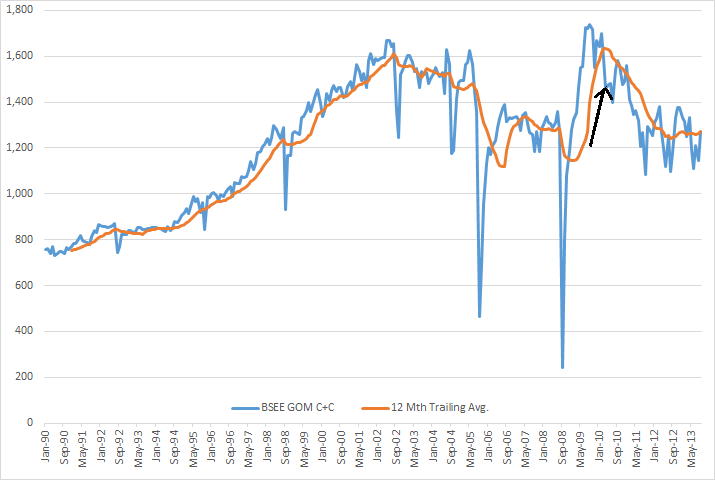

Not much happening on the Peak Oil front these days. I checked out the BSEE Gulf of Mexico production. Data is in kb/d with the last data point September 2013.

Average production from the GOM has been relatively flat for the last two and one half years at about 1.260 million barrels per day. The arrow marks April 2010, the month of the Deepwater Horizon disaster.

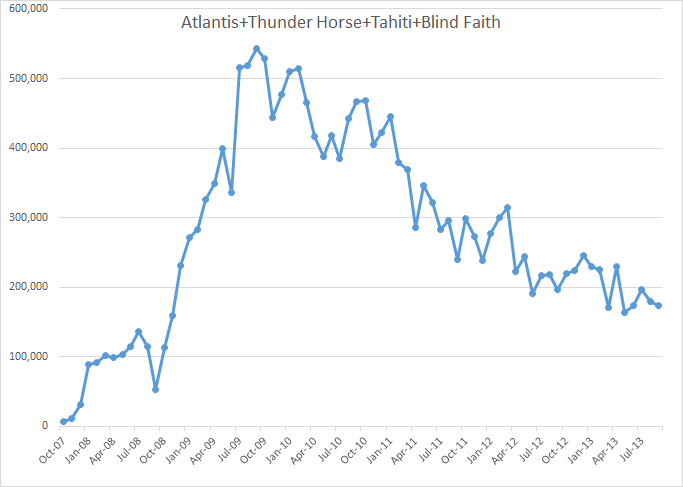

The big deepwater plays continue to decline. I guess they are bringing on other wells in order to keep production flat.

The above chart is combined liquids production of Atlantis, Thunder Horse, Tahiti and Blind Faith. The last data point is September 2013.

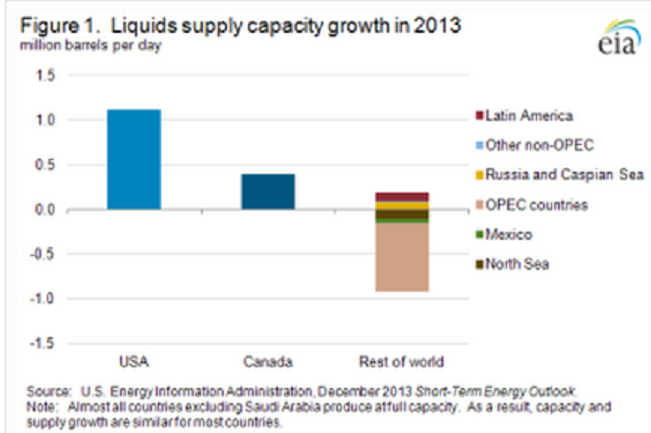

I found this chart while browsing the net yesterday. It was published in the Albany Tribune but they say it is from the EIA’s Short-Term Energy Outlook. I failed to locate it there however.

It’s a little fuzzy because I had to enlarge it. But it clearly shows that without the US and Canada world oil production would be in decline. Even with Canada but without the US then world oil production would still be in decline. And notice the words under the chart. “Note: Almost all countries excluding Saudi Arabia are at full capacity…”

All countries excluding Saudi Arabia are at full capacity. Saudi might produce half a million barrels per day more, perhaps less.

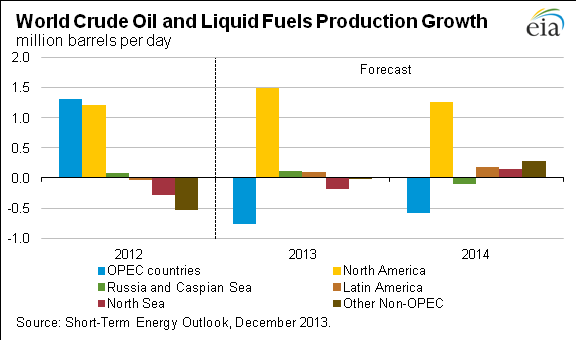

This chart I did find in the December Short-Term Energy Outlook, link above. It is a bit clearer. This chart clearly shows that in 2013 the world would have been in steep decline were it not from increasing production in North America.

Notice that they were expecting Russia and the Caspian, (Azerbaijan and Kazakhstan), to increase slightly in 2013, they did, but are expecting them to slightly decline in 2014. That will be interesting to watch.

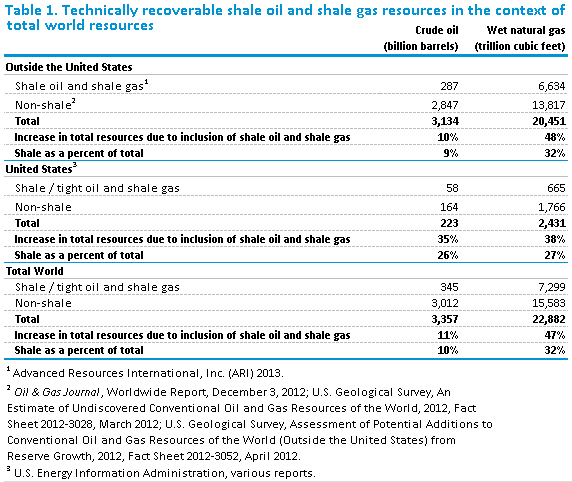

Something else I came across yesterday that I would like to share with you. It is also from the EIA: Shale oil and shale gas resources are globally abundant

3.357 trillion barrels of “technically” recoverable oil with shale oil 10% of that total! All that oil and everyone, with the possible exception of Saudi Arabia, is producing flat out. That is over 100 years worth at current consumption rates. Is that a joke or what?

Note: The EIA still has not published their International Energy Statistics, the report of every nation’s oil production. They are almost two months behind. The last report that came out in November had production numbers only through July 2013. When, or perhaps I should say if, the report does come out I will have a post on it and also update the Non-OPEC Charts page. The OPEC MOMR is due out the 16th with OPEC production numbers through December.

EDIT: Check out this article: Natural plunge in Iran’s oil output

Based on a report which was published by Iran’s Majlis (Parliament) Research Center in October 2009, Iran’s production capacity annually declines by an average of 10 per cent…

EIA also reported in March that Iran’s oil output capacity annually declines by an average of 8 to 13 per cent.

EIA’s latest report published on Jan.7 shows that not only Iran has failed to compensate for its natural production decline by inaugurating new oilfields and using new production methods, but also the country’s natural production decline has exceeded previous estimations

I’m appalled that EIA is failing to report international statistics. I think this is just a sign of things falling apart at the edges rather than an attempt to suppress information. Entropy rules.

Is anyone cold over there yet. The news in Oz has most of the US frozen solid!

On another note, last weeks Petroleum report from the EIA states:

http://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf

“Total motor gasoline

imports (including both finished gasoline and gasoline blending

components) last week averaged 247 thousand barrels per day. Distillate

fuel imports averaged 140 thousand barrels per day last week.”

What happened to the US being an exporter of petroleum products that MSN was all over a few months ago. Finally, the US usually imports gasoline and exports diesel, but by this report and at least few before it has the US importing diesel as well.

Anybody have any views or information on this?

Here in North Alabama right now it’s 13 degrees F. That’s cold.

About US imports and exports, you must look at net imports or net exports if that is the case. But it has been net imports for many decades now and I doubt that will change in the next 40 years or so. Last week we exported 3,641,000 barrels per day of petroleum products on average. But we imported 8,818,000 barrels per day of petroleum products. That was mostly crude oil. So that left us with net imports of 5,177,000 bp/d.

Imports of Crude Oil and Total Products

Ron,

Thanks for pointing out the NET part. Though it does surprised me why the EIA would include imports in their highlights without taking into account exports? Sounds like they are only sharpening one side of the axe for some reason.

I am sure the extreme cold will provide plenty to discuss in the coming weeks, Nat gas draws, Bakken oil production/ non production, etc.

Keep warm now!

Coldest Air in Decades Clearing Customs, Entering U.S.

By Andrew Freedman, Climate Central, Published: January 3rd, 2014 , Last Updated: January 3rd, 2014

A Polish co-worker mentioned that his Dad was telling him Poland has been unusually warm this winter!

Reporting from Belgium: We have 55 degrees F nowadays, where we should have something like 40 degrees F. Last friday we suffered a thunderstorm, normaly appearing under summer conditions. Flowering trees start to bloom. Meanwhile conditions seem to be unfavorable for ice formation on the Arctic: http://nsidc.org/arcticseaicenews/charctic-interactive-sea-ice-graph/

Exclusive: Permit Shows Bakken Shale Oil in Casselton Train Explosion Contained High Levels of Volatile Chemicals

Steve Horn, DeSmog Blog, Sun, 2014-01-05 21:01

“What I know from the testing I’ve done on my own — I went out to the Bakken oil fields and pumped oil from the well — I know there are unprecedented levels of these explosive volatiles: benzene, toluene, xylene,” said Smith.

“And from the data that I’ve gotten from third parties and tested myself, 30 to 40 percent of what’s going into those rail cars are explosive volatiles, again that are not in typical oils.”

So benzene is more explosive or volatile than pentanes ?? Hmmmm

Wow, the US now has 223 billion barrels of technically recoverable reserves, almost as high as Saudi Arabia’s inflated reserves. This mean that the US now has the same minuscule 1% yearly depletion rate as Saudi Arabia. And this is despite a heroic (suicidal) effort to increase production as much as possible.

Keystone XL Pipeline: A Potential Mirage for Oil-sands Investors

Keystone XL Pipeline: A Potential Mirage for Oil-sands Investors(pdf:major paper) shows ‘new Canadian oil-sands development is increasingly economically questionable without the additional export capacity that pipelines such as KXL would bring’, says Mark Lewis, external research advisor to Carbon Tracker. ‘But the vision of improved prices it promises could quickly be wiped out by increasing costs, meaning investors who believed the mirage of improved oil-sands economics with KXL will be left disappointed’.

Some good info on Tar Sands shipping costs to GOM and other destinations, and diluent proportions for different shipping modes in the report.

Mark Lewis formerly Managing Director of Commodities Research at Deutsche Bank wrote “Crude Oil: Iceberg Glimpsed Off West Africa”(pdf) in 2012. It’s worth reading. An interview with him about that report can be found at the Master Resource Report.

Study Shows Fracking Is Bad for Babies

By Mark Whitehouse, Bloomberg, Ticker blog,Jan 4, 2014 4:58 PM ET

Did a quick estimate of the decline rate since peak of those 4 wells in the GOM. It appears to be in the neighbourhood of 24%. Surprising!!

That is four platforms, not four wells. Every platform has many wells. But 24% is about right for deep water.

from the Washington Post

http://www.washingtonpost.com/world/brazils-oil-euphoria-hits-reality-hard/2014/01/05/0d213790-4d4b-11e3-bf60-c1ca136ae14a_story.html

It’ probably impossible for an outsider to determine which is the larger problem for Brazil but it’s obvious that political considerations are hampering development of Brazilian oil to a serious extent.

But it seems to be equally obvious that the so called economic viability of their so called pre salt deep water oil is questionable to say the least at current prices.

It also remains to be seen just what the truth is in respect to Brazilian reserves but they are again to say the least, questionable.

On Energy Matters:

The Primary Energy Tale of Two Continents

Global Oil Supply Update July 2013

Ron, your chart up top is interesting from a couple of perspectives. First it is a record of hurricane activity, building up to the 2005 Oil Drum making event 😉 But post 2008 it has gone really quiet. Second, production seems to be holding up much better than the North Sea. I’m guessing this has to do with phased development as activity moved into deeper and deeper water. But I’d guess one day, offshore production will begin to drop like a stone – unless that is we are doing something wrong this side of the pond.

Note that Federal offshore Gulf of Mexico marketed natural gas production has fallen by two-thirds in 10 years, a double digit annual rate of decline, down from 4.5 TCF/year in 2002 to 1.5 TCF/year in 2012:

http://www.eia.gov/dnav/ng/hist/n9050fx2a.htm

The former governor of Montana, Brian Schweitzer, was on MSNBC this morning, leading a Cornucopian Fantasy Discussion. His primary points follow:

Mexico is on the verge of a showing a huge rebound in production. As US and Canadian oil production continue to increase, North America is on track to become a leading net oil exporting region within 10 years. In that context, it makes no sense for the US to try to protect Middle Eastern oil producers, since we will be competing with them for access to oil importing markets. The thinking was that the Middle East is Asia’s problem, since North America will soon be energy independent, on track to net exporter

status. Also, with vast supplies of cheap energy at our disposal, we are in the early stages of a manufacturing resurgence, as the highly skilled North American workforce benefits from access to vast supplies of cheap energy.

Note that the Cornucopian Fantasy discussion, led by Brian Schweitzer, was Monday morning

Re: Toolpush

To clarify slightly, net US exports of refined petroleum products (e.g., gasoline, jet fuel, diesel) have increased in recent weeks. Looking at the four week running average data, net exports of refined petroleum products is up by about 350,000 bpd in a five week period:

http://www.eia.gov/dnav/pet/pet_sum_sndw_dcus_nus_4.htm

I suspect that this may at least partially reflect lightly refined condensate production, from the Gulf Coast:

http://www.reuters.com/article/2013/11/21/us-magellan-ceo-idUSBRE9AK1I120131121

To clarify your reply Jeffery, your link shows “total exports” not net exports. Net exports were negative.

Ron,

Toward the bottom of the page, they show net imports*. The most recent net (four week running average) imports were as follows for crude oil, for refined petroleum products and for total overall liquids (thousands of barrels per day):

Crude Oil: 7,349

Refined Petroleum Products: -1,862

Total Net Liquids Imports: 5,487

*And of course, they define net exports with a minus sign in front of the number.

Ron,

To my mind, something is missing from the GOM discussion. How can production remain more-or-less flat given the high (roughly 25%) decline rates of deep water plays, plays that are supposed to be the salvation of depletion from mature closer-to-shore deposits? Of course we don’t have access to all Gulf activity but this stuff is undertaken by companies who announce significant discoveries. And, the decline numbers from Atlantis et al are not an insignificant portion on the Gulf’s 1.2 M production total. What am I not seeing here?

Doug

Not sure but I think the GOM has it’s own Red Queen to deal with. There is a lot of activity going on in the Gulf. This article was published last month:

Noble Energy to spend $450 million on Gulf of Mexico drilling projects

Noble Energy Inc. plans to invest $450 million in oil and gas exploration in the Gulf of Mexico next year, with most of the work centering on development of three deepwater discoveries off the Louisiana coast.

On the other hand this was just posted today:

SandRidge Energy Gives Up on the Gulf of Mexico

Well, that didn’t take long. Less than two years after buying Dynamic Offshore to build its Gulf of Mexico business, SandRidge Energy is giving up on the Gulf.

At any rate there is still a lot of drilling going on in the GOM. Old leases dry up as new ones come on line. And as of now they are just staying even, just barely replacing the declines.

“There is a lot of activity going on in the Gulf.”

In the wake of economic apocalypse, we should not underestimate the effect of the Red Queen’s frantic efforts. They are a BOOM in appearance. Look at all this activity!! Look at all these jobs!!

In effect, from the perspective of unemployment, running short of oil is the very best thing that could happen.

Watcher wrote: “In effect, from the perspective of unemployment, running short of oil is the very best thing that could happen.”

For every one job created in the energy sector because of higher energy costs, probably 10 or more are lost in other private sectors as demand for non-energy goods and services decline. Not that I think interest rates will rise anytime soon, but if drillers were not able to borrow at the lowest interest rates in 100 years, I doubt their would have been a drilling boom in the US.

I chuckled when I read this:

http://cnsnews.com/news/article/michael-w-chapman/saudi-billionaire-prince-fracking-competitively-threatens-any-oil

Prince Alwaleed Bin Talal… said the production of shale oil and natural gas in the United States and other countries, primarily done through fracking, is a real competitive threat to “any oil-producing country in the world,” adding that Saudi Arabia must address the issue because it is a “matter of survival.”

Fundamental rule of the universe: There are no stupid billionaires.

Which means he knows better and has an agenda. Maybe he’s negotiating to buy something oil relevant and trying to push the price lower.

“Fundamental rule of the universe: There are no stupid billionaires.”

Not necessarily so. That may be true for those that, on their own, made their billions. But Saudi Princes inherited theirs. I would bet there are a few stupid ones among them.

In addition to the rich who inherit, there are plenty of rich people who have gotten their riches simply thru luck in terms of being in the right place at the right time.

Luck has as much or more to do with getting rich as brains; all it takes is a couple of big bets on long shot winners in picking investments.

Even the greenest novices win a few hands playing poker with world class experts.

The brains come in i holding onto the winnings – if they materialize ! 😉

Train derails, catches fire in northwestern New Brunswick

KAITLYN McGRATH AND THE CANADIAN PRESS, The Globe and Mail, Published Tuesday, Jan. 07 2014, 8:24 PM EST

A CN train has derailed in New Brunswick, near the U.S border on Tuesday evening, resulting in a fire.

Sharon DeWitt, emergency measures co-ordinator for the village of Plaster Rock, confirmed to The Globe that a few train cars derailed about five or six kilometeres east of Plaster Rock and that there is a fire. She said she does not know what the train was carrying and she is not sure whether the burning material is hazardous.

Higher insurance premiums in the forecast after months of wild weather

JACQUELINE NELSON, The Globe and Mail, Published Tuesday, Jan. 07 2014, 6:48 PM EST

Analysts at BMO Nesbitt Burns estimate that the recent damage caused by ice storms in Ontario, Quebec and Atlantic Canada last December could result in between $400-million and $600-million in gross losses for the P&C industry in Canada.

This comes on the heels of the rain storms and flooding that ravaged Alberta, Ontario and Quebec in recent months.

The storms that swept through Alberta last June caused $1.7-billion in insured damages, making it Canada’s costliest natural disaster, according to the Insurance Bureau of Canada.

Here in South East Wisconsin schools and businesses were closed due to the cold weather – which is something unprecedented. Now I have to agree it makes a lot of sense, but I believe that a major factor in the decision to shut the schools down was to control costs – especially costs associated with government services and first responder operations. The last few snowstorms here caused havoc on the roads and stressed the capabilities of first responders. It was even noted in the local paper.

County stays calm during freeze

RACINE COUNTY — An exceptionally frigid Monday passed without any major incidents, hassles or disasters in Racine County as temperatures marched gradually down throughout the day and into the night. Despite a brief power outage in Kenosha County that spilled into parts of Racine County, the coldest day in recent memory passed without a hitch, according to David Maack, coordinator at the Racine County Office of Emergency Management. “Everything so far seems to be stable … cross our fingers,” he said as Monday evening approached. Many businesses, offices, schools and other public services were closed Monday and will be again today, as officials urged residents to stay inside if possible.

I think that there will be more closing like this in the future as governments seek to control costs and work with reduced numbers of first responders due to budget considerations. PEAK OIL!

Amazing to watch – especially the people who get out of their cars and are congregating on the Freeway. It’s amazing that it wasn’t worse.

The Department of Transportation’s traffic cameras captured the frightening massive pileup that happened on Highway 41/45 near Lannon Rd. around noon on Sunday, December 8th. Officials say the video clearly shows people were driving too fast for the conditions on the roadways. They say it also illustrates something you’re never supposed to do — step outside of your vehicle along the roadside — especially when the conditions are as they were on Sunday.

http://fox6now.com/2013/12/10/video-traffic-cam-captures-massive-pileup-on-hwy-4145/

I posted this up top but I put it down here also so no one would miss it:

Natural plunge in Iran’s oil output

Based on a report which was published by Iran’s Majlis (Parliament) Research Center in October 2009, Iran’s production capacity annually declines by an average of 10 per cent…

EIA also reported in March that Iran’s oil output capacity annually declines by an average of 8 to 13 per cent.

EIA’s latest report published on Jan.7 shows that not only Iran has failed to compensate for its natural production decline by inaugurating new oilfields and using new production methods, but also the country’s natural production decline has exceeded previous estimations.

Iran claims 157.3 billion barrels of proven reserves. If that were the case then why is their production capacity declining? 157.3 billion barrels of reserves would give the a R/P ratio of 123 years.

With official proved reserves above 150 billion barrels, you’d think Iran would have no problems increasing production by a magnitude. As it stands, their depletion rate is a measly 0.65%/year. In other words, they’re either incredibly incompetent at extracting oil or their official reserves are total BS.

So maybe a decrease in oil exports from Iran was not all that sanctions relevant. In fact, if it’s intensely geology, even the magic of “investment” won’t solve it.

http://www.brookings.edu/blogs/brookings-now/posts/2014/01/senator-murkowski-calls-for-end-to-crude-oil-export-ban

Ending the ban might probably doesn’t matter one way or the other since oil is fungible and readily available ; it might save some shipping expenses by allowing Alaskan crude to be sent to Asian markets and thus net a larger profit for Alaskan oil.

The problem is that such a move, if it succeeds, will be interpreted as evidence that we’re home free and the days of happy motoring are back again by the cornucopian msm.

And of course Joe Sixpack will believe it, because he wants to.

“Ending the ban might probably doesn’t matter one way or the other since oil is fungible and readily available”

Not exactly. The price of oil in North America (NA) is consideably cheaper than it is in Europe and Asia. I think if US was to export, NA prices would be much closure to the prices in Europe and Asia. frack drillers probably can’t make a profit with NA oil prices, but a 10 to 20 increases per barrel would make a difference for them.

Maersk, one of the worlds biggest ship owning companies sold its oil tanker fleet to the Belgian company Euronav. A transaction of 750.000.000 EURO. Why? Does Maersk know about Export Land Model, and Euronav does not?

“The outlook for the large crude tanker market has improved significantly over the last months indicating a resurgence of demand and an improved near term outlook,” Euronav said.

So they are talking abouth “months”.

http://www.seatrade-global.com/news/asia/maersk-tankers-sells-vlcc-fleet-for-$980m-to-euronav.html

A war between Japan and China puts those at risk, and Lloyds probably will raise that risk by invoking war clauses.

I applaud this move by Maersk. Not a good business to be in.

I think there is a real possibility of a war within the foreseeable future in the Far East but that the risk of it is very small for now, barring unfortunate accidents.

The owners of these giant ships, collectively, have been losing their shirts off and on for the last decade.

Apparently there really is free market in shipping oil, and the folks who own tankers are in a situation similar to that of farmers.

A modest amount of excess capacity in such a market can send prices to rock bottom and the market seems to be glutted with large crude carrier capacity over the last few years.

I didn’t save links, but I remember reading about shipyards having tanker orders cancelled and collecting big penalties from the buyers and that sort of thing.

Interesting & would make sense.

Due to fracking US Domestic Oil imports went down from approx. 11 mb/d to 7 md/d. Europes oil consumption is declining and sluggish at best – reducing its total oil imports, especially because the € periphery is (currently) toast.

China’s car sales in December 2013 jumped +21,47% up (total 2013 sales in comparison to 2012 was +15,71%) and their oil-import bill grew to 219,7 billion $ in 2013 (or 5,6 mb/d).

Since I would assume that china has enough tankers on their own and under their own flag – it means that china does their thing – and the rest of the OECD world restricts their imports (with Japan as exception due to Fukushima).

Here is another link to an article about the possibility of the crude export ban being lifted. This one goes into a good bit of detail.

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/01/08/u-s-oil-exports-have-been-banned-for-40-years-is-it-time-for-that-to-change/?

Only 1 of 9,136 Recent Peer-Reviewed Authors Rejects Global Warming

Only one article, by a single author in the Herald of the Russian Academy of Sciences, rejected man-made global warming.

A clue to the author’s motivation comes on the first page of the article, where he writes,”The switch of world powers first to decreasing the use of fossil fuel and then to carbon-free energy within the framework of the Kyoto Protocol may lead to economic collapse for Russia as a consequence of the reduction and, probably, even loss of the possibility to sell oil and natural gas on the world market.”

Ron,

I should have made that image smaller. I shrunk it down but not enough.

Re: China growth to the rescue.

For those who believe that Chinese growth will solve all of the world’s problems, consider the following:

Chinese Debt

Read between the lines, and one finds that the growth of debt is around 13% of GDP per year.

It currently stands at 56%. So, in another 4 years, China will be at 100% debt-to-GDP, and then there will be problems.