The latest OPEC Monthly Oil Market Report is out. There were no big surprises.

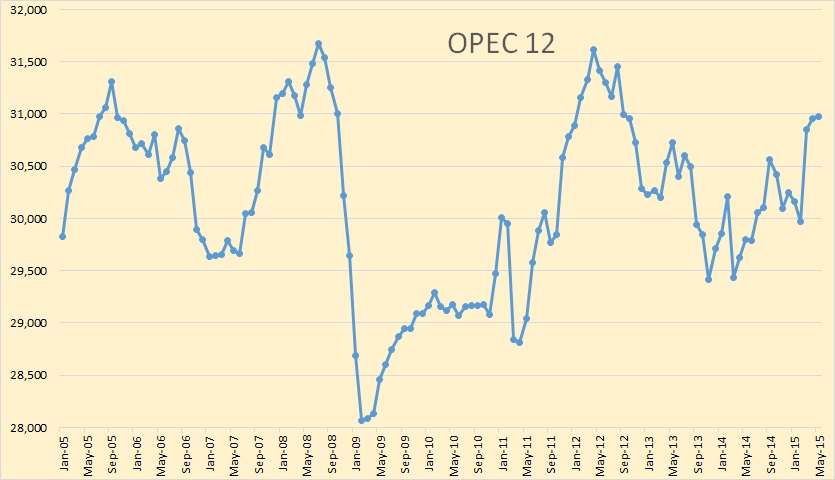

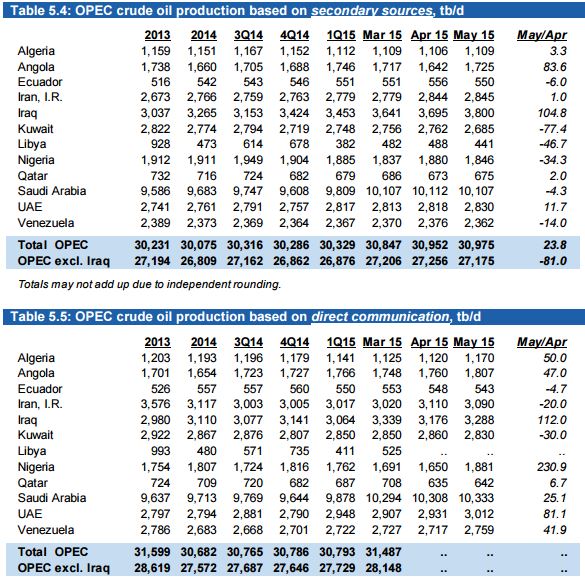

OPEC crude only production was up 23,000 bpd in May but that was after April had been revised upward by 110,000 bpd.

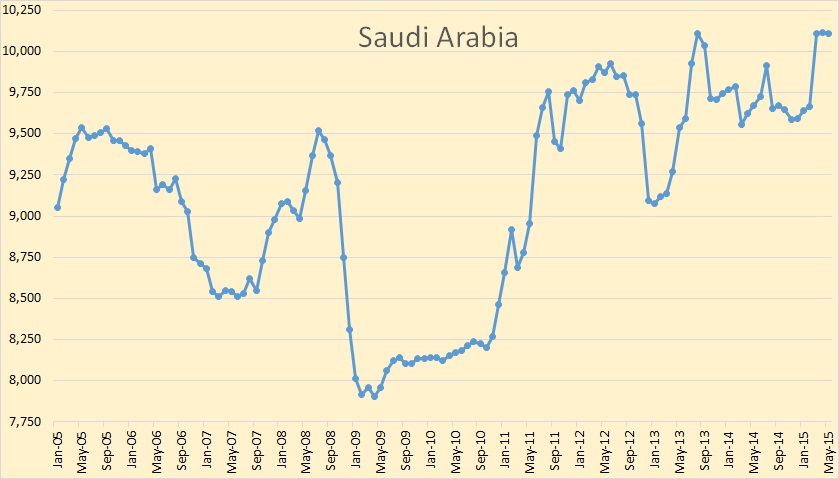

Almost no change is Saudi production, down 5,000 bpd to 10,107,000 bpd.

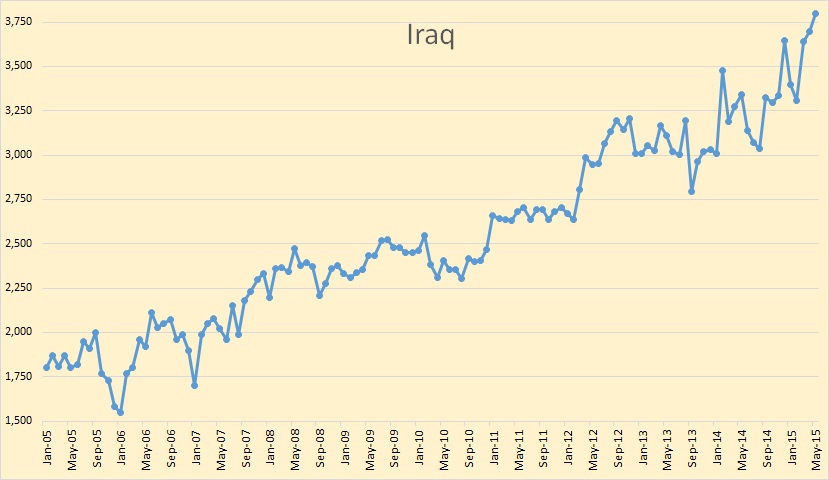

Iraq had the largest change of all, up 105,000 bpd to 3,800,000 bpd.

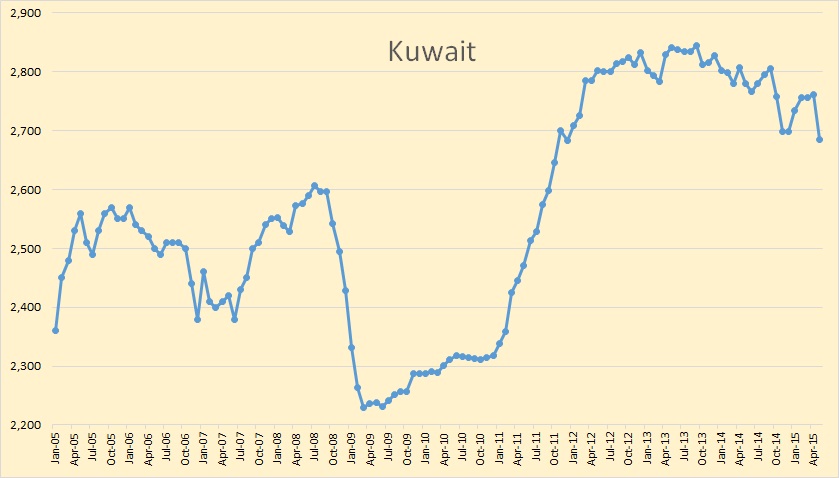

Kuwait suffered the largest drop in May, down 77,000 bpd to 2,685,000 bpd.

Above are the total changes for all OPEC countries. The top chart, “Secondary Sources” is the one I always use.

OPEC is expecting world oil supply to grow by 680,000 bpd in 2015.

World Oil Supply Non-OPEC oil supply in 2015 is projected to grow by 0.68 mb/d, in line with the previous forecast and below last year’s strong growth of 2.17 mb/d. OPEC NGLs are forecast to grow by 0.19 mb/d to average 6.02 mb/d in 2015, following growth of 0.18 mb/d in 2014. In May, OPEC production rose to 30.98 mb/d, up by 0.02 mb/d, according to secondary sources.

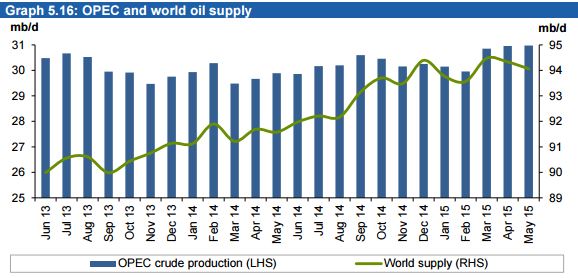

However world oil supply fell in May. They are talking all liquids here.

World oil supply Preliminary data indicates that global oil supply decreased by 0.27 mb/d to average 94.06 mb/d in May 2015 compared with the previous month. The decline of non-OPEC supply in May decreased global oil output, which was partially offset by an increase in OPEC production. The share of OPEC crude oil in total global production increased slightly to 32.9% in May compared with the previous month at 32.8%. Estimates are based on preliminary data for non-OPEC supply and OPEC NGLs, while estimates for OPEC crude production come from secondary sources.

Updated oil production charts of all twelve OPEC countries can be found at OPEC Charts.

Looking at the USA we get a mixed picture from the EIA.

The EIA’s Weekly Group says US C+C production is soaring. They have US production, in early June, at 9,610,000 bpd and rising. Since the last week in April they have total US production up by 227,000 barrels per day.

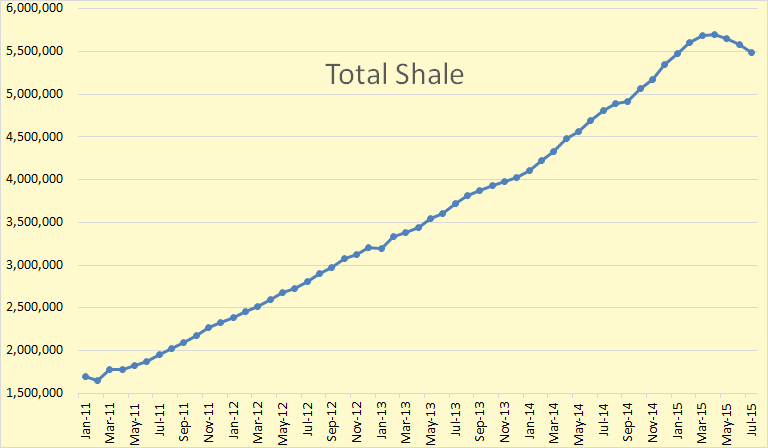

However over across the hall at the EIA, where the shale folks work, they say US Shale oil peaked in April and was down over 115,755 barrels per day in June. And since shale is where all the action is then we could expect total US production to be down by at least that amount.

The weekly folks say total US C+C production was up 227,000 barres per day since April while the shale folks say production was down 115,755 bpd and then will be down by another 93,000 bpd by the time July rolls around. Anyway the difference between what the weekly EIA folks say and what the shale EIA folks say is over 342,000 barrels per day. I think we can safely say that one of them is just flat out wrong.

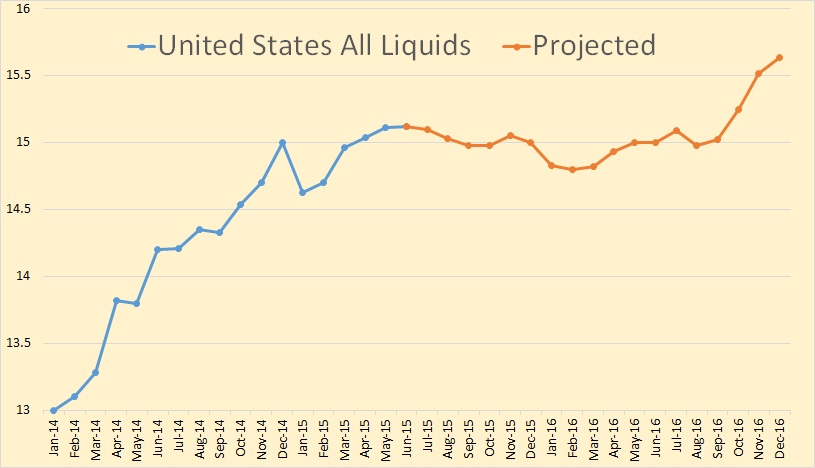

The above is from the EIA’s Short Term Energy Outlook which came out Tuesday. They have US Total Liquids up 80,000 bpd April to June. But they have all liquids peaking at that point and in a slight decline until October of 2016.

Of course shale production is not total C+C production and total C+C production is not total liquids production but they should all three go up or down together. Shale is where all the action is and total C+C and total liquids should follow shale, not in lock step of course but pretty close. But the idea of different groups at the EIA all coming up with different production numbers is getting a little absurd. It is, and should be, causing a lot of people to lose any confidence in anything the EIA does publish.

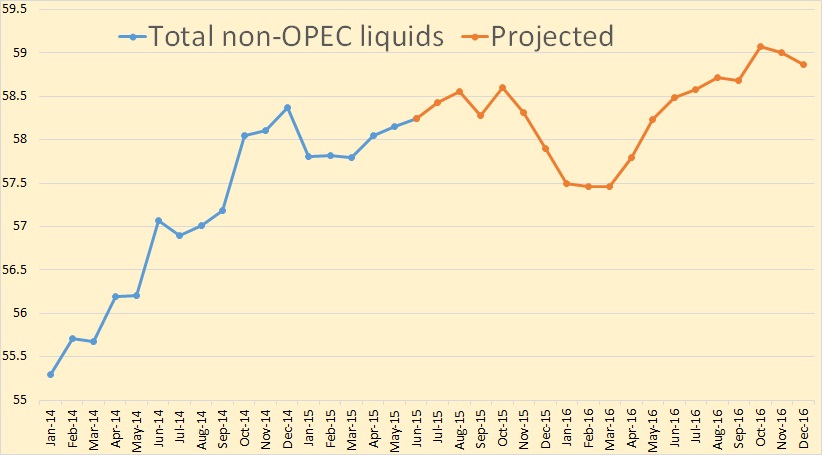

The EIA’s Short Term Energy Outlook has Non-OPEC total liquids peaking in October at 58,600,000 bpd before dropping over a million barrels per day in January, February and March, then heading back to new highs reaching 59,080,000 bpd in October 2016.

Sustainability, Transition, Carrying Capacity or whatever. There has been a lot of discussion on these subjects in the comments section lately. I plan on a post on these subjects in late June or early July. In the meantime I am cramming in every article, youtube video and article I can find on the subject. I watched two great ones last night, they are Mate Hagens latest on the subject:

Energy, Credit and the End of Growth, Nathan Hagens and

Nate Hagens – Turning 21 in the Anthropocene

The first, 25 minutes long is basically a short version of the second, 56 minutes long. But both are very good an have some very alarming stats in them. Anyway, as I said I am boning up on the subject. I will not be joining much of the ongoing discussion on these subjects but will save my opinions until the post in about a month or less. But in the meantime I will be posting more links to other people’s opinions on this subject.

Notice: If the North Dakota NDIC data comes out by Friday, I will have a new post shortly after. If not, it will likely be Monday or later before I have anything to publish.

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

240 responses to “OPEC + Different EIA Data”

Holy Crap, huge diff Nigeria 2ndary vs direct.

Not really. There are just 35,000 bpd difference in the two for May. Nigeria likely just under reported April. Anyway those “Direct Communication” numbers always have to be taken with a grain of salt.

Ron, re: “Sustainability, Transition, Carrying Capacity or whatever.” You have given yourself an impossible task. Because all knowledge, anywhere in the world, is now transferable to everyone else in the world in seconds [the internet], the knowledge base of humans is rising at a parabolic rate (very exponentially). So, no collection of say 1 million people reading 10 million articles per day will ever be able to predict or forecast what is going to happen. That being said, computers that can think and solve problems faster than humans will become the norm. And, as Nate stated that manufacturing is becoming a smaller portion of the pyramid – that is the best thing. Manufacturing continues to grow at a fast rate [with fewer and fewer people required] and it will grow much faster in the future. Humans will manufacture robots, and the robots will manufacture everything else [and then the robots will begin to build and improve on themselves]. For the most part, human work will become virtually just services in the not too distant future. And the computers that can think – well, it might be some form of cold nuclear fusion, or something, but energy will be the least of our worries because of their [the computers] new inventions. As humans become less and less useful and necessary, some humans will want to eliminate most of the other humans. Maybe through birth rate control, which has already started – Germany and Japan for example. Or maybe through other methods. Then the robots eliminate the remaining humans. Just my wild ass guess.

Clueless, I am still a long way from forming my conclusions and what I will put in that post. But it will clearly be way different from your opinions. While energy is not our only worry it will nevertheless be right up there near the top. Cold fusion? Are you serious?

Manufacturing in the US is in serious decline. We now have almost as many people as bartenders and waiters as we do people working in manufacturing. We, the USA, manufacture less but consume more. When a nation consumes more and more and manufactures less and less, then that is a recipe for disaster.

It is a myth that robots will one day manufacture robots. Robots contain computers that require large clean rooms to create the chips and large lasers to etch them. Lathes and milling machines are required to build all the mechanical components. Tiny capacitors are made with precision machines and tiny inductors are made with copper wire so thin you almost need a microscope to see it. A robot cannot do all that, it takes skilled men, women, precious metals and modern machinery to build a robot. Richard Feynman must have had some kind of lapse in cognition when he proposed that a robot might build a smaller robot which might build a smaller robot which…

But talking about robots is getting off the subject, the future of humanity is the subject. So I will try to stick to that.

We now have almost as many people as bartenders and waiters as we do people working in manufacturing.

This is true. Labor productivity has risen dramatically, and manufacturing employment has dropped sharply.

We, the USA, manufacture less but consume more.

Not really. US manufacturing output is higher than it ever has been. We import a lot of stuff, but we also manufacture a lot of stuff, some of which we export: cars, planes, refined oil, etc.

The decline in manufacturing employment is deceptive – it’s not the same as actual manufacturing output: the stuff they make.

Nick – Thank you!! One of the biggest myths EVER is that US manufacturing is down. It is up hugely since the 1950’s. As I have mentioned before, my wife and I of 49 years have no children. However, during that 49 years, I have never run across anyone who said: “I hope that my newborn son someday can obtain a good union job knitting socks at the local mill.” No. US manufacturing is epitomized by Elon Musk: high tech manufacturing with fewer and fewer people.

Ron – you missed the TOTAL point. It is not how many people are employed, it is about what you produce with the people that you have.

One of the biggest myths EVER is that US manufacturing is down. It is up hugely since the 1950’s.

Sorry Clueless but I just flat don’t believe that. You must not be from Detroit, or Pittsburgh, or anywhere in the South where there used to be a cotton mill in every town. And there were garment manufactures in every town also. Now all it is all made in India, or China, or wherever.

And just google it. There are hundreds of articles like this one:

Why Factory Jobs Are Shrinking Everywhere

A report from the Boston Consulting Group last week suggested the U.S. had become the second-most-competitive manufacturing location among the 25 largest manufacturing exporters worldwide. While that news is welcome, most of the lost U.S. manufacturing jobs in recent decades aren’t coming back. In 1970, more than a quarter of U.S. employees worked in manufacturing. By 2010, only one in 10 did.

Really Clueless, it’s not just about what is produced, it is the whole big picture. Employment is the biggest part of that picture but how much is produced also. In 1950 you could walk into a five and dime and 99% of everything in that store would have been produced in the USA. Now walk into WalMart and perhaps 1% of the goods there are produced in the USA. And you say: It is up hugely since the 1950’s. Good God, give me a fucking break!

And you say manufacturing is

Clueless, Mr. Patterson

There is a thread of commonality regarding actual manufactured output coupled with increased employment in regards to this ‘shale revolution’,

The increasingly lowered cost of raw materials as well as cost of energy is starting to offset cheaper offshore labor in making USA more economically attractive for manufacturing.

Newly built or proposed complexes such as the three ethane crackers tentavely scheduled for the Marcellus area bodes well for a wide range of downstream plants using this extremely inexpensive feedstock.

Lowered costs for electricity generation boosts American competitiveness in steelmaking and other related industries.

Ron,

The manufacturing data are available from places like the bls or st Louis fed data pages. The US is unambiguously manufacturing more than ever before according to these data. Yes, fewer people proportionately are employed in manufacturing, but this is because more and more human labour is being replaced or complemented with external energy sources, thus increasing productivity.

However in most of the advanced counties (uk, much of europe, recently the USA) productivity has been stagnant or declining, just at the same time as energy and electricity use per capita has been roughly stagnant. Personally i think it’s very likely that the two are related, though I’ve yet to see energy factors mentioned in any of the articles I’ve thus far seen on the productivity data.

How is China’s economy growing if the USA is manufacturing more? Isn’t the USA running a trade deficit with china?

Europe and USA are consumers; Asia are manufacturers. That is the undeniable circulation of money in the global economy.

I work at an undisclosed place that has just replaced it’s staff with offshore indian workers because they are much cheaper. And labor costs are your biggest expense in a human labor intensive industry.

Any manufacturing companies that don’t offshore their work are at a competitive disadvantage due to labor costs, slave labor policies and environmental arbitrage (china don’t care if you pour your poo poo in the river).

As long as cheap liquid fuels are available!

Where is all the work for the billions in China and India coming from?

Yes, high end items like planes and military will come from USA, etc.

Satan has returned, and he is pissed off!

SatansBestFriend

It is growing because the USA consumption has increased vastly more than it’s industrial output. You might me making 2 as much, but if you’re consuming 4x as much then that extra has to come from somewhere.

As Yanis Varoufakis has said, the US is like a ‘global minotaur’, into which energy and resouces go and nothing leaves in return.

Hi Ron,

US real industrial output per capita (US Population) has mostly increased since 1950, but it stalled around 2000 at 98 got to 100 in 2007 and was back to 99 in 2007, chart is indexed to 2007=100 ( the high point through 2014).

Note that this chart is not output per worker (productivity), it is real industrial output divided by US population.

Fred data for industrial output at link below:

http://research.stlouisfed.org/fred2/series/INDPRO#

Population data from UN to 2009:

http://esa.un.org/wpp/

Population for 2010 to 2014 from US census (most current data V2014):

http://www.census.gov/popest/data/index.html

Illegal alien numbers jumped by 5 million during the Clinton years, and by 3.8 million during the Bush Jr years. That’s a total of 8.8 million illegals. I think industrial production per LEGAL resident would have gone up if those two hadn’t been so irresponsible.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1fco

Above is a link to a chart of real industrial production manufacturing showing the peak in the 1970s coincident with US peak production of crude oil per capita (down 40-45% since) and the onset of deindustrialization and financialization of the economy.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1fct

Above is in per-capita terms.

https://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-ecri-simple-math-output-growth-in-hours-worked-real-gdp-growth

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1fb3

The aggregate of the growth rates of the US labor force and reported real productivity implies a potential real GDP of ~1%, and near 0% per capita, which has been the trend since 2007-08.

https://www.chicagofed.org/~/media/publications/economic-perspectives/2014/4q2014-part1-aaronson-etal-pdf.pdf

The peak Boomer demographic drag effects are poised to further reduce labor force participation and thus result in no labor force growth or a decline, implying that the average monthly payroll growth will be as low as 50,000 (vs. 150,000-200,000 as is the consensus forecast), which is the 9- to 10-year average trend rate today. This fits with the potential real GDP trend of 1% or less and ~0% per capita.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1fcB

However, note that the CBO is forecasting a real rate of potential GDP through the mid-2020s of more than twice the implied trend rate.

http://www.cbo.gov/publication/49973

Consider what the CBO budget and deficit forecasts would look like if they used the more realistic real trend rate of 1% (~0% per capita) or slower vs. 2-2.25%.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1fbq

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1fby

The US is following Japan’s real final sales/GDP per capita.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1fbI

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1fbS

Japan’s better performance per capita in recent years is attributable to the country’s population decline beginning in the late 1990s. Adjust for the differential population growth between Japan and the US, and the trend real rates of GDP per capita are at an R^2 approaching 1.0.

Net population growth in the US is virtually entirely attributable to immigration, which has been dominated by migrants from Mexico and Central America since the 1980s with a birth rate similar to Caucasians at the peak in the 1950s (having since fallen significantly since the 2000s).

Thanks BC, I have been vindicated.

Ummm…how?

BC’s stuff above seems to agree that overall US manufacturing output has grown substantially; and that the primary cause of falling manufacturing employment is an increase in labor productivity.

It also doesn’t seem to disagree with Dennis’ data above showing that US manufacturing production and consumption are growing at roughly the same rate.

B.C’s seems to arguing two things. 1st, that manufacturing output per capita has been stagnant. I don’t exactly see why that’s a big problem – Americans seem to have decided since the 1970s that they have enough stuff – that’s a good thing.

And that growth in labor productivity (overall, not specifically for manufacturing) seems to be slowing down very recently. I agree that’s not great, but that’s different from what we were discussing above.

Yes, I am sure the dollar value of production has increased dramatically since 1950. After all, the population has more than doubled. But even the per capita has increased somewhat but still not nearly as much as the per capita consumption has increased. But the percentage of us consumer goods manufactured in the USA verses the the percentage produced abroad has decreased dramatically.

As I said, just walk into any WalMart and try to find a “Made in the USA” label. I dare you, try it. You may find one or two but they will be outnumbered by “Made in China or India or Bangladesh or wherever” by at least 100 to 1.

In my hometown of Huntsville, AL there used to be 13 Cotton Mills in the early part of the last century. During my youth, the 40s and 50, there were three. But there was also a shoe plant, a stove plant, a farm equipment plant and I am sure a few more. Now they are all gone.

Toyota has an engine assembly plant here and that’s about it. Of course NASA’s Marshall Space Flight Center and the Army’s Redstone Arsenal are located here. They and the associated space industry contractors have far more than replaced the disappearing manufacturing industry. But that has not been the case in Detroit and other blue collar towns. .

Hi Fernando,

Not many illegal aliens work in industry, mostly service industries and farming. I don’t think that affects industrial output or population, so not really relevant to my chart.

The illegals are included in the “per capita”. Illegal aliens tend to do low level jobs, work as farm hands, domestics, dishwashers, etc. These are very low value added jobs. Because I’m an immigrant I know the system very well, and I did a ton of odd jobs trying to get through college. Illegals do work legal residents can do, but are exploited mercilessly. This is one reason why the bush administration didn’t try to close the flood, it was convenient for his buddies who exploit illegals. Legalizing their status is stupid because it encourages more illegals to come in. And leftists love them because they know eventually they’ll have a voting block of poor, uneducated people with a tradition of dependence on government handouts. Which means those statistics will get worse.

Illegals do work legal residents can do, but are exploited mercilessly. This is one reason why the bush administration didn’t try to close the flood, it was convenient for his buddies who exploit illegals.

Yes, except it wasn’t ONE reason, it was the PRIMARY reason.

If anyone really cared about illegal immigration, they’d do something to improve education and upward mobility inside Mexico, so that desperate poor people didn’t need to leave their home country to make some kind of living.

Ron,

It’s true that some industries have seen big losses to off-shoring. You can see how US manufacturing output growth leveled off about 15 years ago when China joined the WTO. That’s when US manufacturing employment started to drop more quickly – when growth in output stalled.

Still, your intuition is simply not a good guide. As both exports and imports grow, fewer things will be both produced AND consumed locally. In 1950 you didn’t expect to see most things stamped “Made in Alabama”, right? That was a big change from 100 years before.

More importantly, even if no offshoring OR globalization happened in the last 50 years, most of those plants would have disappeared anyway: each plant would be making 3x as much, with 25% as many workers.

Hi Ron,

You are correct that real consumption per capita has grown somewhat faster than industrial output per capita.

Average per capita growth rates 1950-2014

_______________________________

consumption per capita= 2.2% per year

industrial output per cap=1.9% per year

From 1951 to 1981, these grew at about the same rate on average but they started to diverge after that point. Chart below has the ratio of per capita consumption to per capita industrial output with each value indexed at 1978=100 data from 1950 to 2014.

A simple explanation for this is that we are consuming more service goods because most families have two adults working. This leads to more business for house cleaners, landscapers, more dinners at restaurants and more money to go on vacations to hotels or bed and breakfasts. So more of the consumption is spent on services than in the past due to two wage earners per family. This is at least a part of the explanation for the change since 1981.

Chart below

fewer people proportionately are employed in manufacturing, but this is because more and more human labour is being replaced or complemented with external energy sources, thus increasing productivity.

That’s really, really not the case. Engineers working in manufacturing are simply not doing that: substituting human labor with extrasomatic energy. They’re improving the way work is done, with better design.

Here’s a classic example: the 1794 hand operated cotton gin. Cotton processing became far less time consuming, and it had nothing to do with energy inputs, just better design.

Now, substituting human labor with extrasomatic energy has often been very, very important, but it’s not the primary thing in recent changes in manufacturing productivity.

However in most of the advanced counties (uk, much of europe, recently the USA) productivity has been stagnant or declining, just at the same time as energy and electricity use per capita has been roughly stagnant.

No, manufacturing labor productivity growth has not even slowed down, let alone stopped. You’re thinking of overall economy-wide stats.

Nick,

That is not the case. This paper by Taylor ( http://www.un.org/en/development/desa/policy/wess/wess_bg_papers/bp_wess2010_taylor.pdf ) fairly convincingly shows that recent improvements in labour productivity have been achieved by substituting exosomatic energy for human labour. A more thorough discussion can be found in this paper by the same authoer and others ( http://epub.wu.ac.at/3842/1/Rezai.pdf ).

In the UK manufacturing productivity has been stagnant since 2008, see chart 2 here ( http://www.ons.gov.uk/ons/dcp171766_381512.pdf ).

Design plays a role, but energy is probably more important.

The first paper doesn’t demonstrate that increasing energy uses causes increasing manufacturing labor productivity (the 2nd paper doesn’t seem to provide any primary evidence at all for this general idea – it seems to just assume it for purposes of their models).

First, they show a correlation between economic growth and growth in energy consumption. But, in a world of cheap energy, economic growth causes energy consumption growth, not the other way around: people get more income and buy cars. Industry ships more stuff. With cheap energy, they just burn more fuel. If energy were constrained, they’d find ways to entertain themselves, and get stuff where it needs to be, while not using proportionately greater energy. In particular, if fossil fuels were constrained, they’d switch to cheaper, cleaner alternatives.

2nd, they’re talking about the overall economy, not manufacturing.

3rd, their analysis primarily looks at the growth curve for developing economies: this doesn’t apply to mature economies in the same way. For instance, Vehicle Miles Traveled in the US has been pretty flat for years.

As for UK manufacturing productivity:the article doesn’t seem to support your argument, except perhaps in the last 3 years. They say: “Manufacturing productivity has grown by 2.8% on average per annum since 1948 – compared with

1.5% in the services industry. The 2008-09 economic downturn resulted in heavy declines in productivity in both manufacturing and services, neither of which have recovered to pre-crisis trend

growth rates. Figure 2 shows the impact is greater for manufacturing, but nevertheless, over the long term, manufacturing productivity continues to compare favourably to that in the services industry and the economy as a whole.”

In any case, US manufacturing labor productivity has been growing just as fast as always. I suspect the same is true in Germany.

Let me clarify: manufacturing labor productivity is measured by labor per unit of product. So, if production rises, and energy consumption rises, labor productivity hasn’t necessarily changed.

If your truck load doubles, the driver productivity might double, and the energy consumed might go up by maybe 30% due to tire flexing and increased power needed for acceleration (most of truck energy consumption is aerodynamic). That’s if fuel is cheap. If it’s expensive, you’ll anticipate an increase in fuel costs, and buy tires that are more efficient, streamline your truck, maybe even move to rail.

But if you redesign the assembly of a widget in order to reduce the number of hand motions of the assembly worker, you increase manufacturing labor productivity but you don’t increase energy consumption.

SamTaylor:

“The manufacturing data are available from places like the bls or st Louis fed data pages. The US is unambiguously manufacturing more than ever before according to these data. Yes, fewer people proportionately are employed in manufacturing, but this is because more and more human labour is being replaced or complemented with external energy sources, thus increasing productivity.”

Not really. First a lot of data from the BLS and the Fed is Manufactured. Most finished US goods are made up of foreign made products. US Cars contain lots of foreign made parts. This is not attributed to the data reported by the BLS/FED.

If you look around your home pretty much everything you have is made overseas. If you look inside product that actually says “Made in USA” (if you can find one), just about all of the parts inside will be foreign made.

If what you said was true, than just about all products will have the “Made in USA” tag instead of the “Made in China” Tag.

“Who are you going to believe [the BLS/FED], or your lying eyes?”

– Groucho Marx

US Cars contain lots of foreign made parts. This is not attributed to the data reported by the BLS/FED.

I’d be interested to see some evidence for that. My understanding is that they account for the origin of parts.

Computers are things that simply process instructions, that are written by human programmers, according to the boolean algebra that is available on the cpu.

They are better at performing these instructions faster and more reliably than humans can do them.

They are so far terrible at adapting to new situations that they haven’t been programmed by a human to deal with.

The idea that robots/computers will soon have human minds is absurd, since no humans understand how the human brain works.

Also, human programmers are very prone to making mistakes (software bugs). We are on Microsoft Windows 10 or something and mine still crashes or has some error regularly.

Operating system programming is astronomically more trivial compared to trying to model the human brain.

Robots will be a part of our culture (undoubtedly since they already are) but they will be mindless emotionless drones as far as the eye can see.

I love Alan Turing, but the Turing Test just showed that machines can fake human intelligence if they are programmed by humans to do so, with algorithms that work for the test.

Satan is Real!

SatansBestFriend

Robots are a lot further along than you probably realize. And they don’t necessarily need to be programmed with a set of instructions. Neural net chips can learn, just like biological brains.

https://www.youtube.com/watch?v=oD9DE0HjMM4

As humans become less and less useful and necessary, some humans will want to eliminate most of the other humans.

Yes, I think that will happen. The rich are amassing a lot of wealth and assets and don’t need lots of people to sustain them. So you’ll have a process where you’ll have relatively small enclaves of very wealthy people who don’t need to care about or bother with the rest of the world. They don’t need much human labor to keep them at the top of their pyramids.

Now, that’s unfortunate for the 99.9% of people who aren’t wealthy, but it is better for the planet because with fewer people there is less consumption and resource destruction.

I smell sulphur.

Malware and spam are also transferable to everyone who interacts with the Internet, but these drawbacks and diminishing returns are scarcely, if ever, mentioned under the standard narrative of progress, nor the huge costs necessary to design and manufacture the next generation of chips, among other such concerns. While the exponential rise in funny cat photos and other such augmentations of the human intellect may doubtless cheer some, others may recall when NASA had the most trafficked web server on the Internet. Speaking of which, what ever happened to space travel? Is it taking a breather for a decade, or four? Or does progress now point to bluetooth-enabled skillets with smartphone integration?

Manned space travel has been replaced by robotic exploration, which makes sense. At this point there is little advantage to putting a man far out into space, mostly just a PR and ego thing now that computers and robotic probes can do a great job of exploring much cheaper, longer and do not need a return ticket.

There is a lot going on at NASA, just not as popular with the people since they are too busy watching singing competitions and “reality” shows. No thought involved so they can escape the hum drum and stress for a while.

There is also no national agenda that machines cannot fulfill right now.

The real ground breaking work is being done at the environmental and biological level now, so interest is not high in the popular mind.

Excellent point. I have been saying this for nearly 30 years, when I was developing a proposal for my son to do a science project on space exploration (which he turned down). A fast overview of cost and benefit showed robotic exploration was the way to go. The space shuttle and the international space station were blunders.

The Earth will likely get hit by an ELE Asteroid long before the Sun begins to fuse Helium. Either way, we should learn how to live in space.

It’s usually better to not wait until the last minute.

Either way, we should learn how to live in space.

That’s going to be one hell of a learning curve, there is no air in space. When you go to space, you must take everything you will consume while there, with you from earth. That includes the air you will need to breath, the water you will drink. And if you ever step outside without your space suit, you will explode.

Hi Ron, As to the last graph do you find any evidence that would support this projection in any real way? If so please tell me. Again congrats on making the list…more than well deserved in my opinion.Lots of good debate, peer review of connents, and a backup with good evidence. Much respect, Philip

Yes we have all lost confidence in anything the government says. That’s what happens when you start lying you just can’t stop.

There are layers to that. Govt employees don’t look in the mirror every morning to shave and know they are going to get on the Metro and go to work that day to lie to the public.

The mechanism has to be systemic. Redefinitions, seasonal adjustments, interpretation of regulations.

“It is in the interests of no one to enforce that regulation.” And thus mark to market was not enforced and changed. The result? Nobody died. They might have otherwise.

But after one applauds the event for avoiding death, one must not get carried away with the applause. It’s still absurd whimsy and deception. Don’t find yourself believing your own propaganda.

As for oil reporting . . . come on, guys. This stuff has been pumping 100 years. Do you really think that after 100 years of methodology development the number of barrels flowing can’t be counted? The presence of dispute and variance points obviously at some agenda in place. For the stuff above, OPEC governments would usually want to under-report output because of their production quota. The exception being, of course, Iran.

One does wonder what the agenda is for whatever/whoever secondary sources are. No reason to think they are clean.

Hi All,

The Short term energy outlook matches the weekly output data quite well. The weekly data is a pretty rough guess and it is never revised so the weekly mistakes look very bad. The monthly data does get revised and is the EIA’s best current guess, the Drilling Productivity report is not very good at all and does get revised eventually, but for Jan to April has badly overestimated output.

For the Bakken Three Forks North Dakota has 1130 kb/d and Montana about 47 kb/d for a total of 1180 kb/d in March, the Drilling Productivity Report(DPR) guesses that output is 1312 kb/d, about 11% too high.

For the Eagle Ford we have to guess, but my Feb 2015 guess was about 1410 kb/d and March was probably similar based on completion data from the RRC (oil wells on schedule as reported by the RRC, not sure of the accuracy). The DPR has the eagle ford at 1711 kb/d in March 2015, I think this is too high by 21%.

I have no guess for the Niobrara so we will assume that the DPR is correct for that LTO play and for the Permian Basin as well because I do not have New Mexico data, only Texas.

For the Bakken/Three Forks and Eagle Ford the DPR is about 420 kb/d too high. The July 2015 estimate in the DPR is likely to be more accurate than March for the Bakken/Three Forks and Eagle Ford, but they will still be 170 kb/d too high.

I have said this before, the DPR is not very good. The monthly energy review (MER) is not perfect, but it is much better than the DPR. The weekly estimate are also pretty bad, but they are better if the 4 week averages are used (this averages out the bad readings, the individual weekly data is very noisy and I ignore that data.)

Dennis,

In the DPR, they give estimates for “Bakken region”, “Eagle Ford region”, etc., so they include production in those regions outside of the named plays

Still, their estimates are not good

Hi AlexS,

Thanks, I had missed that footnote. That makes it harder to judge the DPR, and makes the report less useful. As most of the changes in output in these “regions” are due to LTO output, the best way to attempt to judge the report is to look at changes in output rather than the absolute levels of output. For the Bakken region, we could take all North Dakota and Montana output, for the Eagle Ford it is a bit trickier, I would probably just consider the changes in output.

I find the DPR pretty useless, probably will just ignore it.

Ron,

Can I make a suggestion? If you’re going to listen to people who are worried about credit problems, you should really read the generally accepted wisdom on the subject, which has to include:

“This Time Is Different: Eight Centuries of Financial Folly”.

We see that the world has seen credit bubbles for many centuries. Banks default. Countries default. Some countries continually default: Greece has been defaulting every 25 years, for 200 years.

It’s nothing new.

Nick, I do regard debt, not necessarily credit, to be a very serious problem.

The difference between credit and debt is essentially a story of “before” and “after.” Credit is the ability to borrow money, while debt is the result of borrowing money. When you use credit, you create debt. And the more responsible you are at managing your debt, the more access you may have to credit in the future.

However there are more serious problems facing the world. I will be talking about those other problems in my post on the subject of collapse or sustainability, not debt.

It’s kind of a chicken and egg thing.

People are worried about a credit crunch, caused by excess debt.

I have been observing this monetary/debt issue for awhile, and pose the following possibility-

Is not the accumulation of excessive debt just a manifestation of a culture overreaching in its attempt to grow, borrowing capital to push the boundaries of growth beyond what it could accomplish with more conservative levels of spending? If so, we should expect debt to be an escalating issue as we bounce up against the global limits of resources and exceed the carrying capacity of the earth.

Debt [excessive] can thus be seen as a symptom of an economic system reaching its peak.

Is not the accumulation of excessive debt just a manifestation of a culture overreaching in its attempt to grow

Not really. If we were reaching limits to growth due to commodity scarcity, the prices of commodities would be high, and we’d be seeing inflation. We’re not.

I have bought my own copy of ”This Time It’s Different”.

The long term norm in respect to debt and government is about like the norm involving governments and war. Peace is more common than war but war is pretty much always with us.

Government defaults are far far more common than most people suspect – probably at least an order of magnitude more common. Most of the governments that have defaulted have survived and gone right back to borrowing within fairly short order.

My take is that debt is a hell of a problem but nothing more than a pimple on the ass of the resource depletion problem and the environmental destruction problem.

Most of the debts that exist these days are NEVER going to be paid. In essence all this means is that the people who own the debt are not nearly as rich as they think they are. Their gilt edged bonds are not going to be redeemable for more than a fraction – maybe a small fraction -of their face value at some point.

Nobody knows how the politics of debt are going to work out. Conservatives exhibit a tendency in some cases to turn into liberals once they quit paying taxes and start living off of the largesse of the welfare state – social security , medicare medicaid now Ocare reduced property taxes etc etc. .

I am not argueing that the money given to any one individual is all that important but rather that many tens of millions of people are getting or going to get these tax paid bennies- and this country is after all more of a democracy than a plutocracy regardless of the opinions of some members of this forum.

Social Security passed, Medicare passed, Ocare passed. Rental assistance passed. Food stamps passed. Free school lunches passed. Universal tax paid education passed. Government subsidies enabling people to buy houses for almost nothing down passed. Civil Service passed.

Such things are seldom taken away once granted. I am not sure the welfare class , the working class, the middle class and the old folks can FORCE the government to continue to pay for their bennies- FOR MY BENNIES since I am now an old fart myself – but I think betting against the power of the ballot box is a foolish bet. My bet is on the people rather than the one percent in the end

Wealth – real wealth – is far more likely to be redistributed over time than it is to continue to accumulate in the hands of the top one percent. The fact that the one percent OWNS so much does not mean that same one percent can actually spend what they own. A rich individual can wear only so many clothes, live in so many houses and drive only so many cars and eat only so much.

Whatever they discard trickles down. I know people who work by the hour for peanuts who drive luxury cars – older ones to be sure but still very much luxury cars.

If it helps to think of a rich man as a dog covered with ticks and fleas and the ticks and fleas consisting of his lawyer , cpa, dentist, tailor, mechanic, pool boy, gardener, etc etc – then so be it. Most of the price of a yacht goes to pay the wages of the people who supply the materials in it and who actually build it.

We hear that APPLE is worth so many billion bucks – but let us suppose Apple vanished off the face of the earth tomorrow. There would NOT be a shortage of computers or smart phones for more than a few weeks, maybe not even that long. What I am getting at is that a FEW of the people who own APPLE can cash out. The vast majority cannot. If the majority all tried to cash out the price of APPLE would crash in a flash.

Likewise all the debt held by the various owners of it cannot be redeemed. There is no real wealth in existence with which to buy up the debts of the world.. In essence… most debt is nearly worthless … and nearly nothing is all it will bring if it must be sold once the world figures out it CANNOT be repaid.

The most the owner of a big bundle of debt can hope for in my opinion is to keep on collecting the interest. If the interest rate is four percent and inflation is raising the prices of the things he buys by four percent he is losing not only in terms of current cash income but also likely to lose his capital as well some years down the road. When things get bad nobody is going to want to buy his bonds.

There will be a general round of defaults.

After a very few years the big players, mostly governments, that default will be borrowing again.

OFM,

Interesting observations and thoughts.

”After a very few years the big players, mostly governments, that default will be borrowing again.”

From whom?

The same people they borrowed from before- the people of the country.The people of other countries. In some cases the money is IN EFFECT borrowed from every body who owns the currency of that particular country by means of that country simply PRINTING more currency. Each unit printed reduces the value of each previously existing unit.

MONEY is not a concrete physical resource. IF I loan you a dollar and you deliberately fail to repay me, basically all this means is that you earned that dollar by swindling me rather than working for it. This does not change the amount of existing physical or concrete resources in the world- it only redistributes them.

If it helps think of the history of a troubled family that fights with the various members going their own way. After a while they very often get together again. I have known of some children being bailed out three times over a couple of decades or so by forgiving parents who have managed to forget that they were not repaid the first two times.

I have friends who are landlords who occasionally fail to collect a few months rent. The VALUE of the housing for that period was not LOST – it was merely collected by or transferred to the dead beat tenant.

The really DISRUPTIVE problem with default is the effect it has on CONFIDENCE- it takes a good while for people to start lending again. But they inevitably do start lending again. Basically they have little choice except to either lend or undertake the DIRECT management of their excess earnings.

When a bank loses a million bucks loaning it to somebody living really high on the hog who spends it to support his flashy lifestyle and then loses his high dollar job – the loss of the bank becomes the ( past ) INCOME of the person who consumed that million. The defaulting borrower IN EFFECT EARNS the million the bank loses. There is no getting back the life he lived on that money.He CONSUMED it.

Think in terms of chemistry. The atoms and molecules involved in a reaction are NEVER lost into the ether. They just wind up in DIFFERENT places.

Money that is not repaid does not DESTROY anything with a physical existence- not in a direct sense at least.

The world is a fluid place with old fortunes always being lost and new ones always being created, often out of the ruins of the old.

Specialization is the KEY or one of the KEY components of all economies more advanced than those of hunter gatherers. The more SPECIALIZED you get to be the LESS time you have to become expert in managing any excess assets you cannot use directly in your own line of work. Hence you either loan these assets or buy an ownership interest in some other specialist business enterprises. Lending simplifies this choice enormously – so long as the borrower does NOT default and the government does NOT inflate the hell out of the money.

Sorry I cannot do a very clear job of compressing these concepts into a few short sentences.

Read the book if you have time.If you don’t then you are experiencing an up close and personal encounter with the specialization trap , lol.

It IS a real eyeopener- because it is based on little known hard historical data that is NOT going to be refuted.

“A rich individual can wear only so many clothes, live in so many houses and drive only so many cars and eat only so much.”

But he can own unlimited amount of land, homes, apartment houses to rent out, factories, mines and all other sorts of real capital.

The amount of land, homes, factories etc. is limited. None one is making new land (apart from China in the South China Sea) and the more the rich own, the less for the rest of us. Owning land is meaningless unless it is used productively, and to grow food or house people so that rent can be charged . In a finite world the rich can only get richer by making the rest of us poorer, and in a contracting world, the we will be getting a lot poorer .

” In a finite world the rich can only get richer by making the rest of us poorer, ”

This has proven to be patently untrue so far and will likely prove to be untrue for some time to come yet.

The long term is a different ball game and you may be right in the long term. Or the people of the world may just seize the accumulated wealth of the one percent. If they do , they will find out it is MOSTLY a mirage.

They may not OWN all that wealth but in effect they are CONSUMING it just the same to a very substantial extent in a very real sense. They live in the houses , they stay in the hotels and resorts, they eat in the restaurants.

When I was a poor kid I played with home made slingshots and my Daddy’s real farming tools. When I got old enough and big enough I MADE a go cart out of an old garden tiller engine , some boards, some iron wheelbarrow wheels and some assorted bits and pieces of scrapped machinery.

The poor kids around here these days have their own televisions and computers. My part time farm hands kid has a motor bike , a computer, a cell phone and a tv of his own. My part time farm hand has air conditioning in the ” trailer” he lives in.

I was back home as a university grad well before we ever had an air conditioner in our family home.

We could have had ac many years sooner – but the real difference is that we are savers and investors where as my farm hand is a day to day CONSUMER who refuses to think more than a couple of days ahead. Generally speaking he wants to borrow fifty or a hundred bucks to manage his child support bill on the day it is due.

I loan it to him, month after month, and he pays it back via my withholding half his daily pay for the next few days. We only work a few hours at a time and seldom more than two days consecutively. He works for other people as well of course.

“If they do , they will find out it is MOSTLY a mirage.”

When you look at the history of civilization, the vast majority of it was spent living in feudalism, or similar forms of society. When you own land, water sources, resource mines, you can control whole civilizations. The current “free society”, without slavery or serfdom is a tiny, almost negligible fragment of history. Those empires have lasted for thousands of years, and the wealth of their ruling classes was definitely not a mirage.

The wealth of the one percent class is in a very real sense a mirage in many cases. The people that own EXON own something that is damned near irreplaceable,at least in the short to medium term, but the people that own Apple own a mirage of sorts.

If Apple were to disappear in a puff of smoke a few weeks there would still be PLENTY of computers and plenty of software available.

Ditto brand names such as Coca Cola. When times get really tight people will start buying generic or store branded soft drinks – if they are can afford soft drinks at all.

The Apple and Coca Cola sort of wealth has no solid foundation in physical reality in the sense that Exon owns real physical assets. Patents and copyrights eventually expire. Reputations are not forever.

This is not to say that I expect either Apple or Coca Cola to go broke anytime soon.I don’t.

When peak oil eventually takes a huge bite out of the ass of business as usual- and it WILL eventually – airline stocks are going to go pretty close to ZERO barring a miracle on the synthetic fuel front.

The population of Tokyo is going to start declining pretty soon unless maybe the yokels from the villages move to the big Nipponese Apple. With fewer and fewer residents but the housing stock little diminished, the price of a house in Japan is going to start falling like a rock one of these days.

Lets suppose all us relatively poor folks could just seize the wealth of the entire one percent. Just HOW does anybody suppose this would raise their living standard over the long haul? Doing this would merely TRANSFER the ownership of these rich folks to the rabble – the rest of us. Doing so would not increase the number of houses or the numbers of doctors or the amount of food in stores or the number of flights in and out of the local airport.

Sears and Roebuck was the big retail dog when I was a kid. You bought a lot of your stuff stuff from Sears sight unseen since the local stores did not and could not stock all the things in that big catalog. Sears will soon be history. ILLUSORY wealth, Sears stock. In a sense.

”But he can own unlimited amount of land, homes, apartment houses to rent out, factories, mines and all other sorts of real capital.”

OR he can LOAN his money on these assets – which is vastly simpler and easier to do. Becoming a competent lender is VASTLY simpler than becoming a competent manager of many different kinds of assets. See my six o four comment just upthread. Specialization is both a boon and a bear trap.

“Wealth – real wealth – is far more likely to be redistributed over time than it is to continue to accumulate in the hands of the top one percent. ”

Not true. The nature of capitalism is that wealth flows upward over time, especially when return on capital > the growth rate. Marx and Piketty are worth a read. People forget that Marx was an astute observer of capital, and that he got it more or less correct. Whether or not capital will go peacefully is a different story.

The only reason wealth has been distributed downwards is thanks to those programs you stated.

History says different. I am not fond of the very rich or even the moderately rich element but they do not have a permanent lock on the resources of the world.

Every once in a while they lose their heads as well as their riches. History is NOT over. And the OWNERSHIP of most of the corporate wealth in a country such as the USA is actually pretty well distributed among the middle class in the form of pension funds , retirement accounts and other paper assets.

Let us not forget that a married couple who are teachers in a lot of public school districts are actually quite well off considering that they get pensions and health care etc.I know a few who have combined salaries close to one hundred and fifty grand – for two hundred twenty days work.

The one percent does not actually LIVE all that much better than the professional middle class or even the upper portion of the working class. I am a VERY long way from well off but I have cable internet cell phone a car and money enough to eat out etc. I have central heat and air conditioning and a SUPERB view and a large lawn. I can afford a housekeeper once a week.I could do a bit of traveling if I were free of family obligations.

Generally speaking I find that most people who complain endlessly about the rich don’t make much effort to get to be well off themselves. I have plenty of acquaintances who have spent enough on beer and cigarettes over the years to have gotten moderately rich if they had invested their bad habit money.

When you get right down to it, except by the standards of the envious , I am rich myself according to any sensible and realistic standard. I sure as hell would not trade lives with a rich man who lived as recently as even seventy five years ago. Lots of health issues that might have killed me back then are minor problems today.

Except for the badly overpopulated third world countries most people have been getting to be BETTER OFF in recent times in comparison to the rich. Unfortunately this trend has been reversed recently in most well off countries. But there is no particular reason except pessimism to believe this reversal will stand forever.

The aftermath of which work was Reinhart and Rogoff constructing their completely nonsensical 95% public debt to GDP ratio, with that famous and deeply flawed paper, the result of which has gone on to cause so much harm in so many unforseen ways around the globe.

However the book itself is decent enough.

Yes, debt defaults have happened throughout history. That is good evidence why we can expect it to happen again, when guys like Krugman tell us there are no problems with going into debt.

That doesn’t mean we shouldn’t be concerned.

The global monetary system is fiat dollars + credit. The vast majority of the money supply is credit extended by banks and governments.

If people/governments start defaulting, the global money supply is going to DEFLATE.

Then interest rates will likely sky rocket, because people will be scared to lend their DEFLATED currency to anyone who can’t pay them back.

No big deal, right Nick G?

stop ignoring Satan,

SatansBestFriend

No one is saying that another credit crunch induced Great Recession would be “no big deal”. Krugman doesn’t say that – he says that that risks of doing nothing/austerity are rather greater than the risks of stimulating the economy.

The general idea: we’ve faced credit & debt bubbles/crunches many times before, and we’ll have more in the future. It won’t be fun, but we’ll get through them.

We only owe the money too ourselves and interest rates are at all time lows.

Krugman

Sorry Nick, I interpreted your previous post as saying debt defaults weren’t a big deal.

Nick Wrote:

“We see that the world has seen credit bubbles for many centuries. Banks default. Countries default. Some countries continually default: Greece has been defaulting every 25 years, for 200 years.”

Exccept nearly every country is now swimmng in debt and becoming insolvent at the same time. Its very likely when one Major industrial power defaults, the rest will follow like dominos. The last time this happened, the world plunged into the great depression, which lead to WW2.

2000 – Stock bubble crisis

2008- Housing Bubble crisis

2015-2017? Sovereign debt crisis (I don’t know when it will begin, but it will eventually happen)

Where do interest rates go when there is a financial crisis, and interest rates are already set at zero?

Some interesting information on Saudi Arabia’s oil production capacity.

Key takeaways:

– The Kingdome is not planning to increase capacity

– The sharp increase in drilling activity is aimed at maintaining current capacity, not increasing it

– Saudi Arabia cannot produce 12-12.5 mbd (estimated level of production capacity) with existing wells, it should drill new wells to get there (probably, a lot of new wells).

– the decline rate of the existing production base is 4-6% p.a.

KSA stops oil expansion program, switches to natural gas

http://www.saudigazette.com.sa/index.cfm?method=home.regcon&contentID=20111125112714

JEDDAH — Saudi Arabia has stopped $100bn expansion of its oil production capacity after reaching a target of 12m barrels a day, the Financial Times said on Thursday.

The Times said in an online story that the Kingdom believes new oil resources like Libya will meet rising demand.

The Times quoted Khalid Al-Falih, chief executive of the state-owned Saudi Aramco, as saying that pressure on the Kingdom to raise its output capacity had “substantially reduced.”

It said the comment was an indication that Saudi Arabia is not pushing ahead “with an assumed expansion plan” to produce 15 million barrels a day by the end of 2020.

Including the oil fields in the neutral zone between Saudi Arabia and Kuwait, Riyadh can produce up to 12.5 million barrels a day, the Times said.

“The comments put a cap at least temporarily on a $100bn expansion program that started in the early 2000s when Saudi was able to produce about 8.5m b/d,” the Times said.

Riyadh boosted its oil output to 10 million barrels a day earlier this year, the highest in 30 years, to compensate for the loss of production in Libya, the Times said.

“There was pressure on the Kingdom and Saudi Aramco to raise production [capacity]. That pressure, I think, has been substantially reduced,” it quoted Al-Falih as saying.

Falih told the Times and Saudi Aramco was shifting its spending priorities from oil production into natural gas, refining and the chemicals business. “The downstream [refining] is increasingly growing in scale to equal, and sometimes eclipse, the level of spending we are doing in upstream [oil production],” he said.

========================================================

Saudi oil minister ‘100 percent comfortable’ with market: al-Hayat newspaper

Jun 5, 2015

http://www.reuters.com/article/2015/06/05/us-opec-meeting-naimi-idUSKBN0OL08F20150605

Saudi Arabian Oil Minister Ali al-Naimi said he was “100 percent comfortable” with the oil market, in terms of supply and demand, the Saudi-owned al-Hayat newspaper reported on Friday.

………………………………………..

“I know the oil trading sector well, today the world consumes 93 million barrels per day (bpd) and if we deduct liquids and others, the global consumption reaches 75 million bpd and the annual natural decline rate is 10 percent which means the world loses every year 7.5 million bpd so you can compensate these volumes through drilling new wells.”

Naimi also defended the decision taken at OPEC’s last meeting in November not to cut production in the face of falling prices, saying it was built on predictions that had proven to be true.

Saudi Arabia, the world’s top oil exporter, had said at the time it would no longer cut production to keep oil prices high.

Naimi also said Saudi Arabia’s spare capacity was still at the level of 1.5 million bpd.

“The basic system of our production capacity is that we need if we wanted to go up to 12 or 12.5 million bpd, which is our production capacity, we need 90 days to move rigs from exploration work over to drill new wells to raise production. Its an estimation we have done in the past, but many people don’t want to understand this and claim we don’t have production capacity at this level and this is not true.”

In answer to a question about whether the kingdom had increased the rate of its drilling lately Naimi said: “What is being said is not true, in reality the natural rate of decline in wells in Saudi is the lowest in the world, between 4 and 6 percent”

======================================

Will Saudi Boost Oil Capacity? Naimi’s Retort: Show me 10% Return

6/4/2015

http://www.rigzone.com/news/oil_gas/a/138951/Will_Saudi_Boost_Oil_Capacity_Naimis_Retort_Show_me_10_Return

VIENNA. June 4 (Reuters) – When it comes to whether Saudi Arabia will invest billions of dollars to increase its ability to pump more oil, boosting the world’s only large stand-by reserve, minister Ali al-Naimi has a quick answer: show me the return.

Naimi, speaking informally to reporters in Vienna on Thursday, was asked whether the kingdom needs to lift its capacity now that it is pumping crude at its fastest rate in over three decades to meet a resurgence in demand.

The country last embarked on a $100 billion push to raise its capacity a decade ago amid a price boom fuelled by China’s growth. It can now pump as much as 12.5 million barrels per day (bpd), scarcely 2 million bpd above current output.

With casual banter, Naimi responded: “Is there demand for Saudi crude? Can you guarantee it? If I go and put a dollar, will you guarantee that I would get 10 percent on that dollar?”

He added: “I don’t want 16 percent, just 10 – can you guarantee that?”

While his comment sheds little light on the kingdom’s internal discussions about possible future investments, the question is more relevant than ever as the world’s spare reserve shrinks to its smallest in seven years just as unprecedented regional political tensions are raising new risks.

Some analysts warn that the recent price crash – which has reignited demand and slammed the brakes on much global investment – may be sowing the seeds of another supply squeeze as early as next year.

It may also reflect the financial considerations being made by the world’s biggest oil exporter as it navigates a new market order, one it created last year by saying the kingdom would no longer cut its own production to shore up prices – although it will continue to meet new demand from its customers.

Saudi officials have consistently brushed aside questions of new upstream investment. After finishing the kingdom’s programme to add nearly 4 million bpd of capacity in 2009, Saudi officials and oil company executives have talked on and off about the possibility of targeting another boost to 15 million bpd by 2020, but those plans were shelved several years ago as demand growth cooled and new supplies emerged.

Not that the kingdom has been idle. It launched a $35 billion five-year exploration and production investment plan in 2012 meant to sustain its current capacity.

While the number of U.S. oil rigs has fallen by more than half since last year due to low prices, those drilling in the Middle East have risen to near the highest in records going back to 1975, according to Baker Hughes data.

More than 400 rigs are operating in the region, a more than 10 percent rise from 2013, with just over half of those in Saudi Arabia.

Much of Saudi Arabia’s international influence has derived from a role often described as the oil equivalent of a major central bank, since it holds nearly all of the world’s spare capacity – an emergency reserve that this year has dwindled to its lowest since 2008 as the kingdom steps up output to cover shortfalls in places such as Iran and Libya.

“There’s not a lot of spare capacity left in the world.” said Dr. Gary Ross. executive chairman of New York-based PIRA Energy Group. “The last time they pursued this kind of philosophy in 1985 they had 10 million bpd of spare capacity.”

– The sharp increase in drilling activity is aimed at maintaining current capacity, not increasing it.

– the decline rate of the existing production base is 4-6% p.a.

Those new wells are going into those same fields where the decline rate from existing wells is 4-6% p.a. They are not finding new oil, just sucking oil from the old wells a lot faster. That can be compared to being able to write withdrawal slips a lot faster in order to get your money out of the bank a lot faster.

“They are not finding new oil, just sucking oil from the old wells a lot faster.” Which is exactly what you’ve been saying for how long now? And in how many places is the same thing happening?

They are going into the same fields, but I believe they are justified in part by increasing recovery factor and in part by rate acceleration effects (this is the way it usually works).

If you guys want me to I can sketch a simple diagram to show you how this could work in a high quality carbonate reservoir interbeded with lower quality rocks.

What are “rate acceleration effects”? Is this the same as “creaming”? I remember re-shooting old reservoirs a couple of times to identify pockets of oil/gas so valuable reserves wouldn’t be stranded when the field was finally abandoned. Never heard the phrase “rate acceleration effect”. Of course my background was exploration rather than production. And drilling horizontal holes along the crest of reservoirs was only done after I had retired, as far as I know.

Dough, let’s say we have a field with 20 producers and 14 injectors. We run the reservoir model using three geomodels, 25 times each. That gives us a 75 run ensemble. The p50 result is 52 % recovery factor.

Then we spot 5 extra producers and 8 extra injectors. Run the same three geomodels by 25 runs. The ensemble P50 result is 55 % recovery factor. But having the ability to cycle pore volumes of water at a faster pace accelerates recovery. The case with 13 extra wells requires 28 years to reach the economic limit versus 34 years for the “base case”. So we get the oil production curve front loaded with a steeper decline.

The eventual choice depends on the economic analysis. Quite often when we see oil prices climb we tend to do this type of project. It’s a partial rate acceleration and partial improved sweep effect.

I have no doubt that some oil will be recovered that would eventually be left behind has no infill wells been drilled. I have no idea what percentage of total recovery this might be but I would bet it would not be very high.

Yes, I would be very interested in any light you could lend on this subject.

AlexS. Very interesting. When traders realize there is no spare capacity outside of what is shut in due to war, such as Libya, price could spike. I figured if KSA could ramp up to 12 million they might have done it if they wanted to bury the competition. I wonder if about 10.5 million is the max.

Not to go way off topic but I noticed Plains Marketing LP did not have a posting for either Williston Basin Light Sweet or sour today. Does that relate to your post at the end of the last thread about strong Midwest demand rapidly moving up basis?

shallow sand,

Plains Marketing LP is no longer publishing data for Bakken crude. From their bulletin:

“Effective 6-1-2015 Plains Marketing L.P. will no longer publish the following Postings: Williston Basin Sweet, Williston Basin Sour, Wyoming General Sour, Wyoming Asphaltic Sour, Utah Black Wax, Colorado Western, DJ Basin”

Plains’ data is very close to ND DMR numbers for Bakken sweet crude, both represent wellhead prices.

Their latest data show a narrowing of the differential between Bakken wellhead price and WTI from $15-18 in June 2014 – mid-April 2015 to $10-11 in mid-April – May 2015. I do not know what exactly caused a sharp rise in Bakken crude price in mid-April. In May it was trading near $50/bbl, which means that most of the Bakken new output is now breaking even at the single well level (but not at corporate cashflow level).

As regards the “Clearbrook, Minnesota WTC-BAK” (mentioned in the article I reposted in the previous thread) it is several dollars higher than wellhead price and is now close to WTI. It’s the price at pipeline hub at Clearbrook, Minnesota, and I think it close to Platts’ data for Bakken crude.

Williston Sweet crude vs. WTI price

Source: Plains Marketing LP, EIA

Very interesting Alex, thanks.

I was really surprised to see the level of clarity in the words of al-Naimi:

– Spare capacity. So the spare capacity is just the possibility to drill new wells in existing fields. I don’t think that anywhere else in the world spare production capacity is defined as including additional production facilities that can be build. In this sense, how much spare capacity does the US have? I guess also at least 1m bpd.

– Return on a dollar. Also a very interesting statement: “Can you guarantee me a 10% return?”. How does this reconcile with the “break-even” costs mentioned everywhere of less than $10/bbl in Saudi Arabia. It shows that the cost of new production in SA is also much higher now, which makes of course also perfectly sense.

Now that a larger share of new world production is coming from unconventional sources, the natural annual decline rate must have been creeping upwards. For the US, I estimate it must be quite close to 20% now: According to Ron’s recent article, the US has roughly 5.5 m bpd in shale, and 4.1 m bpd in conventional production. If the shale decline is similar as in the Bakken, where the total field declines with 30% a year, and the conventional part declines with just 6% annually, we are already at almost 20%. That means that the natural decline rate in the US has grown a few percentage points a year.

I agree that approximately 20%/year is probably a reasonable estimate for the current gross decline rate from existing US oil production, in the absence of new wells.

If we stipulate a steady state US production rate, a 20%/year gross decline rate would require the US to approximately put on line the productive equivalent of current Saudi C+C production roughly every five years, just to maintain current US C+C production for five years.

As I have previously mentioned, according to the EIA the observed rate of decline in Louisiana’s annual marketed natural gas production from 2012 to 2014 was 20%/year (falling from 8.1 BCF/day in 2012 to 5.4 BCF/day in 2014). This would be the net change in production, after new wells were added. The gross decline rate (from existing wells in 2012 and 2013) would be even higher. Citi Research put the overall gross decline rate from existing production at about 24%/year.

The EIA put US dry natural gas production at 70 BCF/day in 2014 (25.7 TCF/year). At a 24%/year gross decline rate*, in order to maintain current US dry gas production, the US has to put on line the productive equivalent of total Middle East 2013 dry natural gas production (23 TCF) over the next four years (again assuming a steady state production rate, so that we would be declining against a constant production level).

*At 24%/year, we need about 17 BCF/day or about 6 TCF/year of new dry gas production, just to maintain current US dry gas production; or in other words, we would approximately need the productive equivalent of a new Marcellus Play every single year.

Enno, 5.5M BOPD, really? I don’t doubt that but if you have time to break that down per the 3 shale regions, I’d be plenty grateful. Thank you.

Mike

Hey Mike,

Probably not all of it is shale, but I just follow Ron’s numbers here, from his previous post:

http://peakoilbarrel.com/the-eias-drilling-productivity-report/

Of course, Enno; I should have taken the time to look. Its the PB production that throws the total unconventional production # much higher than I imagined. I agree with you, and am sure MBP would as well, some of that stuff out there is really pretty conventional, just drilled unconventionally.

Thanks.

Mike

Hi Enno and Mike,

The DPR for March was too high by at least 400 kb/d.

My Guesses for March 2015

Eagle Ford ….. 1400 kb/d

Bakken/TF …. 1180 kb/d (includes MT and ND)

Permian …. 1300 kb/d (assumes NM Permian = 200 kb/d)

Big 3 total ….. 3880 kb/d

Others ……….. 550 kb/d

Grand total …… 4430 kb/d

Others are Niobrara, Haynesville, Marcellus, and Utica formations where I simply used the Drilling Productivity report’s guesses.

For the Permian basin my guess is that the Texas portion has about 1500 kb/d total and that 400 kb/d is conventional output, so 1100 kb/d for LTO TX plus 200 kb/d (very rough guess) LTO New Mexico, for 1300 kb/d total LTO. For comparison the DPR estimates 1600 kb/d LTO for the permian basin (if we assume the conventional output is included in the 2000 kb/d DPR Permian Basin guess).

I saw but cannot refind his comments on natural rate of decline, which he put at 4% for SA and 10% globally

I do not know if that term has a definition, and I know the issue has been discussed recently here.

I am curious about whether natureal means no new holes or workovers or what

I am curious about global rate of decline

1. with no activity

2. with workovers and additional drilling within existing fields but no new fields

I wondered if he had shed light on that

Depends on what you define as a “workover”. In most operations we carry a workover expense line item. This is fully tax deductible and doesn’t have to add reserves (it’s only intended to bring the well to top conditions).

Oil is headed higher. Every news article these days focuses on oil supply. Every day there is a mention of glut. However, nobody is talking about demand except Saudi Arabia. Texas, which represents 10% of US gasoline demand, had gasoline tax receipts up 10% in January y-o-y. Looking at import numbers, China was up 700k (it was down in May because of refinery turnarounds), India up 300k, Japan up 300k. US is probably up 500k. World oil demand is probably up over 2mm barrels per day. 2nd half of the year is seasonally stronger for oil demand. VLCC tanker rates are hitting highs not seen in many years. On Frontline LTD’s conference call, the CEO said he did not see any African cargoes having difficulty finding homes.

IEA just put out report expecting world wide demand to be up 1.4 million bopd in 2015 from 700,ooo in 2014, or roughly double.

Some issues I see in keeping up with demand growth spurred by lower prices:

1. US appears to have leveled off, but working through completion backlog is helping offset decline. When that backlog is worked off, could be a big drop. Note Apache, which has zero rigs running in EFS, but is still working through well completions there.

2. As Ron showed in last post, world wide rig count has dropped quite a bit in last year. Assume many of those are longer term, higher EUR wells than US shale.

3. In conjunction with 2., majors have cut CAPEX big time and seem to be favoring a return to US shale.

4. Recent reports about Canada indicate many tar sands projects put on hold. Trade group seeing lower output in 5-15 year range (although I think comments here indicated the trade group is not always very accurate with projections).

5. As Mike has stated quite often US shale will struggle with volatility and unpredictable oil prices.

6. US natural gas prices seem to be stuck below $3. Until that changes, also puts pressure on US “oil” shale as gas production does less to help with economics than it does at $5+. Would seem to apply more to EFS and Permian than Bakken.

7. US shale firms are debt laden. If interest rates rise over next 5 years, puts a lot of pressure on bonds, maybe be more difficult to borrow more.

8. In conjunction with 7., there have to be major reserve write downs coming in early 2016, if not before. PV10 has to take a bath. If WTI stays below $70 through year end, I guess PV10 drops by half or more for US shale companies. Again, just a guess, but if this is the case, many will owe nearly as much or more than PV10. Would think that would surely limit new development.

9. I admit I know little about North Sea, but from what I read, appears that production is suffering greatly and therefore likely that decline continue.

10. Alaska looks like it will continue to decline.

11. Brazil’s state owned oil company is a mess.

12. Venezuela is a huge mess, as Fernando and others point out often. I am surprised their production is relatively flat. I could see an almost complete shut down occurring there, or something similar to Libya.

13. Nigeria, Angola and Algeria struggling with low prices, majors investing less.

14. KSA talk of ramping up production significantly appears to be just that, based on AlexS notes above.

15. Libya is a mess.

16. Iraq is growing production, but can that be counted on? From news reports, Iraqi Army is losing, US bringing in more support.

17. Iran apparently going to add 1 million bopd, but that assumes deal with US and that they can ramp up that fast.

I think oil market has discounted much of the above. Pretty much everything I note above is from information Ron and or others have posted/discussed here. I again thank Ron and many others for all the work, input and information shared.

Hi Shallow sands,

Nice summary.

In almost every case, higher oil prices tends to fix many of the problems. The lower the oil output, the higher the oil price will go, so many of the problems are self correcting.