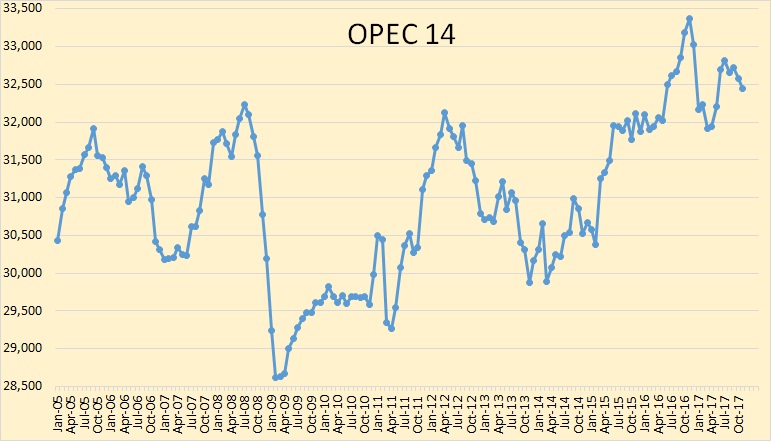

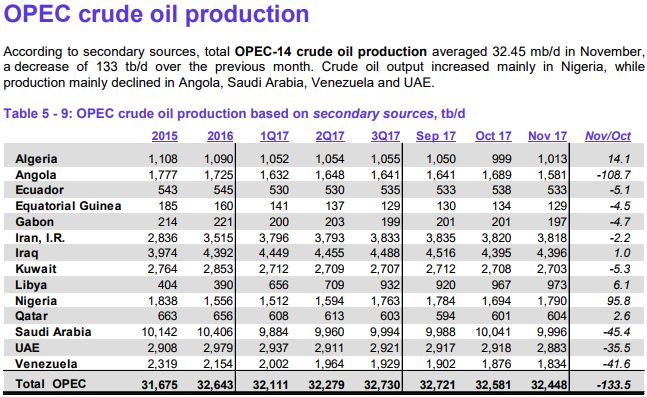

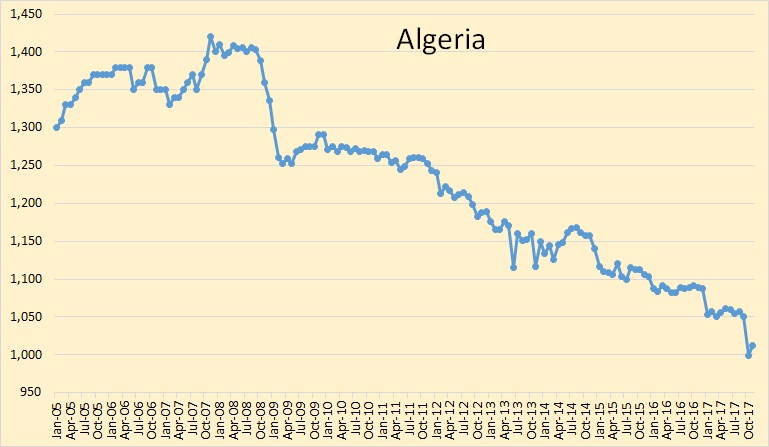

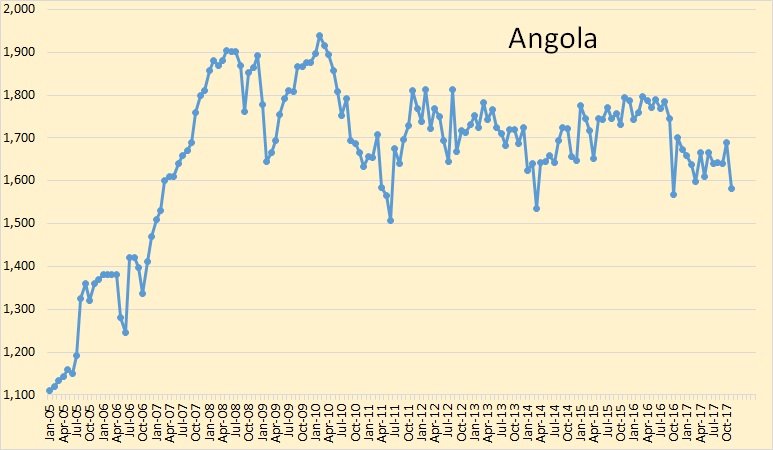

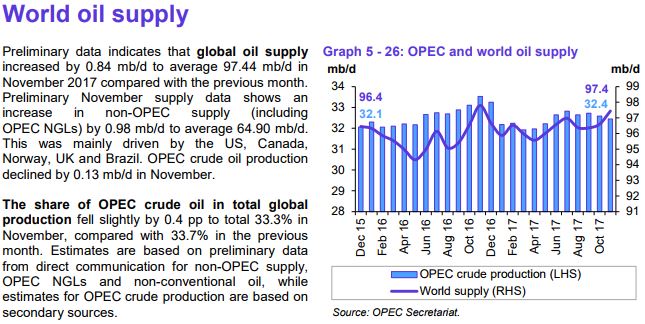

The OPEC data below was taken from the December OPEC Monthly Oil Maret Report. All data is through November 2017 unless otherwise noted.

OPEC crude oil production declined by 133,500 barrels per day in November.

Algeria was up slightly in November after that huge decline in October.

Angola was the biggest loser in November, down 108,700 barrels per day.

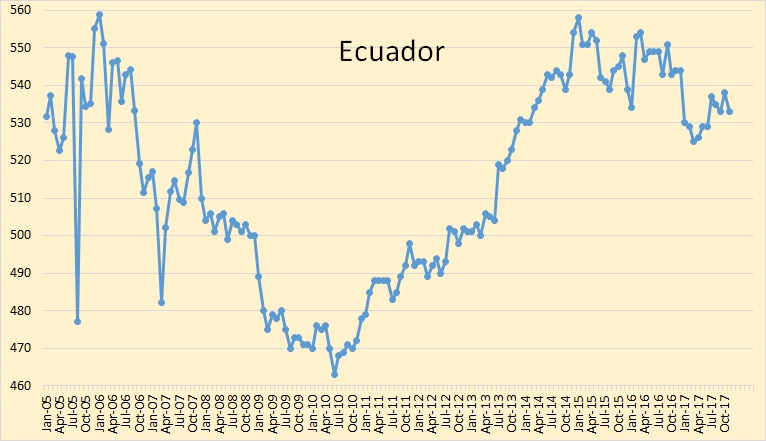

Ecuador, though holding its own for the last year, appears to be in slow decline.

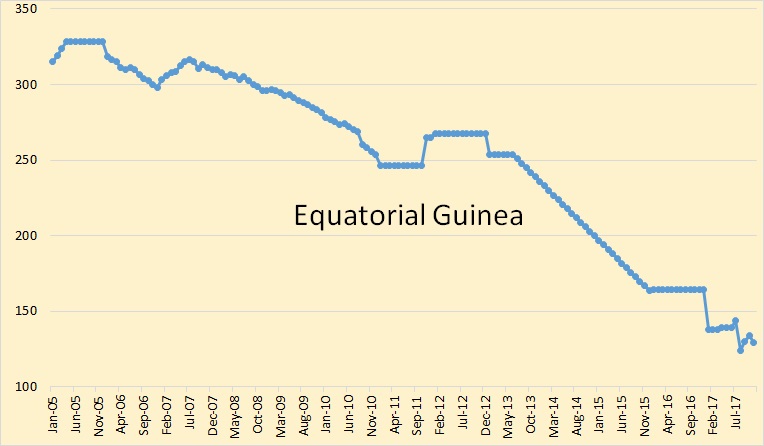

I have managed to cobble together an estimate of Equatorial Guinea’s historical C+C production. I had the EIA’s production numbers through June 2013. I subtracted 10% for “other liquids”, then merged that with the OPEC MOMR data that started in 2016. However, Equatorial Guinea’s production is not enough to make much difference.

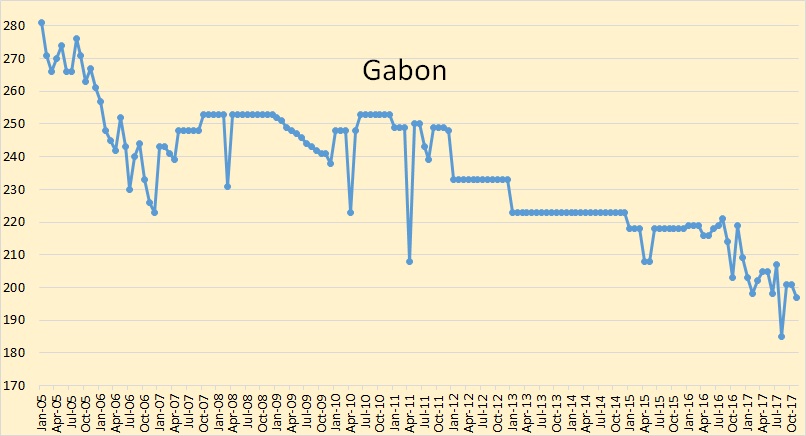

Gabon is also in slow decline. And their production is not enough to make much difference in total OPEC production.

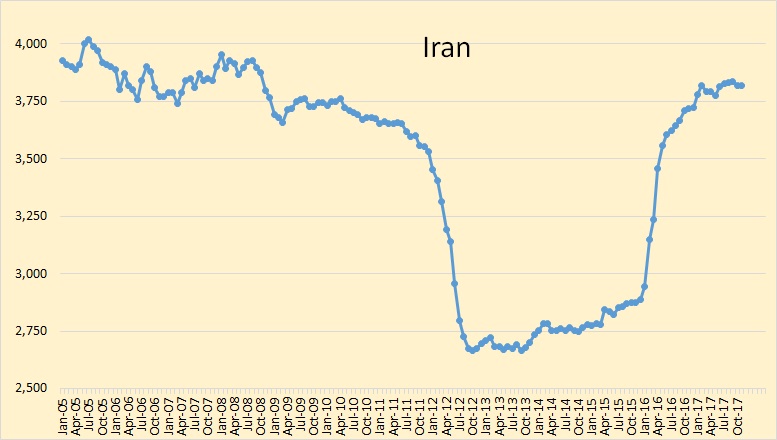

Iran ignores any OPEC request to cut production and continues to produce flat out.

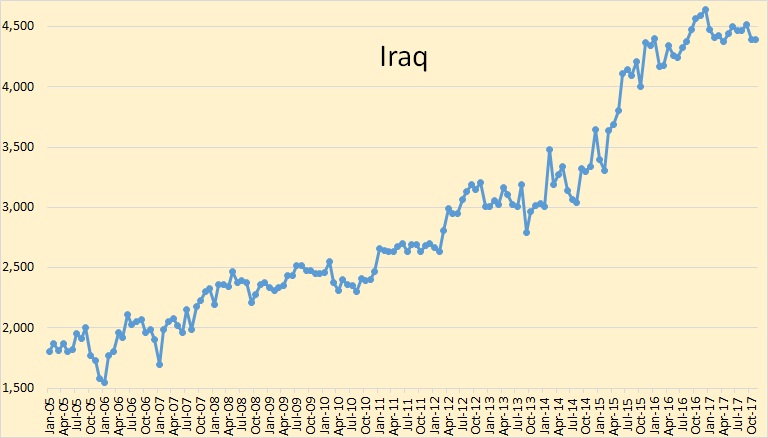

Iraq peaked last December and down only slightly since then.

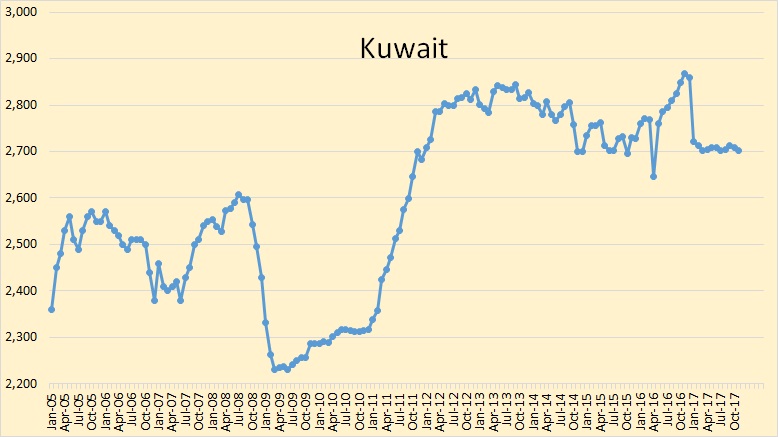

Kuwait peaked last November then dropped sharply in January and has held steady since then.

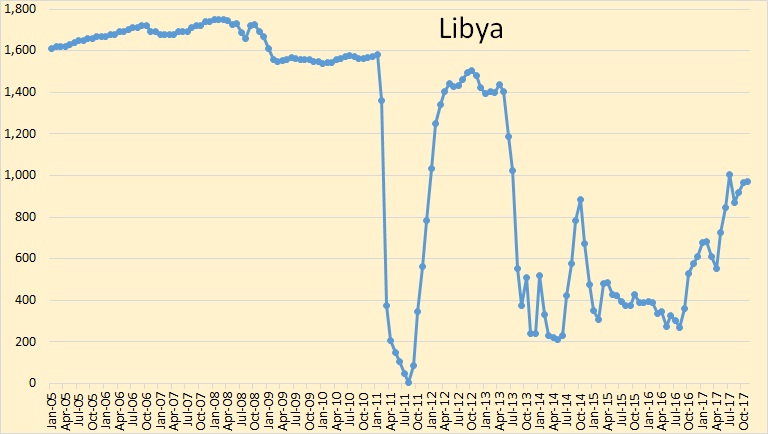

Libya’s political problems have ebbed but their oil production doesn’t seem to be responding very much.

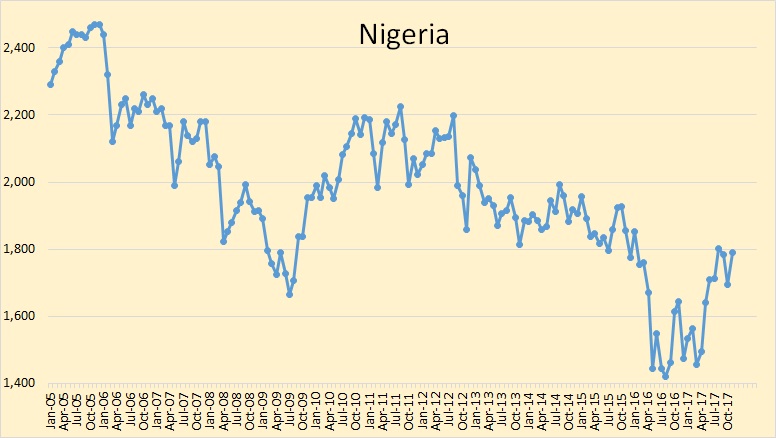

Libya was the largest gainer in November, up 95,800 barrels per day. It looks like Nigeria peaked in 2005 and have been declining since.

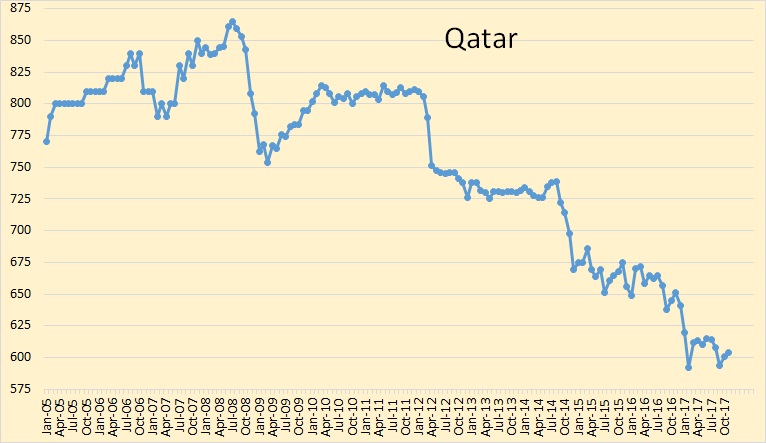

Qatar peaked in 2008. Their big exports are natural gas and natural gas products.

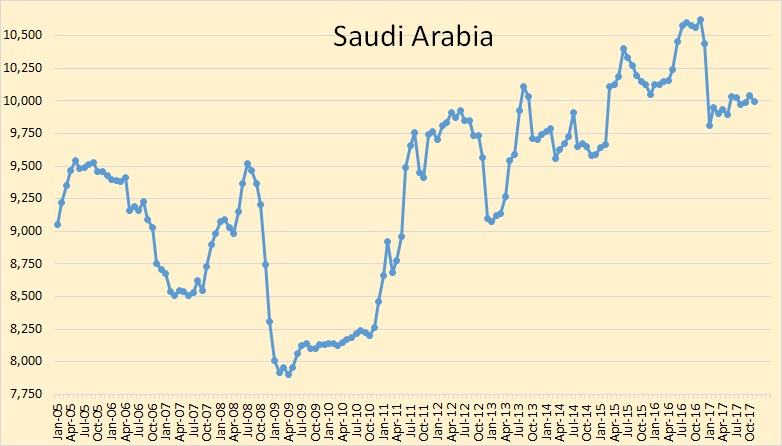

Saudi Arabia is holding steady, down about 600,000 bpd since peaking last year.

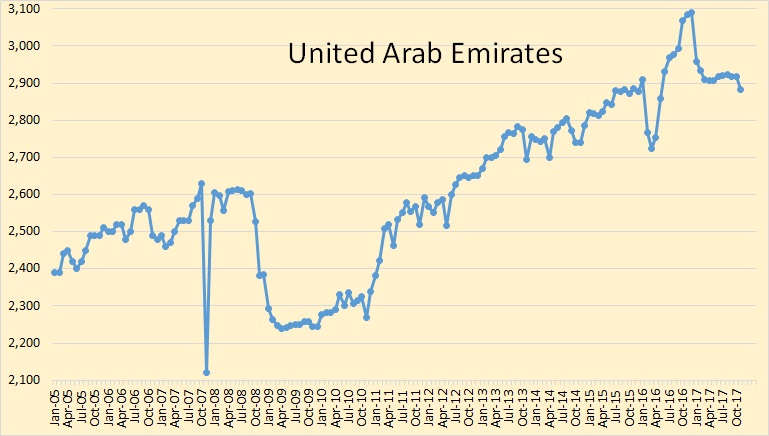

The UAE was down 35,500 bpd in November.

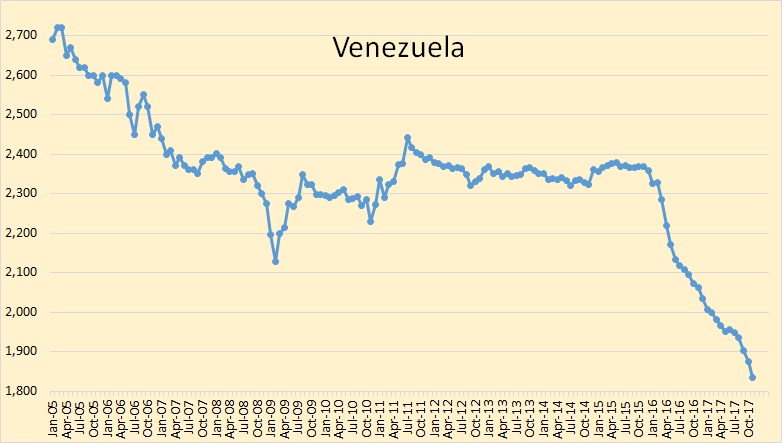

Venezuela’s decline continues. They were down 41,600 bpd in November. Venezuela is on the verge of becoming a failed state. What happens to their oil production in the future is anyone’s guess. But it doesn’t look good.

The OPEC MOMR says world oil production was up 840,000 barrels per day in November while OPEC crude production was down 133,500 bpd. That would mean Non-OPEC total liquids + OPEC NGLs would be up 973,500 bpd. I don’t really think so. Russian C+C was up only 7,700 bpd so that means Non-OPEC and OPEC NGLs were up 965,800 bpd. I think that figure will have to be revised downward.

Russia C+C oil production according to the Russian Oil Minister. I am using 7.3 barrels per ton here. The Oil Minister’s production numbers average about 400,000 barrels per day above the EIA’s Russia production numbers. I have no idea why we have this discrepancy. Both are supposed to be crude + condensate.

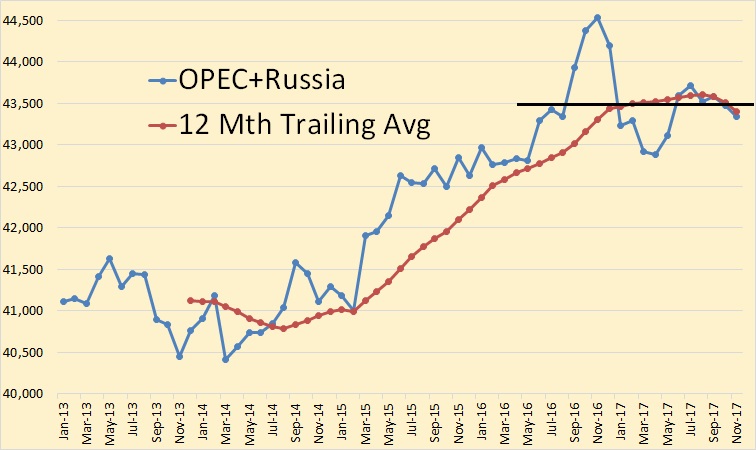

OPEC + Russia is 57% of world oil production. The last four months of 2016 are all above the black line in the chart above. This was all “positioning” for future cuts. This could have been done by draining storage tanks and delaying well maintenance. The sudden decline, January through May, was refilling storage tanks and catching up on well maintenance. The six months since then, June through November, is everyone producing every barrel they possibly can, or near that anyway.

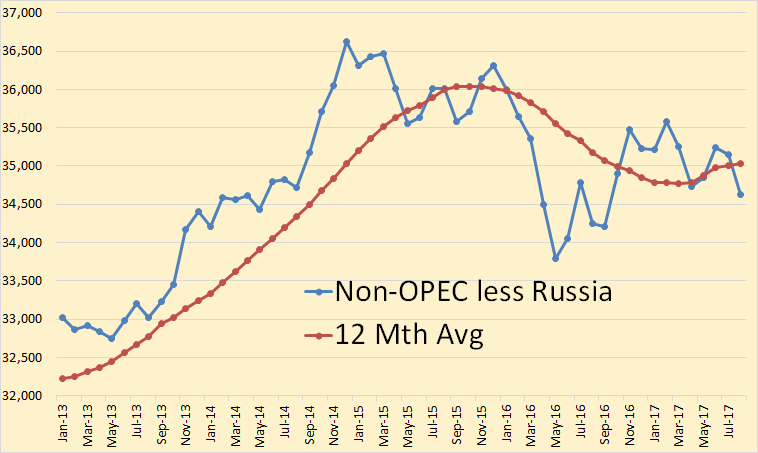

Here is the other 43% of world oil production, Non-OPEC less Russia. This data is only through August 2017, the latest EIA data. Non-OPEC less Russia peaked in December of 2014 and is down 2 million barrels per day since then. The 12 months trailing average peaked 10 months later and is down 1 million barrels per day since, or in August 2017.

Note: For the first chart, OPEC + Russia, I used the Russian Oil Minister’s data. For the Non-OPEC less Russia chart above, I used all EIA data.

The question is: Which of these countries are producing flat out, and which really cut back.

I’ll say all these in decline are producing what they can, they don’t need to choke.

SA, United Emirates and Kuwait look like they have reserve capacity – their curves are too smooth to be producing what they can. Irak is holding some kind of discipline, too. I have heard they are the only one who have enough reserves to add another 2-4 mb/d when they would tap all their fields, besides shale oil. At least they would earn money doing this.

Demand is growing round about 1.5 mb/day the last years, so when Venezuela finally fails completely due to a revolution, all reserve capacity will be strained.

Hi all,

Comments related to oil and natural gas should be under the OPEC post by Ron.

Other comments should be under the Electric Power Monthly post by Islandboy.

Thanks.

Hi Dennis.

I am trying to keep the topic of shale oil wells on rod lift operations alive, as it appears from Enno Peters’ shaleprofile.com data that almost all shale oil wells with first production through 2015 are on artificial lift, and the vast majority are likely on rod lift.

From Enno’s shaleprofile.com, these are my calculations for oil wells’ average BOPD in the four major shale basins (Bakken of ND and MT, Eagle Ford of TX, Permian of TX and NM and Niobrara of CO and WY). Unfortunately OK data remains unavailable, but given present EIA production data for OK, it still is not a major shale oil producer, at least in relation to the “big three”.

Year Average BOPD in 8/2017

2004 18.94

2005 17.81

2006 18.23

2007 22.79

2008 40.91

2009 36.90

2010 23.67

2011 23.78

2012 25.13

2013 30.64

2014 42.27

2015 66.35

I contend the above shows that the average shale oil well is a “stripper” well for all practical purposes by year 2 and no later than 3 years after first production.

I do understand “stripper well” is commonly defined for oil as 10 or 15 BOPD. This definition was arrived at when wells were vertical and mostly less than 10,000′ TD.

The shale oil wells are almost all in excess of 15,000′ TD and all horizontal. I think an argument may be made that a 15,000’+ hz well is a low volume, high cost well if it is on artificial lift and making less than 100 BOPD. I think that argument becomes even stronger when we get to 18-42 BOPD.

Years 2008 and 2009 look good due to many of the best Bakken wells having first production in those years. Those wells, I agree, made their operators a lot of money.

For the first time ever, it seems, the MSM has picked up on the fact that the US shale wells, by and large, become marginally economic once they have been producing for 2+ years.

Unfortunately, when I bring this up on POB or Seeking Alpha, all I hear are crickets chirping.

Coffee, Texas Tea, what about this problem?

This problem has been apparent to me since late 2014, when the oil price crashed Back in 2015 and 2016 I ran a lot of simple numbers and found that large percentages of these wells would not payout. There is a wealth of cost data online, and I do not believe I was every successfully challenged on my assertion, just basically ignored.

There is a tremendous amount of publicly traded debt related to these wells, as well as a very large amount of publicly traded equity market cap related to these wells. Most of this debt and equity is parked in US 401(k) and other retirement plans.

Seems to me these wells should only be worth investing in during a time of high oil prices, which the futures show will not be the case for quite awhile.

However, it appears that even the majors (see Exxon and Chevron) are curtailing most other upstream CAPEX and will focus on these shale basins. So, even Exxon and Chevron are resigned to their future outlook being that of the stripper oil well operator onshore USA.

I await some commentary about the issues involving operation of 2+ year old shale wells that are on artificial lift, as well as the ramifications when, in just a few short years, the remaining shale oil locations are drilled and completed.

Hi shallow sand,

If we consider only the 33,419 wells completed from 2010 to 2014, there are 10,928 of these wells that have been producing for 60 months and their average output at 60 months is 28.8 b/d (data from shaleprofile.com, all US LTO.) Average cumulative output is 144,850 b at 60 months for the average US LTO well that started producing between 2010 and 2014 (in reality this would be wells completed between Jan 2010 and Sept 2011).

I agree for wells which started producing in 2014 and later, many will never pay out. Higher oil prices above $85/b will be needed for profitable wells when all costs are considered (full cycle profitability, the only thing worth talking about). When paying off the debt load is considered, it may be that $90 or $95/b is needed to payoff debt and get these companies in the black.

The sooner that banks and investors realize this the sooner drilling and completion will be scaled back to levels that will allow oil prices to rise.

Probably this is far too optimistic a scenario, it seems investors are not very smart.

I think in many cases when people agree with you they don’t say anything.

I mostly comment when I disagree or have something that I think adds to the conversation.

I have mostly agreed with you, when I said nothing, others might do the same.

Dennis.

Maybe you are correct.

Maybe the shale proponents just agree with me, that these wells are generally marginal after about 2 years.

Seems my cliff thesis may be correct. Just not sure when it hits and how long before some other Energy source takes the place of oil.

I guess it also depends where the pump is set? Pumping a well with a pump set below the kick off point is a huge hassle. On the other hand, if the kick off is fairly deep, it’s not so bad to set a tubing anchor just above kick off, run a stinger below it, and put a pump just above it. These wells have very high GOR, and that’s going to be another enormous hassle. I can see pumping them with a high fluid level because they aren’t that productive.

When I think of it, they may not be worth pumping at all. Just put them on a clock.

Hi shallow sand,

If there is a cliff in output oil prices will increase and the futures market is wrong on the future oil price.

Do you think output will stay low when oil prices increase?

My suspicion is that output will stay low when oil prices increase.

That is why I think LTO may be the “anti-swing” producers: output surprisingly high when prices are low and output surprisingly low when prices are high.

Hi Schinzy,

I believe you assume high prices will lead to a recession, is that correct? Why will that be the case now when it did not prove to be the case (except in Europe where poor fiscal policy and lack of the ability for nations to control monetary policy slowed any recovery) from 2011 to 2014 when oil prices were mostly above $100/b in 2017$?

Eventually I believe high oil prices will lead to a recession (after 2025 and probably around 2030), but in the interim output will increase until about 2025, and oil prices will be high in order for supply to match demand, oil prices will likely increase at an average rate of $2/b each month over the next 70 months, by that time an equilibrium might be reached where demand and supply are roughly matched at $200/b with slowly declining demand and supply until a recession occurs after 5 years of slow or no economic growth (0 to 1% growth in real GWP per capita).

Not exactly.

I think production levels remained high when prices were low because investor money continued to flow into the industry. There were bankruptcies, but the bankruptcies caused more money to flow into the sector.

My conjecture is that money will cease to flow into the sector when the price rises. I believe this will happen because of the buy low, sell high psychology of investors.

With less capital, production will be lower.

Hi Schinzy,

Higher prices will allow LTO companies to self finance in my opinion. If the oil price rises to $85/b in 2017$ or higher, most LTO companies will be profitable.

Hi Dennis,

If LTO companies start self financing, management style will change. Current LTO management is terrific at marketing and obtaining financing. They are big risk takers. It is easy to take risks with OPM. When management self finances. the management style is closer to the prudent style of Shallow Sand and Mike. I think they will pay down debt before drilling a lot of new wells. This means prices will have to remain high for 2 or 3 years before extraction rates rise.

Hi schinzy,

We are almost on the same page.

Scarcity will lead to increases in oil prices to $85/b to $100/b. This price level will enable LTO producers to self finance and pay down debt and will lead to a gradual increase in output from 2017 to 2025.

At that point the tier 1 areas will be fully drilled and as production moves to less productive areas output will peak and decline. Oil prices may continue to rise due to scarcity until a recession hits in 2030 due to difficulty dealing with the energy transition. Then oil prices might start to fall due to reduced demand.

That’s how I see it playing out.

Hi shallow sand,

Can you remind us what your “cliff thesis” is exactly. I assumed it meant a rapid decline in World output (or perhaps just LTO output), but my guesses are often incorrect.

Earlier I was trying to agree with, just presenting the data in a different way.

I agree LTO producers should not be drilling so many wells, there seems to be a problem with the way the CEOs of these companies are rewarded.

If I were a shareholder, I would vote for CEO compensation to be based on the bottom line. Negative earnings should mean negative bonuses.

Dennis. Cliff theory is probably not a good name.

I think there are two presumptions which may be faulty. First is that US will grow production for at least a decadeand meet the needs of worldwide increased demand in the near term (10 years or so).

The second is that within that time, electric vehicles will cause peak demand for oil.

My theory is that both presumptions are too optimistic, and that there could be a major supply crunch in between the “peak” of shale and “peak demand.”

I think maybe you are the one calling for production falling off a “cliff”? My theory is for sure not an original thought.

Hi shallow sand,

No I expect World output will decline gradually (1% to 2% per year), perhaps US LTO output will fall off a cliff, but oil sands, deepwater offshore, and OPEC will likely respond to high oil prices with an increase in output which will make the decline in world output less steep than the decline in US output after LTO peaks (in 2023+/-1 year).

Others believe this gradual decline scenario is far too optimistic, Ron and George believe (I think) that World oil output is likely to fall quite rapidly (maybe 5%/year) so more like a cliff than my scenarios.

Clearly if they are correct this is more likely to lead to severe economic disruption. I think the only way we see such a rapid drop is a major war between Iran/Iraq (on the Shia side) and Saudi Arabia, Kuwait, and UAE (on the Sunni side) which might take as much as 23 Mb/d of C+C output off the World market (assuming output falls to zero in these 5 nations).

This scenario seems far fetched, until it happens.

We would see a major economic crisis as a result of such a scenario, we would probably need to ration oil under such a scenario and $300 or $400/b would not be out of the question, at least until the conflict is resolved.

Dennis. The cliff is not mine originally for sure. Maybe not even a good name.

I think what I am trying to say is I think there could be a gap between peak supply and peak demand that will cause a lot of economic problems.

Hi shallow sand,

I agree.

Typically there is no gap between supply and demand as long as there are not price controls put in place (Nixon’s mistake in 1973-4).

If we want to wait in line for fuel, then price controls are a good idea, but mostly this justs makes the shortage worse (as cars waste fuel idling while waiting in line.)

Let us assume no price controls because someone in the government has studied Econ 101, in that case there is no gap between peak supply and peak demand, the market price will make them equal.

The very high oil price that may be needed to make this so (possibly as high as $200/b, maybe higher) will certainly lead to economic disruption, but if it happens gradually over several years (say an average rise of $2/b each month over 6 years) so oil prices gradually climb to $202/b (2017$) by December 2023, perhaps the economy can adjust.

We would gradually see more hybrids, plugin hybrids, and EVs being sold as oil prices rise, by the time oil prices reach $200/b perhaps 80% of new cars sold will be plugin hybrids and EVs. More long haul shipping would be by rail, short haul transport may start to switch to EVs. I doubt any of this will be smooth and a severe world recession within 5 years of peak oil output (which I believe will be 2025) seems highly likely in my opinion.

In the mean time oil producers can make some money (when oil prices are at $100/b or higher) and save for retirement, or that is my hope.

Hi Shallow.

I seem to recall agreeing with you and Mike on this last year. It is probably the most notable thing I have gotten out of Peak Oil Barrel since I started reading. The problem is, I have nothing to add besides an “atta boy!”. I don’t have any pull on anyone who can change things; yours is an idea that needs a champion, someone who can influence those who make investment decisions. There seems to have been some movement on the investor side, like the WSJ article Ron posted last week, but I doubt they will have any long term effect before the shale sweet spots are all drilled out at low prices and massive losses for investors. The only thing I can think of that might change things is if an actual indictable offense, say, some kind of fraud, could be proven….hard enough to do in normal times, let alone with the current administration.

-Lloyd

Thanks, Lloyd.

Jeffrey Brown and I made a bet 4-5 years ago regarding the percentage of unconventional shale oil wells in America that would actually reach payout based on a weighted net back oil price and realized production data. My bet was less than 40% and I am sticking by that bet. Please remember that most well costs touted in investor presentations conveniently leave out lots of inconveniently costs and I think most wells being drilled in both the Midland and Delaware Basins, for instance, are going to require 350K BO, not BOE, or more just to reach payout. Well productivity is up for sure, but so are costs and the interest on debt per incremental BO keeps whirling like the electric meter on Christmas Vacation when Clark Griswold finally gets his lights working. I B guessing the FOMC probably gave the shale industry a little more heartburn today.

Dennis, we’re on the same page, I think. Shit, that’s scary: https://www.oilystuffblog.com/single-post/2017/12/13/Hydrocarbon-Independence

Hi Mike,

Yes it is. If you agree with me, you must have been drinking too much. 🙂

Happy holidays, I hope oil prices rise sooner rather than later.

Hi Mike,

For the Permian basin at shale profile (link below)

https://shaleprofile.com/index.php/2017/11/27/permian-update-through-september-2017/

For 2016 wells (using year of first flow) it looks like the output vs cumulative chart trends towards about 425 kbo for an average EUR for the average 2016 Permian horizontal well (first flow 2016).

So if your guess of 35o kbo is correct, maybe these wells will pay out (for the average well). I am assuming production problems at the end of life may reduce EUR from 425 kb0 to 350 kbo, it may well be worse than this, clearly you would know better than me.

Lets assume $50 oil based on a hedge and what appears to be growing deduct to WTI because of bottlenecks. Less 7.5% severance and property tax ($3.50), less 25% RI ($12.50), less ($3.00) per incremental BO G&A, less ($2.5o) per incremental BO interest expense, less ($8.00) per incremental BO lift costs = $21.00 per incremental BO take home pay.

I don’t buy the well costs those yahoos tout; the AFE’s I’ve seen for the laterals, frac’s, 600K BW at $1.50 per BW, acreage costs, etc. they have in the Permian are $9M, with no problems and there are always problems…Pioneer in the Midland has now had to add a 3rd string of casing to a lot of their wells.

$9M divided by $21 net back is actually 428,600 BO to payout. Even if we use 400K BO to reach payout, and add the increasing gas component in the revenue stream, and declining WH price per mmbtu, if it is not flared because of its own bottlenecks…its not good. The economics of all shale oil wells suck at $50. Their “breakeven” price calculations are lies.

Then we’re back to what is profitable enough? Fernando can answer this question: is 1.35: 1 ROI on a $9M expenditure sufficient return on investment to be able to pay down $2, 4, 5, 6 or 8 billion of debt? Is that sufficient return to self fund reserve replacement? My answer is NO!

By the time your predicted oil prices come to fruition, Dennis, if they ever do, the shale oil industry will have drilled all of its Tier 1 reserves and be grinding away on flank stuff that is more expensive, less profitable and less productive. If there is actually anything left of the shale oil industry by then. Its private enterprise running America’s oil industry and it must make money to succeed and be sustainable. Unless, of course, one thinks Central Banks (government) should keep giving these guys money they don’t have to pay back.

Hi Mike,

I agree, I just took your initial number (350 kb0) and compared it to the data from Enno’s website. Note that this average includes all wells both bad and good. Some of the companies have cheaper land costs due to legacy wells (maybe Pioneer) and may have tier one leases that have higher output than average.

I am not meaning to suggest this seems like a good business plan, I am simply trying to understand why these wells continue to be drilled and completed as your arguments for why it does not make sense is compelling.

My first assumption is that oil men are not stupid, your opinion seems to be that these LTO guys are not very smart (or something to that effect).

Hey if I guess that oil prices will increase consistently, I am bound to be right eventually. Even a broken (analog) clock is correct twice each day. 🙂

Even if US LTO output increases it is likely to be a 400-500 kb/d annual rate of increase, this is not enough to meet rising World demand for oil which is likely to increase at a 1200 kb/d annual rate for at least the next 7 or 8 years at current oil price levels.

My knowledge of economics suggests the scarcity of oil will lead to higher oil prices (rate of increase unknown).

On central banks giving people money, I am pretty sure these companies get their money from private citizens, either through bank loans, bonds, or sales of stocks.

It’s a free country, people can invest their money where they choose. I would not (and do not) invest in oil companies, but you know what PT Barnum (supposedly) said… every minute.

Oasis Petroleum paid $946 million for 20,300 net acres in the Delaware Basin, with 601 gross locations having a 76% GWI (so 457 net locations).

This comes to $2.07 million per location!

Assume $8 million per well cost, including gathering and other infrastructure (I am likely being generous to Oasis) development of the net locations will cost Oasis $3.656 billion to their interest.

So, to fully develop the acreage, looking at spending CAPEX + land of $4.6 billion.

I will be generous again and assume OAS netback of $25 per BO. OAS will need to produce 184 million BO to payout this project, or 402,837 gross BO per well (to 100% GWI).

Of course, no time value of money calculations are being made here.

I see 3,167 horizontal wells with first production in Reeves, Loving, Ward and Winkler counties since 1/1/2010. Some could be San Andres. Still, only 32 hz wells with first production since 1/1/2010 have cumulative oil in excess of 400,000 BO.

Seems like they will need much higher oil prices to make this work?

SS, let’s agree sometime people and yes companies are people too, do stupid things. But here is the thing, ask your self who are these people, what is the totality of educational, practical experience and previous success in business. And then ask yourself why would they make stupid decision or perhaps they have information that you as a laymen do not. I still recall you our “disagreement” on oil production in Oklahoma, you refused to believe me, which is fine…now 3 years later of course you missed the boat. My point is, even if I give you credit for trying to learn, you come with a preconceived bias that keeps you from seeing the facts. Now without speaking to the exact location of the purchase, I do know that in many areas there are as many as 10-15 different horizon. So if they are developed with 4-5 wells per horizon, that could mean 40 to 60 well per section. Now how do those numbers look?

IN our area in OKLA, we have gone from 6 wells 4 years ago to over 15 wells per section Proved Un-Develped. That is more likely to increase than decrease given the information currently at hand. Good god man, if someone is not paying you by the world you write, I am at a loss why you spend so much time doing what you do.

Hi Texas Tea,

Shallow sand is an oil producer, far from a layperson.

Dennis.

When it comes to shale I might be considered a layperson because I do not understand why so much money has been thrown away.

My assumption is that shale management are more akin to oil well promoters than those of us who actually make money or lose money on the oil.

I think Abraxas is the only shale company whose management took a pay cut during the price collapse.

Imagine if management owned the company privately. They would likely not drill as many wells.

As for OK, I am still not sold on it being a major shale oil producer like the Permian, EFS or Bakken. There is a lot of gas and liquids there, but prices for those commodities are still terrible.

Hi shallow sand,

Fair enough, you do not produce LTO, but you do know the oil business.

I have no clue about Oklahoma.

Output from 2005 in chart below (trailing 12 month average). If all of the increase since 2005 has been LTO, it would be about a 275 kb/d maximum LTO output so far.

Shallow, my dad always use to say to be offended by someone’s insult you must first value their opinion. I am privileged to know your background and you are hardly a “layperson.” That was a stupid remark made by someone who struggles to even spell and construct sentences properly. Consider the source and move on.

If one wants to know the economics of oil and gas extraction, if an oil well, covey of wells, field or resource play is going to be profitable, enough, and be sustainable in the long term… ask a stripper well operator. We deal in facts, down to the pennies. We can’t lie to ourselves, or to others, or we do not eat and we cannot keep ourselves, or are families, warm in the winter.

The American shale oil industry is failing. Yes, it is providing jobs, and cheap gasoline to consumers, but from a business standpoint it is failing, miserably. Debt and oil do not mix. Set aside the lies, the funky arithmetic, a few monster wells here and there, the “hope” for higher oil prices and OPEC cooperation, anybody with a square centimeter of cranial capacity can see the LTO industry is hanging on by a thread and all but four or five of the largest shale producers would not exist but for low interest credit.

Your latest and best example, which I still find remarkable: Continental Resources, the poster child for the shale “revolution,” is over $6.6 billion dollars in debt and only has enough cash on hand to drill one stinkin’ Bakken well.

THAT, sir, is beyond stupid. How’d you like to have that company operating for you? Worse, who would buy a share of that outfit?

Dennis if you need to be RIGHT about oil prices, and all of your growth and recovery models ultimately be correct, then hang in there and continue the best you can to ignore reality. Eventually you might be right.

Smart people do stupid things with other peoples money. Like you, it seems, they make decisions based on hope, not the reality of the presence. Like you, it seems, they don’t seem to think debt is a bad thing. Debt IS a bad thing but I think one has to have been in business for oneself, particularly the oil and natural gas business, to fully understand that. And I would suggest you review where the money has come from to fund this shale phenomena, you might start here, https://twitter.com/aeberman12.

Hi Mike,

There are different points of view on debt.

As long as one has adequate cash flow to pay principle plus interest, debt is fine.

You seem to think I am trying to defend the LTO producers, when I agree with you.

I guess I cannot communicate this clearly.

You seem to assume oil prices will never increase.

To me such an assumption requires either

A. The World economy will not grow in the future or

B. Oil supply will continue to increase as fast as oil demand in the future or

both A and B are true.

I believe both A and B are likely to be poor assumptions.

That’s probably the main source of where we disagree.

The source of my assumptions are

A. World real economic growth has been positive all years since 1960 with the exception of 2008. So I expect most future years until 2030, this will also be the case.

B. Fossil fuel resources are not unlimited and even an optimistic estimate for resources (say a C+C URR of 4400 Gb, or 1000 Gb more than my best guess).

It is of course possible that I am wrong.

If the debt from the LTO companies is not paid back, life will go on, and maybe investors will be more careful with their money in the future.

I think we now have a better understanding of each other’s “opinions” about the role that shale oil will play in America’s energy future. You are not adverse to debt, I am. I am able to see how severe the financial situation is for the American shale oil industry, your not.

https://www.peakprosperity.com/blog/113557/great-oil-swindle. The American shale oil industry is two hundred billion dollars in debt and now forced to manage that debt with wells that produce less than 25 BOPD. And, as Chris implies in his article, not sufficient reserves to cover that debt. That is a disaster in the making. That will not improve with some wishful thinking about $100 oil. “Life may go on.” if the shale oil industry fails, but your predictions won’t. Debt is not “fine, and it is particularly not fine for an industry whose assets decline 45% the first 3 years, then 12-15% per year thereafter.

Hi Mike,

Companies go bankrupt. Other better run companies pick up the pieces and create profitable enterprises.

This has been the case as long as capitalism has existed.

Only “too much debt” is bad. Have you ever borrowed money? I have, to purchase real estate, it has worked out fine. My guess is that John D Rockefeller also borrowed money, but I don’t know this for sure, the Wikepedia piece suggests this was the case early in his career.

I do agree that if the price of oil remains $50/b forever, LTO companies are likely to fail. At $85/b, probably not.

I do not know the future price of oil, nobody does.

Hi Mike,

I was joking about being right, that’s what the smiley face implies (that I was kidding).

I agree that at $50/b not many LTO wells are profitable (probably less than 25%) and the average well loses money.

I also agree this is not a smart way to conduct business. I am at a loss to explain why anyone continues to invest in these companies.

If it’s private equity being funded by institutions heading pensions that are obligated to produce guaranteed rates of return to pay pensions, then as long as the yield is there then they will be funded.

You would think bankruptcy would have taken a toll on those yields, but I suppose bonds are still getting paid? Or by the time the piper needs to be paid the private equity people are hoping to be retired.

Mike: Not to be critical, but did you include land costs in your calculations above?

Oasis just stepped into the Permian with a big acreage buy, to be funded by an equity issuance, and the market reaction yesterday was negative, share price down 17%.

When one throws $30-60K per acre on top of what you lay out above, one needs to produce a heck of a lot more oil to payout.

Of course, they tout a ton of locations. As we know, many of these locations are in zones that, thus far, have proven to be completely uneconomic, even at $90 oil.

I do see on the auction there are two horizontal wells for sale operated by BC Operating, in the New Mexico Permian, which appear to be, dry holes! If you bid $100 you will own them.

I had taken a break from looking this stuff up, but six months later, things have not changed. Still a lot of not so great wells. Still a lot of companies touting high IP’s, with no mention of all the 15,000’+ stripper wells they now operate, that are still $1-5 million from payout.

Shareholders of shale are merely etal’s being promoted, it is no different than it was in the late 1970’s-early 1980’s other than instead of actually owning an interest in wells, one now owns stock. I guess not really much different than the “limited partnerships” that were all the rage 30-40 years ago, which quickly became worthless?

Shallow, ouch those BC Operating wells had to hurt someone. From looking at the record at least one of the wells must have been completed in some manner as they produced 441 bbls of oil in May 2015 and a little gas around that same time. I thought that part of shale’s touted magic was no dry holes except mechanical failure such as a casing collapse.

Did you notice the seller had a 35 percent working interest but only 10 nri, wonder what is up with that, maybe tt has a massive orri.

Yes, what’s up with that?

Rare to see NRI for the working to be that low.

Shallow, though shale oil wells are essentially mass manufactured, they don’t cost the same. My $9M number is indeed conservative, but includes acreage costs, even geophysical costs that are often diluted by multiple wells on a producing unit. Later in these plays acreage costs go sky high, over the $40K an acre number, but including production. If my well costs are low, then UR to reach payout goes up. It is clear to you and I, at least, that not many PB wells are going to get there.

I appreciate your relentless effort at showing people the truth about all this shale stuff. It plum baffles me regarding the exuberance over it all. You must please take note of the fact that none of this exuberance comes from real life experience with the oil or gas business, of having to write checks to get the stuff out of the ground. All of this exuberance is based on internet heresay, and hope.

If I can find the time I am going to write a post this weekend for oilystuff on how the water situation in the arid, dry Permian Basin IS going to affect the rate of growth out there. We have had 3-4 good, wet years in Texas; but that will change and the water situation, already reaching a crisis situation, is going to put the big breaks on Permian operators, who, I might add, have been lying about water and are ill-prepared about not having any to frac with.

my best guess is you are “plum baffled” by the sun coming up each morning, I have never seen so much written by so many people who do not know diddly squat about the subject in which they write. I can assure you, you do not speak for ANY oil men I know. they are still finding grease while you…..are baffled?

Texas, do you work in the patch? And I don’t mean as a service company drone who doesn’t know anything, but on the engineering or g&g side at an operator?

Because I’m going to tell you, as someone who does, you don’t speak for anyone either. You are just as confused as the rest here. You just may be confused in an opposite direction.

Get off your high horse before someone with access to a lot more data than yourself schools you.

Hi Mike,

Chart below adds a trendline in purple for the average 2016 well (eyeball rather than regression). I recognize actual production is likely to be lower than this for many reasons that you and shallow sand have covered.

Good for you, Shellman. Will JJ Brown look like an idjit as he did when he did 2006 ELP thingie? Time will tell.

$200 billion in debt for the US frackers is a bonus for the $1.5 trillion in petroleum savings for US consumers between 2014 and 2020. I may have understated the bonus. Maybe Dennis can do a log chart so that you feel “extra special” compared to the rest us of household peons.

https://fred.stlouisfed.org/series/DGOERC1Q027SBEA

Marmico, its a miracle alrighty, this shale phenomena. Its gives people on the internet something to do with their free time, created opportunities for day traders, incrementally sped up the depletion of America’s last hydrocarbon resources, created jobs for some and took away jobs for others, allowed CEO’s, Wall Street and humble royalty owners like tee tee to make hundreds of billions of dollars, and put the world oil order into a tail spin, including the economies of entire countries. But, its a bonus for the American consumer ! They’ve saved gasoline money so they can go out and buy bigger SUV’s and use more gasoline. Its all been….revolutionary.

And a long way, far more than $200B owed by the upstream shale oil industry, by the way, from being paid for yet. So, get ready. You’ll pay your share of it before its all over; watch.

Hi Mike,

I bounced over to your site again after seeing the link on this post. I love your cover picture, it’s beautiful.

I hadn’t seen that you had put up more content. It’s a great site.

Thank you, Wake. You are very kind and I responded to your comment. Merry Christmas.

shallow, I agree with you. EOG, basically does, too. If the well cant make payback in close to the first year, it shouldn’t be drilled. AT $40 price, you need a 200k barrel first year production, at $100, you could get away with 80k first year production, if prices stayed at over $100, otherwise, you could be screwed. Which means the projections by most pundits, EIA and IEA are really far over estimated. Most of mine will have to stay in the ground until WTI stays above $65 for a while, which is ok by me.

SS, just in from a week of quail hunting and saw your question. I do not spend my time looking at fields I have no economic interest in so I can’t say if your numbers are correct or not. However for the wells I have personal economic interest in my actual results are very different. My oldest Woodford OIL well at month 31 is producing 120BODP and 1200MCFG of very high BTU gas. It has produce 170,000BO and 1.75BCFG. This well is in the middle of the production range of surrounding wells with some doing better and others doing slightly worse, completed within 6 months of each other and using the same completion methods. I think this well will produce ~400,000BO and 4-5BCFG. I will take that all day long. One other note this well was completed BEFORE the latest completion designs which I have noted here routinely increase production 30-50% and sometimes over 100% compared to adjacent wells for the comparisons period. Lastly the operator has recently made a offer to purchase our WI, the offers suggest they are looking at the production numbers we are, otherwise its pretty hard to justify the amounts.

What was the full cost of the well including land and infrastructure?

Was it 9 million?

An upwards angle on US LTO Production Trajectory?

https://seekingalpha.com/article/4130776-shale-oil-myths-u-s-production-struggling-grow

My Take

1. Beware of underestimating US Oil Patch Ability “?Desperation” to surface Oilystuff

2. Results reporting is impacting investing. Destination :: Camp Winner or Camp Looser?

3 . Twilight zone: will ROI/Payout realities be Trumpted by Propaganda storms?

4. WTI Price Rules

Image from Article>

Forties update

2017-12-13 Reuters – Ineos tells customers that the shutdown of Forties Pipeline is likely to last “several weeks” rather than days – source familiar with matter. Ineos is planning to shut down 110,000 bpd crude unit at Grangemouth oil refinery early next week – trading sources

Looks like they have kept the pipe full and slightly pressurised and will be able to fix it with a clamp, which will save a lot of time compared to a full intervention, and unlikely to be similar failures elsewhere.

George, where is your source for this? thanks

Check this one out: The End of the Texas Tea Party This will blow your mind.

“The increase in completed wells and the substantial drop in legacy wells potentially indicates that new well production is increasingly cannibalising legacy production. The level of legacy decline is very significant issue. Permian producers have struggled to stay ahead of the legacy decline of the field.”

The rest of the article and charts will open your eyes. Check it out.

Ron. Thank you for the link.

I think one explanation for the decrease in Permian wells is that, due to the oil price crash, many marginal wells have been shut in. These are mostly older vertical wells.

I might be able to get some data together on how many vertical Spraberry wells have been deactivated since 2014, for example.

We tend to forget Pioneer, etc all are stripper well operators. Most of the areas where Pioneer and other companies are drilling have many, many low volume vertical wells.

Pioneer operates over 6,000 low volume wells in the Permian Basin, for example.

So, in reality, these companies could be canablizimg their own wells by over producing and keeping a lid on WTI.

Here is some data, however, take it with a grain of salt because there could be several injection or salt water disposal wells included that skew the data, as well as many gas wells that could skew the data. There are other reasons why the data may not be the best, that have to do with ownership transfers, etc.

For the following companies: PXD, EOG, XOM, CVX and OXY, I show that, combined, these companies operate 49,383 wells in the Permian Basin.

Of those, 45,355 are vertical wells.

Of those vertical wells, 21,980 are shown as active, meaning that there has been production of oil or gas sold from them in the last year.

Of those active vertical wells, 14,854 produced 450 BO or less in the most recent month reported.

Of those active vertical wells , 78 are shown to have produced in excess of 3,000 BO in the most recent month.

Removing XOM, CVX and OXY cleans up the data quite a bit, as large water floods and CO2 floods are pretty much removed. I do not think EOG or PXD operate secondary or tertiary recovery projects in the Permian Basin.

EOG and PXD are shown to operate 13,674 vertical wells in the Permian Basin.

Of those, 8,147 wells are active.

Of the active verticals, 6,388 produced 450 BO or less in the most recent month.

Of the active verticals, 1 produced over 3,000 BO in the most recent month. That is well #3 on EOG’s Shannon Hospital 1 lease, located in Crockett County, TX.

It appears this well has been a tremendous well, with cumulative production from the Lower Wolfcamp of 1,119,381 BO and 260,645 MCF since August, 2006.

In September, 2017 the well is shown to have produced 4,680 BO, 1,872 MCF and 6,109 BW. The well has a TD of 6,200′, with upper perf at 5,820′ and lower perf at 5,835′. The kind of well us conventional guys dream about.

To narrow down to just PXD, they are shown to have 11,169 operated vertical wells in the PB, with 6,210 active, with 5,681 producing 450 BO or less in 9/2017 and zero producing over 3,000 in said month.

It appears PXD’s best vertical well is well #8 on the Cowden 40-B- lease in Midland County, TX, with cumulative production of 195,888 BO, 2,422,259 MCF and 9/17 production of 2,712 BO, 49,079 MCF and just 52 BW, with all of that production coming since 7/2014. The well has a TD of 11,580′, upper perf of 9,334′ and lower perf of 11,526′ Again, a stellar well.

Again, please do not hold me to complete accuracy on these numbers, but I am confident they give somewhat of a picture into vertical wells in the PB.

Thanks shallow sand,

Also of interest might be the split in number of vertical/horizontal wells for the companies you mention (or just EOG and PXD) as well as the vertical/horizontal output split in the most recent month reported.

The impression I have is that not very many new vertical wells are being drilled in the Permian basin lately (or a lot fewer than in 2014 and earlier), am I correct that most recent development is horizontal wells?

Hi Ron,

I think the piece is wrong on many levels. One basic problem is the EIA’s drilling productivity report is just not very good. Many analysts look at the report and assume they are looking at data rather than a model. The model is flawed and the “legacy decline” is not something that is actually measured in the DPR it is simply a model result which probably does not reflect reality.

I trust the data. See tight oil production estimates at page linked below

https://www.eia.gov/petroleum/data.php#crude

I add up Permian Basin output to create the chart below. Note that I don’t assume anything about the future in this case, trends can change, but if oil prices increase as I expect (to at least $80/b in 2017$ by Dec 2018) the current rate of increase of 360 kb/d each year might be maintained until 2023 (assuming continued price increases to over $120/b in 2017$ by Dec 2023). That would lead to an overall increase in Permian Basin output of about 2 Mb/d to about 4 Mb/d by Oct 2023, if my guess proves accurate (which I believe is a coin flip for whether actual output will be above or below this WAG).

The model is flawed and the “legacy decline” is not something that is actually measured in the DPR it is simply a model result which probably does not reflect reality.

Okay, that statement needs to be explained further. Legacy decline is simply the decline of all wells that did not come online the latest month. It is a simple measurement. It is simply the difference between last months production and production this month less production from new wells.

Legacy decline is simply the decline of all legacy wells. That is the decline of all wells that did not come online this month. If you have a field where no new wells came online this month, then all decline would be legacy decline. Legacy decline would simply be the difference between last month’s production and this month’s production. Of course, if you had wells taken offline for maintenance, then a correction would have to be made for that, as would for wells that came back on line after maintenance. On the other hand, if you had a well taken offline, permanently, because of low production, then that would simply be part of legacy decline.

Basically, legacy decline is just a fancy term for “decline”.

Hi Ron,

Do we have data on this month’s production from new wells?

I am pretty sure this number is based on modelled output rather than actual output. In any case, my main point is that so far Permian LTO output has showed no signs of slowing down based on actual reported data, another problem with the DPR is that it gives us output for “regions” where conventional and LTO are together.

The DPR does a poor job of projecting output in my opinion and the paper you linked mainly uses DPR data.

Perhaps oil prices will drop and fewer wells will be completed in the Permian basin, I doubt this will be the case for another 5 years or so.

Continental Resources has 93 wells for sale in Garfield Co., OK that are producing from either the Mississippian or Woodford formations. They operate most, but do not have 100% GWI in most. Several appear to be shut in. Most data requires a CA, so not a lot of information, but would note that last six month average monthly net for these interest amounts to $56,662 per month.

So not everything in the OK resource plays works out well, it appears.

Sounds like the Bakken is having problems finding new investors, so North Dakota is going to get USGS to calculate a new estimate of how much oil is there.

Bakken to get new estimate of oil resources

By Renée Jean rjean@willistonherald.com 23 hrs ago

http://www.willistonherald.com/news/bakken-to-get-new-estimate-of-oil-resources/article_5c8ff792-dfbb-11e7-af8f-530adb449aae.html

The last study USGS did was in 2013. It found 7.38 billion barrels of technically recoverable oil and gas in the Bakken and Three Forks shale layers. But these days, Bakken oil wells are producing roughly double what a 2011 well did as soon as the seventh month of production. This is a strong indicator that a new estimate will be much higher than the 2013 estimate, state leaders have said.

They and North Dakota’s Congressional delegation have been pressing the USGS to do a new study sooner than the one scheduled for 2020, and on Monday the agency agreed .

Ron Ness, president of the North Dakota Petroleum Association, thanked the delegates for their efforts and said the study is important not just to the oil and gas industry.

“When you look at the development of Williston and other communities, this is something that developers can look at and consider,” he said, “and hopefully it gives them confidence that there is a tremendous future in the Williston Basin. Not only the Bakken, but other targets as well.”

The study will look only at new recoverable resources, Ness said, not any that have already been proven and identified. So the new number could be smaller than the old, but that is on top of what was already here.

“This is important across the board as we look at the infrastructure buildout across North Dakota,” Ness said. “It’s a signal to investors that the Bakken is still a world-class resource.”

The Bakken is a has been, and North Dakota politicians will regret allowing such a fast development pace. This is an excellent example of what some call “the devil’s excrement” problem.

Hi Cats,

Check this post by Enno Peters at shaleprofile.com

https://shaleprofile.com/index.php/2017/11/21/north-dakota-update-through-september-2017/

The chart below is taken from Enno’s blog and I have added trendlines by eye for 2014 to 2016 (first flow) average wells. Wells are grouped by year rather than by quarter to simplify the analysis.

There has been much less improvement in average new well EUR than some seem to believe, perhaps only 10% or so (350 kb to 385 kb). I doubt there will be a significant increase in the TRR estimate from the 2013 estimate, possibly 10% which would take it from about 10 Gb (North Dakota Bakken/Three Forks URR) to 11 Gb. Remember the USGS 2013 report gives undiscovered TRR (UTRR) for all of the Bakken at 7.4 Gb, the North Dakota portion was estimated at 5.8 Gb and there was about 4 Gb of proved reserves plus cumulative output at the end of 2012 which must be added to the UTRR to get the TRR (5.8+4=9.8, which I round to 10 Gb). An extra Gb is not really a big deal.

By 2030’s the Bakken region that increased development due to oil money will be a bunch of zombie towns with abandoned buildings and failed economies as the oil production fails. The legacy of abandoned fracking and wells over the whole countryside will be the final reward to the people there.

I have seen this happen in other areas with extractive economies, some have not recovered 50 years after the failure, in fact lately some seem to be going even further economically downhill.

I don’t know why, but places seem to never be able to revert to their former state, especially rural ones. They just become depressed areas.

Is this one of these windy plains? They could then plant wind engines on all the abandoned drilling towers – wait, oil isn’t like back in the 1900s.

Sure, more wind turbines will be added in North Dakota. It’s a windy state. Not sure how that effects the overall economics and housing demand though in the Bakken region. Once the turbines are up, not many people needed to operate and maintain them. The oil rush allowed lots of building and new business to boom in otherwise small town and rural areas due to the many new people required in the area and the many people trucking in supplies.

Some people will make money on wind towers by leasing out their land, the rest will just keep paying electric bills as always.

World Bank to end financial support for oil and gas exploration

The Bank ceased lending for coal-fired power stations in 2010 but has been under pressure from lobby groups also to halt the $1bn (£750m) a year it has been lending for oil and gas in developing countries.

The Bank said it saw the need to change the way it was operating in a “rapidly changing world”, adding that it was on course to have 28% of its lending going to climate action by 2020. At present, 1-2% of the Bank’s $280bn portfolio is accounted for by oil and gas projects.

It says exploration but I think most of the investment is for development of major projects in Africa and Asia (e.g. base load LNG plants and the like).

https://www.theguardian.com/business/2017/dec/12/uk-banks-join-multinationals-pledge-come-clean-climate-change-risks-mark-carney

Hi George

Looks like the inner moray firth could see some renewed activity in 2018.

http://www.offshore-mag.com/articles/2017/12/farm-in-could-lead-to-well-on-north-sea-wick-prospect.html

IEA december oil market report is out: https://www.iea.org/oilmarketreport/omrpublic/

OECD stocks are down (-40.3 mb), US LTO is assumed to grow more rapidly than previously expected, oil market is assumed to be in surplus in 2018H1 (+200kbd) and deficit in 2018H2 (-200kbd).

“OECD commercial stocks fell 40.3 mb in October to 2 940 mb, their lowest level since July 2015. They are now 111 mb above the five-year average. Chinese crude stocks likely fell in October for the first time in a year. Preliminary global stocks data for November shows a mixed picture.”

“Recently, US drilling activity and well completion rates have picked up again, suggesting higher production to come in a few months. Consequently, we have raised our annual growth forecast for total US crude oil to 390 kb/d this year and 870 kb/d for 2018. Impressive though this seems, according to recent investor updates, the new mantra in the US shale regions is “moderation”, reflecting a desire to greet stronger prices as an opportunity to consolidate rather than to launch yet more headlong expansion. The flexibility and ingenuity of the shale sector raises challenges to forecasters. Even so, when our US outlook is added to expectations for the other producers, output from non-OPEC countries could rise by 1.6 mb/d in 2018, an increase of 0.2 mb/d to our forecast in last month’s Report.”

Looks like Dennis Coyne’s prediction of peak oil around the 2020-2025 time frame is most likely.

Of the 14 OPEC countries only Saudi Arabia, U.A.E, Kuwait, Libya, Iran and Iraq can produce more oil. The rest are now flat or in decline and therefore with increasing domestic consumption their exports will diminish.

The number of non OPEC countries who can increase production is very small, the United States being the country that is single handedly keeping non OPEC production from falling. Once the United States reaches a new high in 4 to 6 years, any increases from Brazil, Canada, Russia? will not make up for falling production in other countries.

If global oil consumption continues to increase at the current rate, then global supply will not meet demand by 2024 and probably earlier.

Hi Peter,

There are many different possible scenarios depending on oil prices and how fast the world transitions to non-ice transport. One possibility is a long undulating plateau as Ron Patterson suggests (80-82 mb/d.) Under this scenario, my guess is that oil prices rise enough to curb World demand and lead to a rapid transition to other forms of transport (EVs, plugin hybrids, electrified rail and light rail) and greater fuel efficiency (smaller hybrid ice vehicles). Where the peak is on such a plateau is the question?

Some will say it is the start of the world C+C plateau (which could be 2015 of we round to the nearest whole digit in Mb/d) some might say it is the end of the plateau (possibly as late as 2030), I would pick the middle (2022/3) which is still 2020 to 2025. My best (current guess) is 2025+/-2 years at a peak output level of 84+/-2 Mb/d, a higher output like 86 Mb/d is more likely to lead to steeper decline after the peak and a lower peak (82 Mb/d) is likely to lead to a more gradual decline for any given URR (best guess about 3400 Gb of C+C including oil sands and World LTO).

Hi Dennis

Where are you getting your C and C figures from?

Also even if diesel doubles in price I would still be able afford the Diesel as it would cost me an extra £4 per day. A new electric car is £25,000 and totally out of my reach.

Thanks

Hi Peter,

From my models and with URR’s based on the work of Mohr and Laherrere.

See

http://peakoilbarrel.com/oil-shock-models-with-different-ultimately-recoverable-resources-of-crude-plus-condensate-3100-gb-to-3700-gb/

Note that this model was my guess based on what I knew 2.5 years ago.

Since that time the extraction rates for the 3400 Gb scenario proved too conservative as current output is above the peak in that scenario.

In the model presented below the extraction rate is for conventional C+C only and does not include oil sands or LTO output. The previous model included LTO and only modelled extra heavy oil separately.

The scenario has 2700 Gb conventional C+C, 500 Gb of extra heavy oil (Canada and Venezuela oil sands), and 100 Gb of LTO (50 Gb US and 50 Gb ROW). Peak is 2026 at 86 Mb/d and I would consider this optimistic as in a low probability (25% or less) that the peak will be higher.

My C+C data is from the EIA from 1960 to 2016 and figuring backward from carbon emissions from liquid fossil fuel prior to that.

On fuel prices and EV cost. The price of EVs will decrease and the price of petrol may rise by a factor of 3 by 2030, each individual will have to decide how best to spend their money.

By 2030 there will be used EVs to purchase. For now a $35,000 dollar car is out of reach for many, prices will fall to $20,000 by 2025 (new car price) and a decent used vehicle maybe 10k.

Hi Dennis

I can only find data for all liquids, do you have a link please.

The model is a useful tool for giving an approximate level of production and when we may expect production to start to decline. However does it not assume that all countries have been producing oil with similar extraction rates?

If a country such as Iraq has large reserves but it’s production has been severely reduced for 30 years. When allowed to produce to it’s full capacity, does that not skew the data?

Hi Peter,

The model assumes there is some average extraction rate from World proved producing reserves.

EIA data from 1973 at

https://www.eia.gov/totalenergy/data/browser/index.php?

tbl=T11.01B#/?f=A&start=1973&end=2016&charted=0-11-12

Earlier data (1960-1972) at document below

http://cdn.ca9.uscourts.gov/datastore/library/2013/02/26/California_crude-oil.pdf

All of this data is World C+C.

Prior to that I use

http://cdiac.ess-dive.lbl.gov/ftp/ndp030/global.1751_2008.ems

and convert from carbon emissions to consumption (on average over this 1751-1959 period I assume production is equal to consumption and that non C+C liquids output is zero.

The model is not perfect (far from it), but it’s the best I can do with very limited data.

Some places have very high extraction rates (US) others have very low extraction rates (Iraq).

The model just finds the World average over history (based on model assumptions about how fast discoveries are produced, time from discovery to production). This might also change over time, the model assumes after 1950 this has remained relatively constant for the World average.

This assumption can be changed and would result in lower extraction rates (if we assume a shorter period between discovery and production.)

There are many assumptions built into this model, any of which could be incorrect.

Think of them as scenarios built on underlying assumptions.

Different assumptions about time from discovery to production, result in different historical extraction rates, also assumptions are made about future cumulative discoveries, which may also prove incorrect.

All of this merely changes the shape of the future production curve.

Another assumption is future URR (I have assumed 3400 Gb),this affects the area under the production curve. Higher URR increases the area, Lower URR decreases it.

For any given URR assumption this area will be fixed and the shape will depend on extraction rate and assumed time from discovery to production as well as the shape of the cumulative discovery curve.

First link didn’t work correctly

See table 11.1b at link below

https://www.eia.gov/totalenergy/data/monthly/index.php#international

this gives World C+C 1973 to 2016.

Hi Dennis

Thank you for the information, very useful.

I think some people have tried to be too precise about dating peak oil.

What I realised some time back is that the difference between educated low and high estimates do not change the date of peak very much.

Given all the uncertainties of data and other variables an estimate of 2020 to 2030 is quite adequate.

Real historical data shows how peak oil has claimed one country after another.

In 1990 only a handful of the top 60 oil producing countries were in decline. By 2010 the majority have gone into decline. Today 40 of the 60 are in decline. That should speak volumes to those who don’t see peak oil coming soon.

Obviously available exports are key and hardly 10 counties can increase exports to supply the world where most countries need to import oil to keep their economies going.

The change in outlook over the last 20 years has been staggering. The next 10 years will leave most people utterly bewildered.

Hi Peter,

I think a focus on output is more important than net exports. The amount of oil that any given nation will export will depend on their internal consumption of oil. As oil prices rise exporting nations may choose to stop subsidizing oil consumption at home (where prices are often far below international average prices for liquid fuel).

If that happens consumption of liquid petroleum in net exporting nations may fall (or at least grow more slowly) and more oil will be available for export.

For this reason I find the Export land model less than satisfying and think a focus on World output of crude plus condensate requires fewer assumptions.

There’s no technical reason whatsoever that we can’t be driving ice powered cars that get very close to a hundred mpg anytime a major car company decides to build one. All that is needed is to switch from the side to side two seat passenger area design to a much narrower two seat fore and aft layout, and to use a lot more aluminum and other light weight materials.

Remember when the minivan sales exploded, when station wagons and ordinary vans just didn’t turn new car buyers on anymore?

I’m guessing at least fifty million households in the USA either own two or more cars, or can easily manage with one two seater.

Such a car could be a plug in hybrid and it could run well over a hundred miles on a very modestly sized battery. With one the size that’s going into the new all electric Chevy Bolt, it would run four hundred plus miles.

AERO drag is the factor that EATS fuel and or kilowatthours.Weight is secondary.

If any major car company sets out to build such a car within the next few years, virtually every component will be as easily sourced as any component of any other car, with the battery being the only likely exception, if the battery companies can’t keep up with demand. The machinery used to make fenders for trucks can be used to make fenders for cars, etc, simply by installing a new set of dies, etc.

I’ve given up on trying to decide how long oil will be plentiful and cheap, having learned my lesson some years ago when I was pretty sure diesel would be ten bucks a gallon by now, lol.

But one things FOR SURE. We know how to build cars TODAY that will run on half as much fuel, or less, as today’s cars, and maybe even as little as a quarter as much.

And if we really feel the need, we can build trucks that run on half as much as well, soon, by running them at lower speeds and thereby making it possible to haul more net cargo in relation to the weight of the truck itself. It won’t hurt the bottom line if an autonomous truck takes an extra hour to get from A to B, by slowing it down ten or fifteen mph saves ten gallons of diesel, or an equivalent amount of battery charge.

And of course pure electric cars aren’t going to use any oil at all, other than a barrel or two per car used indirectly during the manufacturing process and a trivial amount later on for tires.

Plateauing oil production isn’t necessarily going to be the economy killer some people think it will.

OFM

There are 1,300,000,000 cars, vans, trucks and buses on the roads of the world.

In approximate numbers, 50,000,000 are scrapped each year and 100,000,000 new vehicles are sold.

http://www.oica.net/category/vehicles-in-use/

In order for global oil consumption to stay flat, I.E. not drive up prices due to additional demand, all the new vehicles would have to use half the petrol/diesel that scrapped cars used.

At the moment these are the cars sold.

http://focus2move.com/europe-best-selling-cars/

They will all be on the road needing petrol and diesel just as global oil production peaks. If oil production peaked in 2025, in 2026 no more Ford F series could be sold or Dodge Rams. They would have to be taken off the forecourts and crushed.

http://www.wsj.com/mdc/public/page/2_3022-autosales.html

If that were not done, global consumption would still want to increase and the survival of the fittest or rather richest will ensue.

Also many countries cannot produce enough food to feed their populations. The movement of food requires vast amounts of oil and the global population is growing by 80 million each year.

If the global population were static peak oil would still be a difficult problem to deal with. In a world where there will be an additional 1,000,000 people in 13 years will see great hardship for many.

Obviously population will be 1,000,000,000 more in 13 years.

Dennis

Subsidies have led to profligate consumption in some countries, most of these countries are removing these subsidies. However the increase in population will undo any saving in oil consumption.

http://worldpopulationreview.com/countries/saudi-arabia-population/

Saudi Arabia had a population of only 10 million in 1980 now it is over 30 million. In 2030 there will be 40 million Saudi all consuming their share of petrol, diesel, gas, water and imported food.

Hi Peter,

Iran has TFR (total fertility ratio) under 2.1, they did this in about 15 years, Saudi can do the same.

Hi Dennis

The population of Iran is now 80 million and at the lowest estimate to increase to between 90 million by 2030.

The population of the world has grown from 4.4 billion in 1980 to 7.4 billion now.

It will be 9 billion by 2040 and any energy saving policies will be overwhelmed by this shear weight of numbers.

Very interesting talk which explains how even a small percentage increase per year has such a large impact on actual numbers

https://www.youtube.com/watch?v=sI1C9DyIi_8

Hi Peter,

World output of oil per capita decreased from 2004 to 2011 at an average rate of 1% per year. World population grew at 1.2% per year over the same period.

The rise in population will gradually decrease to zero and then decline (peak around 2070). As growth of oil output per capita falls short of growth in oil demand per capita, oil prices will rise to the point that oil demand per capita will fall more rapidly than 1% per year.

Population growth rates in the future, and future changes in oil demand and supply and oil prices are all very difficult to predict precisely.

In general I would say that all of these things will peak and decline with dates and rates unknown.

Hi Dennis

Per capita oil consumption has been decreasing since the early 1980s.

https://ourfiniteworld.com/2012/03/12/world-energy-consumption-since-1820-in-charts/

However as you can see in figure 2. The amount of energy from all sources has gone up mainly due to gas and coal.

This statistics are of interest academically, but utterly irrelevant in understanding what is going on in individual countries and for middle and working classes in those countries.

Syria was able to subsidize fuel to farmers until it’s oil production started to fall. When it made cuts, the farmers could no longer afford to irrigate the land. Less crops impacted the local poor. That is why they started to protest and riot, they were facing hunger.

Peak oil in many countries will not be the nice transition to electric cars as some people think. It will be like Syria.

Libya oil production peaked in 2008, again this led to cuts in welfare payments etc. People are now fighting and dying for a smaller share of the cake.

In the Untied Kingdom, the 1990s were prosperous, oil and gas exports reduced taxes and cheap energy helped businesses. Now many factories have closed due to high energy prices. Despite taxes rising there are cuts to policing, N.H.S. and care. People are getting very angry and politicians have no solutions.

except – the biggest set of profligate consumers – the US – just got its head lopped off on the chopping block. the level of austerity imposed by the new tax bill should put the US quickly on the road to Greece (well, at least those who don’t own a house on the coasts or have a trust fund.) Mass shootings to increase – check. Opioid deaths to increase – check. Suicides and car accidents – check. Fuel consumption? Maybe not.

to ponder – can you really call it (class) warfare if only one side is fighting?

The very wealthy really don’t need most of the world’s people. They probably don’t think to themselves, “These policies will kill off a lot of the unnecessary people,” but they don’t appear to have much concern as to the welfare of the masses.

I keep thinking a global balance recession or depression will put a significant damper on fossil fuel consumption.

OFM Wrote:

“There’s no technical reason whatsoever that we can’t be driving ice powered cars that get very close to a hundred mpg anytime a major car company decides to build one. All that is needed is to switch from the side to side two seat passenger area design to a much narrower two seat fore and aft layout, and to use a lot more aluminum and other light weight materials.”

Try it next to a full loaded semi going 20 miles over speed limit while the operator is on a cell phone. Ditto for the Drunk/texting driver next to you in a SUV.

FWIW: There are already tiny commuter cars like the smart car.

DC wrote:

“world demand and lead to a rapid transition to other forms of transport (EVs, plugin hybrids, electrified rail and light rail) and greater fuel efficiency (smaller hybrid ice vehicles). Where the peak is on such a plateau is the question?”

Unlikely:

1. No sustained transition was made when oil prices began rising in 2000 and peaked at 147 in 2008. Many politicians will defer changes, thinking another tech breakthrough in oil extraction will happen like shale LTO.

2. World debt has doubled in the past 10 years. All those debts depend on abundant low cost energy.

3. Aging demographics in the industrialized world. The Boomer generation is not limited to the USA.

The globe should have entered a global depression from rising energy prices and excessive debt loads. To delay the crisis, Central banks dropped interest rates to near zero, and interest rates have remained low since 2008, which provide the means for debtors to service their debt. However instead of using the lower rates to pay down debt, debtors doubled down increasing there debt, and now they are approaching the same debt loads as they did in 2008. When another recession happens they will again be able to service their debt. But this time lowering rates is probably not an option since rates can’t go below zero. The Industrialized world has painted itself into a smaller corner. Central Banks may not be able to save the day again.

It usually very difficult to replace infrastructure when nations are facing excessively large debts & aging populations (especially when aging populations are promised unfunded/underfunded entitlements & pensions plans)

Hi Tech guy,

The important metric is not total debt it is debt to GDP.

Using data from BIS:

https://www.bis.org/statistics/totcredit.htm?m=6%7C380%7C669

From 4Q2013 to 2Q2017 11 trillion of 13 trillion in increased debt levels (to all non-financial sectors) was in emerging market economies.

This may simply reflect better access to credit in those economies as they develop.

The aging population holds most of the wealth in the World, as they die the assets are transferred to heirs, charities, or collected by the government.

The transition will occur when oil prices become high and stay high and after the peak (around 2025) this will be the case.

A severe recession (2030-2040 is my guess) may result from fossil fuel scarcity, governments might take good policy actions to speed the transition to non-fossil fuel energy in response, thereby reducing the length of the recession.

Or they may choose to reduce government budget deficits in response (the Hoover approach) and thereby lengthen the recession.

The level of spending of WW2 (as a percent of GDP) applied to an energy transition is the proper response to the impending crisis in my opinion.

You are correct that this may not happen and may also be correct that it is unlikely, it’s possible nonetheless.

“The level of spending of WW2 (as a percent of GDP) applied to an energy transition is the proper response to the impending crisis in my opinion.”

You’re forgetting demographics as there was boomer generation that fueled growth, along with growth in resources (energy, food, metals, plastics). Plus the US entered WW2 with virtually no debt. The US had close to a balanced budget. After the War, the US had the only industrial base untouched by war damaged, and supplied the rest of the world manufactured goods. But by the 1970’s Europe and Asia completed rebuilding thier industrial based and no longer were reliant on US manufacturing.

“A severe recession (2030-2040 is my guess) may result from fossil fuel scarcity, governments might take good policy actions to speed the transition to non-fossil fuel energy in response, thereby reducing the length of the recession.”

Most gov’t will be insolvent by then and collapse. My money is on another world war when the reset does come, as gov’t will seek to obtain resources they need from other smaller/weaker nations. Perhaps future historians will predict world war began in 2001 when the US started invading the Middle East. Its a cold/proxy war that will lead to a hot World war once the smaller states are all occupied or stripped of resources.

“From 4Q2013 to 2Q2017 11 trillion of 13 trillion in increased debt levels (to all non-financial sectors) was in emerging market economies.”

Can you honestly believe that the debts owed will every be paid back? The US has over $20T in debt and runs an annual deficit of about $1T USD. Europe and Asia are not in any better shape.

Hi Techguy,

The debt is just rolled over, the economy grows, not as much of a problem as you seem to think.

Also at the World level (I will assume no ETs) every liability is matched by an asset of equal value. Defaults on debt happen all the time, the person holding the liability wins, the person holding the “asset” loses, no more no less.

At the beginning of WW2 (Dec 1941) for the US Debt to GDP was 44.5%, currently it is 104% and could be raised to Japanese levels of 239% of GDP, if necessary.

The 20T in debt is about 102% of GDP.

I do agree while the economy is currently doing well it would be better to raise taxes and reduce the deficit or cut spending, but deficit reduction at present in the US surely would be wise.

We might agree on that point (about reducing the deficit), it does not matter to me if taxes go up spending goes down or both occur(a potential compromise between conservatives and liberals).

https://fred.stlouisfed.org/series/GFDGDPA188S

https://fred.stlouisfed.org/series/GGGDTPJPA188N

This article got me thinking that as the US government pulls money out of health care, and if fewer people contribute to health insurance, it could be the health care industry is the trigger for the next recession.

https://www.nytimes.com/2017/12/18/health/hospitals-mergers-patients.html

And this article from April says as much.

https://nypost.com/2017/04/30/the-health-care-industry-is-bound-to-collapse-soon-experts-say/

While governments might be willing to print money to keep the oil flowing, if they aren’t willing to fund health care, and health care is a major part of the economy, it could get bad in a hurry.

Hi Boomer,

Premiums simply go up for those with insurance to cover all the unpaid bills from those with no insurance. Possibly some hospitals shut down, especially in rural areas where hospitals are less profitable.