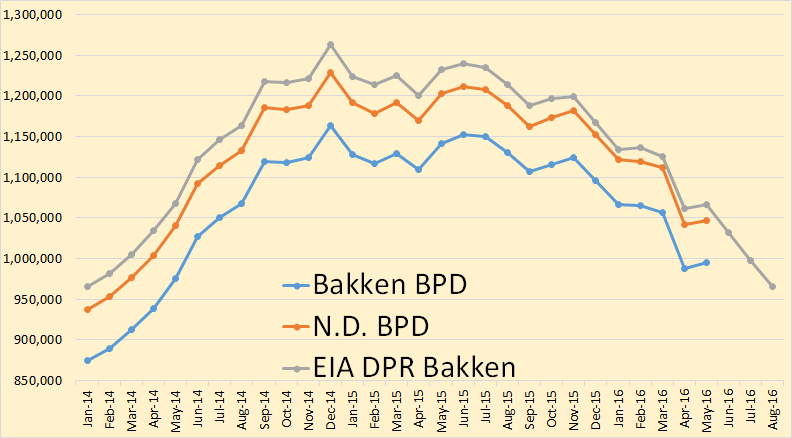

The Bakken and North Dakota production data is out.

Bakken production was up 6,540 barrels per day while all North Dakota production was up 5,383 bpd. This was not posted as a correction to last months data though it looks that is exactly what it is. Last months data was twice as much as it should have been so now it is correct. Notice the data from the Drilling Productivity Report. It appears to have June data exactly correct, or very nearly so. Of course that is all the Bakken, including the Montana Bakken.

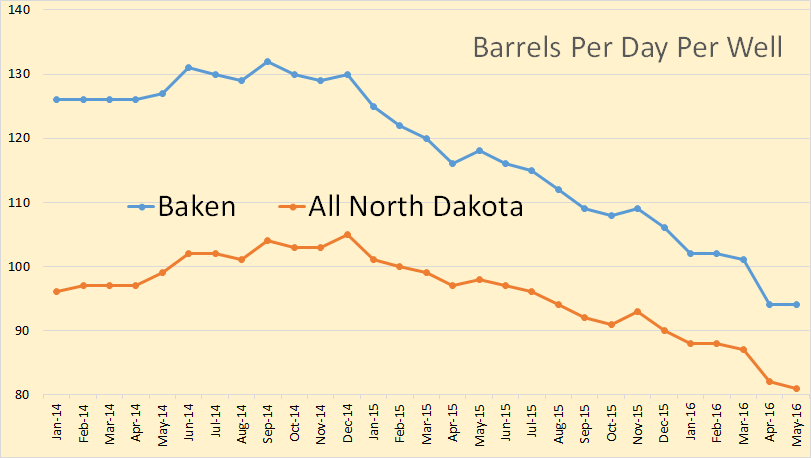

Bakken barrels per day per well held steady at 94 in May while all North Dakota bpd per well fell by 1 to 81.

From the Director’s Cut

Oil Production

April 31,259,426 barrels = 1,041,981 barrels/day

May 32,468,271 barrels = 1,047,364 barrels/day (preliminary)(all-time high was Dec 2014 at 1,227,483 barrels/day)

994,727 barrels per day or 95% from Bakken and Three Forks

52,637 barrels per day or 5% from legacy conventional pools

Gas Production

April 48,503,062 MCF = 1,616,769 MCF/day

May 50,949,167 MCF = 1,643,522 MCF/day (preliminary)( all-time high was April 2016 at 1,710,823 MCFD)

Producing Wells

April 13,054

May 13,167 (preliminary)(all-time high was Oct 2015 13,190)

11,078 wells or 84% are now unconventional Bakken – Three forks wells

2,089 wells or 16% produce from legacy conventional pools

Permitting

April 66 drilling and 0 seismic

May 42 drilling and 0 seismic

June 65 drilling and 0 seismic (all time high was 370 in 10/2012)

ND Sweet Crude Price1

April $30.75/barrel

May $33.74/barrel

June $38.75/barrel

Today $36.25/barrel (all-time high was $136.29 7/3/2008)

Rig Count

April 29

May 27

June 28

Today’s rig count is 29 (all-time high was 218 on 5/29/2012)

Comments:

The drilling rig count fell 2 from April to May, then increased 1 from May to June, and increased 1 more from June to today. Operators remain committed to running the minimum number of rigs while oil prices remain below $60/barrel WTI. The number of well completions fell from 41(final) in April to 37(preliminary) in May. Oil price weakness is the primary reason for the slow-down and is now anticipated to last into at least the third quarter of this year and perhaps into the second quarter of 2017. There was 1 significant precipitation event, 14 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

Over 98% of drilling now targets the Bakken and Three Forks formations.

Estimated wells waiting on completion services is 931, up 39 from the end of April to the end of May.

Estimated inactive well count is 1,584, down 6 from the end of April to the end of May.

Crude oil take away capacity remains dependent on rail deliveries to coastal refineries to remain adequate.

Low oil price associated with lifting of sanctions on Iran and a weaker economy in China are expected to lead to continued low drilling rig count. Utilization rate for rigs capable of 20,000+ feet is 25-30% and for shallow well rigs (7,000 feet or less) 15-20%.

Drilling permit activity decreased from April to May increased sharply in June as operators begin to position themselves for higher oil prices in 2017. Operators have a significant permit inventory should a return to the drilling price point occur in the next 12 months.

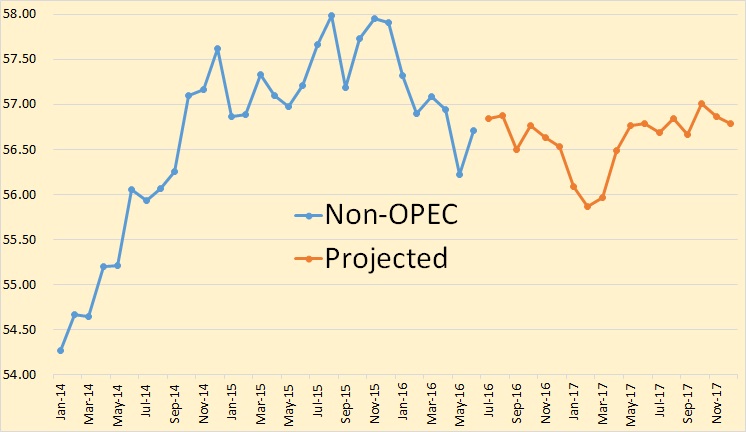

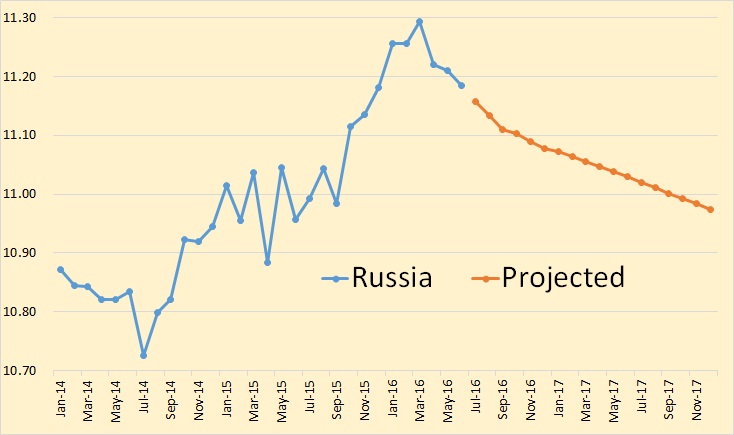

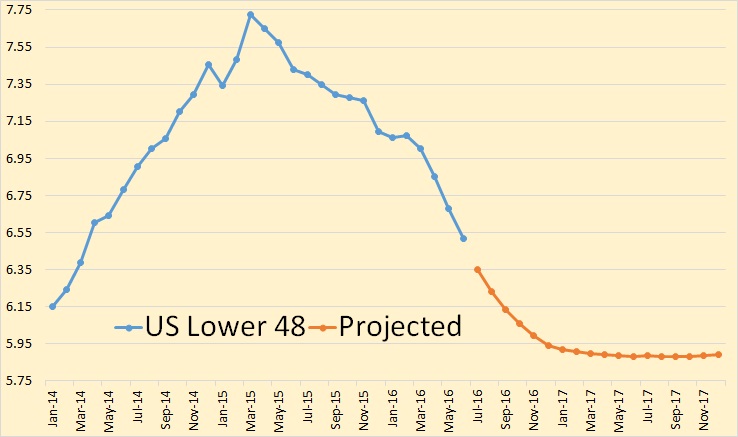

The EIA’s Short-Term Energy Outlook came out Tuesday. I have the most interesting charts from that publication below. All data below is through June, and projected data is through December 2017 and is in million barrels per day.

The EIA has Non-OPEC total liquids peaking, so far, in 2015. This should surprise no one.

The EIA’s projection of Russia is quite a shocker. They have Russia peaking in March 2016. Remember this is total liquids. The data from the Russian web site CDU TEK is crude + condensate.

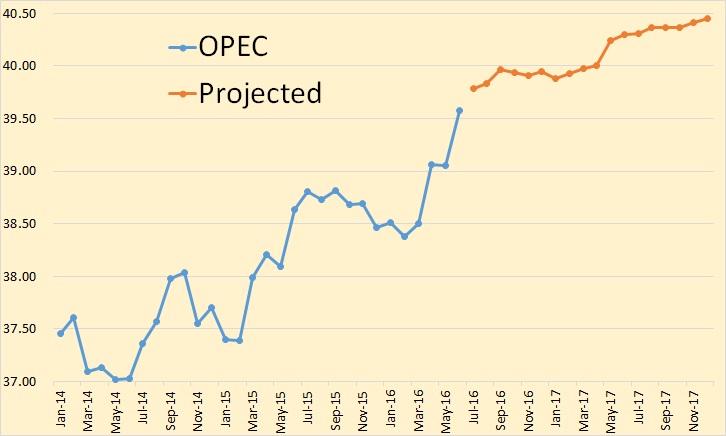

They have OPEC total liquids up 520,000 barrels per day in June. The OPEC MOMR has OPEC crude up about half that amount. I think the EIA is a little overly optimistic concerning OPEC production.

Data in all charts below is crude + condensate.

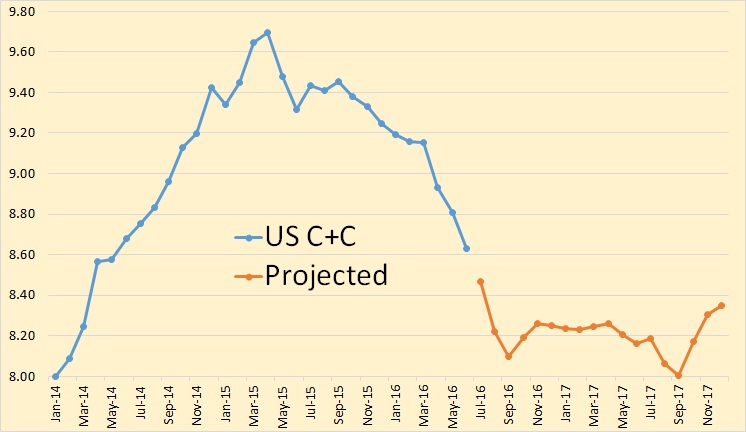

The EIA has the US decline pretty much halting in August at about 8.2 million barrels per day, down about 1.5 million barrels per day from the peak in April 2015.

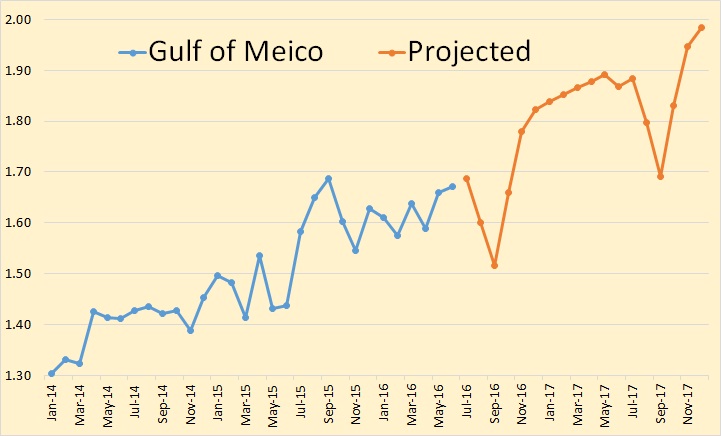

The halt in the decline of US production is due to the ever increasing production from the Gulf of Mexico. The spikes down in August, September and October of 2016 and 2017 is due to the expected hurricane season disruption. In this case I think they are too pessimistic. I think that it is unlikely that we will have much of a hurricane season this year. Next year?

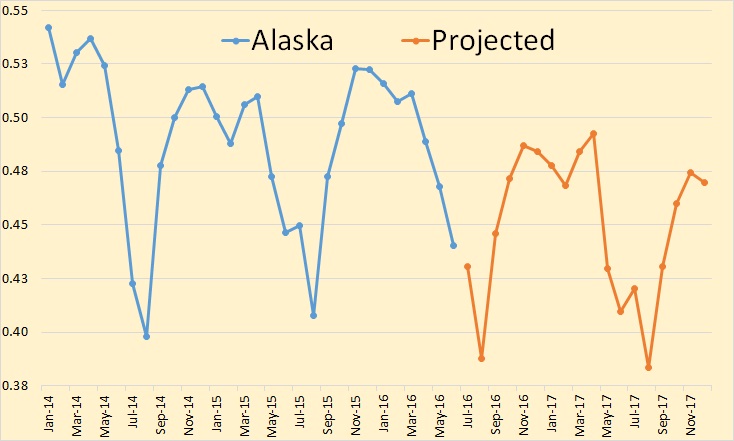

Alaska maintenance season bottoms out in August. The Alaskan decline was halted in 2016 but the EIA expects it to continue next year. It looks like Alaska will never have a monthly average of half a million barrels per day again.

The EIA expects US Lower 48 to bottom out, early next year, at 5.8 to 5.9 million barrels per day, down about 1.85 million barrels per day from the peak in March 2015.

The Peak Oil Paradox

Congrats. Highly recommended!

There have been one or two interesting economic ‘co-incidences’ along with the geopolitical stuff over last 10 years or more: see this reflection on UK productivity and N Sea. http://www.coppolacomment.com/

best

Phil

Euan gets it right.

An alternative projection based on EIA C+C data, with 1% annual decline in C+C output from March 2016 to Dec 2017.

Note that I assume a gradual recovery in oil prices as the oil market balances, if that is incorrect due to an economic recession then Euan Mearn’s scenario is more likely.

In any case decline in C+C output between 1% and 2% through the end of 2017 seems likely to me.

Is oil produced at a loss still considered as a plus on the production side of Hubberts curve?

If so then why should we ever have a peak?

While the fact that global peak oil production will occur is not to be debated, one issue regarding peak oil theory is worth questioning – that is the oft mentioned idea that when peak oil occurs, half of the global oil reserves have been produced. This doesn’t seem like it has to be the case. Any comments on this? thanks

I agree, SouthLaGeo,

Hubbert’s theory is good for a conventional oil region when the rest of the world is still increasing production. It is no longer valid when applied to unconventional oil or when Peak Oil refers to the entire world if oil is being used to extract oil.

Common sense indicates that a lot less oil will be extracted after Peak Oil than before. We won’t have an economy that could extract those Arctic, deep sea, and difficult geology deposits.

Hubbert himself thought that oil could continue being extracted to the end because we would be fully into nuclear energy.

Hubbert’s comment, according to Ivanhoe. http://hubbert.mines.edu/news/Ivanhoe_97-1.pdf

I believe the definition of Peak Oil Theory has been refined (pun intended) as the dynamics of affordability, including debt financing and astounding rising debt levels in all sectors, are added into the mix. Plus, as we approach, or have hit Peak, we are simply more aware of complicating details and nuance. Of course, there are so many other factors arising at the same time.

The other aspect is actually knowing what remains? Sure, there are some very informed and knowledgeable people (on this forum) who live, breathe, and know the reserve numbers. However, it hasn’t yet been produced under unforseen difficulties. Those numbers could be a bit higher or lower. Furthermore, peak itself is now been re-defined beyond geology.

I always think of Forestry. Timber cruisers/forestry engineers are given a plot to cruise that someone has indicated will be harvested using GIS, allowable cut levels, and market conditions to establish the cut plan and sequence. Off they go doing their sampling and extrapolations, and come up with a number of each species per cut block or per hectare. The public is told the cut is supposedly sustainable and falls within the company 5 year plan. But will the plot ever be cut and sold? That decision is always put on hold until someone makes that final decision.

I once flew the Chief Forester for BC to some location or another. While we were trapped together in the plane and he was captive to my questions I asked him just how it could be believed that BC was harvesting timber at a sustainable level, and how the ‘maximum allowable cut’ was mandated? His reply was that the asumption was made that every standing tree on Crown land would be available for harvest, and that this total number established the cut based on the variables of growing cycles. Of course, every tree is not available to be cut as the Clayquot Sound logging protests of the ’80s virtually stopped all logging in that area. Over time, protests have spread to other areas and saved other stands of timber.

Is not oil production and Peak similar? The techno folks believed that whatever was out there would be available to produce. When 1/2 was produced, that would be Peak. But……

I really think Ron nailed it with his 2015 number, and also believe this latest post confirms this. I think it is also amazing that on other blogs I have read, (as recent as yesterday), that LTO is just waiting in the starting blocks to ramp up and that PO has been made irrelevent. Many believe the ‘glut’ exists because there is simply too much oil out there, or that oil companies are just too good at what they do and we need not be concerned, and do not understand that a broke company or country that needs cash will produce flat out until it can’t. They believe today’s modest surplus indicates health and not the other way around.

Just my 2 cents worth. Regards

I think the 50% “rule” is a gross oversimplification. Production seldom follows a symmetrical bell curve. Companies do all they can to keep production going on a plateau for as long as they can – injecting water, well work-overs, infill drilling, sub-sea tie backs etc. But eventually decline takes over, production falls and they give up.

Above ground factors were much discussed in the past and scoffed at by some. But in fact they are likely as important as below ground factors. It’s a battle between human beings (and their systems) and geology.

Hi Euan

I agree.

I also agree there is a possibility that oil prices will remain under $75/be forever.

I don’t think it is likely.

What is your view?

How many times over the past 40 years we have heard that oil prices will never be above $…/bbl, or will never drop below $…/bbl, or that $…/bbl is a new normal.

Oil industry was, is, and will be highly cyclical, with wild fluctuations in prices; and we will see new highs and new lows in the next decades.

Yes, the oil industry has always been a series of boom-bust cycles and any long term projections that don’t reflect this are pure fantasy. Oil price is the key and always has been.

Completely agree.

Absolute statements are usually in error, and with regard to oil prices definitely IMO.

Have said many times, we have sold oil for a low of $8 and a high of $140.

In 2014, one month was $99.25. In 2016, less than two years later the price was $25.27 for a month. These last two prices are monthly averages, which we went to after the 2008 price crash, as we felt purchasers were sandbagging hauling oil as the price tumbled over $100 in five months.

Ah, commodities!

Hi AlexS,

Let’s consider 3 year centered running average prices for Brent Crude.

Base on the history since 1988, I think a prediction of future oil prices (3 year average) at $80/b or more is reasonable.

I agree though that predicting the price precisely is not possible.

Dennis, you might have gotten a better looking chart if you had used a 4 year average. Or better yet if you had used a 5 year average.

Hi Ron,

We could do it by the day and get higher volatility. Most wells produce oil for many years so the average oil price received for the barrels produced is very relevant to the economics of the well.

Here’s 12 month centered running average of Brent spot price.

I have carried my reply to the bottom of the page where the width is wide enough to view a graph.

Thanks Ron.

I also have a new, update on ND.

The USGS should revisit their earlier estimate for undiscovered resources in Bakken / Three Forks now that about four times as many wells have been drilled since the first release.

The way USGS estimated the undiscovered resources was quite simple. Split the region into 6 production zones (which may be stacked); for each zone split into core (sweet spots) and non core areas to give twelve assessment units. For each unit estimate total area (A), drainage area for each well (a), EUR per well (U), the proportion of the area unexplored (p) and the chance of not getting a dry well when drilling (r). Then resource is (A/a)*U*p*r. The values are different for each zone and they actually give three alternatives: maximum, median, minimum. Then they add up all twelve (or 36) estimates to give the total (or 3 different totals). The values for A, a and U might have some reasonable chance of being correct but p and, especially, r are just best guesses; for the maximum cases r is greater than 80% for all areas and for some minimum cases 90% and higher is used. In reality the E&Ps stopped wild cat permitting when they got to 50% success rate (and falling fast) in 2013/2014. Therefore, in the core areas p might be zero – the lease holders know what is there and have already included it in ‘proven undeveloped’, they don’t need to drill to be confident – and in the non core areas p * r is zero – the lease holders drilled wildcats out from the core until they started hitting dry holes, and then they stopped because there is nothing else to find (r is zero for all the remaining p). Therefore overall the undiscovered resources might now be zero for maximum, median and minimum cases, which would be quite a bit different from USGS numbers of 4, 7 and 11 Gb respectively, with a mean of 7.4 Gb.

The EIA did a bottoms up analysis of the “Technically Recoverable” LTO for the Bakken. The result was 23 Billion barrels.

They divided it into 40 different areas, taking the EURs per well for each area and estimating the number of wells that can be drilled per area based on current data.

The data was published in their “World Shale Oil Resource Report”, dated Sept 20, 2015. This is a major update of their June 13, 2013 report.

Hi R. DesRoches,

The geologists at the USGS do a much better job estimating TRR than the economists at the EIA. It will be a 9 to 13 Gbo URR from the ND Bakken Three Forks, maybe 2 Gbo from Montana.

It was only a few years ago that the USGS were telling us the URR for the Bakken was only 5 Billion Barrels, now they are saying it is 9 to 13 Billion. Looks like they are headed in the right direction.

Hi George,

I was responding to your comment about the USGS estimate.

Remember that the estimate was based on data through 2012, I suppose it is possible that there are no longer any undiscovered resources for the reasons you state.

I would still think there are some probable reserves which may become proved with higher prices or development of improved drilling and completion techniques. It seems your expectation is that probable reserves will be zero.

Isn’t is possible that as prices fell that the oil companies decided that they would focus on the core areas? I would be surprised if these companies had booked 6.7 Gb of reserves (including cumulative production which were at one time proved reserves), but only will produce 4 Gb, I would also be surprised if probable reserves were zero.

Either ND needs to hire a proof reader, or I no longer can read with comprehension.

“Gas Production

April 48,503,062 MCF = 1,616,769 MCF/day

May 50,949,167 MCF = 1,643,522 MCF/day (preliminary)( all-time high was April 2016 at 1,710,823 MCFD)”

So which is it? April 2016 was 1,616,769 MCF/day or was an all-time high at 1,710,823 MCFD.

That is a misprint. He meant to say March 2016 was the all time high.

Art Berman also has an article dealing with Peak Oil for economic reasons. It looks like a lot of agreement lately on this issue between experts.

Oil Prices Lower Forever? Hard Times In A Failing Global Economy

Yeah, this is a very good article. Art understands how the world works.

Energy is the economy. Energy resources are the reserve account behind currency. The economy can grow as long as there is surplus affordable energy in that account. The economy stops growing when the cost of energy production becomes unaffordable. It is irrelevant that oil companies can make a profit at unaffordable prices.

I agree. Meanwhile, an army group in Turkey says it has taken over the country; soldiers at strategic points in Istanbul and jets flying low in the capital, Ankara.

GAZPROM

…..Oh, YEAHhhhhhh…

Be well,

Petro

“GAZPROM” ???

From Reuters:

“Erdogan said the coup attempt had been encouraged by the “parallel structure”. This is his shorthand for followers of Fethullah Gulen, a Muslim cleric whom he has repeatedly accused of trying to foment an uprising in the military, media and judiciary.

Gulen, who lives in self-imposed exile in the United States, once supported Erdogan but became a nemesis. The pro-Gulen Alliance for Shared Values said it condemned any military intervention in domestic politics.”

http://www.reuters.com/article/us-turkey-security-primeminister-idUSKCN0ZV2HK

“Any country that stands by the Muslim cleric Fethullah Gulen will not be a friend of Turkey and will be considered at war with the NATO member, Turkish Prime Minister Binali Yildirim said on Saturday.

The government said that followers of Gulen, who has been living in self-imposed exile in the United States for years, were behind the attempted coup by a faction of the military on Friday.

The government accuses Gulen of trying to build a “parallel structure” within the judiciary, education system, media and military as a way to overthrow the state, a charge the cleric denies.”

http://www.reuters.com/article/us-turkey-security-primeminister-gulen-idUSKCN0ZW0K5?mod=related&channelName=worldNews

Bottom line: Turkish top officials accuse a guy who” lives in self-imposed exile in the United States”.

Yes, and best links and elaborations would be appreciated, thanks.

Caelan,

It is pre-emptive coup 🙂 (fake coupe in order to clear the military deck)

It looks to me that this time Turkish political elite pulled pre-emptive coup on Turkish military so it can purge her from the elements that are influenced by remote control from outside the country.

In one word this is Turkish version of Brexit. Basically financial, political, and military international structures that were established after II world war are crumbling because the interests of individual countries are so diametrical.

In one word this is Turkish version of Brexit. Basically financial, political, and military international structures that were established after II world war are crumbling because the interests of individual countries are so diametrical.

Oh Shit! Get ready for a new, old style caliphate and the ushering in of another couple hundred years of dark ages… The Ottomans are coming!

Fred, Ottomans are not coming.. Chinese are coming with trade deals on Orient express train from Beijing…via Istanbul…you guys are so misinformed about what’s going in the world that you will be in state of shock when IMF, EU, NATO close the shop all in one day.

you guys are so misinformed about what’s going in the world that you will be in state of shock when IMF, EU, NATO close the shop all in one day.

Really , well get off your high horse!

Ves, I don’t know who you think I am or what you think my background is but let me inform you of two things.

One, I’m quite sure the Ottomans are not really coming! That was intended to be tongue in cheek. You know, like Ha Ha ha!

Second, as a reasonably well educated citizen of the world, I was born in Brazil, to Hungarian parents, I grew up on three continents with three native languages and steeped in three completely different cultural backgrounds, I’m pretty sure I can safely say that I’m not part of any group that might be labeled ‘YOU GUYS’! Whatever the hell that even means.

Perhaps you mean Americans? If so, then as a US citizen I guess that would apply to me as well! However not every American citizen is ignorant of what is happening in the world today. Perhaps it is you who is misinformed about Americans in general.

Furthermore there is very little that is happening in the world today that surprises or shocks me other than the arrogance and presumptions of people like you who jump to conclusions and think they are in a position to pass judgement on others.

I’ll leave it at that!

Fred,

Caelan have asked a question. I wrote down my speculation. Do you have anything to share with us regarding his question? Go ahead. Topic is not where are you born, who are your parents or if Turkish failed coup is “disruptive” or not.

Ves, just curious is this how you answer Caelan’s question, by addressing me by name?

Fred, Ottomans are not coming.. Chinese are coming with trade deals on Orient express train from Beijing…via Istanbul…you guys are so misinformed about what’s going in the world…

Or did I miss something?

Because between my answer to Caelan and my answer to you is your nested nonsensical post to me about “dark ages” of caliphate and Ottomans coming.

I really, really, love that phrase, Fred. Well said.

Thanks for the elaboration, Ves. So a Turkxit then…

Well, looks like the global industrial brain is slowly losing its synapses.

Relocalization is of course also part of Peak Oil 101.

If Russia is better poised with regard to energy/resource independence and locality than USA and surrounds, then this would suggest a bit of a geopolitical shift in power and empire.

The North America LTO/Bitumen/Arctic deep sea experiment was attempted and didn’t seem to quite work out, like ethanol, and maybe like lithium.

So now I guess it’s in part, Venezuela and some attempts at steering new power shifts overseas, via ISIL, Syria, Turkey, Ukraine and some lacy NATO fringes along Russia’s hemlines?

US is near double the second, Japan.

Art also had this article out last month.

http://oilprice.com/Energy/Energy-General/Why-We-Can-Expect-Cripplingly-Higher-Oil-Prices-In-The-Near-Future.html

I like Art and now he thinks and writes but I also think that he as some Dennis Gartman blood in him, he holds many ideas at the same time and he can argue any of them very well. These articles seem to contradict each other a bit, but they are at least thoughtful..

and now for something completely different:

https://www.donaldjtrump.com/press-releases/an-america-first-energy-plan

?????

The ability to hold two , three, four or more opposing ideas in the mind, whole,fully leafed out, green and vigorous, to be called upon at will, may be THE best single indicator than the person who can do it is a hell of a lot smarter than “the average bear” of Saturday morning cartoon fame.

This is not to say that – if you you can do it – you are a ninny com poop, as a dear little girl used to call me for teasing her about eating grass like her pony, or sniffing the ground to find her puppy( which is how a puppy finds it’s master out in the real world ) but rather that you are able to set aside your cultural and technical prejudices and REALLY THINK when dealing with a complex problem.

A foolish consistency is the hobgoblin of a small mind, so they say.

She is a scientist now, and has been known to remark , paraphrasing Twain, that our problems are mostly the result of things we know that ain’t so.

Who knows, if we really RUN THE EXPERIMENT, we might even be able to ride in cars powered by the wind and sun before the oil is all gone. 😉

“Two years into the global oil-price collapse, it seems unlikely that prices will return to sustained levels above $70 per barrel any time soon or perhaps, ever. That is because the global economy is exhausted” ~A.Berman ca. July. 2016

“But from 2008 to 2015, oil production actually fell in 27 of 54 countries despite record high price. Thus, while peak oil critics have been proven right in North America they have been proven wrong in half of the World’s producing countries” ~ E. Mearns ca. July, 2016

It looks like my posts at this fine blog for the past 2 – 2.5 years are finally being read and understood …..

Maybe one day even Dennis will get the message…….

……one can only hope…..

“…while indeed initiated by geology, this time “PEAK” shall be by the way – and in the form of low prices…” ~ Petro’s main theme for the past 2 years on POB

Be well,

Petro

P.S.: a little hubris and arrogance is healthy now and then….

“Maybe one day even Dennis will get the message…” Good luck on that friend. They’ll be building igloos in Hell long before that happens.

I dunno Doug,

all those Sun spots and the new Ice Age, …….. I am optimistic…………………………..

…………. about “Igloos in Hell”, that is!

Be well friend … and thanx for making me smile,

Petro

P.S.: turkey situation is scary ….. and maybe one of the “triggers” of the INNEVITABILITY to come…

Hi Doug,

So you also thing oil prices will be low forever? I believe the 3 year centered running average for Brent Crude oil will be above $75/b by 2020 and will remain there until the next global financial crisis (around 2025 to 2030 for the start date).

I think oil output might return to 2015 levels or higher by 2019, but oil output will be in permanent decline by 2025.

“So you also thing oil prices will be low forever?”

Dennis, I don’t have the faintest idea what future oil prices will be and have said so consistently. I worked in the industry for 35 or so years and personally experienced several booms and busts which seemed to span about seven year intervals. Fortunately my wife had a teaching-research position that buffered us from downturn fall outs. If not I would probably have gone into something else. Many guys (gals were rare in the business then) packed it in and picked up degrees in law or civil engineering or something and never looked back. Actually I invested a lot of “spare” time refining seismic software code and learning foreign languages which paid handsome dividends and got me a lot of interesting work in good times so I don’t regret the way life went.

Hi Doug,

In that case, why would you think that the argument that oil prices would remain under $75/b (in 2016 $) forever (let’s say the annual average price because some people object to the idea of multi-year averages) makes sense?

That is essentially Petro’s argument, you seem to think he can predict future prices. Your position is more sensible, nobody knows for sure.

I am sure oil will become scarce in the future and generally when a good is scarce the price increases. Petro argues there will be very little demand for oil in the future because there will be an economic collapse, which he seems to think will be permanent.

I agree an economic downturn will happen at some point. probably about 10 years after peak oil is clear (when we see declining output for a 3 year period. The theory that such an economic collapse will never be recovered from is a bit of a stretch in my view.

From the archives…

Caelan and Petro,

If the price of oil [in 2016 US dollars] doesn’t get over 80$/barrel by Jan 31 2018,

I will come over that following summer (hitchhiking) to shovel out your chicken houses.

I have not made any predictions (except in an earlier comment for this year’s average price, though more as a joke).

But if you want to come over, maybe you can help us with and join in the creation (depending on how a few things go) of what I have been calling, ‘a demonstration microecovillage within a gutted small-town context’. What is the point and practicality of traveling a potentially-significant distance just to clean out some chicken coops? I am unsure we will even have them or if so, that they won’t be for the most part, self-cleaning.

Thank you Cae for saving me an explaining comment to Hickory!

Anyway, I have read your:

http://peakoilbarrel.com/petroleum-supply-monthly-texas-cc-estimate-permian-and-eagle-ford/#comment-575355

…and I have an answer for it…coming.

Just remember:

NOTHING was said out of malice and disrespect!

I hope you are correct…. but numbers unfortunately, tell me different…..

You make me happy with your comments and I truly appreciate them…. please do not forget that!

Sincerely (as supposed to: Be well),

Petro

Hi Petro,

That’s fine and thanks and understood. Your comments are fun too.

So what can we say? Let’s just enjoy life and stop working for the man. How’s that?

Hi Caelan,

Ya don’t want to hire no damned CARPENTER to build a chicken house. His brain will almost for sure be entirely fossilized when it comes to such things as level floors. 😉

Get yer ( small ) chicken house well off the ground, and build the floor out of smooth materials, and sloped not less than two in twelve , with a full width door that opens UP, hinged along the top, at the lower end.

Then you can reach in with a rake, and rake the manure and straw out straight into your wheelbarrow. Considering that SUSTAINABILITY is the name of the game, you will be cleaning that chicken house hundreds of times , over the next couple of generations.

The time to put chicken manure in a garden, if you are careful about overdoing it , is when it is still nice and fresh and smelly. That way you capture a LOT more of the nitrogen. Dig it in a little.

My grandparents and great grandparents knew a few things, although they never heard of permaculture, lol.

Hi Glen,

It’s resilience too of course, not just sustainability.

But sounds good and fair enough, thanks, I will keep that in mind.

BTW, what do you think of this?

Here’s my forecast

Unlikely, Fernando. I see very high volatility in oil prices heading our way.

Sustained high prices are only possible with a very good economy or with a very low production (you only sell to the elites).

On the other hand the value of money could tank with a monetary crisis, and oil prices could rise to millions of dollars per barrel.

Hi Javier,

I agree with you that volatility is baked in, and a deep economic slump could force the price of oil down for a while.

But I think Fernando is right about the price of oil going up, on average, over time, for at least a couple of decades and probably a lot longer.

Rust and depletion NEVER sleep.

But on the other hand engineers only sleep a third of the time, and the rest of the time they are busy finding ways for us to get more and more useful bang out of every barrel of oil that DOES reach the market.

I am a big believer in renewable energy, efficiency, conservation, etc, but I read a lot of history and know a little about business and people and the economy, and I just don’t see renewable electricity, electrified automobiles, etc scaling up fast enough to keep the price of oil down in the face of depletion and rising average production costs.

Sooner or later, if industrial civilization survives, we will be able to manufacture synthetic oil from coal or biomass , maybe even supplying the input energy needed with wind and solar farms.

Oil is such an incredibly valuable substance that we can pay a thousand dollars a barrel for it ,if we must, to make lubricants and some other industrial chemicals.

IF Old Man Business As Usual lives long enough, I suppose the price of conventional petroleum oil will eventually be limited by the price of synthetic oil.

Most people who have looked into the synthetic oil question seem to think coal to liquid will be profitable at well under two hundred bucks per barrel.

The climate question aside, two hundred dollar oil won’t wipe out industrial civilization, unless by way of triggering WWIII.

There is a real possibility that a sudden drop in oil availability might play out to mean the end of life as we know it.

A hard economic crash cut result in political decisions that foreclose the possibility of a transition to renewable energy.

“Oil is such an incredibly valuable substance that we can pay a thousand dollars a barrel for it ,if we must, to make lubricants and some other industrial chemicals.”

Your statement has two interesting aspects, the upper oil price and impact of oilprice on essential products.

The latter is quite easy: For many pharmaceuticals/fine chemicals it does not really matter whether oils costs 80 $ or 400 $ per barrel, this only increases the priceof your asperins by a few cents.

The upper price of conventional oil is IMHO given by the price of synfuel from power-to-gas and gas-to-liquid processes:

1) The current price for 1 kWh methan from electricity (and CO2/water) is in the range of 12-15 cents/kWh.

2) Not so elegant gas-to-liquid processes have a loss of 30%, i.e. you need around 1.5 kWh methan to create 1 kWh liquid syn-fuel (which would be superior to oil destillates).

3) 1 liter oil are 10 kWh, i.e. you need 15 kWh methan or around 2.00 $ with P2G + G2L. This gives an upper price of around 300 USD.

For me as stupid chemist it does not make sense to assume that oil becomes more expensive than 300 USD/barrel. 🙂

(I know that with current consumption even 120 USD are too expensive for most economies.)

Hi Ulenspiegel,

At 2015 average output and World GDP in 2015, if we assume the World can afford to spend about 5% of GDP on oil, the upper end of the oil price would be $125/b in 2015$. If World real GDP grows by 2% per year and C+C output remains at 2015 levels then this “maximum” oil price would grow by 2% per year, by 2020 the oil price could rise as high as $138/b(2015$) under these assumptions.

If real GDP growth could continue at 2% per year while C+C output fell by 1% per year from 2015 to 2020, then oil prices could potentially rise to $145/b (in 2015$), I doubt this would be the case however and about $140/b (in 2015$) would be the maximum price in 2020 under fairly reasonable assumptions, growth would be slower if oil output declined. If real GDP growth was 1.5% per year and C+C output declined by 0.8% per year from 2015 to 2020, $140/b would be 5% of World real GDP spent on C+C output.

In 2008 World spending on oil (US imported real oil price times C+C output) was about 5.1% of World Real GDP, that is the basis of the 5% upper limit for oil spending.

Javier, my price forecast is indicative. Prices will oscillate around my projection, but I can’t display the potential oscillations in a simple graph. Like I wrote in my blog, these price scenarios are useful if one is trying to understand large oil company behavior, can be used to estimate the attractiveness of biofuels and synthetics, as well as EV penetration into the car market.

Thanks Fernando for sharing your view. I assumed the volatility but out of curiosity and respect to petro’ view, doe you find it likely to have as much volatility to the upside of your trend as the downside?

Upside volatility used to be easier for me to picture, as oil is so valuable even at higher prices, but these years of deflation and frantic stimulus have me wondering if any upside would be so short lived

Hi Javier,

You do understand what is meant by “real” oil prices, I assume.

The price is adjusted for inflation so the hyperinflation (Worldwide) argument goes out the window.

I totally agree with you. I see the oil price rising well over 100 bucks per barrel before the end of the decade.

As for the persistent fantasies that Russian oil output will decline. The exact opposite will happen in the long-term. Russian oil reserves easily dwarf anybody else’s.

http://www.ogj.com/articles/print/volume-98/issue-21/exploration-development/sw-siberias-jurassic-bazhenov-may-contain-much-larger-oil-reserves.html

The concluding paragraph on the oil reserves of the Bazhenov formation in SW Siberia reaches an unequivocal conclusion:

“Giant recoverable oil reserves contained in the fractures suggest that the Jurassic reservoir is a primary oil accumulation which has no analog all over the world. Therefore, we believe that Russia has the largest hydrocarbon reserves in the world.”

Any info on how the first wells in this play are performing. Seems it is difficult to find much information online about them.

I see you have been looking on the internet for positive articles about russian oil production. But that article is 16 years old. You need to find something newer.

Freddy. I can’t find much about oil actually being produced from Russian shale formations.

Do you know of any articles which reference actual production, as opposed to estimates?

One possibility is that these Russian plays end up being primarily gas plays.

shallow sand,

Current LTO production from the Bazhenov shale is insignificant, probably some 15 kb/d.

Most of production is from naturally fractured zones, with relatively high porosity and permeability.

Several Russian companies are planning to produce LTO, but most of their projects are in pilot stage.

Projects with participation of western partners (Exxon, Shell, Total, Statoil) have been postponed due to sanctions.

“One possibility is that these Russian plays end up being primarily gas plays.”

No, Bazhenov is an LTO play. The EIA estimates its recoverable resources at 75 billion barrels, the biggest in the world.

Woodmac had estimated oil-in-place resources of the Bazhenov shale at 2 trillion barrels.

AlexS. Thank you for the reply.

Any figures available for production cost?

Current costs are relatively low, as oil is produced mostly from naturally fractured zones with vertical wells without hydraulic fracturing.

It is difficult to say what will be operating and capital costs when companies will produce from really tight rock.

The big question is going to be the per well recovery, and whether it justifies CAPEX+OPEX. There’s a large amount of gas condensate in the Jurassic underneath the giant gas fields, which merit priority over the Bazhenov oil prone sectors.

There are many more if one cares to search for them. Both the West & Russia have good reasons to lie about the latter’s true oil reserves for very obvious reasons, hence why references to them tend to be quite obscure.

Many people on this blog are so obsessed with convincing the world that *oil production has peaked* that they avoid rational thinking.

Have you ever wondered why the NATO Axis is so obsessed with undermining/destroying in ascending order, Iraq, Iran and Russia? Well, outside of outright fiendish lunacy there can only be one explanation and it’s related to oil & gas.

Global geopolitics can be readily summed up by one map:

http://www.rubincenter.org/wp-content/uploads/2013/03/Fig-1.jpg

A massive chunk of this “Strategic Ellipse” is found in Russia, and primarily in the SW Siberian region. The other part, is the Arabian Peninsula and Persian Gulf region.

I am shocked by many of the posts on this blog, with so many intelligent and knowledgeable people sticking to many of the platitudes found on the MSM, especially if they tend to support the *end of the oil age* meme that The Economist was pushing 15 years ago.

When one refers to the global oil industry, he should be able to first of all make the most crucial distinction. That between high-cost producers and low-cost producers. The hydrocarbon-producing countries located in the “Strategic Ellipse” are low-cost producers, in matter of fact, extremely low-cost compared to anywhere else, hence why they can tax oil & gas production as heavily as they do. Russia for one, taxes oil production at a dizzying rate.

The high-cost producers are those found anywhere outside of the strategic ellipse, and with the passage of time the gap between the two sets of oil-producing regions grows wider and wider.

After this, there is another hugely important distinction. That between low-cost producers controlled by the NATO Alliance, namely, KSA, UAE, Kuwait, Qatar and Oman and those outside of NATO control which ought to be undermined and ideally dismembered. These are Russia, Iran, Iraq and to a lesser extent Kazakhstan and Turkmenistan.

Obviously, Russia is NATO’s primary target. That country is too big, too clever, has too many nukes and cannot be ever allowed to leverage her illimitable hydrocarbon resources for geopolitical and economic gain. The same principle applies to Iran, but to a lesser extent.

As oil production indeed *peaks* or at least becomes a loss-making endeavor outside the strategic ellipse, the time-pressure on NATO to finish-off Russia & Iran (who may very well wrest complete control of Iraq at some stage) mounts.

If NATO fails to achieve this strategic goal, then the day when Russia & Iran will be in a comfortable position of leveraging their colossal hydrocarbon potential for all kinds of concessions on all kinds of issues (most of all, on global market access) will inevitably arrive.

I have argued repeatedly on this blog that the oil volumes produced by the countries found in the “strategic ellipse” is not much related to their actual capacity. First of all, the NATO-allied GCC countries have largely been stable producers over decades under the economic and military security provided by the US military aegis. From time-to-time, they have been calibrating their production levels in relation to global market forces but it is clear that the GCC countries are producing at a lever they are comfortable with in the long-run.

As for Iran-Iraq, their production levels have been hampered by wars, invasions, NATO-backed insurgencies, sanctions, sabotage etc. Russia can resist NATO aggression much better than Iran-Iraq, but is still susceptible to it. This was especially the case in the 90s, when Russian oil production plunged by almost 50%.

In any case, Russia’s (also Iran-Iraq’s) current oil production is restricted by the temporary glut created by epic over-investment in such high-cost regions as US shale, Canadian tar sands and offshore deep-water (Gulf of Mexico, LatAm, W. Africa, N. Sea)

The current low-price environment will either help to soften NATO’s targets for a take-down, or NATO’s targets will endure the pressure and come out stronger once the high-cost producing regions find themselves with plunging production rates due to a dearth of investment.

Just consider this. Why would a venerable corporation such as Exxon Mobil acquire massive acreage in the one country that resists US influence the most vigorously? Well, the explanation is provided in that old article I linked earlier, Russia’s oil reserves are without analog anywhere IN THE WORLD.

http://www.bloomberg.com/news/articles/2015-03-03/exxon-s-russia-exposure-surges-as-long-view-outweighs-sanctions

http://www.forbes.com/sites/judeclemente/2015/03/25/how-much-energy-does-russia-have-anyways/#4be58ae12daa

Let me stress something out for you. What you read about Russia in Western MSM is deliberate misinformation that suit NATO’s goals propaganda. What you also find in RT or alternative media that tend to be pro-Russian, is also lies that suit Russia’s goals. What I give you above, is a brief sketch of the overall Big Picture, but it is a truthful and sensible one. As Karl Marx once said: “it is what they don’t tell you that is most important.”

What a ridiculous “analysis”. Nowhere does it even mention China.

“Obviously, Russia is NATO’s primary target. That country is too big, too clever, has too many nukes and cannot be ever allowed to …”

Too big and getting bigger as it annexes other countries.

Which countries did Russia annex?

I was half-joking. They only annexed half of the Ukraine.

Greenbub, you have an overdose of propaganda.

Crimea has always been part of Russia since they conquered it from the Crimean Khanate, an Ottoman vassal, in the late 18th century. It was administratively assigned to Ukraine by an arbitrary decision in the 1950’s, and should not have been part of Ukraine when it gained independence. The root of the problem is that Ukraine independence was badly negotiated by Russia. The Eastern part of Ukraine is populated by Russians that only wanted to be part of Ukraine when things were better than in Russia. I guess nobody asked them which country they wanted to belong and now Ukraine does not recognize their right to decide.

One has to know history before understanding the root of many current problems.

While Russia is playing hardball to defend Russians outside its borders, it is not the imperialist aggressor that is being painted by the media.

As Sting used to say, the Russians love their children too, and we would do much better through cooperation rather than confrontation.

You are frighteningly miss-informed….

As a friendly suggestion, may I recommend that you limit your exposure to:

NYT/WaPo/NPR/CNN/FOX/NBC …. and other alphabet soup concoctions. and use other sources of info as your daily news digest….

Just a thought, just a thought….

be well,

Petro

Hi Hickory,

I think that’s a good guess, I would go further and say the 12 month trailing average Brent oil price (in 2016$) will be more than $80/b by June 30, 2019.

In addition I think there is a 50% or higher probability that the trailing 12 month average of World C+C output will be more than the most recent centered 12 month running average of 80.15 Mb/d in August 2015 (EIA data) by August 31, 2020.

http://www.eia.gov/beta/MER/index.cfm?tbl=T11.01B#/?f=M&start=200001

Chart below shows trailing 12 month average C+C output for the World with the peak in Feb 2016 at 80 Mb/d.

This guy has a really big chicken house:

https://srsroccoreport.com/the-coming-breakdown-of-u-s-global-markets-explained-what-most-analysts-missed/

What’s a chicken house (in this context, which I assume is metaphorical)?

Petro,

It is fine and dandy that you show some arrogance when the data is starting to support your hypothesis, however I must point out that a lot of people have been coming to the same conclusions at about the same time. There are a lot of clever people in the world.

Ron Patterson has been onto oil decline for a very long time from studying oil production data. He was about the first to realized that LTO was not a solution to the Peak Oil conundrum. He probably realized about the 2015 Peak long before he put it on writing. He can tell us. I seem to recall reading his prediction within the first half of 2015.

Euan Mearns seems to be reaching the same conclusion from the same background, his geological expertise, but only now have I read him put it on writing.

Art Berman has come to the same conclusion from a very different background, the energy investment field. This is also the first time I read him say it so clearly, but he probably reached his conclusion some time ago and only now he dares to write something so strong in his influential blog.

Myself I reached the conclusion that Peak Oil was imminent in September 2014, from economic insight after I clearly saw that the oil price crash was really bad news for the consumer long term, while most people thought (think) that is great news for the consumer. I studied oil production data and saw my fears confirmed. That is when I started my oil (and climate) blog, and my first prediction on writing of a 2015 Peak Oil is from November 2014, and again February 2015.

My understanding of macroeconomy is not as good as yours, but is good enough to understand that we are facing the end of the road and the can kicking will not continue much longer. Central Banks are buying some time through desperate measures that will make the fall harder while the elites hasten their preparations. We are contemplating the Peak of our civilization (in my opinion Peak Civilization took place in the early 70’s) and its unraveling is going to be a very long stressful one.

We are contemplating the Peak of our civilization (in my opinion Peak Civilization took place in the early 70’s) and its unraveling is going to be a very long stressful one.

I have a very difficult time agreeing with that statement. I don’t think we are at peak civilization at all!

The earliest emergence of civilizations is generally associated with the final stages of the Neolithic Revolution, culminating in the relatively rapid process of Urban Revolution and state formation, a political development associated with the appearance of a governing elite. The earlier neolithic technology and lifestyle was established first in the Middle East (for example at Göbekli Tepe, from about 9,130 BCE), and later in the Yangtze and Yellow river basins in China (for example the Pengtoushan culture from 7,500 BCE), and later spread. Similar pre-civilised “neolithic revolutions” also began independently from 7,000 BCE in such places as the Norte Chico civilization in Peru[11] and Mesoamerica. These were among the six civilizations worldwide that arose independently.[12] Mesopotamia is the site of the earliest developments of the Neolithic Revolution from around 10,000 BC, with civilisations developing from 6,500 years ago. This area has been identified as having “inspired some of the most important developments in human history including the invention of the wheel, the development of cursive script, Mathematics, Astronomy and Agriculture.”[13]

Source Wikipedia

All of these past civilizations rose and fell without the use of fossil fuels.

While throughout history there were certainly dark ages when we lost knowledge previously acquired, I’m not yet completely convinced that humanity cannot rise from the ashes of a post fossil fuel based civilization and create even more culturally, technologically and scientifically advanced steadystate political and economic systems around the world.

You yourself just posted a link to high altitude generating kites. That is exactly the kind of disruptive technology that might allow us to transition to another level of civilization.

Granted on the one hand we have groups like ISIS hell bent on trying to return humanity to the dark ages and that could happen if we allow reactionary forces exemplified by people like Donald Trump and his supporters to lead us there. Witness UK’s Brexit, Turkey, Egypt, Venezuela, etc, etc…

But we also have incredible advances and profound disruption happening in so many technological and scientific areas from AI to artificial synthetic life forms and advances in materials science to name a very few!

I suggest everyone take some time to familiarize themselves with the vast pools of creativity that we have yet to tap. Think Different! 🙂

https://www.thinkdif.co

#SystemReset

Most global economic, social and environmental indicators show a troubling negative trend, which will surely be exacerbated by a rising world population. The time for tweaks to a system that has been faltering for several decades is over. It’s time for a change of operating system. In this DIF 2016 theme, our guests will explore how the rules of the game could be changed to encourage a different way of living, of organising society, of doing business.

Fred,

This is obviously a matter of opinion until enough time has passed, so no point in arguing about it.

From my point of view the period 1975-2015 has seen a lower rate of development than the period 1935-1975. All the low hanging fruit available to a civilization with a much higher level of energy availability, from commercial aviation to spaceship travel, was collected in the first period. In the second we have concentrated in the low energy developments, like internet, computers, and mobile communications, while abandoning all our high energy dreams like human space colonization and space cities. Just pick a late 70’s future science magazine for a catalogue of what we have not been able to do. We don’t even have those types of magazines anymore.

The future is unknown, but what I see is a lower energy future and as a consequence a civilization collapse. Our society is very complex, and thus not amenable to simplification. Several countries have already taken the path of collapse and more will follow, as social unrest, populism, and nationalism are only expected to increase with economic troubles.

Western Industrial Civilization, was born out of intense use of coal for the Industrial Revolution. In my opinion it will fall shortly after Peak Oil. Current science and technology is fragile and dispersed, resting on the integrity of internet and global communications. It is impossible to envision what will survive or what will not and the type of societies and civilizations that will emerge after the fall of the Industrial Civilization, but I seriously doubt that they will have more energy available than we do have now.

The future is unknown, but what I see is a lower energy future and as a consequence a civilization collapse. Our society is very complex, and thus not amenable to simplification. Several countries have already taken the path of collapse and more will follow, as social unrest, populism, and nationalism are only expected to increase with economic troubles.

I know that and agree with almost all of it! Where I disagree is that I don’t think our current stage of civilization implies peak civilization. What we have now can’t continue in its present form for all the reasons you cite so it won’t continue. I expect massive disruption and change, So I guess to some segments of society that will be a form of collapse and also some very hard times. However I fully expect civilization to continue. Therefore I don’t see a peak.

To be clear I’m using this dictionary definition of civilization:

civilization (ˌsɪvɪlaɪˈzeɪʃən) or civilisation

n

1. (Sociology) a human society that has highly developed material and spiritual resources and a complex cultural, political, and legal organization; an advanced state in social development

2. the peoples or nations collectively who have achieved such a state

3. the total culture and way of life of a particular people, nation, region, or period: classical civilization.

4. the process of bringing or achieving civilization

5. intellectual, cultural, and moral refinement

6. cities or populated areas, as contrasted with sparsely inhabited areas, deserts, etc

Collins English Dictionary – Complete and Unabridged, 12th Edition 2014 © HarperCollins Publishers 1991, 1994, 1998, 2000, 2003, 2006, 2007, 2009, 2011, 2014

There can be continuous growth, if there is continuous death. Nature does it all the time. So current business will die and new business will take it’s place. Current ways will fade and new ways take over. On a finite world, an equilibrium will be reached between the new and old. Change is ever present even when equilibrium has been established.

That said, equilibrium set points change too.

Fred,

Was Egyptian Chalcolithic a continuation of Neolithic? Was Eastern Mediterranean Iron Age a continuation of Late Bronze Age? Was Western European High Middle Ages a continuation of the Late Roman civilization?

If you answer yes to those then you look to historical continuities and then you can consider that whatever the disruption civilization will continue,

If you answer no to those then you look at historical discontinuities and then you can consider that the coming disruption will give rise to a new civilization. I belong to this camp.

Whether a new civilization is better or worse depends on the point of view. For the high nobility the feudal system was the best and the French Revolution (new regime) the worst.

Hi Javier,

If you are arguing that things will change, I agree. At some point there will be a crisis and that may lead to changes in how societies are organized.

I think Peak Civilization has to include vagaries of ‘human nature’, especially as we see moving trucks mowing down kids on a promenade this week.

Maybe in the ’70s we were more naive. We were still digesting Hitler and his camps and perhaps too full and stupid to appreciate what might unfold as CC and Peak nudges us forward into current events.

We have never known ‘civilization’, or civilized behaviour. We just had ‘more stuff’ per hour worked, in some countries. Others, not so much.

Hi Javier

I agree that there may be less primary energy available in the future.

We can use energy more efficiently in the future.

Or we can go back to slavery to appropriate human energy again. We don’t know.

Hi Javier,

I agree we don’t know the future.

The internal combustion engine was a disruptive technology, changed the world. It was the zeitgeist at the time. Tractors changed agriculture and transportation. Wilbur and Orville Wright got an airforce base named after them. Airplanes disrupted a whole lot of things.

Everybody back then did think different. No big surprise there, oil was the impetus that started it all. Give it some credit.

The guillotine was a disruptive technology. Don’t know if it helped all that much, but it certainly changed things.

http://oldsite.english.ucsb.edu/faculty/ayliu/research/around-1800/FR/times-9-12-1792.html

I highly doubt that Donald Trump is at fault for the behavior of a few renegades making life miserable for a couple of billion people.

You are finger pointing, a conflation.

If any blame is going to go around, the current crop of politicians deserve it all. I won’t name any names.

In the words of Hunter Thompson, every President from the first one on down the line, it has been all war.

Hunter got it almost right, it started long before any president ever was born.

If we are going to prosecute global warming deniers, we’re no different than the Jacobins.

Enough to drive you to drink, so I do.

I highly doubt that Donald Trump is at fault for the behavior of a few renegades making life miserable for a couple of billion people.

You are finger pointing, a conflation.

No, I’m not! In my opinion the Trump phenomenon together with all the other examples I cite are more a symptom than a cause.

Yep, the internal combustion energy sure put a bang into things. Enola Gay had lots of pistons banging away, before the big bang over Japan. It’s all about explosions and fire, so exciting, appeals to the adolescents and the frothing media. Renewables are quiet and boring, no explosions, no spills, no fires, just there doing their thing. Not sexy at all. We need explosions, fire, sex, violence, war. Humans don’t feel right without their nerves jangled.

No juvenile excitement from renewables. Boring. Dull. Much like plants. Grown up stuff.

BTW, it was coal that started it all, not oil. Nothing like a steam engine, huffing and hissing, pouring out black smoke and ready to explode if the water level gets low. Power ready to explode. We love explosions. Love noise too.

But the new thing is rockets. Lots of fire and occasional explosion, basically a controlled explosion at the best. Lots of noise and flame. Much better than pistons or even jet turbines in afterburner.

https://www.youtube.com/watch?v=bdvv8qIl_WI

“I suggest everyone take some time to familiarize themselves with the vast pools of creativity that we have yet to tap. Think Different!”

In other words pray to the gods of technolology.

“Why looking on the bright side

keeps us from thinking critically.”

http://www.auroraadvisors.com/articles/Optimism.pdf

In other words pray to the gods of technolology.

You can pray to whomever you please!

That is not what I’m suggesting at all. Sure, I think technology and science will by necessity play a part. But I’m saying something much more fundamental and all encompassing.

Or did you miss this little tidbit from my quote above?

The time for tweaks to a system that has been faltering for several decades is over. It’s time for a change of operating system.

I’m going to bet you haven’t visited the link I posted much less explored what is there! If you are not willing to do that Then you won’t understand my point.

Oh, as for:

“Why looking on the bright side

keeps us from thinking critically.”

I think I fall into the category of realist and I’m pretty sure I’m quite capable of thinking critically, thank you very much!

FredM,

What’s “the development of cursive script” doing in there?

Focused Dunning-Kruger alert. Take that source to task!

Time for more port.

What’s “the development of cursive script” doing in there?

I guess you could take that question up with whoever posted that text to Wikipedia. Though I’m not quite sure what you have against the development of cursive as a sign of civilization. Granted, it is more and more a lost art in this day and age. Just for fun, try writing a long text in cursive.

http://www.brainbalancecenters.com/blog/2014/09/brain-benefits-write-in-cursive/

Research shows that learning to write in cursive offers brain benefits to kids that they don’t get from printing letters or keyboarding. An article from Psychology Today states that learning to write in cursive is an important tool for cognitive development. Specifically, cursive writing trains the brain to learn functional specialization, which is the capacity for optimal efficiency. When a child learns to read and write in cursive through consistent practice and repetition, he or she must effectively integrate fine motor skills with visual and tactile processing abilities. This multi-sensory experience supports cognitive function and development.

Well, go for learning/writing a few thousand Chinese characters. I should be a genius by your reasoning. All that happened is that I can’t even remember my phone number now. My wife would roll her eyes and mumble things like: “Jesus, get a life Doug” and “can’t you find something that’s actually useful to do.”

All that happened is that I can’t even remember my phone number now.

Um, I think the operative word in there is kids… 🙂

Research shows that learning to write in cursive offers brain benefits to kids that they don’t get from printing letters or keyboarding.

BTW, my personal excuse for not remembering my own phone number is telling people that I never dial myself…

FredM,

My question is about “the development of cursive” in a list of most important developments in human history having been “inspired by” Mesopotamia (pretty poor phrasing there.)

I’m all for cursive; I was a calligrapher for years. Since the discussion was of important developments in the context of talking about early civilizations in Mesopotamia, I’m saying that cursive isn’t one. The oldest writing we know of, now, that would be Sumerian and Old Elamite, both Mesopotamian (well, Old Elamite was neighboring Mesopotamian), but that’s not what’s in the quote.

Writing developed in the Fertile Crescent, yes, as symbols pressed into tablets of wet clay with reeds cut at a slant to give a wedge shape. That was pretty much the story there for a couple of thousand years. No cursive in sight.

Wikipedia will trip you up, it will, but I apologize for confusion resulting from my overly laconic query.

Rats–the glass is empty…

Writing developed in the Fertile Crescent, yes, as symbols pressed into tablets of wet clay with reeds cut at a slant to give a wedge shape. That was pretty much the story there for a couple of thousand years. No cursive in sight.

Well you are absolutely correct in saying that the form of writing used in ancient Mesopotamia was certainly not cursive.

I think the Wikipedia author may just have been suggesting that writing itself was in part born there. However many different forms of writing from other civilizations including some of their symbols did eventually evolve into cursive over the centuries.

Here is an interesting synopsis of the history of hand writing.

http://www.bfhhandwriting.com/history-of-cursive-handwriting

Here’s another link to a more all encompassing history of writing in general.

http://www.funsci.com/fun3_en/writing/writing.htm

Raising a glass in a toast to you for making me learn a little more about the history of writing. Thanks 🙂

And Cheers!

FredM,

That first link is part of a particular writing program and skips the writing that italic is a rapid version of: Carolingian minuscule, a script both beautiful and functional developed at the court of Charlemagne and not itself cursive. Writing it rapidly leads to connections between letters and a bit of a slant to them, in addition to the up-and-down difference noted in the link.

The second link is pretty good except for calling the Phoenician writing system an alphabet. The Greeks made an alphabet out of it by putting signs for vowel sounds on an equal footing with consonant signs. That was the first alphabet, and the oldest texts we have in it are poetry! They’re graffiti, sometimes scurrilous and ad hom., and inscriptions on containers of various sorts. The oldest texts we have of the very early writing systems were official (accounting or religious) and not to do with ordinary people, but the Greeks were having none of that.

As the article said, a Greek alphabet (there were several versions early on) was adopted by the Etruscans (did the article mention the Etruscans?) from whom the Latins borrowed it and adapted it to their language. Ours is a successor to the later form of that system. By the way, all the alphabets that arose right across the Old World are descended, directly or indirectly, from the Greek one.

“Rats–the glass is empty…”

….oh no!

Shame on you…..

Fill it up…. fast ….. and cheers!

Petro

Thanks Petro.

There’s a line from an old Gordon Lightfoot song titled Blackberry Wine:

Pass it on over. It’s a sin to be sober too long.

My interest in the song is the melody and rhythm, you understand. Fine song.

Hi Javier

I only disagree on the timing of the peak and never believed lto would have much effect on the peak.

I disagree with an analysis that suggests oil prices under $75/b for the 3 year average oil price forever.

Volatility is a good guess though Fernando’s price scenario might be roughly correct for 5 year average oil prices.

Dennis,

You might be right and I might be wrong. What it is clear is that we see more or less the same situation but a completely different outcome.

Two things separate completely my analysis from yours:

The first is that I see a monetary crisis as unavoidable in the not too distant future. Most of the planet’s wealth is in the form of electronic money (derivatives and financial instruments). The folly of Central Banks is hugely increasing those that are in the hands of the financial elite so there is less and less real wealth (land, resources, and productive industries) to support that virtual wealth. At some point the bubble is going to be so big and the leverage so high that there is going to be a run of that virtual wealth to become real at any cost and that is going to destroy every currency you can buy something of value with. Over here in Europe I am already seeing some worrying signs of what is coming, as payments in cash are being limited to ridiculously low amounts and governments are trying to force everybody to have their money in the banks. With a monetary crisis the price of oil in dollars has no point of reference and predictions have little value. The US has no experience for generations on monetary crisis, so that is going to be a real shock.

The second thing is that during economic crisis wealth gets distributed more unequally. The middle classes and low classes lose their savings and everything of value they have while some elite class fare quite well even if they lose part of their nominal wealth. This has several dire consequences. It can lead to bloody revolutions like the French or Russian revolutions. And in any way it leads to most people not being able to consume much. There won’t be enough customers for oil, making your price predictions useless.

My own personal thought is that the current pricing system for oil based on margin pricing will have to be abolished once the shit hits the fan. It will simply not work. They’ll think of something to avoid total collapse of oil production.

Hi Javier,

Well we don’t know how things will play out. But since 2010 World Debt to GDP has not changed very much according to the Bank for International Settlements (the central bankers Bank).

Hi George

Keep in mind those estimates were based on reserves as of year end 2012. A lot of reserves and production have been added since then. Also remember that 2p reserves are probably not 50% higher than proved. I usually assume 1p ND reserves in 2007 were nonbakken.

Hi George,

In my comment above I mistakenly put a “not” in there,

“Also remember that 2p reserves are probably not 50% higher than proved”

should have been

Also remember that 2p reserves are probably 50% higher than proved reserves

Proved reserves at the end of 2012 in North Dakota were 3.76 Gb at the end of 2012 and 0.48 Gb at the end of 2007, I assume 99% of the proved reserves added were Bakken/Three Forks reserves over that period because most of the drilling and increased C+C output over that period was from the Bakken/TF. Cumulative C+C output in the Bakken/TF at the end of 2012 was about 0.6 Gb. If we assume 2P reserves are about 50% more than 1P reserves, then at the end of 2012 2P reserves in the Bakken/TF would be 4.9 Gb. In April 2013 the USGS estimated 5.8 Gb of undiscovered TRR in the North Dakota Bakken/TF (mean estimate), when we add this to 2P reserves at the end of 2012 plus cumulative C+C output we get a mean TRR of 11 Gb (5.8+4.9+0.6). The 95% to 5% probability TRR range is 9 to 14 Gb.

At the end of 2014 ND C+C 1P reserves were 6 Gb, if we assume most of the reserves added since 2007 were Bakken/TF reserves, then Bakken/TF 1P reserves were about 5.5 Gb at the end of 2014 and 2P reserves were 8.25 Gb. Cumulative Bakken C+C output was 1.2 Gb at the end of 2014 which would suggest a URR of 9.45 Gb, if the 2P reserve estimate is correct and all reserves are eventually produced.

If pessimistic projections of future World economic output prove correct, Bakken output might be lower than this, I doubt oil prices will remain low (under $75/b for 1 year average oil price in 2016$) over the next 10 years. I agree prices will be volatile, but the price will bounce between $70 and $130/b and mostly stay in the $80 to $100/b (in 2016$) range from 2018 to 2025 unless a major depression hits (around 2025 to 2030 would be my guess for when that might start).

Dennis, thanks for the reply, I didn’t see it earlier. I think you may have replied to a comment that wasn’t mine, but maybe not, I have trouble following the indents sometimes.

But I have three questions and two quotes below concerning the contributors with whom you are having discussions above, (or maybe below): 1) Why do you think it justified to use probable/proven ratios from mature, super giant, conventional fields originally discovered and developed without much technology on unconventional fields which are developed using the latest seismic, geologic analysis and drilling methods? 2) When USGS went to the top seven Bakken drillers and asked for their estimates on undrilled prospects and likely success rates, as they did in their analysis, do you think the answers were a) vastly over estimated as it allowed the companies to give the impression they have much more resources than in reality without breaking SEC rules, b) about right – i.e. about 50% dry holes but falling as they moved away from the core areas, or c) underestimated knowing that it would be wrong to give potential investors false hopes? 3) Undeveloped reserves have to be online within five years by SEC rules. Currently about 50 wells are spudded each month with, say, maximum EUR for each at 300k which gives 0.9 Gb over the next five years, or upper estimate 1.2 Gb with all the DUCs developed – where do you think all the rest of the reserves are (note, this is so far out I think I must have got something wrong, but after a decent supper I can’t really be bothered to check further)?

Confucius:

“He who knows all the answers has not been asked all the questions.”

“He who knows not, and knows not that he knows not, is a fool. Shun him.”

Mark Twain:

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

(that’s three quotes but so what)

c) underestimated knowing that it would be wrong to give potential investors false hopes. 🙂

Hi George,

The EIA has proved reserves based on second data.

The rules are pretty clear. For the UK north sea the ratio of 2p to 1p is 1.7. Also for the US from 1980 to 2005 this gives reasonable results. I have used 1.5 here to be conservative. Note that when prices are higher 2400 wells per year will be drilled.

Hi George,

The EIA proved reserves data is based on SEC 10ks and the last data we have is from 2014.

If one believes (as many on this blog seem to) that oil prices will remain under $75/b (2016$) essentially forever, then it is possible that the URR will be less than proved (1P) reserves plus cumulative production in 2014 (6.7 Gb).

I don’t think oil prices will remain low forever and eventually they will return to 2014 levels or higher ($90/b in 2015$).

I looked at reserve growth at link below:

http://peakoilbarrel.com/us-oil-reserve-growth-2/

For the US reserves from 1980-2005, if we use a 1.7 ratio of 2P/1P reserves (based on data from the UK from 1977-2013). we get 63% growth in US 2P reserves.

If we assume a lower 2P/1P reserve ratio of 1.4, reserve growth would have to be 90% over that period to account for the increase in US reserves when discoveries and cumulative output are deducted.

Note that if you believe the 2P/1P ratio is even lower than 1.4 an even higher reserve growth would be needed to account for the reserve increase.

Let’s assume you think 90% reserve growth is reasonable (it seems too high to me) and you prefer 1.4 for 2P/1P vs the 1.5 I have used for the Bakken/Three Forks.

In that case 2P reserves in the Bakken/Three Forks would be 8.9 Gb at the end of 2014.

If we assume there will be no discoveries and no reserve growth in the future, then URR would be no higher than 8.9 Gb.

Do those assumptions seem reasonable to you?

Dennis – no I don’t think that is reasonable. It might be correct, but not because of the arguments you use (everything in the oil industry is risk – probability * consequence, so nothing is absolute). I don’t see how growth predictions from old fields, or new off shore fields, or any conventional fields apply to LTO. They are completely different beasts. I don’t see how the available area within the bounds of all the dry holes that have been found in the Bakken can accommodate any more than 5000 wells, even with stacked plays, but lets say 10000 – that is 2 Gb given well EUR seems to be falling with time, with 1.4 Gb already produced, 0.7 to come from already developed wells – that gives 4.1 Gb. I think that agrees fairly well with IEA and Total forward projections.

I don’t think oil price will stay low forever, but I also don’t things will respond as you think to high prices, just as low prices didn’t kill production (in fact it made companies accelerate production from developed reserves) I think high prices might have a non obvious response (e.g. lenders insist on being paid back first – don’t take that as a prediction by the way, just an example). But like Doug, I freely admit I have no idea. But one thing I do know, and this has not got enough attention anywhere, we are discovering absolutely F*CK ALL at the moment and that has never happened in the history of oil.

I think there is a significant risk in the next five years that oil supply will collapse at the same time as the propped up world financial system finally falls over and climate change induced crop failures all combine to just about wipe civilization in the course of a few years. Happy clappy estimates of fairy dust oil reserves just make that so much more likely. I’m quite happy to sacrifice next years cruise if it means the risk of the catastrophe case gets mitigated.

Hi George,

I don’t expect the reserves to grow, but I do expect there are likely to be some probable reserves that get produced.

So you believe there will only be 5000 more wells at most drilled in the ND Bakken/TF, for a total of 15,000 wells. That would amount to about 4.5 Gb URR. I expect at least 35,000 total wells will be drilled in the Bakken/TF, but it will require higher prices. If 1800 new wells per year were drilled at high price levels and 35,000 total wells are drilled (similar to the projection in Drilling Deeper) we could see 14 more years of drilling (from 2018-2031) with 8 to 9 Gb URR.

How do you reconcile the proved reserves in North Dakota with your estimate?

Proved reserves plus cumulative production at the end of 2014 was 6.7 Gb for the ND Bakken/TF.

I guess you are assuming probable reserves are zero (or less), which does not seem a reasonable assumption.

North Dakota proved reserves at link below, 2007 proved reserves were 482 MMb. (I assume most of these reserves are non-Bakken and that the non-Bakken reserves have not increased since 2007).

http://www.eia.gov/dnav/pet/pet_crd_pres_dcu_SND_a.htm