The Baker Hughes International Rig Count is out. I have decided to try something new with the charts. That is to compare the current year’s rig count with the previous two years count and to insert, within the charts, the percent change for this year as compared to last year. Also, this is the total rig count, Oil and Gas. Also the charts are not zero based. I do this in order to better emphasize the monthly change.

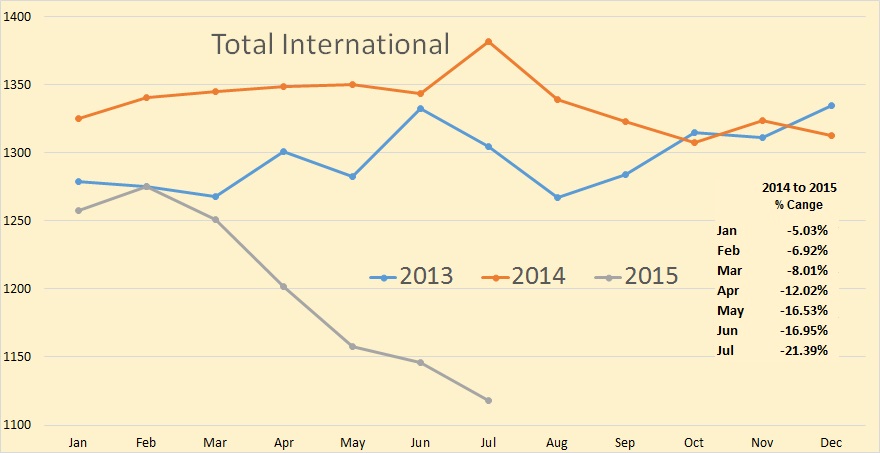

July usually sees a big jump in rig counts. This year there was a very tiny July increase, only a fraction of the increase we usually see for July.

*The Total International rig counts does not include the USA, Canada or the FSU. The Total International rig count was down 28 in July to 1118. Last July it was up3 to 1344.

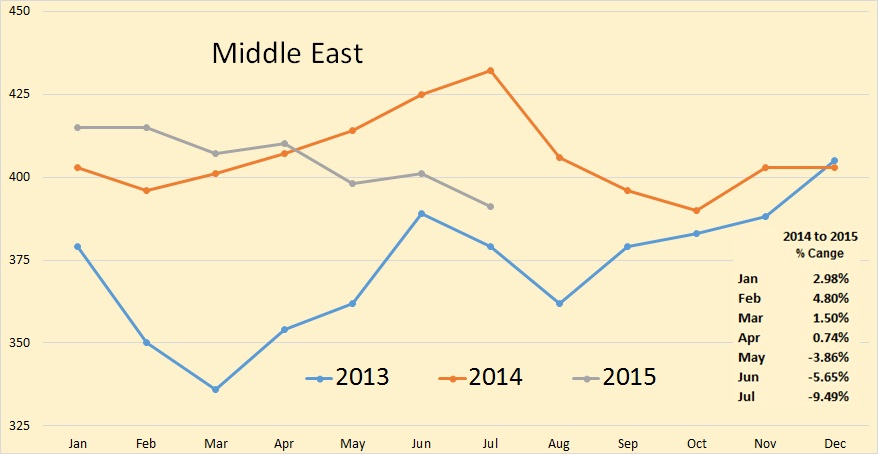

The Middle East is the only place that rig counts are holding up. Rig counts for July are down 32 to 391 but they are still above their 2013 levels.

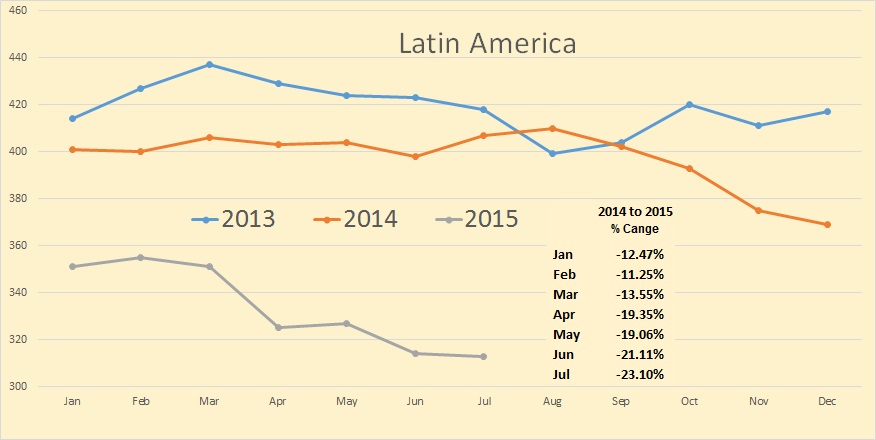

Latin American rigs fell 1 to 313 and are 23% below their 2014 level of 410.

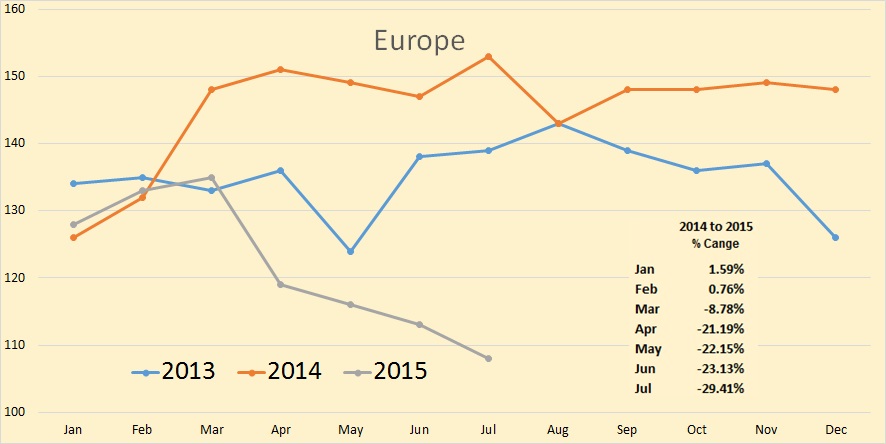

Europe’s rig counts fell in July to 108. That is 45 rigs below last July’s count of 153.

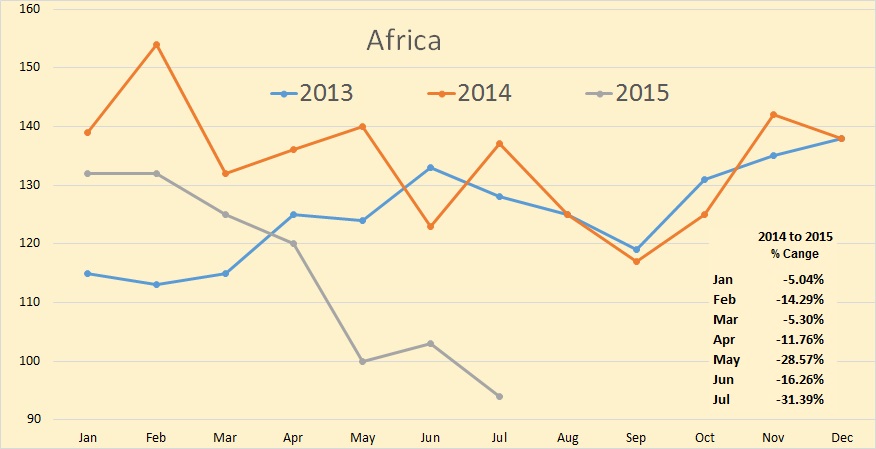

Africa’s rig count dropped by 9 to 94. That is 43 rigs below last July’s count of 137.

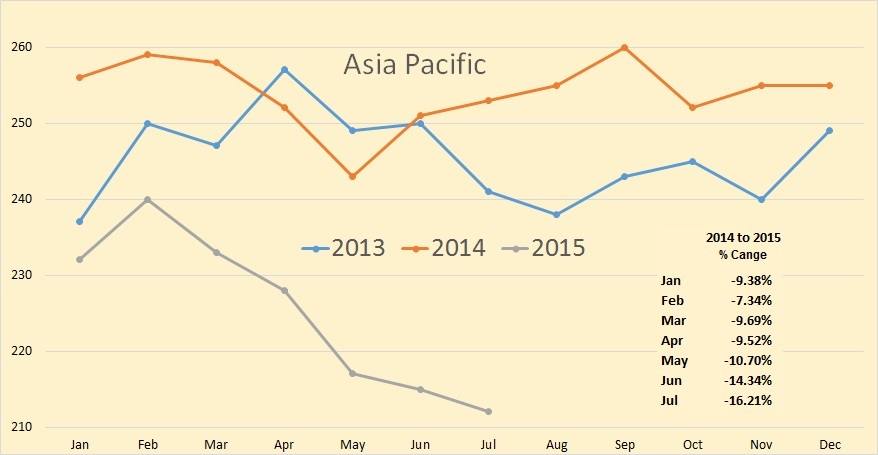

The Asia Pacific rig count dropped by 3 to 212. That is 41 rigs below last July’s count of 253.

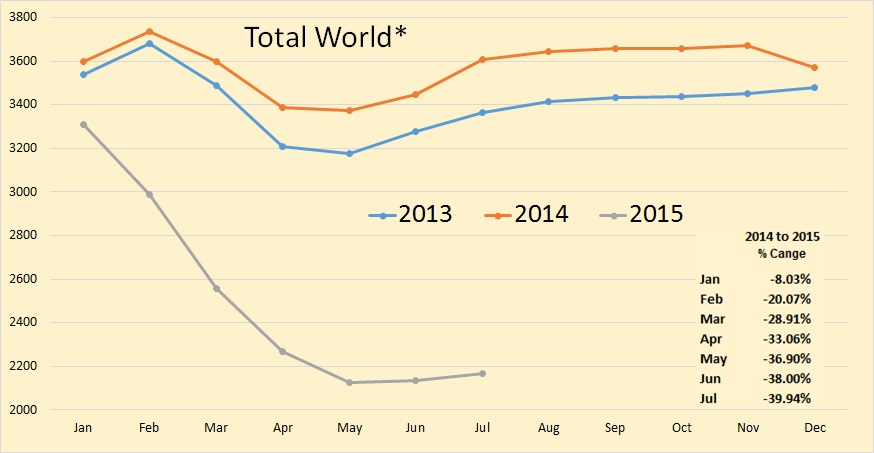

*The Total World rig count includes the USA and Canada but not the FSU. The Total World rig count increased by 31 to 2,167. That is 1,441 rigs below last July’s count of 3,608. The percentage decrease from last July is just under 40%.

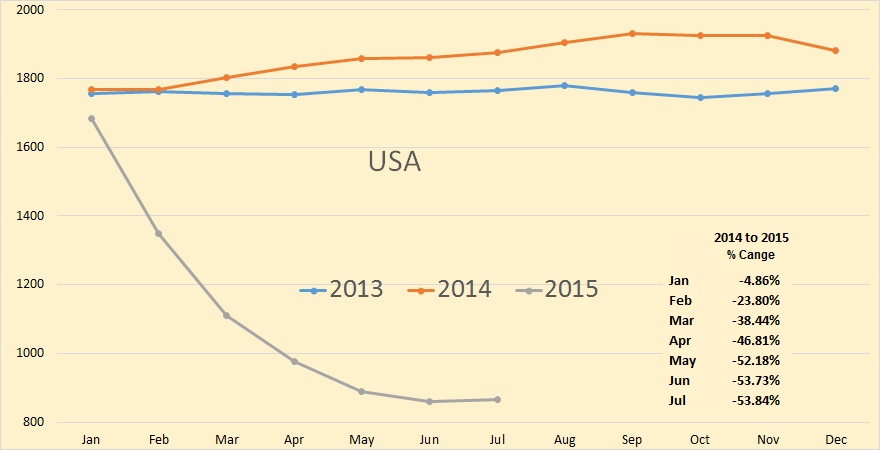

The US rig count is leveling out. The US rig count was up 5 to 866 but that is still 1010 rigs or 53.84 percent below last July’s rig count of 1876 total rigs.

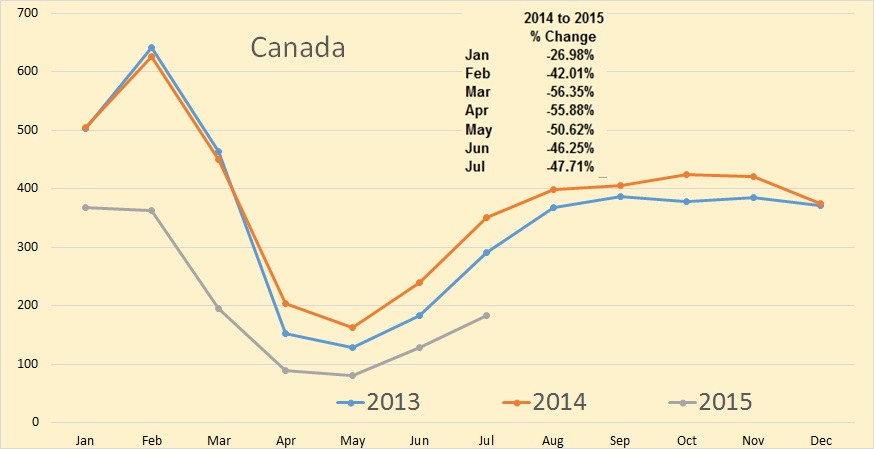

Canada’s total rig count increased by 54, from 129 to 183. However last July’s increase was 110 rigs, from 240 to 350. So this year’s July increase was less than half last July’s increase.

The Rolling Stone says The Point of No Return: Climate Change Nightmares Are Already Here

This article was also featured in the most important blog on the internet, Desdemona Despair

There are no solutions. It’s already way too late. A point hinted at by one of the best Ted Talks I have ever watched: The other inconvenient truth.

Ron maybe this belongs in the previous post. However, I thought it might not be seen and so decided to place it here. Below is company reporting a 25% increase in Bakken production in Q2 over Q1. Did they do it by adding rigs??

CALGARY, Aug. 7, 2015 /CNW/ – Enerplus Corporation (“Enerplus”) (ERF) (ERF) announces the results from operations for the second quarter of 2015.

HIGHLIGHTS:

Through the second quarter of 2015, Enerplus delivered production growth, improved cost performance and maintained a strong financial position.

Production volumes grew by 7% quarter over quarter to 107,429 BOE per day. This growth was primarily driven by increased activity in North Dakota, where production averaged approximately 27,100 BOE per day, up over 25% from the first quarter of 2015. We also saw growth from our gas portfolio with our Canadian Deep Basin and Marcellus assets showing production increases over the first quarter of 2015. Our production mix was essentially unchanged from the previous quarter, with crude oil and natural gas liquids accounting for 43% of production.

What is it about July that typically brings on an increase in rig count?

I have no idea but for the last 16 years the average worldwide increase in July has been 109 rigs. The largest July increase was 179 in 2005 and the smallest July increase was 12 in 2001. But Canada always has a huge increase in June, July and August, far more than any other nation. However this week, the weekly data showed Canada dropping oil 12 rigs. That is very strange. Canada’s gas rigs were up by 5 this past week.

Well, in some places it’s just after the start of the rainy season. The dry season is used to build roads and locations. There’s also the budget bs. If you get the wells in the budget, you don’t get approval from everybody until the end of the year. Then it’s necessary to go through the site work, prepare the rig, move it, etc.

In my case I tried to run contrarian, have everything ready as far as the site was concerned by early January, move the rig in February. This allowed them to drill the first batch of wells in dry weather.

On December 9th, I published on my blog:

That was before the number of rigs started falling. Not so bad so far.

On February 5th, I also published:

On this one the jury is still out.

In my opinion the reduction of US shale oil and a global economic crisis will set the stage for an inevitable peak oil. It looks that this time it will be for real. Embrace for impact.

In my opinion the reduction of US shale oil and a global economic crisis will set the stage for an inevitable peak oil. It looks that this time it will be for real. Embrace for impact.

Agreed!

It’s time to seriously start the process of completely switching the economy over to renewables.

There is a obviously still a place for petroleum products but it is no longer economical for use in generating electricity or powering private automobiles.

http://goo.gl/MC06F2

Why Are Americans Switching to Renewable Energy? Because It’s Actually Cheaper Fossil fuels have become an economic liability—for both consumers and energy companies.

Here’s the way to go GRIN!

http://www.wsj.com/articles/electric-skateboards-a-totally-rad-ride-1438887877

Electric Skateboards: A Totally Rad Ride

Self-propelled and easy to master, the latest electric skateboards are a radical way to kick up your ride. Here, we review: the Boosted Single, Evolve Carbon All Terrain and Yuneec E-Go

“Embrace for impact.” Don’t you mean brace for impact? If not, who do I embrace, not you guys surely. 🙂

group hug for Doug!

Similar product, the Walkcar (check out the video):

http://time.com/3989603/japan-walkcar-transporter/

Of course, I suspect that the commute would be a little more challenging in snow and ice conditions.

The Baker Hughes North America weekly rig count is out. Oil rig count up by 6, gas rig count up by 4. Most places saw little or no change except the Permian which saw an increase of 6.

Canada oil rig count fell by 12. That is a surprise.

Baker Hughes defines its international rig counts as including all the published countries except USA and Canada. Its worldwide counts include USA and Canada. The July upswing you noted is due to seasonal activity in Canada. The International count (ex USA & Can) declined 28 rigs in July to 1118.

Baker Hughes doesn’t publish info on rigs in several countries, notably Russia, China, and Iran. Does anyone have reasonably current data on any of those.

Drilling activity in Russia is traditionally measured in meters drilled. This number has been rising over the past decade and was up about 10% in the first half of this year.

Hi alex, do you have a link to that source, or a name for it?

The number of drilling rigs is variable, depending on the season. The latest numbers I have are for 2012. Given that drilling activity continued to increase in 2013-15, I estimate that the number of active rigs is now seasonally fluctuating between 850-900 and 1000-1050 units

Permian is responsible for more than half of the increase in oil rig count since the low point in June 26th

Total US oil rig count +42

Permian + 22

Bakken and Eagle Ford are only slightly up

Small point. The colours on the line graphs on the first chart do not match the colours on the key. But good stuff.

Sorry Mike, I got really screwed up on that one. I don’t know what happened but I had a sudden emergency and had to drop everything. When I got back I completely lost track of where I was and just messed everything up. It was not even the right chart. It is all now okay I think.

Good stuff! I agree. Very valuable information, Ron. Thanks!

I have an accounting question.

Read an article today that indicated the large service companies, such as Schlumberger, Halliburton, etc. are allowing upstream shale companies to “buy now, pay later” regarding services. Appears it will work like a furniture store, where the well will be completed, but payment is not due for several months or maybe even over a year.

I assume the shale company still has to show that as an expense in the current quarter, and cannot show it when actually paid, either later this year, or in 2016?

I wonder if that is where a large amount of savings is being realized, but surely under GAAP, it must be expensed when the service is performed? OTOH, it seems I read that Q1 CAPEX is much higher than Q2 due, in part, to expenses incurred in Q3 and Q4 of 2014, but not billed and paid until Q1 2015.

Clarification of this would really be appreciated.

On another note, closed below $44 today on WTI. No end in sight. Really going to hurt again, but just have to deal with it, it is reality. There is a price where we will shut almost everything down and lay almost everyone off, but we have not gotten there yet, and depending on how far it falls, would wait a little bit before taking such drastic action. However, I do think $30s WTI is very possible and $20s WTI is not out of the question either. A price that makes any sense as not been with us since Thanksgiving, 2014. Soon it will be one year with prices below the true break even (as I define it) for all of US shale. The more stuff they make up, the lower the price goes.

The head honcho at Pioneer (PXD) really makes some bold statements. I already quoted one, that he expects Permian oil production to reach 5-6 million bopd. I guess in conference call he also said they are adding rigs, and would only remove rigs from the field if WTI stays below 40 for over 18 months.

The article contrasted him with, of all people, Harold Hamm. Hamm says they really need to become cash flow neutral, and could possibly achieve that with $60 oil and second half CAPEX, which will be about 1/3 of first half CAPEX. However, he also said would be $200-300 million cash flow negative in second half with $50 oil.

Of course, 1. oil is now below $44 and 2. is Harold Hamm speaking of WTI or CLR realized price, which is forecast by CLR to be $7-$10 below WTI.

shallow sand,

I think Pioneer was the first to start adding rigs in the Permian.

From a Reuters article a month ago:

As oil teeters at $50, a few shale producers still drilling more

Jul 10, 2015

http://www.reuters.com/article/2015/07/10/us-usa-drilling-idUSKCN0PJ17U20150710

A handful of optimistic U.S. shale drillers are sticking with plans to deploy more rigs in the coming months even as oil prices take a sharp dive well below many producers’ $60-a-barrel breakeven point.

On Wednesday, Pioneer Natural Resources Co. became the first big company to publicly confirm it was drilling more wells, saying it had already added two rigs in the Permian Basin of Texas this month and would keep on adding two a month as long as the oil price “remains constructive.”

Shallow sand,

Regarding your accounting question.

I think the delayed payments to services companies might have been shown in balance sheet as current liabilities.

For example, Whiting shows $430mn as “Accrued capital expenditures” as of December 31, 2014, and only $199 million as of March 31, 2015

Chesapeake shows $3,061 million as “Other current liabilities” as of December 31, 2014, and only $2,474 million as of March 31, 2015

Ill try to look into this more. Unfortunately I know just enough about corporate accounting to be very dangerous. For example, I mixed up free and discretionary cash flow the other day.

Clueless. If you are out there, could you help?

All costs that should be expensed while drilling a well are expensed on the income statement when incurred, regardless of when they will be paid (if ever, in the case of bankruptcy). The accounting entry is a debit to expense and a credit to current accounts payable [unless there is long-term financing for these expenses (probably rare). However, if there were financing in place for these expenses so they do not have to be paid for over 1 year, the credit would be to long term payables].

However, most of the costs are capital items when drilling a well. GAAP also requires a recording these costs when incurred, regardless when they are paid. The entry is a debit to an asset account [property, plant and equipment, or work in progress, etc. If the asset is depreciable (e.g., the pumping equipment) the debit will end in an oil & gas depreciable asset account. If it is amortized as production occurs, (generally, intangible drilling costs) the debit will go into an IDC account. The credit will go to current accounts payable. However, if the drilling companies are financing their services for more than a year, some, or all, could go into a long term payables account.

Obviously, if the company is immediately paying for any expense or capital item with cash on hand, the credit is, in effect, to the cash account.

Read an article today that indicated the large service companies, such as Schlumberger, Halliburton, etc. are allowing upstream shale companies to “buy now, pay later” regarding services. Appears it will work like a furniture store, where the well will be completed, but payment is not due for several months or maybe even over a year.

Well, well, well. As it were. Seems someone suspected this. Cost per well declines on a per quarter basis. They won’t find much interest in this from the truckers, (that’s another pun) though. They need the paycheck now.

And btw, furniture isn’t interest free.

Schlumberger may soon be like Sears or Kohls. > 50% of gross revenues are interest on the credit card inventory, not profit from selling stuff.

Hmmmmmmmmmmmmmm,

So they borrow the money from a lender, and then borrow it AGAIN from SLB or HAL.

Why? So they can report “efficiency”.

Oooh, and it occurs to me . . . this runs the numbers up higher. And higher. And higher. That’s the stuff of systemic disaster and what attracts the Fed’s attention.

“So they borrow the money from a lender, and then borrow it AGAIN from SLB or HAL.”

Watcher, the same thing is occurring at the margin for auto sales with subprime auto loans and lenders desperately hoping that they can “securitize” the average 5- and 7-year loans at a ~0.5% premium to unload the liability/”asset” on some unsuspecting sucker.

The financial media report 17M vehicle sales as a boom when the underlying facts suggest that this phenomenon is just another aspect of the Red Queen Race off the Seneca Cliff of the unsustainable auto-, oil-, debt-, and suburban housing-based economic model.

As a consequence, no doubt the Fed will be compelled by the Fed’s owners, the 10-12 Too-Big-to-Exist (TBTE) banks, to print trillions more in fiat digital debt-money credits for bank reserves to bail out banks’ loans to the shale sector, securitization of subprime auto loans, and the record non-financial corporate debt to GDP to buy back shares to reduce equity share float in order to goose earnings/share to keep the equity market propped up.

If only the masses knew what has been happening since 2012.

I have a technical target for WTI of $32-$39, which, if broken sets up a constant-US$ price of . . ., well, I don’t want to say or risk appearing like an idiot.

http://www.thehillsgroup.org/depletion2_022.htm

Suffice it to say that it conforms to the pattern of the mid-1980s and to the Hill’s Group projection at the link above, including price, wage, and nominal GDP deflation and the 10-year US Treasury yield at 1% or below.

Wasn’t GMAC financial arm of GM making more money than the car unit for a while? The moto of new economy with this NINJ-a loans is “Howmuchpermonth” can you pay but these shale guys can’t even operate in that economic model. They need “Pay Later or maybe Never” model 🙂

In reality, large upstream companies have always taken enormous advantage of their vendors. Some, like CHK, for instance, are notorious for 120-150 day payments to their suppliers and service providers. Those slow paying producers are easily, and quickly, identified and the bills for services rendered will always be more than for those that pay on 90 day terms, more of less the industry standard, to cover the cost of “financing.” I have always in 50 years paid on 30 day terms; when I use a big service provider like Halli they will offer me a significant discount for paying in 30 days, as do others. So I think there is no special reasons for this so called “news” other than trying to calm the masses. There is certainly no accounting privileges to be gained from taking advantage of vendors. To me it is just another example of sleazy business practices that fit right into the shale oil business model. Somebody needs to break this to Watcher easily; I know he will be disappointed.

Sorry to always be the one that offers up the reality check.

http://oilprice.com/Energy/Energy-General/The-Broken-Payment-Model-That-Costs-The-Oil-Industry-Millions.html

Mike

Again, I have always had some issues in understanding accounting rules.

I do notice in looking at CLR, WLL, PXD and OAS, all had a decent sized negative number in accounts payable and accrued liabilities in the statement of cash flows for Q2, 2015, compared to prior periods reported along side. 4 for 4 on that, which I think is interesting.

I do not understand accounting enough to determine if a company is able to “manage expenses”. I assume that in each instance, a report of lower per BOE OPEX is the actual result of lower expenses, and not the result of managing the payment of expenses.

For example, lets say I operate the Smith lease. I incur $30,000.00 of expenses for the quarter on net oil sales of 1,000.00 barrels. $30.00 per barrel OPEX.

But, lets say I do not pay $5000.00 of OPEX until the next quarter. That doesn’t allow me to state OPEX for the quarter is only $25.00 per barrel? I assume the expense is recorded at the time incurred, not paid.

Likewise, I don’t think there is any way I can claim a well cost $7 million instead of $8 million just because $1 million of the well cost was not paid until the next quarter?

I would note I think there is some monkeying around with well cost in one respect. I note that one company disclosed the cost to drill and complete and then separated out the cost of leasehold equipment. In that instance, the cost of equipment was about $800K, which sounds about right. I sometimes wonder what all each company includes when talking about well costs.

However, I think they would have to report well costs consistently. Don’t see how they could get away with saying well cost averaged $9 million in 2014, and then lower that to $8.2 million just by not including leasehold equipment costs.

Mike, I never knew anyone paid on 90 day terms, let alone 120 or 150? What the heck!!

We pay on 30 for everything, always have. Always will, at least till we are flat broke.

That is ridiculous.

We have some really small service guys who want paid on the spot, which is ok because if you do that, they tend to show up at your well before the ones that won’t bring a check to the location.

Mike, I never knew anyone paid on 90 day terms, let alone 120 or 150? What the heck!!

You guys should see what my buddy, who owns a high end flooring and carpeting company in Florida has to put up with. It seems the more luxurious some hotels are the longer they take to pay. 90 and 120 are quite common and then on top of that, how about having to wait almost a year to collect a half a million bucks, a good portion of which you have dished out in materials and monies you paid your subcontractors during the job. Even then only finally getting paid because you threaten to put a lien on the building. And I’m not talking about an isolated incident either.

I think this is just another sign of the breakdown of our country. Doesn’t anyone have any pride? If I don’t pay a bill timely, it bothers me.

So many on here saying everything is a house of cards, those who act the richest are actually most broke. Probably accurate. And probably going to take the rest down with them.

Shallow I am with you 5 X 5 on that; I could not in good conscious do that to anyone. Its partially why I have used the same service companies for 40 years or more. But this 90-120 stuff is an old habit in the oilfield. It started in the 1980’s.

The company that I mentioned above set the standard for shale oil operations beginning in 2008. It jacked bonus rates on mineral leases up 1000% across the country and set the bar so high for mineral lease terms, no oil operator will be able to reasonably lease minerals anymore, ever. It began this 120-150 days payment stuff…and of course chingled millions of royalty owners over post production marketing costs. You know how much debt they incurred in the process.

Mike

Doesn’t anyone have any pride?

That’s a rhetorical question, right?

As for the rest of your comment I think it is spot on!

SS

I believe I covered your questions on accounting timing above. As you know, the Oil and gas industry is unique. Almost all companies, even the the best of times, have current liabilities that exceed current assets. There is a reason for this.

Using averages, and presenting the ideal conditions – Almost all wells have several partners. One of the partners is appointed as operator. The operator might have a 30% interest in the well. So, a cost item is incurred on July 31, 2015. The operator receives a bill on August 15th. The operator has to accumulate all of the July bills and bill the other 70% partners. It takes until August 25th to do that and send out a bill. The partners receive the bill, including the July 31 expense around September 1st. They believe that they are entitled to 30 day term, so they send the Operator a check around September 30th. The operator deposits the check and does the accounting and now feels that he has the funds to pay the company that billed for the July 31st expenses. The operator states that they “cut” checks twice a month – on the 15th and 30th of every month. So they cut the check October 15th and mail it. The service vendor receives the check (for July 31st services) on October 18th. Again, this is best case in many instances.

We have a few et als. A bill paid in July by us goes on the July joint interest billing, which is mailed to the et als by August 10 and which is due August 25.

Some guess we carry et als for about 25-55 days. But we are small, et als are few. Whole different ballgame.

Any reason for increase in accrued liabilities in Q2 compared to prior quarters, that you might think of?

Thank you for previous response as well

“But, lets say I do not pay $5000.00 of OPEX until the next quarter. That doesn’t allow me to state OPEX for the quarter is only $25.00 per barrel? I assume the expense is recorded at the time incurred, not paid.”

You show this $5000 as OPEX in your profit and loss account (income statement). But it is deducted in cashflow statement for this quarter and hence is not included in calculation of cashflow from operating activities until the time your really pay. It should also be shown in the balance sheet as accounts payable.

It depends on the country and contract arrangement. In most jurisdictions it’s booked when the bill is received.

Let me give you an example from a location I audited: Company (operator) has a contract with large service outfit, which includes volumes discounts. The service outfit acidizes a well, they do a job ticket, operator representative signs it.

But the service company can’t bill for services until the end of the month, when they calculate the volume discount. Eventually they submit a bill with the volume discount and all the individual services.

Operator has to allocate the volume discount to reduce the bill for each operation. At this point the actual bill minus the discount is booked as expense for that particular well (or lease, or field, or platform, whatever is required by the operations/accounting system).

The best operation I saw had a computer program in every company rep and engineer portable, into which they input the job description and the estimated cost, on a daily basis, and this was carried into the daily report (it was used to report the daily cumulative well cost, daily ops OPEx, etc).

Mailing the check was a different matter. I’ve been in a couple of jobs where I had to sign the damn checks. We did it every two weeks simply because I had to set aside a morning to have accounting bring in the checks, the associated paperwork, and the people I could quiz if I had doubts.

My assistant, a very sharp young lady, would review the material the day before, she knew which items would look funny, and she had the individuals required to answer questions make sure they knew they may be getting a phone call from me.

Sometimes I refused to sign, which caused a stir, and requested additional reviews. It kept people on their toes. But OPEx or CAPEX was logged in by accounting, the amount in the checks we didn’t send pending further review were just accounts payable.

Hi Shallow, I had a look at the QEP statements as you mentioned them as one of the better shale producers.

I was surprised by the large amount of “Purchased Gas and Oil Sales.” $215M is a significant portion of revenues, effectively zeroed out on the expense side by “Purchased Oil and Gas Expense” ($217.2M). Do the other large shale producers look like this? I can’t help wondering what is the point. I understand maybe buying up production from smaller producers and clipping the ticket on the way through, but I don’t understand why you’d do it and not make any money.

QEP has good hedging gains, both this quarter and last, and maybe some of that comes from the marketing side, but it’s not reported that way. All the hedging gains are reported against the production business unit.

So, scratching my head there, and when I parse out what QEP actually produces, some 50,000 boe, maybe 60,000 with NGL, the production is similar to PWE (63,000 liquids) and PGH (66,000). QEP has more gas production, but not enough to justify the increased valuation, and they have done well on derivatives. But in the end, as you say look at the market cap – they’re at something like 3-4X the Canadians. I’m not seeing it.

DuaneX. I assume that QEP must have a midstream business, and that is what accounts for the numbers you describe. Again, just a guess on my part. I do not notice that with others, except there was a time CLR had those entries, as I recall. That was a few years ago I think.

I will readily admit that why some companies have a higher valuation than others is something that is not always easy to understand just from looking at the financials.

Ultimately, valuations now may be based quite a bit on the market’s view of which companies will survive, or rumors of which are the most likely buyout targets.

I do not have the time, nor the ability, to do in depth analysis of each company and I am always open to other views. My mission is to determine if US shale will render our conventional obsolete.

So far, I am not convinced US shale will render our conventional obsolete. However, the decision of most of these companies to continue to grow production and drill their best locations, at sub $40 oil in the field, has and will continue to hurt both them and all other producers financially.

Plains Marketing, LP crude bulletin for 8/7/15 shows almost all postings below $40. There are some postings in the $20s. So, a shale company with 60 % oil and 40% gas and NGLs is realizing BOE prices in the $20s. My view is almost no shale companies are able to remain solvent long term at those levels.

I can tell you that this price hurts us, we only do what we have to do keep things going, and there is a small percentage of wells that have went down with a down hole failure that we have left down, but we will have to eventually return them to production or plug them. Hate to plug, but that can happen in a long downturn due to state regulations.

So we have cut production. We have done our part.

We may see WTI slip into the 30s this week. For us, that will mean a roughly 70% drop from June, 2014.

To give some perspective, most bank oil loans are of short duration. The standard here is five year amortization. We were able to buy production and pay it out in that time, or shorter, in the 2000-2007 time frame. In 2008, lease prices went through the roof. They did crash in 2009, but by 2011 were back to 2008 levels. We thankfully bought very little after 2006, because prices just got too high.

There is little to no ability to pay principal on loans in our area from oil net income. I do not know what those who recently bought leases with borrowed funds are doing. Maybe on interest only?

Shale companies did not pay loan principal, they used all discretionary cash flow to drill more wells. They can only pay principal now through stock issuance, dilution of existing shareholders, unless they slow drilling more than they have. A goal of cash flow neutrality does not allow for payment of loan principal.

The shale industry is largely a microcosm of US society. Live paycheck to paycheck, and if you want something but don’t have the cash, just put it on the credit card and pay the minimum payments forever.

Thanks SS, that the shale producers continue to flog away is one of the other differences between the Canadians, which I am more familiar with looking at – production in CA is generally down, due to lower capex and selling of assets. It’s stated as such pretty clearly in CA reporting. Other differences – “adjusted EBITDA” vs FFO; no clearly stated opex; relative lack of transparency of production on a boepd basis. The whole QEP financial powerpoint never states BOEPD. Rather a big picture BCFe per year, with a pie chart 32% oil. This for me is harder to work into actual daily production numbers.

The QEP buying and selling has the whiff of a big round trip trade that inflates revenues but doesn’t add any value. Maybe I don’t understand the model, but they’re not making anything out of it.

Agree the comment about the microcosm of society. Listened to an interesting podcast yesterday about taxi medallions. They exceeded $1 Million to buy one in NYC at the top. Now Uber has crushed the pricing and banks are foreclosing on them. The business model was to buy one and hire out the cab for $100/day. The renter gets the cab for 24 hrs and keeps what he makes on top of the $100. Would you borrow a million bucks to enter a business that would at best produce $36K all things being perfect? Not me. But the medallions were going up in price so that was the real game. Until it wasn’t.

From the Rolling Stone article:

They were not victims of climate change but of religious zealotry. It is very unwise to go the entire day-light without drinking any water if Ramadan falls on July, whatever says any religion. Too many hours and too much heat so dehydration can become dangerous.

Another case of miss-attribution. But who cares. These days everything is the fault of climate change to the point that nobody pays any attention to other issues.

How do you know what killed them? Your attribution is a correlation and lacks causality. The most one can say is ‘insufficient data to draw a conclusion’. Ramadan has been in either July or August and/or July and August in 2011, 2012, and 2013. However only 2015 seems to have the death spike. A regressional analysis, off the top of my head, indicates temperatures likely played a significant role in the death spike. Possibly too did power cuts. It would also do you no harm to know a fatwa was passed by Mufti Mohammad Naeem, the head of the biggest madrasah in Karachi, allowing Muslims to forgo the Ramadan fast.

I submit that it is also you who have joined in the program of misattribution.

The article that I linked says clearly that the doctor at a hospital in Pakistan indicated that many died from dehydration. It also says that the majority of the victims were men above 50, specially day-laborers. Both are atypical of an elevated death toll due to a heat wave. In the 2003 heat wave most of the deaths were people with complications, elderly with other diseases mainly, not laborers, and they died of heat stroke and disease complications, very few from dehydration. Usually small children die of dehydration, not adults that can drink water.

In Spain we have frequent heat waves during the summer, and a lot of Muslims that work in the fields. This year to prevent labor problems some farm owners changed the working hours to avoid the warmest in the day, while others only hired Muslims if they could show they were not following Ramadan by drinking water.

http://www.heraldo.es/noticias/aragon/2015/07/05/a_grados_sin_comer_beber_ramadan_los_temporeros_aragon_376998_300.html

To what do you attribute the fact that not all Muslims in Pakistan are dead from dehydration?

Not all Muslims work outside, or obey the Ramadan rules.

Sometimes the boss has special considerations. Work from sunup until two, let them go home. What they do at home is their business. Some locations just reverse the day. Go to work night shift for Ramadan.

In our case the rigs have large fans. And I’ve seen places where a local cleric issued a fatwa saying the rule could be ignored because it was a life or death situation.

In other cases they have air conditioning. This option is not feasible in locations with power cuts.

Others just send everybody on vacation. this doesn’t solve the problem for a laborer who makes a living hauling junk on a cart he has to pull. They don’t have that luxury.

And not everybody is equally sensitive to heat, or sweats the same, or needs the same amount of water, or continues working under the sun when not feeling well, or has diabetes, or any other condition that affects the outcome. Yours is a strange question.

Here’s a link to a post I wrote about Karachi. I haven’t kept up with Pakistan, I worked on a couple of projects there, many years ago, and I had to study their energy system to be prepared to market natural gas if we made a discovery. So this blog post doesn’t include anything I remember from work, it’s all recent material I picked up in recent months

http://21stcenturysocialcritic.blogspot.com.es/2015/08/karachis-heat-wave-and-pakistans-energy.html

Climate change has not yet resulted in massive sustained heat waves in the subcontinent. To be frank the temperatures in summers are always high here and a lot of people die during summer of heat stroke. Anyone would if they had to pull a hand cart loaded with 100kg in 47C temp. Nothing unusual in this. Westerners usually get all scared when they visit this place during the summers, so we end up getting some sensational headlines in foreign newspapers.

The only thing where there has been visible impact are the rains. They are very erratic nowadays. Earlier the rains were regular and predictable, not so any more. It’s either a deluge or a draught. Gentle rain has kind of disappeared.

Ron,

On the link at the end of the article, you misspelled “Desdemona”.

BTW: Thanks for the link; I was previously unaware of this blog.

I had also been unaware of the Desdemona website. I read several of the articles there and those articles are obviously addressing major issues. But one nit-pick: The “Point of No Return” article states: “In Washington state’s Olympic National Park, the rainforest caught fire for the first time in living memory.” But in 1987 or 1988 (maybe 1986) I went camping in the Olympic National Park for two weeks — major backpacking/hiking trip. During that time, there was a forest fire burning that left haze in the sky and an acrid smell. The ranger dude told us there was a fire. Maybe the article means to say “the rainforest experienced a major fire for the first time…”. Or maybe the writer is very young, and so his living memory doesn’t go back as far as mine…?

Here’s a link you may wish to read:

http://www.nps.gov/olym/learn/management/fire-history.htm

I am gonna take a pass on visiting that site. Call it denial if you want. It is depressing enough just driving out of the capital city, where I spend most of my time, to my late father’s homestead an hour away. Yesterday was particularly so since, I was asked by an acquaintance if I could take them and a friend to collect some water, seeing as how the local municipal supply situation has become really bad lately.

I thought, “what the heck, how much skin is this gonna be off my back?” So, I left the house at about 7 am picked them out and followed their directions to a location where they could fill their containers. After about twenty minutes we passed the first public water pipe but that had a small pick-up truck with several 55 gallon drums being filled so we proceeded to another that had nobody there. They started filling the containers and my acquaintance filled twelve 17.5 liter (4.62 US gallon) plastic kegs plus three 6 gallon pails or about 70 US gallons total, not including several smaller bottles like 2 liter soda pop bottles and similar stuff. Maybe 75 gallons in all for a household of at least 5 including an infant?

The friend was a real talker and for more than an hour while the containers were being filled she babbled on abut all sorts of stuff, letting me in on the fact that only one of the fathers of her two little girls, one looked about three years old and the other could have been six or seven, was offering any financial support for the kid. The pipe we were drawing water from was the lowest point in the area so, it seems that our activities meant that some of the nearby houses were not getting any water in their pipes, resulting in a couple folks coming down to the pipe with small containers to collect water. One lady passed on her way to do her laundry in the river running close by, lamenting the fact that there was a pick up truck with “a whole heap of drums” being filled at the other pipe. The locals at one point asked where we were from as they discussed the state of the water supply in the region and how many towns and villages were having a really hard time with water. I thought to myself that we would not be welcome there if we returned, as my acquaintance seemed to have planned, speaking of “two trips”.

Regardless to say, when I dropped them off after 9:30 am, I let then know that I had stuff to do at home and could not help them out with any second trip. I don’t think they had even considered the fact that as “outsiders”, they had inconvenienced the folks in the vicinity of the source. At one point during the discussions with locals, it was pointed out that some people were using water to wash cars, while people wanted water for more important purposes. I opined that one day people would want water to drink and not be able to get that, much less wash their all important cars and pointed out that my vehicle has been washed less than four times in the three years I have owned it and is none the worse for it.

While driving through the countryside, one of the things I can’t help noticing is the amount of young people, in particular young mothers. At one point I thought to myself that these people are not wild animals, they are people with thoughts and feelings but, they sure seem to be breeding uncontrollably like wild animals or yeast if you will!

The other depressing thing is the “wild” fires. I cannot remember ever seeing as much scorched countryside as I have this year and last year. We have had two consecutive hot, dry summers and when you consider the practice of locals including farmers, to use fire as a means of getting rid of trash or clearing land, you have a recipe for disaster. I see acres of steep hillside land scorched and wonder if people are not making any connections between the fires and our water woes in that, fires in watershed areas are going to result in less water in the absence of rain coupled with deluges of unusable silt when it does rain. My theory is that people (idiots?) are starting small fires to burn some trash or clear areas of land for agriculture and strong winds and the presence of large amounts of “fuel” result in the fires quickly getting out of control. I believe that most, if not all these fires are started by man and just find it amazing that people seem to think they can control the extent of their fires, in light of the prevailing evidence that it is just about impossible!

Yeah, so between a general population that sees no harm in people having a few kids and people who don’t seem to see the environmental degradation caused by using a little fire to burn some trash or clear a little land here or there, I’d say we’re screwed enough! I have a hard enough time not letting this stuff overwhelm the little shreds of hope I feel every time I see a new array of PV panels, to go reading Desdemona Despair!

I find myself increasingly feeling like I am an alien, a different species from this bunch of people who go around living their lives and spouting inane drivel while the conditions on spaceship earth continue to deteriorate. Last night while driving along the streets of the city where I live I looked at the half moon as it rose from behind the mountains in the distance and thought to myself, “will we be missed when we are gone?”

Got to go attend the funeral of my late best friend’s 27 year old nephew. He died in a car accident on July 21st when his street racer ( Mitsubishi Evolution IX) got out of control at what must have been over 100 mph. His body was found outside the wreck with fatal head injuries. He was not wearing his seat belt.

Agente i lived in Cuba we had serious water shortages. We seldom had running water at home, so my dad bought me a cart and a large steel drum. When I arrived from school I had to make the trip down the hill to a low spot, wait in line, load the drum one third full and then crawl back up the hill. I was expected to make two trips everyday. If a friend wanted to help me haul the drum we could load more water and he would help me haul it.

As far as I know what you need is to be more proactive about population growth, and remember that Atlantic tropical cyclones will be less frequent as the climate warms. I don’t know for sure about Jamaica, but in Cuba the tropical storms and cyclones would bring badly needed water to Eastern Cuba. The trick is to have the storm miss the island but dump a lot of water.

Hey islandboy, have you ever considered adding passive solar stills to your product line. I’m guessing that in Jamaica a really simple still with a 1 square meter surface area can produce about 6 litres a day of pure drinking water even if you start with polluted water from the ocean.

A few years ago I built some modular hexagonal stills out of scraps I found in a dumpster added some pvc piping and glass and took the contraptions to a beach in Florida to test. They actually worked quite well!

There are a number of commercially available small solar stills and I’m sure you could find plans on line for free and this is something even unskilled people can make. Maybe you could start a community project building solar stills in Jamica!

http://www.appropedia.org/Solar_distillation

The first documented account of solar distillation use for desalination was by Giovani Batista Della Porta in 1958.[4]However, no solar distillation publication of any repute leaves out the Father of solar distillation, Carlos Wilson, the creator of the first modern sun-powered desalination plant, built in Las Salinas (The Salts), Chile in 1872.

[11]This desalination plant, “can be considered to be the first industrial installation for exploitation of solar energy[11].” The Las Salinas plant was envisioned to take advantage of the nearby saltpeter mining effluent to supply the miners and their families freshwater [4]. The facility was quite large for its time and now:

“The plant was constructed of wood and timber framework covered with one sheet of glass. It consisted of 64 bays having a total surface area of 4450 m2 and a total land surface area of 7896 m2. It produced 22.70 m3 of fresh water per day. The plant was in operation for about 40 years until the mines were exhausted[4].”

You have sun and ocean in Jamaica, right?

Cheers!

Fred

It might be worth your time to research these two questions for Jamaica:

1) Why is water managed so badly? Is there a governmental agency responsible for this? What are they doing, and why? Wikipedia is often a good starting point:

“The management of Jamaica’s freshwater resources is primarily the domain and responsibility of the National Water Commission (NWC). The duties of providing service and water infrastructure maintenance for rural communities across Jamaica are shared with the Parish Councils. Where possible efficiencies have been identified, the NWC has outsourced various operations to the private sector.

Water supplies are adequate to meet the demands of all sectors; however, the supplies are not located close to where most of the population lives.” https://en.wikipedia.org/wiki/Water_resources_management_in_Jamaica

Now, does this fit with your understanding? If not, you might want to edit the Wikipedia entry.

and

2) what’s happening with fertility, and why? What are the trends? Is it getting better? Why, or why not?

Here’s a source that suggests that fertility in Jamaica has fallen sharply, and is almost at the replacement level of about 2.1:

“Fertility rate; total (births per woman) in Jamaica was last measured at 2.26 in 2013, according to the World Bank. ”

http://www.tradingeconomics.com/jamaica/fertility-rate-total-births-per-woman-wb-data.html

You might feel better, or at least be glad to understand the situation better.

I think I’ll just try and elucidate on my thoughts with answers to these two questions. Since I have lived here all my life and got interested in politics as a teenager in the seventies, I think the real question is why are the public affairs in Jamaica so badly managed? The answer is complex and goes back to the granting of Universal Adult Suffrage as opposed to the situation where only the wealthy (usually white, descendants of of the colonizers and former slave owners) landowners could vote. While this gave a voice to every citizen it had the downside of encouraging aspiring representatives to espouse populist policies.

Under a populist (socialist) government of the seventies several companies were nationalized including most of the sugar factories, the municipal bus service, the electricity utility and the telephone company among others. The government had owned the national railroad since 1900. Virtually everything the government acquired was managed badly. In terms of the sugar industry, the pro union, anti capitalist posture of the government made the owners of many factories threaten to cease operations with the government’s response being to nationalize them to save the jobs.

The primary aim of government at the time was to improve access to services for the masses (the poor), a noble enough aim, except for the fact that was achieved mainly restricting price increases. As we all know. the decade of the seventies was a time of significant oil price increases and at the same time a hefty royalty on bauxite mining introduced by the new administration resulted in a slow and steady reduction in mining activity and revenues to the government. In a couple of cases the government itself eventually had to take controlling interests in mining operations and seek buyers for the product to prevent closures.

So all in all, a lot of what were formerly private sector operations became government jobs. In many instances the perception (if not the reality) has been that posts, from the board chairmanship to janitorial positions, were filled on the basis of party affiliation rather than qualifications. Unfortunately, in addition, when the government is the owner of the enterprise, priorities are not always the same as when the quality and reliability of competitively priced products and services determine whether the enterprise succeeds or fails. All the sugar factories have been sold back to private owners but most of them have ceased operations. The only part of the railroad still operating is operated by the bauxite mining interests to support their mining operations. I hope that answers the first question.

As for population growth, my casual observation is that, most of it is happening in areas that can least afford it and I sense the prevailing attitude to be a sort of “after the fact” resignation that shit happens. Of my close circle friends/acquaintances some have no children, while others have one or two or three and a couple have four. On the other hand, the unmarried woman we hired as a caregiver for my late father had four when we hired her and added a fifth, for a fifth father, during the time we employed her. I know of several unemployed women who have as much as three children. Is there any way to discourage unemployed people or poor people from taking the chances that might produce children?

The same populist policies that I alluded to earlier up, have sought to “ease the burden on the poor”. No sales tax on basic foods, free education and free health care all contribute to making it less expensive to raise kids. The problem is that, it is likely that if these things are removed, it is the kids that will suffer, not the adults responsible for their predicament. My observation is that it is the people who can least afford it that are contributing the most to population growth in Jamaica.

This observation is supported by the UNFPA page on Jamaica:

Teenage pregnancies

The adolescent fertility rate has declined over the past 5 years and now stands at 72/1000. This is still fairly high, and the fact that 18% of all births in Jamaica occur to teenagers is quite alarming. One major challenge is the fact that teen-mothers often drop out of the school system, and have little support from the ‘baby-fathers’ in bringing up their children. This has a double negative effect – on the young mother, who has her opportunities for development truncated; and on the child, who will not receive the benefits that a better-equipped mother could provide in terms of parenting.

In the area of adolescent sexual and reproductive health, there are also inconsistencies between policies and the legal framework which impede access to reproductive health services for young people. This has been linked to unwanted or unintended adolescent pregnancies among young people as well as STI and HIV infection.

Additionally, the absence of youth-friendly health services and the cultural barriers to effectively promoting comprehensive sexuality education further impedes young people’s access to reproductive health services.

and

Youth and Violence

Homicidal violence, 77% by the gun, is a leading social problem; it is male on male, youth on youth, poor on poor. Of the youth, aged 15–24, 26.2% males and 7.9% females are illiterate. Unattached youth, those who are not in school, unemployed and not participating in any training course, comprise roughly 30% of the total youth population. About a quarter of unattached youths had attained only a grade 9 level or less of education. Their future prospects for productive and satisfying lives is thus limited. This also makes female youth vulnerable to sexual exploitation and adolescent pregnancy and puts male youth in an extremely vulnerable position, which might lead to participation in criminal gangs.

The 2008 Reproductive Health Survey also indicates that approximately 20% of women ages 15-49 had experienced sexual violence. This figure reflects only reported cases, and it is estimated that the actual incidence is significantly higher.

The reports by Fred from his observations in Brazil, sound like things there could be pretty similar. Maybe these things are just facets of developing countries but, it is more likely that they are the result of poverty generally, since reports out of places like the US and the UK indicate that, the situation is similar among their poorer populations.

I think one of the biggest dilemmas we will face as a civilization is how to prevent a wholesale reversion to poverty and desperation in a world of declining oil production. As OFM frequently opines, it will not happen at the same pace in all places and the more I think about it, the more I think I had better sort out my UK passport (born to a British mother) so I can more easily get out of Dodge when TSHTF! Nobody wants to be stuck in the wrong place!

The experience in Cuba was similar after Castro installed the dictatorship, but it was much more pronounced. They nationalized everything, induced middle class and professional flight, and ruined the economy.

But in Cuba the population boom didn’t take place because so many of us fled, and because they implemented a system to encourage abortion. This went as far as advising young women to abort as soon as they visited a doctor for a pregnancy diagnostic.

Interestingly, even though Fidel was very homophobic and had beliefs closer to an Iranian cleric with regards to social issues, he encouraged free sex, hedonism, and later allowed male and female prostitution to become widespread. This was part of a plan to cause social breakdown and build “new socialist man” on the ruins.

Today Cuba has growing crime as the dictatorship faces a disenchanted, nihilist, anticommunist, and very poor youth able to prey on the tourists and Cubans who receive money from relatives abroad. But it’s not like in other countries simply because justice is extremely harsh.

Fernando, it might interest you to know, if you did not already, that the populist leader of the seventies was one Michael Manley who, seems to have had some sort of man crush on Fidel. He was a very charismatic leader who spouted a lot of anti-capitalist, anti-colonialist, anti-imperialist rhetoric and once made a speech in which he said something about walking hand in hand with Fidel to the mountaintop! He scared away many businesses and professional people and migration remains one of the factors affecting population growth here as well.

As I teenager I was quite impressed by him but, alas, I am older and wiser now! 😉

I remember Manley. In those days Fidel was a big name dropper. Used Manley, Allende, Arafat, Lumumba, Bouteflika, Ho Chi Minh, and his Soviet bosses’.

The sources you provide don’t blame the young women. They blame restricted access to contraception, exploitation and rape.

18% of children born to teenagers isn’t great, but it’s not as bad as it could be. It’s about 10% for the US.

Regarding mismanagement:

We’ve got patronage, and a lack of understanding of market economics. That doesn’t seem to quite be enough, though. Can you think of anything else?

It’s good enough. It doomed the Soviet Union and red China, Cuba, etc. Venezuela is getting a triple dose, lack of knowledge about market economics, corruption, and incredibly poor governance and management practices.

Hello Islandboy,

Your description of the woes brought on your little country via expanded government is a great nutshell explanation of one of my reasons for remaining a small government conservative.

I worked for government on several occasions, mostly as a teacher, and know lots of government employees. When you get right down to the nitty gritty the first and foremost consideration of a government employee and the bureaucracy of which he is a part is ALWAYS SELF INTEREST.

The VAST MAJORITY of teachers are not dedicated souls of the Mother Teresa sort. That’s education industry bullshit, just like cheap labor being essential to food production is farm industry bullshit. The VAST MAJORITY of teachers are just plugging away like anybody else doing no more than they have to in order to hold onto their positions from year to year. Ditto the vast majority of cops social workers highway department employees etc etc etc.

I have never yet met a cop who believes there are enough cops nor a teacher who believes there are enough teachers or a fireman who believes he is paid well enough or that his hours are short enough.

The nature of a lot of problems is such that they can be successfully managed only by government, some of these being national defense, pollution control, environmental protection, etc.

Unfortunately the immediate reaction of my liberal acquaintances to any discussion of almost any problem is that there should be a new program or an expansion of an existing program to take care of it.

Probably more than fifty percent of our drug troubles are due to so many goddamned lawyers cops judges probation workers jailers security men burglar alarm guys making a living out of drugs.

Does ANYBODY with a brain really think the criminal justice industry wants what is best for the country ? Only an idiot could possibly be so naive.

But the industry is part and parcel of big government and unfortunately most republicans are conservatives in name only rather than actual principles and too ignorant and scared to think such things thru so they support the criminal justice industry and the ever growing police state which has already robbed us of the last vestiges of any real privacy.

Fools who are afraid to the extent that they wear panties and want to be kept personally totally safe by government in the end are apt to become VICTIMS of the government they expected to save them. Such fools deserve neither freedom nor safety and in the end will have neither.

Any parent who is actually RAISING his or her kid has very little to worry about when it comes to drugs in and of themselves compared to the CONSEQUENCES of the war on drugs. The risks associated with smoking a little pot or even snorting some cocaine are TRIVIAL compared to the risks associated with the criminal justice system’s efforts to regulate personal behavior- which is by my principles the business of the individual so long as he is not harming anybody except maybe himself.

I could go on all day. Government jobs and income redistributions are necessary but should be kept to down to as low a level as practicable. Otherwise big government BECOMES the primary problem rather than the solution.

Big GOVERNMENT includes the Military Industrial Complex, the parasitic criminal justice industry, the mostly parasitic legal industry which exists to enable people to deal with the tens of thousands of obscure laws WRITTEN BY LAWYERS sitting as legislators, bailouts for too big to jail BANKSTERS, and …. well I could go on all day.

Farmers are supposedly the next thing to the traditional mythical cowboy , free men supporting themselves in a free society. BULLSHIT. At various times just about all of us are on government welfare of one sort or another. I know a dozen multimillionaires who got to be multimillionaires because they got sweetheart loans to buy farm land they never intended to farm beyond the minimal necessary extent to keep the loan in effect for the first four or five years. After that they quit and just sat back and watched their country property morph into subdivisions or three hundred acre single family estates over a few decades time. Not a single one has ever been required to pay a penalty of any sort. I strongly suspect they could have quit farming in TWO years no problem.

Get your UK paperwork in order and then work on getting any paperwork needed to get into Canada permanently and the USA as well. The British Isles are already overpopulated and very short of non renewable natural resources.

IF things turn out badly within your lifetime , if tshtf- and there is a distinct possibility it will within a couple of decades or so- you will find much greater opportunities in Canada or the USA.

Of course you know all this already.

But others who know less will be reading and thinking about these things as a result of this conversation.

Getting permanent resident status in Canada may be a piece of cake in your case.

Probably more than fifty percent of our drug troubles are due to so many goddamned lawyers cops judges probation workers jailers security men burglar alarm guys making a living out of drugs.

Almost certainly more than 90%.

So sad that the local military-industrial complex is promoted by republicans, and totally immune to being reined in.

Jamaica’s population trend, according to Mazama Science’s Population Databrowser:

http://mazamascience.com/PopulationDatabrowser/?country=JM&language=en

The thing about some of these plots that opens a few of my mental circuit breakers are the countries that experience significant drops in fertility for a noticeable period…and even countries that experience a notable drop in population for a period…then after that period is over, the population trend-line recovers and marches on upwards…almost as if the killing fields (or whatever the phenomenon happened to be in various countries) never happened. The birth dearth in Jamaica from ~ 1983-~1992 didn’t make a much of a dent in the longer-term trend.

Cambodia (Pol Pot/Killing Fields):

http://mazamascience.com/PopulationDatabrowser/?country=KH&language=en

Peoples Republic of China (‘Great Leap Forward’):

http://mazamascience.com/PopulationDatabrowser/?country=CN&language=en

North America (onwards and upwards, happy motoring!):

http://mazamascience.com/PopulationDatabrowser/?country=US%2CCA%2CMX&language=en

World…heading to 9.5+B by 2050…and still climbing after that..?

World…heading to 9.5+B by 2050…and still climbing after that..?

To me that’s kind of like asking if we can continue to increase the speed of a vehicle, which theoretically has a top speed of 120 mph, when it is currently traveling at 110 mph, but is only 100 ft. from a brick wall.

If the current population growth is sustained we will supposedly reach 9.7 billion around 2050. Personally I highly doubt that will happen. Even if we could keep that many people fed I can’t imagine wanting to live in a world with that many people. Given my current age I will probably not be alive in another 25 years so I guess I won’t find out myself… But our children deserve better than mere survival on a depleted planet so I sure hope we can find humane ways to stop and reverse population growth!

Fred,

It’s far easier to reduce the per capita “footprint” than it is to reduce population by 50%.

Use 50% less water? Easy…stop growing rice in the desert. Cut beef consumption by 33%…etc.

Cut personal fossil fuel consumption by 90%? Easy – drive an EV.

And so on…

Unless that EV is a pedal assist bicycle, or your EV is entirely powered by renewables, 90% cut is simply not physically possible given the weight of a battery vehicle and the requirements for acceleration and deceleration, and the need to travel at speeds to generate a lot of aerodynamic drag.

And transport (outside the US) is only about 25% of greenhouse emissions anyway. Food production generates more.

And efficiency gains are a matter of diminishing returns, whilst population growth is currently about linear, but could easily turn exponential again.

The wealthy on this planet waste vast amounts of resources, but the poor consume more overall, whilst wasting very few.

Unless that EV…is entirely powered by renewables

And, it certainly can be. EVs are rolling computers (as are all new cars), and programming them to charge when wind and solar are available is pretty straightforward.

I actually was thinking of oil consumption, but it really is true that EVs can cut your transportation FF consumption by 90% (and eventually 100%).

transport (outside the US) is only about 25% of greenhouse emissions anyway. Food production generates more.

I included food. The same logic applies: price GHG emissions properly, and they can be reduced very quickly for very little sacrifice. That’s far, far faster and easier than reducing population.

efficiency gains are a matter of diminishing returns

Not at all. Economies of scale, and improved manufacturing and tech can produce continuous reductions.

population growth is currently about linear, but could easily turn exponential again.

Not when fertility is well below replacement in the majority of the world, and plummeting in almost all of the rest.

the poor consume more overall, whilst wasting very few.

Poor farmers are very, very inefficient and wasteful of things like water. Again, rice in the desert. And think of all the kerosene being burnt for lighting and cooking: the indoor pollution, the very high costs…

Some of those variations, especially for small countries like Jamaica, are very likely just statistical errors.

Please note that we can easily see 1% growth per year for some time after after fertility rates have dropped below replacement level, due to the lags in a demographic transition.

Hi Nick,

The population momentum does not continue forever. In the chart below are the UN medium and low fertility scenarios until 2100.

Reality is likely to be between these two scenarios (hopefully closer to the low fertility case.)

I absolutely agree.

My point was aimed at those who see the temporary growth that happens during and after the demographic transition, and are confused about why it happens, thinking it means that population growth will continue forever.

“Interestingly, however, with non-market oil producers controlling a large portion of oil capacity around the world, the contraction of supply could disproportionately occur in the United States.”

“In other words, low oil prices are forcing production cut backs. More declines in output should be expected in the months ahead. Moody’s expects more defaults in the oil and gas industry this year, as debt piles up and lenders cut off access to credit for drillers. ”

* Unprecedented or Not * ?

http://oilprice.com/Energy/Oil-Prices/Could-WTI-Trade-At-A-Premium-To-Brent-By-Next-Year.html

This oil bidness seems to be in a downward spiral, a vortex, a whirpool. Whirling dervishes on tour 24/7.

I get up in the morning to go out and work like a dog. It never fails. You begin the day and then you decide what is most important, then work like hell to get it done to go and work like hell to get the next thing done. There is no end to the work, never will be. Flip flop, it never stops. A fool never learns. Bacon, eggs, and hasbrowns for breakfast. Eat, drink, and be merry for tomorrow may never come.

Even God said to hell with it, I’m taking a day off, dammit. lol

Jeff Rubin on all one needs to know to understand “Peak Oil”:

https://www.youtube.com/watch?v=KU14fItHGgc

Growth per capita is over, which means that we can’t afford to build out renewables AND sustain the fossil fuel infrastructure AND maintain real growth per capita: the end of growth.

$20-$30 oil, deflation, no real growth per capita, debt-deflationary depression, fiscal austerity, and the risk of systemic debt defaults, and systemic collapse.

Jeff Rubin has certainly forgotten more economics than I will ever know but growth per capita is over FOR SURE only if you accept his ( most likely unstated ) assumptions.

Assumptions tend to make ASSES of U and Me unless you are VERY careful with them.

One that might fail to hold involves efficiency and conservation and changes in life styles. It IS possible that energy efficiency can increase at say two percent a year while energy supplies decline at one percent- leaving room for growth for a while yet – maybe for decades- Maybe not world wide but certainly in major portions of the world.

HEY GUYS, HOW MANY of us in this forum REALLY give a shit about the troubles of the people in Sub Saharan Africa?

I do in the abstract but I do not mind admitting i have never donated a dime except thru taxes (foreign aid) to helping them.

Another is that the very Effing definition of growth may be strictly defined in theory but in day to day communications it means something plastic of flexible. We considered the world to be growing when growth was mostly limited to the richer western countries and the peasants of Asia were still just about all of them subsistence farming. MEANING —— WHO counts when we say growth per capita?

Some growth (at least) occurs when a person who has had NO electricity gets his first twenty watts and or his first half a kilowatt hour on a daily basis. We certainly are NOT so hard up that we could not if we so desired supply everybody in the world with THAT much electricity. Small scale renewable energy IS HIGHLY ECONOMIC – if the alternative is doing without.

Another consideration – and a truly major one – is that GROWTH in the gross sense is not necessarily doing ANY particular randomly selected person or community ANY GOOD. My GROSS waist line has certainly been growing for years because I am prosperous enough to overeat the wrong foods.I have in farm country humorous terms certainly done the right thing and built a substantial protective shed over the only tool I own that REALLY matters- well , any way it mattered back when I was younger, lol.

I submit that a person who forgoes owning an F250 four by four diesel tricked out all the way and uses it to fetch beer or go to church – uses it as a status symbol- would be substantially better off , all the way around , driving a vehicle that costs eighty percent less and spending the eighty percent on other things. There ARE other ways to display status.

Yet another consideration is that the population is variable and while we all EXPECT it to continue to grow for decades, the population might level off and start declining MUCH sooner than expected. Mother Nature has a way of throwing problems at us in a somewhat random fashion.NOBODY expected the birth rate to fall so fast back when I was a kid. Nobody much expected tight oil production in the USA to grow like kudzu either.

Even the poorest people in the world now have at least some access to modern communications in most cases – even if this communication is limited to one radio or tv set in the home village. People are able to travel as never before. WORD GETS AROUND when it comes to how the rest of the world is living. Television and soap operas seem to have brought about a revolution among young Brazilian women when it comes to having more than one or two kids.

Maybe Bill Gates or some other mega rich person will decide he is going to spend eternity in hell or that he will be forgotten unless he does something really spectacular – such as founding a major new university – OR making birth control free for any body who wants it.

Would the USA extradite Elon Musk if he were to start delivering free birth control pills with little parachutes by the billions from orbit? How many desperately poor men might show up at a clinic to get a vascetomy if somebody were to offer them a nice set of hand tools and five hundred pounds of non perishable staple foods?

Some body with both questionable intentions (Baptist warriors who believe in sex only within the bonds of matrimony ) and questionable moral values may decide to create a sexually transmitted disease that renders victims STERILE rather than killing them. The medical profession might not get so excited about curing it or stopping the spread of it compared to the response to AIDS.

Such diseases already exist. Tweaking one to make it far more easily transmitted might not be too big a deal.

Then there is the simply UNDENIABLE fact that resources and power are NOT equally distributed all over the populated portions of the planet. Growth PER CAPITA might be over.

Growth in quality of life measured in health, leisure time, intellectual accomplishment, etc, may well continue for quite some time yet in large parts of the world. When the shit hits the fan, we are going to wake up here in the USA and in some other well situated countries and change our ways.

In WWII we built the biggest military machine in history in the shortest time ever. If we cut out the production of tricked out pickup trucks in favor of plug in hybrid cars is that growth or lack thereof ?

It may not be growth in the gross sense but it makes sense and will improve every body’s quality of life. If we mandate that the construction industry retrofit older houses for energy efficiency rather than build new houses for a population that will be declining is that growth or not growth?

NOBODY has proven his case to the best of my knowledge when he claims a transition to a renewably based economy is impossible. Improbable perhaps , impossible not proven. Of course the transition is apt to occur in a world with a lot less people in it. A die off IS baked in. It will NOT be world wide unless the cards fall entirely in the devil’s favor.

I am a poor man when it comes to cash on hand and current income but I could afford a battery and solar power system that would keep the LED lights and my refrigerator on with no problem. My computer too. And such systems will cost half as much ten years from today as they do now.

If we change our ways so that each middle class person who buys one more new car than he really needs no longer buys that unnecessary car but rather spends the money on improving the energy efficiency of his home and or business – well then , we would be over half way there in terms of energy troubles at least here in the USA.

YOGI SEZ PREDICTING IS HARD. 😉

“I could afford a battery and solar power system that would keep the LED lights and my refrigerator on with no problem. My computer too. And such systems will cost half as much ten years from today as they do now.”

In that case my analysis shows you should save your money and wait to buy your solar power panel and battery. If you take the money you would use buying a solar panel kit, and put it in a safe, you will earn the equivalent of 6.9 % interest. However, a more precise analysis should be carried out taking into account any subsidies, tax credits or other goodies you can extract from tax payers.

In that case my analysis shows you should save your money and wait to buy your solar power panel and battery. If you take the money you would use buying a solar panel kit, and put it in a safe, you will earn the equivalent of 6.9 % interest.

I think you are missing OFM’s main point. The PV system he is talking about will most benefit those who have no access whatsoever to electricity today. That’s a couple billion people living in extreme poverty by first world standards. They do not have access to the banking system, don’t have money to put in a vault and make money from the interest. They need the electricity like yesterday.

You talk a good talk about being concerned about human rights and the poor but you keep trying to promote BAU and a system that only works for the elites. Granted you and I and most of the good folks reading this are a part of that elite as well. And as I’m typing these words I’m listening to some Brazilians outside my window discussing the economic crisis and local politics, It’s not quite as bad as Venezuela yet but things are very very interesting here as well.

Population, as you well know coupled, with real physical resource limits is the biggest problem we face. The non negotiable lifestyles of the western world are going to be negotiated and the the 1% that holds most of the wealth and resources will be held accountable.

I strongly suspect that you will see more and more people in the third world getting access to PV systems and going the distributed generation route. The people who are on the forefront of facilitating this transition are the ones who will probably be the members of the new elite.

And communism will have nothing whatsoever to do with any of it.

Cheers!

That system (solar panel plus battery) doesn’t really solve much, simply because poor people who live in remote places can’t afford it. This isn’t going to do much to solve a third world country’s major energy needs. It could be a niche solution to allow them to charge a few cell phones and put in a refrigerator to store some medicines in very remote locations.

If a third world country can get cheap financing from rich donor nations they should definitely buy these kits. But it won’t do anything for the millions living in urban areas.

That system (solar panel plus battery) doesn’t really solve much, simply because poor people who live in remote places can’t afford it. This isn’t going to do much to solve a third world country’s major energy needs.

I think you are wrong about that. No, I’m 100% certain you are wrong about that!

see my comment about 5 days ago:

http://peakoilbarrel.com/world-natural-gas-shock-model/comment-page-1/#comment-530007

And OFM made a similar comment in the same thread about Africa.

The people in the attached graphic will never connect to any grid they will only have PV. It’s the grid that is unsustainabe and will be uneconomic to implement. Just like in my linked comment, the Brazilians with cell phones will never have land lines but will continue to get better cellphones and service. Neither the phone companies nor the end users could ever afford to have land lines at this point in time. This what I keep talking about when I say the old paradigm doesn’t work and there is a new one already being implemented. You sir, seem to continue insisting that what was will always continue to be. Granted I could be wrong but I see things very differently from you.

Oh and here’s that graphic of PV on huts

If these people ever connect to the grid I will happily eat my hat and yours!

poor people who live in remote places can’t afford it

It’s cheaper and more widely available than oil. Hundreds of millions of Africans spend a lot of their income on kerosene for lighting and cooking, and solar is far cheaper.

The perfect is the enemy of the good.

I must agree with Fernando that small scale pv is not going to do a whole lot in the near future for the poor people in the big cities of the world.