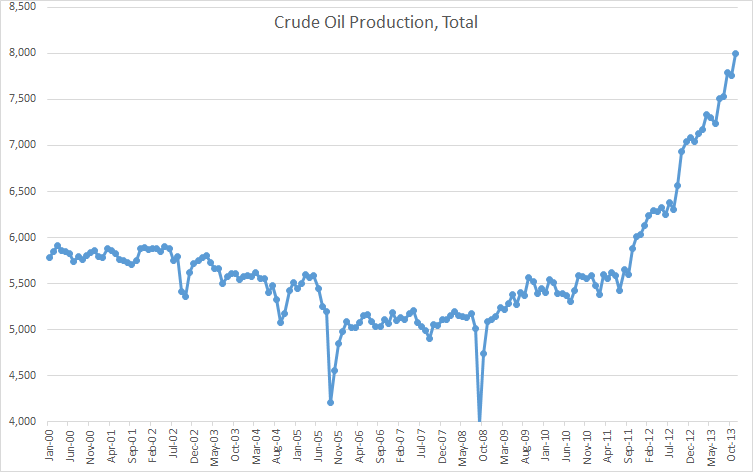

The US Monthly Energy Review is now up with all the US Oil and Gas data for November. US (estimated) Crude + Condensate production was 8,002 kb/d for November. I think that will be revised later because the Bakken had a bad month in November.

The average, so far this year, has been 7,438 kb/d and if December production is as much as November then the average for 2013 will be about 7,485 kb/d. AEO 2014 estimated 2013 production at 7,756 kb/d so it would appear that they are already a bit high with their prediction.

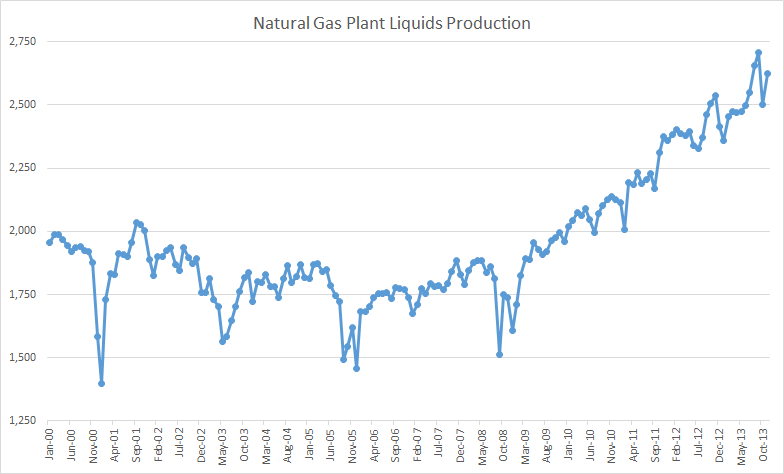

Natural gas liquids, along with natural gas is supposed to be a major player in our drive for “energy independence”, is up about 1 million barrels per day since 2006.

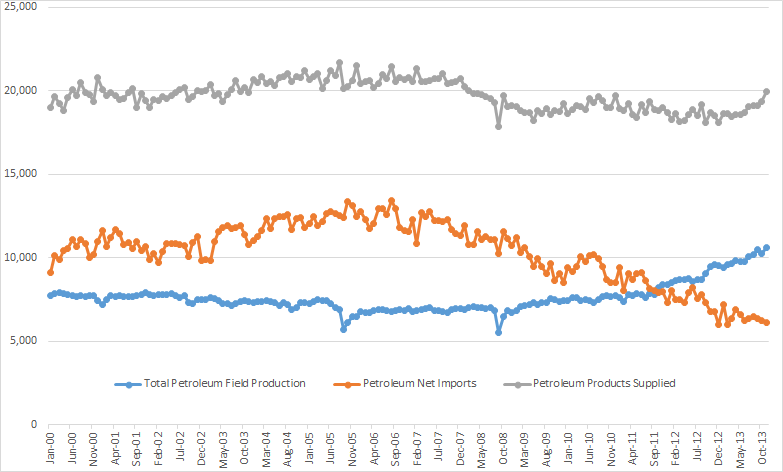

In the chart below I have charted Net Imports along with Total Field Production, (NGLs + Crude) and Petroleum Products Supplied. The difference between Total Field Production and Petroleum Products Supplied is the distance we must go to reach energy independence.

Although most of my charts are not zero based, because I like to amplify change, I have made this one zero based because I wanted to show how far we have come and how far we have to to attain energy independence.

Products Supplied increased by 614 kb/d in November and is up 1,864 kb/d since last December. And notice also that we are back to 20 million barrels per day of consumption.

Important Notice: The only reliable monthly world crude oil production numbers has come from the EIA. I find it extremely frustrating however that the EIA does not see world oil production as a priority. They seem to get later and later each month with their updates. When the old International Petroleum Monthly was published the data was only two months behind at most. Now we must rely on the International Energy Statistics page. Their last update was about 5 weeks ago with the July data. Now they are almost 5 months behind and I don’t expect anything before the first of the year. Friday I posted Patricia Smith, the EIA person who posts the data, though she does not compile it. Here is the exchange:

Due to a staff shortages, technical and database issues, and other priorities, some of the data are late getting posted to the web. There have been so many changes, but hopefully the international program will not be cancelled. Please be assured that we are working very hard to get the thousands of data records updated, I just can’t tell you an exact date. What specifically are you looking for?

Pat

I replied and thanked her for her reply and told her I was looking for world crude oil production data from all oil producing nations. But from the tone of her post I am not hopeful.

That could mean that the data does not comport with the official optimistic story line…

I was thinking exactly the same thing, but you beat me to it. One day it will be decided not to report the data rather than to merely fudge it.

What are the usual and most common end uses of natural gas liquids? I’m presuming they are mostly used as chemical industry industry feedstocks rather than as components of finished liquid fuels such as gasoline and diesel- other than propane which is often used as a motor fuel in forklifts and other industrial engines operated inside large buildings.

Ron and everyone here…

Merry Christmas!

Thanks for keeping the discussion going post TOD.

yes, Merry Christmas to everybody!

Here’s something of considerable interest:

http://e360.yale.edu/digest/russian_oil_giant_becomes_first_in_world_to_pump_oil_from_arctic/4033/

Peak Oil will mean “Peak Everything”. Peak Data, or Peak Information, probably being one of the firsts to be reached.

Ron, I do not understand your graph on the USA pertoleum balance. I understand 20Mb/d consumption (“supplied”), 10Mb/d production and only 6Mb/d import. Where do the remaining 4Mb/d come from? Or do I miss something?

Actually the difference is 3,218 kb/d not 4 Mb/d. 1,213 kb/d of that is Refinery Process Gain. 1,046 kb/d is Renewable Fuels, ethanol and such. I have no idea where the other 1,049 kb/d comes from but you can go to here: Monthly Energy Review/Petroleum and figure it out. Click on “Petroleum” then “XLS” or go here for the PDF version. Those are the EIA’s figures, not mine.

Stock drawdowns are another factor, I believe.

Interesting. When one puts together a variety of factors – declining EROEI; the increasing share of ‘total liquids’ made up by NGLs & ethanol, that have only about 70% the energy content of crude; the Red Queen effect in tight oil; the stock drawdown you note; Export Land; doubtless others – it becomes clear that we are increasingly walking barefoot on a razor’s edge (or some such metaphor) regarding oil supply. ‘Peak Oil is Dead’, blares the MSM, the dominant cultural megaphone. But one can only draw down stocks, live on capital, or eat the seed corn for so long.

The U.S. imports some gasoline from Europe and exports diesel. The US uses more gasoline than diesel. In making gasoline from a barrel of crude, the refinery makes a certain prrcentage of diesel. It cannot just make gasoline. The excess diesel is exported. Europe is the reverse. Check the last page of this EIA report to see product imports.

http://ir.eia.gov/wpsr/overview.pdf

Best wishes to all and Thanx to Ron and Dennis.

Verwimp – Yes, you beat me to it. When PO really starts to ‘bite’, it only makes sense that one of the early casualties will be the information that would allow for clear identification of the peak. The world will be in turmoil, and everyone will be blaming everything from some group of ‘others’ to some deity, whereas the true cause will be right there in the unobtainable oil production data.

Is there a bigger red herring in energy discussions than “Energy Independence”? The US became a net importer in 1949, for Chrissakes. What we really want is decades of $2/bbl oil, like what obtained 1935-1970.

http://www.scientificamerican.com/article.cfm?id=israels-new-motor-fuels-strategy-natural-gas

According to this article, the Israelis expect to be able to sell their own domestic natural gas for about half the cost of diesel fuel and to convert their larger trucks at a cost of about 20,600 dollars each.

I have no idea what diesel costs in Israel, but the before tax cost is probably between three and four dollars a gallon, and since they have no domestic oil, it must be imported.

Given that Israel is a small country, it’d unlikely that a truck would ever be driven more than a thousand miles in a given 24 hour day , even if it is used two or three shifts around the clock, because loading and unloading, waiting in line, paper work, driver’s rest breaks and so forth consume most of the day on short hauls.

Average fuel consumption of a forty gallons per day per truck is typical under such circumstances and close enough for “guvmint work”.This would mean from 120 bucks a day on up to maybe 150 or 160 bucks per day for fuel per truck per day exclusive of taxes.

If they can save half of this amount, they will hit their cash break even cost of converting a truck in well under two years.

Here in the US, where heavy duty trucks are often driven all day, and two or three days sometimes, without stopping to be loaded opt unloaded, the coat of conversion could be recovered in less than a year.

Nothing is stopping the industry from switching except bureaucratic inertia and a lack of strategically located fueling stations – and perhaps fear on the part of the industry that if the switch is made, ng prices will shoot up to the effective equivalent of diesel.

Converted trucks will still run on diesel if it’s either cheaper or ng is unavailable,and in fact will still require a small but steady diet of diesel to even run, since a little diesel must be injected to ignite the ng .

Just a small handful of stations located along major highways would enable at least a couple of million trucks in this country to run almost exclusively on ng and millions more to be profitably converted.

No matter how short lived it turns out to be, the run up in US oil production still astounds me. Is it any wonder that such a graph fuels optimism in the press? In the end, will it only make the disappointment that much more bitter when the promise fades? The remainder of this decade is going to be very interesting.

Re: Calhoun

Note that there are two factors causing the annual volume of US oil production lost to declines from existing wells to increase: (1) At a fixed decline rate, the volume of oil lost to declining production increases as total production increases and (2) As the decline rate from existing wells increases–as high decline rate tight/shale plays account for an increasing percentage of total production–the volume of oil lost to declining production increases.

For example, at a 5%/year decline rate, at a production rate of 5 mpbd, we lose 250,000 bpd per year, while at a production rate of 7.5 mbpd we lose 375,000 bpd per year. But if we factor in an increasing decline rate from existing wells, say to 10%/year, we would have lost 250,000 bpd per year at a total production rate of 5 mbpd (at 5%/year), but at a production rate of 7.5 mbpd, with a 10%/year decline rate, we would have lost 750,000 bpd per year.

So, a plausible estimate is that the annual volume of oil lost to declines from existing wells tripled from about 250,000 bpd per year in 2008 to about 750,000 bpd per year in 2013. This is the basis for my estimate that, assuming a 10%/year decline rate of about 10%/year from existing wells, the US oil industry has to replace 100% of current production over the next 10 years, in order to maintain a 7.5 mbpd crude + condensate production rate for 10 years.

What happens if the US economy does go into recovery mode, and demand for fuel actually increases faster than any supply. Because looking at Ron’s graph, that is what has happened over the last few months.

As most of the drop in US oil imports was actually due to a fall in demand from 2008 to present, but this was never recognized by the MSN. It will be interesting to hear the spin when imports rise, along with a slowing production rate due to higher demand.

Those Caribbean oil refineries that were shut down in such a rush may just have to be de-mothballed.

PS. I believe the answer will be higher oil price, leading to slower economy. Oh well, back to where we started.

“What happens if the US economy does go into recovery mode, and demand for fuel actually increases faster than any supply. Because looking at Ron’s graph, that is what has happened over the last few months.”

That’s just not going to happen. There is no chance for the US economy to recover. There is too much debt and the cost of energy will remain too high for the debt to be paid down. As I discussed many times on TOD, the global economy is likely to be chaotic as the global economy oscillates between large price swing of energy. We will see prices rise up over a period of years than a sudden crash. Prices during the crash will undershoot cause by demand destruction. The crash in energy prices will some economic recovery, but the recovery will never fully match the previous cycle peak. Prices start to rise again resulting in a repeat cycle. At some point a critical tipping point will be breached and the entire global economy will collapse.

I think during the next crash cycle we will see the death of commercial air travel for the masses. This would free up about 10 to 15 mmbd of consumption globally. Air travel is probably the one industry that can disappear without causing any major disruptions (business as usual). Other losses such as global transportation of goods, ground transport, electricity, etc will have major repercussions. My guess is that we will see the beginning of the death of air travel in the next two years, perhaps less. It may have already begun as airlines have been cutting flights and packing in passengers in like sardines to offset operational costs (mostly attributed to higher energy prices). At some point airlines will be forced to raise prices, which will decrease the number of passengers, resulting in fewer flights and less revenue and likely to lead to bankruptcies.

The question that the last graph prompts in the context of the relatively short life of the LTO resource is will the US ever be able to return to importing 12-13mmbl/day like it did just under a decade ago before this new domestic supply became available?

As we have seen the substantial amounts of oil that the US has recently not been importing being easily absorbed by other buyers without meaningful downward effect to price, it would suggest that it will be no easy thing to have the US return to global market as its hungriest importer again. At least not without a profoundly significant upward repricing as an expression of that new supply demand imbalance.

Add to this the continued global declines of mature fields, the inexorable logic of the ELM, and the continued failure of optimistic forecasts of new supply to materialise (Brazil, Iraq, etc), increasing populations, growing sophistication of new economies (China, India, etc), then I think we can conclude that this level of imports will in fact never happen again.

So we can also say that all the LTO resource will achieve is a pause in global price rise, and a tragic recommitment of the society to unsustainable habits, business models, and social orders. It is also allowing other countries to continue in their outdated ways because the world has readjusted to $100 oil, just, and is likewise kidding itself that this price and supply/demand balance will last.

If only the US and the rest of the world were using this pause to reduce our dependence on liquid fuels in substantial ways then this new resource would indeed be a great boon. It isn’t and it isn’t. Tragic is the only word.

The rise in oil prices may lead to adjustments. People in the US have gotten used to $3.50 per gallon gasoline and seem to think with all the oil abundance that the mainstream media is so excited about that prices will not rise much (in real terms) in the future.

I think by 2016 it is likely this “knowledge” will be proven incorrect. When gasoline prices rise to 6 or 7 dollars (in 2013 $) in the United States, then we will begin to reduce our dependence on liquid fuels.

I agree that it is tragic that most energy analysts seem to be so short sighted. It is the world we live in, most people tend not to look ahead beyond a year or so.

Happy Holidays everyone!

DC

@ Calhoun – The rise has indeed be steep and astounding. It appears even moreso when presented as Ron has graphed it, starting in 2000 and not zero-scaled. (Not a criticism, Ron, just an observation.) But it’s the third (bottom) graph that every American should see – especially the many who’ve been duped by the MSM into thinking that the US is a net oil exporter. What bollucks. Thanks, Ron, for that very clear graph. Seeing that data all the way back to pre-73 would be even more fully informative, and give the masses the perspective they ought to have on “American energy independence”. But it’s great as it is, and…

@ Patrick Reynolds – you raise a great point, and I concur, that no way is the US going to be able to import 12-13mbd again, ever, at any price. Westexas’ work should make that amply clear. Matt Simmons used to say, ‘when Saudi peaks, the world peaks’. Well, when US tight oil peaks, geopolitical tension is likely to peak, ’cause Uncle Sam’s gonna be left wanting. As you say, ‘if only’ and ‘tragic’ – indeed.

Ron – You’ve said POB has an edit function. But can you (or anyone) tell me how to access it? Thx.

Clifman, I am sorry but I think you misunderstood me. Or, if you did not misunderstand me then I made a serious error. I really don’t remember where I made that statement. POB does have an edit function but only if you are an editor.

Yeah, I tried to find it and I clearly ‘misremembered’. But I’m following up on Dennis’ suggestion via e-mail to become a subscriber. Thx.

Hi Clifman,

I spoke with Ron about this and for those who subscribe to the blog, and tend to comment, I can change their status from subscriber to contributor.

This will enable those people to edit their comments.

In addition it will allow people to write a post, but only Ron or I can publish the post, so you should contact Ron or me before writing a post or e-mail us a word document or link to where it is published elsewhere if you have your own blog and Ron will decide if it is appropriate. Initially the aim is simply to allow people to edit their comments and add images.

Dennis Coyne dcoyne78 {at} geemail_dot)com

Ron and Dennis,

Are commenters able to include images in their comment? I found that to be one of the most useful features of TOD comments.

aws,

If you put a valid e-mail address in when you post a comment or contact me at the e-mail address in my reply to clifman. I can try to get you set up to do so. At this point only Ron and me have been able to do that and occasionally we edit other users posts to show their charts in the comments, but it is too much work for Ron and I to do that for every link to a chart in the comments. So we are trying this to see how it works.

Dennis

Hi all,

I have investigated the ability of people to edit their comments.

I thought that changing someone from “subscriber” to “contributor” would enable the ability to edit comments, I was incorrect.

I have installed a plug-in which allows people to put an image at the end of their comment. In order to add multiple images, multiple comments are needed or you can use links to where the images are stored in a single comment(as we can already do).

I agree with aws that it is nice to see the chart without having to click on a link.

This is the best I could do.

Dennis

In general, the U.S. government has been downsizing for years, topped off with the sequestration. The recent budget deal will not do much to change the situation. Perhaps they will just shut down data collection as a cost saver and let the market decide who gets the data. Believe it or not, there are such things as staff shortages and they do make a difference getting the job done. Of course, one can also believe that government workers are just a bunch of lazy slobs. That is not my experience but I guess your mileage may vary depending upon what anecdotal evidence one is privy to.

Please, Tstreet, I have never suggested that the government workers were a bunch of lazy slobs. And we are all well aware of the fact that there have been cuts in their budget. That was explained to us by the EIA themselves when they cut out the “International Petroleum Monthly” a couple of years ago.

My complaint is their priorities. If there has to be cuts why do they cut the most important thing they do. The EIA generates hundreds of reports, from the price of kerosene to state by state energy production. Do you care that Connecticut ranks 41st in energy production and that Delaware ranks 49th?

We all know that Congress cut their budget. But they should cut the least important things not the most important. Or, perhaps you think knowing the rank of Delaware in US energy production is really that important.

Re: Ron Patterson December 25, 2013 at 6:31 pm: Statistical Priorities

Hi Ron.

“Or, perhaps you think knowing the rank of Delaware in US energy production is really that important.”

I find it hard to believe you made that statement.

Knowing Delaware energy production is a subset of “all the data”. Without “all the data”, one cannot know the US totals, and without knowing that, one cannot make informed decisions. I’m sure that the costs of publishing the Delaware stats are trivial, and that the costs of not publishing them (that is, putting in programming to discard the information) would be equal or greater than letting it go through.

The real issue here is that conditions have been created that make it difficult to make decisions on a rational, data-driven basis. Non data-driven decisions are typically ideologically based. This is not accidental budget cutting- those on the right are happiest when they can make their decisions without any messy facts getting in the way.

We have the same problem up here- the long-form census was discontinued by our current government a couple of years ago, so we have lost the ability to use that data for long-term planning.

-Lloyd

Lloyd, fixed your italics problem. Now about what you find hard to believe. Believe it then get over it because it is not a big deal. Three states and District of Columbia produce no energy whatsoever, They are Hawaii, Delaware, Rhode Island and D.C. and they are listed in that order, 48 thru 51.

How much oil the world produces is far more important than how much Delaware don’t produce. I was simply trying to make a point that world oil production should be among the very highest priorities on the EIA’s agenda. So don’t try to make a federal case out of it.

It is important to remember the all questions about oil supply and price are, at bottom, about the politics and technologies of transportation. Because while oil, that most useful dense energy sources, supplies ‘only’ about a third of our total energy demand when it comes to transport that number becomes 95%. (OFM’s gas truck plan will happen.)

And transport issues are also always locational ones. The highly dispersed urban form of late 20th century sprawlist cities is becoming obsolete. It is past time to short yourselves of auto dependent property, including all but the most self sufficient rural ones (even they will lose value dramatically in my view). Ironically I think that this may be the saving of countryside: it’s going to empty of lifestylers (ride-on mowers have even worse fuel efficiency than Hummers!). Walkability and the degree to which your place is mixed use are gold now. The sunbelt auto and aircon dependent sprawlbergs have had their heyday, no matter how well they appear to be doing just now, esp. the Texan ones reaping the LTO boom.

I know it’s heretical, and probably impossible, but the best thing new world economies could do would be to tax gasoline like Europeans to get the pricing signal working now. It could be a wholly redistributed Carbon Tax to deal with the regression problem, simply to shift behaviours. Think the Republicans are angry now? Ha! That’d really wind them up…. No chance, especially while that chart up top is still pointing north…

hi Patrick,

I’m afraid I have to agree with you about the demise of the personal automobile centric lifestyle, if you add the word “eventually” to your prediction.

And to be honest, I do have grave misgivings as to how much longer “happy motoring” will last.

Oil prices simply have to go up, and before too much longer.

The single aspect of peak oil that scares me the most is a shark fin decline in production coming at a time when the world economy is actually growing.That would leave virtually no time at all for people to adapt before jobs disappear.

But the “business as usual” economy has survived the heart attack of hundred dollar oil, so far , by hook or by crook, although like most victims of a heart attack the economy’s recovery has been painful, slow, and incomplete. I’m sure the go go days are behind us for good, barring a miracle of some sort .

For now I’m thinking that when the decline comes, it will not be so sudden and sharp as to take people totally by surprise – I’m guessing prices will start going up pretty soon, and up sharply, but hopefully not by fifty bucks a barrel in a single year.

A rise in of ten dollars or fifteen dollars a barrel per year does seem to be a real possibility beginning sometime in the near future.

A continued rise in prices of this magnitude for two o0r three years would be enough to get the attention of enough of the public to put a real crimp in the sales of gas hog vehicles and hopefully convince the manufacturers it’s really time to get with the program on fuel economy.

There’s no reason we can’t have affordable cars that get sixty or more miles per gallon, other than marketing inertia, buyer’s habits, and well intentioned but poorly conceived safety and emissions regulations.

We need to worry a hell of a lot less about nitrogen oxides and more about the amount of total co2 , nox is bad of course, but compared to the environmental cost of an economic down turn or collapse, the last little bit of nox is from the tail pipes of cars is a trivial concern.

A dead or dieing economy will not support environmental programs because every dime will go preferentially to the welfare state and to the military industrial complex.

And while a super efficient car will necessarily be somewhat less safe than a conventional car, everything else held equal, we need to look at why this is so, and what the consequences of driving such cars would be.

Size , weight and shape are the factors that control fuel economy to the greatest extent, and downsizing hurts; there’s no way a 1500 pound car can come out of a collision with a 4000 pound car on equal terms, and only an idiot would argue otherwise.

People hace gotten used to cars already that are reasonably well streamlined, and they are going to have to get used to car designs that hate extremely aero efficient pretty soon if they want a new car at all., because the industry isn’t going to be able to build any car that isn’t ; as it is , I expect the already legislated fuel economy regs will have to be rolled back because manufacturers won”t be able to improve their fleet averages fast enough. They will have to fight for every last tenth of a mpg, and good aero design will be crucial.

Building a very small, very light extremely aero efficient car is a trivial problem from an engineering point of view.

Being allowed to build it is another matter, and actually convincing the public to but it yet another matter yet.

I believe the public will gladly buy such a car in a few more years, and buy it by the millions , because there are many millions of people who will have to make a choice between their Mc mansion in the way out there suburbs and millions more who commute to work from the trial countryside.

If you own a house with a manageable payment out in the far out burbs or the real country,, and are FACED WITH THE CHOICE OF LOSING IT AND LOOKING FOR A NON EXISTENT AFFORDABLE AND DECENT PLACE TO RENT CLOSE TO THAT ALL IMPORTANT JOB, you won’t have any problem giving up the Cherokee and getting into a scaled down Prius other than loss of face when you pull into the employee parking lot.

If ten dollar gasoline doesn’t sneak up on us to fast to react to it, we will see two seater fore and aft three wheeled cars- technically motorcycles- in major manufacture show rooms with the next ten to fifteen years, maybe a lot sooner.They will get a hundred mpg without even being hybrids.

The problem is getting a major car manufacturer to market them. There are only two manufacturers with experience and sterling reputations involving both cars and motorcycles, namely Honda and BMW.

Hopefully one company or the other will take the knead in selling enclosed super efficient motorcycles.

Once there are a few hundred thousand of them on the road, sufficient public interest will result in either relaxing the requirement for a motorcycle operators license to exclude enclosed three wheelers, or even to get the safety regs relaxed sufficiently for subcompact four wheelers to be sold.

Any enclosed car is far safer than any two wheeler, everything else held equal. And the economic situation is steadily evolving towards the point that millions of people are going to be making this choice- unless super fuel efficient affordable cars are available .

The latest BMW plug in electric hybrid is looking like a good breakthrough car . it is in the Prius price range and has an all electric range of 70+ miles and good performance and a small range extender engine, which will keep you going at reduced power to the next recharge or fill up. It should remove range anxiety. It is still too pricey to be a full mass market model.

OT – but there was considerable discussion regarding climate change in the last thread. Guy McPherson has reported that the “Clathrate” Gun has been fired. The paper is a rather interesting read and can be found here:

https://sites.google.com/site/runawayglobalwarming/the-non-disclosed-extreme-arctic-methane-threat

I don’t buy the gun hypothesis ( gut feeling based on diffusional processes on the ocean/clathrates interface ) but as it had been said above, this decade will be rather interesting and unpredictable.

Another relevant bit of news-

City of LA is aggressively ticketing pedestrians . I failed to copy the link properly but there is an article in the NYT about this right now.

Hi Tim E,

I think I am in the minority here, and I am not an expert on climate change, but David Archer at Real Climate is an expert as far as I can tell

http://geosci.uchicago.edu/people/archer.shtml

My view is based on several posts by Dr. Archer concerning Methane:

http://www.realclimate.org/index.php/archives/2013/11/arctic-and-american-methane-in-context/

http://www.realclimate.org/index.php/archives/2012/06/methane-game-upgrade/

http://www.realclimate.org/index.php/archives/2012/01/much-ado-about-methane/

I would read the oldest first (Jan 2012) and then work your way to the most recent (Nov 2013).

This is just one scientist’s view, but my impression is (as an outsider to the field) that Dr. Archer’s view is in the mainstream of the climate change community. Dr. Archer’s position strikes me as reasonable, but I could be wrong.

Dennis Coyne

Thank you Dennis.

I have reviewed the 3 papers that you referenced and noted that in Dr. Archer’s last paper, dated Nov. 24, 2013 he does insert the caveat:

Changes in the atmospheric concentration scale more-or-less with changes in the chronic emission flux, so unless these sources suddenly increase by an order of magnitude or more, they won’t dominate the atmospheric concentration of methane, or its climate impact.

Dr. Archer also notes that while Methane emissions are higher than most scientists thought, it is short-lived in the atmosphere. The EPA claims 12 years.

http://epa.gov/climatechange/ghgemissions/gases/ch4.html

Mr. Lights paper seems a bit alarmist with some strong opinions and it was perhaps produced to fit an agenda. I am concerned with his call for Geo-engineering – something which I believe might create a worse problem.

Thank you for the additional information and a special thanks to Ron for providing the information and insights that are found here.

Dennis & Tim,

I have listened to many interviews and watched many video presentations on climate change with the majority coming from Paul Beckwith. Paul had a recent interview in which he explains why Dr. Archer’s understanding of methane is lacking.

Even thought Archer is an expert on Methane, Beckwith says he is a in-house climate modeler. Basically, Archer’s strength is in his modeling from where he gets his forecasts and opinions on methane release.

Beckwith goes on to say that the data coming from field scientists who are studying and measuring the methane are seeing changes occurring much more rapidly than what the IPCC and Archer have forecasted.

The problem with Archer is that he is basing his work on models that are becoming worthless as the conditions in the arctic are rapidly changing. Again, Archer is not a HANDS ON scientist.

Furthermore, Beckwith believes the huge anomalies, either extreme cold or hot are taking place because the Arctic is heating so much that it is messing up the Jet Stream. The hot air in the Tropics and extreme cold air in the Arctic are what make the Jet Stream move and function normally.

However, now that we are seeing 20+ C anomalies in Arctic temperatures IN THE WINTER, it is causing the Jet Stream to fracture and slow down. This is why there have been 6-12 months of rain fall taking place in areas in just a few days. The Jet Stream is slowing and becoming volatile.

Anyhow, I have listened to many different climate scientists and I have to say Beckwith is the most well rounded and probably a Genius when it comes to putting all the pieces together as it pertains to climate change.

steve

Dennis & Tim,

Here is an excellent 3 part video on Paul Beckwith’s explanation on Global Atmosphere disruptions and Extreme Weather

PART 1: http://www.youtube.com/watch?v=EKq_XRdeonY

PART 2: http://www.youtube.com/watch?v=59ma5msE64E

PART 3: http://www.youtube.com/watch?v=3ZoIPjmj9Vk

steve

SRSrocco –

I just watched the videos – and they certainly are an eye opener. In the second video Beckwith clearly states that he believes we are “undergoing an abrupt Climate Change Today.”

He also discusses the PETM climate change – with temperatute changes of 5-10 degrees Celsius in a decade or two.

Here is an article I found on the event I believe Beckwith is referencing:

PETM Shocker: When CO2 Levels Doubled 55 Million Years Ago, Earth May Have Warmed 9°F In 13 Years

http://thinkprogress.org/climate/2013/10/08/2750191/petm-co2-levels-doubled-55-million-years-ago-global-temperatures-jumped/#

Interesting times ahead.

Near the top of the article:

“I think that will be revised later because the Bakken had a bad month in November.”

Helms said November was pretty good, a better month than October. It is December that has been poor.

Last week’s decline in US natural gas storage was 177 BCF, versus 285 BCF the week before, for a two week average decline of 231 BCF/week. Storage at the end of last week was 3,071 BCF.

The natural gas market be interesting by the end of the heating season. Note that the forecast high temperature for New Year’s Day in International Falls, MN is 12 degrees below zero (Fahrenheit).

WSJ: Natural-Gas Inventories Show a Shift in Market

http://online.wsj.com/news/articles/SB10001424052702304753504579282442825702268

Excerpt:

While not quite going from feast to famine, the U.S. natural-gas market suddenly looks a lot different.

Futures prices have soared of late to a two-and-a-half year high as cold weather caused a spike in heating demand, taking an unprecedented bite out of inventories. Last week’s report on underground gas stockpiles from the Energy Information Administration showed a drop of 285 billion cubic feet, shattering the previous weekly record established in January 2008. The report for the week ended Dec. 20, due Friday, should show a more typical reduction. . . .

It has been conventional wisdom in the industry that a glut of cheap gas from shale deposits would keep prices depressed for the foreseeable future. And it is odd that the record (285 BCF) draw came during a week that wasn’t nearly as cold on a population-weighted basis as when the 2008 record was set. The amount of gas available for heating demand may be lower than many analysts believed.

Another week and another massive draw in total commercial petroleum inventories:

http://ir.eia.gov/wpsr/wpsrsummary.pdf

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.7 million barrels from the previous week. At 367.6 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 0.6 million barrels last week, and are in the upper half of the average range. Finished gasoline inventories increased while blending components inventories decreased last week. Distillate fuel inventories decreased by 1.9 million barrels last week and are below the lower limit of the average range for this time of year. Propane/propylene inventories fell 2.5 million barrels last week and are well below the lower limit of the average range. Total commercial petroleum inventories decreased by 12.7 million barrels last week.

Hey guys, over on PeakOil.com this morning you will find this:

Jeremy Jackson: Ocean Apocalypse

This is a one and one half hour video of what is happening to our oceans. (1 hour for the lecture and slides and 1/2 hour Q&A) This is all about what is happening or has already happened, not just what is going to happen. It is all about data, not theory.

It is shocking.

Ron,

Thanks for the link on the OCEAN APOCALYPSE. I saw the entire presentation and agree 100% with your reaction.

Ron… after I went through all the recent climate change data and that Ocean Apocalypse presentation, my focus on energy and the precious metals seems much less important. I don’t know about you, but I think we are in for serious trouble… and much sooner than later.

steve

WTI tops $100/barrel this morning. Something must be going on, but what!

Inventories are down, oil stocks dropped 4,731,000 barrels from 372,305 kb to 367,574 kb.

The EIA’s Weekly Petroleum Status Report was delayed two days because of the Christmas Holiday.

In my major metropolitan area, GasBuddy is showing on Dec 28 2013: ~ sixty+ locations selling ‘regular’ gasoline between $2.57 and $2.95/U.S. gallon.

Unfortunately possibly means more consumers will give themselves the gift of gas guzzling new vehicles. A few years hence, many of them may wish they spent the same money (or less) on a Prius rather than their tricked-out big pick-up or SUV.

Iran deal is falling apart.

The feds are predicting that only one percent of cars will be electrics in 2040.

http://www.wired.com/autopia/2013/12/electric-cars-2040/

I think they will be as far off in this prediction as they have been on the price of oil historically speaking.

It’s hard to believe they are doing anything except whistling past the grave yard if they actually are serious about believing gasoline will still be under four bucks adjusted for inflation.

I find it a lot easier to believe they are following the unwritten but very real rulebook that details the rules for going along to get along and putting out predictions intended to keep their political masters happy and their paychecks and retirement secure.

Gasoline and diesel engines are about as good as they will ever be after a century of development whereas battery technology is still in elementary school and it is reasonable to expect enormous progress in battery capacity , durability, and manufacturing cost over the next couple of decades.

Batteries pushed submarines around half a century ago. Haven’t improved all that much since. They are in subs still as reactor backups. Ask a guy who works on them. Not much improvement.

“Batteries pushed submarines around half a century ago. Haven’t improved all that much since.”

Not really. It was a pair of 10 to 16 cylinder diesels that moved Subs. The batteries were only used for very short periods when the sub was fully submerged and trying to evade surface warships.

“They are in subs still as reactor backups.”

For the reactor cooling system and to power the electronics when there is a problem with the reactor. The batteries are not used for propulsion.

“Gasoline and diesel engines are about as good as they will ever be after a century of development whereas battery technology is still in elementary school and it is reasonable to expect enormous progress in battery capacity , durability, and manufacturing cost over the next couple of decades.”

Batteries have been around well before Gasoline and Diesel engines. The Lead Acid battery was invented in 1859, well before the age of internal combustion engines. To believe Battery technology is in “elementary school” was be a false analysis. Battery Technology has nearly reached its limits, as there is little improvement left. Most the improvements left have trade-offs. Charging cycles can be increased, at a cost of less capacity, and capacity can be increased, but at a cost of few charging cycles.

The issue with all batteries is anode erosion as every time a battery recharges, it losses some of the anode mass. Eventually the anode looses to much mass and falls apart. Battery capacity is a function of how much surface area is exposed to the electro-chemistry. The more surface area, the more capacity a battery has. As the surface area is increased the thiner the anode is which subjects the anode to rapid failure since there is less mass available during recharging.

Back in the 1980s and 1990s there was a big push for fuel cells that do not suffer the problems of batteries, but the technology was never price competitive because relies on precious metals or expensive alloys and expensive membranes that degrade over time. Its very improbable that any significant improvements to fuel cells will be made in the near future.

Today, researchers are focusing on hybrid batteries using super-capacitors. SuperCaps have an unlimited number of charge cycles since there is no electro-chemical reactions. The problem with SuperCaps is that they can only provide about 1/20 to 1/50 of the capacity of a battery and have relatively high self-discharge rates. However, when they couple SuperCaps with batteries, they can extend the capacity and recharge cycles probably by 50% to 100%. Still this isn’t going to be sufficient to displace fossil fuels in transportation.

If there is ever a breakthrough in power storage it will not be electo-chemical batteries, fuel cells, or SuperCaps. It will be something entirely different.

My recommendation stands that everyone should have a “Plan A” to be self-reliant, and not bet the farm that technology will find a solution. Believing in a techno-solution is the same in believing in fire breathing dragons or other mythological creatures exist.

It’s true that batteries have been around for a very long time.I should have said that “modern” batteries, the sort of batteries made possible by twenty first century chemistry , electronics, and manufacturing technology, are still in elementary school.

One more doubling of capacity and one more halving of cost will make modern batteries sufficiently powerful and affordable to compete quite well with gasoline and diesel engines in passenger cars and light trucks for the majority of people .

Those of us- in my humble opinion- who don’t think batteries and electric vehicles are the future of personal transportation just don’t seem to get it- the vast majority of autos and light trucks are driven under a hundred miles a day the vast majority of the time.

We live in a two and three car per household world in the rich countries, and one car out of of the two or three with a gasoline or diesel engine will suffice for the occasional longer trip.Most people who can afford only one car will buy an ice car if they think they really need long range of course , for decades to come.

But otoh, we live in a world with improving mass transit,especially rail transit, and it gets easier to rent a car every year.There are car rental businesses even in towns too small to have more than one or two traffic lights.

I’m a gear head of sorts, even a back yard amateur engineer, and I have spent years in an industrial environment working on all sorts of machinery including cars and trucks and farm machinery, and I know a few things after all this time about ice’s, multi speed transmissions, and electric motors.

There are literally hundreds of intricately machined moving parts manufactured to very close tolerances in engines and transmissions and every last one of these parts is subject to wearing out from friction and to failure due to thermal cycling,high stress loads, corrosion, and failure of secondary systems such as the radiator.

It may come as an utter surprise to believers in ice’s , but it is quite common for ice’s and the transmissions associated with them to fail at well under one hundred thousand miles and require repairs that cost well into the thousands of dollars.Four to six thousand dollar engine and transmission rebuilds are par for the course in a lot of popular vehicles these days and two and three thousand dollar repairs are absolutely commonplace, the bread and butter work of every engine and transmission shop.

On the other hand , an electric motor has no more than a bare handful of parts parts subject to friction , no shock loads associated with reciprocating parts, no elaborate cooling system to fail, and only a few dozen parts in total.

A high quality electric motor is a lifetime machine.

And as far as Aamco goes- well, there generally aint no stinking transmission in an electric car.

An electric car that is well cared for truly has a practical potential lifetime measured in generations if it doesn’t rust away, except for the battery.

Put in a new battery, new wheel bearings, a few rubber bushings in the suspension, new struts and or shocks, and you are looking at a refurbished electric car that can be expected to last as long as the new battery with very very few repairs.

The Toyota Pruis has already proven that a modern battery can last for hundreds of thousands of miles ; very few older Prius batteries have failed thus far.

Tesla has shown us already how easy it can be to swap out a battery. I think it is very likely the battery in any mass produced car will be easily swapped in a matter of a three or four hours max if and when it must be replaced, and that the swap will not require the services of a highly paid mechanic- swapping a battery out will be low paid grunt work similar to swapping out tires.

When the public figures out just how reliable and economical an electric car really is- once batteries are better developed of course- electric cars are going to be seen in a new light by current potential buyers.

Now as far as cafe buyers in developing countries are concerned- well, this is a peak oil site, and the audience here can appreciate the export land model if any audience can.

Governments in oil importing countries are going to have an ever increasing trouble paying for imported oil , but there is plenty of free wind and sun in most developing countries.Coal is still cheap and is likely to stay cheap for quite some time.

A person who has never had a car before will be satisfied with an electric car even if it has only a fifty mile range- thats easily ten times the practical time limited range of a horse drawn wagon and at least five times the range of a bicycle unless the rider is a rather athletic individual.

Plain old ordinary incremental improvements in design and manufacturing processes plus economies of scale will bring us batteries that cost us half as much with twice the capacity as current day batteries within a decade.

Any technical breakthroughs in battery design will simply be more gravy on the meat and potatoes.There will be some breakthroughs – maybe not paradigm changers, but welcome nevertheless.

All true. The one thing OFM left out is that the electric cars are 7 X as energy-efficient; we get 4.2 miles per KWH (140 MPG equivalent).

For less than the cost of 3 years’ gasoline for an average gasoline car, you can buy solar panels to power an electric car for the same number of miles per year for the rest of your life.

We have had a Nissan Leaf and Chevy Volt for two years now; they work great. No issues. No repairs.

Another side of the oil and gas boom:

http://www.npr.org/2013/12/27/250807226/on-the-job-deaths-spiking-as-oil-drilling-quickly-expands?ft=1&f=1001

Good AP article on the global retirement crisis:

http://hosted.ap.org/dynamic/stories/U/US_GREAT_RESET_RETIREMENT?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT

It’s interesting to read this article, and then plug in assumptions about constrained global net exports of oil.

Given peak oil, peak food production, climate change impact on farming, peak other resources, difficult to see anything other thann a decline in age expectancy in the developed world, rising death rates and declining population. Combine all this with youth unemployment and shortage of affordable housing for young first time buyers and a falling fertility/birth rate. As for the less developed world…….

Can’t see this 10 billion by 2050 ever being achieved like the “experts” keep talking about .

From your link:

Here’s the excerpt I attempted to block quote:”Leslie Lynch, 52, of Glastonbury, Conn., had $30,000 in her 401(k) retirement account when she lost her $65,000-a-year job last year at an insurance company. She’d worked there 28 years. She has depleted her retirement savings trying to stay afloat.”

The rest of my comment above is my reaction to that.

Many of those interviewed in that article point out how vacations to distant lands are essential to their lifestyle. It is odd how hopping on a plane has become essential in just a generation, or two.

The way I see it tourism and civil aviation as we know it are the first industries to whither…

It’s interesting to read this article, and then plug in assumptions about constrained global net exports of oil.

Ya, right. Constrained global net exports of oil, my ass. Where is the 6 mb/d decline in U.S net imports of crude oil and petroleum products in your grossexport land model?

And to squash all the high price, “easy oil is gone” anecdotal bullshit, U.S. domestic consumption of energy goods and services and gasoline is not historically out of whack relative to after-tax income.

Interesting graphs, Marmico. I believe you will find the net imports of crude shown in Ron’s final graph above. Not news here. And re: the ratio of US income spent on energy products graph – yeah, it’s the lack of awareness of the approaching storm that’s troubling, here. Pretty much everyone – apparently including you – is going to be caught by surprise as tight oil peaks and there isn’t anything to pick up the slack. As Patrick Reynolds points out above, the US is not going to be able to import those prior levels again, ever, at any price. Most folks have no clue because they aren’t reading sites like this. You apparently have some other reason for lacking said clue. Oh, and you could stand to clean up your language a bit. This is a civil discussion.

Cheers,

Clifman

While (currently) rising US crude oil production and a post-2005 decline in consumption (with an apparent rebound in 2013) have affected our demand for oil imports, I fail to see how a decline in demand in a net oil importing country affects the global supply of net oil exports (other than having an effect on prices of course).

In any case, following are the net export supply data:

Global Net Exports of oil (GNE*), 2002 to 2012:

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps3161a25b.jpg

Available Net Exports of oil (GNE less CNI), 2002 to 2012:

http://i1095.photobucket.com/albums/i475/westexas/Slide04_zpsd68833b7.jpg

GNE/CNI Ratio, 2002 to 2012 (Showing extrapolated decline to 2030):

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps9ff3e76d.jpg

What I define as Available Net Exports (or ANE, i.e., GNE less CNI) fell from 41 mbpd (million barrels per day) in 2005 to 35 mbpd in 2012. While there has been a rebound in US consumption, there is some question about how accurately the EIA is accounting for product exports in the short term, but in any case I would argue that the dominant post-2005 pattern, at least through 2012, was that developed net oil importing countries like the US were gradually being forced out of the global market for exported oil, via price rationing.

I think that most countries fundamentally misunderstand what is going on in the global oil market, or probably more accurately, we are seeing denial on a global scale, what one writer called “The Age of Denial.”

To the extent that we have seen a rebound in the US economy and in US oil consumption, it’s important to remember how many trillions of dollars in deficit spending we have seen in recent years (largely financed by the Fed).

I think that the fundamental reality we are facing is that we are in the middle of a relentless transformation from an economy focused on “Wants,” to one focused on “Needs.” But governments in developed net oil importing countries refuse to acknowledge, or are incapable of acknowledging, this transformation, and they are desperately trying to keep their “Wants” based economies going via increased deficit spending, despite the post-2005 decline in the volume of Global Net Exports of oil available to importers other than China & India.

As shown in the third slide, at the 2005 to 2012 rate of decline in the GNE/CNI ratio, in 17 years China & India alone would theoretically consume 100% of Global Net Exports of oil.

I suppose that one way to look at the data is that a lot of developed net oil importing countries might not have to worry about how to pay for their oil imports in future years.

*GNE = Combined net exports from (2005) Top 33 net oil exporters, total petroleum liquids + other liquids, EIA CNI = Chindia’s Net Imports of oil

It’s instructive to review what has happened, from 2002 to 2012 for key net export and consumption ratios, versus annual Brent crude oil prices, which rose at an average rate of 15%/year from 2002 to 2012 (with one year over year decline, in 2009).

Normalized Liquids Consumption (2002 = 100%) for China, India, (2005) Top 33 Net Oil Exporters and the US, Vs. Annual Brent Crude Oil Prices:

http://i1095.photobucket.com/albums/i475/westexas/Slide14_zpsb2fe0f1a.jpg

GNE/CNI Ratio* Vs. Annual Brent Crude Oil Prices:

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps5f00c6e5.jpg

GNE/CNI Ratio* Vs. Total Global Public Debt:

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zps01758231.jpg

*GNE = Combined net oil exports from top 33 net oil exporters in 2005, EIA data, total petroleum liquids + other liquids

CNI = Chindia’s net oil imports

Here’s a link worth a minute or two:

http://peakoil.com/production/daniel-yergin-the-global-impact-of-us-shale/comment-page-1#comment-64627

Personally I think this article just more of the same sort of “happy motoring forever” poorly founded optimism that will eventually result in anybody and everybody having to deal with a supply crunch that will bring the world economy to it’s knees . Nevertheless it pays to keep up with what people like Yergin are saying.

I will say this for him. He’s an extraordinarily capable writer, and anybody who reads his older book “The Prize” is in for a highly enjoyable and heaping helping of energy history.It may be the best single book ever written dealing with the history of the oil industry, up until it’s publication, but of course it’s outdated now in respect to more recent history.

When time permits I intend to read his new book.

Hello everyone,

I teach ecology and conservation biology and one of my old students sent me the following link:

http://www.footprintnetwork.org/en/index.php/GFN/page/calculators/

I have not done any research on the site and so I do not know how accurate the footprint calculator is. But I thought many of you would find it interesting. For what it is worth, I am a vegetarian (not vegan) one child, drive a Smart car and my score was a “4”. My biggest points likely came from my single family home that is powered largely by fossil fuels.

Best,

Tom

Interesting, but it’s perfectly meaningless for those of us who grow a good portion of our own foods.

http://www.bbc.co.uk/news/business-25546725

A short interview with the Shell UK chairman. Towards the end he makes the statement ‘the easy oil in the world is gone’. Not really a shocker but the interview is running hourly on the BBC. Unfortunately I doubt many people are paying attention to it, Schumacher being in a coma is far more interesting.

I live in South East Wisconsin, specifically Racine, which has been hit hard financially and whose manufacturing base has been decimated. The jobs only leave and empty factories and homes are increasing. The former Chrysler Plant in Kenosha was recently torn down and the loss of those jobs and that factory has impacted the region hard. As I began seeing all the boarded up houses, stores and factories, I began using government databases and information to begin researching some of these closings. I use on-line Property Records, WI. Department of Revenue Databases such as Delinquent Taxpayers and IPAS (Integrated Property Assessment System, CCAP (Circuit Court Access), along with local government budgets and their audited financial reports, to get a clearer view of what Peak Oil has meant locally.

What I find is shocking – and leads me to conclude that South East Wisconsin, Racine in particular, is heading for Bankruptcy/Default and it’s irreversible. Property assessments have decoupled from sale prices by tens of thousands – large numbers of properties are in arrears and underwater. Downtown businesses which have political connections have not paid their property taxes in 5+ years and are allowed to continue operation. Assessed values have to remain high because Wisconsin law limits municipal borrowings based upon a percent of total assessed value. Forgive my political messages, but I publish the data in a blog from time to time – and those interested can take a look here:

http://racinesales.wordpress.com/

AWS says: The way I see it tourism and civil aviation as we know it are the first industries to whither…

Racine’s future, according to the politicians is based upon those 2 things. Racine has invested in DeltaHawk, which promises to revolutionize airplane small engines, but has so far failed to deliver, and Peak Oil almost guarantees it’s failure:

RACINE — DeltaHawk officials have said it before and they’re saying it again: They will start making aviation engines — soon!

http://journaltimes.com/business/local/deltahawk-struggling-before-takeoff/article_5e999cbe-702f-11e3-a7fa-001a4bcf887a.html

The other business venture is Reef Point Marina, which Racine County took over in 2013 and says will revitalize the City. The Boaters will save Racine is the mantra! Looking at the County Budget I found that the occupancy rate was only 42% and the new Bar and Restaurant that replaced the former failing Bar and Restaurant is being given a pass on making rent payments – because it is unprofitable like the last venture. Further, there are problems with the infrastructure that will require tens of millions of $$$ in the future.

The end of growth is here, and locally, this may be the beginning of a trend:

SILVER LAKE — Dissolving or un-incorporating the village of Silver Lake is an idea that has gotten some lip service over the last couple of months.Officials there are struggling to balance the annual budget, maintain services, attract a commercial tax base and keep taxes in check.

“I think it is something we may have to consider given that we have no growth and no potential for growth in the near future,” trustee Patrick Dunn said.

http://www.kenoshanews.com/news/village_of_silver_lake_may_dissolve_474942789.html

The ending of extended unemployment benefits and the rise in natural gas prices will only exacerbate the situation. That is my local view.

Re: Tim. E.

The GELM (Government Export Land Model)

Let’s think of local and state (provincial), and for that matter, national governments as being similar to oil exporting countries, in that they consume a percentage of tax revenues and net debt infusions, in order to pay current benefits to employees and operating expenses and to pay current and future retirement/health benefits.

And let’s just really focus on current and future retirement benefits.

As Michael Lewis noted in his recent book, “Boomerang,” a lot of local governments, especially in California, are on track to consist of little more than a small staff that collects taxes and forwards virtually all tax revenue to retirees. And of course, most public pension systems are assuming a (highly unrealistic) estimate of 7% to 8% on future annual returns. Of course, the lower the actual investment return, the larger the unfunded pension obligation.

In any case, if we assume flat to declining tax revenue, combined with rising retirement obligations (especially as investment returns continue to disappoint), it seems to me that the net result would be an accelerating rate of decline in services provided to the taxpayers, perhaps even as governments try (probably) unsuccessfully to materially raise tax revenue, by raising tax rates

Excerpt from an Amazon review of “Boomerang”

Quoting Lewis quote UCLA neuroscientist Peter Whybrow in the book’s last chapter (on California’s financial problems, not European countries), Lewis writes, “‘Human beings are wandering around with brains that are fabulously limited. We’ve got the core of the average lizard.’ Wrapped around this reptilian core is a mammalian layer (associated with maternal concern and social interaction), and around that is wrapped a third layer, which enables feats of memory and the capacity for abstract thought. ‘The only problem is our passions are still driven by the lizard core.’ Even a person on a diet who sensibly avoids coming face-to-face with a piece of chocolate cake will find it hard to control himself if the chocolate cake somehow finds him. Every pastry chef in America understands this, and now nueroscience does, too. ‘In that moment the value of eating the chocolate cake exceeds the value of the diet. We cannot think down the road when we are faced with the chocolate cake.’ … Everywhere you turn you see Americans sacrifice their long-term interests for a short-term reward.”

Peak chocolate cake – 2007?

The go to book for anybody interested in learning something on the layman’s level about the three level brain is ” The Dragons of Eden” by Carl Sagan if memory serves.

It’s fairly short, highly enjoyable and available from any large library.

And small town librarians can borrow a copy for you from another library, although the one I use has found it necessary to charge a couple of bucks to cover the postage.

The longer I live, the more I come to appreciate some of my professors, like the one who had us read The Dragons of Eden in a freshman seminar those many years ago…

Police Salaries and Pensions Push California City to Brink:

http://www.nytimes.com/2013/12/28/us/police-salaries-and-pensions-push-california-city-to-brink.html?hpw&rref=us&_r=0

Bankruptcy is the only way to get back the increased pensions that were retroactively granted in the mid 2000s by a lot of agencies in California based on false information from PERS about future returns from the pension fund. The only thing that made 8% returns possible was continually reduced interest rates, which had pumped up bond yields since the 80s. It doesn’t require a financial hotshot to figure out that once interest rates go to 0 that the process of increased returns from falling bond yields will end. PERS knew this but presented the increased retirement benefits as a no cost perk to local agencies. Bottom line is they lied and are now trying to stick the public with the tab. Many local agencies owe PERS tens of millions to pay off the retroactive pension increases.

Peak Oil will be local!

Bakken Production Profit

I started work on trying to estimate how much money a typical Bakken well makes over its lifetime. Originally I used a simple decline curve of about 38% about a week ago. Ron posted a better production curve since my original estimate was not accurate. So I took the graph and created a table with about 50 data points so I could create a curve fit equation. From the data set I generated a ten order curve fit equation that I believe matches the decline curve fairly accurately. Below is a link to a graph using the curve fit equation:

http://s1361.photobucket.com/user/TechGuyFive/media/BakkenWellProductionCurveFitPlot_12-24-2013_zpsfdcc6193.png.html

Using the curve fit equation, the estimated total recovery of oil is about 200K (199,871) barrels over a six year period. If we assume that the total cost of drilling and operation of the well is $15 Million USD, and the average price per barrel of LTO is $65 bbl, the average bakken well loses about $2 Million USD. 200K*65 is about $13 Million. My guess is that the drilling and production costs are less than $15M and the average prices for LTO is probably higher than $65/bbl. Regardless, the profit margins on Bakken production are likely to be razer thin.

If anyone has Mathematica or Matlab here is the plot equation you can use for your own purposes:

Plot[2.718281828^(6.289439107718543` – 0.011543315289183781` x +

0.00006035241819860633` x^2 – 1.9952239638304292`*^-7 x^3 +

3.962939760372318`*^-10 x^4 – 4.923012495812217`*^-13 x^5 +

3.860008680236791`*^-16 x^6 – 1.85110898087435`*^-19 x^7 +

4.939129575330045`*^-23 x^8 – 5.5985240664919645`*^-27 x^9), {x,

0, 365*6}, PlotStyle -> {Red, Thick}, PlotRange -> Full,

GridLines -> {{30, 60, 90, 120, 150, 180, 365, 365*2, 669, 365*3,

365*4, 1429, 365*5}, {500, 450, 400, 350, 300, 250, 200, 150, 100,

50, 32}}]

Hi Tech Guy,

Very nice. Let’s try the calculation as follows. We will assume the Bakken crude is shipped to the East Coast at a cost of $12/barrel and the refinery is willing to pay $100/barrel (essentially we will assume Brent prices remain at $100 or above and that this determines the refinery gate price on the East coast). So at the wellhead the price is 100-12=88 per barrel. Royalties and taxes are 24.5% of the well head price or $21.56/barrel and operating costs are $4/barrel so the net revenue is $62.44 per barrel. The capital cost of the well (for drilling and fracking) is $9 million. The net revenue is 12.49 million if we assume a zero discount rate. Profit is 3.49 million dollars with no discounting, when done properly, we determine the net present value (NPV) of future cash flows. If the NPV is greater than or equal to the capital cost of the well, then the well has a positive profit over its life. In this zero discount rate scenario, if the Brent oil price drops to $82.56 the well barely breaks even, this is equivalent to $45/barrel net revenue at the well head after operating costs, royalties and taxes are paid.

DC

Interesting that Texas crude production rises exactly 50 kbpd since March: http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPTX2&f=M

I think you meant exactly 50 kb/d per month since March.

Yes, that is very strange. One would would think they are just plugging in numbers. I know that is what I think. Thanks Kam for pointing this out. The odds that Texas crude oil would rise by exactly 50 thousand barrels per day ever month for seven straight months is astronomical. They are just making up stuff. How much oil has really been produced in Texas since March? I have no idea and I doubt that the EIA has either.

Bingo.

In this past year we have caught several items like this.

ZeroHedge seems to gravitate its reader base to a similar reality, which would go something like:

Things are getting great according to the numbers — that no one should believe.

The data that the EIA is showing for Texas + Louisiana (marketed) gas production are pretty interesting.

January, 2012: 881 BCF (28.4 BCF/day)

January, 2013: 850 BCF (27.4 BCF/day)

Difference: -31 BCF (-1.0 BCF/day)

September, 2012: 850 BCF (28.3 BCF/day)

September, 2013: 792 BCF (26.4 BCF/day)

Difference: -58 BCF (-1.9 BCF/day)

Note that Texas hit 21.3 BCF/day in December, 2012, versus 20.4 BCF/day in September, 2013.

LA Gas Production:

http://www.eia.gov/dnav/ng/hist/n9050la2m.htm

It seems likely that budget cuts are making it impossible for the eia to do it’s job.

DC

There’s been another oil train wreck.

Fortunately this one did’t hurt anybody, according to early reports.

I saw an early report that seems to have vanished that said the oil train hit another train that had

itself derailed, presumably blocking there oil train’s track.

http://edition.cnn.com/2013/12/30/us/north-dakota-train-fire/index.html

The big German newspaper Frankfurter Allgemeine (FAZ) stated the same as you. The following link contains a longer Video with voice comments in German that restate exactly what you have read elsewhere: http://www.faz.net/aktuell/gesellschaft/ungluecke/vereinigte-staaten-gueterzug-mit-oel-explodiert-12732767.html

Looking at these explosions, I believe shows how light this oil is. These explosions look very much like a BLEVE rather than an oil fire. BLEVEs are normally associated with liquidized gasses, eg LPG and LNG.

LTO is “barely crude”. : )

Correct, that was my point.

I can see some disruption in rail oil transport as regulations are tightened up, especially as there is a massive back log in rail tanker cars already in progress, and it will be very difficult to up grade the tanker already in service in a short time period.

From G&M, some good background on the volatility of Bakken LTO…

VIDEO: How oil from the U.S. Bakken formation decimated Lac-Mégantic

… and the latest article on their investigative reporting on Bakken LTO rail transport.

North Dakota’s explosive Bakken oil: The story behind a troubling crude

Grant Robertson, The Globe and Mail

Published Tuesday, Dec. 31 2013, 11:36 PM EST

IS this stuff so light it will always sell at a discount to the more easily processed somewhat heavier crudes?

It’s been my impression so far that it has sold at a discount because of transportation bottlenecks.

We’ve all heard about the guy with his foot freezing water hand his head in a fire being , according to a statistician, comfortable on the average.

But it does occur to me that this super extra light crude might be used advantageously- without very much chemical restructuring- by blending it into a very heavy crude during the refining process .

Any given “too light” molecular fraction of the light tight oil would have to be either “fattened up” chemically speaking or else used for some other purpose than gasoline, diesel, or lubricating oil. But the heavier fractions of lto might be easily blended into gasoline or diesel being made from an extra heavy crude.

I’m in over my head but I’m sure somebody in the forum knows how the economics of processing a super light crude play out at the refinery and therefore the implications for the price of it once the transportation infrastructure catches up.

“But it does occur to me that this super extra light crude might be used advantageously- without very much chemical restructuring- by blending it into a very heavy crude during the refining process .”

While I am not a Petro-chemist, I don’t think it works that way. When Crude is refined its typically passed through a fractional distillation column to separate the various hydrocarbons by molecular weight. In order for LTO to be used to produce heavier hydrocarbon fuels they would need to use a chemical process similar to fischer-tropsch which is expensive and time consuming. I believe its much cheaper to use a hydrocarbon cracker to reduce heavy crudes into lighter hydrocarbons.

Adding LTO to heavier crudes does not result it chemical reactions that alter the molecular weight of the heavy hydrocarbons. There needs to be a chemical process to alter them. Adding LTO to crude would be like adding water to alcohol and distilling it. You still have the same quantity of alcohol in the batch, and when the process is done you just separated the water from the alcohol.

Perhaps LTO may be added to very heavy crudes as a solvent so that the heavy crudes don’t gum up the processing equipment. Another way may be to crack LTO into hydrogen gas use for cracking heavier crudes, but I believe hydrogen gas is usually produced using NatGas and there probably is a added cost to using LTO instead.

Found this:

http://www.econbrowser.com/archives/2012/07/shale_oil_and_t.html

“We’re still learning about tight oil. Here is an interesting anecdote. At my refinery, we started getting some kind of North Dakota sweet crude that evidently had amines in it at maybe 250 ppm levels. They concentrated in the overheads from our atmospheric distillation tower, and completely fouled our overhead coolers, forcing us to cut rates and eventually replace exchanger bundles at great expense and lost production.

While amines are common in refineries, they’re part of downstream processes that get sulfur out of fuels. They are generally not seen by themselves in crude oil.

Our best guess is that the frackers use amines in their fracking fluids. They’re probably benign until they get concentrated at the top of a atmospheric distillation tower.”

So it looks like LTO causes problems with fractional distillation.

Ha.. Many additives in upstream operations can cause problems in distillation towers. I remember a particular corrosion inhibitor containing phosphorus used in crude pipelines that was causing a particular tray in an atmospheric distillation unit getting fouled up with phosphorus deposits.

Also to add to the above, in adding LTO to heavy fractions does nothing to those fractions other than reducing viscosity, altering pour points and other physical properties, but heat it up and those fractions will flash off.

So- Light tight oil is not worth much if anything to use in the in the refining of heavy oil; this does not bode well for the price of it.

Might it be possible for a refinery to profitably refine lot by causing the small molecules to join together in pairs and make them of a size suitable for gasoline and diesel?

If the stuff can’t be used easily and economically to make a liquid fuel it will probably always sell at a substantial discount to other crudes such as Brent.

LTO has the right molecules for gasoline, and lighter fractions. Gasoline is comprised from 5 carbon molecules all the way to C10+ molecules. Deisel is much heavier. LTO molecules also find their way to chemicals through the fractionators.

http://www.rbnenergy.com/It-Aint-Heavy-Its-the-Bakken-light-heavy-crude

“Exception #4. I want my diesel back. Since we are talking about Oops, there is one last point to consider that was also illuminated by Jim Jones. The new crudes are light in another way. They are light on diesel yield. Bonny Light, one of the Nigerian crudes getting backed out of the Gulf Coast has kerosene (360-500 °F cut) and diesel (500-650 °F) yields at 20.8% and 24.8% respectively. For Bakken, the numbers are much lower at 14.7% and 14.3%. Condensates, which make up more than half of Eagle Ford production have even lower kero/diesel yields– well south of 5%. These numbers mean that refiners will be getting significantly less diesel out of the new crudes. Today refiners are making most of their money on diesel – so much so that the U.S. has become a net exporter of diesel, to Latin America and Europe. Declining distillate yields can’t be good news for the refiners who see this material coming. For this reason and others, it is entirely possible that distillate yields could become a primary determinant of future price differentials for different grades of crude oil.”

Hope explains a little, to see the link you will have to open an account, it is free, and a very handy site. Basically if you want gasoline and the refineries are set up for light oil, Bakken would be selling at a premium. Unfortunately the refiners have just spent a heap of money preparing for the flood of Canadian heavy oil sand, production and have an indigestion problem with all the LTO coming to market.

The other issue that seems to be appearing, is the Bakken oil that is blowing up in the train derailment seems to be lighter then what has been advertised. Are the sweet spots for the most preferred oil being crowed out and some of the less preferred oils now being produced? I don’t know the answer to that question but it is shaping up as though there are some near condensate being produced in the Bakken, and being sold as crude oil.

Gonna burn through a lot of NG in the next couple of weeks…

Bundle Up for New Year as Door to Arctic Is Wide Open

By Andrew Freedman

Published: December 31st, 2013 , Last Updated: December 31st, 2013

Care to speculate what the price of NG will do in the next couple of weeks?

And as noted up the thread, the year over year decline in Texas + Louisiana’s combined (marketed) natural gas production accelerated from down 1.0 BCF/day in January, 2013 to down 1.9 BCF/day in September, 2013 (relative to respective months in 2012, EIA).

Does anyone know what is behind the story about “maintenance water” for LTO oil wells?

maintenance water

The water is used to dissolve the salt. Is it done on a monthly basis?

Canabuck,

I must admit to never hearing the term maintenance water, but salt build ups whether it is Na salts Barium salts or any other salts are a problem in producing wells. Flushing with fresh water seems a reasonable method of keeping of keeping it under control, certainly beats pulling the completion tubing and cleaning it or replacing it.

To clean up the returning brine, then it could be put through a Reverse Osmosis unit. This would give a high concentration brine to be disposed of, along with clean water to be used for flushing the well. Now I have no idea of the cost of RO v buying fresh water, but this is the only method to recover any of this water. If they intend using too much water then they will need to get used to RO .

If anyone has any charts to post, please try to choose a chart to upload in the box below the comment.

Test with Temp images. Only one image per comment so if you need to do multiple images you would either need multiple comments or you could put several images in a word document then take a screen shot and edit.

Unfortunately this is the best I can do so far.

DC

Thanks DC.

Wikipedia’s 65 year trend in Canada’s annual high temperatures.

Notice the warming trend.