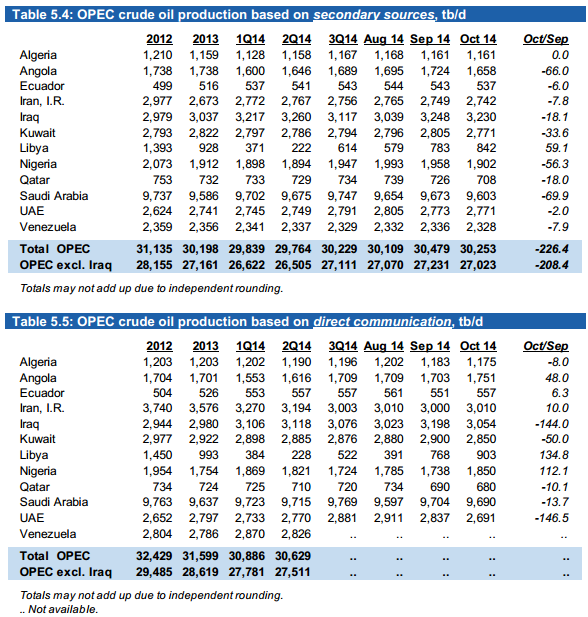

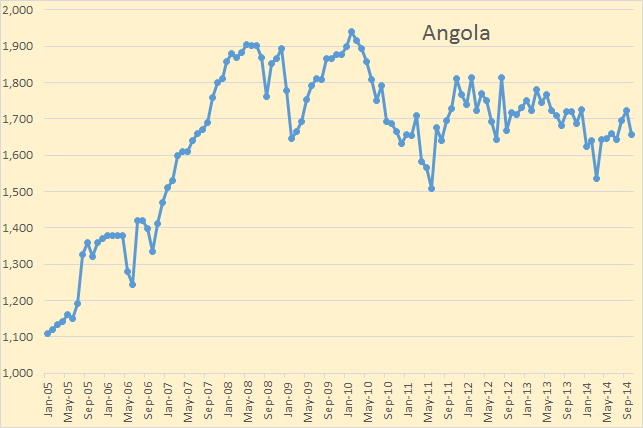

OPEC just published their November Monthly Oil Market Report which contains crude only production data for all OPEC nations. The only big surprise was that everyone had declining production except Libya and Algeria, that is according to “secondary sources”.

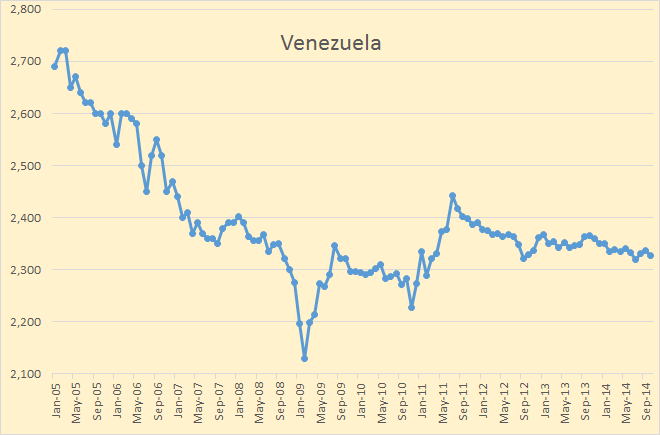

I find it interesting that Venezuela has, for the last several months, refused to give OPEC their production data.

All charts below are in the charts below are in thousand barrels per day with the last data point October 2014 and is based on OPEC’s “secondary sources”. I have decided to post all OPEC charts in this post.

OPEC production declined 226,000 bpd. September production was revised only slightly, up 5,000 bpd.

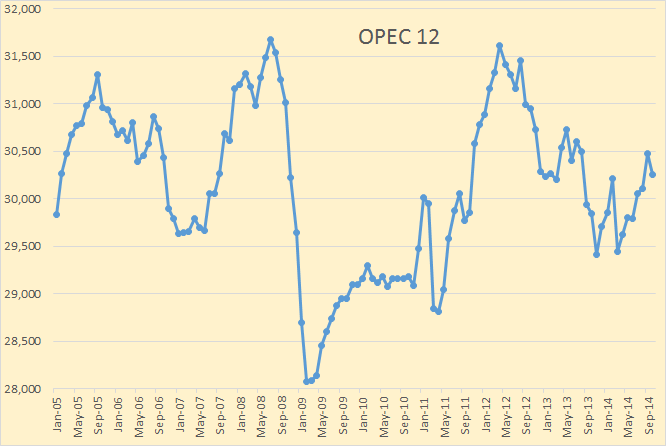

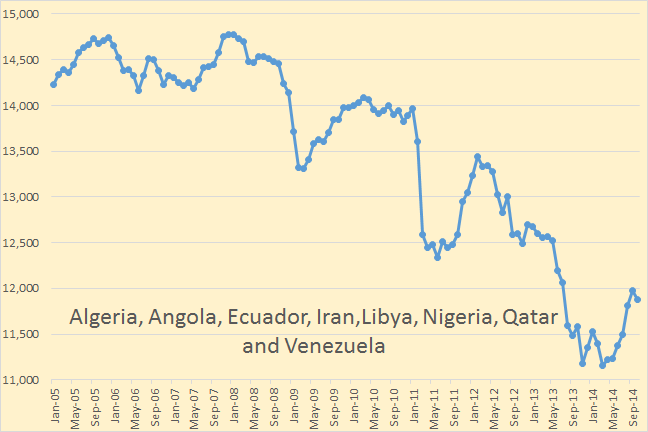

Algeria has stopped their decline, temporally at least.

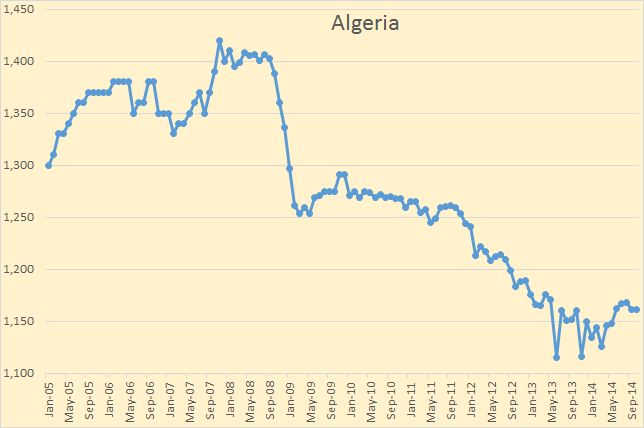

Not much news from Angola except that production was down 66,000 bpd in October.

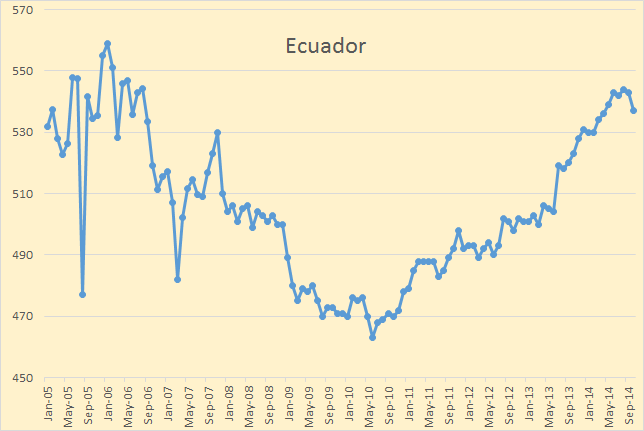

Ecuador which had been increasing production since 2010 now seems to have hit resistance. Production was down 6,000 bpd in October.

Production in Iran was down 7,800 bpd in October. I would love to know what they could produce if sanctions were lifted. My guess would be about 3.5 million barrels per day… or less. Notice they were in decline before sanctions were imposed.

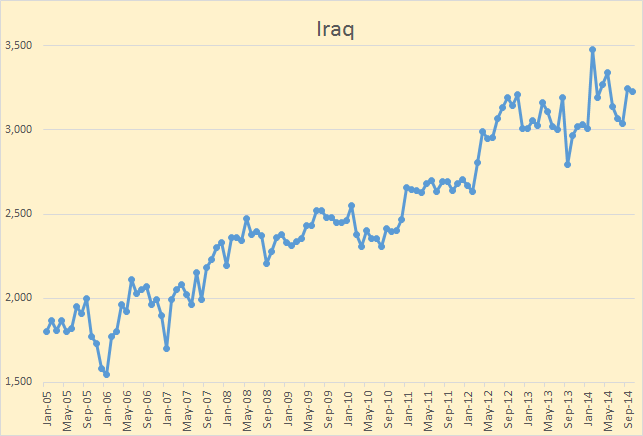

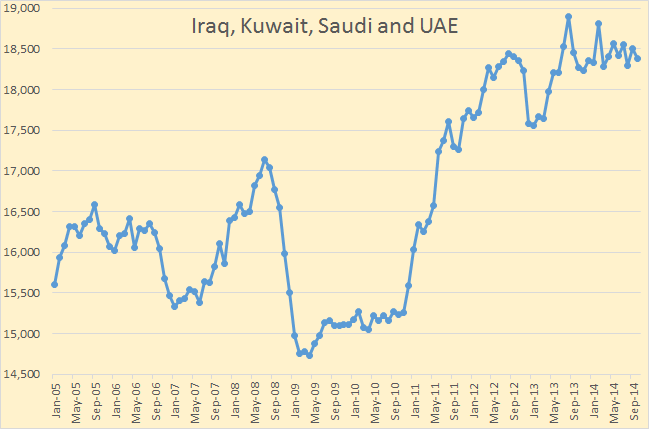

Iraqi production was down 18,100 bpd in October but their September production was revised upward by 84,000 bpd.

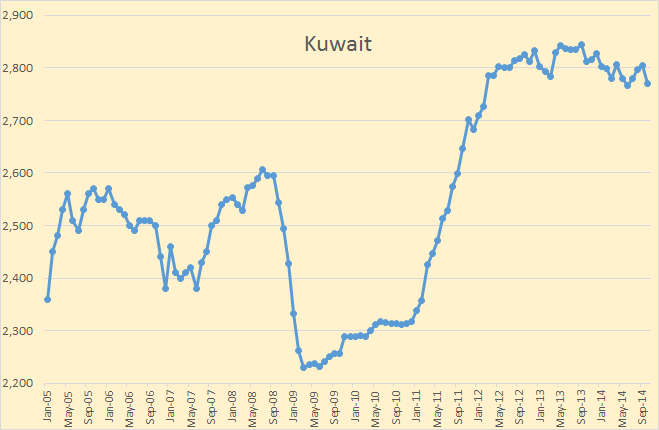

Kuwait production was down 33,600 barrels per day in October. Their massive infill drilling program that began several years ago has now reached its maximum level and decline has set in. Here is an interview with with the deputy manager of Kuwait Oil Company’s North Kuwait about a year and a half ago:

These goals will be achieved through a multi-year aggressive infill drilling and well maintenance programs aimed at lifting current well capacity by 43%.

I don’t think they got it up to 43% but they did pretty good. They are now sucking the oil out a lot faster now.

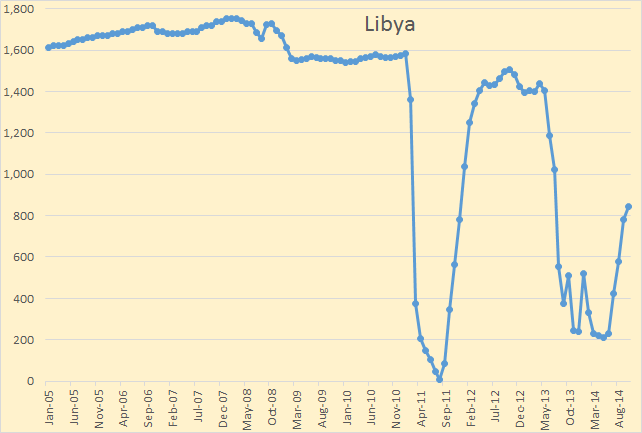

Libya, according to “secondary sources” was the only OPEC nation to increase production in October. They were up 59,100 bpd. According to Platts they went even higher but are now back down again.

Libyan oil production, having hit a recent high of 1 million b/d at the end of October, is now running at around 540,000 b/d, a source with close ties to state-owned NOC said Tuesday.

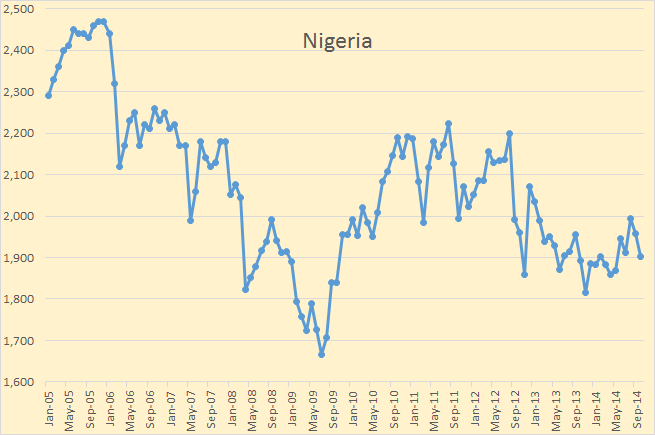

Nigeria, down 56,300 barrels per day in October is still fighting rebels who are stealing a lot of oil every month but who knows how much?

Crude Oil Theft: Does Nigeria know the actual volume it loses each day?

The federal government does not know; the Nigerian National Petroleum Corporation (NNPC) does not know; our security agencies cannot tell; and even the foreign multinational oil companies either do not know also or are trying to play politics with figures of stolen crude for selfish gains.

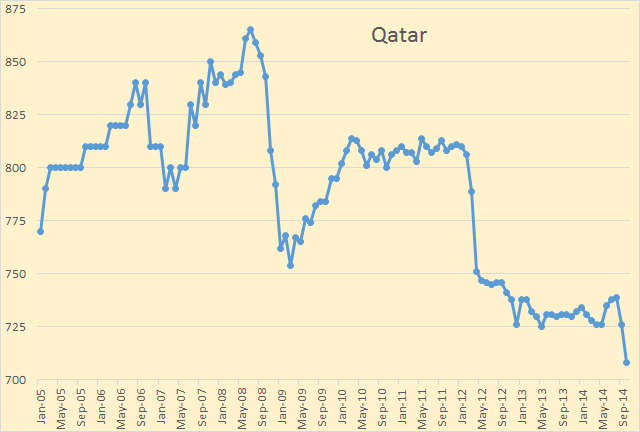

Qatar was down 18,000 bpd and that is a lot for Qatar. They may be in serious trouble, the same kind of trouble they had in March and April of 2012 when they dropped 55,000 bpd… and never recovered. Now they are down another 43,000 bpd from that April 2012 level.

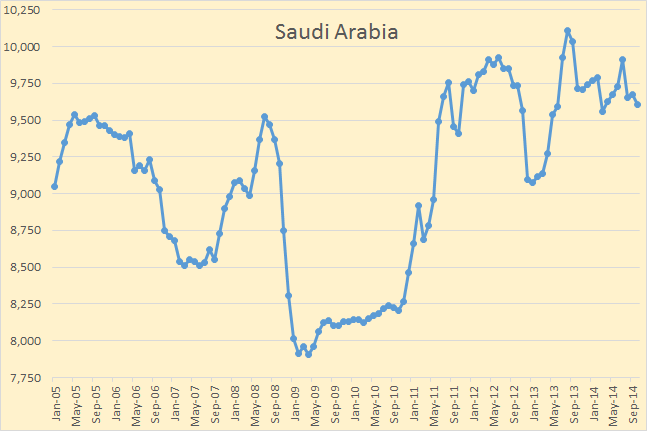

Saudi production was down 70,000 bpd in October. It is my strong opinion that Saudi is producing flat out, as is every other OPEC nation except Iran. And Iran is producing every barrel they can sell. <b>OPEC has no spare capacity</b>, and people are catching on to that myth:

Oil Price Slide – The Real Problem

A very significant part of what we have been led to believe is exaggerated. Saudi Arabia’s oil exports were much higher back in the late 1970s than they are now. When they cut oil production and exports in the 1980s, they likely did have spare capacity.

But where we are now, the situation has changed greatly. The population of the Middle Eastern oil producers has risen. So has their own use of the oil they extract. Their budgets have risen, and the countries need increasing revenue from oil taxes to meet their budgets. Some countries, including Venezuela, Nigeria, and Iran, require oil prices well over $100 per barrel to support their budgets.

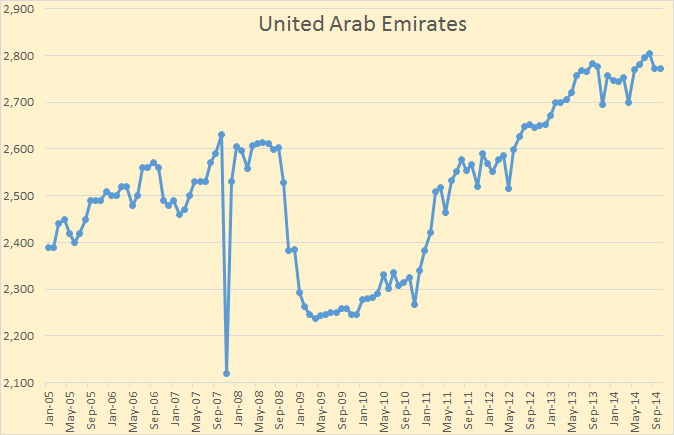

UAE production was down only slightly, 2,000 bpd. But September production was revised down 39,000 bpd.

Venezuela production was down 7,900 bpd in October. Their trend line is sloping slightly downward. They could produce a lot more from their very large bitumen patch but no foreign contractor will risk investment in Venezuela. In the past they have had a very bad habit of nationalizing foreign holdings and paying them pennies on the dollar for their investment.

Opec, until 2012, had four nations that were increasing production, Iraq, Kuwait, UAE and Saudi. But those four, even with their massive infill drilling programs, and for Saudi, two new fields, seems to have peaked.

Their combined production was down 124,000 bpd in October.

The other eight is still in a continuous decline though they have had a recent recovery, which was all Libya’ recovery. Their combined production was down 102,000 bpd in October.

Actually one of the above eight, Ecuador, has increased their production about 70,000 bpd over four years. But that increase has stalled in the last six months and I expect them to plateau for a year or so then start to decline. And Ecuador’s slight increase has been lost in the almost 3 million barrel per decline in the combined production of the other seven since their peak in January 2008.

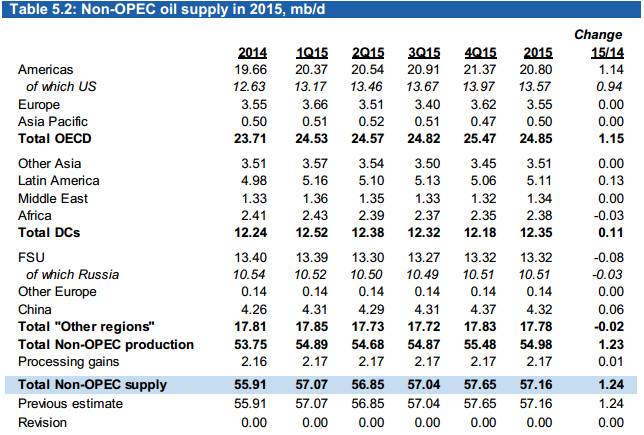

Thought I would add this. This is OPEC’s opinion of what Non-OPEC production will be next year. They have Non-OPEC production up 1.24 million barrels per day next year. Americas up 1.14 mbd of with the US supplying .94 mbd of that and the rest from Canada. They have Latin America up .13 mbd. I suppose that is mostly Brazil.

They have FSU down slightly with Russia down .03 mbd. Not much at all but at least they think Russia has no gain left in them. I believe most of their guesses are just copied from the IEA.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

China-U.S. Move to Curb Global Warming Loosens Climate Logjam in Developing World

I think this is an indirect confirmation of imminent peak oil…

The mainstream media makes it a big deal. In fact, the “commitments” are roughly consistent with long term global warming of 3 degree C or higher. We will all be “cooked”.

IIRC, the IPCC doesn’t acknowledge PO, or PO-lite.

How much difference does that make to the model?

Depends how big of an effect you think peak oil will have. I reckon it’ll save us from above 2c, but maybe that’s a perverse form of wishful thinking.

No, I’d say Climate Change is a much, much bigger problem.

Oil is expensive, dirty and risky. We have better and cheaper alternatives. We should kick the habit ASAP.

Peak oil perhaps can save us from more than 3C, if only the “fast” climate feedbacks (like water vapor) can considered. But if slow feedbacks (vegetation change and albedo effects) are taken into account, according to James Hansen, 3C eventually will take us to 6C or more.

Hi PE,

Let’s assume for a moment that a doubling of atmospheric CO2 causes an equilibrium climate response of 3 C, this would coincide with a transient climate response of about 2 C. The change that Hansen is talking about at 6C is the Earth System Sensitivity.

The CO2 levels are unlikely to remain at 560 ppm they will gradually decrease as they are absorbed by the ocean and sequestered as calcium carbonate over a thousand year time frame, so temperatures may rise above 3C for a few hundred years, but 6C is unlikely. In addition there is considerably less ice than during the last glacial maximum, so any ice albedo feedback will be considerably less than the period from 10,000 BP to 250 BP(before the present).

Notice from BlueHost.com 1:15 PM Wednesday, November, 12

This email is notification of server maintenance which will occur either tonight, 12 November, 2014, or tomorrow 13 November, 2014 between the hours of 10:00 pm and 3:00 am MDT (UTC/GMT-6) , for the server which hosts peakoilbarrel.com.

We expect the estimated downtime to be 30 to 45 minutes while the server is rebooted. None of your data will be lost, and any temporary performance issues you experience may be due to the maintenance process. This maintenance adds extra security to your server and resolves issues relating to server performance.

We apologize for such short notice and for any inconvenience this may cause.

This link if nothing else proves that OPEC ministers have as low an opinion of the intelligence of the public as carnival barkers.

But nevertheless … this Saudi official is presenting the official Saudi position on oil markets.

Forgot to paste the link.

http://www.ft.com/intl/cms/s/0/57282f3e-6a8b-11e4-bfb4-00144feabdc0.html?siteedition=intl#axzz3IsrFWclL

The EIA came out with their Short Term Energy Outlook earlier today. Points of interest from their predictions for 2015, everything is all liquids:

US liquids production will be up 1.9 mbd to 14.95 mbd.

Total Non-OPEC liquids will be up .95 mbd to 56.98 mbd. Which means:

Non-OPEC liquids, less US liquids, will be down .14 mbd.

Russian liquids will drop .05 mbd.

Looks like everyone is predicting 2014 to be the peak year for Russia.

US is up 1.09, not 1.9 according to the table

1.09-.95=.14

That makes sense

So, they’re projecting 2015 crude at only 237k bpd below the peak of 1972 (9,637M bpd)!

Even after adjusting for BTU content and excluding ethanol, total liquids still have to be higher than 1972.

I haven’t been able to find an EIA total liquids data series back to 1972. Have you seen it?

Synapsid the broken record here:

Does anyone have any figures on Libyan oil exports nowadays? I only see material on production.

Thanks.

Sguy, there was a ransquawk this morning announcing the pipeline from the Sharsomething oil field in Libya was “blocked”. No other info. Typical of Libya.

Qatar and the UAE are fighting a proxy war there. It’s unlikely much data from there is legit.

Watcher,

Thanks.

I agree about how trustworthy any data are, but one lives in hope. Sometimes.

Keep in mind there is now also a developing narrative of a “need” for higher prices, so we’re going to hear a lot orchestrated stories of booming economy and lower supply. They won’t be lies, they’ll just be massaged.

Ok, this article is tangential to the topic at issue here. However, there is an interesting observation that can be made from the comments on the article: http://www.theatlantic.com/business/archive/2014/11/can-quitting-your-job-help-stop-war/382648/?single_page=true

So many in the comments decry the economic actions of this man, undertaken for moral and principled reasons in powering down and reducing his consumption. He’s being pilloried for not being maximally economically productive and consuming, despite sincerely undertaking his less economically intense lifestyle for moral, and at first glance, admirable reasons.

If that is the actual underlying attitude towards word and personal economic decision-making (I don’t know that it is, but it’s an example of what at least some people think), it’s going to be an incredibly tough slog to get the average Joe’s ideas about economic BAU to change.

This guy voluntarily cut his own salary by 75% so as to not fund wars he didn’t agree with. He’s being pilloried as a moocher (which I kinda see) and would prefer he work. Some people would rather he move out of the country and make $100,000 somewhere else than stay at home and protest his government’s actions by working less and living more of his life for himself.

There’s a remarkable pro-BAU mental bias underlying these comments that must be noted from a Peak-Oil problem aware perspective. How will this mindset be overcome if anything is to be done to avoid the hard times predicted here? In my view, this is more evidence that nothing will be done. Nothing about Peak Oil and nothing about climate change either. The dominant mental framework simply doesn’t allow for it. BAU uber alles.

Perfectly reasonable life-style – then only when everyone reduces income and consumption, we can reduce energy and resource consumption as society. With the time gained it is possible to do a lot more for oneself – which reduces the need for part of the ‘lost’ income.

I do this myself since 1,5 years – and can only say that I gained greatly. It is not anymore clear to me why people work to earn money and spend it for things that may ‘safe time’ because they work so much, that they don’t have any time ‘left’ (cooking you own food, doing/fixing stuff yourself, biking to work instead of having/using a car if its possible. taking time to read/rest).

Totally agree with all that. I quit TV- BIG plus. I quit reading depressing articles in NYT, another big plus, and, by gum, am seriously considering quitting reading this excellent chat group, way too much chat about oil prices, and not by a long shot enough emphasis on the FACT that we simply gotta get off the stuff, and the real price-the biosphere- is out of sight too much. No possible argument against that.

Except it’s so entertaining sometimes.

He didn’t have to take a pay cut to not pay taxes. He could have just donated most of his salary to charity.

I’d say he’s definitely a moocher. He’s taking advantage of tax deductions to save but not pay taxes, and he’s having fun when there’s a lot of work that needs to be done in this world. Having fun may be understandable (even sensible, maybe), but it’s not saintly.

As for resource limits: this guys not doing much to help with that. He’s just dropping out.

If you’re not part of the *active* solution, you’re part of the problem.

There are two types of people in this world. Those who divide people into false dichotomies, and everyone else.

I like that quote.

Okay, point taken: I should have characterized his actions, not his character.

So: instead of “He’s a moocher”, I should have said: “He’s mooching”.

Doesn’t sound as good.

No, there are three kinds of people, those who can count, and those who can’t.

There are 10 kinds of people, those who know binary and those who don’t.

Actually, he isn’t burning much oil doing what he is doing, so he is really letting his share of consumption be available for military purposes, it is a lose lose for him.

Besides, it is permanent war now, so it is hopeless to protest war. Everybody just has to sue for peace and it can be over. Fun just isn’t important when there is war to make. It’s the War Olympics, something like that.

Ever since the Winter Olympics in Sochi ended, all of the fun ended too, snafu set in and it all ended up fubar ever since. Fun is over.

Somebody send the poor guy a pair of shoes so he doesn’t end up in the hospital with a flesh-eating bacteria. It does happen. Other than that, leave him be, he can live his life the way he wants. Not much of a plan there, but why should it matter to anyone? Unless, you think he should be forced to work.

Arbeit Macht Frei! Get to work, you, you, you… untermenschen!

Gotta round up people for not working and striving to their full potential and get them working, and if it takes a concentration camp, if that is what has to be done, then it is the only way to get the work done, the solution.

Just who in the hell does he think he is, quitting his job and becoming a burden on society? No good lazy good for nothing bum, that’s all he is. There’s gulag for him somewhere in the taiga. Having fun is one thing, but having fun all of the time is Verboten. Can’t let it happen and it is not going to happen, especially here, in the real world, at Camp Work you work, fun is what you do at the Funny Farm.

Does the bum think he’s free or something to be able to choose what he would like to do for a change? Liberate him to a ball and chain, that’ll teach him to think he can be free and have fun. Vagrancy is not much of a goal to pursue, but more power to him.

Bigger problems in this world other than one person quitting their job, a tragedy, yes, but a million people quitting their job, a statistic, not really viewed as a problem, just the way it is.

Here’s an idea: let the guy live his life the way he wants.

Too many brain cells dedicating too much time to an issue that takes up too much precious time.

Thomas Jefferson, a revolutionary, independently minded, told the King of England to take a hike, traveled over to France, sat around writing papers and documents, did it until the day he died. Wore fancy clothes, everything was cool for Thomas Jefferson. After he died, two weeks later his creditors took possession of Monticello. Old Thomas Jefferson ran out of luck, he died broke. Even if the harder he worked, the more luck he had, it finally ran out. His money was gone long before his luck ran out, however. He lived his life the way he wanted to live. I’ll bet he had some fun now and then. Nothing wrong with that. At least he had nice digs where to have some of the fun. He didn’t walk around in his bare feet all of the time, he had some brains. He wrote words about life, liberty, the pursuit of happiness, words that are not allowed to be mentioned these days. Don’t utter the word ‘freedom’, even in a low voice. You’ll be in big trouble if you do.

When my son was in the first grade, six years old, I asked him one day what he said when he wasn’t on the school playgrounds.

“You know what I say when I’m not on the school grounds?” he said to me.

“What?” I asked.

At the top of his lungs he yelled, “I’m having goddamn f’ckn’ fun.”

I am sorry but that they way to hell is paved by “active solutions”. Read Overshot, by William Catton. He in fact argues that it is time to do less, not more, to be more homo sapiens and less homo colossus. I think he is right.

Catton knows very little about modern energy problems. Most of his analysis is drawn from agricultural societies that over expanded, like the Roman Empire.

The fact is that the Roman Empire was a ponzi scheme – ag based societies simply can’t grow quickly, so the Romans stole from their neighbors in an everwidening circle of exploitation. When that circle reached it’s limits, the ponzi scheme collapsed.

That’s typical, but it tells us very little about modern societies.

Replace conquering your neighbours and appropriating their surpluses with exploiting fossil fuel reserves and the parallel is kind of strong.

And, of course, wind, solar & nuclear are all cheaper, cleaner and more available than oil.

None of them compete with oil. They compete with gas and coal.

Hi Sam,

I think some creative thinking may be required.

At the current relative prices in the US, nothing competes well with oil.

In Europe liquid fuel prices are considerably higher and there is quite a bit more public transportation, which is more fuel efficient and runs on electricity to some degree.

Do you think transportation choices will not change as liquid fuel prices gradually climb?

The average consumer will be priced out of the market and fuel will be used for trucks(for the last few miles from the railhead) and tractors on the farm.

It will not happen overnight, it will take 20 or 30 years, but once the peak in oil output is clear to all (by 2020 or so), consumers will see the writing on the wall.

Well, actually, they’re all cheaper than oil. Wind, for instance, produces power at about $.07/kWh. With $.05 for transmission & distribution, that’s $.12/kWh.

The Leaf gets more than 3 miles per kWh, so that’s less than $.04 per mile. Compare that to $3.50 per gallon and 22MPG (the US fleet average), which equals about $.16 per mile.

4 cents per mile, vs 16 cents per mile.

Except that there are really good substitutes for fossil fuels.

Wind, solar and nuclear (if needed) work very well. Wind is already cheaper than coal. It’s available more widely in the world. Solar, of course, is incredibly scalable and available almost everywhere.

And we don’t have to convert to them overnight. If we kept natural gas at 10% of the grid’s kWhs, that would make balancing really easy. Balancing without NG would be very doable, but that requires some explanation, so I’ll focus on the first argument: that 100% conversion isn’t needed any time soon.

Are you being sarcastic? From what is understood, nothing can really replace fossil oil.

…I’ve tried everything, even linseed oil, but nothing gives me a softer smoother body the way Fossil brand oil does. Try it and see for yourself. I think you’ll agree. Fossil’s fabulous.

The secret is to use flaxseed oil (linseed oil is flaxseed oil gone bad), and to eat it rather then put it on your skin!

It’ll give you a glossy coat!

Cool, didn’t know that.

Seriously, though, Nick, if you were not being sarcastic, I’d urge you to rethink nuclear, and possibly the others too, although I am getting conflicting, inconclusive info so far.

Nuclear is definitely the riskiest and most expensive option. I include it only because some people have a hard time believing in renewables.

What can I tell you about renewables?

Hi Cae,

We might be able to do it with renewables alone, but nuclear research on fast reactors should continue along with further work on pebble bed reactors which shut down safely on their own when power goes out.

When fossil fuels deplete and we eliminate nuclear and renewables to provide energy, what do you propose?

Nuclear is not an option.

Why it is even being discussed at this stage while Fukushima’s nuclear sore continues festering; the waste-can is kicked down the road; and in light of possible peak government, seems rather reckless, irresponsible and insane.

I propose we take cues from squirrels. I realize it’s hard being nowhere near as intelligent, but we must try. If the animals could laugh and they weren’t so pissed off at us– I mean the ones that are still around with habitat intact– we’d be the laughing stock of the animal kingdom.

A renewable and quality-of-life is a natural forest (rather than lumber plantation, duh) or clean river to drink from and swim in without fear of a rash, etc., seeing as we are on about skin in this subthread. Shiny coats shouldn’t be related to fossil oil slicks.

But, naturally, we know all this, so I guess it’s for the newbs and as a form of narrative-insistence, while some of us like to talk about Leaves™ as though they’re cars, happy motoring a la Kunstler and all that. (Even he still seems to think, amazingly enough, that we adults need coercive government– you know, like a corrupt, weaponized version of mom, dad and the nanny? But that’s another subject.)

We might also be aware of the rewilding (and Permaculture and Transition) movement(s), otherwise, it might be good to consider/reflect on their particular approach. Or the squirrel approach.

Oil is a central part of Catton’s overshoot. In fact he differentiates two methods by which humans have been expanding human carrying capacity, the first method is the takeover method, which is what you described the roman empire did. In fact that was the only method known to humans up until the industrial revolution when we started to use the second method, the drawdown method. The drawdown method has allowed us to grow to 7 billion people and of course given us all the things we enjoy in our modern society, we have in fact become homo colossus. The argument goes that the drawdown method by its own nature has to be temporal it can not go on forever. Going to solar and wind means to go back to the takeover method but now with 7 billion people instead of the 1 billion that that method maxed out at.

The idea that fossil fuels represent temporary access to an enormous cache of solar power is…unrealistic.

The amount of energy released by fossil fuels in the last century represents a couple of months of the solar power that lands on the earth. Fossil fuels do indeed store solar power, but they do it incredibly inefficiently. They stored something like .000000000001% of the solar energy arriving on earth.

Humans release something on the order of 10 terawatts of power, on average. The sun drops 100,000 terawatts continuously.

The idea that wind, solar and nuclear can’t replace fossil fuels is highly unrealistic.

The problem with that argument, at least with the part related to solar, is that it assumes that all that energy arriving to earth from the sun is there for us to use, for free. However how much of it can we take that is not already being “used” by the ecosystem? or at least how much can we take without altering the ecosystem too much? For example, how much of it goes into keeping the current climate as it is? Of course it could be possible that nuclear energy would provide for a very long time, it still is drawdown method and will not last forever, things eventually decay into stable nuclei.

The amount used by plants is a tiny, tiny fraction.

The US could supply most of it’s needs by just using rooftops. A very, very small portion of desert would work.

PV has a slightly lower albedo than the Earth, on average, but it’s about the same as the average roof. If you install it over a parking lot, you’ll actually reflect more than you did before.

Well, depending on what you (think you) mean by ‘replace’ and (level of) technology, from part of what is understood, those techs are much less mobile compared with oil. Secondly, they rely on some levels of oil input in their resource-extraction, manufacture, distribution, maintenance and replacement (etc.). Thirdly, they rely on a working BAU infrastructure… in the face of the increasingly-dubious dynamics of the global-industrial civilization plutocorpratocracy. Fourthly, they may be less as effective or democratic as all that, and/or compared with say, other forms/levels/types of local, sustainable, resilient, community-/self-empowered tech. Lastly, some of these rely on questionable activities for their operations, such as with nuclear, tax-theft by the governpimps on the backs of the wage-prostitutes and with regard to mining activities, land-grabbing.

Aside from just those issues, there’s also the issue of ‘other forms of reality’ that exist beyond one’s head and how they mesh.

those techs are much less mobile compared with oil.

EVs and rail cars are pretty mobile.

they rely on some levels of oil input in their resource-extraction, manufacture, distribution, maintenance and replacement (etc.).

A little, but that’s not essential. Mining equipment is already electric in many cases. Manufacturing primarily uses electricity. Rail can handle distribution. Maintenance workers can drive…EVs. Utilities love electric vehicles, and are already using them.

they rely on a working BAU infrastructure

And oil doesn’t? EREVs like the Volt are much more resilient than ICEs – they can run on electricity or oil.

they may be less as effective or democratic

What’s more decentralized than PV on your roof??

‘Pretty’ means what and ‘mobile’ in what contexts?

Batteries (lifespan/disposal)? Land issues? Resource issues? Highways and other infrastructure and their Maintenance? Costs? Habitat issues? Democracy issues?

I’m going through a lot of laptop batteries and they are expensive to replace. And I have seen images of foreign children in among foreign waste like batteries. Technology doesn’t just occur in a vacuum. This also includes the issues of what we want and need. Many needs are manufactured… maybe like your own.

“A low-energy policy allows for a wide choice of lifestyles and cultures. If, on the other hand, a society opts for high energy consumption, its social relations must be dictated by technocracy and will be equally degrading whether labeled capitalist or socialist.” ~ Ivan Illich

** Please delete previous post that looks like this one. Sorry, and thanks!

‘Pretty’ means what and ‘mobile’ in what contexts?

Batteries (lifespan/disposal)? Land issues? Resource issues? Highways and other infrastructure and their Maintenance? Costs? Habitat issues? Democracy issues?

I’m going through a lot of laptop batteries and they are expensive to replace. And I have seen images of foreign children in among foreign waste like batteries. Technology doesn’t just occur in a vacuum. This also includes the issues of what we want and need. Many needs are manufactured… maybe like your own.

“A low-energy policy allows for a wide choice of lifestyles and cultures. If, on the other hand, a society opts for high energy consumption, its social relations must be dictated by technocracy and will be equally degrading whether labeled capitalist or socialist.” ~ Ivan Illich

Oil is the infrastructure; its lifeblood.

** Please delete the two previous post that look like this one. Thanks! Probably the last time I use the blockquotes like this! ‘u’

‘Pretty’ means what and ‘mobile’ in what contexts?

Batteries (lifespan/disposal)? Land issues? Resource issues? Highways and other infrastructure and their Maintenance? Costs? Habitat issues? Democracy issues?

I’m going through a lot of laptop batteries and they are expensive to replace. And I have seen images of foreign children in among foreign waste like batteries. Technology doesn’t just occur in a vacuum. This also includes the issues of what we want and need. Many needs are manufactured… maybe like your own.

“A low-energy policy allows for a wide choice of lifestyles and cultures. If, on the other hand, a society opts for high energy consumption, its social relations must be dictated by technocracy and will be equally degrading whether labeled capitalist or socialist.” ~ Ivan Illich

Oil is the infrastructure; its lifeblood.

So what.

Apparently, the horse can run on food; be adaptively-re-used; eaten; composted, and produce compost.

Your cars, by comparison, are one-trick ponies. And they need working roadways which use what for construction, materials and maintenance? I’ll let you answer that.

Walking and biking is pretty good too, as is relocalization that in part those two can leverage.

And then reality isn’t a GM advert; advertising has many different ways of distorting reality and reality has its own ideas of what works and what doesn’t.

“Upon closer consideration, moving from petroleum-fueled vehicles to electric cars begins to look more and more like shifting from one brand of cigarettes to another. We wouldn’t expect doctors to endorse such a thing. Should environmentally minded people really revere electric cars? Perhaps we should look beyond the shiny gadgets now being offered and revisit some less sexy but potent options—smog reduction, bike lanes, energy taxes, and land-use changes to start. Let’s not be seduced by high-tech illusions.” ~ Ozzie Zehner

Simple passive solar for example– sun shining through some glass or on you or some plants (that you can use)– but a way of life in general that doesn’t care what happens when your large-scale/uneconomy-of-scale-produced PV fails or breaks and you can’t find or get the parts or replacements anywhere for your broken crony-capitalistic corporatocratic technofetishes and can take your thumbs out of your in and out doors and fix things yourself for others and more locally. Stuff like that. When you and real community are more self-empowered/decentralized.

I’ll close by offering you one of my TOD posts I just thought about.

For better or worse, peakoil is not going to create the anti-technological society you envision.

You, and everyone else who feels the same way, will have to make that decision on your own. It’s not going to be forced on you by resource limitations.

“For better or worse, peakoil is not going to create the anti-technological society you envision.” ~ Nick G

The mindless dash toward technology(/complexity) for technology’s(/complexity’s) sake, without some levels of sense behind it, seems, ironically, anti-technology, anti-society and anti-life, etc..

If it were as simple as ‘peak oil’, then there’d have likely been far fewer collapses and/or declines of previous civilizations and less degradation of what we truly rely on, rather than, for example, a greenwashed technology named after part of a plant.

“You, and everyone else who feels the same way, will have to make that decision on your own. It’s not going to be forced on you by resource limitations.” ~ Nick G

Decisions on our own?

You mean like direct-/pure-/participatory-democratic ones, or do you mean ones that hardly matter outside of ones based on force, lies and manufactured illusions, etc., by a small elite in limited touch with reality?

Peak oil can be, or could have been, managed by a smart society– say, through collective pure-democratic decision-making– that didn’t squander/isn’t squandering its resources like oil, etc..

Given some observations, we will be lucky if we have a liveable planet left, or one worth living on, never mind one that supports, as you mischaracterize, an ‘anti-technological society’.

How about an anti-stupid society?

“Why do complex societies become vulnerable to the very kinds of stress which, at an earlier time in its history, the society in question would simply shrug off? Tainter’s answer lies with complexity, itself, and the law of diminishing returns. As a society becomes more complex, greater complexity becomes more costly. The escalation of complexity becomes increasingly difficult to maintain, until it finally becomes impossible.” ~ Jason Godesky

Well, you’re conflating a few things.

I agree that we’re doing great harm to our environment, and that this harm carries great risks.

I also agree that our society is not very democratic, and that is greatly undermining our ability to cope with Climate Change and PO.

That’s a whole separate thing from whether a simpler life is better for our psychological health. It may be, but what does that have to do with either Climate Change or PO, except that you may be hoping that one of them forces us to simplify?

And, it’s different from whether Peak Oil/LTG is going to cause economic collapse due to basic limits to commodity/oil/FF supply- it’s not. Tainter is just…irrelevant. We have very little in common with the agricultural societies on which his analysis is based.

If some individuals, entire societies and their institutions are predisposed to compartmentalize, specialize, decontextualize, etc., then I can understand how holistic, contextual views might be viewed as ‘conflating’ and why ‘great harm is being done to our environment’…

“I agree that we’re doing great harm to our environment, and that this harm carries great risks.” ~ Nick G

“I also agree that our society is not very democratic, and that is greatly undermining our ability to cope with Climate Change and PO.” ~ Nick G

“Utilities love electric vehicles, and are already using them.” ~ Nick G

‘Utilities’ love the tax-paying wage-prostitute who has little say in how they operate or whether they even operate at all. Utilities would seem to include nuclear power plants like the ones in Chernobyl, Fukishima and 3-Mile Island.

Real, pure, participatory democracy begins by understanding what it is, and finding out whether you have it or not, and what you might be paying lip-service to and shrugging off…

“Tainter is just…irrelevant.” ~ Nick G

“I also agree that our society is not very democratic, and that is greatly undermining our ability to cope with Climate Change and PO.” ~ Nick G

You could back-to-front that too and suggest that a fundamental lack of democracy has created and exacerbated (and continues to do so) PO/climate change and their issues.

It’s hard to argue against being holistic and democratic.

It’s really not clear what you’re arguing for.

If you want to drop out, you’re free to. If you want to start a communal farm with like-minded individuals you’re also free to do that.

I have to say though, I really like my indoor plumbing, my long lifespan, and a very low infant mortality rate.

“It’s really not clear what you’re arguing for.” ~ Nick G

But you just answered your own question:

“It’s hard to argue against being holistic and democratic.” ~ You

“If you want to drop out, you’re free to. If you want to start a communal farm with like-minded individuals you’re also free to do that.” ~ Nick G

Not exactly, because I live on the same hijacked planet as/by/for the sleepwalking, and they are messing it up for me, themselves and everyone else.

“I have to say though, I really like my indoor plumbing, my long lifespan, and a very low infant mortality rate.” ~ Nick G

Mm-yes that sentiment that’s inclined to see reality (and technology) on a very narrow timeline (in a very narrow context) while draw-down, depletion and despoilment, etc., continue their relentlessness and infants’ futures are thrown under the bus with relative abandon.

With regard to your ‘indoor plumbing’, I’d consider where my water actually comes from (hint: not from the tap) and what’s involved with regard to its infrastructure; take a look at humanure composting and (vis-a-vis) peak phosphate/etc.; some recent research on health vis-a-vis “progress”; and nutrition vis-a-vis industrial agriculture.

There’s your homework, Nick.

With regard to lifespan, it’s moot if we’re all zombies.

Oh, my. I actually am familiar with that stuff. The water, phosphorus and nutrition risks are all over-estimated. Sure, they’re all problems that need real improvement, but none of them are going to end civilization.

I agree that contemporary culture has a long way to go to attain a healthy, maturity. But, I suspect you’re glamorizing either the past, or the alternatives to contemporary OECD cultures.

Climate Change is the one big risk that I see. The contradiction here is that you’re underestimating what we can do to address it. EVs, in particular, are an extremely practical solution to both PO and Climate Change.

“Sure, they’re all problems that need real improvement, but none of them are going to end civilization.” ~ Nick G

This kind of ‘civilization’ that upholds whatever one might myopically glamorize about it needs to end, though, but it appears already on its way out anyway.

And it’s nowhere near just about climate change, although agreed, it’s a big issue, maybe the biggest.

Sooooooooooooo, more evidence production was down in October. Whilst the price was cratering.

How interesting.

Oh, look. A fight is underway, but it appears close will be sub $77 today. An attempt by the CLR funding will be made to defend it, but oh well. Sterling was slammed hard. 134 pips. That’s a ton for one day.

How interesting.

Hi Watcher,

Supply is just one part, demand is the other. Supply from OPEC was down, we don’t know about the rest of the World (though I doubt it matched OPEC’s fall, Canadian and US increases may have offset the OPEC drop). The US crude input to refineries (4 week avg) dropped by 800 kb/d in October, but that was the same as last year at this time, there is a tendency for oil prices to fall in autumn (in the US at least). If supply dropped and prices dropped, then demand must have fallen as well.

Of if supply dropped and demand dropped too, by the same relative amount, then prices, well, son of a gun, they dropped.

How interesting.

I think oil prices are driven more by expectations than by short term supply and demand. It is hard to deny it is driven by the groupthink of a small group of narrowly focused people.

The irony of all this hullabaloo about the “American Energy Revolution” and “Saudi America” is that it may drive (or already have driven) prices down to the point where LTO is no longer viable.

To some extent, maybe causation isn’t critical, but what IS critical is the potential one way street of destruction of the industry.

It would lead to high yield bond defaults. HY instruments are not swapped because they DO default often. That means lenders will be badly burned, and the reason that matters is a price rise will not generate a queue of lenders to be re-involved. The oil price required to restart oil flow will likely be higher than the industry smashing price. A hysteresis, of sorts.

Other things to elevate the restart price would be trash cleanup thrown onto the state. I looked up the security bond in NoDak required by a driller to drill a well, and it’s only $20,000. That won’t fund plug and abandon for a bankrupt LLC, so NoDak will essentially elevate the price of anyone wanting to restart the industry in the future.

Add to all this the loss of oil transport reservations on the railways. The railways will get occupied with other freight, who may themselves get long term contracts. Then oil can’t flow.

The collateral for many of the loans is the book value of lease holding at a given price. The falling price probably is triggering recall covenants right now as value of the collateral crashes. The lenders essentially can be foreclosing on their loans, and these won’t be like no recourse mortgages. Other CLR property can be seized.

The overall point being, it’s a one way street. The price that smashes the industry will be far lower than the price that might let the industry try to restart.

Add to all this the loss of oil transport reservations on the railways. The railways will get occupied with other freight, who may themselves get long term contracts. Then oil can’t flow.

That seems to me to be a statement that is self contradictory. If the oil can’t flow then the economy takes a hit and the railways won’t get occupied with other freight… And we are another step down the the other side of the peak oil ladder with all its consequences.

If BAU is dead then it makes no sense to make assumptions based on BAU, or am I missing something?

You are. Grain shipments.

Hi Watcher,

How is the grain being shipped now? I think the railroads will be happy to get the business back and as business gets slack they may even reduce their prices.

The one given general class of commodities in the world that is most subject to uncertain supply is agricultural crop yield for dead sure.

Hence anybody who spends a lot of time observing ag commodity prices will eventually develop some insight into prices and the effect of buyers and sellers expectations on prices.

Fear will certainly cause a temporary short term run up in the price of any given ag commodity in the event it seems it will come up in short supply.This can happen for numerous reasons such as drought or frost or flood or a strike in the fields or even war if there is fighting in the place it grows.Insects and blights can wipe out a significant portion of yield of any crop especially one grown in a limited area such as for instance citrus fruits in Florida.

If the crop actually proves to be short the price stays up to reflect this reality. If not it comes right back down.The very simple and basically unavoidable fact is that anybody who buys more early in anticipation of higher prices will buy less later since his immediate short term supply is already on hand or at least paid for and in the pipeline.

The opposite situation- the expectation of a big crop leads to a speculative and optimistic ( on buyers part) drop in price and this drop will last if the crop is indeed a big one. If not it creeps right back up since the actual buyers have to have it and the way they get it is to bid higher for it.

So now- the users can buy ahead -physically taking early delivery or by executing a naked buy contract for later delivery.Producers can change their production plans in anticipation of higher or lower prices..

But once a farmer has a crop in the ground he is generally locked in for the year. It is extremely rare for a farmer to VOLUNTARILY walk away from a crop in the ground since he already has money invested in it and it is risky and hard to plow up an existing crop and plant something else even if he has the equipment and capital to do so- and there is sufficient TIME do do so.

So- farmers are in about the same situation as oil producers except the time frames are different. The time frame for production decisions by farmers is basically annual.

I don’t know how for sure long it is for oil producers but for conventional oil it is not less than five years ” from scratch” and probably closer to ten on average.Tight oil producers can probably make the decision to drill or not to drill on a much faster basis but it seems that they are also to a large extent locked in by the fact that they have already spent a lot of money buying up land rights and hiring all their personnel and buying or leasing offices and equipment etc.

So I am guessing that any oil producer who made the decision to drill a particular field in July to drill in December will almost for sure be drilling in December. Plans for drilling next May or June would be easier to shelve.Plans for December 2015 would be even more tentative at this time and it would be easier to cut anticipated losses by means of not renewing equipment leases and employee attrition and better planned layoffs etc.

In any case the actual price is always determined on average— over any time frame which allows producers and buyers to adjust their operations- by the actual willingness of buyers to buy what is actually available.

Both oil and grain are easily storable although storage is not cheap since it eats money that could be used for other purposes.

Fear or optimism may in my opinion cause a temporary run up in oil prices but over a matter of a few months the actual price is going to be based almost solely on how much the end user is willing to buy and how much the producers and refiners send to market. The price will circle closely around this core interaction like a moth around a light and never get very far from it very long.

Given that oil prices are down and staying down for a few months now it seem perfectly obvious to me that demand is down at a time that production is actually probably going up.This indicates that some oil producers are up shit creek without a paddle because the highest cost producers must be losing money.

But nevertheless it is better for a producer to run at a (hopefully) small loss while generating some cash flow and praying for better prices than it is to shut down and lose even more

.So – it is likely hardly any high cost producer has as yet actually shut down his production.This cutting back or shutting down takes a while.But if it costs a hundred bucks to produce a particular oil field and the price stays at eighty very long you can bet your last can of beans that pretty soon- say within a year at most would be my wild ass guess- you will see the drill rigs leaving the neighborhood.Unless the mood changes and the producers of that field aare willing to gamble prices are headed up again in the near term of course- and of course assuming they have the money to hang in there waiting.

It is always supply and demand in the end except when the producer or distributor has a way of actually controlling how much product gets to the end user.

This control rarely exists when there are a number of producers who need to sell.It generally requires either active government participation or at least government that is willing to look the other way.

Sugar producers in the US are a classic example of producers who with the collusion of government manage to partially control supply and thus raise the price they get.The biggest consequence of the defacto American sugar cartel has been for most former sugar buyers to switch to corn syrup and the producers of a few products such as premium candy that simply must be made with real sugar to move production to another country.

One of the regulars here who has actual oil production experience can probably throw some light on how far ahead most oil producers are actually committed to producing a particular field.

But I feel comfortable saying that tight oil producers are not yet cutting back in big way based on the rig count news.

It is certainly possible that Uncle Sam and the Saudis are actively out to inflict some serious pain on Russia and Iran by encouraging as much production as possible thereby keeping the price of oil as low as possible.The Saudis are authoritarians and can do this simply by making the decision and telling their managers to implement it.

Uncle Sam is not so powerful in this respect but by manipulating the credit markets and environmental and tax regulations in favor of oil producers Uncle can achieve the same result to a substantial degree- more oil production every thing else held equal.

I have no firm opinion as to whether this credit and regulatory manipulation is happening as deliberate foreign policy ploy or simply in hopes of goosing the domestic economy. BUT it IS happening to some extent in my opinion .

I thought drilling activity was starting to decline? Coupled with speedy LTO depletion rates there will be a big change a comin.

Surely, investors will be shy going forward?

Hi Paulo,

My guess is that the drilling plans will be cut back to a level that will just barely maintain output until prices go back up.

The weaker players will sell off some of their assets to the stronger players and some of the bigger oil companies may swoop in to buy up some of the acreage in the sweet spots. It’s a dog eat dog world, the more profitable companies will be looking for deals.

The Financial Post just stated this in its article on the new WEO:

“The IEA sees total production of crude staying at around 68 million barrels per day until the early 2030s before dropping to 66 million barrels by the end of the period, leaving the task of meeting rising demand entirely to unconventional production and natural gas liquids.”

My understanding is that global production of conventional crude has been on a plateau for almost a full decade, but that the plateau was around 74 mbpd. I see that in your articles re. JODI stats the number is more like 72. But I’ve never heard IEA (or anyone else) say that it was as low as 68 mbpd.

Have I missed something?

I think the IEA is talking about crude only while JODI and the EIA are talking about Crude + Condensate. That would account for the difference. This seems to be a departure from the IEA’s usual language. They usually speak in terms of “total liquids”.

Thanks for your prompt reply, Ron

Do you know how common it is for “crude” stats to be only crude (not including the condensate from the same oil well)? The EIA seems to always cite “crude and lease condensate” so I figured that’s what everyone else does.

Is that not the case, or would UK, Saudis, etc do their calculations differently?

Almost everyone uses crude + condensate except OPEC. They always use crude only and never give condensate figures. So all OPEC nations use crude only and everyone else uses C+C.

Of course the EIA never uses crude only even when repoting OPEC production numbers. They treat OPEC nations just like everyone else.

However it gets even more confusing. The EIA gives “total oil supply”, “crude oil, NGPL, an other liquids” and “crude oil including lease condensate”. However the only difference between “total oil supply” and “crude oil, NGPL, an other liquids” is the former includes refinery process gain. The EIA is the only agency in the world, to my knowledge, that includes refinery process gain in their stats.

BP and the IEA usually give their stats as crude oil plus NGLs.

Hi Ron,

You are definitely correct about BP production data being C+C+NGL, their consumption data is all liquids (includes biofuels, coal to liquids, and such). For some reason I thought the IEA only gave all liquids data, which would be similar to the EIA’s total liquids minus refinery gains.

I am not trying to correct you, I am trying to learn you follow the data more closely than me.

Comparing July EIA and IEA data, the EIA has total supply at 91.9 Mb/d and IEA has it at 93.0 Mb/d, I think this is why I had the impression that the IEA includes everything in their supply number.

Hey, please feel free to correct me any time. I do follow the EIA data very closely but not the IEA data. So you are probably right.

But, if you do find out for sure, I would appreciate you posting what you find.

Thanks for clarifying, Ron.

It would sure be helpful if the various reporting agencies would standardize their definitions and reporting practices… I don’t see why they can’t/won’t.

Ron,

Why do the eia not separate out crude and condensate in their figures? It can’t be that hard to figure out a rough average percentage cut, at least?

I really don’t know why the EIA always counts condensate with crude. No it’s not that hard to figure out the amount of condensate since condensate comes primarily from gas wells, not oil wells. But the percentage differs greatly from country to country.

Anyway most other countries count condensate with crude also. Russia does, but Norway does not. Norway gives three counts, 1 crude, 2 condensate and 3 NGLs.

You would have to ask someone on the inside at the EIA why they don’t count condensate separately. And I’ll bet most would answer: “That’s just the way we’ve always done it.”

Hi Ron,

You are correct that condensate comes from the gas wells, but there is a significant amount of natural gas that is “associated gas” (especially in the Eagle Ford), no doubt there is some “condensate” from this natural gas as well, it is pretty difficult to measure this at the well head as the “condensate” is mixed with the crude so the EIA decided a long time ago to just lump it all together into a crude plus condensate category.

Yes Dennis, I am well aware of “associated gas”. That’s why I said condensate comes “primarily” from gas wells.

But with oil wells, some condensate is, no doubt, mixed in with the oil, but not all. The temperature of the oil exiting the well is usually quite hot and much of the condensate is still a gas at that temperature.

Or to simplify somewhat, one can simply say that condensate is a byproduct of natural gas production (from all sources).

Ron,

That is correct, the gas then gets separated from the oil, and depending upon how quickly this happens the condensate may remain in the natural gas, I imagined that it would cool down and the condensate would condense out of the gas, by the time the gas had been separated from the oil.

I imagine they just put the oil in a tank and pump the methane off the top into a pipeline or separate tank, by the time the process is complete, a lot of the condensate is mixed with the oil unless they keep the oil heated for some reason.

Well it’s not really that simple. But the oil has gas, water, oil and often a lot of sand that comes up with it. All are separated at the same time. The thing runs continuously and I doubt that the oil or gas has very much time to cool.

Youtube 3 Phase Separator

Thanks Ron,

I didn’t know that.

Hi Ron,

The video was interesting, it didn’t say anything about how long the fluid sits in the separator, in order for the water, oil, gas, and solids to have time to separate, I would think the stuff would be left to sit for a while and it would cool down to some degree while it sits.

It is unclear what temperature these separators typically operate at. Part of what enables the lease condensate to be removed is the lower pressure in the separator, though temperature may also be important.

The fluid only stays in the separator for 5 minutes or so. Wellhead temperature info is hard to find on the web.

Dennis, the oil never sits, it is always flowing. How fast it is flowing I have no idea. Of course it cannot flow too fast or the oil would not have time to separate from the water.

If they have a lot of oil, they just use more separators. I have seen several of these horizontal separators sitting side by side at Safaniya in Saudi. Back then it never occurred to me to count them. But thinking back there were likely less than a dozen.

The oil coming out of the ground is quite hot but it depends entirely on the depth of the well. The temperature increases by 104 degrees F per mile of depth. And of course the oil must travel some distance to get to the GOSP. That allows it to cool some more.

The temperature of the deepwater Gulf of Mexico oil is 456 Degrees F(235 C). Of course most wells are not nearly that deep.

But yes, some of the condensate stays mixed in with the oil. I have no idea what percentage however.

I do know that in Safaniya they got an awful lot of sand coming up with the crude and water.

Thanks Mike,

I know the oil is hot, but I am thinking mostly of onshore production where the relatively low pressure of the separator will allow most of the lease condensate to be removed from the associated gas. My guess is that there is very little of the pentanes plus that remains in the gas stream from the separator, most of the NGLs that are left mixed with the methane would be butanes, ethanes, and propanes (in their various forms). Though Ron is correct that a small amount of the pentanes plus may remain in the gas phase due to the higher temperatures.

Dennis, to generally answer a few of your questions below, you may use a bottom home temperature gradient of 0.032 F per ft. So say, a 9000 ft. well would have at BHT of 288 F. Ambient air temperature is also part of the issue at the surface, but then there is often cooling that occurs as high GOR liquids go thru chokes, etc.

Pretty much any kind of separator, 2 phase or 3, vertical or horizontal, works on a simple gravity basis and within a few minutes of residence (retention) time phases are separated, often not perfectly but close enough. Some fluids are separated better, faster than others based on density. The process can all be sped up by internals in the separator, for instance coalesce plates, etc. The oil phase might then go to a heater treater where the liquid is heated back up to reduce BS&W, water goes to more retention time for disposal or reinjection and the gas phase may go to a lower working pressure separator where the change of pressures helps separate the high end hydrocarbon chain, like condensate.

Ron beat me to it, but he is right. BHT’s in deep wells can cook bottom hole assemblies in the drill string, like steering motors, and logging tools, the technology has really improved on that, however. I have been around a few well heads (Christmas trees) that were too hot to touch.

Solids are often part of the production stream, as Ron says, and that can be a bitch to deal with. Separation engineering is actually very complex.

Mike, keep in mind that though I spent 5 years in Saudi Oil fields I was in computers, not dealing with the oil directly. Back then, the early 80s, I was not even interested in oil production, just the computer technology I was dealing with. It was basically flow technology, and very primitive compared to today’s flow technology I am sure.

Back then I only knew the oil was hot because of putting my hand on the pipes on the offshore platforms in Safaniya. And I knew about the sand only because I heard the engineers bitching about it.

As an oilman we do appreciate your input on this list. And when we get things wrong, and we often do, please feel free to correct us. We will not be embarrassed I promise you.

Mr. Patterson, you guys are doing plenty fine without my input. Temperature gradients are fun to know about; sometimes in weird places, for weird reasons they get all out of kilter.

Safaniya is offshore, yes? I can only imagine the sand problems those guys have and how that effects surface production facilities in limited deck space.

Mike

Rick,

If you haven’t seen it, following is the current version of my “Crude Oil Versus Condensate” essay:

Peak (Crude) Oil in 2005?

In my opinion, actual global crude oil production (45 or lower API gravity crude oil) may have effectively peaked in 2005, while global natural gas production and associated liquids (condensates & natural gas liquids) have so far continued to increase.

I’ve always thought it odd that when we ask for the price of oil, we get the price of 45 or lower API gravity crude oil, but when we ask for the volume of oil, we get some combination of crude oil + condensate + NGL (Natural Gas Liquids) + biofuels + refinery gains.

This is analogous to asking a butcher for the price of beef, and he gives you the price of steak, but if you ask him how much beef he has on hand, he gives you total pounds of steak + roast + ground beef. Shouldn’t the price of an item directly relate to the quantity of the item being priced, and not to the quantity of the item plus the quantity of (partial) substitutes?

In any case, the closest measure of global crude oil production that we have is the EIA data base that tracts global Crude + Condensate (C+C). In regard to this data base, a key question is the ratio of global condensate to C+C production. Unfortunately, we don’t appear to have any global data on the Condensate/(C+C) Ratio. Note that when the EIA discusses “crude oil” they are talking about C+C.

Insofar as I know, the only complete Condensate/(C+C) data base, from one agency, is the Texas RRC data base for Texas, which showed that the Texas Condensate/(C+C) ratio increased from 11.1% in 2005 to 15.4% in 2012. The 2013 ratio (more subject to revision than the 2012 data) shows that the 2013 ratio fell slightly, down to about 15%, which probably reflects more focus on the crude oil prone areas in the Eagle Ford. The EIA shows that Texas marketed gas production increased at 5%/year from 2005 to 2012, versus a 13%/year rate of increase in Condensate production. So, Texas condensate production increased 2.6 times faster than Texas marketed gas production increased, from 2005 to 2012.

The EIA shows that global dry gas production increased at 2.8%/year from 2005 to 2012, a 22% increase in seven years. If the increase in global condensate production only matched the increase in global gas production, global condensate production would be up by 22% in seven years. If global condensate production matched the 2005 to 2013 Texas rates of change (relative to the global increase in gas production), global condensate production would be up by about 67% in seven years.

We don’t know by what percentage that global condensate production increased from 2005 to 2013. What we do know is that global C+C production increased at only 0.3%/year from 2005 to 2013. In my opinion, the only reasonable conclusion is that rising condensate production accounted for virtually all of the increase in global C+C production from 2005 to 2012, which implies that actual global crude oil production was flat to down from 2005 to 2012, as annual Brent crude oil prices doubled from $55 in 2005 to $112 in 2012.

The following chart shows normalized global gas, NGL and C+C production from 2002 to 2012 (2005 values = 100%).

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps45f11d98.jpg

The following chart shows estimated normalized global condensate and crude oil production from 2002 to 2012 (2005 values = 100%). I’m assuming that the global Condensate/(C+C) Ratio was about 10% for 2002 to 2005 (versus 11% for Texas in 2005), and then I (conservatively) assume that condensate increased at the same rate as global gas production from 2005 to 2012, which is a much lower rate of increase in condensate (relative to the increase in gas production) than what we saw in Texas from 2005 to 2012.

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zpse294f080.jpg

Based on foregoing assumptions, I estimate that actual annual global crude oil production (45 or lower API gravity crude oil) increased from about 60 mbpd (million barrels per day) in 2002 to about 67 mbpd in 2005, as annual Brent crude oil prices doubled from $25 in 2002 to $55 in 2005.

At the (estimated) 2002 to 2005 rate of increase in global crude oil production, global crude oil production would have been up to about 90 mbpd in 2013.

As annual Brent crude oil prices doubled again, from $55 in 2005 to an average of about $110 for 2011 to 2013 inclusive, I estimate that annual global crude oil production did not materially exceed about 67 mbpd, and probably averaged about 66 mbpd for 2006 to 2013 inclusive.

The price of crude oil is linked to the global “oil+substitute” demand versus supply. So if crude oil production decreases but substitute production increases to compensate, the equilibrium is reached. The big question in the coming years will be: how crude oil production decrease will be compensated by substitutes? The current continuous decline in oil price could have a big impact on the whole production next year. To guarantee budget equilibrium in producing countries, oil price should be higher than $100. So the current price situation cannot continue for many months/years. I think OPEC will lower production (decision or consequence of peak production) or the rest of the world will lower production (peak production or lack of profitability). Within several years, USA will decrease with high decline rate. I think nobody (no country) is prepared for this.

Of course, if global crude oil production has effectively peaked, it’s when, not if, that global condensate + NGL production also peaks. Note that even on the high end of the API gravity range of crude oil, the distillate yield drops significantly, just going from 39 to 42 API gravity:

http://i1095.photobucket.com/albums/i475/westexas/Refineryyields_zps4ad928eb.png

And when we calculate Global Net Exports of oil (GNE*), we use total petroleum liquids (+ other liquids for EIA data). GNE fell from 46 mbpd in 2005 to 43 mbpd in 2013. Available Net Exports (GNE less Chindia’s Net Imports, CNI) fell from 41 mbpd in 2005 to 34 mbpd in 2013.

*Combined net exports from Top 33 net exporters in 2005

I’m kind of watching all the recent talk of new condensate refineries proposed, and chasing funding.

That funding isn’t going to be there. This SHOULD restrict production.

Thanks for that, Jeffrey.

I have no idea whether IEA has followed your line of thinking but their conclusion (crude volume around 67 -68) is consistent with yours, which strikes me as perfectly sensible and yet another cause for concern.

Excellent analysis.

If actual global crude oil production is projected to be flat, what happens to net exports of crude oil as exporting countries consume an increasing share of their own crude oil production?

The 2005 to 2013 rate of increase in (2005) Top 33 Exporters’ total liquids consumption from 2005 to 2013 was 2.6%/year (EIA).

Hello everyone,

I posted these links at the end of a thread a few posts ago. My guess is very few people saw them. I thought I would throw them out again.

I am most interested in the first link. I would love an independent confirmation of their claims.

http://www.sciencedaily.com/videos/7bdf3c8319a5ffeae565a710fea6ea74.htm

http://www.sciencedaily.com/videos/923ccd12c60ef1e458fa2e41cf5ef7e8.htm

Best,

Tom

I forgot to put the titles to the stories.

For the first link:

Israeli firm makes solar power at night

and the second link:

Saharan solar project to power Europe

Best,

Tom

Water crisis in Sao Paulo:

http://www.huffingtonpost.com/2014/11/07/sao-paulo-drought_n_6118888.html

http://www.bloomberg.com/news/2014-10-21/sao-paulo-warned-to-brace-for-more-dramatic-water-shortages.html

http://www.theguardian.com/environment/2014/oct/31/amazon-rainforest-deforestation-weather-droughts-report

It would be great if World leaders would own up to the carbon problem, but I won’t hold my breath, especially with the R’s controlling Congress…and ideological fellow travelers in countries such as Australia:

http://www.theguardian.com/environment/2014/nov/12/us-china-climate-deal-boosts-global-talks-but-republicans-vow-to-resist

http://www.theguardian.com/environment/2014/nov/12/pressure-on-australia-to-slash-emissions-but-no-cost-effective-policy-to-get-us-there

As was just proven in the midterms, as described by the New York Times was essentially this:

“. . . and also we found that no matter how many left wing billionaires spent how many millions trying to make climate change an important political issue, from coast to coast nobody cared. “

“…nobody cared. “

Its not that they don’t care its more a matter of the fact that all of their “caring” is going into trying to make a living. The vast majority of the population a rapidly loosing wealth and earning power putting themselves and their loved ones at risk of economic then physical death.

They fail to see how focusing on climate change will address their financial concerns or if they are smart enough they realize that addressing climate change will in fact make their financial prospects even worse.

No, it’s a matter of misinformation – especially from Fox News.

Kicking the oil habit is very cost effective. For instance, the Nissan Leaf is the cheapest vehicle on the road to own and operate.

Right. I’m way ahead of my neighbor who went on with his BAU buys when I spent LESS money on PV, Leaf, all PV run electric appliances.

Now, no gasoline bills, no electric bills. He still pays what he paid, plus.

Well, nobody cared is always relative. Do you care about brocolli? Not at all until I mentioned it, but now that I did you think about it . . . care about it . . . more than you did a minute ago.

The point is millions were poured into climate change hype and it didn’t move the care needle. They did a helluva lot more than the mention I just did, and got nothing for it.

It’s a non subject for the people who pay the bills.

I have this site bookmarked and check it frequently. The people who run it have good intentions and don’t run anti science bullshit but they do run often run stuff that is technically feasible or potentially feasible but unlikely to be commercialized any time soon if ever.Let’s just say there is a lot of chaff in the grain.

Some stuff they link to is no more than company pr or marketing release. The first link about Israelis generating electricity at night with some new form of storage technology similar to but different from molten salts looks to me to be a press release. Maybe the company is for real but I estimate that ninety nine percent plus of the time such press releases describe things that never come to pass.

The second link is about solar power plants in the desert near the Med being built out on a grand scale and HVDC lines built to transport the juice to Europe by 2018.

This general plan has been around for a good while now but it got bogged down because of the price tag and associated political problems and more or less permanently put on hold a couple of years ago.Maybe longer.

I cruise the energy news quite often but this link is the first one I have seen that indicates this giant project has been dusted off and put back on the front burner. May be it has.

But if it has it has not been headlined by any of the major sites that deal with politics or energy or the economy in recent days unless I missed the headline.

I doubt it is going to happen anytime soon but this scheme may have been reborn in the last few days as the result of Europeans getting their act together out of fear of the Russian bear.If this is the case it should be a lead item on a lot of sites including lots of major newspapers..

The idea of creating huge solar fields in the Sahara bogged down because nobody can figure out whose interest it is supposed to be in. Maybe in a science fiction world you can imagine it being in “everyone’s” interest.

In the short term it doesn’t make much sense for the North Africans, because it’s just foreign capital using almost free land and exporting the results. Energy shortages in the Middle East and North Africa are mostly caused by political and governance problems, so decentralized solar is probably a better bet in the short term.

It doesn’t make much sense to Europeans because in the short term there is no lack of land and sunshine in Southern Europe.You could increase the solar energy industry tenfold in Southern Europe without running into land issues. Why bother with North Africa?

Your comment reminds me that I just listened to Radio Ecoshock’s podcast last night and interestingly, there was some mention in the discussion about this issue regarding nuclear power (brief):

“I ask Olli about the Finish government’s position on climate change (they favor the bureaucratic solutions which don’t really do much); and about the expansion of nuclear power in Finland. We agree that nuclear power pre-supposes and enforces a centralized government that must be willing to use force to protect the reactors – for generations.”

…Nothing like peak government digging in its heels with nuclear power on the eve of civilizational decline/collapse to keep one up at night.

Caelan, a few years ago I was very strong pro nuclear power. Then I got to thinking about a possible total economic collapse. What would happen to those nuclear power plants then? That was when I turned on a dime and became anti nuclear power.

Yep! And that in a nutshell is my main personal reason for being anti nuclear at this time! Nuclear requires the maintenance of a very complex society for a very long time to come. Unless I have been reading the writing on the wall incorrectly, our complex societies are about to undergo a rather drastic simplification… and that doesn’t bode well for nuclear power generation.

The recent landing of a ‘drone’ on an asteroid, rather than, say, another shipment of people for a current Martian terraforming project (funded by a non-coercive taxation system) is as good a metaphor as any for

ourtheir squanders and corruptions.Caelan, with all due respect if we directed all our space technology and resources toward a Martin terraforming Mars, every hour worked and every penny spent would be a total waste of time and money. From Wiki:

The atmosphere of Mars is less than 1% of Earth’s, so it does not protect the planet from the Sun’s radiation nor does it do much to retain heat at the surface. It consists of 95% carbon dioxide, 3% nitrogen, 1.6% argon, and the remainder is trace amounts of oxygen, water vapor, and other gases.

If we went to Mars we would have to carry every ounce of food we needed with us. We would need to carry every ounce of water we needed with us. We would need to carry every breath of air we need to live with us.

The bottom of the ocean is a thousand times more hospitable and much easier to reach than Mars. If you wished to colonize empty space it would make a lot more sense to start there. Or if you were dead set on space, you could start with the Moon. It is a whole lot closer so when you ran out of air, you wouldn’t have so far to to get some more.

My metaphor was somewhat exaggerated, but still, would you (or others reading this) have different ideas on how your stolen money was to be spent?

By the way, did they not already find water on Mars? But anyway, I suggest that they get a big gas compressor ship to suck Venus’ atmosphere up and blow it out on Mars. To increase its gravity and maybe add to its surface material and atmospheric composition and pressure, maybe smash relatively-useless Phobos and Diemos into it as well, perhaps along with a few asteroids from the nearby belt. Then, after that’s all done and the dust has settled, gradually build a moon from more of the asteroid belt to give Mars some tidal forces to increase internal heating/volcanism and expulsion of more material and for the early imported terrestrial organisms. Simple. ‘u^

Local governments could tax it for revenue, and Europeans could get a more diverse supply base.

It would be limited – there’s no question Europeans don’t want to import a large percentage of their power from Africa.

With regard to Greer’s and Orlov’s recent articles about collapse, and mentions of these warbands and losing control of peripheries, etc.; I would suggest that that state governments are ‘warbands’ in a sense– superset warbands– so it seems to stand to reason that things like that, (etc.), would fragment into smaller and more diffuse localized forms that echo the parents as it were.

Anyway, one question I had for the group here is if there was any thought or discussion about the results of US fracking vis-a-vis the recent drop in oil price. I have been reading something of a fracking struggle as a result, but how much of US fracking production is exported out of the US and what will happen when US and other countries become more ‘localized’. (I also have come across some recent discussion of ‘protectionism’, but of course this kind of post-peak oil protectionism seems quite different.)

Old farmer mac;

If you read this, I have heard that (at least many) (so-called-) farmers have been farming ‘wrong’ for the past 7000 years or so– monocropping, tilling, soil depletion, pesticides and fossil fuel inputs to name a few.

I’ve also always had a hard time with the term ‘weed’ by the way. A weed is a plant, and often, if not usually, edible, hardy, self-propagating, wild and perennial. ‘Agriculture’ may not be as hard as some seem to think, and of course we, as a species, have been making things hard for ourselves as almost par for the course.

Lastly, I hear that if we want to feed a lot of people post peak oil and maybe even as climate change really kicks in, ‘weeds’ may become among our best bets. And bbq’ued rat. ‘u^

Anyway, one question I had for the group here is if there was any thought or discussion about the results of US fracking vis-a-vis the recent drop in oil price.

It will take a while for the price drop to show up as a drop in production. There is a backlog of wells waiting for completion so it will not affect them. But the rig count has already started to fall. A few weeks ago the rigs drilling for oil stood at 1,609 and a couple of days ago it was at 1,568, a drop of 41.