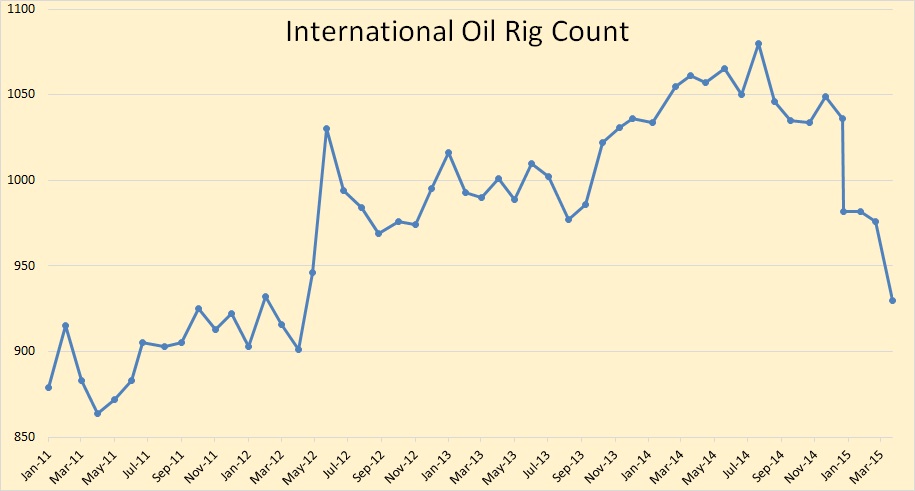

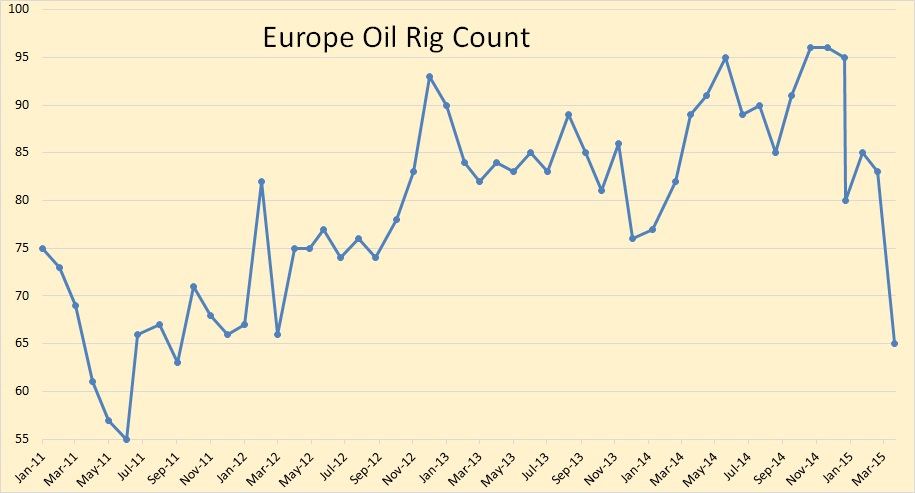

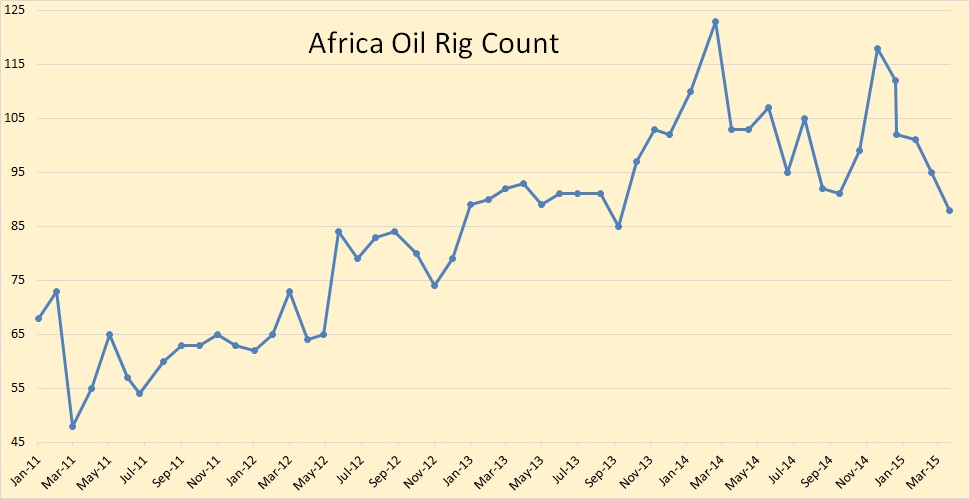

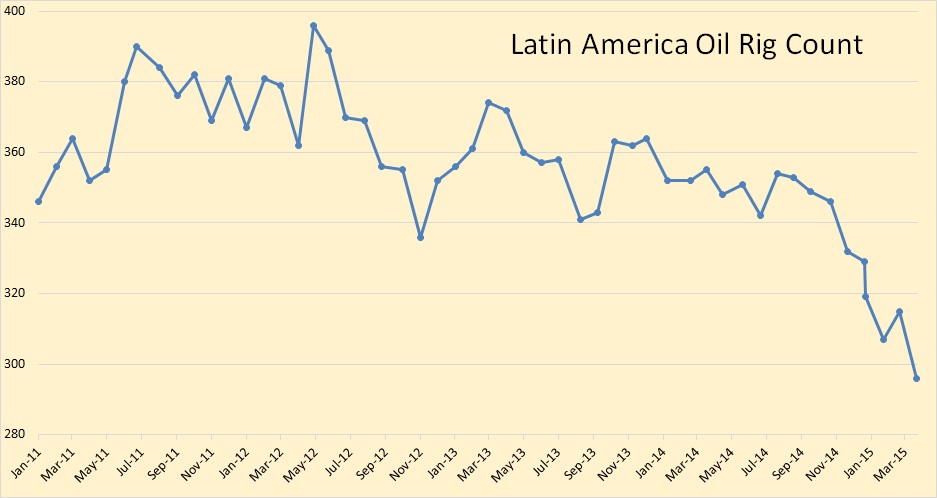

All rig count data is provided by Baker Hughes. All monthly charts are oil rigs only. Gas rigs are not included in the count. The last data point for all monthly charts is April 2015.

When I talk about “peaks” in this post I am only speaking of the peak since 2011 and am not suggesting that there were not higher peaks in previous years.

The International Rig Count has fallen by 150 rigs, from 1,080 in July 2014 to 930 in April 2015. This count does not include the USA, Canada or any of the FSU countries.

The European Oil Rig Count dropped from 96 in October and November to 65 in April.

The African Rig count peaked at 123 in February and dropped to 88 in April.

The Asia Pacific rig count stood at 211 in January 2011 and now stood at 164 in March and April.

The Latin America oil rig count stood at 396 in May of 2012 and has since dropped 100 rigs to 296 in April.

The Middle East oil rig count rose from 179 in January 2011 to 349 in July of 2014 and stood at 317 in April.

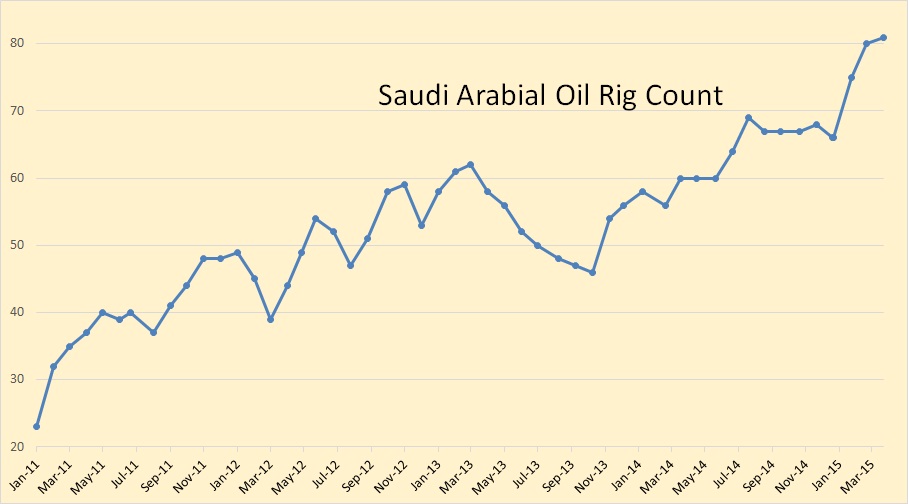

The Saudi Arabia oil rig count has been bucking the trend. They have been increasing rigs while everyone most everyone else has been cutting rigs. Saudi oil rigs have increased from 23 in January 2011 to 81 in April 2015. Saudi is doing everything it can to ramp up production.

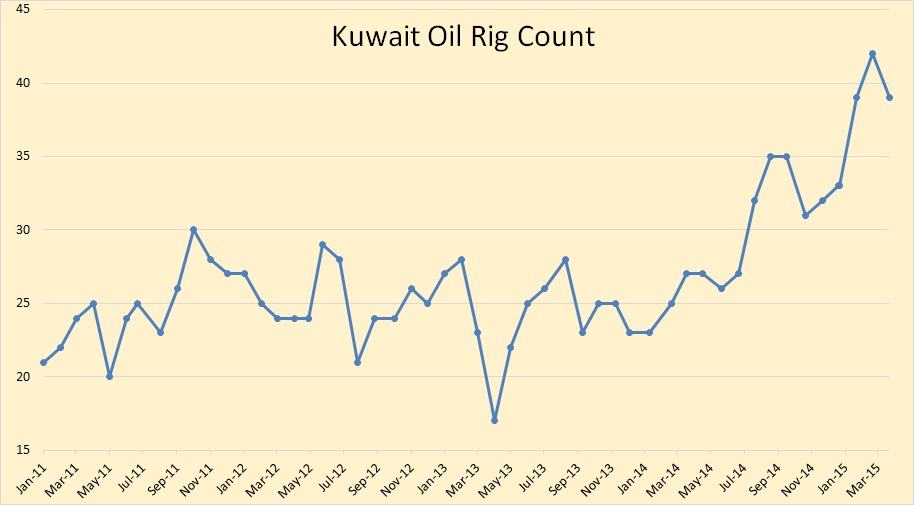

Kuwait has also been trying to increase production lately and have increased their rig count, though it fell by 3 from March to April.

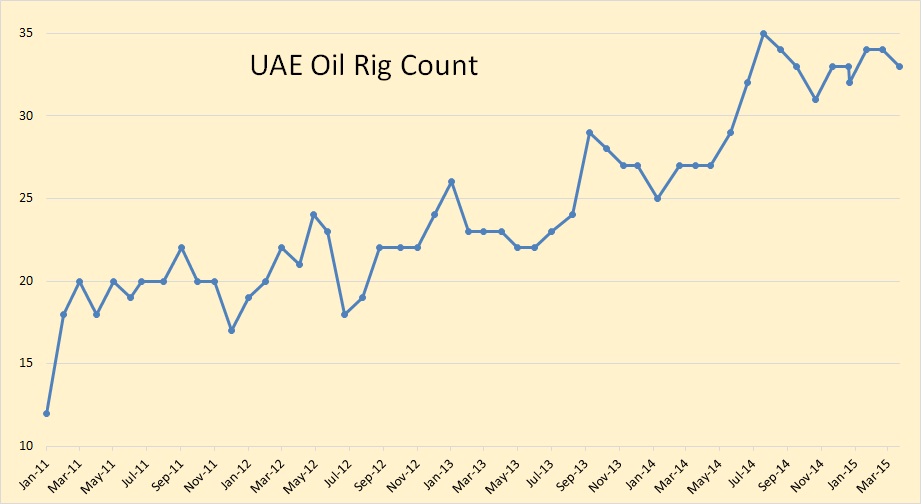

The UAE, like Saudi And Kuwait, have been increasing their rig count as of late.

Iraqi oil rig count has fallen from 96 in June to 53 in April. That’s quite a drop. I don’t understand that zero rig count until June of 2012 but that’s just what Baker Hughes is Reporting.

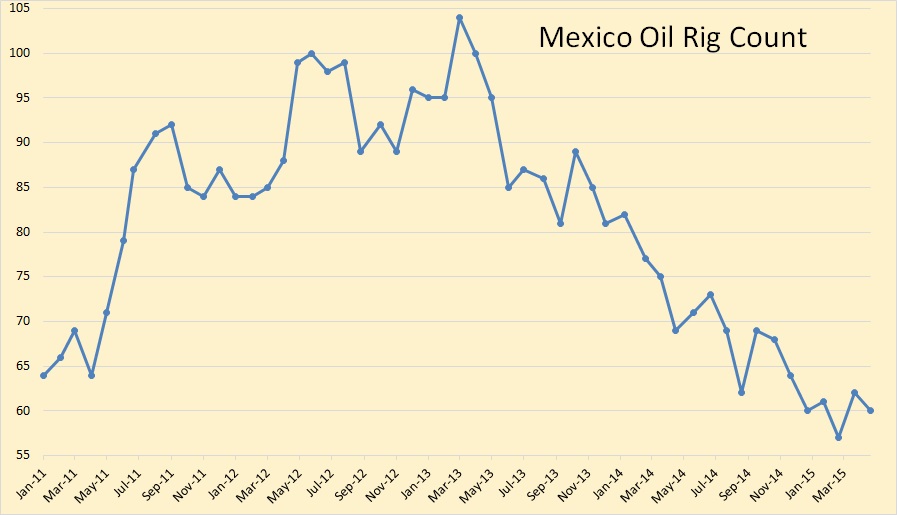

Mexico’s oil rig count began to erode long before the price collapse. The recent peak was 104 in march of 2013 but stood at 60 in April.

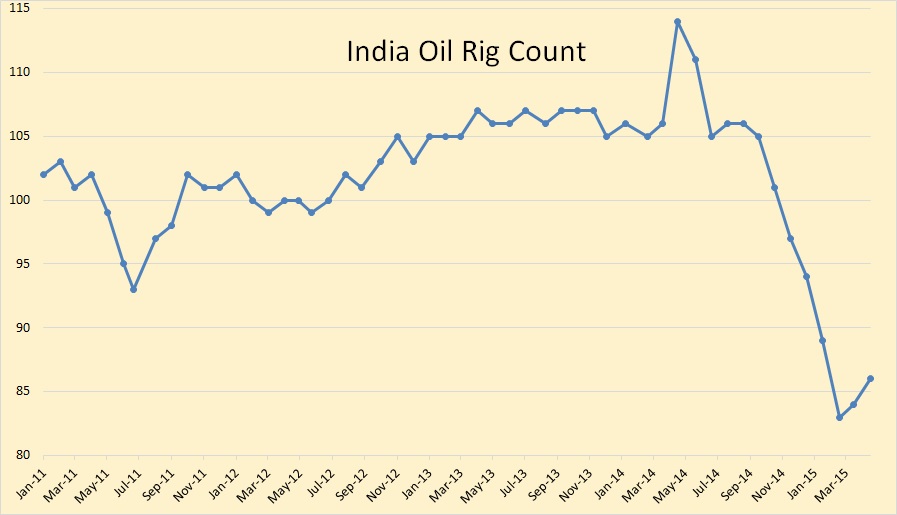

India has a strange profile. Hitting 114 last April but dropping to 86 in April.

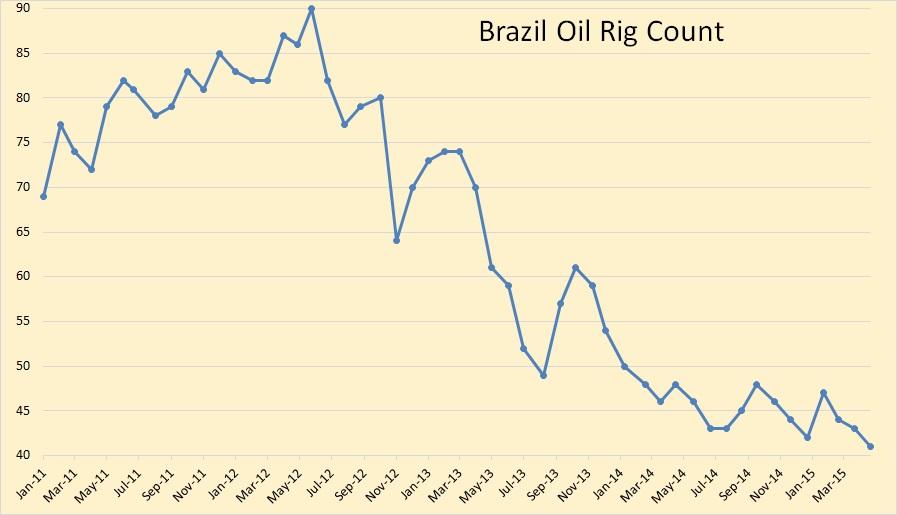

Brazil’s oil rig count has dropped considerably, from 90 in June of 202 to 41 in April.

There were far too many graphs of rig counts to post, but I wanted to post the most interesting to give you some idea of what is happening. One question bound to be asked is why does it take so many more rigs in North America than it does in the rest of the world. That would be a good question to discuss in the comments. I won’t attempt to answer it right now.

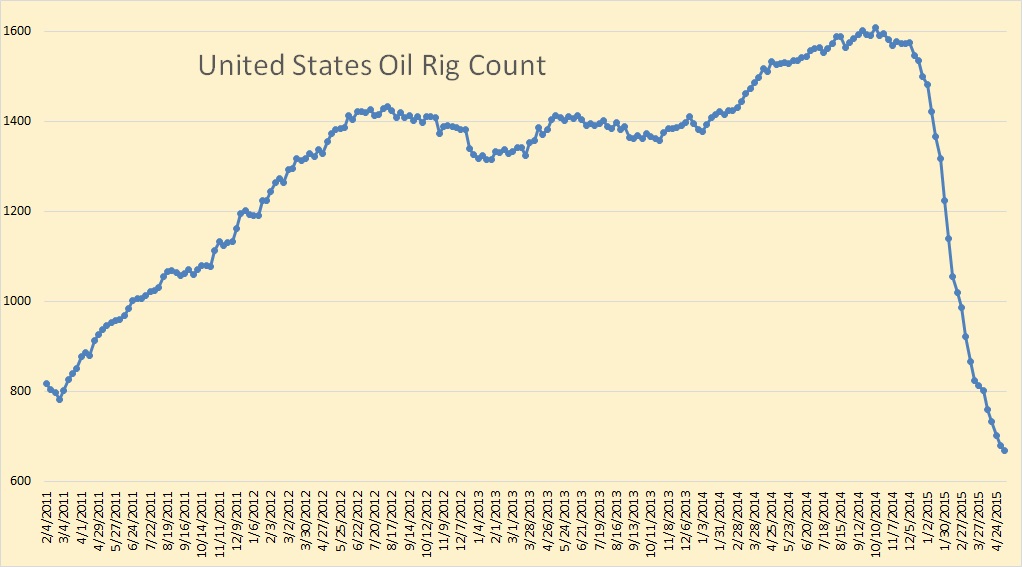

This is the USA weekly oil rig chart. The peak was 1609 the week of October 10, but we were still at 1575 the week of December 5th then dropped to 1546 the week of December 12th. The last data point is the week ending May 8th.

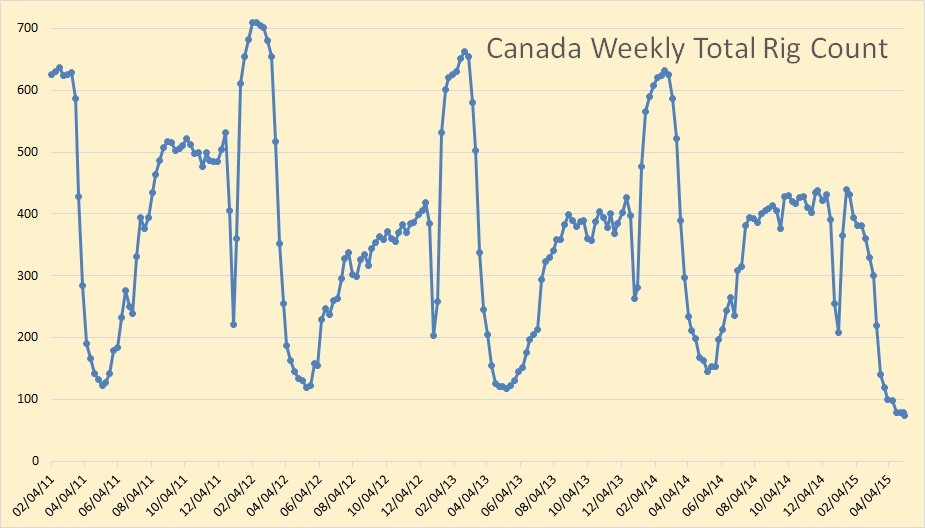

But I would like to post the weekly rig count from Canada. The weekly count gives us one detail that the monthly count did not show, the spike downward at the very end of every year. I hope some Canadian can give us the reason for this phenomenon.

The above is the Canada’s total rig count, which differs from the oil only rig counts above.

Canada exhibits a strange annual rig pattern. The rig count normally bottoms out the first or second week of May at around 120 rigs, though it was 145 in 2014. Then it heads up and reaches a plateau around August. It remains on this plateau until near the end of December. Then it spikes down at the end of the year. Then it heads back up and peaks in February. Then it goes back down and bottoms out again in May. Except this year, when it started up at the first of the year it did got only about half way up before the oil price collapse knocked it back down again. This year that huge first quarter hump is completely missing and now sits at 75, or 70 rigs lower than it was at this point last year.

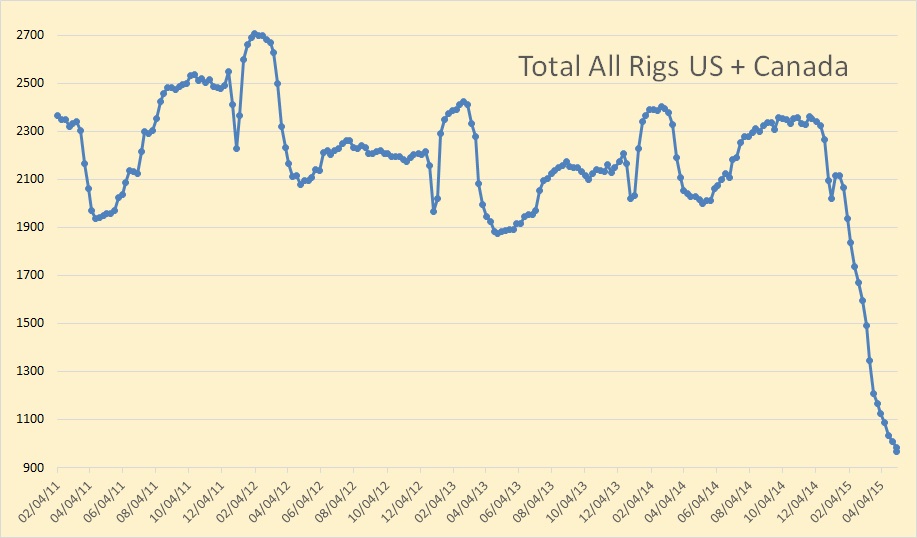

This is the combined total of all rigs, gas and oil, from the US and Canada since February 2011 to the present. The high for this period was 2707 in February of 2012 and now stands at 989, a drop 63% since that point.

_____________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

Check back to the tail end of the last post for useful discussion of the value of the new Tesla battery. I am putting a link there with discussion of it.

Mac, I wrote a critique, it’s under your link.

O-F-Mac – (and anyone else) you can link to a comment by right-clicking –> “Copy Link” on the date/time stamp under the poster’s name, then one can paste that link, like the one immediately below (to your comment…).

http://peakoilbarrel.com/reserve-growth-in-west-siberian-oil-fields/comment-page-1/#comment-516088

Fernando – you’re (usually) a smart guy, think a little bit.

For $3,500 one gets a battery pack that is warranted for 10 kWh for 10 years at _weekly_ cycle,

For $3,000 one gets a battery pack that is warranted for 7 kWh for 10 years at _daily_ cycle.

7/10 = .7 3000/3500 = .86 520 cycles / 3652 cycles = .14

About the same cost/capacity, just disparity in cycles.

Both have the same POWER RATINGS/WEIGHT/temp rating/dimensions/etc.

Both can be ganged up to 9 units (bonus quiz, why 9? (see below))

DUDE – it’s (essentially, if not exactly) the SAME BATTERY!

They just manage/warrant it differently. The decline in capacity per cycle is finessed with software in their charge controller/BMS (Battery Management System) (inside the powerwall).

Both are probably around 12 kWh batteries under the covers (same weight!), with a good BMS – something Tesla has a lot of experience with.

http://rameznaam.com/2015/04/30/tesla-powerwall-battery-economics-almost-there/

They may put “lower capacity” cells in the 7 kWh unit (analogous to slower chips in slower computers), or not, depending on their cell yield/variance.

Back in the day when one could look at a chip on a computer circuit board and say something like “that’s the lower nibble of the 3rd byte of the ALU”, it was not uncommon for processors to be identical, but sold at different speed ratings. Need more power? Send in a big check and some service guy would come out and replace a clock or sometimes just cut a jumper or reprogram some microcode, and voila – twice the speed.

Plus ça change, plus c’est le meme chose.

Then, electronics had gotten so cheap, one could afford to “hide” “excess power”.

Now, batteries have now gotten so cheap, Tesla can afford to “hide” “excess” capacity.

Computers used to require a full-time operator, and systems analysts to interface for users.

Now you’ve got a computer inside your cell phone that’s more powerful than the ones the US went to the moon with, and you use icons and gestures and maybe voice to interface to it.

Batteries used to need dedicated rooms and technicians with hygrometers and electrical meters making the rounds.

Now they’re sealed, and a BMS hides the individual cells from the user.

And Elon comes along and offers them in designer colors (just like computers or their covers now!).

Announcement event video at:

http://www.teslamotors.com/powerwall

re: why 9?

you can gang these with 3 phase inverters (as well as single phase/split phase), so you want multiples of 3 (or 1 or 2). If you want more storage, they do that too – like the ones they powered the announcement event with.

BTW your properly discounted analysis needs to include the increasing cost of fossil fuels, with cases for various carbon taxes and cost of disruption due to lack of fuel, grid outages, etc.

Decline in capacity is already handled/hidden by the BMS – triumph of software, electronics and the learning curve.

Sunny: the method I suggested to Mac is plain vanilla, to fix the problems I saw in the analysis he linked. Such an analysis doesn’t use fossil fuel costs, it uses the peak versus off peak rates charged by the power utility. Those rates are impacted by too many factors for me to consider making a ten year forecast.

If you wish me to give you a better analysis load a text file with two columns, time and kW for a typical residential customer. I propose to run a 10 % discount for those using financing, a 7 % for those who forego stock investments, and 4 % for those who invest in CDs and bonds.

The round trip loss will be 10%, and I’ll b extremely generous and assume the capacity doesn’t degrade. The house won’t be used at all 21 days per year, and I’ll assume there’s no extra insurance costs. Maintenance will be $50 per year. Fair enough?

Of course this analysis was written by a layman rather than an engineer and Fernando as usual has a hard nosed engineers dollars and cents way of looking at an investment.

I am still waiting for him to admit IN SO MANY WORDS that the world will eventually have to run on either renewables or nukes.

Now his argument about a house not being used twenty plus days a year in California will not hold water. Noboby in California who can afford one of these systems is going to turn off anything except the tv when he leaves home. He MIGHT turn the thermostat up or down. Most such folks will even put their lights on a timer to fool potential burglars into thinking somebody might be home.

There are certainly opportunity costs and lost energy in the round trip but I strongly suspect that almost any Californian who buys one of these batteries will manage to use it to the max allowed by the software just about every day. Coming home to a nice cool house at five thirty is the ticket. The people that buy them are not going to be skimping on electricity like misers. The typical customer will probably be using well over the average monthly number of kilowatt hours.

The question boils down to this. If the owner finances the battery and installation at say six percent will he lose or save money?

I don’t pretend to know.I just posted the link with enough commentary to let other forum members know what it claims without having to read it.

Plus there are probably going to be some tax incentives involved for most customers. I have extremely mixed feelings about tax breaks for rich or well to do consumers.

Personally I do not buy the argument that folks who own pv are freeloading on the folks who are not – if the rate structure is properly set. Net metering can allow a utility to cut back on present day and future expenses in peaking capacity and upgrading transmission lines.

Mac: In this particular case I’m only trying to perform a customer protection service. If I find the power consumption curve I’ll give you my result. But I can confirm the analysis you linked is flawed.

Here´s the analysis result: The 7 KWH Powerwall yields negative value for a customer served by Southern California Edison.

Here´s an overview of what I did:

I checked the Southern California rates, as issued by Megan Scott-Kakures here

https://www.sce.com/NR/sc3/tm2/pdf/CE220.pdf

This is a California Public Commission form, I used the sheet 2 rates for generation, because the other rates are held constant. If you look carefully at the sheet 2 you will see the important figures are the Level I and Level II rates for winter and summer for peak and regular hours.

They have an OPTIONAL program, under which a customer can offer to have a two tier rate plan, with a much higher price during peak hours, which are defined as 12 noon to 6 PM on weekdays. They don´t offer a definition of winter season, so I assumed half the year is “winter” and half is “summer”.

I can´t find the level I KWH. When consumption exceeds level I, the rate goes up slightly. However, the difference between the two is less than 2 cents per kwh, so I assume the hypothetical customer uses the average of the two levels.

Here are the actual differences listed in the rate sheet

Here is a table showing the Present Value Results for three discount rates.

And here is the present value evolution, shown in a graph. The problem is simply that the cash flow generated by arbitrage of the peak rate to normal rate just doesn´t pay for the battery investment.

This is a safe conclusion, otherwise we would see large industrial players buying industrial scale battery systems.

Lesson learned: We see a lot of flawed analysis printed in the media or discussed in the internet. A careful analytical approach should be used before getting scammed by investments like this.

Ok, thanks Fernando for the analysis.

Now one more question.

You are handy at math whereas I haven’t done any serious math for close onto fifty years and have forgotten what math beyond arithmetic that I once knew.

Assuming the same rates and discounts etc, how what would be the break-even price for the customer for such a battery?

What is the most he could pay for the turnkey installation without losing money?

Mac, if you look art the graph, the fully installed cost would have to be about $3000 if the differential between peak and normal increases at 5 % per year. The graph shows a negative value at the end of the analysis = $4000 for the 7 % discount (red) curve. To avoid going underwater by that amount we have to make the negative $7000 climb to ~ $3000. A person who gets 10 % financing over 15 years would have to pay $2500 to break even.

A home equity line of credit in my area currently has interest rates of 3% or so, but the rate is variable. For a fixed rate line of credit it is about 4.25%, with a 15 year repayment period.

Hi Old Farmer Mac,

A problem with Fernando’s analysis may be the assumption that electricity rates will rise at the same level as inflation.

As peak fossil fuels hits, does that seem like a reasonable assumption? Let’s assume peak fossil fuels arrives in 2025 as Steve Mohr’s analysis suggests, I would submit that electricity rates for thermally generated power will rise by about 3% per year in real terms, if we assume inflation is 3%, that would be a 6% rise in electricity rates after 2025 (with gradually rising rates from 2015 to 2025 say by 0.333 % per year).

As far as I can tell Fernando assumed the various summer and winter peak and off peak rates were fixed at present levels for the next 14 years.

These types of “investments” are not done to make money. Early adopters of this technology will do it because they can afford to do what they think will be good for the planet.

Another thought is that as more solar power is installed, the price of backup grid power may rise as this will be best provided by spinning natural gas backup that can be ramped up and down quickly. This electricity could be quite expensive in the future as natural gas peaks and the “off peak rates” when the sun is not shining may be much higher than the way current rates are structured so that batteries become more valuable.

Dennis, I assumed variable RATE DiFFERENTIALS. The 4 % discount rate requires the peak to regular charge differential to increase at 14 % per year for almost 15 years to achieve the zero pv4. I must conclude the Powerwall is a senseless investment for a private home served by Southern California Edison.

Hi Fernando,

If we assume a $3000 home equity loan at 4.25% interest and we discount the loan payments at a 5% real discount rate (assuming an investment in the stock market will yield a real rate of return of 5%), then if the regular rate is the average of the winter and summer rates, if that rate rises by 5% per year in real terms, then the power wall breaks even.

I was wrong, Fernando has the differential between peak and off peak rising at 5% per year. I would think the differential might narrow over time as more solar is installed, the peak demand for fossil generation will decline and the demand for off peak fossil power for back up would increase and we would expect the differential to narrow rather than increase. However I would also expect fossil generation to increase in price as fossil fuel depletes.

My expectation is for both peak and off peak rates to rise with the differential between peak and off peak narrowing. So off peak rising by 6 % per year and peak by 4% per year due to more solar power being installed.

Dennis, the battery system is sold as an arbitrage device. The article Mac linked mentioned the ALL INCLUSIVE installation cost is $7000.

The price increase in electricity has no impact, what enhances the battery’s economic return is the DIFFERENTIAL. And even when I assumed absurd escalators for the differential (on top of 3 % inflation), the battery fails to pay out.

I decided to look at this particular case because it gives me the investment cost to make power storage break even, just to arbitrage the daily peak.

It looks like it takes about $2800 to $3500 per 7kwh equivalent. $400 to $500 per kWh.

The trick for California seems to be to use a long lived storage device (not a battery system). I haven’t looked at it in detail, but it seems that linking up a pumped storage catchment pond to an existing dam and rigging up solar and wind to drive the water pumps may be the better solution. Unfortunately the California regime seems to lack working brains. Therefore they specified pumped power storage couldn’t be bid for state projects.

They also lack water. So they need to use gravel or sand as their potential energy storage device. If they have abandoned mines, that would work for water since the evaporation rate would be low.

Of course, since California is high tech, they could be the first to implement large scale molten metal batteries for storage. Nice to see if they can be made to work at scale.

Hi Fernando,

I missed the $7000 as I didn’t read the article Mac linked to, I also forgot the 10% losses, so I would have to try again.

I agree that the energy arbitrage use is unlikely to work for very long. In fact if many people did this, it would tend to reduce the price differentials by increasing off peak demand and decreasing peak demand, more installation of PV would have a similar effect, tending to smoothe the differential between peak and off peak demand from fossil fuel generation due to the day night cycle.

What will not change is that the general price level of fossil fuel generation will tend to rise as fossil fuels deplete.

The only way this does not occur is if there is so much power supply from wind, solar, hydro, geothermal, and nuclear power, that the prices of fossil fuels falls due to a lack of demand.

Even I am not that optimistic, though Nick G thinks in these terms. There is a possibility that we might get there by 2075 if all the stars align. We will need peace to guide the planets and love to steer the stars 🙂

Dennis,

Declining prices for coal, especially, is exactly what’s assumed by the Peak Coal analyses that you’ve been looking at.

The world has *enormous* supplies of coal. The reason that production, and economic reserves, have been falling is that there have been cheaper alternatives. Resources that were reserves are being abandoned in places like the US, UK and Germany.

See http://energyfaq.blogspot.com/2008/06/are-we-running-out-of-coal.html

and

http://energyfaq.blogspot.com/2009/02/are-we-running-out-of-coal-part-2.html

Marble, here’s a link about California hydropower.

http://www.energyalmanac.ca.gov/renewables/hydro/

the battery system is sold as an arbitrage device. The article Mac linked mentioned the ALL INCLUSIVE installation cost is $7000.

Well, let’s say it one more time: No. It’s not sold as an arbitrage device for the US. The $7k cost is for the 10kWh backup system, not the 7kWh daily load shifting system.

The load-shifting systems are being sold without inverters because their primary residential use is as an adjunct to an existing solar system, which already has an inverter.

Neither solar PV nor the load-shifting system can be cost justified based *purely* on US grid prices (in most of the US). Fortunately, most people are more foresighted than that.

Electricity rates may fall as more solar and wind power comes on line. Especially during the day when solar will provide most of the powr, which would make having some storage capability nice for the evening and nighttime, storing almost free electricity.

What makes the installation of Tesla batteries so expensive, sounds odd to me?

It looks like the average differential is about 15 cents. Is that about right?

Again, what about residual value at the end of 10 years? The battery is likely to have 80% capacity remaining: if you have 1-5, you can just add one and bring the whole thing up to capacity.

Nick, the economic evaluation assumes the battery life is 15 years (it doesn’t get used on weekends or vacations). The negative value exceeds the initial price, therefore the investment doesn’t make sense unless the differentials increase at incredible rates. If any of you want to defend this particular technology you have to find a logic to support higher differentials.

I didn’t get into the really nitty gritty details, but I do want to remind you this is only an analysis for peak to regular arbitrage. Other ahalyses can be prepared for other uses. For example, I think I can game the system to exploit loopholes in the California public utility commission rules. But once every Tom Dick and Jane starts gaming the PUC will catch on and change the rules. They tend to be brain dead, but I don’t think they are that stupid.

I agree – when it comes right down to it, the original article was silly, as these rates are very likely to change soon. They have to: the pattern of consumption in CA has changed dramatically since these were created.

FWIW, I don’t see a firm basis for your counter-analysis: I don’t see any basis for: a 15 year life; a zero residual value; a $7k price (which was for a different use); or assuming only a single unit. It’s also not clear what differential was used here.

otherwise we would see large industrial players buying industrial scale battery systems

Isn’t that pretty much what we ARE seeing?

The product was just launched 9 days ago, and they’ve already sold out until the summer of 2016, with most of the customers being businesses.

http://www.techtimes.com/articles/51311/20150508/want-a-tesla-powerwall-its-sold-out-until-mid-2016.htm

Yes John, they may live in areas other than the ones served by Southern California Edison with extreme peak power surcharges.

Or maybe they lack the ability to do the analysis, or are being deceived by the plethora of pompous printed propaganda prepared for prospective victims.

Hi Fernando,

Yes most businesses do not know how to do a discounted cash flow (DCF) analysis and need your protection.

Many businesses need backup power, so the competition is other types of battery back up systems. In many urban applications backup power using a fossil fueled generator is not a viable option.

No doubt the powerwall is competitive with other battery backup systems. If not, few would purchase them.

Dennis: the discussion was about the article linked by Mac, which referred to a residential use for arbitrage of peak vs off peak.

A business may wish to buy the battery to show off its green credentials. For example, one of those restaurants serving funky salads to Beverly Hills millionaires. They could have Christos wrap it in colorful biodegradable plastic sheets.

A restaurant is going to be in deep trouble if a power outage happens in the middle of the night and thaws out all their food.

A UPS can be very cheap protection.

Yes. if the California grid sees more renewables and goes unstable a restaurant should comsider a kit with a small gasoline powered generator backup. It’s cheaper.

Generators are noisy, smelly, dangerous, and require on-site operation and substantial maintenance. They’re not appropriate as a UPS.

In many countries the grid only operates for limited hours during the day: a PV/battery system will be better in every way.

And, given that renewables are domestic, they have a significant edge over imported fossil fuels in reliability (security of supply).

Whoa! You’ve got a way to get a *guaranteed, risk-free* 7% return on stocks, and 4% on bonds/CDs??

Who’s your broker? Email me their phone number!

10% financing cost? A lot of people are looking for investment ROI of 2% for their cash…

Finally, what about residual value at the end of 10 years? The battery is likely to have 80% capacity remaining: if you have 1-5, you can just add one and bring the whole thing up to capacity.

actually, forget guaranteed and risk free. Show me 7% stocks and 4% bonds (and not including Greece). And I do know the history supports such rates, but for one stocks are elevated due to the low interest rates prevailing (source. Buffet). Two, in a world of declining resource growth, which I think everyone here more or less buys into, that 7% is going to be harder and harder to get. So is 6, 5,4,3….

The 4 % to 10 % is intended to cover prospective battery purchasers who may range from a debt free investor to a person who holds debt at 10 %.

4 % is a fairly conservative figure for an investor with a diversified portfolio, when inflation is 3% (assumed in the analysis). If you can’t get 4 % then you should change investment advisors. I get that in dividends from plain vanilla hospital and retired folk stocks, real estate trusts, mixed bond funds, farmaceutical stocks, etc. it’s below the historical return for stock investors. But hey, if you want to buy the battery suit yourself. It’s intended for people like you.

4 % is a fairly conservative

No. The investments you’re discussing have risk – they can go down in a recession. As a general thing (as opposed to this California analysis, which is a bit of a red herring), investments in domestic cost reduction are risk free – that’s very different from the investments you’re discussing.

inflation is 3%

Not in most of Europe, and not in the US. Inflation is below 2% – in some cases well below.

the battery..It’s intended for people like you.

No, it’s not. The 7kWh version isn’t being marketed for residential customers in the continental US. It’s for businesses, and residential customers outside the continential US: India, China, Hawaii, etc.

Thats’ why this whole discussion is a red herring: some US customers will save some money in addition to the Uninterruptible Power Supply function, but that’s not the primary market.

I assumed inflation would be 3 %. When inflation runs 3 %, a 4 % return is considered conservative. If you don’t like it, give me what you want me to use. If your numbers are close to rational I’ll plug them in my spreadsheet and give you an answer.

US 10 year Treasuries are about 2.2% right now. They have some risk, of course, as rising rates could lower prices. 3% would be conservativley high as a general rule, especially given the large non-cash benefits of a whole-house UPS.

You also need to assume 2-3 units, which would reduce unit costs: most people are ordering multiple units.

And, include a residual value: these will only lose about 20% of capacity.

Of course, keep in mind that in the end this is all unrealistic: the original article is just speculating, as these units aren’t being marketed for this purpose in the US.

Recall the analysis I am doing is constrained to the case used in the article linked by Mac. I read the article and I volunteered to reanalyze the economics using what I felt was a sounder method.

Economies of scale may be possible, but I´m not sure installing three battery packs will drop the price enough to make it worthwhile.

I also confirmed the $7000 installed/unit cost via a different source, which said this was the actual offer being made by a company allied with Tesla.

I consider these batteries to be a dead, end, but since Mac was interested I decided to read whatever came up on the subject, and I found articles which seemed to have very similar content, mentioned the economics were poor, but then went on to discuss what a nice technology it was, etc. Seems to me there´s a tendency for some publications to write pleasantries about the Tesla products, but the authors understand the economics don´t work for a residential customer.

I ran the economics at 3 % inflation and 3 % interest rate, and the results are similar, the loss is reduced by about $200. But the overall loss is still very high, $2000 to $3000.

As an engineer who dabbles a bit in electronics (for the little high school projects I mentor here), I don´t see this technology to have much of a future, except for houses in remote areas equipped with solar panels, like somewhere in South Western Argentina, where the solar panels and a small wind turbine should do fine to supply fishing camps and remote cabins (the problem I see with such remote installations is theft, this is a pretty expensive kit).

If you want to spend time on this, and have others spend time reading it, you may as well read real feedback and use realistic assumptions(le.g., a realistic life; realistic scale of number of units, realistic operating conditions,etc) and show your calculations.

I don’t see much point in your just repeating unrealistic assertions.

The cell level BMS is internal to each cell. cell All 8000+ 18650 cells in the P85 PAK are protected and have the Sieko chip and switch. If the “18650” Battery is Protected it is actually measures 19×68 mm and will not allow over or under charge. You can never bring back to life a Li cell below 2 volts or so.

“Declaration of Religious Leaders, Political Leaders, Business Leaders, Scientists and Development Practitioners“

Unless any cost analysis includes the cost to the future, it is a crime against humanity and the biosphere.

On the Chevy volt, GM restricts the useable charge range from 25% to 80% to maximise battery life. In other words, battery charge is not allowed to go higher than 80% of full charge or lower than 25%. Only the middle 55% of the battery capacity is used.

Does anyone know what the useable battery charge range is on a Tesla car and power wall? Is there a more standard/wider range built into laptop computer batteries thru a BMS? How sensitive is the useable charge range to the duty cycle?

I think the duty cycle on a car battery would be much more severe than on a computer battery

The analysis I prepared didn’t consider this detail. But since the use of the Tesla Powerwall to arbitrage (peak to off peak electricity charges) is such a turkey, we don’t really have to focus on the nitty gritty. It would be like beating a corpse.

My question was not intended for the analysis. It was more of question of “Is Tesla pushing the useable battery charge range to get his 500 mile car range, and in the process sacrificing battery life. In other words, will a Tesla owner find out that he needs a new battery, at a huge cost, 5 years from now.

Considering the wealth of the people who are buying the Tesla, replacement cost may not be an issue.

That’s right. Tesla products are luxury goods, intended for rich folk with money to burn. I remember the time I went nuts and spent $100 on a leather belt (around 1990, I think). The feeling of power lasted 30 minutes. So I imagine a Tesla buyer must be doing it to get a 30 week rush. After that, it’s just a piece of metal full of lithium batteries.

Tesla products are luxury goods, intended for rich folk with money to burn

No. Not in the long run. Tesla’s EV business plan is built around developing economies of scale, to make EVs cheaper at every price point, including the very cheapest (e.g., the GM Spark and Nissan Leaf, the very cheapest cars on the road to buy and own). This battery pack accelerates that process.

Think of the tens of millions of business owners and homeowners in India, China, Pakistan, Iraq, Afghanistan etc., who use their generators for 1-20 hours per day, paying 30 cents or more per kWh. They can buy a solar system that provides power for about 15 cents per hour for direct power about 8 hours a day, and use the Tesla battery as a substitute for *most* of the rest of the diesel generation: much quieter, much more reliable, and a bit cheaper at about 25-30 cents for the timeshifted power (15 cents for the PV, 10-15 cents for the amortized cost of the battery per charge-discharge cycle). Really, a no-brainer.

I think those poor country homeowners will do better if they have access to cheaper electricity delivered at industrial scale using a high efficiency coal plant, nuclear, gas turbines, and hydropower, and other renewables to serve as extenders.

I realize you have a very quaint idea about little villages in third world countries, but most of the population is urban, and their economies require something better than a Tesla battery. This conversation is getting a bit boring, you really need to read a bit about energy problems in the third world, disconnect your thinking from an individual solution used by a rich person, and remember the key target is an urban population living in a crowded city, with poor sewage, bad air, and more crime than you are used to.

those poor country homeowners will do better if they have access to cheaper electricity delivered at industrial scale using a high efficiency coal plant…

In theory that might work in the very, very long run, assuming the world doesn’t get serious about climate change.

In reality, people living in Karachi won’t have that any time soon.

quaint idea about little villages in third world countries

No, I’m thinking of Karachi, Mumbai, Kabul, etc. Power there is expensive and/or unreliable.

This conversation is getting a bit boring

Yes, it is. It’s not surprising: you seem to be having it with yourself, as you’re not incorporating my feedback.

an individual solution used by a rich person, and remember the key target is an urban population living in a crowded city

There are many 10’s of millions of people around the world who live in compounds with high walls, and run generators for hours every day to deal with their unreliable grid.

There are millions who live in areas where the power is very, very expensive because it’s generated from oil.

There are millions of businesses who use UPS units to safeguard their operations.

There are many large and small utilities who are using or planning to use batteries to deal with various operational challenges.

Hi Ovi,

The Tesla range in normal use is about 300 miles. If anyone is getting 500 miles they are “hypermiling” which is driving very conservatively at slow speeds (probably 30 to 40 miles per hour).

In a Prius I have managed about 85 miles per gallon (US gallon) on a tank of gas doing this, where my typical mileage is about 50 miles per gallon. So about a 70% improvement by hypermiling.

Almost nobody drives like this in the real world.

Dennis I got the units wrong. I once saw 500 in an article and assumed it was miles. Looking into it more closely today, it is 500 km (close to 310 miles) on the New European Drive cycle vs 265 miles on the EPA cycle. The European drive cycles are not as severe as the US EPA cycles.

On the EPA drive cycle, the Tesla model S is rated with a range 265 miles when equipped with an 85 kwh battery. The new 2016 Chevy Volt is rated with a 50 mile range with an 18.1 kwh battery. Allowing for differences in aerodynamic drag and weight between the two, the numbers for range scale reasonably well, i.e. 85/18.1*50=235. This tells me that the Tesla battery is also designed for long life and both use between 50% and 55% of the full battery charge

I just never thought to dig out the above numbers before I posed the question.

A discussion of load shifting in the US is a red herring: the 7kWh version isn’t being marketed for residential customers in the continental US. It’s for businesses, and residential customers outside the continential US: India, China, Hawaii, etc. Some US customers will save some money in addition to the Uninterruptible Power Supply function, but that’s not the primary market.

You can do this for far less with lead acid. I’m surprised this have been given so much attention here. It’s just a gimmick. Society has an idiot vein thick and wide, clever people like Musk tap into that vein to enrich themselves.

You can, but it’s far more expensive.

Lead-acid is very useful when the duty cycle is undemanding and you want to minimize capital expenditures. If you’re going to use a lot of deep charge-discharge cycles, it won’t work.

The Tesla power wall weighs 100kg and contains 10kWh of power. Approximately the same amount is contained in 1kg of gasoline. Peak oil is so incredible important because no battery to date even comes close to the energy density contained in oil derived fuels.

“There is nothing special about the Tesla technology, lagging the competition in various aspects, but the hype is a case study in itself. Almost at the same time Toshiba firmed one more contract with its own stationary Lithium ion technology, that is supposed to last 6 to 7 times longer that Tesla’s. To that the media remained widely silent, while on Tesla they went wild. Forbes started by claiming a manufacturing cost of 0.02 $/kWh, meaning it would be essentially free. It then switched discourse to claim that figure was relative to operational costs – but even in that case it still remains ridiculously low.

Once again the media appears little interested in informing the public, it ignores relevant developments while promoting dubious products. As long as the hype lasts there is money to be made in stock markets; but at some point reality settles in. This same dynamics was in great measure responsible for the shale sub-prime bubble. “

Yes, and only 15% of that one gallon of gasoline becomes effective energy, the rest is waste heat, noise and pollution. While electricity is about 90 to 95% efficient. So really the battery has about 6 gallons of gasoline equivalent useful energy.

A good Honda generator is about 15% efficient in producing electric energy from gasoline. A car is about the same as far as energy to the wheels.

Weight is not much of a factor in a house and not a huge problem in wheeled vehicles.

It’s aircraft that have the big problem with energy density and weight.

I was talking 1kg of gasoline, not 1 gallon. Also, it is mostly fossil fuels that generate electricity, that is not 95% efficient. Weight certainly affects all transportation because it is the useful net load that counts. If you need a lot of energy to cart the batteries around, then there is less left for the actual load.

Ok, then 6 kg of gasoline would have to be burned to provide the electricity that can be stored in the battery. Since you want to talk about source power, the power can come from a rooftop. The efficiency is irrelevant since it’s not burned. It takes a continuous effort to produce gasoline at a huge pollution and land sacrifice (US oil and gas took over the area of Massachusetts and Rhode Island since 2000 ). With rooftop, it happens once, no land takeover and it provides power for 3 to 4 decades.

Unlike gasoline, which is getting worse as far as net energy and has a future footprint about 10 to 20 times it’s initial cost, PV and batteries are improving. PV is 3 times better than commonly available panels and I expect commonly commercial ones to become twice as good. Batteries will become twice as good. The rest of civilization could disappear and those PV panels would still keep making electricity. Can’t do that with gasoline or diesel.

As far as rolling energy goes, electric cars use 0.25 kwh/mile (EPA test figure) while gasoline ICE cars average out at 1.4 kwh/mile equivalent energy. Even the low performance high mpg cars use 0.7 kwh/mile. I expect when electrics reach full design capability (current technology) they will be below 0.2 kwh/mile. So apparently you don’t need a lot of energy to cart the batteries around and get high performance to boot.

Consider that the electric motor is far lighter than an ICE engine and cars can use lighter materials now, the difference in weight is fast disappearing. I won’t even get into the latest technology which cuts the battery size in half without losing range. Coming soon to a planet near you.

Thanks for all that, Zepp. I agree.

People usually don’t realize how rapidly a good new tech improves in its early days of development. I myself am so pleased with my leaf, esp its simplicity relative to the old familiar ICE I spent my life around, that I am sure EV’s are gonna take off like a booster rocket when people start to notice their capabilities.

If I had any energy left, which I don’t, I would take that tesla domestic battery and stick it into a really bare bones commuter car, which is all we ever use anymore. Running on PV, of course.

It would still be there for domestic boost if grid goes down, so no loss in using it to scoot around when not otherwise employed.

Much like the pioneering days across the American Continent, a few hardy adventurers explored the new regions. Soon more and more followed until a flood of people came.

I think that is the way it will be with electric car types, PV, wind, carbon-free houses and building. The mad rush is yet to come.

Yabut try burning that kg of gasoline more than once.

NAOM

NOAM may not have a whole lot to say recently but today he wins hands down on brevity and relevance. WELL SAID SIR!

So I finally get around to watching the 18 minute video of the launch and what I think has gone over the heads of far too many people is that, Musk must have spent at least half of his time on stage talking about his vision for a 100% renewable future. This is Hermann Scheer/Tony Seba kind of crazy talk! What is significant is that since he is now a celebrity of sorts, in the business/finance arena at least, I would imagine he is reaching a far larger audience than any of those other guys.

Also worthy of note is that, this is the first time I am aware of that any body has spoken of dismantling the status quo that actually has the chops to do anything about it. He not only has ideas about what needs to be done but he has somewhat workable ideas about how to do it and might I add, a lot of what he thinks needs to be done fits in with those of us who believe in a near term peak in global oil production and/or global warming!

And as far as financial viability goes, there are companies making expensive, deep cycle flooded lead acid batteries that need a lot of care and maintenance, if they are to last as long as they are designed to. These companies are in business because there is a market for their product no matter how uneconomical Fernando’s analysis says they are for Southern California. Tesla is just making that market bigger and in my neck of the woods , where electricity is generated by oil and the utility pays half of the retail rate for electricity consumers feed back to the grid, these batteries might just pencil out! I certainly like the idea of a small maintenance free battery with a ten year warranty!

Here’s an interesting article from may 2013, two years ago almost to the day, that I’ve just skimmed so far:

When Will Solar Batteries Become Economical?

Silicon Valley sees opportunity in disrupting traditional energy, utility, and transportation companies.

There’s a lot of money floating around there looking for the next big thing to transform and become involved with.

My analysis was for the Southern California market served by Edison. Jamaica should build two coal fired supercritical steam power plants to provide reliable service to the island. If you want to be green hitch solar collectors to the feed water, upstream of the boilers. Using diesel for such an island borders on economic insanity. By the time the coal plants are old something else will hopefully turn up.

With due respect Fernando, increasingly when I read a lot of what you write about renewables and solar PV, I hear Tony Seba’s voice in my head where at about 3 minutes 45 seconds into the video of his keynote to the Sept 19, 2014, AltCars Expo and Conference, he says:

“There’s something interesting about disruption. it’s usually the experts and the insiders who basically say, ‘Nah! Never gonna happen. Not in this lifetime. No way. Gonna take a hundred years. You know, good boy, go home. Right?'”

It is the same video I have linked to a few times before, in which he extrapolates cost and growth trends for PV and batteries to predict that solar PV will become the lowest cost source of new electricity generation within the next fifteen years. In other videos of his that I have watched, he has predicted that solar PV will generate electricity at cost that are below the cost of transmission of centrally generated electricity to distributed consumers! That is going to disrupt electricity generating and distribution markets in a very big way.

What you propose is basically a continuation of BAU. Note that Jamaica is not alone as an island in depending on oil (not diesel but Bunker C) to generate most of it’s electricity. AFAIK Hawaii and up to quite recently Puerto Rico and the Dominican Republic have/had similar oil use in the electricity generating sector. However if I were going to invest in a generating plant on any tropical island and saw Tony Seba’s video (or read his book), there is no way on earth I would invest in a plant that, I could not easily decommission and ship back out any time solar PV took over the market. Right now, in Jamaica, electricity from grid tied solar PV is less expensive than electricity from the grid and with each introduction of batteries that are less expensive and require less maintenance, like Tesla’s, the point at which a fossil fuels become uncompetitive seems a little bit closer. I can envision a point where solar PV generates electricity at a cost that is less than the cost of delivering fuel to islands. I believe that, unless something, like Peak Oil, comes along and interrupts the growth of solar PV, it will eventually produce electricity that is “too cheap to meter”.

What I think would be better for islands, especially those relatively close to large NG markets, is to use gas turbines. If such creatures exist I would opt for modular units preferably mounted in shipping containers and configurable as combined cycle plants. I would site them as close to shipping ports as possibly and try to use CNG as opposed to LNG to reduce the fixed infrastructure requirements. Finally, I would lease rather than buy, preferably for periods no longer then ten years with the option to renew every five years after the initial period. There is a precedent for this when in 1995 the local utility leased plant from a San Francisco based Kenetech Energy Systems.

Islandboy, in that case the solution may be for you to continue to burn diesel and take on IMF debt, and in 15 years you can install the technology Seba extrapolates using little dashed lines into the unknown future.

I´m really good at crunching numbers, when I started reading the blog I thought Ron, Dennis and the others were a bit obsessive but I think I´m like them, and I do enjoy running these cases in a spreadsheet. If you give me the expected end state, and how you get there by burning diesel, or what you think Jamaica can do now to install solar panels and batteries, I will run you the economics assuming you get a cheap World Bank loan. Given what I read, I think you are out of luck with the solar power game at this time, but I´m willing to show you the numbers.

Regarding Seba´s statement, it´s simple baloney. Ask Seba what he thinks happened to Moore´s Law when it ran into quantum effects. Solar power, with the technology used by Tesla, just doesn´t have the physics behind it to work at large scale. There´s a need for radical solutions which may involve using some sort of bacteria that sweats ethanol, a fusion power engine with a radical new design, better cheaper geothermal, and things like that. This electric battery just doesn´t meet the requirements.

If you continue to make silly assumptions, like that a 100% solar grid makes sense, or that batteries are an appropriate solution for seasonal lulls in solar/wind, then, yes, you’ll find that renewables won’t work.

Garbage in, garbage out.

Top Ten Facts about Tesla’s $350/kWh (DC) PowerWall battery

http://www.catalyticengineering.com/top-ten-facts-about-teslas-350kwh-powerwall-battery/

Tesla Powerwall & Powerblocks Per-kWh Lifetime Prices vs Aquion Energy, Eos Energy, & Imergy

May 9th, 2015 by Zachary Shahan

http://cleantechnica.com/2015/05/09/tesla-powerwall-powerblocks-per-kwh-lifetime-prices-vs-aquion-energy-eos-energy-imergy/

Ron,

The Canadian rig count does seem a real mystery, but I will throw in a few ideas, and maybe I can be corrected where I go wrong.

spring thaw shuts many rigs down due to weight restrictions, and most rigs are laid down and the boys have a traditional break. Many are laid off.

Summer, rigs go back to work and crew up with new employees.

It appears many rigs get the Christmas new year off. Lucky them.

I believe the February peak would come from any rig relying on ice roads. I know in Alaska, drilling in some regions is restricted to January to Mar/Apr, due to ice road construction. I suspect Canada would be the same? Not sure how many rigs would be normally be effected by this, but it looks like it could be a good deal.

Which brings us back to spring thaw again.

All I can say is, it would be a strange place to work?

That’s interesting what toolpush said about Canadian rig counts.

As for the sudden drop at the end of each year, here’s a wild guess. Maybe at that time drillers are moving a lot of rigs to areas with ice roads where they’ll be drilling January to March. If a lot of rigs are in transit during a particular time, that would show up as a drop in the number of active drilling rigs, right?

My guess is that the end of the year drop has something to do with Canadian taxes. After all, we don’t see such a corresponding end of the year drop anywhere else in the world.

Don’t know if it’s involved, but Suncor (the primary oil sands folks) tried to divest a substantial interest in Libya and failed. If rig count is down there, it may be in these Canada numbers.

Could the December drop in Canadian rig count actually be due to moving the rigs on newly opened ice roads to drill in those northern areas?

Mason,

It could be a possible reason, but if you look at this winters numbers, you see we still have the Christmas break without the Feb increase. If no peak in Feb, why the drop in Dec?

If Canadian oil production is depending on ice roads, how will it be affected by climate change thawing the ground? Like the germans when they invaded Russia?

Regarding the downward spikes, my guess with my background in industrial construction is they send the lads home for christmas and call in the welders for maintainance. Just a guess.

Regarding the downward spikes, my guess with my background in industrial construction is they send the lads home for christmas and call in the welders for maintainance. Just a guess.

Okay, but tell me why no one else in the world does this? Why do only Canadians send their crews home for Christmas and New Years while not giving the maintenance crews the same break?

If I were a Canadian I would be asking “What the hell is this all aboot?” 😉

I have no clue. But this is a signal. Whatever it is, its man made. They do this is by design.

It is common to send in maintanance and reconstruction crews when the staff is off. I’ve done work in alu melting plants and the cellolouse industry during vacations. Also christmas season is no-home-time in that branch. But I’ve never worked within the petroleum industry so I have no experience of that.

JW, it´s hard to generalize. I´ve worked on a rig in Xmas offshore West Africa. The only nod to the holiday was better food in the galley (they flew lobster for senior personnel, and I think the hands got grouper).

On the other hand, when I planned operations in Venezuela I always made sure we had an excuse to shut down from mid December to the day after the three wise men dropped off their presents in early January. This avoided heavy abseteeism, drunks, and industrial accidents. If a rig had to work we planned the crew shifts to make sure those who did have to work had a chance to see their families before or after the holidays, prepared better meals, gave them little presents, gave away food baskets, and also put on extra safety types to keep an eye on things, with the authority to shut down operations if they felt an accident was bound to happen.

About never sounds like ‘aboot’ when I pronounce about. It is only my American acquaintances who seem to hear ‘aboot’… perhaps their hearing is suspect. 🙂

Here is the first line from Alberta Transportation dated May 6

Road Ban List

Please Note:

When inquiring for current road ban information prior to the effective date shown on this list, please see the previous ban order. Changes From Previous List: (15 – ROAD – 09)

————————————————————————–

Effective 1:00 pm Wednesday, May 6, 2015:

50% Axle Weights Will be Placed On:

Highway Description:

686 Jct. 88 – Trout Lake

I work in the athabasca oil sands (sagd) and have worked further north by the alberta/ nwt border.

Terrain is the same (muskeg) and activity off high grade roads require ice roads. These become available first few weeks in january typically. End of december if we have an early freeze.

Even on paved roads though, usually secondary highways there will be weight restrictions in unfrozen conditions. This can be gotten around by trailers with more axles, but definately alot more hassle.

I dont have any involvement with anything rig or downhole related, but have seen a bit of a slowdown around christmas new years. Even road crews which seems silly because that is exactly when you are getting the roads in. There would be rigs in transit, but i dont know if that would affect the rigs that were working previous.

This

Thanks Danny,

It sounds like I was not too far off the mark. It does seem as though Canada has its own little drilling cycle all by itself.

Global Production Up One Million bpd in March

Ron, this is my monthly “Vital Statistics” post. The US steams on. And while rig count is way down, there are still about 700 rigs drilling oil in the USA – that’s still a lot of rigs. North Sea is only place to see a fall in production in March.

What I found just as interesting about the latest IEA report, besides supply and consumption and the fact that the Saudi Arabian government decided to boost production by almost 1 mb in March, is the amount of oil going into storage.

A simple materials balance analysis yields the following equation:

And as the IEA reported, there was “a build in global oil inventories of nearly 140 mb in 1Q15.”

Over half of this — 76 mb — was in China.

The US, despite all the hype in the US MSM and alternative media about Cushing “filling up,” accounted for less than one fourth — 33.3 mb — of the build in global oil inventories in 1Q15.

The remainder of the buildup took place in the rest of the world.

The Chinese, it appears, see this as an opportunity to stock up on oil at what they believe to be fire sale prices.

However, if the Chinese were to have a change of opinion, and everything else stays the same, I’d say look out below for oil prices.

Saudi Arabia increasing rig count almost 4 fold in just 4 year to keep production at current levels is pretty alarming.

Sawdust,

The last major project announcements I know of are to produce from the bad end of a couple of previous developments

http://www.reuters.com/article/2013/07/02/dz-saudi-oil-idUSL5N0F81R520130702

(Reuters) – Saudi Aramco plans to develop two less productive areas of major oilfields, industry sources said, as Riyadh takes care to maintain excess capacity for the long term, even while non-OPEC oil supplies are on the rise.

The plan to increase capacity from Khurais and Shaybah by a total of 550,000 barrels per day (bpd) by 2017 will take the strain off Ghawar, the world’s largest conventional oilfield, two sources familiar with the plans said.

The next step for Saudi after Khurais and Shaybah, is for Saudi

1/ to explore and develop their own shale

2/ Develop their Nat gas fields and displace oil from power generation for export.

3/Prey.

We may have to wait and see if they have an alternative for number 3, but I suspect some pretty serious EOR projects will get the go ahead. The one thing about the Saudis is that they are very conservative with their production and seem genuinely interested in the long term production of the fields rather than the next quarters financial report.

The increasing rig count certainly leads one to believe the productivity per rig is definitely falling.

The Khurais megaproject started in 2006, and must have been fully completed by now.

Shaybah is the newest of all the big Saudi oilfields, discovered in 1998, and would have had the benefit of using advanced technology right from the start.

Do they really believe they can get another 550,000 barrels/day out of these two already heavily developed fields. More likely they’re trying to prevent their production from dropping. And Ghawar, they’re pretty well admitting that it’s watering out.

That is why I sad they plan on developing the “bad end” of the fields. They had already developed the better areas. But basically they are install Gas Oil Separators with the greater capacity, and then it will be a matter of drilling and producing enough to fill the gas oil separator.

But the trick is, the spare capacity calculations will be made on the gas oil separator capacity, and not what is being produced?

The next step for Saudi after Khurais and Shaybah, is for Saudi

1/ to explore and develop their own shale

2/ Develop their Nat gas fields and displace oil from power generation for export.

3/Prey.

Prey on what/whom?

That might be necessary post peak.

The person who can fully explain what is going to happen in US production has to be named “Gunga Din”, because he be a far, far better man than I.

I do know that the Eagle Ford permits have dropped about half of what they were since January 2015, and in May they are barely a dribble, so far. Eventually, this will result in less oil being produced. How much? Possibly, the best way to look at it is to take the best scenario, and the drop that will actually happen will be larger. Take the largest in company in the Eagle Ford with the best overall lease area, and project that point. Fortunately, EOG has provided us with some really good guidance with what to expect. There first quarter is only minutely less than what they produced the last quarter of 2014, at around 300,000 barrels a day. The second and third quarter, they expect a 10-12% drop in production with less wells being completed, with a rebound in the fourth quarter to closer to 300k barrels due to rebounding prices that would have to get over 65 a barrel to make it worth it. Let’s make a wild assumption then say all of the rest of the companies have the same assets, and can do the same. Then a 10% reduction in the second and third quarters will result in a decrease of about 450,000 barrels a day from US shale in the second and third quarters, then rebounding to ending production the last quarter of 2014. Obviously, this is a totally unrealistic projection at a high point. Not all companies have the same assets, and not all companies can command the same response from drillers and the fracing industry. At one point, while drilling was reaching it zenith around 2011, there was a six month backlog of wells to frac. That is when the fracing industry had not dropped down to 41 to 61, and the remaining companies lost half their people. Going 0 to 100 mph in the last three months is not going to happen. Don’t forget, more than half the rigs have been laid down with a corresponding cut in drilling operators. You can’t steal employees from McDonalds to cover what is needed to get it back up to speed. There are enough horror stories of fracing operations blowing up, and employees killed to give a good picture of how bad it could be with brand new GED grads running it.

I am projecting a 450k barrel a day drop by the end of the second quarter to be at the low end of the drop. It will take years to get back to 2014 production if it ever happens.

Just as an FYI, GEDs are more difficult than outright graduation. IQ profile of GED recipients is above 100. High school grads . . . right at 100.

I had no disrespect for GED achievement vs high school grad, and I have no idea how you perceived that I did. Inexperience, and untrained is the point, and would represent either within context of the discussion. There is no attempt to demean someone’s IQ as a distinction between either groups’ achievement, nor was IQ ever mentioned.

Hi Guy,

In March about 132 oil wells were completed in the Eagle Ford, if we assume the wells completed continues to drop to 100 wells per month by Oct 2015 and stays at that level until 2035, with 33,000 total oil wells completed, output drops by about 250 kb/d by Jan 2016 and continues to drop more gradually, Economically recoverable resources (ERR) is about 7.4 Gb. Oil prices rise from $57/b (2015$) in 2015 to $137/b in 2034 (about 4.65% per year). This scenario is unrealistically conservative in my opinion.

Not sure what you are trying to do, it bears no resemblance to what I was saying.

Hi Guy,

I thought you stated that output would drop by 450 kb/d by the end of 2015.

I am showing that if we assume the average new well’s estimated ultimate recovery (EUR) over 20 years decreases starting in June 2015 and that the rate of decrease in new well EUR gradually increases to a 6% annual rate of decrease by June 2016 that 100 new wells per month will result in the output profile shown in the chart. How low do you expect new well completions to go in the Eagle ford on a wells per month basis. Last year they averaged about 225 new wells per month so 100 new wells per month is less than half the peak rate.

Bottom line, 150 new wells per month keeps output relatively flat, 100 wells per month results in a gradual decline. There will not be a problem completing half the number of wells with half the number of rigs.

Guess you missed the last half of the sentence.

And the Saudis are still ordering new rigs as my friend in the seamless steel tube industry informed me. But nobody else is, according to him.

Another rig company in trouble:

http://www.upi.com/Business_News/Energy-Resources/2015/05/04/Another-rig-company-stumbles/1561430739883/

If you live in the United States or Canada, you’ll be able to watch the biggest TV show yet about the Bakken this upcoming TV season. ABC has picked up the drama formerly titled “Boom,” now in search of a title, that portrays the shale oil industry in North Dakota and the people moving in to get a job.

SHOW INFO

The largest oil discovery in U.S. history is happening right now in North Dakota and people are coming from all over the country to strike it rich. Heading there with big dreams and sky-high ambition are the young married couple of Billy (Chace Crawford) and Cody Lefever (Rebecca Rittenhouse), pulling their truck full of washers and dryers to start their first laundromat. Their plan: to lever-up, and step-by-step, build their fortune from scratch. The growing boomtown of Winslow, ND has 100% employment with oilrig jobs paying $100/per hour. While the champagne is flowing and the clubs and restaurants are packed, living here is shockingly expensive and everyone is too ambitious for a normal paying job. Just ask Sheriff Tip Hamilton (Delroy Lindo) – whose department is understaffed as the crime rate is rising – not a good thing in a town full of roughnecks, grifters and newly made millionaires with cash to burn on anything. This really is a modern-day Wild West. The town’s wealthiest and most powerful man is Hap Briggs (Don Johnson). This iconic selfmade oil baron has made billions and lost them too, and he’s married to Carla Briggs (Amber Valetta), as brilliant in business as she is beautiful. Together, they have the inside track on everything oil, turning that world to their advantage. This power couple is out to charm Oil And Gas Commissioner, Myron Stipple, a Mormon and not easily seduced by the decadence of the Briggs’ lifestyle. Hap’s children, Wick (Scott Michael Foster) and Lacey (Caitlin Carver), have their major challenges with stepmother Carla, but it is Wick’s complicated relationship with his successful father that leads to the ultimate showdown between father and son.

In the pilot, Hap cuts Wick off, taking him out of his will. Wick gets help from his lover, and ambitious businesswoman, Jules Jackman (India De Beaufort). Spurned by his father, Wick’s choice is to become a dangerous wild card in the oil game, building his own Cowboy Mafia from scratch. Hap’s daughter, Lacey, is on the opposite side of the oil business: a fracktivist. She’s a bleeding-heart environmentalist – with a brain. Job one is to stop the drilling before it destroys the land, which includes sacred Native American burial grounds the oil is buried two miles under. Lacey and AJ Menendez (Yani Gellman), Hap’s driver, are having a secret affair, and he takes Lacey’s side in this oil debate. But AJ has his own agenda and is not who he seems to be. Billy and Cody’s dreams are derailed right from the jump when their truck is hit and their washers and dryers are destroyed, strewn like tumbled dice across the highway. But oil fever is contagious, and after hearing a tip, they leverage everything they have to make a last-ditch play to be become part of the boom, putting them squarely in bed with the Brigg’s family, way over their heads.

Ron made an interesting point in his post as to why the US needs so many more rigs running than the rest.

I assume part of the answer is the largest and best fields in the US have long since depleted and US has to scramble the most to fight the decline.

I think also interesting is feet drilled in US compared to the rest. I think one of the major service companies made reference to this recently, and the numbers were pretty staggering.

Is it possible that KSA and their Gulf OPEC brethren are going to go for broke and put the US and Canadian (as well as some other high cost locales) out of business. If KSA could knock prices back down into the 40s or lower it could be the knock out blow for many US companies. We see how poorly they did with oil in the 40s in the first quarter.

I would really be interested to hear others opinions on this.

This may be of help in illustrating one of your points:

http://i.imgur.com/Zzb2mm4.png

Thanks Glenn. That is the illustration I was referring to.

Looking at those figures really drives home the fallacy of Saudi America.

In all likelihood, however, the real battle is between the sovereign wealth funds and the US bankers/investors in a race to the bottom.

Again, will US banks keep increasing their LOC with US drillers, and as those fill up will there still be demand for US driller bonds/equity?

Regardless, KSA gets the benefit of increase in long term oil demand plus less push for renewables.

I know the EV folks here will disagree about the renewable part. It may keep chugging ahead, but 2.50 or less gasoline v 4.00 gasoline surely slows EV progress. Until EV can be get a full charge in less than 3 minutes, I think only extremely high gasoline will cause a massive switch.

China won’t care. They must strive to improve their citizens’ lives and that requires increased per capita consumption of oil.

April China car sales up 6% over 2014 April. They aren’t slowing down.

Running faster up

the sloping Seneca hill

and over the cliff

A proper Haiku is supposed to refer at least obliquely to a season or seasons.

Fall.

Nice double entendre.

On the other hand, total penetration is still low. It’s pretty clear Chinese cities are realizing they can’t car up the way American cities did. Heck even American cities are having second thoughts.

Like a lot of Western cities (London Paris, New York, San Francisco, most cities in Holland, Denmark, Sweden and Germany, Montreal Chicago, Indianapolis, Pittsburg, Los Angeles, Bogota, Medellin, Buenos Aires, Mexico City, Guadalajara etc) Chinese cities are turning back to bicycles and public transportation.

Hangzhou has a bike sharing system with 60,000 bikes.

Here is an interesting article about it.

http://www.ecf.com/wp-content/uploads/Tang-Yang-Bike-sharing-Systems-in-Beijing-Shanghai-and-Hangzhou___.pdf

It includes a list of 70 Chinese cities introducing or already having bike sharing systems.

Here’s an up to date overview:

https://www.google.com/maps/d/viewer?mid=zGPlSU9zZvZw.kmqv_ul1MfkI

I’m certainly not a member of what here in Mexico they call the círculo rojo, that very small number of powerful insiders that is in the know. So I certainly don’t know what Saudi Arabia, the U.S. government, China and Russia are up to.

But I think one must leave open the possiblity that Saudi Arabia, Russia and/or China could have much bigger targets in their cross-hairs than the U.S. shale oil industry. And that bigger target might be the Anglo-American financial system, or even dollar hegemony.

These are treacherous waters, full of hidden whirlpools and eddies, swirling with deception and intrigue, and many unintended outcomes.

The VERY EXISTENCE of the Saudi royal family – except possibly as scattered refugees-is totally dependent on the USA protecting them from their neighbors.

You can bet your last can of beans the Saudis are NOT so dumb as to try to upset the YANKEE apple cart. Tweak our nose , rob us to the extent they can , well that is ok. Stab us in the back, in a serious fashion- absolutely not.

The Saudis have no use for their neighbors and little to no use for the Russians. They are smart enough to know they can never ever ever hope to resist a country as powerful as China ( maybe not today but soon ) or Russia or the USA.

So they made a deal with us. We protect them. When the chips are down they help us by manipulating oil prices. I repeat myself. Nobody in official Washington REALLY gives a damn about the problems of American oil companies except maybe the congress critters owned by oil companies – most congress critters are not oil company property.

The BIG banks have ten or a hundred times as much money invested in other businesses and industries such as real estate. What they might lose in oil they are making up several times over in other areas.

It never ceases to amaze me that peak oilers are so clannish and provincial that they seem to believe Uncle Sam sees low oil prices as a problem.

Listen to me folks. With the exception of a very small handful of congress critters in individual races that might turn on oil prices there is not a SOUL in Washington who is not TICKLED PINK that oil is dirt cheap.

Ye OLDE BEST ELIXIR when it comes to winning the next election is a strong economy if you are an incumbent.

If anybody has a lick of understanding of international politics they must understand that Uncle Sam and all the major western countries are extremely mad at Putin and company and want to hurt Russia to the extent possible at this time. Low oil prices are the only real option other than import export hat tricks.

On the OTHER HAND the Saudis and the Russians do have a common interest in RAISING oil prices- as soon as they can figure out how without creating too many problems for themselves.

I personally think the Saudis have made a hard core decision to let the rest of OPEC ROT LIKE FISH IN THE SUN THIS TIME AROUND so as to make SURE the OTHER cartel members understand that NEXT time they WILL stick to the agreement and cut production along with the Saudis.

If one wants to speculate about hidden motives and secret agreements think about this. Low oil prices may be THE DIFFERENCE NOW between an American economy that is at least hanging on and showing some signs of good health versus our sinking back into a bad recession.

The so called ” powers that be ” LIKE cheap oil. They LOVE cheap oil.

old farmer mac,

You assert that “The VERY EXISTENCE of the Saudi royal family…is totally dependent on the USA protecting them from their neighbors.”

I’d argue the Saudi royal family’s “very existence” is far more dependent on the USA protecting the royal family from the Saudi people.

And, as happens with all these puppet dictatorships installed and maintained by the United States by the use of state violence, the Saudi royal family gets trapped between Washington’s demands and the popular demands of the country’s people. Washington’s economic and political interests and those of the nation’s great unwashed are, after all, almost invariably the opposite of each other.

Perhaps the Saudi royals are beginning to suspect there’s trouble in paradise, are beginning to doubt the US’s prowess in projecting state violence, and are beginning to look for options in an attempt to stay ahead of the power curve and not behind it?

Also, speaking geopolitically, maybe you’re right in saying the Saudi royal family “helps us by manipulating oil prices.” However, this is not the 1980s. The world is far closer to peak oil now.

Granted, there is a surfeit of oil at the moment, but it is small and is not of the cheap-to-produce variety. Creeping peak oil means Saudi Arabia’s power as swing producer is now greatly diminished from what it was in the 1980s, making low prices almost impossible to maintain for an extended period of time and making Russia’s ruling regime far less vulnerable to an oil price war, the way it was back in the 1980s.

Turning our attention away from politics and towards more purely economic considerations, I agree when you say that, “On the OTHER HAND the Saudis and the Russians do have a common interest in RAISING oil prices.”

The theory here is that the the Saudis and the Russians are joined in a Rockefeller-Standard Oil monopoly and predatory price cutting strategy. Here’s how the strategy works:

I would just add that your analysis in this regard is not nuanced enough, that there is a huge difference between BIG OIL (the majors or IOCs: transnational corporations with both upstream and downstream operations) and LITTLE OIL (the independents: domestic corporations which operate within national borders and with only upstream operations).

We all know of course that ExxonMobil CEO Rex Tillerson has gone out of his way to talk the price of oil down. The question is why? Maybe BIG OIL sees its interests served by jumping on the Saudi-Russia predatory price cutting strategy? Total’s CEO could not have been more explicit when he stated:

”I’d argue the Saudi royal family’s “very existence” is far more dependent on the USA protecting the royal family from the Saudi people.”

I believe you are partly right in this remark – but otoh many many oppressive governments stand for a very long time because the common people are not organized and capable of overthrowing them.

I will agree that the royal family enjoys protection from the commoners as well as the outsiders due to American support but I believe that the danger to the family from OUTSIDE the country is many times greater.

If we had not stopped Saddam where do you think the borders of the Iraqi empire would be today?

Now as far as supporting the USA on the price of oil TODAY – there is absolutely so far as I can see NOTHING preventing the Saudis from unilaterally cutting production to any extent they please.

SOMETIMES you support your allies by NOT doing something.

It would take all day to get into all the various ins and outs of oil politics. You make some EXCELLENT points.

No doubt a lot of big oil companies are ready in the wings to buy up the assets of any relative small fry at fire sale prices when they go broke. Big oil has deep pockets and management with a long term pov.

The more you understand the more you come to realize that any given player both gains AND loses by following any given path. The question is whether the gain or loss is NET long term and there is no way to even answer it for sure since the future cannot be reliably predicted.

The Saudis are definitely losing tons of money right now by refusing to cut production. If they cut their short term revenues would fall but their long term revenues would surely rise by enough to justify the short term losses since they would have MORE oil to sell later when prices are up again.

So- They have plenty of well trained business guys and they must understand this basic fact. Oil sold today is selling for a lot less than it would sell for later and they have megabucks in the bank.Holding onto that oil and spending down the cash would almost for dead sure be the more profitable thing to do.

Why then are they continuing to sell cheap?

I do not believe they think they can run American tight oil companies out of business – not for long at any rate. The tight oil guys will be back in a year once prices are high enough to justify their going back to work.

I do not pretend to know how much tight oil really has to sell for to justify producing it but my GUESS now is that prices above about eighty bucks will result in the tight oil industry hanging in there so long as interest rates are low. It might take a price of well over a hundred to make tight oil truly profitable when interest rates go up.

I am a firm believer in peak oil and think the industry is like an old geezer that keeps on surprising his doctor and family by remaining healthy well beyond normal expectations.

But every old geezer like that eventually winds up in an armchair or hospital bed and eventually out on the hill by the church pushing up daisies.

DECLINING oil production cannot be too far away now, at least not at prices below a hundred bucks.