A guest post by Ovi

All of the oil (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM. After the production charts, an analysis of three EIA monthly reports that project future production is provided. The charts below are updated to May 2021 for the 10 largest US oil producing states.

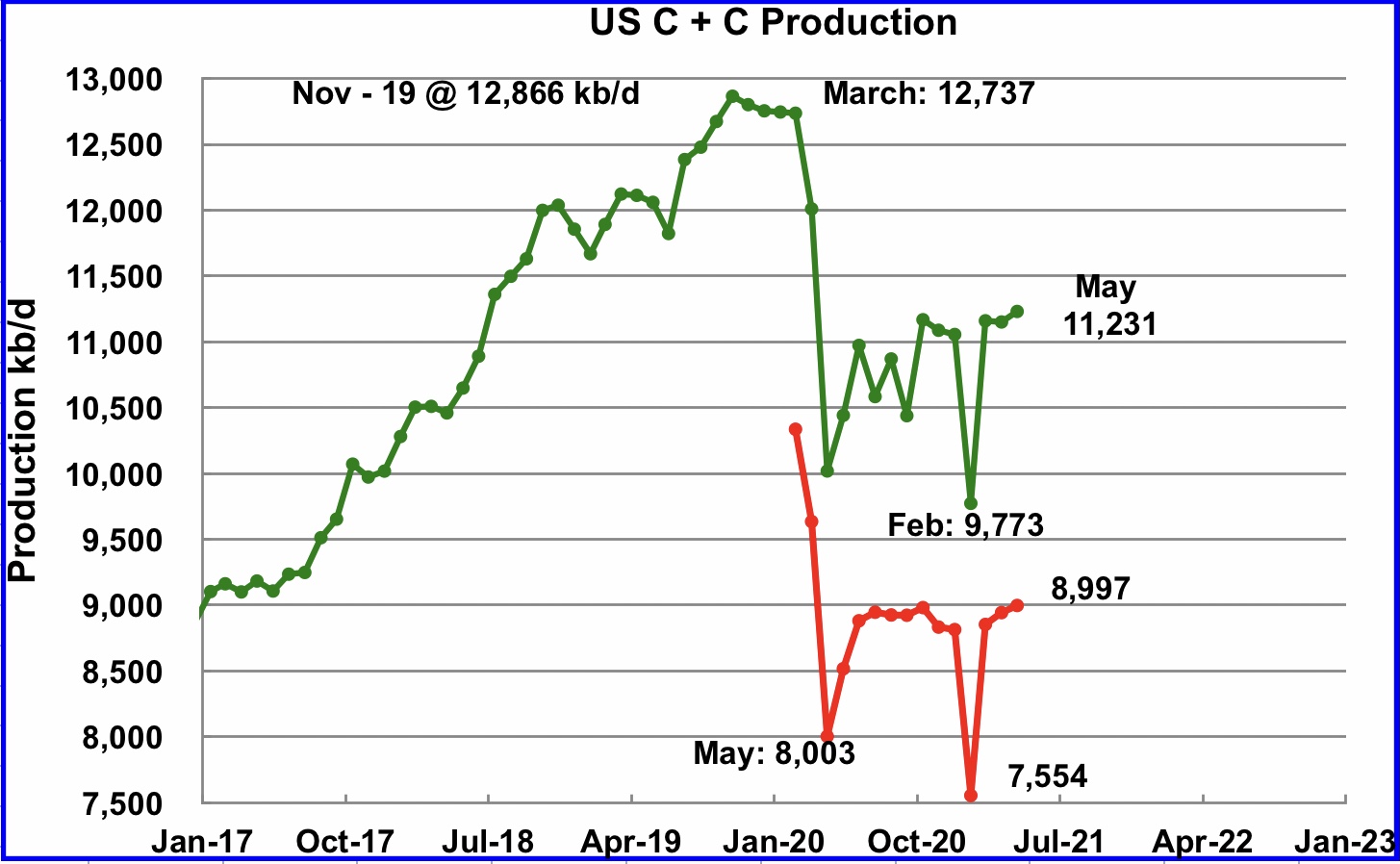

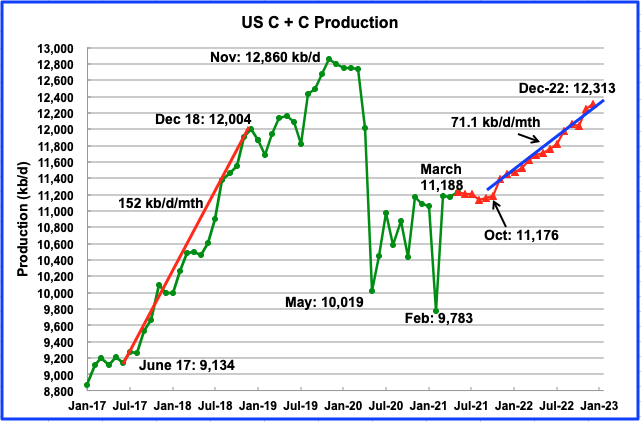

U.S. May production surprised to the upside by 80 kb/d. Production increased from 11,151 kb/d in April to 11,231 kb/d in May. It was also 175 kb/d higher than January’s.

The July STEO report forecast US May output would be 11,230 kb/d. A Very accurate forecast. In fact it is predicting relatively flat output of close to 11,200 kb/d out to October 2021. See first chart in Section 1 below.

In the onshore lower 48, May production increased by 54 kb/d, red graph. The 36 kb/d difference between the US’ increase and the On-shore L48’s increase was mostly due to the 29 kb/d increase from the GOM.

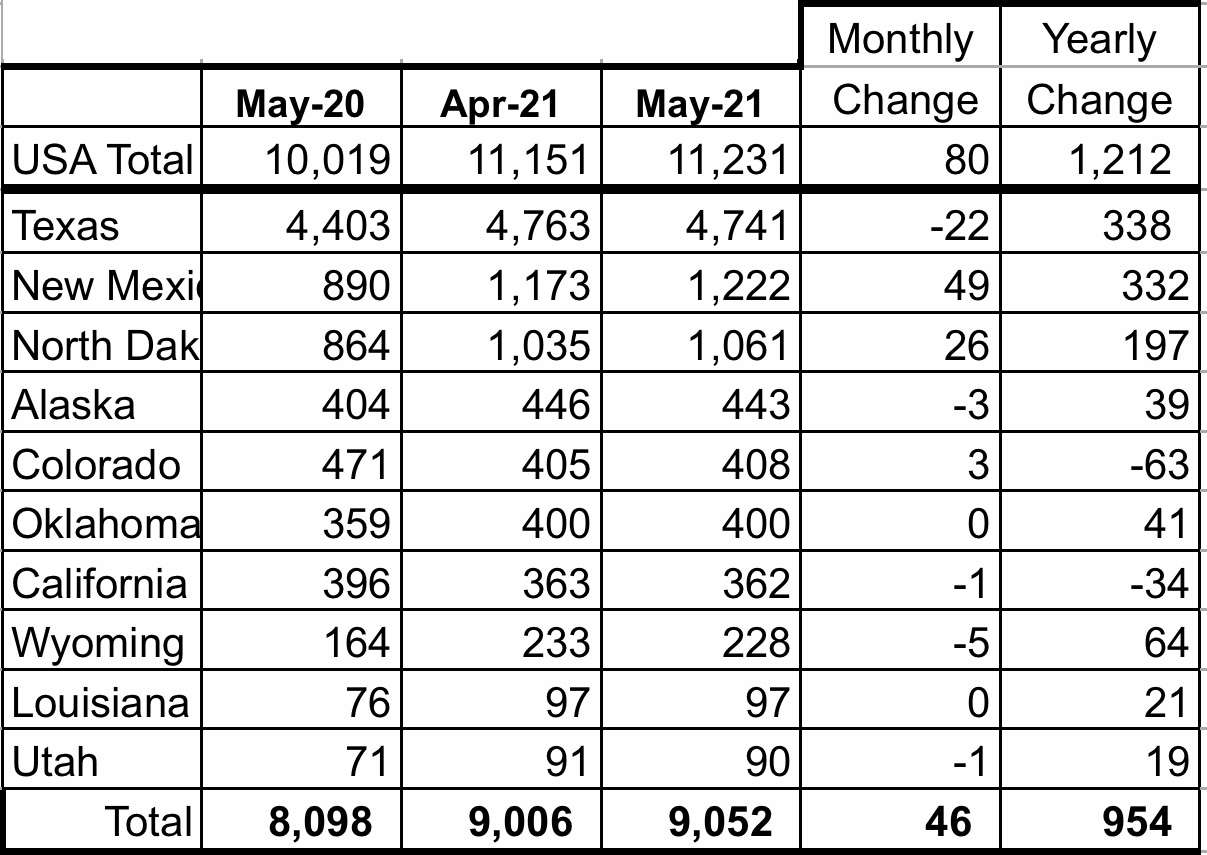

Ranking Production from US States

Listed above are the 10 states with the largest US production. These 10 accounted for 80.6% of US production out of a total production of 11,231 kb/d in May 2021.

On a MoM basis, the largest increases came from New Mexico and North Dakota. Surprisingly, Texas dropped 22 kb/d. On a YoY basis, all states except Colorado and California had a greater output than last year.

Production by State

Texas production decreased by 22 kb/d in May to 4,742 kb/d. In the EIA’s July report, April’s output was revised up by 18 kb/d from 4,745 kb/d to 4,763 kb/d.

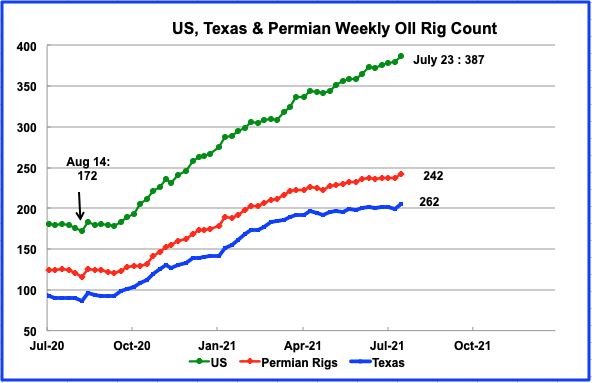

In May there were close to 197 oil rigs operation in Texas. By the week of July 23, 206 were operating.

May’s New Mexico production increased by 49 kb/d to 1,222kb/d. May’s output is another new record. New Mexico had 71 rigs operating in the Permian in May and they have been increased to 75 in July.

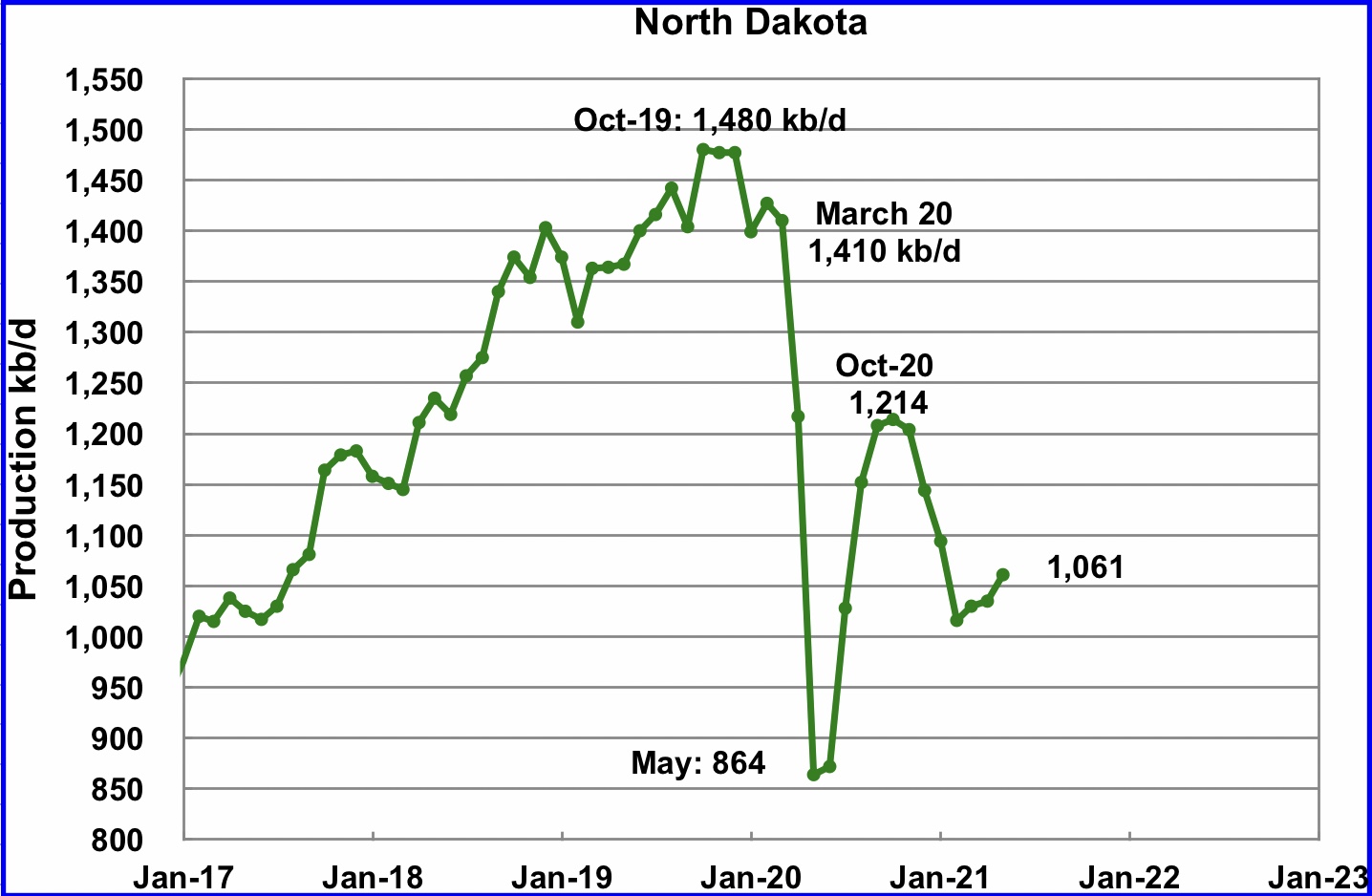

According to the EIA, May’s output was 1,061 kb/d, an increase of 26 kb/d over April. During May, North Dakota had 16 rigs operating and by the fourth week of July they had increased to 18. The July report revised up the April output from 1,029 kb/d to 1,035 kb/d.

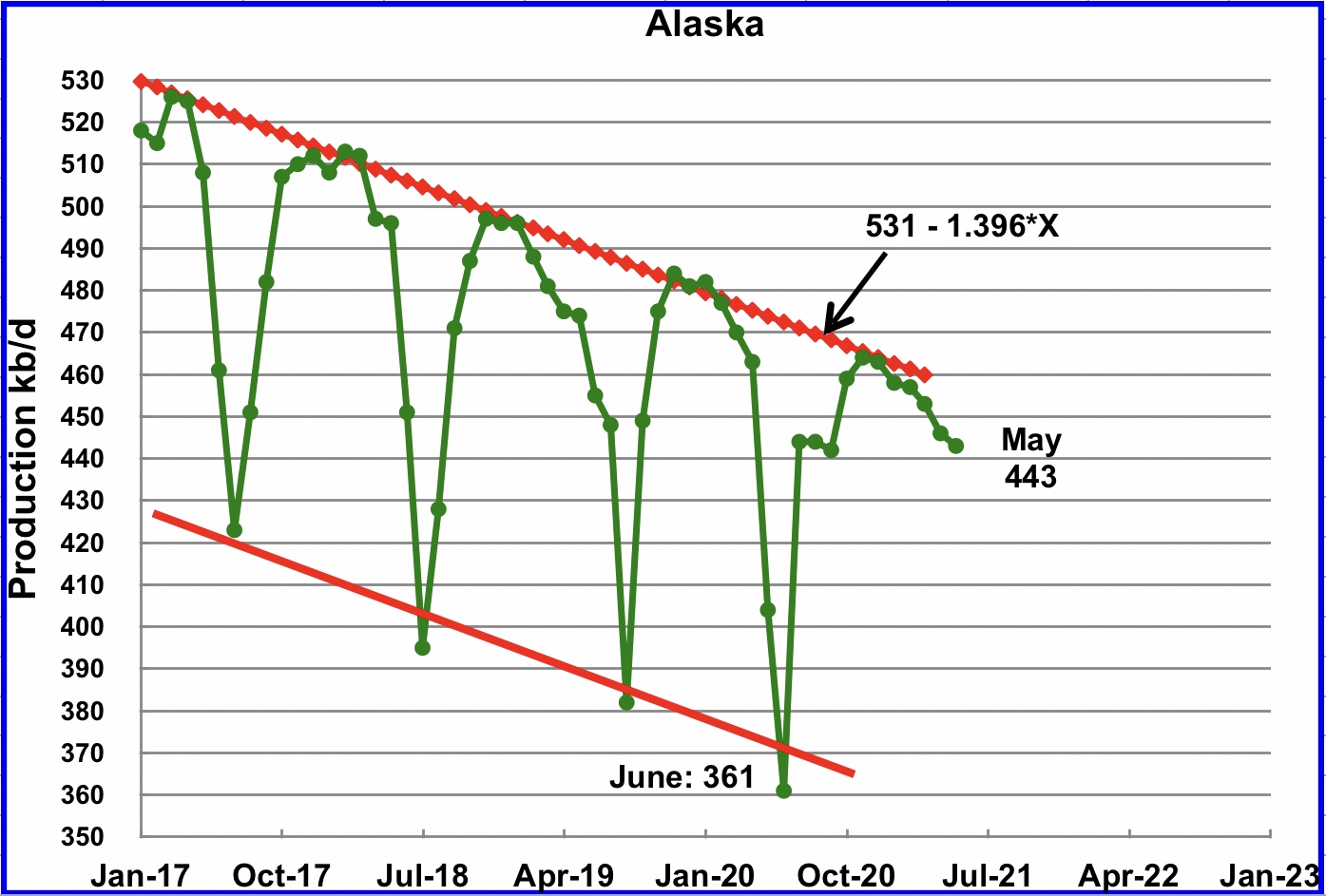

Alaskaʼs May output decreased by 3 kb/d to 443 kb/d.

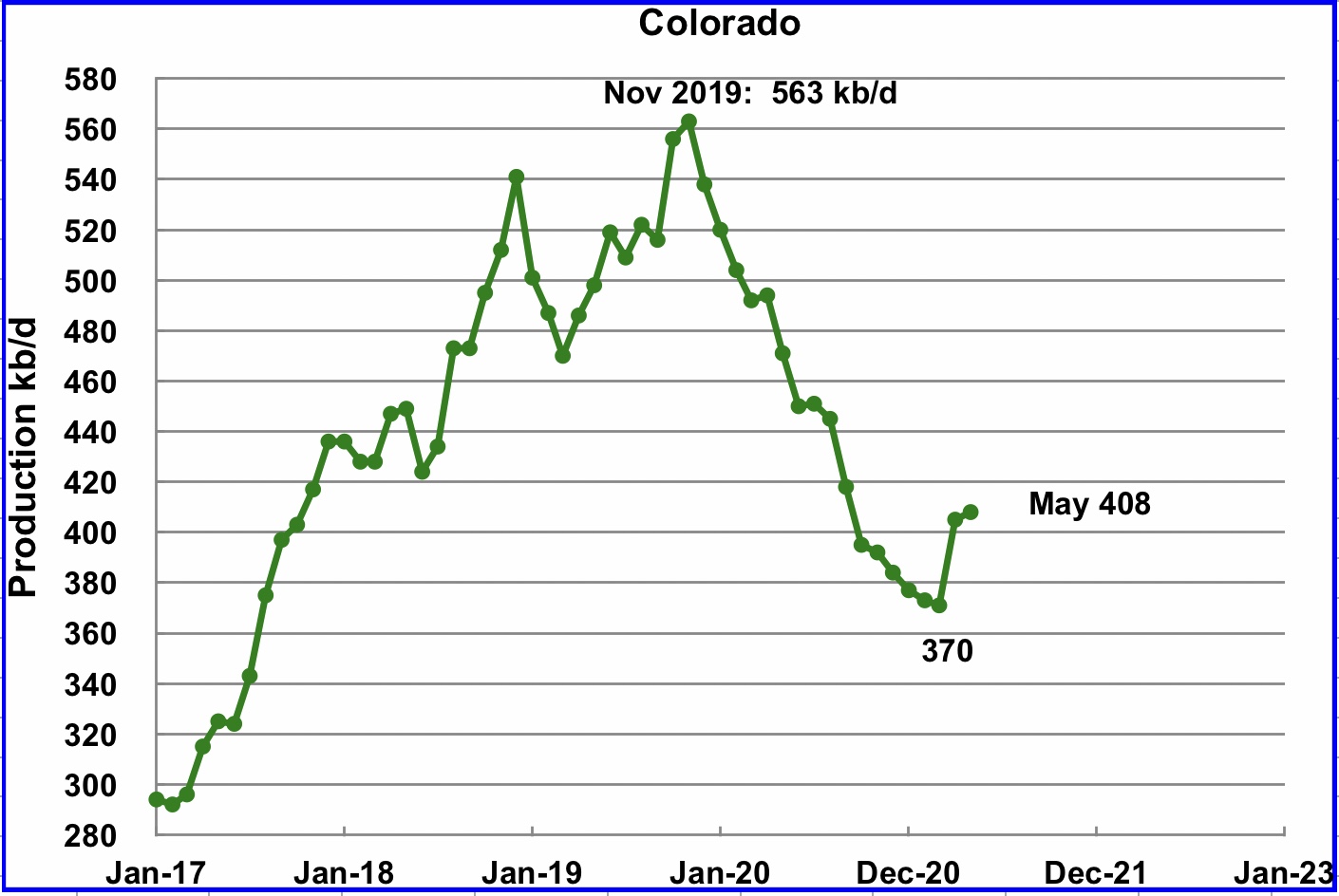

Coloradoʼs May output increased by 3 kb/d to 408 kb/d.

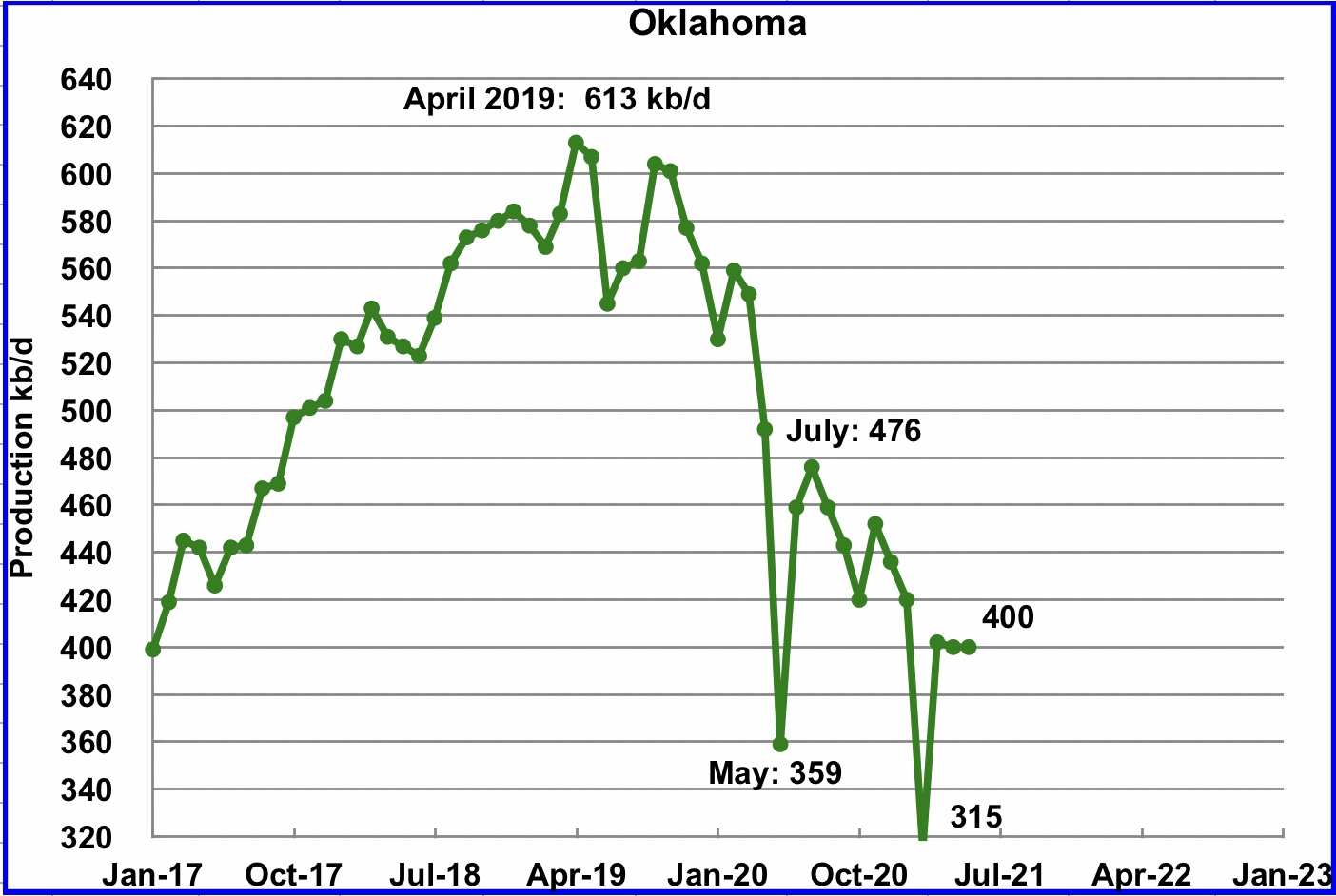

May’s Oklahoma output was unchanged at 400 kb/d. At the end of May, 28 rigs were operating. From the beginning to the end of May, 7 rigs were added. Even though 7 rigs were added during May, production was flat. By the week of July 23 the rig count had increased to 30.

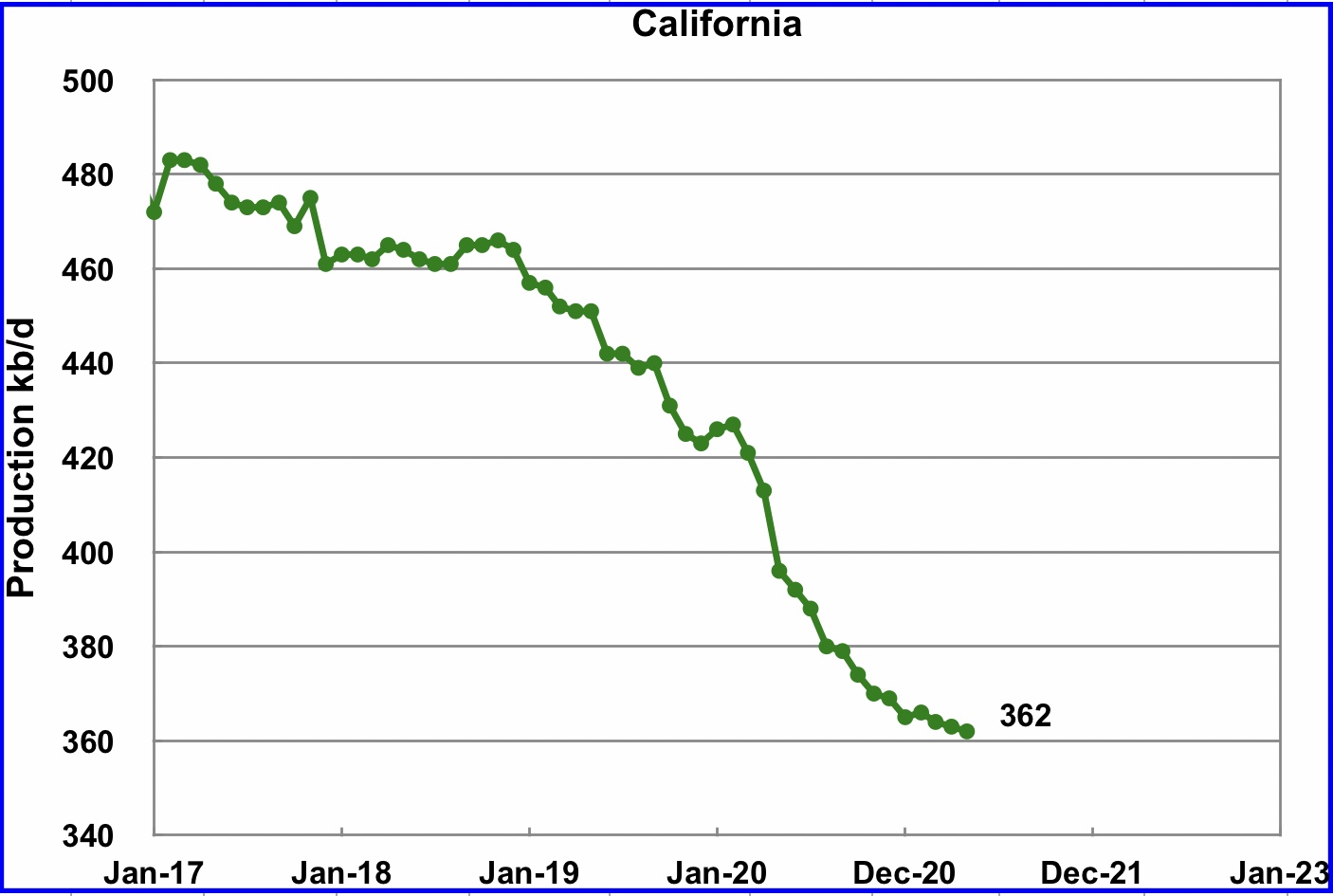

Californiaʼs slow output decline continued in May. Its production decreased by 1 kb/d to 362 kb/d.

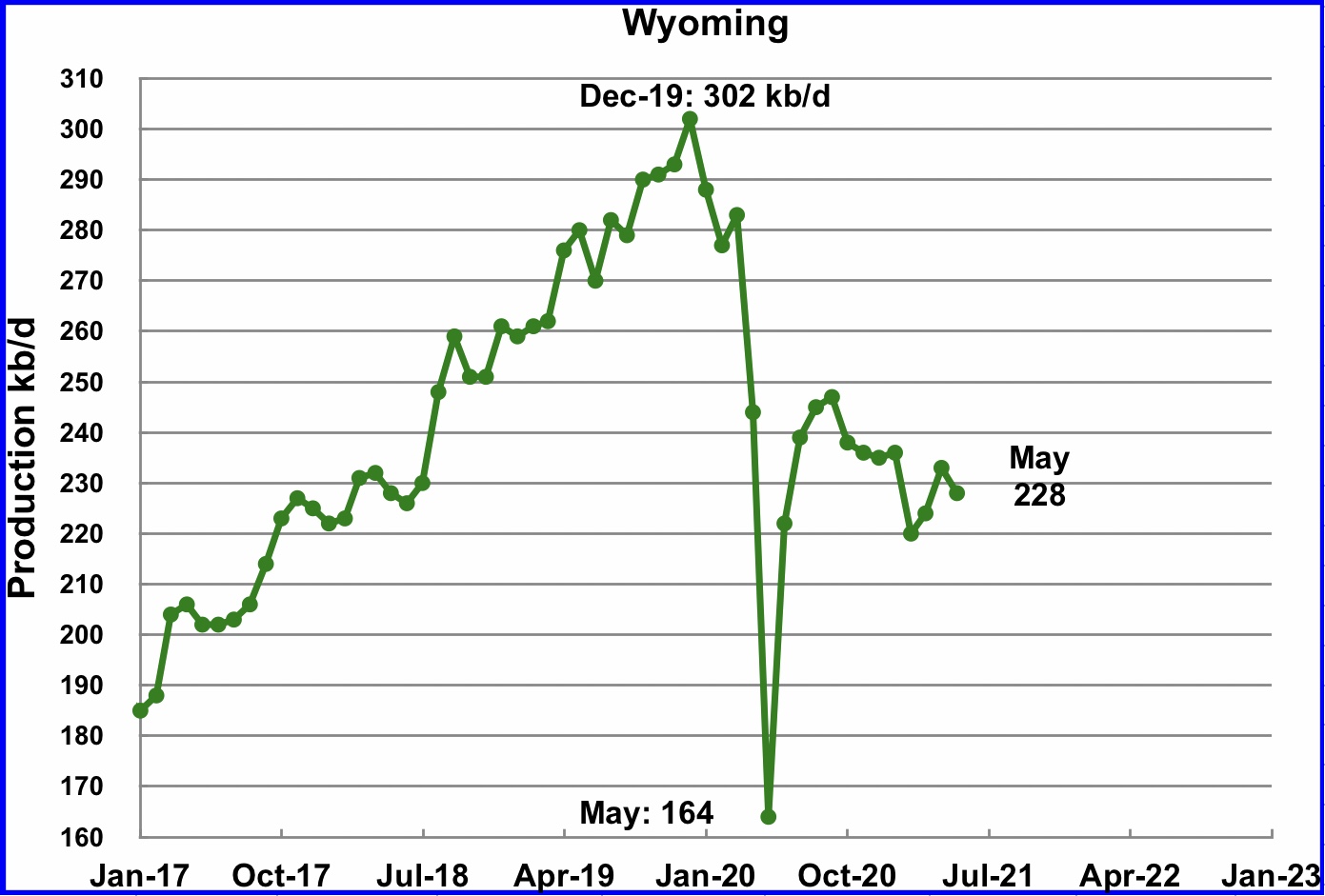

Wyomingʼs production in May decreased by 5 kb/d to 228kb/d. Wyoming had 3 oil rigs operating in May and they were increased to 12 by late July.

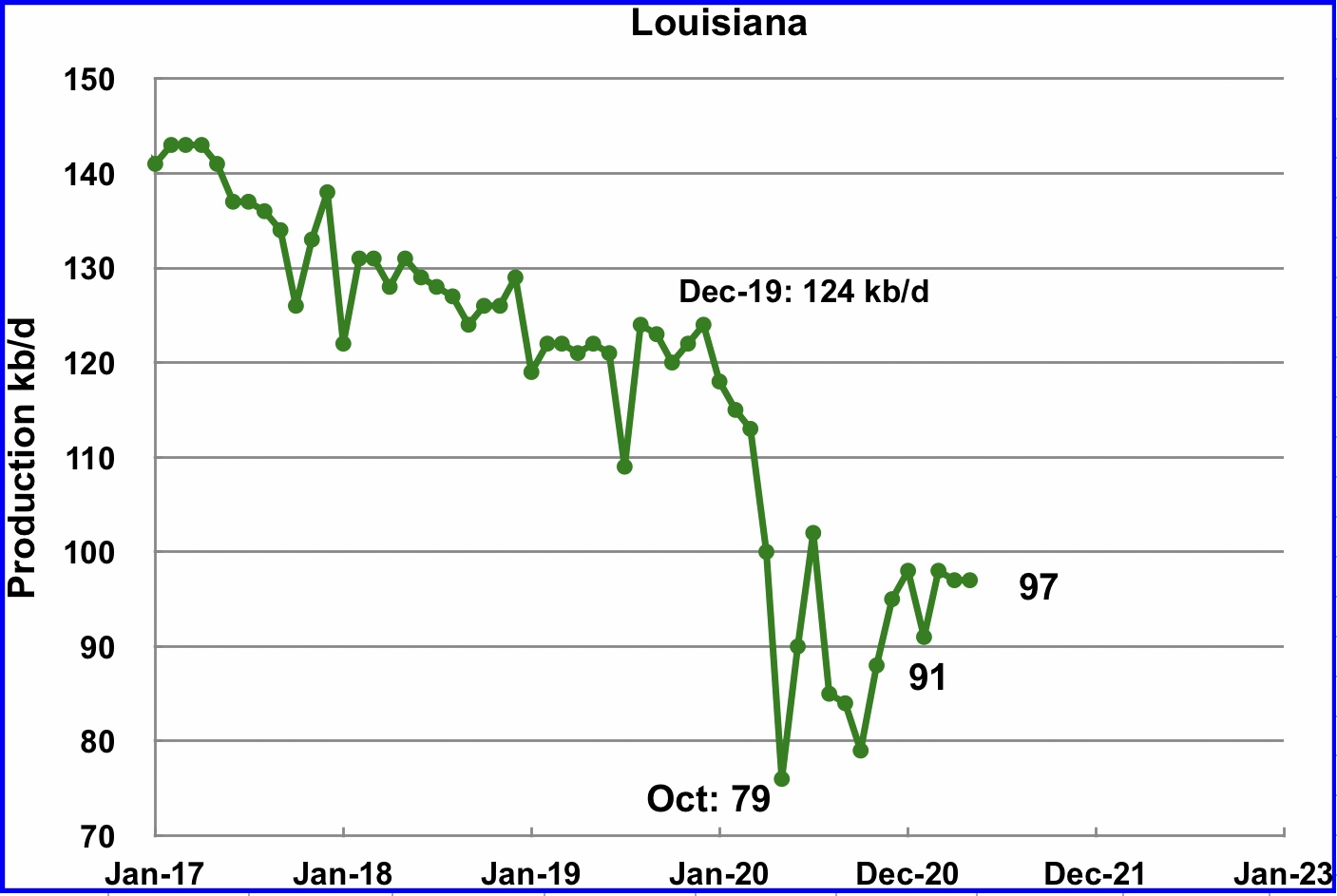

Louisianaʼs output was unchanged in May at 97 kb/d.

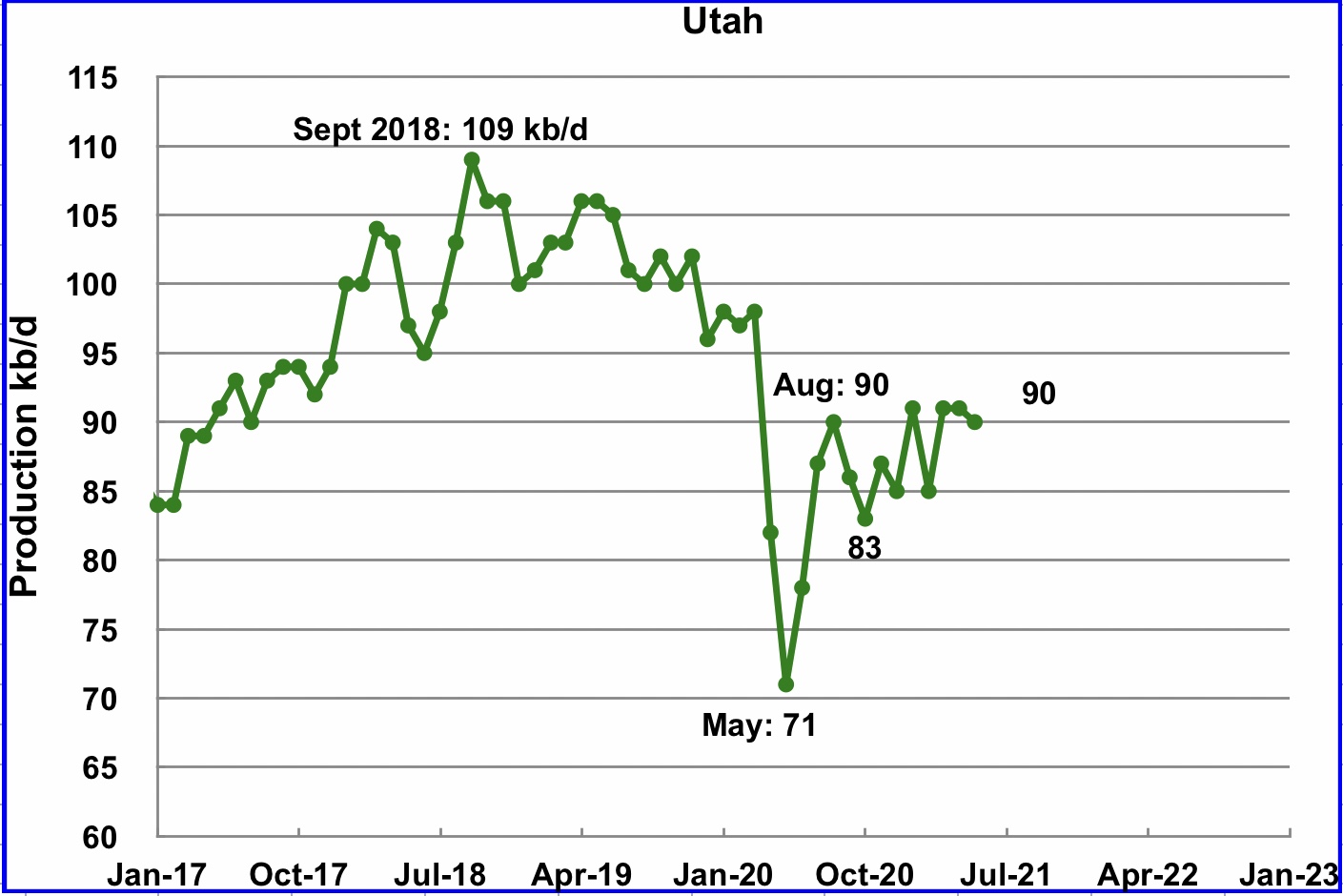

May’s production dropped by 1 kb/d to 90 kb/d. Nine oil rigs were operational in May and were increased to 11 by the fourth week of July.

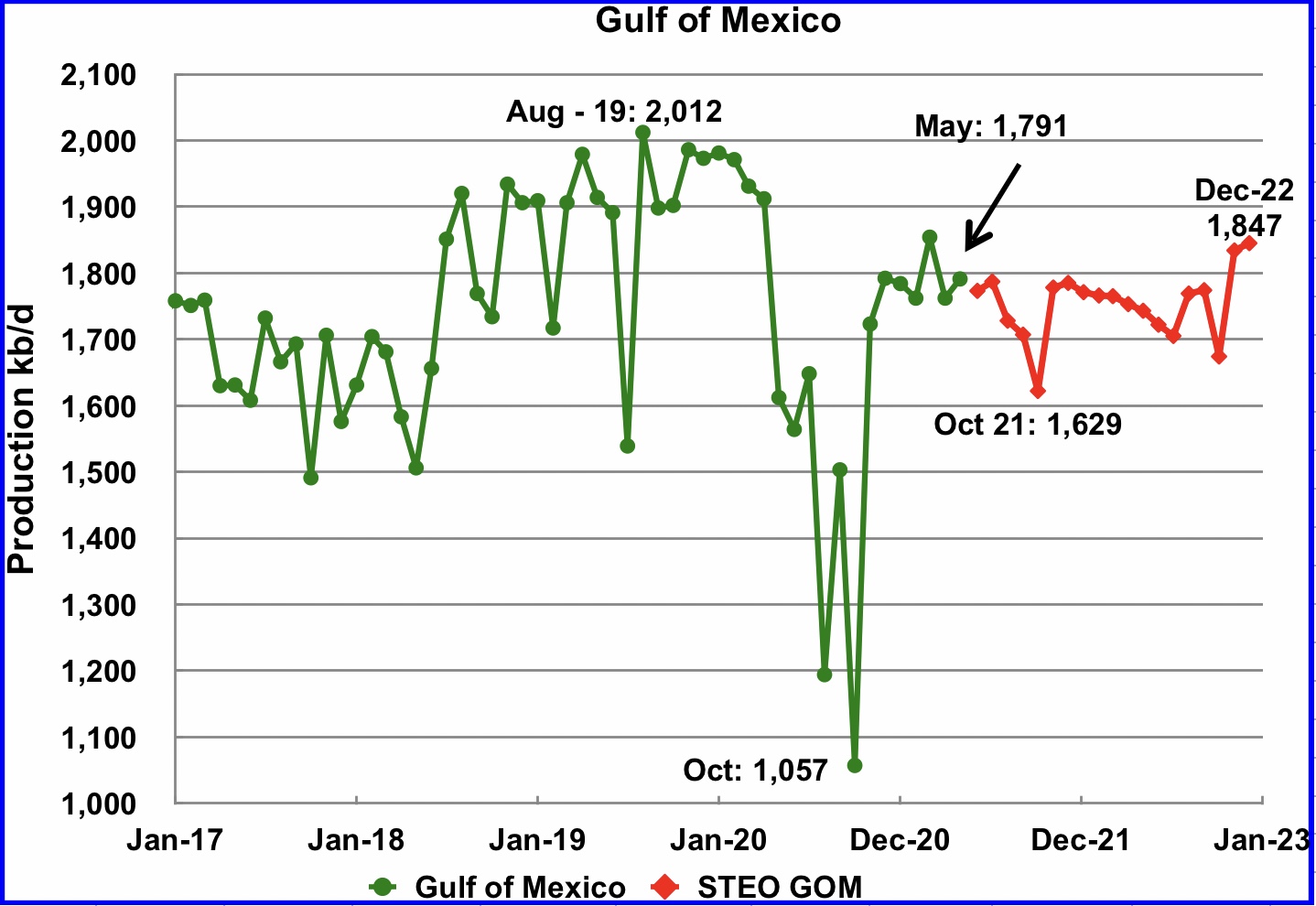

Production from the GOM increased in May by 29 kb/d to 1,791kb/d. If the GOM was a state, its production would rank second behind Texas.

The July STEO projection for the GOM output has been added to this chart and projects output to be 1,845 kb/d in December 2022, little changed from the June report.

1) Short Term Energy Outlook

The STEO provides projections for the next 13 – 24 months for US C + C and NGPLs production. The July 2021 report presents EIAʼs updated oil output and price projections to December 2022.

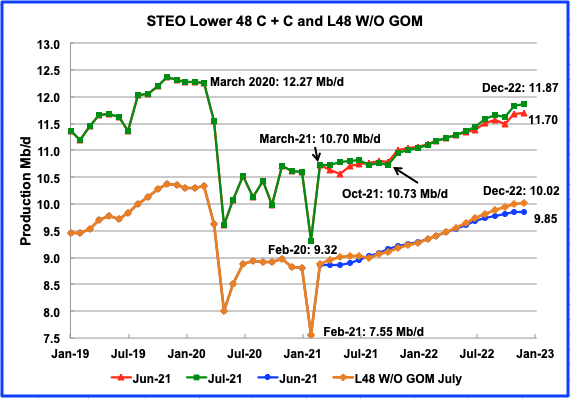

There has been quite a change in outlook from the STEO June report to the July report regarding the US oil production for the rest of 2021. According to the July STEO, US output is forecast to be essentially flat from March to October. It then begins to climb in an almost linear manner from December 2021 to December 2022 at an average rate of 71.1 kb/d/mth. In the previous report, output began to increase in June. It is not clear why output begins to climb almost linearly after December.

The July STEO added 166 kb/d to December 2022 output from the previous June report which was 12,147 kb/d to increase it to 12,313 kb/d.

The July STEO output projection for the L48 states is very similar the one provided in the June report except for the output increase of 170 kb/d in December 2022.

In the onshore L48, L48 W/O GOM, production starts to increase in September 2021 from 9.06 Mb/d to 10.02 Mb/d in December 2022, an increase of 0.96 Mb/d. The average monthly increase in production rate from March 2021 to December 2022 is 64 kb/d/mth.

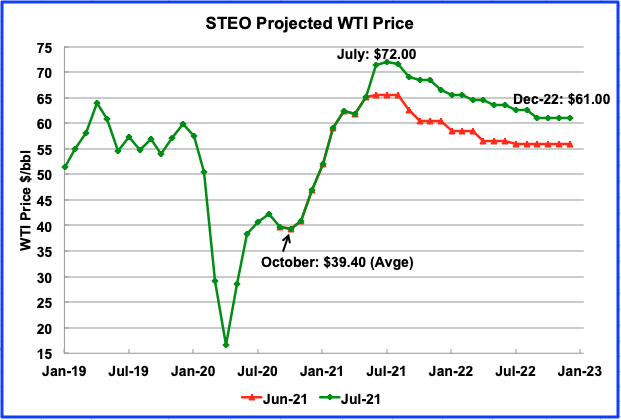

The July 2021 STEO oil price forecast was significantly revised up from the one in June. During June, July and August, the price for WTI is exepected to average close to $71.50/bbl. After August it begins a slow decline. WTI drops to a low of $61.00/b in December 2022.

The September WTI contract settled at $73.95 on July 30, slightly higher and reasonably close to the EIA projection of $72.50.

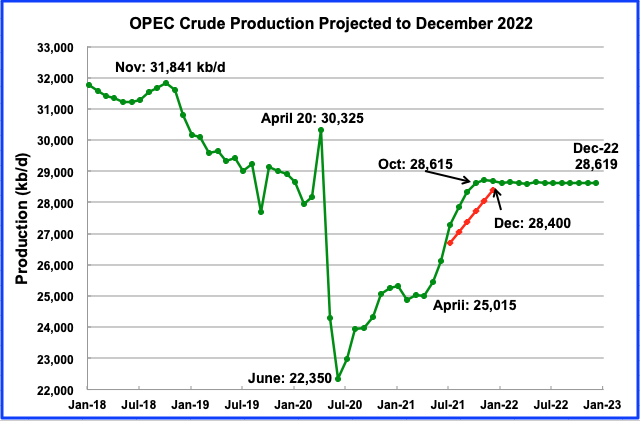

This chart shows the STEO’s July forecast for OPEC crude output to December 2022. OPEC’s output is projected to increase from April to October by 3,600 kb/d. After October output remains essentially flat. The October output is virtually the same as OPEC’s output on January 2020, just prior to the onset of the pandemic.

OPEC’s July report announced that their production in June was 26,034 kb/d, very close to the EIA forecast. According to this report, OPEC + will add 2,100 kb/d from May till July. How much will OPEC add in July?

From April to June, OPEC added 1,100 kb/d. Using an approximate 85 – 15 split for OPEC and the remaining + members, of the 2,100 kb/d, OPEC would add 1,800 kb/d and the + members 300 kb/d. So for July we should expect OPEC to add close to 700 kb/d since they have already added 1,100 from April. This will bring their output in July close to 26,700 kb/d.

Below is my best guess for which OPEC countries will supply the expected 700 kb/d.

- Saudi Arabia 300 kb/d

- Kuwait 150 kb/d

- UAE 150 kb/d

- Iraq 100 kb/d

- What is your best guess?

From August to December, OPEC + announced that they will add 2,000 kb/d at a rate of 400 kb/d/mth. Using the same 85 – 15 split, OPEC will add 1,700 kb/d and the + members 300 kb/d. OPEC will add on average 340 kb/d/mth starting in August. This will bring OPEC output to 28,400 kb/d in December 2021. (Red line).

If this estimate is correct, it raises the question of why did the price of WTI drop by $5/bbl after the OPEC + announcement since OPEC will bring oil back to the market at a rate slower than initially planned. (Red graph chart). Possible market over reaction! I should note that WTI has recovered by $5/bbl since the hitting bottom at $66/bbl.

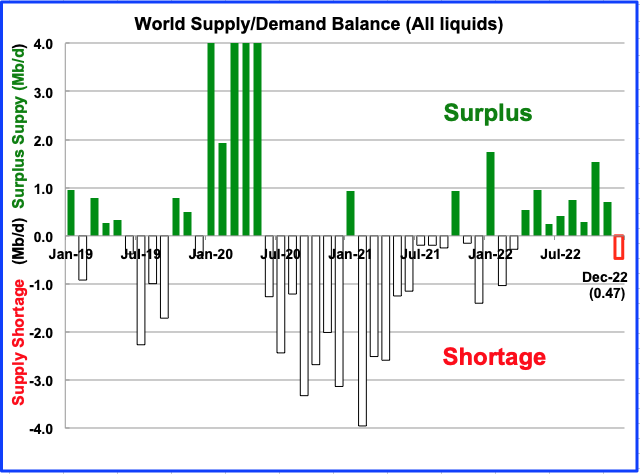

This chart show the historical supply/demand situation up to June 2021 and after that, the EIA’s forecast out to December 2022. After the supply surplus from February to June of 2020, world oil supply was intentionally reduced by OPEC and its partners. The US also reduced its output but the reduction was related more to the low price of oil.

From April 2022 to November 2022, the STEO is forecasting an average surplus of close to 0.675 kb/d. A recent report indicates that OPEC is concerned with the surplus shown after July 2022.

In the May report, the December 2022 deficit was 0.88 Mb/d. In the July report it has been reduced to 0.47 Mb/d.

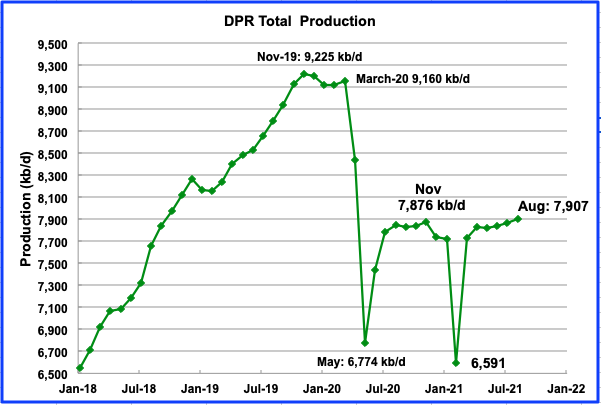

2) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The following charts are updated to July 2021.

Above is the total oil production from the 7 DPR basins that the EIA tracks. Note that the DPR production includes both LTO oil and oil from conventional fields

The DPR is projecting output for August 2021 to increase by 42 kb/d over July to 7,907 kb/d. From March to August, output in the DPR increased by 175 kb/d or close to 35 kb/d/mth.

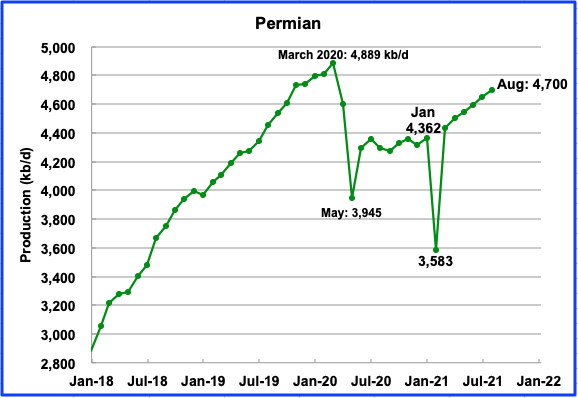

Permian output in August 2021 is projected to be 4,700 kb/d, up by 53 kb/d from July. From January to August production increased by 338 kb/d or approximately 48 kb/d/mth. At this rate, production will be very close to the March 2020 peak of 4,889 kb/d in December.

During July, close to 238 rigs were operating in the Permian, up from 100 in November. These 238 rigs are clearly sufficient to increase production in the Permian.

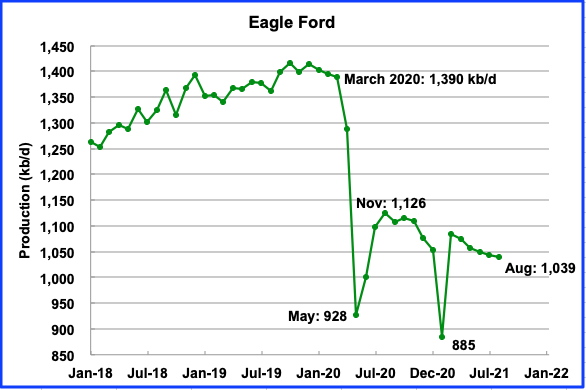

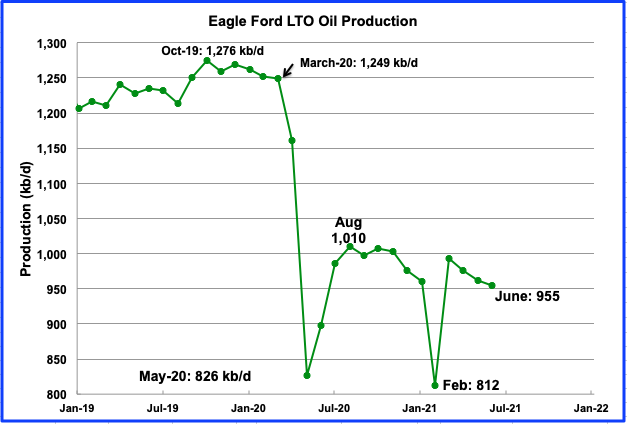

The forecast for the Eagle Ford basin has shown a dropping output for five consecutive months. Output is expected to drop by 4 kb/d in August to 1,039 kk/d.

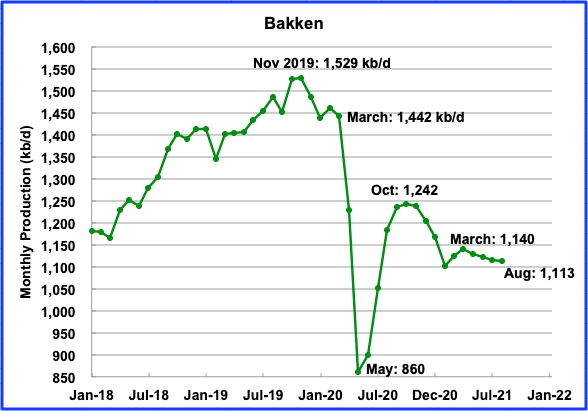

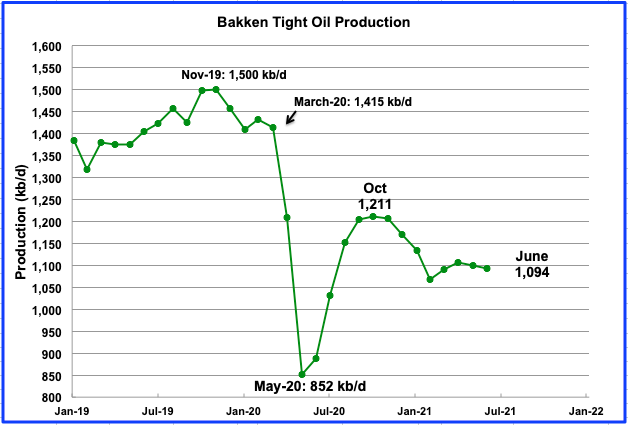

The DPR forecasts Bakken output in August to be 1,113 kb/d a decrease of 3 kb/d from July.

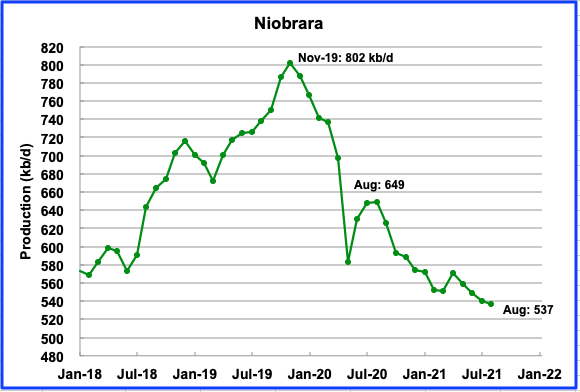

Output in the Niobrara reached a new low in August 2021, 537 kb/d. The Niobrara is spread over Wyoming and Colorado. In July 11 oil rigs were operating in the Niobrara, 9 in Colorado and 2 in Wyoming. There were no rigs operating in Wyoming from January to the middle of June.

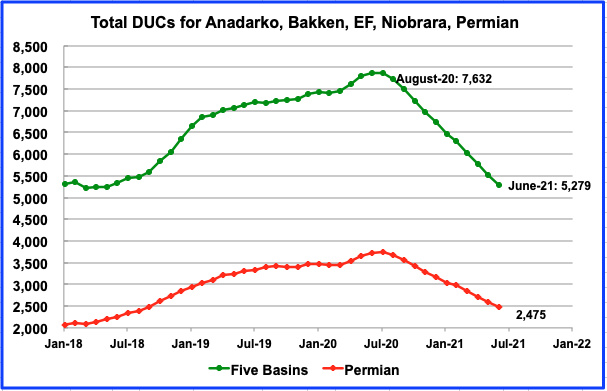

In these five mainly oil basins, DUCs are being completed at an average rate of close to 235 DUCs/mth. In the Permian the completion rate is close to 120 DUCs per month

3) LIGHT TIGHT OIL (LTO) REPORT

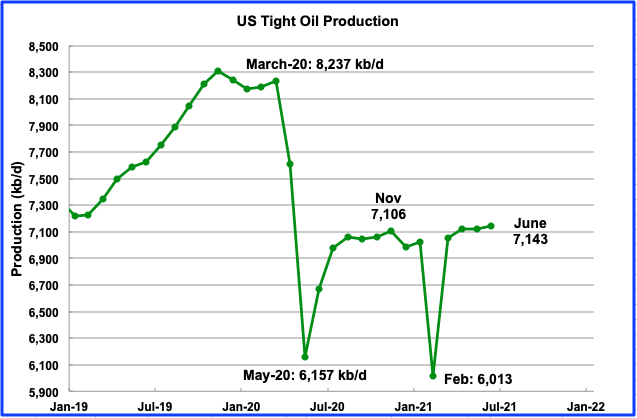

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The July report projects the tight oil production to June 2021.

June’s LTO output is expected to increase by 19 kb/d to 7,143 kb/d. In the July report, May’s forecast output of 7,030 kb/d was revised up to 7,124 kb/d. It appears that the early estimates are always on the low side.

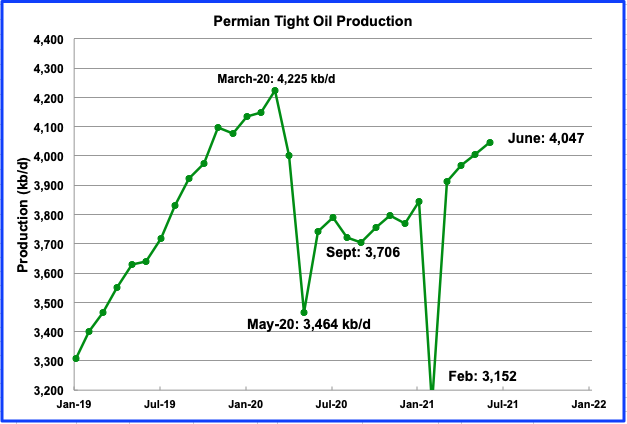

Permian LTO output in June is projected to increase to 4,047 kb/d, an increase of 44 kb/d.

From the September low of 3,706 kb/d, LTO output in the Permian is increasing at an average rate of 38 kb/d/mth. By December, the March 2020 peak will be exceeded if production growth continues at this rate. It should be noted that Permian DUCs are being completed at a rate if 125 DUCs per month.

The Bakkenʼs June output is forecast to decline. June’s production is expected to drop by 8 kb/d to 1,094 kb/d.

The Eagle Ford basin is expected to produce 955 kb/d in June, a decrease of 7 kb/d from May.

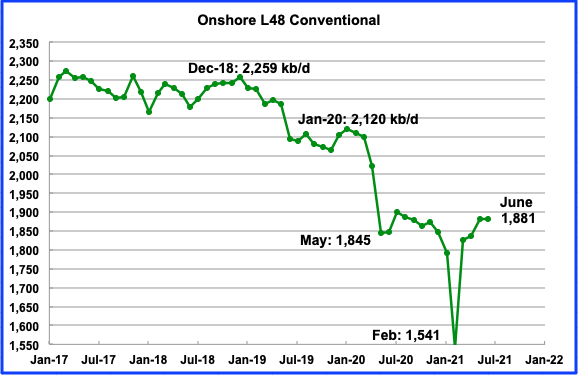

Conventional oil output in the On-shore L-48 is expected to remain flat in June at 1,881 kb/d in June 2021. This estimate is based on a combination of the June LTO output and the July STEO report that projects US on-shore L48 to May.

In the July LTO report, May’s output was revised up from 1,831 kb/d to 1,882 kb/d. Again the forecast was too low.

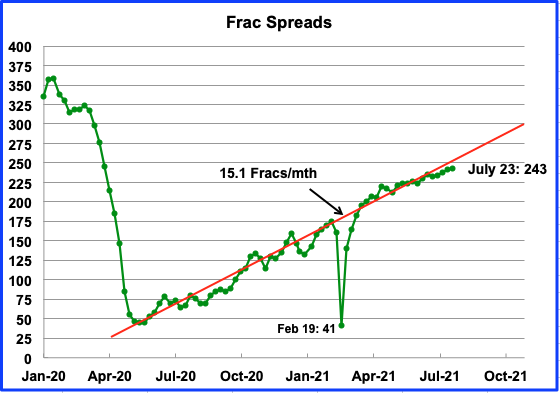

4) Rigs and Fracs

After a slow growth phase of close to two months, 7 oil rigs were added in the US in the week of July 23 for a total of 387. Five were added in Texas and all in the Permian. For the week of July 30, 2 oil rigs were taken out of service

Frac spreads continue to be added at a rate of approximately 15 spreads per month but there is a hint of slowing in the past few weeks numbers. In the week ending July 23, 1 frac spread was added for a total of 243. For the week of July 30, 4 spreads were decommissioned for a total of 239. Possible slowing?

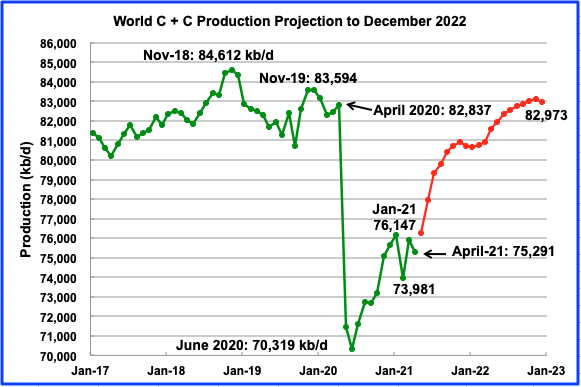

World Oil Production

World oil production in April decreased by 617 kb/d to 75,291 kb/d according to the EIA. Of the 617 kb/d decrease, the biggest contributors were the Canada 452 kb/d, UK 218 kb/d and Libya 70 kb/d. Two of the biggest April increases were Russia 214 kb/d and Brazil 130 kb/d. Canadian production was down due to maintenance on a number of oil sands operations.

This chart also projects world production out to December 2022. It uses the July STEO report along with the International Energy Statistics to make the projection, red markers. It projects that world crude production in December 2022 will be close to 82,973 kb/d. This is 1,639 kb/d lower than the November 2018 peak of 84,612 kb/d. Note that the November 2018 peak has been lowered by 19 kb/d in the April report.

Ovi,

Great job. Thanks.

Shaleprofile also estimates DUCs

see well status and on well status dropdown pick DUCs only

https://shaleprofile.com/blog/us/us-update-through-march-2021/

Chart at

https://public.tableau.com/shared/YRQHBR53M?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

In May 2020 the DUCs were 6182 for Bakken, Permian, Eagle Ford, Niobrara, and Anadarko (Scoop and Stack), By March 2021 the DUC count was 4485. So over 10 months a drop of 1697 in DUC count for an average of 170 per month for all the major tight oil basins. For the Permian the DUCs were 3254 in April 2020 and in April 2021the DUC count was 2137, a decrease of 1117 over 12 months or 93 DUCs per month on average.

In my view the shale profile estimates for DUC counts are likely to be better than the EIA estimates.

Dennis

Thanks for the info. Since I am doing the DPR report, I feel that I should report their data.

I am wondering if the difference is that Shale Profile is just reporting oil DUCs, while the DPR reports both oil and NG.

Ovi,

Good point, I forgot DPR was reporting both, but I think we are looking at similar data because we grouped by basin and I used the same basins that you did. Shale profile reports both oil and natural gas wells in their well status tab. So I think there is just a different methodology, Enno is very careful with the data, but some of it comes late and gets revised over time, the EIA may try to guess what these future changes might be. Enno justs waits for the revised data and does not make many guesses, except in his supply projection.

Ovi , wow . 5 in 1 . Total US ,DPR , LTO , rigs & fracs , total world . You sir are a gem .

Hole in Head

Thanks. Lots of free time these days.

So we are are 11.2 mbpd from the peak at 12.89 mbpd when all cylinders are firing . How will the peak be breached when (a) CAPEX(OPM) is dead (b) DUC’s available are declining (c) rigs are not in pace with the red queen

? One can’t beat the laws of Physics , Geology and Mathematics . They surrender to no one .

Hole in head,

The answer is relatively simple. Rig and frac counts can increase, higher prices lead to greater profits so that future wells can be drilled using cash flow from operations (as I assume in my scenarios for tight oil). As more wells are drilled the proved developed reserves will increase and the problem of reserve replacement that some are concerned about goes away.

US tight oil can easily return to its previous peak and likely can reach about 10 Mb/d, but definitely can get to 9 Mb/d even under very conservative assumptions about the rate of future development of the Permian basin.

Dennis , you are back to your conventional arguments about price . I demolished that in the last thread . Getting bigger boats and bigger nets is not going to catch more fish because there is no fish to catch in EU waters . Mike S has demolished all your arguments . He and others like SS, Mr Kaplan , LTO ‘s , SLGeo etc have an ear to the ground . As Mike S once said about you ” have you ever seen a horizontal well ” . Reminds me of Richard Pryor when caught in bed with another woman by his wife .

Wife : I can’t believe what I am seeing .

Pryor : Whom are you going to believe , me or your f++++++ eyes .

🙂 , 🙂

Hole in head,

No your argument was not convincing. LTO survivor has said the oil is there, it just needs higher oil prices. His $150/bo estimate is very conservative, Permian tight oil will be very profitable at $100/bo, at $150/bo we might see a URR of 75 Gb.

Mike Shellman ignores natural gas and NGL in his analysis, he must assume all natural gas in the Permian basin is flared, I assure you this is not the case.

See shale gas astimates at page below

https://www.eia.gov/naturalgas/data.php

In June 2021 Permian basin produced 12.5 BCF/d of natural gas. Recently natural gas prices at the Waha hub in the Permian were about $3.47/ MCF.

So 12.5 times 30 is 375 billion cubic feet for the month of June if we multilpy this by $3/ thousand cubic feet we have 375/1000*3=$1.125 billion dollars of revenue that Mr Shellman chosses to ignore in his analysis. In addition there are about 83 kb of NGL estacted form each billion cubic feet of natural gas so we need to add 83*375=31125 kb of NGL at about $17.50/b NGL=544 million dollars of revenue. So in total we have 1.67 billion dollars of revenue per month which Mr. Shellman ignores for the Permian basin.

I include all three revenue streams in my analysis (crude plus condensate, natural gas, and NGL). Mike looks at crude only. When I point this out he ignores it.

No, I don’t ignore natural gas and liquids. Associated natural gas only matters to you, now, because in the past 4 months those prices have more than doubled and there is new hope for your dumb ass models regarding debt and the ability for the Permian tight oil sector to work off net cash flow…for the first time in history. Nobody in the real world actually gets $3 at the WH, but you’d have to work in the real world to know that.

To quote Billy Beane, if the US shale oil sector was such a big hitter, why doesn’t it hit big? Its lost money since its inception; nothing has changed just because you THINK it has.

I ignore YOU because you don’t know your ass from a hole in the ground about the oil business and the message you deliver about our nations hydrocarbon future, and our energy security, is misleading, wrong, and harmful. Your opinions are contrary to my 50 years of actual work in the industry and my real life struggles with decline, depletion and price volatility. You only wish to advance your own agenda, not the agenda best suited for my country and that is one of hydrocarbon conservation and debt discipline. I can only hope that NOBODY is really listening. For their own good, not mine.

Is all this bitchy invective really necessary? It’s just a fucking blog for christ’s sake not some imputation of your manhood. Nothing written here is going to change anything significant by one iota. All you have to do is choose not to read it and everyone’s suddenly much happier.

Thank you, George.

Well I just got my fair and reasonable comment on the non-petroleum side unceremoniously deleted without warning, apparently by Ron Patterson, along with some misrepresentation/mischaracterization and invective from him, complete with a ripped out and decontextualized sentence-quote of mine from the comment he deleted.

While he might be having a bad day and trying to give his misery some company, and while this is ‘merely’ a blog, it is possible that people who drop in do look to it for some semblance of integrity… Well, it’s possible. LOL

Dennis if it is still your site (although it’s also people that make a site what it is) how about leaving Ron out of its back-end? He seems to have enough with his own.

First of all, the cash flow enjoyed by most LTO companies is being subdued by hedges in the “$50’s from last year. Most PE firms force their portfolio companies to place on swaps and most lending institutions require the same therefore a lot of “would be increased cash flow is being trapped” by these restrictions.

I want to be clear about what I said. The only thing that can get the vast resource being left behind extracted is much higher prices like $150 oil.

We all could drill 8 wells per section now but the rate of return on those wells is insufficient to compete with drilling 4 wells per section. It all comes down to profitability since for the most part capital coming into this industry is vanishing. If drilling, completion and operating costs stay relatively flat and oil prices increase considerably then there well be more infill locations attempted despite the reduced bottom hole pressures. However, as it stands currently most companies have very few years left of quality drilling inventory and without appreciable price increases the domestic shale industry’s production will fall off a cliff. The only other factor could be secondary recovery but not sure if anyone has figured out how to effectively do this in Shale reservoirs.

PE, ESG and wokism has significantly impaired our energy security in the future. There is no silver bullet replacement for hydrocarbons no matter how much we wish it. I don’t know how all these woke 30 year olds plan to power the rest of their lives and lamborghinis but they are betting a lot on the ability of man to control climate and still maintain their expected lifestyles. Sorry 30 year olds- I am just equating your age group with wokeness.

Mike,

I had ignored natural gas before because I hadn’t done the well profiles for natural gas. It was pointed out by a person collecting royalties in the Permian that natural gas and NGL were important so I added it to the model in the past couple of years.

The model gets better based on input from oil pros like you, shallow sand, and LTO survivor and I appreciate the input I get.

You can call me any names you wish, I appreciate the input. Thanks.

Do you really think the majors are paying 6.5% interest on their debt? Can I get in on that action?

Mike Shellman,

Note that for my “dumb ass model”, I assume natural gas prices are $2/MCF and I realize this has not always been the case, sometimes the Waha hub price has gone much lower than this. What is the typical difference between Waha hub price and Permian wellhead natural gas price over the past 5 to 7 years?

You are certainly correct that you would know far more than me about any of these details.

Thank you for setting me straight.

Found this site that has Waha hub prices

https://texasalliance.org/daily-market-information/

Currently Waha hub price is $3.92/MCF, but in June 2021 the average price was $2.86/MCF and in May 2020 the price was $1.52/MCF, in February 2020 the price at Waha hub was 0.52/MCF which was $1.37/MCF less than the Henry hub price that month. The low point was March 2020 at 0.44/MCF at Waha, in April it increased to $1.40/MCF. Prices dropped again inthe summer to fall period to around 50 cents per MCF, prices started to recover in November 2020 ($2.14/MCF). The pandemic was an unusual time.

Recently, as you know, there have been a number of natural gas pipeline projects completed and the spread between Henry Hub and Waha has narrowed.

https://www.eia.gov/naturalgas/weekly/archivenew_ngwu/2021/06_03/#tabs-prices-2

Lto survivor

My scenarios use four wells per section width, as I believe you suggested.

Pernian output has continued to increase, do you expect that will stop in the near future?

Good details in this article on LTO hedging decisions

https://oilprice.com/Energy/Crude-Oil/Shale-Giants-Hit-Hard-By-Poor-Hedging-Decisions.html

Thank you Mike. It needed saying.

George Kaplan,

Could you check your email please?

Thanks.

First of all, the cash flow enjoyed by most LTO companies is being subdued by hedges in the “$50’s from last year. Most PE firms force their portfolio companies to place on swaps and most lending institutions require the same therefore a lot of “would be increased cash flow is being trapped” by these restrictions.

I want to be clear about what I said. The only thing that can get the vast resource being left behind extracted is much higher prices like $150 oil.

We all could drill 8 wells per section now but the rate of return on those wells is insufficient to compete with drilling 4 wells per section. It all comes down to profitability since for the most part capital coming into this industry is vanishing. If drilling, completion and operating costs stay relatively flat and oil prices increase considerably then there well be more infill locations attempted despite the reduced bottom hole pressures. However, as it stands currently most companies have very few years left of quality drilling inventory and without appreciable price increases the domestic shale industry’s production will fall off a cliff. The only other factor could be secondary recovery but not sure if anyone has figured out how to effectively do this in Shale reservoirs.

LTO Survivor

I wonder if the EIA STEO division has spoken to a number of drillers and has the information you provided above regarding swaps and collars and that is why they are forecasting US output of essentially 11,200 kb/d to be flat out to October. Production then starts to ramp up in November for some unknown reason. Maybe a lot of the swaps start coming off.

Also this week’s inventory report dropped the weekly output by 200 kb/d and back to 11,200 kb/d.

The March 2022 oil contract on the futures market is close to $70/b. Do you know any drillers willing the provide oil at $70/b next March or is that to thin a margin for them?

LTO Survivor,

Not all tight oil companies are hedged, but I agree with Mr Shellman the tight oil companies have done a poor job with their hedges.

Always a problem predicting future prices, if they had decreased the $50/bo hedges would make these companies look very good, instead oil prices increased to $70/bo and they look like chumps. The companies that chose not to hedge look like geniuses now, if prices had gone to $40/bo they wold ne the chumps.

The money lost on hedges will only be a short term problem.

Can you give us any insight into what a Permian producer receives for their natural gas when Waha natural gas prices are $3.50/MCF?

Also I use a rough estimate of 25% of WTI price for the price of an “average barrel” of NGL, does that seem a reasonable guess? I understand these numbers fluctuate over time, but am just looking for long term rough estimates to use in a simplified economic model of future output based on a set of economic assumptions used in a discounted cash flow model. Also what would you use as a discount rate in such a model? Mike Shellman has suggested a well should pay out in 36 months (net revenue equal to CAPEX is what I think he means), this seems to correspond with a discount rate of 15 to 20%. I use an annual discount rate of 25% for my model of the average 2019 Permian well and assume a natural gas price of $1.80/MCF and wellhead oil price of $65/bo. The discounted cash flow is 10 million (well cost, full cycle) after 54 months and the well pays out after 28 months. I assume wells are shut in at 20 bo/d (per Mr. Shellman’s suggestion) OPEX is on average $13/bo produced over the life of the well, but I model OPEX per barrel as increasing over time as well ages and water cuts go up. OPEX is about $9/b for first year and increases to $32/bo when the well is shut in at 20 bo/d output level,

Ovi,

That sounds like a good possible explanation for the STEO forecast, but I do not know when these hedges expire.

Tks LTO for putting things in the correct perspectives .

Mike S strikes me as a man unhappy that time has passed him by. His technical expertise leaves much to be desired. He rarely contributes much past calling everyone who disagrees with him an idiot.

Mr. Milder, I am actually quite happy, successful, made lots of money in shale oil and anxious to get out after 50 years or more in the industry. I am unclear what you mean by “technical expertise” given I have had WI in shale oil wells and been a conventional operator for 50 years. If you mean with statistics and the belief that past results are indicative of future performance, no.

I have no desire to “contribute” to poor analysis and, for instance, have what I say twisted around to satisfy someone’s incessant need to be right. For instance I never called anybody names, never said OPEX costs were X and never “assured” anybody about economic limits in the Permian being 20 BOPD.

I think projections about the future of shale oil based on a snapshot of product prices is idiotic, yes. After over a decade of being lied to about shale oil, I think my country deserves a different perspective and needs to start getting prepared, now; I have been trying to get that point across here on AOB for seven years and have grown weary of being lectured to by people who don’t know which end of a workover rig to walk to.

We’ve never met, you know nothing about me, or my career, and your observation is, granted, also idiotic.

https://www.bnnbloomberg.ca/shale-drillers-leave-12-billion-on-table-with-bad-bets-on-oil-1.1636020#.YQlsbDREFrw.twitter

These derivative losses equate to 1,600 HZ tight oil wells that won’t be drilled in 2021, PDP reserves that will NOT be replaced, and $12B of LTD that will still require $660MM or so of interest to be paid this year, which essentially equates to another 88 wells that won’t be drilled. That seems really stupid to me, and puts a BIG dent in dumb projections about the future, but I am trying to be as “pleasant” as I can be about it. Sir.

Mike Shellman,

Can you clarify what I missed? Didn’t you say that you expected Permian wells would become unprofitable at around 20 bopd?

You did a quick analysis of Permian wells a year or so ago where I thought you used a LOE of about $13/bo, so that is what I have used assuming your analysis was correct. LTO survivor has suggested $13/bo is not far from the mark.

You are correct that I have never worked an oil rig and never will.

In any case, I guess I have “lectured”enough, though the intention was to ask questions and learn.

Mr Milder , Mike S has forgotten more about oil than you will ever learn in your life . You want take a straw poll , I am more than sure even his detractors will agree with my statement . Of course if you know more than he does then please be kind enough to share your knowledge with the thirsty folks here and enlighten us . If not , then keep lurking and learning .

Tim, we are proud to have actual drillers and other people who are actually in the business, contribute to the comments. What expertise do you have that you can insult their expertise? How many years do you have in the oil business? How many wells have you drilled?

Tim Milder,

I strongly disagree. Mike knows the oil business inside and out. I have learned a ton from him and appreciate his insights.

“US tight oil can easily return to its previous peak”

Dennis I believe you said in the previous thread that tight oil would likely not meet its previous peak again but now you are singing a different tune. Hard to be believe that the Permian alone can do all this magic with Eagle Ford and Bakken sputtering. What changed in your opinion?

Stephen,

Perhaps I misspoke. I think I have said I do not believ the US will reach it’s previous peak, but that depends on what happens to US C plus C minus tight oil.

Below is my best guess for US tight oil centered twelve month average (CTMA) is plotted for model and compared with CTMA for EIA tight oil data, for 12 month average output the final peak in 2028 is about 2100 kb/d above the previous 12 month peak of about 8000 kb/d in 2019. US C plus C minus tight may fall by more than this increase from 4549 kb/d when tight oil peaked in 2019 to 2449 kb/d when the next peak arrives in 2028. On further thought, US C plus C minus tight oil is unlikely to fall by that large an anount by 2028 in my opinion, that would be a 46% drop over 7 years or about 8.4% per year.

So I have revised my thinking, US C+C will reach a new peak in 2028.

Sorry forgot chart

Gotcha thanks for the explanation.

Two scenarios for Permian basin. One is based on the USGS best guess TRR estimate of 75 Gb and when reasonable economic assumptions are applied we get a URR of 56 Gb, the maximum completion rate is 624 new wells per month for this scenario about 25% above the highest level reached to date (500 new wells per month for Permian basin based on shaleprofile.com data). The second assumes a lower TRR of 60 Gb and a maximum completion rate of 460 new wells per month and has a URR of 35 Gb.

In my opinion the higher scenario is far more likely, others will claim the low scenario is way too high. Time will answer which is closer to the truth.

Note that both of these scenarios assume that wells are shut in at 20 bo/d, which Mike Shellman assures us will be the case (though historically tight oil wells have produced to lower levels of about 8 bo/d).

Chart below has scenarios, click on chart for larger view.

Guys. I am not trying to burst anyone’s bubble. I just know only what I am experiencing. M&A is occurring rapidly because companies are running out of quality locations with their current Rig Count, need for consolidation to reduce G&A per barrel and increased production for cash flow. All in hopes a major will come buy the barrels at a great price. I don’t believe we will see rig count increase even with increased product prices. If company A is running 15 rigs and is merged with company B running 15 rigs, the result will be 20 rigs running once the rig contracts expire. The excess cash flow from higher prices will be used to reduce debt and possibly to return capital through dividends. I just don’t believe we will see a repeat of the destructive behavior we saw encouraged by cheap debt alternativesand the Private Equity idiots. Therefore the model predicting future behavior is not static and highly dependent on behavior as demanded by the marketplace… ie those few brave souls would willing to invest in this difficult space and their demands ( Shareholders)

How soon do you expect to see this in the data?

LTO , ” Guys. I am not trying to burst anyone’s bubble.” No need to apologise . Your facts are always eye openers . Example what you have explained about the merger scenario in your post . I am sure 99.9% are thinking 15+ 15 = 30 when actually it is 15+15 -10 = 20 . Keep posting reality so that laymen can get a better and clearer understanding of events on the ground . Tks .

I will continue to share what I know. I have been in the oil business for 40 years and I have never seen such political headwinds facing this industry. The world needs oil even in a transition which is years away. I also know that oil projects take time and most of all lots of money. There will come a day very soon where we as a global community will experience energy poverty unless some undiscovered fungible energy resource will magically surface. What I have seen in the shale industry is a once predicted long horizon of drilling inventory , severed in half almost overnight. Companies believing that they had 20 years left of drilling inventory in the Permian now are faced with 6 years or less. The only game left is M&A and consolidation which in my opinion leads to flat or lower production until the inventory is exhausted which is not very long from today. Similarly countries like Russia and Saudi Arabia are struggling to maintain their production. The lack of capital being reinvested in this industry by the NOCs and the Major Companies will be felt soon rather than later. The world economy has grown rapidly post WWII in large part due to cheap, available, fungible energy and hydrocarbons for materials and enhancing food supply. Energy poverty includes lack of sufficient food, materials, and fuel for our modern world and over populated planet.

We will come to rue the day that this industry became ruled by bankers, commodity markets, private equity firms and Wall Street. This period of hydrocarbon capital starvation in exchange for hopeful solutions to supply sustainable infinite energy for our future will result in significant misery and suffering to mankind.

Aside from my depressing rant, those of us in the Shale industry were optimistic as oil men that we found the holy grail in the Shale oil but we as a collective group were irresponsible in our management of that resource and we destroyed way too much capital in our “irrational exuberance”.

Look for rapid consolidation in the E&P industry because that will be the best sign indicating the industry’s realistic view of the remaining LTO reserves.

As Bismark said, God as blessed the United States and the ten years of shale oil and gas was an opportunity to get the house in order. Remember the LNG import terminals being built 15 years ago? But the 10 years of extra time was wasted on a big party. But don’t worry coal to liquids will come along at $120 per barrel. If you want to extend the life of the coal reserves then used the Bergius process with hydrogen produced from power from nuclear reactors. Similarly nuclear reactors producing steam for the Canadian oil sands would stop a lot of natural gas from being wasted. For us to experience this nirvana all that is required is that everybody be a lot less stupid.

We are so fucked.

LTO survivor,

I realized it is easy to take my OPEX model and plug in the output scenario to get field wide OPEX per barrel of oil produced. The field wide OPEX=number of operating wells times 15000 plus $7.50 per barrel of oil produced times total barrels of oil produced per month. OPEX per barrel is found by dividing field wide OPEX by the barrels of oil produced each month to get the field wide average OPEX per barrel.

This is a very simple fixed plus variable cost model where on a single well basis 15000 per month is the “fixed cost” (think of this as a fund used for future downhole maintenance and repair) and $7.50 is the variable cost which changes based on number of barrels produced per month. For a single well OPEX per barrel is low when the well is “new” (first year or two of operation) and increases over time. For my scenario field wide, the OPEX per barrel is shown in the chart below, as you suggested costs per barrel increase over time.

Dennis, what the hell does that chart represent? is that barrels per day or $ per something? That is not at all clear. It looks like ” —–OPEX/bo (2021 $)” is barrels, as the “OPEX/bo” would mean OPEX barrels of oil. But nothing peaked in 2013 as your chart indicates. I cannot make heads or tails of this. Please explain.

Ron,

Sorry, I responded in wrong place, see. comment at link below

https://peakoilbarrel.com/us-may-oil-production-growth-surprises/#comment-722553

That was not a problem Dennis. I read the comments in the administrators “comments” page anyway and saw it soon after you posted it. Thanks for the clarification.

LTO survivor,

Great information, thank you. Note that on a field wide basis I expect OPEX per barrel produced will increase in constant 2021 dollars as well productivity decreases and proportion of older wells increases. I need a bit more granularity in my model tl see how this changes the OPEX per barrel field wide.

I will get that for you

LTO survivor,

Comment with OPEX per Barrel in 2021 $ for Permian basin field wide average from 2010 to 2041 for scenario with URR=56 Gb at link below. Sorry I put it in the wrong place.

https://peakoilbarrel.com/us-may-oil-production-growth-surprises/#comment-722523

LTO

Notes on this and your previous detailed comment.

The history of the oil business, from it’s inception in the US, has small companies making discoveries and drilling with abandon. At some point, major companies buy out the small companies and manage the resources much better. I’m not a fan of the history of Standard Oil and their strongarm theft, but the results were good from the perspective of recovery. However, the oilfield is littered with fields that were ravaged to the point of wasteful demise in just a few years.

In conventional reservoirs, right of capture and the sometimes fiduciary responsibility to protect correlative rights lead/leads to too rapid of exploitation. State sanctioned unitization mitigated the mania and waste for decades. Not a fan of regulation but the structure and precedent make for good results that otherwise might not occur. With tight oil reservoirs, in my opinion, the development could have taken place more slowly and efficiently from a recovery standpoint; not to suggest in the least that pressure depletion has and will be an ultimate driver of recovery. Perhaps leases with stringent and foolish drilling commitments aggravated the problems. Legacy HBP acreage development could have been drilled at a slower pace in the PB and DJ for sure. I’m not certain if unitization agreements universally override drilling commitments. The three units that I have operated were all well past having all of the spacing units drilled prior to unitization.

Historically, at least in the first century of domestic production, oil was produced by oil companies utilizing financing. The shale patch appears to be the playground of financial entities masquerading as oil companies.

Oil sands, heavy oil and bitumen (Venezuela, Columbia, SE Africa) and even CA low gravity projects are the antithesis of unconventionals, providing long cycle production which is a stabilizing force for increased recovery efficiency and price stability. It is this stability that yields greater recovery in conventional fields as well. Mike speaks to this reality nomatter one’s opinion is of his attitude, experience or heritage; it is the truth. Along with variables affecting recovery such as price and rock properties, the variable of “time” is significant, perhaps overarching.

Thanks for all of your enlightenment from first hand experience with unconventionals and I hope it continues. As always, I appreciate correction and more explanation.

LTO Survivor

The financial institutions along with their political masters will soon wake up when the military doesn’t have enough fuel to complete simple manoeuvres and comes calling looking for answers.

The end of the fossil fuel era will allow the planet to rebalance. Without sufficient growth in oil production the financing of the U.S. deficit through the petrodollar system becomes strained. If the U.S. retreats from the world, war (especially in Europe) is a given. If two thirds of the world’s population vanished. The world would be a better place for those who remain.

Ron,

The chart represents average OPEX per barrel of oil produced for Permian basin over time in constant 2021 US$. OPEX=operating expense. Over the life of a well from first flow to shut in the OPEX per barrel produced increases for an individual well. Field wide it will change based on this fact and the completion rate and how it varies over time. The model for OPEX has a fixed monthly cost of 15000 per producing horizontal well plus a variable cost of $7.50 times the number of barrels of oil produced in a month. That gives us total monthly OPEX, then we divide that OPEX by the number of barrels of oil produced in a month (crude plus condensate only) to get OPEX per barrel. This is done for each month in the chart from Jan 2010 to December 2041.

Thanks LTO survivor,

As an economist, I realize a merger should result in greater efficiency so I would expect fewer rigs may operate, but wells drilled per rig may increase and might lead to lower average well cost per foot of lateral length compared to pre-merger cost. Can you give us a rough idea of average OPEX per barrel of crude plus condensate produced in the Permian basin? I use $13 per barrel based on my understanding of comments Mike Shellman has made in the past. My understanding may have been poor because more recently Mr. Shellman has said he has never said costs were that low. He did not correct my understanding so I am looking for a better estimate from someone more knowledgeable than me.

Thanks.

We are drilling much faster and this has led to a reduction in drilling costs but the frac costs are still stubbornly high and comprise the majority of the D&C costs. Operating costs will not fall and I anticipate that on a per barrel cost will continue to rise as production falls. Perhaps with industry consolidation we will see lower G&A per barrel but Opex is only going to rise. $13 per barrel is a fair number today until we run out of drilling inventory and at that point I anticipate it will rise rapidly on a per barrel basis.

LTO survivor,

Agreed. I will try to modify my Python program so I can calculate OPEX per barrel produced field wide vs time for my scenarios. Currently I only have the number for individual wells. OPEX per barrel starts around $9/b and increases to over 30 by the end of life at 20 bopd, average over entire well life of 13.5 years is about 13 dollars per barrel of oil produced.

LTO survivor,

Note that my model assumes capital discipline, the change in behavior you point to.

Over the July 2016 to July 2018 period the monthly completion rate increased in the Permian basin at an annual rate of 52% per year with completions going from about about 150 per month to 450 per month over that period. The scenario with larger URR that is my best guess (URR=56 Gb from 2010 to 2049) has the monthly completion rate increasing at a 21% annual rate over the July 2021 to July 2023 period and then decreasing to a 4.5% annual rate of increase for monthly well compleetions from July 2023 to July 2025.

You assume that I assume BAU, but I do not.

The maximum 12 month centered average monthly completion rate to date has been about 460 new wells per month in August 2019, the maximum rate for my scenario is 624 new wells per month reached in October 2026, recent monthly completion rates have been about 350 per month, this is roughly an average annual increase in completion rate from 2021 to 2025 of about 12.2%.

Of course all of this is a guess about future completion rates which are unknown, though clearly you would be able to make a better guess than me.

URR=56 Gb completion rate scenario for Permian basin in chart below.

I just don’t feel as comfortable about your completion rates 2023-2024. If we are experiencing the significant well interference already in 2021, I just don’t see how completion rates go up unless prices go screaming up and if that’s the case then 2026 goes back to 200 frac spreads sprinkled through the Permian. I just don’t see the drilling inventory lasting longer than 2026-2028 unless someone will figure out how to go back into these reservoirs with a different kind of stimulation or secondary recovery method to coax more oil out of the ground. The GORs are rising rapidly. This tells the story. The gas is bypassing the oil and coming out of solution. Our mismanagement of the reservoirs predicated on production growth and payback of significant debt burdens casted our lot of leaving a “shit ton” of oil in the ground.

LTO survivor,

Consider what you knew 5 years ago and compare to what you know now. I assume you know more now than you did five years ago. Now fast forward 5 years to 2026, I imagine you will know still more then than you do now (or if you have retired, the industry will know more). It is this fact that I keep missing when I project oil output in the future. I continually underestimate future oil output by underestimating reserve growth due to increased knowledge. Now perhaps it is the case that we have reached the end of any technological progress in the oil industry, but I am skeptical.

GOR will stabilize for a couple of years then increase slowly see chart below. It is not clear there is a lot of well interference at 1320 foot spacing, there is little evidence basin wide of average well productivity decreasing significantly. My model assumes $75/bo at well head from Jan 2022 to June 2033, in my view that is a very conservative oil price assumption.

I use your spacing suggestion, Mr Shellman’s suggestion of 20/bo shut in for Permian wells and a OPEX assumption of $13/bo average over life of well (from day one to shut in). Obviously OPEX per barrel produced will increase as the well output decreases as maintenance and repair costs will increase and disposal costs for produced water will also increase as the well ages.

No doubt there are things I am missing, which is where the oil pros can correct my mistakes, this is a work in progress.

Chart below has GOR for scenario (this is the 56 Gb URR scenario for the Permian basin).

Dennis

Perhaps I missed something but can you explain the rationale behind the slope of this GOR curve going forward?

GOR is a critical issue so assumptions should be well grounded IMO.

Rasputin,

I model oil and natural gas output in my scenario based on well profiles and completion rate.

I use actual data through 2019 for well profiles, then I assume well productivity decreases after Dec 2020 and assume the productivity of both natural gas and oil decrease at the same rate in the future.

GOR is simply gas divided by oil for the scenario.

Rasputin,

The units for GOR are MCF natural gas produced per barrel of C plus C produced and the chart is for the Permian Basin scenario with URR of 56 Gb presented in other threads.

When it comes to price you have to follow the money. In futures markets the market makers. Those who sell Puts and calls often buy or in some cases sell the underlying assets in order to protect themselves from losses. These market makers that sell all these derivatives and contracts drive price in order to protect their book. Oil is no different in this regard. There is a lot of borrowed money holding up the price of oil. And a lot more has to be borrowed to drive prices even higher.

We can have an oil deficit or shortage without spikes in price if there is no money available to bid up price due to a collateral shortage or collateral impairment. Both equal dollar shortage as loans just aren’t made. It’s real easy to spot just watch the dollar. If it sinks then loans are being made and debt is expanding. If it’s strengthening loans aren’t being made and we have a dollar shortage.

Average income for Americans rose like 20% due to government response to covid. So we got a cliff coming where spending falls off of a cliff. My best guess is prices are near peak.

Very interesting take HHH. I agree about the economy definitely softening as the money give away programs end. It is interesting to note that congress is attempting to continue rent moratoriums. I believe the Congress also knows that when the Covid money machine grinds to a halt, then the economy will follow suit in short order hence congressional election jeopardy for incumbents responsible for this S$#t show. I also anticipate that oil prices will plummet as well as in 2008-09. This isn’t going to be pretty I fear.

China has done well with controlling Covid, but they may have met their match with the Delta variant. Their penchant for strict lockdowns and their status as the worlds largest oil importer could devastate oil prices here in the next week or two if Delta looks like it’s getting out of control.

https://www.bbc.com/news/world-asia-china-58052894.amp

In the post above I estimated that OPEC could add 700 kb/d in July. According to the article below, OPEC could have added 760 kb/d in July but only added 610 kb/d. If correct, this should keep the market under supplied and put a bottom in WTI at around $70/b.

“Moving to supply, and we are starting to get preliminary OPEC production estimates for July. According to a Reuters survey, OPEC output increased by 610Mbbls/d MoM to 26.72MMbbls/d, which is the highest output from the group seen since April last year. The increase was still below the 760Mbbls/d they could have increased by (including the return of voluntary cut volumes from Saudi Arabia). Unsurprisingly, Saudi Arabia saw the largest increase over the month, with output growing by 460Mbbls/d.”

https://think.ing.com/snaps/the-commodities-feed-opec-supply-grows-in-july/

Ovi , just confirms what I have said earlier ” there is no oil sitting on the sidelines” . 610kbpd instead of 760kbpd is a 20% shortfall . This is far away from a marginal shortfall . The question is ” if not now , then when” . Prices are pretty high right now .

Hole in Head

OPEC Plus has agreed to add 400 kb/d starting in August. So I believe there is more to come. I think what you are pointing out is that they may not make the grade on that 400 kb/d each month. That will be the clue that problems are coming.

Maybe the shut down damaged the wells.

Ovi see my comment below

https://peakoilbarrel.com/us-may-oil-production-growth-surprises/#comment-722403

I inadvertantly put the comment in wrong place.

Ovi,

Perhaps Saudis decided not to increase their voluntary cuts all at once, but to bring on output gradually and see how oil prices react.

Russian oil production rose slightly in July according to Bloomberg. Using 7.33 barrels per ton, they produced 10,461 Kb/d in July. Basically, they have been about flat April.

ExxonMobil Q2 2021 Upstream CAPEX Spending Still Higher Than Earnings

While investor optimism has returned to the U.S. Shale Patch, the economics are still a CLASS “A” CANARD. It doesn’t matter how much more water, sand, and BS is pumped down these Super-Fracks, the Shale Industry will always be known as a DESTROYER OF CAPITAL.

We have proof from ExxonMobil’s Q2 2021 Results.

Exxon Q2 2021 Upstream Earnings = $663 million

Exxon Q2 2021 Upstream CAPEX = $925 million

ExxonMobil will continue to throw Good Money After Bad in its Shale Assets. But, it seems that shareholders are happier that ExxonMobil is throwing away LESS MONEY into the Shale Black Hole to boost Free Cash Flow.

If we go back to before the Pandemic shutdowns, ExxonMobil was throwing away $3.2 billion in U.S. upstream CAPEX Q2 2019, while earning $335 million. So… it seems that ExxonMobil is moving in the right direction.

So… by cutting its quarterly CAPEX spending in the Shale Black Hole by nearly 75%, ExxonMobil is DESTROYING CAPITAL at a much slower and lower rate. Again, this makes Shareholders happy.

With excellent data and wisdom from Retired Oil Reservoir Engineer, James Dietrich’s book “TOO MUCH BY HALF – The Coming Cut In Proved Oil Reserves,” the world will finally realize they have been BAMBOOZLED by Geologists who have overstated oil reserves for the past 20-25 years.

Make sure you get your POPCORN ready for the COMING ENERGY CLIFF.

Steve

Hell, I never knew this book existed. Why didn’t someone post this link before?

Too Much by Half: The Coming Cut in Proved Oil Reserves Paperback – July 8, 2019

I just ordered the Kindel edition, four bucks. I will report my opinion in a few days after I have had time to read it.

Awaiting .

Ron,

Here’s a bit of a critique. While James Dietrich provided some interesting data about his career in the Oil Business as a Reservoir Oil Engineer, he seemed to spend a lot of time explaining about the wonderful Hotels he and his wife stayed at and restaurants they ate during foreign consulting services.

I wish he spent a little more time on the DETAILS of TOO MUCH BY HALF.

Anyhow, I am planning to contact him and do an interview for my SRSroccoReport.com website if he agrees. So, he might provide some more DETAILS.

steve

“Make sure you get your POPCORN ready for the COMING ENERGY CLIFF.”

Other than popcorn, and returning to Nixons federal law lowering all national highway speed limits to 55 mph,

what are some steps that US could take to lower fuel demand?

Particularly interested to hear about measures that would do least damage to core sectors of the economy.

Careful- its a tough crowd. People thought it was ludicrous when I previously suggested that some transport could shift toward nat gas or electric vehicles.

Hickory,

More COVID-19 Lockdowns?

steve

Steve,

is that indeed a question, or a suggested mechanism to limit fuel demand???

Lockdowns aren’t needed where most of the population conducts themselves according to factual science and medical technology based thinking- no belief required. To be clear- these areas have high vaccination rates. Unless a new more virulent and uncovered variant arises.

My 2017 ICE gets 30 to 31 mpg @ 70 mph and 44 to 45 mpg @ 55 mph. We live in a world of cheap gasoline in the states.

A carbon fuel tax

Yeah, $5 a gallon would improve things in many ways. It wouldn’t be a good idea in the short term, but adding a few cents a month would give the economy time to react.

Why not allow the oil price to go to $300 a barrel. That’ll get everyone out of their vehicles. When the masses start complaining the government can direct them to public transport.

Home installation, heat pumps and reversing soil erosion are some of the other things we could put in practice utilising all the environmentalist on both ends of the political spectrum.

Hey, let’s not get your whiteys dirty. Capex is an expense before profit and oil recovery is a capital up front business. If you listened to or read Chevron’s press conference last week, you would know the majors aren’t increasing their production in the Permian and tightly managing their Capex. It’s the independents. Which for me rises a question.

There are few small producers here who claim the shale fields are losing pressure. The Permian shale is a huge field spanning across Texas and New Mexico. The shale is fracked to release production. What is the distance from the well bore that pressure loss is affecting?

100 feet, 1000 yards, 10 miles, 100 miles ?

HUNTINGTONBEACH,

Thanks for the clarification that “Capex is an expense before profit and oil recovery is a capital upfront business.” I really had no idea….

But, if that is the case, then this should provide more CLEAR EVIDENCE in ExxonMobil’s case, that Shale has been a MAJOR DESTROYER of CAPITAL.

For Q3 2018 to Q2 2021, but omitting the DISASTROUS Q4 2020 $16.8 billion loss due to impairment.

So, if we exclude ExxonMobil’s disastrous Q4 2020 U.S. Upstream Earnings and CAPEX, this is how the Shale Black Hole has benefited the company’s financials

ExxonMobil U.S. Upstream CAPEX Q3-2018 to Q2 2021 = $23.8 billion

ExxonMobil U.S. Upstream Earnings Q3-2018 to Q2 2021 = -$149 million

So, with ExxonMobil investing $23.8 billion of CAPEX in its U.S. Upstream Sector over that period, it has provided its shareholders with a $149 million loss.

Hence… ExxonMobil’s Shale Assets are exceptional DESTROYERS OF CAPITAL.

steve

Steve, does it matter that capital has been consumed? Has the lender noticed?

The oil was produced, and someone paid for it.

OK, paid a lot for for it.

As long as someone will still pay, the players will attempt production.

Collectively the market cap, and borrowing power of the industry is still very high.

There are marketeers, and believers.

And with higher prices some will be rewarded very well.

Hickory,

You bring up a valid point worth discussing. If we are considering the subject matter of “CAPITAL,” then there is GOOD & BAD Capital usage. Good Capital usage provides a decent Return on Capital Employed. Bad Capital usage provides a lousy return on capital employed.

So… while it is true that ExxonMobil is providing Shale oil-natgas-ngls with its tens of Billions of CAPEX, it has been a LOUSY RETURN ON CAPITAL.

Now, if someone likes to throw their money away… I have no problem with them doing it. All they have to do is call up anyone in the Shale Biz. They are desperate for investor CAPEX FUNDS to DESTROY.

steve

Steve,

Let’s take a tight oil focused company such as EOG.

I use quarterly data for net income from page linked below

https://www.macrotrends.net/stocks/charts/EOG/eog-resources/net-income

I assume tight oil became the focus of EOG starting in 2011Q1 when Eagle Ford began to ramp up output. From the first quarter of 2011 to the second quarter of 2021 the cumulative net income of EOG has been $10 billion. From 2015 to 2017 they did poorly (due to low oil prices), from 2017Q2 to 2020Q2 they had positive net income every quarter, they were negative for the last 2 quarters of 2020 and positive for the first 2 quarters of 2021.

Steve,

The number will be different at $70/bo, I noticed you picked a period with very low oil prices, do you expect oil prices will remain at that low level?

If both OPEC and tight oil producers remain disciplined we can expect a tight oil market until that behavior changes. If we assume that disciplined behavior does not change, we are likely to see higher oil prices.

Dennis,

Maybe you are right. Let’s give ExxonMobil a little more credit. Great idea.

So, in looking at Exxonmobil’s ramping up of Shale starting in 2016, if we include all U.S. Upstream CAPEX & EARNINGS until Q2 2021, it provides more clear evidence that Shale Assets have been a MAJOR DESTROYER of CAPITAL for the company.

I omitted the data for Q4 2017, due to Tax Reform inflated one-quarter earnings and Q4 2020, the DISASTEROUS $16.8 billion impairment. So the data below is for Q1 2016-Q2 2021, omitting those two quarters I stated.

ExxonMobil Q1 2016-Q2 2021 Total U.S. Upstream CAPEX = $32.8 billion

ExxonMobil Q1 2016-Q2 2021 Total Net U.S. Upstream Earnings = -$3.9 billion

So, ExxonMobil invested $32.8 billion, with the majority in its Shale Assets to lose $3.9 billion in Earnings.

Now, unless my GRADE SCHOOL MATH is off… that turns out to be a LOUSY RETURN on CAPITAL EMPLOYED.

We must remember, Shale Oil Fields decline about 48% per year. So, this CAPEX spent is being destroyed at a rapid rate, especially when we see how completely awful ExxonMobil’s earnings have been.

Again… I don’t have a problem with Investors throwing money away in the SHALE OIL BLACK HOLE.

It’s still a FREE WORLD.

Steve

Steve,

You no doubt thought Amazon would never be profitable as they burned a lot of cash for a lot of years.

I noticed you added a couple of more years where oil prices were low. Also include all quarters in your analysis, don’t selectively omit quarters, the tax laws are the tax laws, the oil company does not have much control over legislation that passes in Congress.

I will ask again.

What is your expectation for future oil prices?

If they are low (under $50/bo in 2021 US$) for most years in the future, you will be correct and tight oil will never be profitable.

If on the other hand oil prices average $75/bo at the well head from 2022 to 2033 as in my scenarios, then tight oil is likely (about 70% probability imo) to be profitable.

In my view this oil price scenario is very conservative, my expectation id that the average oil price over the 2022 to 2033 period is more likely to be $85/bo or higher at the wellhead, but may not reach LTO survivor’s $150/bo that he believes is necessary for much of the Permian resource to be extracted profitably.

Dennis,

I don’t know if I would compare AMAZON with ExxonMobil when we are speaking about CAPITAL INVESTMENT. Why? When Amazon spends Billions on expanding its Regional Distribution Centers, these buildings last decades. So, yes… Amazon can lose money for a while, but those Distribution Centers DO NOT DEPRECIATE at 48% per year like the U.S. Shale Oil Industry.

Indeed… you may be correct that the price of WTIC Oil will rise in the future. No doubt, we could see much higher oil prices.

However, I would kindly like to remind you… when the oil price goes up higher… Do you think, Pipe, Fracking Sand, Truckers, Equipment, Well Lease Rates are going to stay low?? Of course you don’t.

So, if we go back to a time when the Shale Industry was getting $100+ a barrel, they were still lost money. Why? Because as the price of oil rises…. something very odd happens… SO DOES THE COST OF DOING BUSINESS in an industry that DESTROYS CAPITAL at 48% per year.

Maybe the next time around, if there is one, we can remember this dynamic relationship.

steve

Comparing Amazon and Exxon. When Exxon leases or purchases a field it’s like when Amazon builds a warehouse. When Exxon develops a field it takes more assets and labor. When Amazon operates a warehouse, it takes more assets and labor. Both have a long term cost of capital to there acquisitions and than a variable cost of operations.

Steve,

So you don’t seem to have an opinion on future oil prices, or you think they are going to decrease over the short to medium term (next 10 years), but are embarrassed to admit it.

Interesting.

Steve, my first thought to your response to my reply was the same as Dennis above. You have selective time periods and than your reply back to him again was still selective. I know you have been around long enough to understand the price for oil has gone from under supplied with increasing prices in 2005 to over supplied lower prices today. Why? Because of shale and being over developed over the last 10 years. About 10 years ago Exxon was pumping out record 10 billion dollar profit quarters. This is the nature of the oil business. What you should be learning from your numbers is the future of the price of oil is headed up. Today, shale is the worlds marginal high cost producer. Economics teaches us in time, the marginal high cost producer costs must be recovered or go out of business. Without world shale production, I can only imagine how far the world would be into peak and how high the price of oil would be today.

Now on the over hand, I believe it’s been 5 years since you were promoting here buying gold. Over the last 5 years gold has gone from about $1250 to currently about $1800. Less than a 50 percent increase. That same period the DOW and S&P 500 have doubled and the NASDAQ has tripled. Plus, equities pay a dividend which gold doesn’t. I’m not ready to buy your financial analyst.

HUNTINGTONBEACH,

Actually, I am surprised and shocked by your statement, “that you are not ready to buy my financial analysis.” Please forgive me if I lose sleep tonight over this matter. 🙂

Regardless… if individuals believe gold to be that silly BARBAROUS RELIC, then they are free to buy all the DOLLARS, TREASURIES, & UNDERVALUED REAL ESTATE & STOCKS to their hearts’ desire. Please do.

GOD HATH A SENSE OF HUMOR…

steve

Gold is a commodity with useful economic uses. One can say the same thing for oil. Freeport McMoran has quadrupled in the last 18 months in price. Exxon could and is on course to do the same from October 2020 to April 2022. Investing includes risk. Timing can be everything and we know you like to cherry pick your dates.

“GOD HATH A SENSE OF HUMOR…”

Indeed. I was 100% in gold for many years (actually caught the bottom, but dumped NASDAQ 18 mos early; painful, still remember it ~25 yrs later; dumped it all for oil stocks last fall…which I tried never to do since it’s my business…recalling the Enron tragedies). That said, this time is different…gold won’t fulfill it’s historical role..God has something different coming:

“And he causes all, the small and the great, and the rich and the poor, and the free men and the slaves, to be given a mark on their right hand or on their forehead, and he provides that no one will be able to buy or to sell, except the one who has the mark, either the name of the beast or the number of his name. Here is wisdom. Let him who has understanding calculate the number of the beast, for the number is that of a man; and his number is six hundred and sixty-six.”

Revelation 13:16-18 NASB1995

https://bible.com/bible/100/rev.13.16-18.NASB1995

Face it, these are the days when “cryptocurrency” has value and gold (God’s money) is a “relic.” That said, He who made the gold made the oil too…and he knew what would happen when supplies grew short:

“When He broke the third seal, I heard the third living creature saying, “Come.” I looked, and behold, a black horse; and he who sat on it had a pair of scales in his hand. And I heard something like a voice in the center of the four living creatures saying, “A quart of wheat for a denarius, and three quarts of barley for a denarius; and do not damage the oil and the wine.””

Revelation 6:5-6 NASB1995

https://bible.com/bible/100/rev.6.5-6.NASB1995

Trust in God, He’s good.

Trust in God, He’s good.

Which god are you talking about? Yahweh, the god who supposedly drowned millions of people in a flood because they did not worship him? Are you talking about that jealous and vindictive god? That god who possessed the vainest of human emotions, the desire to be worshipped? Are you talking about the god who will torture unto infinity all those who do not believe that bullshit?

Oh, I almost forgot: “But he loves you”. (Sorry George Carlin but I just had to use your line.) 😉

Gold and oil are relics but tik tok and crypto currency has real value. 🤪

“ Which god are you talking about? Yahweh, the god who supposedly drowned millions of people in a flood because they did not worship him?”

Yep, that’s Him…but it wasn’t because they didn’t worship Him:

“Now it came about, when men began to multiply on the face of the land, and daughters were born to them, that the sons of God saw that the daughters of men were beautiful; and they took wives for themselves, whomever they chose.”

Genesis 6:1-2 NASB1995

https://bible.com/bible/100/gen.6.1-2.NASB1995

Some think that implies corruption of the human gene pool…like what’s happening now.

And, “Then the Lord saw that the wickedness of man was great on the earth, and that every intent of the thoughts of his heart was only evil continually. The Lord was sorry that He had made man on the earth, and He was grieved in His heart.”

Genesis 6:5-6 NASB1995

https://bible.com/bible/100/gen.6.5-6.

It had nothing to do with a failure to worship.

“ Are you talking about the god who will torture unto infinity all those who do not believe that bullshit?”

Yep, that’s Him…the One Who sent His Son to die for you; frankly, I consider it a generous trade (don’t forget, He threw in eternity in paradise for those who believe):

“For God so loved the world, that He gave His only begotten Son, that whoever believes in Him shall not perish, but have eternal life. For God did not send the Son into the world to judge the world, but that the world might be saved through Him. He who believes in Him is not judged; he who does not believe has been judged already, because he has not believed in the name of the only begotten Son of God.”

John 3:16-18 NASB1995

https://bible.com/bible/100/jhn.3.16-17.NASB1995

Hell is a choice, all who end up there volunteered.

Interesting observation though, those “millions of people [drowned] in a flood” will be “torture[d] unto infinity” … but only because He has the power to raise them to life once again.

Really bad fiction.

Plus extra violent, and very poor character development.

Read Homer– much better.

The gullible mind of the true believer is a thing to behold. It’s all about epistemology, what is belief and what is opinion based on fact. Human beings are believing animals. Ancient traditions, not facts, determine their worldview.

I cannot criticize this poor guy Roger. He believes the same bullshit half the world believes. He believes the same thing almost all my ancestors believed, including my dear dad. How can anyone truly believe such stupid ignorant bullshit? Trying to figure that out is something I am working on.

More on that later. And thank you Roger for explaining your worldview to me.

Ron, how?

They indoctrinate very young with parent reinforcement and the fear of eternal damnation. I’m sure there is more to it.

At 15 I stopped believing. It took almost another 10 years to say the words out of my mouth. 90 percent of people are followers. I have a friend and she says she figured it out in second grade.

I agree HB. But those poor bastards. If they were indoctrinated, from birth, to believe in the wrong god, then they will be tortured forever and forever for that error of birth. imagine that, screaming in torment for a trillion, trillion years, because you were indoctrinated to believe in the wrong god.

Can you believe that? I cannot. What kind of a mind does it take to believe that. How strong must the indoctrination be to make an otherwise intelligent person, believe such a thing? Do they not see the contradiction there? A loving god is an evil demon instead.

“ And thank you Roger for explaining your worldview to me.”

You’re welcome Ron…and you’re welcome at my home anytime. If you’re traveling through Houston on I-10 again, look me up. I’d enjoy having a glass of wine or shot of whiskey with you.

Spacing at 1320 still see pressure reduction but will yield 78% of the volume of a parent well.

LTO survivor,

Don’t you do these in blocks where 4 wells per section are completed over a short period of time?

I have read that is the proper way to do this, it is cheaper per well and optimizes output per dollar of CAPEX spent. Can you correct me if I have misinterpreted the scientific literature?

Dennis, if I understood LTO correctly. The loss of pressure is a distancing optimization issue. Between cost of each well and it’s production over time. The loss pressure isn’t effecting other leases.

Huntington beach,

The issue is that many believe that 660 foot spacing is viable. So their estimates for total resources are roughly double what they should be. In addition many investor presentations suggest average EUR per well of about double the actual EUR. Putting these two mistakes together results in a URR that is 4 times too large.

I don’t make either of these mistakes, but there is no doubt my model is imperfect.

I rely on experts such as Mike Shellman, LTO Survivor, Shallow Sand, George Kaplan, Doug Leighton, and others to correct me where I have lost my way. I am not an expert on oil production, I know physics (BS) and economics (MA) plus what I have learned from reading scientific literature. There is always more to learn.

I guess I did pretty much understand LTO’s reply. Thanks for adding a little more color to it. What I had picked up on sounded like much larger distances and were spoiling larger parts of the field.

BA in Business Administration with a double concentration in finance and economics. Been following oil production for 50 years starting with reading the back page of my father’s Business Week magazine.

Government has a revolving door for Exxon CEOs and CFOs. At this point Exxon is run as a public company with the same disregard for turning a profit or reducing loss making activity. America needs the oil to export and Exxon is there to meet those ends.

A very incestuous relationship.

https://docs.google.com/document/d/e/2PACX-1vS8H0oQSgTki5_05-8NisScaPWGSHYwtLbeKt-P0wdJQy-gL-Bic2vREj6jO7mubNmYMMAPYlQwQThW/pub

Talking of overstated reserves . Read this old article by Prof Bardi about the supposed 200 billion barrels of oil in the Caspian Basin .

Ovi,

Note the following in the Bloomberg piece.

https://www.bnnbloomberg.ca/russia-s-oil-condensate-output-rises-amid-higher-opec-quotas-1.1635561

An excerpt:

It’s difficult to assess Russia’s compliance with the output-cut deal between the Organization of Petroleum Exporting Countries and its allies, as CDU-TEK’s data don’t provide a breakdown between crude and condensate, which is excluded from the deal. If Russia produced the same level of condensate as in June — about 900,000 barrels a day — then daily crude-only output would be some 9.56 million barrels, slightly above its July quota of 9.495 million barrels.

Deputy Prime Minister Alexander Novak told reporters on Friday that the nation’s adherence to the deal would be about 100% in July.

Russia’s compliance increased to 96% in June from 94% in May and 91% in April, the International Energy Agency said in its latest monthly report. Planned maintenance led to a drop in June’s crude-only volumes, according to the IEA.

Under the deal with OPEC+, Russia was allowed to raise its crude-only production by a total of 116,000 barrels a day from May to July. Last month the alliance agreed to raise output by 400,000 barrels a day each month starting August, continuing until all of its halted output has been revived. That means that, starting August, Russia can increase its daily crude production by 100,000 barrels each month, according to Novak.

My uderstanding of this text is that Russia is producing slightly above its quota so claims that they are producing “all out” or that possibly their wells are damaged seems premature, based on data available.

Also I would note that just because the Russians have claimed they have peaked does not mean they will not return to that previous peak (12 month average peak) and then maintain that level of output for several years. In fact that is exactly what they have claimed they will do.

I don’t have an opinion on whether they will be correct, but I am sure they are more familiar with Russian output potential than I am.

Dennis

My comment was not aimed at Russia. I found it surprising that OPEC Plus left 150 kb/d on the table. More so because SA added 460 kb/d in July. They are the one that unexpectedly in April took off an extra 1 Mb/d to really support the price of oil. They are now recovering that cut back. So if Russia and SA are on or close to their allowable, who did not meet their commitment. We will get a clue when the OPEC post comes out.

Ovi,

Yes I misunderstood your comment, sorry. I imagine everyone will not produce at the level of the quota which as you pointed out supports higher oil prices. In future OPEC meetings they may raise quotas a bit faster if there are nations not producing at their alloted quota.

OPEC is on the brink of becoming superfluous. Without competition from US shale, there will be no need for production quotas and we will really see the true capacity of oil production around the world.

LTO survivor,

Depends on speed of transition to electric land transport for personal use. OPEC could keep prices high in the face of declining demand, but it is more likely there will be unrestrained maximum output in a market share war amongst large producers and a crash in oil prices around 2035, and perhaps sooner. Tight oil producers would be wise to input this into their models. They should maximize output and profits through 2025 and then scale back completions sharply to prepare for the coming crash in oil prices as former OPEC members drive oil prices to $20 per barrel in 2021 $ by 2035 or perhaps 2040 at the latest.

Dennis,

You show too much faith in OPEC paper barrels. It’s all hat no cattle. But we’ll see soon enough. Next year, I reckon.