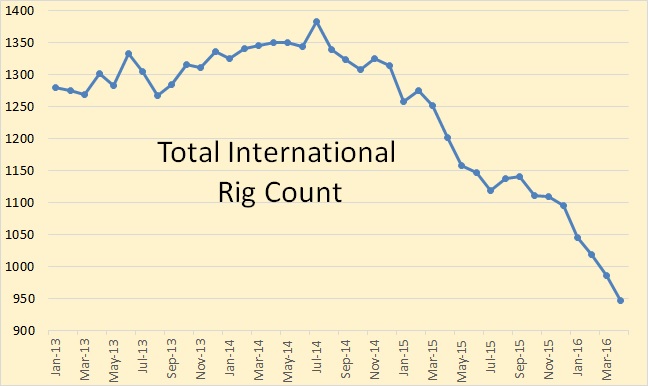

Baker Hughes recently published their International Rig Count. This rig count is at the end of April. It does not include the US, Canada, any of the FSU countries or inland China. The count includes both oil and gas rigs.

Total International Rigs stood at 946 in April, down 39 for the month and down 436 rigs since the latest peak in July 2014.

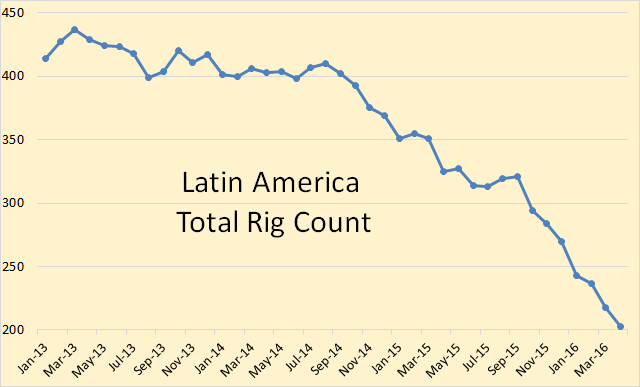

The Latin America rig count stood at 203 in April, down 15 rigs since April and down 204 since July 2014.

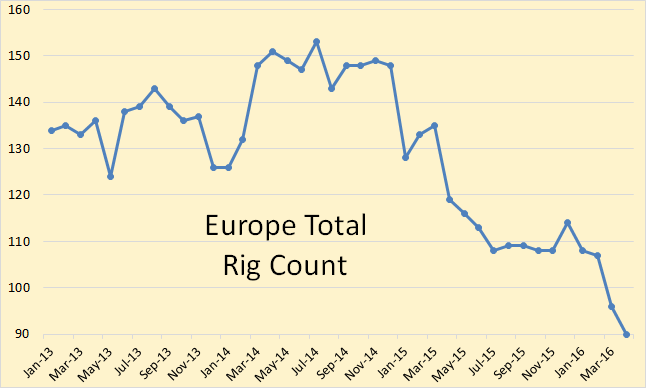

Europe rig count stood at 90 in April, down 6 in the last month and down 63 since July 2014.

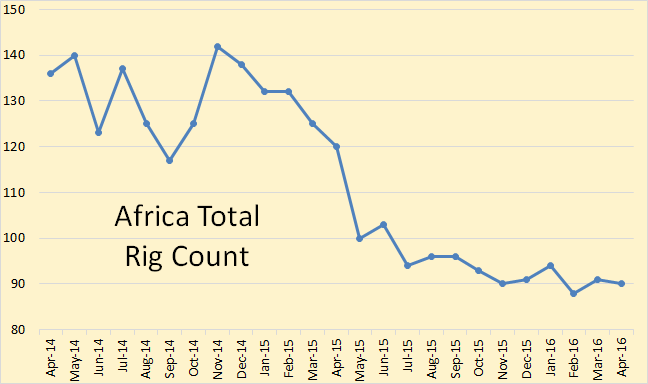

African rigs seem to have leveled out. They stood at 90 in April, down only 1 from March. Africa’s latest peak was in November 2014 and they are down 52 from that point.

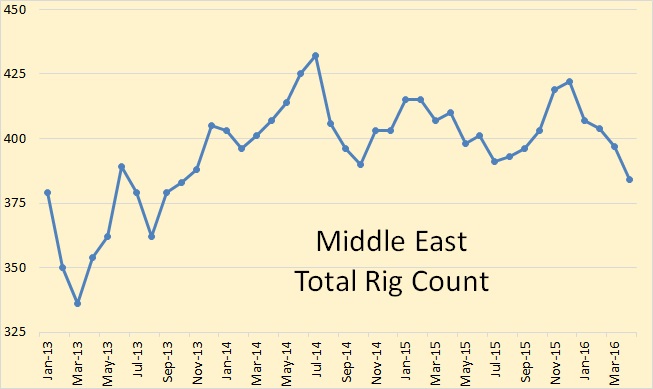

The Middle East rig count had been holding steady but dropped 13 rigs in April. That is down 48 rigs since their latest peak in July 2014.

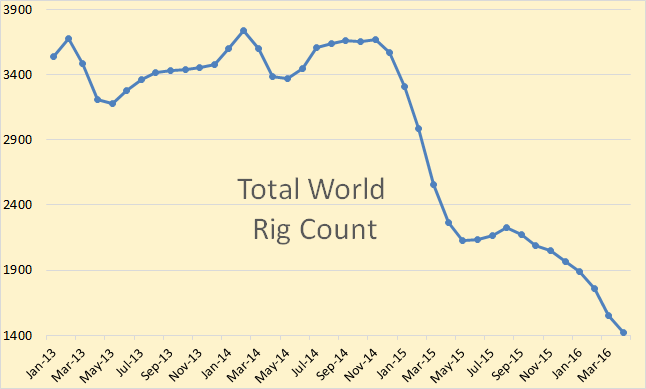

Baker Hughes’ total world rig count is just their total international rig count plus the US and Canada. It still does not include any FSU countries or inland China. The total world rig count did not start dropping until after November 2014 when it stood at 3,670 rigs. It is down 2,246 rigs since then and now stands at 1424 rigs after dropping 127 rigs in April.

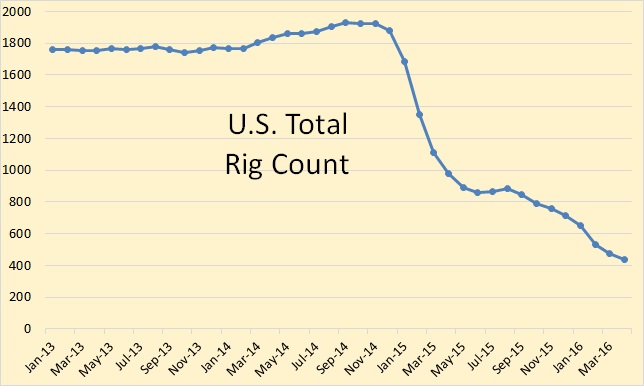

The US monthly rig count dropped 41 rigs from March to April and now stands at 437. The Count stood at 1,925 in November 2014 and is down 1,488 rigs since that point.

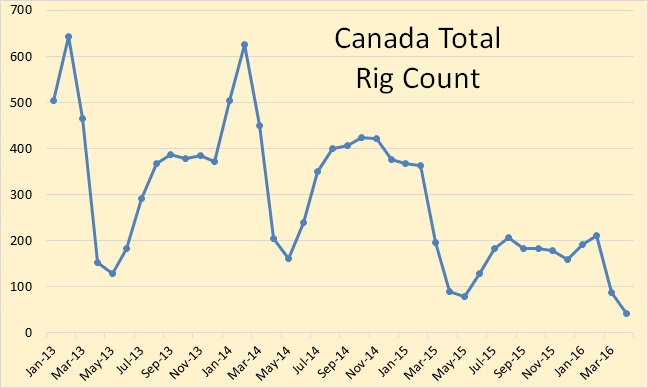

The Canadian rig count is highly seasonal and usually peaks in February. The last normal February peak was in 2014 when it peaked at 626 rigs. The 2016 February peak was 211 rigs. The March to April decline was 47 rigs and their total rig count now stands at just 41 rigs.

The Australian public broadcaster hasn’t even discovered that US shale oil has peaked

30/4/2016

Australian Public Broadcaster ABC unable to look at oil statistics

http://crudeoilpeak.info/australian-public-broadcaster-abc-unable-to-look-at-oil-statistics

The Australian public is as a whole completely apolitical. Discussions about politics and world issues are seen as party poopers. Such a society cannot be expected to come up with a competent government or a public broadcaster that deals with important issues.

The Australian Broadcasting Corporation sings their one or two note opera about their pet subjects without really ever digging deeper into facts. Critical thinking is not part of the Australian psyche.

One thing that laymen such as myself have a hard time appreciating is that the oil industry is probably the SLOWEST moving of all the really big important industries. Even with the rig count having dropped so far, and so fast, as it has over the last year, production capacity is still more than ample to keep the market flooded with oil and thus keep the price down in the pits.

When it comes to the price of oil going back up into “normal” territory again, the question boils down to this:

How long will the time lag be between the drop in production capacity and the drop in the rig count, assuming the economy holds more or less steady?

It now seems obvious enough that over the last decade, the rig count got high enough that eventually production capacity exceeded the needs of the oil market, at the prevailing HIGH prices.

I don’t crunch numbers, but it seems to me that with IRAN and IRAQ, etc, getting back into the market, they can produce enough to offset the decline of the legacy oil fields for a year, or maybe two years at the absolute outside.

With the world economy just about holding its own, or maybe going into recession soon, Iranian and Iraqi production may mean the price of oil won’t be going up much at all for a year or two, presuming these countries remain stable enough to keep their production up and growing. I am assuming they don’t need many rigs at all, because their wells so are superb and long lasting high producers.

And that sluggishness means that, even though the fast decline in rig counts started in December 2014 coincides with, and therefore looks like it was caused by, the OPEC meeting to maintain production and a start to rapid price fall, the decisions to cut drilling costs would have been made 6 to 12 months before, when prices were close to the highest yearly average ever seen.

Apart from the slow response, another defining characteristic of the oil industry is group think – everybody in medium to large companies, IOCs and NOCs, gets the same data input and based on it makes virtually the same decisions at the same time. The ‘recovery’ will be influenced accordingly.

Not sure about that level of group think, although I would agree that the general press is incapable of independent thought. Unfortunately, even the CEOs read and follow that junk.

Remember, the Chairman of EOG was threatening to outdrill the Saudis until he was replaced in late Dec., and Hamm sold all his hedges in early 2015, because he was sure oil would be back to 100 in a few months. However, no one can fire Hamm.

In support of group think, I do remember reading something that indicated that many believed something was beginning to go amiss in July. However, December is not usually a big drilling month, anyway. Drilling units only dropped 11 in December 2014, which is not a huge drop for December.

In the fall of 2013, on their quarterly conference call Transocean said that “there is an ill wind blowing.”

They had to be among the earliest to see the problem.

Hamm sold his hedges in late 2014.

Yes, there is a very considerable lag-time in the global oil industry between price movements and oil production itself.

The US rig-count is an important but minor part of the story. One of the reasons that the epic collapse in rig counts has only resulted to a substantial but relatively small fall in actual oil production is that US shale companies were already in possession of a massive inventory of drilled but uncompleted wells before the price collapse. Now, I don’t think that all of those are found in the so-called “sweet-spots” but they have gone a long way mitigating the calamitous collapse of drilling itself. Nevertheless, around 2/3rds of the cost of an oil well is its completion, not it drilling, so the finances of the shale companies have gone from very bad to even worse.

As for conventional oil production, my amateur knowledge leads me to believe that there is something like a 3-year lag-time between oil prices and oil production (do not take my word for it, and here I would appreciate some input from pros on this blog)

If I am correct, the we should be seeing very substantial drops in oil production by early 2018 and through the end of this decade. The possibility of a serious oil crunch down the road is very real.

The only way that the global economy can be adequately supplied with oil and without a massive shortage of crude down the road, will be if the GCC + Iran/Iraq + Russia are as low cost producers as I think they are. Up until now, these producers have held up remarkably well (despite the fact that some of them are really short on capital) and I expect them to keep doing so. Everyone else will see production declines (with the possible exception of Libya)

One of the reasons that the epic collapse in rig counts has only resulted to a substantial but relatively small fall in actual oil production is that US shale companies were already in possession of a massive inventory of drilled but uncompleted wells before the price collapse.

“Substantial but relatively small” is a contradiction in terms. In truth the decline has been substantial but definitely not small. The decline in the 7 shale production areas, since peaking in March 2015 has fallen by 671,000 barrels per day or 12.2 percent. That is definitely not small but it is definitely substantial.

Well, at least you got it half right.

Yes I could have worded that more precisely. My point was that the decline in oil production we have seen up to now in the shale patch seems to be less than what one would expect from looking at the monstrous collapse in the rig count. The reason for this is that the oil companies active across the shale patch have been running through their inventory of previously drilled but uncompleted wells. That was the point I was trying to make.

Hi Ron,

If we pay attention to data rather than the DPR model (which is not very good), we only have tight oil data through March 2016.

See

http://www.eia.gov/energy_in_brief/article/shale_in_the_united_states.cfm#tightoil

Based on that data, from the peak in March 2015 US tight oil has declined by 411 kb/d, which is 9.2%. Based on Dean’s estimate, my guess is that the decline may have been less than this because the EIA is overestimating the decline in Texas output (if Dean’s estimate is more accurate as I suspect).

Also note that the EIA thinks that the Eagle Ford has declined 393 kb/d since the peak in March 2015 accounting for 96% of the overall decline in tight oil output from March 2015 to March 2016.

Based on Dean’s data and data shared with me by Enno Peters, I think the Eagle Ford output in March 2016 may be as much as 100 kb/d higher than the EIA estimates. If any other estimates are inaccurate by the EIA we will assume that over and under estimates cancel each other so that the tight oil estimate minus Eagle Ford is roughly correct.

In that case the decline might be only 311 kb/d or a 7% decline in US tight oil output from March 2015 to March 2016.

I agree with Stavros that “the decline in oil production we have seen up to now in the shale patch seems to be less than what one would expect from looking at the monstrous collapse in the rig count.”

Just one point: 1500-1600 oil rigs were needed to increase production by 1 mb/d annually and to offset sharp declines in existing wells output.

Much less rigs are needed to maintain slightly declining LTO output, especially as:

(1) with less new wells drilled, the overall decline rates for shale plays is not as steep as in 2012-2014;

(2) newer rigs and pad drilling has allowed to sharply reduce average drilling time;

(3) almost all new wells are drilled in the sweet spots.

Therefore, relatively slow declines in LTO production can be explained not only by completion of the DUCs

I also agree with Dennis that DPR data is not reliable. The monthly estimates of LTO production currently published by the EIA (based on DrillingInfo statistics) are much better, but they also may slightly underestimate output volumes.

Thus, the EIA/DI numbers show that the bulk of the decline in LTO output in 12-months period between March 2015 and March 2016 was in the Eagle Ford.

Such steep decline rates in EFS compared with the Bakken are difficult to explain.

Change in the U.S. LTO production: March 2016 vs. March 2015 (kb/d)

Source: http://www.eia.gov/energy_in_brief/article/shale_in_the_united_states.cfm

Alex,

Thanks for your long list of great contributions here in the last few days again.

The subject of recent shale production & decline is not crystal clear due to lag times and revisions. Still, based on preliminary data I do have a somewhat different take on it than you.

1. Shale decline

Below you’ll see a picture that shows on a monthly basis the decline (legacy) & growth (first 2 months of production shown in blue) of oil production from all the 31000+ shale wells in my dataset, with data until Dec. It does show that recent monthly declines are very high.

These high declines are likely to become gradually less indeed, but currently the monthly drops are still steep due to the large number of wells completed in 2014 & (even in) 2015, and the % increase in faster-declining (especially non-Bakken) wells.

2. EF vs Bakken

I have the impression that well costs in the Eagle Ford & Bakken are not radically different. However, EF wells seem to peak higher, and then decline much faster than Bakken wells : by year 5 a typical EF horizontal well is doing 20 bo/d, while a Bakken well is still above 50 bo/d, therefore also leading to a much lower UR. By “grouping wells by basin”, you can see these differences (even if you remove the excellent Bakken wells from 2008/9).

That gives me the impression that for EF wells it is even much more important to be completed in a higher price environment, and that gives credence to the idea that recently indeed fewer EF wells have been completed. That together with the faster declines in the Eagle Ford, could explain the larger drop in production there.

To be sure, for me it’s also too early to say whether this take is indeed correct, due to the possibility of major TRRC revisions. But it would make me less surprised if the EIA got this right.

I do agree with you that fewer rigs are needed to maintain production, as rig efficiency has increased way more than well productivity.

Enno,

thanks for very important clarification.

If I understand you correctly, your calculations show that higher decline rates of individual new wells offset the lower share of new wells in total LTO output?

As regards well costs for the EFS and the Bakken, the former are indeed less expensive (Bakken is deeper).

I’m not sure if individual company guidance is representative,

but here are drilling & completion cost numbers provided by QEP Resources and Encana:

QEP – Bakken (South Antelope): $6.1 mn

QEP – Permian (Spraberry):$5.9 mn

Encana – Eagle Ford: $3.5 mn

Alex,

I have not really calculated anything (except for the estimation of Texas well profiles, but I think that can be done quite reasonably), so the graph above is just the result of looking at the contribution from all the months of production for all wells. And indeed we can see that the total decline so far has hardly gone down. Also, we can see that recent wells in all basins together peak a little higher, and then decline more sharply, so that indeed is the explanation in my mind.

Regarding well costs : your numbers for Encana highly surprise me. I didn’t check them, but I did check what EOG has paid for the average net well during the last 3 years (based on cash flow statements), and it was just over $8m, of which most were drilled in the EF. Encana’s wells are even doing a bit better than the average EOG well in the EF, so are they really so much better than EOG?

If I understood Mike correctly, his impression is also that horizontal EF wells are typically > $8m.

Enno,

capex in cash flow statement includes items not directly related to drilling and completion costs

Alex,

I just looked at Encana’s latest presentation. Indeed I find the $3.5m well cost for the Eagle Ford there.

But a few remarks:

1. They mention that the average D&C cost in 2015 was still $6.3m, in the past probably higher

2. There is a * that shows that all these costs are normalized to 5000 feet laterals, so in practice these costs were higher. Aren’t typical laterals in the EF also not close to 9000, like in the Bakken?

3. I have the impression that certain typical well CAPEX is not included when these D&C costs are mentioned (e.g. the installation of pumps later on?). Often the claimed well costs are quite a bit lower than the ones you can calculate yourselves based on the CF statement (a little more complex in Encana’s case, as they are active in many basins).

So all in all, probably they are a bit cheaper in the EF due to lower depth, but maybe < 20%?

Hi Enno,

The laterals in the EF are about half the Bakken, around 5000 feet. For EOG they use 8400 feet for their average Bakken well and 5300 feet for EF, this probably varies from company to company.

In 2015 EOG claims average well costs (normalized to 8400′ in Bakken and 5300′ in EF) were 7.2 M in Bakken and 5.7M in Eagle Ford (EF).

It looks like this summer will see a big change in S/D.

In Q3 demand goes up by about 1.5 million barrels a day as fir example the Saudis U.S. oil to generate power for A/C. Demand stays at this level thru Q4.

The decline of US tight oil production has been masked by offshore oil projects coming on line. That addition is about done, and the 1.5 million barrels per day per year decline rate will take effect.

We are at the point where decline rates will pick up speed.

The fires in Canada has shut in about 1 million a day in production. How long it will take to come back on line is still unknown.

Last week we had the Saudi oil minster fired. Is this a change in the Saudis holding down prices by over producing.

IMO prices may go up faster than many expect.

I have read in the last couple of days that most or nearly all the senior economic ministry leaders have been sacked or transferred, along with the oil minister, who is EIGHTY years old.

The new guy what’s his name is consolidating his power. He may be reckless and lacking in good judgement overall, but he sure does seem to have it in mind to do what he can to start diversifying the Saudi economy.

In my estimation, saving the Saudi economy and the country itself is just about a hopeless proposition, over the long run, but he might be able to diversify enough to stretch out the oil endowment a generation or so.

There is nothing underpinning the Saudi economy except oil, and once it’s gone, there is no reason for anybody to want to live there or go there, except as a tourist or scientist. Unless the birth rate crashes hard and fast, there will eventually be a mass exodus of people out of the country, because there is no way in hell for them to support themselves once the oil is gone.

They aren’t going to turn into a nation of German engineers. They have the brain power, but they hire everything done, and look down on actually WORKING. By the time the NECESSITY of working becomes obvious, it will be too late for them to change their ways.

The rich ones, the royal family and those closely connected to them, will be able to emigrate.

As for the rest of them………. Damned few countries in a world growing short of resources are going to be willing to accept more than handful of immigrants without useful skills who speak only a foreign language and follow a religion strongly associated with social unrest.

Oldfarmermac wrote:

“[Saudi Arabians] have the brain power, but they hire everything done, and look down on actually WORKING.”

Where did you get that Saudi Arabians “have the brain power”? The average IQ in Saudi Arabia is only 84.

In the absence of abundant and highly desirable natural resources, no nation has ever been able to get wealthy with such low levels of average intellectual capacity.

KSA has a very poor education system Mac. I guess it depends on what you mean by ‘have the brain power’.

Here’s a video to a book review of ‘On Saudi Arabia.

https://youtu.be/9tHwvZ9XDLU

I believe they have neither the training nor education, as well as the culture, to engage in meaning self reflection and improve themselves as a society so that they may mitigate future challenges as an intact society.

Well, Saudi women are sub-human which may decrease the country’s average IQ.

KSA and the rest of the GCC have it made, despite their lack of civilizational attainment. Their oil is not running out, and on top of that they possess massive amounts of natural gas as well that will come more and more into play as the century drags on.

What can bring KSA down though, is their exploding population, or sooner than that, an ill-conceived invasion of Syria without US cover. Russia & Iran will be rubbing their hands if that even occured.

Stavros,

I think you need to tell the leaders of Saudi, Kuwait and the UAE where all those “massive amounts of natural gas” are hiding, because currently these 3 large oil producers are all importing Natural gas by pipeline or LNG, and/or burning oil instead.

They would all love to be burning Nat gas, and exporting all the oil for cash Unfortunately, after spending a heap of time and effort, the three of them are all gas starved. Not sure, but I think Iraq can be included in there as well.

Very good question.

According to the CIA, KSA’s natural gas reserves are the 6th largest on the planet, at 8.6T cubic meters. The UAE’s reserves are the 17th largest in the world (almost as big as Norway’s) Kuwait’s are the 20th largest. Put together, these three states are in possession of the world’s 5th largest natural gas reserves, behind only Russia, Iran, Qatar & Turkmenistan. That is a massive amount by any standard.

In terms of production, KSA is the 8th largest producer in the world (almost as big as Norway & China) UAE are the 17th largest largest gas producer in the world (as big as Mexico)

Some overview of KSA & nat gas. Apparently KSA does not import or export any gas: https://www.worldenergy.org/data/resources/country/saudi-arabia/gas/

Just a quick look at Kuwait.

http://af.reuters.com/article/commoditiesNews/idAFL8N13T1RJ20151204http://af.reuters.com/article/commoditiesNews/idAFL8N13T1RJ20151204

ROME Dec 4 (Reuters) – Kuwait liquefied natural gas (LNG) imports are on track to rise around 17 percent to 3 million tonnes in 2015, boosted by the fuel’s increased competitiveness with gas oil, an executive from Kuwait Petroleum Corporation (KPC) said on Friday.

The Gulf Arab state imported around 2.5 million tonnes in 2014 via its floating import terminal, which it leases for the peak energy demand months from March to November, with an option to extend over additional months.

Your reference

https://www.worldenergy.org/data/resources/country/united-arab-emirates/gas/

Despite its large endowment, the UAE became a net importer of natural gas earlier this decade.

To help meet the growing demand for natural gas, the UAE boosted imports from neighbouring Qatar via the Dolphin Gas Project’s export pipeline. The pipeline runs from Qatar to Oman via the UAE, and is one of the principal points of entry for UAE natural gas imports.

So the large Nat Gas reserves of UAE, Kuwait and Saudi, are mainly tied up in associated gas, which will be produced along with oil production. UAE has a large gas re-injection program along with high Sulfur content.

Once all the oil is considered all gone, the fields will be depressurized and the remainder of the gas will be produced. I don’t think any of the 3 counties will be depressurizing their big oilfields soon.

The other caveat is, we generally don’t trust the oil numbers out of these countries, so how much faith can we put in their Nat Gas numbers?

They seem to have a real problem producing enough gas just for their own needs, from these “massive” Nat gas reserves! So really how big are these Nat Gas reserves that they state?

Maybe you are correct, I am not really in a position to argue against what you are saying. But my intuition would be that all big oil producers can also be big gas producers (while not all big gas producers can be big oil producers) For example, the US & Russia have been massive oil producers for several decades on end and also massive gas producers as well. Norway has been significant on both resources as well. It would seem truly bizarre to me if a region so fantastically rich in oil can be poor (or middle of the road) when it comes to natural gas (which is by and large much more plentiful than oil around the world)

There may be some particular geologic & geographic characteristics in those 3 countries that hinder the development of natural gas production at the same time as oil production (which is I guess what those reports are alluding to) I really don’t know.

Oil has turned the rulers of the gulf countries into helpless idiots. A friend of mine was the Polisario ambassador to the gulf, and he said there was simply nobody to talk to about the future of the region. He has some more colorful language, but I’ll spare you. Mass emigration would begin with the foreign workers, who actually know how to make the country work.

Last I did research on Saudi oil fields, the mainland was mostly drilled up. The big fields they were going to pursue existed off the coast into the Persian/Saudi Sea. They looked pretty, with connecting roads/pipelines. Horizontals into the sea. I can’t imagine that being an 8 dollar a barrel cost. I don’t give much credence in the popular opinion that either Iran or the Saudis can ramp up production in a short time frame to keep oil prices lower for longer. Matter of fact, I really doubt that any of the lower for longer proponents have a grip on reality.

Iran & Iraq have been increasing their production relentlessly in recent months. Iraq is up 4.31m per day, while Iran has boosted production up to 3.31m per day. It’s all on oilprice.com.

Both Iran & Iraq are oil behemoths that will play a massive role in the coming decades in supplying the world with black gold.

According to the IEA Oil Market Report, Iran’s oil production reached 3.56 in April. The growth rates were faster than most experts had expected.

from the IEA OMR, may 2016:

“OPEC crude output rose by 330 kb/d in April to 32.76 mb/d as a 300 kb/d jump in Iranian flows and a boost in Iraqi and UAE supplies more than offset outages in Kuwait and Nigeria. Saudi output was steady near 10.2 mb/d. Iranian supply rose to 3.56 mb/d, a level last hit in November 2011 before sanctions were tightened.”

“For Iran, oil production in April was close to 3.6 mb/d, a level last achieved in November 2011. Even more important for global markets, oil exports reached 2 mb/d, a dramatic increase from the 1.4 mb/d seen in March.”

Hi

Been trying to find answer to this question:

How much of the boost of Iran output come from old storage verses real production output? If that number has old storage in it we will probably see a drop in output in the near future. The question is how much.

sales from oil storage are reflected in exports numbers, but not in production numbers.

Iran indeed has recently indicated that they have already sold all their inventories of crude oil stored in tankers, but they still have large volumes of condensate.

Exactly.

Iran’s thunderous return to the oil markets is a proof of what I have been arguing all along, namely that Iran’s oil deposits are vast and easy (cheap) to extract.

Remember all the “experts” in the MSM telling us that Iran would require 10s of billions of dollars in investment and lots of “western expertise & technology” to restore its oil production back to pre-sanctions levels?

It seems that once again, the MSM in the free-world were full of bovine excrement.

Hi R DeRoches,

Some expect prices won’t go up at all, some expect prices will go up to $100/b by 2018. I think we will see $60/b by July 2017 and maybe $80/b by 2018. Rising LTO output may keep oil prices from rising much more than that until 2020. That assumes there is adequate oil demand. Rising sales of EVs from 2018 to 2020 and beyond may reduce oil demand at a similar rate as oil supply falls after 2020, the rates of growth or decline in demand and supply will determine the oil price.

There are factors that may make the oil price higher and others that suggest the reverse.

Number of cars in the world: 1 100 000 000

If 2020 will be 20 million electric vehicles

this is 1.8% of total

Bet you are wrong!

World new car sales were about 88 million in 2015, plug in vehicle (both hybrid and EV) sales were 0.55 million. If total light duty vehicle sales grow by 1% and plug in vehicle sales grow by 30% from 2016 to 2035, then plug in slaes will be 97% of total new light duty vehicle sales by 2035.

My earlier speculation that 90% of new car sales will be plugins by 2030 would require unrealistic growth rates (about 41%/year from 2016 to 2030).

In this still not very realistic scenario with growth rates of 30% per year until 2030, plugin sales would reach 27.5% in 2030.

The growth rate in Worldwide plug in vehicle sales was 71%/year from 2014 to 2015 (320,713 in 2014 and 550,297 in 2015).

Data from link below

http://insideevs.com/monthly-plug-in-sales-scorecard/

EV sales were very strong in China in 2015.

EV-growth doesn’t have to mean as much if people’s EV’s become stranded assets overnight as the dying so-called economy that supports them takes another writhe and convulsion.

One day you’re bopping about the countryside in your EV without a care in the world, and the next, you’re worried about where your next meal is coming from.

There’s little one can do with a so-called government or industry that decides it doesn’t owe you anything, is there?

This is why I have been saying for a long time that the private electric car as a solution to Auto Addiction consuming 70% of US oil usage is a delusion. If the US ramped up Green Transit Rail as it did from 1942-45 it could easily cut its oil usage 10% per year not 1% as with the private car. Also ignored for millions of private electric cars is the huge infrastructure costs of deploying electric charging stations. It is a LOT easier to convert Rail to renewable electricity – the Dutch already power 50% of their Rail with renewable electricity with concrete plans to power Rail 100% with renewable energy!

http://www.railway-technology.com/features/featuremichel-kerkhof-of-eneco-discusses-the-dutch-rail-networks-renewable-revolution-4647194/

According to the EIA productivity report LTO production is now declining at a rate of almost 1.5 million barrels a day per year.

This high decline rate has been masked by an increase in offshore production which is coming to an end.

The Alberta fires and the shutin of 1 million a day of production may last much longer than the market expects, and could be a

black swan event.

The 33% drop in international rig counts will start having a bigger impact on production in the coming year or two.

“Last week we had the Saudi oil minister fired. Is this a change in the Saudis holding down prices by over producing.”

On the contrary, Saudi Arabia will try to maximize output. While the former oil minister Ali al- Naimi was willing to discuss the freeze in output, prince bin Salman has actually broken the Doha deal.

This Undulating Plateau is starting to amplify. At least the inputs are. It will be noticed.

Signed a two year extension of drilling in the small percentage of 2k acres in the Eagle Ford, lately. They drilled two of the forty or fifty wells they will eventually drill, because both will get in excess of 150k bbls the first year.

I have now happily resigned myself to root along with the lower for longer “intellectual” discussions being promoted. Yeah, oil is going to trade in the 50 to 60 range for another three years.

Or, better, we are swimming in oil. Going down to 20, or maybe 10! Giggle.

Oil Production Vital Statistics April 2016

I have some rig count charts too.

I just copied this out of a Bloomberg article.

“Strategic and commercial stockpiles provide some security, but they’re a one-off. Once drawn down, they’re gone. The OECD countries have about 1.6 billion barrels of crude and refined products in government-controlled storage and almost twice that in industry stockpiles. More more than enough, in theory, to offset a three-year loss of Kuwait’s production.

But it’s not that simple. Much of the commercial inventory is needed to keep pipelines and refineries running, so can’t be used. As well as issues of quality and location, there’s the problem of how quickly oil can be drawn from storage. In 2005, the IEA reported that government-controlled inventories could be drawn down at an initial rate of nearly 13 million barrels per day, but only for a month. By month six that falls to about 1 million barrels and by the eighth it’s a trickle (nowhere near enough to cope with a major, prolonged loss of supply.)”

The last couple of lines are scary as hell, considering we might someday have to depend on these strategic petroleum reserves to get us thru a long lasting crisis.

Is this article credible?

This is the first time I have seen this claim made but otoh, I am only a layman, and not an expert in any aspect of the oil industry.

I think maybe in the event of a real supply crisis, Uncle Sam could find ways to encourage the folks in North Dakota to giddy up pretty damned quick, with production starting to pick up a good bit in as little as a couple of months.

This could be accomplished by declaring a national emergency and throwing money at the tight oil industry.

Or, we could do something sane for once, declare a national emergence, preferably about a decade ago, and throw money at solar/wind etc, which everybody in the world knows is what we are going to end up with everywhere, for the simple reason that s/w are everywhere and we know how to do it.

And, oh by the way, we HAVE to do it. Don’t forget that little titbit so often ignored here.

Now my own personal note. I had NO trouble and suffered no pain taking my house and car off ff’s and on to PV, I see no reason at all that everyone on my road couldn’t do the same, in the same way I did. And I see no reason my whole little town couldn’t do it too, and —-.

Keeping in mind that it’s stupid to talk about oil shortage while at the same time gobbling diesel to haul soda pop, and mow huge empty lawns with huge empty heads sitting their fat butts on that crappy contraption that breaks down every n seconds.

Pardon while I puke.

I am with you all the way on the necessity of going renewable, but it’s going to take a long time to do it.

In the meantime, if Old Man BAU has a heart attack, or somebody murders him, the transition won’t happen, and we will slide back at least as far as the muscle power era, and even farther than that maybe. We might not even survive the crash, excepting a few small pockets of people in extremely isolated places.

Hi OFM,

Wind and solar have been growing at 20% per year, if oil and other fossil fuel prices remain low then growth might slow down. The price of solar in particular has been falling quite rapidly so it is likely that the rapid growth could continue.

This growth may keep the economy functioning, not BAU though because the energy supply and transportation will be changing.

Dennis, while solar price has fallen rapidly, wind has not. Although solar price has fallen rapidly, I think a fair evaluation would show that it remains two/three times more expensive than coal/gas-fired electricity.

Solar price will not fall indefinitely. In the next decade or so, we’ll find where it stabilizes.

In any case, price is not the only constraint on renewables. I still think solar/wind will be limited to a fraction of the electricity supply in the next few decades because of intermittency. If the world oil production does peak, say, around 2020, solar/wind will not be easy substitutes for liquid fuels.

The economy will continue to function, but possibly with growing degree of malfunctioning.

There will be bigger investment in storage capacity – like a second Glen canyon dam behind the first one designed as pumping storage between the 2, to hold a month of energy.

Hopefully the not too expensive fossile energy will still hold 20 years to perform these investments.

Or cheap natrium based batteries for home use to use the photovoltaic energy at night – lithium is a rare resource and will get really expensive once the demand explodes.

“There will be bigger investment in storage capacity”

Why Used ‘Second-Life’ Electric Car Batteries Are A Clean Energy Game Changer

major EV makers — BMW, GM, Nissan, Toyota — are now exploring how much value their EV battery has for use in the electricity storage market after that battery can no longer meet the strict requirements for powering its car. This potential second life for EV batteries is a clean energy game changer for two reasons:

These used EV batteries hold the promise of much cheaper electricity storage for renewables than is available today.

If used EV batteries have value, then EV makers can charge less for their cars, making them even more affordable…

BMW has had over 18 months of testing that demonstrates its used batteries can deal with “demand response” requests from the California utility Pacific Gas & Electric. Demand response is rewarding consumers and businesses for adjusting their electricity use during peak hours (or during times when the sun isn’t shining or the wind isn’t blowing).

Under the program, PG&E manages 100 kilowatts of demand from BMW, made up of repurposed BMW Mini E batteries in a stationary unit and a charging program for up to 100 BMW i3 vehicles.

When PG&E alerts BMW the grid is short of electricity, BMW signals vehicles to stop charging (thereby reducing the load). If a vehicle is plugged in or the customer isn’t participating, then the array of second-life batteries is used: “Since July, PG&E has sent BMW 26 demand-response events, and the automaker delivered on all of them. Depending on the time of day, the vehicles met between 10 percent and 75 percent of the capacity needed. So in every case, the system relied on the second-life batteries.

http://thinkprogress.org/climate/2016/05/09/3775606/used-second-life-electric-car-batteries/

Hi Political Economist,

One does not need to assume PV costs will decrease forever, just until they are cheaper than coal and natural gas (with all externalities from solar, coal, and natural gas included in the cost).

Remember that if we are going to add in the transmission lines, roads, fences, etc into the cost of wind and solar we should be sure to add those costs to the coal and natural gas as well.

Another consideration is that natural gas output will eventually peak and if there are not alternatives, we may see energy shortages. Wind and solar are likely to be far cheaper than coal with carbon capture and storage or nuclear power in the long run.

We cannot just flip a switch and have replacements available, the higher cost today is to ensure lower future costs when a peak is reached and the price of fossil fuels increase.

Climate science has many uncertainties so it would be best to reduce carbon emissions as rapidly as is feasible.

A widely dispersed set of wind turbines and PV solar interconnected by an HVDC grid will reduce the problem of intermittency.

I assume you have seen the work of Mark Jacobsen

https://web.stanford.edu/group/efmh/jacobson/

It seems you believe his thinking is flawed.

I like the idea of a cap and dividend policy as conveyed by Jim Boyce and others. No doubt you are very familiar with this, others may not be.

http://www.dollarsandsense.org/archives/2014/0714boyce.html

An excerpt:

Under a policy with a carbon price, households’ purchasing power is being eroded by that big price increase. But with cap and dividend, money is coming back to them in the form of the dividend. Because income and expenditures are so skewed towards the wealthy, the mean—the average amount money coming in from the carbon price and being paid back out in equal dividends—is above the median, the amount that the “middle” person pays. So more than 50% of the people would get back more than they pay in under such a policy. As those fuel prices are going up, then, people will say, “I don’t mind because I’m getting my share back in a very visible and concrete fashion.” It’s politically fantastical, I think, to imagine that widespread and durable public support for a climate policy that increases energy prices will succeed in any other way.

Hi Political economist,

See

http://www.utilitydive.com/news/utility-scale-solar-booms-as-costs-drop-challenging-gas-on-price/406692/

The utility-scale solar sector is maturing right before our eyes. The resource’s prices are falling so fast, it’s on the verge of edging out natural gas on cost, according to the industry’s latest progress report from the Department of Energy’s Lawrence Berkeley National Laboratory (LBNL).

The article also suggests that in the Southwest US Solar is cheaper than Wind.

See also

https://emp.lbl.gov/sites/all/files/lbnl-1000917.pdf

Chart from page 36 of document above.

Dennis, PV is already cheaper than local coal plants.

At least in the UAE: http://www.bloomberg.com/news/articles/2016-05-03/solar-developers-undercut-coal-with-another-record-set-in-dubai

The cheapest form of energy by far is conservation. All governments need to do is tax the bejeezus out of consumption and the problem will go away.

Heck you could drastically reduce car travel in the US just by changing the zoning laws that ban corner stores.

Amen to that!! My sister lives on Camano Island, just across from Whidby. There is a little community of houses where she lives of approx. 1,000 people. Run out of milk? They have to drive 20 minutes across the Island to a grocery store, or into Stanwood another 10 minutes. (at 55 mph) There used to be a store, but it shut down for awhile many years ago and zoning prohibits anymore re-opening.

Where I live on Vancouver Island, even in the boonies, I am just 6 km from a store that even sells booze. When I lived in town we were 6 blocks away. Everyone is under 1/2 mile to a corner store in town; very walkable.

It’s all about common sense. Times get tough there will be little bodegas everywhere, just like there are dope dealers everywhere. Imagine, you can walk out and by crack, but you can’t buy milk or bread.

I use my MC to go to the local store if we ever need something, (about once per year!).

Cheapest BY FAR, and BTW, easy. And, with local walk-to stores, you actually get to know your neighbors, which might be vitally important. Sometimes, you get to learn one thing or another that’s actually useful-interesting by talking with people.

To me, Paulo, and Wimbi,

I agree 100%, conservation, and walkable neighborhoods/better urban/suburban design are as important or more important than ramping up alternative energy and transportation. We will need to implement all of these strategies to make a transition possible.

I think it can be done, but do not believe it will be easy to accomplish, on the contrary it will be very difficult indeed.

Pardon the interruption, but where are you planning to get the diesel fuel to make and maintain replacement parts for your solar arrays and wind farms? Turbines suffer wear and eventually the PV panels will no longer provide power. Show me the all-electric hydraulic lifts and heavy-duty trucks needed for the remote sites, not to mention offshore installations. Also, the all-electric factories that make the replacement parts. You’re dealing with FF “hamburger helper” that goes away when the FF goes away. Try to see the big picture.

Please read what I wrote. Does that comment about diesel hauling soda pop have any relevance to your question?

And all that about mining trucks and etc. Answered a thousand times. ALL that stuff can go just fine on electricity, and solar/wind makes electricity, far more than it took to make the panels/turbines in the first place. Go ask NREL.

I SAY NO MORE.

may I rest in peace.

Try to see the big picture.

Based on your comment you are having a difficult time with that aren’t you?

You really need to expand your horizons and educate yourself about the possibilities. There is nothing in the laws of physics that says fossil fuels are necessary for civilization.

Granted the current population overshoot based on fossil fuel agriculture will probably suffer a major correction but that is the consequence of overshoot.

If humans don’t survive then something else will!

Please read what I wrote. Does that comment about diesel hauling soda pop have any relevance to your question?

Given that there are over 1500 different kinds of soda pop in the US alone and every single one of them is part of our non negotiable lifestyles and the only way to transport them is by diesel powered trucks therefore we must conclude there is no way for civilization to exist in the USA post fossil fuels. BURP!

As for the rest of the world…

https://en.wikipedia.org/wiki/List_of_soft_drinks_by_country

I think I’d like to try this one! 🙂

From Vanuatu

Lava Cola – soft drink containing kava extracts, marketed for its relaxing properties and described as an “anti-energy drink”

I have to wonder if that was a typo and it was supposed to be anti-aging drink but maybe anti energy works just as well.

It’s not true, or, in other words, it’s a lie that “all that stuff can go just fine on electricity”. Educate yourself. Try this: http://sunweber.blogspot.be/2011/01/energy-in-real-world.html

Same O same O! blah blah blah! That is NOT education and it totally lacks any imagination to do things differently.

So how did industrial civilization arise? BTW, the devices used to power industrial civilization are not renewable either. Nor are they green or sustainable. As for oak trees and horses they could go extinct as could we if we continue to burn fossil fuels!

And for the love of SKY Daddy please don’t use the word ‘GREEN’ unless you are referring to Kermit the frog! We aren’t on Sesame street. If you want to argue your points do it with math and science not some political BS!

Lots is possible and feasible until we put the human into the equation…

Add to that, the size of its population currently inhabiting this planet and a lot of possibilities just plain crash-and-burn.

Now, I am not talking about crashing-and-burning casually, either, but seriously crashing-and-burning.

You just can’t take an essentially tribal small-scale species and pop it in the middle of the fundamental cognitive dissonance that are the vast arrays of already-dubious large-scale centralized systems of various sorts and expect awesome results, unless by awesome, we mean the shock-and-awe kinds.

And therein lies another side to this problem; typically, humans simply not thinking these kinds of things through, perhaps in part because their thoughts are borne of small-scale tribal wiring and evolution including a sense of a planet that can support their refuse because it was all natural and limited at one time…

Throwing a few thousand apples over the shoulder is very different from throwing a few million or billion batteries over the shoulder.

Kicking up dusty earth with a few kicks of a few hundred human feet is very different than kicking up the dust of a large-scale mining operation.

(Landfills? Nuclear waste? Sewage? Burning millions of barrels of fossil fuels? Industrial pesticide spraying? Industrial waste? Parking-lots? Oil Sands? Plastic in the sea? Etc.? How many planets have we got?)

These are not scales and differences in kind that humans typically think about or appreciate.

These are not scales and differences in kind that humans typically think about or appreciate.

Caelan, quite a few people, especially on this site do, think about and very much appreciate all of the above.

While there are absolutely no guarantees as to how things are going to unfold I am going to reserve my final judgement until after the fat lady sings.

It ain’t over till it’s over! Just between the advances in AI, genetic modification of organisms and the creation of artificial life forms I think we will see quite a few interesting developments. Some good some bad… However the changes are coming very fast and disruptions are happening in all fields all over the world.

Yogi of course is as right as ever! 🙂

The planet is fine! It’s the people that are fucked

George Carlin

Just try not to build your home on the San Andreas Fault…

Cheers!

Edit: Right on cue this just in:

http://www.ncbi.nlm.nih.gov/pubmed/26013580

Angew Chem Int Ed Engl. 2015 Jun 26;54(27):7900-4. doi: 10.1002/anie.201412202. Epub 2015 May 26.

An Efficient Halogen-Free Electrolyte for Use in Rechargeable Magnesium Batteries.

Tutusaus O1, Mohtadi R2, Arthur TS1, Mizuno F1, Nelson EG1,3, Sevryugina YV4.

Author information

Abstract

Unlocking the full potential of rechargeable magnesium batteries has been partially hindered by the reliance on chloride-based complex systems. Despite the high anodic stability of these electrolytes, they are corrosive toward metallic battery components, which reduce their practical electrochemical window. Following on our new design concept involving boron cluster anions, monocarborane CB11H12(-) produced the first halogen-free, simple-type Mg salt that is compatible with Mg metal and displays an oxidative stability surpassing that of ether solvents. Owing to its inertness and non-corrosive nature, the Mg(CB11H12)2/tetraglyme (MMC/G4) electrolyte system permits standardized methods of high-voltage cathode testing that uses a typical coin cell. This achievement is a turning point in the research and development of Mg electrolytes that has deep implications on realizing practical rechargeable Mg batteries.

© 2015 WILEY-VCH Verlag GmbH & Co. KGaA, Weinheim.

Are you being sarcastic, Fred?

We both know that some lab research finally makes it into the real world, only to be misunderstood, misinterpreted, misimplemented and mismanaged by ‘ours truly’.

Naturally, reality has a different idea of and for lab results.

“Just between the advances in AI, genetic modification of organisms…” ~ Fred Magyar

We already have it: It’s called humanity and genetic pollution, respectively. Why reinvent the wheel and make a very bad, practically unworkable copy of it to boot? Because ‘we’ can? Who can? And why?

Technology is hardly ‘answered’ and is often just thrown out for its own sake or for the sake of some small elite minority.

If we want it to work (better), it needs, at the very least, democratic input and a strong sense of how it needs to work in the real world– for everyone and everything.

This also means of course, democratic/equal ownership and control of business-as-usual and ‘government’-as-usual.

CRISPR-cas9

Hi Caelan,

How do we get to equal ownership?

This might have existed in some places 30,000 years ago, though my guess is that women were not treated as equals (nor are they today, but I assert their position is likely better than during prehistory.)

We love ourselves to it.

Failing that, maybe someone who knows better can open the fridge and look in the CRISPR for something to ‘take out’.

(Maybe Trump will know of a good candidate in that regard.)

I Am The Virus

(Ignore the music if you wish and simply follow the ‘bouncing bean’. Or bring the whole family for a sing-along!)

Hi Caelan,

I agree that a more equal distribution of wealth is a nice idea.

It is not clear that singing old Beatles tunes will get us there. (All you need is love, …, love is all you need, …, she loves you ya ya ya….) But one can dream.

Hi Dennis,

Just a friendly reminder that previous civilizations didn’t collapse because of a loss of oil and no PV’s for smooth transitions. So how did they?

Running their own brand of BAU, maybe with a few desperate BAU-based tweaks to BAU by the BAU elites, as far as it could go?

A loss of nurture? A loss of nature?

A loss of love?

There are dreams and then there there are sleepwalks.

Lennon, like many others, likely got murdered because he woke up.

Hate

deleted duplicate comment

See the link in my comment on the other thread

http://peakoilbarrel.com/texas-update-april-2016-us-l48-os-cc-annual-decline-rate/#comment-569312

The Oil Age is rapidly coming to an end! I for one, believe there still will be quite a bit of civilization left after it is dead and gone.

I invite anyone who still thinks it should continue to be propped up at all costs to visit what is left of the coral reefs in my back yard. Bring your mask snorkel and fins and I’ll give you a free tour!

Cheers!

Are you still dumping sewage on your reef?

Are you still dumping sewage on your reef?

YEP! That certainly is a still a local problem in some places, especially on the one near my home! Nothing good about that.

However if you’re suggesting that that is what is killing the entire reef from West palm Beach all the way down to the Dry Tortugas and just about everywhere else in the world where there are coral reefs, then you are just being disingenuous!

Anyways you forgot to mention that the sewage discharge pales in comparison to agricultural runoff from sugar plantations and even the film of oil washing into the ocean from roadways or pesticides and herbicides from peoples garden’s every time it rains. Did you know for example that sunscreen from beach goers is especially harmful to corals? Which is one reason I wear a skin when I’m out on the reef!

https://cdhc.noaa.gov/_docs/Site%20Bulletin_Sunscreen_final.pdf

Though right now the final straw among all the possible stressors is CO2 causing acidification and warming. And nothing you can say alters that reality!

But I know your comment was not intended to foster any kind of constructive discussion you are just doing a little trolling!

Cheers!

Renewables are a pipe-dream.

Nothing more than a publicity stunt, sustained by government subsidies, propaganda, false numbers and a deliberate campaign of disinformation.

If there was any viability in so-called renewables nobody would care one iota about the Middle East, while in reality, the exact opposite is going on.

Any country that attempts to run an economy based on wind and solar will very quickly go bankrupt. In spite of environmentalist fantasies, oil + gas + coal + nuclear are here to stay for the very long haul.

Just google: David MacKay – A Reality Check on Renewables.

Also: “Google engineers say renewables won’t work”

Also: “The Folly of EU’s Energy Policy”

http://manhattancontrarian.com/blog/2016/4/15/the-under-reported-disaster-of-renewable-energy-schemes

renewable.50webs.com

Or, to put it another way. If renewable energy was remotely efficient, then there would be no wars in Syria, Iraq, Yemen and Ukraine, the Pentagon’s Central Command would not be in the Middle East and NATO would not have expanded up to the Russian border.

Hi Stavros,

So fossil fuels will never peak?

Did you forget your smiley face?

Can you suggest to us your estimate for the URR of coal, oil, and natural gas in tonnes of oil equivalent or Exajoules.

Despite the delusions of some economists, fossil fuels are not unlimited, nor is the biosphere’s capacity to absorb the excess carbon dioxide unlimited.

Eventually the World will need to transition to wind, solar, hydro, and geothermal. If one has delusions that nuclear material in the hands of terrorists is not a bad idea, then an expansion of nuclear power is not a smart way forward, renewables widely dispersed and interconnected will be far cheaper in the long run especially when all costs (including insurance risk, pollution, and geopolitical instability) are included in the analysis.

EROEI of fossil fuel trending down so they are becoming more and more uneconomic. Ask the guys working the shale deposits how their finances are doing.

EROEI of renewables trending up, wind and solar becoming more and more economically viable in most parts of the world.

Where are you going to put your money?

I don’t see it that way Stavros.

Renewables aren’t as cheap as many wish/pretend them to be, but we will find that depleting fossil fuels aren’t cheap either.

In essence, we are transitioning to a time of much higher energy prices, be it from solar or from heavy oil, offshore wind or low grade coal, nuclear plants or oil dribbles from tapped out fields, etc

EOG says two year lead time. Up until then, it is only slowing the decline.

And that will be only when EOG sees the price has stabilized (at around 60 to 70) for about six months. They are the biggest Eagle Ford producer. They also hold in the Permian and Bakken.

Because, it doesn’t matter how much capex you have to throw at it, if you don’t have enough people to run it.

I cannot be alone in thinking that the current set of events is not going to end well!

In my neck of the woods, people seem to have bought the “lower for longer” narrative hook, line and sinker. I recently had a conversation with a local used car dealer who I had gone in to ask about the market for used EVs in Japan. He repeated the idea that there is probably enough oil for another 100 years and that he thought EVs would remain a niche product with very little demand, as evidenced by the one guy who had pestered him into securing a used Nissan Leaf. He also reminded me that for many (?) people a car is not just a means of transportation but an extension of one’s self (I finished that sentence for him!).

People are busy scurrying to and fro, with the new two month old administration focusing on growth and how to implement the increase in the income tax threshold ( from US$8,300 to $12,500) that they promised during the election campaign. Most people are tickled pink that their electricity bills are down to about half what they used to be eighteen months ago.

My belief is that before too long, my fellow countrymen are going to be reminded why it is a really, really, really, really bad idea for an island economy to be dependent on fossil fuel imports for energy especially oil. Now, unlike back in 2008, 60 MW of new wind generating capacity is under construction to add to the current 39 MW, only 21 MW of which was available in 2008. There is also a 20 MW solar farm under construction and an undetermined amount of grid connected rooftop solar that is well over 8,344 kW, the amount I have been able to get verifiable capacity data for. The government is apparently looking at several proposals for waste to energy plants and feasibility studies have been done for additional hydro power. So, there is going to be be some renewable capacity to cushion the effects of a FF price spike but, it remains to be seen whether anybody will be able to finance renewables and EVs in the midst of another fuel price shock.

I guess the same goes for all sorts of places, all over the world! For example, with the experience of the rapid build out of solar and offshore wind in my islands former colonial masters, the UK, will they be able to continue to justify continuing with plans to build what somebody else posted on another recent thread, “will be the most expensive object ever put together on Earth”?

islandboy, lowest solar PPA is $0.030 per kWh. Lowest wind PPA is $0.024 per kWh.

The French company EDF building Hinkley Point are guaranteed $0.133 per kWh (2012 prices) , escalating to an estimated $0.172 per kWh by completion date.

As a UK tax payer, I am not impressed. Where is capitalism when you need it? 🙂

Capitalism could be great if only we could try it; but cronyism and monopoly always gets in the way…

Hi JN2,

Are those solar PPA levels correct for the UK? I doubt it. Wind, possibly, though the best locations are probably near the coast and wealthy landowners (who have a great deal of power) probably object to their view being spoiled.

Hi DC,

Good point. Solar PPA was for Dubai. I’m sure it could be shipped to the UK for less than 14 cents per kWh! (and still be cheaper than Hinkley Point nuclear)

UK not great for solar but wind, yes. Sadly, hard to find per kWh numbers for UK wind PPA’s, yet alone solar…

Hi JN2,

Try this

http://www.independent.co.uk/environment/wind-power-now-the-cheapest-source-of-electricity-but-the-government-continues-to-resist-onshore-a6685326.html

They claim onshore wind is cheaper than coal or gas at 0.085 $/kW-hr or $8.50 per MW-hr. For some reason the conservatives don’t like wind power. I would think there is plenty of transmission for existing power, the wind could just replace aging coal and nuclear power plants with some peaking natural gas plants as backup, tie them all together with an HVDC grid and disperse them north south east and west and intermittency will not be much of a problem.

They keep forgetting the batteries.

Hi Fernando,

Batteries are not needed with dispersed wind generation highly interconnected and over built (just as is the case with fossil fuel power plants), existing peaker natural gas power plants can provide backup as could vehicle to grid as EVs ramp up. Demand management can also help. Heat the hot water and run the air conditioners when the wind is blowing and prices are low, when the wind is not blowing, prices rise (check your display at home to find the price) and for the wealthy they heat and cool when they want and for the rest of us we decide if running the AC or heating the hot water or baking the cake need to be done when electricity rates are high.

People respond to changing prices.

People respond to changing prices.

This just in

Renewables peak at 95% of German electricity demand

The calculations by Agora demonstrate that conventional power sources were also actively feeding into the national grid. At 11 AM they generated a total of about 11.39 GW. In general, during the whole day on Sunday, power production was surpassing consumption, resulting in negative electricity prices.

On Sunday, between 10 AM and 5 PM, energy prices remained negative, with the lowest of -130 €/MWh reached at 2 PM. Which means that the operators of power plants commissioned under the German renewable act EEG-2014 will not receive any compensation for the electricity generated over this period.

Bold mine. It will be interesting to see what the responses to these price signals are in Germany, as these kinds of situations can be expected to occur more and more frequently. It is only a matter of time before the headline will read Renewables peak at 100% of German electricity demand and then eventually, Renewables peak at over 100% of German electricity demand. The more frequently these situations occur, the greater the incentive to invest in short term (less than a day) energy storage

I guess they could try connecting China to Europe to avoid batteries. ?

You need to build a coal plant.

Hi Fernando,

The cost of a coal plant is not very cheap, natural gas as a backup is probably cheaper especially when the costs of pollution are included. Coal could be used, but for a peaking or backup type use natural gas would be preferred.

Okay let’s look at the long term competitive prospects for a coal plant but, first take a look at some current news:

33.1 MW PV project wins in Jamaican renewable energy auction

OUR selects bidder for solar facility

The process saw the selection of Eight Rivers Energy Company Limited (EREC) as the preferred bidder to build, own and operate a 33.1 MW solar photovoltaic power-generation facility at Paradise Park, Westmoreland. The proposed price (all-in tariff) is 8.54 US cents/kWh.

This latest OUR-managed project is the most competitive renewable energy procurement project to date and is in keeping with the trend in the reduction in the price of energy from renewable sources. This bid is significantly cheaper than the tariffs proposed for the projects which were selected from a similar competitive procurement commenced in 2012 and based on wind turbine and solar technologies. The 37MW project has so far met all its deadlines, with the evaluations being completed by the OUR on April 26, 2016 and the highest-ranked bidders being notified of the evaluation results on May 6, 2016.

“The OUR is pleased with the proposed all-in tariff of 8.54 US cents/kWh, which we believe has set the pricing bar for future renewable projects,” said Albert Gordon, director general of the OUR

The story at second link, which I quoted, has a comment in the comments section which starts:

“This is encouraging but, should be cause for concern regarding investments in fossil fuel burning plants going forward. If, in 2016, solar PV can be this competitive, what will be the case in another five years or ten years time? How will fossil fuel powered plants compete when the cost of electricity from PV falls to 6 cents/kWh or 4 cents or lower? Will the cost of fuels be going down at the same rate over time?”

On the matter of the last question, I have taken pains to point out to supporters of the construction of a coal plant in this island that, in 2008 when the price of oil peaked at $147 per barrel the price of coal also was at it’s highest. According to this 15 year price chart for Australian thermal coal, at indexmundi.com, the price hovered around $60 for the three years between April 2004 and April 2007 before rising to over $192 in July 2008, a price 3.2 times higher than the average 2004 to 2007 price. According to this 15 year chart for WTI from the same source the average price for WTI between April 2004 and April 2007 was about $58 before peaking at almost $134 in Jun 2008, a price 2.3 times higher than the $58 average from the selected period. From that, I have drawn the conclusion that using coal as a fuel instead of oil does not insulate an economy from fuel price volatility, if anything the price of coal is more volatile as shown in this 15 year chart from indexmundi.com showing the price ratio of between coal and oil.

Before I continue I’m going to post a graphic from the following page:

http://www.gaisma.com/en/location/kingston-jm.html

It is a “Sun Path Diagram” for Kingston, Jamaica, showing the range of angles at which sunlight hits a horizontal surface at the location in the yellow shaded portion. The midday angle ranges along the vertical line labeled N-S so you can see it varies from a little more than 80 degrees to the north, to slightly less than 50 degrees to the south. According to data from the same page, average insolation varies from a low of 4.25 kWh/m²/day to 6.65 kWh/m²/day, average temperatures range from 25.5 to 27.2 degrees Celsius, the shortest sunrise to sunset time is 11 hrs. 20 min. and the longest is n13 hrs. 12 min.. There is no need for heating at sea level and moderately warm clothing and a blanket will suffice during the cooler months, in the hills. In my next post I will compare the data for Kingston, Jamaica with the data for Madrid, Spain.

Below is the Sun Path Diagram for Madrid Spain. The midday angle ranges from a little more than 70 degrees to the south, to slightly more than 25 degrees to the south. According to data from the same page, average insolation varies from a low of 1,51 kWh/m²/day to 6.89 kWh/m²/day, average temperatures range from 2.4 to 24.8 degrees Celsius, the shortest sunrise to sunset time is 10 hrs. 7 min. and the longest is 15hrs. 1 min.. Fernando, this makes me wonder if you have forgotten what the climate in the land where you were born is like. Being a tropical climate, the solar resource is good and there is no need for heating with the major non industrial load for electricity being air conditioning and refrigeration.

If the cost of PV and storage technology continues it’s downward trend for the next ten years or so, it seems pretty likely that it will eventually be cheaper to generate electricity and store it for night time use, than to generate it using any fossil fuel. When that happens, individual utility customers will increasingly switch to solar, leaving fossil fuel generators largely as stranded assets.

That argument is made in the following video:

The Solar Disruption – Why Fossil Fuels and Nuclear Will be Obsolete by 2030

I invite anybody to watch that video and then come and tell us what guarantees they would require if they were to invest in a coal plant in Jamaica. I don’t think Jamaicans will be happy if they are forced to pay costs which make a coal plant profitable when there is a less costly alternative.

Nice. Don’t forget Madrid gets really cloudy, and it’s got a very short day in winter time.

The fact is that you need a coal plant in Jamaica, and you can sign a 30 year contract to get coal at a stable price. Jamaica needs 700 mw, minimum.

Nice. Don’t forget Madrid gets really cloudy, and it’s got a very short day in winter time.

That is precisely what the comparison was intended to draw attention to. A resident of any temperate region, say at a latitude greater than 30 degrees, could be forgiven for thinking that solar PV cannot power modern civilization. As you get closer to the equator the nature of the solar resource changes as well as the nature of the loads. In particular, the requirements closer to and in the tropics shift to cooling during the warm months when the solar resource is good. Temperate regions have a contrasting need for heat in the winter when the solar resource is poor.

The fact is that you need a coal plant in Jamaica, and you can sign a 30 year contract to get coal at a stable price. Jamaica needs 700 mw, minimum

Is the supply contract signed before or after the plant is built? The only plan for a coal plant I am aware of, is one to supply electricity to an alumina refinery owned by UC Rusal, a plant that was allowed in response to threats from UC Rusal to cease operations unless electricity costs could be reduced. In the meantime current low oil prices have reduced electricity costs significantly and nothing more has been made public about plans for ports and transport from the ports to the plant, ash disposal etc. How long do you estimate it would take to plan and design the power plant, coal and waste handling facilities, get the plans approved and complete construction? If the whole process takes three years, what happens if solar is available at 5 c/kWh by the time the plant is built? What happens if ten years after the plant is completed, solar plus storage cost less than the electricity from the plant? Can it be decommissioned and sent back from whence it came?

Texas is the biggest producer of wind power, as well as producing the most oil and gas. While I want a good price for my oil, by the same reasoning, I know it won’t last forever. Texas now produces 9% of the electricity via wind power. You can watch the large blades being constantly transported out to West Texas to plant next to the oil pumps. Old meets new for as far as the eye can see. Your price may be bad now, but wait until later, and make judgements.

http://latino.foxnews.com/latino/news/2016/05/06/leader-opposition-party-in-venezuela-assassinated/

Leader opposition party in Venezuela assassinated

Venezuelan politician German Mavare, leader of the opposition UNT party, died Friday after being shot in the head, an assassination that occurred in the western state of Lara, his organization said.

Not sure what this will mean, but it doesn’t sound like it will end well.

The odds of a civil war in that unfortunate country just went up by fifty percent.

Read in Bloomberg that oil dropped there by 188k bbls a day the first quarter. In the same article, they said some projected a total decline by over 600k bbls for the year. Country has debt payment problems, big time. They are part of OPEC, and while the press is concentrating on what Iran’s imaginary numbers are, they fail to weigh that against what the rest of OPEC does. Only on this site will you get real numbers.

Mavare’s murder is a minor issue. Let me give you an overview of more significant events:

1. Although it’s raining some, the Guri hydropower water levels remain at – 241.7 meters above mean sea level. This means power is curtailed and intense rationing continues.

2. Maduro has initiated illegal maneuvers to arrest National Assembly deputies.

3. Today ends the time lapse to have electoral authorities announce the next step in the ongoing recall referendum.

4. The Supreme Court continues to issue unconstitutional rulings against the National Assembly.

5. The government has refused to pay a large debt to city governments controlled by the opposition.

6. Food lines continue. In some areas people are starving, eating stray dogs, cats, birds, etc.

7. The medical system has collapsed, many old people and babies are dying. Some hospitals report they don’t have food to feed patients.

8. Schlumberger and other service companies haven’t been paid for a while, they have curtailed or shut down activities.

9. The supply of gasoline is dwindling.

10. Maduro keeps insisting the recall referendum won’t put him out of power, ordered a full scale “revolt” if at any time it looks like he may be forced out.

11. Chanel held a large parade in Havana, attended by Vin Diesel, who is filming a movie on site. Meanwhile the Raúl Castro dictatorship keeps siphoning oil and cash out of Venezuela. President Obama is happy, thinks this is all going according to his plan.

12. It does look like oil production will continue to drop. Some of us are advocating firmer actions against the regime, including peaceful large scale protests in oil production areas. My analysis shows the key may be the closure of the roads in Maturin with a series of large scale protests. That may convince the ruling Mafia to allow the referendum vote to take place so Maduro can be removed via constitutional and peaceful means.

Good article about Venezuela.

http://www.theatlantic.com/international/archive/2016/05/venezuela-is-falling-apart/481755/

Meanwhile the pope is sending best wishes, and Obama keeps sucking up to the guy who runs Venezuela from Havana.

Venezuela doesn’t even matter according to BING and GOOGLE or BBC as of 2

Venezuela is right in our backyard, here in the USA, and ought to be at the top of the news but the coverage is pathetic. You have to go LOOKING to find anything.

Apparently Maduro still has a some gold, and was able to sell enough recently to make the payments due on the last due date on the national debt held by other countries. Nobody who might really know is saying if the regime will be able to dodge the default bullet much longer, but if there isn’t more gold, my bet is the regime defaults.

It seems like a safe bet that oil production will drop off quite a bit more there before it starts going up again.

It is not a preferred vacation site for the family, right now. Murder and other violent activities are WAY up. Nobody has food or medicines, or much of anything. Inflation is skyrocketing. Mostly move it down the bucket list.

OFM,

Halliburton announced the other day that they are curtailing activity in Venezuela because they aren’t being paid–I add to that, mentally, “and because of everything else.”

This is about the same message Schlumberger sent a week or so ago.

There isn’t much hope for increased production when the oil-service companies fold their tents and head offshore (for good reason.) Looming behind this, as Fernando has mentioned, is the loss, under Chavez, of a significant part of the expertise needed to keep PDVSA functioning at a useful level (more tents folded.) Venezuelan production has been dropping for years, and PDVSA couldn’t turn that around if democracy broke out this week and tonnes of money drifted down from the heavens.

I was chatting with a Venezuelan colleague the other day who told me things were pretty grim for his extended family back home in Venezuela. His younger educated relatives are emigrating, if they can afford to.

Thing are rough for his parents who don’t have the stamina to stand in multiple endless lineups for basic food supplies so they have to pay a premium on the market price. And then you have to eat the food quickly as there isn’t electricity to keep the fridge on and the food from spoiling.

My colleague is now sending money to his parents as their pensions are now worthless.

And then you have to eat the food quickly as there isn’t electricity to keep the fridge on and the food from spoiling.

They should have read the writing on the wall and invested in solar panels and 12 or 24 volt DC powered refrigerators when they could still afford them. C’ est la vie!

That’s what I’m trying to tell my friends and family in Brazil right now. If they think renewables are too expensive now, wait till their economy collapses completely. Flying to Disney World is still more important…

Do you really think Venezuelans should invest in solar panels? What are they supposed to do during the rainy season?

Thermal storage

I see, a huge tank full of hot water, enough to last 6 months?

Hi Fernando,

The sun never shines during the rainy season, for 6 months,

I have never been to Venezuela, but my guess is that the sun may shine less during the rainy season, but no sun for 6 months sounds somewhat implausible. 🙂

Based on some quick research the insolation varies by about 30% from dry to rainy season, so you split the difference or build the solar for the rainy season and have excess energy during the dry season when more energy might be needed for AC.

This stuff is not that hard to figure out, but Venezuela has other problems that are more pressing at the moment.

What are they supposed to do during the rainy season?

Uh, maybe use Hydro?

Is everything in your world always just plain black or white?

It’s pretty bad. I wrote a list of items about what’s going on, but it disappeared. It’s safe to bet things are going to get worse. The Curaçao Red Cross is making contingency plans for a large contingent of boat people appearing in the near term.

Hi Fernando,

Sometimes stuff goes in the trash and I have to retrieve it, not sure why.

Maybe avoid the numbered list in the future.

More of a question than a statement. How much is world oil production going to drop next year? And what is that going to look like for supply/demand?

For instance, when we look back at March of last year, there was a purported glut of 2.5 million barrels.

To the end of 2017, EIA has US dropping by about 1.6 million barrels. Rystadt has just infield drilling off of Brazil, SE Asia, and the Gulf of Mexico dropping by 1.5 million in 2017.That’s 3.1 million added to a demand increase of about 2.4 million (1.2 million in 2016 an 2017). Or, 5.5 million, which should by far outweigh any previous glut laying around still.