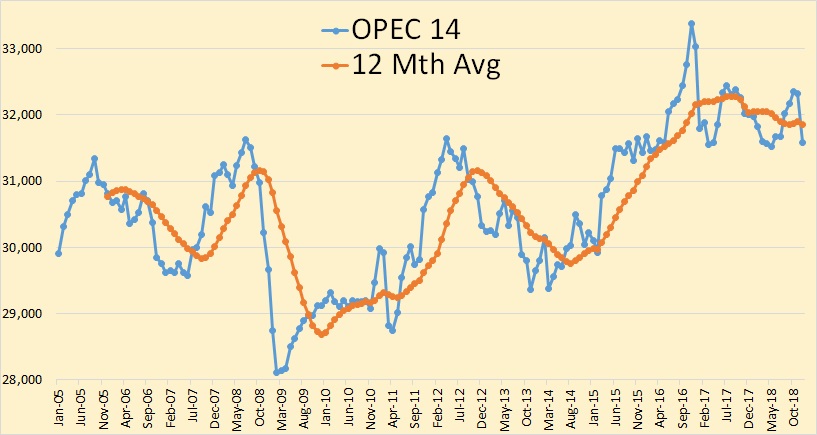

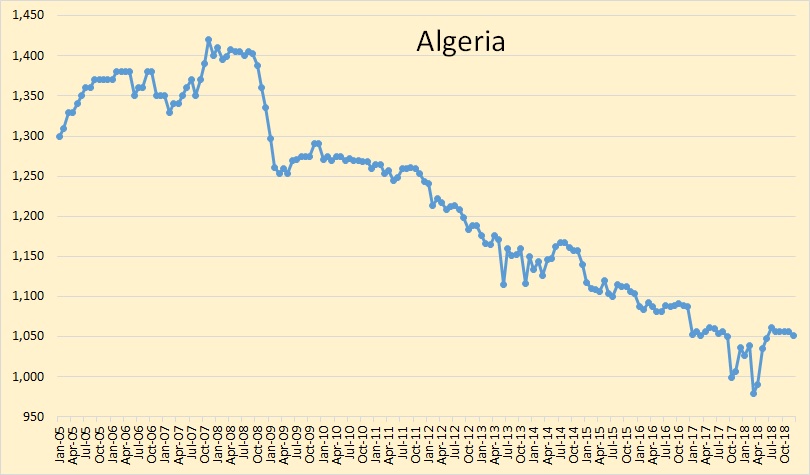

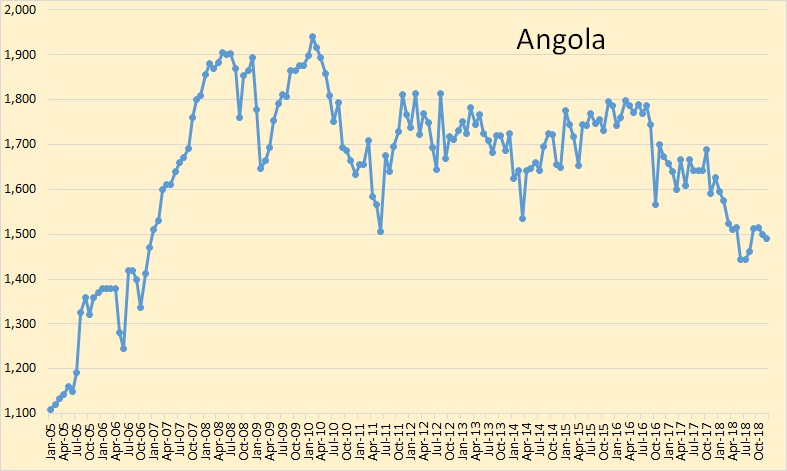

All OPEC data below is from the January OPEC Monthly Oil Market Report. All OPEC data is through December 2018 and is thousand barrels per day.

Qatar has left OPEC and is not included in this months report. All Qatar historical data has been removed from all OPEC charts.

OPEC 14 production was down by 751,000 barrels per day in December. That was after November production had been revised downward by 23,000 barrels per day.

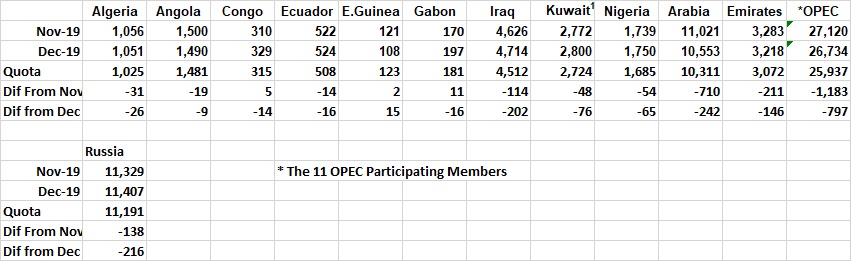

Here you can see who had the big declines in December.

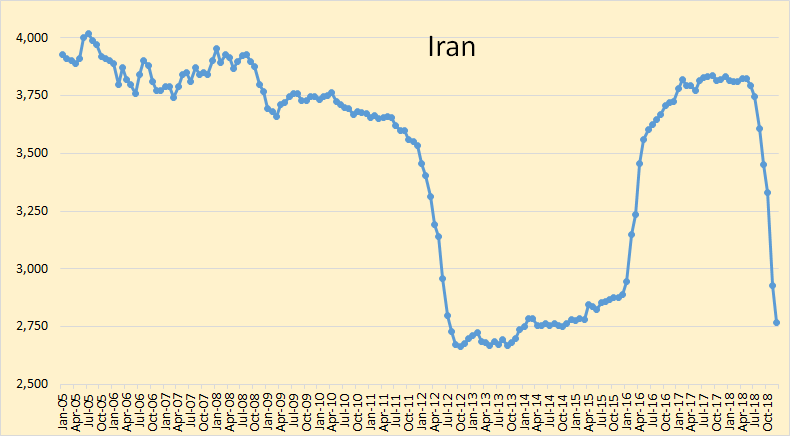

Iran is now at about the average they held during the previous sanctions period.

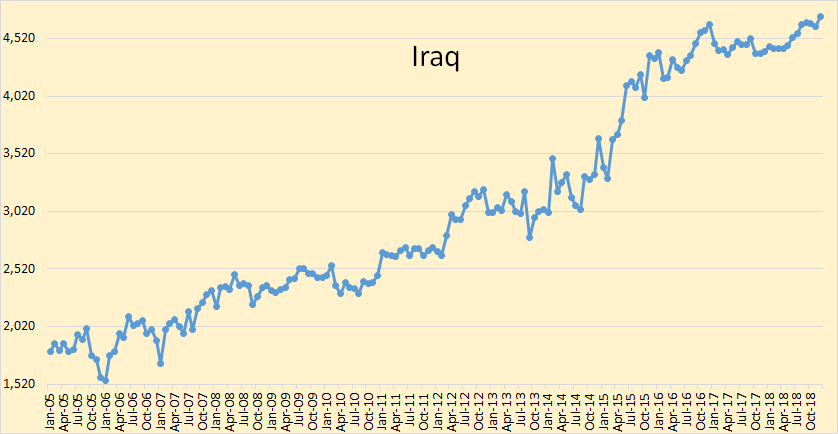

Iraq reached a new all-time high in December of 4,714,000 bpd. That was up 88,000 bpd from November.

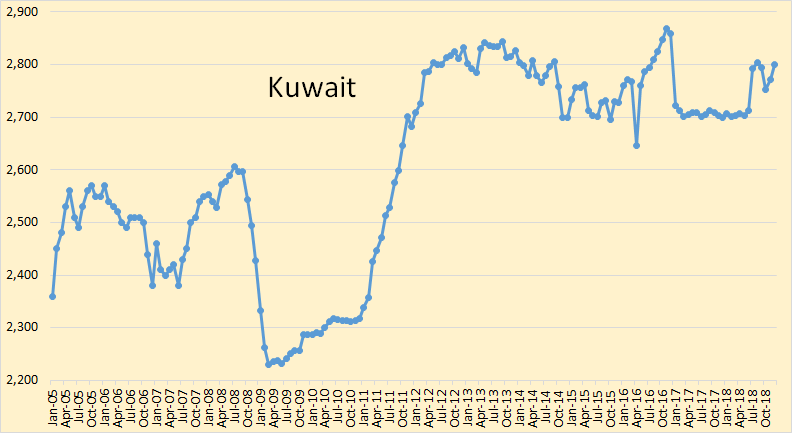

Kuwait also increased production in December, up 29,000 bpt to 2,800,000 bpd.

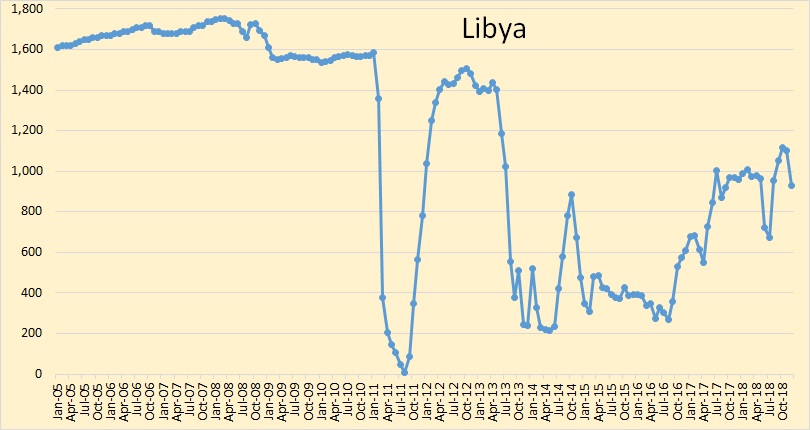

Libya is still having serious political problems.

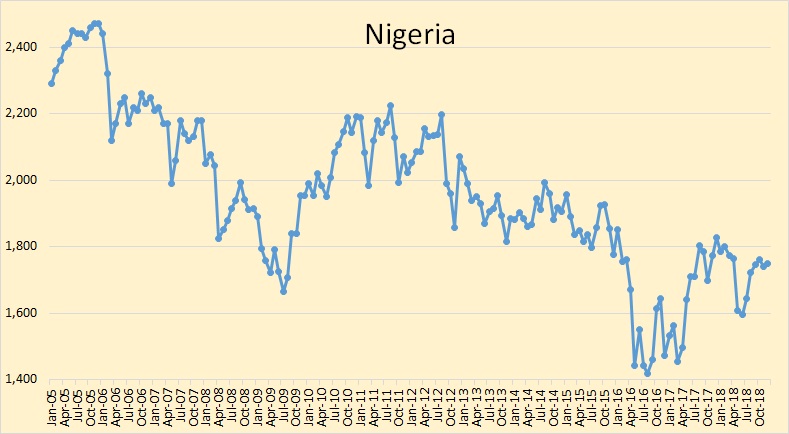

Nigeria is also having political problems but it is hard to tell how much of their decline is due to politics or natural decline.

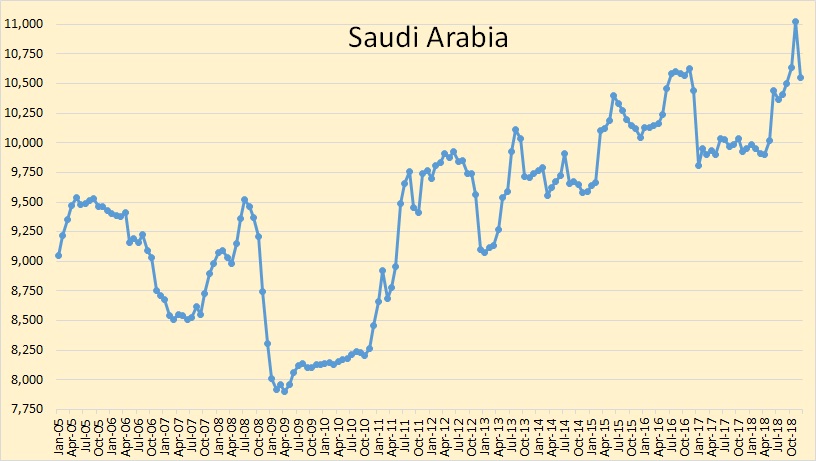

Saudi Arabia was down 468,000 bpd but that was after they spicked up by 384,000 bpd in November. They are now back close to their average for the last seven months.

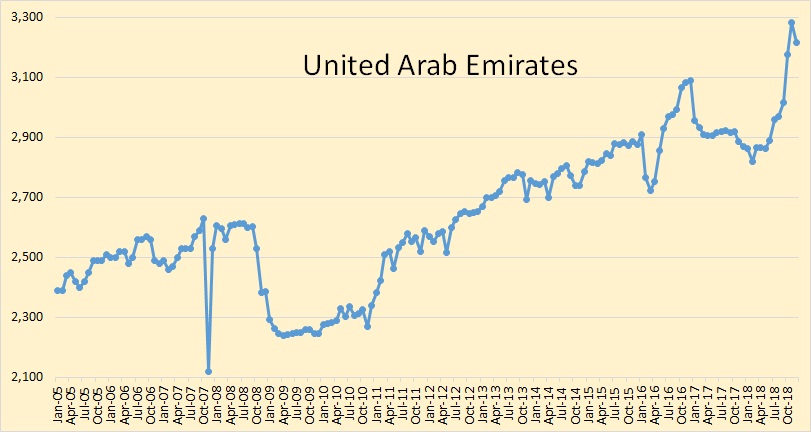

The UAE dropped by 65,000 bpd in December.

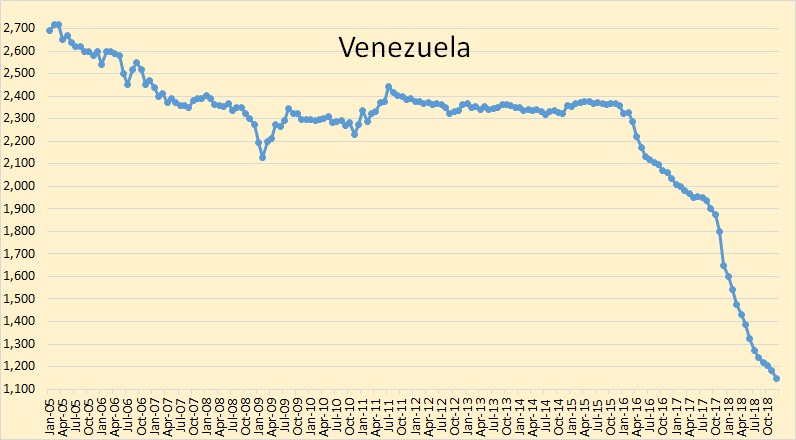

Slowly, slowly Venezuela sinks into the abyss.

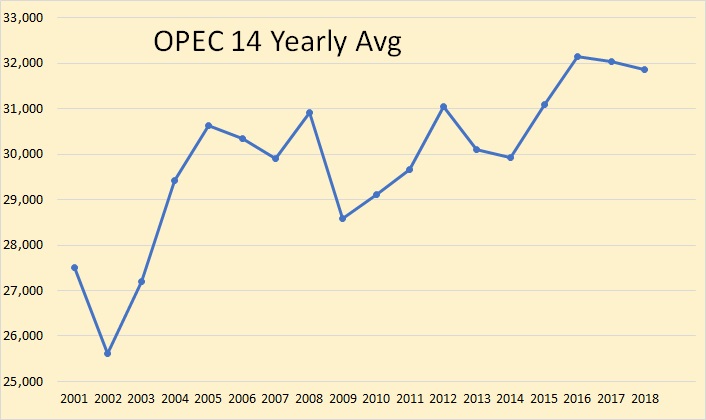

OPEC 14 peaked in 2016 at an average of 32,157,000 barrels per day and in 2018 was down by 300,000 bpd from that average.

World oil supply, including NGLs, declined by 350,000 barrels per day in December.

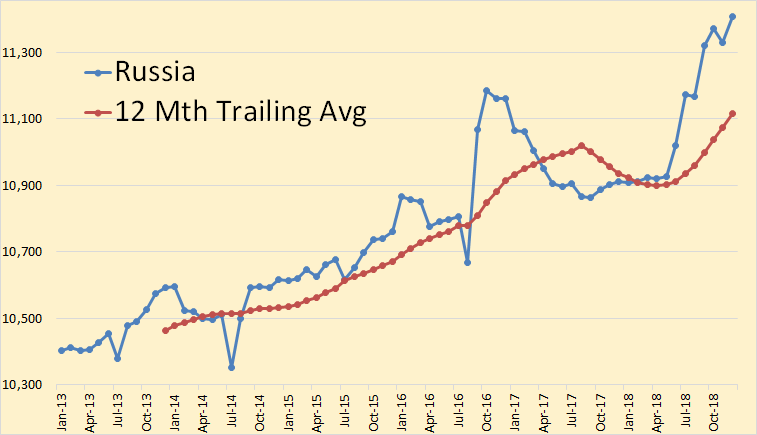

Russian C+C increased by 78,000 barrels per day in December to 11,407,000 bpd.

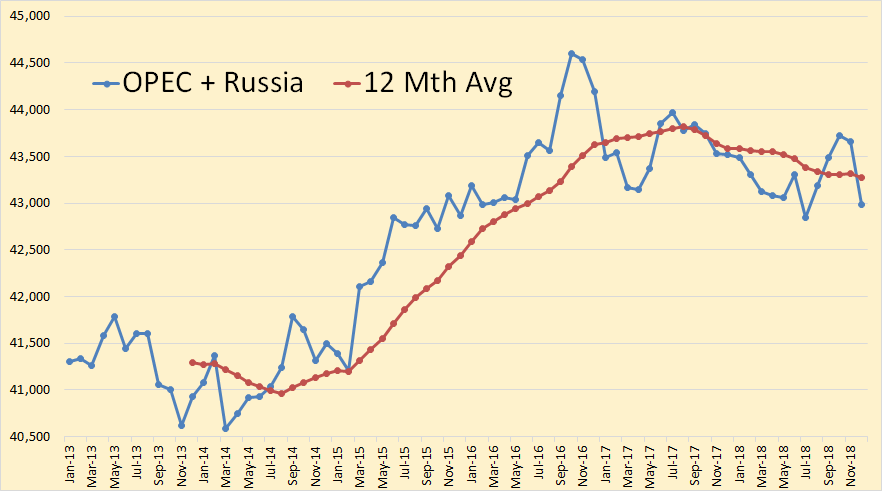

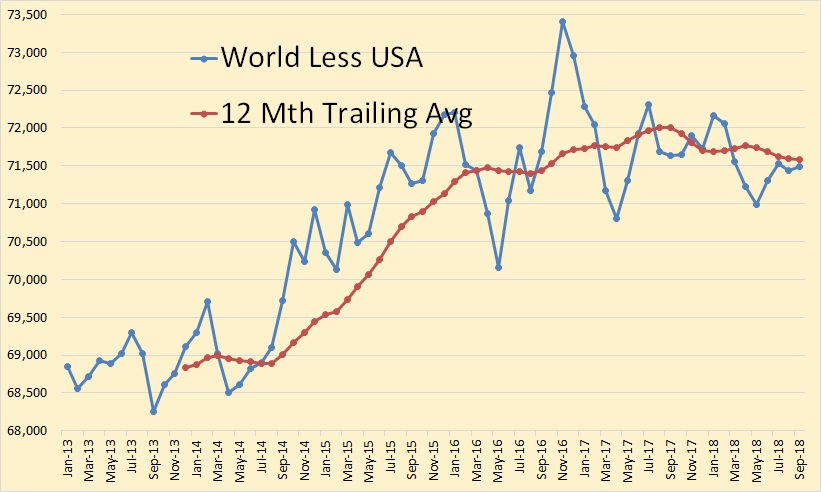

Even before the December decline, OPEC+Russia was in decline. It’s all up to US and Canada to keep up any increase. The EIA includes Brazil in the mix but others have doubts about the ability of Brazil to have any kind of dramatic increase.

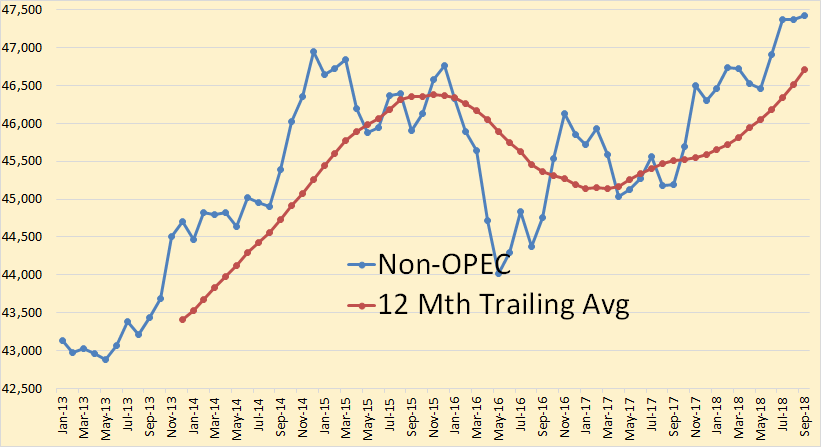

This data is from the EIA and is only through September 2018.

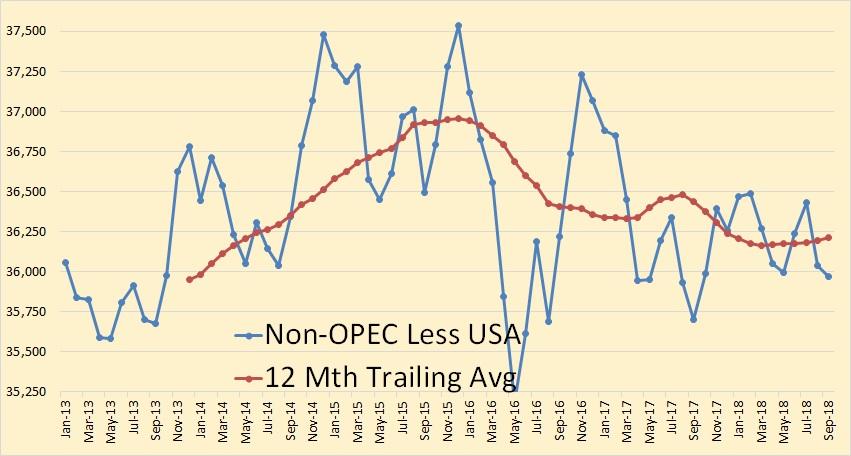

Again, EIA data through September 2018.

I think it is quite obvious that Non-OPEC less USA has peaked.

Likewise…

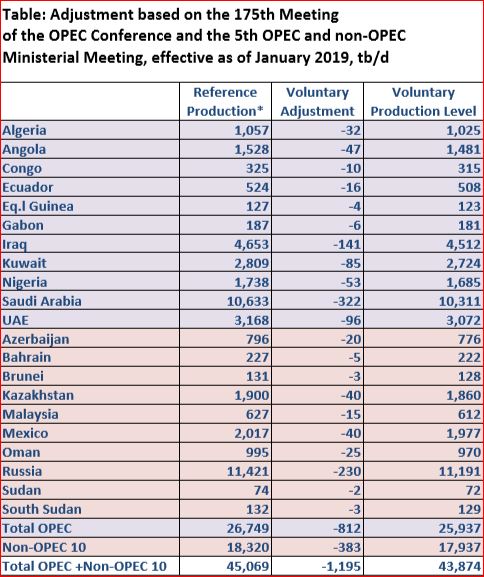

Iran, Libya and Venezuela are exempt from quotas.

It appears that outside OPEC and Russia, production growth will largely be from the Permian Basin.

Doesn’t look like Bakken or EFS will grow much more and other shale basins are not large enough to move the needle much, at least based on current data. Canada will be transport constrained for awhile.

When shale hits the tipping point, things will get interesting, but looks like PB will not hit that for a few years.

The charts at the end are really good for analysis. I see if US production is flat, or close to it, for 2019, then World could be flat to down for that period. That could still put 2019 over 2018, depending on how long the OPEC cuts last. I really don’t expect it to remain that way, its just the way it looks at this point, in time. However, it is likely to remain that way for a longer period of time than I first imagined, as the Permian pipelines are likely to be on hold longer than first expected. I see little substantial increase in the Permian during 2019. While Dennis and EIA expect a 500k bpd increase from shale in 2019, I don’t. Even if it does, plugging that in, makes the world, essentially, still flat. Which is horrible for supply, when you consider decline rates, and any increase in demand.

GuyM.

Looking at shaleprofile.com, it appears that PB will add almost 2 million BOPD from 2018 wells, but will drop over 1 million BOPD from 2017 and prior wells (shale only) once final numbers are in for all of 2018.

For USA total, and estimating OK production, looks like US will add around 3.5 million BOPD from 2018 wells and will drop close to 2.5 million from 2017 and prior wells (shale only).

No wonder the market has no clue and is so volatile.

A 100 million BOPD market that is very dependent upon US shale. When US shale hits the tipping point, assuming demand has not began to fall worldwide, oil could jump $100 or more IMO. I assume that will be the shock that will cause demand to crater.

I know I will be subject to much poo poo, by saying this, but I see the price approximating $100 this year. It will not be the tipping point, it will need to be much higher that $100 to kill demand. IMO Obviously price is not determined by fundamentals, especially, when you have such beneficial organizations supplying fundamental information like the EIA. But, panic can override BS.

GuyM,

Let’s say you mean the Brent Oil Price reaches $100/b by Dec 2019 and the average oil price for the year is about $80/b for Brent and perhaps $70/b for WTI. My expectation is for US shale output to grow at an annual rate of about 450+/-100 kb/d, if my guess for average WTI oil price in 2019 of $65/b is correct.

This is for all US basins which are likely to see increased output with oil prices rising. Not sure that OPEC will maintain cuts when oil gets to $80/b or more, I think they will bring on some supply (along with Russia) to keep oil prices under $90/b. If US output is flat rather than a 450 kb/d increase as I have guessed, OPEC/Russia will be able to increase output to keep oil prices in check, if they choose to do so.

I’d rather see higher oil prices to get the EV transition rolling, above $100/b would be great for the environment, but unclear if OPEC/Russia will let that happen as they would prefer to delay the transition to EVs as long as possible.

My guess is that they will aim for $80/b.

Dennis

You are correct. Oil price will not hit $100 this year unless for political reasons. There is now enough spare capacity in OPEC and Russia to cover demand growth that is not met by US production.

The number of electric vehicles sold is nothing to do with OPEC and oil price and everything to do with how good electric vehicles are and their price. If i could buy an electric vehicle for £20,000 which would drive 300 miles, i would buy it tomorrow.

Hugo,

If petrol prices increase by 50% it might make sense to buy an electric vehicle, but I am not sure about electricity costs in the UK.

The price of EVs will decrease while the cost of oil increases, we may reach your price point by 2025, at which time oil prices are likely to be $100/b or more.

I am frustrated by the fact that EV vendors still seem to be bifurcated between totally exotic very expensive cars and those designed for the nerdiest of eco-freaks. All of those available here seem to be burdened with electronic foo-foo designed to attract the short attention span of those much younger than me. Living somewhere between those extremes I’m driving a Chevy Volt, a plug-in hybrid. When I acquired the car in 2016 I assumed that by now some interesting cars would be available at reasonable prices. Here in California that does not seem to be the case. My lease is up in May. I assume I will just buy the car and drive it until one of us stops functioning.

JJHMAN

I agree, BMW have an electric car, which looks awful compared to their petrol models. I really think it has been thrown together to please the eco geeks. Their claim of “up to 160 is rubbish. Real life range is 120 max. I would have to recharge 3 time to make a journey I do regularly.

When you think BMW make about 70 models and variants, it is disappointing.

Things like this car is only usable as a 2nd family car at the moment.

Driving to work while the partner takes the bigger (gasoline) car to distribute children to sporting, activities or for longer rides.

This can be useful if commute ways are long enough – a 30 km single way commute adds up to lots of km in a year.

Anyway, there isn’t enough battery producing capacity now and all these cars are still studies of possibilities.

Next or overnext generation battery tech is necessary to bring a real mass market. When something like this works in mass market, even planes accross the atlantic will be possible:

https://www.greencarreports.com/news/1120563_honda-presents-new-battery-chemistry-that-could-succeed-lithium-ion

The company doing the clains is Honda, not a small startup begging for investor money.

Still 10 years to go and muddle through.

The perfect answer to intermittent wind and solar and needing to reduce CO2 emissions is hydrogen.

Hydrogen produced from renewable energy can be stored to produce electricity or used for heat.

http://www.actaspa.com/projects/project-2/

If the US spent half it’s war budget on this kind of technology the world would not be worried about lack of oil.

There would be plenty of clean electricity.

Why does the US spend so much on war?

https://ourworldindata.org/military-spending

Demand is not limiting the growth of the EV market. Every model has long waiting lists, sometimes years. Hyundai has more back orders for EVs in Norway (population 5.2 m) than it plans to produce worldwide in 2019.

Oil is an expensive form of energy and can’t compete with electricity on cost. Not sure, but I think the prices would have to fall well below $10 a barrel. A lot depends on taxes etc. So cost isn’t really the issue. In fact Tesla’s great contribution to the industry was noticing that most of California’s EV compliance cars were bought buy rich people looking for something cool, not by penny pinchers or people who give a crap about the environment.

The real issue is that the battery industry can’t keep up with demand. The most successful EV manufacturers — BYD and Tesla — are also battery manufacturers. Everyone else is scrambling to find a supplier. For example VW brags it has enough for 15m cars, a drop in the bucket, and SAIC, China’s biggest car company, is partnering with CATL, China’s biggest battery company.

The quickest way to cut oil consumption (if that’s your goal) would be to switch to hybrids, which use much less oil and have much smaller batteries. But EVs are cheaper and easier to design and make, more profitable, much easier to maintain, and more attractive to consumers. From a marketing perspective, hybrids are neither fish nor fowl. The only advantage to hybrids is that they save gas, but that isn’t really a priority, even at $100 a barrel.

In Spain electric vehicles are more expensive, even though they receive subsidies and preferential parking. Most taxis use conventional hybrids, buses and trucks are diesels.

Sometimes I use taxis, and ask the drivers why they don’t use electrics, they explain electrics are too expensive, have short range, take too long to recharge, and the battery lasts even less in cold or hot weather.

Cost per mile of electrics vs ICE over 10 yrs-

(including all costs such as purchase, energy, maintainenece)

about 1/2

if you don’t like that result, then use faulty assumptions for your analysis. You may be able to get results that are closer to equivalency.

Used to like this site for its good analysis and high level of debate.

Now we´re down to “I´m always right, I own the truth and who doesn´t agree with me is faulty”.

I take it you think that professional taxi companies refuse to use “cheaper” subsidized electric taxis because they are ALL stupid? Why don’t you invest in an electric taxi fleet in Spain and make a ton of money?

Fernando, your comment contains real facts from the real world and is the kind of useful commentary that makes this site so good.

My response was to Hickory’s comment, which is the opposite: no facts, only bold statements and harsh words.

Sorry for the misunderstanding.

Hickory, what capital cost have you assumed for your calculation? 0%?

Baggen- my hasty mistake. Should not have indicated purchase price as part of that ‘cost per mile’ statement. Rather just fuel and maintenance.

There are two big wild-cards to these projections. One is the longterm cost of petrol. It might go up rapidly some year. The other is longevity of the EV battery pack. If they wear out prior to a 7-10 yr timeframe, the economics certainly fall short.

Nice anecdote, but the real reason there are so few EVs on the road is that manufacturers can’t produce them any faster. Sales doubled in 2018 over 2017, and factories can’t keep up.

Oil is still too cheap.

In most of Europe with all the taxes added we pay the equivalent of $250 per barrel.

I know 3 people who very recently bought cars and they did not even consider an electric car due to range and cost of the vehicle.

Sorry, sometimes I switch over into delusions of grandeur that I can predict the future? I can pretty well be assured that it will not resemble what the mainstream media, nor EIA think. Never does. Ok, my prediction for 2019, is that it will surprise most in relation to oil price and production. How’s that?

I would be surprised, Dennis, if production rose to 350k bpd, even if prices eventually get to $65 in the next few months. Then again, my delusions are coming over me again?

GuyM,

I am not saying you are incorrect, just expressing an alternative position. So I think your expectation for the change in US output in 2019 might be something like 0+/-100 kb/d?

Not really a huge difference from my 450 kb/d+/-100 kb/d.

Heck we could call it 250+/-250 kb/d and we’d have it covered, and that’s probably not a bad guess, imo.

Bottom line, neither of us knows, I tend to guess a little higher because I consistently guess too low on future output.

Going from a 1300 kb/d increase to zero in one year seems like too big a change at $50/b. If it were $40/b, I would be more inclined to guess that low and maybe oil prices will fall back to that level, but that would surprise me unless there is a recession, which would also be unexpected.

Permian did about 200k better than my expectations with takeaway constraints, so those constraints were incorrect. But, it is at the wall, now. Some of those constraints will possibly go away in the third quarter, allowing for another 1 million. Or, maybe not. Other than a max of 200k from other shales, if the price is right, I can’t see production ramping up until the final quarter, at best. But, then, I was 200k short on the Permian for 2018, so what do I know? Except, I know US production will be far short of making IEA expectations. We are going to have some serious draws on inventories in 2019, and OPEC is licking their chops. In contrast to the EIA economists, Opec has some real oil people covering US and the rest of the world”s production.

Shallow

You, Eulenspeigal, and Dennis made some pretty good comments towards the end of the last thread concerning 3 MM bbls online from 2018, 2 MM bbl decline pre 2018.

Powerful context and implications with those numbers.

Eulenspeigal observed how the mining model applies with the cost of tires/diesel playing a role in decision making regarding production, along with ultimate product pricing.

Dennis employed a flawed, IMHO, projection using past history to assess future production probabilities.

Unconventional hydrocarbon production in the US is now in new territory

vis a vis historical norms and the sooner that this is recognized, the more accurate assumptions may be made regarding what to expect down the road.

Shallow, when EOG claims it now costs less than $5 million to drill and complete a Bakken well, when 5,000 foot laterals in the Niobrara are routinely drilled/completed at – or under – $2 million per, how does that impact the economics?

Does a Colorado well that produces “only” 100 thousand barrels first year now seem viable if the development cost is so low?

In the ongoing Rice brothers/EQT dispute, some interesting data points are coming out.

Contrary to recent trends, the Rices are adamant thst 1,000 foot interwell spacing is optimum. Rather than seeming to forego the recovery of in place hydrocarbons, the Rices feel that cutting edge completion practices can now recover the same – or more – gas with fewer wells.

Think about the implications.

Furthermore – again bucking trends – the Rices claim that 12,000 foot laterals are optimum and longer lengths prompt both operational and recovery shortfalls.

So, if they are correct (and if this view starts to spread to other areas), relatively fast drilled, ultra precisely targeted wells can be put forth on short notice – susceptible to near term market forces – and these wells will now be completed using the entire range of innovative completion techniques (the near wellbore and far field diversion processes being only 2 of these highly impactful processes).

Furthermore, to expand upon my recent chiding of Dennis’ use of ‘averaging’ in looking at LTO stuff, there is WAY too much variability to try to gain accuracy unless one is willing to look deeper.

The Bakken/Three Forks is a good example.

The recent targeting of the second bench of the Three Forks is showing very strong results.

This bench has had a minimal development history as the first bench and Middle Bakken were the early, main targets.

These second bench wells are apt to show completely different profiles than the other wells (higher GOR, faster drop off in production).

These differences are apt to cause skewed analysis absent an understanding of what is going on.

This is true in spades with the SCOOP/STACK/MERGE formations in Oklahoma and most probably with the different stacks in the Powder River Basin and the Permian to boot.

What is going on here, Shallow, is a vast, vast newly accessible resource- both gas and oil – that can be brought to market at short notice, in an increasingly lower cost manner.

Markets seem to be slow to recognize this.

coffee.

I am not sure about the costs you quote. Don’t follow as closely.

In general terms, there will not be good returns in US oil until the Permian Basin is developed to the point the EFS and Bakken are now. The oil price will stay too low.

Exception is in the event of a major Middle Eastern War.

It appear natural gas E & P’s will be a poor investment for decades.

Cheap energy for consumers in the USA.

Interesting that XOM is going wild in PB and CVX is taking a more measured approach.

Would love to know the reason(s) for the different strategies.

Shallow

Regarding d&c costs …

A couple of years back, PDC brought online 4 wells simultaneously from the same pad.

Using so-called monobore drilling along with fracturing all the wells at the same time, PDC claimed a per well cost of $2.3 million.

Recent wells have been drilled in the Niobrara in 2 days time.

Same same in both the Bakken and Appalachian Basin areas that I follow as laterals are routinely drilled at or near a mile per day pace.

The frac water is all piped in.

Sand is used almost exclusively with little to no ceramics.

Sand mines are increasingly located within the basins, thus eliminating much of the expensive shipping costs.

People quoting $10 million dollar range per well may only be accurate where the activity is still in the earlier phases.

Heck, even CNX claims their latest Deep Utica well costs have almost reached their $12 million d&c goals.

This is down from near $30 million just 5 years ago.

This lowered overhead, coupled with quicker, higher recoveries, will expand the prospective footprint enormously across the country.

Coffeeguyzz,

One needs to include land costs pad costs, storage tanks, gathering lines, cost to abandon the well at end of life, it all needs to be included in the cost of the well to evaluate the investment.

Investor presentations are notorious for painting a rosy picture.

In the Permian Basin the full cost of the average well is about 9 to 9.5 million dollars.

For Bakken see

http://www.petroleum-economist.com/articles/upstream/exploration-production/2018/where-next-for-the-bakken

Note that the EUR estimates give in the piece above often use BOE to inflate the EUR when natural gas earns very little for Bakken producers, in fact if they could they would flare it all at current natural gas prices in North Dakota.

The more important metric is Barrels of oil produced, and for the average 2016 Bakken Well this is about 360 kb rather than the 1 to 1.2 million claimed by some. For the average 2017 North Dakota Bakken/Three Forks well the EUR is about 390 kb. The 2018 wells look like they might be 405 kb, but it is too early to make a very good estimate. This assumes the tail of the 2018 well is no worse than 2017 wells and that the tail of the 2017 well is no worse than the average 2016 well. That assumption may prove too optimistic.

Dennis

Actually, operators do not need to incorporate your stated factors when determining the costs to drill, complete, and bring online new wells as those expenses, sans P&A, have already been accounted for.

That is why Rune Likvern’s Bakken Free Cash Flow graphic was both so dramatic as well as misleading.

Pads are built.

Lines, tanks, processing hardware, roads, power supply are already working.

Now, to bring in a rig, frac crew … do their thing so a couple hundred thousand barrels earl will be produced over the next few months … now THAT costs new money.

Hence, the classification of D&C … drilling, completing and bringing online.

As per your referenced article, Hess in 2017 has d&c of $5.8 million per.

Continental has $7.5 million for 50/60 stage wells that are producing way more than earlier wells.

BTW, if you re-read the next to last paragraph of your (one year old) referenced article, you can see it is already wrong about Bakken output.

This is simply another example of why one may want to use discretion when reading the analysis of others.

Final note …

The data used in your referenced article for well costs for Hess, Continental and Whiting came from … wait for it …

INVESTOR PRESENTATIONS!!

Coffeeguyzz,

Land cost has to be factored in as without land there is no well.

All other costs also are part of the equation. It is pretty simple if one has a facility, pad and all other equipment for 10 wells, then one tenth of the cost is assigned to each of the 10 wells on the pad.

This is how businesses analyze investments.

Including D+C costs alone is not the way to analyze the investment, plain and simple.

Well, you may not want to analyze it that way, but the companies spending half a billion/2 billion bucks this coming year to drill, complete and bring online the roughly 15,000 unconventional USA wells do it like that.

They are not gonna track down property owners and give them a check ev’ry time they fire up the compressors.

Coffee. We will never really know any of the true costs for sure.

The only data I have ever seen which gave me any feel for complete accuracy were payout statements for some wells wherein the mineral owners (unfortunately for them) went non-consent.

I suspect the operators with regard to those payout statements listed every expense, as it was to their benefit to do so.

OTOH, it does the operator more good to leave out as many expenses a possible in investor presentations.

Kind of like the fine print which discloses EUR assumes a 50 year well life. What investment banker would care about what a well makes in year 10, let alone year 50?

I suspect you are in the same manner of thinking as Nony, lower forever is best. Ultra consumer thinking, not understanding low oil prices for the world’s largest oil producing nation are now deflationary, and drag down equities (see early 2016 – late 2018). But if you live paycheck to paycheck, as most of the US does, and have no retirement plan, as most of the US does, this is probably how you should view it.

One of three things will likely happen.

1. US Shale hits the tipping point with worldwide demand still rising, and then will be profitable.

2. US Shale hits the tipping point with worldwide demand falling, and it will have never been profitable.

3. A major Middle Eastern War occurrs , which causes shale to be profitable during the time Middle Eastern supplies are disrupted.

Of course, I didn’t see shale coming like it has nor did I see operators in that space be willing to cut their own throats, so I am likely wrong on my predictions.

Shallow

The “we” in your first sentence certainly includes me, you, and I guess everybody who reads and comments on this site.

With over 40 years experience running several successful small businesses, I am well acquainted with the myriad tools, techniques, processes that our system has in place so enterprises can navigate the “revenue in, revenue out” labyrinth to their best advantage.

This is one key reason I look at the financial side with only passing interest.

Important, yes, but – again – pertinent info is simply not available to us.

Heck, even the army of analysts have been fucking up prognostications for years now.

When reality shows that they have been incorrect, tangential excuses are put forth with the atmosphere of “any day now …” being the latest face of those who simply cannot man up and acknowledge that they were wrong.

What’s the big deal here?

Everybody, back in 2008, was of the impression hydrocarbon scarcity was looming.

Excellent array of reasons to hold that stance.

Things changed.

Here we are, a decade on now, and the Permian – a region David Hughes described in his now-modified, no-longer-viewable “Drilling Deeper” passage as inconsequential – is now on the cusp of surpassing Ghawar in daily output.

Surpassing Ghawar, Shallow.

Rapier just said that and I agree.

You would be incorrect to think that I unabashedly favor a lower for longer price scenario as best.

I try to set aside any attachments I may have and coldly assess myriad factors with an eye to future probabilities.

At the moment, hydrocarbon abundance in North America seems assured looking far out into the future.

You want to know what’s coming, Shallow?

What was Rystad’s US estimate?

16 MMbpd by 2025 or something?

That is what is coming.

In your general neck of the woods, smaller, bold operators will start drilling shallow, horizontal wells and fracture like the big boys do, if the geology and economics allow.

Already happening in northwest PA, northeast OH, and south central CO.

Wouldn’t surprise me if it is actually more widespread.

North American hydrocarbon abundance will exist until the Next Big Thing – Energy-wise – comes along to replace it.

Coffeeguyzz,

Not sure about the Rystad estimate, if we assume the non tight oil US output remains at about the 2018 level of 4 Mb/d (it would likely decline) then tight oil output would be about 12 Mb/d, my scenario has tight oil output at 9.5 Mb/d in 2025 (about 7 Mb/d is Permian output).

If there is a war that impacts real crude flow, would that not limit diesel dependent LTO production? It’s clear that such production is TOTALLY dependent on Real Crude flows, but if even a slight disruption of crude flows would rein complete havoc on just about everything.

Longtimber

A war or other event(s) that disrupted oil flow would certainly impede LTO extraction, amongst other major condequences.

However, there continues to be a shift towards electrification and natgas fueled operations across the whole spectrum of upstream operations.

One small frac outfit has been hauling around a gas turbine to power their fracturing activities in the Appalachian Basin for a couple of years.

They just got bought out, are growing rapidly in size, and are planning on working in basins all across the country.

In fact, the innovations regarding natgas processing are so impactful, I would not be surprised to see natgas continue to nudge aside oil – as it is doing to coal in power generation – in a wide array of applications, including the big enchilada – transportation, in the coming years.

Coffeeguyz,

It is the proper way to analyze an investment and I am pretty sure that’s the way a financial analyst within the company would analyze it.

You take all the capital cost connected with a project and you look at your discounted net income over the life of the project to find your return on investment. This is very basic stuff.

When I controlled budgets I separated the pad civil works (road, pad, electric line conduits, potable water well, emergency pit, fencing and as needed payments to land owners) into one item. The mechanical and controls part (pad multiphase line, manifold and individual well lines, test separator, instrument air, telemetry) went into a second item. The well drilling and completion went into a third item, each clearly delineated. This allowed the work to be managed by three separate team leaders, although drilling and completion were performed by separate groups.

The pad project was assigned to a pad coordinator, a senior engineer who made sure the team leaders, the safety, security, legal, community relations, environmental protection, and other departments were able to have input, assign individuals, and get their respective roles carried out.

The pad coordinator didn’t supervise the team leaders, the role rotated to give experienced engineers an entry into project management. All team leaders would go through one year as coordinator before becoming a team leader, except for the drilling team leader, who was usually too senior to spend one year in training.

We controlled every dollar, piece of equipment, hour of labor, and coffee cup, because we had to always be ready for partner and tax authority audits. To accomplish this we had a program in each engineer’s computer, and he or she was upload the charges being incurred, and keep a diary of daily activities. This was used for the daily and weekly reports, and also by accounting when they reviewed service company invoices. The system worked very well, it allowed us to catch over billing and time sheet shenanigans, and in the end we controlled well costs and knew how much they cost.

Fernando,

Thanks for the insight. So bottom line would be that the financial guys probably looked at all costs and looking at a well as an investment would likely have assigned a proportion of the appropriate costs to each well to evaluate the return on investment (using petroleum engineer’s projections of expected future well output and costs to do the DCF analysis (DCF=discounted cash flow).

Is that roughly correct?

I am trying to learn how this works in the real world (at some simplified level, obviously it is hard to convey your years of knowledge in the oil industry in a single comment.

(A blog post would be really cool if you ever wanted to share more of what you know.)

Dennis, where I have worked the “financial personnel” has been almost non existent. The cost control was an engineering, operations and accounting department concern. As I got older I eventually supervised all technical personnel, and the costs were my focus and my boss’, because we had to deliver within the approved budgets.

One issue I have observed working as a consultant is the proliferation of “financial professionals” in the ranks who devote their time preparing PowerPoint slides and excel sheets for others in the “financial organization”. My impression is they should all but one be fired, they contribute almost nothing. The one person I would keep should focus on comparing our performance with other business units and competitors, to make sure we are moving in the right direction.

The assignment of costs (for example the total pad cost) was done according to the Accounting Procedure, a document we shared with the government tax authorities and partners (in many cases the accounting procedure has to be approved by the owners in a joint venture, unitized area, or other partnering arrangement).

Economics for a new pad or platform aren’t run on the accounting procedure costs, they usually load additional costs, for example if a platform has 30 slots but the initial project is for 11 wells, we load all the costs and assume only those 11 wells are drilled. Additional wells which may or may not be drilled are approved later with economics which exclude the sunk costs. So there are three worlds, the accounting books, the financial books used to keep the SEC happy, and the cost books we use to make decisions.

“Additional wells which may or may not be drilled are approved later with economics which exclude sunk costs”.

Exactamundo.

Hence, the sub category of drilling and completion with a seemingly low cost number in areas that are already mature in the development phase.

EQT, as an example, can now decide to drill/complete/turn inline 5 to 6 wells simultaneously from one of their already in place mega pads which will ultimately host 40 to 60 wells.

The efficiency and economy of these efforts is one reason that future production – from mature regions – will be highly influenced by product pricing.

I second Dennis’ appreciation for your contributions to this blog, Fernando.

Coffeeguyzz,

It’s been a very long time since my financial accounting and tax accounting classes ‘ but perhaps there is a difference of purpose here.

Ignoring sunk costs for an incremental financial decision is different when sunk costs have already been armortized or are currently amoritized over the useful life of an asset.

Ignoring sunk costs that can’t be amortized because the sum is greater than the value of proven reserves over its useful life for a incremental financial decision looks like wizardary to me.

Fernando,

I know you have never worked developing tight oil. Would you analyze whether to go forward with developing a set of wells, by considering full cycle costs or only drilling and completion?

It seems to me the kind of financial analysis that only considers drilling and completion cost is the kind of power point financial analysis that is a waste of salary.

For most of the tight oil pads that might have 8 to 12 wells per pad, It would seem there would be no “future slots”, each well is expected to last 15 to 30 years.

If there were a refrack it might make sense to only include D+C for analyzing whether the refrack makes sense financially.

In my earlier comment by financial guy I probably should have said accountant, basically whoever is in charge of running the numbers to make sure the investment makes sense, in your case it sounds as if the senior petroleum engineer/or project manager (not sure what your title was) basically did the financial analysis.

Basically when I look at the numbers in investor presentations, the information looks woefully incomplete you probably don’t bother reading them because you know they are crap.

John

Your last 2 paragraphs get to the heart of much of the current disputes/discussions revolving around “the value of proven reserves over the course of its useful life”.

What happens to the value, John, when WTI goes from $80 to $30 to $65 per barrel?

What happens when recovery rate of OOIP goes from 3% to 20%?

What happens when re-entries like Marathon is doing in the Bakken by running new, smaller size casing, (re) frac’ing with the latest techniques and boosting recoveries higher, in some cases, than the original profile?

Many people here use Enno’s fine site and consistently misconstue the presented data.

The Bakken November numbers have just been incorporated on shaleprofile and I offer you this exercise …

Display Marathon’s production history, then the monthly graphic for 2008/9/10/11, then the monthly graphic for 2017 and 2018.

You should notice several things, most prominently, perhaps, is the profile of the earlier wells.

Big time increase.

Also, the exceptionally high recovery (>200/300k) of the newest wells.

Looking further, one may see the abrupt changes in the monthly production as these usually indicate shut in times.

Enno’s site, AFAIK, still uses calender months versus actual online production days when presenting the profiles.

All in all, John, it would be far beyond mere financial wizardry to obfuscate these valuations as the numbers involved are, understandably, staggeringly large.

The people who – collectively – point suspicions at the unconventional hydrocarbon industry are no longer able to ignore the production numbers.

Focusing on financial vulnerabilities/shortfalls is something I – personally – will leave to those investing hundreds of billions of dollars into these efforts.

Dennis, the economic analysis for single wells or small projects is mostly an engineer’s responsibility, the analysis is reviewed by his boss. Accountants aren’t usually involved. Exxon trains young smart engineers to run economics por larger projects. A company like BP uses a guy with an MBA…but BP wasn’t well managed when I ran into them over the years, although I hear Dudley has straightened them up a bit. So it depends.

As far as I’m concerned the decision has to be made based on actual costs which are incurred from making the decision, and actual benefits ditto. Sunk costs should not be considered, but the tax benefits should be included. This may lead you to abandon acreage with a discovery if you paid a huge bonus in the Gulf of Mexico, because the tax write off can bring immediate cash flow above the PV of the development.

Hope this helps.

Fernando,

Thanks.

A point forward analysis is an odd way to do things in my mind, but I guess economists consider opportunity costs and engineers do not.

In any case, I imagine if you were considering a tight oil project for undeveloped acreage, you would look at the full cost of the project (including land costs , facilities, etc) and not simply drilling and completion costs which is typically how things appear in investor presentations.

Dennis: I worked in a basin where wells were drilled and completed in such a fashion that they had hyperbolic decline very similar to the fracked horizontals in the US. Part of my job was to recommend well locations, part was to study both short term and long term investment options, as well as optimize developments to keep production on plateau (a management strategic objective).

In those days we had to use an HP67 or an HP97, which I programmed to do some of the hyperbolic decline curves. We also had an ibm 38 programmed to store production data and project declines using automatic matches. This system also issued warning flags, such as sudden increases in water cut or gas oil ratio, fluid level anomalies, and low production rate.

As far as planning is concerned, the math doesn’t care much about the well shape, what counts is days to move and rig up, days to drill, time to ru completion equipment, completion days, and time to first oil. Also important were well reserves, expected initial rate, cleanup performance, and type of hyperbolic curve. We drilled about 50 wells a year, and had about 800 active wells. Later I worked offshore for years, in several countries, and later with multiwell pads with horizontal wells in Russia and Venezuela. So when I discuss these topics I assure you I know what I’m talking about.

Fernando,

I am sure you know what you are talking about.

My point was simply that from a business perspective, one needs to look at the overall project costs to evaluate the investment so sunk costs would never be ignored.

As a simple example, imagine a single well was drilled on a pad designed for 10 wells and all facilities were installed that were needed for the eventual 10 well project.

You seem to be implying that all the land, pad, and facility costs would be assigned to well #1, and you would do a point forward analysis on wells 2 through 10 which would only consider the drilling and completion costs for each individual well as the capex.

This may be the way engineers would do things. An economist would take the total capital cost for all 10 wells (at full cost) and consider the capex for each well to be one tenth of the total.

Bottom line, sunk costs should not be ignored in my opinion and a point forward analysis gives a very incomplete picture.

Dennis, the full cost estimate is used BEFORE any money is spent, the sunk cost tax effects are included, but the DECISION is made on a point forward basis. The full cycle appraisal done after the project is complete is useful, and can influence a decision on a similar investment. This isn’t “an engineer” talking, it’s the way it’s done by company managers if they know how to run a company. Play around with a spreadsheet which shows an investment spread over a 10 year period, and run 1. point forward economics every year, and 2. Full cycle economics, and you’ll see how it works.

Fernando,

For deciding on whether to drill a particular well, I agree point forward analysis makes sense.

I tend to think big picture. Imagine you were CEO of am oil company a d are trying to decide if starting a brand new project makes sense.

I believe the anaysis would look at the full life cycle cost when doing the DCF analysis.

Or that’s how I would do it.

Coffeeguyzz,

You may not like the idea of averaging, but it works pretty well.

Chart below compares model vs data using average well profiles convolved with well completions per month. At some point it is likely that the EUR of the average well profile will no longer increase as less productive areas see more completions after core areas are fully developed. For the North Dakota Bakken/Three Forks this is likely to occur by 2020 and perhaps in 2019. After that further drilling is likely to lead to a decrease in average new well EUR.

” … core areas fully developed. …Bakken/Three Forks … perhaps in 2019″.

THIS 2019???

Like, um, THIS year???

(Quickly clasps hand to heart, eyes roll upward, pirouettes 180, faceplants onto floor).

Coffeeguyzz,

We will see, in the Bakken average new well EUR shows very little sign of increase in 2018, at some point an optimal well design is determined and the best areas have already been developed. Further development might keep new well EUR constant for a few years, but at some point the best locations get drilled up. Despite what you may believe, all areas do not have the same productivity.

The oil companies drill the best areas first and eventually those “core areas” run out of room. This has been the case for every field ever developed and is not likely to change for tight oil plays.

Dennis,

Take a look at this recent research and note how the modeling of fracked oil is being reconsidered:

https://phys.org/news/2019-01-physics-big-gains-shale-oil.html

If this is any indication, we are on the right track with a diffusional model.

https://3c1703fe8d.site.internapcdn.net/newman/csz/news/800/2019/2-understandin.jpg

Not sure exactly how EOG is doing it in the EF, as it is a company secret, but they maintain they have been getting 30 to 50% more EUR with a huff and puff for the past three years.

We don’t know any company secrets but only apply basic physics to figure this out. How the flow of oil from a fracked well can be anything other than predominantly diffusion is beyond my understanding. When the ground is fracked, fissures go out in all directions, and that is what a random walk — in other words diffusion — describes. The oil will both go deeper in the ground as well as going to the surface.

The rapid decline of fracked oil wells also has all the indications of a diffusional process. In addition to a hyperolic profile, we used an Ornstein-Uhlenbeck diffusional model (well known to condensed-matter physicists) to model fracked well production.

Interesting Paul,

Thanks.

Wake up DENNIS bakken declines already !!!

You overestimate the shale oil.

Hi tomas,

A one month decline is not really a big deal, below is a very conservative scenario for future Bakken output, my expectation is that actual output will be higher than this scenario.

There are many who would argue that this is an underestimate. It is consistent with the economics and the USGS mean TRR estimate for the North Dakota Bakken/Three Forks.

“Unconventional hydrocarbon production in the US is now in new territory”

Clear, one called scorched earth, basically :

https://www.google.com.br/maps/place/Midland,+Texas,+%C3%89tats-Unis/@32.1635489,-102.2272391,23729m/data=!3m1!1e3!4m5!3m4!1s0x86f9613991a5d10f:0x4715ede17f061bf9!8m2!3d31.9973456!4d-102.0779146

And pumped through QE and zero interest rates, will not end well, most probably, kind of ugly, alas ..

Re Iran chart above (remember, Iran ships a lot of condensate, Ron do you know if that’s captured in the chart?) Their shared gas field with Qatar flows liquid, too.

https://www.bloomberg.com/news/articles/2018-10-17/permian-drillers-are-said-to-sell-new-lighter-crude-oil-grade

“Sales of West Texas Intermediate Light, or WTI Light, started in September with deliveries into Midland, Texas, the people said. Most of the supply for WTI Light would likely be coming from more recently drilled parts of the region, such as Loving and Culberson counties, with initial volumes estimated at around 100,000 barrels a day, they said.

The new stream is being primarily blended to produce so-called Domestic Sweet crude, WTI Midland or benchmark WTI for delivery at Cushing, Oklahoma, the people said. While lighter oil is typically higher-priced, the new grade is being sold at a discount to WTI Midland, the people said.”

[So we have a renaming underway of WTI, not just a new API degree assay, and it’s not as valuable]

“WTI Light has a gravity of 45-50 API, lighter than the typical 38-42 API of WTI Midland, the mainstay sweet benchmark.”

A move started a few years ago to redefine “condensate” up to API 50. But there are many many quotes online that specify it as 45.

And so . . . competition for Iran’s output.

[btw I have yet to find an assay with constituent yield for Permian LTO. It’s always Permian conventional.]

Re Iran chart above (remember, Iran ships a lot of condensate, Ron do you know if that’s captured in the chart?) Their shared gas field with Qatar flows liquid, too.

No, the OPEC MOMR reports crude oil only, not C+C.

From Jan 2015 to Oct 2018 (where we have EIA data) about 52% of US output was 40.1 API or higher.

About 9.8% was 50.1 API or higher, 11.8% was 45.1 to 50.0 API, and 30.7% was 40.1 to 45.0 API for the Jan 2015 to Oct 2018 period.

https://www.eia.gov/dnav/pet/pet_crd_api_adc_mbblpd_m.htm

But Iran most probably sells quite a few barrels getting out the radar of these figures

Take a look at shaleprofile with regard to 2016 and 2017 wells for Chevron and ExxonMobil in the Permian Basin.

Is the decline much lower than would be expected?

Shallow sand,

Compare all operators vs everyone except chevron and XOM, not a big difference to my eye, about 81% decline over 2 years for 2016 wells (all operators minus Chevron and XOM) and same result for all operators (used month 2 and month 25 to get 2 year decline rate).

So looks ok to me.

Thanks.

Better look at the two year cumulative.

Fernando,

Average 2 year cumulative is 183 kb for all operators (175,7 kb for all 2215 wells completed in 2016 for first 22 months, only 1811 wells have 24 months of data).

If we exclude Chevron and Exxon-Mobil (all operators except those 2) the 24 month cumulative is 186 kb (1643 wells) and the 22 month cumulative is 178 kb (2034 wells). For chevron and Exxon Mobil the 24 month cumulative is 156 kb (168 wells) and the 22 month cumulative is 149 kb(181 wells).

So the big boys are not doing so well for 2016 wells over the first 22 or 24 months compared to the overall average cumulative output.

The question we need to answer next is well cost, and whether the large companies drill wells to have a longer life. It can get complicated.

Fernando,

I don’t have information on company well costs. It is possible some companies wells will perform better than others. A full analysis with the limited information available is not possible.

I agree the analysis is complicated indeed.

Thanks for helping me understand the way this works in the real world.

For example: in some cases we have found that a well with a very long horizontal lateral can have a higher initial rate, but it barely drains the toe region (the wells can be very sensitive to pressure drops in the horizontal section, thus gets really bad when it slugs due to production fluid changes and the well drilling plan).

Fernando,

Clearly that information would only be available internally at oil companies. The only information I have is average lateral length (and sometimes not even that) and average output per well over time and number of wells completed. Information on well costs is also not very good, I only have rough averages.

I do the best I can with the limited information available.

Some international distillates inventories week/week changes

(million barrels)

Total Distillates: +10.35

Chart https://pbs.twimg.com/media/DxIp3N8X0AQZKDu.jpg

Light Distillates: +8.55

Middle Distillates: +2.76

Heavy Distillates: -0.96

Chart for light & middles https://pbs.twimg.com/media/DxIql2gX4AUR3te.jpg

USA inventories week/week changes

(million barrels)

Crude Oil: -2.7

Total Distillates: +10.1

Total (Crude + Distillates): +7.5 (shown on chart)

Natural Gas (Propane + NGPLs) -3.3 (not included in the total)

Chart https://pbs.twimg.com/media/DxIsRkOWkAANeMa.jpg

Japan’s seasonal pattern is to draw into February or March

https://pbs.twimg.com/media/DxIt1H7X4AAqDxB.jpg

This year is the largest Holiday+New Year inventory build. The date shown is the Friday at the end of the 4 week period (It’s the inventory change for the last 2 weeks of the year plus the first 2 weeks of the next year). (Crude oil + oil products without propane or NGPLs)

Bar chart: https://pbs.twimg.com/media/DxJT8-fW0AAmqdQ.jpg

Interesting. I knew that water was an issue, but I had no idea it made up 15% of the cost of a well.

https://oilprice.com/Energy/Energy-General/Low-Oil-Prices-Are-Not-The-Only-Problem-For-The-Permian.html

I’d be interested if anyone had other breakdown of costs. The well has a lot of different costs. Pads, pipelines to major pipelines, drilling expenses, “mud” for drilling, more than three miles of pipelines for many wells, and those are just in the first 40 to 45% of the cost of the well. Then, we have the demolition experts that provide the fracs (how the hell do they do that over about two miles of pipe over a mile down) the pressure pumpers, personnel, water, sand, and I am probably just showing my ignorance because I am sure there is much more. Drilling a vertical is not simple, but these horizontals are a real technical feat.

When “man” is gone, and the next generation of biped or triped takes over, I can imagine them scratching their heads over what the hell these things were for.

Available source water, the cost of that source water, how many times it can be recycled and at what cost are one of the many things that will affect the future growth of unconventional shale production in America. Steel, labor, produced water disposal costs, earthquakes, sink holes, anti-oil, climate change agendas, demand, politics and finally…money, money and money and where all that money is going to come from are all vital to America’s hydrocarbon future. My research indicates it will take another $480 billion to drill enough wells simply to fill the 4.5MM BOPD of additional pipeline capacity coming out of the Permian in the next 3 years.

To simply state the solution to these problems is higher prices, is really stupid. Or, if you are Coffee, ignoring prices, and profitability in ignorant bliss, is especially stupid.

It would be helpful to have someone comment on Peak Oil Barrel that actually knew something about the oil business and well economics. But whenever someone like that shows up for awhile they eventually get tired of the dumb ass charts, and price predictions, and getting talked down to, like Coffee talking down to Rune Likvern, Art Berman, David Hughes and Shallow Sand, and they leave. You can’t blame them, really; everyone has an agenda here and seldom does that agenda have much to do with real life. Where do people that don’t even know which end of a shovel to pick up, from Maine and California, no less, get off talking well economics to oil men?

In the Delaware Basin source water costs can now be upwards of $3 per bbl. with ponds and transport and most 18MM# fracs now use every bit of 600K BW. That is why Delaware wells cost $10MM plus. The shale oil industry is woefully behind, still lying, about its recycling, reprocessing of produced flow back water. Every time it starts to crawl forward on that issue leveraged oversupply causes the price of oil to drop and they stop spending money on water and buy it from Juan Venado for $2 per barrel. Groundwater sources are drying up and recharge in arid West Texas only takes several hundred thousand years. Its pretty stupid, but then again, EVERYTHING about the shale oil business is really pretty stupid…especially flaring associated gas to facilitate the exporting of America’s oil, all on borrowed money that cannot be paid back. Our kids will love us for that someday.

Well, hope you hang around some.

Not everybody has an agenda. Many are just interested in learning, and sharing like Energy News.

My interest mainly comes from owning mineral interests. Good, bad or ugly, it’s going to get drilled. Somehow, I feel I owe it to family members, who are no longer with me to learn more. My grandfather had the first fold down drilling rig in S Texas, and is responsible for me having mineral rights. My father was a mud engineer for Fleet fo many years, and my brother did his time as roughneck offshore.

It was your conversation with Dennis that got me interested in looking up the pending data file. I also understand from Enno’s site, you helped with that to cover Texas production. So, when you speak, I listen, first.

Mike, thanks for bringing up the flaring issue. That alone is a frustrating one.

Flared gas in North Dakota in 2018 would have supplied more than the natural gas consumed in all of North Dakota AND South Dakota in 2018.

Flared gas in New Mexico in 2018 would have supplied more than the natural gas consumed in all of New Mexico in 2018.

I know we apparently have cheap natural gas until the year 3000, but even so, this seems to be a tremendous amount of waste, most of which could have been avoided.

I am baffled why XOM would be drilling like gangbusters in the shale areas at this time. As a shareholder, I am stunned that they think it is better to produce 2 million bopd at $50 than 1.7 million bopd at $80.

Most of those guys at XOM are smarter than me, so I am sure I am missing something?

One thing I do know, XOM stock has really been crappy for quite awhile, only the dividend has saved it. I also seem to recall XOM lost in the billions some quarters in 2016 on their upstream onshore US business.

Maybe Mr. Woods can explain all of that to us dumb stripper well operators.

I would sell the stock if I had a clue what to buy, and if I did not have such a low basis in the stock. Funny how well they did prior to the shale revolution.

Split adjusted share price 1/19/1979 $3.07

Split adjusted share price 1/13/1989 $11.13

Split adjusted share price 1/15/1999 $35.53 – when oil was about $10 per barrel.

Split adjusted share price 1/9/2009 $77.57 – in the depths of the Great Recession.

Split adjusted share price 7/18/2014 $102.73 – during the end of a five year run where oil prices were at their highest all time.

Closing price 1/17/19 – $72.13 – $30 and change off the 7/18/2014 price.

Yes, we don’t care about the economics, we just are in awe of the technology and the $2 gas prices.

I hope I live long enough to see how this shale thing plays out.

I posted earlier that Exxon has 280k bpd part of the refinery in Baytown shut down for two months to upgrade it to taking oil from the Permian. They plan on using some, but they are getting the buggy in front of the horse. Another interesting take, is after they complete it, they will be able to make 10k barrels a day more of jet fuel than before. I’m not sure what they are pulling from the Permian now, but in 2016 it was 158k bpd, so they will probably be able to use most of it. If so, that would be a heck of a savings.

Shallow sand,

If you believe oil prices will remain low, sell XOM and buy the market maybe Vanguard’s Total Stock Market Index or S&P 500. If you believe oil prices may someday increase, XOM may increase in value so holding would make more sense, then sell when you think oil prices are near their peak.

Just always remember United States Leather was one of the original 12 Stocks in the Dow Jones Industrial Average (1896 to 1901), it was later bought out by Central Leather Company (also part of the Dow 20 from 1912 to 1920).

At some point it will make sense to sell XOM before it goes the way of Kodak, Sears, and Woolworth’s (all former members of the Dow Jones Industrial Average), I waited too long on GE before selling.

https://en.wikipedia.org/wiki/United_States_Leather_Company

https://en.wikipedia.org/wiki/Historical_components_of_the_Dow_Jones_Industrial_Average

Dennis.

Probably not a bad idea.

I just own 5 energy stocks, not counting whatever may be in mutual funds.

There will be a time to get out for sure, not there yet. But XOM hasn’t been doing so well after a really good run as can be seen above.

OIL (BRENT) PRICE COMMODITY

62.90 USD +1.75 (2.86%)

According to Haynes and Boone 1/7/2019 report, 167 bankruptcies in the N. American E & P space concerning $96 billion in debt since 2015 (inclusive). Of those, 29 in 2018.

http://www.haynesboone.com/publications/energy-bankruptcy-monitors-and-surveys.

Mike,

I agree, my model (assuming AEO Reference case prices) has 4.3 Mb/d higher output in the Permian Basin above Nov 2018 levels (EIA tight oil production estimates by play) of about 3 Mb/d. That will require about 69,840 new wells to be completed from Dec 2018 to Jan 2028 (about 6930 wells per year). If we assume 9.5 million as the full cost of the average well, that would be about $663.5 billion in 2017$, so you may have underestimated the cost, in nominal dollars it would be higher, about $801 billion (nominal dollars), if we assume well costs increase at the rate of inflation (assumed at 2% per year in this example).

In the AEO reference scenario, oil prices in 2028 are about $88/b in 2017$ (or $109/b in nominal dollars assuming 2% annual inflation rate). For comparison note that if we assume an average annual inflation rate of 2% (Fed target rate) then the $100/b oil price of 2013/2014 would be $131/b in 2028 in nominal terms. In other words $100/b in 2014$ is equal to $131/b in 2028 $ if the average rate of inflation was 2%/year from 2014 to 2028.

To me the AEO reference case seems quite conservative.

Tight oil production estimates by play at page below (click on XLS symbol for spreadsheet with data).

https://www.eia.gov/petroleum/data.php#crude

Chart with Permian scenario

https://drive.google.com/file/d/1oSlCRzx1XKqgCOe1KklImcNNH8F1FPFk/view?usp=sharing

Best I can come up with is about 68% of the cost of the well in the Permian based on a site’s quote of an IHS study.

Drilling, rig and fluids 1.28 million

Casing and cement .98

Pumping 1.95

Fluids (I’m sure mostly water) and flow back disposal 1.43

Proppants (sand) 1.28

Total 6.92

Still interested in more detail. The above amount for fluids sounds low, based on what Mike posted. Which could run the cost of a well over 11 million. And, I have no idea what the other 32% was for. Other than they did not discuss roads, site clearing and grading, pads, pipelines to feeders, site equipment and storage, and whatever etc, is. Also, not discussed is the guys who blow holes in the pipes, which can’t be cheap.

GuyM,

Wouldn’t there be some cost for land? Also Plugging and Abandoning?

I am sure Shallow Sand and Mike would have better ideas. Also if it is an older IHS study (from 2016), then water costs may have risen (and costs in general).

Were you using this?

https://www.eia.gov/analysis/studies/drilling/pdf/upstream.pdf

That study gives 6.6 to 7.8 MM dollar well cost in 2014 (today laterals are longer and well costs are likely higher than in 2014).

In the Wolfcamp in 2014 (much of most productive drilling is here) costs are 7 to 8.5 MM in Delaware and 5.5 to 8.6 MM dollars in Midland and again today costs are likely higher. Lease acquisition costs in 2014 were estimated at 1 to 1.3 million per well, but note that as lateral length increases and acres per well increases this cost also increases.

Based on this information and increasing average lateral lengths in the Permian basin

Mike Shellman’s average estimate of about 9.5 to 10 million per well (more in Delaware and a little less in Midland) seems spot on, and clearly he is there and has probably worked on some of these wells (or at minimum knows others who have.)

I assume an average cost of $9.5 million per well in the Permian basin based on his comments.

Mike.

I assume you agree that if every payout statement for every shale well drilled since 2014 were released, the debate would be put to rest?

What are the valid reasons for a public company to keep this financial information private?

I would agree, yes. And could be prepared to prove it. Easily. I could do so with crayons.

The American shale oil and shale gas industry is in desperate need of money, low interest rates, lax regulations, public confidence, more money, liberal loan refinancing over the next 18 months and more money. It wants American’s to believe it is doing good things and all that wasted gas, wasted water, wasted exports of our last oil resources and…debt is important and a necessary sacrifice to the greater good. The shale phenomena and the way it is financed is a great redistribution of wealth in our country; cheap gasoline and fuel oil is a form of fiscal stimulus. If you are in the middle of this redistribution of wealth, life is good and there is a lot of money to be made. So the lying will continue.

Stay warm this weekend up there, man; wow, its gonna be cold !!

10 F isn’t too bad, especially as it is expected to warm up again pretty quickly.

Has been a mild winter here, unlike last year when it got so cold the day after Christmas we had to shut in some low volume wells, and were not able to return to production until a couple days after Valentine’s Day. Had not been that cold since winter of 2013-14, which was very cold. I recall early March, 2014 having a day that began -8 F. But, at the end of the month I was watching a tennis match in short sleeves!

Which is more volatile, Midwest weather or oil prices!

No, it was a more recent one from a company’s site that used current numbers, they said, from a IHS report. But, Fernado’s reply above gives me a hint of what was left out. I really enjoy this site when it gets posts from the likes of Shallow Sand, Mike, Fernando, George, S Louisiana and others who are real live oil people.

Guy, in the shale industry everyone lies about everything. They lie to themselves in morning meetings, to the public in investor presentations and to their shareholders. A recent example of this is the EUR exaggerations reported by Brad Olson at the WSJ, the ramifications of which to reserve estimates in our nation are stunning. As is this: https://www.linkedin.com/pulse/wall-street-journal-validates-predictions-made-scott-lapierre/ A lot of indemnity disclaimers on press releases and investor presentations will, in small print, admit they are lying; Parsley is a good example. That was its “defense” against the WSJ allegations. If one is relying on information about the role shale oil will play in our hydrocarbon future, from the shale industry itself, you are going to have a very distorted picture of the real world.

I am privy to AFEs from every shale oil basin in the country and one of the biggest whoppers the shale industry uses is well costs, that and the stupid metric of breakeven prices. Well costs are much higher than always stated and the shale industry uses all kinds of neat tricks to move stuff around and hide this and that. Not long ago I received AFE’s in the Delaware from a major integrated company whereby est. costs were over $11.5MM per well, with no acreage costs included. As to the really stupid comments above about “sunk” costs that should not be used in the economic analysis, well all that “sinking” put companies like Continental $6B in debt, or Devon $8.5B in debt and ignoring that is sort of, well… it reminds me of socialists who want free this and that but don’t have a clue how to pay for it. New, good wells must pay for old bad wells in any companies asset inventory, even mine and Shallows.’ That is not happening in the shale oil revolution.

By SEC filings I believe less than 20% of the American shale industry’s $20B of potential P&A&D liability is actually set aside.

The real oil and natural gas industry is NOT like the shale industry, I assure you, sir. I am proud of MY industry.

Your smart, you have a good handle on it. Stay the course. Listen to Shallow. I can’t hang around here. Lots of the stuff being said here drives me nuts; the ranting yesterday I simply had to address. To somebody actually laboring in the oil and natural gas industry, exposed to price volatility, out of debt and still providing jobs to good men and women, it was goddamn insulting. I think the asshole told me, or people like me, to “man-up” and admit we’re wrong. I’ll do that when the shale industry pays back its half trillion dollars of upstream and midstream debt and can do what it does without credit cards. I can’t stand people who think they know everything because they read it on the internet.

Thank you, sir. You’ll appreciate this, I know, as will Shallow: https://www.oilystuffblog.com/single-post/2019/01/15/Night-Shift

Mike,

I think coffeeguyzz was talking about me and others that have made predictions in the past that were wrong, rather than things that you have been saying.

I apologize for what ever I have said that has offended you, or for posting too many charts. I find visuals easier than just words, but guess many find that annoying so I’ll use links.

I am with GuyM and Shallow Sand and all who have not already said that any comments you make here enlighten all of us.

Just watched the video, awesome, thank you.

Dennis, the oil business is a complicated assortment of very complex matters, all of them very ‘fluid,’ so to speak; all changing every minute of every day all around the world. There are a lot of headwinds facing the US shale phenomena not solvable by greater productivity, many not even solvable by throwing good money after bad. You did not deserve than man-up comment either.

Thank you.

Mike

Mike,

The Scott Lapierre article is interesting, the tails of the Permian wells (2011-2014 first flow) seem to be showing roughly 15 to 20% terminal decline, significantly different from the Bakken which is showing about 10 to 12% terminal (exponential decline rates).

Could be differences in the rock or perhaps the amount of dissolved gas, we have slightly older wells from 2008 and 2009 to look at for the Bakken, but there seem to be significant differences between the well behavior.

I should probably try the model with 15% terminal decline rather than the 10% I have used based on the Bakken data.

Doing that (changing terminal decline to 15% from 10%) reduces ERR for my model from 61 to 54 Gb (before I have examined economics closely, so far I have only adjusted well profiles, leaving everything else as is.)

When I include all the economics the ERR drops to 53 Gb and 171,000 total wells drilled, so 152k wells after Dec 2018, at 9.5 million per well (2017$), that is 1.444 trillion 2017$. About 50 Gb gets produced after Dec 2018, maybe 48 Gb of this is oil from wells with first flow after Dec 2018.

So the net back on the barrels produced would need to be $30/b on average in 2017$ for net return to be zero.

Definitely does not work at $50/b (in 2017$). I doubt oil prices remain at $50/b, but I am usually wrong on oil prices.

The WSJ article is very technical. I sense something . . . apocalyptic about it. Can one of you more astute commenters put it in plain English?

I submit the following paragraph as one to make a person stop chewing and sit up & listen:

“It is clear that industry tools are failing to reliably forecast long-term oil production from shale reservoirs. As the authors of the WSJ pointed out, these original projections were used to entice investors to pour billions of dollars in to shale developments. Let’s not also forget that these same, questionable, projections were also used to convince the US Congress to lift the longstanding, strategic oil export ban. For readers of my previous articles and the WSJ article, it should be clear by now that models incorporating oil expansion as the primary reservoir drive mechanism offer marked advantages in forecasting production from shale oil reservoirs.”

Michael B,

One way to think of it is that investor presentations often claim the cumulative production from and average well will be about 1200 kb over the 25 year life of the well. In reality the average well produces about 400 kb in the best tight oil plays (Bakken and Permian Basin).

Doing simple math suggests for a given number of wells, output will be about 3 times less than claimed by many oil companies.

Seein g that they tend to exaggerate the extent of their potential productivity, it may also be possible that there are 3 times fewer wells that are economically viable, which would then cut potential oil to one ninth of that claimed. This second step is mere speculation on my part.

The number of completed wells will depend on output, capital and operating costs and the price of oil, many assumptions needed to estimate future output, many of which will be incorrect.

As Mike said it is complex, much more complex in reality than my simplified models. As is often the case Mike is correct, the only one more correct would be his wife. 🙂

Thanks for helping make sense of this.

We don’t use demolition experts, shaped charges are used to make holes in the pipe and into the rock to create a flow channel for the fracture fluids. The shaped charges go in the hole inside a piece of pipe we call a gun. The pipe has the charges aiming perpendicular to the pipe, parallel to its radius. They explode simultaneously because they are interconnected by an explosive chord. There are YouTube videos you can find showing how all of this works, and what to do when loaded guns are run in the hole but then fail to detonate as required.

Ok, not demolition experts, but the job is probably not handed out to newbies. Gotta be some training. Thanks, Fernando.

I was taught to put a yellow helmet on new personnel to make sure we knew who couldn’t be trusted and had to be kept under close supervision. The service companies providing the perforating gun services never sent anybody they felt required a yellow helmet because our contracts specified the minimum experience level we had to have in some critical jobs, like those handling explosives, toolpushers, drillers, wireline unit operator, mud engineer, crane operators etc.

The skill set of many in these jobs is not easily recognized by many observers.

All the moreso as constant improvisimgs, making on the fly decisions, working with whatever is available material/resources often far off the beaten path all put a premium on those able to get ‘er done.

On one of the rigs I worked, a converted drillship, delays, costs, tensions were rapidly rising due to a bunch of unforeseen obstacles.

The experienced crane operator refused to continue risky activity, quit on the spot, and was on the helicopter to the beach next day.

Pressed into service, the young, inexperienced replacement tipped a jury rigged pallet of 4 barrels of hydraulic fluid and killed the tagline holding roustabout a few feet away from me.

So much skill and expertise required up and down the line in this industry that it is amazing what has taken place these past 150 years of hydrocarbon development.

Yes, I have worked in dangerous heavy industry and sometimes the man next to me was the most dangerous part of the operation. One stupid act can quickly get people injured or killed.

Also management that ignores warnings about potentially dangerous equipment does cause major disasters.

Schlumberger Q4 report is out.

Revenue in North America was down 12% in Q4 compared to Q3. Revenue in international markets was near unchanged. Fracking (OneStim) revenue dropped 25%, as Schlumberger decided to warm stack a number of their fleets in the latter part of the quarter.

Haliburton Q4 report coming next week to comfirm the picture of just how much of a decline there is in completion activity overall in North America at the moment.

Low Oil Prices Are Not The Only Problem For The Permian

While low oil prices are beginning to slow the growth of U.S. shale, in the years ahead oil and gas drilling could be curtailed by a different problem: a shortage of water.

Water is a crucial ingredient in the fracking process, and drillers use copious volumes of it. The problem for the U.S. oil industry is that so much of the output growth expected over the next half-decade or so depends very heavily on the Permian basin, where water is increasingly scarce.

Water already accounts for about 15 percent of the cost of a shale well, according to analysts at Morgan Stanley. “In the Permian, total spending on water is expected to double over the next 5 years, to $22B, with E&Ps on avg using 50 barrels (bbls) of water for each lateral foot completed,” the investment bank wrote in a new report. “Assuming 10k lateral feet per well, this implies that the ~5,500 existing Permian well permits will require ~2.75 billion bbls of water to complete.”

That’s a lot of water in an area that doesn’t have a lot of it. “Given the sizeable water need, we believe drought and water scarcity present long-term risks to shale economics, particularly in the Permian, a core area of growth in a drought-prone region,” Morgan Stanley warned.

It’s worth pausing and noting that the warning is not coming from an environmental group, or even a local community organization opposed to a drilling presence. It’s coming from a major Wall Street investment bank, which says that drilling economics in the world’s hottest shale basin could be upended because of water scarcity.

It’s a rather ironic development. Greenhouse gas emissions from oil and gas drilling are fueling climate change, which in turn could make the most desirable oil and gas play increasingly costly due to growing water problems.

Morgan Stanley goes on to provide further detail into the scale of the problem. Morgan Stanley overlaid water scarcity data from the World Resources Institute with Permian well locations, finding that “53% of Permian wells being drilled today are located in areas with high water risk,” the investment bank concluded. “While operators are comfortable with water availability at the moment, there are precedents (most recently in 2011/2012 in Oklahoma) where severe drought conditions materially affected completion performance.”

There is also another separate water problem facing shale drillers. “Produced water” – water that comes out of a well when drilled – must be handled somehow. The volume of produced water that comes out of a shale well can exceed that of oil by a ratio of 10 to 1. The ratio also increases over time as the oil from individual wells begins to deplete, so the cost-per-barrel for water disposal also rises.

There is more to this “Oil Price.com” article than I quote here.

Yeah, that was our discussion we were having above on the same article I posted yesterday. I was trying to get more detailed costs other than water.

The 10 to 1 ratio looks like baloney. Evidently the answer lies in the wonderful world of chemistry. We will have to learn to clean up produced water and use it as carrier fluid.

What morgan stanley report are they referencing ? Shouldn’t be a link for publication purposes ?

Condensate factoids:

Lease vs Plant condensate ratio remains about 82%.

Condensate shipped to Alberta for use as diluent is priced $10 above WTI.

Condensate middle distillate yield varies a great deal by region:

Iran condensate diesel+kerosene (jet fuel) proportionate distillate yield sums to 45% (!!!)

Algerian condensate equivalent yield — 16%

Thai condensate equiv 27%

Australia Northwest condensate 26.1%

WTI (crude, not a condensate) sums to 38.3%. (This is a dated assay, probably lower now and note lower than the excellent Iran/Qatari condensate yield — yes, a US crude has less middle distillate than a Middle East condensate )

(The Iran yield is suspicious. Qatar is lower (though not by too very much) Both superior to Bakken “crude”.)

It depends on the condensate stabilization process used. If you take condensate off the low pressure separator, feed it to a stabilizer with a hot bottom temperature, it drives the light ends overhead. These can be fed to a gas fractionation plant. The bottoms will be whatever you design for. If you run the bottoms hot and keep the top of the tower reflux a bit warm the bottoms will have lower API. The Iranian condensate is probably processed to have the required vapor pressure to be stored safely long term in Persian Gulf tanks where temperature can exceed 50 C.

They ship it fast. Maybe no need to store it. China’s total petroleum product consumption is now 30% diesel, and they buy Iran’s condensate. That distillate yield is why.