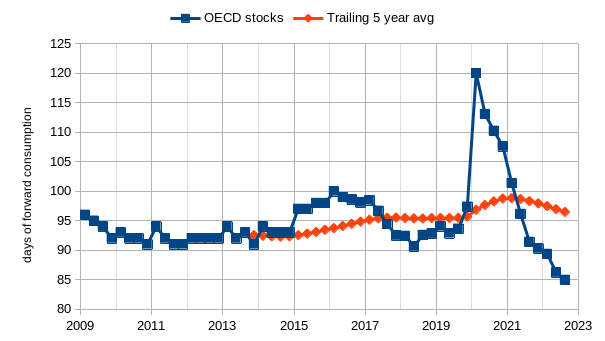

OECD total stocks, including both SPR and commercial stocks have fallen even lower than last month’s estimate to 85 days of forward consumption (last month we were at 87 days). Perhaps stocks will build in the fourth quarter of 2022 and in 2023 as the likely recession may reduce demand for oil. If not, we should expect oil prices to increase.

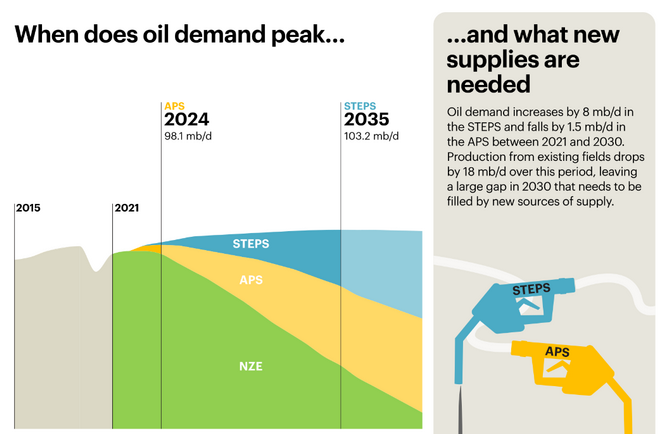

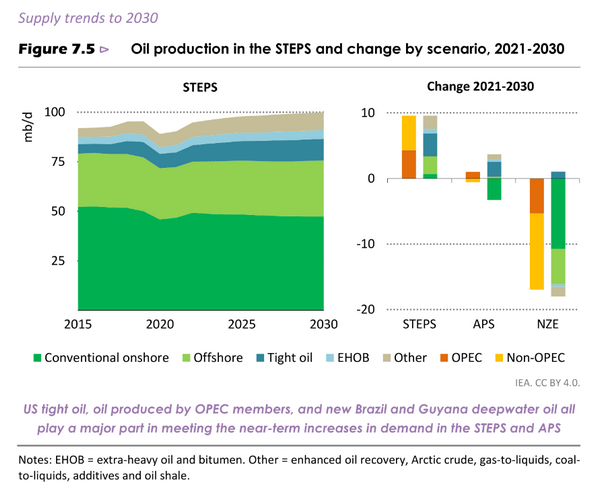

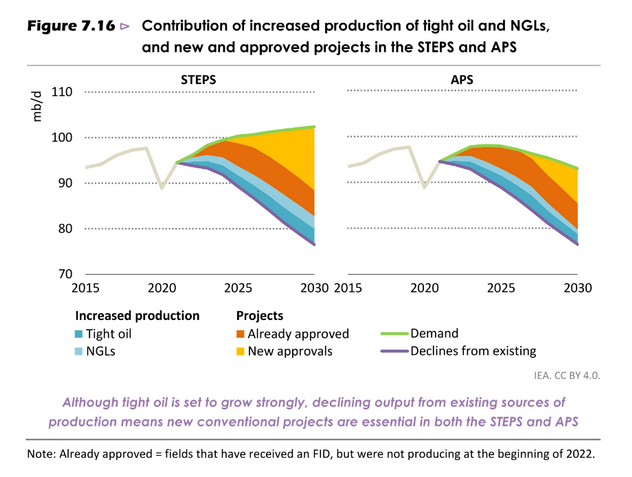

Based on BP data on NGL output and the recent trend in natural gas output and the barrels of NGL produced per MCF of natural gas production recently, I estimate that the peak for the APS scenario in 2024 corresponds with World C+C output of about 84.5 Mb/d. I did not try to estimate for the STEPS scenario as it does not seem realistic, likewise I am skeptical that the NZE scenario can be achieved, but hope I will be wrong. Something roughly midway between the APS and NZE scenarios might be achievable in my opinion.

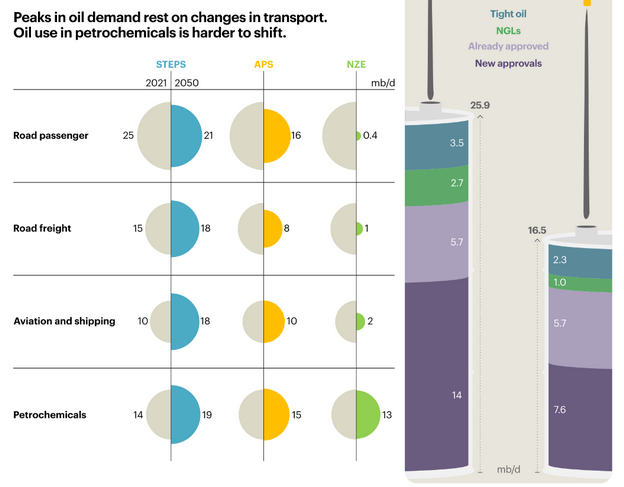

About 26 Mb/d of new oil output is needed between 2021 and 2031 (see right side of figure 8) and in figure 9 on the right side it shows how this supply gap will be filled for the STEPS and APS scenarios. On the left side of figure 9 it shows how demand is expected to change in various sectors from 2021 to 2050 for the 3 scenarios.

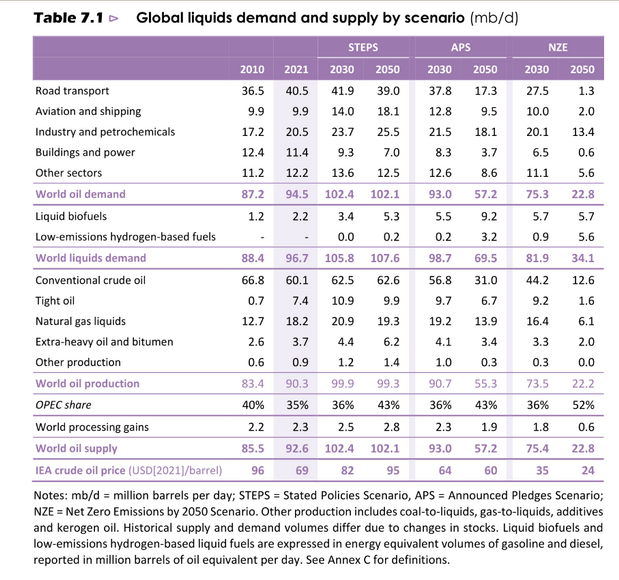

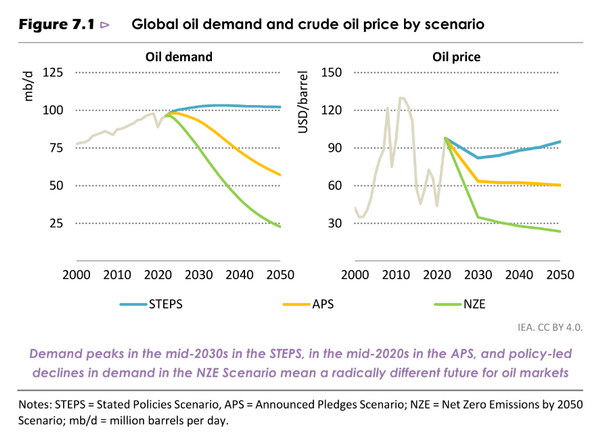

Demand and supply for oil for the 3 scenarios is covered in figure 10 above.

Oil demand in figure 10 includes NGL, at the peaks C+C output would be roughly 14% lower. Note the difference in oil prices in the three scenarios in the right panel of figure 11.

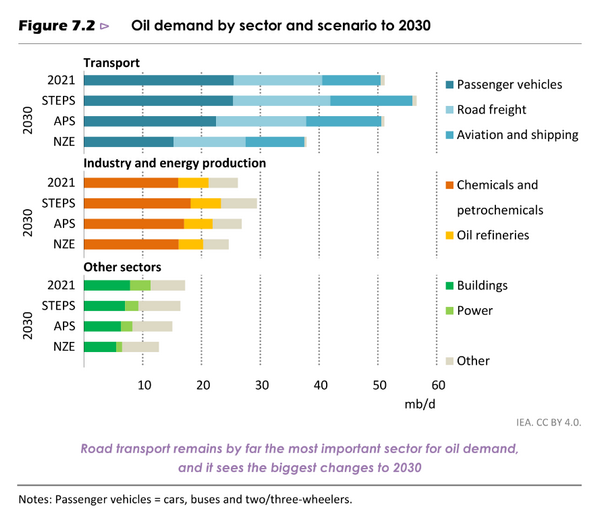

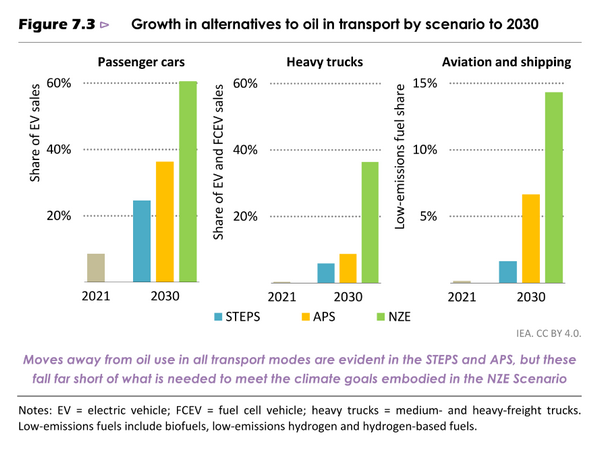

Note that by 2030 only the NZE scenario has a significant change in oil demand in the transport and Industry and energy sectors relative to 2021, there is a slight decrease in oild demand in the “Other Sectors” demand in both STEPS and APS, with the highesr reductions in the NZE.

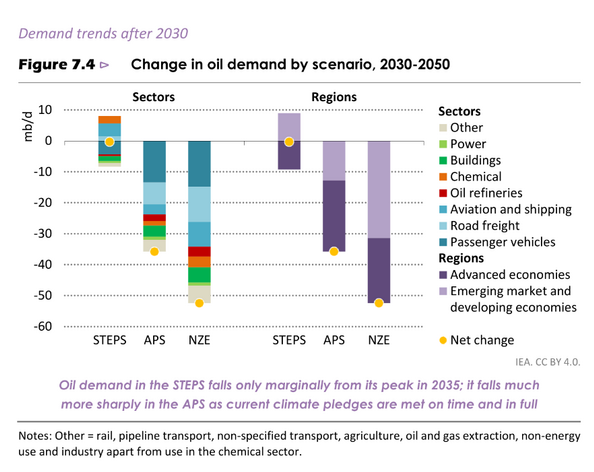

Chart above focuses on changes from 2030 to 2050 where the previous 2 charts looked at changes from 2021 to 2030.

The panel on the right looks at changes for the 3 scenarios from 2021 to 2030.

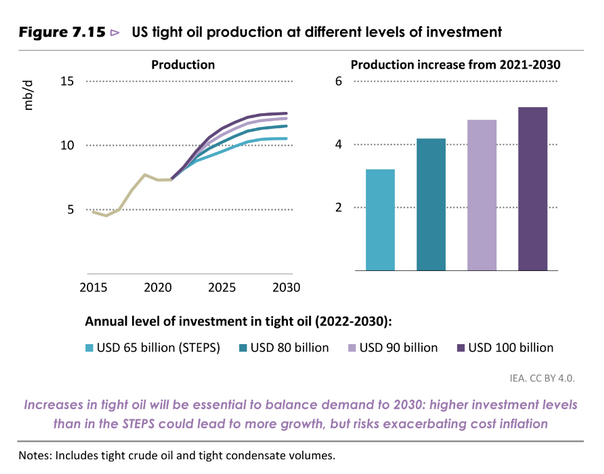

My best guess scenario has US tight oil output at 10.7 Mb/d in 2028, between the two lowest scenarios shown in Figure 16 above with the difference that my scenario has output decreasing to under 10 Mb/d by 2030.

To me the APS scenario with no new approvals looks reasonable, that would put 2030 output at about 73 Mb/d for C+C (85*.86=73 Mb/d). Between 2030 and 2040 I expect demand for oil may be falling eevn more rapidly and the decline curve may steepen.

239 responses to “OPEC Update, November 17, 2022”

Earlier today oil futures for DEC 22 and JAN 23 slipped 6 cents into contango. Now think about how tight supply is right now.

Just another sign inflation isn’t what we should be worried about.

HHH

That is just a one day event. The WTI contract flips on Monday. Once January becomes the front month, it will be back into full backwardation.

There appears to be a discrepancy of roughly two million barrels per day in the production/consumption data between Table 10.1 and Fig. 7.

Am I missing something?

Old Chemist,

The difference is biofuels and liquid hydrogen. Look at the oil demand and oil supply rows in table 10 and the numbers match.

Fig 7 is oil only, biofuels and hydrogen are excluded.

Dennis

Sorry, I did not explain my question very well. From table 10.1 the 3Q balance is 1.06 million barrels per day of total liquids surplus over consumption, which should lead to an increase in liquids inventory of close to 100 million barrels, but in figure 7 oil inventory decreased by roughly 4 days of consumption which is roughly 90 million barrels. There is surely no storage capacity for that quantity of biofuels and hydrogen, nor any commercial incentive to do so. It is that two million barrel per day gap that has me puzzled.

Old Chemist,

Sorry I misunderstood your question.

The chart with OECD stocks in days of forward consumption only covers OECD. Unfortunately we do not have good data for World petroleum stocks.

You are absolutely correct that if OPEC estimates for World Supply and Demand are accurate for 2022Q3, then World oil stocks would have increased. If we assume OPEC estimates for oil production and consumption are correct and that the OECD stock estimates are also accurate, then this would suggest that non-OECD stocks increased in 2020Q3.

Old Chemist,

A correction to my second comment from 11/20 (2:35 pm USET). I missed oil on water as outlined below. World petroleum stocks increased in the third quarter of 2022, this explans both the fall in oil prices and OPEC’s decision to reduce oil output.

If we look at total barrels rather than days of forward consumption it is easier to make a comparison. OECD total stocks decreased by only 7 million barrels from 2022Q2 to 2022Q3, but oil on water (in transit on tanker ships) increased by 96 million barrels so we have a net stock increase of 89 million barrels in the third quarter of 2022. This matches fairly closely to the OPEC estimate for supply and demand changes from the second to the third quarter of 2022 of about 97 million barrels, the 8 million barrel difference may be due to an increase of 8 million barrels in non-OECD petroleum stocks which are less transparent. This assumes the OPEC estimates for third quarter 2022 World supply and demand for petroleum are accurate.

PeterEV posted a link from ExxonMobil and stated:

According to Exxon Mobil, we will be peaking in **world** crude oil production around the year **2032 ** (was 2040 for many years prior to this). The link:

Energy supply

He was mistaken. Peal oil supply was not mentioned in the text but there was a graph titled:

Liquids supply highlights the need for investment

Global liquids supply by type – million oil-equivalent barrels per day

The chart clearly showed that C+C peaked in 2018. That is conventional crude, plus deepwater, oil sands, and tight oil.

“Liquids supply highlights the need for investment …” – says the company which has committed thirty billion dollars over 2022 and 2023 to share buy backs (enough to add about 500 kbpd if the sort of projects from the 2013 bonkers period were still available, but they aren’t because discoveries have virtually disappeared, but that is never acknowledged, and never will be, in any of these glossy future scenario brochures from the majors.

Ron, looks like a honest graph till present, then the lines are getting straightened and the volumes are blown up. Especially – but not only – conventional oil will diminish much faster. So again, the peak took place exactly four years ago. We are watching in real time how societies are working their way out of this mess. And it’s not a nice exhibition of reason and common sense.

true

‘philosophers have only interpreted the world, in various ways; the point, however, is to change it’.

-Friedrich Engels

The rest of that shit above “tight oil” ain’t even oil, amirite?

Yes, and condensate is combined with crude under tight oil, and you can’t sell that stuff as oil either.

I think this chart should shock everyone. Just look at the slope of the chart below tight oil. That slope peaked around 2016 and will never get anywhere near that 2016 point again. However the chart also shows tight oil holding at about 10 million barrels per day until 2050 without any decline whatsoever. In fact nothing declines after about 2024 except conventional oil. And NGLs and biofuels both increase. Is that reasonable? We will turn all that food producing land into fuel producing land. And we just hit 8 billion population this month.

Ron

Below is an attempt to get an estimate of the decline shown by XOM for conventional crude plus condensate. On the attached chart, a red line has been placed over the post pandemic decline period. Note that I have chosen the post pandemic period to estimate the decline rate since there is a step drop in production in the order 2 Mb/d to 4 Mb/d between the pre and post pandemic periods due to damaged wells.

The red line in the attached chart shows a steady decline from 2022 to 2050. Production in 2022 is close to 60 Mb/d and in 2050, 50 Mb/d. A 10 Mb/d drop over 28 yrs or 0.357 Mb/d/yr. This is smaller than the 0.5 Mb/d/yr to 0.7 Mb/d/yr when using EIA data.

It is also much smaller that the 7% decline rate XOM mentions in the article.

“The natural decline rate of existing oil production is 7% per year. Significant investment is needed to offset this decline and meet the projected demand growth.”

Assume that the 7% applies to fields that are past peak. If half are past peak, 40 Mb/d, that means decline is 2.8 Mb/d in these fields. With the red line showing decline of 0.357 Mb/d, that implies that “significant investments” noted by XOM are needed to find/add at least 2.5 Mb/d/yr to stay on the low decline rate of 0.357 Mb/d.

The blue line tries to pick off the Post Pandemic peak for C plus C where it intersects the tight oil contribution and is lower than the November 2018 peak. It is in the 2032 to 2033 period.

The chart indicates that XOM thinks that all liquids will peak around 2035 due to growth in NGLs, excluding biofuels.

I tried to upload a small graph (jpeg) but it didn’t work. Can anybody give me a hint?

Westtexasfanclub,

save file as a jpg or gif and reduce the size to less than 60 kB.

Thank you Dennis, I gave it much more compression. I also “compressed” the graph from 2022 to 2050 about 10%, nothing scientific, just by gut feeling. But we know theses predictions are mostly on the rosy side of the probabilities, and now it looks a bit more realistic to me. Just my 2 cents …

Wes, a gif can be posted when the same-size jpeg cannot. Gifs use less than half the data of a jpeg, so therefore you can often post a graph or anything else as a gif when you cannot post it as a jpeg.

Westtexssfanclub,

I agree the Exxon scenario and the STEPS scenario from the EIA are not realistic, I think APS is pretty good, but I think it may be lower if good policy is adopted to reduce demand.

This is a similar graph but published in 2016:

Nov 17 (Reuters) – The Organization of the Petroleum Exporting Countries (OPEC) is “back in the driver’s seat” as the top swing producer amid slowing U.S. shale growth, Hess Corp (HES.N) Chief Executive Officer John Hess said on Thursday at an investor conference in Miami, Florida.

https://www.reuters.com/business/energy/hess-ceo-says-opec-back-drivers-seat-us-shale-growth-slows-2022-11-17/

Ron, I am afraid solar panels are already competing with corn and soybeans.

I’m stunned there is almost zero planning as to where all the solar panels will be installed. I have seen solar farms covering the most highly productive soils in Indiana, Illinois and Iowa.

These solar landmen offer a ton of dough. It’s more Wild West than leasing shale, I bet I have received offers from over 20 different companies. Many with Washington DC addresses.

“I’m stunned there is almost zero planning as to where all the solar panels will be installed.”

I agree. It is similar to how all other industrial uses of land goes- money over ecology, so maybe it shouldn’t be too surprising.

On the other hand, not too many people seems concerned about corn ethanol landuse. Roughly 30 million acres of prime farmland is diverted to ethanol production with a very poor net energy yield/acre. Solar on 1/140th as much of marginal lands (sparse grazing) could yield the same amount of net transport energy/yr.

According to SHift Project, the peak of gas production will be around 2030. This graph is also irrelevant for this.

another chart from exxon

The space in the gap reads: “New oil supply required to meet global needs”. Hell, no one could possibly argue with that. In fact my guess would be we would need a lot more than that. It all depends on world economic expansion and the progress of renewables.

But what we will need says nothing about what we will get. That is another story altogether. 😫

Dennis

Using 92 Mb/d in 2021 and 15 Mb/d in 2050, gives close to 6% annual decline rate. A slightly lower rate than stated by XOM above. Maybe the numbers I guesstimated are wrong.

Ovi,

I cannot find the data behind the charts,

Often it is difficult to estimate from the charts accurately.

Dennis

I agree. I just made a rough guess at the numbers to see how close it was to 7%.

To meet that sort of development pattern would require about 600 to 700Gb of new production coming on line. Last year we discovered just over 3Gb. This year has been better but a linear trend of discoveries over the last ten years reaches zero before 2030. This year has also been just about the worst ever for lease sale uptake.

George,

Based on data from Laherrere there are 800 Gb or so of TRR, his estimates tend to be conservative and there may be some reserve appreciation, if oil prices are high and as resources are developed. I doubt demand will be high enough to support the Exxon scenario.

That Exxon projection jives with the observations/prediction that Ron has been making for the past years regarding peak oil production.

What may be very surprising to most is just how long and thick that tail of liquid fuel production potential is.

I have no idea what is underground, but that shallow decline rate for global liquids production

is pretty shocking. My ‘belief’ is that is it wildly optimist, but belief isn’t worth a dime.

For one thing- this graph of supply means a huge amount of carbon still to be injected into the atmosphere.

Secondly- the yellow segment of Biofuels is an utter shitshow for the environment and habitat.

Hello Ron,

I just responded to your comment from the other post with this

Hi Ron,

I agree but 2018 & 2019 are past and there is an increasing amount of supply according to Exxon although less than the 2018 & 2019 period. Since we have “survived” that peak so far, I’m focusing on the 2032 secondary peak. After 2032, I appears it’s all downhill and appears to be “permanent” with no tertiary peak insight .

I’m wondering how the electrification of transportation will affect the curve due to the uptake?

We also have about a third of the world’s oil shale where a third of that is supposedly recoverable but needs a lot of water. Will we build pipelines from the Missouri river and/ or Great Lakes to the western Colorado and Utah areas? or will we have enough EVs not to worry about it. Somewhat like OFM, this takes sharper pencils and calculators than I have.

***

With that, Ovi’s presentation details a lot of the underlying dynamics. Very good job!!!

By 2030 there will be another 700 million people on the planet. Double the population of the United States.

With only 7 years to go, how many electric and hydrogen trucks are being made?

Those 700 hundred million more people will need food, clothing and fridges delivered just like Americans expect.

This year an additional 20 million diesel and petrol vehicle are driving in the world and who knows how many more motor boats ships and planes.

700 hundred million people will want their share and will strive for it.

China now uses half the coal in the world 15 million barrels of oil and ever increasing gas.

In order for these 700 million people to have the same electricity as Americans the equivalent of all U.S. wind power would need to be built every 6 months. If they drove electric cars and there were electric trucks just for those 700 million then that would need to be done every 3 months.

People simply do not understand the scale of the problem

Americans consume about twice as much energy per capita as EU countries without having a higher standard of living.

Depending on how you view it, it might actually be quite a bit lower, on average at least…

Part of living standard is home size and many people want to live in larger homes. That is why we have over 100,000 extensions built in U.K each year. Which take more energy to heat.

I am not sure that the population will keep on growing at this rate. Several factors are going to slow this : the impact of the increasing number of droughts/floodings in the world with the climatic change; the decrease of oil, gas and coal supply. We are post peak for oil production; we are in the middle of the coal peak production (every categories) and the peak of gas production should be in 2030. We are going to be in a swamp of economic stagnation which will not be favorable for birth, including the third world countries.

Population growth is falling by About half a percent per year, only 80 million more people this year.

Even if they used half the electricity that Americans use all the installed wind production in Europe would have to be built each year just to meet population growth. This assumes all electric transport to prevent 2.5c warming.

There have been terrible famines poverty in the past, which did not stop global population increasing from 1 to 2 billion etc

The ghost of Joseph Goebbels. Repeat a lie often enough. “Increasing floods and droughts due to climate change “. The truth. Output per acre of all, I repeat, all food stuffs has grown steadily over the last 20 years world wide. India has had 5 record harvests the last five years. Sorry to say but your not going to get what you wish for.

A more careful analysis of the data yields definite limits to growth in food production:

https://theproudholobionts.substack.com/p/a-limit-to-growth-in-food-production?utm_medium=email&utm_campaign=cta&utm_source=substack

Industrial food production has probably peaked:

https://theproudholobionts.blogspot.com/2022/07/why-agroecology-is-future-of-food.html

Charles, in 2030 there will be much less cars produced than today. The number of electric and hydrogen trucks will be very small, and most of them will be produced in China.

Transportation will rely mostly on cars produced before 2030, powered by ICEs.

My extrapolation of car production numbers reach zero about 2035.

Berndt

I do not see why car production should go to zero. However once oil production starts to fall in a few years then there simply will not be enough fuel for all the vehicles. Many people will start to drive less but eventually there simply will not be the diesel and petrol for cars no matter what price.

Governments will probably prioritize ships, planes and trucks to ensure global trade in goods continues.

Because the global population increase wind and solar, after 20 years of investment is still only 5% of total energy used.

Demand for gas and LNG is already very high and the likes of China and India will need much more. The global LNG trade is increasing which means gas will go to the highest bidder.

https://www.eia.gov/todayinenergy/detail.php?id=52139

Every country are either using more or in serious decline

http://www.geni.org/globalenergy/library/energy-issues/saudi%20arabia/index.shtml

As oil production falls, those who can afford to will buy electric cars. However they will be competing with homes and businesses to charge their cars.

It will be an interesting decade

Will there soon be a blog site called Peak gas tank? According to French think tank The Shift Project, the peak of gas production should be around 2030. They will make a webinar about this December 6. https://theshiftproject.org/article/invitation-rapport-gaz-2022/

Thanks for all that info Dennis.

There is much confusion regarding the term Demand.

Up to the current day it actually means Consumption.

I don’t know how the poor choice of terminology came into common use.

Consumption level of petroleum products reflects various factors including status of the economy, supplies available, end user behavior, population size and prosperity. and a new factor is just starting to come to play- EV replacement of ICE vehicles.

When we look at these future projections- there is no distinction made between product available for purchase vs product desired for purchase.

Demand is the amount of a product consumers are willing to buy at a given price. That’s the economic textbook definition. It is not a constant value. Demand rises when the price falls and falls when the prices rises.

Alim- yes that is the economic definition, but that is not how the term is used in the oil supply/consumption context.

That point seems hard for people to grasp.

As I write this comment it’s 4 degrees Fahrenheit in Thunder Bay, Canada. Those 100,000 people’s demand for fossil fuels is a mater of life or death. And it’s only November.

“fossil fuels is a mater of life or death…”

So, what will people in these cold winter areas areas do when fossil fuels no longer are available or affordable to import to their region?

After the lignin box cars sit empty in the rail yards, they will go back to wood.

All out.

With todays population levels it will take less than a decade to strip the north woods bare.

A terminal deforestation event.

I dunno, insulate their homes maybe?

Well, people lived there for many thousands of years without oil—

Our limited view, and declining genetic fitness, has repercussions.

Well, people lived there for many thousands of years without oil—

Eight billion people most certainly did not live anywhere for thousands of years without oil.

Yep, over 200,000 years, our population was 1-5 million, with a near ET 65,000 ago.

We don’t have the ecosystem health for those levels now.

Hickory,

You’re welcome.

These projections assume that supply and demand will be balanced at the projected oil price level. Note the figure that shows oil prices for the 3 scenarios along with C plus C plus NGL output for each of the scenarios, figure 11 in the post( IEA figure 7.1).

I think there is a big disconnect on this aspect.

The charts of predicted production look far too high for the given price levels expected in that Fig 11,

as I see it.

I think it will take considerably higher pricing to get that level of production, with either the steps or aps projections.

https://www.youtube.com/watch?v=DcxPB_kekn8

Peter Zeihan is bullish on Houston. 2 minutes and oil focused.

Recharging a Tesla in Kyiv

Recharging a Tesla in Kyiv

Sums up our current situation to a tee

If he has to recharge using a generator, it’s likely the gasoline stations are without power too.

Dennis

Thanks for the IEA outlooks charts.

I don’t get STEPS in Figure 11. Is STEPS BAU since demand stays steady at above 100 Mb/d and the price of WTI rises after 2030.

In APS, It appears the world is at peak demand/consumption now and drops going forward. Also the oil price is falling out to 2030. Is this because supply exceeds demand and prices drop trying to increase demand?

Ovi,

You’re welcome.

Prices drop because of too much supply at STEPS scenario oil prices. Prices drop to balance market, reducing output and increasing consumption relative to higher oil prices, essentially a chabge in policies reduces demand in APS and a different set of policies for the NZE scenario reduces demand by mre than the APS.

STEPS is more or less BAU, the World peak for C plus C is 2024 for APS about 1 Mbpd above 2018. I doubt that is realistic as 2022 will probably be about 80 Mbpd for annual average C plus C and that would require a 2 Mbpd increase for 2023 and 2024. A more realistic scenario in my opinion is for oil output to reach between 83 an 84 Mbpd by 2027/2028, CTMA peak in Jan 2028.

A rough summary of the WEO 2022 oil price scenarios after 2030 is

$90/b for STEPS

$60/b for APS

$30/b for NZE

NZE is not even worthy of a comment by a reasoned intelligent person.

Ervin,

NZE is aspirational to limit damage from climate change.

Intelligent people think this is the best of the three scenarios, though it will be difficult and perhaps impossible to achieve.

See Great transformation by Tony Seba on You Tube.

Many think his projections are absurd, but some of his projections from 2014 have proven fairly accurate.

Time will tell if his current projections are as good as those in 2014.

Dennis wrote: I doubt that is realistic as 2022 will probably be about 80 Mbpd for annual average C plus C and that would require a 2 Mbpd increase for 2023 and 2024.

Okay, so a 2 million bp/d increase would be required for 2023 and 2024. But what is your prediction for the world average of C+C for 2023 and 2024? Will that requirement be met? If not, how close will the average come to that requirement?

Remember, I am predicting a decline in world C+C production in 2023 compared to 2022.

Ron,

Just saying that in order for the APS to be correct the average increase in oil output would need to be 2 Mb/d, if my guess of 80 Mbpd for 2022 is correct.

I believe I said 83 to 84 Mbpd by Jan 2028.

So 2024 might be 81.3 Mbpd with average annual increases at about 636 kbpd in World C PLUS C up to Jan 2028. This is folled by decline in output as demand falls below supply and oil prices start to fall in 2028.

Dennis

So you have changed your mind again? Now you think global demand will start falling before geological Peak Oil?

In other words, you think the extra 400 million people on the planet in 2028 will effectivley use no oil.

Looking around my house and office, the computers are made of plastic, the double glazing is made of plastic, TV, carpets etc. All the food grown for the 400 million extra people will need fertilizers and pesticides. Only diesel tractors and combines can work all day to plant and harvest all that food.

How much more shipping will we need and only a diesel truck can drive 500 miles and take 5 minutes to fill up. Anything else would add hugh costs which people already cannot afford.

Charles,

The parts of the World with growing population tend to use less oil per capita, the areas with higher oil use are using less oil.

Yes I have changed my mind. When I see new evidence I adjust my expectations. I have gradually come to the conclusion that the progress in replacing oil used for land transport might lead to demand falling faster than the supply of oil. I do not think it will happen as fast as the APS scenario, but I also do not believe that supply will grow as fast as predicted by the IEA in the STEPS or APS scenarios.

Note that the fall is output predicted in the scenario below is due to lack of oil demand as the World shifts to other forms of energy for land transport (including both private and public transport). Oil price start to fall by 2029 due to demand growing less than supply at 2028 oil prices.

There will be plenty of oil for farms and plastic. Note that the main petroleum input to plastic is ethane and propane (these ar part of the NGL stream) which mostly is associated with natural gas production.

Click on chart for larger view

Dennis-

that updated projection, which reflects a combination of supply and consumption factors, looks entirely reasonable.

I applaud your continual search for reality, rather than being one who is stuck in their preconceived mire.

I take no sides on whether peak global production was a few years ago or a few from now, since I can’t see underground or predict the behavior of nations. Regardless of that small point, the big point on this remains the arrival of peak plateau by around 2015. We are there. The clock is ticking on making the big adjustment.

Hickory,

Thanks, yes it is roughly a plateau from 2013 to 2031 with output between 76 Mb/d and 83.5 Mb/d and average World C plus C output over those years of 80.8 Mb/d (if my scenario is correct and that is highly unlikely).

I agree the World recognizing this and adjusting policy goals to reflect this reality is the important point. Whether the peak was in 2018 or some future year (2027 in my most recent scenario) will be of little consequence.

Putin’s war sabotages Russia’s energy future Bold mine

Russia’s share of internationally traded energy is projected to decline more than 7% over the coming decade, thanks to economic shifts resulting from Russia’s war against Ukraine.

In a recent report, the International Energy Agency (IEA) says that Russia’s war sparked a global energy crisis that will significantly reduce Russia’s own future energy exports.

“Russia has been by far the world’s largest exporter of fossil fuels, but its invasion of Ukraine is prompting a wholesale reorientation of global energy trade, leaving it with a much-diminished position,” IEA says in an October 27 statement announcing the release of its report, World Energy Outlook 2022 (PDF, 13MB).

“Russia’s share of internationally traded energy, which stood at close to 20% in 2021, falls to 13% in 2030,” the IEA statement adds.

In its 2022 outlook, IEA projects Russia’s oil production in 2025 will be 2 million barrels per day lower than in its 2021 outlook, issued prior to Russia’s full-scale invasion of Ukraine. That’s a 17% drop in projected production from 11.45 million barrels per day to 9.46 million barrels per day.

Meanwhile, Russia’s projected natural gas production for 2025 is 23% lower in the IEA’s 2022 outlook than in its 2021 report, with projected production levels dropping 200 billion cubic meters, from 859 billion cubic meters to 656 billion cubic meters.

The IEA also estimates that by 2030, Russia’s share of internationally traded oil and gas will have fallen by half compared to 2021 levels. “Russian fossil fuel exports never return — in any of our scenarios — to the levels seen in 2021,” the report adds.

Russia’s oil exports never return because their oil production never returns to 2021 levels.

Russian C+C 2021 production was 10,275,000 bpd according to the EIA and 10,514,000 according to the Russian Minister of Energy. The levels cited above by the IEA are obviously total liquids. A 2 million barrel per day drop in C+C production would put Russian C+C production at from 8.25 to 8.5 million barrels per day.

Ron,

I guess we can pick and choose which IEA projections to believe. The Oxford Institute for Energy Studies has a different projection for Russian output.

https://www.oxfordenergy.org/publication-topic/oil-monthly/

OIES expects Russian Output in 2022 to average 10.67 Mbpd in 2022and fall to 9.83 Mbpd in 2023. Not sure what their long term forecast is, much depends on the state of future oil sanctions.

The Last Time This Happened

In December 1991, the Soviet Union collapsed. At the time, Russia, less the rest of its empire, was producing about 8.3 million barrels per day. But a lot started happening; their production began to decline. In the following six years, Russian oil production dropped by over 2.5 million barrels per day. It took them another eight years to fully recover. That was twelve years from the day all their foreign expertise pulled out to recover fully.

To anyone who believes that if the war ends soon and sanctions are lifted, Russia will go right back to producing as much as before, then you are badly mistaken.

Ron,

The transition from socialism to capitalism takes time. The situation is not comparable to today.

Of course, it’s comparable to today. The political system had very little to do with it. Russia, under socialism, treated the oil fields just like a capitalist would have done.

The repair of the Russian oil system will take at least a decade. The destruction has only begun. That will take at least half a decade. You will see, at first, a sharp decline because of sanctions. Then there will be a further slow decline due to the lack of imports of spare parts as well as a lack of Russian expertise in the oil patch.

Ron,

You seem to think there was a seamless transition from the Soviet Union to the current state of affairs.

I think you need to review the history, maybe a historian can comment. There was a large degree of social turmoil and corruption that occurred in the 1990s in Russia.

I disagree that the situations are even remotely comparable.

https://en.m.wikipedia.org/wiki/History_of_Russia_(1991–present)

There was a large degree of social turmoil and corruption that occurred in the 1990s in Russia.

What we are talking about, Dennis is turmoil that could affect oil production. And just what do you think is happening right now in Russia? You seem to think that the major oil companies and oil service companies all leaving will have no effect on oil production. And Russian oil field workers are leaving as fast as they can. And many of the ones that are staying are being conscripted into the army. And of the few that are staying, food and supply shortages are deeply affecting their lives.

But I do agree with you on your last point: The situation today is not comparable to what happened in 1992; it is far worse.

We can’t have it both ways. The name of this place is Peak Oil, which most people seem to think has already hit and we’re now experiencing a decline in global oil. Ad infinitum we have heard testimonials about the misery in Europe. Fertilizer is scarce. Electricity to modulate temperature extremes is expensive. In America, diesel is in short supply, the SPR has been tapped.

If and when the time comes when we are truly going over the Seneca Cliff that the Italian think tank came up with, it won’t make a damn where the energy comes from, there will be a market for it. At that point the pressure will be on Exxon to send its crack engineers back to Sakhalin Island. The Europeans will be quick to forgive and forget Putin’s treachery.

After all, because of the U.S. administration’s quest for cheap and abundant oil, it has been decided that Mohamed bin Salmon cannot be held accountable for the atrocious murder of Jamal Khasshogi. This is only one murder, not hundreds as in Ukraine, but still, the analogy is obvious.

Neither you nor I can say it out loud without a beef-fed, steroid-pumped meathead in a lifted, quad cab, dually diesel pickup yelling at us but we know we’re mostly wasting a one time bonanza of the most useful substance ever discovered by humans. Well, clay might come close.

Many of us are going to miss the worst of the Seneca cliff (I’m around your age and just bought your book) but good goddamn, I’d like to give the kids some hope. The ones that survive, I mean. Almost certainly, billions of them won’t but millions might. Have you ever looked at Devon cob dwellings on the English coast? Some have withstood North Sea gales for 600 years. They’re small but constitute a large thermal mass that tends to retain heat unlike a stick frame house with fiberglass insulation.

Nothing close to a solution, I know. Just something I’m interested in. For the kids.

Teholder, much is going on with cob and I will post this here even though it’s not oil related, please excuse me. New international residential codes were approved for cob in 2021 (www.cobcode.org). I am a general contractor building inspected cob homes in North Carolina, feel free to reach me through my website and I can get you up to speed on this topic if you want to learn more as I agree building with local clay has vast potential for affordable energy efficient housing for much of the worlds population. (www.kthonik.com)

GERRY MADDOUX,

Just for grins, here’s the link to your (I think) book which I just bought because I think so highly of your comments here and am of the age to possibly benefit from it: https://www.amazon.com/gp/product/0978543653/

I think I’ll pick up MikeB’s book while I’m at it: https://www.amazon.com/gp/product/1736009885/

This is not related to your comment but I wonder why there is no “REPLY” button under the comment of STEPHEN HREN. I’d like to thank him for the link to his website and will be contacting him regarding Piedmont cob.

I slept in and worked on cob dwellings in Oregon and they were magical for the short time I spent in them, extremely thrifty, heated with only sticks burned in a rocket stove. I don’t know about long term comfort or suitability for climates colder than the Willamette Valley in OR.

The Russian fields were badly run under communism, which meant there was a big margin for improvement when the western service companies moved in (e.g. in many cases as easy a decision as adding water flood). That opportunity is not there now, the fields had been optimised as much as possible and appeared to have entered decline. That decline is still ongoing, even if it is masked by the cut backs due to sanctions. In fact it is almost certainly accelerating without western expertise, equipment and software, and as the Russian engineers are conscripted (and I’d expect have a fairly short life expectancy if they are sent to the front), or try to leave the country as soon as possible. This year that were no lease sales in Russia after several years in which it had the largest single leased acreage, presumably much of it to western IOCs and therefore now void. If the sanctions last long enough the decline will eventually catch up and there will be small chance of recovering any lost production, the best may be just to be able to balance the decline with new developments on some plateau, at a lower level than the recent peak, and all that is likely to depend on how quickly and how well the Yamal deposits can be developed. Ukrainian sabotage, permafrost melt and the exponential growth in wild fires may also have negative impacts that are difficult to foresee at the moment..

Thanks, George. I am glad someone else on this blog understands Russia’s current problem. If Putin had any idea of the problems he would cause when he invaded Ukraine, he would never have done it. But now he is in a real pickle. He is too proud to back down and too weak to finish the job.

And the whole world will suffer. It is not just the oil that the world will lose but also the food produced in both Ukraine and Russia. I have seen many predictions of famine in Africa and possibly many Asian nations.

“If Putin had any idea of the problems he would cause when he invaded Ukraine, he would never have done it ”

Certainly. Russia would have been much better off just riding the global fossil fuel dependency for another decade or two. But Putin wanted to begin the restoration of the Empire for the sake of his personal legacy.

Huge mistake for the nation.

Careful when you vote- for those who favor the drift toward autocracy folks.

As economic growth reverses, oil decline really sets in, climate change accelerates and the bright green revolution is shown up to be a rather sickly chartreuse (https://go.ind.media/webmail/546932/1196565636/37fe2e51f16e0e16c33bd2ffc0eceb1409604fabfbd15f982c8092685091087a), a lot of world leaders are going to be seen to be making horrendous mistakes or shown up for their true incompetent, venal selves – look at the endless “worst PM ever” kakistocracies we have in the UK. Thatcher is much lauded but she just got lucky (or unlucky for the rest of us as she and Reagan stuck us with neo-liberal economics, financialisation of everything etc.). She had the benefit of: the take off of North Sea oil and gas; a very high and rising ratio of tax payers to dependents as the baby boomers were moving from education to earning, women increasingly entered the workplace and the few new retirees were from a small cohort born, and often quickly killed off, during WWI through the early twenties; the early effects of the technology revolution; and at the end maybe the beginning of the influx of dodgy money from Russia and elsewhere as London became the world’s money laundering centre – though it didn’t help her much, more so Blair. If she was around now she’d be floundering as much as the rest of them.

George- I had come across that linked article before seeing your post, and had thought of you when I read it.

If I understand your perspective- I think they cover it well. Yes?

Near the end they say the following. Not sure if you agree with this point.

” In essence, we need renewables for a controlled soft landing. But the harsh reality is that, for now, and in the foreseeable future, the energy transition is not going well and has poor overall prospects.”

I find this viewpoint has a lot to take seriously. Unfortunately… and there are no other good or better options.

Another path to the same article. Worth the read for the sake of digesting reality.

https://www.resilience.org/stories/2022-11-22/the-renewable-energy-transition-is-failing/

We need renewables for a soft landing but we don’t have enough to even maintain our present growth rate as our infrastructure decays away, assuming adequate fossil fuels continue to provide the necessary energy, therefore we are not going to have a soft landing. We don’t have enough resources in the ground and we certainly don’t have enough mines or processing plants, or the time to build them. We are not just short by a bit, it is orders of magnitudes for some metals. And this is just to build out the first generation replacement power generation for fossil fuels. The ERoI of renewables is not enough to allow us to live even close to our present standard and we are not going to collectively accept that, so violence is inevitable.

However, a soft landing actually requires much more, in particular raising the world’s poor to middle class status so they, in theory, have fewer children and consume less, and building out from scratch the largest industry ever seen to remove carbon dioxide from the air. We are heading for three degrees warming and I think that is incompatible with a steady supply of cereals at scale, which means without removing the CO2 there is no civilisation in the long run.

All this is supposed to happen while we are running out of water, soil and fish; poisoning every living thing with everlasting plastics, acidifying the oceans, killing ever larger parts of the oceans and lakes with fertiliser run off and wiping out most of the ecosystems on which we almost certainly rely but in ways we barely understand (and probably never will before they are gone). Presumably a soft landing also implies building out some kind of technology to cover for all those losses too, and hence a whole extra pile of minerals and renewable energy suppliers are required.

The secular millennialist eschatology that we all have an awakening and start helping each either isn’t going to happen. We are going to be at each others throats as soon (i.e. it’s already happened) as we think someones getting something that should be ours. In times of growth we could accommodate psychopaths, sociopaths and malignant narcissists; during contraction they are going to take a horrendous toll and further hinder any hope of ameliorating climate change, resource depletion or any of the other planetary boundaries that have been, or soon will be, exceeded.

Thank you for your commentary George.

Very few could say so much in so few words.

How much military spending will it take to protect each grid substation, transformer bank, water pumping station and grain terminal? Ask Ukraine for a rough estimate.

Saudi Arabia cuts oil exports 6% in month

“Saudi Arabia cut oil exports sharply this month as the kingdom delivers on an OPEC agreement to shore up global crude markets.

Saudi shipments were down about 430,000 barrels a day, or roughly 6%, by mid-November compared with the previous month, according to data from energy analytics firm Kpler Ltd. An even bigger slump of 676,000 barrels a day was observed by another consultant, Vortexa Ltd.”

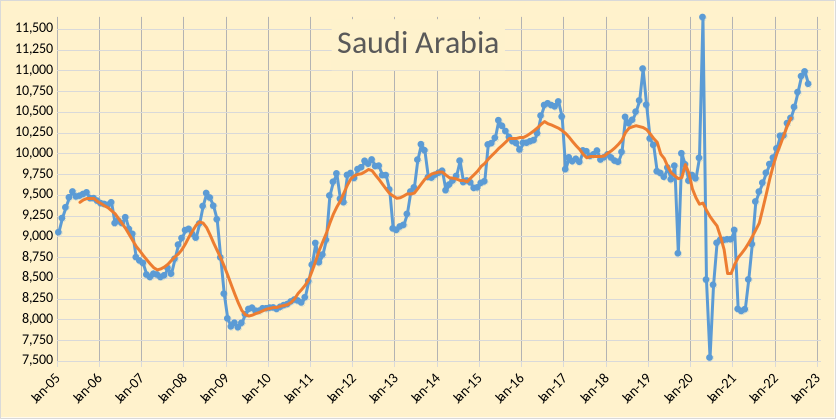

While the above article refers to “shipments” and not production, the average of those two numbers is 553 kb/d. The official drop for SA production in November is 526 kb/d to 10,478 kb/d and the same for December, 10,478 kb/d.

Note that SA produced close to 10,600 kb/d in the later half of 2016 and averaged close to 10,500 kb/d between June 2018 and December 2018.

If WTI can maintain a price range between $75/b and $85/b, it will be difficult for OPEC to justify a change in their production commitments in the first half of 2023. That will give us a chance to see if SA is comfortable producing 10,500 kb/d for a period of over 6 months. However if Russian sanctions kick in and production drops by more than 500 kb/d, OPEC and SA may be forced to increase their commitment and that will begin to stress their capability.

https://www.arkansasonline.com/news/2022/nov/18/saudi-arabia-cuts-oil-exports-6-in-month/?business

On the other hand, this article is saying that seaborne shipments are rising, “Russia’s Shipping Crude Oil Like Mad Ahead Of Sanctions”

https://www.baystreet.ca/commodities/5934/Russias-Shipping-Crude-Oil-Like-Mad-Ahead-Of-Sanctions

Bloomberg explains why Russian oil production will nosedive next year.

IEA Sees Russia Oil Output Nosediving in 2023 on Lack of Markets Bold mine

(Bloomberg)

Russia may struggle to find new markets for its oil once a European import ban kicks in, potentially pushing the nation’s average output below 10 million barrels a day next year, according to the International Energy Agency.

Russia has redirected more than a million barrels a day to India, China and Turkey since many of its traditional customers fell away following the invasion of Ukraine, the agency said Tuesday. Yet flows to those countries have steadied recently, raising speculation they may not be able to ramp up imports further.

Should their purchases remain stable, the rest of the world would need to triple Russian imports to around 3.3 million barrels a day by February, the IEA said in a report. “We do not think this is feasible,” it said, predicting Russia may lose close to 2 million barrels a day of output by the end of March, compared with prewar levels, and pump an average of just 9.6 million barrels a day next year.

Russia’s production in January through October averaged about 10.7 million barrels a day, according to Bloomberg calculations based on media reports and data from the Energy Ministry’s CDU-TEK unit.

The European Union is set to ban imports of most Russian crude on Dec. 5 and refined products from Feb. 5. The move will not only create production risks for Russia, but exacerbate a supply headache for the region as alternative fuel sources may not be enough to fill the gap.

SNIP

Based on October data, the Kremlin will need to find new markets for roughly 1.5 million barrels a day of crude and 1 million barrels of oil products, according to the IEA.

Slick use of loophole keeps Russian oil flowing into Britain

At least 39 cargos, worth more than £200m, have not been declared

A cat and mouse game the IEA may not be aware of.

https://www.thetimes.co.uk/article/slick-use-of-loophole-keeps-russian-oil-flowing-in-798j805mp

Crack spreads must be near a record?

WTI tanking again, while locally gasoline is $3.92 and Highway diesel is $5.69 per gallon.

I assume OPEC+ will cause physical shortages to reverse this trend given the lack of liquidity in the paper markets appears to be the primary driver of cratering crude oil prices?

If that happens, maybe a wake up call?

Chatter going of OPEC production increases.

Saudi denies oil output hike discussion, says OPEC may cut if needed

Nov 21 (Reuters) – Saudi Arabia on Monday said that OPEC was sticking with oil output cuts and could take further measures to balance the market amid falling prices, denying a report it was considering boosting output, according to state news agency SPA.

You have to wonder how much money was made and lost on this rumour

https://www.reuters.com/business/energy/saudi-arabia-eyes-opec-production-increase-wsj-2022-11-21/

Dennis

For global oil demand to fall by 10 million barrels per day by 2035, just under half the cars of the world would have to be fully electric.

https://peakoilbarrel.com/wp-content/uploads/2022/11/749100-1.png

Globally only 40 million ICE cars a scrapped each year, that means by 2035 a maximum of 500 million ICE vehicles are scrapped. Why would anyone scrap as valuable ICE car before it’s time?

Lets say in 2025 out of 70 million cars sold, 34 million fully electric cars are sold and the rest are ICE. This is optimistic as manufacturers are mainly promising to make half of all cars electric by 2030.

pg32

https://iea.blob.core.windows.net/assets/ad8fb04c-4f75-42fc-973a-6e54c8a4449a/GlobalElectricVehicleOutlook2022.pdf

In 2026 if fully electric car sales reach 40 million and 40 million older ICE vehicles are scrapped then for the first time we we see the number of ICE vehicles start to fall.

The only way poorer people will scrap their older ICE cars is because they cannot afford the petrol. Which means peak oil happened before your peak demand.

The most optimistic outlook is for 350 million electric vehicles in the world by 2030 and sales reaching 70% of all vehicles sold. pg99

https://iea.blob.core.windows.net/assets/ad8fb04c-4f75-42fc-973a-6e54c8a4449a/GlobalElectricVehicleOutlook2022.pdf

By 2035 there will still be 1 billion ICE cars and trucks on the road. Also their will be another 1 billion more people who I assure you will use some oil products.

I think geological Peak Oil will hit us first.

Charles,

You may be right, it might not be possible for demand to fall as fast I had in my previous scenario.

I took a quick look at an ev transition scenario and for demand to be reduced we would need greater fuel efficiency for ICEVs, more public trnasport to reduced miles travelled with ICEVs and possibly the greater use of EV Robotaxis which might reduce ICEV use in urban areas. This might occur (AV approval) by 2030, if not supply would need to remain on plateau. In addition, people can simply drive less, ride bikes and walk in urban areas, also car sizes may be reduced and more 2 and 3 wheeled vehicles powered by EVs may be used.

Sales may grow faster than you believe, I expect about 880 million ICEVs may still be registered in 2035 (if there is no approval of AVs) and demand for oil would remain about 76 Mb/d, this also assumes no increase in the use of public transit, also I have not accounted for less use of oil due to the growing number of EV buses and motorcycles (2 and 3 wheel) in the World. Including those factors would reduce demand somewhat, but I have not tried to model that, I focused on light duty passenger vehicles and heavy duty trucks in my analysis. Also the commercial heavy duty truck analysis is quite conservative, once costs reach a lower level for EV heavy duty trucks, the change to EVs may be very quick. When autonomous vehicles are approved the passenger vehicle fleet will very quickly drop by a factor of 4 or 5 and Heavy duty trucks will also switch more quickly at that point.

Revised scenario below, always possible this is too optimistic as well, much depends on the pace of innovation which is difficult to predict.

I don’t look at rates that vehicles are scrapped I look at past pugin sales and project to future at rates of sales growth seen in the past until all vehicles sold are plugins at about 93 million per year in 2030. Cars can remain in driveways and not driven much without being scrapped. I also assume average fleet efficiency of ICEVs increases and for heavy duty trucks I assume this as well.

Heavy duty trucks are assumed to ramp up at a similar rate as personal vehicles with a 10 year lag. As to why one would scrap a car, it will lose its value as fewer petrol vehicles will be used, many petrol stations may close as there will not be enough sales to justify the number of existing locations, driving a petrol vehicle will become less convenient as charging stations proliferate and fuel stations become more scarce. Many ICEVs will become a stranded asset with very little value and if they cannot be sold (the market will become very small) they will be scrapped.

One other thought is that prices rising does not necessarily mean we have reached the geological peak in oil supply, simply that demand is growing faster than supply, if we see declining output with rising oil prices then the peak may have arrived. I agree for this scenario it looks like the peak will be due to geology and scarce supply, much depends on what policies are adopted, how fast the prices of EVs decrease, how much public transport is built, whether autonomous vehicles are perfected, and the decisions of oil companies on whether to invest in new production. The number of possible future scenarios is infinite, only one scenario will be correct and the chances of creating a scenario that perfectly predicts the future is zero.

Thanks, Dennis. I find your charts rather interesting. I always save them for future reference. Of course, they change over time. That is wise. It is precisely what I do also. New data causes us to adjust our predictions. I have three of your past predictions. Unfortunately, I did not date them. But your first has peak oil In 2031 at 84.9 million barrels per day. Your next prediction had the peak in 2028 at 85.0 Mbp/d. You moved the peak three years closer but kept the level about the same. And now this prediction has the peak in 2027 at 83.5 Mbp/d. You moved it a year closer and dropped the peak by 1.5 Mbp/d, just half a million bp/d above the current peak in 2018. If you drop it by another .6 Mbp/d, you will get the peak year spot on, 2018, but you will still be a little high with your data.

Oh, I haven’t changed my peak year prediction; it is still 2018.

Ron,

Thanks. Predicting the past is easier, I can usually get that right.

No, you completely misunderstand my prediction. I am predicting the future. I predict that future production will never reach the level it attained in 2018.

Ron I know what your prediction is. Note that it is a much easier prediction to say output will be less than this known amount from 2018 in the future. We know there was a peak in 2018 and we know what output was. I can make a similar prediction that at some point in the future 2018 output will be surpassed.

Note that for your prediction you make no specific output claims. You say for example that in 2023 output will be less than 2022 (which last time I asked you estimated at about 80 Mb/d). What specific output do you expect in 2023, 2024,…, 2029, 2030?

If you gave those, you would be out on a limb with me, different branch though, lower on the tree.

Dennis, I have no idea what World oil production will be in 2023 or any year thereafter. I know world oil production will be in decline, and I have already stated several times that 2023 production will be below that of 2022. I may be wrong, but no big deal if I am.

But other than that, I will not make a prediction as to exactly what the production level would be. Anything can happen. And I do not have a crystal ball like you apparently do.

But I do enjoy reading your predictions even though I think they are foolishly too high. But please keep it up. And don’t look for any such specific predictions from me because they will not be forthcoming.

It’s great to see Dennis adjust in real-time, we should plot the change in his predictions, they may trend towards a realistic value…

I still think Dennis places way too much importance on effect of Covid on world supply/demand. The minor demand drop only delays peak by a couple months at most, not years…however, damage to supply side issues (refining) was likely significant.

I think almost everyone in the tight oil game realizes the growth phase is over, now it’s just keeping it all running (well replacements).

Hopefully the current setup can keep going for 5-10 years with minimal drop in production, but that seems like a lot to ask…

Ron,

That’s fine. I will note that often you specifically ask how much I expect output to increase, so I think it is fair to ask you in return how much you expect output to decline.

That is fine if you do not have an answer or are unwilling to reveal your expectation.

I have no crystal ball, I make a guess, that is all. The guesses are wrong 100% of the time as we would expect. Number of possible scenarios=infinity, chances that the one scenario I choose from the infinite set is correct=zero.

Dennis, forgive me but I did make a prediction some months ago. I am sure you remember it. But in my dotting old age, I just forgot. Here it is again.

Best Guess Yearly C+C Production

…….. Denniis ……. Ron

2020 ….. 76.0 ….. 76.0

2021 ….. 77.0 ….. 77.0

2022 ….. 78.7 ….. 80.0

2023 ….. 80.6 ….. 79.0

2024 ….. 82.3 ….. 78.0

2025 ….. 83.5 ….. 77.0

2026 ….. 84.3 ….. 76.0

2027 ….. 84.8 ….. 75.0

2028 ….. 85.0….. 74.0

You have revised your predictions somewhat since then. I will stick by mine, for whatever that means. But, as you say, they will clearly be wrong. But I am far more confident of them in the near term than in the long term.

But there they are. Sorry I completely forgot that I had made that prediction months ago.

Ron – Oh, I haven’t changed my peak year prediction; it is still 2018.

RON PATTERSON

01/27/2015 at 10:21 am

I am expecting prices to rise to $90 a barrel or more by the end of the year. And I am still calling September 2014 thru August 2015 as the all time peak.

https://peakoilbarrel.com/rig-count-drilling-less-oil/#comment-485991

Ron- we should just watch C C because that is the only really good data we have.

https://peakoilbarrel.com/rig-count-drilling-less-oil/#comment-486109

Okay, I missed twice. The third time is the charm. 🤣🤣🤣

Huntington beach,

That thread is interesting, I forgot how conservative my estimates were in January 2015.

My comment from

https://peakoilbarrel.com/rig-count-drilling-less-oil/#comment-486068

Hi Jeff,

Texas and OPEC account for 43% of World C C output. Is it possible that in the other 57% of the world that the condensate output remained the same or decreased? We don’t know. The important metric is energy and energy output should be reported in GJ not by the barrel or by the tonne. Though mass is probably tracks a little closer to energy content than volume.

I do not dispute that there will be a peak and that we are getting closer to it. I disagree that we can determine the peak of crude only output and think the 2014/2015 call on peak oil is too early I think 2017/2018 is more likely and we won’t fall below 74 mbpd before 2020, I also think it unlikely that the 12 month average C C output for the world will rise above 79 mbpd (we are at 77 mbpd now). As always, time will answer these questions.

I was wrong, my prediction in Jan 2015 was that the 12 month average for World C plus C would not rise above 79 Mb/d and that the 12 month average would not fall below 74 Mb/d before 2020. I was correct that output would not fall below 74 Mb/d before 2020 (in 2020 it fell to 76 Mb/d), but obviously the first part was wrong as World annual C plus C output rose to 83 Mb/d in 2018.

My main mistake was underestimating future tight oil output.

See the following from July 2015, the Permian basin wasn’t even on my radar at that point, I expected a peak in tight oil (Bakken and Eagle Ford) of about 2600 kb/d in 2017/2018, this proved to be about 3 Mb/d too low in Jan 2018 (actual tight oil output was 5600 kb/d in Jan 2018 and the 2018 average was about 6500 kb/d). So this accounts for most of my underestimate for World output in 2018 (3900 of 4000 kb/d).

https://oilpeakclimate.blogspot.com/2015/06/eagle-ford-permian-basin-and-bakken-and.html#more

Another estimate from May 2018

https://peakoilbarrel.com/us-light-tight-oil-lto-update/

In the post linked above I was a bit closer to reality (except I did not foresee the covid 19 pandemic) for 2018 I had average output at roughly 5700 kb/d or about 800 kb/d too low and for 2019 I estimated about 6700 kb/d which was 1062 kb/d too low. Note that this estimate was before we had the update from the USGS on Delaware basin TRR which was published in late November 2018. This increased my mean estimate for Permian basin TRR by 30 Gb (from about 45 Gb to 75 Gb) and has increased my URR estimate for US tight oil from 54 Gb to 71 Gb and moved the peak up from 8100 kb/d in 2022 or 2023 to about 11000 kb/d in 2029, part of the shift forward in time is due to low output in 2020 and 2021 during the pandemic and recovery, also the slow ramp up due to operator capital discipline has lead to a slower ramp up in the completion rate than foreseeen in 2018. This scenario assumes oil prices start to drop due to oil demand falling faster than oil supply after 2030, if that is incorrect and oil prices start to fall later (after 2035) then a higher scenario with slower decline from 2030 to 2035 is likely with an ERR of 84 Gb rather than 71 Gb for US tight oil.

Dennis,

“… the Permian basin was not even on my radar …”.

Exactly, Dennis, and this ties in with your demonstrated inclination to do extensive modeling primarily on what currently available data can be utilized.

Under the radar (outside the box?) scenarios do not much come into your projections.

To that end, EOG’s CEO just made a comment regarding their new Utica operation as “reminiscent of the early Delaware”.

Info is available online, but the fact that EOG bought – not leased – ~135,000 mineral acres supports the theory that field gas re-injection may occur without the royalty concerns in traditional leasing.

The mere fact that hundreds of thousands of Ohio goat pasture is now deemed very viable according to EOG’s exacting criteria ought to give pause to the hydrocarbon supply pessimists.

Coffeeguyzz,

I will note that it was not on the EIA’s radar either in 2015.

Here is the EIA’s AEO 2015 tight oil projection, with the peak output shown.

click on chart for larger view, peak was 5.6 Mb/d in 2020.

Dennis, a lot has changed since 2015. But, I think from 2008 to 2015 was when the real change happened. Tight oil and electric vehicles became reality. A bridge to the future as we know it became apparent. The first poster here to see it, that I remember was Nick G and he got run off the website because of it. Yourself Dennis, your mother must have dipped you in Teflon some time during your childhood. Because nobody here takes more incoming than you and you seem to weather it well. Just keep sticking to your education of economics and you will out weather them all. I discount all the others and keep betting on Dennis projections. You haven’t let me down yet.

The future of ground transportation is electric and there is no turning back. It was around 2015 and I thought optimistically the world could stop building light weight ICE by 2030. I don’t think I ever posted it in fear of being laughed off this site. But the reality is, its going to happen sooner than most anyone ever expected back than.

AV/Robo Taxis, I see this a little different than yourself. I see it lowering the cost of a taxi, but in most cases not replacing personal vehicle ownership. I do see a major impact coming to the truck industry from it. Without the need of a driver cab, tractor trailers use will mostly disappear with 40 foot long three axle trucks replacing them with nearly the entire truck used for cargo. With no driver, the cost function per mile completely changes. Fuel/energy becomes the main factor and refueling the only factor from not running 24/7. Slow those trucks down to 50mph from 70mph and your energy cost is cut in half. That’s before the advantages of drafting with autonomous vehicles.

In economics we learn humans have unlimited wants, but in a finite world I was hoping autonomous vehicles could be used as a restraint for rational speed behavior.

Here’s a prediction for you. Tesla’s market value will never again be worth more than the day Musk closed his purchase of Twitter.

Huntingtonbeach,

With fleet owned AVs costs per mile will be reduced by roughly a factor of 8, and by a factor of 16 for pool type services, I think many will find these costs attractive, it will also reduce miles travelled with ICEVs much more quickly than privately owned EVs, basically 6 times fewer vehicles would be needed tor the transition to electric transport. An EV will be able to last 500 thousand to one million miles, fleets which use the cars 100 k per year will have far lower depreciation costs than a private owner who might drive 15 k per year (it would take 30 years to reach 500k miles).

Many do not see this, and perhaps AVs will never become a reality (though Waymo seems pretty close), but the model works even with fleet owned EVs who hire drivers to drive the vehicles, though costs would be a bit higher.

Coffeeguyzz,

I agree that often my scenarios have been too conservative. Besides you, most have suggested that my scenarios are unrealistically high.

They might be too high if demand for oil and natural gas fall as wind solar batteries and EVs drive demand for fossil fuel to very low levels by 2050. Resources will be stranded because prices will be too low to allow for profitable production of oil and natural gas. Expensive resources like tight oil and oil sands will become unprofitable first, then Arctic oil, then deepwater offshore and finally the more expensive onshore resources.

It may be that my scenarios prove too high due to peak demand around 2024 to 2026, especially if Transportation as a Service takes off.

said

Delusional. 135,000 acres is the size of Mille Lacs Lake. Pin your hopes on that donkey.

You say: I think geological Peak Oil will hit us first.

It already has, we are on the undulating plateau at the peak. If, as some predict, oil prices drop substantially, ICE vehicles will be economically very competitive.

Old Chemist,

With the expected future prices for electricity and EVs, the price of oil would need to drop to about $30/bo in order for ICEVs to be competitive, once AVs are perfected, the price of oil would nee to be about $10/bo for ICEVs to compete with robotaxis. There will not be a lot of oil produced if the price of oil falls to $10/bo in 2022 US$.

Hello Dennis. I still don’t buy into the AV/Robo Taxi movement as being a major influence on energy demand… yes in highly urban areas it will be useful and popular but will most likely just cannibalize Uber and Taxis like I said before. Most people in urban areas take the subway/bus for their daily commute anyway, so the best use of AV’s/Robo Taxis is highly concentrated in urban areas that will be largely energy neutral in my opinion.

I also still strongly believe that humans that currently own personal vehicles will continue to do so (whether EV or ICE) for the foreseeable future. AV/Robo development will not likely have a major impact here.

The reasons for humans outside of high-density urban areas to still own a personal vehicle are numerous, but here are a few highlights…

-Freedom and control to go where they want when they want… on demand.

-Freedom to break the rules and speed, drive aggressively and get creative to get where they want when they’re late or stuck in traffic, etc. We are too emotional to sit in a Robo when we are late.

-Style and expression… a personal vehicle is a powerful expression of style, choice and pride to many people, especially here in Texas.

In any event, most people I know here in Texas would never give up their transportation independence and rely or wait on a robo taxi when they have instant, on demand transport with all their gear and stuff in their car. Plus, the radio is already on their favorite station. AV/Robo’s, just like Uber, certainly have a great specialty use when destination parking is bad, or for a boozy night!

I still go back to the Lime and Bird electric scooter phenomenon from a few years ago… those things were littered all over the ground, everywhere… it was pure mayhem… then poof! They are now almost gone. Novelty wore off and practical reality set back in.

Gungagalonga,

Well Kodak thought digital cameras were a novelty. I expected I would never have a need for a cellphone or a smart phone, or a computer at various points in my life.

See https://www.rethinkx.com/transportation-report

I respectfully disagree and see the future utilization of AV/Robos very different.

AV/Robo Taxis will certainly gain ground, but mostly just at the expense of Uber/Human Taxis… therefore no real impact on energy demand. To your point… Just like digital cameras replaced film cameras, one gained while the other lost… the transition to digital was likely more or less neutral on the total number of active cameras out there (until every cell phone came with a camera, of course). There is no real utility difference between an AV/robo taxi, human taxi or Uber…. all are simply point A to point B. The total demand for this type of third-party vehicle transport will remain more or less neutral it just adds another option with AV/Robo’s.

I also do not see mass transit folks migrating to third party vehicles… they all take the bus and rail which are far cheaper for a daily commute. Plus, logistically, there would not be enough road infrastructure capacity to handle all the Uber/Robo’s if everyone wanted to use them instead of mass transit.

On private car ownership disappearing… I just do not see any compelling reason why humans that currently own a private vehicle would give that freedom and convenience up just because they can take an AV/Robo. AV/robo doesn’t add any value above taxi/Uber. Proof of this is in the fact that even after introducing human taxis then Uber and Lyft… none of these third-party transport options have had much of an impact on slowing the growing total number of private vehicles owned, so why would AV/Robo now change that? Yes, we will use a human taxi, robo taxi or Uber for special purpose transport as needed, but we will also continue to own private vehicles for many other uses and reasons.

Apologies on rambling a bit!

Gungagalonga,

Cost savings will drive the change, a robo taxi will be considerably cheaper than owning and driving a car, it will also free up time for people to relax or work during their commute, reduce parking needed in urban areas freeing up valuable space and reduce the need for charging infrastucture spread all over, fleets would charge at charging areas just outside of cities.

Did you read the rethinkx piece or even the executive summary?

People in 1905 thought of cars as fast horses, but they were much more than that. AVs will change transportation fundamentally in ways you do not appreciate.

You can disagree, but be careful spending a lot on a vehicle in the future as it will become a stranded asset (if it is an ICEV and not AV capable).

As more people reach this conclusion it will destroy the ICEV industry and in addition the number of passenger vehicles needed will be dramatically reduced.

Dennis, you are making a similar kind of logical error that has been used by those who have said that, if the engine efficiency had been increasing at the rate of microprocessor speed, we would be able to get 5000 miles per gallon by now (actually the number is much larger than that, but I am using this for the sake of argument). The fundamental issue is thermodynamics. We still rely on fossil fuels for 86% of our primary energy needs. The energy conversion devices have thermodynamic limits and in addition there capacity factors for wind and solar. The bottom line, let’s avoid false comparisons.

Seppo,

Respectfully disagree. The initial issue at hand is replacing oil use for land transportation. The electricity to power these vehicles can be produced by wind, solar, (with battery backup), nuclear, natural gas, or coal, as well as geothermal, and possibly tidal power. Of course there is a capacity factor for wind and solar, when I look at the growth of these I look at TWh produced, so capacity factor is accounted for.

An EV at the wheel uses 25% of the energy of an ICEV and when the electricity is produced with wind, solar or nuclear power is very low emission.

There is also room to increase ICE efficiency, my Prius typically got about 50 miles per gallon vs average ICEV efficiency in the US of under 25 MPG, my Camry hybrid got about 40 MPG over its life, my guess the 50 MPG is close to the practical limit for a hybrid drivetrain. My model 3 have averaged about 4 miles per kWh over 70k miles of driving, the Camry is more comparable in terms of the size of the vehicle.

Camry for 10k miles uses about 29 million BTU (250 gallons gasoline), Tesla M3 for 10k miles uses about 8.53 BTU (2500 kWh). This is somewhat less than a factor of 4 because that comparison uses an ICEV (not a hybrid) which would get something like 30 MPG using 333.3 gallons of gasoline in 10k miles or 38.7 million BTU ( a factor of 4.5 higher energy use for the typical ICEV.

Dennis

Does table 7 include the drawdown in OECD SPR’s?

Old Chemist,

I assume so in 2021 (I assume you mean Table 7.1 which is from the IEA’s WEO 2022, in the post this is labelled Figure 10) as the demand for (consumption of) oil is higher than the supply (production) of oil by about 1.9 Mb/d. Some of this may be from SPR and some from commercial stocks, I don’t think the report breaks it out.

Dennis, I appreciate the debate and will look at that link. Thanks for sending. I will review and respond after reading it… meanwhile, here are my “raw” thoughts…

Yes, a year of robo taxi rides will be cheaper than a year of owning a private car. That is clear, but irrelevant. I never brought that up because it doesn’t matter. People who currently own private cars will still want to own private cars out of lifestyle, independence and convenience priorities. It’s a luxury expense and humans are vane and inefficient with money and resources. Humans have made it very clear that owning their own private transport is a major priority in life for many decades. The cost savings of taking third party vehicle transport like robo taxis has never been compelling enough to replace private car ownership. Proof of this is in the ever-rising number of privately owned cars that goes up year after year on average. Even with the convenience of Uber and Lyft the past 10 years, private car ownership continues to grow year over year on average.

Robo taxis offer nothing more than an Uber… they are the same… so Robo Taxis are also unlikely to penetrate the private vehicle ownership wall. They simply become part of the options for point A to B when going out for a boozy night with bad parking.

Gungagalonga,

Currently it is not cheaper to use uber or lyft than owning your own vehicle, when that changes due to autonomous vehicles that are fleet owned by transportation companies, cost per mile for transport may fall by a factor of ten ( a factor of 20 for those that choose “pool” type services.) So we will continue to disagree about how the future will look if autonomous vehicles become a reality.

Dennis, I read the Rethinks article on robo taxis. It is a mildly entertaining extreme fantasy thesis by another group of over-funded algo-academics in my opinion. Probably just to push eyeballs to their website with a “what if” extreme teaser scenario to explore. It offers me nothing more than a 1980’s civilization disaster movie like Escape from New York or Planet of the Apes. It also appears that this analysis is already getting dated and the clock is ticking on their thesis while the trends still have not changed in their favor. Private car ownership is still increasing.