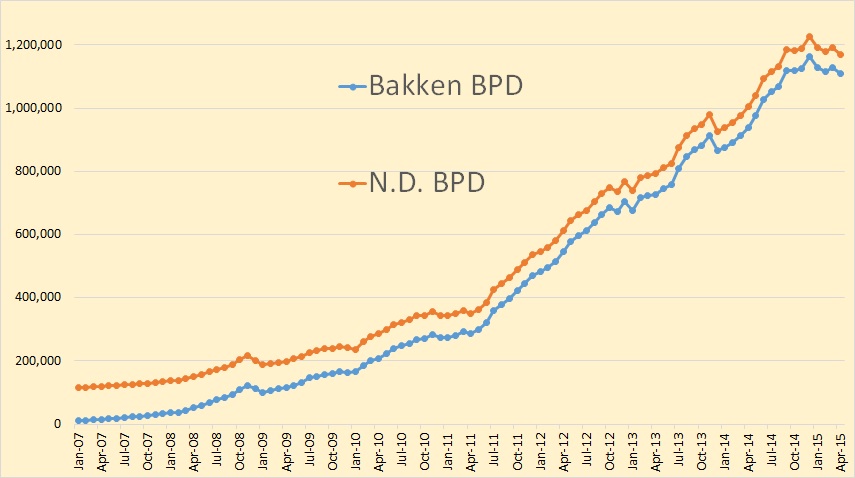

The North Dakota Industrial Commission is out with the April production Data for the Bakken and all North Dakota.

Eight month of flat to down production from the Bakken.

I have shortened the data to 16 months here to give a better picture of what is really happening. North Dakota reached an 8 month low. North Dakota, in April, was 17,631 barrels per day below their September 2014 production. The Bakken was only 11,024 below September 2014 so conventional wells seem to be dropping off pretty fast.

The Baken is 54,599 bpd below their peak in December and all North Dakota is 59,385 bpd below their December Peak.

As usual there was very little adjustments in the previous months data. Bakken March production was adjusted down by 114 barrels per day while North Dakota production was adjusted down by 81 barrels per day.

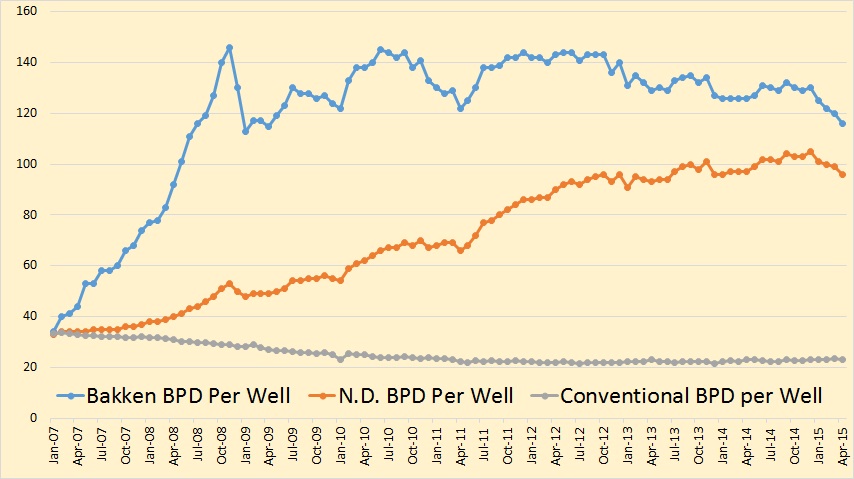

Bakken BPD per well has been dropping for four months now. Bakken bpd per well now stands at 116, down 4 from March. All North Dakota bpd per well is now 96, down 3 while conventional wells bpd per well is 23, down 1 from March.

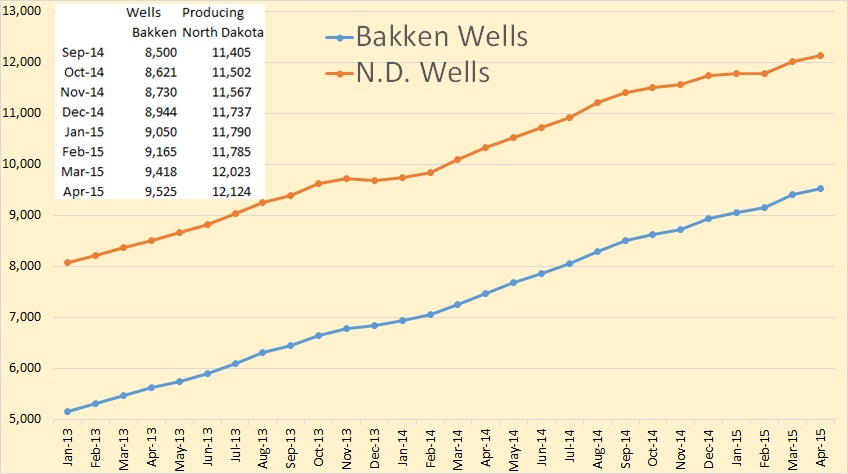

Bakken wells producing increased by 107 while North Dakota wells producing increased by 101.

The North Dakota rig count now stands at 75, down 7 since Wednesday.

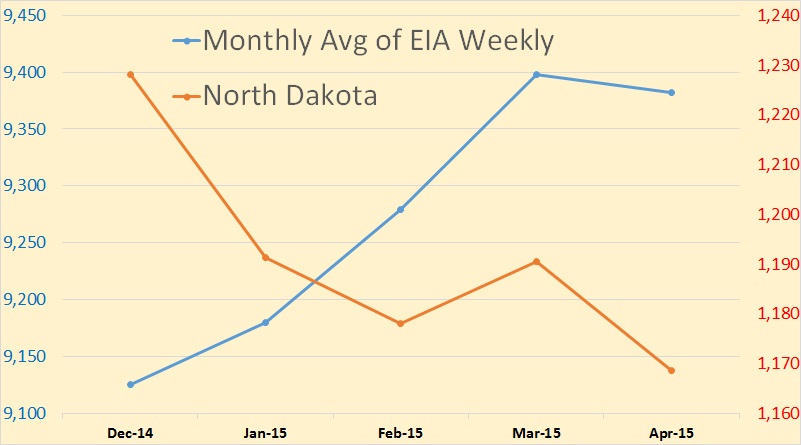

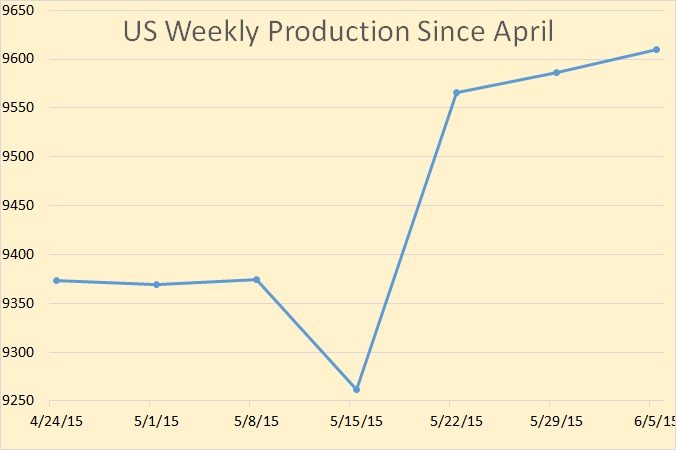

The EIA’s weekly C+C production has been increasing. It is way up in May and June but since the North Dakota production only goes through April, I have limited the above chart to a monthly average of weekly production through April. From December to April, the monthly average of the EIA’s weekly production was up 256,000 bpd while North Dakota production was down 59,000 bpd. That means that from December to April, US production, less North Dakota, had to be up 315,000 bpd.

And need I remind you of what has happened to US production since April. The EIA weekly crew has US production up another 237,000 bpd to 9,610,000 barrels per day.

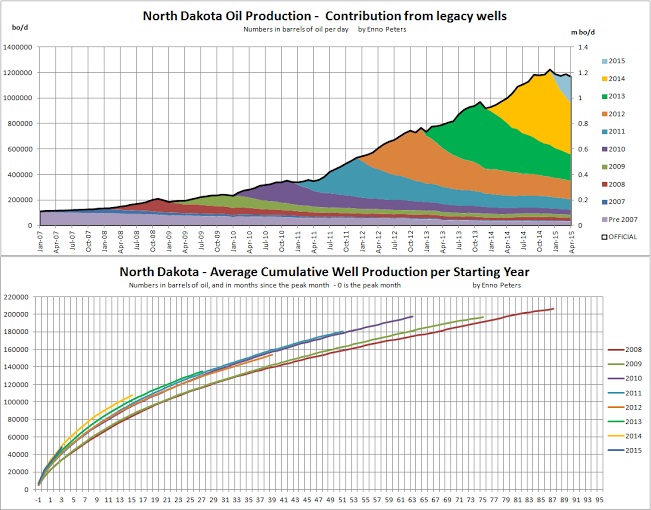

Enno Peters posted the above charts.

Also from Enno’s data I counted 153 new wells that went on line in April, or 5.1 wells per day. That compares to 188 that went on line in March or 6.06 per day. Those 188 new wells brought production up 12,371 bpd while those 153 wells saw a decline of 21,866 bpd. So according to my calculations it would have taken about 175 new wells to have kept production flat. That’s a few more than I would have thought.

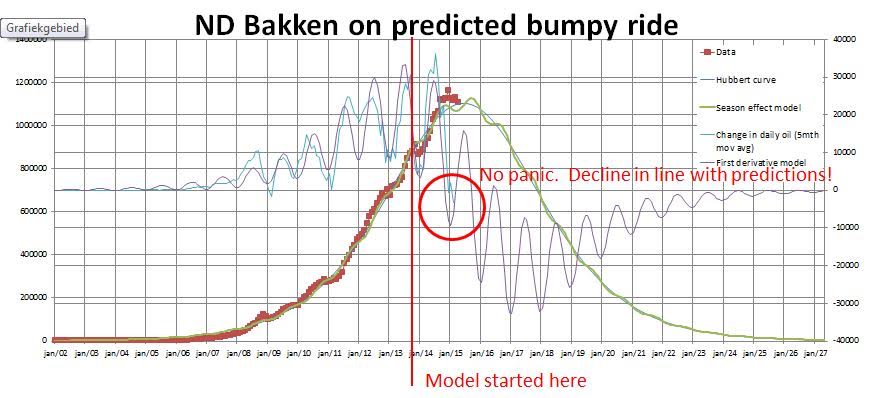

And Verwimp sends his Bakken prediction above.

There was no Director’s Cut Friday due to Lynn Helms’ scheduling problems. I will post excerpts from that report Monday, or whenever it comes out, either here or in a new post if I have one.

The Baker Hughes Rig Count is out. Apparently their data dates from about Wednesday, or early Thursday. It shows Williston and North Dakota with no change and they are down 7. Remember Baker Hughes does not count rigs that are MIRU, or Moving In Rigging Up.

Anyway oil rigs are down 7, Directional down 1, Horizontal down 10 and Vertical up 2.

The only thing Mr. Helms needs to do is admit that Verwimp wasn’t that wrong after all… 😉

An additional factor contributing to lower production in North Dakota is stricter regulations on gas flaring

North Dakota ordered five firms to reduce April oil production

06/12/2015

http://www.ogj.com/articles/uogr/print/volume-3/issue-3/north-dakota-ordered-five-firms-to-reduce-april-oil-production.html

North Dakota oil and gas regulators ordered five companies to reduce their April oil production to 100 b/d on certain wells or face potential daily penalties for violating the North Dakota Industrial Commission enforcement policy on gas flaring.

NDIC’s 100-b/d restriction applies to companies not capturing at least 77% of associated gas from an oil well. The restriction was imposed for 1 month pending a review of monthly production reports from the companies.

North Dakota Oil & Gas Division spokeswoman Alison Ritter said five companies was the highest number to be placed under restriction at once since North Dakota’s flaring order took effect Jan. 1.

The companies were Emerald Oil Inc. of Denver with 10 wells restricted, OXY USA Inc. with nine wells restricted, QEP Resources Inc. of Denver with six wells restricted, Abraxas Petroleum Corp. of San Antonio with three wells restricted, and Enerplus Corp. of Calgary with two wells restricted.

State officials also restricted production for some companies during January, February, and March, but Emerald Oil was the only company to face restrictions every month through April.

Enerplus was restricted for two wells in February, and Whiting Petroleum Corp. was restricted for three wells in February.

Separately, XTO Energy has asked North Dakota energy state regulators for an exception to the percentage of gas that can be burned off at 140 of its wells in Dunn and McKenzie counties.

A subsidiary of ExxonMobil Corp., XTO executives said they had nowhere to take the associated gas for processing. They asked for exceptions to the North Dakota flaring regulation until late 2016 when a proposed Bear Creek gas-processing plant in Dunn County is scheduled to become operational.

As of January, XTO flared 38% of its gas and sold the rest to Oneok Partners LP, Tulsa, and other gas-processing companies. XTO reduced its oil and gas production during February and March to comply, saying it also has delayed bringing wells onstream and is deploying gas-capture units.

If they have nowhere to take their gas they should choke back production to whatever rate meets their gas handling and marketing capacity. North Dakota regulatory authorities lack environmental common sense.

Fernando

Many operators have been doing just that as the detailed, monthly production numbers clearly show. There have been dramatic dropoffs in both the total output as well as number of days wells have been producing during the month starting around November.

XTO is somewhat unique in that a dispute has prevented a relatively short pipeline from being built across tribal land.

Coffee,

Indeed it looks as if there is a small drop in average number of days that wells have been operating recently, although it is not unprecedented, and only explains part of the drop. Below graph is based on all individually reported wells in ND (>10.000). I compared the number of days that a well was producing, divided by the number of days in the month, for all wells that had production and were not confidential.

Hoy short is short? I’ve had problems like that and had the line laid using a zig zagging right of way. It seems to have worked, because afterwards we didn’t have land owners getting into really tough negotiating stances.

Fernando

As per an article in the Bismarck Tribune, dated April 21, 2015, the Three Affiliated Tribes turned down a $10 million per mile easement fee on a pipeline less than two miles long crossing tribal lands.

BTW Fernando, seems some guys beat you to the punch by using heat from produced water to generate electricity.

Story from Star Phoenix paper, dated June 12, 2015 describes 250kwh generated by two small turbines on a pad run by Continental.

Gotta hustle faster with your ides, Fern.

ExxonMobil should have lined up the pipeline row at the same time they obtained the pad construction permits. This is a simple housecleaning issue. As far as I’m concerned they can shut in the wells or truck the gas using high pressure systems.

Try reading this about real geothermal

http://www.geothermal-energy-journal.com/content/1/1/4

There is a visible correlation between the change in Bakken oil production and the increase in the number of new wells. In most cases, production declined when the number of new Bakken wells increased less than 125 per months

What you are counting is “wells producing”. That number counts the new wells that came on line during the month then adds the shut in wells that were brought back on line and then subtracts the number of old wells that were shut down during that month. The number of new wells that came on line in April was actually 153 compare to 188 that came on line in March. Shut in wells brought back on line minus old wells taken off line changed those numbers to 101 in April and 238 in March.

But the numbers that really made a difference are 188 in March and 153 in April.

Ron, I am not sure that the number of well completions is more important than the change in wells producing.

1/ Read the Disclaimer in the Director’s Cut, which says: “The number of completions is an estimate on the part of the director based on idle well count and a typical five year average. Neither the State of North Dakota, nor any agency officer, or employee of the State of North Dakota warrants the accuracy or reliability of this product and shall not be held responsible for any losses caused by this product. Portions of the information may be incorrect or out of date. Any person or entity that relies on any information obtained from this product does so at his or her own risk”

2/ There are huge fluctuations in stated number of well completions that are difficult to explain. That probably proves that this number may not be accurate.

3/ The number of shut-in wells or wells brought back on line could be large during some months, and some of those wells could be relatively new with high production rates.

4/ The number of well completions refers to total N. Dakota wells, although I admit this is not particularly important, given than 99% of drilling activity is in the Bakken region.

4/ From Director’s Cut (May 2015): “To maintain production near 1.2 million barrels per day, 110-120 completions must be made per month.” This statement better corresponds with what I said in my previous post, than with their own numbers on well completions.

5/ Looking in the table below, could someone say that the number of wells completions is better correlated with the changes in production than changes in the Bakken producing wells?

(P.S. just for information: the table shows a rapid decrease in the number of producing conventional wells)

Wells statistics and oil production in North Dakota and N.D. Bakken

Hi AlexS,

Ron has access to Enno’s database and that gives the number of new wells which started producing each month. I have not confirmed Ron’s data but I think he pulled it from Enno’s data which is based on NDIC reports. Perhaps Ron or Enno could confirm. The completion number is the most important figure in my opinion, though I would defer to Ron and Enno’s judgment.

Hi Dennis,

The number of well completions by month can be found in the Directors’s Cut (see my table). Other data is from NDIC reports.

A detailed database obviously could show a real picture, especially if there is data on these new wells combined production during a given month, declines in old wells, and change in volumes due to wells shut in and wells brought back on line.

The timing of well completions is also very important, as if, for example, most of new wells were completed in the end of the month, they contribute little to production in this month. So, a detailed breakdown of factors contributing to changes in production would be very helpful. Otherways, with the data published by NDIC, we are seeing some very strange numbers, like 145 wells completed in October with production down 1kbd, and 48 wells completed in November with production up 6kbd.

Also, the disclaimer in the Director’s cut make me suspicious about their data on well completions.

Hi AlexS,

The completion information in the director’s cut is not very good.

Yes, I got my numbers from Enno’s data. I just counted the wells that came on line.

The Director’s Cut numbers are not reliable. They often do not match the actual count from the field.

I am unsure about those “wells producing” numbers. If a lot of non producing wells were shut down, why would that matter? On the other hand if wells were shut in for maintenance, then that would matter. Though if they had been producing for a couple of years then their production numbers would not be that great.

If 153 wells were completed I think they would pretty well average out over the whole month. I think it would be very unlikely that they would be bunched up toward the end of the month.

But in the final analysis, production was way down and that is the important thing.

Ron,

Are your numbers of wells completed significantly defferent from Director’s cut numbers.

If so, I’m just wondering why, given that the database is based on NDIC numbers.

Alex, I have no idea why. Helms obviously has access to the NDIC data, why he does not just count the wells is beyond me. But sometimes his numbers are radically different. Perhaps he is counting something else?

I was also wondering about this. Maybe an oil guy can explain why the completion date is not always the date that first production starts.

Is he emailable?

Maybe they are missing production equipment? I seldom see the completion date match first oil. But I guess that depends on the well and local rules.

Ron, Enno, thanks

Maybe indeed there is some time lag between well completion and the start of production

Alex, Enno

The lag between completion time and production may be prompted by a number of factors, particularly logistics.

The current online issue of American Oil and Gas Reporter (aogr.com) has an informative, wonky article on facility design that addresses the daunting challenges that operators face capturing and processing associated gas with high decline rate shale wells. The final section, titled Operational Flexibility, nails the topic in summary fashion.

An additional example of logistics constraining production post completion was just displayed by Rex Energy in Butler county, PA.

After simultaneously drilling four wells from the same pad, two were completed, tested, and evaluated. One, targeting the Upper Devonian, was surprisingly more prolifific than the other completed well which targeted the Marcellus.

No production will occur from any of these wells until takeaway capacity is in place, and that is several months off.

Ron,

Excellent update. I gather a 60% decline in oil drilling rigs doesn’t really matter after all. Maybe the drilling industry can pack up and go home as U.S. production takes out 10 mbd. Hilarious dichotomy between EIA weekly figures and the EIA DPR folks.

Anyhow… look at the whopping decline rate at the MIGHTY MARCELLUS. Looks like the first month the Marcellus will actually show a net decline. Is this the Peak of the Mighty Marcellus??

steve

Sorry for those folks who have trouble reading. That’s as large of a graph as I could make.

steve

So, the EIA is saying that–in order to maintain about 16 BCF/day of production from the Marcellus–operators in the play need to put on about 8 BCF/day of new production per year?

To put 8 BCF/day in perspective, the EIA shows that federal Gulf of Mexico marketed natural gas production in 2014 was 3.4 BCF/day.

Mr. SRSrocco

I suppose you are aware there are, at this moment, over 2,300 wells in the Pennsylvania Marcellus alone that are drilled and awaiting takeaway pipelines?

As of last month’s reporting, there are 6,529 producing horizontal wells in the PA Marcellus.

Gerard, as always I am appreciative of your passion for shale oil and shale gas, however economically unfounded that may be. Forgive me but it is clear to me that you and the shale oil and shale gas industry that you re…(sorry), the shale oil and shale gas industry, can’t get past the fact that it cannot make money, regardless of big IP’s, coiled tubing conveyed slick water frac’s and lack of take away capacity. There is no take away capacity in the Marcellus because there is no place to take it. There have been a dozen grandiose plans for take away capacity out of the Bakken that never got legs because of decline rates, so goes the Marcellus.

Technology can no longer save the day, mate. The shale industry cannot sho America the money. It can’t pay its debt. It can’t stand on its own two feet.

I hope you are well.

Mike

Mike I generally read you wall to wall and tree top tall good buddy.

But who is this Gerard?

Mike, OFM

Gerard c’est moi, monsieur.

Mike, I just composed a thousand word response to you, aaannnnd it’s gone! Won’t re-write, but I want you to know I, as do many others, greatly appreciate your posts, as well as the hard work you do and have done these many years.

The Marcellus/Utica output will be shipped on the 35Bcfd capacity that is planned to be built within the decade. (RBN has numerous articles on their site about these pipelines.)

The three ethane crackers – total cost over $10 billion – may or may not get built, but the plans are in the early stages to construct them.

The businesses in eastern Massachusetts are relegated to emplacing underground propane tanks for future heating needs. Minimum three year wait for new gas customer hookups.

The Bakken pipelines will carry several hundred thou barrels/day to Clearbrook by 2017/18.

The hydrocarbons exist, are technically recoverable, and – should economics allow – will be produced.

Looking forward to your future contributions to this site.

Gerard

Coffee ,I presume you are acquainted with THE Gerard the Fox of eternal fame.

You and Mike are in good company and worthy companions.

Those who have not yet been immunized by experience when it comes to fools and their money -and their wives, etc- will be doing themselves a BIG favor if they read the life of Gerard.

OFM

Thanks. Should I ever encounter a rowdy robot in some saloon some Saturday nite, I would be much obliged to have Mr. Roughneck or someone similar, back to back taking on ol’ R2D2 and friends.

And I would have your back, sir.

OFM, thank you for the compliment. Gerard is Coffee, an old oilfield hand, a diver. Big huevos, those guys; not quite as big as us well control guys, but almost.

Mike

Merci, mon ami, Gerard; et vos contributions ainsi.

I agree the hydrocarbons exist and can technically be recovered. I agree also in a perfect world that technology can improve the recovery, and economics of shale oil and shale gas. I envision a perfect world being 120 dollar WTI oil and 8.00 HH gas. But nothing in life is perfect and the one thing predictable about life is that it cannot be predicted.

For all the rhetoric about the future of LTO and shale gas in our country, for all the graphs, charts, models, discussions about production reporting, robots, multi well pads, frac stages, exporting LNG, Bakken this and Eagle Ford that, to me it all boils down to one simple thing: economics. Shallow gets it, and a few others. None of this will work for the benefit our long term energy needs unless…it makes money. It’s not rocket science. This from an old hand who has drilled hundreds of wells in a half century; its gotta make money or your pissin’ in the wind.

This shale stuff is not profitable. If you owe money, you ain’t making a profit. Pay it back, then I’ll be impressed. Until then I am grateful, as should all Americans be, for the grease, providing we don’t have to pay off the shale industry’s debt someday.

2,300 Marcellus wells sitting up there shut in with no take away capacity is way over a billion dollars of spent capital at a dead stop, with only the interest meter running. Sorry, that’s stupid.

Mike

Mike, I have a brother who is a petroleum engineer. He has a client company active in the Marcellus that is selling its gas for 25 cents/mcf.

I won’t mention the client company’s name but it is not one of the companies named up thread. They are one of the more active companies in the Haynesville.

At 25 cents/mcf. I am not sure they can pay the light bill.

John S./Mike

The two biggest factors in 25¢ natgas are:

The above chart re Marcellus’ output shows under 2Bcfd at the 2010 hash mark. The 2015 hash mark is over 16Bcfd. That’s a lot of marshmallow roasting in five years time.

Second factor is the imperative to get retention wells on already-leased land. The fact that the areal extent of the Marcellus dwarfs both the Bakken and Eagle Ford combined (over 30,000 sq miles in PA are permitted for drilling) has led to the incredible oversupply situation at present. The inadequacy of takeaway capacity has greatly exacerbated the situation.

As it is, several of the big outfits there have about 25% of their leased land with no production, and risk losing their hold on that acreage.

Mike

You are 100% correct in the view that, absent economic justification, shale development does not make sense.

Thought experiment … if I told you last June that one of the biggest oil producers in the world would launch a war on its neighbor, fail in attempts to bribe Egypt and Pakistan to send invasion troops to augment their own air campaign, suffer counter incursions losing both military personnel as well as bases (the Saudi head of their air force was killed last week … ‘heart attack’ supposedly), be hit by a scud missile with the accompanying threats of the entire KSA territory subject to extensive missile attacks … and all the while the price of oil semi shrugs these events off … if I were to describe the above scenario to you last June, Mike, you would understandably think I’m nuts.

And yet it is happening.

All the while, the king is dead and an epochal succession struggle is unfolding.

The inlet and outlet channels in Hormuz are still one mile wide each way.

Mike, we may see triple digit WTI sooner than later and be grateful that the hydrocarbons are available.

My memory is not what it once was. I was thinking about Reynard of literary fame- my book of stories being translated from the French makes it a bit more understandable.

Reynard continually fools the shit out of just about everybody. These tight oil operators may have studied up on his legendary trickery.

From wikipedia :

Reynard (French: Renart; German: Reineke; Dutch: Reinaert) is the main character in a literary cycle of allegorical French, Dutch, English, and German fables. Those stories are largely concerned with Reynard, an anthropomorphic red fox and trickster figure. His adventures usually involve his deceiving other anthropomorphic animals for his own advantage, revenge, or pure malice, or trying to avoid retaliations from them. ”

Reynard would be right at home in the tight oil patch.

coffee. Who are the big players in the Marcellus? Range and Cabot are. Rex Energy is a smaller player, as is Magnum Hunter. Any others besides integrated majors?

Shallow

I just tried to retrieve the top five producers in 1stQ2015, can’t find it … but I am certain that a virtual unknown, Antero, surpassed Range for the number one spot. Chesapeake is still reeling from McLendon’s reign, but they were the biggest for awhile. Cabot has spectacular operational as well as production results. EQT has been around since the 1800s and is ramping up steadily. Seneca and Console are big players.

Magnum is similar to your neighbors, Sandridge, in being bokoo shaky money-wise. Rice is a tiny outfit that is targeting the Utica and has a half dozen monster wells producing 14/20MMcfd on restricted chokes. Its first one has been online a year now and has produced about 5 1/2Bcfe (close to one million boe).

I’m still pretty ignorant of these plays, but a couple of sites, esp marcellusgas.org, have a ton of current, granular-level data.

Shallow

I just tried to retrieve the top five producers in 1stQ2015, can’t find it … but I am certain that a virtual unknown, Antero, surpassed Range for the number one spot. Chesapeake is still reeling from McLendon’s reign, but they were the biggest for awhile. Cabot has spectacular operational as well as production results. EQT has been around since the 1800s and is ramping up steadily. Seneca and Console are big players. Rice is a tiny outfit that is targeting the Utica and has a half dozen monster wells producing 14/20MMcfd on restricted chokes. Its first one has been online a year now and has produced about 51/2Bcfe (close to one million boe).

I’m still pretty ignorant of these plays, but a couple of sites, esp marcellusgas.org, have a ton of current, granular-level data.

coffee. I looked at Antero and Range websites. Both have cut CAPEX quite a bit. Antero production in Q1 will be the highest for the year, it is expected to fall as they cut down significantly on drilling and completions, including deferring 60+ to 2016. I think Range is too, but they talk more about year over year, so tough to tell.

Antero has over $4 billion of debt. Range just floated a $750 million bond issuance to pay off their line of credit. Both were very cash flow negative in Q1. Both have a large amount of 2015 production hedged at much higher prices, unlike a lot of the shale oil guys.

There are some huge wells noted, and they both have large acreage positions.

I wouldn’t say they are in trouble yet, but it doesn’t look like their business plans work with sub $2.00 natural gas any more than the shale oil guys work with sub $60 WTI.

My uneducated guess is that they have found a better resource than US oil weighted shale, but are looking at even more depressed prices. Just like oil, wells are not cheap and costs, though coming down, are high.

Wouldn’t surprise me if production falls in Marcellus and slows in Utica. Prices are too low.

The Marcellus has been pipeline restrained for a long time. This is demonstrated by the fact that Marcellus gas has been trading at deep discounts to Henry Hub. It appears as though the Marcellus is reaching a plateau, but currently it is hard to tell if this is due takeaway capacity restraint, the ability for the formation to produce, or for the gas to be produced at a sustainable profit.

In the next month or so, the REX pipeline, Rocky Express, Zone 3 will be reversed. Taking 1.2bcf of gas from the Marcellus to the Chicago market. If the Marcellus has peaked, then we should see a narrowing of the spread between, Marcellus local price and Henry Hub. If the area is just pipeline restrained, we should see and increase in volume.

we shouldn’t have long to wait to find out.

http://www.downstreamtoday.com/news/article.aspx?a_id=47955

Rockies Express Zone 3 East-to-West In Service Date Pushed into Q3

Tallgrass Energy has confirmed that the highly anticipated Rockies Express (REX) Zone 3 East-to-West project has been delayed and will not be completed until July 2015 or later in Q3 2015. The project is set to provide an additional 1,200 MMcf/d of firm transportation service, which has been fully contracted. Once complete, Zone 3 on REX will be able to flow 1,800 MMcf/d bi-directionally between the Clarington Hub and the Moultrie interconnect with NGPL, 600 MMcf/d of which is currently being served by the Seneca Lateral. As of June 1, 2015, East-to-West flows reside around 1,060 MMcf/d.

This reversal will allow Appalachian gas to reach Midwestern markets via interconnects with NGPL, ANR, Midwestern GT, Panhandle, and Trunkline. The aggregate design capacity for these delivery interconnects will essentially double from 1,572 MMcf/d to 3,102 MMcf/d. The Moultrie interconnect with NGPL makes up the bulk of the incremental capacity by adding 1,135 MMcf/d.

In either case, depletion marches on.

Based on the EIA estimates, in order to maintain current production, operators in the Marcellus have to put on line the productive equivalent of Mexico’s 2013 dry natural gas production–roughly every six months–or all of Canada’s dry natural gas production every 20 months.

Or, if we combine the two, in order to maintain current Marcellus gas production, operators in the play have to put on line the productive equivalent of all North American dry natural gas production, excluding the US, every 27 months or so.

Or another way to put it. The EIA is estimating that the Marcellus is currently losing about 3 TCF/year from existing wells. Based on my rough count, the EIA shows measurable dry gas production for about 96 countries worldwide. The estimated current annual volumetric loss of production in the Marcellus exceeds the 2013 gas production of all but eight countries worldwide. For example, 2013 UK dry gas production was 1.4 TCF/year.

Of course, the volumetric decline from existing wells would fall with time, but I am stipulating a “What if” steady state scenario, i.e., how fast does the Red Queen have to run just to stay in place?

Copy of my comment on US decline rates on prior thread:

If we stipulate a steady state US production rate, a 20%/year gross decline rate would require the US to approximately put on line the productive equivalent of current Saudi C+C production roughly every five years, just to maintain current US C+C production for five years.

As I have previously mentioned, according to the EIA the observed rate of decline in Louisiana’s annual marketed natural gas production from 2012 to 2014 was 20%/year (falling from 8.1 BCF/day in 2012 to 5.4 BCF/day in 2014). This would be the net change in production, after new wells were added. The gross decline rate (from existing wells in 2012 and 2013) would be even higher. Citi Research put the overall gross decline rate from existing production at about 24%/year.

The EIA put US dry natural gas production at 70 BCF/day in 2014 (25.7 TCF/year). At a 24%/year gross decline rate*, in order to maintain current US dry gas production, the US has to put on line the productive equivalent of total Middle East 2013 dry natural gas production (23 TCF) over the next four years (again assuming a steady state production rate, so that we would be declining against a constant production level).

*At 24%/year, we need about 17 BCF/day or about 6 TCF/year of new dry gas production, just to maintain current US dry gas production; or in other words, we would approximately need the productive equivalent of a new Marcellus Play every single year.

Using an estimate of about 6 TCF/year for the gross decline from existing US gas production, this volumetric loss of production from existing wells would exceed the annual production for every country in the world, except for the US and Russia.

Mr. Brown

I just wrote a reply to your post and it disappeared. (Black holes do exist, mebbe?)

Gist of my reply concerned the seldom mentioned Utica dry gas.

The Penn State University website, Marcellus Outreach’ has some new, informative maps of both Utica and Marcellus formations.

Takeaway is that the Utica is MUCH larger than the Marcellus.

The wells by Shell in Tioga county, located 400 miles northeast of the WV monster Utica wells indicate the vast expanse of this resource.

The 43MMcf IP that Range just announced as the highest Marcellus IP to date is only a few miles from the Utica’s 59MMcf IP.

As many as 51 gas wells have been drilled on 5 acre pads (Encana in 2011 in the Piceance).

Production from this area is just beginning and is apt to be long lived.

I found it’s a good idea to write a long comment in word processing, and then copy and paste.

In any case, based on the foregoing, it seems likely that in order to just to maintain current US production, in round numbers US operators have to put on line virtually the combined productive equivalent of 2013 dry gas production from Canada + Mexico–every single year.

Incidentally, circa 2011 the EIA estimated that Poland had the largest technically recoverable shale gas reserves in Europe. As noted on another thread, one little problem has arisen: there have reportedly so far been no commercial shale gas wells completed in Poland, and most international companies seem to be headed for the exits as fast as they can leave.

Are the Marcellus decline curves hyperbolic? Or are the wells too young to tell for sure?

Fernando

Hyperbolic, parabolic, anabolic, anorexic … I’m not well versed in technical, mathematical terms.

Average Marcellus wells produce at about 20% initial production at the three year mark.

Laterals are definitely getting longer, more stages/proppant just like the oil guys.

Coffee, they are hyperbolic. This means the decline rate drops continuously. This leads to lower decline rates as wells age, which means that it requires less new wells to make up for the decline. If I know nothing else I assume a large number of wells will have a 10 % decline rate after 5 years. But this depends on well spacing and well design.

coffeguyzz,

Due to the high decline rates of shale, transportation cost are up to 10 times higher than for conventional gas as the invested money has to be depreciated over a few years, which is in stark contrast to conventional gas transportation depreciated for decades. This is the reason for unconnected wells. Much higher gas prices are needed that companies can afford the high transportation cost. Transportation is a major weak point for shale gas.

That problem can be worked around by sequencing well. There are infinite solutions. For example: Bakken and three forks wells can be drilled from 12 well pads. The pads are located relatively close to each other. So it’s easy to work out a profile whereby the wells are drilled and completed on a schedule which allows production to be carried by a single flowline for a pad, which in turn feeds to an adjoining pad. Flowline costs are fairly insensitive to flowline diameter, and the full production can be gathered.

What we see in North Dakota is only the result of very lax state regulations and industry participants who seemed to lack the will to get their act together.

Mr. Leopold

I do not follow your statement on several accounts …

The six and a half thousand producing PA horizontals (out of the 9,000 drilled) are operating on slightly more than 4,000 pads.

Therefore, most production comes from solitary wells.

The gathering lines connecting these wells continue to feed into larger pipelines until ultimately reaching the high pressure, high volume takeaways. These larger pipelines pipelines are being planned/built by the industry’s heavyweights who rely on firm, legally binding commitments from suppliers.

EQT has permitted a pad for 27 wells. As at least three productive zones exist in much of western Pennsylvania – the Marcellus, the Utica, and the smaller, shallower Upper Devonian – operators will have significant opportunity to economically maximize output as the near-million-dollar pads are already operational.

To compare transportation cost from a well from a conventional gas formation with a single shale gas well would certainly be grossly disadvantageous to the latter. However, when there are hundreds of wells on dozens of pads sequentially producing (as per Fern’s observation), the ‘Energy Corridor’ approach as is used in the Bakken – or something similar – will become the relatively inexpensive norm.

coffeeguyzz,

Thanks for your reply. As always it is more complicated as it looks at first sight. It could be also that pipline operators want to look first where the supply is and then decide on a pipline strategy. In my view one of the most supply restraint comes from the drop of futures beyond 2016 to record low levels. Companies like RRC are hedged through 2016, yet can only hedge at low prices beyond 2016. This gives the companies less ability to invest in future projects.

Thanks for the update Ron and Enno.

Ron wrote:

”So according to my calculations it would have taken about 175 new wells to have kept production flat. That’s a few more than I would have thought.”

FWIIW

NDIC records show a net addition of 581 producing wells as from January through April 2015.

Enno’s list shows 645 wells started production for the same months.

Production declined with about 55 kb/d as from Dec-14 to Apr-15.

No matter how those numbers are whipped for confessions the number of monthly well additions needed to sustain production now appears to be in the range of 150 – 180 (which is above what I expected).

I agree with Mr.Likvern.

Based on data shared by Enno Peters (thank you Enno, you are very gracious). I put together completion data for Jan 2014 to April 2015 for the Bakken/Three Forks of North Dakota.

For the most recent 6 months I have assumed that confidential wells from the counties where most Bakken/Three Forks wells already exist are in fact Bakken/Three Forks wells (this may be an overestimate). Output was relatively flat from Sept 2014 to April 2015 and the average new wells completed in the Bakken/Three Forks of ND was about 176 new wells per month over that 7 month period, I am also surprised by this, perhaps new well productivity is decreasing or the new wells from 2014 are declining more steeply than before, it may be too early to tell. Completion data below.

Dennis, I notice your count is a little different from mine for some months. I am sure your count is more accurate. I just counted wells and some of those wells should not have been counted. I see some wells in the 50,000 well number (permit) range. I never see these wells in the Daily Activity Report Index. I have no idea why or what it means when wells are listed in the 50K range.

Ron (and everyone else taking an interest),

I suspect those 50 000 (well number ID’s) are produced water disposal wells and they are all targeted the Spearfish/Madison formation.

Several of these wells have some monthly production reported which I suspect is reclaimed oil (simple gravity process and takes a little time) from water processing which then gets allocated to wells that delivers to the disposal site.

This may explain a portion of the monthly revisions to LTO numbers.

I did some checks for some companies and found the amounts from these disposal wells comes in about 0.1 – 0.2 % of (monthly) totals.

Hi Ron,

Rune is correct, which I would expect. The wells with ID #s of 50000 or higher are disposal wells, my count is not necessarily more accurate than yours, especially November to April includes confidential wells which requires some guessing. The counts through October should be pretty accurate (+/- 1 well, I think), but I may have counted incorrectly.

Dennis, from now on I will sort by well # first and get rid of all those 50,000 numbers before I start counting.

Never mind, just noticed loads of double counting in this months Excel.

I follow the daily reports too, and this month’s production drop has blindsided me a bit, to be honest. I have been predicting next month’s production thus:

1) decline rate for all existing wells

2) adding on all producing well completed and confidential well completed/plugged notices from the daily reports, assuming they will follow an average production profile from the last 12 months for the county in which they have been drilled

I guessed 1.22 million for this month – so I assume that I should have plugged more confidential wells than I did in my model. I’ve tried to rectify this by plugging confidential wells that appear in the daily reports but already exist in the dataset – but some confidentials (e.g. well 27477, completed January 2015) apparently only appear as completed/plugged in the daily reports months (March 2015) after they appear in the published data. I can’t understand why this should be the case.

As for the 50k problem discussed below – in the Monthly Production Reports these wells are classed variously as “Recovered Liquids from Gas Lines”, “Disposal Well Skimmed Recovery”, and “Waste Oil Treating Plant Recovery”. They account for Mason Inman’s 0.6% discrepancy a few months back, and generally have counted for around 7000-8000 bpd in recent months.

Ron, I don’t follow your comments in the article about US production estimates vs ND/Bakken figures.

“That means that from December to April, US production, less North Dakota, had to be up 315,000 bpd.”

“And need I remind you of what has happened to US production since April. The EIA weekly crew has US production up another 237,000 bpd to 9,610,000 barrels per day.”

So, unless ND has a spike up in May, Texas and other states are up over half a million barrels from beginning of 2015? Is that what EIA projections of 9.6 million bopd should be telling us?

It seems TX rigs fell off a cliff in a similar manner as ND. Further, I can’t see any other states having that much of an impact over a four month period.

So TX was underestimated for months? I don’t see how we got to 9.6 million with one of the two states driving the US boom falling and a huge rig loss in the other as well.

Down 110 from June of 2014 with the rig count at 75.

13,750 jobs lost. Translates to no paycheck, no money, and find a new job.

March of 2008, 520 Bakken/Three Forks wells.

April of 2015, 9525 wells in the Bakken and Three Forks.

9005 wells more than in March of 2008.

Each one at 9 million dollars per well.

9005 times 9 000 000 is a big number.

Very big, too big, let’s say it is much too big, bit off more than can be chewed, just have to keep on chewing, nothing else can be done. The banks are going to have a bone to pick after the chewing is over and it ain’t over until it is over.

81,045,000,000 numbers, one through 81,045,000,000 will take some time to get there. Are we there yet?

How long will it take for all of those numbers to return to the beginning, zero?

If General Motors had 81 billion to invest, they could come up with something other than 9000 wells depleting to an unsustainable economic disaster.

It’s only money. Got a million barrels of oil out of the deal.

But, hey, it created a boom not soon to be forgotten.

Ronald Walter. Pretty good statistic about 9,005 wells and $81+ billion dollars to drill and complete them.

Now lets just figure many of those in prior years cost over $9 million. Plus add in all of the $$ spent acquiring acreage, building infrastructure, pipelines, etc. And add on all the interest payments to date.

So we will assume $100 billion which in April produced 1.1 million barrels per day gross. Assume 20% royalty, so 880,000 net bopd to the working interest owners, who paid the $100 billion. That is $113,636 per flowing barrel.

There is some gas production, which helps a little. But offsetting that even more is a low oil and natural gas price, low basis (that has improved quite a bit recently) and high decline.

$100,000 per barrel for a lease only makes sense if oil is $100+ per barrel, OPEX is low, and decline is low.

Thanks for the overall perspective, Mr. Walter. I have been analyzing this stuff in many different ways financially, but this big picture view hits it home.

Economics right now are comparable to early 2000s at best, when oil production of the low decline variety brought $10-30 thousand per barrel and $100,000+ per barrel just did not happen.

So, without the high oil prices from the recent past, which clouds judgment, Bakken production which cost maybe $100 billion to develop is likely worth $10-30 billion in the current environment?

Would like some comments on this “back of envelope” calculation.

I throw out another back envelope calculation. Those 9005 wells are going to produce around $7 billion in pre income tax income in 2015 if the futures strip holds, assuming $250 K of OPEX per well, with one down hole pump change and one tubing hole repair per well, also assuming 10% production/extraction taxes, and assuming $50 billion is still owed on those wells.

7% pretax return won’t cut it when, over the next five years, those 9005 wells will decline to less than half of what they will produce in 2015.

Lets say in 2020, those wells average 40 barrels per day, which may be generous. The wells will need $120+ oil to return the same as in 2015, unless OPEX per well decreases, and/or interest expenses decrease.

Ronald when I see how many thousands of wells being drilled and all the money flowing around in the Bakken shale oil fields and Williston plus other places in ND I just get BESIDE MY SELF WITH EXCITEMENT!!!!! if they are begging for people to work walmart for $17.00/hour think what Ill be getting paid when I come up to ND as a welder!!!! a SKILL!!!!! Im getting ready to grad welding school this fall. will have Mig,Tig,Oxyfuel as well as SMAW and FCAW for my structural and will include pipe cutting. I got my eye on the oil fields in wiliston ND etc. SURE it be cold and yea I will work hard in it BUT I will make great living and future for myself!!! and getting dirty,working hard in cold or hot weather is nothing I have not done all my life on the farm and as a farm hand . NOW!!!! if that is what it takes Ill gladly start as a welders helper or ranch hand to get started.far as weather I just know how to dress for the occasion.

FYI – I understand that the real shortage of welders is in the Gulf Coast off Texas and Louisiana. Good luck!

Dustin, pay attention!

A cutting torch will come in handy from time to time.

Mosquitoes, woodticks, two critters that will make you look like a flea-bitten varmit when you are out there all day long, and don’t forget horse flies and deer flies. You’ll have welts on your skin all summer long. No insects during winter, the cold weather makes it difficult to survive.

-35 degrees makes everything creak and moan. Steel breaks, you might be welding on days when it would be better to stay inside. Cattle need to be fed and watered, you will have to brave the elements each day. No two weeks off every two weeks, Sundays, Saturdays, every day will be a workload.

Texas is hot and the sun will boil your brains out. Never been there, it is too hot and dry, the winters are mild, but that doesn’t count.

Alberta is a great Canadian province and there is cattle and wheat along with oil. Edmunton is a long ways from anywhere with plenty of Canadian prairie in between. The Peace River Valley is more or less the end of the line, after that, you’ll be in the Canadian wilderness. You won’t escape mosquitoes though.

Actually, there is never an end to the work, no matter what that work is. The charts and graphs displayed at this site require work too and it don’t come easy.

Pasture land, wheat fields, oil fields, all require a heavy workload and it won’t stop. Quitting is not an option until you retire and you are not going to win them all.

Oasis is hiring.

Colorado has the best beer in the world, so it would be a good decision to find work there.

Good luck to ya.

Say ‘Hi’ to dn_girl for us…

She’d (or her hubby) be a-twerkin’ for work ’roundabout now for Da Boss-Mans, I figure. Gotta get mugged for them governpimp dental plans ya know.

Don’t worry, in a short time those well plots will get covered with wind towers and solar panel farms. Lots more money to be made, fantastic growth industries to keep the wheels spinning. It costs about 2 million dollars to cover a four acre drilling plot with solar PV, road is there already and power lines can be run out to a main road and a few substations built. More money for the services.

PV only declines at a percent or less per year so it will be 70 years or more before it’s down to half power. Bet the oil people wish they had that kind of decline rate.

My thoughts exactly, Zepp. What is going on in the heads of all those people drilling all those holes? They do the most exact arithmetic over and over to show beyond any doubt that what they are doing is less profitable than the same money in wind turbines in that same windy site.

What?

Besides, wind turbines get better and better, with lots of room to keep getting better for a long time, where holes get more and more worse and less and less chance to do any better.

“….wind turbines get better and better, with lots of room to keep getting better for a long time…” How much better are they going to get? To my knowledge, commercial utility-connected turbines currently deliver 75 to 80% of the Betz limit of power extractable from the wind (at rated operating speed). Of course there are devices around claiming to improve efficiency of turbines, particularly the so called shrouded turbines: But, there appears to be little data to support the greater efficiency claims. Perhaps you know better.

“Better” means anything that makes it more desirable. Like cost. Or reliability.

Eg. Gearbox- biggest maintenance cost. Why bother? No need for a gearbox. Gets rid of some cost as well as maintenance.

Bigger alternator? Sure, So we have a bigger propeller hub. Actually increases efficiency of the blades.

And power kites. Blows everything else away–hahaha.

And intermittancy? No problem. Each unit pumps air one step farther up the pressure ratio, almost constant temp compression at max efficiency. Store the air in a big bag way down in the water the unit is floating on. Power on demand, any time, any wind.

And on and on and on.

Ditto for solar.

So now let’s hear the similar list for holes in the ground.

Gawd! How exhausting, time to take a nap.

You may be right. Apparently the main problem of conventional rotor support structures is gearboxes are performing structural and mechanical functions at the same time; this is especially critical offshore of course. In the Netherlands there is a lot of discussion about whether gearbox failures are due to the gearbox inability to withstand specified loads or to the fact that real loads experienced by the gearboxes are higher than those specified by the turbine manufacturers.

I have always thought the way it’s arranged, the turbine gearbox is just begging to fail. A dumb design for sure, and what are they doing just making the same thing over and over when there are so many better options?

Suddenly, a solution! Switch designers, the gearbox designers go to ND and think about better ways to do that, and the hole experts go to the wind turbines and do them.

Instant result. Both guys say what’s being done now is nuts and we can do better- and then they do it.

That will be ten cents consulting fee, please.

OK, make it two.

I think the gearboxes in windmills are there so they can use induction motors, which don’t require permanent magnets. Induction motors require higher rotation frequency.

You mean generators? I think they just need to beef up their designs. This may be growing pains. But it’s bound to increase the price while allowing the windmill to survive. This will be critical in offshore settings. I suspect the industry is growing too fast and has lots of inexperienced buyers.

Huh? What’s an induction motor doing in a wind turbine? What’s the purpose of any motor, apart from those that position the nacelle to face the wind and those that adjust the pitch of the blades?

They are getting bigger.

Yep, and how’s that for thinking out of the box? Bigger turbine, gotta have bigger box for it, haha. Sigh.

There’s so many better ways to get better. I like the pumped air idea, no alternator, just a crank- conrod- piston(super rugged) pumping up the pressure ratio. Storage, and power on demand from one big central gas turbine.

One nice thing about any storage system is that they can be local. The electric power can be stored in batteries, pressure storage, pumped hydro, and hot salt. The storage could be locally situated and activated by remote signal as wind and solar vary.

Old power plants could be converted into power storage facilities.

Air storage loses a huge amount of energy. It’s a thermodynamics issue. I think the better solution is to build a better turbine. They also need to develop a heavy lifter to carry very large blades from the factory to the site by air.

Isothermal compression and storage do not lose energy, and a close approximation to isothermal is multiple compression and intercooling, as would be easy using multiple stages in a bunch of wind turbines.

it’s a thermodynamics issue.

What you propose doesn’t work. It’s impossible to design a compression system with infinite inter cooling, and there’s no heat exchanger with perfect heat exchange. You know, the more surreal you guys get the less energy I have to try to mentor you. Try to keep things a bit more practical.

goddam it, fernando. It’s obvious you don’t know squat about this subject.

I do, and have some impressive looking pieces of paper from the two most rooty-tooty engineering schools in the country to that effect.

D. G Wilson, the guy who wrote the book on it ‘Design of High Efficiecy turbomachinery and gas turbines” is a personal friend.

Go to page 106 of the second edition and read about intercooled compression.

BTW- no real engineer ever talks about “perfect”or “infinite” anything. They know there ain’t no such.

But sometimes one process gets closer than some other process. Intercooling and store is better than adiabatic and store with heat leak back to local temp.

As Wilson -and any thermo book -will tell you.

Hi Wimbi,

Thanks. Sometimes Fernando assumes he knows more than everybody else.

In the case of petroleum engineering, this is probably close to the truth.

In other areas I will continue to reserve judgement.

Do you have any opinion on the grid stability issue of reactive power making it “nearly impossible” to maintain grid stability with high PV solar input to the system or are you mostly a mechanical engineer with minimal power engineering expertise?

Dennis. My experience with actual grids is pretty limited to elementary physics. My EE friends seem to have a similarly simple sort of idea about balancing RCL circuits with the right C to balance the L so as to get the voltage-current phase angle close enough.

And, I am always of the mind that the best thing to do is to look around and see what is being done already. People using a lot of solar and wind have not been squawking very loud, so, say I, things can’t be all that tough.

BTW, my long experience in engineering R&D gives me a high regard for the capability of a good team to solve almost any problem that has a solution in the realm of applied classical physics.

The problem of human stupidity is not one of those.

Dennis Coyne had a spreadsheet on here a few months ago showing cash flow from bakken wells. With oil at $60 oil companies can produce positive cash flow by completing previously drilled wells. Cash flow from drilling and fracing a well would be close to break even at $60.

With oil at $60 I expect to see in the directors report that the number of uncompleted wells has declined. The continued completion of these wells will support production in the short term, but when those numbers run down, you will need drilling to pick back up or production will accelerate its decline.

Gerd,

Sounds like a great investment. What lunatic would invest their money in a company that breaks even on a point forward basis?

LOL… Steve

Steve,

PROFITABILITY does not matter any more.

Get with the program!

FWIIW,

NDIC data showed 107 net added producing wells in April 2015, this would result in an estimated negative cash flow of about $200M for April.

Enno’s more detailed data show 153 wells had their first production in April -15.

Rune,

I hear ya. I’m putting in a bid for one of the Feds used printing press. If I can get my hands on one of those babies… I can invest in lousy unprofitable shale companies all day long.

Steve

Steve,

You would be very, very busy investing.

And if you by any chance get the winning bid for a printing press, you could just…. print the profits as well before the wells are drilled.

Somewhere around here I have a big old coffee table type book full of tales of the robber barons and the gilded age. I can’t remember which two were involved in this particular story, but one of the two became aware of the fact that the other one was trying to corner the stock of certain company in which he was heavily invested.

So he bought himself a press and started printing off stock certificates and selling them quietly thru various intermediaries.

When one of his guys asked him how much to print to scam the other fellow, his reply was

” As much as he wants so long as that press don’t break down. ”

Nowadays the number of shares and who has them and who is selling them and buying them etc is well known to the regulatory authorities. Printing stock certificates would get you an all expenses paid vacation at the gray bar hotel pretty quick.

But that does not matter to people who understand selling smoke and mirrors. They just adapt to the rules as the rules change and generally stay a jump or two ahead.

The investing public has apparently not learned very much in the last century plus. It is still in effect buying as much as the presses can churn out under the new rules.

It was one of the railroad guys. Jay Gould comes to mind.

Rune,

Brilliant idea. Printing profits sounds like a hell of a lot more fun than wasting time with highly leveraged shale company debt cows.

If the collapse of the subprime housing market in 2008-2009 and its impact on the U.S. economy is any indicator of what’s in store when the Great U.S. Shale Energy Industry finally implodes…. better get your bids in for the Feds used printing press before they run out of ink.

Just saying…

Steve

I have said it before, and I have to reiterate, this just isn’t on the scale of the great-bust-just-passed.

Use the calculation from earlier that came up with $80B to drill ALL the new wells in the Bakken since 2008. $80B is a lot of money no doubt, but it’s a drop in the bucket compared to the earlier fiasco.

$200B was guaranteed to Citigroup alone, over $1 trillion was dedicated to buying questionable materials from Fannie and Freddie, another $1 trillion was guaranteed for consumer backed loans such as credit card paper.

And on and on. Some of these lines weren’t tapped, but it was a shock and awe response for sure.

Heck isn’t the EU printing $80B a MONTH at the present time? Until you’re talking about those kinds of numbers in the oil patch, and you’re not and you never will be, I find it hard to make the comparison.

DuaneX,

It’s much bigger than that… MUCH BIGGER. Depending on the analyst, its been speculated that twice as much money that went into propping up the Sub-Prime Housing Market, has been used to prop up the U.S. Shale Oil & Gas Industry.

It’s not just the Bakken wells that were drilled… thar’s a whole bunch more shale crap wells in the U.S. For example, the U.S. drilled something like 36,000 wells in 2014 to produce its total liquids. How many were horizontal fracked… who knows, but I would imagine the majority.

So, you start adding up say 15,000-20,000 per year for the last 5 years or so… then you got some seriously big numbers. Furthermore, the Banks wrote a lot of derivative hedging bets. There seems to be many layers of financial crap piled on more financial crap in this ENERGY PONZI SCHEME besides the capital to drill wells.

steve

Still not seeing it, though I have no argument with the idea that there are layers upon layers of crap out there.

You could drill 15,000 wells at $9M per well for $135 Billion dollars, each and every year, and just throw them away, meaning all 15,000 never produce a single marketable thing, which I don’t think anyone is actually suggesting, and it would still be a rounding error compared to the efforts expended on behalf of the property markets.

If there are such seriously big numbers, and if banking exposure to energy-related loans is a big risk, go to any major bank’s financial statements and find it.

Go to eBay and buy a 100 trillion dollar Zimbabwean note for twenty dollars US. Printing presses are a waste of time.

I got my Zimbebwean conversation piece note back when they were only four bucks including postage etc.

Shouda bought a sackful seeing that they are already up to twenty , lol.

Unless you change current legislation, you can only buy federal government issued debt instruments with the printing press.

If I understand correctly.

Checks and Balances was the intention I believe.

The government can print money, but it has to be straddled with debt to discourage abuse.

Hasn’t worked so well..LOL!!!!

Hi Gerd,

I think that spreadsheet may have been incorrect. Rune Likvern pointed out to me that I was not doing the break even calculation correctly. If the future price of oil increases in a manner similar to the EIA’s Annual Energy Outlook (AEO) high oil price case (from AEO 2015), then the net present value of future income may be equal to the cost of a new well (assuming a discount rate of 10% and an inflation rate of 3% both at annual rates). That is not the same as a break even of $60/b (WTI), where oil prices are assumed to remain at $60/b in 2015$ indefinitely.

Everybody is making money. The drivers, the workers, the pipeline people, the motel owners, the railroads, the restaurants, the concrete and gravel people and more. Except of course the oil company and investors. It’s a new way to move money around, a merry-go-round economy with only the people reaching for the brass ring as the losers. How wonderfully democratic.

Can’ t forget all that sand, the sand quarry people are living it up. Three local railroads near me and a couple of mainline rails are getting the money too. Redistribution of wealth, yippee.

“Everybody is making money.” Yes we are!

Prospecting for Black Gold

Norm’s next big move: opening a hotel in North Dakota

http://www.inc.com/magazine/201109/small-business-advice-from-norm-brodsky-on-prospecting-for-black-gold.html

September 2011 article. I would guess that things have changed somewhat by now. It would be interesting to see a follow up story. On the other hand, they may have paid for their entire investment in 2 years.

Expectations and investment outlook in Canadian oil production are on the wane as production is expected to plateau much sooner. Let’s see if the expectations fall further in a year or so.

http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/canadian-oil-industry-slashes-growth-spending-outlook/article24872952/

Apparently Great Britain has the highest production costs per barrel in the world. They are getting hit hard by the price drop.

“Lower oil prices will hammer Britain’s North Sea oil industry for decades to come, according to the government’s fiscal watchdog, which has slashed its revenue forecasts for the sector over the next 25 years. ”

http://www.telegraph.co.uk/finance/economics/11667839/Oil-price-plunge-will-hammer-North-Sea-producers-for-decades.html

Apparently Nigerian oil production exports were diverted from the US due to the shale oil boom, with Nigeria looking for customers. Maybe Nigeria will again be exporting to the US as the shale oil boom fades out.

http://www.naij.com/456822-china-dumps-nigerian-crude.html

Less US imports from Nigeria. Yes. Look at Fig 1 in my post

6/11/2014

US oil dependency on Middle East has hardly changed since 2007

http://crudeoilpeak.info/us-oil-dependency-on-middle-east-has-hardly-changed-since-2007

Looks like most of the drop in imports from OPEC has been from Nigeria and Venezuela.

http://seekingalpha.com/news/2168435-exxon-sees-global-emissions-surging-north-america-to-be-energy-exporter

Latest XOM Annual Outlook :

“North America is set to become a net exporter of oil and natural gas, and its production of unconventional will nearly triple by 2040, surpassing the combined output of Russia and the Caspian region as the largest gas-producing area, the report says.”

Smoking BABY Smoking .. New finds in Cuba? .. Trains Leaving Station, better get on… XOM says so.

So XOM is gung ho about actually creating an energy cliff in the future. With friends like that ….

http://news.yahoo.com/union-hackers-personnel-data-every-us-govt-employee-195701976.html

China steals the personnel data of every us government employee.

“Mike Rogers, the former chairman of the House intelligence committee, said last week that Chinese intelligence agencies have for some time been seeking to assemble a database of information about Americans. Those personal details can be used for blackmail, or also to shape bogus emails designed to appear legitimate while injecting spyware on the networks of government agencies or businesses”

When US shale oil took off, China started its own battle

10/6/2015

China’s offshore CNOOC started to peak in 2010

http://crudeoilpeak.info/chinas-offshore-cnooc-started-to-peak-in-2010

The island building campaign by China could not possibly be a more obvious strategy for Peak Oil.

I suggest it is ELM peak oil models that are driving the urgency (Jeff’s excellent work). I used to be Boltzmann Brain IV, but no one cares anyway. I have converted to Satanism in the name of absolute stupidity.

And to justify the multi-billion dollar project expenditures, with risks such as being attacked by the US or Japanese Military, must have a very good reason!!!

Combine that with the multi-decadal, multi-billion expenditures from NATO to build a missile shield aimed a Russia.

Here is a hint: ( Western nations with publicly traded oil companies can’t implement a strategy for securing oil and gas, State owned China and Russia are taking advantage of this…..BURP!!! )…

This can’t possibly be a coincidence.

Is Old Farmer Mac a Russian spy in disguise? LOL!!!!!! (love OFM’s posts!!)

Satan will win the battle between GOOD and EVIL!!!!

Guaranteed!!!!

Military types often refer to islands as unsinkable aircraft carriers.

History ain’t over yet.

The South China sea is full of submarines so makes sense.

Nothing a bunker buster couldn’t deal with. Lol!

Typhoons have a way of undoing any infrastructure on an atoll. There is an atoll in the Caribbean Sea called Swan Island with an airstrip. In October 1998, Hurricane Mitch moved through the area with winds of 180 mph. That can rearrange a flight line and maintenance hanger in no time.

I suppose if they put their minds and backs into the job the Chinese can build better islands than they do motor scooters.

I have no clear idea how you build an island other than to just dump millions of tons of stone in the sea in an ever growing pile. I guess if the stones are large enough – boulders the size of cars and trucks mostly – the pile will mostly stay put in even in a hurricane.Whatever is built on TOP of the pile can be replaced easily enough. They would fly out their aircraft and most personnel in the event of a major storm.

Mac, it depends on what that reef is made of. Reefs can be very treacherous because they can have very heterogeneous rock strength (caused by caves, large pores, leaching, cracks, etc). This means piling rocks can lead to partial reef collapse. Even if we use driven piles to provide support we are limited on the load we can apply, so in the oil industry we try to avoid reefs and build on the flat areas just off the reef shelf.

An island like the Chinese are building can use dredged material, mostly sand and reef pieces found off the shallow sector. Some engineers like to build cement walls, but those usually collapse. The best approach is to pile lots of sand and be prepared to pile lots more later. And I would build a raised platform on steel piles, about 20 meters above sea level, on top of which I would put the sleeping, cooking, generators, and a second one for a radar station about 300 meters away. Sort of like a pair of offshore platforms. This thing would have zero military capability other than the radar.

Thanks Fernando,

Sand obviously makes a lot more sense since stone is probably not readily available anyplace close by in the necessary quantities anyway.

I presume you pile as much stone as you can find around your sand pile to help slow down erosion.

Now as far as military use goes, such islands might be more useful politically than militarily. But if they could build them large enough to launch a few fighter aircraft, helicopters or rockets on short notice that could be a game changer given it might be cheaper long run than keeping a ship on station in the same area.

It doesn’t take much in the line of facilities or personnel to support a few planes that can be rotated regularly on pilot training flights back to the mainland for repairs and scheduled maintenance.

But the primary intention may be simply to plant the flag on these islands thus providing some color of title to nearby waters as territorial rather than international waters.

There have been some good discussions regarding the unexpected situation in ND that we have quite a large number of newly producing wells, but still an overall decline. As others, I expected that we would need about 120 newly producing wells to keep production at current levels, but the actual number is higher, while production has declined.

I have tried to analyze why that is. To do this, I broke total production down into 3 groups of wells:

1) old (producing > 1 month) wells that show a decline

2) old (producing > 1 month) wells that show growth

3) wells producing for the first time

The total increase in production of group 2, minus the total decline of group 1, plus the new production of group 3, should show the net increase/decrease in ND.

I have done this, and the 3 groups, plus the total net increase/decline is shown in the below graph.

What this shows is for each of the 3 groups:

1) The group of declining wells follows the trend of growing overall decline.

2) The total growth from growing wells however has drastically fallen behind during the last half year. The causes of this are unknown to me, but it looks as less effort is placed on accelerating production from existing wells. This of course makes perfect sense in a low-price environment, but maybe there are also other causes, such as restricting new production due to gas-flaring restrictions.

3) Total production from new wells (producing for the first time) has fallen a little, but this is mainly due to a lower number of new wells, the quality of new wells seems still quite similar to 2014 wells.

If these trends continue, indeed a much higher number of newly producing wells are needed to keep production up, compared with earlier estimations from several us (and also estimations by Helms).

On a monthly basis I update a database that includes the monthly oil/gas/water production numbers for all individually reported wells in ND. I have shared this with several on this board. If you are interested in it, just drop me a line. My email is my full name, with a dot between the names, and it’s a hotmail address.

Enno, thanks for the graph.

A hint to those who would like to view a larger image of this graph. If you right click on it, then left click on “copy image”, then paste it into “paint”, you will get a much larger image that is very easy to read. “Paint” is a program that comes with Windows. If you have Microsoft Windows then you have Paint. You could also paste it into Word but that doesn’t help. There the image is not enlarged. But there you could go to “view” and zoom to 200% and get an even larger image.

You say the quality of new wells is similar to 2014 wells. If they are selectively fracking, from the very large pool of unfracked wells, then the quality of wells should be better than 2014 wells. Perhaps they are but the wells are still comparable to 2014 wells.

Three things occurs to me (which are not mutually exclusive): (1) Older wells are declining faster than expected; (2) Operators are running out of sweet spots and (3) Well interference (fracs on new, more closely spaced wells are intersecting already partially depleted areas).

Some supplements to Enno’s work

Continental added 93 producing wells from Jan through Apr 15 (26-27 in average from Jan through March and 14 in April).

First month average flow: 2.4 kb (Jan – Apr), 1.8 kb for Apr

EOG added 14 producing wells from Jan through Apr 15 (none, so far, reported for March and April).

First month average flow: 7.8 kb

Whiting added 107 producing wells from Jan through Apr 15 (23 in April).

First month average flow: 9.7 kb (Jan – Apr), 6.4 kb for Apr

One should not read too much out of data for the first month flows, but this may describe a trend that has been observed for other companies as well.

I presented a more detailed look at those 3 companies in the post linked below

http://fractionalflow.com/2015/06/07/the-bakken-red-queen-is-restrained-with-more-credit/

Hi Enno,

Interesting data. In previous months I discussed that when you complete a well close to an existing well, production in the old well increases. So if the number of new completions which are close to old wells decrease, then the number of old wells that increase production will also decrease. That could explain at least some of point 2.

Now we know why there was no Director’s Cut Friday.

North Dakota oil production down 1.8 percent in April

North Dakota oil production decreased 1.8 percent in April to nearly 1.2 million barrels a day, preliminary figures released Friday show.

Director Lynn Helms said last month he anticipates the state’s oil production to remain between 1.1 million and 1.2 million barrels per day until oil prices recover. Helms was not available to make comments on April’s oil production Friday due to scheduling conflicts….

The percent of North Dakota crude transported by rail remained unchanged in April from the previous month at 54 percent, the Pipeline Authority said in its monthly report.

I suppose we will get the Director’s Cut on Monday.

The EIA drilling productivity report shows the decline from legacy wells for the Bakken at 80 000 bopd per month, after reaching a peak of 85000 bopd last month. This can be verified as a reasonable number.

1) Various estimates put first-month production from new wells in the Bakken between 600 and 680 boepd with 80% oil to gas ratio.

2) We know that average decline curves mean that after 12 months, production has declined to 25% of first month production. Taking the average, we can calculate a monthly decline for these wells.

3) Looking further out in time, average wells decline 50% in their 2nd year, 33% in year 3 and thereafter show a slow decline around 20% per year.

4) Historically we know that over 12000 wells are producing in the Bakken. Taking these numbers, the EIA estimate of decline from legacy wells as 80 000 to 85 000 is a good number.

I estimated that in order to replace this monthly decline, the Bakken requires between 125 and 149 wells to be completed each month, based on first month oil production of between 480 and 595 bopd per well.

The fact that your numbers suggest 175 wells per month are needed to negate legacy well declines, suggests that average first month production is 457 bopd – a little less than the lower end of the range of estimates I used.

DMR numbers suggest that a total of 2066 wells came on stream in 2014 or 172 per month. So with increased legacy drops, the industry in the Bakken has to complete wells at the rate they did in 2014 just to maintain production where it is. Meanwhile, the rig fleet has reduced by 62% in the Bakken. No matter what efficiencies may have come to play since October last year when the rig count peaked, it is impossible to drill and complete the same number of wells with the rig fleet 38% of its former size.

All of which indicates that the EIA drilling productivity report showing a production decrease is much closer to the truth than the EIA weekly report claiming a rise in production.

The EIA estimated decline from legacy wells for all plays reached 347 000 bopd per month. The same type of calculation for other plays shows that light tight oil ought to have dropped by around 500 000 bopd from its peak in December 2014.

This aligns quite nicely with American Association of Rail data showing that crude transported by rail year-to-date in 2015 is down 9% from where it was in Q4 of 2014.

Hi Keith,

There have been some new pipelines that have come online in North Dakota and in addition some of the crude by rail was being trucked in from Canada. There have been some new crude by rail terminals that have opened up recently in Canada so less of this Canadian crude is being loaded at US rail terminals. Most of the crude by rail starts in North Dakota (some of it is from Montana) and we have good output numbers from North Dakota.

Hi Dennis,

Thank you for your response.

The American Association of Rail web pages say that the US figures exclude the US operations of Canadian operators. There is a separate measure of Canadian rail transport which includes cargoes originating in Canada and transported in US, as far as I understand the explanations given.

https://www.aar.org/Pages/Freight-Rail-Traffic-Data.aspx#monthlyrailtraffic

Hi Keith,

I think I was unclear. New rail terminals have opened in Canada recently so more Canadian crude is being shipped on Canadian rail rather than US rail. Before those terminals opened the crude was trucked in to North Dakota from Canada and shipped on American railroads. Less of that is now happening.

https://ndpipelines.files.wordpress.com/2012/04/wb-oil-export-options-4-13-2015.jpg

In addition about 100 kb/d of new pipeline capacity came online in 2014 in North Dakota.

These two effects in combination account for the drop in US crude shipments by rail.

“Average number of new well starts per month from October 2014 through April 2015” by Drillinginfo.

As I understand, this is the number of wells drilled, not completed

Source: http://diindex.drillinginfo.com/archive/perspective-2015-05/

If Drillinginfo numbers indeed are for newly drilled wells, that means that, in March and April, there were more wells completed than drilled, and the fraclog is diminishing