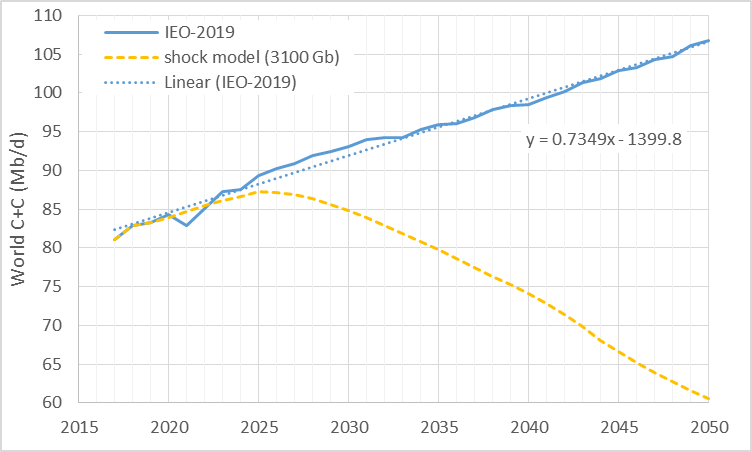

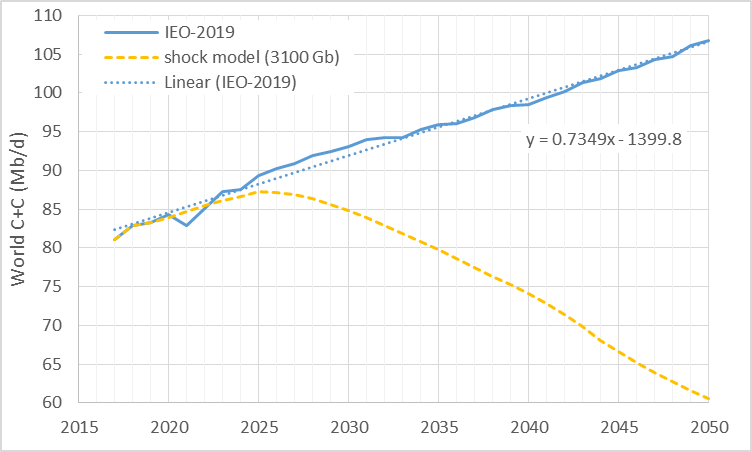

The EIA recently released its International Energy Outlook and it is quite optimistic. In the chart below I compare their estimate for World Crude plus Condensate (C+C) output with an oil shock model with a URR of about 3100 Gb.

The EIA recently released its International Energy Outlook and it is quite optimistic. In the chart below I compare their estimate for World Crude plus Condensate (C+C) output with an oil shock model with a URR of about 3100 Gb.

The climate change scientific consensus is summarized via the annual IPCC documents. In one of the IPCC sections, projections of CO2 emissions from fossil fuel usage are made in the context of several scenarios, which are referred to as Representation Concentration Pathways (RCP). Historically, the “business-as-usual” pathway was declared to be RCP8.5.

That has worked out as describing an extreme emission scenario IF society did not take corrective action in reducing emissions. In other words, RCP8.5 tracks a growth path in fossil fuels that is extrapolated from the current economic growth rate and largely dead-reckoned FF production increases.

Recently an energy analyst named Michael Liebreich challenged this assumption in the context of the possibility of greater fossil fuel depletion than is currently mapped out in the IPCC, calling the RCP8.5 estimate “bollox” in a tweet. When challenged on this assertion, he rationalized his claim as follows:

“Here’s why I reject scare stories based on RCP 8.5 and SSP5. They assume a vast increase in coal use in the absence of more international cooperation on climate. But the reality is that it coal power is peaking already. Climate change is scary enough, we don’t need ghost stories.”

— Michael Liebreich (@MLiebreich) August 4, 2019

An interesting analysis was recently published by BNP Paribas (one of the top 10 banks in the World by assets) entitled Wells, Wires, and Wheels… . In that analysis they argue that long term oil prices will fall to $20/b or less in order for oil used for personal land transport to compete with EVs powered by wind and solar at current cost levels.

I reworked my oil price assumptions, first with a simple scenario that follows the EIA’s AEO 2018 reference oil price scenario up to $70/b in 2017$ and then remains at that level long term. Second I noticed that a scenario with such an oil price assumption sees tight oil output fall in 2022 so the scenario was revised with oil prices rising from 70 to 80 per barrel from 2022 to 2024 and then remaining at that level until 2028. The BNP Paribus analysis suggests that EVs will have cut significantly into oil demand by 2022 to 2025 so I assume oil prices fall to $20/b over the next 10 years.

Scenarios below.

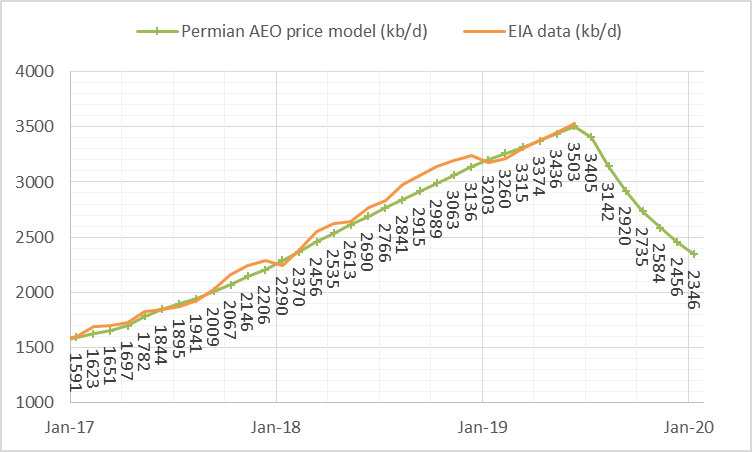

US tight oil legacy decline can be estimated by assuming no future tight oil completions in the various US tight oil basins. The charts below illustrate such an estimate for the Permian, North Dakota Bakken/Three Forks, Eagle Ford, Niobrara, and other tight oil basins (not included in the previous 4 tight oil basins).

Permian legacy decline is 3405 minus 3142 or 263 kb/d. Read More

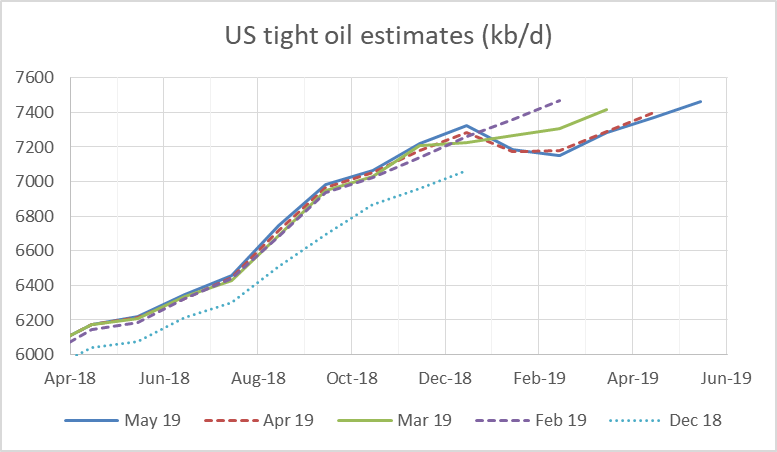

New tight oil estimates were recently released by the EIA. The chart below compares estimates from Dec 2018 to May 2019, where the Dec 2018 estimate is that estimate with the most recent month estimated being Dec 2018 and likewise the May 2019 estimate has May 2019 as the most recent month estimated. The May 2019 estimate is fairly close to the April 2019 estimate with a slight downward revision of the April 2019 estimate from 7399 kb/d to 7368 kb/d, March 2019 was also revised lower by 10 kb/d from 7292 kb/d to 7282 kb/d. For May 2019 the most recent estimate is 7462 kb/d and if past history repeats this estimate may be revised lower next month.