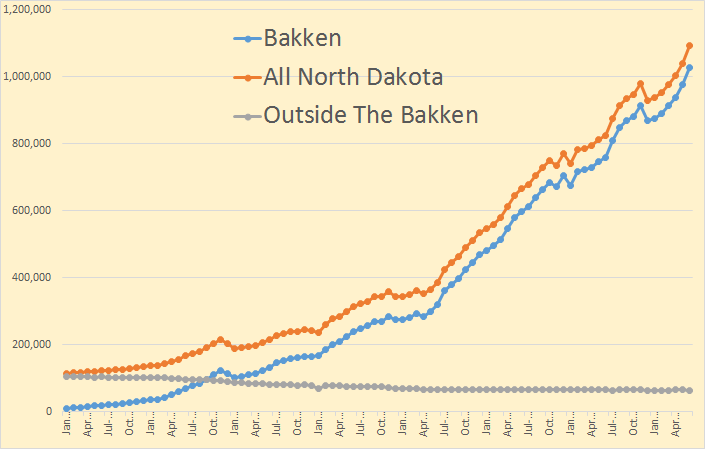

The Bakken and North Dakota production numbers are in for June. There was a big jump in oil production in June. The Bakken was up 53,162 barrels per day to 1,028,352 bpd. All North Dakota was up 52,148 bpd to 1,092,617 meaning the area outside the Bakken was down about 1,000 bpd.

From the Director’s Cut:

May Sweet Crude Price = $88.31/barrel

June Sweet Crude Price = $90.03/barrel

July Sweet Crude Price = $86.20/barrel

Today’s Sweet Crude Price = $79.50/barrel (all-time high was $136.29 7/3/2008)

The drilling rig count was up one from May to June, and up two more from June to July.

The number of well completions increased as weather impacts eased in June with

significant rainfall on 2 days near Minot and 1 day near Dickinson. However, there were

still 6 to 8 days with wind speeds in excess of 35 mph (too high for completion work).

At the end of June there were about 585 wells waiting on completion services, a decrease

of 25.

For the first time in a couple of years he did not give us the exact number of new well completions, only that they increased. Last month there were 227 well completions and production was up 37,000 bpd so we can assume there were aroun 235 to 240 new well completions in June.

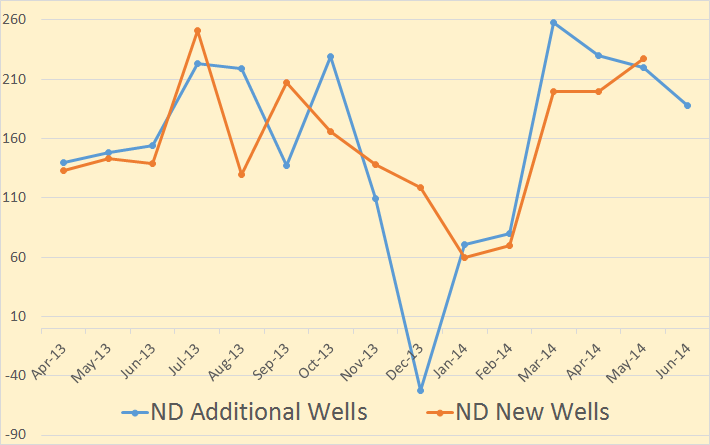

Well completions should not be confused with “additional wells producing. That is and entirely different figure.

Additional wells producing is new wells completed, plus previously shut down wells brought back on, line minus wells shut down. Sometimes this number goes negative as it did in December of 2013. That month “Wells Producing” dropped by 52 even though there were 119 new wells completed. All data is barrels per day.

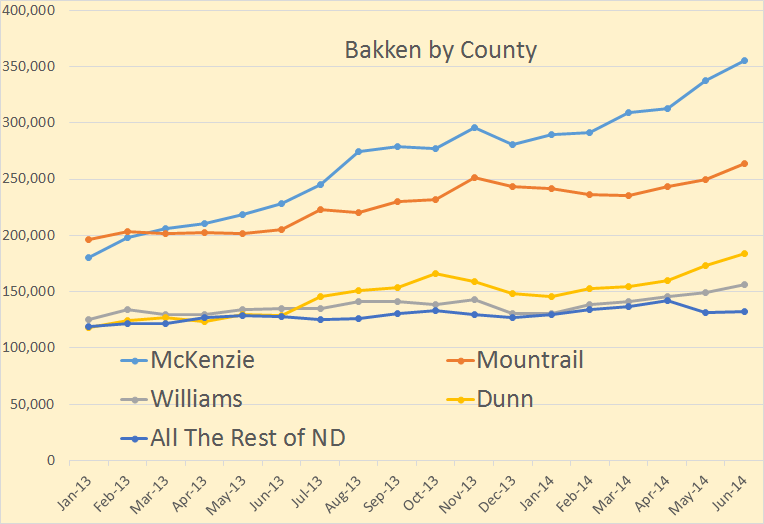

All four counties were up in June. Since October McKenzie is up 77,962 bpd, Mountrail up 32,146 bpd, Williams up 18,619, Dunn up 17,899 and all the rest of North Dakota down 439 bpd.

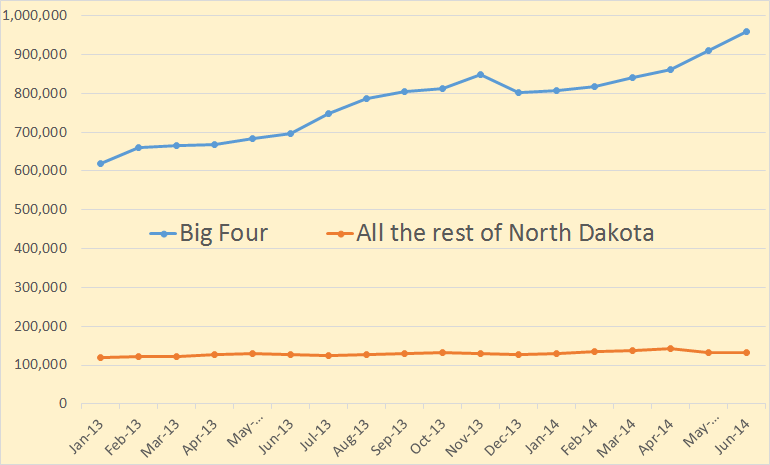

This zero based chart should give you some idea of the dominance of the production from the big four counties in North Dakota.

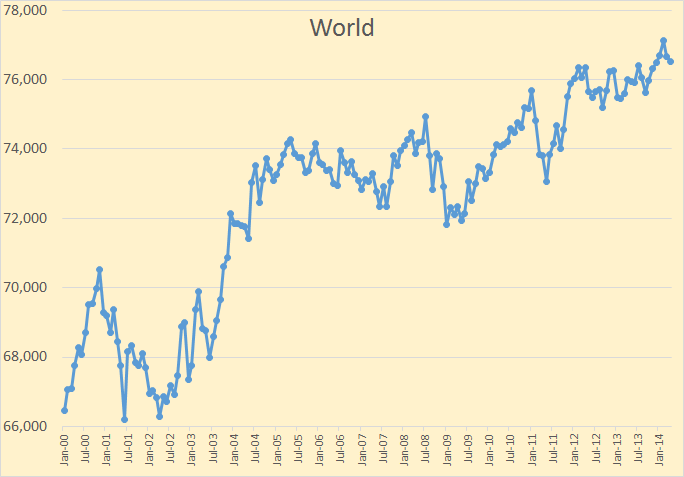

The EIAs International Energy Statistics has been published with the April production numbers. No big surprises, the world still depends on the USA to hold off peak oil. All EIA data is thousand barrels per day with the last data point April 2014.

World C+C production was down 157,000 barrels per day in April and down 626,000 bpd since the last peak in February.

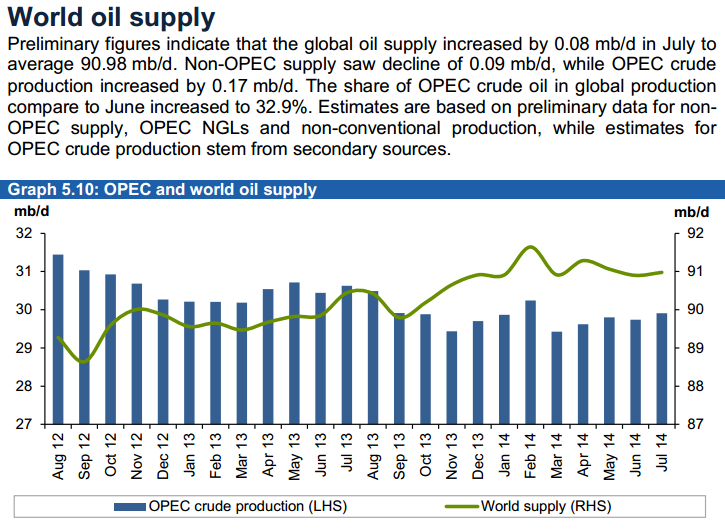

And according to OPEC that was also an all liquids peak that is still holding thru July.

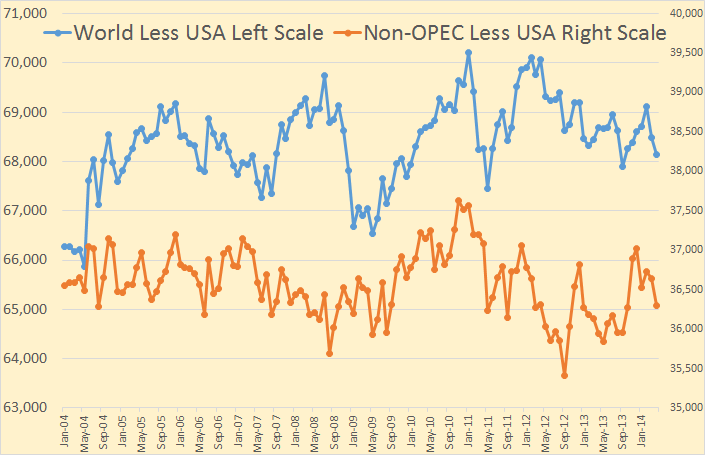

World less USA is down 2.069 million barrels per day since the peak in January 2011 and Non-OPEC less USA is down 1.325 million barrels per day since peaking in November 2010.

I have looked at all the charts of oil producing nations and concluded that only the USA and Canada will any significant increases in production in the next few years. Kazakhstan will have some increase beginning late 2016 and Brazil is finally getting some pre-salt on line, but not much.

I invite you go go to the just updated Non-OPEC Charts page and look at the nations that have recently peaked and especially those that are in long term downward trends.

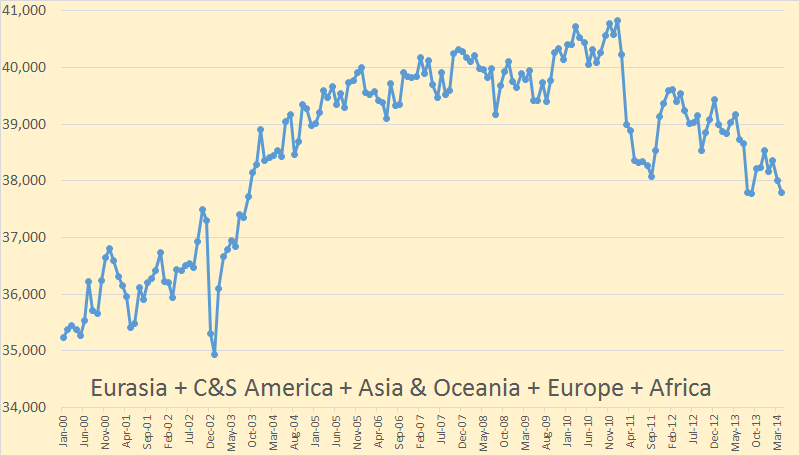

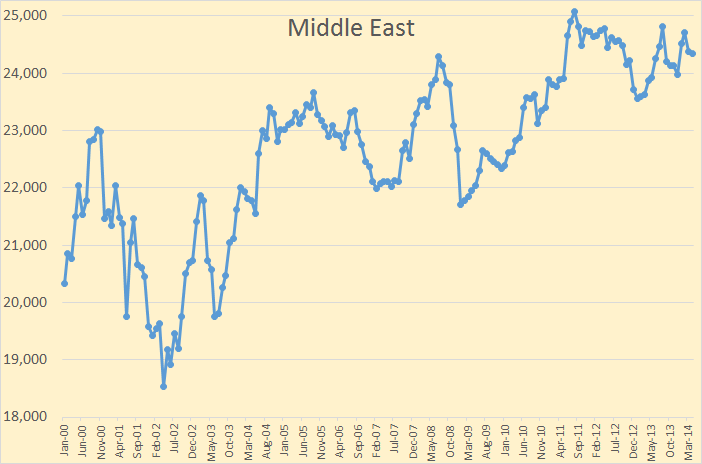

The combined production of six geographical areas peaked in January 2011 and are down just over three million barrels per day since that date. That is everywhere except the Middle East and North America.

And the Middle East isn’t doing all that hot, down 724,000 barrels per day since August 2011. Only North America is booming. Of course things will fluctuate from this April data. The Middle East may go up a little or down a little depending on what happens in Iran and Iraq. But they are on a plateau that, in the long run, can only go down.

The page World Production by Geographical Area has also been updated.

120 responses to “Bakken Production Data for June + EIA Data”

Peakoilbarrel.com is my go-to site for staying abreast of peak oil. It is a great resource! Thanks Ron!

Does this month’s Bakken oil report change the trajectory of the North Dakota peak as discussed in an earlier article about the Bakken?

My hunch is that, due to the decline rates, LTO is even more prone to a “blow off top” than something like Iran or Alaska (rapid effort to push to max production). Every well drilled today is (a lot) more drag next year. That a ton of wells have been drilled 2012-2014 means that 2015 will be rough. It has to be.

There’s also an incentive to drill as much as possible because of the financing structure.

Overall, I would not take strong increases in production to mean that the resource has fundamentally changed.

Forgot to post my name. Sorry!

If I am not mistaken my prediction was for the Bakken to peak no later than December 2015. That date hasn’t changed as far as I am concerned. Others will have to make their own assessments.

If the USGS mean estimate of undiscovered technically recoverable resources(TRR) from April 2013 is correct for the north Dakota Bakken/Three Forks (5.8 Gb), then the TRR is about 10 Gb when proved reserves and produced oil (combined about 3.8 Gb) are added to UTRR.

Using reasonable economic assumptions and oil prices consistent with the EIA’s AEO reference scenario, I assume new well EUR starts to decrease by June 2015 and reaches a maximum rate of decrease of 12% per year by June 2017 I also assume that initially 170 new wells are added each month until reduced profits causes the drilling to slow down in 2019. Peak is in late 2017, output and number of completed wells (on right axis) are shown in the chart below. (Without profitability concerns and with 170 new wells added per month until 45000 wells are completed, the TRR would be about 10 Gb, the economics reduces output to 8 Gb with about 25,000 wells completed.)

Thanks Ron! I checked and realized I was thinking of Davis Archibald’s recent Bakken commentary/chart:

http://peakoilbarrel.com/wp-content/uploads/2014/08/Laherrere-2014.png

Would you please ask David if the strong North Dakota June production # changes his Mckenzie (and the rest of the Bakken) Hubbert linearization plot?

Thanks!

Top 10 Operators in Each North Dakota County

Watcher’s question the other day of which operators dominate Mountrail County piqued my interest in asking the same question for other counties. So I charted the results for the four big counties along with Divide and Stark, the two most important peripheral counties. For space I have included only the top 10 operators of each county in the chart below. This is an exclusive to this blog, I hope you like it.

The county abbreviations are the same as what the NDIC uses (DUN=Dunn, MCK=McKenzie, MTL=Mountrail, WIL=Williams, DIV=Divide, STK=Stark). The well count includes active wells, confidential wells that have been spud, and wells on ‘DRL’ status (drilled but not yet completed). If desired I can chart other counties or show more than just the top 10 for any of these counties.

Interesting that Continental is only 4th in McKenzie. And that is a major county.

One explanation is that CLR has always been far more focused on well information as opposed to short term money. Rather than develop their own properties they have invested heavily in getting a WI (working interest) in competitor’s wells spread out over the entire Bakken. This practice has surely lowered their short term gains, but has given them immense insights in how to best develop the Bakken overall. This will likely pay off very well for them in the end. But, it is primarily because of their WI arrangements in competitor’s wells, that they are considered to be such a good proxy for the entire Bakken. Their average EUR, which also includes all their WI arrangements is 603,000. That claim is solidly backed up by Enno’s maps.

June 2014 ” The Bakken was up 53,162 barrels per day to 1,028,352 bpd”

In the EIA Drilling Productivity Report

http://www.eia.gov/petroleum/drilling/archive/dpr_jun14.pdf

they have 1,074 kb/d for June, or 46 kb/d higher.

If DMR data are correct, how will the EIA ever correct their PDF files?

Actually that is pretty close. The EIA is counting all the Bakken, including the part in Montana. And 46 kb/d is pretty close to what the Montana Bakken produces.

Good Job, however this is a part of the equation, you invest and drill, and the oil flow and only drillings and well completion are contributing the most of the increase. Plots presented do not need more comments. The countries where oil production is on decline have potential to increase it, but this need investment, successful new technologies, because the one well known are not satisfying the investors. The bottom line is the investors need to search for new technologies, This may come gradually. Peak oil comes soon if we do not work effectively. If we will work hard then we have oil for more than a century, conventional and conventional and on addition heavy oil reservoirs. World has billions of years life, and during this time oil has generated and accumulated. To bring it we need the technologies. So to my opinion and arguments are many, oil peak can come any time, but if we work, then we will postpone it decades away at least after 2050.

Doubt that peak will be after 2025 technology has been applied. There are no magic bullets.

Some things are doable. Some aren’t.

The whole Marine Corp couldn’t sweep back the tide with shop brooms.The oil industry on a world wide basis is not going to scale up tight oil production fast enough to offset the decline of the large and giant old legacy fields that supply the vast bulk of our oil today.

I am willing to stipulate that in principle it might be possible to ramp up unconventional oil production world wide and increase energy efficiency enough to avoid the crash we associate with peak oil.

There is a hell of a difference between the theoretically possible and what can be expected to be done as a practical matter.I can see no indication whatsoever that we will actually be able to afford the necessary investment in tight oil that could in principle offset the decline of conventional oil or that we would make the investment even if we could afford it before it is too late.

The market and politicians today are not going to do much to get ready for shrinking oil supplies five ten or twenty years down the road.

This is not to say however that once the shit is in the fan that rich and powerful countries such as the US cannot weather the peak oil storm without foundering. We do after all have both food and democracy to export and a navy to guard and ensure the delivery of both.

Beyond that we have enough domestic production to get by under a planned economy until we can ramp up renewables and coal to liquids and maybe nukes.It will be very very hard but not catastrophically hard here if we are lucky enough to have decent leadership when the real troubles arrive.

Sky Daddy alone is the only hope people in such countries as Egypt have left. Collapse there is just a matter of time.

“I am willing to stipulate that in principle it might be possible to ramp up unconventional oil production world wide and increase energy efficiency enough to avoid the crash we associate with peak oil.”

Not possible even in theory to avoid a peak. It is possible to move the date of the peak, but it is mathematically certain to occur, not only for oil but for all other non-renewable resources. But perhaps you are only speculating that it will be possible to avoid negative economic consequences of the peak.

Whether there will be an economic “crash” associated with the downslope after peak oil depends on whether other energy resources of sufficient EROI have come on line as substitutes by then. My opinion is that they will not. To date, I see insufficient capital being shifted to coal-to-liquids or grid expansion and other infrastructure needed for electrification of transportation. Losing our main source of transportation energy will have dire consequences.

The Limits to Growth baseline scenario is playing out as predicted over forty years ago. The big unknown after economic growth turns to irreversible decline is whether financial crises will cause rapid collapse or whether governments will be able to manage to slow the decline with command economies, rationing and martial law. My opinion is that, whenever it comes, economic decline will be rapid enough to warrant the term “collapse” or “crash”. Take your pick.

”Not possible even in theory to avoid a peak. It is possible to move the date of the peak”

You are correct of course. I forgot to add the key words involving time frame.A peak is inevitable at some point no matter what. Discussions such as this one are mostly apt to be as messy and useless as a cafeteria food fight unless all parties are on the same page in relation to the time frame.

But Steve is right in his comment below that IN PRINCIPLE there is enough oil in the ground to delay the peak for a very long time if economical means of extracting it could be devised.

I am dead certain however that the odds of delaying the peak for another half century are essentially a million to one against.Read that as zero for all practical purposes.

I do believe that it is at least IN PRINCIPLE possible to avoid the coming collapse we associate with peak oil.IF I were the all powerful and well loved dictator of the world as of this minute there would be a conference held within thirty days explaining the facts and what we would be doing to prevent our grandchildren living energy deprived miserable lives.

Collapse as a general thing IS inevitable NOT ONLY because of peak oil but because of peak resources in general but RATHER and IN ADDITION because we are just hairless monkeys with monkey attention spans and will do little or nothing to prevent it.

BUT if we were to spend half what we spend on war and consumer throwaway goods and mindless entertainment and above all education and reducing the population via policies designed to encourage small or no families then we could turn the corner on our energy troubles.The time frame issue would still matter and we might have to stipulate that collapse could only be avoided for some period of time such as the next century or two centuries rather than permanently.

I know plenty of people who spend enough on beer and cigarettes to pay for the changes they would need to make to cut their personal energy consumption in half.I am dead serious in saying this. Insulation and triple glazed windows and high efficiency appliances are not THAT expensive and subcompact cars are actually cheaper than bigger ones.In principle there is no reason the folks who make their living selling beer and cigarettes can’t make their living building bike lanes alongside existing streets and planting shade trees and installing solar domestic hot water systems and ripping out the runways at giant airports and planting beans there.Not even ten percent of air travel serves any really useful purpose that could not be equally well served by other means in the modern world given we have electronic communications now.

There is certainly enough coal to manufacture synthetic gasoline and diesel fuel to last a century. It costs twice as much but the fact remains that we can burn less that half as much by means of building cars and trucks that are twice as efficient and using trains for long distance freight hauling.There are actually things out there called buses and street cars although most Americans class them with unicorns having never seen any.

Now OF COURSE we aren’t going to GO PROACTIVE . Hence I am doing a little bit every week to turn my little farm into a comfortable doom stead in case collapse comes on stage before I make my exit.

BUT I still maintain that before it is a general collapse happens on a world wide basis some rich and well endowed countries such as the US will take notice of the bricks of reality smashing upside the collective head of society and go on a war time footing and have a good shot at avoiding a truly disastrous outcome.

Half the population on beans and bread welfare is not nearly as bad an outcome as half the population dead of starvation and exposure, never mind disease and violence.

We Yankees are incredibly lucky geographically with only one border to defend and – if we use it wisely- an enormous remaining endowment of natural resources including a good bit of oil that could be made to last a long time.

Beyond that we have food to export and a navy to ensure the safe delivery of it and of oil and other things coming in.Of course nothing is inevitable except change itself and we are not going to be top dog forever in a dog eat dog world.

“some rich and well endowed countries such as the US will take notice of the bricks of reality smashing upside the collective head of society and go on a war time footing and have a good shot at avoiding a truly disastrous outcome.”

My mother, who was a teenager during the later stages of WW2, remembers that time well. She keeps telling me that the US can “turn on a dime” if the urgency of doing so is apparent to enough people.

I guess that might be true, but I have been waiting with gradually thinning patience since the 70’s for any sign that the powers-that-be in the US are taking any notice whatsoever that our collective future is in dire jeopardy. So I may be impatient, but it’s only because it is very likely that the deadline for that “war footing” has long since passed.

Of course, we won’t know for sure until we try. It still might just be possible to make a deliberate transition to a sustainable energy system and economy, but I suspect that the transition will be totally involuntary instead, crisis driven on multiple fronts and devastating to the vast majority of the population. I can only hope that my family will be watching in fascination from distant sidelines. That’s what I work toward every day.

My mother is of that generation as well.

However, one of the things I’ve learned from her is that the American expectation regarding the material abundance required for happiness has grown markedly since WWII.

Profligacy is now an American value, and I think this will inhibit a change of cultural course, if one is needed in the future.

My sentiment exactly, it would be cheap to invest in fuel saving now. It would also be easy for the government to drive, in my opinion, by simply taxing fuel and spending the proceeds on fuel saving programs or infrastructure. But it is unlikely to happen.

Imo it is too late to save ”business as usual” even in a country such as the US.No matter what we might do to lessen the effects of peak oil and other peaking resources the bingeing lifestyle is soon going to be history.

But the end of the energy binge does not HAVE to mean the end of industrial civilization any time soon and maybe not ever.

My basic premise is that collapse is going to happen piecemeal rather than all over the world silmantaneously and that countries such as the US will indeed go on a wartime like footing and do SOME THINGS – a lot of things actually, while there is still SOME time left to react.

The reason we are still waiting to see this happen is that only a few of us have felt the bricks of reality upside our heads and even then only in an abstract intellectual fashion.

I am getting old and can remember only a half a dozen days in my life when I could not buy gasoline at an affordable price even though I make a lot less than most people most of the time.(At times I have made very good money .)

Peak oil is only an abstract intellectual concept to me in terms of the way I live.I still have cars and trucks and tractors and a riding lawn mower and a four wheeler off road tav and other oil burning machinery.I still have air conditioning and I still burn a hundred gallons or so of oil for supplemental heat every winter.

Most people in most of the developed world are in a similar situation.

We all of us who were alive and paying attention to politics back during the thirties knew about the threat posed by Nazi Germany and Japan but very few of us took the threat seriously until war actually broke out- and that few were considered warmongers and alarmists and worse by those who just wanted to think about something else.That few were mostly part of the previous generation that experienced WWI which primed them to be on the lookout for a coming WWII.

We have not yet had our REAL WWI in terms of the public being aware of our energy problems. Most of the public does not even vaguely understand that all our military adventures since Korea and Vietnam have been mainly about oil rather than power and freedom and religion.

This lack of understanding will not be remedied until the day the supertankers fail to arrive.

Only THEN will the public finally get the brick upside the head that will wake it up.

Peak oil is only an abstract intellectual concept to me in terms of the way I live.I still have cars and trucks and tractors and a riding lawn mower and a four wheeler off road tav and other oil burning machinery.I still have air conditioning and I still burn a hundred gallons or so of oil for supplemental heat every winter.

Most people in most of the developed world are in a similar situation.

I’m not sure that’s true.

http://oilprice.com/Alternative-Energy/Renewable-Energy/Germans-Happily-Pay-More-For-Renewable-Energy-But-Would-Others.html

Not a great article, but as a long term resident of Germany I can vouch for the main claim, which is the the government’s energy policies are broadly popular even though they cost people a lot of money. People like it because they think it is the right thing to do. Per capita oil consumption is much lower.

OFM. Thanks for all the good words. You are carrying the torch so well that I can sit back and goof off with my gadgets games- transmissions, gasifiers, etc.

I think the folks here are not paying enough attention to the solar revolution and the local awareness groups. Around here, a very average sample of the US, people are getting together to get serious about getting off carbon, and are really doing it.

In a few weeks we are having a massive get together of the all the little groups which have sprung up here and there, including a couple of important town mayors.

I have bought a big pile of solar panels at a bargain, and have passed them all out to DIY types at cost. and I myself have no gas burners left and good riddance.

Since solar can only go down in cost, and fossil fuels can only go up, the result is a near certainty.

It’s hard for most people to feel how fast any new tech can evolve. Solar/wind is evolving very fast indeed.

Of course, other countries are already way ahead of us, but things are moving here, way faster than most people realize.

I don’t see why we couldn’t push peak back to at least 2100, if the damn socialist Govt would step aside and let capitalism do its job.

Steve

Steve, did you forget your smiley face? Or are you serious? Sometimes it’s hard to tell.

Ron,

They call it an Elite clue. Those who know me… get it. Anyone else would get a misdirection. 🙂

Steve

From SRS: “I don’t see why we couldn’t push peak back to at least 2100, if the damn socialist Govt would step aside and let capitalism do its job.”

Perhaps it’s because it is in the majority’s genes. Democracy rules. The demise of Humanity is not my fault.

LANDMARK Adelaide research showing that sperm and eggs appear to carry genetic memories of events well before conception, may force a rethink of the evolutionary theories of Charles Darwin, scientists say.

It also suggests the bad habits developed through a parent’s lifetime could be passed on genetically to their children.

Darwin’s theory of evolution challenged by University of Adelaide genetic memory research, published in journal Science

This is called “epigenetics”. Genes in a given cell are switched on and off all the time in the course of a lifetime. The difference between say liver cells and brain cells is the pattern of gene switching, since they contain the same genes. But even within a given cell type there is constant switching. For example hormones are messenger substances to switch genes on or off, and heat stress can switch on the production of heat shock proteins.

Some of this patterning is passed on from mother to child. This finding is not really new. It is real and an interesting complication but less significant than is being made out in the article.

From the well respected journal on evolutionary biology, ‘THE ADVERTISER‘ we have this incredible, peer reviewed paper, that has all supporters of Darwin’s theory of evolution quaking in their boots!

“It paves the way for a review of the work of French biologist Jean-Baptiste Lamarck, whose theory that an organism can pass to its offspring characteristics acquired during its lifetime was largely ignored after Darwin’s publication of On The Origin of Species in the mid-1800s…”

Really?! ROFLMAO! No, it most certainly does not!

Disclaimer: I haven’t read the actual paper but whatever it says I’m pretty sure that even though most cpmpetent modern biologists are familiar with and accept epigenetic inheritance as fact it doesn’t in any way challenge the basis of Darwinian evolutionary theory.

“The evolutionary biologist T. Ryan Gregory has written that epigenetic inheritance should not be considered “Lamarckian”. According to Gregory; Lamarck did not claim the environment imposed direct effects on organisms, instead Lamarck “argued that the environment created needs to which organisms responded by using some features more and others less, that this resulted in those features being accentuated or attenuated, and that this difference was then inherited by offspring.” Gregory has stated that “Lamarckian” evolution in the context of epigenetics is actually closer to the view held by Darwin rather than by Lamarck.”

(Source Wikipedia)

Epigenetics is a playground for fringe theorists, especially religious kooks and racists.

Yes.

You certainly are correct.

Because the Pyramids were built by Stone Age People with Hand chisels and Hammers.

As was Puma Punku and Tiwanaku

Thank god modern man knows it all.

Name calling solves all intellectual debates, when the OTHER side has no reasonable explanation. It’s a time honored strategy. Please – what else am I?

The Egyptian pyramids were built in their bronze age. But I guess you’re just trolling now.

Um…

New evidence of weathering on the Sphinx points to an older age.

Let me assist you – I work in a modern CNC equipped Machine Shop. I manufacture precision parts.

I know some things – but not all things.

http://ancientaliensdebunked.com/references-and-transcripts/puma-punku/

Nice Link.

What’s your experience?

None?

I’m a Machinist – so quit Playing.

Given enough time – these also may randomly appear – machined by soft brass and copper tools, and assembled by Monkeys.

https://www.facebook.com/158049994227980/photos/pcb.841913155841657/841913005841672/?type=1&theater

Ancient Machine Built The Great Pyramids

You can’t do that with soft Copper or Bronze Tools.

And not to that precision – repetitively. Do you understand the concept of repetitiveness? All tools wear – continuously. Have you ever machined parts? And where are the measuring devices? I have numerous drawers filled with precision calibrated tools which measure various dimensions. If you aren’t a Machinist – you have NO CLUE.

IF ancient Man did that – it wasn’t with the tools that Evolutionists say were available at that time.

PERIOD.

Your explanation? Please.

There was a time when everything not understood was explained as the work of the gods. Now it is explained as the work of work of extraterrestrial aliens.

The pyramids and everything else on earth was that was not built by nature was built by man. The idea that extraterrestrial aliens went about hewing stone and building stone structures is just silly. But such stories do sell a lot of books to very gullible people.

Call me guillible.

But ancient man did NOT build those structures with the physics that define the 21st. C.

I know this – because I am a modern Machinist. Your beliefs don’t shape the product- and your inexperience shows.

So what.

What’s your experience in this World?

I got 51 years. You got what? Under 100?

How Old do you believe the Universe is?

And Death is a door that is just as frightening and an adventure into the unknown to you, as it is to me.

You are NOT a Machinist.

You are an opinionated educated old Man.

Who has very limited experience in the Universe.

Want to machine some parts and increase your experience? Let me know. It might open your eyes.

But don’t try to impose your limited experience in this World on it’s entire lifetime.

I know the difference.

You are an opinionated educated old Man.

And you are a modern day machinist who doesn’t know jack shit about the abilities of ancient stonemasons.

How Old do you believe the Universe is?

About 14 billion years and the earth is about 4.6 billion years old. What hast that to do with anything?

The idea that ancient aliens built stone structures for ancient man to worship, or whatever ancient man wanted to do with them, is really just down in the dirt stupid. Ignorance gone to seed.

“And where are the measuring devices? I have numerous drawers filled with precision calibrated tools which measure various dimensions. If you aren’t a Machinist – you have NO CLUE.

IF ancient Man did that – it wasn’t with the tools that Evolutionists say were available at that time.”

Well Tim, I’m 61 and have been around more than a few blocks. I’ve even enjoyed making some of my own metal alloys and personally worked with some excellent machinists as well. I also studied Biology among quite a few other things. I’ve worked on projects with engineers and scientists from many different fields. As for precision, I’ve worked as a jeweler, had my own jewelry business and also did things like precisely scaling Medical images for a top liver surgeon… So maybe I do have at least bit of a clue!

The Theory of evolution is something you either understand or you don’t but to understand it you do need to put in quite a few years of highly specialized study so being that you are a machinist, I’m willing to cut you some slack on that one. Though I’m not quite sure what you mean by ‘Evolutionists’ I’m guessing you mean professional biologists, being that The Theory of Evolution is the foundation of all biological science.

For the record, professional biologists, or ‘Evolutionists’ as you seem to call them have very little to say about what kinds of tools or techniques were used by ancient man to build anything, let alone the pyramids which, BTW were not built by ancient man, as the earliest pyramids were built about 2600 BCE, certainly not ancient man.

As for how the pyramids in Egypt were built that is not a very great mystery and the Archaeologists have a pretty good handle on it. And no it wasn’t built by aliens, sorry to burst your bubble! You can do your own search on Google Scholar and read up on it should you be so inclined

Oh, I even worked for an Egyptian art gallery in New York at one time so I did more than a little reading on that particular subject as well.

So forgive me if I find a world view based exclusively from a machinist’s perspective to be somewhat limited and myopic, though I can live with that… but to be quite frank I find anyone who thinks the pyramids or any other structures to have been built by extraterrestrials or with the use of ‘Alien’ technology to be a little too far out in left field for there to be any meaningful dialog between us.

So I wish you well and urge you to do some serious study on all of these subjects. Reality is absolutely amazing and while it takes quite a bit of effort to understand even a tiny part of it, it is better sometimes to admit that we don’t know how the universe works and accept that as opposed to believing in magic, aliens or sky daddies!

Cheers!

Fred

I am not a machinist as such but I can run a lathe and a milling machine in a pinch if the job is simple enough.

Beyond that I can fix a dent in a bent car hood and do it so well that even in bright sun with very shiny new paint on it nobody can find the repair.There are plenty of people who can do as well who cannot even read a ruler.

With adequate manpower and a few brass or copper tools and string lines and instruments built out of string and wood and a couple of nails I could lay out the pyramids myself and build them if put in charge.All that is needed to square up a stone within a thirty second in four feet is a straight edge and the will power to do it and another stone.

As far as moving the stones- it is extremely likely it was done on rollers and with spiral dirt ramps built up as the pyramids went up.

This would have taken an incredible amount of manpower and a long long time but nothing at all in the way of advanced technology.

OFM,

Those large statues on Easter Island are a good indicator of what can be done with rock and muscle over time. The island is basalt; as that’s what they had to make statues from, that’s what they used. So are the picks they worked the stone with, which littered the main quarry in the early 1950s (I don’t know about now.)

Basalt + human muscle + creativity, et voila.

The island is basalt; as that’s what they had to make statues from, that’s what they used.

Not really. It is a volcanic island but different kinds of stuff are belched out of volcanoes. Basalt is harder and heavier than granite. Basalt makes great tools but it is damn hard to carve anything from basalt. However hardened solidified volcanic ash is a bit easier to carve.

Easter Island – The Statues and Rock Art of Rapa Nui

Using basalt stone picks, the Easter Island Moai were carved from the solidified volcanic ash of Rano Raraku volcano.Using basalt stone picks, the Easter Island Moai were carved from the solidified volcanic ash of Rano Raraku volcano.

Fred,

So, are you trying to sat that my Great Grandpappy was an APE?

steve

Worse than that Steve, I’m actually saying he is a great ape, as are both you and I, though not a monkey’s uncle.,, Heck he might have been an Orrorin tugenensis >;-)

Hey look on the bright side at least he isn’t an ‘Alien’!

Cheers!

Fred

Yeah, Fred…

Because it’s too hard to understand.

If evolutionary theories hold true, how did the leap from 24 to 23 chromosome pairs occur from ‘apes’ to humans? How is it possible for two chromosomes to merge into one, and for the resulting species to survive to breed?

-A high school student from the UK

August 29, 2007

Some very tough questions you’ve just asked! I will first start out by saying that scientists don’t know for sure why our ancestors split into two different species.

But we do know that chromosomes can stick together. And we know that people who have two chromosomes stuck together usually have no problems.

How do we know this? Because there are lots of people like this running around. Something like 1 in 1000 live births has this kind of chromosome mix up.

So there isn’t really an issue with the chromosomes sticking together. The tricky part of your question is how this changed chromosome could have taken over the population and became what is most common in people.

We’ll go over some of the ways this might have happened later on. It is important to say up front that we don’t yet know exactly what happened. And that we may never know for sure.

But before going over this, let’s talk a bit about how we know that one of our chromosomes is actually made of two ape ones. And why chromosomal rearrangements don’t cause more of a problem.

You are right that evolutionary theory says that humans evolved from an ape ancestor who had a different number of chromosomes than modern day humans. Humans have 23 pairs and apes have 24.

Fukking’ Magic

It’s a XXX unexplainable miracle.

Humans have 23 pairs and apes have 24.

There is one hypothesis of how we came to have 23 chromosomes. I’ll let you read it and make your own decision. http://www.macroevolution.net/human-origins.html

Yes but an overachieving ape that pioneered the use of tools.

These are June’s numbers. Drilling permits would have already been granted for this output.

June’s decision to require documentation for handling nat gas before drill permits would be approved would show up, however, by now (the July numbers), if it was anything but lip service.

And we see no slowdown in July permitting in the Director’s Cut.

Here is a view of the monthly change in Bakken oil production, over the last several years.

To make it more understandable, I smoothed the monthly data with its nearest neighbors (+- 1 month)

One notices that the range is from -10,000 to +50,000, and that December and January are difficult months for production increases. 2014 is shaping up to be a very healthy year for production increase.

I expect production to level off in the Bakken when the December dip is equal to the Summer peak. Currently, that would be -30,000 in December and +30,000 in July. This condition does not appear to be in the near future. However, one must remember “Past performance is not an indication of future results”.

That chart is a bit of a head scratcher for peakers, especially since it is net production (as I assume). It would be interesting to see this data compared to drill counts or completions.

So, ((production increase) / (well completions) ) vs. time

okay, here it is.

Where did you get well completions? The only place they are given, to my knowledge, is in Helms’ “Director’s Cut”. And he didn’t give a number for June, only said they were above May, (227). If there is another source please let me know. I could sure use that source.

I just took the change in the wells producing from here:

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

May was 218.

Is it okay to do this? I don’t know where the data really came from.

There is nothing wrong with the data except it is total Bakken wells producing, not Bakken wells completed. In May there were 227 wells completed in North Dakota. I don’t know how many were in the Bakken but likely all but one or two of them. Last week there were 53 wells completed and every one of them was in the Bakken.

Last week was the first week that they seemed to have a complete list here of “wells completed”. All previous weeks had only a partial list and few of them gave “barrels of oil produced”. I hope this complete data is a permanent change.

Last month’s Director’s Cut:

The number of well completions increased 14% to 227…

This month’s Director’s Cut just says there they increased over last month:

The number of well completions increased as weather impacts eased in June

Every month lots of wells are shut down, some permanent because of low production and some are shut down for maintenance. Some previously shut down wells are brought back on line.

If you go back to 2004 the a lot of months the additional wells were a negative number. And from November to December 2013 North Dakota the “wells producing” number declined by 52. So obviously a lot of wells are being shut down. So just by looking at “wells producing” there is no way you can tell how many new wells were put on line.

EDIT: I forgot to add. Low producing wells being shut down is one reason that the “Daily Oil Per Well” number stays high or even increases. So when you see this number really jump, as it did in June, this is a good sign that a lot of low producing wells were shut in.

An Impending Oil Shortage?

An uncertain investment climate in oil-exporting Middle Eastern countries may lead to a two million bpd shortfall and a $15 jump in oil prices by 2025.

Forget North America’s shale revolution, the world needs Middle East oil for long-term sustainability and to quench growing global demand for fossil fuels.

The International Energy Agency’s (IEA) latest report on global energy investments notes that while unconventional crude oil and natural gas reserves from North America have snared the majority of investments over the past decade, the Middle East will be crucial to meet the energy demand of a fast-growing world.

“We look at the Middle East, where increased investment remains absolutely critical to the longer term outlook for oil markets, once the current surge in non OPEC production starts to plateau in the 2020s; if investment does not pick up as needed, this will mean much tighter and more volatile oil markets in the 2020s,” Maria van der Hoeven, executive director of the International Energy Agency said in a speech unveiling the report in June.

The IEA is worried that an uncertain investment climate in oil-exporting Middle Eastern countries may lead to a two million bpd shortfall and a $15 per barrel jump in oil prices by 2025.

They have every reason to be concerned but that impending oil shortage will happen way before 2025.

Will there be investments in NA refinery capability for this type of LTO. I think I read somewhere that the Bakken & EF Average API is increasing as newer techniques are used.

Today I learned that “long term sustainability” is another word for pumping oil out of the ground as fast as you possibly can.

This does seem alarmist by IEA standards. Of course $15 doesn’t seem like much of a jump considering that 15% (cumulative) inflation seems likely between now and 2025. We’d be back to where we are now (actually below it, because 1-15%+15% is only 97.75%).

The problem with inflation is that it tends to outstrip wage rises – I doubt many workers will be seeing a 15% wage rise over the course of the next 10 years.

I bet they will in China.

Guess folks who don’t get a raise will have to stop driving a pickup to work.

Ron’s chart of additional wells vs new wells, the two differing by netting shut in wells against new ones brought online — juxtapose that with Enno’s critical parameter that 60% of production is from wells less than 18 mos old.

It occurs to me that given finite truck numbers and finite road area, were it me I might be shutting down more low producing wells so as not to occupy my oil hauling trucks making trips to wells that only do 20 bpd when I might need that truck time spent on my new wells. And so we get wells shut down at higher and higher output rates. This will amplify Enno’s parameter.

It costs roughly between seventy and a hundred twenty-five bucks an hour to keep an eighteen wheeler on the road depending on the drivers wages and the amount of hours the truck is used and so forth. Capital and other fixed costs fall fast with extended operating hours but old trucks are generally cheaper if used only forty or fifty hours a week.

My guess is that it would not be hard to hire enough older trucks probably mostly owner operated to move oil from local storage tanks at wells to shipping points where it can be loaded onto trains or into pipelines.

This would not cost the well owners anything in terms of capital and thus free up any newer trucks they own for the more time critical job of hauling materials to new well sites.Emptying a tank at an existing well could be easily delayed a day or two or moved up a day or two depending on the size of the tank and the number of wells feeding it. The ones I have seen pics of look to be big enough to hold a few hundred of barrels but I ain’t no photo analyst!!

I don’t know what tight oil is worth at the well tank but my guess is at least seventy-five bucks.Twenty barrels would be fifteen hundred bucks.How much of that is consumed in variable operating costs to keep the well in production is anybody’s guess.From what I gather reading sites such as this one running the pumps sucks up a lot of either diesel or in some cases ng since in generally speaking there is either no or grossly inadequate grid service near the wells to run electric pumps.

Gas might be free or nearly free given that a lot is flared any way but diesel is most certainly has to be paid for.

Maybe some of the oil field pros can tell us how big the local storage tanks are and how much fuel is needed on average to pump a well on a daily basis.

Farmer Mac,

Sorry… didn’t get a chance to answer your question about Russian gold reserves. They hold about 1, 050 tonnes. However, they nearly doubled it since 2010.

I think they had a lil more than 540 tonnes in 2010. They added 500, 000 oz in June alone.

Both Russia and China are rumored to hold a great deal more than their official figures. There’s good inside info that suggests Russia has 2-3 times their official figure while China may have over 5-6, 000 tonnes.

Lastly…. there is also speculation that a great deal of U.S. gold was leased and sold on the market to

depress the price.

The gold market will become quite interesting when the Dollar is no longer the worlds reserve currency. And it looks like this U.S. backed overthrow of the Ukrainian govt may just speed up the timeframe… as Germany will soon exit NATO and the Euro and joins the BRICs Bank.

Steve

Watcher,

Consider that all the high EUR wells are in the 10,000 square mile USGS determined thermally mature part of the Bakken, that is centered on Mckenzie county, as depicted in Enno’s maps. Middle EUR’s (400-600 k) are mostly located in the outer 4,000 square mile marginally mature area surrounding the core. Outside of that are all the low EUR areas. There are almost no low EUR wells in the center core, and only a few in the marginally mature area. It is all just one big sweet spot, as depicted on Enno’s maps. Road congestion is a serious problem there and greatly hampers production at present. There is not much anyone can do about it.

Actually farmerguy shot down the speculation. It’s a duh moment. The wells have onsite tanks. So it’s silly to think trucks make a trip to a well to pick up 20 barrels. The well fills up the tanks and then the truck trip gets scheduled and the same oil total is loaded going there as for any other trip.

It is, however, eyebrow raising that Dickinson is the BNSF crude and proppant rail terminal and trucks go there to offload and onload. That’s a 100+ mile drive from Williston, shorter from Mountrail. Big state. Much more distance than I’d thought.

Hmmm speaking of which. I wonder if a tanker truck carrying oil one direction can pick up fracking water on the way back north. Otherwise a LOT of deadhead driving is going on. The fracking trucks hauling proppant north from the terminal similarly drives empty going south to Dickinson.

This is just bizarre.

Maybe it’s less severe for water. They haul production water from well in production to the disposal well/point. Then I guess they have to clean out the tank with clean water before filling it up with clean water to go back to the well being fracked.

Then when empty, go back to the production well to pickup dirty production salty water and repeat.

I’ll bet trucking up there is 0.3% of national GDP.

Hmmm speaking of well site tanks, okay so we load up a tank with 200 barrels before the 200 barrel capacity tanker truck shows up.

But the water cut on these wells is north of 90%? So I think that’s 2000 barrels of water to be hauled away for each 200 barrel truckload of oil.

Hmmm, I wonder how you tell when a production water disposal well is filled up and you have to occupy a drill rig drilling another.

Oh and btw, just found an article saying after fracking is done and oil is flowing, it takes 600 gallons per day to keep flushing the well bore (I guess) to stop salt encrustation and blocking. Or maybe they are just flushing things at the surface.

A 10 year well is eating more water post production start than for fracking.

This is just bizarre.

http://news.nationalgeographic.com/news/energy/2013/11/131111-north-dakota-wells-maintenance-water/

That’s the article. And I hadn’t read far enough.

They DO flush water down into the wellbore to dissolve encrustation.

600 gallons per day . . . these wells are staffed??? And wow, come winter you can’t do this. The water is frozen on the surface.

Well maintenance like that is usually a monthly thing. A chemical truck will drive around to a bunch of locations and pump water and with some scale inhibitor or w.e. they use to deal with the issues that they have downhole. I’m sure they use a hot oiler in the winter to deal with wax precipitation.

the article says 600 gpd. Monthly that would be 18,000 gallons. That’s too much weight for one truck trip so gotta use the tanks on site if they are going to accumulate water for the monthly event. There is a video of a big swimming pool sort of open air tank where trucks load up water for the millions of gallons fracking event. Could use it, but it will freeze in winter.

Makes a bit of sense, though, biocide addition-wise. You would not do that every day. Maybe add it to the tank for the monthly flush down the hole.

There were 53 new wells completed the week ending August 15. That works out to be an average of 235 new wells if they averaged that every day of the month. (53 divided by 7 times 31) They were all in the four main counties of the Bakken. Below is the count for each county, average Barrels of Oil Per Day, and average Barrels of Water Per Day for the first 24 hours of full operation.

Bakken Stats for Week Ending August 15

Average production for all new wells brought on line this past week.

Look at Mountrail’s water cut. Maybe that’s where Enno’s red splotch came from. They don’t have to occupy trucks hauling salt water to disposal anywhere near as much so as for elsewhere.

Good point. What in the world do they do with all that water?

If you want to see some pitiful results from new wells, just look at the Permian.

From Permian Completions Week 8/17 (This is the entire Permian, not just the part in Texas.) Keep in mind however that many of these wells, perhaps most, are conventional vertical wells. All production numbers are for the first 24 hours.

Water cut doesn’t look too bad on most of those.

The water cut? That was not my point. The average barrels of oil per well, during the most productive first 24 hours, averaged 213 barrels per day. They average 695 barrels of water per well during that first 24 hours.

That works out to be a 77% water cut. Yes, that is quite bad but not nearly as bad as their barrels of oil per well.

Is the water cut in the first 24 hours systematically different than say for the first month?

I am not an oil man but I would bet a lot of money it is not, not any better anyway. It starts out as good as it gets and gets worse from that day on. Over one month however there should be very little change.

But on conventional wells the increase in water cut is slow and takes place over many years. I am not sure how that would play out for tight oil wells however. But since there is no water injection, I would guess it would change very little.

I would imagine that the water numbers from the first 24 hours include load water (or flowback water, whichever you want to call it). That being, that it is water flowing back from the frac and not actual formation water.

I would imagine they would wait until that is out of the way before they started measuring. That shouldn’t take more than a few minutes, an hour or so at the most.

Load water takes a long to produce back. Fracs take millions of gallons of water to complete, and even at 1,000 bbls/day it is not simply minutes or hours to get all of the water back. Usually when a first 24 hour IP is given you are still producing load water, and as your get closer to producing all of your load water back (well, the part that you will get back) the water cut will go down. That is not the case 100% of the time, but it is the general way in which it works.

Permian = scam. Only a couple of those wells have any prospects of making money. Zero chance that that is how Wall Street is selling it…

“Quick, buy some Petroplex before it’s all gone!”

Somewhere in this discussion, it may fit.

Miracles Out Of Nowhere

On a crystal morning I can see the dewdrops falling

Down from a gleaming heaven, I can hear the voices call

When you comin’ home now, son, the World is not for you

Tell me what’s you point of view

Hey there Mister Madman, wat’cha know that I don’t know

Tell me some crazy stories, let me know who runs this show

Glassy-eyed and laughing, he turns and walks away

Tell me what made you that way

Here I am just waiting for a sign

Asking questions, learning all the time

It’s always here, it’s always there

It’s just love, and miracles out of nowhere

Tell me now dear Mother, what’s it like to be so old

Children grown and leavin’, seems the world is growin’ cold

And though your body’s ailin’ you, your mind is just like new

Tell me where you’re goin’ to

It’s so simple right before your eyes

If you’ll look through this disguise

It’s always here, it’s always there

It’s just love and miracles out of nowhere

And so I shall go on another bike ride….

Thank you Ron P.

Bingo.

From above and the issue of maintenance water. Clean water isn’t good enough. You gottta lace it with Chlorine Dioxide. It’s a biocide. (Done to the frack water too). The reason this is done is to keep oil eating bacteria out of the well.

And that, boys and girls, answers the terrorism question of a few RonPosts ago. “How do you do irreparable damage to an oil field?” You flush the right critters down into it.

Well terrorism is not the right word, I guess. It was about Libyan rebels seeing Egyptian troops approaching to steal Libyan oil. Deny it to them.

A thought that crossed my mind recently with regard to all this recent and strange geopolitical stuff happening, such as with regard to sanctions, Ukraine, and comments like ‘Fuck the EU.’, etc., that I thought to share was attempts at ‘managed contraction’. Has there been any recent discussion about this hereon and, if so, what was the general thinking, and if not, what do you think?

FWIW, I have so far not really read anything anywhere that suggests this (as a simple explanation).

Managed contraction?

Highly unlikely. The central banks coordinated QE across the world, but that didn’t require their staffs to be walking around with such a huge secret in their heads and none of them talk.

Quantitative Easing doesn’t seem to manage contraction exactly does it?

“Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.” ~ Wikipedia

So after QE (denial?), what’s next? War/’Fuck The EU’/sanctions (anger?)?

It’s like those five stages of grief, only applied macro-systemically.

Sanctions seem like a form of contraction/relocalization if less is being shipped.

“The Kübler-Ross model, or the five stages of grief, is a series of emotional stages experienced when faced with impending death or death of someone. The five stages are denial, anger, bargaining, depression and acceptance.” ~ Wikipedia

If this makes any sense, I wonder how bargaining and depression will manifest. Sanctions re-negotiations? (That already seems well on the books) Sobbing politicians? 😀

“Occam’s razor… is a principle of parsimony, economy, or succinctness used in problem-solving… It states that among competing hypotheses, the one with the fewest assumptions should be selected. Other, more complicated solutions may ultimately prove correct, but—in the absence of certainty—the fewer assumptions that are made, the better.” ~ Wikip.

Sobbing politicians negotiating… wait for it. ;D

Oh, contraction does seem to be the order of the day. Even Germany just reported -0.2% GDP. That’s GERMANY . . . in recession. Is anyone listening?

The primary way this will be addressed is by redefinitions. The US -2.9% Q1 GDP followed by +4% in Q2 could pretty much all be traced to recently hyper volatile measures of inventory. Hugely down in Q1, hugely up in Q2. Both wrong. In the new normal, traditional measures don’t seem to measure the same thing anymore. Lots of reasons for this to be so. Regardless of what they are, all econometric models are rendered wrong and the inevitable response by all and sundry is . . . change the definitions.

So don’t ever, ever, ever presume there will be a big doomer moment where announcements are made of relentless decline and inevitable death. You won’t even see such an announcement after such a thing happens. It will be . . . redefined. Dead won’t mean dead.

“…traditional measures don’t seem to measure the same thing anymore.” ~ Watcher

“The motions of the sun, moon and other solar system planets can be calculated using a geocentric model (the earth is at the center) or using a heliocentric model (the sun is at the center). Both work, but the geocentric system requires many more assumptions than the heliocentric system, which has only seven.” ~ Wikipedia

Are we at lunar-centric yet? That should wake up a few more…

Caelan,

I don’t believe there is a “managed contraction” when there is something like a quadrillion in derivatives floating around the market being kept together by duct tape and baling wire.

Once this thing really starts to unravel… watch out. Theres nothing left to prop it up this time.

And… I don’t think it’s a matter of 5-10 years, but rather just a few at the most.

Steve

I once took a university economics course when I was quite young, and even then, I realized its utter stupidity because of its ‘decoupling’ of/from (fundamental disregard for) nature– externalities and all that.

I mean, we had much older profs teaching this stuff with a straight face.

In such a landscape of internal logic insanity, anything appears possible, until nature hits the brakes.

“And… I don’t think it’s a matter of 5-10 years, but rather just a few at the most… Once this thing really starts to unravel… watch out.” ~ SRSrocco

Roundabout when the shale plays peak.

It’s a race against time… Centralized uneconomics versus decentralized economics Smackdown! 😉

Washington Post article linked on Drudge on California drought:

West’s historic drought stokes fears of water crisis

http://www.washingtonpost.com/national/health-science/2014/08/17/d5c84934-240c-11e4-958c-268a320a60ce_story.html

The late, great Elmer Kelton reading the intro to his book, “The time it never rained.”

https://www.youtube.com/watch?v=Tqaek4w9c5k

“And many a boy would become a man before the land was green again.”

The predominant crop in Willows is rice. California agriculture is hurt as much by their thirsty crop selections as by the drought.

c:\users\administrator\dropbox\campagnes\mescodespromo.fr\c15 –

t2 (ser sur high profil)\forum_image_blog_video_desc_comment\GSA

SER Perso – Code R

Ron, your website is among my handful of must reads. Today CNBC comments on how US production has shifted away from Alaska, which has massive resources that are off limits since they’re federal, not state or private. Once the US hits peak oil and politicians are aware of it, do you think federal lands in Alaska, Colorado and Wyoming will open up?

John,

Respecting Alaska, oil reserves are pretty much exhausted. There is some heavy oil that may or may not be economic. There is a fair amount of gas but as yet no pipeline. And the word “massive” is one that should be avoided when referring to natural resources because no one will know what it means.

I can see a clear need for clean water to do the initial job of fracking a new well.

But when water injection is needed to force the oil to the production well it is hard to see why produced water is not satisfactory. Of course it is my understanding that water injection is not much used with tight oil wells in order to enhance production.

Pipe is expensive but not all that expensive and I can’t see any reason to be hauling all that water hundreds of miles to get rid of it.It should be possible to lay pipe to carry that water far cheaper than hauling it day after day. Pipe laid on top of the ground can be easily coupled and uncoupled and moved as needed once a year or so.

Hauling so much water would appear to be a case of well intentioned environmental regs having the perverse effect of actually increasing environmental damages.Thousands of trucks running day after day chewing up roads and spewing co2 are going to do a lot more damage than an occasional spill of some greasy water.The whole point of drilling for oil in sane terms is to use it in a useful way rather than to burn half of it up in the process of getting the other half to market.

Well intentioned child labor laws make it impossible for small businessman to have a kid around helping with odd chores for a small wage with the occasional result being that the kid is out on the street unsupervised with the devil finding work for empty hands.

( I am not advocating the repeal of child labor laws but merely pointing out one of the unintended consequences of them. All laws and regulations have unintended consequences.)

I can’t speak for Ron but there is little doubt in my mind that once the fecal matter is clearly and indisputably in the fan that most federal lands will be opened to mineral exploitation.

This is going to be a political decision and we will imo do damned near anything to avoid a serious pain or even discomfort once it becomes obvious that ”damned near anything ” is the option.But drilling is not the same thing as actually finding oil in useful quantities.

Of course they will be open but oil on federal lands is way, way over hyped. ANWR is the only area with any significant oil. But it will take perhaps a decade after the area is opened up to get any significant oil flowing. The project would be similar to the Prudhoe Bay operation. Also pipelines would have to be built from ANWR to the head of the Alaska Pipeline. There are many estimates as to the amount of oil in ANWR but the best estimates give an average of from 7 to 8 billion barrels or recoverable oil.

The lower 48 federal lands hold a minuscule amount of oil. They are always talking about the Green River Formation which holds no oil whatsoever.

https://en.wikipedia.org/wiki/Arctic_Refuge_drilling_controversy

NPR-A has jack. It ain’t that far away. I read through that pretty careful and as best I can tell, despite fairly intense efforts by Bush to at least get an exploratory well or three drilled, THERE HAVE NEVER BEEN ANY EXPLORATORY WELLS DRILLED IN ANWR. If I misread it, then oh well.

Like NPR-A, it could all be natgas . . . or nothing. Not real clear why the Democrat side opposes an exploratory drill. I suppose they are sure it will show big oil totals. It never occurs to them that it might show nothing. If it shows nothing, their case would be HUGELY supported, to the point of default victory, but their policy must be don’t risk it.

I updated my numbers & graphs again based on the latest NDIC data, of oil production in the whole of ND.

So far the average well in 2014 produces very similar as the average well in 2013.

The 3rd graph shows for each month the number of wells that have first production, and the average peak output for wells that peaked in a certain month. I can’t determine the peak output for last month yet, so that is not shown.

Graph 5 shows that recently the water/oil ratio has been going up somewhat on average.

Graph 6 is a new graph that shows the average 1st year well return for the top producing companies during each of the last 4 years. Very interesting is to see the performance of EOG here. (don’t use this as any investment advice)

Coming back to the post of the geographical analysis : Luís de Sousa in further email conversation made me recognize that the chart where the surface areas were calculated for different levels of first year well returns is incorrect. I still stand by the results of the animated gif (with the note that 2013 seems not captured correctly, probably due to too few data as of yet).

Now 64% of production from wells less than 18 mos old. That’s growing.

Yo ManBearPig, Enno’s water cut graph shows more water than maybe suggested by your comment above, though you may have been referring to just recovery of frack water and not the pre-existing water.

Interesting how the post fracking years show a very sudden spike in water cut X number of months past initial/peak production.

I’ll speculate that the big stage count or better fracking process of recent years is moving that spike leftwards.

Re that spike . . . again focusing on above ground issues, the worse the water cut, the more trucks you have driving around “unprofitably” aka “not carrying oil or proppant”.

Hi Enno,

Great stuff as usual, thanks.

http://www.reuters.com/article/2014/08/15/us-continental-divorce-idUSKBN0GF14S20140815

This link is not directly related to peak oil or the Bakken but it does throw some light on the way the oil industry has grown and how conventional economists evaluate that growth.

That’s a good article and Hamm looks screwed to me. Hard to see how someone has $8B in cash laying around to pay off her half, so he sells shares or borrows money — with shares as collateral.

He’s going to lose influence, if not control.

Oil prices are tanking, 14 month lows. That’s going to be painful for all the cash-bleeding frack operations that are on completion binges.

Since the late 1990’s, we haven’t seen two years of sequential year over year declines in annual Brent crude oil prices, i.e., annual year over year declines have so far been followed by increasing oil prices, since 1998 (until the next year over year decline):

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=rbrte&f=a

The average Brent price for 2014 was about $109 through July (versus $109 for annual price for 2013), but the spot Brent crude oil price is threatening to crack the $100 mark.

I would think that the pretty significant cuts in upstream capex by many major oil companies, e.g. ExxonMobil, will start having an impact on supply, but we shall see what happens for the rest of the year.

No doubt, but for the fracking operators who have most of their cash flow from a well in the first 24 months, any relative downswing in price is a huge problem. Most aren’t cash-flow positive anyway.

Anon,

How about providing us with a list of these companies, that are not cash flow positive, along with the exact reasons why they aren’t. I don’t think you have any idea of what you are talking about.

The August issue of The Bakken Magazine is now on line.

The Bakken Magazine

Lead article is about saltwater disposal. Went thru it.

I would guess such a well costs $2-3 million? They have a good description of it and how monitoring instrumentation has to be between an interior cylinder and the casement. Can’t be cheap. So . . . they aren’t going to get any oil revenue from such a thing. And they say they are handling 15,000 bpd of production water.

If they charged $1 / barrel to dispose of it that would be $15K/day and quite a profit in a year. So the price must be something like 25 cents per barrel. That would be $1.3 million in a year before salary expense. It would pay off the loan in 3 or 4 yrs, let’s say. Of course, nothing in the article says how soon a well fills up. That would be bad if it did so after 6 months.

The Texas guy here did have a comment sometime back saying disposal costs of production water decided when wells get shut down. Not really how much oil is coming out.

Cool.