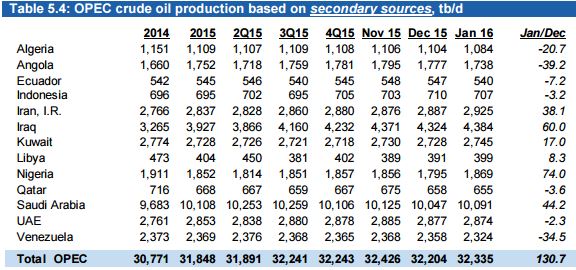

The latest OPEC Monthly Oil Market Report is just out. The the data is “Crude Only” production and do not reflect condensate production.

Also the charts, except for Libya, are not zero based. I chose to amplify the change rather than the total. The chats do not include Indonesia. That will be added within the next few months when I am able to get better historical data for Indonesian crude only production.

All Data is in thousand barrels per day.

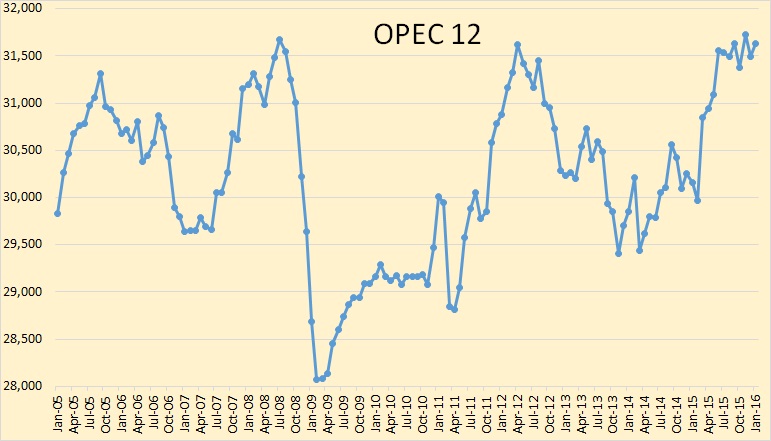

OPEC production, not including Indonesia, was up 130,700 barrels per day in December.

OPEC uses secondary sources such as Platts and other agencies to report their production numbers. These numbers are pretty accurate and usually have only slight revisions month to month.

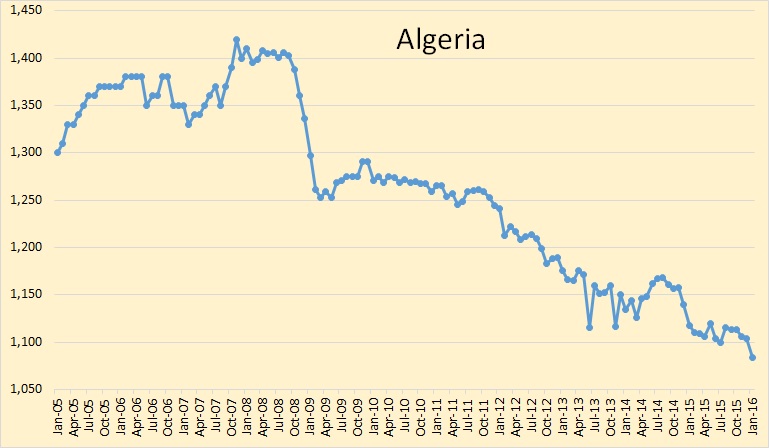

Algeria peaked in November 2007 and has been in a steady decline since that point.

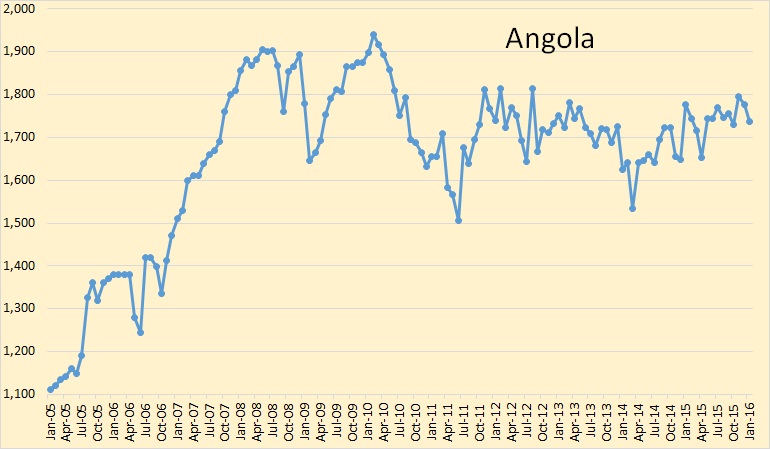

Angola has been holding steady since peaking in 2008 and 2010.

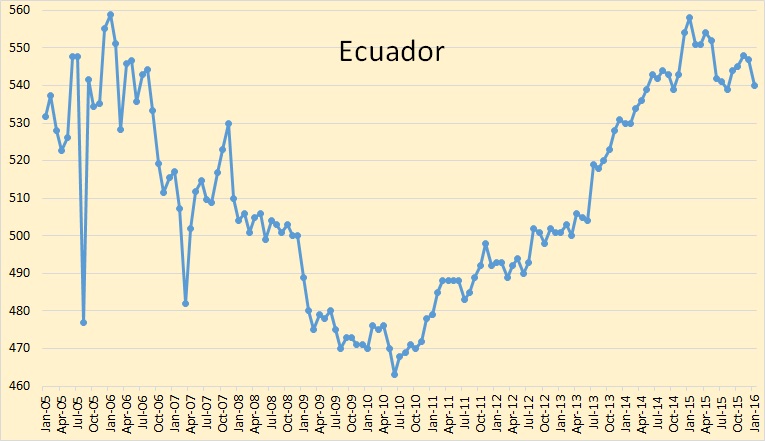

Ecuador appears to have peaked last year. It is likely production will be down, but only slightly, in 2016.

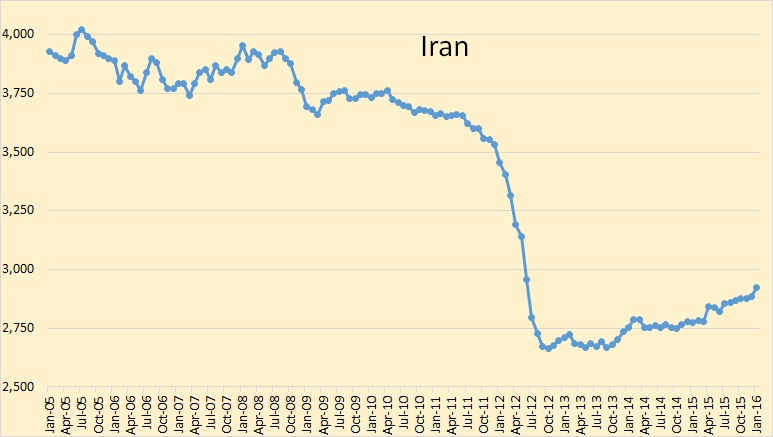

Sanctions were just lifted, in the middle of January, on Iran. I expect their production to be up by about half a million barrels per day by year’s end. However I believe Iran will be the only OPEC nation with any significant production increase in 2016. Most other OPEC countries will, I believe, be flat to down slightly.

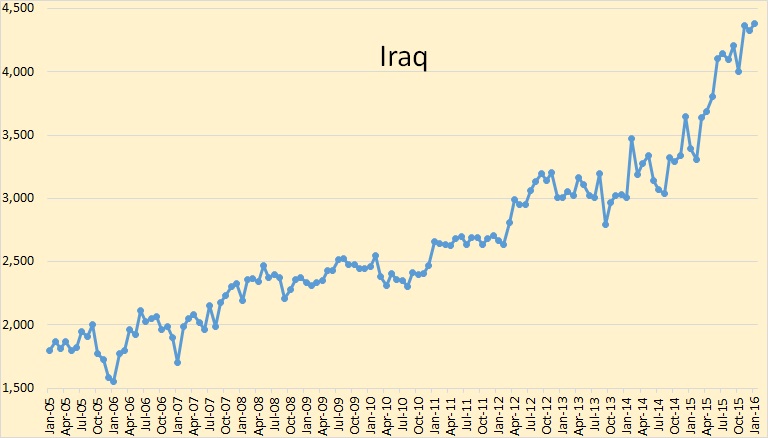

Iraq increased production more than any other OPEC nation in 2015. However I believe their increase in 2016 will be very moderate, if any.

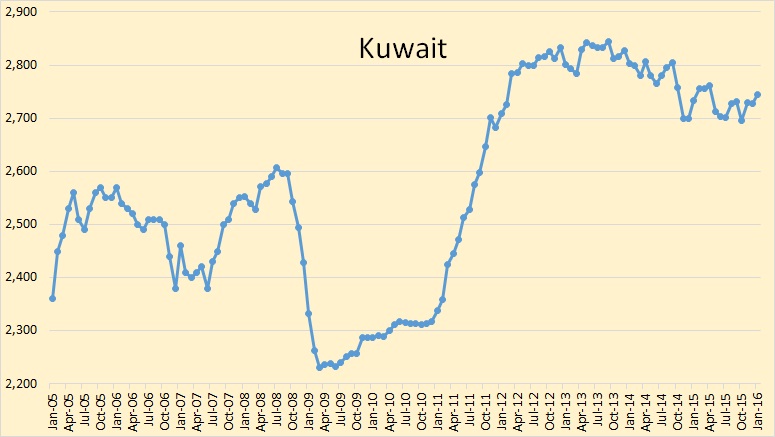

I expect Kuwait will continue its slow decline from its peak in 2013.

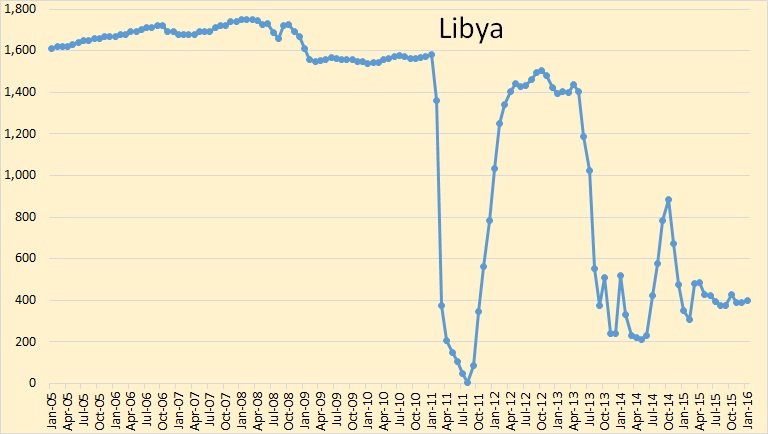

Libya is struggling with their own Arab Spring. There is no way of knowing when, if ever, peace will break out there. I think it extremely unlikely they will produce as much as 1,000,000 bpd within the next 5 years or so.

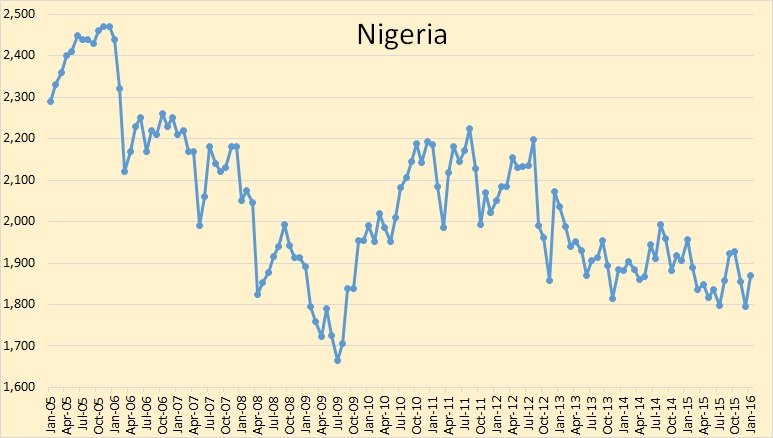

Nigeria is struggling with their own political revolution. But it appears they are in decline regardless of their political problems. However they had the largest increase in January, up 74,000 bpd.

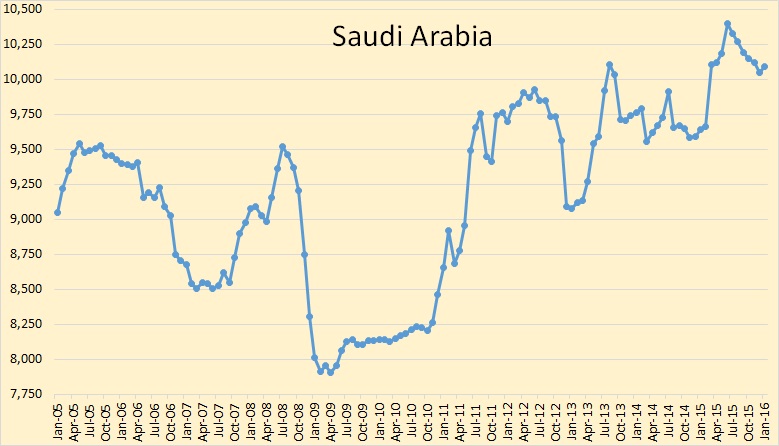

I believe Saudi is producing every barrel they possibly can. They will be lucky to hold this level for much longer.

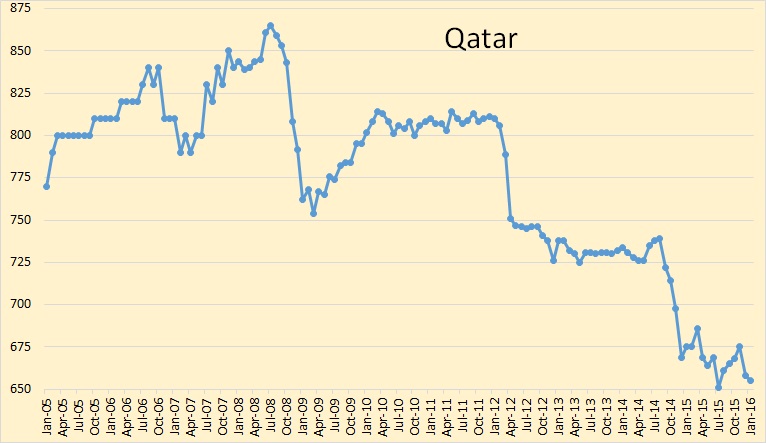

Qatar has lots of natural gas but their oil production has clearly peaked and is now in decline.

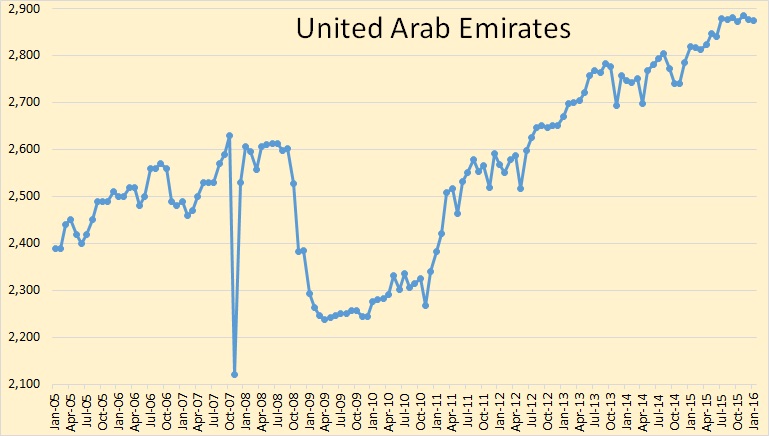

From 2005 through 2010 the oil rig count in the UAE averaged around 12. In November their oil rig count stood at 48, 4 times their average. They have managed to increase their production about 11% above their 2008 peak. I believe UAE production is about to follow Kuwait’s lead and rollover. The UAE’s rig count stood at 44 in January.

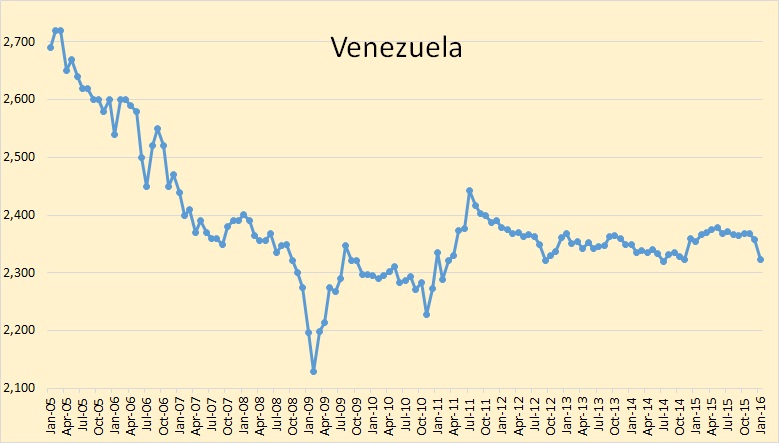

Not much can be said about Venezuela. Their conventional oil is in decline but their bitumen production is keeping production relatively flat. They took a hit in January however, down 34,500 bpd.

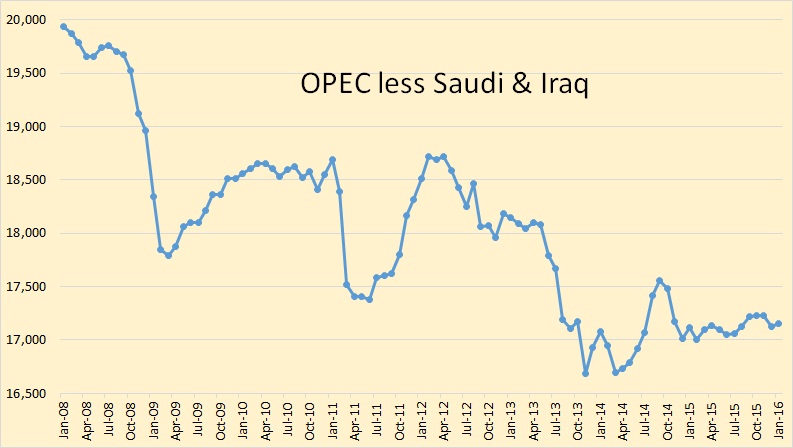

The combined production of OPEC, less Saudi Arabia and Iraq, peaked in January 2008 at 19,931,000 bpd and is down 2,778,000 bpd since that date 17,153,000 bpd.

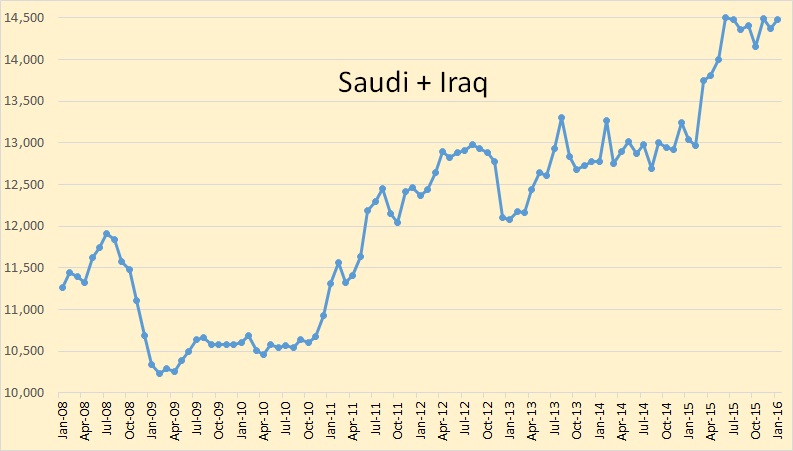

Since the combined production of the other OPEC 10 nations peaked in January 2008, Saudi and Iraq have increased their production by 3,625 bpd, from 10,850,000 bpd to 14,475,000 bpd. That is 33,000 bpd below their peak in June 2015.

Again, none of this data includes Indonesia. Historical crude only data for Indonesia is not available. I will include Indonesia in OPEC charts when I can calculate those numbers.

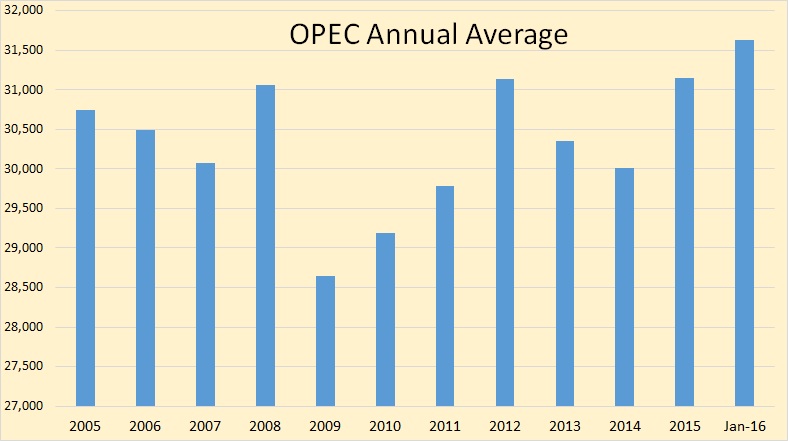

OPEC average crude only production in 2015 was 31,152,000 barrels per day. In January their production was 31,628,000 barrels per day.

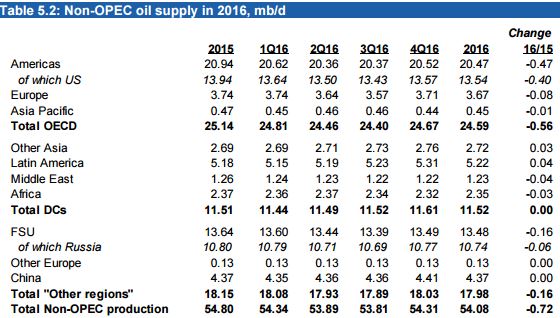

OPEC expects Non-OPEC liquids production to be down 720,000 barrels per day in 2016. If OPEC manages to hold production relatively flat from January, their 2016 production will be up 475,000 bpd. That is their gain would be about 250,000 bpd short of Non-OPEC’s decline.

However I expect OPEC to be slightly up this year due to Iran increasing production. But the increase will be modest as the rest of OPEC will likely be down. However I believe Non-OPEC will be down a lot more than 720,000 barrels per day.

China, the world’s fifth largest oil producer, has peaked and will suffer a sharp decline in 2016.

Why Declining Chinese Oil Production Is Good for Global Prices

China’s role as a big oil consumer has become a crucial factor in energy markets in recent years. Now, its role as a major producer is gaining attention as well.

China is among the world’s top five oil producers, but its fields are growing depleted and are increasingly expensive to pump. The country’s leading companies are choosing to leave more of their oil in the ground and some analysts now say Chinese oil output may have peaked.

Cnooc Ltd., China’s third-largest oil producer–which produces most of its oil from offshore fields–also said last month it expected output to decline by 5% this year, after years of rapid growth.

As China’s production starts to decline, demand for oil from overseas should remain firm, which would be good news for prices, which have been languishing near multiyear lows amid a global supply glut and weak demand in the rest of the world.

Thanks for the info, appreciate you putting this together.

There is a lot happening to Venezuela now. Do you think they could be headed to a crash in oil exports?

Venezuela is a wild card. They just imported light crude from the USA (a 550,000 barrel load), which they have to use to blend with faja 8 degree API crude. The load was placed by CITGO because pdvsa doesn’t have the cash to pay for diluent imports.

The country is in terrible shape, with increasing anarchy. Police and armed forces are being robbed of their weapons, in one case soldiers killed each other as one of them tried to steal weapons before deserting. Armed bands are attacking whole buildings to sack their parking areas for car spare parts.

I have a close friend who lives in a poor neighborhood who tells me she can’t even find iodine or alcohol to put on a burn. She managed to get oral antibiotics from the local Cuban post, but they didn’t have bandages or anything else to give her. Right now she’s boiling some clothes and will dry them to use as a cover for the burn.

She tells me her nephew, who is in the national guard in southern Venezuela, hadn’t answered his phone when she called to tell him he needed to get help for his seven year old son, who was abandoned by his mother at her doorstep because she couldn’t feed him. This seems to be what is happening to poor people outside of Caracas. As for the middle class in Caracas, they are getting water cut off, and are having serious problems finding food, but I think they’ll get by.

I hope your friend will be ok. Is she trying to get out of Venezuela, or will she stay and deal with whatever comes?

She’s too poor to leave. I get emails and messages via chat services several times a day from different friends. One sent me an email that he was getting out this morning. He’s the son of Portuguese Inmigrants, is heading to the USA to see what he can do. Tells me there were 450 murders in Caracas in January, and he’s afraid they’ll kidnap him or his wife.

This morning I read there are dozens of military and government officials who are turning information about the drug trade and theft networks over to USA officials, who are mapping out who got what funds where. The idea is to have the means to help the Venezuelan government retrieve some of the stolen money after Maduro falls. The communist faction within the Chavista regime seems to have been directing cash to support extremists in Latin America and Europe. The other factions were simply stealing as much as possible. The total amount stolen may range as high as $500 billion.

Although it’s been awhile, I listen sporadically to The Expat Files (focuses on Latin America) over at PRN, and even some time ago, Venezuela was already looking in bad shape.

Anarchy, as a particular definition, is not really what it is in or heading toward, by the way, but more like chaos. Anarchy is what it may have after the dust settles and if it is lucky.

Likewise, what you call communism never really occurred in your contexts. What you call communism is actually more like authoritarianism.

Best with your friend. Keep us posted and give us some good/best news links to keep track of things there if you’d like. Nice to see the ‘e’ back at the end of your name.

What i call communism is what comunists put in place when they take over. They ARE authoritarian. I think you tend to get lost in theory, while i have lived nearly 60 years fighting against them. I have lived inside their monster, went to their schools, received their education, and learned much more than your book learning will ever teach you.

I’m not into violence, but it should be clear they intend to destroy society,they are barbarians who do implement terrible dictatorships, and need to be fought to the death if need be.

There can be no truce, no accommodation, no respite. They are like Muslim extremists, they will metasthize, and will probably never disappear.

The West needs to keep an eye on two balls at this point, communism and Muslim extremism, both are deadly enemies which really can’t be allowed to exist in a modern society.

Is North Korea communist? If so, why? Because they say they are?

https://www.quora.com/Is-North-Korea-communist-or-fascist-What-is-the-difference

North Korea is an ultra nationalist right wing facsist state. They can call themselves whatever they like. A little critical thinking and standard definitions of what communism is and is not would probably lead to a better construction of the problem definition. Attempting to solve inaccurately defined problems is usually not a good starting point.

A right wing government or a left wing government won’t solve Venezuelas problems. Nor Egypts or Nigerians. It’ll change the structure of the patronage networks and who gets what when they divide up the spoils of power, but as States they’re screwed either way.

Just a pleasant reminder, in case it’s conveniently slipped your mind/eye, of your ‘The West’ and its covert-and-otherwise wars, infiltrations, weapons and drug dealings, false-fronts (USAid?), military bases, and propping up of dictatorships around the world, including the KSA and various areas in Latin America (Venezuela? Perish the thought.).

That’s why I ‘lean toward’ anarchy, which is probably the only social setup that seems to have withstood the test of time and approached its ‘purest form’ in reality in the form of the band or tribe of yore.

But even so, inside ourselves there can be a struggle against our own little despotic dictatorships over ourselves, which is more or less where everything begins, yes? I guess there will always be hierarchy with the difference being in how it is approached and managed… Beauty hierarchy; strength hierarchy; intelligence hierarchy; height hierarchy; capital accumulation hierarchy; social influence hierarchy; luck hierarchy and so forth…

Anarchism was big in Spain in the 1920’s-30’s.

Once the civil war started the anarchist forces were the worst performers and as they were generally despised, they were usually taken over by socialist and communist forces in the fight they maintained for supremacy of the government forces. So they basically lost against everybody else.

This is as close an experiment I am aware of and I would conclude that anarchism is likely to lose against any organized form of government when it comes to competition and conflict.

I am just heading out, but…

Relative anarchy is apparently human’s natural or original form of social organization.

“I once mentioned– perhaps here– that we are not ants and therefore don’t need a queen. But if The Queen– say, Queen Elizabeth– insisted, it might be possible to still run things kind of democratically or at least fairly or equably. But here’s the rub: She would have to behave like a real queen ant and relinquish her disproportionate privileges. She’d have to stay in Buckingham palace all day and night and pop out kids while the workers arrived from the outside to feed and take care of her. And her clone-like offspring would have to be workers, drones or soldiers or somethings like those. They couldn’t fly around the world in helicopters on the taxpayers’ dimes. But the problem with the human queen, and human elites in general, is that they want to eat their cakes and have them too. But nature doesn’t seem to allow, for very long, more complex organisms like us to have elites that eat their cakes and have them too, so [as a likely result] humans seem to collapse their social orders after a time.” ~ Caelan MacIntyre

I will repeat that inside ourselves there can be a struggle against our own little despotic dictatorships over ourselves. If ‘our little dictator’ wins and we, for example, drink too much too often, then it can threaten our bodies’ (think of our bodies as our social orders) general health (as well as our social relationships outside ourselves).

List of Anarchist Communities

See also; ‘Human and Nature Dynamics (HANDY): Modeling Inequality and Use of Resources in the Collapse or Sustainability of Societies’.

Your list of anarchist communities says it all.

Two of them are Catalonia and Aragon during the Spanish civil war, of which I have already wrote and that I consider them a failure.

And only two lasted for more than a few months, the Korean and Ukrainian ones, and both were under control of an army, without doubt the most hierarchical organization of all.

I don’t find any evidence that anarchism is not a failed utopia that cannot work for our species. Perhaps if we were different, but we are not.

I have already written that (stateless, ‘lawless’), relative anarchy has been around for most of our existence, is our natural way, and as already previously written as well– likely on here– ‘failed state’ seems almost a tautology.

The list of anarchy groups was posted relatively casually and is not meant to support my point per se. Your ostensibly ignoring the historical aspect of our natural anarchy and the ant example (Hey, you do/study biology, right?) and zeroed-in cherry pick with regard to the anarchy group link seems disingenuous and typical, though.

Anarchy was likely big in Spain long before it was called ‘Spain’ and before the phonetic passage, ‘The rain in Spain stays mainly in the plain.’.

Caelan,

I ignored the ant example because it is awful. To a biologist, an ant colony is the equivalent of a single individual, with the queen being the reproductive organ. The relationship between individual ants of a single colony is very much similar to the relationship between your cells.

If you are telling me that natural anarchy took place before organized complex civilization, that also tells a lot about it. Perhaps that is our future, but we are going to be dragged to it kicking and screaming, not as an evolution to a superior state as you imagine.

You seem to have just embellished my point for me, Javier, with regard to the ants as an organism as, up-thread, I mention– twice (and with another ant reference)– internal cooperation and how, if we have some sort of ‘internal dictator’ or some, say, ‘financial organ that is cooking the books’ and not doing what it is supposed to do, it’s going to, potentially seriously, mess with body, the organism.

The lungs, heart, liver, etc., have to do their work properly, and only their work, otherwise, there may be serious trouble for the organism as a whole.

So part of my argument is that for complex, specialized civilization to work, it would seem to have to function more like an organism, otherwise, we get… anarchy?

In other words perhaps, this current system is, at best, transitional, at worst, unsustainable– a lethal mutation— which I have also previously posted a quote about.

The problem for individual humans would seem that, while they are social, thus, ‘networked’ creatures, they are not organs or cells or ants. They are too behaviorally-complex as individuals, too free. Too anarchic. But they seem to nevertheless be constantly attempting– over and over again throughout history– to compose these ‘casually-networked’ structures called civilization, only, for the most part, to fail.

So a concern is, is that if we want to have success, we would appear to need a different strategy, which would appear to include being aware of what it is we are doing ‘wrong’; and who and what exactly we are as a species.

“The West needs to keep an eye on two balls at this point, communism and Muslim extremism, both are deadly enemies which really can’t be allowed to exist in a modern society.”

I’d add to that list Theocracy!!!

What i call communism is what comunists put in place when they take over. They ARE authoritarian. I think you tend to get lost in theory, while i have lived nearly 60 years fighting against them. I have lived inside their monster, went to their schools, received their education, and learned much more than your book learning will ever teach you.

Yeah! Says the guy who who recently claimed that the ultra right wing fascist authoritarian dictator Augusto Pinochet was preferable to the democratically elected President Salvador Allende solely because Allende was a Marxist. So apparently you have learned nothing! You are an ideologically blinded authoritarian supporter yourself.

I’m of Hungarian descent and many of my relatives left Hungary after the 1956 revolution so I am definitely not a supporter of the authoritarian communists who controlled Hungary at that time! However I also do not support the authoritarian neo fascists currently in power in Hungary. Furthermore I also lived under a right wing authoritarian military dictatorship in Brazil who were anti communists.

I have experienced both sides of that coin.

So I can with a straight face say it’s all the same old shit with different flies!

Kinda slippery, coming from someone who escaped a right wing dictatorship in Cuba (as a privileged member of the elite), and then embraced Fascism in Spain under Franco.

(who supported Nazi Germany).

What about authoritarian rule do you not like?

What Venezuela actually needs is 18 years with no leaded gasoline:

http://www.ricknevin.com/

The violent street crime waves in Venezuela, and the irrational series of authoritarian leaders (both right-wing and left-wing, though you ignore the right-wing ones because of your bizarre personal biases) are precisely what we’d expect from the historic lead exposure.

Come now Fernando– You escaped a failed right wing dictatorship in Cuba, to go to Fascist Spain under Franco (who supported Nazi Germany).

Authoritarian rule seems to be your preference.

I feel the whole region is headed for a crash in pretty much everything except producing and exporting drugs. It’s beyond failed states. It’s a failed continent.

http://www.insightcrime.org/organized-crime

It’s beyond failed states. It’s a failed continent.

Don’t worry Donald Trump and Bernie Sanders will form an alliance and they will make America great again and the we will go and save all those failed states from themselves.

BTW, I think what we are seeing is that BAU is failing everywhere around the globe.

So in terms of economies we have a failing planet. To make matters worse all the economies of the world are subsidiaries of Ecosystems Inc.

http://www.overshootday.org./

August 13th has been Overshoot Day 2015 – the day on which humanity has consumed the resources which nature is providing for the entire year.

In less than eight months, we have used up nature’s budget, with carbon sequestration making up more than half of the demand on nature, according to data from Global Footprint Network. The Club of Rome is partner of the 2015 Overshoot Day Initiative.

And, just in case you don’t believe the Economy is a subsidiary of Ecosystems Inc…

http://www.bloombergview.com/quicktake/negative-interest-rates

Imagine a bank that pays negative interest. Depositors are actually charged to keep their money in an account. Crazy as it sounds, several of Europe’s central banks have cut key interest rates below zero and kept them there for more than a year. Now Japan is trying it, too. For some, it’s a bid to reinvigorate an economy with other options exhausted. Others want to push foreigners to move their money somewhere else. Either way, it’s an unorthodox choice that has distorted financial markets and triggered warnings that the strategy could backfire. If negative interest rates work, however, they may mark the start of a new era for the world’s central banks.

Yep, we are in uncharted territory and this is indeed new era for the world’s central banks and most of the economies in the world…

Poor little oil rich Venezuela is just one of the canaries in the coal mine. (none of the puns are intended).

Oh, and last but not least these are all clear indications that those who argue that renewables can’t power our economies and therefore SAVE THE WORLD are 100% correct. But what they fail to grasp is that neither can fossil fuels or nuclear or any other form of energy.

So we are all due for some major resets in our expectations and consumption patterns. We have been spending our resources like drunken sailors. Now we are broke and have a major hangover to boot.

Cheers!

Wow! Bad day Fred? I expected at least a little optimism there at the end.

“…renewables can’t power our economies and therefore SAVE THE WORLD…”

My beef with “renewables” has always been simply that. Now if that was universally understood then we could get down to the real work of doing what actually needs to be done.

Fred: “…renewables can’t power our economies and therefore SAVE THE WORLD…”

Jef: Now if that was universally understood then we could get down to the real work of doing what actually needs to be done.

Ron: And just what kind of work would that be?

Prepare for impact to try to reduce the consequences.

aka ‘turtle up and wait for the pain’

The unimaginably difficult work of doing LESS!

Pay people to not consume.

Huge fines for conspicuous consumption.

Huge fine for polluters.

Pay people to farm, relocalize, transition, etc.

Free tiny houses on rural farming land in trade for farming.

Destroy big corps.

Pay people to go to school, learn trades, do art.

Make low/no carbon travel a universal right and pay people.

Funny thing is all of this is what most people want anyway. The main thing getting in the way is money, not lack of it, there is 10 times more than it would take to accomplish this given out to 1% of the population over the last few years alone. The problem is too much of it going into the hands of a few allowing them to live like gods on earth. Once that happens everyone wants in on the action.

Hey Jef I think some of your ideas are definitely on the right track there. As things progress and more and more people are no longer employed in so called 9:00 to 5:00 jobs, I think societies will need to find ways to provide for their members while keeping them doing productive and useful things. I would also add free health and dental care to your list. There is no doubt that the current extreme concentration of wealth in the hands of a very few is not something that most people consider just.

Cheers!

Hi Fred and Jef,

Many of those ideas sound good.

The problem is we need to find a way to get people to choose that path. Perhaps a crisis would do it, but sometimes this leads to social progress (US during Great Depression for example), in other cases we get fascism.

In any case a redistribution of wealth in a democratic society would be positive in my opinion and might be accomplished by proper tax policy.

Less consumption and other incentives to farm differently and work differently might also be accomplished through taxes, and reducing pollution could be accomplished by high taxes on polluters.

It is all a matter of convincing people to elect the right representatives who might enact such a policy.

People should be suspicious of politicians supported by super-pacs in the US because where the money comes from is far from transparent.

“…a redistribution of wealth in a democratic society would be positive in my opinion and might be accomplished by proper tax policy…” ~ Dennis Coyne

With the key/trick passage being ‘in a democractic society’… (with coercive taxation?)…

Coercive democracy… (oxymoron?)

Somewhere… out there… just not here… democracy lurks… It’s waiting… it’s lurking… it’s waiting… it’s lurking…

Sailing Through The Bardo

Hi Caelan,

In any society with rules there must be coercion or the rules would not be meaningful.

Your thinking that coercion will not exist in an “anarchy”, is cute but unrealistic.

Dennis, there is a world of difference between State coercion and the ‘coercion’ behind rules democratically achieved (and ones of the State that are not.)

Your ostensible notion of ‘government‘ is of course nothing of the sort and is far from cute. It is also highly unlikely to be sustainable and is therefore not realistic.

Dennis, I have continued this here. Enjoy.

Alright!

(And enjoying the planet more, due to leisure that we should have had by now, instead of losing the paradise we’ve inherited in the face of continual multifaceted degradation at the hands of structural violence and privilege.)

“If I’m rich, what do I do with money? Buy lots of land and resources out from under everyone’s feet? Then what? Charge them rent and have them work for me to pay the rent? Take my business overseas and do the same thing there? What good is that?”

Vancouver’s Multimillion-Dollar Rotting Homes, or; China Exports Invaluable Ghost City Knowledge, or; Westernization, Chinese-style, Comes Home to Roost, or; China’s Ghost Cities’ Ghostly Refugee Crisis Overwhelms Vancouver’s Overpriced Heritage Housing Market, or; Remember The Leaky Condo Fiasco?, or; Never Mind East Hastings’ Gentrification, Here’s The Rotting Houses…

And just a bit further south than that soon to be failed state of Mexico are three countries that arguably constitute the most violent region on the planet and are already failed states; the Northern Triangle. All just a relatively short boat ride from US southern shores. The overland distance from Guatemala to Texas is about 2/3 that of Syria to Germany. Given recent events I now suggest that can be considered “walking distance”. Unregulated mass migration has historically speaking been a hallmark indicator of collapse.

http://www.insightcrime.org/news-analysis/the-northern-triangle-the-countries-that-dont-cry-for-their-dead

You’re probably ignoring the US-backed coups which keep creating instability in the region. Of course you are.

Mexico, meanwhile, is more stable than the US, which is probably the #1 most likely to become a failed state in the world, based on a large number of predictors — our political system is completely dysfunctional;Presidential systems generally collapse. Net migration is now FROM the US TO Mexico.

Actually South America has been on the upswing for over a decade and is probably a model for the future.

A Tale of Two Oil Price Declines

If we define the duration of the 2008 oil price decline as the number of months below $100, until we saw a sustained oil price recovery, the slump only lasted four months in 2008 (last $100 month was 8/08).

Annual OPEC crude only production fell from 31.1 million bpd in 2008 to 28.6 million bpd in 2009, a decline of 2.5 million bpd. (US C+C production increased by 0.4 million bpd over same time period.)

In contrast, annual OPEC crude only production increased from 30.8 million bpd in 2014 to 31.8 million bpd in 2015, an increase of 1.0 million bpd. (US C+C production increased by 0.7 million bpd over same time period.)

Using the same metric as above (number of months below $100, until a sustained price recovery), we are at 17 months and counting (last $100 month was 8/14).

On the demand side, global total liquids consumption fell from 87 million bpd in 2007 to 86 million bpd in 2008 and fell again to 85 million bpd in 2009.

Regarding the current decline, global total liquids consumption rose from 91 million bpd in 2013 to 92 million bpd in 2014 (BP consumption data), and I believe that consumption increased in 2015.

US total liquids consumption hit a seven year high in 2015 (the highest since 2008), and recent data indicate that the US is becoming increasingly dependent on net crude oil and total liquids imports:

http://peakoilbarrel.com/oil-production-is-going-to-drop/#comment-558945

Based on most recent four week running average data (week ending 2/5), US net total liquids imports were running at 5.5 million bpd, versus an average annual level of 4.7 million bpd for 2015.

If we define the duration of the 2008 oil price decline as the number of months below $100, until we saw a sustained oil price recovery, the slump only lasted four months in 2008 (last $100 month was 8/08).

Kinda needs fleshing out some? http://www.fedprimerate.com/crude-oil-price-history.htm

Says crude was $100+ late Sept/08. Got back to $100 in 2011. I guess you mean when the upturn started . . . that was Jan 09 and the Fed started QE of only MBS in late 2008 — but just MBS to bailout banks. It wasn’t until later that Treasuries were being bought and of course that sort of began the process of destroying the definition of a dollar — so the time frames in question, particularly the 4 months alluded to, are probably legit in that the yardstick was still a yardstick then.

I was talking about monthly Brent crude oil prices:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RBRTE&f=M

And yes, the sustained oil price recovery began in January, 2009. Monthly Brent prices rose from $40 in 12/08 to $74 in 12/09.

Regarding the current decline, monthly Brent prices fell from $62 in 12/14 to $38 in 12/15.

okie doke

Anyone have an annual global total liquids consumption estimate for 2015?

To answer my own question, the EIA puts 2015 global total liquids consumption at 94 million bpd:

https://www.eia.gov/forecasts/steo/report/global_oil.cfm

So, global consumption fell by 2 million bpd from 2007 to 2009 (87 to 85 million bpd), but global consumption rose by 3 million bpd from 2013 to 2015 (91 to 94 million bpd).

Jeff: I read your article this morning on Condensate production. It was my understanding that EIA Condensates referred to those API fractions above 42 that came out of oil wells. I further thought that NGPLs were those same API fractions that were extracted from NG at the NG processing plant. I gathered/inferred this information from looking at the weekly EIA numbers where they separately list NGPL.

A clarification would be appreciated.

Ovi, no, I don’t think that is the case at all. The below is from the EIA’s glossary. Bold mine.

GLOSSARY

Condensate (lease condensate): Light liquid hydrocarbons recovered from lease separators or field facilities at associated and non-associated natural gas wells. Mostly pentanes and heavier hydrocarbons. Normally enters the crude oil stream after production.

The condensate in the EIA’s Crude + Condensate data includes condensate that comes from gas wells as well as from oil wells.

Qatar is a good example. Most of Qatar’s condensate comes from gas wells. In October the EIA says Qatar produced 1,537,000 bpd of C+C. But the OPEC MOMR says that, in October, they produced 675,000 bpd of crude only. That means that from their massive number of natural gas wells, they produced 862,000 bpd of condensate. And the EIA counted it all.

BTW Ron it would be nice to see the latest . . . absolute latest reserves estimate for all OPEC (and non OPEC) countries, hopefully of a non economic sort, though I suspect all sources quote in terms of reserves price-wise.

Though if we held about $30 for years and companies just stop operating (until nationalized) we might see some real live geologic reserves data. Reserves before nationalization. Reserves after nationalization.

Non economic reserves tells us when the food stops moving.

Watcher, proven reserves are mostly unproven. And it depends on who you ask. According to the EIA the world has 1,650 billion barrels of proven reserves. But that includes the Orinoco bitumen and the Canadian oil sands. Subtracting out the bitumen and oil sands would leave you with about 1,200 billion barrels.

But everyone, including the EIA, is basically taking the OPEC countries word for how much they have. I don’t believe a damn word of it. My guess is that Non-OPEC reserves are about 400 billion barrels, and OPEC reserves are slightly less than that, about 350 billion.

OPEC Share of World Crude Oil Reserves 2014

The below chart is every country with 2 billion barrels or more of proven reserves. There are several countries with less than 2 billion barrels of reserves that are not included in this chart.

EIA World Crude Oil Reserves

Not bad. The reserves numbers probably have economics AND technical stuff in them.

It would be really nice to know what the MTBF is on parts on already producing oil wells. The point would be disruption of shipping of anything but food would stop production from wells already drilled, not really addressing inability to ship the oil itself, but rather the spare parts for the pumps and whatever.

This would serve to redefine reserves somewhat. Economic, technological AND no spares production. Anyone know how long stripper wells can operate with zero repairs? This would have to reduce your 700B estimate further.

Not bad. The reserves numbers probably have economics AND technical stuff in them.

No they don’t. The numbers are just what these countries say their proven reserves are. There is nothing in them but their word.

It would be really nice to know what the MTBF is on parts on already producing oil wells.

Errrrr, yes, but I don’t get the connection between “Mean Time Between Failures” and proven reserves. And I understand that you tried to explain the connection in the rest of your post. But I still don’t see any connection.

Proven reserves are just what oil producing countries say are their proven reserves, nothing more, nothing less. There is no algorithm or survey that the EIA, IEA, or anyone else uses to calculate proven reserves. Just their word, that’s all.

And that is why any estimate of world proven reserves that uses “the countries word” as their estimate is not worth a bucket of warm spit.

Can’t argue with that. Adding MTBF to numbers pulled out of the air doesn’t change anything in those numbers.

But if they were based in something meaningful, MTBF will affect them — in a world where you can’t repair wells for lack of parts.

It’d be interesting to see The Oil Shock Model expressed with 750Gb URR.

HI Jimmy

URR is reserves plus cumulative production.

That would be about a 2000 Gb URR.

See simplified shock model at oilpeakclimate

Thanks very much I appreciate the info.

Hi Jimmy,

Your welcome. I was on a cell phone and couldn’t reply properly sorry.

Cumulative C+C minus extra heavy (oil sands) output through the end of 2015 is about 1260 Gb. So if there are 750 Gb of proven reserves excluding oil sands in Canada and Venezuela, then the URR would be about 2000 Gb, if no new proven reserves are added and there are no new oil discoveries in the future.

Jean Laherrere estimates 2200 Gb for the URR of C+C less extra heavy(XH) oil and 500 Gb for the XH URR.

Link below to an oil shock model using those assumptions (which are too conservative in my opinion).

http://oilpeakclimate.blogspot.com/2015/02/the-oil-shock-model-with-dispersive.html

Chart below with URR=2700 Gb scenario(including XH oil) which peaks in 2015. Note that a Hubbert Linearization suggests the C+C less XH URR will be 2500 Gb and the USGS estimates 3100 Gb, my medium scenario splits the difference at 2800 Gb.

Those scenarios are at

http://oilpeakclimate.blogspot.com/2015/07/oil-shock-models-with-different.html

Thanks a lot Dennis! I really appreciate it. I tend to be pessimistic on future production. It seems to me that the highest decline rates are in tight oil fields, in second place is off shore, and the lowest decline rates are conventional on shore fields. As we proceed into the future I feel the new production is unlikely to come from conventional on shore fields. A larger and larger portion of our oil supply going forward will come from the types of fields that suffer the higher decline rates. I’m hoping for the best and planning for the worst. Thank you for helping me understand the information you have.

Hi Jimmy,

The observation on decline rates is correct, but LTO is not really a huge player, probably 50 Gb worldwide at most and maybe 5 Mb/d peak output. Deep water may become a bigger player and that concern is valid.

One thing missed by many is that new proven reserves are continually added. From 1980 to 2005 US proved plus probable reserves grew by about 63% in 25 years.

Let’s assume proven reserves are 600 Gb (for World C+C les extra heavy oil), 2P reserves would be 70% higher or 1000 Gb and if these reserves grow by 50% over the next 50 years, we would have 1500 Gb, add that to cumulative production and we have 2750 Gb for a URR, close to my medium scenario for C+C less extra heavy (oil sands).

As an aside, Fernando thinks that is reasonable, he has forgotten more about the oil industry than I know.

Thanks a lot Dennis. I appreciate you sharing your knowledge.

The last few years have been very interesting in that when prices were high we saw non OPEC producers going as hard as they can to produce oil, and now that prices are low we’re seeing OPEC members going as hard as they can to produce oil. In the non OPEC group it was Canada and USA with the big gains. In the OPEC group it’s Saudi Arabia and Iraq. This gives us a rough indication of whose got what in their hand. Perhaps what a competitive card player/gambler might call ‘a tell’. Based on estimates of decline rates from existing fields and in consideration of who can raise production levels if needed it seems to me that we are at an inflection point, and perhaps have been for sometime.

The oil market is in chaos in many ways. For example it’s probable that US storage is filled with condensate and it suppresses the price of crude. The Gulf Region/Middle East hasn’t seen this much turmoil since WW1 yet geopolitical risk premiums on oil don’t seem to register. Saudi Arabia is making money but nowhere near enough to survive as a State. It could be said that Saudi Arabia is facing an existential crisis yet nobody in the oil market seems to feel energy supplies are at risk anytime soon.

US/NATO/The West/Whatever you want to call it has tried three distinct ways of dealing with Middle East foreign policy over the last decade and a bit. As Tony Blair puts it; “We’ve tried intervention and putting down troops in Iraq. We’ve tried intervention without putting in troops in Libya. And we’ve tried no intervention at all but demanding regime change in Syria.”

When US/NATO acted in Iraq with an all-in strategy, it failed; when US/NATO sort of acted in Libya with an air campaign and no troops, it failed; when US/NATO refused to act in Syria, except for perhaps supporting proxies via arms supplies, it failed.

Unknown unkowns. Where we go from here is gonna be great history one day.

The troops on the ground option has not exactly FAILED in the usual sense of the word. It would be more accurate to say it has not achieved long term success.

Personally I believe troops will be sent hither and yon , again, and yet again, in pursuit of a steady supply of oil, for the easily foreseeable future. The powers that send them will bring them home whenever they can, and send them back whenever they must.

Troops are expensive, in both blood and treasure, but not so expensive in treasure as doing without that oil, and a few hundred or a few thousand troops are a price that this country will pay, if necessary, to keep the economic apple cart greased and upright, and rolling along.

It won’t matter much which party is in control, except maybe close to election time. Neither the R nor the D party will burden itself with the issue of sending troops , if doing so can be avoided, in the run up to an election.

I am a big a believer in renewables and other new tech, but I try to be realistic, and I can’t see the world, or the USA, or our friends and allies, freeing ourselves of our oil addiction in less than twenty to thirty years, and that is an OPTIMISTIC estimate imo.

My belief is that the policy in each case did not achieve its objective. To me that’s the definition of failure. Close enough anyways. To ask what policy would have achieved that objective is hypothetical and not really worth debating but from the three basic policy options/concepts of operation I/Tony Blair kinda pointed out in my comment above it seems likely no policy option would achieve the hoped for objective. Let’s assume for the sake of argument the objective in each case (Iraq, Libya, Syria) was stability and a pro-west regime. So damned if we do and damned if we don’t. For the sake of the costs involved I think we’re better off at the end of the day if we don’t.

Alternately we could support one side until they’re in the lead, then switch and support the other until they’re on top. Do this back and forth several times bleeding both sides as much as possible, then leave a damn mess of failed states full of radical fundamentalist psychopaths on Russia and China’s periphery and undermine the possible creation and organization of any Eurasian continental economic empire that might one day pose an existential threat to America. That’d be the Machiavellian thing to do I guess. If a Eurasian continental economic empire was on your radar I mean.

OFM:

“Troops are expensive, in both blood and treasure” Even more so I think that after a while troops become expensive in the credibility of the government. Vietnam comes to mind. The greatest cost to the US of that war (and some other concurrent policies)was the general destruction of the relatively blind faith that most Americans had in their govt. Mideast policy that includes decades of military intervention will exact a similar toll.

Jimmy,

I think this is a very apt observation:

A real “tell”. Why they are increasing production if the world is already full of unused (and already delivered somewhere) oil? Because they are still able to sell it despite “glut”.

If we believe EIA and friends it is impossible to consume all this oil. So it’s the customer who pays and then is hoarding all this cheap oil.

But the problem is that the cost of private storage is pretty high those days, especially in the USA and ordinary companies and refineries can get only losses out of such strategy: “…limited crude oil storage facilities caused crude oil storage costs to rise to $0.90 per barrel on February 9, 2016—compared to $0.10 per barrel in August 2015. ” ( https://marketrealist.com/2016/02/crude-oil-storage-costs-rose-9-times-us-crude-oil-tests-new-limits/)

If we believe that world has on average 2 Mb/d surplus for at least 18 month that’s one super-large tanker full of oil/condensate a day. 30 tankers a month, 365 tankers a year (over 700 Mb a year). In other words for the total duration of oil glut period 1000 Mb or more — a billion barrels of oil — should now be stored somewhere on customer sites.

Where on the globe such a huge oil inventory is located. And where you can store such amount physically. Not of the ground — storage costs way too much and data about ground shortage does not show such a huge built-up of inventories. Not in tankers — cost of storage is even more (~1% a month if we assume $30 per barrel average price) and number of tankers of such a size is very limited and they are very expensive.

USA is the primary “glut country”, but “glut oil” somehow definitely did not landed here. EIA does not see any increase in storage in the USA since March 2015:

http://www.eia.gov/forecasts/steo/images/Fig14.png

Europe is the same. Only China remains — it did bought some oil for strategic reserves “The IEA says that in the first quarter the gap between China’s measure of demand and supply stood at 650,000 barrels a day – equivalent to storing 58m barrels over the three-month period.”

OK. let’s assume that china absorbs 0.5 Mb/d from this glut. So we still have 1.5Mb/day glut left.

Where are those volumes? Does this make the hypothesis of 2 MB/d “oil glut” completely absurd? That means that all this period of sharply dropping oil prices supply and demand of physical oil were pretty finely balanced and Iraq and Saudis were recruited to avoid shortages of physical oil, which would spoil the whole game. If this is true, then “oil glut” existed only in “paper oil”. In other words it was artificially created. Or I misunderstand something ?

BTW Russians now feel they were taken for a ride by “casino capitalism” sharks. Below are laments of hapless Rosneft top honcho Igor Sechin:

Oil price forecast as an instrument for oil price manipulation

Edited Google translation. Originally from http://izvestia.ru/news/603843

“If we believe that world has on average 2 Mb/d surplus for at least 18 month”

According to the EIA, the surplus exceeded 2 mb/d only in 2Q15.

The average surplus for 2015 was 1.85 mb/d, for a total of 675 million barrels.

The accumulated surplus since the beginning of 2014 is 995 million barrels.

World oil stock change & balance (global liquids supply – global liquids consumption), mb/d

Source: EIA STEO February 2016

“EIA does not see any increase in storage in the USA since March 2015”

According to the EIA, from March 2015 to January 2016, the U.S. commercial inventory increased by 125 million barrel.

Over the period 2014-2015, the OECD commercial inventories of crude oil and refined products increased by 493 million barrels, including 277 mbbl in the U.S. and 216 mbbl in other OECD countries.

In January 2016, total OECD commercial inventories amounted to 3066 million barrels, of which the U.S. acounted for 1342 million barrels.

The U.S. Strategic Petroleum Reserve remained flat at around 695 million barrels.

So the OECD in-land storage absorbed about a half of total estimated global surplus over the period 2014-2015.

The rest is the increase in commercial and strategic inventories in China, other oil-importing non-OECD countries, oil exporting non-OECD countries, floating storage, and the so called “balancing items”.

OECD Commercial Inventory (million barrels)

Source: EIA STEO February 2016

Hi AlexS,

If the EIA estimate is correct, it looks like there is only 500 to 600 million barrels above Dec 2013 storage levels.

If the Dec 2013 level is “normal” or close to the 5 year average and supply falls to 1 Mb/d below demand, then it would take 2 years to get back to normal storage levels.

Dennis,

The EIA, IEA and others expect the global excess supply to gradually diminish, but supply will still exceed demand until 3Q17 (according to the EIA).

Hi AlexS,

I think the EIA forecasts will be wrong, supply will be lower and demand will be higher than they predict, especially at $30/b or less. If the supply and demand forecasts are correct, why would oil prices rise? I would expect if those forecasts are correct, that the oil price would fall further so that supply and demand will balance.

Dennis,

The EIA’s projections may be wrong, like any other forecasts.

But if you say they are wrong, I would like to know, where exactly their supply or demand projections are wrong. This should be based on detailed analysis by country, region, resource type, key projects, etc. Otherways, these are only empty words.

BTW, as I remember, about 2 weeks ago you said that the EIA may the overestimating the decline in the US production this year. Meanwhile, it is the US LTO output, which is expected to decline the most this year.

As regards global demand, the EIA, IEA and OPEC are projecting growth of about 1.25 mb/d this year, which is close to long-term average. The effects of low oil prices are offset by slowing economic growth. In fact, demand growth has already been slowing in 4Q15.

For 2017, the EIA projects global demand growth of 1.4 mb/d, which is above LT average.

“I would expect if those forecasts are correct, that the oil price would fall further so that supply and demand will balance.”

As the EIA (and other) numbers show, supply and demand are in the process of rebalancing since 3Q15, but this will take some time. The EIA (and apparently IEA) expect the market to rebalance by 3Q17.

I have seen some forecasts that the balance will be reached by the end of 2016. But, unlike the EIA’s STEO or IEA’s OMR, these forecasts were not supported by detailed supply-demand numbers.

Hi AlexS,

Low oil prices might be offset by lower growth, the demand for oil tends to correlate with GDP much better than price, but demand may be a little higher than the EIA forecast. I expect World supply will be lower and that at current oil price levels the market will rebalance faster than the EIA forecast, if their oil price forecast is correct.

The most recent STEO has Brent rising from $33/b in Q1 to $42/b in Q4 2016.

The Brent price rises to $56/b in Q4 2017.

I am not convinced that these oil prices will result in the increase in liquids output forecasted by the EIA. Perhaps the lag time is greater than I believe, but low prices from 2015 should affect investment by mid 2017 and I would expect oil output would start to fall by that time.

What kind of time lag do you expect between low prices and lower oil output?

Dennis,

I think the impact of low prices on oil production was already very significant in 2015. If priced remained at $90-100, U.S. oil production in December 2015 would be about 1-1.2 mb/d higher.

Outside the U.S., the supply-side response to low oil prices was more modest (probably a few hundreds of kb/d).

There is no doubt that the EIA forecast for 2016-17 largely reflects the effects of low oil prices. But if oil prices stay at $25-35 levels for several months, the decline in non-OPEC and in some OPEC countries will likely be bigger than they are projecting.

As I had said earlier, I view $40 as an important threshold. At or above this level, a vast majority of current production remains profitable (albeit only marginally profitable in most countries). At >$40, most conventional producers have enough cash for maintenance capex and relatively inexpensive brownfield projects, although they are cutting spending and delaying or canceling new capital-intensive projects with long lead times..

Prices below $40, and especially around $30 are a completely different territory. At these levels some of current production becomes loss-making and much less cash is left for investments. Oil companies may continue to produce at loss for a few months due to high costs of shutting down production. But if these prices stay for longer, we will see a severe impact both on conventional and unconventional production.

Let’s discuss it in more details in the new thread.

As regards global demand projections for 2016, I see the risks both on the upside and on the downside. And a slowdown in demand in 4Q15 suggests that the EIA, IEA and OPEC projections are not too conservative.

As a result, the OECD inventories will continue to increase, albeit at a much slower pace.

The EIA expects total OECD Commercial Inventories to peak in August 2017, at 3196 million barrels, 130 million barrels above January 2016 levels.

OECD commercial inventories (million barrels)

EIA STEO February 2016

The EIA expects the OECD commercial inventories to decline from September 2017, but the pace of the decline will depend on how demand will exceed supply.

In any case, the EIA projections imply that the OECD inventories will remain above the upper limit of the historical range well into 2018. And it will decline to the mid-range no earlier than 2019.

Hi AlexS,

Does their forecast seem reasonable to you?

Alex,

I am confused.

Can you please explain discrepancies between this graph and the data extracted from http://www.eia.gov/forecasts/steo/tables/pdf/3atab.pdf

That’s 92 Mb (or 104 Mb if we limit ourselfes to the 4Q of 2015), but in no way it is 125 Mb. Is not the size of the difference a little bit funny ?

Looks like it is slightly higher then 1% error margin we assume inherent in EIA data.

And those figures are different (absolute numbers almost twice smaller) from commercial inventories data from

http://www.eia.gov/forecasts/steo/images/Fig14.png

Why inventories are twice smaller? Were they use using special slimming diet for them ?

And they, in turn, are also different from http://www.eia.gov/dnav/pet/PET_STOC_WSTK_A_EPC0_SAX_MBBL_W.htm

Still assuming your average 1.85 mb/d for ten month we have 1.85*30*10 = 555 Mb of “extra”, glut oil. That’s a lot of oil to store.

And all mighty USA absorbs, by your estimates, only around 120 Mb or it, punching well below its category and none if we believe EIA data from http://www.eia.gov/forecasts/steo/tables/pdf/3atab.pdf

BTW who you think made such a huge blunder paying quite a lot of money for useless stock (for at least another two years) plus storage fees and why ? We need to know the names of our heroes.

Even more interesting question is who paid for other 430 Mb ? With their set of financial problems (which include Greece, and other Southern states) all money in Europe are needed to bail out banks. Europeans now are scroogy as hell and they definitely are not inclined to buy useless oil. They have reliable supplers. Only Germany has some money but they don’t do such stupid things. They have a direct pipeline from Russia. French? This would be a good joke. They barely found money for barter with Iranians 0.2Mb/d supplies (or less) in exchange of Iran buying several Eurojets. GB? They have their own production which is suffering huge losses and no money.

Something is fishy here. Looks like we have several agencies under one roof in EIA each of which produces its own set of data. In humans such condition is a symptom of schizophrenia

Likbez,

STEO February 2016, excel file, Table 3A

Commercial inventory in OECD countries

OECD Total stocks (commercial+government) by country,

September 2015

source: IEA OMR, January 2016

The numbers below are from the EIA STEO February 2016

What may seem really suspicious is the difference between the global surplus liquids supply accumulated during 2015 (675 million barrels) and the increase in OECD commercial inventories (308 million barrels).

This difference, which amounts to 368 million barrels (rounding effect), includes the increase in non-OECD inventories (both commercial and strategic), in floating storage, and the so called “balancing items”

I do not know exactly what was the increase in non-OECD inventories and floating storage, but the number looks too big.

The “balancing items” are also called “the missing barrels”. In that particular case they actually mean that the global excess supply may be overestimated, i.e. demand is higher or supply is lower than estimated by the EIA.

Alex,

In no way this is “Commercial inventory” for the USA.

Those figures from EIA include strategic reserve (which is around 695 Mb; nobody knows exactly as caverns might be leaking).

Commercial inventories as of today are around 500 Mb. So we should have around 1200Mb as of today. Why EIA reports higher numbers I do not know.

likbez,

The numbers below are from the EIA STEO February 2016, excel file, tab 4A

US Commercial and strategic Inventory (million barrels)

likbez,

see the chart from the IEA OMR above

They have total U.S. inventories (commercial +SPR) at 2002 million barrel as of September 2015

The EIA data shows 2001 mbbls for the same month.

Alex,

Those tables all look very nice. But please read the bottom line on the following graph from EIA.

http://www.eia.gov/forecasts/steo/images/Fig14.png

and

http://www.eia.gov/dnav/pet/PET_STOC_WSTK_A_EPC0_SAX_MBBL_W.htm

I think you might become speechless 😉

likbez,

For some reasons I didn’t become speechless

This table represents commercial inventories of crude oil:

http://www.eia.gov/dnav/pet/pet_stoc_wstk_a_EP00_SAX_mbbl_w.htm

And this one of crude oil and petroleum products

http://www.eia.gov/dnav/pet/pet_stoc_wstk_a_EP00_SAX_mbbl_w.htm

And this one the commercial stocks of crude oil and petroleum products + SPR:

http://www.eia.gov/dnav/pet/pet_stoc_wstk_a_ep00_sae_mbbl_w.htm

some ликбез for likbez 🙂

Faced with the choice between changing one’s mind and proving that there is no need to do so, almost everyone gets busy on the proof. So I am not surprised at your reaction.

Let’s begin from the very beginning.

1. There is a claim that there is a hugee, unpalatable oil glut around 2Mb/d or 60 Mb/month or 700 MB/year, give or take 100 Mb. And that this glut caused sharp drop of oil prices due lack of “price elasticity” — the theory taken from neoclassical economics bible.

2. Due to this we need to see a rapid increase of commercial oil inventories which somehow currently in the USA are around 500 Mb and did not grow substantially from March-April 2015.

As the USA was the country that caused “oil glut”, this effect should be pronounced in the USA crude oil inventories (moreover there was an export ban on raw oil until recently).

3. If we assume that some idiot bought this oil and stored commercially that does not mean that there are bigger idiots who refine this oil losing even more money. So refined products, ethanol, etc which are included in EIA figure 1,337,939 ( Total Crude and refined products excluding SPR) for Feb 05 (which you love so much) are of no interest here. We should use only Crude oil commercial inventories which are, I would like to stress again, around 500Mb as of 02/05/2016. And they were already 471.444 MB on Mar 28, 2015. Rising only around 29 Mb for 10 month period or 2.9Mb/month or 0.09Mb/d. And God knows how much of this oil was bought for arbitrage.

4. So logically most of the “oil glut” should result in a rapid growth of commercial oil inventories.

5. This is not the case.

Likbez,

I really cannot understand what you want to say.

Are you saying that:

1) I am not correctly interpreting the numbers from the EIA, IEA and other source?

2) Or that their numbers are wrong?

Hi Likbez,

Isn’t it possible that less crude oil was imported by the US than before the increase in LTO output. See chart below, US crude imports dropped by about 2 Mb/d from 2012 to 2016.

I would like to know why the OPEC report data is so different compared to STEO for OECD inventories. It shows little or no growth in inventory since August 2015. The numbers are 2982,2982 and 2974 MM barrels for the last three months ending in December 2015.

The last few years have been very interesting in that when prices were high we saw non OPEC producers going as hard as they can to produce oil, and now that prices are low we’re seeing OPEC members going as hard as they can to produce oil.

You have a choice here. You can immerse yourself in economic thinking and twist and turn and contrive to make some contorted explanation within the context of what you think economics is supposed to mean.

Or you can realize the world disappeared in 2008/09 when printing got underway globally and none of that stuff has any underpinning anymore and from THAT perspective try to understand why frantic production is still ongoing. And btw, you didn’t need to delineate OPEC and non OPEC. It would still be right.

Thanks for the reply to my post. Looks like it got taken for spam and disappeared. It seems to me that frantic production of oil only results in increases in two locations. One OPEC and one non. One North America, the other The Gulf. One when price is high. The other when it is low.

aaaand it’s back again. Thanks Ron!

Do you think those that run central banks and others understand and agree with you, Dont understand but are doing things that have the same effect anyways, or neither?

Do I think those that run central banks and others understand and agree with me that frantic production of oil only results in increases in two locations. One OPEC and one non. One North America, the other The Gulf. One when price is high. The other when it is low?

I don’t know. I have insufficient evidence to draw a conclusion. It’s a moot point anyway. I’m not so much concerned with what other people think. I have no ability to determine what others think unless they choose to honestly inform me. I’m more interested in what the future/my future holds and how I can best prepare to prosper. My visits to Ron’s fine blog are part of my effort to understand that and not much more.

A bit off-topic but I looked at what was discussed at the recent World Economic Forum:

9/2/2016

IEA in Davos warns of higher oil prices in a few year’s time

http://crudeoilpeak.info/iea-in-davos-2016-warns-of-higher-oil-prices-in-a-few-years-time

Everyone and their brother keep saying how crud(ish) prices are going to be higher after ____ months/years. Salvation: when enough drillers fail and get out of the business. There will be shortages and … higher prices!

What these experts don’t ever say is HOW the prices are going to be higher!

Where is the money going to come from?

Money is credit: what group/organization/banking sector/finance is going to lend to ordinary end users when these same users cannot earn a penny by burning their fuel?

Leave out farmers, deliverymen, bus drivers and bulldozer owners. 90% of fuel use is simply waste. A person does not fly to Disney World to pay for the fuel used in the airplane, he does something else. The commuter does not drive back and forth to work in order to pay for his commute, he does something else. A businessman does not waste fuel to pay for it; all of these folks borrow, either directly from their own lenders, indirectly by way of their bosses’ companies’ lenders or their customers’ … or governments borrow in their place. No borrowing, no fuel buying.

Somehow or other a shortage of fuel is going to render these hapless deadbeats able to borrow when a ‘glut’ of fuel cannot.

What Jeffrey Brown points out over and over is the so-called ‘glut’ is simply another finance industry -slash- media narrative, a pleasant lie that glosses over the fact that fuel supply is declining, that purchasing power is declining along with it and that no easy solutions to these declines exist. (The only solution is stringent conservation — getting rid of the cars).

Underway is a structural breakdown of the fuel financing regime. It is not going to ‘unbreakdown’ itself, any shortages will make matters worse.

The fuel supply may be declining,but we don’t know that for sure , not yet.

It is not yet declining at a rate high enough to cause serious problems, and improving efficiency can probably mostly offset decline for a while, assuming the decline is gentle, say one percent or so annually.

It’s not written in stone that the economy WILL go downhill short to medium term. I am not saying it won’t , but rather that nobody KNOWS for sure that it WILL.

If the economy really does get worse and worse, in the near term, then the amount of oil the end users can afford WILL decline, and it is altogether possible that the decline in purchasing power COULD BE great enough to more than offset the decline in marginal cost supply , so that prices WILL stay low.

But prices WILL NOT and CANNOT STAY BELOW PRODUCTION COSTS, medium or long term.

The costs of production simply MUST be paid, in order for production to become a reality, rather than a possibility.

Methinks this assertion is as iron clad, in economic terms, as any law in a physics text.

Production can be paid for via oil selling for enough to cover the costs of production, with a profit.

Production can be paid for via a formal subsidy, with the customer paying part of the cost, and the rest borne by government, but it will STILL BE PAID FOR.

Production can be paid for, short term maybe into the medium term, by a producing company burning thru it’s capital, but it still gets paid for. When the capital is gone, production stops, unless loans are to be had.

Production can be paid for via a producer borrowing money, and then going broke, but production still gets paid for. When the borrowed money is all used up, and no more loans are forthcoming, production stops.

There is nothing wrong with the abc’s of economic theory, when it comes to such elementary matters.

Assertions to the contrary are nothing more than smoke and mirrors.

Oil will not be produced, in substantial quantity and over the medium or long term, unless the costs of production are PAID.

SOMEBODY pays.

I don’t give a crap how tough times get. OIL will go up, unless the economy goes down hill fast enough that enough oil can continue to be produced, so as to keep the wheels turning, at the same price- today’s price.

So far as I can see, most current oil producers are bleeding money. If I am right about this, they WILL EVENTUALLY QUIT producing until the price goes up again. I might be wrong, but I don’t believe there is enough production, world wide, that costs thirty bucks or less, which is roughly the current price, to meet demand even in an economy contracting at a fairly fast pace, at least not for very long. Depletion never sleeps.

If they continue to produce, by way of subsidy, the REAL price of oil will still be UP.

My best one hundred percent redneck hard core republican buddy, who died about three years back, often had this to say, paraphrased.

“I don’t want to hear no more bullshit about the fxxxxxg price of gas when every damned store that sells gas sells sugar water for a buck a pint. ”

Now times may actually BE sort of tough, but METHINKS the people who obsess about how tough times are blind themselves to just how GOOD times actually ARE.

A few observations about how tough times REALLY are , here in the backwoods of APPALACHIA, where unions are scarce, and jobs few and far between:

Well over half of all the kids have personal phones. Well over half of the people thru the country side who rent have dsl internet and or satellite tv. The parking lot at the local high school has a third as many parking spaces for STUDENT’s cars as there are students. Another quarter of the students are dropped off by parents, picked up by parents.

Fast food restaurants are jammed three times a day, and there are dozens of better restaurants all doing ok to great.

There are over a hundred new Chevies on the parking lot at the nearest Chevy dealer. With the exception of the high performance models, and a half a dozen pickup trucks kept on hand for the old timer who wants a new truck with a stick shift , EVERY LAST ONE of them has an automatic transmission, air conditioning, power brakes, a nice am fm radio, carpet, clear coat paint, etc. If you want a bare bones Chevy, you have to ORDER it from the factory that way, and you will find that it is generally impossible to delete features such as automatic transmission, etc.

It is actually pretty common for common people to fly hither and yon these days. I know three or four myself who have flown coast to coast to visit family and goof off who drive fifteen or twenty year old thousand dollar cars because they can’t afford nicer cars.

We spend billions and billions on all sorts of foolishness, such as loaning fifty grand to doofus kids to major in basket weaving or writing poetry for four years. I use the word doofus judiciously because they are dumb enough to believe they can make careers out of basket weaving and writing poetry.

What I am getting at is that we CAN and WILL pay more for oil, over the coming years, even if the economy is declining, because we have PLENTY of income that can be diverted to oil when necessary. .

I don’t pretend to know how long this will continue to be true, but it seems likely it will hold true for a good while,maybe a couple more decades, barring the economy having a heart attack.

For what it is worth, I do expect the economy to eventually fail in catastrophic fashion, but just not any time soon, although “soon” is not out of the question.

You are right, Mac, extraction will not last long when the returns are less than costs.

The price is not going to go up. It can’t. End user-customers are flat broke. Nothing will make them ‘un-broke’. To say that prices will rise without demonstrating how is an act of faith. If customers were not broke the price would be higher. It’s that simple. There is nobody to buy oil products except customers; gasoline and diesel aren’t being sold to Martians.

It isn’t just fuel that’s taking the hit: the trucking, overseas shipping, retail are flopping. So are non-fuel commodities such as copper, iron, nickel, grains, etc. China is cutting back but that is because China’s customers are broke and cannot afford the crappy Chinese products.

In the meantime the wells have been paid for along with the plumbing, the drillers pump what they can because they know what will happen when they stop.

Of course fuel supply is declining, there is nothing else for it to do! We started with everything back in 1858 … and are half-way to nothing. Every gallon burned brings us a gallon closer to oblivion.

http://www.economic-undertow.com/2016/01/04/a-look-to-2016/

2015 U.S. household spending on energy goods and services relative to wage and salary compensation at 6.8 cents per dollar is the 6th lowest in the 66 year history of the data set.

https://research.stlouisfed.org/fred2/graph/?g=3qz5

I’m from europe, and gas is dirt cheap in the USA – either it is at 1 or 3$ / Gallon.

If gas prices would be pressing people, they would buy smaller cars, and that I can’t see on my visits in the USA. A few Prius, but not the big number of very small cars like in europe.

And for commuting a small car is enough.

Eulenspiegel,

Yes you are right that broke people don’t buy SUV if they are broke in conventional terms.

Confusion arises because Steve does not make distinction between “broke with cash” and “broke with credit”. Majority of population in NA is/was “broke with cash” for the last 20 years but not broke with a credit.

In other words in exchange for your labour you get credit/debt but not cash in order to keep up with built in price inflation in the current monetary system. That is all to it. So yes majority of population is broke in conventional terms but still can “afford” to drink $6 lattes and to drive expensive and big $100k SUV’s. Well that is the consequence of US$ reserve currency status. How long that will last? It is being determined in ME at this very moment.

Ya right, the 2016 edition of the 1956 Ward Cleaver’s live in a house twice as big, four times more well appointed, with 2.2 cars in the double car garage and spend less for energy per dollar of wages.

Heh, Wally, Beaver here. I want the transistor radio with the flashlight under my covers tonight!

So are you saying that 2016 edition of Ward Cleaver is happier than 1956 version? Do you ever wonder why consumption of anti depressant drugs is probably 1000x greater today then in 1956?

2016 edition of Ward Cleaver are never going to have ENOUGH because he is never “Good enough”. After buying house with one car garage he needs to buy house with 2 car garages, and when that is not “Good Enough” poor Ward has to buy house with 3 car garages. That is example of suffering and not of well being.

But if you really want to do some math exercise you can calculate how many jobs/working hours Ward and his wife had in 1956 to keep up with payments. His wife probably did not work and he worked 40 hours. Today both, he and his wife have to work, and on the top they have to have even extra job on the weekends. You can also calculate how much Ward earned in Defined Pension Plan in 1956 and compare that with his company pension non-existent earnings today. Then you can compare how many paid weeks of vacation he had in 1956 and how many days of paid holiday he has today.

Then when you add all this up you will know if Ward is really better off today or he and his wife just work waaaay more to pay for things that are not really making him happier than his 1956 edition.

Thanks, marmico!

…Hey kids! What’s wrong with this picture that marmico has put forth? Would anybody like to volunteer? Can we get a show of hands?

Anybody with a brain understands that fossil fuels will not last forever. If you are talking about the LONG TERM, in terms of the BIG picture, yes potential or actual fuel supplies are decreasing.

But it seems to me the discussion is mostly about CURRENT reality. I was certainly talking about current reality.

If you think the world wide economy is going to decline at a faster rate than marginal high cost oil production is going to decline, thereby reducing the REAL TIME demand for oil , FASTER than the supply falls, you are a doomer indeed.

I do not know how long it will take, but barring catastrophic economic collapse and or miracles on the technology front ( enabling us to give up oil quickly) the supply of cheap oil is going to decline pretty fast.

Price involves TWO basic factors. You are obssessed with just one of them, affordability, while apparently refusing to understand that producer costs are EQUALLY important in determining price, over the longer term.

Oil producers simply CANNOT run at a loss, long term.

The price WILL go up as the high cost producers and high cost production leave the market.

The question is this:

Will the economy go downhill faster than high cost oil production?

I do not believe that it will. Apparently you do, as a matter of faith.

Maybe you are right, but MY opinion is that people will reduce purchases of other goods and services FASTER than they reduce purchases of oil , and that efficiency will continue to improve.

In the VERY long run, the last marginal barrels of oil will damned near priceless unless technology enables us to substitute other energy sources for oil.

I expect I could trade a couple of barrels of diesel fuel for a good looking virgin daughter in a heartbeat, if oil production were to suddenly come to a halt.

Other energy

http://www.resilience.org/stories/2016-02-12/is-our-future-possible

Hi Steve from Virginia,

The resources of oil in the ground are not considered oil supply, oil that has been produced and is ready for sale to oil refineries is “oil supply”.

Ron thinks this “supply” of crude plus condensate peaked in 2015 and will never be higher on an annual basis in future years. I don’t agree, I think supply will decrease in 2016, but the 2015 output level will be surpassed by 2019 when oil prices have risen.

As to the oil price being low because people are broke, no I don’t think so. It is a simple matter of more oil being produced than people want to consume at a high oil price. Do you think the World is 3 times worse off today than during the 2011 to 2013 period when oil was over $100/b? If so, I would disagree. I would agree the World economy is not doing well, but the World can easily afford $75/b oil and when oil supply falls due to low profitability at $30/b, you will see that my guess is correct.

We will see $75/b by June 2018 (and probably before this).

I feel a lot of discretionary expenses i.e. six dollar latte and a muffin, a new Apple Ithing every time they make one, extensive clothing and fashion purchases, etc etc will all diminish and those funds will be redirected towards the most important consumable of all, energy. The kind that goes in your mouth and the kind that goes in your tank. I see a lot of people wasting all kinds of money on Star Wars crap, conventions where you pay to get your picture taken with some actor who plays a vampire on TV, and on and on. I see a lot of people pissing away a lot of cash all the time. I don’t think all the debt is generated to pay for oil. It’s generated to pay for lifestyle. In the future the stupid stuff will go unpurchased. The important stuff will not. Nothing is more important than food and energy. I forecast inflation in food and energy. Deflation in everything else.

The problem with a declining economic environment is that it can be liner until it isn’t. At some point a critical mass of people decide to change things outside of the existing paradigm…and that never turns out well.

This is not exactly for you, steve from virginia, but for those who may suspect that progressive efficiencies will ‘save us’:

The potential problem with this rationale is that past oil production paid for and created the infrastructures, the ‘complex wiring, piping, filters’ and vested interests– the particular type of ‘sociopoliticeconomic engine’– we have in place that still, for the most part, requires past oil production and energy levels to be maintained. This includes other forms of energy infrastructure, such as nuclear, and hydro.

My point doesn’t even touch on how humans have maintained a fundamentally-unethical crony-capitalist plutarchy system (which doesn’t actually work for people in a fundamental sense) and what happens there when energy-levels start diving; or how humans (mis)manage complex systems when they start to become overcomplex and chaotic. Overcomplexity and chaos of course imply mismanagement.