A Guest Post by George Kaplan

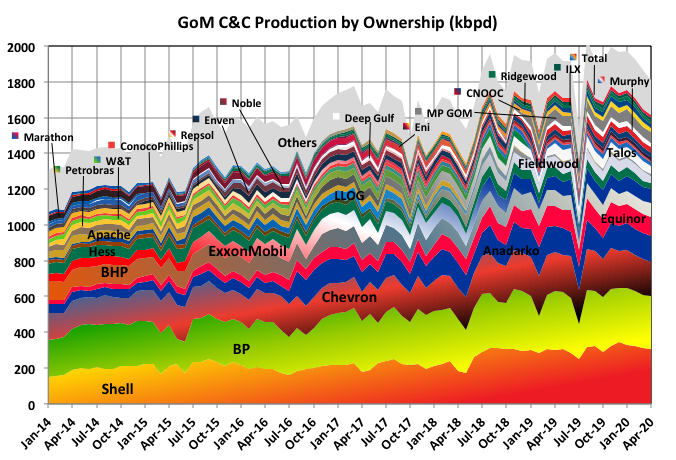

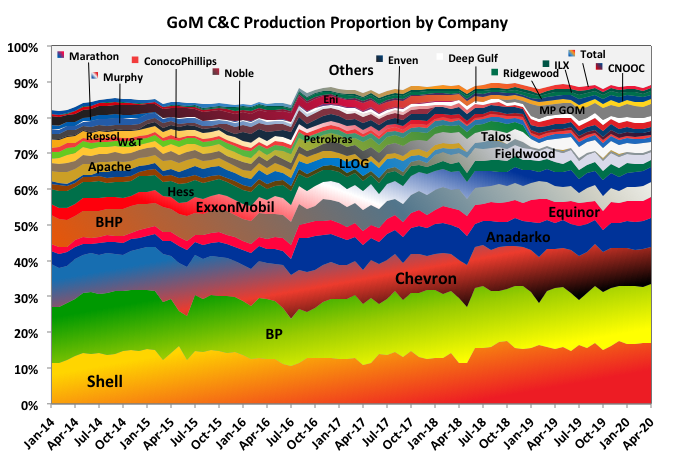

Production is dominated by major international companies particularly, and maybe surprisingly, European ones. Principally Shell and BP, but with Equinor, Eni, Total and Repsol also active and many are (or were) seemingly wanting to expand in the area. Maybe this is an example of reciprocal technology transfer: the North Sea was initially developed with a lot of American offshore know how and there it may now be the reverse is happening as deeper water fields using floating and subsea systems are developed.

The recent growth in production has come from the larger players, and they are taking a bigger slice of the expanding pie. The medium sized independents and smaller non-operating owners held many assets in shallow water but do not have the money, risk acceptance or knowledge to participate in the deep and ultra deep projects.

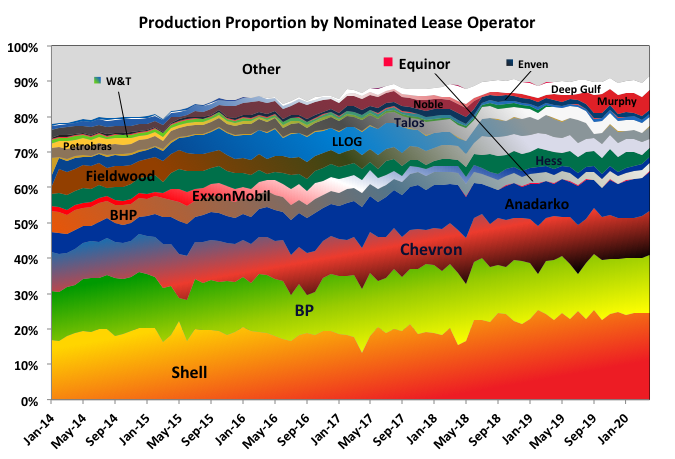

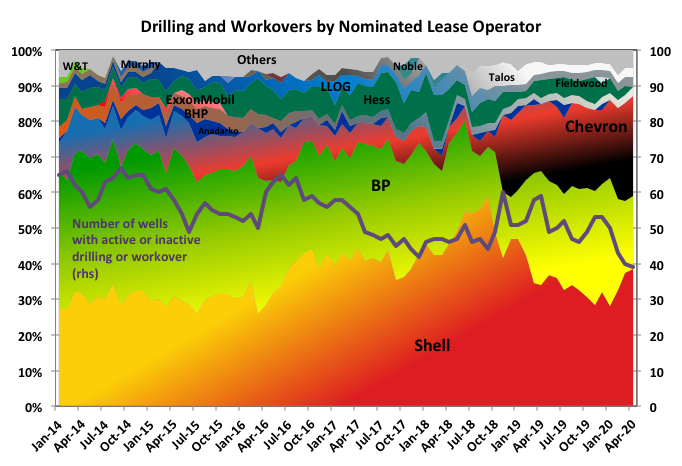

Lease Operatorship

Each lease has a nominated operator, and the proportion of production for each operator is shown. This is not the same as the operator of the surface processing platform for example Julia is a subsea lease operated by ExxonMobil but the fluids are processed in the Chevron operated Jack FPU. ExxonMobil provided the subsea control system that interfaces with the subsea wells and Chevron installed and now operates it. Operatorship of the leases is concentrated, and the proportion growing, amongst the major oil companies (shown), and still more so for the operations of the surface facilities.

The big three operators dominate the drilling activity, which is now almost all deepwater, even more than they do production.

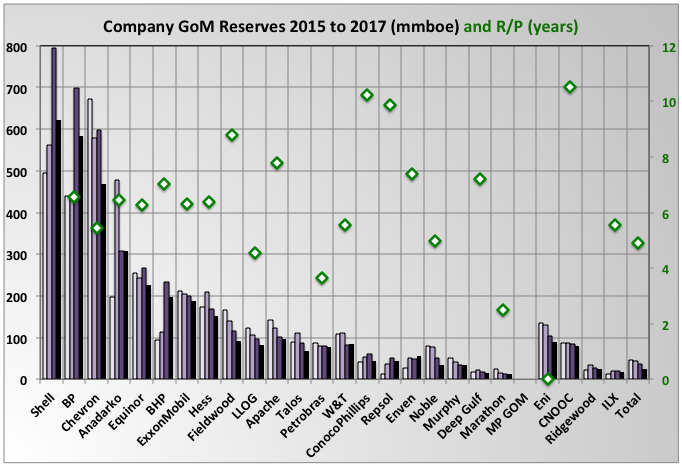

Reserve Holdings

Reserves are concentrated among the larger players they also mostly show reserve growth (from brownfield growth I think), whereas the smaller companies mostly show decline. These figures are BOEM estimates and only go to 2018, but I think the trend would continue in 2019 as the projects announced for FID, and therefore that allow booking of reserves, are owned by the super majors. Lord knows what’s going to happen for 2020 though. Note that the numbers are more fuzzy even than the BOEM estimates as I don’t know how reserves are shared when a field is split across several leases with different ownership, so the best I could do was a simple equal pro-rationing of the field across each lease. The R/P numbers are around six to ten years but they change a lot from year to year. Only 2018 numbers are shown; in 2017 there was a clear trend of larger companies having higher R/P but that disappeared.

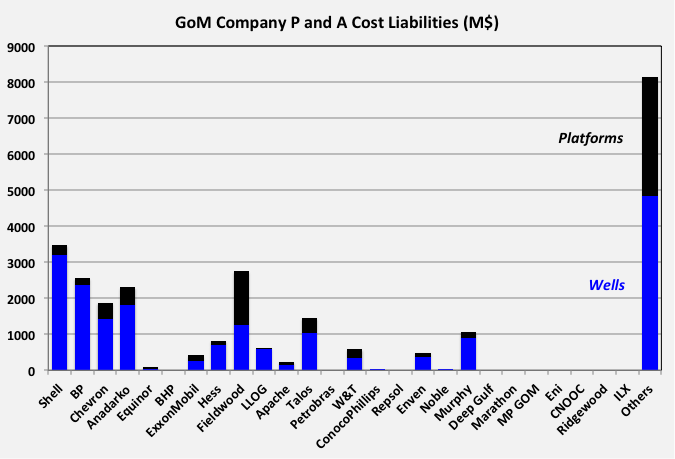

Company Liabilities

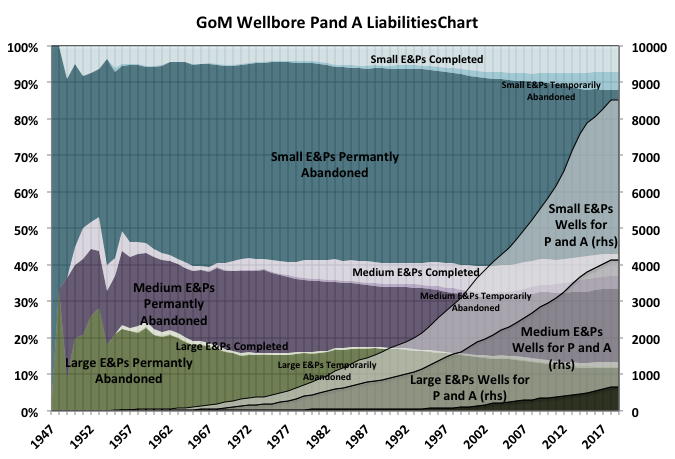

The large E&Ps keep up pretty well with their plug and abandon commitments for wellbores. They have a low proportion of temporary abandoned wells, although their number of completed and operating wells is growing because production is growing. Medium sized E&Ps, and still less the small independents are not; even as their proportion of operating wells fall their proportion of temporarily abandoned wells, and the total numbers of wells requiring future P&A are growing significantly. I think there is a good chance that many of these smaller operators will go bankrupt leaving a number of potentially leaking wells, presumably for the tax-payer to clean up (Fieldwood is quite a large company but with large liabilities – see below – and is leading the bankruptcy charge).

These liabilities are based on BOEM estimates and I’ve only added them based on the operatorship. In reality it is likely to be a lot more complicated with lease owners having to contribute so that more cost would devolve to the smaller companies. However the huge liabilities against “Others” is apparent. I’m not exactly sure how this would be included against the company’s net worth but it wouldn’t be a surprise if many were technically bust. The shallow water wells, which make up most of the inventory for the independents may be a bit easier to abandon, but there is no guarantee as they are not necessarily shorter and may require a MODU to access, whereas many of the deep-water platforms have dedicated rigs. Similarly floating deep-water production units are easier to remove than piled jackets.

Individual Companies

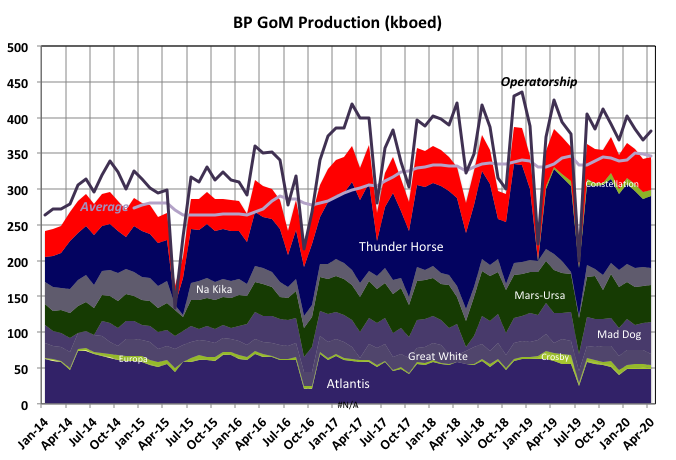

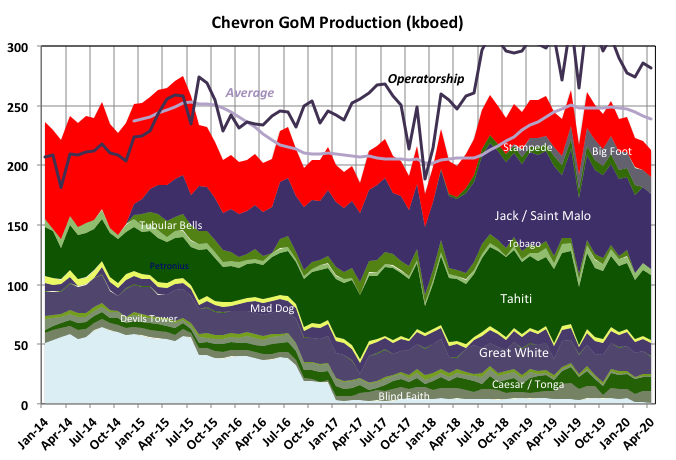

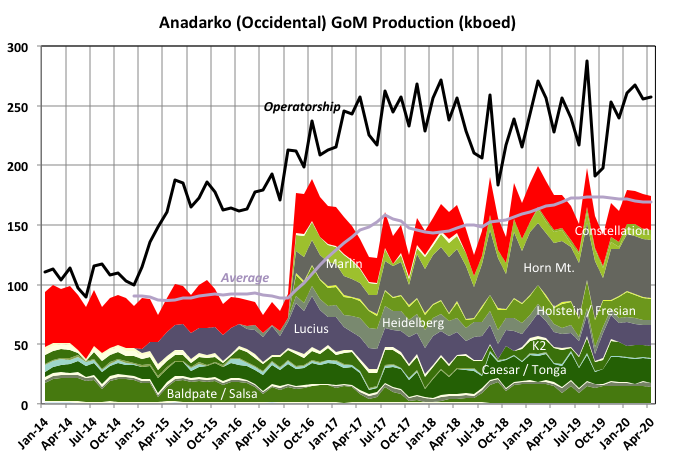

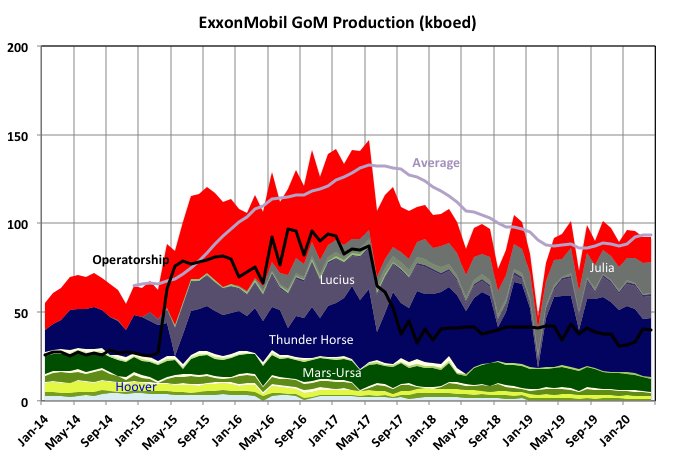

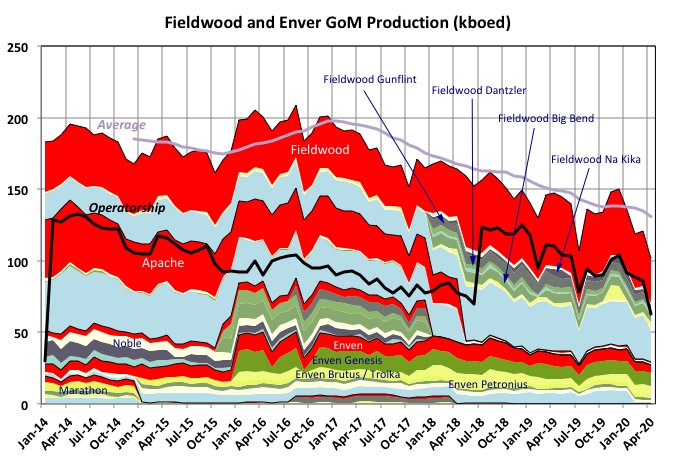

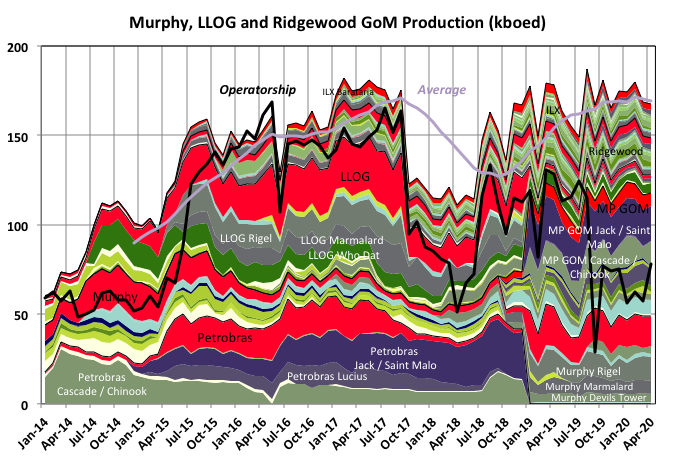

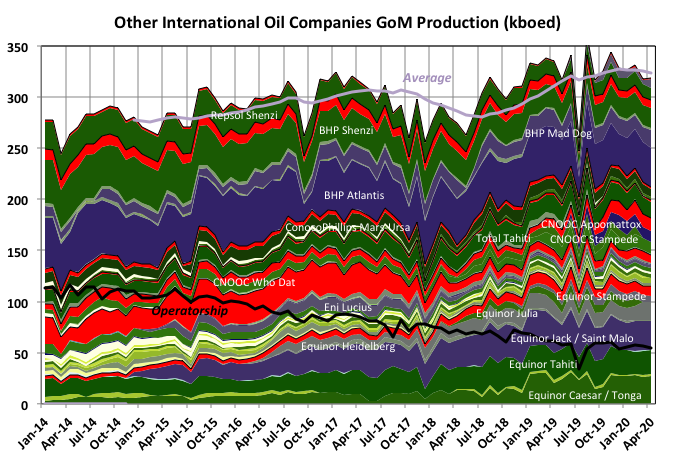

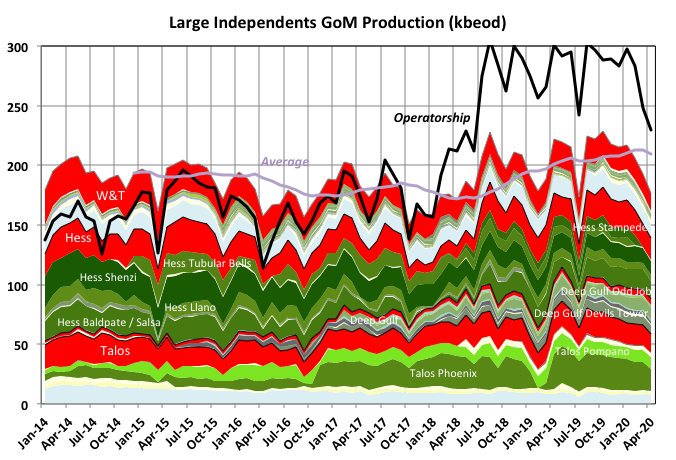

In the following charts the red band at the top of a companies production shows the total equivalent gas, pale blue at the bottom) is shallow C&C production, deep C&C is yellowy-green and ultra deep is greeny-blue. The more green for deep, and blue for ultra deep, the hue means the larger the present size of the field. Only the most significant fields in a company’s portfolio are named. The average line is the twelve-month trailing average for the combined production of the companies shown, and operatorship the combined operated lease production.

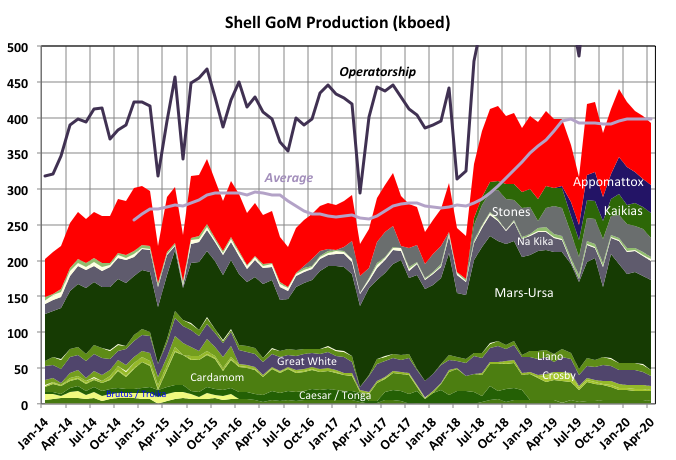

Shell

Shell is the biggest producer and operator, mostly thanks to Mars-Ursa, which is the biggest basin in the GoM. To date it has concentrated in deep water rather than ultra deep, but that is now changing as Appomattox continues to ramp up and with Vito due. Shell has a 60% ownership in Whale described as one of the decade’s largest discoveries in the Gulf, and expected to be a 100 kbpd development, even if it has been mooted as a tie back to Perdido and tie-backs that size are rare (in fact I don’t think I know of one). Shell has enough reserves, developments and prospects to stay top ad increase production even given the latest slow down.

BP

BP is top dog in ultra-deep and is likely to keep expanding with Mad Dog II under development and Atlantis III in ramp-up. Mad Dog II (aka Argos) at one time had break even price of $80, the highest of the GoM prospects at the time by about $20. It was considerably simplified afterwards and costs have decreased but current economics must be marginal at best. Thunder Horse and Atlantis were something of disappointments initially but recent brownfield developments and in-fill drilling have continuously raised reserve values. Most of the super majors tend to sell off assets once the get to run down stage but BP does this more than most.

Chevron

Jack / St. Malo is the Chevron flagship, taking over from Tahiti. Both now seem to have completed the major development phases. Stampede and Big Foot are still ramping up.

At the end of 2019, when oil was still at $60, Chevron booked write downs of around $10 billion and stated that much of its deep water resource was not commercial at this price range, although I think most was not in the GoM. Chevron has significant undeveloped assets as operator at Anchor (in mid development), Ballymore (a qualified field in BOEM but with no FID until 2021 and the last news I saw was that it was planned as a tie-back to Blind Faith, which would tend to imply maximum production around 30 to 50 kbpd); and also has minority ownership in Shell’s Whale (no FID before 2021) and BP’s Mad Dog II . In December 2019 the IHS Upstream Capital Cost Index, a measure of development costs, was 180, down from 230 when oil prices were at their peak. Given a supply shortfall enough to cause a price spike it is likely this index would rise significantly, made worse by the loss of workforce through demographic changes and the two recent price crashes. Therefore prices of $100 or more could be required to make some of deep-water projects attractive again. Will this ever be seen – the camp that says the world economy can’t afford them seems to be winning at the moment, but maybe some kind of shale-like economic con or government intervention would allow it.

Occidental (ex-Anadarko)

Originally Anadarko had interests in deep-water fields with platforms operated by others. In 2016 Anadarko acquired and took over full operation of assets from Freeport-McMoran, which, in turn, had got them mostly from BP. It did completed several in-fill wells through 2018, which just about kept production increasing slightly, but that activity stopped and Anadarko mostly switched to share buy backs. Before that its two big new projects were Lucius and Heidelberg, neither of which, I think, has done quite as well as expected (originally there was a phase two planned at Heidelberg that seems to have faded away and Lucius processing system is more used for tie-backs: Buckskin, North Hadrian. Anadarko was taken over by Occidental before the current crash (though BOEM still have Anadarko as the operating entity) in what now looks like a bit of a nightmare deal. Occidental mostly wanted Anadarko’s shale holdings so their GoM assets might have been seen as a bit of a millstone even with $60 oil.

ExxonMobil

ExxonMobil would like to find a buyer for their GoM assets, but is probable going to be frustrated without dropping the price unrealistically or a sudden oil price spike. It operates a few leases, the largest producer is Julia; there has been talk of a Julia II expansion (larger than the original) but seems to have gone quiet – maybe waiting for spare capacity at the Jack floater. It had one of the original large deep-water projects at Lena but that has been abandoned over the last few years.

Fieldwood and Enven (Apache, Noble and Marathon)

Enven and Fieldwood are fairly new E&P companies with exclusive interest in the GoM. Fieldwood was formed during the irrational exuberance high price era in 2013 from Apache shallow water assets, with a lot of gas. It later took over the rest of Apache, and Sandridge and Noble assets in 2018. Production has been steadily falling and it declared bankruptcy in early August 2020 with $1.8 billion in debts and for the second time in two years). It has very high P and A liabilities for shallow water fields and a lot of end of life deep fields (all grouped in the pale yellow strips, which represent several similarly coloured lines) including Bullwinkle, which has the highest platform decommissioning costs. Its larger deep-water fields of Dantzler, Big Bend and Gunflint are all processed through the Thunder Hawk platform; combined they are over 50% depleted by BOEM reserve figures, unless there have been significant revisions since 2017, with Big Bend and Dantzler at end of life. It has operatorship of Katmai, a deep water field with 25kbpd design capacity and due this year. I don’t know how that will procede now.

Enven was also formed in 2014 and acquired assets from Shell, Eni and ExxonMobil through 2016 and took over Marathon Assets. It applied for an IPO in 2018 but withrew in February this year. Performance has not been impressive and it might be in the cue for the chopping block. It operates four old deep-water platforms, with interest in two others and doesn’t get involved in much greenfield exploration, but concentrates on near field low risk opportunities.

Murphy, LLOG and Ridgewood/ILX

Petrobras opted out of the GoM in 2019, selling up to mostly selling up to Murphy in a new venture, MP GOM, in which Murphy holds 80%; Murphy also took over operations. The Petrobras holdings in Cascade/Chinook and its Lucius were pretty disappointing and the Jack / St. Malo project, which has done well, has come to the end of its main development phases. Murphy also got a lot of assets from LLOG, including the development and operation of the 80 kbpd Kings Quay FPU. I wonder what the stake holders think of its expansion plans now. LLOG also sold their holdings in Shenandoah development (70 kbpd originally planned for 2024) to Blackstone, a fairly new private equity player in the GoM.

LLOG seems to have had a bit of a fire sale in early 2019 and it also sold a chunk of assets to Ridgewood/ILX. LLOG is privately owned so maybe the owners were cashing in but they also lost some income in 2017/2018 with a major failure in a subsea template at Delta House FPU. Ridgewood is a private equity company but also partly owns ILX with Riverstone Energy. Both entities concentrate on non-operated deep-water GoM developments, often they have independent holdings in the same leases,. LLOG concentrated on one or two well tie-backs and it looks like Ridgewood/ILX are continuing that way and have a number of prospects, though exploration may be delayed.

Other International Oil Companies (Equinor, Eni, CNOOC, Total, BHP and Repsol)

Equinor is a significant producer and expanding, proportionally, faster than any other, and that is likely to continue as it has holdings in Stampede and Big Foot (still ramping up), Vito (in development) and North Platte (in FEED). It does not operate leases or platforms.

Eni looks to be fading away, it owned a part of some small recent tiebacks but nothing planned

CNOOC, which used to be Nexen, was trying to pull out of GoM activities in 2018 because of the Trump trade wars but haven’t done so and are unlikely to find a buyer at the moment.

Total is a small but ambitious producer and will grow as it has 37% of Anchor (80 kboed, due in 2024, but may be delayed) and 60% of North Platte, for which it will be operator (80 kboed in delayed FEED and with 20 ksi completions, like Anchor).

ConocoPhilips is a small producer and would probably like to sell up if possible.

BHP is a significant but declining producer and a couple of years ago there was talk of shareholders agitation to sell up.

Repsol has an agreement with LLOG to develop Leon and Moccasin as tiebacks. They co-operated on the similar Buckskin project, which, like these two, was originally thought to be a larger field.

Other Large Independents (Talos, Hess, Deep Gulf and W&T)

Most of the assets of these independents are in decline with nothing much new on the horizon. Deep Gulf, owned by Kosmos since 2018, and Talos, which took over Stone in 2018 and Castex in August this year, have expanded slightly recently, Hess stayed about level (but I think was trying to sell some assets to fund developments offshore Guyana) and W&T is mostly in shallow water. These sorts of companies tend to go for short cycle, high margin projects, and economics and geology are militating against those at the moment (and for the near future). Combined these companies lost over $700 million in the second quarter (though only W&T is exclusive in the GoM, and Talos mostly there). I’d imagine all are suffering with debt. Hess operates Tubular Bells, tied back to the Williams FPS, Gulfstar. It was supposed to be the anchor field for the platform, to be followed by other tiebacks; there was a small discovery and single well tieback this year, which is counted against the Tubular Bells field, but I don’t know of any other prospects.

Off Topic Finish: Denial

There’s a recent theory that an ability for denial is evolutionary adaptive in a cognitive species and was necessary (even if not sufficient) for us to become the dominant homo species. The theory goes that without it we’d understand just how horrible life and death can and will be, descend into a “slough of despond” and stop struggling to reproduce. I think the jury’s out on that, and don’t know how it could be demonstrated. It feels a bit “just so”-ish but nevertheless there’s a lot of denial about and its prevalence seems to grow, or at least becomes more overt, as things get worse. It looks like a battle of short term freeze-flight-fight – mostly freeze maybe – response from the reptile brain, mainly the amygdala (mostly dominant in conservatives) and longer term problem solving, planning, logic and post-rationalisation from the mammalian side (mainly the anterior pre-frontal cortex, more influential in liberals). If you want to argue the politics then one notable result is that someone’s voting preference can be predicted with a high level of accuracy just from an MRI brain scan (over 85% from memory; it’s somewhere in Behave by Sapolsky, which I highly recommend, but it’s a long book with small print and smaller footnotes).

The most obvious form at the moment is climate change denial and it is strong evidence of denialism’s dominance that however much the accelerating tide of evidence sweeps all before it the die-hards remain completely refractory, albeit subtly changing their arguments as each is successively knocked down. However there are plenty of other trends threatening civilization and possibly the human race that have their own deniers, often, but not necessarily, overlapping with the WUWT gang. Take your pick from biodiversity loss, water shortages, new pathogens for humans or crops, resource depletion, soil erosion, financial crises, secular development cycles, AI, demagoguery, overpopulation etc. They all have potential to take big lumps out of our collective wellbeing, they are all pretty well advanced and the combined probabilities and consequences are much more than the sum of their individual risks.

There are two often-cited future scenarios that I find particularly bothersome. One is the technocopian dream that we transform to a shiny Star Trek like future and the other that we can achieve a localised, sustainable bucolic idyll (more Star Wars maybe). They both have a tacit assumption that such transformations would see the end of all our major problems. It’s a kind of humanist eschatology that I find as delusional as organized religions and more distasteful than a few (though not the monotheistic ones).

Denial, to some degree, often comes in because someone knows all the risks in their particular field but is ignorant of the issues involved in any solutions – usually because they involve many other, unrelated fields. For example a typical climate change paper on causes and environmental effects, written by a scientist, or one concerning the societal consequences, written by an economist, sociologist or similar, will have a load of details on the actual subject, and then right at the end something like “we just need to get off fossil fuels in X years, but time is getting short” (as it has for the last forty years).

I can’t believe any of these authors have ever been even peripherally involved in a multi-billion, multi-disciplined engineering project. These are difficult at the best of times and invariably overrun schedule and cost estimates. What turns them into complete disasters is everything that we face in trying to switch to “renewable” energy: a tight schedule because it “has” to be; engineering with technology that has not been properly tested and proved at large scale (e.g. CCS); an environment in which the equipment supply base has to expand rapidly and virtually in step with the demand; rapidly increasing requirements for trained personnel; project management teams with management experience in unrelated industries or only technical experience in the relevant industry; a huge demand for trades people during the construction phases so they can up sticks whenever a new, and longer lasting, contract becomes available; the need to work in undeveloped countries with poor infrastructure, untrained staff and corruption; constant planning issues; social disruption and unrest; inevitable extensive state and political interference (not limited to regulatory oversight which states do best); financing issues; etc. There is a saying in large projects: quality, schedule or cost – pick any two. But when there are a few detrimental influences as above you are lucky to get any of them. Usually after lots of rework and delay something near to minimum quality will be met and with luck there will never be an incident that tests the design at its weakest limits.

Especially, it is almost impossible to do any of these large projects in widespread and prolonged volatile geopolitical environments; and you only have to look at USA/Hong Kong/Lebanon/Belarus/ Middle East (pretty much anywhere)/Libya/Brazil/Bolivia/Chile/Venezuela/Kashmir etc. to see that is only going to get worse. Climate disasters (see Asian flooding to come or South East USA if the hurricane season is as bad as predicted) and food shortages (see Lebanon in a couple of weeks) make thinking more short term and unrest more damaging. In almost every revolution the “newly liberated” peoples end up initially, and for some time, worse off than before.

There is a hydroelectric development project in Labrador which offers a salient lesson – it was forced through partly as a political statement when there were better alternatives, the management team were locals (also a political decision) mostly from the oil industry with no hydroelectric experience; add a few harsh environmental issues that hadn’t been sufficiently allowed for during planning, many contractual issues especially as insufficient contingency had been included, and most recently Covid19. At last count the price had doubled (to over $12 billion) has virtually run out of contingency (again) but still has considerable downside risk. It is two or three years late and counting, and the electricity produced is going to be very costly. There was a large enquiry completed last year that had fingers pointed in all directions. That was a one off multi-billion, multi-year project, done when there were few limits on workforce availability. Switching fuel sources (especially when it is forced rather than a natural progression to “better” ones) is a continuous, global, multi-trillion, multi-decade effort and would consequently have far more ways to go completely off the rails.

It’s often said that we need an Apollo or Manhattan project, but what is needed is nothing like those which involved small teams of dedicated and appropriate personnel, with unlimited resources producing compact one off devises. I’m not sure it’s much like the WWII mobilization either, that just had one relatively short term problem to solve, and there wasn’t much thought given to what was going to be done after victory.

The second idealised future is the sustainable, localised rural retreat type, often coming from ecologists or liberal leaning sociologists and journalists. It seems to me that would involve some kind of giant social engineering project, it might work with a hive species with common DNA, but even then I doubt it on a global basis. The proponents seem to think that once shown the error of their ways everyone is going to behave just like themselves, or at least like they are told to. They seem not to get that people’s behaviour is not logic driven but by ancient hormonal reward pathways, status signaling, dynamic tit-for-tat etc.

I’m a bit out of my comfort zone with philosophy but I think there is a concept of ethos (which I’d associate with our reptile brain) that is a culture’s spiritual base, and eidos (the mammal part) that is its logical and intellectual character. The proponents are relying on changing the global eidos, but ethos is always going to win and will always prioritise the short-term self-interests and reproductive rights of the elites. One theory of how this sea-change is supposed to happen is through cultural evolution, which can occur much faster than the ecological type. But the nature of evolution is stochastic; every event is random and localized (I think they would be called Markov chains, but my memory is going for a lot of mathematical things). Evolution has no sense of objective “improvement” and can’t be directed, so I don’t see how this can be expected to lead to any sort of sustainable arcadia.

I don’t see much chance of retaining any sort of even medium scale civilizations, though the decline might take a long time and, for most, an increasingly unpleasant one (another common denial is the “by 2100” one, which kind of implies that any bad trends stop at that magical date, maybe that’s when the humanist rapture is expected). The trouble is the longer and larger the overshoot is allowed to become the bigger and deeper the collapse. Catton, in the book Overshoot, admittedly on a fairly limited sample size, indicates that, following collapse, the undershoot is of the same order as the overshoot, and if deep enough the species goes extinct. If, after the main population drop, all that is left is a collection of isolated and genetically bottlenecked tribes then it’s easy to see how each could be wiped out from separate and random events (pathogens, drought, crop disease, strife, genetic disorders etc.) especially in a wrecked environment that would still be changing at a rate that is orders of magnitude faster than any evolution processes could keep up with.

Common advice is to do something positive even if you feel things are hopeless, which is fair enough but I think still smacks of a large amount of denial. “Armageddon, it been in effect, step … c’mon, let’s crank this shit up and get busy,” (Professor Griff). Words to live by.

End of rant

The opinions expressed in this post are those of the author. They do not purport to reflect the opinions or views of PeakOilBarrel owners or other contributors, or those on any of the other sites that may choose to download and repeat this post, whether with or, as always, without permission (please feel free, but only if you take all of it).

Hi , George yet to read your piece ,but I know it will be interesting . For the moment I am going to post video of Art Berman . Art is well as his name says “Art”.

https://www.youtube.com/watch?v=rsFlCqnqERI&ab_channel=TheRealEstateGuysRadioShow

George , back again . Very well explained the mechanics of GOM operations . For someone who has been following peak oil for 15 years, the info provided by you has cleared a lot of fog regarding deep water E&P . Finally I am in complete agreement on your conclusion : DENIAL . No better word to put the case . This is as Perry Mason would say ” an open and shut case ” .Kudos .

George, a question. Abandoned wells not plugged by operater . Who pays ? The Federal government or the state that is on the coastline.?

Hole in Head,

Often, the Feds will go after the original operator to get them to properly abandon the field. In the case of the GOM, many of these original operators are companies like Amoco (now BP), Gulf, Tenneco, Texaco, Chevron (now Chevron), Mobil, Exxon (now Exxon), Conoco, Shell.

I’ve been involved in property sales, and this is one of the biggest concerns – can the small operator buying the field afford to properly abandon the field when that time comes. If not, the field becomes a “boomerang” field to the original operator – a field that has already been sold, but comes back later as a field that has to be properly abandoned.

Thanks .Boss

South ,back again . What are the rules for the North Sea ? Same as in USA or something else .?

Hole in head, I see some good comments from you and Watcher below on this and related issues. I assume what I said above is something of an industry wide practice, but am only familiar with offshore and onshore US GOM. Not sure how things may change in places where the NOCs are involved – Equinor in Norway, or Pemex in Mexico, for example.

I have to applaud you on that final tangent. That pretty much echoes my sentiment on every level, given my ecology training and grasp of present physics, technology, and the way people generally think (Kahneman, among others, help), it’s often depressing to see the same kind of comments pop up on here, among other blogs or social media sites, echoing the same simplistic notions.

“We won’t need oil, we’re well on our way to all having EVs.”

“Solar and wind is cheaper than any fossil fuel.”

“Overpopulation is a Malthusian talking point. And that guy was wrong and a total shit.”

“Climate change can be solved, we have the technology.”

“The gov’t can just print more money if people cannot afford the Green New Deal.”

“Scotland powered 90% of its homes off wind this week. We’ve almost done it!”

“Fresh water crisis? Ever heard of desalination?”

“Something, something, Elon Musk and batteries.”

And so on. It’s like people get infatuated with one possible problem on the horizon and take a basic stance that, yes, it doesn’t have to be a problem. But never account for the holistic view that, just maybe thinking aloud that we’d all be fine if people didn’t consume so much and we got rid of capitalism, isn’t actually a solution. It’s a goal, yes, but it’s not an actual plan of action. And it certainly never takes into account politics, psychology, technical capability, energy and cost expenditure, time, black swans etc. You see this, as you stated with the hydro project, when specialists focus on solving X, but don’t account for Y. Yes, given unlimited resources and no people to object to it, we could have solved hydrocarbon dependence decades ago. We didn’t. And we need a growing economy that requires more energy and resources to employ and keep watered and fed ever more people. And you want us to tear this down and replace it all outright, at a time of diminishing energy returns, with environmental devastation, and a less stable global stage, while carrying on with BAU so the plebes don’t riot? Have you seen what happened this year with a few months of disrupted economic growth?

We had electric cars a century ago. Solar and wind power nearly as long. We’ve known about finite hydrocarbons being a thing, and we know that climate change is devastating. And yet, here we are, in 2020, approaching nowhere like the world we desperately need right now. All the pie in the sky solutions are decades in the future, where I guess climate problems and resource depletion, and social unrest, and financial collapse, simply don’t factor in, since they only kick in about 2100, not start creeping in with ever greater impact immediately. Rather skews the numbers, you see.

And your suggested course of action is?

Not many deny that therecare significant problems that are not easily addressed.

Reducing fossil fuel use by any means available and reducing population growth seem a start to reducing human environmental impact on the planetary ecosystem.

Dennis,

“And your suggested course of action is?”

Why must a person have a suggested course of action if he/she doesn’t think a viable one exists? Earth faces dozens of existential issues, do you have a “suggested course of action” for all of them? What, for example, is YOUR solution to world population overshoot? NB: it’s already here with us so don’t repeat your claptrap about educating girls and women. Meanwhile we have yet another issue facing us:

NITROUS OXIDE EMISSIONS 300 TIMES MORE POWERFUL THAN CARBON DIOXIDE ARE JEOPARDISING EARTH’S FUTURE

“Nitrous oxide from agriculture and other sources is accumulating in the atmosphere so quickly it puts Earth on track for a dangerous 3℃ warming this century. The Intergovernmental Panel on Climate Change has developed scenarios for the future, outlining the different pathways the world could take on emission reduction by 2100. Our research found N₂O concentrations have begun to exceed the levels predicted across all scenarios. The current concentrations are in line with a global average temperature increase of well above 3℃ this century.”

https://phys.org/news/2020-10-nitrous-oxide-emissions-powerful-carbon.html

“And your suggested course of action is?”

We are having predicaments, not problems.

Problems might have a solution that can be acted upon.

Yes, species that have gone extinct owing to climate change and human encroachment faced an existential predicament. Any “solution” they might have had to their dilemma remained un-realized. For them it’s hard to discover a viable “course of action”.

Doug,

No action is a course of action. I have not claimed I have solutions for every problem faced by humanity.

The claptrap on population is based on work by Wolfgang Lutz

http://www.wittgensteincentre.org/en/staff/member/lutz.htm

The analyses by Lutz et al are excellent in my opinion, YMMV.

A selection at link below

https://www.austriaca.at/0xc1aa5576_0x003a9cbc.pdf

Dennis, I am sure you have heard the phrase “locking the barn door after the horse has already escaped”. Well, that’s exactly what you and Dr. Lutz are advocating. All this education and empowerment of women will definitely slow down the population explosion… a little. The population growth rate of Sub-Sahara Africa is declining steadily while the population is still growing steadily. The population of Sub-Sahara Africa is just over one billion people. It will hit 3.3 billion by the end of the century. This all the while the growth rate is dropping from its current rate of 2.62% to .71% by the end of the century.

Ron,

There are many different estimates, we do not know what the population will be, it will depend upon the decisions made by people in those nations, fertility rates can change rapidly, much depends on education levels for young women.

Have you actually read any of Lutz’s work.

See page 118 of work linked below, projections for World population.

http://pure.iiasa.ac.at/id/eprint/15226/1/lutz_et_al_2018_demographic_and_human_capital.pdf

Yeah, I read that page, Dennis. That page is about World population and I was speaking of Sub-Sahara Africa. From page 9:

The population of sub-Saharan Africa, on the other hand, is likely to more than double by 2060 from currently

around 1 billion to 2.2 billion under the Medium scenario

and even 2.7 billion under the Stalled development SSP3

scenario.

That is right on target with my estimate. His estimate is from 2.2 billion to 2.7 billion in 2060. My estimate is 2.5 billion by 2060 and 3.3 billion by 2100.

Read Chapter 7, beginning on page 76. It will blow you away. I am doing some serious studying concerning Sub-Sahara Africa. I will have more to say on that subject in a week or so. Thanks for the link. It is a great help.

And to add to that, it’s not even really the new babies being brought into the world that is the major pressure now. It’s that we’re not dying as often as before, with people living longer in just about every nation, and that feeding into the massive pension bomb in the developed world.

We may have stabilised new births and, in many nations, now be below replacement (another issue for another day when we look at workforce and the population pyramid inversion). Still, so long as we’re living as long as we are, it means we’re adding on to the other end of the spectrum to births by quite a rate.

It’s a horrible balancing act. Too few births, and we get Japan and their stagnant economy. Too many, and we look at Nigeria with all the turmoil reduced access to resources that entails.

Nitrous oxide has a half life in the atmosphere, in daylight, measured in hours. It is also so reactive that it is used as rocket fuel. It is also measured in parts per billion in the atmosphere.

Wrong.

‘Nitrous oxide molecules stay in the atmosphere for an average of 114 years before being removed by a sink or destroyed through chemical reactions. The impact of 1 pound of N2O on warming the atmosphere is almost 300 times that of 1 pound of carbon dioxide.’

IPCC (2007) Climate Change 2007: The Physical Science Basis Exit. Contribution of Working Group I to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change. [S. Solomon, D. Qin, M. Manning, Z. Chen, M. Marquis, K.B. Averyt, M. Tignor and H.L. Miller (eds.)]. Cambridge University Press. Cambridge, United Kingdom 996 pp.

“And your suggested course of action is?”

Flee!

Things that can’t go on forever will eventually stop. When a civilization is created using methods that cannot be sustained it will collapse. And when collapse comes, all sorts of bad things will happen. They are best avoided.

Flee to a location where you can grow food, provide for your own water and energy supplies and where other people are doing the same. Build a mutually supportive community, hunker down and wait. It won’t be long. Survival is certainly not guaranteed, but one’s chances go up significantly. That’s about the best that anyone can do.

Every once in a while I come across something interesting that provides some ideas [and hope]. This one from a farming team that was trying to control costs and get away from using a lot of chemical$:

https://www.agweb.com/article/skeptical-farmers-monster-message-profitability They found some additional benefits and you can take their ideas with you as you search for a better place.

Seconded.

And with permaculture or better.

“Overpopulation is a Malthusian talking point. And that guy was wrong and a total shit.”

Bullshit. You have never seen that on this blog. No one who posts here is that stupid.

“Climate change can be solved, we have the technology.”

More bullshit. No one has ever posted such nonsense on this blog.

“Fresh water crisis? Ever heard of desalination?”

Nope. No one here is that stupid either.

Kleiber, I will not comment on your other accusations but others might. However, you should not accuse people on this blog of being as stupid as people you find on other blogs. Yes, some posters have beans for brains, most of them are Trump supporters. But even the few Trump supporters you may find on this blog are not that stupid.

If you find someone saying very stupid stuff on this blog, then quote them. But don’t just make up bullshit, and accuse people on this blog of posting it. That is what liars do.

With respect, Ron, you may have jumped the gun a bit there. My comments aren’t meant to be focused on just this blog, it was a general response one sees on such sites to the issues being debated. But I most certainly have seen the EV comments and the odd climate denial posting too, over the years.

But nothing as obviously outright in the face as the comments I make. It’s the sentiment. And believe me, as I know you’ve also addressed this, there are many who see no problem with BAU, just so long as we move off oil. Leaving aside how improbable that even is to achieve, it smacks of a tunnel vision to the bigger picture. Energy is, obviously, the most prominent issue. It does not change our path, though, if we simply carry on as before, but now with the peace of mind technologies of the renewable sector.

I lament the idea that so many smart people I know and have met online, will happily swallow narratives that show we don’t need to change much at all. Yes, change is hard and scary. It is also inevitable. And the future is not going to be as the past before it, even if we do have the mettle and resources to make the changes needed.

And that’s all it is: having the gumption to do what must be done. Nothing here was really inevitable, even if it now seems we’ve left energy transition and climate mitigation far, far too late.

As they say, it’s a predicament now. They don’t have solutions, merely consequences.

With respect Kleiber, you do paint with a broad brush. You said:

it’s often depressing to see the same kind of comments pop up on here, among other blogs or social media sites, echoing the same simplistic notions.

That definitely suggests such comments are made hee. Occasionally we do get some real goofballs here. But we make short work of them. If their comments suggest the logic of a second-grader, they don’t last very long. So when you throw us in with the flat earth goofballs, I take it as an insult.

Yes, we have had climate deniers here. But they get shot down pretty fast and are either banned or shamed into leaving.

Yes, the very idea that we can find a fix for all the problems humanity faces is a little absurd. But for some people, hope springs eternal. And I must say I enjoy reading their posts. It gives me insight into other people’s world view and how they were obtained. It is really astounding to learn that some really smart people can believe absurdities.

That’s fair. I didn’t mean to say that the majority here believe in outlandish panaceas to our worldly problems. Just that you get that odd comment that makes out like things will be rosy once we get X.

And I agree with you on the insight to be gleaned from the more optimistic commenters. I, myself, was the paragon of a futurist not long ago, prior to my awakening via TOD in 2007. Since then, my hope has been whittled away to naught as I see less and less pushback against a broken system, culminating now in the situation we have with the populist Johnson, Bolsanaro, and Trump governments. I was somewhat more hopeful with the pandemic highlighting so many flaws in how we run things. Then I saw how many would revert back to pre-pandemic mindsets, wanting to take this once in a generation opportunity, and simply find a way back to the well tread path of BAU. Depressing more than the virus’ impact is seeing change be suffocated outright.

It makes one consider that a people cannot save the world if they cannot help themselves from wanting more out of the Earth at any cost. Are we smarter than yeast? Jury’s out, though don’t hold your breath.

Okay, perhaps I overreacted. Sorry.

Your comment above is very insightful. I will try to reply in more depth later. But right now I had a lot on my mind and my brain is not functioning as well as I would like.

Thanks for the comments.

Geez Ron, I didn’t get that Kleiber was actually quoting anyone on this blog … “echoing the same simplistic notions”. Some of what he put in quotes may indeed have been a quote, but I took it they were generalized statements that do reflect what some people who post on this blog and elsewhere think. And I don’t think his comments are bullshit. And I don’t think he’s a liar for what he wrote.

Yeah, I overreacted. Sorry.

Another great post, George. Thanks.

You’ve confirmed something I thought for a while, but couldn’t easily demonstrate – the increase in GOM production in ~July-2018 was not due to any individual field coming on line, but the results a number of projects and fields. Looks like Shell had both Kaikias coming online about that time, but also Mars/Ursa had an increase, BP appears to have had increase at Thunderhorse, and Chevron had increases from both Jack/St. Malo and perhaps Tahiti. See chart below showing about a 200 kbopd increase starting in July-2018.

SLG – hope the retirement is going well. The production seems to have risen in a series of jumps followed by 18 to 24 months of plateau – or am I just seeking patterns where there are none? I think it’s something to do with group think that pervades the majors, e.g. they all have their own economic models which are secret but are also almost all pretty much the same and hence they make pretty much the same decisions based on the same prevailing economic, geological and technological conditions. There may, additionally, be some influence of installation periods (e.g. from loop current, hurricanes, and gas demand and refinery maintenance cycles) but it’s not as obvious as the North Sea or offshore Canada. I was looking to add a bit on this in my next post on future pathways, assuming there is something there to say.

This is another great post about GOM!

Am I correct to assume that almost anything in the GOM that has not already paid out is probably uneconomic at $40 WTI?

COP stated awhile ago it wants to divest of GOM. Is it stuck with the assets it has because there are no buyers, or just waiting for another day?

Finally, I wonder what the P & A liabilities are offshore US v onshore US in aggregate? Maybe before companies drill more wells they should first be required to plug wells they have not produced for a significant period of time, both onshore and offshore?

What would be the downside to such a rule, provided it is a reasonable time, say 2-3 years?

To me, if it is uneconomic to produce wells that one doesn’t want to plug (because those wells could be economic at a higher reasonable price point, say $60-80)the company shouldn’t be drilling new wells.

SS

A lot of good questions. I’ll take a stab at them.

1. Am I correct to assume that almost anything in the GOM that has not already paid out is probably uneconomic at $40 WTI?

To answer this, I’m going to differentiate between projects and wells. I suspect almost any GOM project with a new facility, not a tieback, that has come online since late 2014 is not going to payout. And keep in mind when operators sanction these projects, which may have happened in 2011 or so, they are assuming not only payout, but significant value creation beyond payout.

In this low price environment, near term cash flow is king. So if the producing wells can generate enough revenue to offset the operating costs of keeping the facility up and running plus taxes and royalties, they will keep the facilities running. I suspect some of these wells will payout (keeping in mind the well may have been drilled in, for example, 2016, and been online for 4 years), but, again, the overall project, which includes the facility costs, will probably not pay out, and certainly not create the project value originally anticipated by the operator.

2. COP stated awhile ago it wants to divest of GOM. Is it stuck with the assets it has because there are no buyers, or just waiting for another day?

I don’t think any of George’s graphs mention Conoco, unless I missed them. Conoco is mentioned in the text. I went to Conoco’s website and found they have a non-op interest in Ursa-Princess (Shell-operated in the very prolific Mars-Ursa area) and K2 (Anadarko/Oxy operated in southeast Green Canyon). Their total net production from these fields is about 15 kbopd.

I’m not sure how actively Conoco is marketing these assets. Typically, the field operator, and other partners, get the first stab at picking up working interest of a partner who wants to sell out of a field.

Assuming that has happened, and not resulted in a buyer, then Conoco would go to the open market to sell their interest in these fields.

Like any marketing venture, the seller and buyer have to agree on a price. Until that happens, Conoco is stuck with these assets.

These are both fairly mature assets. Conoco is possibly promoting a lot of upside, while prospective buyers are seeing fields where the operators are just riding down the production decline, and a lot of abandonment liability.

3. Finally, I wonder what the P & A liabilities are offshore US v onshore US in aggregate?

Two really big numbers!

4. Maybe before companies drill more wells they should first be required to plug wells they have not produced for a significant period of time, both onshore and offshore? What would be the downside to such a rule, provided it is a reasonable time, say 2-3 years?

Personally, at least from a GOM perspective, I’m not too keen on this idea. It could involve an operator, say BP, needing to abandon a well at Thunderhorse in order to obtain a drilling permit at Atlantis. The majors, at least, have pretty robust abandonment plans in place for their deepwater GOM assets. These plans include contracting rigs specifically for abandonment activities (some rigs are better suited for abandonment work, while others are better suited for drilling and completion work).

5. To me, if it is uneconomic to produce wells that one doesn’t want to plug (because those wells could be economic at a higher reasonable price point, say $60-80) the company shouldn’t be drilling new wells.

I think that is one of the reasons we are seeing so few development wells being drilled now in the GOM with oil prices in the $40 range.

SouthLaGeo. Thanks for your response!

Maybe my plugging before drilling proposal is too tough?

Just have seen several companies continue to drill onshore with investor money while having many SI wells that probably should be plugged.

I receive a lot of sales brochures for onshore projects that are for sale. Almost all have as many SI wells as operating wells.

Just got one yesterday for a project in LA that is for sale. 2 active producers,one active SWD, three SI producers.

There are SI wells all over the place, with operators trying to dodge being the “bagholder” for plugging them.

Shallow ,correct me if I am wrong . You are respected . In my opinion the whole oil industry across the spectrum has become a Ponzi . Conventional, non -conventional , Deep water, shale , we can add others like bio fuels etc . There is no profit any more in producing oil . Period . Jaw boning and lying is now the exercise to get a bigger fool to load off your loss making assets . This has now become a search for someone who will be the bag holder . Hopefully Mike S will give his POV ,one who is black in the face with the black goo .:-)

Shallow – your plugging before drilling proposal may have some merit onshore, especially with small operators. I’m curious regarding some of the properties for which you get sales brochures – Would they have value if the operators literally gave them away? Do you think the abandonment liability is less than the value of the remaining production (assuming $40 oil)?

Hole in Head – if the entire industry has become a Ponzi scheme, then, in my opinion, this has just happened as a result of the disasters of 2020. Over the years, shale has probably been the closest thing to a Ponzi scheme, but not so with deepwater and probably not with most (onshore) conventional. Regarding shale, if anyone can make money in shale, it is Chevron in the Permian basin, where a majority of their production is on fee acreage (no up front lease acquisition) and is either royalty free, or very low royalty. That’s probably a 10-15% advantage, maybe more? Not sure if others, like Exxon for example, have the same advantage.

SLaGeo.

I am sure some of the stuff doesn’t get a bid.

I think there is a lot of production being operated at a loss in hopes of a better day. Stuff that barely works or doesn’t work at $40 WTI works great at $60 if it is low decline. We are in that camp. We did really well in 2018. Really crappy in 2020.

What I wonder about is the debt. There was a lot of debt on US conventional in 2014. I assume a ton of that has since been defaulted on, just like with US shale and smaller US GOM.

Hole. The whole industry is not a Ponzi. I do not have enough information and knowledge to say what is and isn’t.

New well CAPEX is very high for most US onshore conventional in relation to the return at $40 WTI. There are some conventional locations that still work at $40 WTI, but they are few and far between is my best guess.

On the USA conventional side onshore, rig count has been the lowest in recorded history. That should tell you what you need to know?

Operating existing conventional is not necessarily a Ponzi, but I do know there is a heck of a lot of junk out there too, where maybe 1-2 producing wells work and the rest are shut in.

I think every publicly traded MLP that focused on onshore US conventional production has went BK. Denbury, which focuses on CO2 floods, went BK. So that should tell us something about the state of US onshore conventional. However, those companies did overpay for a lot of junk.

Much depends on LOE. We have some leases where LOE is very low, we have some where LOE is higher than $40 WTI. But it is easier to lose a little on those than just SI. But we did SI for about 4 weeks, which we had never done. Negative prices will cause that.

Shale generally doesn’t work at $40 WTI, or $50 WTI for that matter. We’ve discussed that enough.

As to GOM, I defer to the experts who post here, Mr. Kaplan and SLaGeo.

Seems Canadian tar sand has had a lot of financial trouble this year, from what I read.

It appears international works at $40 for the majors. But that might just be because they aren’t spending much CAPEX international.

To me, there has been a signal that most oil producers need to go into wind down mode. Generate cash flow from what you can, but new projects aren’t needed.

Each producer is different. Each well is different. Much drilling in shale is due to onerous requirements in leases negotiated when WTI was $90-100 and everyone thought we’d be there forever.

From what I know about Mike’s production, he has some of the lowest cost conventional onshore lower 48. But all around him there are a lot of shale wells that make no financial sense.

When XOM is in trouble, I would say most are in trouble?

Hih, that is not correct. For shale it might be more or less an accurate assumption but for convential absolutely a big NO. There are operators out there making big profits at current price, heck there are operators out there who made FCF even during q2 of this year, when you have opex of 3 dollar a barrel that’s what happens.

Baggen ,opex of $3 per barrel? . If SS is having to do shut in at current prices, difficult to believe that there are others with lower costs . SS and Mike S operate wells that have been paid up(little or no debt) and most important have “sweat equity ” . These fellows are not sitting in an airconditioned office and flying around in private jets , they are having to use a bottle of shampoo to wash up after the day is over . Conventional in the USA is now I think +50% stripper wells and the majors are not active in this area . Maybe you are referring to $ 3 as lifting cost for KSA ,Kuwait,UAE etc but I have commented on an earlier post that the total Opex of KSA is the cost of keeping the heads of the Saudi family attached to their shoulders . Take away the freebies given to the local population and it will be ” off with their heads ” . I think SS said it correctly “When XOM is in trouble, I would say most are in trouble?”

Yes, opex of 3 dollar per barrel and no im not talking about us production or saudi production.

They are of course an outlier i believe the very best in the world all arab producers included. They prove not all oil production is a Ponzi, theirs is more like a printing press for money.

Hih,

Im not talking about us production or saudi production.

Yes an opex of 3 dollars per barrel and that should answer your initial question as several other posters has aswell.

This is not stripper production, its not tight and its not in any arab county. Conventional world class assets.

ShallowSand – Hess gave a presentation last month and stated that they had some near field prospects none would be considered until WTI reached $50. Also shown was a chart of breakeven prices for various offshore and onshore projects from RS energy with a range of $52 at Vito to $71 at Big Foot. Future projects had Shenandoah at $68 and North Platte at $62. The numbers were from Jan. 2018 so would be a bit lower now.

For COP the particular lease if owns part of in Mars-Ursa is in fairly steep decline. It has a part of Shenandoah for future and P&A liabilities in a couple of non-producing leases.

Appreciate sharing your perspective George. The conclusion near the end (overshoot…) does indeed resonate with me.

And then-“Common advise is to do something positive even if you feel things are hopeless, which is fare enough but I think still smacks of a large amount of denial.”

Fair enough. Sometimes , such as in a state of terminal illness, denial can be a blessing.

And of course, outstanding work detailing the GOM production scenario.

Port Fourchon the HUB for GOM logistics, is expecting a visitor named Hurricane Delta. Right now, So much rides on immediate decision making. Impossible to be fully prepared for a big one. In Pensacola, Lawyers are fired all up to cash in on 20 rouge barges that were freed by Hurricane Sandy. If a Storm blows this way, the only way to protect the shoreline and population is to sink them deep in the GOM. Who ya going to call?

The Taylor Oil Disaster. An unstoppable GOM Spill?

https://www.youtube.com/watch?v=QdU-mJgcoyQ

It’s been a pretty bad year for production outages due to storms – five so far, affecting June, August, September and October, and probably more to come. Currently 92% oil, 62% of gas and 70-80% of rigs offline. There was a pause caused by some complicated oscillation that causes Atlantic thunderstorms and high wind sheer so the storms get wiped out, but that has reversed so conditions are conducive to formation off the Sahara (one forming there now perhaps), which tend to bend away north east as they get to the west side of the Atlantic, but also forming in Caribbean, which usually enter the GoM, and pop-ups in the Gulf itself. These seems to be the ones that grow quickly, become major hurricanes and can move slowly, dumping a lot of rain.

Hickory – agreed in part, though personally I don’t think I can do it, whether it would make me feel better or not, however I can accept an issue and still do nothing about it, whether through overwhelm or something else, which may amount to the same thing.

This is from a psychologist’s article on denial:

“When a person is in denial, they engage in distractive or escapist strategies to reduce stress and help them cope. The effect upon psychological well-being in doing this is unclear.

…

The American Heart Association cites denial as a principal reason why treatment for heart disease is often delayed. The same is true for cancer.

…

From a psychoanalytical viewpoint, denial is a pathological, ineffective defense mechanism..On the other hand, according to the stress and coping model, denial can be seen as an adaptive strategy to protect against overwhelming events and feelings.

Therein is the appeal of denial to humans. Denial allows someone to keep going unchanged despite reality. Denial is the path of psychological and moral least resistance.”

A good book, mainly on medical denial, Denying to the Grave by Gorman and Gorman. It particularly discussed why and how some parties encourage and take advantage of others denial to their own benefit.

ps I’ve fixed the spelling mistakes but god knows how many others there are through the post.

One point on GOM.

Look at the GOM service companies. The public ones’ stock prices are horrific. Worse performance than the producers.

HAL stock was higher during 1980 than present.

SLB stock hasn’t been this low for almost 20 years.

Pretty much every offshore driller is either BK or stock is below $1.

Per Haynes & Boone, 233 US service firms have filed BK on $100 billion of debt from 1/1/15 to 8/31/20.

During the same period, Haynes and Boone notes 172 US oil & gas producers have filed BK on $172 billion of debt.

The above BK are both onshore and offshore.

I guess us and the little mom & pop service firms we use not having went BK yet is a sign of what?

Hole, maybe most of it is a big ole Ponzi.

I don’t think Ponzi is the right term, but it’s hard to see how the oil industry (or the car industry) will maintain its current size when there are things like that out there:

https://www.youtube.com/watch?v=_tWXu372O3k

I just love these promotional videos . I called Nikola a scam when it went public in June . The whole EV is another scam like shale . Shale produced oil but no profits . EV’s will be produced but no profit . It took shale 10 years to unravel , how many years for EV’s, my guess 2025 so 5 years . It is a guess so not placing bets . Oh, after the end of airlines and aircraft mfg ,auto industry will be next . As a matter of fact we are already seeing the start of the decline . I am in agreement with you ,there is no future for automotive manufacturing . No, the end of the automobile is not on us , but the end of NEW auto mfg is . Second hand car market will continue . The next EV mfg to go will be Rivian .

h in h.

There is only one scenario where your prediction/outlook on the EV industry will be anywhere close to correct.

That scenario is is the outright collapse of modern economic life in the world. A long period of depression level collapse that affects all major economic regions of the world.

Its possible.

Short of that..well lets just say the prognostication will be embarrassing.

Well said and well analyzed also . I have commented earlier and have said that the problem with the EV is “affordability” . No ,there has not to be an utter economic collapse ,only a slide into poverty . I am seeing this from a front row seat in India . The upper middle class is now the lower middle class ,the lower middle class is now the “poor middle class ” , the poor are now the poverty class , the poverty class is now the destitute class who are surviving on 6 Kg of free wheat or rice per month for a family of 4 . I have worked that out in calories per person per month ,it works out to 3 pcs of bread per day . Just because it has not happened to you does not mean it is not happening . I commented earlier , take away the trillions printed to support the economy since 2008 of the GFC , then where would the US economy be ? Surprising that even after QE , ZIRP and all the alphabet soup shenanigan’s of the FED and the treasury the public heading to food banks and under food stamps are the highest in history .

In the meantime the government of the soon to be most populous country in the world has announced that all two and three wheeled vehicle to be sold after 2025 will be electric rather than ICE. This includes all scooters/motorbikes/rickshaws etc. That ruling will pertain to a large number vehicles- over 8 million 2- wheelers and 500K three wheelers.

“Mahindra introduces Treo, a revolutionary new range of electric three wheelers. Powered by the most advanced Lithium-ion technology, Mahindra Treo will change the world of three wheelers forever. ”

https://www.mahindraelectric.com/vehicles/treo-electric-auto/

Thats just one segment in one country. This trend is just starting to ramp up across the transport spectrum, from trains, buses and ferries, to bicycles and everything in between. I even saw a surfboard.

Tesla Cybertruck (to be first built in Texas) has pre-orders of just about 700,000 thus far. Pretty decent level of interest some would say.

So, until collapse, its happening.

Governments announcing by certain deadlines when all vehicles must be EV’s is mostly just talk. It sounds good right up till everyone tries to do it at the same time and these all governments come to the conclusion that they don’t have access to enough copper,nickel,cobalt, and silver to make it happen. Not even remotely close.

All that really matters is how much oil is available for export to all of Asia and Europe from the middle east and Russia. And how fast exports to all of Asia and Europe go to zero.

War is going to breakout in Asia the moment China runs out of US dollars. I expect them to sell all their US treasuries to get dollars over next 5 or so years. China needs US dollars to import all the natural resources including oil it needs to keep their economy going and people from rioting.

HHH, can you please explain the last part of China running out of dollars ? I have some inkling on this ,but how can China do that without unplugging itself from “the dollar ” based trading infrastructure . I hear about them trying crypto etc but will it work ?

“not enough copper”

I first heard we about to run out of copper in the late 1970’s. The global reserves are much higher now than then.

Someday we will run out copper perhaps, but not in the next three decades. Beyond that, time will tell so they say.

https://copperalliance.org/about-copper/long-term-availability/

I’m not a buyer of your opinion basket.

Hi Hickory, since this is a “peak” thinking site, I wonder what the graph of the ore grade in those mines looks like? How many more tons of rock are we crushing and processing to get that copper, and how much more energy does that take? Are we really going to be able to get those reserves out of the ground? I always love your data driven comments, so I’m just trying to expand the debate. And I haven’t answered my own question, because these type of data are not easy to find, I’ve previously tried with iron ore and it was harder than I could be bothered with in the end 🙂

Good question Phil. I don’t have that info, but would be interested to see it too. I wouldn’t be surprised to see that it takes much more energy to get low grade ores mined and purified than higher grade ones. We have seen this with coal in a very large way.

Nonetheless, I suspect that copper produced with higher energy requirement would still be well worth it. Its like driving to work. Even if it cost twice as much for energy to get there, people would still find it worth the investment.

I would not be surprised if industrial production and processes become much more expensive over time.

It will be wise to learn to live with less, and much slower growth.

Copper is so cheap nobody can be bothered to mine it any more. We are probably close to peak copper.

I agree that EVs are a low profit business compared to ICEVs. The car industry is going to shrink. VW predict employment in the manufacturing sector will fall by a third, for example.

The after sales business (spare parts and maintenance) which is the part of the industry which is most profitable, will be hit even harder than the new vehicle business. EVs are have lower maintenance costs.

This leads to leasing problems. Resale prices for the existing ICEs are already falling in anticipation of future EV sales, which will make leasing new ICEs much more expensive. When the typical three year lease runs out, the manufacturer needs to resell the used car, and if the expected reselling price is low, the leasing rate has to be higher to compensate.

High leasing costs for ICEVs will force fleet buyers to switch to EVs. As you say, this will deliver lower profits to manufacturers. Fleet buyers will provide the volume needed to reduce EV costs even further, flooding used car markets with cheaper EVs and pushing up ICEV leasing costs.

EVs are also expected to survive longer than ICEs, because they have many fewer moving parts. This should also put a damper on the total used car business, but more on the ICEVs than the EVs.

Where you analogy falls down is that frackers are attempting to replace low cost conventional oil with high cost fracked oil. This looked great at $120 a barrel, and doubtful at $60. At the current $40 it looks unviable.

I suppose if conventional oil runs out and demand is still high fracking could make a comeback. (This is the “economic” argument against peak oil.) But the current industry has jumped the gun on this.

The Andreessen/Horowitz mantra that “software is eating the world” means lower profits for gadget builders across a wide variety of industries. Software is a zero marginal cost business. You design once and sell as many units as you want without additional cost. When you build a machine, you have design costs up front, like software, but additional material, manufacturing and shipping costs per unit sold. Internal combustion engines, “the machine that changed the world”, are the ultimate gadgets, and will be hit hardest in the coming decade.

Alimbiquated , a very good explain .I like to add some points .

In my opinion the world is giving too much hype to technology services . We must understand that services support manufacturing . A decline in manufacturing will lead to a corresponding decline in tech services . If VW has no orders then it is not going to order new software for its CNC machines . After all we may order take out meals by an app but someone has to cook it(manufacturing) and someone has to deliver it (logistics) . We cannot download the meal from our laptop or smartphone.

Second , our industrial civilisation is a three legged stool ,the legs are oil , electricity and metals . Even if one leg is wobbly or broken the stool will become unusable ( repeat unusable),the leg does not necessarily has to break . The oil industry is where I think the wobbling will come first or maybe we are seeing the initial stages of the wobble with the current low price of oil . That is my opinion and please feel free to correct me .

Hole in head,

I would substitute energy for oil for one of the legs of the stool, oil is great stuff, but energy per unit volume is not the most important metric (despite what Art Berman believes), cost is what really matters and as oil becomes scarce and expensive, other forms of energy will gradually replace oil.

As metals become more expensive, more of them will be recycled and scarce metals will be substituted (aluminum for copper) where possible as well as recycled. Electricity can be produced with many types of energy (natural gas, hydro, nuclear, wind, and solar) and wind and solar are becoming less and less expensive and will substitute for most other forms of energy used to produce electricity over time, especially depleting resources like coal and natural gas which will become expensive as they deplete.

Dennis ,on the wrong track and I will tell you why .?

Oil : Please tell me what are these ” other ” forms of energy ? Answer , Null, Nada, Shunya , Nincs ,Zero . That is five languages if you want more, I can . Also as Dr Robert Hirsch pointed out in his report ,we need a transition time of 20 years to move from one energy source to another . Regret to say we do not have the transition time . Something I want to add from a personal experience . When you transition you need both resources, the old and new . When my business transitioned from manual book keeping to computerized system we kept both book keeping systems operational for a year as insurance . So actually we have run out of road .

Metals : How are you going to replace steel in construction ? With plastics , aluminum ,copper ? All metals have specific uses . Are you going to replace aluminum with tin for making aircrafts ? Are we going to make ships out of glass ? Does not work that way . What happens when the power plant needs immediately a steam pressure tank but no sheet plate is available ? Are we going to make one out of sand ?

Electricity : Let us keep renewables out of the argument because that has been discussed here before and issue of storage and intermittency . Nuclear is out of question now . NIMBY prevails and also the lies about safety and price have been exposed . Hydro expansion is not possible . Best sites have been dammed . Let me give you a real example . This was the year when Soccer World Cup was in South Africa . South Africa was almost at the verge of cancelling the event because the roads to the power plants were in such bad shape that trucks carrying coal to the power plants were unable to do so . Why ? There was a shortage of asphalt . We know asphalt is a petro product. What happens when the diesel train bringing the coal to the power plant is docked because of no diesel ? You can look for a solution .

Hole in head,

Steel is mostly iron and carbon, these are both abundant. Oil will be used more efficiently if it becomes scarce and expensive which may allow an energy transition to occur.

The Hirsch report is quite old and the oil resource has proven larger than he imagined.

You believe an energy transition cannot happen, I disagree. The future remains unknown, as always.

On renewables, intermittency can be handled with a small amount of fossil fuel backup and overbuilding of wind and solar power widely dispersed and interconnected by a high voltage grid, there is plenty of existing research outlining how it might be done, as fossil fuels are gradually replaced more research will be done on the best way forward, of the infinite possible scenarios that might be devised, I suppose it is possible all will fail. In that case, the World uses less electricity and the system will adjust in some fashion. I expect things to change in the future as has always been the case in the past.

Dennis , your reply is worse than that of an amateur . Is steel making the same as making a cup of coffee ? All we need is coffee , sugar , water and milk . In what ratio is not important . Is construction steel the same as steel used for making ball bearings , is there any difference in steel used to make transmission gears and a barrel of a gun . Is there a difference in sheet plates used for making car doors and compression tanks ? My view is either you are ignorant or in denial .

As to the Hirsch report being out of date , well then so is Hubbert’s observation and so is Newton’s law of gravity and the laws of thermodynamics . They are all past expiry date .

For the rest of your arguments they are useless . They are in “ether ” . If this is done and if that is done is just “hopium ” . Just like nuclear fusion ,still on its way since last 40 years but never arrives . Reminds of a friend who ALMOST got married for 40 years but died a bachelor . 🙂

Hole in head,

name calling does not really dignify a response.

Made a long reply to this in the appropriate thread.

Dennis , I apologise if you feel so but saying that iron ore + carbon = steel is NOT something I would expect from you ,that is why I said amateur . You are held at a higher standard by me . As to the last part about the bachelor ,it is the way we explain in my culture regarding things that will never happen. See the smiley at the end . Maybe better if I had said ” Waiting for Godot” . Still apologies ,if you are offended . It never is or was my intention .

P.S : Your saying iron ore +carbon = steel is akin to the comment of Tonymax on the other post saying that carbon and oxygen are life giving materials ,so CO2 is not dangerous for mankind .

hole in head,

Read what I wrote, I said that steel is mostly composed of iron and carbon. From link below

https://en.wikipedia.org/wiki/Steel

In the contemporary steel section it has:

Carbon steel, composed simply of iron and carbon, accounts for 90% of steel production.

If your point is that energy is also required, I agree. Sometimes I assume my readers do not require statements of obvious facts. 🙂

The issues underlying this sort of thing are of course far from limited to energy and materials.

For one, ‘industrialism’ is often, if not usually, predicated on certain modus operandi that include wage and tax slavery; social, spacial and wealth stratification; and land-grabbing and ecological despoilment.

So when we decide on or advocate such government-industrial output as EV’s and PV’s, we need to keep the above in mind, which we, almost ritualistically it seems, often don’t.

There were comments on the prior post regarding affordability of oil.

A few additional thoughts/questions on the subject-

Some oil demand will not vary based on price until extremely high (inelastic demand), such as basic industrial function.

What is the most elastic (responsive to price) demand? Leisure (entertainment, sports, vacation) travel for example?

I wonder what proportion of fuel consumption is ‘optional’ based on price.

I’m sure it varies by country and level of prosperity.

If you are a manual labourer who uses fuel to get work, how expensive does it have to be before you will abstain from purchase? A price/gallon below 2 to 3 hours of wage will be readily absorbed I suspect, based on my experience when younger.

And just how high does the price of fuel have be to before you will switch your vehicle to a form that uses a less expensive mechanism to propel you? (I think most readers here know full well what that less expensive/mile mechanism is).

The answer to these kind of questions has a lot to do with how affordable fuel is. The other side the equation is obviously the employment/wage level of the overall population.

Great post, George. PS Who is changing the fonts and format of this blog?

‘blockquote’ doesn’t seem to work.

I think it’s Mr. WordPress who also thinks I’m Polish for some reason.

I was wondering about that. The format had all changed and it’s a little disorienting.

I’m also not so hot on my Polish skills.

Greenbub,

It is me with input from others (Ron, Ovi, and Paul). We wanted a theme with two columns and body of post on left. This is what I could find at no cost from Word Press. Not perfect, but the original theme used by Ron is no longer maintained by its author, an update to the most recent version of WordPress broke that original theme (comments would not appear). We switched to a three column theme, but this did not work well for charts in the posts (they were too small), so we switched to the current theme.

None of us are programmers (except Paul, but he has other stuff to do) so fixing the theme is beyond my skill.

Not a perfect solution, but you get what you pay for. 🙂

Ok, I wish you luck- I have no programming skills either.

Really challenging blog for me now.

But maybe just need to use it.

Highhtrekker, you complain too much . Under the new format I have the maximum posts as of today ( maybe Dennis has more , I am not counting )and I have had no problems . Nada ,Nulla, Nil , Shunya ,Niks ,Nincs . That is in six languages ,if you want more I can say that in more . Inconvenience ok ,but challenging ? Give me a break . You are not climbing Mount Everest . Acknowledgement, thanks to both Dennis and Ron keeping this blog active . We all know where TOD went when members became uninterested in the topics under discussion . I and others ( speaking on behalf ) sincerely hope that this does not go the same way because of petty issues . By the way ,you are a respected commentator but as Shakespeare said ” thou complaint too much ” . In Dutch it will be ” Te klagen ,te veel ” . Be well and take care , The end of the oil age is going to be exciting for those who are on this forum and you have a front row seat .

Hole in head, maybe it’s time to find a new hobby.

hightrekker,

Sorry for the changes, hopefully we will become accustomed to it.

My kids laugh at me now, I used to be the computer expert in my house, now I go to them when I can’t figure stuff out. Things change, makes life interesting and sometimes frustrating.

Thanks Dennis—

Yea, I was actually a consultant for Apple, and sent to solve problems.

Denial

Americans are past denial. What’s left is ignorance, stupidity and self interest and the self interest oil industry are burning their own house down. From their belief in their own disinformation that oil has a monopoly on transportation and can sell everything produced. The oil industry is drowning in inventory, yet can’t help it’s self from it’s self. Example

“we have some where LOE is higher than $40 WTI. But it is easier to lose a little on those than just SI. But we did SI for about 4 weeks”