These first charts are taken from the EIA’s Monthly Crude Oil and Natural Gas Production. The data are through June 2018 and is in thousand barrels per day.

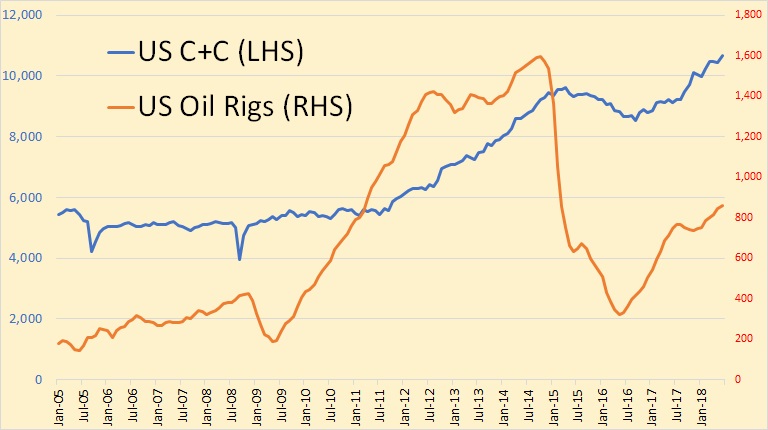

US C+C production was up 231,000 barrels per day in June to 10,674,000 bpd, an all-time high.

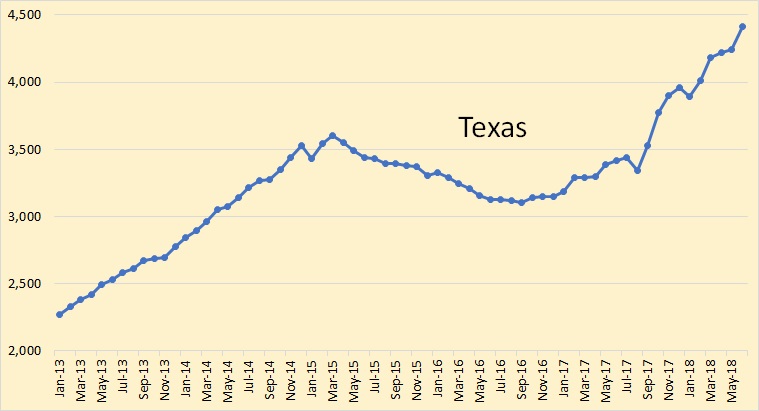

Texas was up 165,000 barrels per day in June to 4,410,000 bpd.

New Mexico was up 5,000 barrels per day in June to 657,000 bpd. The Permian extends into New Mexico.

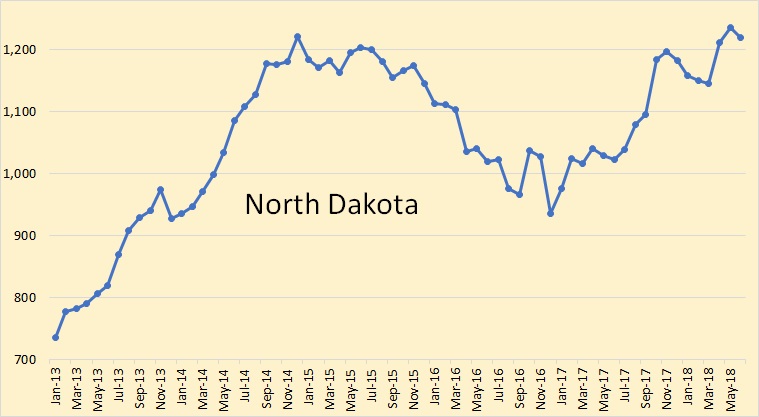

North Dakota was down 16,000 barrels per day in June to 1,220,000 bpd.

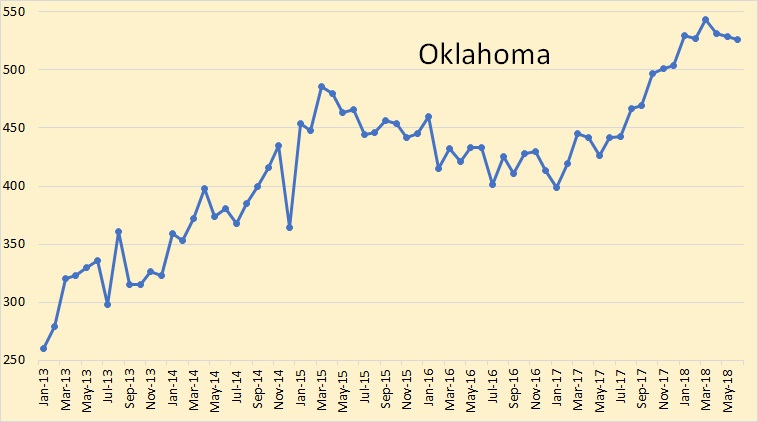

Oklahoma was down 3,000 barrels per day in June to 526,000 bpd.

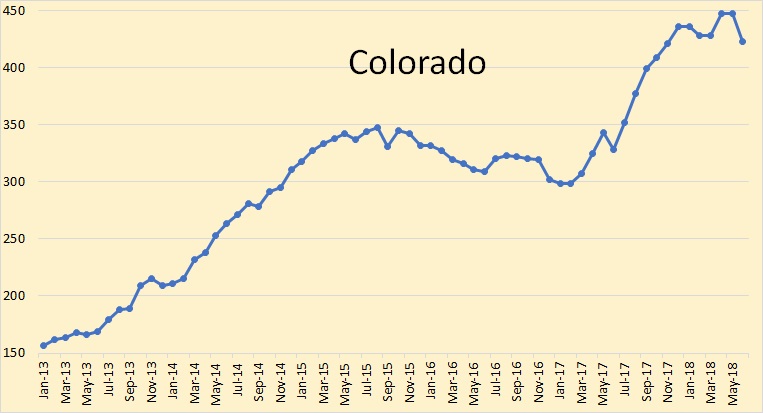

Colorado was down 24,000 barrels per day in June to 423,000 bpd.

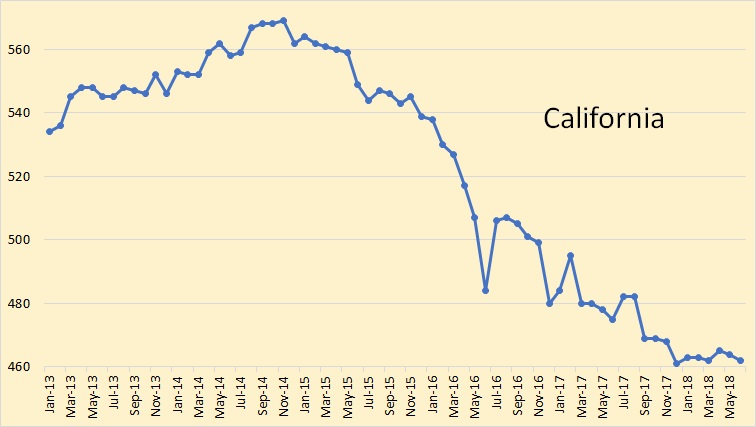

California was down 2,000 barrels per day in June to 462,000 bpd. California peaked in February of 1987 at 1,109,000 bpd.

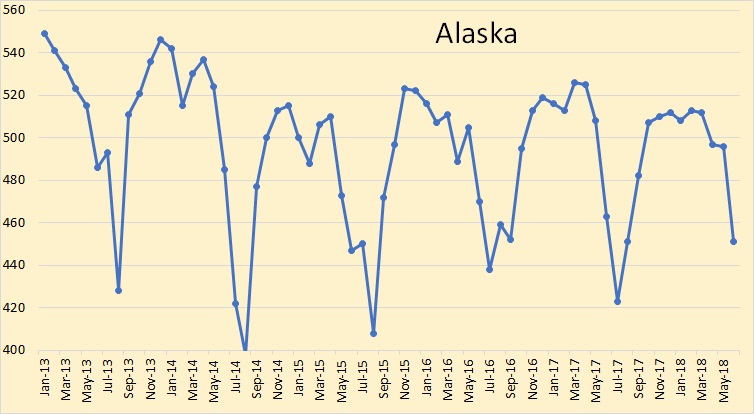

Alaska was down 45,000 barrels per day in June to 451,000 bpd. June, July, August, and part of September are the prime maintenance months for Alaska. The maintenance includes pigging the pipeline and overhauling the pumps along the pipeline.

The Gulf of Mexico was up 154,000 barrels per day in June to 1,658,000 bpd. Just a couple of years ago the EIA was predicting the GOM to be at almost 2 million barrels per day by now. I really don’t think that is going to happen anytime soon.

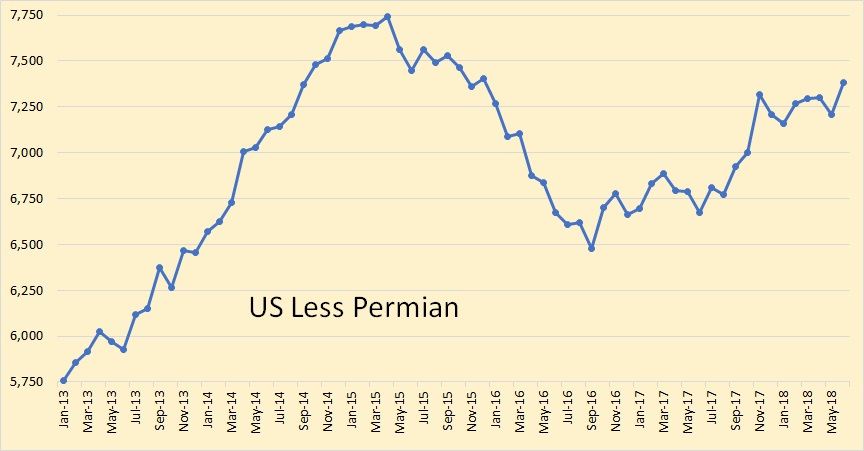

Using the EIA’s Drilling Productivity report for Permian production, through June, the US less the Permian, is still 357,000 barrels per day below the peak reached in April 2015. It is obvious that the Permian is the driving force behind the major increase in US production.

The above data is through June 2018. This is oil rigs only, no gas rigs.

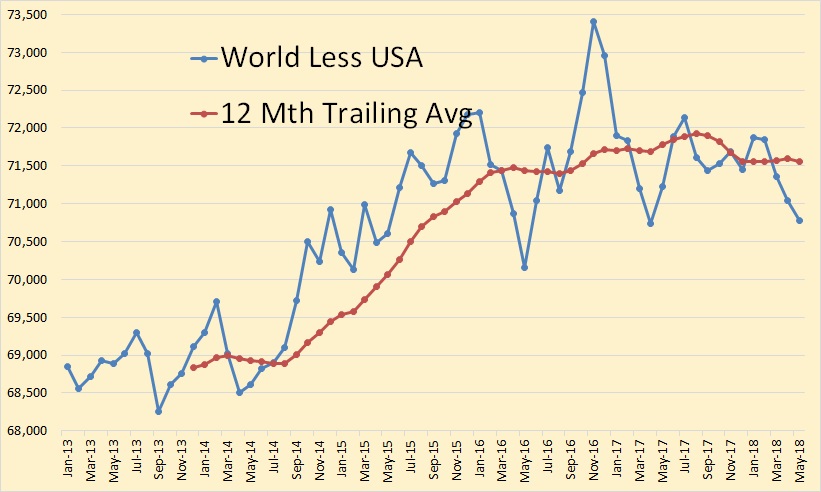

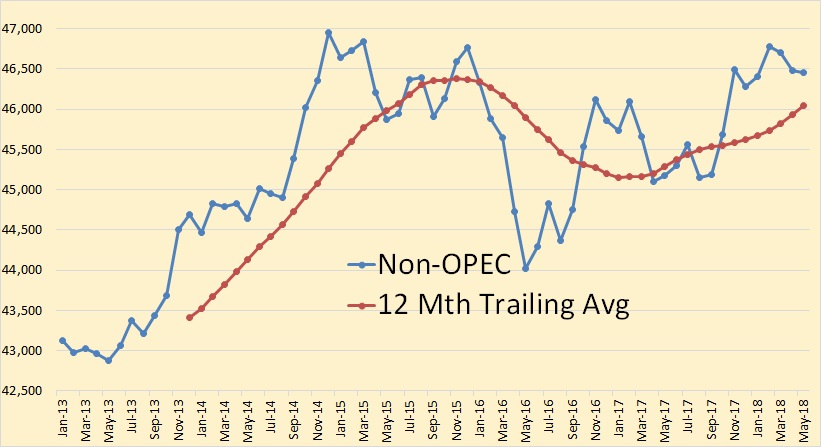

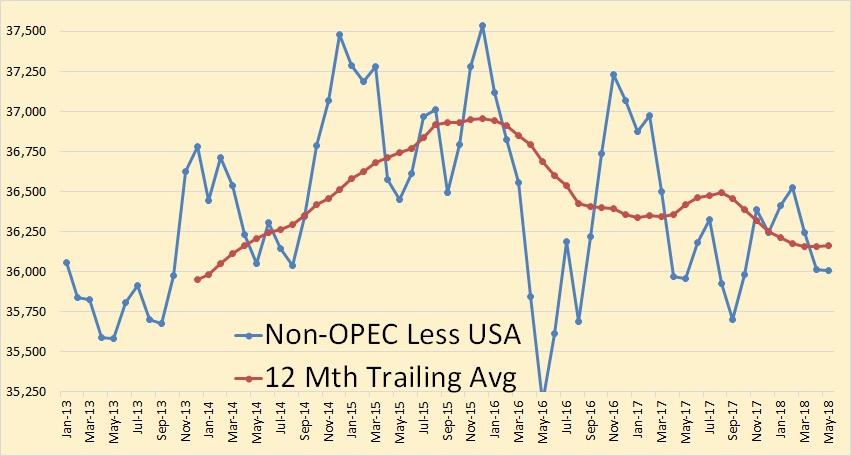

The following data are from Table 11.1b World Crude Oil Production: Persian Gulf Nations, Non-OPEC, and World. It is through May 2018 and is in thousand barrels per day.

The numbers here are only through May 2018. We are obviously on that proverbial bumpy plateau. A prediction! I see world C+C production peaking around July or August, remaining level to slightly down for about two years, then begin a steady decline.

It all depends on the USA. The US, and to a lesser extent Canada, are the only nations that are still really growing by any significant amount. The US has increased production by 1.6 million barrels per day in the last 12 months, June 17 to June 18. Total world has increased less than half that amount.

Non-OPEC is half a million barrels below its previous peak of December 2014. It may breach that peak later this year, but not by much.

Non-OPEC less USA is 1.5 million barrels below its previous peak of December 2015.

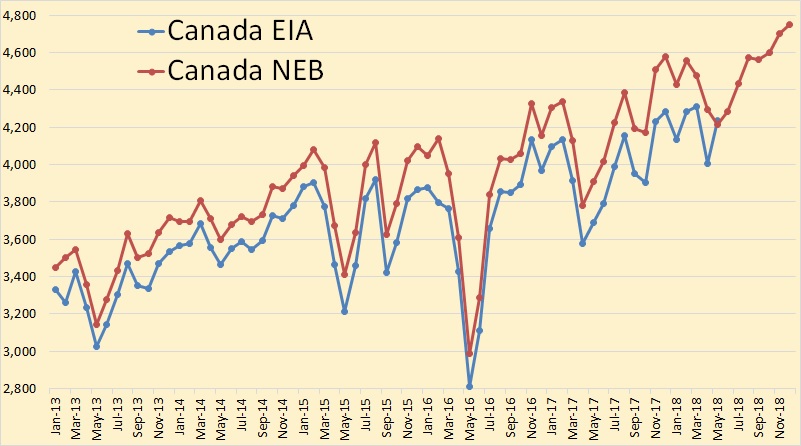

Canada EIA through May with Canada’s National Energy Board’s projection through December 2018.

China has slowed its decline somewhat.

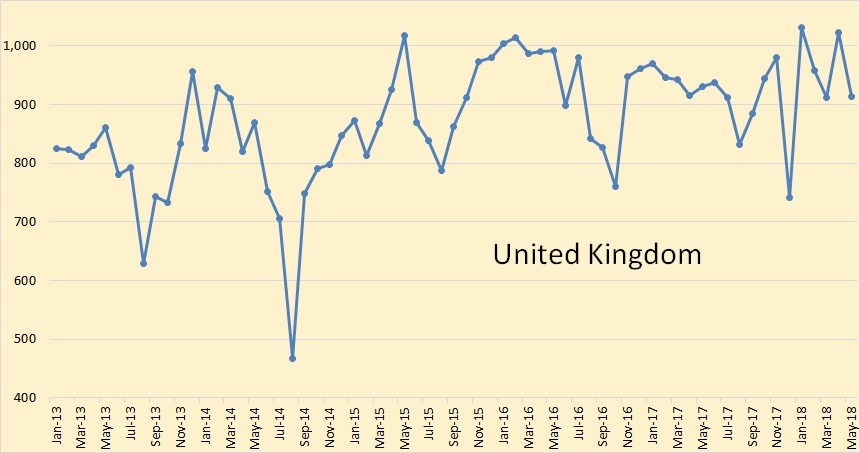

The United Kingdom has, for now anyway, completely halted its decline.

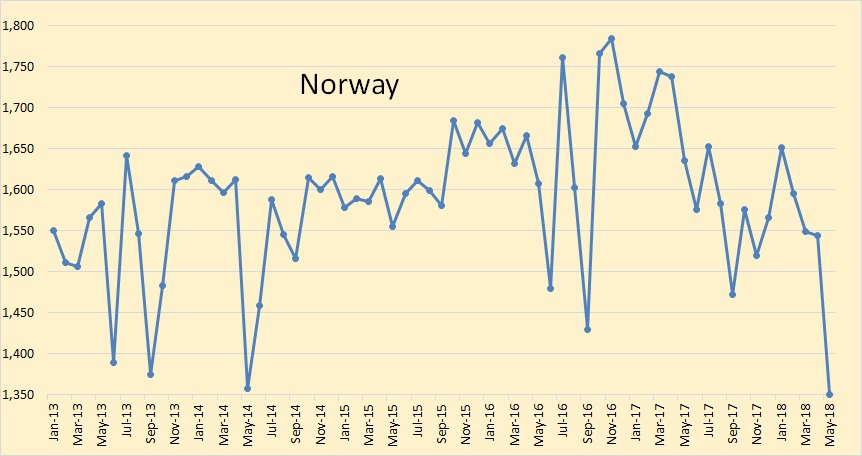

Norway… well that’s Norway.

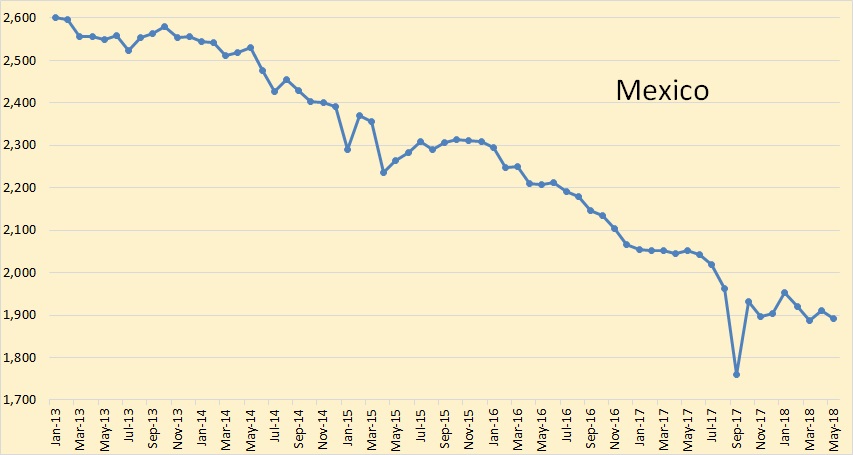

Mexico, for the time being, has slowed its decline.

This is the EIA’s estimate of all Persian Gulf production. That includes Saudi Arabia, the UAE, Kuwait, Iran, Iraq, Qatar, Bahrain, and Oman. This is through May. There will be a slight uptick in June, July, and August but will not likely breach the previous high in November and December of 2016.

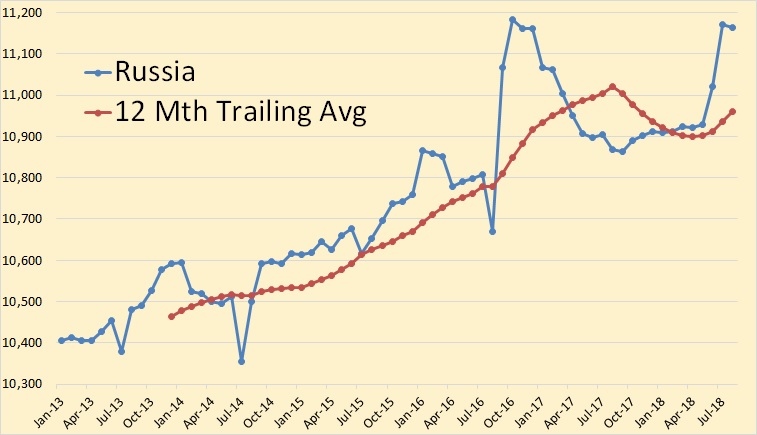

This is Russia through August 2018 from the Russian Minister of Energy. They are now back to the level they reached in the last quarter of 2016.

US – all liquids full throttle;

Russia -all liquids full throttle;

KSA -all liquids full throttle;

Now it will be interesting to see who blinks first.

Ron,

Using the US tight oil estimate, which is broken down by basin, we can look at US C+C less Permian basin tight oil output. For June 2018 the level was 7962 kb/d and the peak was March 2015 at 8372 kb/d, so currently about 410 kb/d below the previous peak in March 2015 for US less Permian output.

Alternative view

Thanks Dennis. I should have done that but I just didn’t think of it. In fact I will do that right now.

Edit: Okay I just updated the chart with US Less Permian.

Thanks again for the reminder.

Chart above is slightly different from Ron’s chart which uses the drilling productivity report to estimate output from the Permian Basin region. My chart uses the EIA’s tight oil estimate from link below

https://www.eia.gov/energyexplained/data/U.S.%20tight%20oil%20production.xlsx

from page linked below (tight oil production estimates by play)

https://www.eia.gov/petroleum/data.php

Good analysis. Prediction is spot on. I am guessing your change from 2019 to 2018 is caused mainly by the more recent analysis of how much exports will be affected by the sanctions, and Venezuela’s continuing implosion. The limited amount they project out of the joint Kuwait/SA region would have caused me to reconsider, too. No increase from the US or Canada to speak of until the end of 2019, makes 2019 look very bad, now.

A decrease in 2019, and a limited plateau a year, or so after that, is my guess, too. Whether that plateau extends above 2018 from US/Canada is anybody’s guess, and is mainly unimportant. Demand will far exceed supply by then.

Iran update

http://crudeoilpeak.info/iran-update

Good info, Matt. Whether the decrease in production is 400k or over 1000k, the result in 2019 will end in a decrease to World production. Or, at best, mostly flat.

Guym,

What happens when demand exceeds supply? Prices increase, investment increases and output may increase. It is not clear that the US will not increase output, nor is it clear that higher oil prices will not result in higher output from the Persian Gulf, Russia, Canada, and Brazil and slow declines elsewhere. Perhaps 2018 will a temporary peak, but it is likely to be surpassed when pipeline contraints ease in the Permian basin in 2020. I maintain that 2025 is the most likely peak date, but it could be 2 years before or after depending upon oil prices, Global economic conditions, wars, etc none of which can be predicted with any precision.

In fact, high oil prices could spur more rapid development of oil resources which might extend a plateau from 2025 to 2030, but declines would be more rapid and this would depend on the global economy not faltering due to high oil prices (which I think is unlikely,t hat is there will be a slow down in economic growth due to high oil prices)

I regard your opinions very highly, Dennis. I just think you are more optimistic than I am. My pessimism is derived from three thoughts:

1. The capacity for US shale expansion, beyond the incredible point it is at now, is over rated. No matter what oil price is.

2. World declines will continue to increase in rate.

3. If future oil is discovered, it will take years to extract, putting us, probably beyond the point of increasing. Slowing declines, maybe, if it is ever found.

Guym,

Possibly World decline rates will increase, if you look at Ron’s recent charts, in many cases the rate of decrease in nations past peak is lower rather than higher.

Lately (since 2015) there has been a glut of oil, low prices and lack of investment in new field development World wide, that explains the flat oil output from 2016 to 2018. Without the pipeline constraints being experienced in the Permian basin, US tight oil output can reach 8 Mb/d in the US by about 2023.

I respect your opinion as well, but what you see as my “optimism”, I think is realistic (2025 peak). I agree the plateau until 2030 is optimistic, though there are some that view my “scenarios” as quite pessimistic.

Everyone always believes their personal view is the “realistic” one, which makes the conversation interesting. We won’t have to wait very long to see if 2018 is the peak, I imagine we will know within a year or so (when looking at trailing 12 month World C+C output). We will have to wait longer (another 8 years or so) to see if 2025 is correct.

We will have to wait longer (another 8 years or so) to see if 2025 is correct.

I really don’t think so. I believe we will know long before 2025.

I have a very strong argument to make in my next post, the OPEC post due out one week from today. I believe that will shed a different light on things.

Ron,

If you are correct about the peak, then we won’t have to wait that long. If output continues to increase through 2024 as I believe, then we won’t know if 2025 is the peak until 2026 or possibly even 2029, if we remain on an undulating plateau from 2024 to 2028.

Will high oil prices keep output from declining much from 2024 to 2028? I think this is possible, the high oil price from a plateau in output could lead to a recession or even a depression, but my guess is the depression starts in 2030.

Hi Dennis, thanks for all the great comments. I’m interested to know more about your ideas regarding the depression, the one that perhaps starts in 2030. What do you foresee as the overall and general conditions of the global, and perhaps regional, economies? Do you feel it will be a lengthy depression? Any silver clouds?

It would depend enormously on how countries and individuals respond: do they bury their heads and try to keep fuel prices low with price controls and subsidies? That would cause enormous budget deficits and crashes. Do they allow exchange rates to move as their oil imports rise? If not…more exchange rate and foreign exchange crises.

Or, do they work to accelerate the shift away from oil? Do they raise fuel taxes, to in effect keep the profits of high oil prices at home?

Survivalist,

Thank you.

My foresight is quite cloudy 🙂 but I will give it a go.

My expectation under a scenario where there is a peak in 2025 with perhaps an undulating plateau from 2023 to 2028 (peak year could really be any year in this range) is that oil prices will rise quite a bit maybe rising to $175 per barrel as the price will serve to ration oil to its most important uses.

The adjustment to oil scarcity by the World economy will be very difficult, with gradually slowing economic growth and an attempt to substitute EVs, plugin hybrids and hybrids as well as more efficient smaller vehicles for low mileage pickup trucks and SUVs.

This is likely to be too little too late. Possibly the government can incentivize people to switch to EVs with tax incentives granting special lanes to EVs only for faster commutes as well as a lane for car pools, perhaps better public transportation will be built (though clearly this will not happen overnight).

In the end, I suspect the World economy will succumb to some kind of economic crisis as slow growth may lead to higher unemployment and poor business conditions and possibly a financial crisis.

As far as regional economies, those that depend less on oil imports are likely to fare better and those more dependent on oil imports may fare worse, but the results are likely to be highly variable (that is, I have no idea).

For those nations whose policy makers have read and understood Keynes’ General Theory, the depression might be fairly short, nations that choose pre-Keynesian ideology and choose fiscal austerity in the face of a major recession are likely to have a lengthy recession (European policy during the GFC would be a classic example or US economic policy from Oct 1929 to Feb 1933 would be the classic example of how not to deal with a major recession.)

Hopefully people will read a little economic history between now and the next Depression as the repeat of history often results when people have never learned history.

Given what I have seen in the last 10 years, I am not optimistic about the recession being short (less than 3 years), probably 5-7 years would be my best guess, even with “proper” policy.

An aggressive fiscal response to the onset of an economic crisis by all G20 nations might make for a short 3 year recession, but the odds are probably 1 in 10(or less) that this would occur.

Silver lining? People may see that peak fossil fuels are right around the corner and it might be the brick in the head that gets society to move aggressively away from f0ssil fuels to non-fossil fuel sources for energy. In fact, fiscal policy could be used to move society in that direction.

It is possible that the deeper the depression, the more likely radical measures might be taken, unfortunately as Russians, Germans and Italians well know, not all radical change is positive.

Unfortunately, radical change is needed sooner rather than later.

Spot On Dennis!

Also consider the impact that the global debt and demographics issues are likely to add a severe drag on the economy as well as tie up resources & capital for migration efforts. It is not as if the US & EU will give up entitlements & pensions for resource mitigation. Between 2021 & 2023 all US federal revenues will be need just to service the interest of the Debt & entitlements\gov’t work pensions. I presume most of the industrialized world doesn’t fair any better. Debt & demographic problems will only get much worse in the second half the 2020’s

Dennis Wrote:

“Unfortunately, radical change is needed sooner rather than later.”

The time for radical change is 15 to 20 years over due. The world should have listened to the Cassandra’s like Matt Simons (2005) or even much earlier, Hubbert (1956). Consider that 2005-2008 was the wake up call, yet BAU didn’t even blink.

Ok, if optimistic offends, I will rephrase to “less pessimistic”.?

Guym,

I agree that my expectation is more optimistic than yours, no offense taken.

The reason I think my scenario for 2025 is “realistic”, is that an assumption that high prices increases the speed with which oil resources are developed from an average of 39 years from discovery to field maturity (when field reaches maximum output) to 21 years from 2017 to 2041. The rate of development has a mean value of 39 years for oil discovered from 1918 to 2017, with rate of development increasing from 3 years in 1870 to 39 years in 1918 (a 0.75 year increase each year from 1871 to 1918).

My previous oil shock models left the rate of development unchanged at 39 years mean value from 1918 to 2250 ( a maximum entropy distribution is used for fallow, build, and maturation stages of resource development).

The optimistic scenario (using my medium scenario URR=3400 Gb of C+C ) peaks in 2041 at 89.6 Mb/d and then declines quite rapidly with the annual decline rate rising to 3.5% by 2054.

Without the increase in the rate of development and extraction rates the same as the scenario below results in a plateau from 2028 to 2040 with output between 85.5 and 86 Mb/d, also quite optimistic, relative to a scenario that peaks in 2025 or 2026 (plateau from 2024 to 2028).

In sunny places, EVs + solar energy are competitive with combustion engine vehicles when oil is well under $10 a barrel. This is new and makes it hard to extrapolate from previous market conditions.

The main thing restricting EV sales growth is a worldwide shortage of batteries, but this will likely change soon.

Dennis Wrote:

“In fact, high oil prices could spur more rapid development of oil resources which might extend a plateau from 2025 to 2030”

Probably not considering that most of the oil major canceled their big projects that would have replaced reserves. Instead they opted to drill wall street with Stock buybacks & replace reserves by purchasing smaller players. Usually these big projects take 5 to 7 years to bring Oil to market. I don’t think they will consider restarting them until they think Oil prices will be high & stable enough to earn a profit.

I also suspect that their will be significant retirement of old hats that will be difficult to replace. the Oil industry has a lot of boom\bust cycles and younger people in the industry left for less chaotic careers.

Perhaps immigration of oil workers could close the gap, but since there is a broad demographics cliff pending, there probably will be a worldwide labor shortage for skilled Oil workers. If US companies Poach workers oversea it just create shortages overseas.

That said I suspect the the world could make due with a peak and shallow decline for decade or more. But I have no idea how long the SuperGiants will be able to defer significant declines. If they start running into major production problems we could experience declines that the global economy cannot cope with.

I think Debt & Demographics problems will hit first before Oil declines matter. But once all three merge (Oil, Debt & Demographics) that likely be an impossible hole to escape from. I think the Debt & demographics issues will come due before 2025. US National Debt will be around $28T by 2025, and we’ll like see a lot of states run into debt problems as pension costs become a severe problem. Already several states are running into pension obligations.

No, I still see the world average peaking in 2019. I just think July and August of 2018 will be above that average. But production in the first half of 2018 will hold the 2018 average below that of 2019.

But there are so many uncertainties out there. Like Libya, or Nigeria, or Iran. Anything can happen to upset any and all predictions. We will just have to wait and see. Anyway, I am not all that confident in my peak guess. It is nothing more than just a wild ass guess.

What happens if we lose 800k a day from Iran, plus whatever from Venezuela in 2019? Yeah, it’s all just a wag.

What happens if the Trump economy crashes and drives the whole world into a recession? Hell, on second thought 2018 just might turn out to be the peak.

There ya go! Insanity reigns.

Ron,

If there is a recession it won’t last for more than a few years prior to 2025 (or whenever peak oil occurs), WW3 before 2025 might result in a 2018 peak. I am hopeful that won’t occur.

Damn Dennis! I wish I had your knowledge and insight on future recessions. I always thought economics was the most uncertain of all disciplines. I won’t call it a science because I don’t think there is anything scientific about it.

But I don’t think we have anything to worry about concerning WW3. Not that Trump would not try to start it, because he most definitely would. But don’t think the Generals in the White House babysitting him will let him anywhere near the nuclear codes. And if he orders an invasion they will ignore him. He told them to assimilate Siria’s Assad. They said they would and then just ignored him.

James Mattis Reportedly Ignored Trump’s Order To ‘F**king Kill’ Bashar Assad

In one account shared by The Washington Post on Tuesday, Woodward writes that Trump told Secretary of Defense James Mattis he wanted to assassinate Syrian leader Bashar Assad last year. While Mattis agreed, he allegedly gave aides completely different instructions.

We live in dangerous times but fortunately, the danger will be out of the White House in January of 2021.

Disruptive wars can start from places other than DC. There are countries that import more than 50% of their net energy use. In a peak oil world they may be compelled towards desperate acts.

This list includes Germany, Japan, S.Korea, Turkey, Phillipines, Italy, Spain, Netherlands, Taiwan, among many others.

Other countries desperately need their own energy export income, such as Russia, Iran and Venezuela. If curtailed they could choose war, or face collapse.

This does not even begin to address others causes such territorial disputes, religious conflicts, etc.

Wars have a way becoming unpredictable, and can grow from a civil war to big regional one rapidly.

Many such scenarios exist as possibilities that could disrupt world trade and or energy flows.

This surely is not not news to anyone, just a reminder.

Hickory,

I agree, wars, like recessions are difficult to predict in advance. Generally my scenarios assume there are no major shocks to the World order, an assumption that is likely to prove false.

Lol, I realy like it when americans write some holy soup about germany(I am german).

Believing that germany could act agressive because of a lack of oil supply is far away from reality.

We dont have the menpower for this, the culturemarxism made our society so weak that it is absolutly unable to face a real war. We also dont have the navy for this. If we would like to invade a county because of its oil, which one should it be? Poland? France? They dont have oil. We would have to conquer some shit county, where we cant get there without NATO logistics. It just wont happen.

But what will happen with germany is a great civil war, like a lot of other european nations, guaranteed. It is just like peak oil: idk when exacty this will happen, but it will happen in the next decades.

Hi Karl,

I am not expecting Germany to start a war over oil, but I do believe it is possible that various countries that are heavily dependent on imported energy may face a scenario in the upcoming decade that puts a massive strain on their stability and well-being.

That may be severe enough to lead to chaos. Germany for example, may find itself with export customers who cannot afford the goods its sells, and may find it very hard to compete with other energy importing countries for the fuel it needs.

I hope that the transition from fossil fuel can be gradual for the sake of stability, but it may not be. Climate instability may be the trade-off to a slow transition away from fossil fuel.

Ron,

Deep recessions like 1929 and 2008 happen infrequently, most other recessions are short lived (1875-2018), so you will note that I said nothing about when a recession will occur or precisely how long it will last, just that it is likely to be short as has been the case for most recessions especially since WW2.

Social science tends to be very imprecise as the knowledge gained by individuals about how society works affects individual behavior and changes the system under study, unlike physics, chemistry, or biology.

January of 2001?

Sorry, January 20th of 2021, the day a new president is sworn in. But it could be sooner than that.

Ron Wrote:

” But don’t think the Generals in the White House babysitting him will let him anywhere near the nuclear codes”

Are a lot of crazy people in gov’t. I think some are pressuring Trump into conflict. Consider that Candidate Trump said we need to exit Syria, Afghanistan, end NATO and Make Peace with Russia. Since the election Trump has done full 180 supporting just about every military campaign presented to him. He also select war hawks like Bolton, Pompeo & Haley.

Seems that the US continues to become more belligerent no matter who is in the white house. That said China is becoming an active military power and expanding its influence worldwide.

All countries extract oil as fast as they can, but the ever hungry beast wants MORE. It will always want more, untill we cannot provide more, and the industrial civilization collapses.

Ron,

Sorry, I didn’t read carefully enough as I thought you meant July or August would be the trailing 12 month peak in World output. I also am not all that confident in my WAG even though it’s a wide 2023-2027 guess (probably a plateau over that period with the 12 month centered peak possible anywhere in that range of years).

Very opportune. The day before yesterday I was having a conversation with Dennis about it here:

http://peakoilbarrel.com/open-thread-petroleum-august-28-2017/#comment-650809

And this is what I said:

“Oil production has entered a plateau. There are higher values and lower values than 81 k, but it isn’t going anywhere like it didn’t between 2005 and 2010.

This is how Peak Oil looks and nobody knows. Date of entering the plateau: second semester of 2015. When it leaves the plateau it will be going down, not up.”

http://peakoilbarrel.com/wp-content/uploads/2018/08/650809.png

Dennis believes that the increase in oil price can solve the situation. But here is an interesting article:

https://www.theglobeandmail.com/business/article-saudi-arabia-cuts-oil-output-as-opec-points-to-2019-surplus/

The Globe and Mail

Saudi Arabia cuts oil output as OPEC points to 2019 surplus

Published August 13, 2018

“OPEC on Monday forecast lower demand for its crude next year as rivals pump more and said top oil exporter Saudi Arabia, eager to avoid a return of oversupply, had cut production.

In a monthly report, the Organization of the Petroleum Exporting Countries (OPEC) said the world will need 32.05 million barrels per day (bpd) of crude from its 15 members in 2019, down 130,000 bpd from last month’s forecast.

The drop in demand for OPEC crude means there will be less strain on other producers in making up for supply losses in Venezuela and Libya, and potentially in Iran as renewed U.S. sanctions kick in.

Crude edged lower after the OPEC report was released, trading below $73 a barrel. Prices have slipped since topping $80 this year for the first time since 2014 on expectations of more supply after OPEC agreed to relax a supply-cutting deal and economic worries.

OPEC in the report said concern about global trade tensions had weighed on crude prices in July, although it expected support for the market from refined products.

“Healthy global economic developments and increased industrial activity should support the demand for distillate fuels in the coming months, leading to a further drawdown in diesel inventories,” it said.

OPEC and a group of non-OPEC countries agreed on June 22-23 to return to 100 per cent compliance with oil output cuts that began in January 2017, after months of underproduction by Venezuela and others pushed adherence above 160 per cent.

In the report, OPEC said its oil output in July rose to 32.32 million bpd. Although higher than the 2019 demand forecast, this is up a mere 41,000 bpd from June as the Saudi cut offset increases elsewhere.

In June, Saudi Arabia had pumped more as it heeded calls from the United States and other consumers to make up for shortfalls elsewhere and cool prices, and sources had said July output would be even higher.

But the kingdom said last month it did not want an oversupplied market and it would not try to push oil into the market beyond customers’ needs.

DEMAND SLOWING

Rapid oil demand that helped OPEC balance the market is expected to moderate next year. OPEC expects world oil demand to grow by 1.43 million bpd, 20,000 bpd less than forecast last month, and a slowdown from 1.64 million bpd in 2018.

In July, Saudi Arabia told OPEC it cut production by 200,000 bpd to 10.288 million bpd. Figures OPEC collects from secondary sources published in the report also showed a Saudi cut, which offset increases in other nations such as Kuwait and Nigeria.

This means compliance with the original supply-cutting deal has slipped to 126 per cent, according to a Reuters calculation, meaning members are still cutting more than promised. The original figure for June was 130 per cent.

OPEC’s July output is 270,000 bpd more than OPEC expects the demand for its oil to average next year, suggesting a small surplus in the market should OPEC keep pumping the same amount and other things remain equal.

And the higher prices that have followed the OPEC-led deal have prompted growth in rival supply and a surge of U.S. shale. OPEC expects non-OPEC supply to expand by 2.13 million bpd next year, 30,000 bpd more than forecast last month.”

The entire article makes no sense. It is full of reasons to increase production used to justify a decrease in production. OPEC and Russia agreed to cuts in production, they decrease production by 130% of the agreement (I know, quite fictitious), and KSA says it is no longer needed because price has recovered so they are going to… cut production further.

This is when surprise hits you, Dennis. You are following 101 resource economics that say an increase in price is met by an increase in production. What happens when it doesn’t happen?

Welcome to Peak Oil. Post-Peak Oil era will be inaugurated shortly.

OPEC does not want to increase production, or for them it is not cost beneficial to. US E&Ps will post horrible financials, overall, for 2018 and 2019. 2019 price increase would help, but they are fighting huge headwinds. Where will they get all the big bucks for huge capex increases in 2020?

OPEC used to regulate production according to demand to prevent oil price spikes. Now who knows.

OPEC is using shoddy projections from the US to justify getting a higher price, plus I don’t think SA has it, anyway. None of the EIAs, IEAs, Opecs, or banks are counting Iran’s drops, yet. This, with the exception to Iran’s decrease, will continue into the second quarter of 2019, when panic takes over. EIA will not change their estimates, until final data proves they had their head up their posterior.

Carlos

We have just come out of 2 years of a major oil glut that drove prices down to $27 a barrel.

Your graph also shows the 2005 peak oil which made a fool out of a lot of people. The world is now producing 8 million barrels per day more of Oil and 15 million more of total liquids.

When prices start hitting $150 and more, then we can start talking peak oil.

Suppose price is controlled by decree, as it would have to be if there was scarcity and food could not move to shelves.

When prices start hitting $150 and more, then we can start talking peak oil.

You are forgetting just one thing. Peak oil is the time of maximum oil production! Prices at maximum oil production are far more likely to be low than high. When the world produces more oil per day than ever before in history, that will be a time of glut, not a time of scarcity. Prices will not start to skyrocket until well after peak oil.

Ron

You could be right.

But I think crude oil production will increase but will gradually fail to meet demand over say 3-4 years. During that time price pressure will drive down demand.

My guess is the oil industry will fail to meet demand in 2020 and peak in 2023-2024.

By then oil prices will be $140 plus. A plateau after that for 2-5 years and then who knows what countries will do to get their share.

It’s failing to meet demand, now. When world inventories go down, supply is less than demand.

I’d love to know how much of a buffer we have in term of ‘stored oil’. If we are depleting storage then surely the price will have to jump when this supply nears depletion.

Dave P,

Part of the problem is the storage data is not very good at the World level, but typically the focus is on OECD inventory levels (which are pretty good) and the storage level relative to the past 5 year average level when it falls significantly below this level we usually see an increase in the price of oil.

In August, IEA data shows oil inventory about 1% below the 5 year average level, if the level falls to 4 or 5% below the 5 year average we may see a faster rise in the price of oil.

https://www.iea.org/oilmarketreport/omrpublic/currentreport/#Stocks

Thanks Dennis. Those graphs were very helpful. Pardon my ignorance but how frequently does the IEA update these numbers?

DaveP,

You’re welcome.

The report is published once each month, first there is just a summary released and the full “public” (free) report comes out after two weeks.

See

https://www.iea.org/oilmarketreport/omrpublic/

The next report is Sept 13 and is available at the public site on Sept 27.

https://www.iea.org/oilmarketreport/schedule/

The price jumps before storage reaches depletion, because everybody watches storage levels and bids future prices accordingly.

So would you say that the current price already reflects the current declining storage volume and you don’t expect price to increase much when storage actually depletes?

I would have thought if we’re still drawing stored oil then the current price isn’t high enough to temper demand or promote more production (granted production would have lag time so perhaps it already has stimulated an increase which will eventuate later).

Dave P,

If the inventory levels continue to drop, then oil prices will continue to rise, my WAG is that the rate of increase in the oil price may accelerate if inventory levels in the OECD fall to 4 or 5% below 5 year average levels or if the inventory falls below the 5 year range.

Like Denis says, it can just continue rising as storage declines. Problem is the market has zillions of players, and they don’t behave rationally. For example, Trump is following guidance from Bolton, a neocon sold to the Israelis, and placed sanctions on Iran with exquisite timing to screw GOP electoral chances in November. Such stupid behavior is hard to model.

Guym,

That is right, production is currently less than consumption (causing oil inventories to decrease). When OECD oil stock levels fall to 3 or 4% below the 5 year average level, we will see oil prices increase and consumption may decrease (or at least grow more slowly) and oil output may increase (grow at a faster rate) to bring production and consumption back into balance.

Guym

Have you got international data?

China is now the biggest oil importer and it is increasing it’s strategic oil reserves.

https://www.reuters.com/article/china-oil-storage/update-1-trade-tensions-could-boost-pace-of-chinas-strategic-crude-storage-idUSL8N1RQ45H

China has been increasing it’s strategic oil reserves for many years. It is still adding more reserve facilities.

Looking at US strategic reserve I do not know what you are referring to.

It has varied widely over the years and has nothing to do with global production.

https://www.eia.gov/todayinenergy/detail.php?id=24072#

Ok, I don’t remember writing anything about strategic reserves. There is no one source for world oil statistics. Energy News posts frequent updates on the places that keep some track of world commercial inventories, and there are occasional updates on floating inventory. Dennis posted a link above to IEA where you can find OECD inventories. China is a black hole for information. Are their inventories commercial or strategic??!

In future analysis, we need to take a look at Iran buildup of inventory. Is it floating or increasing their buildup of inventory.

I follow tankertrackers on twitter. At least one billion barrels in storage capacity they say. So a lot even if I have no idea if that includes strategic storage as well.

@TankerTrackers 4. sep. Milestone: Though not done, we have now passed the measuring and cataloging of a billion barrels of crude oil storage space in China. 2500 storage tanks so far. #OOTT

Well, at least one of the squirrels is storing up nuts for the winter. They are about equal to us, now. On the other hand, our Administration is delusional, and imagines us as oil independent, so they are selling reserves.

Guym

The China storage is in government strategic reserves. I consider all reserves to be very quickly accessible no matter who is storing it.

Current oil prices are too low.

The best selling vehicles are Jeep Wranglers, F series monster pickups, Dodge Ram etc.

https://www.autotrader.co.uk/cars/dodge/ram

Unless you are a rancher or lumberjack you don’t need monster vehicles like that to exist.

100 million vehicles are sold in a year.

If everyone bought cars like this.

https://www.carwow.co.uk/peugeot/208

https://www.carwow.co.uk/ford/fiesta

Oil prices could treble and you would be no worse off. Taking into account fuel and vehicle cost.

the UK uses 8 barrels per person, the US citizen uses 22 barrels per person.

The main reason is driving ridiculous trucks around. So anyone who says the global economy cannot cope with $150 oil should look at countries where we already pay $270 oil including tax.

That is why we drive small cars.

“Unless you are a rancher or lumberjack you don’t need monster vehicles like that to exist.”

The situation here in the US northeast is deplorable. Most males, particularly teenage boys, drive the most hideous, monstrous and loud pickups–to school, to the store, just to be assholes. They purposely alter their exhaust systems so that the noise is intolerable. We live close to a “rural” road which, now that oil is cheap again and the economy is “booming,” is a clusterfuck of noisy traffic. There’s a part of me that wishes peak oil to be swift and catastrophic to deal justice to these careless, narcissistic jerks.

I live on a small farm and need a truck to deliver boxes of apples to stores. I make do with a 2004 Ford Ranger–with an intact muffler.

Europeans would use even less oil if they could get their act together about freight. The average European (including the UK) uses only 18% as much fuel for personal transportation.

If Europe could standardize it’s freight trains, and tax commercial diesel properly, they could reduce fuel use much more.

Ron,

In a situation where oil consumption at $120/b is equal to maximum output and where even an increase in oil price to $150/b keeps consumption and production equal, then we would be at peak oil at a high oil price. Now it certainly is true that when oil output starts to decrease that oil prices would be likely to rise further, a glut would only be likely to arise if the high oil prices and lack of oil supply leads to an economic crisis and then we would see low oil prices once the lower economic activity reduces the demand for oil.

This seems a far more likely scenario for peak oil than a glut of oil and low oil prices, unless a severe economic crisis happens to occur at precisely the moment of peak oil output. I guess that’s possible, but seems a low probability event.

Peter, everybody thinks they know how Peak Oil is going to be. In your case associated to extra-high oil prices.

That ain’t so. The 2005 peak in conventional was reached with low prices, and with low prices we reached the 2015 plateau.

Peak Oil is the result of a series of circumstances that together will determine that future oil production will no longer beat depletion most of the time. The oil glut that you mention is one of those circumstances as it has led to a particularly low investment in future oil production for a few years.

Going forward future oil production will not be able to meet the requirement from a healthy growing economy, so the most likely outcome is that there won’t be a healthy growing economy. And that is regardless of oil prices, that respond to the ratio between oil production and oil demand. So it is futile to try to attach an oil price to Peak Oil.

Carlos

I think we are having a repeat of what happened between 1997 and 2007.

There was a glut of oil, leading to very low oil prices which in turn led to a dramatic cut in exploration spending. Then the global economy took off and there was insufficient oil. Prices went up to $140. The financial crash confused people who claimed peak oil for a second time, or third time.

After oil prices were over $100 for several years leading to large increases in exploration. This led to the crash in oil prices in 2015.

At the moment there is no sign of oil production leveling off nor consumption leveling of either.

Also conventional oil did not peak in 2005, it is 3 million barrels per day more than that now.

Peter,

Very different situation to 2002-2005, when the economy was going very strong due to the joining of China to the WTO, the expansion of credit, cheap oil, and several bubbles in different places. It continued going strong amid increasing oil prices until China’s summer Olympics when oil hit the roof and the whole thing became unsustainable.

But now the keeping of the world’s oil production rests in North America, and within North America in the US and Canada, and within the US in the Permian. We know Canada can continue increasing production, even if it is not the right stuff, but we already know from experience that the Permian will not grow for long.

We need ideal conditions in the rest of the world so production can recover in those places where production could increase or at least be maintained. Instead we have Venezuela imploding, Libya and Nigeria’s problems do not improve, and on top of that sanctions are imposed on Iran. To compound the problem the low level of investment since 2015 means a gap in new oil for a few years.

Unless there is something we can’t see, like shale in 2005, there is no way to fix this for several years. Which means we are in peak oil now. The economy needs to grow. It requires oil growth. And it isn’t going to get it.

I don’t know what is going to happen. Perhaps supply will not keep up to demand and prices will go too high. Or perhaps the economy will stop growing so demand doesn’t go above supply and oil prices never get too high. In both cases it means serious economic troubles, and pretty soon, a couple of years maybe three at most.

And serious economic troubles mean a decrease in oil production as has happened before. A few years down the road, when the economy recovers, depletion will have grown probably becoming larger than the increase in production can overcome. Peak Oil will be a thing in the past and nearly nobody noticed it when it happened. Then the mother of all crises will take place when the financial world awakes to the meaning of no growth.

Carlos Diaz,

Nobody knows what will happen. We do know that since the GFC the global economy has been growing and that it did so even when real oil prices (2017$) averaged $114/b from 2011-2014. An alternative scenario is that rising oil prices will allow increased output in Russia, the Persian Gulf, US, Canada, and Brazil over the next 5 years and that the higher oil prices will lead to further development of deep oil resources in the Gulf of Mexico, North Sea, and Africa and perhaps further development of oil resources in OPEC nations as well. As long as prices don’t rise too much too fast (maybe $5/b each year), the World economy may be able to adjust to higher oil prices (they would reach $120/b in 2027 in one possible scenario).

The higher oil prices will make EVs, plugin hybrids and hybrid vehicles more attractive, buses and trucks may also become EVs, more long haul shipping would move by rail which could be electrified due to higher oil costs. The transition to electric transport will create business opportunities which may create economic growth.

People may see the struggle to increase oil output and may realize that a peak in all fossil fuel output is not far in the future and businesses will see the opportunity to replace fossil fuel electric power with non fossil fuel alternatives creating further economic growth. Electric distribution companies may see the need for a modern HVDC transmission network to easily move variable output resources like wind and solar across nations and the investment needed for this endeavor will create further business opportunities and more economic growth. As this transition moves further and further along fewer and fewer fossil fuel resources will be needed and this helps the climate change problem.

Better tax policy to reduce the unequitable distribution of wealth may lead to higher incomes generally throughout the world with better education for women and equal rights for all people, under such a society total fertility ratios fall to 1.5 births per woman and global population peaks and then begins to decline reaching 2 billion by 2200 and continuing to fall until societies decide an optimal World population level is reached and larger family size (2.1 children per family ) 🙂

Note that it is pretty doubtful this scenario will play out, but something along these lines would be a target to aim for.

You are considering oil prices in isolation, and that is a mistake. As I explained the three most important factors for the economy are energy, labor, and finance, so you have to keep track of the three at the same time if you want to understand.

Oil is needed for every aspect of the economy, so economic expansion requires oil growth. During the period that you talk about China’s economy was expanding strongly due to very favorable conditions on the other two factors. It still possessed a sizeable pool of young people to transfer from the countryside to industrializing areas. And due to its starting very low level of debt, it was expanding its debt at an amazing speed. China’s growth was affecting positively many other places, and together they were bidding oil prices high. This had a very negative effect on economies that had an unfavorable demography and a high level of debt, and could not afford the high oil prices, triggering a debt crisis in those places.

Now conditions are very different. China’s pool of available young countryside laborers is greatly diminished. Since 2010 its working base is contracting. Due to the one-child policy the demographic effects are catching up. China’s population is ageing at the fastest speed in the world and its demography has turned into a negative factor that will grow with time. China’s level of debt has also caught up with the developed world. They built cities in the middle of nowhere that nobody occupied, so they have a lot of debt without return in bad investments.

Unless you have another China to rapidly develop in the world, the global economy will not sustain the oil prices it was able to sustain in the 2010-2014 period. The world is wrong about that. The global economy will now sink long before it reaches $115/barrel. The dangerous oil price level is obviously impossible to determine, but we will notice when we reach it.

Oil is only a few percent of the world economy, and most of it is completely wasted, adding no value. Doubling or tripling the price won’t do any harm. Some people might have to drive a Fiat Cinquecento to the beer store instead of a three ton pickup, but that is not The End Of Civilization As We Know It.

In addition, oil is about the most expensive energy source. It is insulated from the electricity market because transporting liquid fuel is so handy. But electrification of everything continues apace, and may soon envelope the transportation market.

That’s an incredibly silly argument. Are you the site joker?

Of all the energy used in the US in 2017, 29% was for transportation, and of that 89% was petroleum derivatives.

https://www.eia.gov/energyexplained/?page=us_energy_transportation

Oil is the blood of transportation, and transportation is the pulse of modern economy. You affect oil supply and the economy goes into arrhythmia.

Read and learn:

https://www.admiralmetals.com/admiral-metals/copper-oil-prices-a-look-at-the-correlation/

Oil and copper prices strongly correlate with a lot of other economic factors, including Chinese GDP, World trade, global industrial production, and EU GDP.

But we know that oil price is determined by the demand/supply ratio and the level of oil in storage.

http://1.bp.blogspot.com/-3CoyeFl5Dkc/VQ9AVfOHpOI/AAAAAAAAILs/YT5-e0tv-Bo/s1600/fig2.gif

That’s how important is oil price.

Carlos,

Transportation in America is a joke. Americans waste immense amounts of fuel driving around the “Great Triangle” connecting their suburban tract, their cubicle, and their favorite shopping mall.

Worse, they do it in ludicrously oversized vehicles. The amount of waste involved is titanic. The only people who really benefit are those selling oil.

Carlos,

The fact that both copper and oil are closely correlated with GDP should tell you something. Both copper and oil consumption are determined by GDP, not the other way around.

If oil prices rise slowly, the economy will handle it pretty well. If they rise quickly there will be a shock which would cause recession if we’re near the end of a business cycle, as we are now.

Carlos,

The oil price scenario I have in mind is below, real Brent oil price in 2017$ reaches $100/b (2017$) in 2024 and reaches $113/b in 2027 and then remains at that level.

China still has plenty of room to grow, as does India and many other nations. World real GDP growth has been 2.92% per year on average from 1975 to 2017, based on World bank GDP data in constant 2010US$ (market exchange rates rather than PPP).

Carlos

I think it is highly unlikely that the world goes from increasing production by 1.5 million barrels per day to decline, almost overnight.

Back in 1995 when almost every single oil producing country could increase production, the world could increase production by over 6 million barrels per day. coming from OPEC, UK, Norway, Nigeria etc, etc.

As one country after another peaked, the ability for the world to increase production diminished.

However it is not at zero yet, United States shale oil has 3/4 more years to run. Those who said how much US shale would increase have been proved correct.

OPEC has some more spare capacity, but is now at historical lows.

https://www.bloomberg.com/news/articles/2018-06-19/opec-s-plunging-spare-capacity-poised-to-boost-forward-oil-curve

I see global production increase being about the same in 2019 as in 2018.

2020 oil prices will rise as production cannot meet demand. Perhaps increasing by a million barrels per day.

2021 will see further price rises and production increasing by only 0.5-0.8 million barrels per day.

2022 prices of $120-$140 and demand curtailed to the small increase.

2023 peak oil.

But then a war somewhere or a global recession could disguise all that.

I guess I am not making myself understood. People have this curious idea that Peak Oil will take place when demand will not be satisfied because it will not be possible to increase oil production.

Peak Oil is economical not geological. Of course you are right and oil production can still be increased. For sure there is oil in ocean basins, and in the Arctic, and in shale plays elsewhere that can be exploited to produce more oil.

My point is that it won’t happen. Peak Oil is taking place because the economy, demography, and credit situation of the world have reached a state in which demand will not be sustained when the oil price reaches a critical level that is much lower than in 2011-2014. And the oil price will reach that level because the geology and lack of investment, coupled with political factors are making sure that supply growth cannot match demand growth at present.

When this plays out the economy will settle at a weaker level and the decline rate and depletion will make sure that oil production also settles at a lower level and increasing oil production will be so much harder that it won’t be possible to reach peak levels.

And this should take place faster than you estimate. By 2020 we should already be in economic woes with oil demand flat or in negative rate of change.

Carlos Diaz,

I do not think anybody can predict what will happen with the World economy, perhaps there will be a recession in the near term, but I am skeptical of those predictions. A gradual increase in oil prices ($5/b annual rate of increase in Brent oil price) is likely to handled by the World economy. The average rate of increase in World C+C output has been about 800 kb/d from 1982 to 2017 (using linear least squares trend on EIA data). The oil price will adjust in an attempt to continue this average rate of increase until geology reality intervenes so that higher oil prices simply ration the available oil supply to its most important uses as the peak is reached and we remain on an undulating plateau of output around 85 to 86 Mb/d (C+C only) from 2024 to 2028. Eventually there is likely to be a severe recession, my WAG is around 2030-2035 for the start date and it might last for 3 to 7 years.

The transition to other forms of energy to power transportation (whether it is natural gas, electricity, or improved efficiency or some combination of all of these) will no doubt be exceedingly difficult.

No, nobody can predict the future, my estimate is likely to be wrong. Stuff happens. Our country operates only by management by crisis. Planning is a completely foreign concept, and would be opposed by whichever party is not in power. I can imagine many future decisions, which could throw any estimate out the window. And future unknown foreign crisis will happen, including wars, civil disturbances, and economic crisis. Stuff happens. Five of the top 10 oil exporters do not have any stability, to speak of. Some, are actively fighting each other.

Carlos

Sorry but the term peak oil was defined by geologists and not economists.

https://en.wikipedia.org/wiki/Peak_oil

It is when an oil producing country reaches it’s maximum output and goes into decline no matter how much drilling is done to stop it.

You are talking about affordability which is something that many on Automatic earth discuss.

global oil consumption has gone up decade after decade and recessions have come and gone.

It will be peak oil that comes first and the recession that follows will be different due to the fact that oil production is on the decline.

We agree on that. We disagree on what is going to cause it.

That’s called observer bias. We wouldn’t be discussing this otherwise. It says nothing about next time the same way throwing a coin doesn’t say anything about next time result.

Exactly. Peak oil in 2015 and the recession will follow in 2019-2020. Then the next period oil production will not go above plateau levels.

Carlos,

Today the 12 month moving average of World C+C output is higher than in 2015, can you clarify how much oil output needs to rise before you are convinced that output has risen. Currently the trailing 12 month average C+C World output is 1 Mb/d higher than at any time in 2015 if we switch to centered 12 month average, it is about 700 kb/d higher than the highest 2015 centered 12 month average.

I define the peak as the highest 12 month average output of World C+C output, for the trailing total it is currently May 2018, next month it is likely to be higher. I would wait until we see at least 6 months of declining 12 month average output before calling a peak and even then I would be hesitant to call it until 12 month output had fallen 1 Mb/d below the peak and was showing no sign of recovery.

If 12 month output remains below 81.5 Mb/d for 6 more months, we are likely to see oil prices increase as inventory levels are likely to continue to fall.

Higher prices may slow the growth in consumption of oil, but it is also likely to increase oil company profits and investment in new wells and projects which in turn is likely to increase output.

Chart shows percent of World real GDP spent on oil using my medium oil price scenario and Medium oil shock model for 2018 to 2030.

Dennis, undulating plateaus undulate. From the top point in the 13-month averaged production data for 2015 to the top point since the increase is ~ 0.6%.

If it continues growing in 2019 and 2020 I will be wrong. As simple as that. But if it keeps being around 81 mbp/day it will be in a plateau, and there is a good chance I am right. But that means economic collapse, so I rather be wrong. I would prefer that we find a way of stopping burning oil derivatives that is not due to not getting what we need. But that is not what I see.

Carlos,

I use 12 month rather than 13 month averages, are you defining your “plateau” at 80.5 to 81.5 Mb/d, or perhaps 80 to 82 Mb/d? It is not all that clear.

Let’s say you are correct and output remains at a 12 month or 13 month level that is the same as now, wouldn’t you expect that oil inventories would decrease further and eventually cause oil prices to increase? Eventually the increased oil prices are likely to lead to higher oil output in my opinion, at least until 2021 and possibly until 2030 (though increases will become smaller and smaller as the peak is approached).

Time will tell.

Peter Wrote:

“When prices start hitting $150 and more, then we can start talking peak oil.”

Adjusting for inflation, $150/bbl is not sustainable. High Oil prices will trigger demand destruction. I would imagine Industries like commercial airtravel would collapse if Oil prices were high for a sustained prices.

“Suppose price is controlled by decree, as it would have to be if there was scarcity and food could not move to shelves.”

That never works, it just makes shortages worse. Nixon tried it during the Arab oil embargo. The best option is to let prices float so that people cut consumption & Energy companies have incentives to increase production. Venzuela is a prime example of price controls.

Peter Wrote:

“My guess is the oil industry will fail to meet demand in 2020 and peak in 2023-2024.”

Demand has exceeded supply for more than a decade already. Real Oil demand is likely in the neighbor of 140Mbpd. China, India, US, EU, etc could all use more Oil. I am sure ever consumer in the world wishes for $10/bbl.

Techguy

Practically nowhere can produce and deliver oil for $10 a barrel.

https://www.quora.com/What-is-the-break-even-for-top-oil-producers-by-country

Perhaps you want to differentiate between desire and need?

In the UK the most popular car is the Ford fiesta which has a 1.0 litre or 1.5 litre engine, followed by Ford Focus and Vauxhall Corsa. With similar engines and MPG.

This monster is the most popular vehicle in the United States.

http://carsalesbase.com/us-car-sales-data/ford/ford-f-series/

Even your equivalent of our small and mid sized cars have much bigger engines and consume far more petrol.

There is plenty of oil to meet need, never enough for mindless decisions.

Another way to frame this: oil consumed because the price is only $10/bbl is providing a very, very marginal value. There is a value to having fun driving a big vehicle (disregarding, of course, the cost to drivers around you of driving a heavier vehicle which poses more danger to them), but it’s a very marginal value. It’s far smaller than the value of getting to work.

Just applying efficiency to ICE’s will not cull demand since the number of vehicles on the road is steadily increasing, possibly doubling in the next 20 to 30 years. That along with increasing demand from other uses means that the only way out is to not use oil to fuel transport.

Global consumption of oil in 1950 was about 1/7 that of current consumption. US oil consumption since 1950 has tripled.

Global oil consumption has risen by a factor of seven.

The fact is that the ROW has been on a much faster track over the last 7 decades than the US as far as oil consumption. Similar problems with coal as exemplified by China and several other nations. Fact is US oil consumption has been running a “plateau” for the last two decades.

I do agree that efficiency should be improved in the US. However, if the ROW has already improved efficiency, the use of oil for transport will come to a grinding halt in the near future since there is little room for improvement and developing countries are going to double transport units.

The best solution is to eliminate oil as transport energy.

I couldn’t agree more.

The key is to reduce fuel consumption quickly, whether it’s through efficiency or electrification.

Actually, the fastest and most effective method may be carpooling and car sharing: the average light vehicle only carries 1.2 people in the US. Just double that number and you’ve cut oil consumption by 50% overnight.

Carpooling and car sharing used to be very difficult, but smart phones have revolutionized things.

Nick,

I agree, AVs and smartphone ridesharing might increase riders per car quite a bit. In addition EVs might catch on pretty quickly especially as larger automakers commit to EVs.

The Tesla Model 3 supposedly was the best selling sedan in the US in August, when the Model Y is eventually produced and ramped up, it may surpass the F150.

Carlos,

I do not believe an increase in price will always result in higher output, but higher profits are likely to lead to more investment and higher output ceteris paribus than would have occurred with lower oil prices and lower levels of investment.

A scenario I did last june for a “medium URR” World C+C scenario.

I am not convinced that more investment will significantly increase oil production. But since I personally don’t know what is left in the ground, I have to depend on what others claim is still available.

However, from a business perspective, I don’t see investment money necessarily going to support significant capex. Yes, there are still people throwing money at money-losing companies, but when the investors realize they won’t make any money doing this, they will stop.

I also think that just like corrupt politicians who try to get as much money out of their countries and into safer havens as they can, oil executives will quietly transfer their funds elsewhere.

The oil industry is on the decline. It’s not the future. Who wants to be in coal these days? I think the same will happen with oil.

While I expect oil prices to rise, I don’t see that it will be a favored industry to park money. And as mature fields decline, it will become more obvious that this won’t be an economic growth area.

Boomer

Who wants to be in coal?

https://asia.nikkei.com/Business/Markets/Commodities/Asia-coal-prices-soar-as-China-and-India-continue-dependence

It is now over $110.

The article says that both China and India are reducing domestic coal production: China because they don’t like coal, India because of their bad transportation infrastructure. It also says Indonesia is suppressing exports.

As a result, Australian exports are in greater demand, but…not necessarily that coal demand is up. Maybe it is, but you can’t tell from this article.

Boomer,

My claim is simply that scarce oil will lead to higher oil prices, the higher prices will tend to lead to higher (or less negative) profits and higher profits tends to lead to higher investment levels than a lower profit scenario.

Lets’s say investment is X and oil output is Y at time t1. At some later time t2 oil output would be lower at ZX, I am simply saying that oil output would be higher than Z due to higher investment, it may well be less than Y.

In other words output may go down, it will just decrease by a smaller amount at P2 than it will at P1. (P2>P1)

“My claim is simply that scarce oil will lead to higher oil prices, the higher prices will tend to lead to higher (or less negative) profits and higher profits tends to lead to higher investment levels than a lower profit scenario.”

Only if they believe the higher prices will be sustained for a considerable period & that spending CapEx will return big profits. If I was an Oil Exec for a Oil Major, I probably look to buy up smaller companies. I would wait for another recession and buy them up at a discount. Its far less risk then spending $100B in capEx to develop a field that has a long term payback and might not result in any profits. What’s left is Artic & deep water fields & lots of tiny pockets of oil that was bypassed when there were more profitable fields to tap.

Techguy,

Perhaps you are right, but as oil prices rise their will be competition for available prospects among the more profitable enterprises.

I addition there is always the risk that those who wait will have invested in resources that will eventually fall in price as EVs will eventually outcompete ICEV and oil will see a shrinking market of air transport, water transport, and farming as land transport switches to electric power (trains, light rail, overhead wire and battery).

I agree there might be some thresh hold price ($85/b in 2017$ perhaps) and we might need to see that price or higher for a year or so before a significant increase in investment occurs.

I doubt we will see falling oil prices due to substitution of electric transport for ICE until 2035 at the earliest (my WAG would be 2040).

I hear phrases like “investment money” or even “wall street throwing money” at E&P for fees. but who are these investors? where is the money coming from? until that question is answered in more detail it will be hard to tell when it will stop.

For example, if the money is coming from pension funds that are underfunded to begin with and might have trouble covering redemptions or even issuing bonds, then we will begin to see cracks.

many university, colleges and institutions have so much money they really don’t know what to do with it… and if the people making the deals are getting hefty fees to push the deal… and as long as interest payments can be made… and debt can be rolled… then it really never has to end. We are back to geological limits only… back to Dennis and 2023 – 2027

Dennis, I do not believe models of very complex phenomena can tell us anything we can trust about the future. You are just making an educated guess.

Political and economical conditions that are not included in your model can make a huge difference. It is my opinion that there is plenty of oil in the Earth’s crust, but Peak Oil will be determined mainly by economic factors with a great potential for political factors to bring it forward.

As your model does not include any of that, it can only be considered a best case scenario and then it becomes more probable that peak oil will take place earlier than you anticipate. The exact date for the peak has a lot of randomness into it, but 2015 will be the year when we entered the peak’s plateau and thus is the most appropriate date in my view for peak oil.

Carlos Diaz,

All forecasts are educated guesses.

The political and economic factors that might affect oil extraction can be included in the model by changing the rate of extraction. Political and/or economic crises are difficult to predict and are not easily modelled.

A variety of assumptions might be made about future extraction rates to give a range of possible scenarios. I do this all the time. Below I show the model with extraction rates, not that in 2030 in this model the extraction rate only increases to half the 1950-2017 maximum extraction rate (about 12% in 1973). Prior to 1950 (1871-1949) the minimum extraction rate was 8.7% in 1949.

Oil Shock model below assumes extraction rate remains at 2017 level through 2100. Other scenarios have assumed as oil becomes scarce and prices increase the extraction rate may increase to the levels attained in 1973 (note that US extraction rates are about 14%, so higher World extraction rates may be technically possible.)

XH=extra heavy oil, LTO=light tight oil, and C+C-XH-LTO =conventional C+C or World C+C minus extra heavy and tight oil

Also note that lower extraction rates result in lower annual decline rates, with the 2050 annual decline rate in World C+C only reaching 2%/year by 2050.

Dennis, I don’t believe that model for a second.

– So after four decades declining its rate of change, extraction rate increases faster from… now. Yeah, right.

– Annual decline rate shows a curious gap from 2009 to 2025. I guess it is too difficult to calculate an average 1970-2010 and apply it.

– You say price can’t be predicted but you could smooth the data to get a decadal rate of change and compare it to the extraction rate. On average price is going up over time, and extraction rate is increasing less and less.

Carlos Diaz,

The extraction rate is for C+C minus extra heavy oil minus tight oil and is defined as output divided by producing proved reserves.

The model uses a dispersive discovery model fit to discovery data provided by Jean Laherrere.

The following posts describe the model:

http://www.theoildrum.com/node/2712

http://www.theoildrum.com/pdf/theoildrum_4171.pdf

http://www.theoildrum.com/node/3287

http://www.theoildrum.com/node/2376

In many cases there are interesting ideas discussed in the comments so they are worth looking at.

If you want to minimize reading the last of these posts is the best summary, but keep in mind that one mistake made by Sam Foucher in this post is to confuse producing proved reserves with proved reserves. Extraction occurs from producing reserves.

For the lambda used in the Foucher post (April 5, 2007) My model uses lambda=13. The basis for that choice is that Laherrere estimated 2P reserves of about 800 Gb in 2010. Using US data for producing reserves and proved reserves and assuming 2P reserves are about 1.7 times proved reserves based on UK data (the only proved and 2P data publicly available) from 1980 to 2015. For the US in 2005 (before LTO ramped up), I make the conservative assumption that the 2P/1P reserve ratio is only 1.4, thus the ratio of producing reserves to 2P reserves was about 51% in the US in 2005. If we assume the world has a slightly lower producing reserve to 2P reserve ratio of 50%, then producing reserves in 2010 would be about 800*0.5=400 Gb. The shock model presented above has producing reserves estimated at 459 Gb in 2010 using lambda of 13 years for fallow, build, and maturation stages of the shock model.

The extraction rate falls because producing reserves increased from 1980 to 2018, see chart below.

On oil price and extraction rate there is very little correlation, there is a strong correlation between World real GDP and oil output, especially through 2000 or so, but extraction rate will be determined by output and producing reserves. Producing reserves are determined by discoveries and the rate that reserves are developed. Price may have some role in the rate that reserves are discovered and developed, but the relationship is not likely to be a simple linear function.

For individual enterprises and consumers, the oil price has an influence, but at the macroeconomic level the correlations are quite weak.

The “gap” you see in decline rate is that an annual increase in output of say 1% is the same as a -1% (negative) annual decline rate. I don’t show the rate of increase (negative values of decline) because it is if little interest. For a 1970 to 2010 average we have output increase from 45.9 Mb/d to 74.6 Mb/d, which would be an average rate of increase of roughly 1% per year or an average decline rate of negative 1% per year.

As to whether you believe a mathematical model or ad hoc explanations is clearly your choice.

Chart below shows US oil extraction rates from proved producing reserves from 1999 to 2016. Note extraction rate is annual output in year t divided by proved producing reserves in year t-1. In other words for 2016 the extraction rate would be annual C+C output in 2016 divided by proved producing reserves at the end of 2015.

I see you are recycling somebody’s model from 2007. Did it predict the same Peak Oil then? I guess the input data was different then, so all that talk about a mathematical model doesn’t hide that the result depends on the assumptions taken, as usual.

The extraction rate parameter then is meaningless as it depends on changes in reserves and they change all the time for different reasons and in some countries cannot be trusted.

Carlos Diaz,

That is the way science works, people build on the ideas of others.

The discovery data provided by Laherrere is based on proprietary data and is the best data I have access to. It is difficult to predict future discoveries and reserve growth.

Here are a few posts from 2012, these early models were different in that they did not break out extra heavy and LTO oil output into separate models as I do now.

http://oilpeakclimate.blogspot.com/2012/07/

Of course the model depends on the assumptions made, always true. Yes the reserve data is far from perfect. The reserves are based on the best discovery data I could find from Laherrere.

In my view, Paul Pukite’s Oil Shock Model with dispersive discovery is the best model I have seen.

In physics, the recycled old models are used and improved upon all the time.

https://www.zerohedge.com/news/2018-09-04/india-defies-trump-allows-state-refiners-import-iranian-oil

from end of last thread

Watcher –

Be interesting to see how this plays out, petro-dollars and all.

Before this I thought it was at least credible that tankers headed to Shanghai might be interdicted by the US Navy. But with them going to both countries it becomes less likely.

It is a sanction, not an embargo. The penalties are through the banking systems, we are not going to take their oil.

Big companies, like some in Europe and India use the US Banking system extensively, so they are not going to buy the oil. Smaller operations in Europe and India that do not deal extensively with the US banking system can bypass the sanctions. It is just most, not all. China’s big oil companies work with US financial systems, but they are able to bypass it with financial institutions which are primarily subsidiaries of the oil companies. The US would never be able to cut off all of Iran’s oil shipments, because we don’t have leverage, everywhere. Cutting off even some of Iran’s oil is a double edged sword. The nuclear expansion of Iran is a national security concern. Not having enough oil in the world is a national security concern. Is the sword going to cut the opponent, or the user of the sword?

“It is a sanction, not an embargo.”

Yeah, but does Donald Trump know the difference?

The anti Russia and anti Iran stuff extends back to Obama. I don’t think Trump particularly wants to have a hard line on this. There are forces inside the administration, or Washington as a whole, that have a different agenda and push this direction at him, with other voices shut off.

Not good.

DougL,

And what a difference it is: If my memory serves, an embargo is an act of war.

btw suppose methods to evade banking sanctions evolve

They have. You can run it through the Venezuelan kleptocurrency.

Iran is developing nuclear power for electricity generation, and it is under strict inspection controls. The Trump sanctions simply follow Israeli wishes. Israel of course wants Iran kneeling so it wont help shiites. It would rather encourage the growth of salafist sunni regimes which will become muslim terrorist sponsors. The aim of course is to turn Europe and US into raging Islamophobes. Its an interesting gambit by a rabidly right wing and nutty Israeli leadership.

And the Israeli government is financed by crazy right wing Americans like Sheldon Adelson, but also lots of nuts who pray that Iran will nuke Israel, so Jesus can come down on a mushroom cloud to carry them off to heaven.

So the dog is biting its own tail.

Cutting off funding for Palestinian refugees was a telling move by the Trump administration. It was pointless, spiteful and extremely petty. More importantly it was an admission they are clueless about foreign policy. If Netanyahu hadn’t told Trump to do it, Trump would have no ideas at all.

Nut&yahoo and Trump are just the results of late stage capitalism.

Maduro is an example of 21st century democratic socialism.

FL-You been hanging out with your little buddy CM too much.

No sir. My conspiracy theories are developed in my own think bunker, where i have access to all sorts of information, some of it from sources who were former employees of the GRU, CIA, and other spook services.

“my own think bunker,”

Ugly place. Not on my travel list.

The summer tourist crowd in this town is just about right. The beach is large enough to accommodate everybody, traffic gets heavy, and its hard to find parking, but they do bring in huge piles of cash. And now we get to enjoy life in bunkerland until June of next year.

Fernando,

Are you still in Alicante? It was a beautiful spot back in Dec, 1981 when I was last there, no doubt it is a bit more developed today. Nice beach.

Excellent beach. I can snorkel out about 200 meters and its mostly sand, with a few rock outcrops slanted at about 35 degrees sloping down to the north, and a steeply cut face facing Cabo Huertas. The geology shows at one time there was a line of hills or ridge to the South, which is now completely eroded except for the two hills near downtown. The ice age coastline was about 30 km offshore, and given the topography, a river must have run through the Albufera all the way to the ocean. This means that submarine archeologists should find ancient hunter gatherer settlements dated to say 15000-12000 years ago, under 110 to 130 meters of water.

It was hinted at in the post, but it is important to note that the decline in world oil (less US) is happening in a period of increasing prices.

Muppet,

The oil market is a World market so only World output (and World consumption) will affect the World market price of oil (usually Brent is considered the best measure of the World oil price at present).

Exactly, wouldn’t increasing oil prices over the past year encourage more countries and independents to increase their output to take advantage of higher prices? If they are unable to do so, it would seem this is telling.

Muppet,

Several countries such as Mexico, China, and the UK have slowed their decline. Some nations in crisis such as Venezuela and Libya have other problems that are causing decline. World output has indeed increased since 2017 even with OPEC and Russia cutting back. The cost of producing oil is different in different places so the oil price that will need to be reached to spur more investment in various nations will depend on the local cost to produce oil.

Even if Capex gets a big boost in 2019 and beyond because of higher oil prices is it even possible for discoveries of oil to even hit half of consumption in a given year? The last 4 years of oil discovery have been abysmal but how much of that was a drop in Capex. Would those years discoveries have been double had there been more money to explore? I guess there is always a chance of discovering an elephant field but I have to think these days a 1 billion barrel discovery could qualify as such.

AdamB,