The EIA, a few days ago posted their International Energy Statistics. They publish lots of statistics here but on monthly basis I only follow their production of world Crude Oil including Lease Condensate.

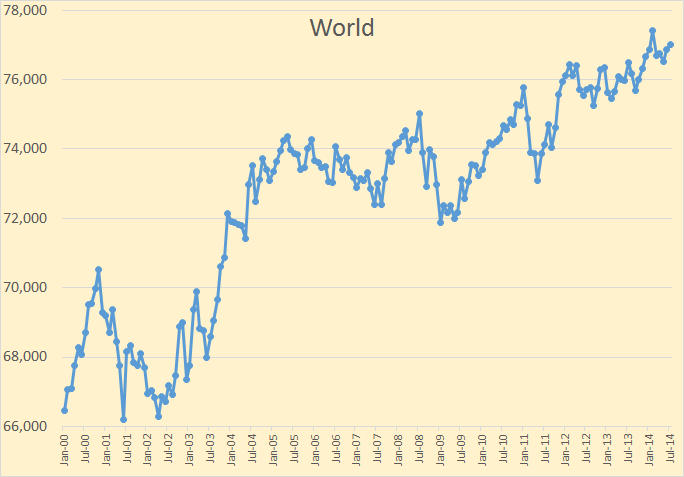

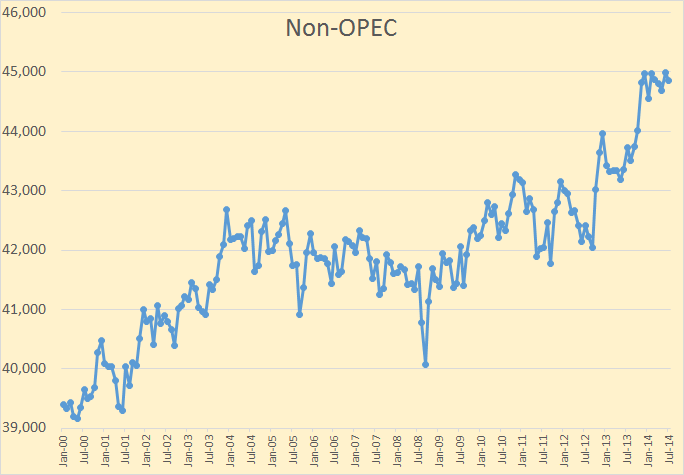

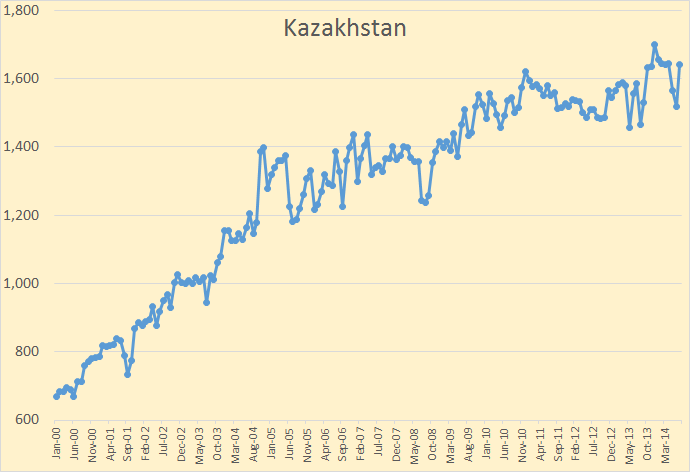

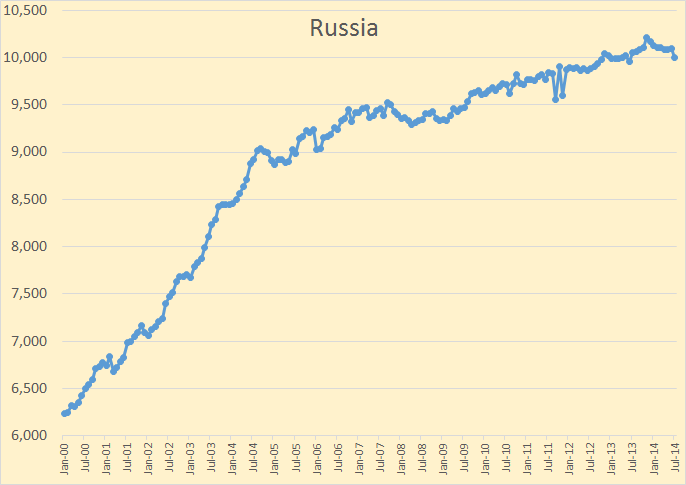

The data on all charts below is Crude + Condensate production through July 2014 and is in thousand barrels per day.

World C+C production was up 168,000 bpd to 77,023,000 bpd. The high, so far, was in February at 77,409,000 bpd.

Non-OPEC C+C was down 135,000 bpd from it high so far. It has been on a 9 month plateau high.

That surge upward in world C+C production was, of course all US production. Without US production Non-OPEC production is 1,365,000 bpd below the peak in November, 2010 and is currently below the level hit on November, 2003. World C+C less US is 2,069,000 bpd below the peak of January 2011.

I believe that Non-OPEC production, less US, is well past its all time high. I think we will see considerable decline in Non-OPEC less US production in 2015. It remains to be seen whether US production will keep Non-OPEC production increasing. But I am predicting that US production will not keep Non-OPEC production increasing past 2015.

The EIA C+C data above is through July while the MOMR Crude Only data is through September. (The MOMR with October data will be out Wednesday.) I have predicted world C+C to peak no later than next year, World peak still depends on what OPEC does. I believe OPEC will decline after 2015 also but that is just my guess.

The biggest loser in July was China, down 175,000 bpd to 4,084,000 bpd.

The biggest gainer, outside OPEC was Kazakhstan, up 124,000 bpd to 1,641,000 bpd. The biggest OPEC C+C gainers in July was Libya, up 200,000 and Saudi Arabia, up 150,000 bpd. I will have the OPEC MOMR post on Wednesday, Nov. 12.

Russia is always of interest. Russia had a bad month in July, down 92,000 bpd to 10,003,000 bpd. Russia has since recovered and are producing around the same amount they produced earlier in the year. The Russian web site CDU TEK always has Russian C+C production about 400,000 bpd higher than the EIA reports. I have no idea why this is the case. Russia list daily production in thousands of tons per day. You must be registered to get their monthly and annual data. Their Registration Page is all in Russian with no translation button so I cannot figure it out.

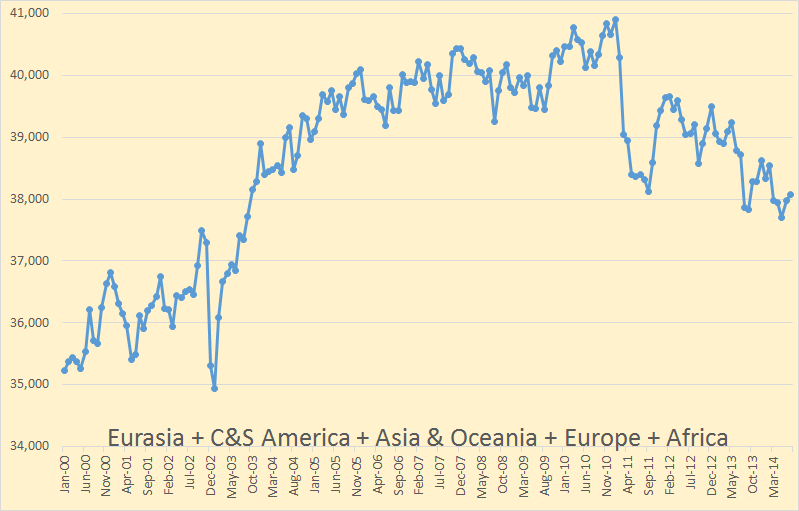

Half the world’s crude oil production is in decline, down 2,834,000 bpd since the peak January 2011. The chart is starting to look like the classic bell curve.

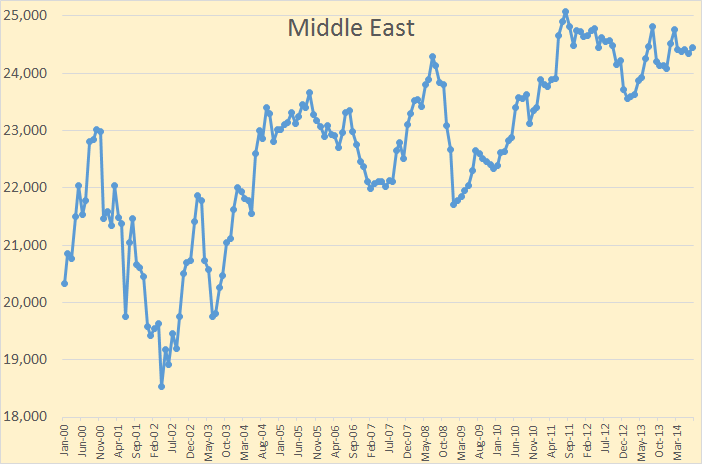

And even the Middle East with 32 percent of world crude + condensate production may also have peaked, down 625,000 bpd since the peak in August 2011.

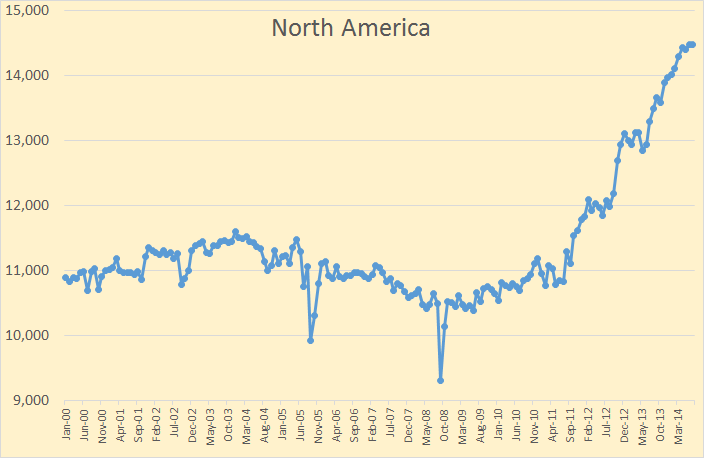

But North America is booming. With about 18 percent of world’s C+C production it is keeping peak oil at bay for perhaps one more year.

Other News:

Harold Hamm says oil prices are headed back up:

Oil Baron’s $433 million Bet that OPEC Blinks First

Harold Hamm called OPEC a “toothless tiger.” Now, he’s backing up that comment by unloading his company’s oil hedges in anticipation that OPEC won’t engage in a price war with American producers. In Wednesday’s earnings release, Hamm said:

We view the recent downdraft in oil prices as unsustainable given the lack of fundamental change in supply and demand. Accordingly, we have elected to monetize nearly all of our outstanding oil hedges, allowing us to fully participate in what we anticipate will be an oil price recovery.

‘Small oil’ could end up with a big debt problem

In order to fund the rapid growth, exploration and production companies have borrowed heavily. The energy sector accounts for 17.4 percent of the high-yield bond market, up from 12 percent in 2002, according to Citi Research.

“A lot of these smaller companies, in particular the smaller frackers, they rely on debt, and the debt markets have been wide and open for them,” Gregory Zuckerman, author of “The Frackers,” told CNBC’s “Power Lunch.” “It not clear it’s going to be (that way) going forward.”

The question is whether companies can keep their balance sheets healthy and continue to grow in the face of falling prices. U.S. oil futures have fallen about 24 percent from a high of $103.66 in June.

The page Non-OPEC Charts and the page World Crude Oil Production by Geographical Area have both been updated with the July production numbers.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

This short excerpt is from a pr piece by Chevron but it is probably nevertheless factual.

”According to the Bureau of Transportation Statistics, most freight shipments by value and tonnage move less than 250 miles today. By weight, only 5 percent of shipments travel more than 1,000 miles. Compare that to figures from the mid-2000’s – when the average length of haul was around 800-1,300 miles – and it becomes clear that we’re facing a major change in the way transportation businesses operate, and how drivers are behaving on the road.”

– See more at: http://www.delolubematters.com/2014/07/09/over-the-road-how-american-truckers-are-dealing-with-changing-driving-habits-part-

Business is slow no doubt but the trucking industry must be doing a whole lot less long distance hauling above and beyond what is explainable by the slow economy.

The mid 2000s didn’t have 2000 truck trips per year per well going only 30-40 miles hauling oil and water. This enormous impact on those stats is why I suspect GDP portion represented by fracking is hugely underestimated.

The mid 2000s didn’t have 2000 truck trips per year per well going only 30-40 miles hauling oil and water.

Would fracking truck travel actually be enough to skew the national averages that much? I’m guessing that as a percentage of national truck traffic, fracking trucks would be just a small percentage.

rail service is becoming faster and more reliable. Intermodal is gradually chipping away at the time advantage that over-the-road trucks have long enjoyed. Higher fuel prices are driving more freight onto the rails, where operating costs are already lower. As a result, hauls of 500 to 600 miles are now being considered serious candidates for intermodal.

In other words, trains are taking over the long hauls and trucks are only there for the last mile.

Intermodal transport or freight on trains, i.e containers and less often trailers on railcars, has been fast growing and important for the rails.

However, it accounted for only about 1.7% of truck tonnage by 2010, and the last report I looked at had it climbing all the way up to 2.4% by 2016.

There are lots of barriers, with the slow time travel, the need for a truck on either end to load, unload, and deliver, and the incredible complexity of rail systems that trucks with their flexibility can crush. Just thinking about all the work trains do to get unit trains, all the bridges and infrastructure to consider in a double stack, all the switching cost (want to gas up a truck? pull in. Want to fuel up a locomotive? dance back and forth in a rail yard around other locomotives, cars, etc after substantial planning)

One thing no one I not been able to find a study about is how much freight rail would be efficient at hauling. Rail is said to be as much as 4x the fuel economy vs truck, but 1) trucks are improving fuel economy very fast, and

2) that train hauling grain is a lot more efficient than hauling boxes of Cheerios. With more air filled loads you are rolling a lot of steel versus your freight.

I wonder about the actual fuel efficiency crossovers on loads that cube out faster than weighting out in trucks

Dropping a few hundred billion bucks on the Interstate system (and more on other roads besides) doubtless helped those truckers out a bit. Granted, the highway trust fund is now once again insolvent; maybe they’ll continue bailing it from the general fund? In related news, Massachusetts nixed the gas-tax-to-inflation thing—doubtless entirely due to cackling Kochian conspirators fiendishly rubbing their fingers together—though I’m sure they’ll find the money (and energy) to maintain all those roads somehow.

Now I know even less about trucking than I do about farming but one of my neighbors is an owner operator and he told me ten minutes ago that in order to break even he has to drive 120,000 mi/yr and trucks get 6 miles per gallon (diesel obviously). This is Western Canada (and probably all of Canada?). Presumably this is fairly accurate but truckers may be like farmers — always moaning about their lot. [Yellow Face]

Those are frequent flyer mileage maniac numbers.

For NoDak, 180 wells/month = 2160 / year and each one needs 2000 truck trips of say 35 miles one way, 70 r/t. = 302 million miles + say triple that for Texas (3X the well total?) = 906 –> 1.2 billion miles driven and divide by 2 for the half of the year that doesn’t get the full 2000 trips.

600 million miles driven by trucks for shale, not counting gas wells/NGL/proppant hauling.

per year.

600 million miles driven by trucks for shale, not counting gas wells/NGL/proppant hauling.

It’s still just a fraction of total truck miles driven.

“397.8 billion miles logged by all trucks used for business purposes (excluding government and farm) in 2010”

http://www.trucking.org/News_and_Information_Reports_Industry_Data.aspx

Good data. We did an estimate some months ago of truck expense in the Bakken, it wasn’t a lot, excluding cargo and trains etc.

We need to store that for a good number re diesel consumption.

400 / 6 mpg = 66 billion gallons / year –> /42 = 1.6 billion barrels / 365 = 4.4 million bpd. Somebody check those numbers.

Of the US 19 mbpd burn . . . 4.4 is trucks? Wow.

The American trucking Association says it’s 2.4 bpd.

Well, somebody’s number is wrong. Either that 2.4 or the initial 397 billion. The math looks correct.

They’re both from the same source. At the top of the page: ” It also takes over 37 billion gallons of diesel fuel to move all of that freight.” That’s 2.4M bpd.

Lower on the page:”397.8 billion miles logged by all trucks used for business purposes (excluding government and farm) in 2010 ”

So, divide 398B miles by 37 B gallons: that’s 10.8 miles per gallon. Higher than I expected, but it seems like a decent source.

aha, so mpg is the variant. I’ve never ever seen a number that high.

http://www.answers.com/Q/How_many_miles_per_gallon_do_semi-trucks_get

Quotes 6ish

Reading further, I think there are definition changes. There is talk of Mack and then talk of F-150s.

Maybe this is the comparable figure to the fuel number: “131.2 billion miles logged by all Class 6 – 8 trucks used for business purposes (excluding government and farm) in 2010 “.

That would give about 3.5MPG. That’s a bit less than I would have expected, but maybe.

6ish sounds about right, 4.5 – 8.5.

Google ‘how many mpg does a mack truck get’ for answers

NAOM

Heavy truck fuel economy is improving sharply, but 10 is still aspirational, particularly for the fleet.

The supertruck project got to 10.7 mpg I believe, with a stock engine and some very fancy aerodynamics, particularly on the trailer.

6 to 8 is probably a fair range for newer long haul trucks. A Mack, while relevant, is not going to put on many miles in local in town service for what it is worth. Perhaps 50 miles a day, versus 400-600 for long haul

As for Harold Hamm, for the zillionth time, OPEC DIDN’T DO ANYTHING. Ron’s data shows that at least through July there was no big spike in supply happening. So we either believe a collapse in demand, or we have to look at other things to explain the price drop.

Watcher, according to the IEA’s Oil Market Report world oil production was up in September:

Global supply rose by almost 910 kb/d in September to 93.8 mb/d, on higher OPEC and non-OPEC output. Compared with a year earlier, total supply stood 2.8 mb/d higher, as OPEC supply swung back to growth and amplified robust non-OPEC supply gains of 2.1 mb/d. Non-OPEC supply growth is expected to average 1.3 mb/d 2015.

That may have been a significant enough increase to affect oil prices.

However in August production was down quite a bit.

Global supply was down 400 kb/d in August, to 92.9 mb/d, on lower non-OPEC production. Compared with a year ago, global supply was 810 kb/d higher, with an increase in non-OPEC of 1.2 mb/d more than offsetting a 370 kb/d OPEC decline. Non-OPEC supply is set to expand by 1.6 mb/d in 2014, and 1.3 mb/d in 2015, to reach 57.6 mb/d.

And remember the IEA’s estimate is almost always revised quite a bit.

August had a price decline.

Oddly Sept did not, particularly. Big smackola in Oct.

Take if from a Farmer. The price of a commodity that is essential but of very little use in greater quantity in the short term to a buyer whose needs have been met can and does vary wildly in response to minor changes in supply.

Let us imagine that there is an isolated community someplace that has as it’s only food fresh eggs and that there are numerous egg producers.If for some reason the egg supply comes up short even five percent everybody with plenty of money will buy as many as usual rather than go hungry. The price of eggs could easily double on even such a minor shortage. Some people might actually starve but with luck they would just lose enough weight to get back into old clothes.

If the egg supply comes up five percent surplus the egg farmers will invariably engage in a price war since you cannot turn a chicken off. The price of eggs at the farm may well fall to close to zero.This is assuming eggs are not storable and there is no use for them other than eating them.In actuality they could be used as pet food perhaps.

I have hauled many a bushel of apples that cost us dearly in cash and labor out of storage and dumped them into a gully when we couldn’t find a buyer.

People given time will increase the amount of oil they use if the price falls off noticeably but this is going to take a while to happen. You don’t just go out and trade in the Focus for a new F150 as soon as gas falls off a dollar and you don’t start driving a whole lot more immediately because your are busy and it takes a while to change your driving habits.

But if gasoline goes up a dollar a gallon you will still buy almost as much in the short term because you have to in order to get to work and do all the things you ordinarily do involving driving. Cutting back won’t happen overnight. You won’t trade the F150 immediately for a Focus.

The name for this game is elasticity of price and demand for oil of course. I have often searched for estimates of the numerical value of this economic measure but there is very little information available about the short term relationship between oil supply and price that I have been able to find.

Nevertheless I am personally satisfied to believe that if supply has outrun demand by no more than five percent that the price in the short term may well have dropped as far as it has for no other reason.If I remember correctly a supply increase of five percent resulting in a price drop of twenty five percent puts the elasticity value at five which is computed simply by division.When the price goes up faster than the supply goes down the situation is described as inelastic.This actually means less production brings in a higher gross revenue and as a farmer your fondest dream is to have a good crop when every body else is mostly wiped out by drought or frost or flood or any other sort of bad luck.If you are lucky this way once in every ten years you can probably stay in business.That one year can make up for three or four break-even years.

The people sending oil to market are like people that drive cars. They can change their behavior but they cannot change it very quickly except maybe in the case of a country such as Saudi Arabia.

I suppose that even the Saudis have guaranteed the delivery of tanker loads of oil at some certain price a few weeks to a couple of months ahead simply because the tankers take a while to load and unload and make the round trip to market and back and the supply pipeline needs to be kept full. Their customers need to know just when to expect a delivery no doubt in order to operate efficiently.

So- as a practical matter even the Saudis might need a few weeks or months to start cutting back on sales to any great degree. But they aren’t going to cut back right away in any case – it probably is going to take the oil ministry people a few weeks to a few months to dicker the decision with the rest of the government.

I think the entire market for oil is necessarily going to move slowly and ponderously in either direction as either supply or demand changes. Think months and months rather than days and weeks for the industry to adjust to new price realities.

So -Cutting back on sales – for those of the sellers who are in a position ENABLING them to cut back- is going to take weeks to months. Ramping up any spare capacity is probably going to take a month or two or maybe longer to affect supplies at the consumer end.

Bringing new capacity online is going to take years starting from scratch. It might be possible to speed up the production of oil from a new field already partly developed by a few weeks out of a year or two if the price goes up enough to justify overtime and more men on the job.

Now I actually don’t know anything more about the marketing of oil than any other regular reader of the oil news and a peak oil site or two.

So maybe I am way out in left field someplace and gold in sacks with a little help from their buddies is responsible for oil being temporarily cheap and a few years down the road we will find out that after driving the price down they bought up lots of broke producers for ten cents on the dollar.

I do know about the gut wrenching price swings of agricultural goods not only from bitter experience but also from formal study of this subject.I do know that I cannot in the short term do very much about my oil consumption habit in term of cutting back and that I am never going to go back to driving a four hundred cubic inch pickup truck simply because gasoline drops from four bucks to three.I might plan an extra weekend at the coast fishing if the price is still down next summer but a dollar off on the gas is only going to save me forty bucks on a five or six hundred dollar weekend fishing trip.

What I am trying to say is that the world is a big place and by human standards things such as oil markets move rather slowly.

If the last million marginal barrels of oil can be produced for eighty bucks then the price of oil will settle around eighty bucks varying a little or maybe a lot on either side of that price. If the last million barrels to be sold can be produced for fifty bucks oil will fall to fifty.

Now I have only the figures I see mentioned in forums such as this one and on the financial news sites to go on but it seems that the cost of production of deep water oil is at least eighty bucks and that a hell of a lot of the world supply is coming out of deep water. So the price of oil will necessarily go back up to eighty bucks before too long if this figure is accurate.

Personally I expect oil to be back up around a hundred within a year or two unless the world economy goes downhill from the flu to pneumonia in figurative terms.In the meantime I will probably rationalize my extra six hundred buck weekend fishing trip on the basis of saving forty on the gas. LOL.

Yo Farmer guy, I seem to have been taken in by a myth.

From their site:

Myth: Monsanto Sues Farmers When GMOs or GM Seed is Accidentally in Their Fields

Fact: Monsanto has never sued a farmer when trace amounts of our patented seeds or traits were present in the farmer’s field as an accident or as a result of inadvertent means.

The misperception that Monsanto would sue a farmer if GM seed was accidentally in his field likely began with Percy Schmeiser, who was brought to court in Canada by Monsanto for illegally saving Roundup Ready® canola seed. Mr. Schmeiser claims to this day the presence of Monsanto’s technology in his fields was accidental – even though three separate court decisions, including one by the Canadian Supreme court, concluded his claims were false.

The Organic Seed Growers and Trade Association (OSGATA) and others filed a lawsuit against Monsanto in an effort to invalidate Monsanto’s patents because of alleged fears of Monsanto exercising its patent rights and suing farmers if crops were inadvertently cross-pollinated. The U.S. District Court for the Southern District of New York dismissed the case and commented:

There was no case or controversy in the matter because Monsanto had not taken any action or even suggested taking any action against any of the plaintiffs.

Monsanto had a long-standing public commitment that “it has never been, nor will it be, Monsanto policy to exercise its patent rights where trace amounts of our patented seeds or traits are present in a farmer’s fields as a result of inadvertent means.”

Plaintiffs’ allegations were “unsubstantiated … given that not one single plaintiff claims to have been so threatened.”

Plaintiffs had “overstate[d] the magnitude of [Monsanto’s] patent enforcement,” noting that Monsanto’s average of roughly 13 lawsuits per year “is hardly significant when compared to the number of farms in the United States, approximately two million.”

Trace amounts? Meaning near or lower than the quantifiable detection limits. Doesn’t that mean that when these frankenseeds cross pollinate into normal seeds at a quantifiable level of traits, they will sue the farmer for polluting his crop?

The Monsanto site blurb is pure corporate/legalistic flim-flam to make one of the worst corporate predators look more benevolent.

Monsanto is a corporate octopus of the scariest sort. I will never defend their business practices and consider all the major biotech companies to be as dangerous to the safety and stability of the economy and the environment as the military industrial complex ..

BUT BUT BUT The emergence of such companies and technologies seems to be foreordained by laws of nature.And they do fulfill useful functions. Industrial agriculture is a damned if we do and damned if we don’t proposition.

The long and short of it is that we are going to stick with what we are doing today because we are in defacto agreement that starving in the short term is a less desirable outcome than suffering an economic and ecological collapse plus starvation in the long term.Sometimes I think our only real hope is that Sky Daddy will save us from ourselves.

Here is a comment I just posted at Resilience in response to Kurt Cobbs article ostensibly about food labeling but actually more about damning GMO’s.It is headlined at their site right now.

( If I were getting paid I would do a far better organized and more thorough job of presenting both sides of the story. In my estimation Cobb is deliberately being more alarmist than is justified in order to make his case.)

xxxxx

I will not argue that Cobb is actually wrong in his arguments. There is no way to prove him wrong.Some of the things he predicts will happen might happen and I am as a matter of principle of the opinion that all foods which are sold in substantial quantities be labeled completely and accurately in any case.

Farming is my profession and I am professionally trained in this field.There is a flip side to the gmo story and unfortunately the author hardly mentions it.

He is aware of some of the very real shortcomings of modern industrially based agriculture but if he understands the advantages of it he certainly does not mention them in this article.

Let us examine a couple of his arguments in order to illustrate my point.

”The argument that we have no evidence that this could happen is, first of all, false: We already have superweeds as a result of excessive use of glyphosate, the herbicide used in conjunction with soybean crops genetically engineered to resist the herbicide.”

TRUE enough but rather misleading.

Weeds have as expected by any farmer or biologist evolved the ability to thrive in the presence of glyphosptate but that does not make them super weeds in any real sense. They are still just as subject to control as they ever were by the methods we used to use- cultivation and plowing being the primary ones along with crop rotation. Glyphospate tolerance confers no super powers on weeds in the absence of glyphosate.

The fact that we produce the vast majority of our foodstuffs in monocultures these days is not the result of the recent invention and commercialization of GMO’s. We have been farming mono culturally for centuries for some very very good reasons involving cost and efficiency.We are virtually certain to continue for the foreseeable future to obtain nearly all of our food the same way.

Doing it any other way would cost a hell of a lot more and require a hell of a lot more land under the plow and a hell of a lot more people out in the fields doing manual labor.

I doubt very many readers of this forum are interested in hoeing corn all day in the summer sun. I can say from personal experience as youngster fifty years ago that it is brutally hard work and that it paid barely enough to eat never mind enough to enjoy a modern lifestyle.

( My folks already had tractors and other modern equipment when I was a kid but my grandparents continued to grow a couple of acres of corn the old way for our own use and I spent a lot of time with them. Had we been grain farmers we would have used a tractor and combine and raised a hundred acres or more of corn but we were primarily orchardists.So we plowed that couple of acres with a tractor but we cultivated it with a mule and gooseneck hoes.No weedkillers. )

The risks of monocultural agricultural production are very real and not to be lightly dismissed but so are the risks of just about every other aspect of industrial civilization.Hardly any aspect of our modern lifestyle is risk free or truly sustainable over the long term.

There are always more things to be considered in such a discussion than are never brought up by people with an agenda. It matters not a whit to me either way considering that I am retired and own no stock in ANY company at all.

But the truth is that farming with pesticides and herbicides and gmo crops increases yields substantially while conserving water, petroleum, and soil which is prone to winding up in the sea due to plowing rather than sod planting.

Modern farmers get two or three and sometimes four or five times the yield per acre that our grandparents and great grandparents got on the very same acres using these modern techniques.

Going back to the older methods would require cutting down huge tracts of forest and putting the land to the plow and destroying that much more of what is left of the natural environment.It would require the building of housing and moving people by the tens of thousands – most likely against their will- onto farms to work as laborers.

I am not argueing that agriculture as it is practiced today is sustainable over the long term.It is not. But we are going to be doing it for the foreseeable future the way we are doing it today because we have no real choice in the matter in the short to medium term.

Hopefully we will get away with the risks we are running. If we don’t we don’t. Run them we will because we have no choice for now.

It is conceivable that there will be a huge problem emerging one day as the result of our growing and eating gmo crops. This will not be anything new under the sun. We are already suffering huge problems from growing and eating foods that are not gmo’s.

Ask any doctor or nutritionist about our current diet and the effects it has on our collective health.

ASK any informed environmentalist about any thing from alpha to omega that has to do with industrial civilization.

He or she may be willing to give up a personal automobile but it is very unlikely you will find one out of thousand willing to give up refrigerators and cellphones.

I am in favor of labeling one hundred percent of the way.I am also one hundred percent in favor of telling both sides of the story.

If I had time I could expand this comment into a rather long essay but I think I have said enough to get my point across to people capable of critical thinking.

There are no little green men on Mars to invade us but our lives are nevertheless controlled nowadays by an immortal non carbon alien life form that cannot be jailed or horsewhipped or even embarrassed. We know this life form as corporations and we created it ourselves.

If it were not for unaccountable corporations we would not be worrying about gmo foods.

Mac, on the issue of GMO foods I agree with you completely. Altering the genes in plants is something we have been doing for hundreds of years. They have just figured out a much faster way of doing it rather than the way it was done in the past which was with selective breeding.

I love Kurt Cobb but he should stick to what he knows best and leave biology to the biologists. He reminds me of a demonstration they had in England several years ago. There was a crowe of picketers protesting GMO foods. One of them was carrying a sign reading: We don’t want DNA in our tomatoes.

Ron

I disagree with this line of thought. While it is indeed true that old methods if farming essentially functioned as a slow moving method of altering genetic properties, the way it was previously done (selective breeding) was at the same time subject to selection pressures from the natural environment. Since selective breeding is a slow process this means that the modified plants would be subject to lots of years of natural conditions as well. So if a particular type turned out to not do so well in a colder winter, or be particularly susceptible to a type of blight, it would be removed from the pool.

GM crops are made much much more quickly, and aren’t subject to anywhere near as much field testing in the real world before being deployed on a large scale. Thus the danger is that they work great for 5 or 10 years, then some 1 in 50 winter, or other unanticipated condition, comes along and wipes out the entire crop. As such there is the potential to significantly increase systemic risk.

Nassim taleb wrote a good paper on the subject of GMO systemic risk here: https://docs.google.com/file/d/0B8nhAlfIk3QIbGFzOXF5UUN3N2c/edit?pli=1

Sam, looks like a great paper but since I am not a speed reader, I really don’t have a couple of hours to digest it.

Of course there are risks with GMO foods. There is a risk with everything. But GMO foods have been around for decades and we have had no disaster yet that was caused exclusively by GMO. So looking at the balance over time, it should be obvious to anyone that the massive increase in production overwhelms, or rather has overwhelmed, any increase in risk.

The only drawback is GMO has massively increased the food supply thereby enabling the population to massively increase also.

Ron,

Taleb would argue that the risk suffers from a “fat tail”, that is to say that while a the odds of a disaster are low year to year, but when disaster does strike it’s on a massive scale.

As an example he uses is the ” great moderation ” from the mid 80s to 2009. Everyone looked at how stable things were financially and thought we were in a new era of prosperity and that depressions were a thing of the past. Then the financial crisis hit, and utterly invalidated all the past data with it’s sheer scale. As such this evidence based approach to assessing risk is not sufficient when it comes to identifying large scale systemic risk.

Taleb argues that a similar crisis, but with gm crops, would have potentially disastrous consequences. I used to be in favour of gm food, but his arguments have swayed me I think.

http://www.donabee.com/health/klebsiellaplanticola.htm

In the early 1990’s, an European genetic engineering company was preparing to field test a genetically engineered soil bacteria called Klebsiella planticola. The plan was to then commercialize use of it on a major scale. The new mutant bacteria had not been tested properly. In fact, the minimal safety tests done were careless, very unscientific and done by scientists working for the biotech industry. The mutant bacteria was certified safe for the environment.

Careless testing of this mutant strain of Klebsiella planticola allowed it to almost enter the public domain, before research by independent scientists (Dr. Elaine Ingham, et al.; Oregon State University) showed that this GM-strain actually killed any wheat planted into the soil where the GM-strain was dispersed. Plant matter was to be collected along with Genetically Modified K. planticola in large containers for ethanol production. After the plant matter was decomposed, there would be a deposit left over that would be rich in nitrogen, calcium, phosphorus, magnesium, and sulfur-basically a good fertilizer. It was after this residue was redistributed on to fields that it would do its damaging deed. The K. planticola actually sticks to the root system of plants by creating a slime-like layer. The GM- K. planticola would then be connected to the plants root system and while it is there it would produce ethanol in levels of 17 ppm (~1-2 ppm ethanol is deadly for plants). K. planticola can attach to any plants, not just wheat, so essentially all global plant life could have been put into jeopardy because of a genetically altered bacteria. (2)

http://en.wikipedia.org/wiki/Unintended_consequences

“In the social sciences, unintended consequences (sometimes unanticipated consequences or unforeseen consequences) are outcomes that are not the ones intended by a purposeful action. The term was popularised in the 20th century by American sociologist Robert K. Merton”

Monsanto has its roots in Iowa. Muscatine is located on the Mississippi. Kent Industries is also from there. If you work in an office, you might have some HoN furniture for the office . HoN is located in Muscatine.

The Button Capital of the world knocked a hole in the button industry and the price of buttons became affordable. A lot of clams in the Mississippi mud bit the dust, they became buttons. The industry actually wiped out a couple of species and the harvesting of clams is forbidden by law. Got to make a living somehow, they found a way in Muscatine.

Do you like sweet corn? Do you like worms in the sweet corn? Bacillus thuringiensis, a tiny organism, is also a pesticide. What it does is grow in the bowels of cabbage worms, corn worms, turns the bowels of the worms to mush, the digestive system of the worm gets eaten by BT. The worm dies, your cabbage grows with those critters gone thanks to BT applications. If you add BT protein to the seed corn, genetically modify, the seed corn develops with the BT protein in the corn crop while it grows. The result, no worms in your sweet corn. I have seen acres of sweet corn absent of any worms. Every single ear is free of any worms whatsoever. Hundreds of thousands of ears of corn developed perfectly with every ear edible with no damage from those pesky critters. BT has been used in organic farming for 50 years. It is safe, organic, adds to production and crop loss is then minimized. People come from miles around to pick the sweet corn, pick up loads. If the worms were there, they would be the only ones feasting on the sweet corn. People would not pick the sweet corn to eat if it had corn earworms crawling everywhere you look on those ears of corn. The corn is free, the farmer would rather you get something to eat rather than you go without simply because he wants to make 50 cents an ear. The farmer has plenty, doesn’t need the money, would rather you have something to eat. Thanks to modern ag practices, there is less waste, not more.

Whether Monsanto is a bad guy concerning lawsuits, I don’t care. I followed the Percy Schmeiser story too. A level headed crop farmer from Manitoba, attempted to climb Mt. Everest, a hard-nosed tough guy. I don’t think he was making up stuff and hoping Monsanto would blink. He was defending what he thought was right. If you can’t judge Monsanto, you can’t judge Percy. If Monsanto is not at fault, Percy is not at fault.

If you know anything about plants and how resilient they are, grasses are at the top of the hill. Their ability to survive against all odds can’t be beat. As for bugs, potato bugs are tough critters too. You really can’t use a pesticide on potatoes, the bugs don’t die in great numbers, you just chase them away if you dust them. Tough as nails, those guys. If you have to control them with a pesticide, they’ll come back. Tempo is illegal to use as pesticide on a vegetable crop such as potatoes, it is not a good idea. I pick tens of thousands of them, but will never kill them all. I have my own technique to get rid of them, it is not a hard job, it just takes some time and you are not using a pesticide on the potatoes, they’re all organic. You save the expense of paying for a pesticide, it is very poor ag practice, the job has to get done one way or the other, time to apply pesticides has to be accounted, the time factor is there, no matter what. Not one single outside input to control the potato bugs, it saves more than you know. If you pull a new potato plant from the soil, you can usually find a new potato bug at the root base just under the soil. They’re ready for action from the beginning.

The potatoes sell like hot cakes. People want them free of malathion systemically deposited in the potato tuber. When they ask if they have been sprayed, it is no lie to say no. A small crop, but the yield is good enough, I’ll never be able to eat them all myself and high end restaurants prize them. Sold out, every year. Of course, I retain some for seed. Not a good practice to eat them all and have none for next year’s planting. It’ll be a disaster if you do.

I chose the route of minimal oil product inputs, use of fuel, no pesticides, nor herbicides, simply because the hand writing is on the wall. A tractor and a plow. If you don’t have that, forget it. A mule needs to eat too, so there is a cost, no matter what. Fuel for the tractor or grazing land and hay for the horses and donkeys, one or the other. You have to take good care of your tractor and take good care of the horses and donkeys. You want a mule and if you want one, nature doesn’t provide one naturally, maybe in a few instances, however, you’ll have to obtain one by breeding them into existence. Mankind is involved with the breeding of mules. No humans, no mules in the numbers you see or there were in the past. Stronger than a horse, more effective than a donkey. If you have a zebra, you can breed a zonkey. I digress.

Large farmers will use two to three thousand gallons of diesel fuel each week during harvest and planting. There are farmers out there with 50,000 acres of land in production. It’ll take more than a twenty mule team to make that happen.

Oil will play a big part of that operation.

When diesel fuel was 99 cents a gallon back in 1972, the farmer that hired me for spring’s work said the cost was minimal, not a burden on the expense side of the sheet. Basically, it was free. “Better than having a horse farting in your face all day long,” said the farmer from the hicks. Those days are still here, just not like they once were, but might come back anyway.

At 4 bucks for diesel now with today’s ag practices, the diesel fuel is being given away to farmers.

When I was a kid, the car sat in the drive way all week long. My Dad walked to work. A Sunday drive to the country was about it.

I’m going to go out and burn my share of today’s 77 million barrels of oil. Have to. I’ll be damned if I don’t, and am probably damned if I do.

Mac and Ronald,

terrific posts…Thanks for the effort.

Yair . . . Excellent posts Mac and Ronald . . . pretty well sums it up from “Westerncentric” perspective.

However have you ever had a good wander around Asia . . . Indonesia, Laos, Cambodia, Vietnam?

Folks in those places tend to it different and large populations are fed locally by small scale farmers.

There is a political push here in Australia to turn some of our high rainfall Northern areas into a “foodbowl” with further development of the Ord River irrigation scheme and even further dams on other rivers.

This is despite the fact that many crops have been trialled and nothing much but Indian Sandalwood and Lucaena (a bushy legume shrub fed to cattle) seem to be able to make money in these hot remote areas.

The soil is reasonably fertile and water is unlimited but a few large scale farming operations with White Blokes sitting in air-conditioned John Deeres and Caterpillars can’t seem to make it work on an ongoing basis.

On the other hand if the same country was in (say) Indonesia or the Philippines the country would be worked by water buffalo, walk behind tractors with ten horsepower engines and millions of little brown hands . . . it would then become productive and truly would be a “foodbowl”.

I am just trying to point out that agriculture is different in different regions and, although I have participated in some of the largest land clearing and agricultural development projects in Australia I dislike large scale farming . . . why the hell would anyone want to grow twenty five thousand acres of wheat?

Small scale farming can work and will work in the future . . . at the moment food is too cheap.

Eventually folks will have to pay the true cost of what it takes to fill their bellies and rearrange the perception of what is really important.

Cheers.

I don’t think anybody except the people making a living out of it directly or indirectly really likes big scale industrial farming.

I don’t but then I wandered on and off the farm all my life and any significant amount of money I ever earned I earned elsewhere.

If I had stayed on the farm the only way I could have ever earned even a modestly respectable income would have been to get bigger and bigger and bigger…. because economies of scale determine costs and costs determine the price you get at market.

Farming is an industry that basically operates at cost and the smaller less efficient operators are constantly being squeezed out.

Beyond that is is a culture and a lifestyle and the people in it are extremely unwilling to give it up and are quite often willing to work forty in town to support the farm.

A classic farm joke goes that a local farmer hits the lottery for a couple of million and asked what he will do with his prize money thinks about it for a while and says,” I guess I’ll just keep on farming till it’s all gone.”

COMMIDITY farmers do not make more money because of gmo crops. They make LESS collectively but grow more and larger crops THAT SELL AT COST ON AVERAGE OVER TIME and constantly drive each other out of business with the more aggressive operators buying up or renting the assets of those who go bust.

Beautifully clear and informative post OFM.

I’ve been reading you since TOD days, and always enjoy your contribution.

All of the above is why people don’t understand how likely their deaths are before old age. Oil scarcity will lay waste to billions, and soon.

FYI draft animals. The ratio of hay acres to human crops acres was 1:3 in olden days (for getting the animals through the winter). Oxen are just cattle given special training from birth to build muscles.

That ratio today is likely 1:2. The cattle have been bred for food production, not to pull plows. Their genetics are not what they were.

Oxford in England was Oxen Ford in the 1200s-1300s and this was written about. The oxen owners supplemented income by renting out their oxen when their own acres were done, planting or harvesting. An oxen owner was a very rich farmer, but keeping them alive was never easy.

The other item of consequence was that water powered mills were much desired by feudal lords. The custom got embedded early that mill output was taxable in that it could be easily measured, unlike taxing farmers who could hide things.

Modern farmers get two or three and sometimes four or five times the yield per acre that our grandparents and great grandparents got on the very same acres using these modern techniques.

How much of modern agriculture in the US is going toward foods we don’t really need?

Seems like a lot of corn is used for corn syrup. And meat production is pretty inefficient in terms of diet.

In another discussion I mentioned that if we had to feel lots of people with more efficient food production we could turn to insects and algae.

It will be hard to maintain current industrial agriculture without oil, but what about entirely new forms of food production? Why do we need lots of acreage to feed people if we can do some of it in vertical rising tanks?

A video of a recent Japanese invention that is a game changer in small farming, no engine, no oil, no fuel, reduces planting time from hours to minutes:

https://www.youtube.com/watch?v=EWd8gBJgEMY

Of course, I had to have one.

A huge amount of food is certainly wasted and eating beef is certainly in inefficient way to eat.We on average eat way too much.

Now as to what can be done in terms of growing food in factory like settings—-it is not yet possible to do so as cheaply as growing it in the fields and it won’t get to be cheaper anytime soon. Maybe never.

We are surely going to be eating further down the food chain on a collective basis in near and mid term. The long term picture is not clear- After a population crash there might be plenty of cheap meat to go around.

Resources are unequally distributed and power is unequally distributed. My own seat of the pants belief is that we will have plenty of oil to run farms and food distribution in the US and some other rich countries for a very long time to come.

The problem in our part of the world is going to be unemployment on the grand scale.

I wouldn’t want to be caught in a poor third world country for any amount of money plus a dozen GOOD LOOKING virgins.

Now as to what can be done in terms of growing food in factory like settings—-it is not yet possible to do so as cheaply as growing it in the fields and it won’t get to be cheaper anytime soon. Maybe never.

I’m going to guess that growing a tank full of algae is cheaper and more efficient than growing crops in a field. I’ll poke around and see if I can find any numbers.

I just found this, though I will keep looking for more info.

“Comparing algae to soybeans, van der Meulen notes that the former has a year-round harvest and can produce 38 times more usable protein per acre per year than soy, using one percent of the water that crop needs.”

http://www.forbes.com/sites/amywestervelt/2012/05/04/forget-fuel-algae-could-help-feed-the-world/

Here are a few more numbers.

“Most algae strains — though far from all — have protein content in the 40-60% range. Which, at the end of the day, puts any algae farmer into the meal market. …

“Fishmeal is running around $1500-$1700 per ton. Algae enterprises that can realize $1500 per ton, averaged, for 60% of their crop — well, you start with great economics and a proven market. From there, if you have around 15 percent carbohydrate content and can sell algae based starches at around $900 per ton, and 25 percent oil content and can sell that for $770 per ton, you have dry algae biomass with revenues of $1227 per ton.”

http://www.biofuelsdigest.com/bdigest/2014/09/29/algae-will-bossie-like-it/

I’m going to guess building 300 million acres of steel tanks is going to get spendy.

Mother Nature won’t be providing all the plumbing for free either

I’m going to guess building 300 million acres of steel tanks is going to get spendy.

How did you come up with that figure?

OFM. As usual, I agree with most of what you say, and for that matter, most of what all you highly qualified folks say here.

BUT. You don’t say much about my favorite sport at the moment, thinking up ways to make solar power irresistible to just about everyone, and ASAP.

Since I happen to believe the IPCC, etc, when they say we absolutely must get off ff’s right now, and not wait for later.

So I put together a small tractor that I call a solar horse- in fact, maybe as many as 3 horses – work/day equivalent. Powered by my “oversized” PV array. Very simple to do, lots of local hillbillies saw it and were envious. And any one of them could do the same with a little up front capital.

And there are lots of other obvious widgets all ready to go for anybody who is willing to look.

Another one is a pyrolyzer that puts out good fuel gas and dumps out the residual carbon after all the other stuff is torn apart by heat and gets back to simple gases.

I don’t tell anybody, but this pyrolyzer loves any kind of plastic, as well, of course, any kind of biological material.

The gas can be used to run a thermocompressor, a super simple heat engine that produces compressed air, and anybody knows how to turn that to electricity or shaft power.

And so on. Don’t need the mules.

Take a look around.

Go Wimbi! >;-)

Hmm, how to make solar irresistible?

How about a solar powered energizer bunny…

My favorite- solar sex partner, programmed to do any weird thing I like and could never tell anybody about.

Make the doll very energy wasteful, so when you aren’t having fun with her (it), you will still have all those extra panels to do other stuff, like plow the garden.

Have any links to read up on for what you put together?

http://www.bioenergylists.org/stovesdoc/Boyt/pyrolysis/pyrolysis.html

Thanks, I have been reading up since I saw your original post. interesting stuff

OFM,

Interestingly enough my macroeconomics textbook used oil as the ideal example of an inelastic good.

Apparently this is due to it being inelastic in both supply AND demand (which compounds the price effect) and it having a high coefficient for inelasticity.

This was in the early 2000s, before the ensuing oil shock that for some reason isn’t identified as an oil shock by the average person, or the media… even though it was worse than both oil shocks of the 70s/80s.

That Macroeconomics course, its section on elasticity, and its use and explanation of oil as the ideal example was actually a big piece of what alerted me to peak oil and its ramifications in the following years.

Sort of makes you realize all of us here only pay attention to this issue because of fortuitous circumstance, as opposed to being more capable or insightful than others.

Lady luck surely has a lot to do with what comes to our attention. But once we have had our attention attracted to any particular information it is our own decision to either follow up on it , or not.

I learned about price and supply elasticity in the first basic ag econ course back in the dark ages which incidentally had a different catalog number but was taught by a professor of business administration and economics in the business school for business majors.Same classroom same hour. So we cow college guys had to hump our way to the far corner of campus to make that class and a few others depending on our own specialty.

My real enlightenment began when the biology professors who taught us the two years minimum of basic biology classes along with the premeds and biology majors got mad as hell about the things the ag professors were teaching us such as the dosing of livestock with antibiotic laced feeds and the use of large amounts of fertilizers and weed killers.Somebody had to be wrong about the wisdom of such practices.

Curiosity has gotten me to where I am today here in this forum.

I’ve got to say I’m with Watcher on this if the price decline is due the oil market supply & demand then why did a whole basket of commodities decline at exactly the same? The answer of course is the strength of the dollar & we even have a good reason for that, massive currency intervention by the Russian central bank which was needed to prop up the Ruble due to Western sanctions.

Hi Marcus,

The dollar strengthened by 10% against the three largest currencies that it is traded with (Euro, British Pound, and Yen which together account for about 90% or more of the transactions of US dollars with other currencies.)

The oil price fell by about 30%, this leaves 20% of the fall in the oil price unexplained if we are going to claim its all because of the stronger dollar.

Did all of the commodities fall in price by 30%?

Hi Dennis, no the other commodities did not fall at the same rate, but they all fell at the same time. The key is the strong dollar was the initial impetus for the fall once a commodity (or any tradable asset) is moving firmly in a particular direction traders tend to pile on the bets & the move gets extended. Happened when WTI went to $145 a barrel & it happened when was shorted all the way down too.

Hi Marcus,

I don’t think speculation plays as much of a role in oil markets as some people think. Do you have specific evidence that speculation has played a role, I think Ron’s explanation of a small increase in supply and a larger decrease in demand for oil is a better explanation, speculation may play a minor role, but a relatively unimportant one in this case.

Of course all the commodities moved at the same time, that is because of the change in the value of the dollar relative to other currencies, I agree that is a part of the reason for the change in the oil price, it explains 10% of the price change.

Do you think the other 20% is because of speculation?

I do not.

“I have hauled many a bushel of apples that cost us dearly in cash and labor out of storage and dumped them into a gully when we couldn’t find a buyer.”

Try this next time, Mac:

Fuel Alcohol

The Fort Bragg Grange hosts a group called the Mendocino Alcohol Fuel Group which holds the goal of distilling their own fuel from local sources. Here at the Ranch, we have a 300 gallon still that hasn’t been used in decades, and with the help of interns and community members, this still is being brought back to life. The goal is to collect lees from the vineyards in the area (a waste product from wine production) in order to distill our own ethanol for running equipment and vehicles.

http://www.grangefarmschool.org/Projects

The distillation of alcohol from fruit for use as fuel is a waste of time unless you happen to have friends in government to get you a big fat subsidy. If we had enough money to get legal we would just move down to the coast and fish all summer and come back here for hunting season and spend the winters way down south someplace. Legal is for rich people.

But we used to to give some of those excess apples to people who slept a lot during the day and spent a lot of time in the woods at night making brandy..

But it is hardly worthwhile making it since growing a little pot is safer and far more profitable and only a very minor fraction of the work.

Here’s what Cousin Klem had to say about it a while back at the local country store.

You can never tell exactly when he is serious and when he isn’t. Sometimes he believes his own bullshit and other times he is just telling tall tales with a dead straight face that would do any big time lawyer credit.I walked in during the middle of his tale and didn’t catch the beginning.

”Damned guv’ment aims tuh keep pore fokz pore ‘n rich people rich.

They bust up ya still but they let people with money make alla booze they want to.* And when they couldn’t putcha outa bizness lockin’ ya up they opened ah damn ole abc store jist about everwhere.

Ya can’t hardly git ah nuf perduckshin outa a small still noway ta make any money with tha guvmint selling so cheap ‘n handy right on th main drag all day legal on toppa that. An anyhow sugar ‘n corn done got so high it ain’t hardly worth making it noway.

Then tha boys that come home frum Vetnam ‘n college learnt us about wacky backer ‘n we done ok fer awhile with it.

Then they started flying a dam ole hella copper near every week all summer an sinnin the cops to pull up yer plants. ‘N putcha in jail fer ten years if they caucha too.First time!!Never did git over ah couple ah years fer making ah little likker first a fence ‘n mostly less’n that.

An when they figgered out they couldn’t put us outa bizness that way by god they done turnt aroun ‘n started legalizing it. Outa spite pure’n simple ah reckin.”

Unfortunately I had to get back back to work and didn’t get to hear the rest of this particular monologue.

* One of the richest people in the community just finished building a distillery- the first legal one in the immediate neighborhood.

Hi Ron,

By looking at the IEA quarterly data and comparing 3Q2013 with 3Q2014 demand and supply we find the following:

————————2013______2014

demand(Mb/d)___92.5______92.98

supply(Mb/d)____91.71______93.22

So in 2013 for quarter 3 there was a draw down of oil stocks of 0.8 Mb/d and apparent excess of consumption over liquids produced during the 3rd quarter, but in 2014 there was a stock build of 0.24 Mb/d during the third quarter. The supply increase from 3Q13 to 3Q14 was 1.6%, but demand only increased by 0.5%.

Based on third quarter to third quarter comparisons it looks like demand was relatively flat and that increased supply was the main thing driving down prices.

Note that in both 2012 and 2013 there was excess demand (stock draw) in the third quarter, a third quarter increase in world oil stocks is unusual.

I looked at this a little more and demand is the bigger factor based on 3rd quarter changes from 2012 to 2013 compared with changes from 2013 to 2014.

Explained further in my comment further down in the comments.

Speaking of demand and no evidence of recent collapse:

Re: China

An industry group said Monday that sales of passenger vehicles in the world’s biggest auto market rose 6.4% in September from a year earlier, slowing from 8% growth in August. [haha they are trying to celebrate a slowdown of *only*6.4% growth]

. . .

The China Association of Automobile Manufacturers said total sales, including trucks and buses, rose 2.5% over September 2013 to 1.98 million vehicles. Passenger car sales totaled 1.69 million vehicles in September, up from 1.5 million in August. [that’s of just chinese made vehicles]

How many of those were electric. hahahahahahah looks like about 12,000. That’s 0.006 or 0.6% hahahahah oooh and guess what, I believe that number has been hanging around 0.8%. It’s FALLING.

But that digresses. Chinese oil burners have not stopped jumping off car lots, so it’s hard to make a case for recent demand collapse to explain oil price reductions.

Hi Watcher,

China is not the only country in the World, increases in demand in a single country does not mean that World demand for oil has increases. It could be that a fall in demand in the rest of the world was equal to or greater than any increase in China.

Also Ron suggests that possibly there was an increase in oil supply which would cause prices to fall with no change in the oil demand curve.

I have suggested that the 30% change in oil prices are partly explained by the 10% change in US dollar exchange rates, the other 20% is best explained by a change in oil supply and/or oil demand.

I do not know what has happened to World demand for oil, but based on IEA data it looks like the oil supply curve has shifted to the right.

Of course, one can simply look for demand information. Or rather, consumption information.

And guess what, total US consumption of gasoline, kerosene type jet fuel, distillate fuel oil, residual fuel oil and propane/propylene in sum logged in the last week of Oct at 19.6 mbpd.

And son of a gun, in August 15th week of this year that number was 19.88 mbpd. That looks rather a lot like a consumption increase over the relevant time period (during which price fell).

But hey, if neither China nor the US show signs of consumption decrease, then it must be everyone else dropping consumption because everywhere else is decoupled economically from the US and China.

haha mistyped, Oct 24th was north of 20 mbpd (20.06 mbpd). Consumption increase precisely there, though not really the point. Rather, simply, no cratering of burn rate. In either US or apparently China. (Note the US car buy rate isn’t showing any cratering either, though that matters less because of the back end of the pipeline.)

Dennis, I have to agree with Ron. In my opinion the fall in oil prices has been made possible primarily by slumping demand from the US as fracking has boosted domestic production from 5 million barrels per day to 8.4 million in only the past six years. During this time, neither the Saudis nor their allied producers have countered the fall by cutting production. This may to an overly simplistic view, because the relative change in the dollar’s value is obviously a big factor, but I think not.

Hi Doug,

I think Ron said that supply increased, I missed the part about demand. Watcher thinks demand increased, though he confuses a move along a demand curve due to lower prices with a shift in the demand curve. The US and China account for roughly 30 million barrels per day of consumption out of 90 million b/d of world liquids consumption, any increases in US and Chinese consumption might have been balanced by decreases in consumption elsewhere.

I do not know what has happened to the world demand curve for oil, but if Ron thinks it has shifted to the left (lower demand ceteris paribus) he likely is correct (he follows the numbers more closely than I do.)

Note to Ron: I am not trying to put words in your mouth, my interpretation of your comments is that World supply may have increased (based on IEA estimates), I do not think you gave an opinion on world demand.

Dennis, you are correct, I did not give my opinion on demand. But now I will.

I do think supply increased, slightly, in September… and I also think that demand decreased. The combination of the two sent prices tumbling. Most of the world is still in a mild recession. That recession got slightly worse in September, creating a drop in demand.

And now you have my opinion on why the price of oil dropped.

If, at their November 27 meeting, OPEC decides to cut production, it will send prices up, greatly increasing the recession in most of Europe. The world is in a no win situation.

Thanks Ron,

Trying to untangle movements along the supply and/or demand curve and shifts of the supply and/or demand curve are difficult, but your explanation makes the most sense to me.

Note my comment further up where a comparison of third quarter data in 2012, 2013, and 2014 suggests that 2014 supply demand balance was different from 2012 and 2013. This does not tell us if demand growth was slow or supply growth was high.

Supply grew by 1.2% from 3Q2012 to 3Q2013 and demand grew by 1.6% from 3Q12 to 3Q13.

So as Ron said above supply growth was a little greater in 2014 (1.6% vs 1.2% in 2013), but demand growth was much slower (0.5% vs 1.6% in 2013).

Ron nailed it, as usual.

Ron said:

I have predicted world C+C to peak no later than next year

I think you may be a year early, 2016 looks like a more likely scenario. As you have said it is the US that is holding up overall world production, and the reason that US production is up is because of price. The shale plays have been known for a very long time, but it wasn’t until the price made them attractive that they began to contribute any significant production.

Shale production really began to grow in 2007, when WTI hit $66.52/ barrel for the year. We think that it is reasonable to assume that it will start to contract when the price hits that same level on the way back down. Our analysis puts WTI at $66/ barrel in 2016.

http://www.thehillsgroup.org/depletion2_022.htm

Of course I’m splitting hairs here, 2015, 2016 not much difference. I can hear that old fat lady warming up in the background. We’ve had a century and a half of unparallelled prosperity because of petroleum, its a pity that we didn’t plan a little better for the day that it ends.

http://www.thehillsgroup.org/

Yes, 2016 may be the peak year however I think non-OPEC in the rest of the world will be declining pretty strong by 2016. If US production is still increasing in 2016 I don’t think it will be enough to offset the decline in the rest of the world.

OPEC is the wild card however. If sanctions are lifted on Iran they could increase production pretty strong and delay the peak for a year or so. But I am still betting on 2015.

You guys know more than me.

It seems a bit opaque now, but I will try not to get postmodern.

Dear Ron, in your peak estimation of 2015 you did not take the fall of oil price into account. Low oil prices start to have an effect on US production and probably also on other producers (Russia?). I was convinced about 2016 for peak oil, but it is highly probable now that the peak will be reached by the end of 2015. 2016 will probably be a plateau, followed by a strong decline thereafter. OPEC spare capacities are decreasing and the peak of oil production + spare capacities is probably behind us. I guess that by doing about nothing OPEC will just keep low prices up to 1H2015 maximum. After that demand will reach supply and it will be difficult to increase supply.

Chris, no I made that 2015 call several months ago, well before the price of oil started to fall. I do not expect US production to peak until 2016 but I expect that US production will not increase enough in 2016 to offset the decline in the rest of the world. Also my prediction is about C+C, not total liquids.

I think we are on the same line… Peak total liquid will probably follow after peak crude oil.

Does anyone have this graphic for US (1940-2013), but only for crude

Source:

http://www.aei.org/publication/the-great-american-energy-boom-us-oil-and-gas-output-this-year-will-be-close-to-the-highest-in-us-history-thanks-to-shale/

You can have Crude + Lease Condensate here from 1980 to 2013. The current production is at the same level as in 1986-1987. The graph you are reporting is for Oil + Gas.

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=5&pid=57&aid=1&cid=US,&syid=1980&eyid=2013&unit=TBPD

You can also drawn a graph from 1965 to 2013 by looking at the BP Statistical Review of World Energy 2014 here: http://www.bp.com/content/dam/bp/excel/Energy-Economics/statistical-review-2014/BP-Statistical_Review_of_world_energy_2014_workbook.xlsx

US is still below its peak, what is the estimate for 2014?

This is the graph using the Excel data you shared:

Thou North America has not yet peaked

You might want to read back about quality of oil and its definition. You can get any graph you want if you change definitions.

BW, you wrote over on PeakOil.com in response to my prediction of a 2015 peak:

Remember, we are talking about all liquids.

No, you are talking about all liquids, we, me and the mouse in my pocket, are talking about Crude + Condensate. I have made that very clear in several of my posts. I have no idea when bottled gas will peak. Then there is palm oil and ethanol and… I have no idea when they will peak either.

Ron said:

BW, you wrote over on PeakOil.com in response to my prediction of a 2015 peak:

I think you are referring to this post:

The EIA’s International Energy Statistics 11/09/14 PO News

I put this up at Ron’s site an hour, or so ago. I’ll re-post it here. Remember, we are talking about all liquids. Conventional (the most important of the liquid hydrocarbons) peaked in 2005, and total energy from petroleum peaked in 2000.

The “we” refers to the Hill’s Group, not to you! All liquids is a collection of assorted compounds, most of which are so insignificant in volume they aren’t even statistically significant. If all the other liquids in “all liquids” outside crude, and condensate suddenly increased by a factor of 2, it wouldn’t move the peak date by half a year. LNG, and propane (which are significant by products of condensate production) would decline with it.

Because of the EIA’s propensity to talk about “all liquids” (which we think is confusing), and people’s conditioned behavior to think in terms of “all liquids”, I generally just refer to “all liquids” to save long drawn out explanations that I have stated at least 50 times before. The difference in the peak of C&C and “all liquids” will probably be just a few months.

Sorry for the confusion, cross talk between sites apparently can be difficult. I’ll keep that in mind in the future.

My normalized graph for global gas, global NGL and global Crude + Condensate (2002 to 2012), followed by an attempt to estimate actual global crude versus condensate:

Normalized estimates for global crude versus global condensate:

The price of oil will make a big difference as to when the peak occurs.

For the ND Bakken/Three Forks I recently did a scenario with oil prices held constant at $80/b (2014$) from now until 2040.

Economically Recoverable Resources(ERR) are 4 Gb and the peak is 2015 at about 1150 kb/d if my economic assumptions are correct and real oil prices remain $80/b.

Chart at http://peakoilbarrel.com/debt-oil-price-bakken-red-queen/comment-page-1/#comment-420070

For comparison I left all assumptions the same except the real oil price which was increased to $100/b (2014 $) from now until 2040. ERR is 6 Gb to 2040 and peak is in 2017 at about 1200 kb/d, I think it more likely that oil prices will rise back to $100/b relatively quickly and reality will look more like the chart below (avg oil prices around $100/b)

The total for North Dakota Bakken and Eagle Ford if real oil prices average around $100/b in 2014$ over the 2015 to 2030 period is an ERR of 11 Gb with a peak in 2016 at about 2.6 Mb/d, chart below where Bak+EF is the combined output of the ND Bakken and Eagle Ford.

The pool of liquid in the foreground is oil.

http://www.sjvgeology.org/history/lakeview/lakeview06.jpg

And I guess those plants are specimens of a rare petroleum weed species. Maybe they even serve as nesting places for Oil ducks.

Humans are indeed very special…

Oil ducks?

I suggest that you actually “google” Lakeview gusher, or blowout, 1910, Midway/Sunset, California; you might actually learn an important part of oil and gas history. This was the largest onshore, uncontrolled release of hydrocarbons ever in the U.S, likely larger even than the BP mess in the GOM. This well blew out of control for a year and half and many millions of barrels of oil flowed into the hills around Taft, CA. In reality that probably is oil in the photograph. The efforts made to control this well, including the building of a coffer dam around the well to assist in bridging the well closed, is a testimony to very tough, brave men. Midway Sunset Field is one of America’s few “giant” oil fields. Its development is worthy of respect.

Fred does sarcasm well but that doesn’t mean everybody recognizes it..

Yeah I forgot to add this > 😉

I actually took a drive through Midway last year (5 is a drag anyway).

Midway is the 4th largest field in the US.

My father worked there in the 50’s, and my brother born in Taft.

The oil you see is there because right after the gusher happened, a sand berm was built to keep the oil from entering the ocean. It was all they could do for an immediate response. It was later piped to storage. The column of oil was 20 feet wide at the beginning and 200 feet high, as you can see in the picture. The daily amount released was at a rate of 125,000 bpd at the peak.

It lasted 18 months.

Here is the Lakeview No. 1 story:

http://sjvgeology.org/history/lakeview.html

“The daily amount released was at a rate of 125,000 bpd at the peak.”

Now that is a MAN’S oil well. 125K bpd.

A Bakken IP is 1/100th that.

That’s what we’ve been reduced to. Pathetic.

As I continue to read and read again and then re-read Mr. Likvern’s data, it begins to paint a bleak picture. It takes some time, sometimes, my skull feels like its all bone, a bonehead, lol.

At 77 million barrels of oil being fed into the gaping maws, consumption, a thousand days from now might not be a pretty picture. Tomorrow will be another 77 million barrels. After a hundred and fifty years of burning oil’s liquids, somebody better develop a plan to reduce consumption and fast. It might hurt, but the real hurt will get there if all you do is stand on one leg and hold your breath.

Titusville went dry, land sold for one million dollars per acre when the oil boom was going strong. It went bust and land sold for 25 cents per acre. That’s the way it goes moving west, land around Beaumont went nuts in price, Texaco became the green shoot. Then Jed Clampett moved to California and made fun of all the rich people by buying a Beverly Hills mansion and sat whittled wood on a tree stump.

At one time, 40 percent of the production of oil in the US was exported. Times change.

In the long haul, the oil vortex don’t look good. There can be an oil vortex, I don’t have any idea what it might look like, but it looks like a real possibility. A Twilight Zone episode. It won’t be Green Acres, that’s for sure.

Here is an article from zero-hedge ranting about the statistical cover-up of the actual US consumption of gasoline.

http://www.zerohedge.com/news/2014-05-30/us-gasoline-consumption-plummets-nearly-75

Here is the relevant EIA chart for retail gasoline consumption:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=a103600001&f=m

I don’t know what to make of this info, but I have thought that limits on carbon consumption might come more from the demand side than from regulations. The very political forces that don’t want to acknowledge global warming have also helped the rich get richer. And that means less consumption by those who are getting poorer. If you wipe out the global middle class, car driving, living space, goods buying, meat eating, and so on go down. Consumption goes down. Oil demand is likely to go down (or as this info suggests, has gone down significantly in the US).

In the EIA chart what does ‘retail sales by refiners’ mean? Does that include exports, if so, it is hard to conclude too much from it. However if that reflects US domestic consumption in total, then it is very interesting on two fronts. Obviously the recent nose dive, which matches the dive in VMT, but also the sustained plateau before that…. Anyone know?

Allan,

This has been discussed many times before, going back to the TOD days. “Retail sales by refiners”, means Gas station sales by Exxon, BP, Chevron etc. In days gone by, these were the main outlets for fuel. These days the refiners consist of Valero, Koch industries, Tesoro, etc, that don’t have retail outlets. Also the major oil companies sell a lot of their product to unrelated retail outlets, but not so much of their own brand name.

It doesn’t mean the amount of fuel being sold has fallen, just means some else is doing the selling.

Correct, and to the credit of the ZH commenters, they nailed precisely that quickly and attacked the article.

😉 svayambhu108

Yes, the numbers did not make sense. Average car would be doing just a couple of miles a day.

By looking at the sales types, the retail sales by refiners is only a small portion of total sales. Most is by Rack at 215 million gallons per day and has risen far more than enough to compensate for loses of sales in other categories. Total sales look like 315 million gallons per day, which makes more sense.

I mentioned in another thread that the Saudis seem to be acting like it is 1984 and they can flood the world with oil to bring down an empire. I continue to scratch my head at all of this. Don’t they know they are about to peak? FWIW, based on the data I have seen, I fundamentally believe they are on the verge of peaking, probably in 2015 or 2016. It would appear that they do not believe it.

OPEC shaken by Saudi price move

http://www.cnbc.com/id/102155933

The prime motivator for the Saudis is to compete against U.S. shale oil. But John Hall, chairman at Alfa Energy, sees other benefits for the desert kingdom.

Russia, which competes with OPEC, is already hurting from low oil prices and Saudis are tightening the vise — “seizing the opportunity to reduce prices, hit Russia and hit Iran in one go,” he says.

As I have occasionally opined, what really counts is the volume of net petroleum liquid exports that exporters deliver to importers.

I suspect that the Saudis have been waiting for a downturn in global demand that would allow them to maintain their production and net exports (especially during their low demand winter season), as a way to drive down oil prices, which would hurt the high cost tight/shale producers .

But an important point to remember is that the Saudis have so far been unable, or unwilling (take your pick), to exceed their 2005 annual net export rate of 9.1 mbpd (total petroleum liquids + other liquids, EIA). This post-2005 decline in net exports is in marked contrast to the large increase that they showed from 2002 to 2005, as their net exports increased from 7.1 mbpd in 2002 to 9.1 mbpd in 2005.

A second, and almost totally ignored, point is that CNE (Cumulative Net Exports) depletion marches on.

By definition, it’s not whether Saudi Arabia has depleted their remaining volume of post-2005 CNE, it’s a question of by how much. The following chart shows normalized values for Saudi production, net exports, ECI Ratio (ratio of production to consumption) and remaining estimated post-2005 CNE by year (with 2005 values = 100%).