A Guest Post by George Kaplan

UK C&C

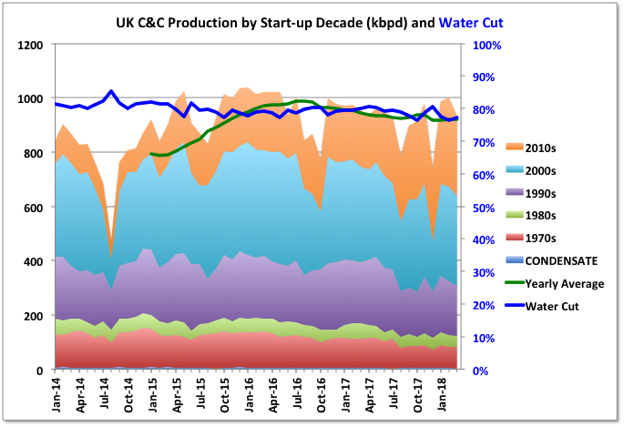

It was expected by many, me included but more importantly UKOGA and a couple of the bigger oil and gas consultancies, that UK offshore oil production would increase significantly from 2017 to exceed 1000 kbpd for the yearly average in 2018. So far this is proving a bit of a challenge. March production was 934 kbpd, down 7% m-o-m and 2% y-o-y (but up 0.8% for the first quarter compared with 2017). It’s possible that some fields have not reported but those showing zero for the month are not big producers. The biggest single field drop came from Clair but most fields saw declines, even the newer ones. Jodi data indicates there will be a rise shown for April to slightly above 1000 kbpd and then a fall back to around March numbers in May (note edit based on July Jodi data); there is usually a summer dip because of maintenance shutdowns (plus this year some strikes at Total platforms will impact).

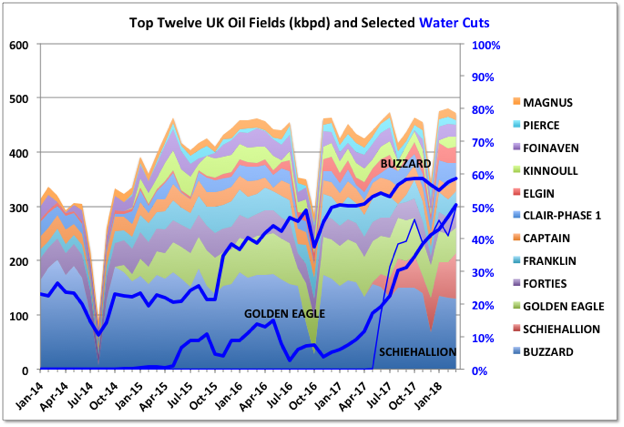

Two of the largest oil producers, Buzzard and the Golden Eagle Area Development, both operated by Nexen, have started accelerated decline following increasing water breakthrough (especially noticeable in GEAD over the past year). The newest large field is Scheihallion. This is a redevelopment with its neighbouring field, Loyal, through the Glen Lyon FPSO (also called the Quad 204 project), which was started last year. So far the combined decline in Buzzard and GEAD is almost matching growth in Scheihallion.

The Clair Ridge platforms, which will also exploit the remaining heavy oil in the Clair field, were installed last year but there have been multiple delays and production is not now expected until later this year. Once it is ramped up, which could take three or four years despite it having some predrilled wells, the project will be the largest producer at 100 to 120 mmbpd and has an eight year plateau, while Scheihallion/Loyal will plateau and decline quickly.

Pierce and Captain are heavy oil developments. Pierce was redeveloped in 2009 and Captain has recently switched to using polymer injection to improve the water flood performance. Heavy oil projects require many wells, tend to produce high water cuts from the outset and have low recovery factors. Clair and Clair ridge are mentioned above. Kraken was a heavy oil start-up in June last year, it has the largest water processing capacity in the UK North Sea and has already seen water at 60 to 65%. Mariner is another due to start later this year for Statoil (now Equinor), it uses condensate for EOR, and there are other heavy oil prospects like Bressay (cancelled by Statoil when the oil price collapsed) and Bentley.

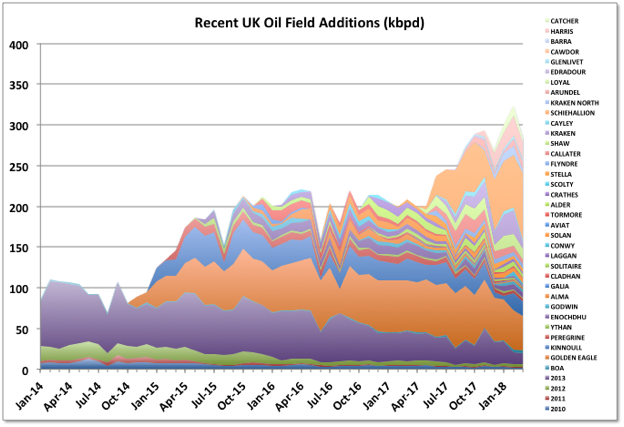

Another reason for the possibly lower than expected total production is early decline in many of the smaller producers started up from late 2015 through 2017. For example the P10 production plan for Scolty & Crathes had over 7,000 bpd average in 2018 and a decline out to 2032, but the current production is around 3,000 bpd and declining, all from Crathes as the Scolty field expired after about four months. Similarly Solan was predicted to average around 18,000 bpd in 2017 but achieved 10,000 bpd only briefly and is now below 5,000 and declining.

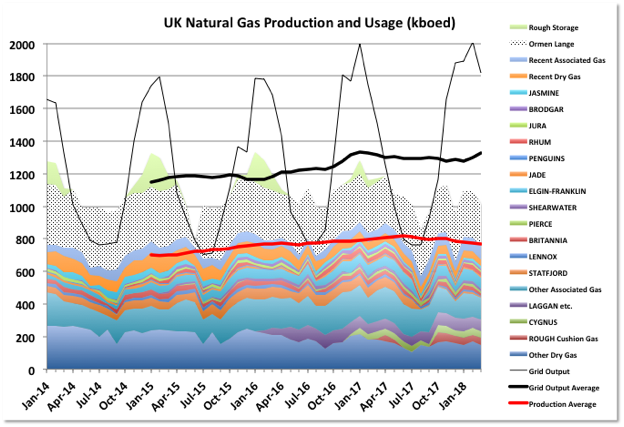

UK Natural Gas

UK Natural Gas production is in decline, probably terminal, while usage continues to grow. The biggest single supplier is the Ormen-Lange field in Norway, which is also in decline, but it will be augmented by newer Norwegian developments like Aasta Hansteen and Dvalin that are due in the next few years and will deliver to the same gas plant at Nyhamna as Ormen Lange and then export via the Langeled pipeline to the UK.

(Grid data is from DUKES – Digest of UK Energy Statistics).

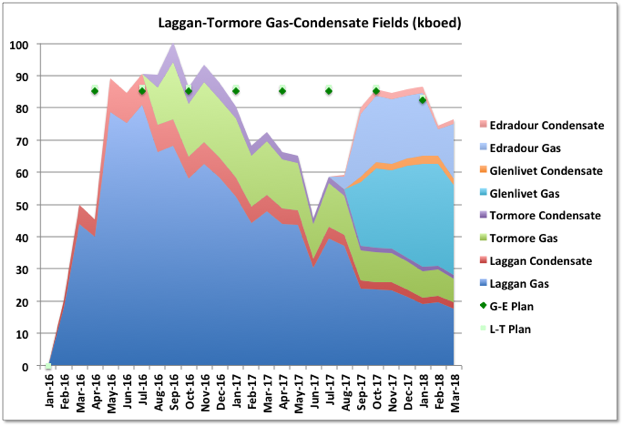

Shetland Gas Plant

The Shetland Gas Plant (SGP) in Sullom Voe is a Total operated facility, receiving production from gas-condensate fields West of Shetland, and was one of the largest recent North Sea projects. I think there is enough evidence now to declare this project to be something less than a rip-roaring success. I don’t know if they will make money on it but the construction phase had a lot of problems (Petrofac took it on as a lump sum contract and lost money through various different issues) and the reservoirs look much poorer than expected, with the main ones of Laggan and Tormore only containing about a third of the expected reserves. The green dots in the chart show the originally planned production for these two, with them coming of plateau to be replaced by Glenlivet and Edradour about now. In fact the original fields are approaching exhaustion and the smaller additions are now declining after being brought on-line early. The gas plant has recently been in turn around and some work may have been done to improve well delivery. (Note I think I’ve got the correct data shown now after messing up the Edradour numbers in two different ways previously.)

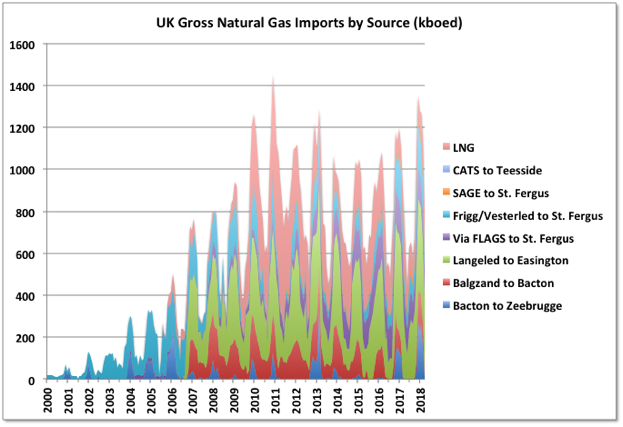

Natural Gas Imports

The chart shows gross imports, net numbers are slightly less as there is some balancing through the Bacton interconnectors. Imports have been fairly steady since 2010, mainly because newer production in the North Sea balanced decline in mature fields (some of the new gas production is actually the final blow down of gas caps on mature oil fields). Imports are likely to need to increase now as overall production decline is accelerating again and demand appears to be increasing. Most new gas is likely to have to come from LNG.

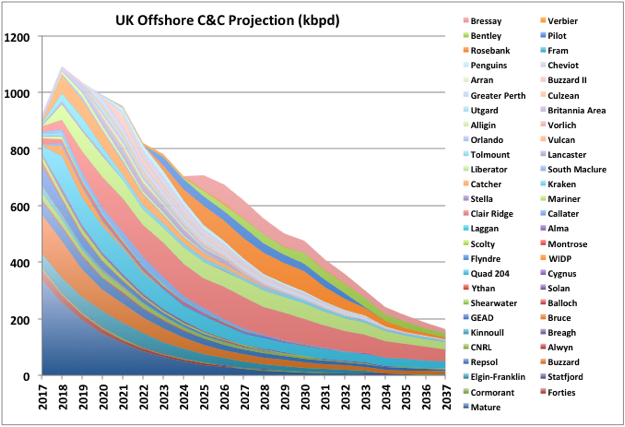

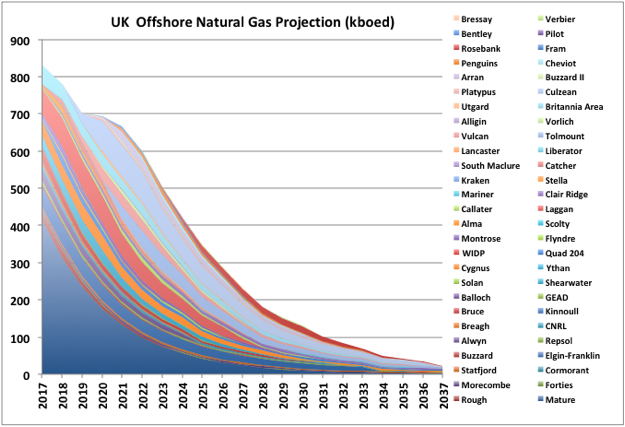

UK Production Projections

Previously I’d made an estimate of future production based on simple, assumed decline curves and overall reserves. The steepness of the curves, especially for natural gas, was striking so I have tried to get some better data using Environmental Statements, which each project is required to submit to the UKOGA as part of the development approval process. These include expected production profiles and are usually available on the E&P company web sites. Some later prospects that are still in the planning stages I’ve estimated based on available data from companies’ news releases and presentations. Overall the oil projection came out similar to before, but for natural gas it is slightly worse. The biggest unknown is the decline in small fields labelled “Mature” that I’ve approximated based on eyeballing recent performance and fitting overall reserves reported by UKOGA.

The production profiles presented in the applications are usually for P10 cases, so actual decline will be steeper than shown, for example this year’s drop off in Buzzard was actually not predicted until next year, even in their P50 case (which was presented as part of the Buzzard II development application), and if the new projects perform as well as Laggan or Scolty & Crathes then the decline will be very quick indeed.

I have included all known discoveries that look commercial with reasonable oil prices but have not included any allowance for future discoveries, though there aren’t many of those at the moment. Also not included are some larger discoveries that have not been fully appraised (e.g. Cambo, which is close to Rosebank and of similar size, Jackdaw, which is an ultra high pressure / high temperature marginal gas field, and some other gas prospects in the West of Shetland area) plus several smaller discoveries that may be commercial at high prices or may need neighbouring discoveries to become so.

The UK oil industry is in its declining years and there is a fair amount of mergers and acquisitions activity as the E&Ps seek to reduce costs. ConocoPhilips is swapping assets with BP and pulling back from the North Sea to concentrate on Alaska and LTO, Maersk Oil and Gas has sold up to Total which is now looking to offload a fair chunk of its assets, Chevron is looking to sell all its North Sea operating assets (but retain Rosebank as a development project), Repsol bought into some assets but it seems now it wants to get out again. With smaller players taking over there is sometimes a short term production increase from mature fields, but it also tends to signify there are fewer large projects to come.

Off Topic Finish

Here are the three founders of the main Hellenistic philosophies: Cynicism, Stoicism and Epicureanism. They were attempts to find meaningful ways to live with honour or virtue, especially in the face of hardship of which there was much as the Greek City States, in which these philosophies were developed, arose, fought each other and nature, and finally declined. They therefore may be relevant again in the coming years. Epicureanism has been co-opted to mean pleasure in fine dining but it was more about gaining honour, including that which could live beyond a person’s death, and finding pleasure in what was available rather than seeking more (a health food nut rather than a gourmet or glutton). Stoicism was more about living with virtue and endurance (preppers) and cynicism about virtue through independence and eschewing societal norms (hippies). From what I’ve seen of recent self help books, though not an area I take particular notice of, a lot of their ideas are just repackaging of parts of these philosophies.

Antisthenes, c445 to c360bce – Cynicism

Zeno of Citium, c333 to c264 bce – Stoicism (“We have two ears and one mouth, therefore we should listen twice as much as we speak.” It’s unlikely he would have been a fan of social media or reality TV.)

Epicurus 341 to 270 bce – Epicureanism

Thanks George.

Can you tell us what you mean by a reasonable oil price? If World supply is less than demand at a reasonable price, then oil prices may become unreasonable. 🙂

Whatever price the E&Ps are using that allows them to keep the development under appraisal, as a minimum either in concept or pre-FEED.

Hi George,

I’ll try again. You said:

I have included all known discoveries that look commercial with reasonable oil prices but have not included any allowance for future discoveries, though there aren’t many of those at the moment.

So what oil price x is the level (in July 2018 $) that is above a reasonable oil price level. It would seem you have some price level in mind. You picked commercial discoveries at reasonable oil price levels. Is that $80/b,$100/b, $150/b, there’s a wide range of possible oil prices and the price level does influence what is commercial and what is not.

As I said – whatever the E&Ps think is reasonable for development appraisal at the moment, they usually give information on what projects they are looking at, though sometimes it takes a bit of reading between the lines, but not how they came to that conclusion, and it certainly won’t be the same price for all developments.

Got it this time.

Thanks.

…and cynicism about virtue through independence and eschewing societal norms (hippies).

Hmm! Given current world events, color me more a product of a mid 20th century type of cynicism, from the Greek School of Hard Knocks.

Believing that people are motivated by self-interest; distrustful of human sincerity or integrity.

Though there are still some modern day Greek Academics who might disagree:

Why Germany Cannot and Should Not Pay to Save the Eurozone

https://www.youtube.com/watch?v=QtrrN2uWUl8

OT:

Good to see Epicurus and Zeno, rather than that “fan boy” that Christianity served to the masses, Aristotle.

Sorry if I’m in Antisthenes corner.

https://www.hellenicshippingnews.com/russia-seen-adding-600000-b-d-of-oil-output-by-late-2019-analysts/

600k is a projection if Russian companies gear up, enough. Note the ministry is much more conservative, as in the article. However, its continuing the trend of unsupportable news to the detriment of oil prices. Drilling productivity report by the EIA has another 143k increase from shale oil for August. The market gets jittery, because we added 5 million to crude supplies, and 6 million to overall supply. If we use year to date averages, the net increase in crude imports (imports less exports of crude), we have a weekly net import increase of 9.898 million barrels for the week, on a yearly average basis. Weekly estimates of US c&c production edged up to 11 million, based on a 50k increase in Alaska. If we add back in the temporary loss from GOM back to April monthlies, production was right at 10.6 million. So, according to the EIA, US production has increased by 400k since April.

Hellenic shippingnews is the source for a doubtful article I found a few months ago. I think they may be biased towards OPEC propaganda. Russia can claim a lot, but we all know they for certain moments in history have resorted to propaganda and the answer to look for is how many barrels they actually provide. And that can be hard to guess.

Guym,

I ignore the DPR for LTO output. The best US LTO data is at

https://www.eia.gov/energyexplained/data/U.S.%20tight%20oil%20production.xlsx

or

https://shaleprofile.com/index.php/2018/07/16/us-update-through-march-2018/

Russian production rates are problematic as the huge amount of infill drilling has been used to stave off what’s long been expected as the start of the terminal decline, even by the Russians. There’s no fracking and no new major discoveries, just drilling more conventional wells in the same resource.

Russia may jawbone they could do this and may (less likely) be able to do it for a while, but how much closer to the edge of their cliff does that push them? Probably isn’t wise.

Propoly

This is an old article but I remember raising an eyebrow at the time.

https://www.energyandcapital.com/articles/russia-fracking-soviet-oil-fields/3189

2013 was pre-sanctions. US tech was cut off after the Ukraine shenanigans.

This was more recent but sounds like propaganda beyond they need an alternative to fracking.

https://oilprice.com/Energy/Crude-Oil/Russia-Claims-To-Have-Invented-Alternative-To-Fracking.html

If we are to believe TankerTrackers, export of oil from some main exporters are down for the first 14 days of July compared to June. Iran, Libya, Venezuela and Saudi Arabia are down, while Iraq increased their exports. There has been much talk about aboundant supply lately, but actual barrels coming out on the market may be in a downtrend compared to the big hike in June.

https://twitter.com/TankerTrackers/status/1018897898342420483

I have been looking through some of the presentations from E&Ps operating in the North Sea (Norwegian ones mostly) and it is notable how costs have been reduced significantly compared to 2014. Drilling cost less and takes less time, often using the most modern rigs (e.g. high specification jack-ups in shallow waters) at affordable rates. Unmanned wellhead platforms are being installed, and the digitalisation efforts means less employees and more work are being done onshore. With oil prices trending upwards, a lot of the smaller companies will most likely see some opportunites and do more going forward. But for some time still, the 3+ years of starvation in the oil industry will impact production numbers to the downside. The big question remains however; are there any big plays/fields still to be found in the region? In the core of the North Sea probably not, but the less explored offshore areas outside it and probably far away from it could hold some surprises.

George, Mariner field uses condensate piped from the FPSO to dilute the 12 to 14 degree API reservoir crude.

Statoil has changed its name to Equinor.

https://mobile.reuters.com/article/amp/idUSKBN1K709A

Who knows?

https://financialtribune.com/articles/economy-business-and-markets/90071/russia-kazakhstan-slash-hrc-exports-to-iran

The key question is if China can absorb all the exports from Iran that have been halted, elsewhere. Their large NOCs are heavily into US investments, so I would think not.

Not putting in numbers into the projections, one only has to look at it from the OPEC, non-OPEC division. Can OPEC keep up with Venezuelan and Angolan drop since the first of the year, temporary outages of Libya and Nigeria, and Iran sanctions? On the other hand, can increase in US, Canada and Brazil production (less non-OPEC depletion) keep up with demand increases and any shortage of OPEC? The only two real variables are US production and Iran sanctions, at least to me. I think it is apparent, all OPEC can, or will do, for 2018 is around one million barrels, so far. That may keep up with most OPEC drop since the first of the year, except Iran sanctions. US production will be far short of needs, but only the monthly oil reported will prove that, and there is a two month delay on receiving info on exactly how much it will be short.

The keyer question is whether Iran will bend over and accept US (meaning Netanyahu) demands? I believe they won’t and will gradually evolve to self supply and become more dependent on Chinese companies. This struggle is seen by the Iranian leadership as an existential fight against Sunni and Israeli domination, which they can’t afford to lose. The big question in my mind is whether they’ll convince the Iraqi government to create a Shiite alliance to stop a Sunni caliphate?

I think Iraq will be fairly unstable for awhile, from what I read. There will be no toppling of Iran’s government, and, no. they will not agree to US demands, no matter how bad things get.

Indeed, Iraq is unstable, I’m just wondering if the new al Sadr led government will be able to consolidate power. What happens in Iraq will be influenced by Turkey and Saudi Arabia as well. I suspect the Saudi Prince who’s running things is an overreacher, got in trouble with Qatar and that seems to have backfired, then he attacked Yemen and that’s gong to be his Afghanistan. Next he started financing radical Islamists in Syria and is losing that war as well. He also had Vader relations with Kuwait but they seem to be getting better. And he allied with Netwnyahu to manipulate Trump into a hostile position against Russia in Syria…which also backfired. So I don’t expect the Iranians to take it without response. I think eventually we will see a rebellion of the Shiite population in Saudi Arabia. But that depends on al Sadr.

5 to 10% Shiite in SA???

Hard to tell how many they are. I do know they are an abused minority and they live in the East, near the oilfields. There’s almost no media coverage about what goes on, but here’s an article you may like

https://edition.cnn.com/2017/08/12/middleeast/saudi-arabia-awamiya/index.html

More force majure (armed groups raiding fields) in Libya, different facilities than the last dispute.

https://oilprice.com/Latest-Energy-News/World-News/Libya-Declares-Force-Majeure-On-Another-Oil-Port.html

https://sputniknews.com/business/201807171066442070-china-may-soak-up-iranian-oil-exports/

This is why the market is not reacting to Iran sanctions. They, and everyone else, are clueless on what will really happen. Supposedly, originally reported by WSJ.

Guym,

I would be fairly skeptical of “news” coming from Russia.

A claim that something was reported by the Wall St Journal would need to be verified.

https://www.mrt.com/business/oil/article/Steel-tariffs-could-halt-energy-dominance-strategy-13067903.php

I can’t find a clear explanation on how the quotas fit in. If there is a quota involved, it will, no doubt, delay constructions.

https://www.cnbc.com/amp/2018/07/19/setback-for-trump-saudi-arabia-wont-pump-much-more-oil-this-month-o.html

Won’t, or can not?

Even if they can’t pump more oil, it might be useful to appear not to take orders from Trump. Does it serve any country’s interest to let Trump take credit for whatever it does? Better to be seen as an independent entity.

Boomer

“Even if [KSA] can’t pump more oil, it might be useful to appear not to take orders from Trump.”

The USA is providing KSA with Military resoures (equipment, training, Air power & troops). Its likely KSA is pushing the USA into War with Iran. Recall the recent MBS interview comparing Iran to NAZI Germany. MBS had engage in a Proxy war with Syria as well as direct war in Yemen and needs the US to avoid defeat. Trump’s request for more Oil from KSA is in exchange for the USA providing KSA with Military resources.

I don’t follow US/KSA relationships closely. So I went looking for articles. They indicate that rather than the US providing significant help, we’re expecting them to buy it from us.

https://www.al-monitor.com/pulse/originals/2018/05/saudi-defense-spending-economy-washington-yemen.html

1. US is emposing Sanctions on Iran (in favor of KSA)

2. US has provided Air Power in Yemen & Syria. ISIS was largely funded by KSA with the US providing small arms to ISIS (aka the Free Syrian Army). Like most hired armies, they decided to form their own nation instead of being a puppet of the US\KSA.

3. US is providing Military hardware & training at a discounted price.

It would not surprise me if the US had a hand in getting MBS as KSA’s ruler.

BTW: What do you think would happen to KSA if the US left KSA on their own to fend against Iran? I don’t think KSA would last long without strong US support.

Our Middle East situation has been screwed up since WWII. We’re probably not making better decisions now. I have no idea whether any current deals we might be cutting with any countries there will be smart or actually happen.

My concern with KSA really only goes so far as to how it impacts oil supply and demand. I certainly don’t want to see more wars in that area because of the costs, both economically and loss of life, but whether we will plunge into more quagmires there I have no idea.

My gut feeling is that if Trump thinks an idea is a good one for him, it’s probably bad for the rest of us.

https://www.independent.co.uk/news/saudi-arabia-oil-trump-riyadh-petrol-prices-us-supply-a8457751.html

https://oilprice.com/Energy/Crude-Oil/Norway-Oil-Strike-Ends-Just-As-Another-Is-Set-to-Begin.html

UK oil workers set to strike.

https://www.marketwatch.com/amp/story/guid/6817907A-8C2C-11E8-9897-AFAE7A11BECD

Year end oil price projections vary about $70. $120 seems a bit high before 2019.

Some more smallish impacts here, but now, with no spare capacity and stocks heading down, everything is likely to be proportionally more important than before: Hibernia (130 kbpd Brent like oil) looks set for 40 day turn around in September; Cameroon is heading for civil war, which could hit its production (70 kbpd) and Chad’s exports (130 kbpd); Phoenix field FPSO in GoM (30 kbpd) will be off station for two months in early 2019. And what’s the biggest news story that some of the trade mags. could come up with this week: a 4000 bpd well (and I’d guess very short lived) started up a couple of months early in the GoM.

Things coming to boil in Southern Iraq.

Guym,

I agree, my guess is 80 to 90 per barrel for a high Brent oil price between today and Dec 31, 2018.

I doubt we will see Brent at $120/b before 2021.

Jodi data for May is out: https://www.jodidata.org/oil/

Draw on Saudi crude stocks (primary) stopped in March, which may indicate they had new production coming on stream then, but overall draw including products (secondary) hasn’t changed much, so maybe not. June and July may make things clearer.

Phil Flynn reported that Saudis expect some substantial draws to world inventories to the end of the year. Big surprise.?

Why would the Sauds want a lower oil price? For that matter, why would ANY producer want a lower oil price. High oil price may eat into demand, but it has to be apparent to some that oil supplies will never meet demand, again. Just sell less oil, at a higher price. Stretch your years of supply for a little while. The whole world has gone into some type of weird denial.

Yeah, if you know you can always sell whatever you produce, why not try to get the most money for it?

And it’s not likely that other countries can take away your market share if there isn’t enough oil to meet global demand as it is.

Guym,

Over the long run (3 to 5 year period) production (aka supply) of C+C will be equal to consumption (aka demand). As long as the market price is allowed to adjust higher or lower when production and consumption are not in balance.

The only reason why the Saudis may not want a higher price is that they are concerned that output of tight oil might increase too much too quickly or that higher fuel prices may lead to the take off in demand for EVs for land transport. I like the tight oil explanation better over the next 5 years, over the longer term (10 years or more) the second factor should be a legitimate concern. Lower oil prices ($65-75/b) may slow down either of the two factors mentioned.

US dropped a few rigs last week. GoM is down to 14 oil

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsoverview

Canada has been mostly following last year, though it’s noticeable how the drop off because of the thaw has been tending to get earlier each year.

Those 14 rigs need to get busy, as it is less than a half year to go, and they still have not attained any of the 400k increase in the GOM that EIA is still predicting.?

And early numbers suggest May will be about like April with some big outages at Mad Dog for turn arounds cancelling recovery at Great White and Mars (I think Shenzi and Jack, another two big producers, might be planning major turn arounds this year as well).

OK. Net zero to negative for 2018 considering declines? Slightly less than 400k a month. Bakken better get pumping, they need to produce close to .6 million, or more to keep up with EIA’s predictions. I get little or no increase coming from the Eagle Ford. They are recently racking up DUCs, too.

To point out EIA’a progressive errors, and covering errors, One can reference their January STEO report compared to the most recent, below:

most recent:

https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf

January:

https://www.eia.gov/outlooks/steo/archives/jan18.pdf

We start off with a one million increase, of which .8 million is expected to come from the Permian. The other .2 from other areas and the GOM.

The most recent shows a 1.2 million increase. I would have assumed that the increase related to the Permian, making it one million. No, they switched it all around. Now, they are decreasing the Permian by .2 million, making it .6 million, and the remaining gets made up from other tight formations and the GOM. Games, anyone?

Guym,

They adjust their forecast each month based on the data they have. That’s the way forecasts work. The 600 kb/d increase for the Permian seems reasonable, I agree the rest of the oil (600 kb/d) might not be realized, though, GOM might be flat YOY (2017 avg to 2018 avg). I also agree Eagle Ford output may be flat YOY, but we may see increases in the rest of the US tight oil plays (all except Permian and Eagle Ford) of about 450 kb/d, that’s about 150 kb/d short of the recent STEO forecast, and this is pretty close to their 1000 kb/d forecast in Jan 2018.

The 1000 kb/d forecast is probably too high by at least 100 kb/d, and perhaps as much as 300kb/d, the recent forecast (1200 kb/d increase) is probably too high by 300 to 500 kb/d, in my opinion.

If I am correct, we are likely to see rising oil prices as stocks of oil will continue to fall and eventually this will drive oil prices higher.

They can’t adjust it down? They have to rearrange where it will come from??

Guym,

They adjust what they think needs adjusting. It is certainly possible that they will be correct and I will not. The future is difficult to predict accurately.

Not much of a crystal ball needed, now. There is less than six months remaining in the year.

Guym,

We only have c+c data for 4 months of 2018. We do have tight oil data for 5 months. The estimates sometimes get revised. So your crystal ball may be precise over an 8 month period.

Mine is in the shop. ☺

57 vertical rigs in US. 15 less than 2017 when oil was $25 per barrel less.

US is now almost completely at a point where all new wells are multi million dollar endeavors.

Those hoping for sub $50 WTI will only see it with a recession or a radical shift away from oil. The later will take awhile IMO.

Shallow Sand,

How much do new conventional onshore wells cost (full cycle cost) these days in your area? At what oil price do they look attractive?

I would think with WTI $90/b or more there might be a few prospects.

$60-80 K. Those are 1,000’ wellbores. Those are ultra shallow compared to most places, of course.

They would work at current prices but given the roller coaster and given the last three years of sub $50 WTI, no one is active. I am aware of a couple rigs running a few counties away. Those are running with OPM.

There is really nothing much going on around here as far as drilling when it comes to producers using their own money.

I’d say the Baker Hughes numbers for conventional rigs give a good idea of the optimism in that segment of the industry onshore lower 48.

Commodity volatility is getting out of hand IMO. But I could be wrong. Just makes things very difficult when the bottom could be pulled out at any time.

Your not the only one who thinks that.

https://oilprice.com/Energy/Crude-Oil/Is-The-Oil-World-In-Panic-Mode17839.amp.html

Guym.

By 2014 some producers around here had gotten very bullish.

Not uncommon to see 40-160 acres drilled on 10 acre spacing, 5 spot pattern. RI ranging 15-20%.

So a 40 acre tract would cost around $400K to drill, complete and equip.

One close to us has cumulative 14,000+ BO since 9/14. Still knocking out 7-8 BOPD. Problem is most of the flush was sold sub $50 WTI. Still a pretty darn good result, on the upper end for around here. The good thing for the owner, it will eventually settle out 3-5 a day, and stay around there for about 2 decades.

So, sure enough people borrowed to drill in 2012-14. Then it hit. Things got pretty testy. No BKs, but some modifications to interest only is the gossip.

So people are trying to recover after three very bad years.

Almost nothing sold 2015-17. But has been some activity this year. Going for less than half of 2013-14 peak is where it seems.

$99.25 cash 6/14. $25.25 cash 2/16. $65.92 cash 5/18.

How in the heck is anyone supposed to plan with that kind of oil price volatility?

Shallow Sand,

What trailing 12 month WTI price, might lead to activity for people using their own capital (not borrowed, but saved), maybe $75 to 80/b? Talking about your local area which clearly you know well.

Dennis.

Actually present prices are enough to see a resumption of drilling, provided those stay stable into at least the next year.

My guess would be little will occur this year, more next year if prices stay $65 WTI or better.

Keep in mind, we are a small niche here. However, I’d say price stability is what is needed, or at least not another drop back below $50 WTI.

Thanks. My guess is that prices will continue to head higher from now until 2025 and then will remain high until 2030. At that point there may be a recession due to difficulty adjusting to declining oil output and high oil prices.

I doubt the transition to EVs and other alternatives to oil for land transport will be enough to reduce consumption of oil enough to bring oil prices lower, until 2035 or later (maybe 2040). A global Depression similar to 1929 to 1933 would do it though.

A rapid transition to EVs (along the lines of Tony Seba’s predictions) might keep oil prices below $150/b and this might be enough to avoid a major Global Depression.

In short, things may be good for oil producers for another 15 to 20 years (high oil prices are likely).

This could become a problem fot the kingdom.

https://www.reuters.com/article/us-yemen-security-aramco/houthis-attack-aramco-refinery-in-riyadh-using-drone-houthi-run-tv-station-idUSKBN1K8262

https://mobile.twitter.com/TankerTrackers/status/1020444489620623361?p=v

Iran figures Sauds are messing with their oil income, so I would expect other retaliations to follow. Scuds are pretty much useless, but drones could be a real problem. Especially, if they start targeting pipelines.

Thanks, George. Someone can predict when there will be problems in supply and the decline in oil production?

Supply is at a deficit to demand, now, as confirmed in inventory draw downs. The only projected increases to supply are expected increases in tight oil, mainly. OPEC has run out of steam. The Permian has run out of steam until late 2019, or later with the steel tariffs. Other US tight oil can not increase anywhere near as much as the Permian. Demand will continue to increase each year. My personal opinion, is that we may not have reached peak oil, nor “peak demand”, but we probably have reached the point where oil supply will not keep up with demand. Stay tuned for next month for Ron’s post where he will guess when peak oil occurs. My guess is that he picks from 2019 to 2021, which I have no argument with. By that time, increases in the Permian would be hard pressed to keep up with non-OPEC and OPEC declines. If Iran production is seriously affected by the sanction (which I doubt) and stays there, then we may have hit it this year.

Guy puts it better than I could. If there is serious talk of releasing the strategic reserve and/or oil going to spike above $100 by the end of the year and/or continued warnings of under investment from OPEC and IEA and/or more and more fanciful supply side rubbish from EIA, and there are all of those things at the moment, then there are probably supply problems. I’d add that if we start hitting a serious recession now then we will almost certainly be seen to be past peak sometime in the next year or so.

Is there any evidence of a looming recession?

If there is a severe recession then output might decrease. Doubtful this would last long. Output may increase when economy recovers.

For how many recessions can you show there was clear evidence of them looming? I think Wall Street and the City would be interested to know your method.

The stock market is the best predictor. The stock market has correctly predicted 11 of the last 5 recessions. 😉

George Kaplan,

I am not the one claiming that there will be a recession. Ron is right that typically a financial crisis will result in a Global recession.

World real GDP has only decreased 2 times since 1879, the Great Depression (1929-1933) and the Global Financial Crisis so about 1 event on average every 65 years.

My contention is no that I can predict there will not be a Depression, simply that we don’t know the future. An assumption that a low frequency event is likely to occur in the near term, is not one I would make without some evidence.

I agree trade wars that Trump is causing are bad policy. As long as most other nations don’t follow the dumb policies of the US, the World economy may be fine and mostly the US will suffer the consequences of electing someone woefully unprepared for public office.

Seems to me that tariffs on trade are a great way to reduce fossil fuel usage and encourage a more localized economy and hurt the globalists.

No need to credit Trump, its just a natural regression to mean.

Anything that lowers consumption should also lower fossil fuel use. So putting the global economy into a recession or depression works, though the effects will not be equally distributed.

The tariffs I am most against are those on solar panels. I’d like to see those get as low as possible by whatever means.

I can’t agree with you there, Boomer, even though I am a big solar advocate. Do we really want to outsource our energy infrastructure to China and be beholden to foreign powers regarding our renewable energy, like we have been with oil? China is clearing dumping panels and not playing fair. Not a big Trump guy, but a globalized world will never be a sustainable one imho.

I fear the US won’t move fast enough on renewables and China is likely to be world’s best option for making the transition.

It’s possible that they will invest in solar plants here, so we may get more plants. But I think China has already taken the lead globally and we have given it to them. Adding a tariff on their solar products seems likely to stifle our own solar progress rather than to boost our own industry. Has Trump expressed any interest in making the US the world’s solar leader? Has he said anything about the strategic importance of solar to our future? I think the tariffs are to hamper US solar rather than to protect it.

Boomer,

It will hamper the ramp up of solar pv installation, but it will help US manufacturer’s of Solar.

I think rather than tariffs, the US should subsidize solar manufacturer’s in the US (reduce taxes perhaps or allow an extra tax break for solar utility scale projects that use components manufactured in the US).

Basically the US can match the government assistance that the Chinese give their solar industry.

farmboy,

That is true, but in the short term it hurts producers such as soy bean farmers. I also think that Global trade is a good thing, the last time their were Global trade wars (before WW2) the result was the most devastating war in history, better to avoid that in my opinion.

See

https://en.wikipedia.org/wiki/Comparative_advantage

to understand why free trade is a good idea. It has been the underpinning of international economics for a long time and is widely agreed in the field.

Trade also joins countries together which makes wars less likely.

Agreed.

I’m not sure if your understanding of the words “if” and “recession” are the same as mine. I was pointing out that unknown changes on demand side, which i’ve always been very clear to say I don’t know about, and hence never predict prices more than a day ahead, will affect supply. I don’t know if you put words into other’s mouths as much but you seem to do it an awful lot with me.

George Kaplan,

My apologies, you simply said if there is a serious recession, we will be seen as being past peak within a year.

I do not agree. Any possible serious World recession (which I understood as being like the Global financial crisis in 2008 which happens infrequently) will be recovered from in the near term.

Rising oil prices if the supply of oil is short is likely to lead to more tight oil output which may allow increasing output until offshore and oil sands projects can come online. There will also be more infill drilling in OPEC nations and Russia in response to higher oil prices.

There will be a peak, but the odds are pretty low (5% or less) that it will occur before 2020, the odds increase as we approach 2023 (maybe 25% probability the peak occurs between now and Dec 2023), by 2025 (midyear) roughly even odds the peak in World C+C output will have been reached.

I do agree that if there is a serious world recession before 2020 World output of C+C will decrease, but when the economy recovers C+C output will increase to a new peak. If a recession occurs in 2023 to 2025, then we may never return to previous levels of output, this is harder to guess.

Dennis, I remember a couple of years back when you and Ron had a disagreement over how a trend line should be drawn on a graph. As I recollect, Ron drew the line as he thought best fit, and you picked a beginning month and ran a least squares fit.

In the above post, you say there is a less than 5% chance of peak oil before 2020, and less than 25% chance before Dec 2023. I know that you have excellent math skills. I also know that you don’t have the data to actually calculate the probability of peak oil at any certain date. So your calculation of a 5% chance is actually just a guess. Informed, and considered, but just a guess the same as if Ron, George, or any of us cared to post a guess. Why infer that you have calculated the probability of a peak when you are guessing.

In my opinion, one of the great failures of the Oil Drum was that in some cases posters were using limited data and extrapolating it to far.

I appreciate your work on this site, and enjoy the information and discussion.

Dclonghorn,

Correct, these are subjective probabilities, I am just giving my guesses, my best guess is 2025, and that has been my guess for a while.

A best guess is simple, there is a 50% probability that peak will be before that date and a 50 % probability it will be after.

We could put it at June 30, 2025.

A better guess in 2023 to 2027 and my guess is that there is about a 3 in 5 chance the peak will fall within those 5 years.

Always a problem with limited data, I use what is publicly available.

With my URR estimates (2800 Gb conventional, 500 Gb extra heavy, and 100 Gb LTO) which total 3400 Gb for my “medium” estimate. My oil shock models suggest a 2025 peak is reasonable.

Note that the Oil Shock Model was developed by Paul Pukite aka Webhubbletelescope at the Oil Drum.

The USGS has conventional World URR for C+C at 3000 Gb and unconventional (continuous or extra heavy and LTO) oil URR at 1000 Gb.

I also have a “high” URR scenario at 3700 Gb (I think the USGS estimate is too high especially unconventional oil), that scenario peaks around 2029. In addition there is a low scenario with URR of 3100 Gb of C+C, that scenario peaks in 2021.

We don’t know what the World URR for C+C will be, that’s the reason picking a single year or a very narrow window for the peak, is likely to miss it.

My guess is the medium scenario URR is most likely, even if that’s correct, output could follow different paths depending on how quickly oil resources are developed and produced.

The 2023-2027 guess is based on the assumption that World C+C URR will be close to mu medium scenario.

No accurate predictions can be made.

My guess is World C+C output will peak between 2023 and 2027, roughly a 60% probability it will be in this time frame and about a 20% probability it will be before 2023 or after 2027.

Wow! Nostradamus, how can you be so bold as to make such a pinpoint prediction?

/sarc

Ron,

Picking a couple of year window is fine if output follows a smooth symmetrical Hubbert curve, I would suggest that an undulating plateau is more likely that will last 5 (more likely) to 10 (less likely) years and the peak is likely to occur anywhere during that 5 year period. Note also that tight oil plus conventional oil together will push the peak a little to the future than conventional oil alone.

In an earlier conversation I suggested that conventional oil alone might peak in 2021, tight oil might move the peak in C+C output by a few years into the future.

If you want a tighter window you can use 2025, or 2024 to 2026, etc.

Of course if that’s not precise enough for you we could say June 30, 2025 at Noon. 🙂

“Of course if that’s not precise enough for you we could say June 30, 2025 at Noon.”

You’ve got to use astronomical events and vague sentences when making predictions:

“When the planets Saturn and Neptune are in Conjunction, the precious liquid will be in permanent retrograde.”

Tech guy,

I do things using probabilities. About a 20% probability the peak will occur from 2018 to 2022, about a 60% probability the peak will occur from 2023 to 2027 and about a 20% probability the peak will be after 2027, roughly a 99.5% probability it will be 2030 or earlier.

This is too nebulous for Ron, he seems to want a single year, for me the highest probability would be 2025 (maybe a 25% probability the 12 month centered average peak in World C+C output will occur that year.)

Hi Dennis,

It was a joke plain and simple.

A weekly measure for inventories (Total: crude + products)

https://pbs.twimg.com/media/DiokQBSXkAARGDO.jpg

Floating storage – Clipper Data

https://pbs.twimg.com/media/Diiko1bX4AEiaKh.jpg

World demand is still strong, the June estimate looks a bit high though

Bloomberg chart: https://pbs.twimg.com/media/DiY01ToXUAAKB-y.jpg

Per your statement June looks high, if you look at the previous June increases for years past, it really doesn’t look high to me. Each June shows a huge increase, tapering off at around September. Peaks a little higher in December, usually. Looks like the floating storage ended up in inventories?

Good info. Sort of a snapshot current picture of supply/demand.

Looking at EOG’s stuff. They are in the Permian and Eagle Ford. Over 50% of their production as of the first quarter, is expected to come from the Eagle Ford. They expect a small percentage of their Permian stuff will be subject to discounts, with most of those discounts covered by derivatives. Looking at current completions, they seem to be heavier in the Eagle Ford than their projections for the first quarter. 27 of their District 2 completions in 2018 were in the Austin Chalk only in Karnes County. Those are monster wells at about an average of over 3k IP rates, that don’t have the fast decline rates of the Eagle Ford, until later. Pretty much covers capex in the first six months. Permits in the Eagle Ford, have not increased, recently, though. If I was expecting increases in the Eagle Ford toward the end of the year, I would first look at EOG, as they have the largest coverage in the Eagle Ford.

Saudi Arabia, May (domestic demand for products + direct crude use) up +496 kb/day month/month, down -215 kb/day from May 2017.

Fuel demand is close to last years level, but direct use is down.

https://pbs.twimg.com/media/Dio7UjxXUAAVPgG.jpg

Saudi Arabia, May Net Exports (crude oil & total oil products) at 7,827 kb/day, down -390 kb/day month/month, up +44 kb/day from May 2017

https://pbs.twimg.com/media/Dio-_UQXcAAIIj-.jpg

Saudi Arabia, May Net Oil Products Exports (total oil products)

(They imported: gasoline 334 kb/day and diesel 207 kb/day)

https://pbs.twimg.com/media/Dio_2jBX4AIe6AU.jpg

Have I got this right – net exports are down, internal use is down y-o-y, stocks are down – yet production is up, (or is that not shown in the numbers yet)?

Yes Jodi is only up to May, yet we have the June production number from OPEC MOMR

(direct sources)

4-2018 9,868

5-2018 10,030 (+162 kb/day)

6-2018 10,489 (+459 kb/day)

Fernando Leanme. The head of Quadrant Energy (formerly Apache Australia) has said that the Dorado oil discovery off northwest Australia is staggering. My guess is in the range of 1 to 3 billion barrels. Please have a look at the announcement and inform us of what you think the size might be:

https://www.asx.com.au/asx/statistics/displayAnnouncement.do?display=pdf&idsId=02000404

It has 79 metres of oil-saturated pay, 20 km long, 3 km wide, 20% porosity and 82.5% oil saturation. At a depth of about 4,500 metres.

NBS China Refinery Intake

June 12,163 kb/day (using 7.33 barrels per tonne)

Average full year 2017 was 11,376 so June is up +787 from 2017

https://pbs.twimg.com/media/Dis2weDXkAAWOVB.jpg

NBS Crude Oil Output (domestic production)

June: 3,872 kb/day (using 7.33 barrels per tonne)

up +95 kb/day month/month

Average full year 2017 was 3,848

https://pbs.twimg.com/media/Dis27H-WkAADdYB.jpg

China Refinery Intake

The data that China reports to Jodi Data is on average 0.9 million barrels per day higher (using 7.33 barrels per tonne) than reported on the NBS website.

The spike in April was 1.3 million barrels per day higher

https://pbs.twimg.com/media/Dis3CtzWkAElUgd.jpg

I’m guessing that both sets of data are for the same thing = the amount of crude oil processed in their refineries

Joint Organisations Data Initiative: Refinery intake = Observed refinery throughputs

National Bureau of Statistics of China: Output of Processing Volume of Crude oil

Texas initial production out for May. At, first blush, does not appear to be much of an increase.

87,665,663 oil bbls

9,870,636 condensate bbls

Latest estimate of Texas C+C output from Dean Fantazzini.

Thanks Dean.

He has been pretty close, so far. He puts it at a little under a 100k over last month.

Guym,

Compared to his own estimate last month (one month vintage estimate) May is 167 kb/d higher than April. The 12 month trend in Texas C+C output is an annual increase of 1065 kb/d from June 2017 to May 2018 based on Dean Fantazzini’s latest estimate (one month vintage data).

http://www.worldoil.com/news/2018/7/9/permian-pinch-spurs-pipeline-binge-and-fears-of-overbuild

Pretty much my guess on the pipelines regarding an over build. To increase by the same amount each year takes more activity than the previous, because of decline rates of the wells. Not considering pipelines, there are too many other constraints to allow for such an increase as some are anticipating. Not the least, is personnel. Note, construction delays are already starting.

https://seekingalpha.com/amp/article/4186260-permian-basin-oil-gas-pipeline-projects-will-narrow-oil-gas-discounts-2020

2020 does look more likely.

Note, all the articles are using the, not too long ago, EIA projection that one million is expected. It’s already been lowered to 600k by the EIA, which may be too high. One million won’t happen.

Correct they will be limited by rail and pipeline capacity in the Permian basin.

Investment dollars will move to the next most profitable area.

Likely Bakken or Eagle Ford.

If they had the pipeline capacity they could increase output to a level that fills the pipes, but only for a couple of years.

A more sensible approach is a plateau in output at current levels, then excess pipeline capacity after the peak will be less of a problem.

Ok. I misread the STEO. They are projecting 1.2 from June 2018 to Dec 2019. All original stuff for 2018 has not changed. Nothing has been corrected. So, there is no reference point, as they don’t say what it is to date. All I know for sure, is that they estimate average production to be 10.8 for 2018 and 11.8 for 2019. Which hasn’t changed.

But, totals from 2017 to 2019 are stated. 1.2 million from the Permian, 300k from the Eagle Ford, close to 300k from the Bakken, 200k from the GOM, and another 100k from other. That’s 2.1 million, or thereabouts. So, a total of about 12.1 million by the end of 2019.

If we take away the EF and GOM increases and reduce Permian increase to 500 kb/d each year (1 Mb/d total) that doesn’t look bad to me, about 11.4 Mb/d by Dec 2019, though it will depend on pipelines being built to carry Permian output.

I get to about the same net (but 1.2 to the end of 2019 and that’s a very small difference), from different locations. If the pipelines come online early, your prediction has no argument with me. However, I do not expect that to be the case due to personnel shortages (again) and tariff consequences that delay the completions of the pipelines. I think we will see higher Eagle Ford and Bakken in 2019, as a result, but not to the magnitude that EIA has.

Yes we are pretty close, the average of our guesses is a 1.1 Mb/d increase in US C+C output from 2017 to 2019, with 1 to 1.2 Mb/d covering the range.

To those not paying attention this, would be an average annual rate of increase in US C+C output of 550+/-50 kb/d from Dec 31, 2017 to Dec 31, 2019.

Reminder. The president requested lower prices. He didn’t say anything about how much oil anyone was to produce.

No reason KSA can’t sell oil for any price they want under the going rate.

Watcher,

Yes they could give their oil away.

Not very likely though.

Maybe he really meant to say he wouldn’t want lower price, just got the the double negative a bit mixed up again.

Watcher wrote:

“No reason KSA can’t sell oil for any price they want under the going rate.”

Doubt that it would work. An enterprising Billionaire could simply buy KSA Oil at a discounted price and sell it at market prices and pocket the difference. Its like when a Socialist gov’t sells goods below market price and a black marketeer sells market prices (aka black market or ships it out of the country). Bottom line: Price fixing critical goods & services never works.

Well now wait a minute.

The entire LNG export-to-Europe strategy is to observe reality, note that GAZPROM’s piped gas is far less expensive than LNG, and demonize GAZPROM/Russia so severely that it leads Europe to purchase product that has the higher price, and do so voluntarily.

How does that differ from KSA choosing to lower their price (which btw would force others lower in order to compete).

Y’all really don’t grasp what Bernanke did.

While ignoring GAZPROM now, they won’t in the near future.

Reality will eventually intrude.

“While ignoring GAZPROM now, they won’t in the near future.

Reality will eventually intrude.”

But GAZPROM might ignore the EU once the trans-siberia pipeline to China is operational. Pipeline is expected to be operational by December 2019.

Probably wrong name. Altai maybe you meant.

That really doesn’t address any GAZPROM strategy or preference. If they don’t want to send gas to Europe, they don’t need to have a scarcity excuse of shipping some to China. Leaving it in the ground for the grandchildren always looms as a possible choice and there doesn’t need to be any reason for it beyond whimsy, or more likely, assertion of power.

I didn’t look up the official name of the pipeline. I just know its going to be operational by Dec 2019. Russia needs cash flow to sustain its economy, so I don’t believe Russia will simply leave it in the ground. They aren’t building that pipeline just to leave it in the ground.

IIRC, the price for natGas & oil is higher in the Asia market than the EU market. Thus either EU will have to pay more, or it goes to Asia That’s presuming that Russia does not decide to ignore EU demands, and just ship all of its NatGas Exports to Asia.

Meanwhile the US (Trump) wants the EU be become reliant on US Shale Gas exports (presumably to cut trade deficit as well as make the EU reliant on the US for energy).

That’s this ongoing propaganda about Russia’s “Economy”. What does that mean? That they are backwards? That they’d have to borrow money if they were in trouble? Do you know what % of GDP US debt is right now?

They are . . . in a particular way, the pre-eminent technology on Earth. Have a look at this post 2010 —

https://en.wikipedia.org/wiki/List_of_International_Space_Station_expeditions

To see the historical progression for the UK

http://d1o9e4un86hhpc.cloudfront.net/images/tinymce/asd1.jpg

It’s an intuitive guess that there are two major elements that affect the price of oil. One, is strictly an investment pricing related to commodities and their derivatives of “oil futures”. The other is what the refiner has to pay at spot, or contract prices. Somebody has had to studied the relationship between the two at some time, but I am clueless of where to look to find it. Anybody?

I’m sure the pricing for the past four years has been more dependent on commodity interest. It won’t be too long before the refiner need interest will become more of a factor. Maybe my wording into already established jargon is faulty.

Or, we could be like Trump, and blame it on OPEC:

https://www.forbes.com/sites/rrapier/2018/07/22/how-the-fracking-revolution-broke-opecs-hold-on-oil-prices/amp/

https://www.washingtonpost.com/world/national-security/pompeo-likens-irans-leaders-to-the-mafia/2018/07/22/e4f559a8-3f06-439c-8b83-a23278956ebe_story.html?utm_term=.3abce023128f

Looks like keeping oil prices down will take a back seat to other tweets about Iran.

https://oilprice.com/Geopolitics/Middle-East/Iranian-President-Threatens-US-With-Mother-Of-All-Wars.html

Geopolitical plus. Hogwash, you say, the US would not attack Iran, the people here would not accept that. Well… Travel back in time when the US was at odds with Saddam. Nobody expected the US to again enter another war against Iraq, unilaterally. Then there was 9-11. The majority of the terrorists were Saudi not Iraqi, but it was laid at the feet of al-Qaeda, and Iraq was supposed to have supported them. Hence, the rationale for the Iraq War. That and weapons of mass destruction (which never existed, but were convenient)… That resulted in the re-election of a very unpopular president, who gained new popularity with a storm of anger over what happened. Deja Vu?

We have an unpredictable imbecile for a president. There is no telling what he might do. His “all caps” tweet this morning was a direct threat that he would go to war for just something the Iranian leader said. Not something he did, or might do mind you, but he would go to war for something he might say. Be afraid, be very afraid.

Trump Tweeted: “To Iranian President Rouhani: NEVER, EVER THREATEN THE UNITED STATES AGAIN OR YOU WILL SUFFER CONSEQUENCES THE LIKES OF WHICH FEW THROUGHOUT HISTORY HAVE EVER SUFFERED BEFORE, WE ARE NO LONGER A COUNTRY THAT WILL STAND FOR YOUR DEMENTED WORDS OF VIOLENCE & DEATH. BE CAUTIOUS!”

Yes, I read the Iranian President’s comments (translated, no doubt), and it did not imply that they were trying to start a war with the US, it indicated that if the US chose war, it would be the “Mother of all Wars”. If the US chose peace, it would be the “Mother of all Peace”. Hard to know for sure, because I do not speak or read Iranian, but that was the gist I got. Scary, for sure. If some unknown terrorist group does something, and lays it at the feet of the Houthis, then….

I was never fully convinced of all the official stories regarding 9-11, and I don’t believe that Elvis is still alive. It is easier to believe in Elvis than some of the official stories.

I was never fully convinced of all the official stories regarding 9-11, and I don’t believe that Elvis is still alive. It is easier to believe in Elvis than some of the official stories.

Of course it is. What really happened was an army of engineers, between 500 and 1000 men strong, snuck into each of the twin towers, and another 500 or so snuck into building 7, on the weekend before the attack, and planted about 10 tons of explosives into each building. Then they timed them to go off starting at floor just below where the planes were scheduled to hit. And Dick Cheney was at the controls setting off the explosives. The whole thing was planned by the CIA under the direction of George Bush.

And just one more thing, anyone who believes such a bullshit conspiracy theory has fucking rocks in their head.

But it was a conspiracy, a conspiracy dreamed up by Assam bin Laden who convinced 19 stupid Muslims that if they carried out the plot to kill as many infidels as possible, they would receive 72 virgins upon entering heaven.

That is the official story and that is exactly what happened.

Not what, but who. I watched the damn jets.

Who? There were 5 Muslims on each jet. That’s who. They were likely giddy with joy as they awaited their 72 virgins.

What’s your theory? Who were the conspirators? I mean in addition to the couple of thousand engineers who planted the several tons of explosives, while no one was watching.

Yeah, right!

What the hell is the engineer thing? Jets ran into the buildings! There weren’t just five, their were supposed to be 19 involved. 15 of the 19 were Saudi. It was perfectly coordinated, and they were all al Qaeda. Right.

Okay, you said:

I was never fully convinced of all the official stories regarding 9-11, and I don’t believe that Elvis is still alive. It is easier to believe in Elvis than some of the official stories.

The official story was that there were 5 hijackers on each plane that hit the world trade center, 5 on the one that hit the Pentagon and 4 on the plane that crashed in Pennsylvania. And those 19 were the only people involved except for the planners in Afghanistan. That is the official story. And that is the story I believe. But you said you did not buy the official story. So the army of engineers planting explosives in the twin towers, and building 7, is the conspiracy story, and the one I assumed you bought.

However, if you buy the story of only 19 hijackers, then please accept my apology. But if you don’t, then just what is the conspiracy theory that you do accept?

My view is that only the pilots were briefed on it being a suicide mission. Need to know and all that. It’s quite hard to keep 19 dudes on target in a highly coordinated one way mission.

I suspect the guys in the back running box cutters likely thought they were in for a non-suicide mission. I have no evidence of course, however- garden variety opsec protocols would dictate that.

I suspect the guys on box cutters in the back were expecting something along the lines of an Indian Airlines Flight 814 scenario with lots of cool-guy pussy to be had for all once it was over.

It’s easier, and better opsec, to get your hands on 4 suicide pilots, and just dupe the rest. Also explains why some guys in the back didn’t seem like the suicide type.

Indian Airlines Flight 814 may have been a pre-op/pretext to aid in recruiting for 911.

My view is that only the pilots were briefed on it being a suicide mission.

And you find that, that four American pilots were converted to Islam, or had some other reason, to decide to sacrifice their lives to kill 3,000 Americans? Well, how did they arrange that those four pilots would be chosen for those four flights?

Sorry Survivalist, that is the most absurd conspiracy yet. But it is original. First time I have heard that one. And I dearly hope it is the last time I will ever hear it. I am pretty sure it will be the last time I hear it. After all, who would dare pose such an absurd theory? Well, except you of course.

That 4 sets of terrorists were able to subdue and probably kill 8 pilots in a single mission armed only with box cutters, then subdue 4 loaded planes with the same weapons should give a slight twinge of disbelief. Box cutters can kill, but only if they are extremely lucky. Box cutters cut, they don’t stab. A multitude of things can be picked up to counter a fritzing box cutter, including a pocket pen. Four flights loaded with no past or current military or law enforcement people, who have not faced worse conditions would be required. Not likely. That’s my first clue, not all was told, or they just guessed it. Four of their pilots gained enough experience to fly the type of plane they were on. On a fritzing flight simulator? To expect to accomplish such a mission armed with only box cutters defies the imagination of any past military person.

The only “conspiracy” theory, is that it is somewhat unbelievable.

Guym, fucking conspiracy theory nonsense. I find it amazing that some people will believe the most absurd things rather than follow the very obvious logic. Occam, of Occam’s Razor, was a genius. Too bad that such intellects are such a rarity these days.

Bye now, you can have the last word. I will not respond to such conspiracy theory nonsense.

Ron

The four pilots I’m referring to are the four al Qaeda operatives that flew the planes into their targets. Not the American pilots they killed to takeover the cockpit. 19 al Qaeda operatives were involved. Only those tasked and trained as pilots were briefed on the suicide nature of the mission. The other 15 doing the security work with box cutters and defending the cockpit from the passengers probably thought it was an air India flight 814 type gig. ‘Need to know’ and all that. It’s not a conspiracy theory. It’s mission analysis. Perhaps all were briefed on the true suicide nature of the mission, but that would have made recruitment more of a challenge, cold feet and backouts more likely, and operational security more vulnerable. Terrorist cells are usually heavily compartmentalized, and there was likely a large overhead team for counter surveillance, logistics and communications to keep the mission on track. Telling the guys who don’t need to know is not standard procedure in terrorist cells. If you ever wonder why some Lebanese casino loving playboy was on a box cutter job it’s likely because he didn’t know it was a one way ticket.

Getting men to accept suicide missions is difficult. Tamil Tigers, the inventors of the suicide vest, would do it by threatening a persons family unless they did it. It’s easier to get 4 who are willing to accept a suicide mission than it is 19. Combine that with ‘need to know’ protocols and the answer seems likely to be that only the 4 al Qaeda pilots knew the real plan. The rest probably thought it was an air India flight 814 type job.

The only conspiracy theory I’m aware of that duped most folks is that one about Saddam having WMDs

Poor mind-controlled baby boomer gets triggered by a conspiracy theory, lol.

I first thought it was Chile, as we over through their government and killed their leader on 911.

I was in Sonoma, no TV, etc and didn’t know about it until a friend called and couldn’t cross the GG Bridge.

But it became clear, as Ron’s view became obvious—

FWIW: For started not a Trump fan, but its pretty evident on his modus is to bark as loudly as he can, and than offer an olive branch: See North Korea for example. Recall that its appeared that the US (Trump) was going to Nuke North Korea. But recently he talked to Kim about building Trump hotels in North Korea.

My understanding is that White house officials have been trying to reach Rouhani for a meeting, but Rouhani has refused\ignored it. Thus ratching up the rhetoric to force a response.

Iran Says Trump Sought Meeting With President 8 Times at U.N. Last Year

https://www.google.com/url?url=https://www.nytimes.com/2018/07/18/world/middleeast/iran-rouhani-trump.html&rct=j&q=&esrc=s&sa=U&ved=0ahUKEwikie_7mbbcAhUrnq0KHWamCKIQFggdMAM&usg=AOvVaw102z8t8YFwJZo_HKRqqaJj

Bottom line: The rhetoric will likely continue to go up until Rouhani agrees to meet with Trump.

That said, Iran is the last Major Middle East Country that the US hasn’t invaded or implimented Regime Change that has energy resources. An Iranian take down has been in the card since at least the 1990s (recall Cheney’s infamous presentation in 1999: The US needs another Iraq for Oil). Trump is practically following Israel’s marching orders. Every few months Israel releases another “Line in the sand” presentation regarding Iran, and Trump buys their argument.

That said please don’t get upset at me. I am not trying to get you mad, or pissed off.

Its been apparent to me for a very long time that the coming crisis is going to end with other global war. As the global economy continues to get pounded by a three front attack: Depleting resources, Debt & the Demographics cliff, the public is going to continue to select much crazier leaders: recall the communism & fascism uprising during the early 20th century. This time won’t be any different: Desperate people in desperate times select despotic leaders.

But if you look at what is happening in the US, people seem more willing to put up walls and keep people out than to go invade other countries. The Trump supporters, who might have supported invasions in the past, now want to applaud Trump’s peacekeeping missions with North Korea and Russia, and agree with him that we should start shutting down our foreign bases.

Ironically they are supporting what the global far left has wanted all along: that the US withdraw from the world and stop acting like an imperialist nation.

I think it is possible that countries like Russia and China can engineer a collapse of the US without drawing us into a war.

Boomer Wrote: I think it is possible that countries like Russia and China can engineer a collapse of the US without drawing us into a war.”

Erwin Rommel: “No plan survives contact with the enemy”

Bottom line: when a global crisis kicks off a long term global economic decline, There will be chaos, Riots, Civil wars, terrorism, will all become the norm. We had a taste of things to come back in 2008 when the Arab spring took hold. We saw gov’ts overthrown, riots in most of the world (Europe, Asia, Latin America). Any plans to collapse the US without collapsing there own economies is improbable. China suffers the the same huge problems as the US: enormous debt, Demographics cliff, & resource depletion.

I was just looking for info on The Republic of Congo – the newest member of OPEC

They had 9 oil rigs running at the end of 2014, now down to 3 (Baker Hughes)

Chart data is from EIA International Data:

https://www.eia.gov/beta/international/data/browser/#/?pa=00000000000000000000000000000000003g&f=M&c=000000004&ct=0&tl_id=5-M&vs=INTL.57-1-COG-TBPD.M&vo=0&v=H&start=199401&end=201804&showdm=y

BRAZZAVILLE Dec 8 2016 (Reuters) – Congo Republic expects oil output to rise to some 300,000 barrels per day in 2018, up from around 250,000 bpd now, partly due to a new deep offshore field (Moho Nord) due to come online next year, the oil minister said on Thursday.

http://af.reuters.com/article/equatorialGuineaNews/idAFL5N1E3613?

OPEC MOMR, June 2018: 331 kb/day

Congo just about to add one rig

https://mobile.twitter.com/angloafricanog/status/1021752200635330560?p=v

copied from twitter:

Giovanni Staunovo

?

@staunovo

Hess has shut oil production at its Baldpate field in the Gulf of Mexico since Friday

Reason for shutdown and duration unknown

Could be to do with the Enchilada pipeline issues still. I think they disconnected the pipeline from the platform to allow some flow to continue but that might need to shut down to reconnect, or could have other problems but just speculation.

fuel prices

2018-07-24 (Bloomberg) Being an emerging-market economy can be tough when oil prices surge and your currency crumbles.

So far, several of the larger emerging-market countries that previously had subsidies appear to be returning to them, albeit less aggressively than they did when crude soared to a record a decade ago. While such interventions may place a strain on their budgets, they also mean the threat to oil demand should be cushioned for now.

… Russia “You can expect the government will step in and do whatever it takes to keep the prices down,” said Kostantsa Rangelova, energy analyst at JBC Energy. ?

https://www.bloomberg.com/news/articles/2018-07-23/oil-demand-outlook-clouded-by-emerging-economies-currency-pain?

Chart: https://pbs.twimg.com/media/Di2PFgBXcAA-MCw.jpg

EXPERT MAKES THE CASE FOR $400 PER BARREL OIL:

https://www.washingtonexaminer.com/policy/energy/expert-makes-the-case-for-400-per-barrel-oil

…. He predicted a 2020 economic collapse based on the oil commodity market and the lack of diesel fuel. “Catastrophically high oil prices will cause the impending recession,” said Verleger. “The world oil market will see prices at least double.” And from there, the sky is the limit, according to his analysis.

From the $200 mark, the price of crude oil could surge to a price of $400, he said. Prices currently range from $65-$74 per barrel. Other analysts and oil market observers have noted that global oil reserves are thin and anticipate oil prices surging to $90-$100 per barrel after Iran sanctions kick in, while also pointing out the coming diesel crunch that Verlenger is watching.

This seems a bit extreme, but there are more predictions now that are stretching the average and standard deviation for predicted prices as near as 2020 to $100 and well above. I don’t think the low sulphur rules would be strictly enforced if things got as bad as this article suggests, in fact I think it is pretty much written into the IMO advice to shipowners that they wouldn’t be. If there isn’t a real price signal before 2020 then a surge of non-LTO oil wouldn’t be seen before 2023, and possibly not even then given the dearth of discoveries, plus the development cost inflation will be huge if the spike is as sudden as seems possible.

Mr. Kaplan

A quote from Rapier’s article yesterday … “It is hard to overstate the consequences of the fracking (sic) revolution”.

Just so.

While I concur that your referenced article may overstate the upper price range for oil, I think the wider market is slow to recognize the looming impact that natgas will exert in the hydrocarbon/energy world in the coming years.

In addition to following on a micro level – time permitting – the operational developments in the unconventional oil/gas industry, I have been observing the impacts on power, aka electricity, generation as the fuel sources have been swiftly and dramatically changing.

The effects of new hardware, specifically the ultra efficient Combined Cycle Generating Turbines, fueled by an extremely economical source, natgas, are upending longstanding practices in electricity markets in the US.

For every incremental ‘bump’ in the price of crude, the $3/mmbtu energy cost in gaseous forms increases its economic advantage.

Transportation is the Big Enchilada for oil’s usefulness (necessity, a la Watcher).

Just as this so called Shale Revolution caught so many by surprise, I am highly confident that the replacement of natgas for oil – already in the early stages – will accelerate FAR more swiftly than people presently recognize.

As always, I thank you for your contributions to this site.

Coffeeguyzz,

Yes the US tight oil output has largely been responsible for keeping World oil output from peaking. Both shale oil and shale gas output will eventually peak in decline.

For shale oil (aka tight oil) the peak is likely to be 2023 to 2025, I am less sure about shale gas as I have not followed that as closely, but the resource is not unlimited.

If we switch to using natural gas for transport, consumption increases and the peak is reached sooner.

EIA estimates about 622 Tcf of unproved shale gas resources (technically recoverable) which in boe is about 107 Gboe. At current natural gas prices the economically recoverable resource is likely to be much smaller, probably about half this level. As of the end of 2016 proved reserves of shale gas were about 210 TCF (36 Gboe). The US produces about 29 trillion cubic feet of natural gas per year. With a total resource of about 830 TCF and if peak happens about at the half way point (415 TCF) that would be in roughly 14 years or in 2032.

Alternatively there has been 776 TCF of cumulative shale gas produced through the end of 2014, reserves at the end of 2014 were 200 TCF and the TRR estimate was 622 TCF in 2015 (when only 2014 reserve estimates were available). The URR based on these estimates is 1600 TCF of shale gas. Using a 50% estimate for the peak, this would be at a cumulative output of 800 TCF, current (June 2018) cumulative shale gas output is 1461 TCF, so the peak might be soon.

US Shale gas output from EIA 2010-2018.

Dennis

That the ‘gas’ world has taken a back seat to the ‘oil’ world is pretty well recognized in these matters, most especially due to oil’s role in transportation.

Guy’s mention of buying used SUV-type vehicles and converting them to CNG- fueled transport sparked my delving back into this realm (something I’ve not done in awhile).

Going by Ford’s OEM specs (new car warranty), I thought the conversion from gasoline to natgas involved a strengthening of valves and valve seats.

Not so, apparently, in the aftermarket as simplified conversion kits have been available overseas for years.

Pretty fast, simple, and cheap process.

Now, I realize you put quite a bit of effort into future supply potentialities, and I’m not inclined to get into a debate on this matter …

But, when USGS assessments skyrocket from 26Tcf to 52 Tcf for the Barnett, from 30 Tcf from the Haynesville to 300 Tcf from Haynesville/Bossier, 1.6 (1 point 6) to 66 Tcf for the Mancos, a trend should become clear.

I have tracked the Appalachian Basin development (Utica, Marcellus, Upper Devonian formations) on a daily basis for awhile now and can assure you the updated USGS assessments will be stunning.

Comparable, in combination, to North Dome/South Pars.

When the practical transition from oil to natgas picks up steam (already started), the resource availability stresses upon oil will change.

These effects will be monumental in economic, political, and social consequences.

This very day, Dennis, 16 bucks will buy you the energy equivalent of 70 buck earl, if obtained in gaseous form.

The supply is there.

The economics are compelling.

The fierce race to effectively commercialize this situation is ongoing.

Yes,

Natural gas is very cheap, note I was using EIA resource estimates (which are often much higher than USGS estimates).

Also keep in mind that technically recoverable resources are unlikely to be profitable at current natural gas prices.

Lots of infrastructure needs to be built for natural gas use to become widespread for transportation.

Also consider that due to the poor thermal efficiency of internal combustion engines, it might be more efficient to use natural gas to produce electricity to charge EVs.

My guess is that natural gas will peak between 2030 and 2040 and natural gas will no longer be cheap after the peak is reached.

If natural gas is used widely for transport consumption will increase more rapidly and the peak may move to 2025 to 2035.

If I was a betting man, I’d put the money on battery improvement for EV out competing adsorbed onboard vehicle storage of nat gas. So, if I am correct in this, the abundant nat gas would be best used to fuel the electric system, rather than directly burned in vehicles, as Dennis said.

Either way, its a pleasant problem to have, other than too much CO2 floating around.

From the “Where did these guys come from?” department, Nikola Motors may well be an outfit worth watching as the scope of their ambition is nothing short of breathtaking

They just ordered a thousand megawatt capacity electrolysis system from some Norwegian guys to cheaply produce hydrogen.

Nikola is in the process of setting up a 2,000 employee truck manufacturing plant outside Phoenix.