All of the oil (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM. After the state production charts, an analysis of two EIA monthly reports that project future production is provided. The charts below are updated to May 2022 for the 10 largest US oil producing states.

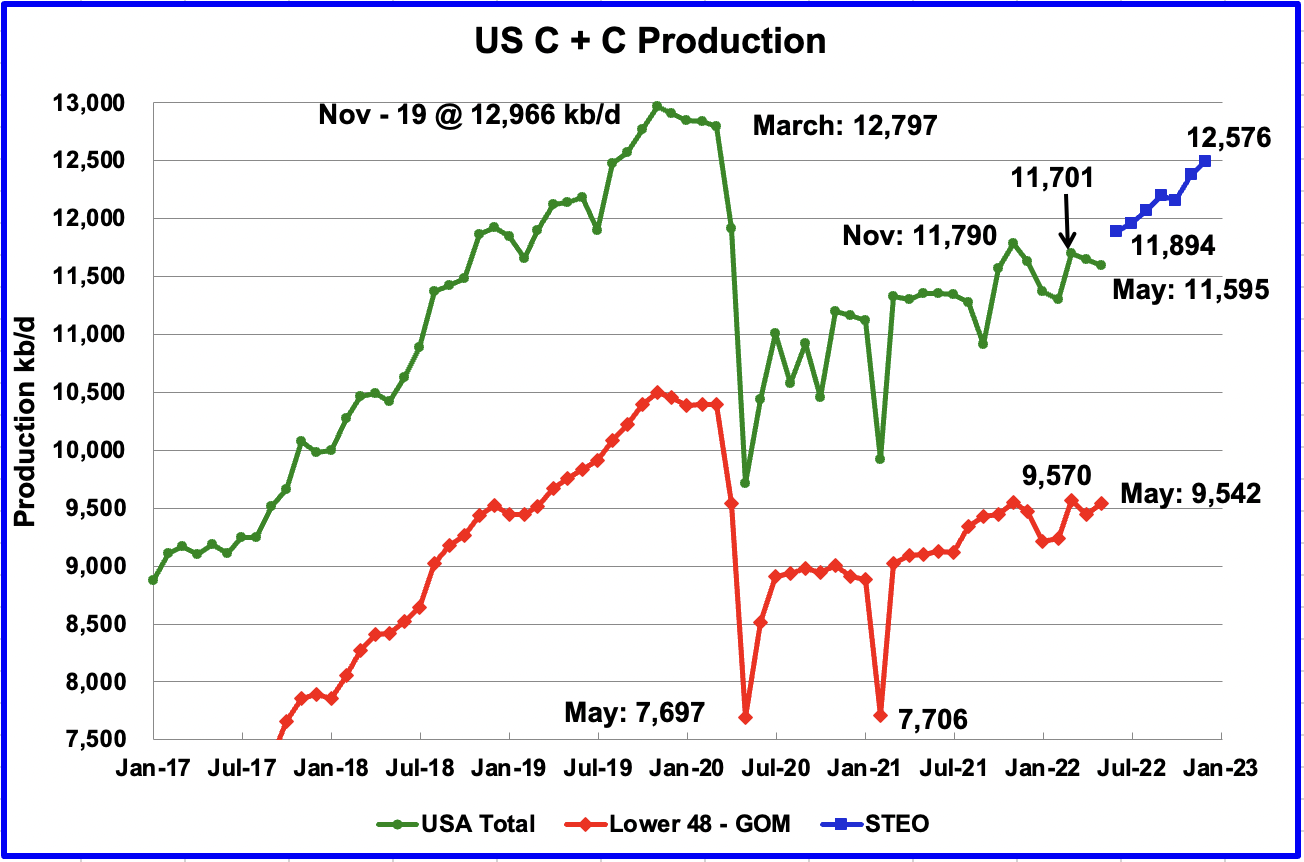

U.S. May production decreased by 57 kb/d to 11,595 kb/d. The largest production decreases came from the GOM, Texas and New Mexico. The largest drop occurred in the GOM but was offset by the increase in North Dakota. May production was 195 kb/d lower than November 2021 which was producing at a rate of 11,790 kb/d. The production drop in all three Southern areas was affected by the May storms.

“May 23rd and 24th brought several rounds of thunderstorms, complete with tornadoes, damaging winds, hail and widespread rain, to the South Plains region of West Texas. The activity was fueled by returning Gulf of Mexico moisture following a strong May front that provided a relatively cool and dry weekend leading up to the stormy stretch. Moderate to strong instability developed across the western South Plains and eastern New Mexico Monday afternoon and evening (May 23rd) as the improving low-level moisture and temperatures warming into the 80s developed beneath an approaching upper level storm system”

While overall US production was down, a clearer indication of the health of US onshore oil production can be gleaned by looking more closely at the On-shore L48 states. In the On-shore L48, May production increased by 95 kb/d to 9,542 kb/d.

The blue graph, taken from the July 2022 STEO, is the production forecast for the US from June 2022 to December 2022. Output for December 2022 is expected to be 12,576 kb/d. From June 2022 to December 2022, production is expected to increase by 682 kb/d or at an average rate of 113.7 kb/d/mth.

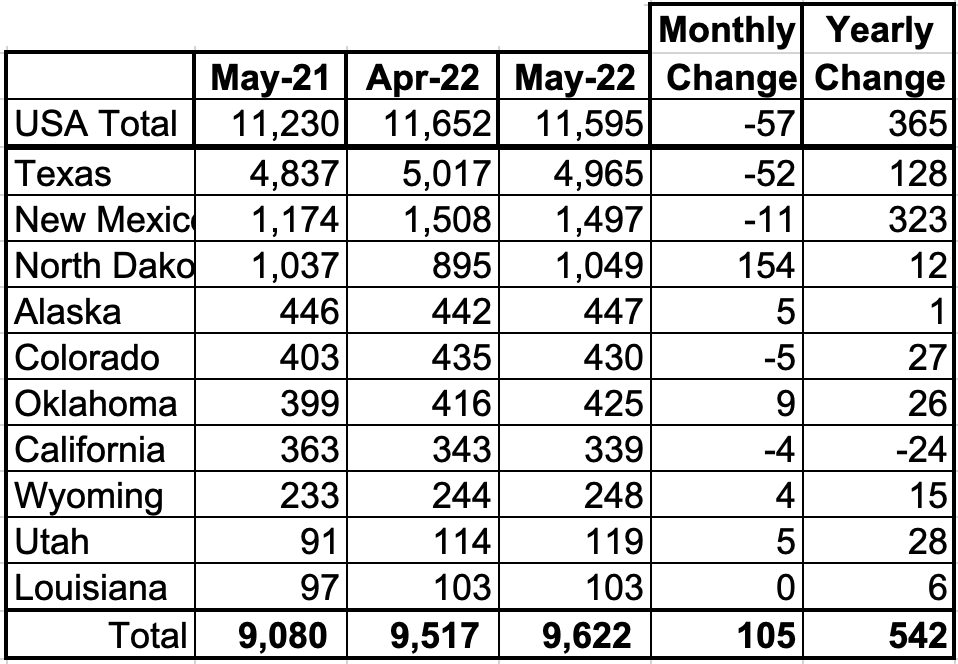

Oil Production Ranked by State

Listed above are the 10 states with the largest US production. These 10 accounted for 83.0% of all U.S. oil production out of a total production of 11,595 kb/d in May 2022.

On a YoY basis, US production increased by 365 kb/d with the majority having come from New Mexico.

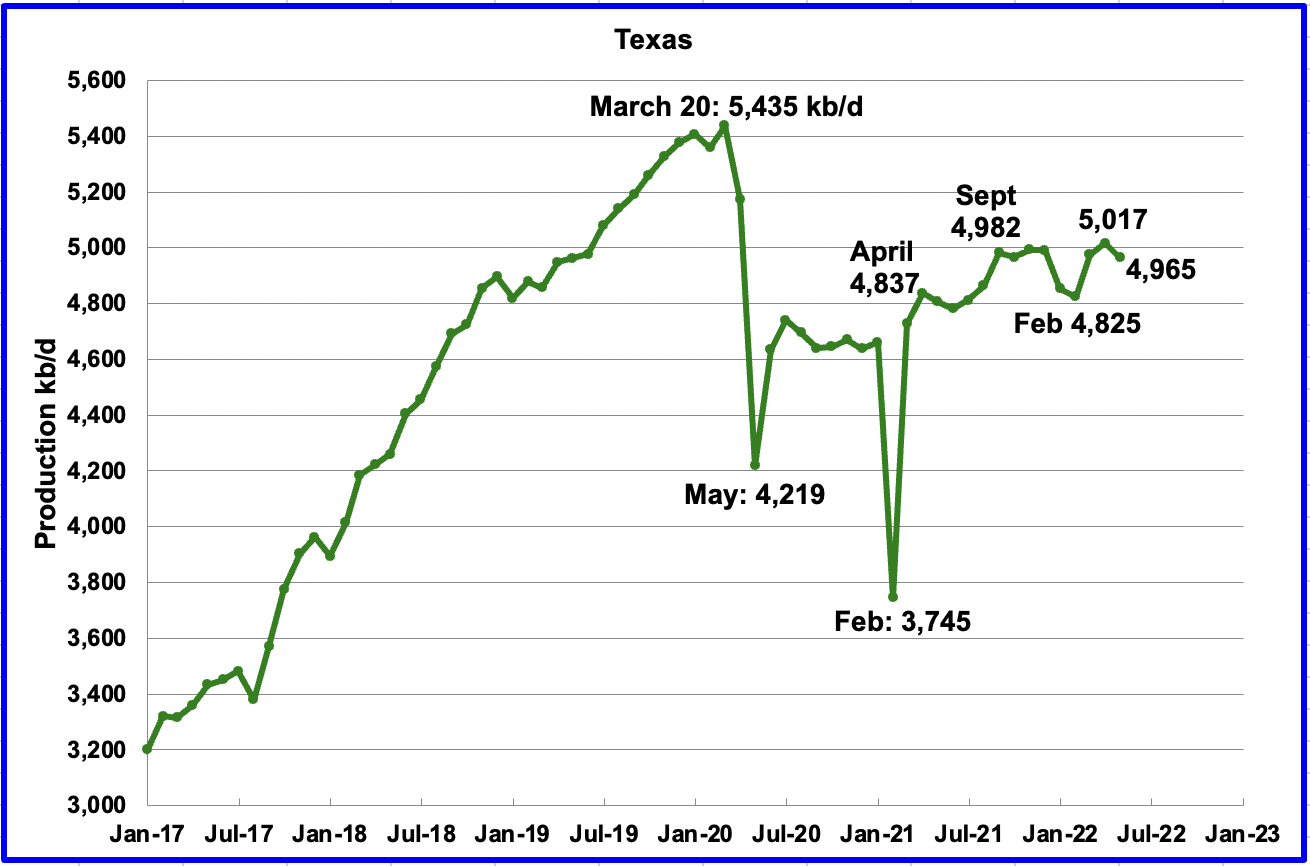

Texas production decreased by 52 kb/d in May to 4,965 kb/d from 5,017 kb/d in April due to weather.

In September 2021 there were 205 Hz oil rigs operating in Texas. By the last week of May 2022, 303 Hz oil rigs were operational, an increase of 98 rigs and production decreased from 4,982 kb/d in September to 4,965 kb/d in May, a drop of 17 kb/d.

May’s New Mexico production decreased by 11 kb/d to 1,497 kb/d due to weather. From January 2022 to the end of May, close to 92 rigs have been in operation in the New Mexico Permian. However in June and July operational rigs exceeded 100. The recent production increase is due to more wells being completed than drilled.

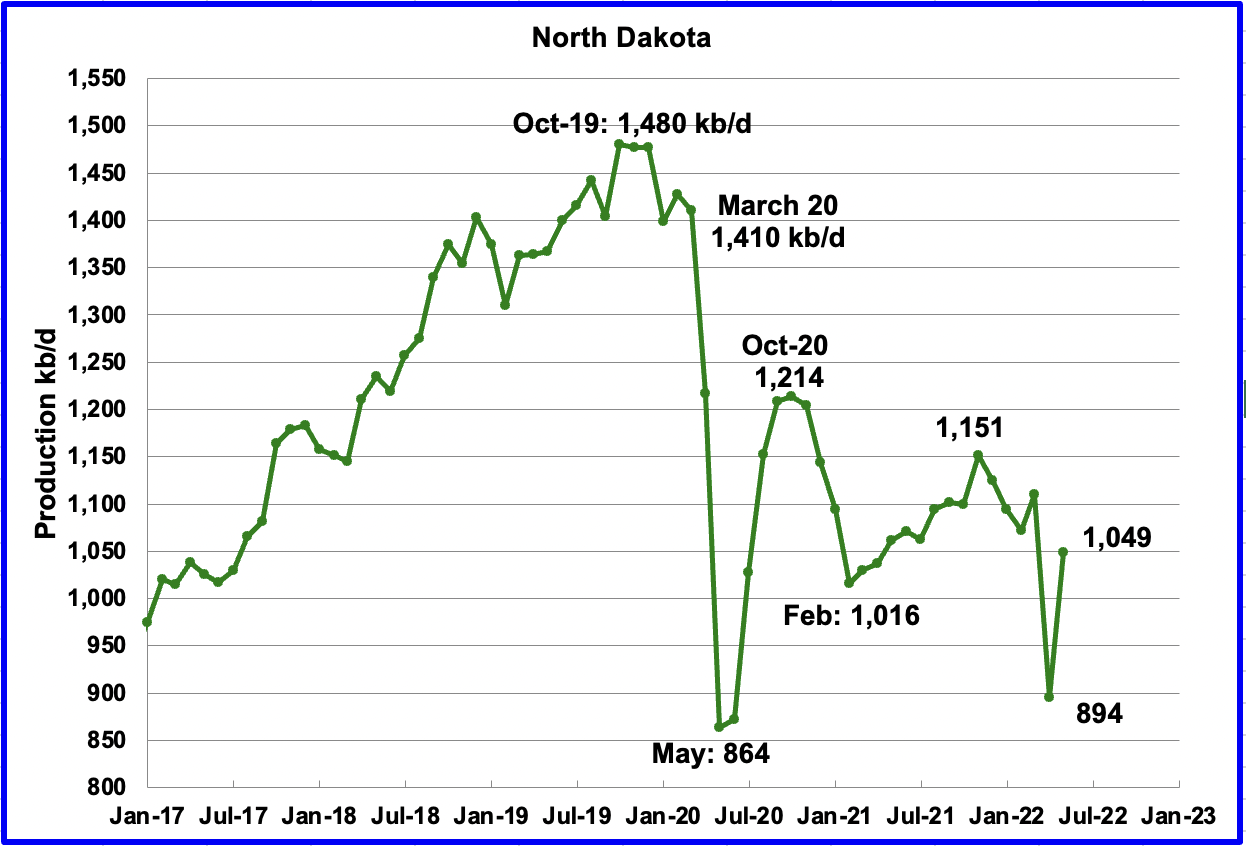

North Dakota’s May output rebounded from the April storm to 1,049 kb/d, an increase of 155 kb/d from April.

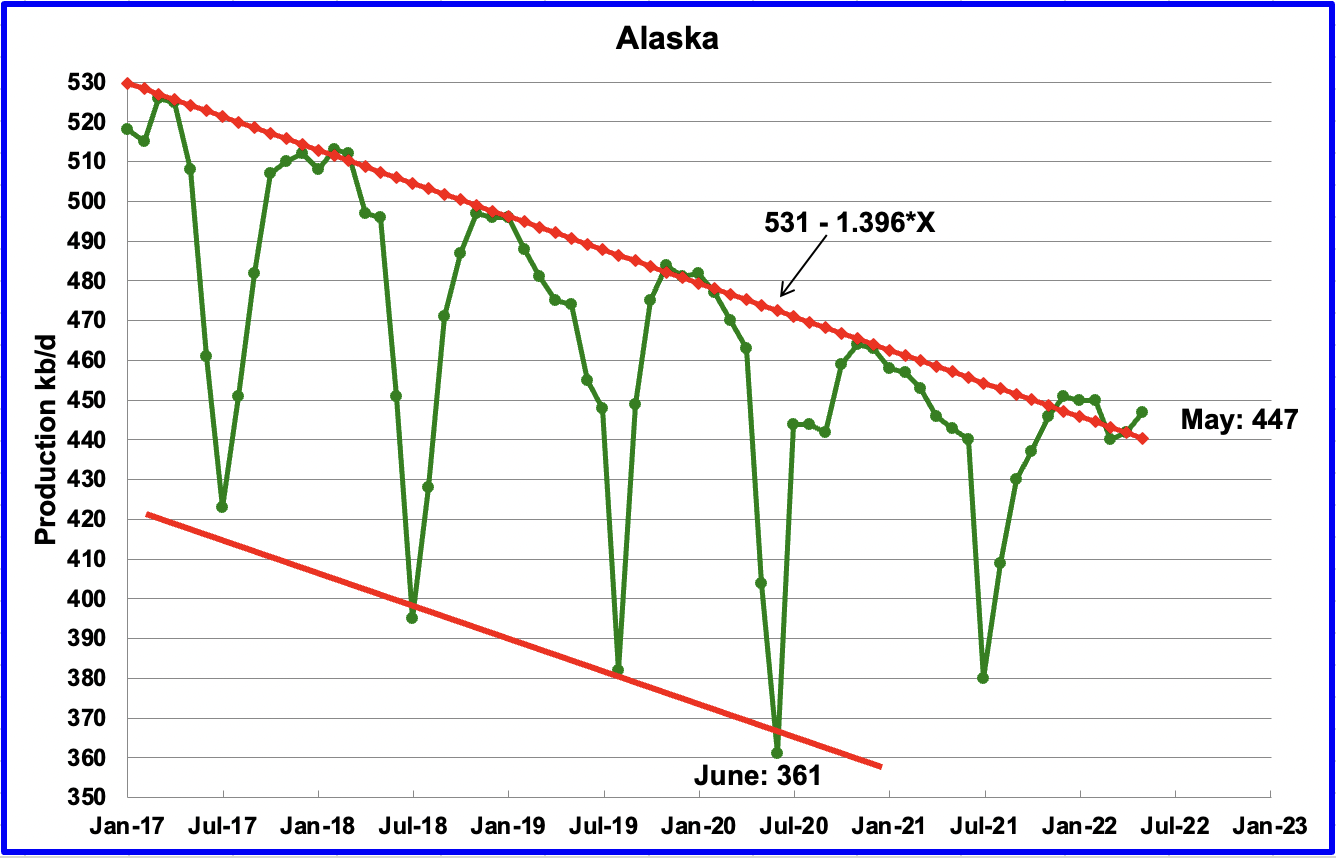

Alaskaʼs April output increased by 5 kb/d to 447 kb/d. Typically May production falls in between the red lines. Is this increase from a new production area in Alaska?

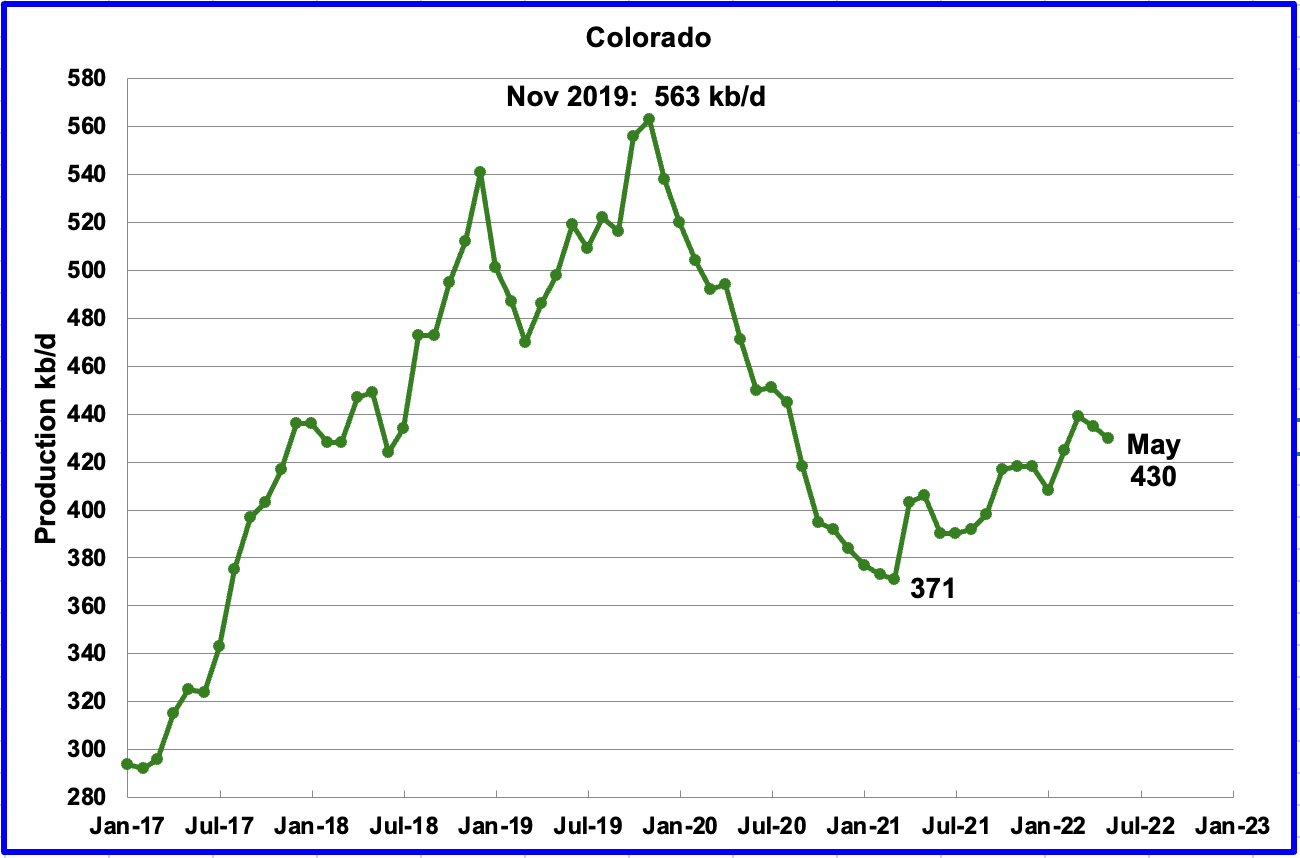

Coloradoʼs May production decreased by 5 kb/d to 430 kb/d. A recent Colorado report estimates little oil growth likely in Colorado for 2022.

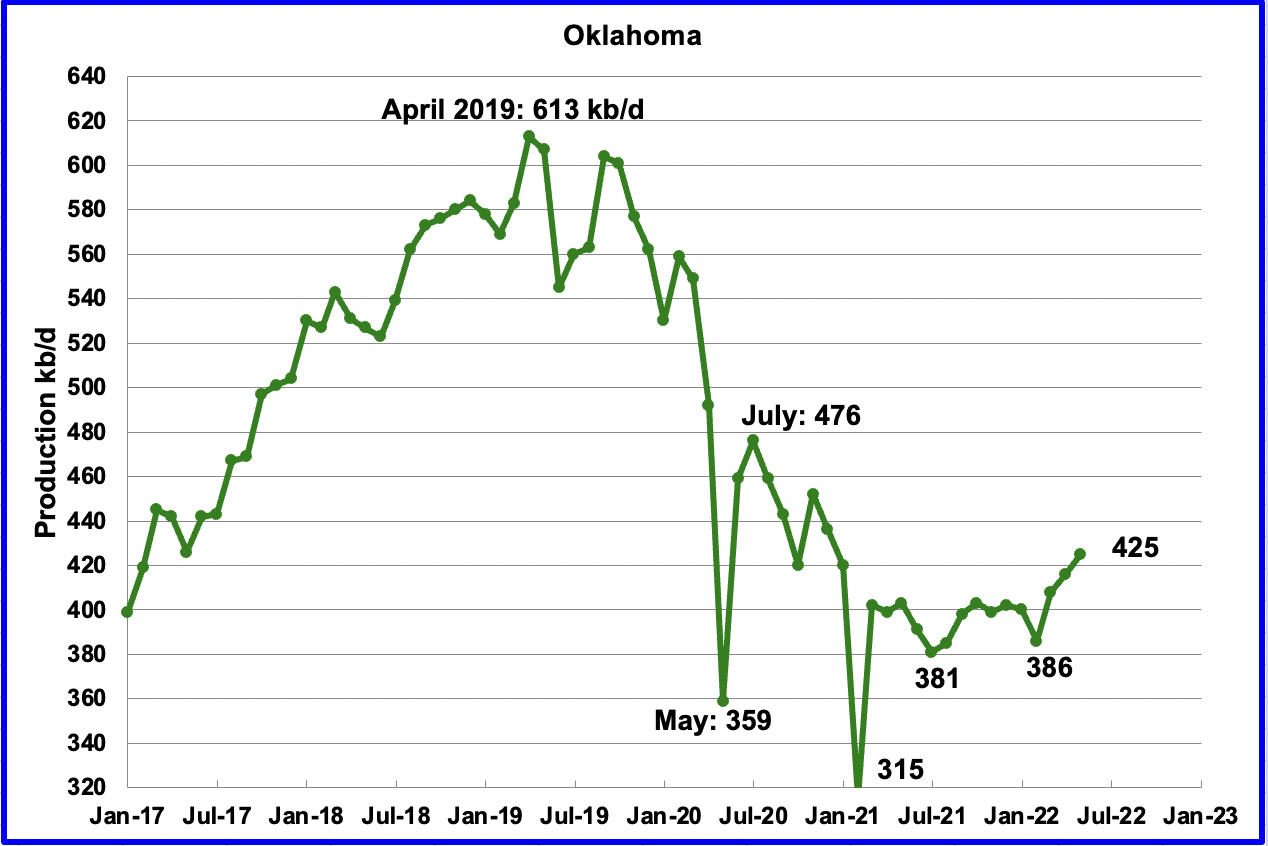

Oklahoma’s output in May increased by 9 kb/d to 425 kb/d. May’s’s output broke out above the 400 kb/d level it has been struggling with since September 2021. From January to April, close to fifty rigs were operating in Oklahoma. In May the rig count increased to 54.

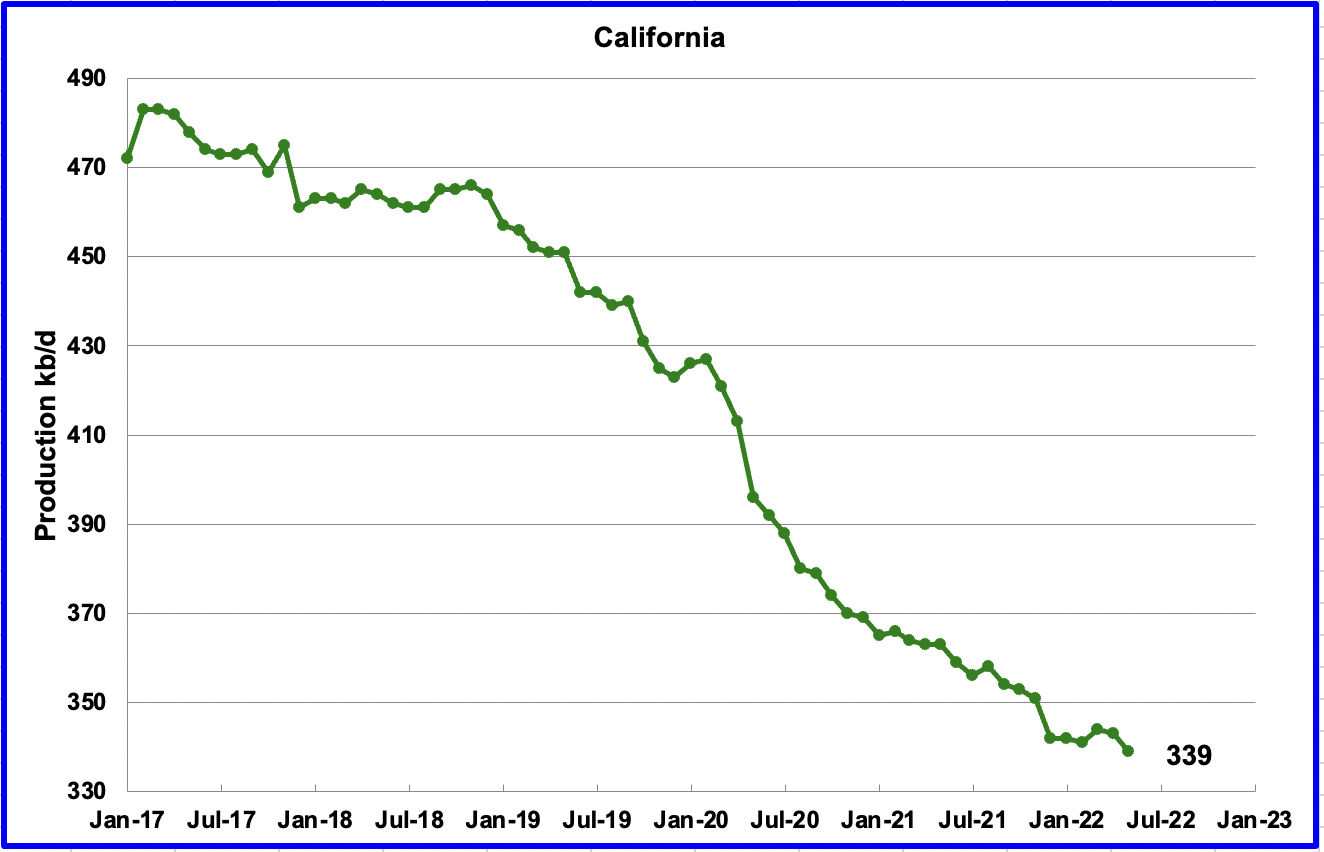

Californiaʼs slow output decline continued in May. Output decreased by 4 kb/d to 339 kb/d.

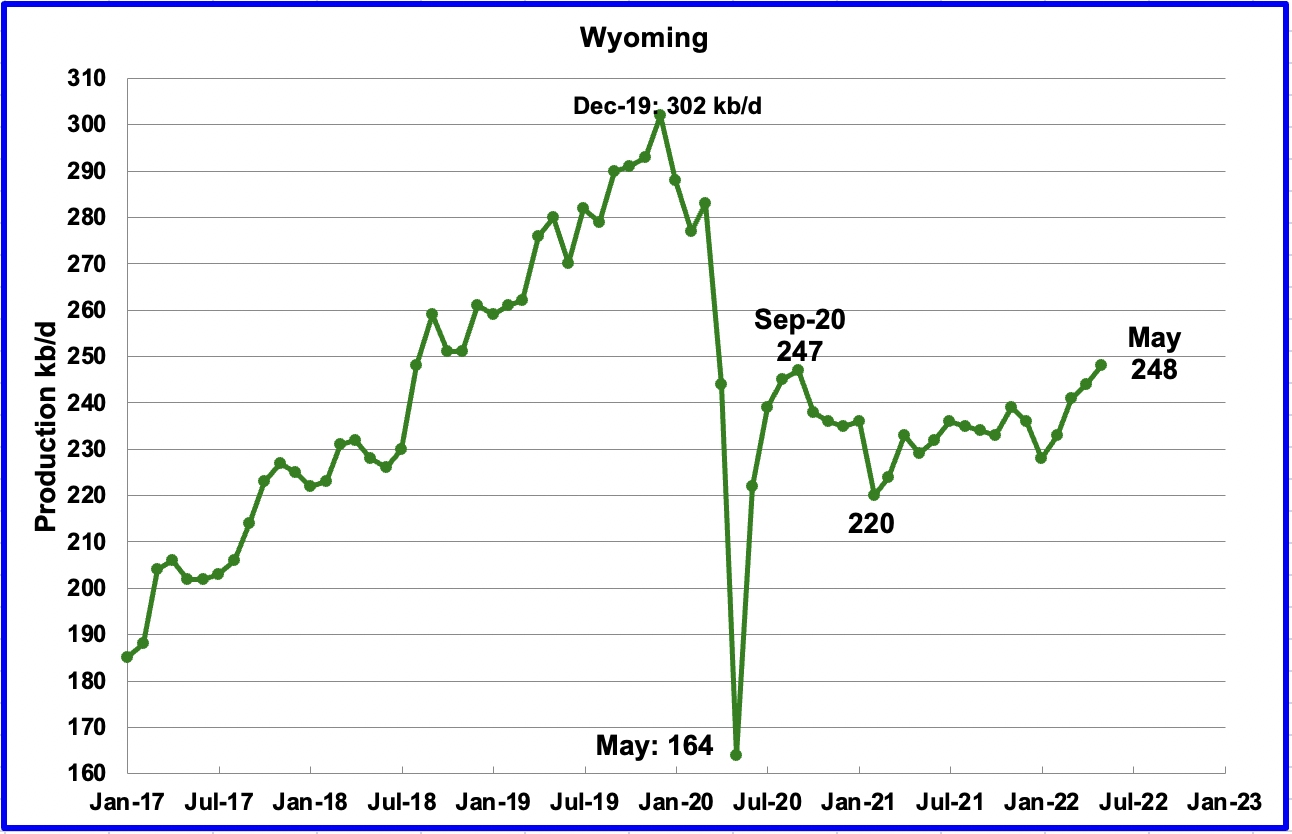

Wyoming’s oil production has been on an uptrend from the low of 220 kb/d in February 2021. According to this source, the increase is related to increased drilling. May’s output increased by 4 kb/d to 248 kb/d.

“Pete Obermueller, president of the Petroleum Association of Wyoming, told the Joint Minerals, Business and Economic Development Committee on Monday that the state’s drilling rig count is slowly increasing and reached 21 this week. (Baker Hughes, which tracks rigs differently, reported Friday that Wyoming had 18. (Note the difference between BH and local reporting as noted earlier by a few of our participants)

The current rig count “obviously is better,” Obermueller said. “Still not where we’d like to be, but we’re moving in the right direction.”

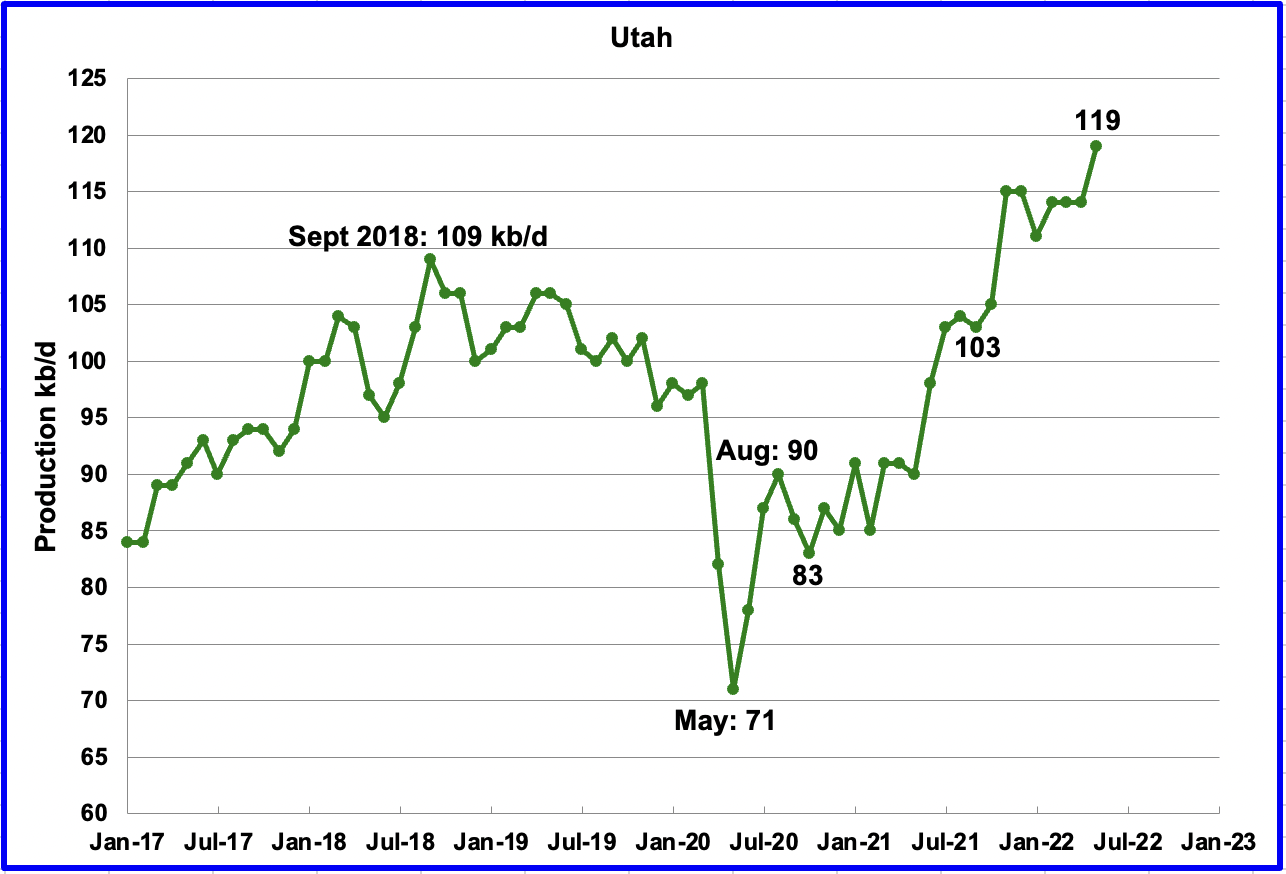

Utah’s production hit a new high in May. May’s production increased by 5 kb/d to 119 kb/d. Utah had 9 rigs operating in May, an increase of 4 over January.

Louisiana’s output was unchanged in May at 103 kb/d.

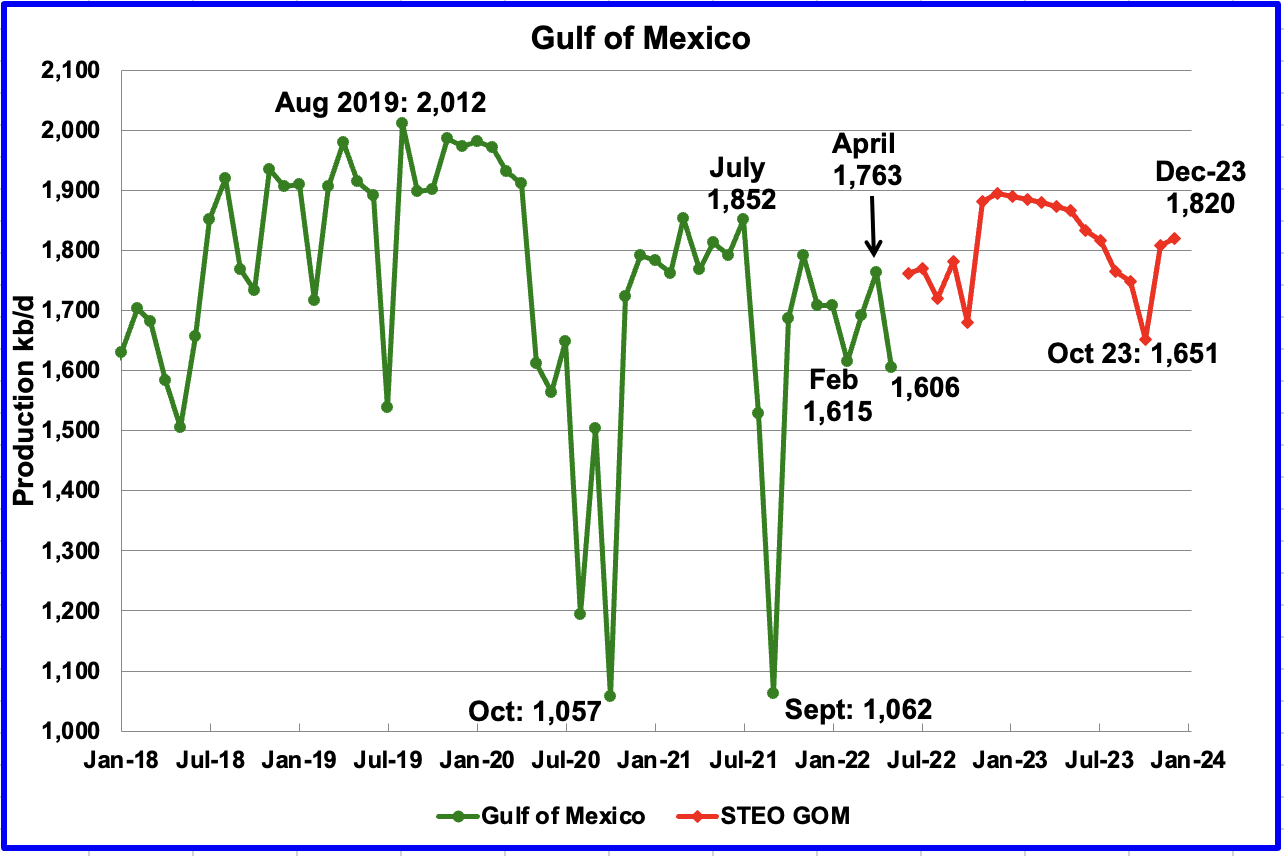

GOM production decreased by 157 kb/d to 1,606 kb/d in May due to weather. If the GOM was a state, its production would normally rank second behind Texas.

The July 2022 STEO projection for the GOM output has been added to this chart and projects output will be 1,820 kb/d in December 2023. For June 2022, the STEO is projecting a rebound of 155 kb/d to 1,761 kb/d.

A Different Perspective on US Oil Production

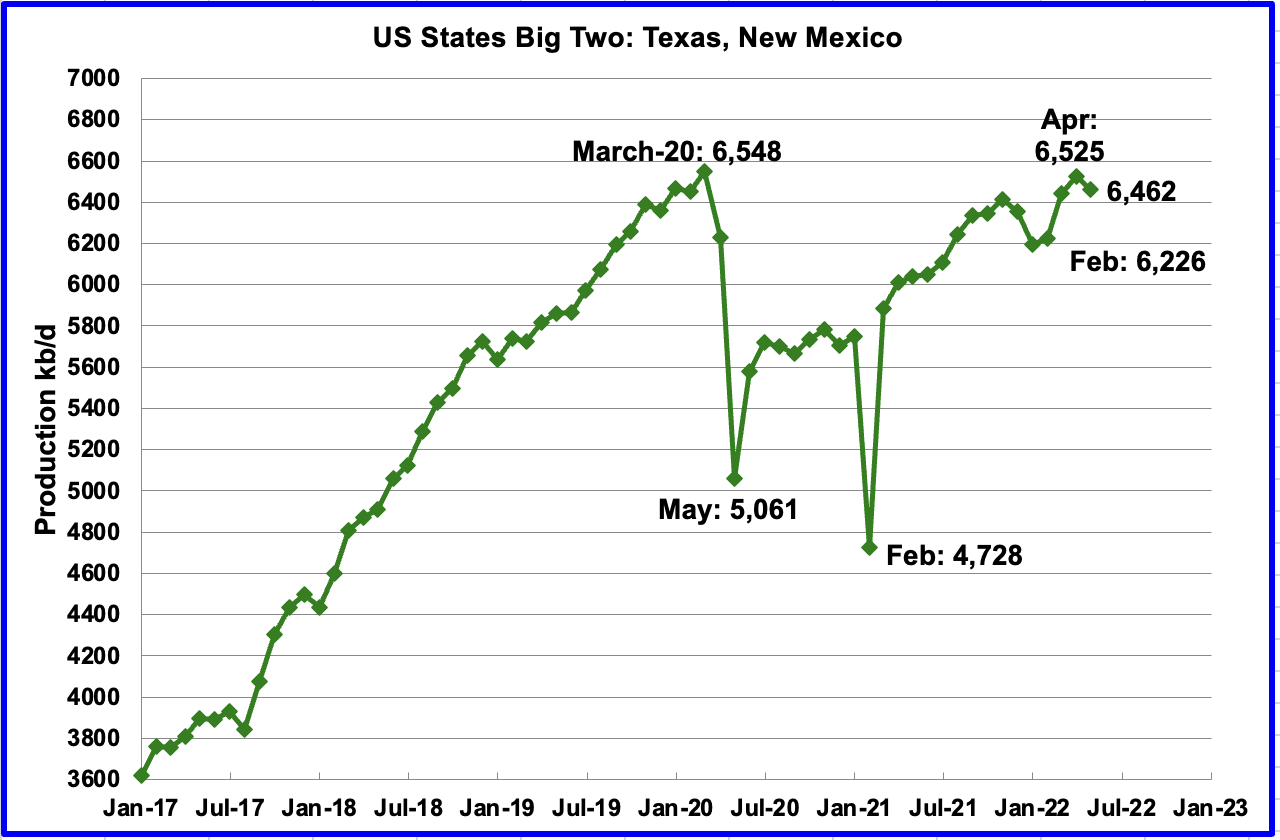

The Big Two states, combined oil output for Texas and New Mexico.

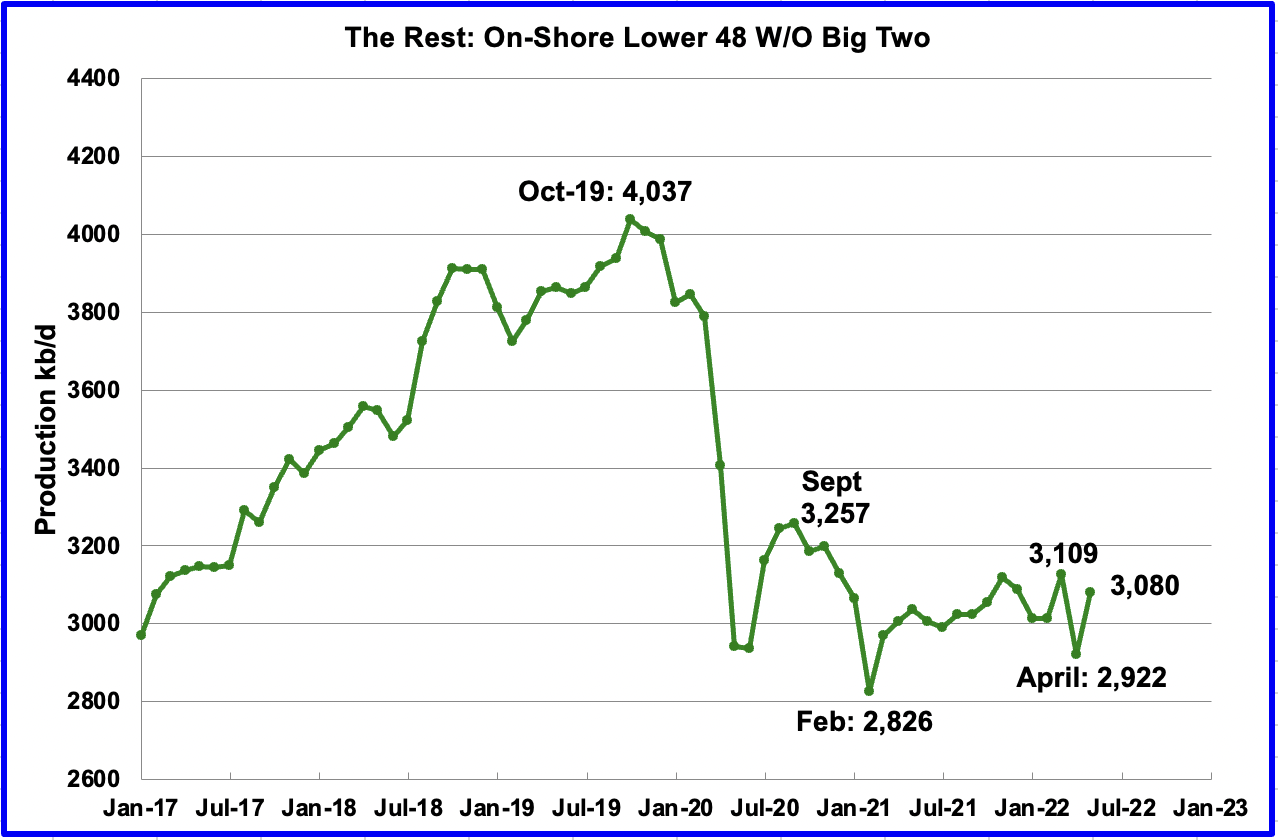

Oil production for The Rest

To get a different perspective on US oil production, the above two charts have segregated US state production into two groups, “The Big Two” and the “On-Shore L48 W/O Big Two” or The Rest.

May’s production dropped in the Big Two states by a combined 63 kb/d, with Texas dropping 52 kb/d and New Mexico dropping 11 kb/d.

Over the past year, production in The Rest appears to be holding steady at close to 3,100 kb/d.

Rigs and Frac Spreads

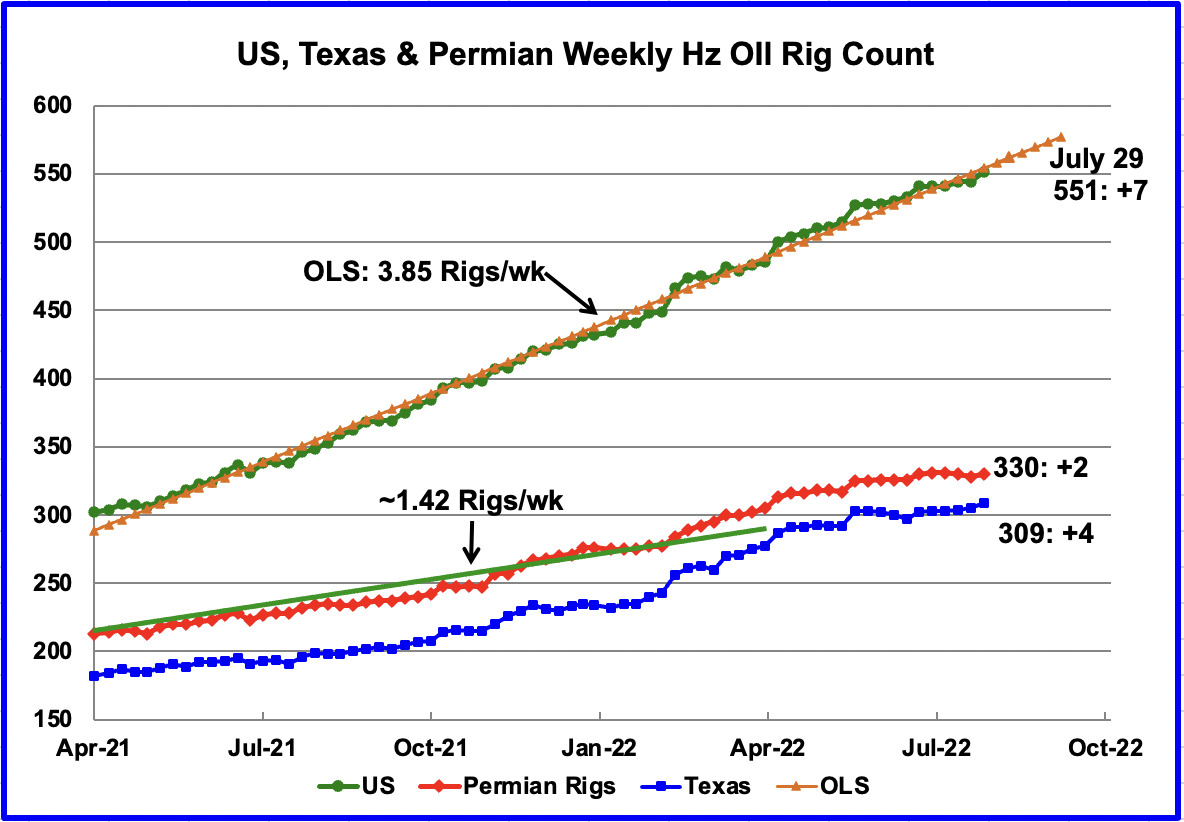

Since the beginning of April 2021 through to the week ending July 29, 2022, the US has been adding horizontal oil rigs at a rate of close to 3.85 rigs/wk, OLS line. From April 2021 to February 2022, 1.42 rigs/wk were added to the Permian. However, over the last 10 weeks only 5 rigs have been added. This slowing of rig additions in the Permian relative to the whole U.S. indicates the increase in U.S. rigs is occurring in the smaller basins, see next table.

In the week ending July 29 there were 330 rigs operating in the Permian, an increase of 2 over the previous week. In Texas 309 were operational, an increase of 4 over the previous week.

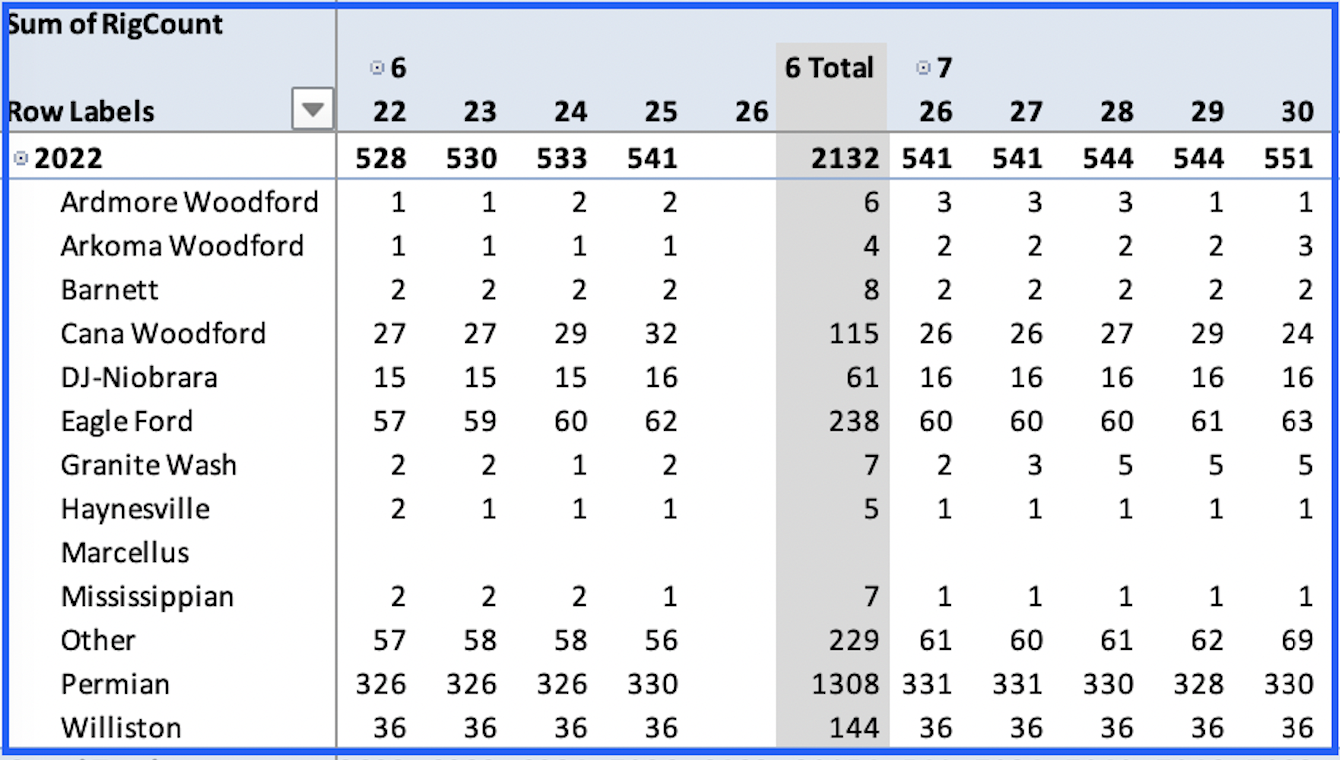

This table shows the horizontal rig count in the US basins starting from the beginning of June to the end of July. From the beginning of June to the end of July, a total of 23 (551 – 528) rigs were added in the U.S. Comparing the first column with the last, the biggest increase occurred in “Other” basins, 12. Over the same period, the Permian added 4 and Eagle Ford added 6, for a total of 22. Clearly 50% of the rigs are going to smaller lessor known basins/areas.

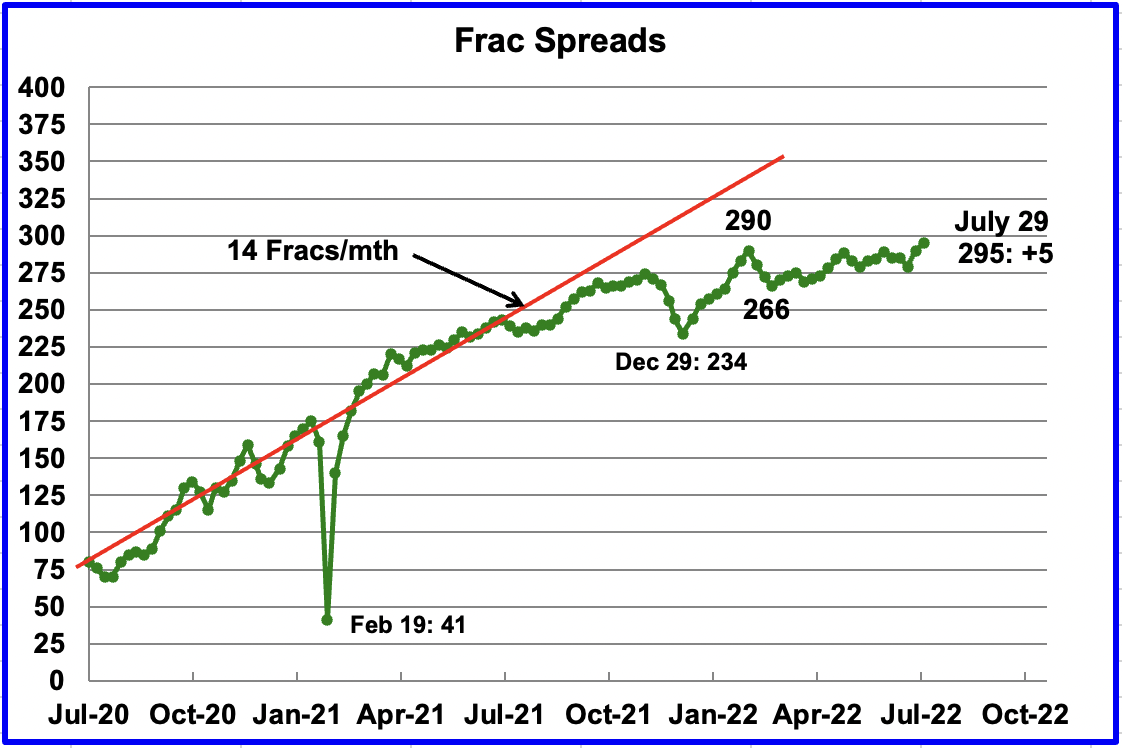

Over the last two weeks, completion activity has increased since 16 Frac spreads were added while over the previous 5 to 6 weeks, there was no net change since additions and deletions were offsetting each other. In the week ending July 22, 11 were added while 5 were added in the current week ending July 29 for a total of 295.

Since early February, the growth in frac spreads has not been keeping pace with the growth in rigs. In the week ending July 29, 295 frac spreads were operating, 5 more than the 290 operating in the week ending February 25. Now that summer is here, the frac spread count may begin to increase provided the hurricane season does not impact plans/operations.

As noted in the Rig count table, only 4 rigs were added to the Permian from the beginning of June to the end of July. Would that imply that only a few, say 1 or 2, frac spreads were added in the Permian.

Note that these 295 frac spreads include both gas and oil spreads.

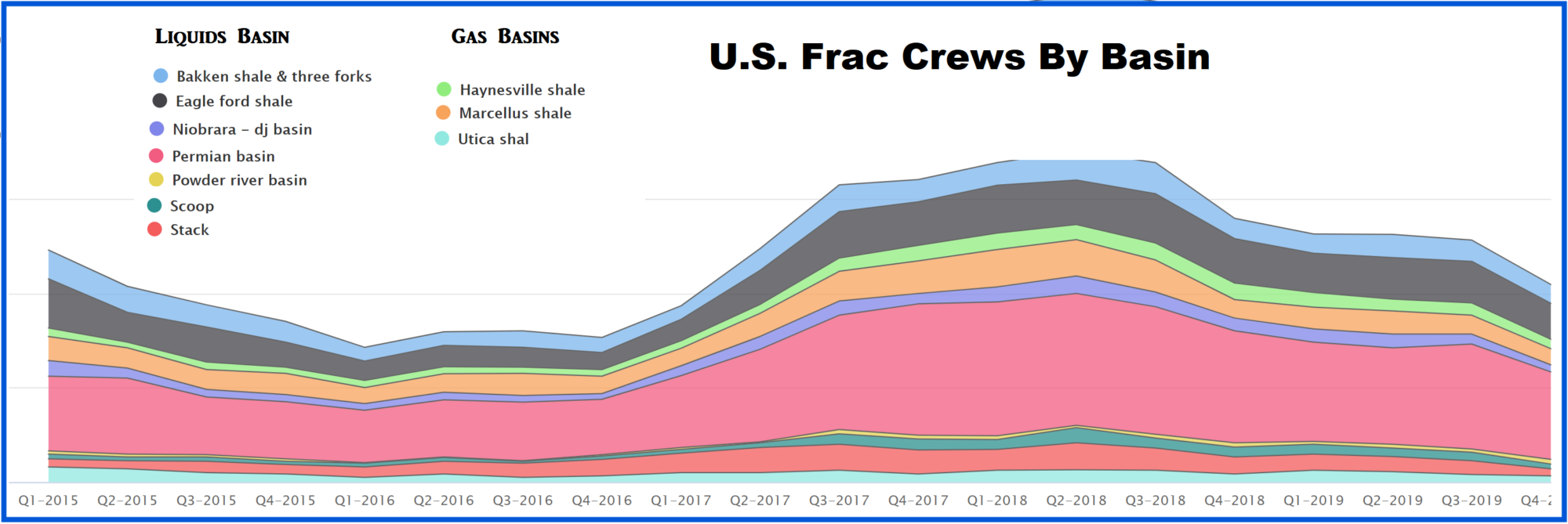

This is an old graphic taken from this source. Throughout the period Q1-16 to Q4-2019, the majority of Frac spreads, over 50%, were located in the Permian. Is it safe to assume the same is true today?

Assuming that 50% is a good estimate for the number of Frac crews in the Permian, that means that close to 148 are operating in the Permian. In the DPR section below, it shows that 436 DUCs were completed in the Permian in May As a rough guide this means one DUC crew can complete three DUCs per month.

1) Short Term Energy Outlook

The July STEO provides projections for the next 20 months, starting with May 2022 to December 2023, for US C + C and other countries.

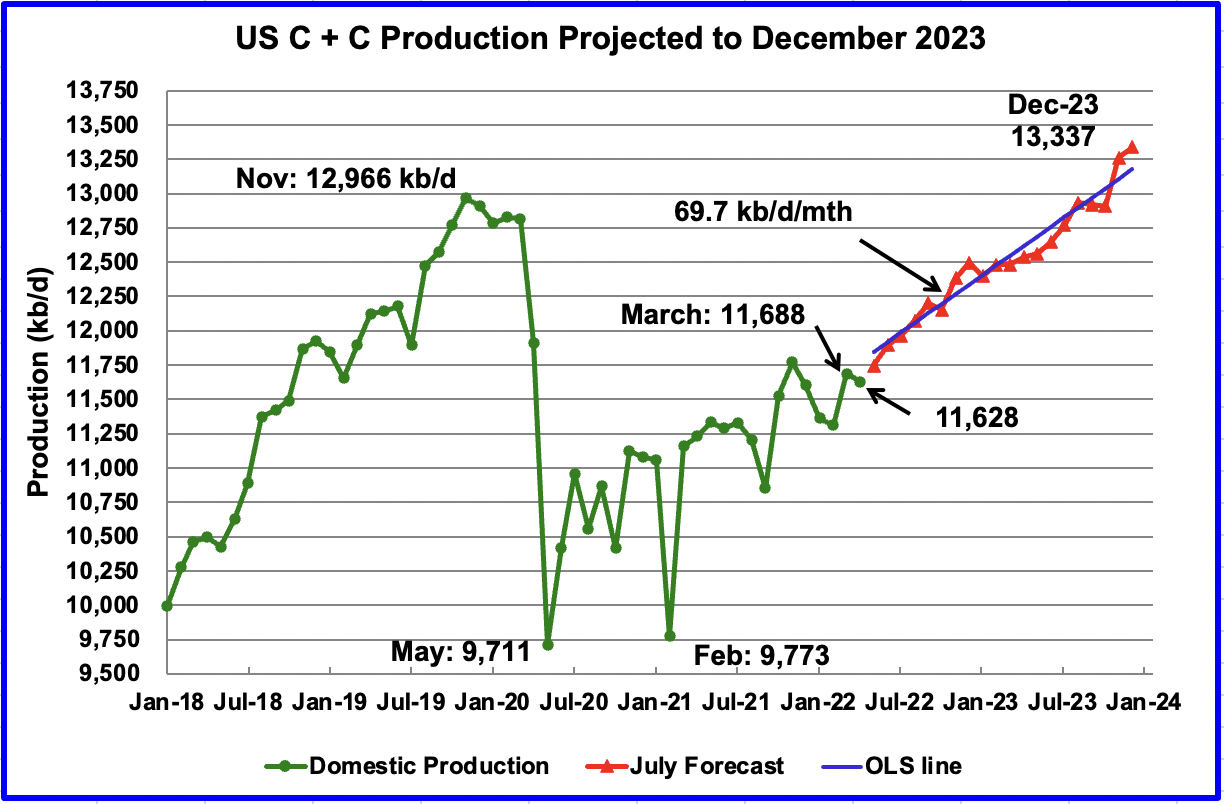

The July 2022 STEO revised down its projected US oil output from May 2022 to December 2023. In December 2023 output is expected to reach 13,337 kb/d, 107 kb/d lower than reported in the June report.

Using only the projected data from June 2022 to December 2023 to fit an OLS line, the STEO is forecasting production will increase at an average rate of 69.7 kb/d/mth, lower than the average rate of 83.8 kb/d/mth estimated in the June report. If the December 2023 output is achieved, it will be 71 kb/d higher than the November 2019 record. The monthly rate of 69.7 kb/d translates into a yearly increase of 836 kb/d.

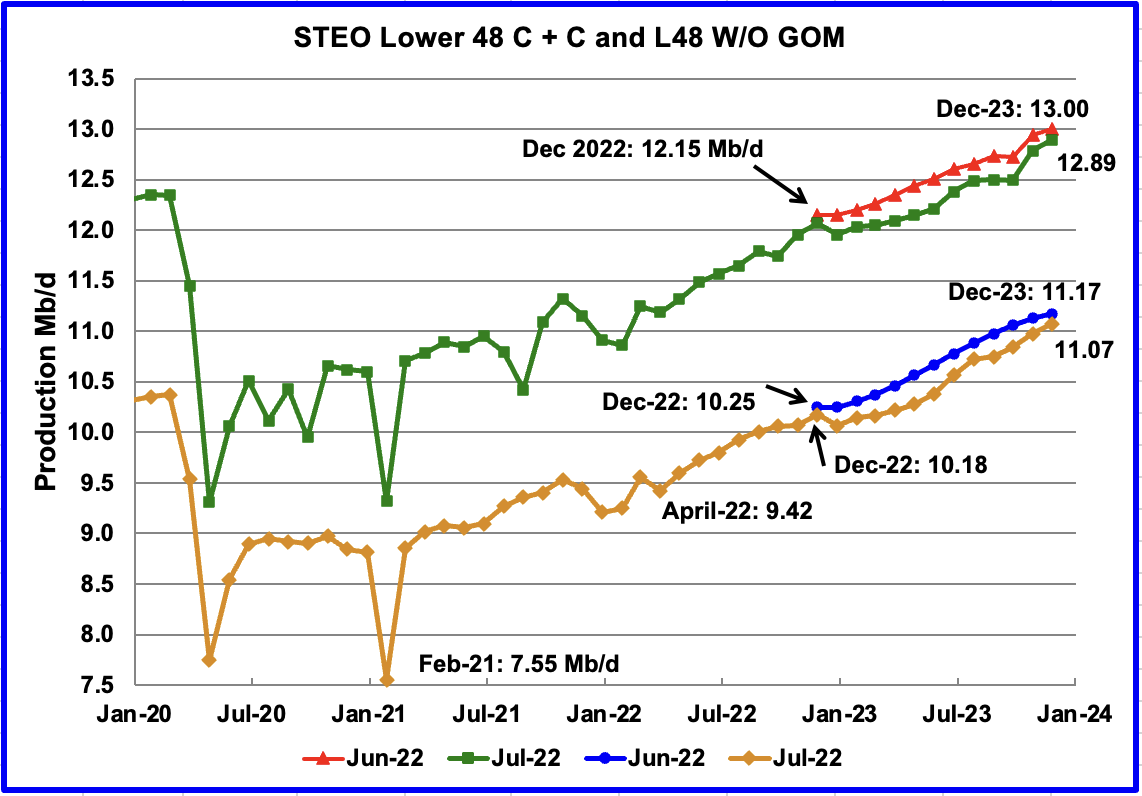

This chart compares the STEO forecast from the June report with the current July report to better illustrate how the output forecast for July 2022 changed. For the Lower 48, the December 2023 output has been revised down by 110 kb/d to 12.89 Mb/d.

The July output projection for the Onshore L48 states has also been revised down from the June forecast. For December 2023, output was lowered by 100 kb/d to 11.07 Mb/d.

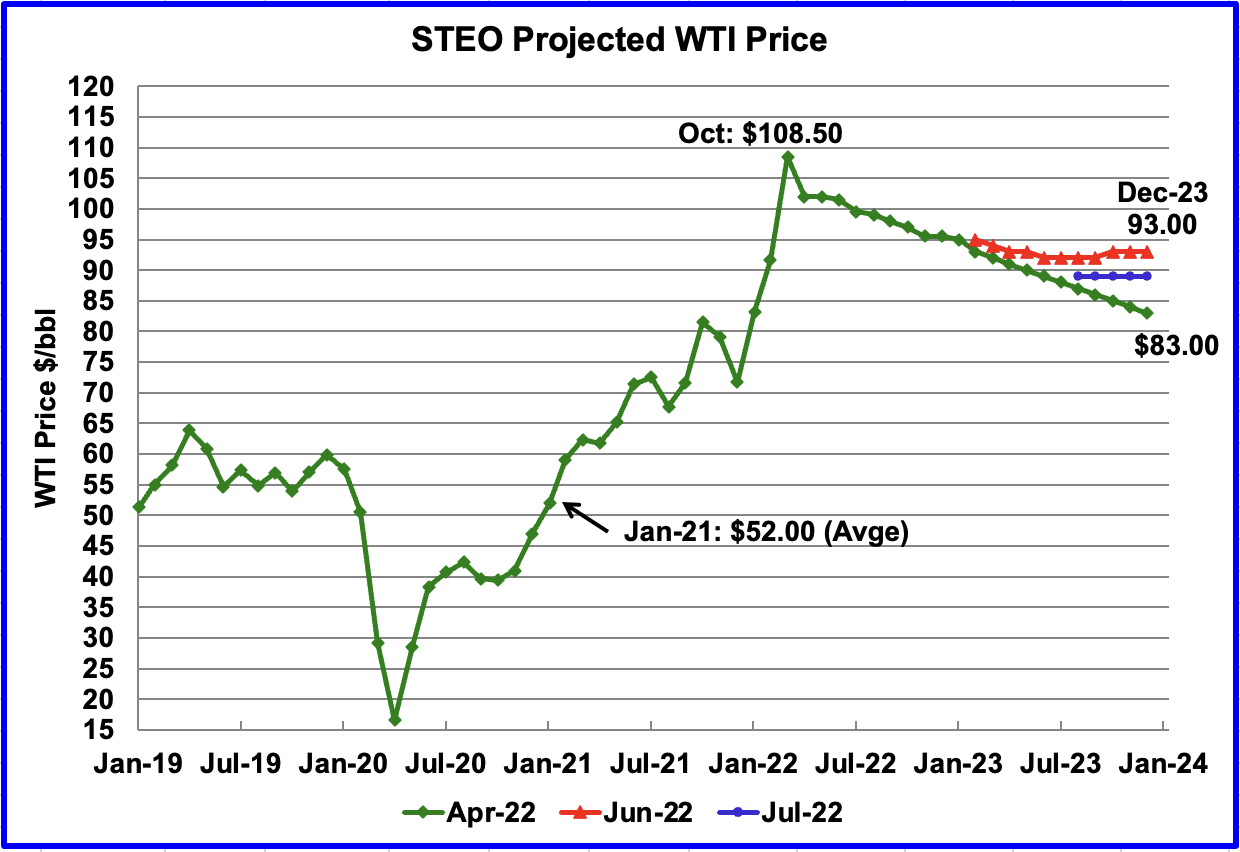

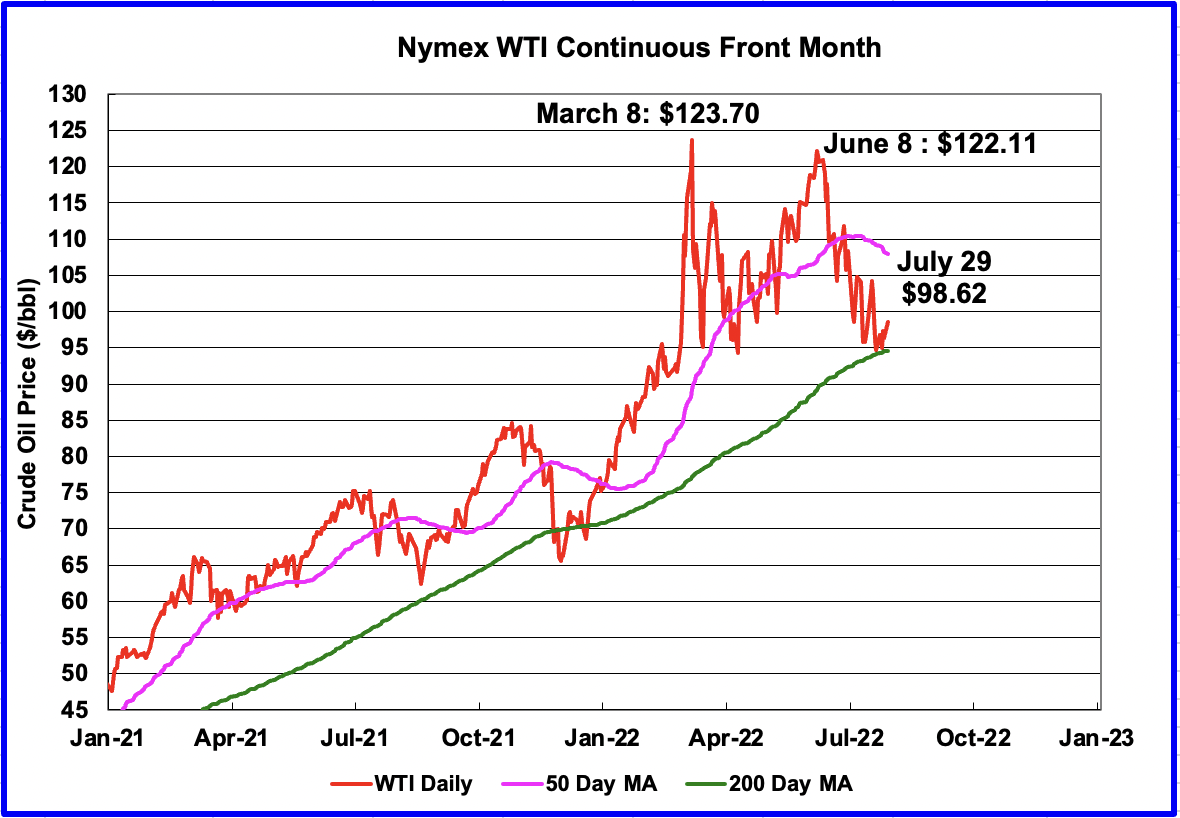

The July 2022 STEO oil price forecast continues to show a steady decline from the EIA’s March peak of $108.50/bbl to $89/bbl in December 2023, blue markers. Essentially the EIA is continuing to forecast that the only direction for the price of WTI going forward is down to the $90/b range. However what is different with their latest forecast is that the price of oil stabilizes in the $90/b area during the later half of 2023. The July forecast has been added to the chart to show how the STEO WTI forecasts from April to July have converged on a year end WTI price in the $90/b range.

The September WTI contract settled at $98.62 on July 29, $0.62/b higher than the EIA’s forecast average price of $98.00/b for the September contract. An incredibly great projection.

WTI on July 29 settled above the 200 day moving average after bouncing off it on July 22. It has now formed a triple bottom at $95/b along with bouncing off the 200 day moving average at $94/b. These are bullish indicators for WTI, over the near term, next three months.

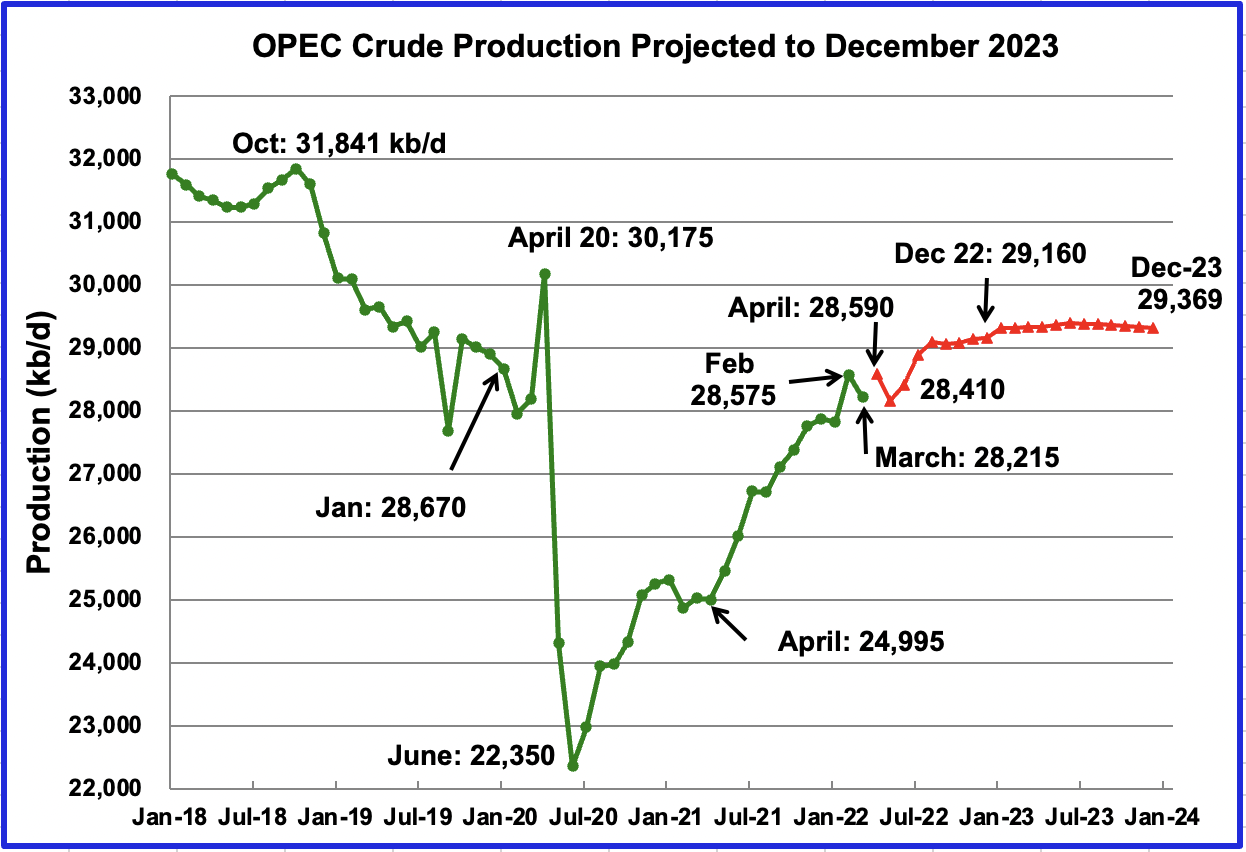

This chart shows the STEO’s July forecast for OPEC crude output from April 2022 to December 2023. OPEC’s output is projected to increase from April 2022 to December 2022 by 570 kb/d to 29,160 kb/d, which is 200 kb/d lower than in the June report. After December 2022, production remains essentially flat at close to 29,350 kb/d out to December 2023. The July OPEC report indicates that the call on OPEC in Q4-22 is 30.46 Mb/d, which is 1.31 Mb/d higher than the STEO is forecasting for December 2022, 29,160 kb/d.

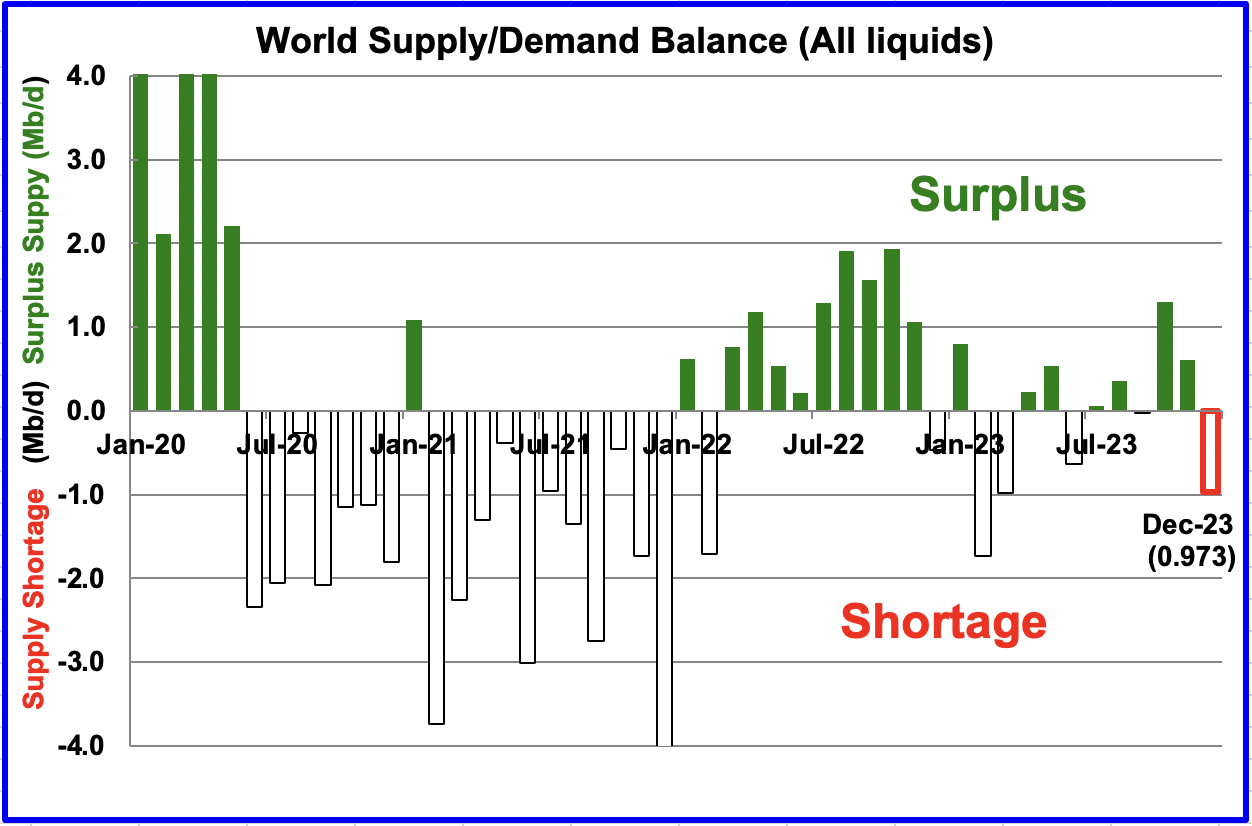

This chart shows the historical world supply/demand balance up to April 2022 and after that, the EIA’s forecast out to December 2023. The surplus of over 1,000 kb/d between August and December is inconsistent with the current tight market and expected increase in demand heading into winter.

2) Drilling Productivity Report

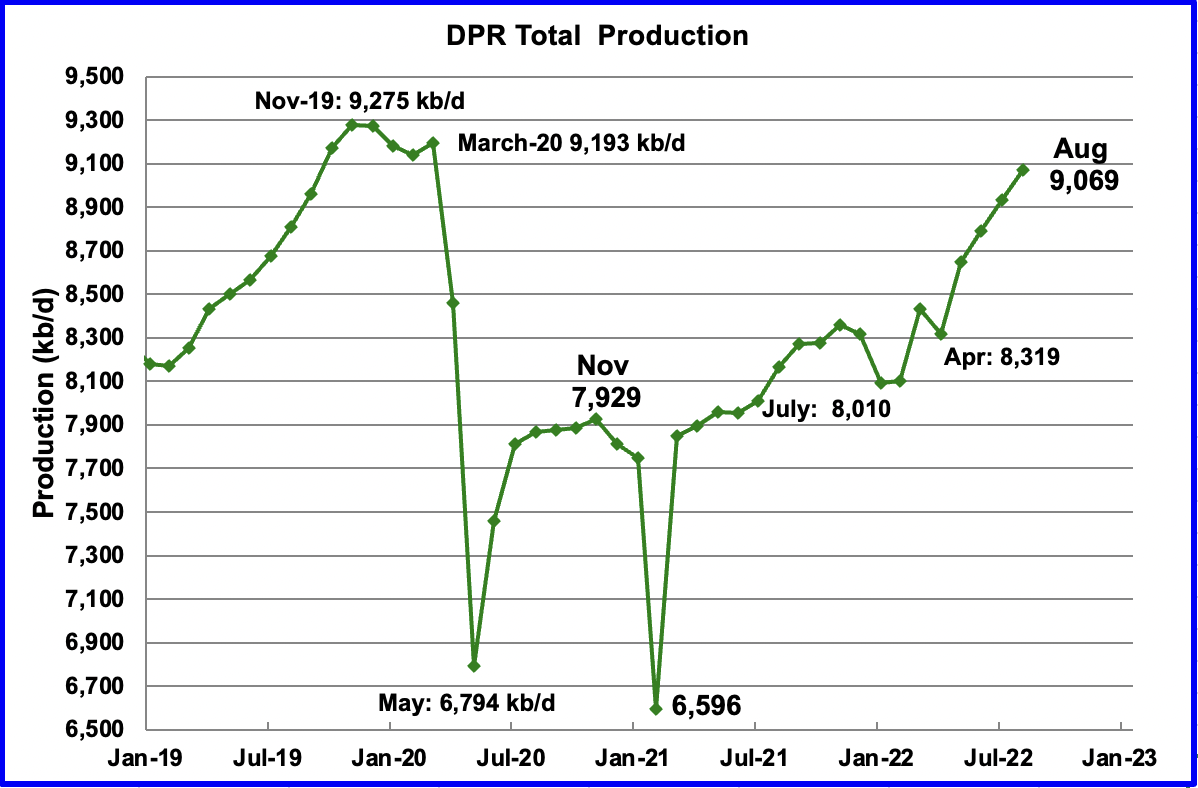

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The July DPR forecasts production to August 2022 and the following charts are updated to August 2022.

Above is the total oil production projected to August 2022 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional wells.

The DPR is projecting oil output for August 2022 will increase by 138 kb/d to 9,069 kb/d. Note that the chart now shows the April decline that occurred in the Bakken. From January’s output of 8,093 kb/d to August 2022, output in the DPR basins is forecast to increase by 976 kb/d or by an average of 139.4 kb/d/mth. Note that this monthly production rate is much higher than the STEO rate of 83.8 kb/d projected in the STEO section above.

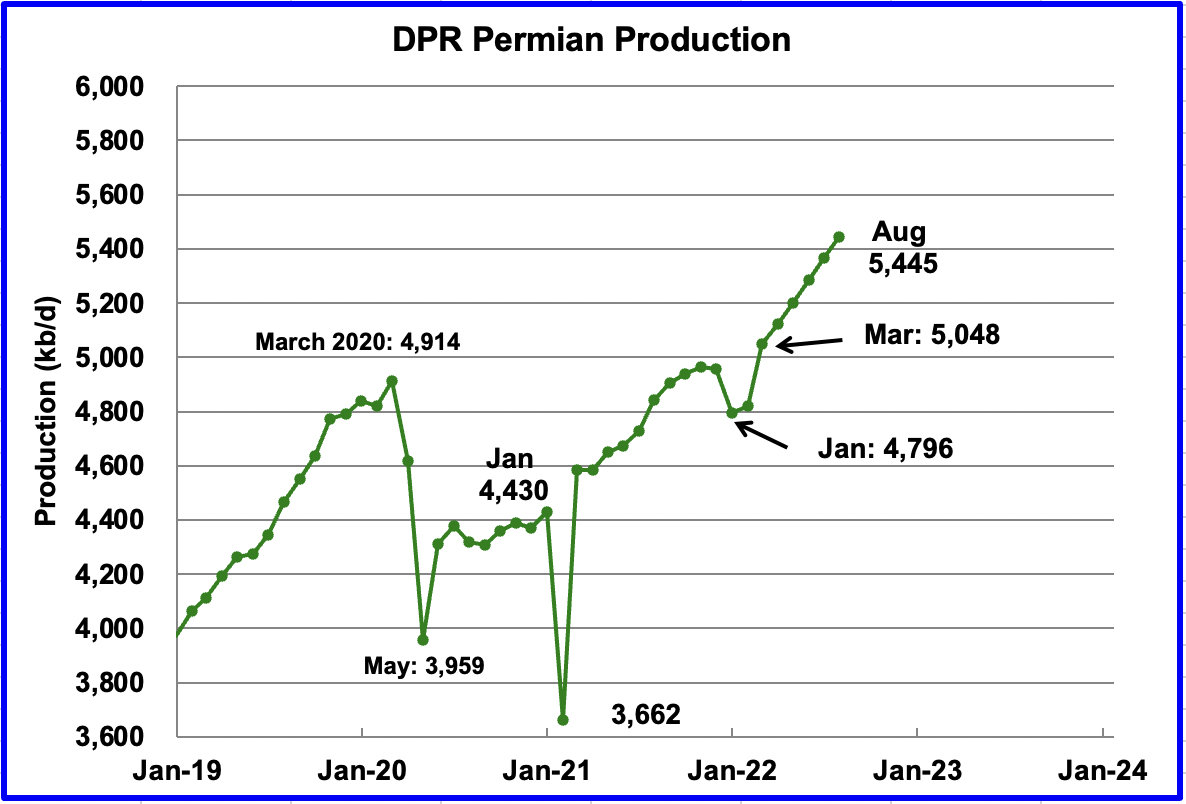

Permian output exceeded 5,000 kb/d in April 2022 and continues to increase. August production is expected to increase by 78 kb/d to a new high of 5,445 kb/d. From March to August, production is forecast to increase by 397 kb/d or at an average rate of 79.4 kb/d/mth. If the Permian were part of OPEC, at 5,445 kb/d it would be the second largest producer after Saudi Arabia.

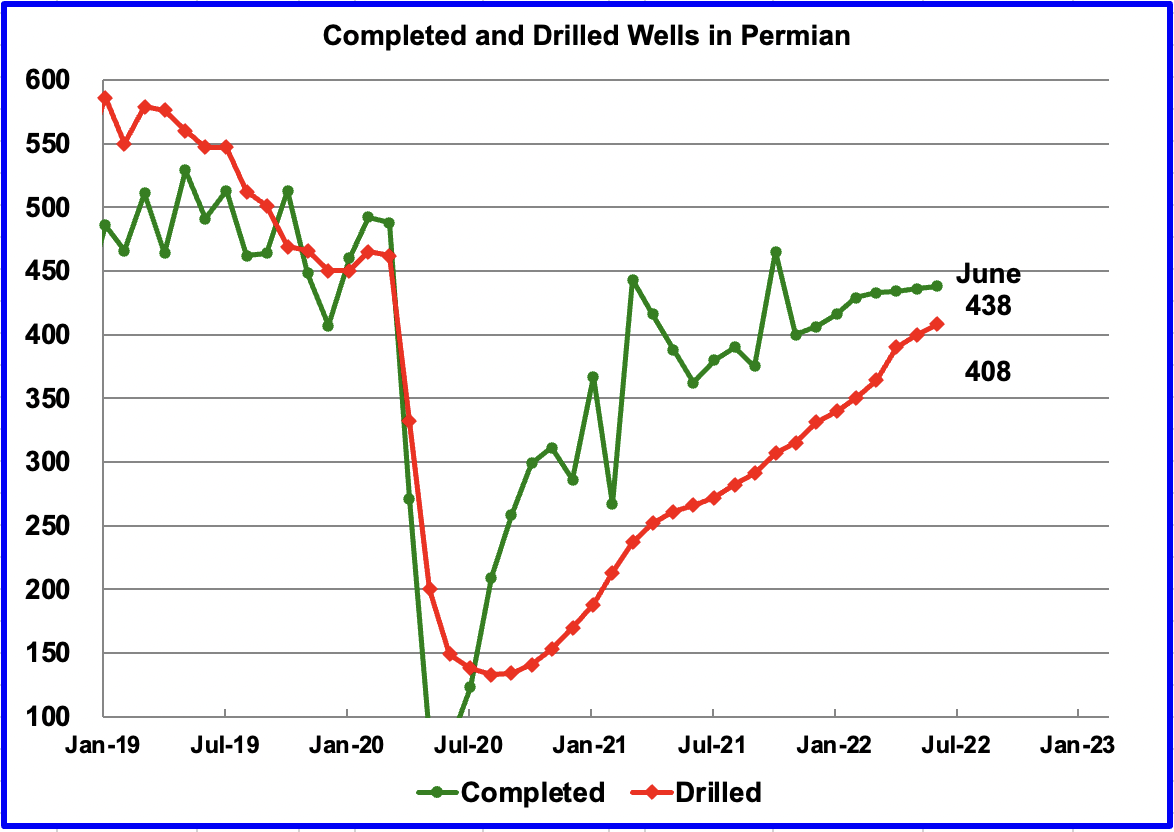

During June, 408 wells were drilled and 438 were completed in the Permian. The completed wells added 373 kb/d to June’s output for an average of 852 kb/d/well. The overall decline was 288 kb/d which resulted in a net increase for Permian output of 85 kb/d. The completion of 30 extra DUCs over the drilled wells contributed 25.6 kb/d of the 85 kb/d increase.

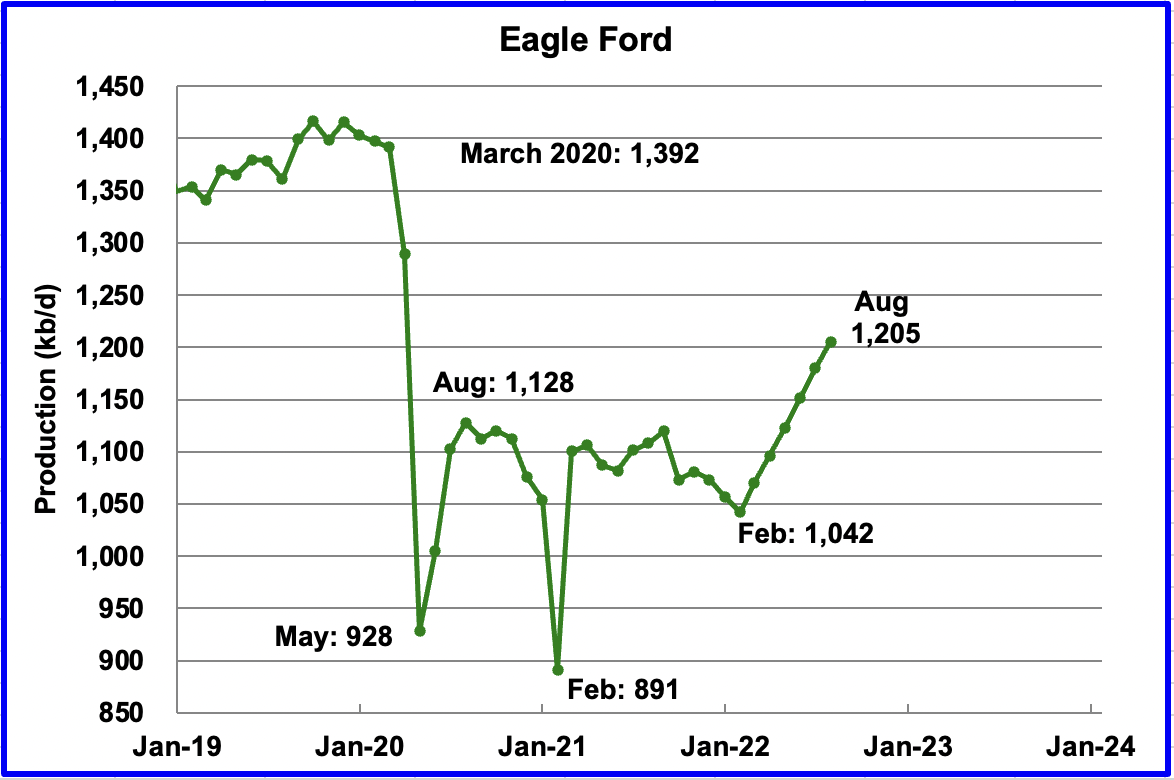

Output in the Eagle Ford basin has been showing an increasing trend since March 2022. For August, output is expected to increase by 25 kb/d to 1,205 kb/d.

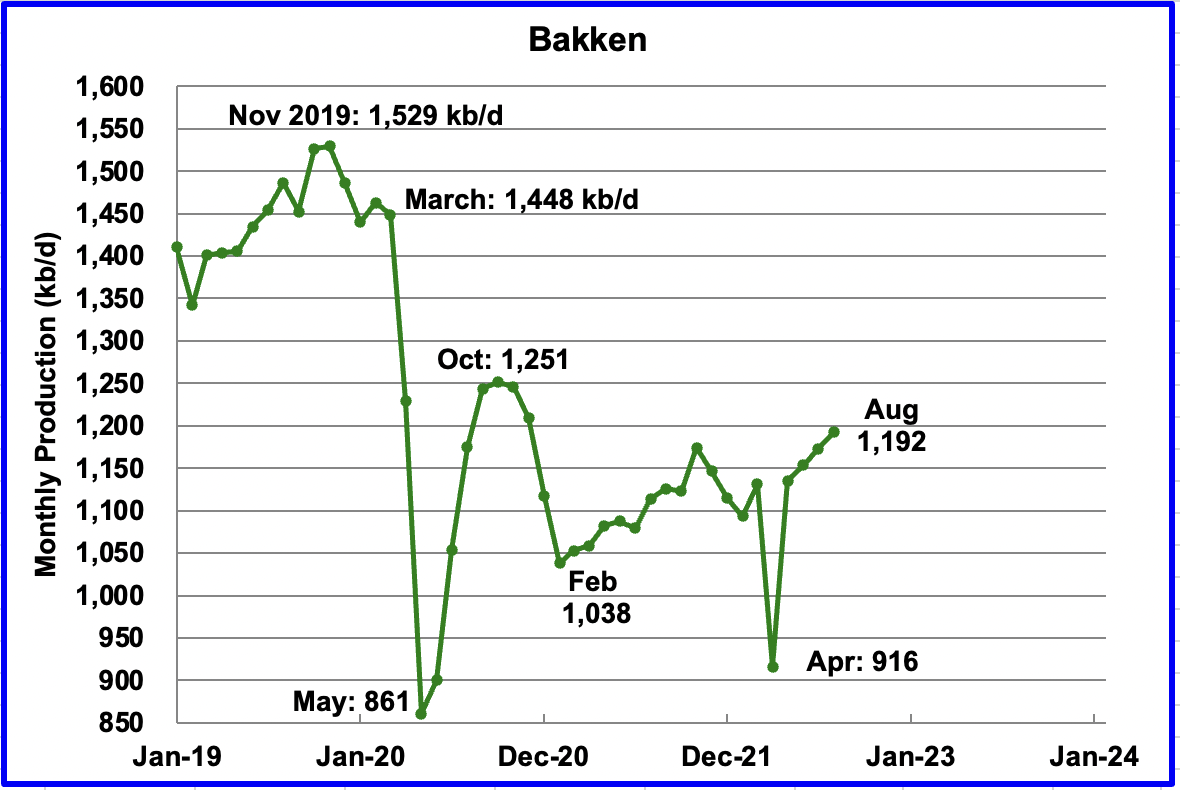

The DPR forecasts Bakken output in August to be 1,192 kb/d an increase of 19 kb/d from July. The April drop reflects the severe winter weather in April. According to the ND Department of Mineral Resources, Bakken production rebounded in May to 1,018 kb/d, which is much lower than shown in the DPR Bakken chart.

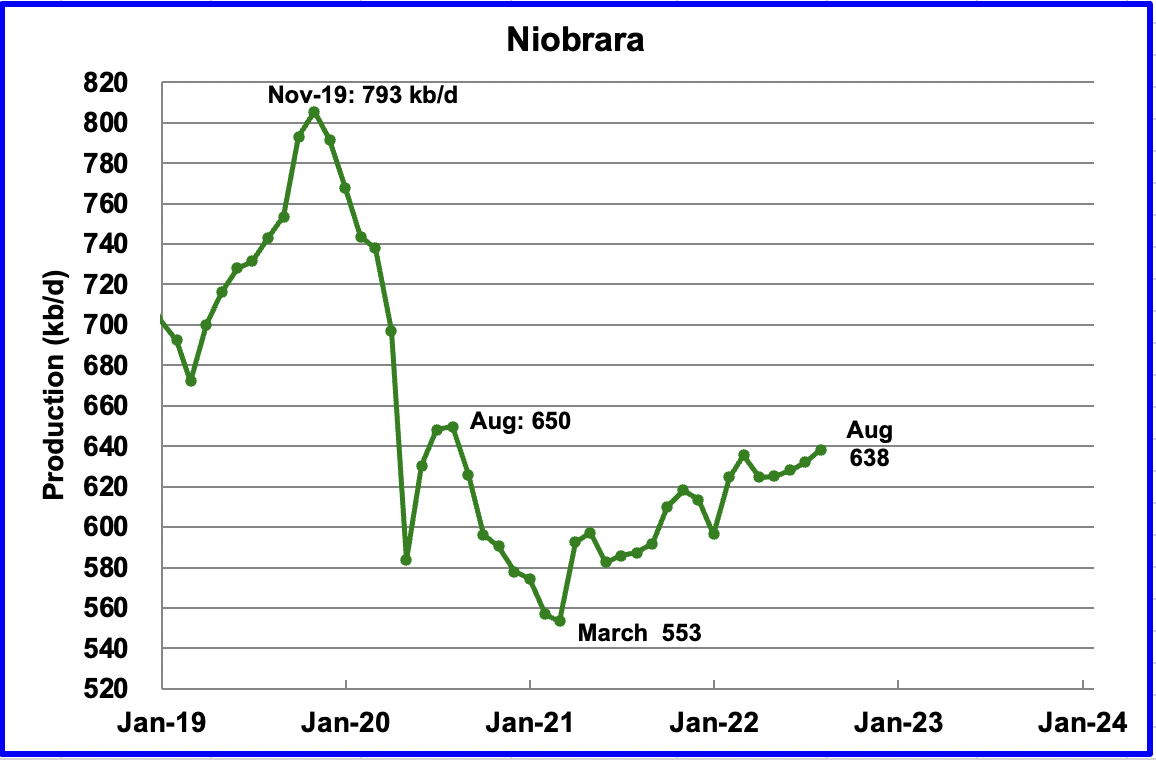

Output in the Niobrara is growing slowly. August output increased by 6 kb/d to 638 kb/d.

DUCs and Drilled Wells

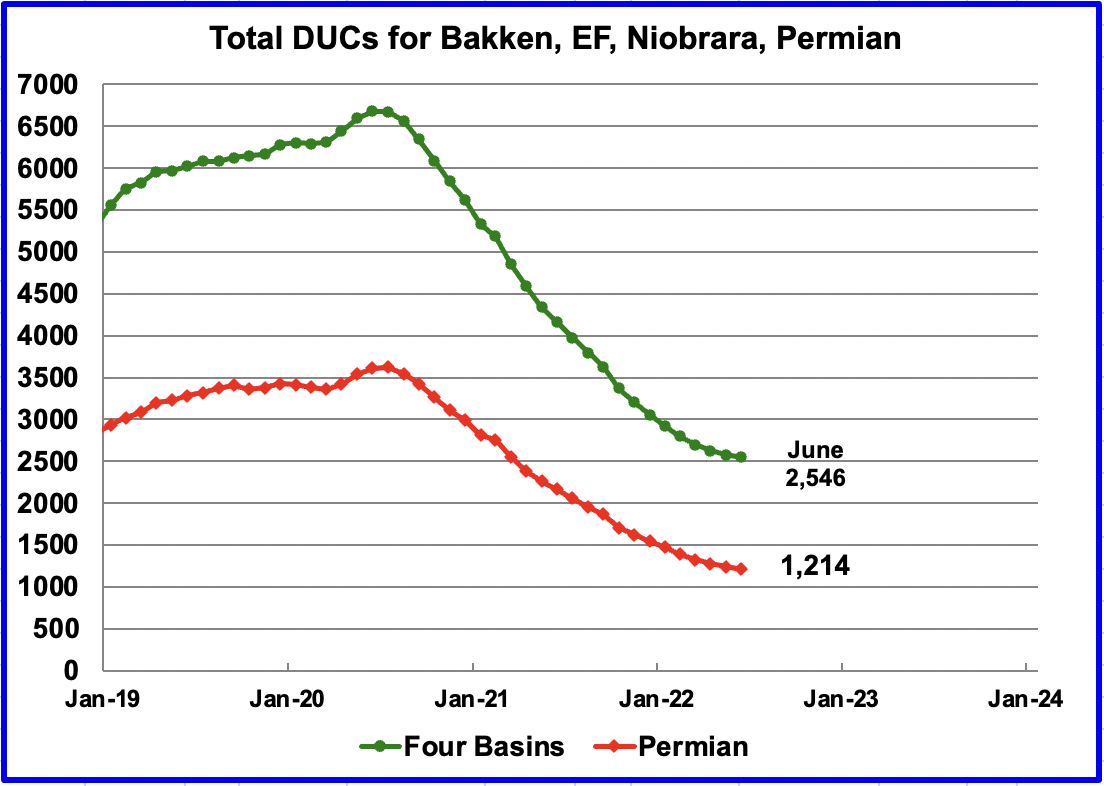

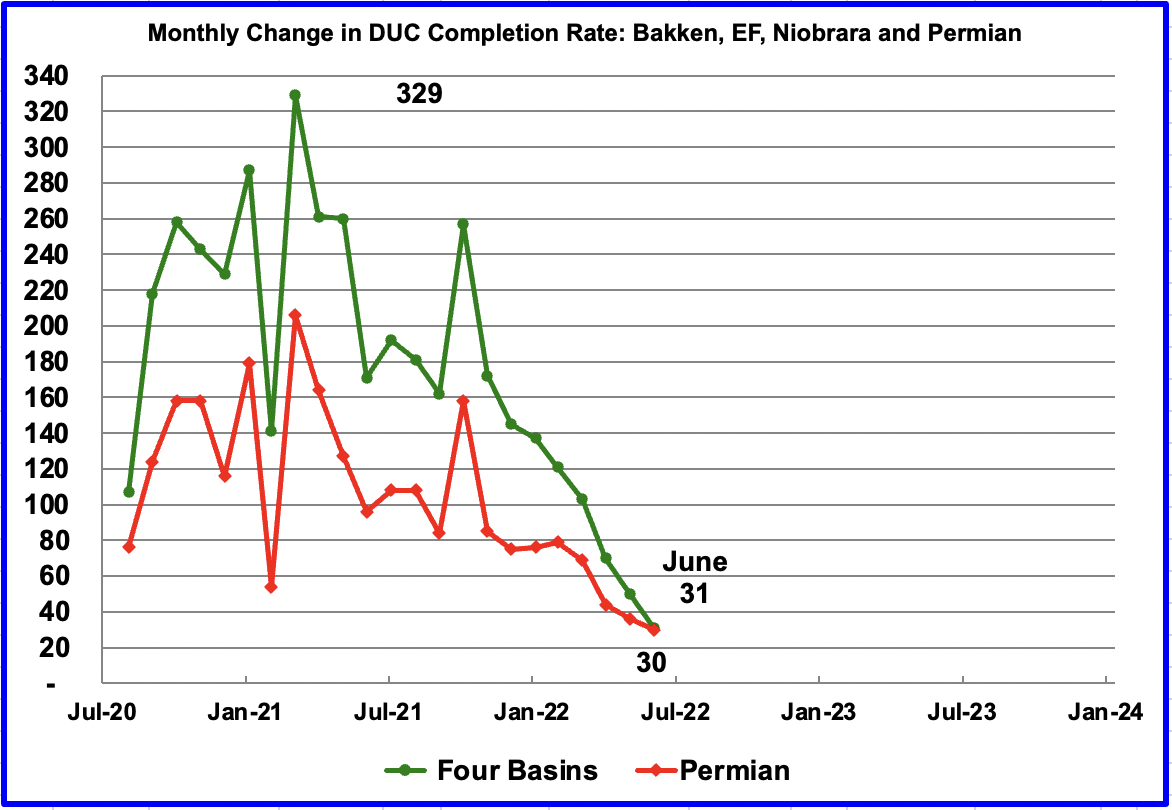

The number of DUCs available for completion in the Permian and the four major DPR oil basins has continued to fall every month since July 2020. Prior to July more wells were drilled than were completed. Also note how the monthly use of DUCs is slowing and stabilizing at a lower level .

In these four primarily oil basins, the change in the monthly completion rate of DUCs started to slow after peaking in March 2021 at 329. In June 2022, 31 fewer DUCs were completed, 2577 vs 2546, than in the previous month, see previous chart. Similarly the change in monthly completion rate for DUCs in the Permian slowed. It dropped from 36 in May to 30 in June, 1,244 vs 1,214, see previous chart.

This chart shows that the number of completions of DUCs has stabilized in the Bakken, Eagle Ford and Niobrara basins while they continue to drop in the Permian since of 30 of 31 fewer completed DUCs came from the Permian.

In the Permian, the monthly completion rate of wells has been showing signs of slowing since March. In June 438 wells were completed, 2 more than in May. During June, 408 new wells were drilled, an increase of 8 over May. To counteract the lowering use of DUCs, drilling has been increased.

Thank you Ovi for all the work you do. I appreciate your efforts greatly.

https://finance.yahoo.com/news/oil-markets-havent-yet-priced-121500759.html

“Oil prices tend to drop 30% to 40% in all recessions, the bank said.” says the bank. Of course, oil prices over the past couple months dropped by this much but then subsequently rose to, but the during a recession the lower prices last longer. While prices during a recession. the consumption much less in percentage terms.

Seppo

Thanks. Much appreciated.

Ovi, great job, thanks. One caveat, For the rest of the lower 48 less big 2, you have Oct-20, which I think should be Oct-19.

I think this is the most important chart you show. Since this group peaked in October 19, their production has dropped almost one million barrels per day or 25% of their total production and they show no sign of recovering.

I’ve wondered if this drop was caused by strippers shut in then not restarted? Can they be or is it supply/labor problem?

That may very well be the cause. However, I am not an oil man so I cannot say for sure. But one million barrels per day is nothing to sneeze at. They were higher in July 20 than in May 22, so they are not recovering.

Ron

Thanks. Fixed.

Interesting that some frat spreads have been added recently. Without that I’d have said that the rig additions in the Permian and Eagleford last week meant all the four LTO basins are pretty much in balance between drilling and completions. They are also all pretty much at minimum working inventory for DUCs, with only EF possibly having a few spare. Therefore: 1) there is no more ‘cheap’ oil to be had where the drilling costs have already been sunk into a DUC, and 2) any increase in completions would need to be preceded by an increase of rigs by about 3 to 5 months, so it would be quite difficult to raise production quickly, even if the operators wished, which I think they don’t, if for no other reason than the continuing price volatility and recession risks, and had the human, capital and supply chain resources to do so, which they don’t. But the spreads may be in gas basins, until the final, adjusted completion numbers are in it’s difficult to tell for sure.

Ovi,

What was the weather event in the GOM that caused production to be down?

Bob

Click on the Link “May Storms” in the paragraph under the first chart. I just took a guess that it was weather since all three were down and that link came up. It sounds like bad weather but with no name.

Ovi,

Thanks. That weather may have impacted Texas and New Mexico, but I’m not sure that it impacted GOM production. It would not have impacted things offshore, but maybe the production coming onshore?, but not sure of that either.

Bob

Could some of the GOM platforms been doing maintenance by coincidence at the same time?

The drop was mainly because of a turn around by Shell at Mars-Ursa (the biggest single throughput in the Gulf). Na Kick has quite a big drop too. A bigger story might be how fast the Mars-Ursa production is falling, at about 15 to 20% per annum. The most recent tie-in there, PowerNap, was a downgraded from about 30 kboed to around 16 and the older big fields are well into late life. The platforms came back on-line in the first week of June.

There might be big weather outages to come as the Atlantic hurricane season fires up in the second half of August. The GoM is set up similarly to 2005 and could allow for rapid and large scale intensification of storms. I read somewhere, and can’t now find it but I think might have been from David Wallace-Wells, that the levees rebuilt and added after Katrina are not designed to cope with a category five hurricane and may not have been built or maintained to a high enough standard to be able to handle a direct hit from a category four.

George or Bob,

What was your expectation for the rate of decrease in Mars Ursa output?

Average annual production for Mars-Ursa in kbopd

2018 – 202

2019 – 211

2020 – 162

2021 – 132 big Ida related outage – 155 prior to Ida

2022 – 143 through 5 months but shut ins in May, 157 prior to that

The big drop between 2019 and 2020 was at least partially due to the covid price crash.

It currently is hovering around 150 kbopd with interruptions from shut ins and storms. If you back out the shut ins and storms, the decline is pretty low – 5%?

Thanks Bob.

Are the shutins due to maintenance/ equipment failures typically?

Yes, shut ins are typically due to maintenance and equipment failures. On big offshore platforms, usually, alot of preplanning goes into these. You may plan a shutin for a year or two. You want to maximize the shutin time to try to keep it as short as possible while still getting everything done that needs to get done.

BSEE just came out with their estimate of GOM production for May and it was 1.51 mmbopd, compared to 1.61 for the EIA estimate.

This difference is bigger than normal. EIA data will line up better with BSEE data as the months pass. The BSEE data is that which is reported by operators and is what I have always considered the most reliable. BSEE data also changes slightly as operators do prior period adjustments.

Ovi,

Thanks again for the U.S. May Oil Production Update. I know it must take many hours to put together these posts. Interesting that the EIA Weekly Estimates for May at 11.9 mbd are 300,000 bd more than the 11.565 mbd shown in the Monthly data. Will this divergence continue? Or will the Permian and other shale fields finally begin to grow in the 2H 2022? That remains to be seen.

I just put out a new Public article on Peak Gold & Peak Oil… I believe we are at the ultimate plateau for both:

PEAK GOLD & PEAK OIL ARE HERE: Means Big Prices Moves Coming

With the world consuming five times more oil than it is discovering, Peak Oil and Peak Gold have finally arrived. However, the world hasn’t figured this out yet, but it will. And, when it does, we will see much higher prices for precious metals in the future. Why? Peak oil equals peak gold and peak silver production.

https://srsroccoreport.com/public/peak-gold-peak-oil-is-here-means-big-prices-moves-coming/

In that article, I posted this updated Rystad Oil & Gas Discovery Chart. With the world consuming 5 TIMES the oil that it is DISCOVERING, for whatever reasons, it won’t take long before we head down the OIL ENERGY CLIFF.

steve

Steve

What are your thoughts on this article? This popped up on my iPad this morning. I assume they were trying to manipulate the short term price to make a quick profit. I don’t think they could influence the longer term price.

JPMorgan’s Gold Chief Not ‘Mastermind’ That US Claims, Lawyer Says

https://www.bnnbloomberg.ca/jpmorgan-s-gold-chief-not-mastermind-that-us-claims-lawyer-says-1.1799123

Ovi,

First… thanks for looking at some of the precious metals articles. While this is an Oil Blog, Gold & Silver are important as they still function as a form of money, even though institutions value them currently as commodities… based on the Cost of Production & Supply-Demand forces.

Secondly, I will make this brief as this is an oil article, but I wanted to reply to you here. The weakness in the gold and silver prices is tied to the Institutional Market that controls the price action via the futures exchanges and, more importantly, the Gold & Silver ETFs. Due to the Fed & Central Banks, deflationary policies, we are seeing huge outflows of metal from the top Gold & Silver ETFs. Thus, if we want to understand the price action of the metals, we need to look at the ETF flows.

There is a direct correlation between the metal flows of the gold and silver ETFs and the price action… see attached chart.

My analysis suggests that when we start to go over the ENERGY CLIFF, then most financial assets, stocks, bonds, and real estate get into serious trouble as the values-prices start to collapse. This is when it is important to hold some precious metals.

Why? Gold and Silver have been stores of ENERGY VALUE for 2,500 years, just as they were during the Ancient Roman Empire. A Federal Reserve Note performs as a currency currently, but it does not store Energy Value; rather, it is an ENERGY IOU, the same with stocks and bonds.

Lastly, I agree that the Spoofing of Gold via the JP Morgan traders DOES NOT manipulate long-term prices. The gold and silver prices have been based as commodities on their cost of production and supply and demand. Bankers cannot change that correlation.

CHART BELOW: Gold Line is Gold Price and Bars represent Gold Metal Flows in & out of top Gold ETFs. Chart dated June 2020 to May 2022.

steve

Steve

The July 15 EIA Weekly estimates production at 11,900. Maybe that is a clue that they are hoping for some catchup. For July 22, production has jumped to 12,100. I wonder if they use a dart board sometimes.

As for Gold, you have added a new wrinkle that it is linked to oil. I used to think that an ounce of gold could buy 20 barrels of oil. That puts gold at close to $2,000/oz.

Then the economists convinced me that Gold and the dollar were linked and they moved in oppose directions. Below is a one year chart comparing the DXY to GLD. Up to April of this year both GLD and the DXY moved in the same direction. Then investors changed their mind and made them go in opposite directions for the last 3 months. Does this mean that economists are right 25% of the time?

We have participants on this board that say that dollar shortage will lead to oil going back to $25/b. I don’t believe that.

Steve, maybe you can find a unifying theory that will link the dollar, oil and Gold. The world would be grateful to you. Maybe its is simple as supply and demand.

As I understand, the main institutions buying gold are Russia, China, Switzerland and possibly some OPEC countries. Are these countries keeping the price of Gold up because they don’t believe in the $US.

Thanks for the link to your board. I also was glad to read “Setting the record straight, On gold and Silver Manipulation. I had a friend who always spoke of naked shorts and manipulation in the Gold and Silver markets.

My opinion on gold is you better own some and not the paper variety.

I said a week or so ago traders will try to ramp US stocks up off the way oversold conditions. Mainly the RSI reading. And this would be dollar negative. Until the oversold reading cleared up.

Might have a little further to run with this. I suggest selling into the rally because the dollar shortage is real.

Gold is also use a collateral. And when the collateral chains start breaking down further gold will get sold to meet margin calls. So a better buying opportunity for gold is coming.

Falling bond yields aren’t a positive for stock, gold or oil. Yields are falling because everyone is willing to pay a premium to get the collateral they need to borrow money in REPO. Collateral shortage not enough collateral. Avalanche of selling is on the way.

Another view of drilled and completed wells for major tight oil basins reported in Drilling Productivity DUC spreadsheet. This is Permian, Bakken, Eagle Ford, Niobrara, and Anadarko basins (only Appalachia and Haynesville are excluded because mostly shale gas is produced in those two basins). Data from page linked below (DUC data spreadsheet link is on the right side of the page)

https://www.eia.gov/petroleum/drilling/

Currently the DUC inventory is about 4 months at current drilling rate, back in 2014 (before first crash in tight oil completion rate in 2015) the average DUC inventory was about 2.25 months.

The average completion rate from Jan 2018 to Dec 2019 was about 1044 wells per month in the 5 major tight oil basins, in June 2022 the completion rate was about 804 wells, with 765 wells drilled. The increase in the drilling rate from Sept 2020 to Jun 2022 has been about 316 wells per year, if that rate of increase continues for another year we would reach the 2018/2019 average completion rate. The future rate may slow down, though if oil prices remain close to the current level (or higher) the rate might increase.

US tight oil data through May 2022, the annual rate of increase from March 2021 to May 2022 was about 537 kb/d (monthly average rate of increase was 44.75 kb/d). In 2021 the average Brent Oil price was about $71/bo and in 2022 the EIA expects average Brent price will be about $104/bo. Note also that there is typically a minimum lag between changes in oil price and changes in tight oil output of 4 months so we may start to see a higher rate of increase in tight oil output in the second half of 2022.

Data from spreadsheet linked below from US EIA

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

Dennis, I know that Bakken tight oil and all North Dakota production are two different things, but for obvious reasons, they track each other with only a slight advantage for all North Dakota. However, the EIA completely missed the Bakken weather anomaly for April and May.

In view of this glaring omission, I would conclude that the the EIA’s estimate for the rest of US tight oil for April and May is not worth a bucket of warm spit.

Perhaps Ron,

My guess is that the tight oil estimate is imperfect, especially for the most recent few months.

Can you point to a better estimate? Note that the estimate looks pretty good through March 2022 and will be revised over time.

For the rest of US tight oil output, historically the estimates have been pretty good. Obviously they missed the April blizzards for North Dakota, but as far as I know Colorado, Texas, New Mexico, and other tight oil basins outside of the Williston basin were not affected.

So in the absence of evidence to the contrary, I disagree with your assessment.

Can you point to a better estimate?

Of course, I can point to a better estimate. That was the one published by the North Dakota Department of Mineral Resources. That EIA report was published in July, three months after the April weather problem and two months after the May follow-up problems. The data was there, available to the EIA, but they have a serious problem. Their data is only updated as history.

Ron,

What about for tight oil basins outside of North Dakota? You specifically said the tight oil estimates besides North Dakota must be wrong. A bold claim sans any evidence.

The EIA was dealing with a serious server crash during Late June and early July, usually the data is pretty good imo.

Ron,

I found this interesting analysis from Novi Labs, Bakken with about 5 to 10% of Tier 1 loctations left based on this 2020 analysis.

https://novilabs.com/blog/the-bakken-core-is-running-out/

The article linked below is also interesting

https://novilabs.com/blog/can-unconventional-well-productivity-predict-peak-oil-production/

Note that based on the March 2020 analysis of the Williston and the wells completed since March 2020, if we assume all completed wells from April 2020 to Feb 2022 were tier one wells, that would suggest only 500 wells are left to complete that are tier one. This may explain the low completion rate in the Williston basin. If we assume tier 2 wells are also completed, the total wells completed in the Williston would be about 26000. There are about 8600 tier 2 wells left to complete as of March 2020 in the Williston.

Surprisingly, my analysis based on economics, well profiles and USGS TRR estimates suggests 27000 total wells completed in the Bakken/Three Forks with about an 8.5 Gb URR, this is fairly close to the Novi labs estimate based on more sophisticated machine learning models with more extensive data and which is likely more accurate than my very rough guess based on more limited data.

Ron

The DPR July report shows the April Bakken drop. See chart in post.

The EIA missed the July LTO report which would have shown the April result. Maybe this week a new LTO report should show up with April corrected.

Yes, Ovi, the DPR gets it right through April. They miss May by a country mile. And of course, their estimates for June, July, and August are likely off even further.

They were told that May would be affected by the April weather event. Yet they ignored it and just made their wild-ass guess anyway.

Ron,

The DPR is often wrong, but was updated more recently than the LTO data (last udated on July 7, 2022). Notice that the DPR was too low by a “country mile” from Feb 2021 to June 2021.

I don’t expect these estimates to be perfect. Note that the DPR was released on July 18 one day before the NDIC May data was available on July 19, the future is difficult to predict.

Notice that the DPR was too low by a “country mile” from Feb 2021 to June 2021.

Yeah, the DPR normally corrects their obvious mistakes. I have no idea why they failed to correct them for those five months. But I find it rather amusing that you would point out their mistakes in the past in an attempt to explain their mistakes this time around.

Dennis, five wrongs don’t make a right. 🤣

Ron,

I guess I should have spelled it out more clearly, sometimes their estimates are too low, that was the point. In any case I have never thought much of the DPR estimates. Though they can usually predict the past pretty well.

The DPR Bakken region includes 5 counties in Montana. Does North Dakota include those 5 counties within their estimate in order that it is a head to head comparison as it appears on the chart?

No, of course not. The data does not include Montana. I thought I explained that. But it makes little difference because the Montana input is so miniscule.

Reservegrowthrulz,

The Montana output is relatively small and not changing very much lately so we would expect the difference between the two to be relatively constant over the recent 12 months. Notice how closely the two data sets track from Jan 2018 to Dec 2020, we would expect that to continue for the most part from Jan 2021 to the present.

from a few days ago Mike said

“eliminating personal ICE vehicles because they all represent a “waste” of valuable resources is far-out extremism and divisive. Between the entitled left coast and the far left privileged coast, there is Middle America, where all the work gets done. We are decades away from economic, affordable use of renewables as transportation fuels.”

There is a lot of political angst here, which I will struggle hard to steer clear from, but there are also some very ill-conceived notions expressed.

First- ICE vehicles are not about to be eliminated. Rather, they are going to fade off… primarily in response to global oil depletion. Most places in the world are not oil producers, in fact only a tiny portion of the worlds population lives within a hundred miles of significant oil production. To be reliant on purchase of oil produced elsewhere serves a massive global incentive to switch to EV, simply based on the reliance of purchase of a depleting resource. Depleting resources get very expensive, unless replacements are part of the scenario.

This notion is not extremism- we are now in the early stage of a global mainstream transition in transport technology. If you don’t see it now, you will certainly find the trend impossible to ignore as this current decade unfolds.

Secondly. The view of a country where ‘all the work gets done’ in the middle is an incredible fallacy. This map shows where GDP is generated in the US. A big part of GDP comes from people working, even in this strange world. https://howmuch.net/articles/americas-economic-output-2018

Third, on being decades away from ‘affordable, economic use of renewables as transport fuel’, a few comments. We don’t have decades to get off petrol for general transport use- we have a short 10-15 years…the affects of depletion are already in the early phase.

Regarding affordable transport my observation is that miles traveled by any vehicle are generally going to be more expensive than we have gotten used to in past decades, whether this is sticking with a tank fill at the gas station or switching to a vehicle that gets charged up. There are two possible exceptions to this. One is that a less expensive battery pack gets developed. Secondly, many people will find per mileage cost with EV to be much less than a ICE mile traveled when petrol is over $2/gallon.

If oil was indefinitely abundant and much more equally distributed on earth, this story would be less clear-cut, but even so would likely shift slowly in the same direction. The electric direction.

Finally, consider the idea that the quicker most light transport is shifted to EV, the longer unrationed petrol will remain available for those with ICE, for whatever reason.

Nothing personal in any of this- focused on the subject matter.

Hickory,

You didn’t realize that people on the coasts just hang out at the beach all day? Clearly everything in the US is produced in Texas.

Many people see the country divided up in a simple way as Mike expressed.

In reality it is a very complex mosaic.

Downtown Omaha or Dallas has just as many office ‘workers’ per capita as does Sacramento or Hartford.

Wheat grown in WA requires as much work as wheat grown in Dakota.

Many see things in terms of rural vs urban. And yes these are big differences, but the word urban encompasses a huge and varied world, filled primarily with working people. And horse country Kentucky is a whole different rural world than is sugar beet field Calif.

And working in an urban or rural hospital is indeed work, just as is working at a manufacturing facility- urban or rural.

The country is not easily split into distinct provinces in any sense. It is a mosaic made with very blurry overlapping fragments.

Though I agree with much of what you say, I do have one remark:

A high cost share does not indicate that a sector contributes a great deal

to economic production as neoclassical economic theory claims. Indeed,

taking a simple derivative indicates that the dynamics of the cost share

gives a better indication as to the importance of a sector in producing

wealth. In particular if the derivative of the sector with respect to growth

is negative, that is an excellent indication that the sector creates wealth.

Thus, in a growing economy one expects a decreasing cost share in sectors

producing wealth, and in a contracting economy one expects in increasing

cost share. This is the case with energy production. See

https://doi.org/10.1007/s41247-020-00081-4

from your link- “Our analysis indicates that the contraction phase of world oil extraction began in 2020 and that it will be characterized by relatively low oil prices. ”

Well, that is something that i just don’t comprehend., unless they mean that oil will be rapidly replaced by some other energy at a quick enough big enough scale to match depletion.

I am skeptical that the job will get done.

“I’ll go out on limb and say that driving a personal vehicle around with an internal combustion engine falls into that category of extreme wasting of a precious resource, considering how lousy that mechanism is at utilizing the energy contained in the fuel,” is a incredibly radical statement and itself full of “angst.” mostly anti-oil angst, I suspect. If you feel the need to qualify that statement, I don’t blame you, but it wasn’t my statement. It was yours.

People that feel as if they they hold the moral or intellectual high ground over others are often miserably out of touch with reality. Retired urbanites, for instance, can afford to embrace expensive EV technology because they’re habitat is limited. No so for rural folks and particularly the common laborer who can barely make ends meet anyway and rather than buy a $60K EV to get to and from work would simply like to feed his family meat one day a week. That’s what I meant by “Middle America,” who by the way, is mostly fed up with having the financially privileged tell them what is best for them and for the country. For most of us folks it will indeed be decades before renewables can affect our standard of living in long term, meaningful ways. That is what I meant, you know what I meant; if you are through lecturing me about how complicated America is lets both move on. I am well aware of the different forms conservation of natural resources needs to take, including the realistic ones; thanks.

Dennis, If you don’t spend all day every day on the computer while lying on the beach, I’m sorry. Thats a bummer.

You folks don’t like conservative conservationists worried about oil and LNG exports and absurd stuff like long term energy security, I can tell. Got it. Adios.

“For most of us folks it will indeed be decades before renewables can affect our standard of living in long term, meaningful ways. “- Mike

Well, Iowa got 57% of its electricity from wind energy in 2020.

Their retail electricity rate is about 10% less than average in the country.

Thats meaningful. And its the beginning of a huge story.

Hickory- “internal combustion engine falls into that category of extreme wasting of a precious resource, considering how lousy that mechanism is at utilizing the energy contained in the fuel,”

ICE vehicles have tank to wheel energy efficiency of 28% best case scenario. This poor efficiency is on top of the crude oil energy losses that occur from the wellhead to refinery to endpoint delivery.

Regardless, once again I remind that we are having this discussion in the setting of global oil depletion.

As you well know- there is no choice on that, its just a matter of time.

Mike,

It was a poor attempt at humor. When you refer to the coasts of the nation (I assume you mean Atlantic and Pacific) and then say everything is produced by Middle America, I though you were talking about geogrphy, sorry for misunderstanding, so when you say Middle America you mean the middle class (or so it seems).

I think you are great Mike and like you a lot. Just because I don’t agree with everything you say does not have anything to do with liking you. Do you agree with all your friends on every topic?

Life would be pretty boring if that were the case.

I agree with many conservative political principles such as free trade. I also agree that we should conserve resources. We could stop producing 3.6 Mb/d of tight oil if most people think that is wise. I can afford the higher prices, but it is not clear that Middle America would be happy about the higher fuel prices that would be the result.

You are correct that EVs may not work for many in rural areas that have to tow a boat or trailer on long trips, ICEVs are better suited to those applications.

Many EVs are about $45k in price, similar in price to the average light duty vehicle. In my view it is up to individuals as to whether they want to purchase an EV.

The more people that choose to drive an EV the longer we can stretch out oil resources. Charging infrastucture will get built out and at $4.50 per gallon for gasoline an EV can be cheaper to own and operate, in addition competition among auto producers may lead to innovation and lower cost for EVs over time.

I agree it will take a long time before alternatives to fossil fuel will have a significant impact, but as fossil fuel depletes alternative sources of energy will help reduce demand for fossil fuel so that more can be conserved.

Am I correct that you would like to ban all oil and natural gas exports? The natural gas exports would be something new as far as I know.

The US government could stop approving new LNG facilities in the US which would limit a further increase in natural gas exports and may be a good idea. It seems unfair to restrict exports for facilities that are operating or under construction unless those firms are compensated for the change in the rules.

On conserving tight oil for future generations, about 4.4 Mb/d of tight oil can be handled by US refineries. If we stopped all exports of crude oil and let tight oil output decline to 4.4 Mb/d and id my 74 Gb URR estimate for tight oil is correct (not likely) we would have enough tight oil to last about 32 years at a constant output of 4.4 Mb/d (1.6 Gb per year) as we have about 51 Gb of US tight oil left to produce after May 2022 (cumulative production through May 2022 is about 22.76 Gb). This is not the policy I would choose, but I do not rule the world.

Ugh, Dennis. He comes here, willy nilly, and slaps you around and insults you to your face, and you respond this way:

“I think you are great Mike and like you a lot.”

Mike B,

I do think Mike Shellman is great. He expressed his opinion, fine with me, I have learned a lot from Mike and still do.

It’s not called the ‘splinternet’ for nothing. I’d pay good money to see Mike and Dennis hold a debate on any topic this blog covers. Make it a YouTube.

I personally believe that renewable energy and electric vehicles are going to have significant and possibly substantial positive impact on the cost of living for people who can’t afford them over the next five to ten years.

I’m basing this belief on the assumption that since new electric vehicles tend to be heavily used, and the assumption that they are going to sell quite a bit faster than anybody other than gung ho believers think they will………

We are likely to have five or possibly even ten percent less demand for gasoline per capita within that time frame. Given that the price of oil is obviously highly inelastic, this could easily mean electric vehicles will result in gasoline selling for quite a bit less than it would OTHERWISE.

Of course the demand for oil might nevertheless increase faster than electric vehicles can reduce it.

And shouldn’t there be a substantial tax on jet fuel?

Great Data Here OVI!

I ask for the insights here from Shallow Sand, LTO Survivor, Mike S., George K and others on REFRACS in the Permian.

I am in the upstream sector and we are getting a fair bit of feedback from oil co’s discussing interest in refracking – most specifically in the Delaware Basin. Mentions of WPX success is a driver. Apparently (news to me) a fair number of Barnett Shale wells were refracked (especially the early ones).

Is there a way to mine the data on the number of refracs in Texas?

Many Thanks

The RRC has a wellbore query form and I think one of the outputs is the number of recompilations. It may be a subscription service though. I find using the RRC site rather annoying. Part of the problem is that there are so many wells that you either get enormous data files that can’t be handled on a simple laptop or you have to spend hours filtering the requests to get many smaller files.

Drain that SPR…we don’t need it…

A longer view of SPR, data from EIA

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCSSTUS1&f=M

There may be people that believe that because the US now produces 11.6 Mb/d, that we don’t need as much oil in the SPR. In 1985 the US produced under 9 Mb/d of crude plus condensate.

I tend to agree with those that believe that drawing down the SPR to combat high oil prices is a very unwise policy move.

weekly stocks at link below

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCSSTUS1&f=W

most recent week (7/22/22) 475.5 million barrels.

Lowest level in >20 years…

Would SPR correlate with peak oil hubbert linearization?

Seems like it could but might not have to…

On current trajectory we’ll be at 1980 levels in a month or less…

I agree with Dennis and others of like mind that using SPR oil to keep prices down short term is a serious mistake, in simple black and white terms.

But given the well known tendency of the American public to vote for incumbents when the economy is doing well, and against them when they’re unhappy about the economy………

I’m personally happy to support this policy, with elections coming in a few short months.

Having Democrats in control, or at least having more instead of fewer Democrats in office is without any doubt whatsoever, as I see things, a guarantee that we will pursue more sensible energy policies in coming years.

You don’t have to pay a whole lot of attention to know that the R’s are the guys who tend to vote against regulations mandating higher fuel economy and against policies that will hasten the transition to electric transportation.

A very interesting 9-minute YouTube video on the oil hub of Cushing Oklahoma.

How Cushing Became the Most Important Place in All of the United States

Thanks Ron, nice video with great figures to put the geography into perspective.

Just looked at two drastically different time periods for US oil production:

For the the big shaleboom runup, September 2016 to November 2019 (little over 3 years) had production jump from 8.5 MBOPD to 13 MBOPD. Meanwhile, for the past ~2 years (July 2020 – May 2022) production has barely moved from 11 MBOPD to 11.5 MBOPD.

More recently, higher prices should have moved production up but looking at past 6 months a high of 11.79 MBOPD in November 2021 hasn’t been reached yet…

It seems that there is a production ceiling at 11.7 MBOPD that’s only been broken once in past 2 years…

Unless production really takes off I don’t see any of Dennis’ scenarios being remotely possible, I’m sure Dennis can tell me why they still work….

Kengeo,

It takes about 6 months between rising oil prices and a change in oil output, it takes time to make the decision to invest, prepare the site, drill and complete the well, typically 4 to 6 months. We have data for tight oil output through May 2022, December oil prices were $72/bo and they have only been over $100/bo since March. In addition investor sentiment is for oil companies to keep output flat and return cash to shareholders so mostly privately held oil companies are investing enough to increase output significantly, publicly traded companies are increasing output more slowly. On top of that there are shortages of labor, equipment, and materials which makes it more difficult to increase output.

If my guess that the lag time between oil prices being above $95/bo and increases in output is correct, then by August we might see a more rapid increase in tight oil output. Note also that if rig count and drilling rate continues to increase at the rate of the past 24 months, we are likely to see the completion rate return to the Jan 2018 to Dec 2019 average level.

We will see, the likely coming recession, if severe, could change things. It is always difficult to make accurate predictions of the future, my best guess inevitably is incorrect.

A refresher, I believe Dennis’ model has LTO monthly production increases of ~0.17 MBOPD for next 3-4 years…

Dennis – looking forward to an updated model when you get a chance!

OPEC oil output rises in July despite outages

The biggest increase in production, of 150,000 bpd, came from top exporter Saudi Arabia, the survey found, although the kingdom continued to pump less than its target.

Output in Libya, which dropped sharply due to unrest in June, posted a slow recovery and by the end of the month had recovered to normal levels. Libya is one of the members exempt from making voluntary cuts.

The United Arab Emirates and Kuwait boosted supply largely in line with their quotas, while Iraqi output edged higher.

The biggest decline, of 70,000 bpd, came from Nigeria, where outages and maintenance curbed output. Production in Iran and Venezuela, the other two exempt producers, was steady.

https://www.reuters.com/business/energy/opec-oil-output-rises-july-despite-outages-survey-2022-08-01/

Saudi Arabia’s July commitment was 10,833 Kb/d. Their August commitment is 11,004 kb/d.

The table shows that SA’s July production was 10,750 kb/d, 83 kb/d below target.

I can see some fancy words from SA along the line of “Saudi Arabia will increase their production by 250 kb/d in August, 79 kb/d more than the required 171 kb/d required by the OPEC 10 DOC.

That would make the Big Guy Happy and SA would still be in compliance. 😁😁😁

Decline rate of LTO wells, plus an extra source comparison plot decline rate shown as the [?] graph.

note- years of operation for the unknown source vs months of operation for the LTO wells

Hickory,

Output is the convolution of the well decline profile and the number of wells completed per month.

See post linked below for a detailed explanation.

https://peakoilbarrel.com/oil-field-models-decline-rates-convolution/

The output decline profile for the chart in the upper right corner is not for an oil or gas well.

92% of original output after 30 years

Hmm…how ever you slice and dice it the shale growth era is done:

https://daily.energybulletin.org/2022/02/oil-frackers-brace-for-end-of-the-u-s-shale-boom-wsj/

“U.S. oil production, now at about 11.5 million barrels a day, is still well below its high in early 2020 of about 13 million barrels a day. The Energy Information Administration expects U.S. production to grow about 5.4% through the end of 2022.”

It sounds like the ‘conservative estimate’ is no growth for US production above 12 MBOPD…

I continue to be thoroughly confused how anyone could project significant growth for US production…even with high prices…

Kengeo,

This is my best guess for US tight oil.

My view: OPEC+ has waited a long time for the shale basins to fizzle out. Tier-1 shale has been, for all purposes of consideration, exploited. Tier 2,3 along with refracs will keep American oil at a reasonable level for a couple years. There’s some mopping up to be done: going back to rapidly exploited areas like the Granite Wash, Austin Chalk, etc, and putting in a few hundred wells. And then it’s done, this thing known in America as domestic oil. But it’s worse. Roughly 75% of global oil production is on the wane. The world will likely see $300+ oil just before we go over the Seneca Cliff. This is coming faster—in my opinion—than most people understand. Along the way, as globalization winds down because of transportation cost and carbon tax, the nature of civilizations will change and the fabric of the world as we now know it will unravel. Much of the discussion on this site assumes an orderly transition to renewables and EV’s, presumably with enough oil to satisfy the petrochemical feedstock. I doubt that. I see raging inflation for pharmaceuticals, fertilizer and thousands of common goods. I see famine. They don’t call it a Seneca slope, but a cliff. You don’t go over a cliff without a lot of damage. GDP has for well over a century correlated with energy. Every electricity shortage pushes us back toward the cave. To go thoroughly dystopian, there is no way in hell to switch to non-fossil fuels energy before we run out of relatively cheap oil.

I’m in agreement with the gist of your comments.

Timing and severity of downtrend is debatable and unknowable.

Humans are damn good at kicking the can down the road, but are also untrustworthy and

tend to throw fuel on the fire of chaos.

They often revert to authoritarianism first. Watch out. Benevolent and wise authoritarian is an extremely rare animal.

Wow Gerry…that was really depressing

“The world will likely see $300 oil just before we go over the Seneca Cliff.”

Coal-to-liquids. If you aint got no oil and aint got no coal…you are in BIG TROUBLE!

Gerry, I formed the opinion over 20 years ago when I stumbled to Jay Hanson’s dieoff site. I has been a long road to where we are now, but the trends are accelerating.

I’m also of the shark-fin persuasion, not just in oil but in all resources and even society in general. The reasons are numerous and endlessly rehashed but at root, it is income suicide for any politician to talk about what needs to be done in advance. Luckily global warming became fashionable and may accidentally help mitigate PO, to an extent.

But comparing now, to 25 years ago when I first began reading about and attempting to do something about PO in particular, I find now is much easier. In 2002 when I decided to bug out the first time there just weren’t any reachable, viable small scale alternative energy sources beyond ethanol or bio-diesel—and those only using plenty of manual labor as input.

Today I have put together a pretty good 12kw 240v PV system with 30kwh of LFP batteries for a small fraction of what it would have been 10 years ago, let alone 25. Though I have been working remotely for most of 25 years it is very typical to do so now and even VERY remote is possible with starlink and others to come. The reason to work remote is obviously no commute, the reason to live remote is simply that land is more affordable and if you think you may ever need to grow calories — like say proxy wars between the 2 of the biggest oil, grain and fertilizer exporters— then access to a little land is important.

Could be that LTO bought enough time for enough RE to scale, could be that the population curve will bend for good reason not bad, could be we learn to live within our means. Could be there is enough time to prepare on a personal level.

Gerry,

I agree we may run short on cheap oil and it will become more expensive. Higher oil prices sometimes lead to changes such as what happened in the OECD after 1973 and 1979 (two big oil shocks). See my comments linked below suggesting a Seneca cliff in oil output is not very likely (especially the two charts).

https://peakoilbarrel.com/us-may-oil-production-extends-dropping-trend/#comment-743787

Gerry…

Probably not likely to see this doomsday scenario… humans are too creative and resilient… they change the rules and adapt. Plus, we like comfort and pleasure way too much to let society unravel. All will eventually be well in the face of adversary, as it always has.

Helping this… Tier 1 shale and the great unknown future discoveries will carry us longer than we need for fuel transition. Northern Howard County, TX, for example…. originally drilled targeting the Wolfcamp A… now has the Lower Spraberry Hz play working very well and consistently on the same acreage and some places even have the Wolfcamp D now starting to contribute. This has effectively started this region over for shale production development. So, I disagree that Tier 1 shale has been “exploited”… Even Tier 2 plays like Fisher, Scurry and Dawson Counties are gaining momentum to help offset mature decline. Really cool exploration stuff going out there if you look close enough. I spend hours a day, every day looking at it and it has blown my wildest expectations. From my first glimpse of a vertical Barnett Shale rig up in Wise County to seeing acreage in remote Reeves County go from $200/acre to $20,000/acre overnight (with all minerals)…. has been a shit ton of fun to be along for the ride!

So, I don’t see a cliff, just a rolling transition where oil/gas has its place and persists much longer than expected while transport fuel is replaced much quicker by EV than expected. Enphase just revealed that in its latest quarter…. amazing company.

Some news from Russia’s new field coming on line, but not before 2027.

https://www.rcinet.ca/eye-on-the-arctic/2022/07/28/deep-crisis-looms-but-here-comes-russias-biggest-ever-arctic-oil-project/

I’m sorry if it’s depressing but it is what it is, which is very different than the rosy scenario that is frequently promulgated. Iraq possesses roughly 10% of the known oil on earth. Russia has its share and then there’s Saudi Arabia. Mr. Shellman is correct: properly marshaled the U.S. has enough oil to just about last for a smooth energy transition. But with aggressive export, we will soon—very soon—be forced back into the position we were in during the first major energy crisis, the Saudi oil embargo of the mid-70’s. Only this time the Saudis won’t be sitting on an endless supply—their fields are in fairly dramatic decline that is mostly hidden due to some astounding technology. You seem to be shocked by the $300/bll figure. What would you charge for a necessary commodity in precious short supply?

I agree. Oil and gas production will decline faster than the expansion of renewable energies. Everyone here knows that oil and gas are finite resources. But still think that the availability of mineral resources as they are needed for harvesting renewable energies, batteries, electrification etc. (copper, lithium, cobalt, nickel …) is far better. It isn’t. Prof. Harald Sverdrup and his System Dynamics Group have developed the “Global Integrated Assessment Models” WORLD6 and WORLD7 to analyze the resource availability of almost all important resources. It is shown that the production peak for almost all resources under BAU conditions are between 2030 and 2080. A large-scale study by the German Federal Environmental Agency can be downloaded here (pages 407 to 409 show the summarized results)

https://www.umweltbundesamt.de/publikationen/the-world-model-development-the-integrated

Here is an abridged version

https://conference2020.r3-0.org/wp-content/uploads/2020/09/Harald-Sverdrup.pdf

In the case of copper, 2007 was the last year in which more copper was found by prospecting than was mined.

Copper discoveries – Declining trend continues

https://www.spglobal.com/marketintelligence/en/news-insights/research/copper-discoveries-declining-trend-continues

In addition, the EROI or EROEI of photovoltaics and wind, assuming buffering due to intermittency, is by far too low to support an industrial society.

Gerry Maddux,

It is not clear that the 50 to 75 Gb of tight oil the US might be able to pull from the ground will make much of a difference. Let’s imagine that the US bans exports of crude oil and the rest of the world follows the lead of the US and does the same. The US input to refineries is about 5.8 Gb per year. The US produces about 4 Gb per year and if we cut back tight oil output as Mr Shellman suggests by about 1.5 Gb per year (no exports leads to this fall in tight oil output because we do not have the capacity to refine more than 4.1 Mb/d) we produce only 2.5 Gb per year. This leaves the US about 3.3 Gb per year short on crude oil to feed our refineries.

I agree we need to prepare for peak oil and if there is no transition to EVs as some believe we may indeed see $300/bo before 2028. I expect demand would fall quite a bit at that price either through transition to EVs, or just less driving by choice or lack of affordability.

Do you have a definition of a Seneca cliff? I often see it bandied about, but even very sophisticated people don’t have an answer when I ask. I will arbitrarily define a Seneca cliff as a prolonged steep drop in production of 5 years or more with average annual decline rates of 10% or higher.

I don’t think we will ever see that unless we have a nuclear holocaust or a major asteroid strike.

Here’s a revised Oil shock model that I believe is extremely conservative (this is about as low as is feasible for World oil output). Note that I don’t know why the extraction rate for conventional resources would decrease as in this scenario. The annual decline rate in World C plus C output remains under 5% for all years from 2030 to 2100 for this scenario. Cumulative C plus C output from 1871 to 2065 is 2282 Gb and is 2490 Gb in 2280.

The extraction rate shown on the right axis is for conventional C plus C resources only, unconventional resources are modelled separately. Also note that world extraction rates for conventional oil were 8% or higher from 1871 to 1984 and 2020 was the lowest annual extraction rate of all time at about 4.8%, it seems unlikely that the extraction rate will fall below the 2020 level unless demand crashes due to a severe recession or a transition to alternative transportation.

Dennis, from eyeballing your chart I cannot quite make out what you have for world average production for the years 2022,2023,2024, 2025, and 2026. Could you give me the figures for those five data points? I realize it is just a guess on your part but I would still like to know what you guess world production to average for those five years. Of course, I would then be glad to provide you with my best guess average for those five years as well.

I see you have posted another guess below. I only wish to have your most probable estimate.

Thanks a million in advance.

Ron

Ron,

Data on chart below, the two scenarios are the same up to 2026.

Year— 2021–2022–2023–2024-2025-2026

Mbpd 77.04 78.70 80.54 82.26 83.48 84.29

Here is my best guess along with yours.

Edit: Sorry, I got too many i’s in your name. I can edit content of the post but not the chart.

Thanks Ron,

It will be fun to watch over the next few years. I think your guess is likely to be better for 2022 than mine, I think 2024 will be interesting where there is a 4.3 Mb/d difference in out estimates only 2 years in the future (though it will be a little longer than 2 years before we have the data for 2024, more like 2.75 years).

I think we will know before the end of this year whether or not the cornucopians are right. We can watch what happens to the total world production and get a very good idea. It all depends largely on two countries, Saudi Arabia and the USA. I would have included Russia but we now know Russia is in decline, even if sanctions are lifted.

Russia will be down 1 million barrels per day from her March 2022 production level next year. I doubt seriously that Saudi and the US can make up that difference plus make up the difference that the rest of the world will decline. As you can see from the chart below, World less Russia, Saudi, and the USA is clearly in a serious decline.

Click on the chart below to enlarge.

Ron,

There are lots of oil producers, sometimes output increases when oil prices are high, though it takes some time for projects to be developed, difficult to know exactly how it plays out.

Ron I will note the cornucopian forecast is less than yours for 2022, so I would say we need to wait until at least the end of 2023 to see if output is 79 Mb/d or 80.6 Mb/d.

Ron – Denis is rubbing off on you, 74 in 2028!

That’s basically flat production for the next 5 years…no way…

Adding my guess, it’s the least optimistic…

Kengeo, I am probably very bad at guessing the decline rate. The important thing is there will be a decline rate and world oil production peaked in November 2018.

We are post-peak, end of story.

Thanks Dennis.

A reason that global extraction could fall as you indicate here is producing countries moving towards failed state status and international relations breakdown.

We have seen examples such such Venezuela and Libya in the past decade.

No producing country is immune to sub-optimal internal operating conditions.

These potential limitations are impossible to model, of course.

You could compress the timescale to make it look like cliff so as to appease those who like that steep cliff narrative [or those who use such a compressed chart for marketing purposes].

Hickory,

Does it seem a reasonable assumption that all oil producing nations would become failed states simultaneously? In the absence of a worldwide catastrophe (such as a major asteroid strike or a nuclear WW3) such an assumption seems far fetched imho.

Also note the Mr Maddox assumes crude oil will cost $300 per barrel, under those conditions some oil producing nations will have high income from oil sales, the high price of oil might be an incentive to increase rather than decrease extraction rates and also note that during a period of very low demand in 2020 extraction rates only fell to 4.8% (annual average), prior to 2020 the lowest annual extraction rate ever was in 2019 at 5.26%, in 2010 the extraction rate was 5.58%, in 2000 it was 6.06%, in 1990 it was 7.12%, in 1980 it was 10.17%, 1970 it was 10.8%, and in 1960 it was 8.3%.

Failed state status and thus failure to meet oil production expectations is very unlikely to be a simultaneous occurrence in the near future.

And I suspect that in general you are right- high prices will be a big incentive for more production and this will help keep production going for longer than many here are expecting.

Nonetheless I still think the odds are strongly in favor of big unsatisfied demand, with very volatile markets and economic damage.

Hickory,

I agree prices will be high and volatile and oil will be in short supply at least until 2030 and perhaps much longer (if those who believe an EV transition is unlikely are proved correct).

An alternative scenario where I assume the conventional oil extraction rate does not fall below 4.8%, the higher extraction rate after 2030 in this scenario compared to the previous scenario increases the URR by 500 Gb to 3000 Gb.

Dennis – See graph below. Blue dots are similar to your light blue line…but doesn’t peak in 2026. The green dots are an extrapolation of current rates of decline. Other dots are ‘seneca’ cliff scenarios…yellow is 5 year crash from 2027-2032. Brown dots are a 2-3 year drop until 2027 and then slow fall to 2055 then stable trend. I image some hybrid of the green, yellow, and brown dots will be reality. I don’t think your blue line or the blue dots are realistic…the economy wasn’t built for stability while running in reverse…

Kengeo,

Oil is not the only form of energy. In 1973, people thought oil would need to grow at 7% per year for the World economy to function. From 1979 to 1995 oil output fell and did not return to the 1979 level for more than a decade.

Over the 1983 to 2019 period oil has output has been growing for more slowly than before 1973.

Perhaps after 2028 when oil reaches its final peak, the World economy will adjust as it has done in the past.

We just don’t know the future.

The fact is we have never seen a sharp drop in extraction rates, extraction rates have dropped from 1979 to 2019, by about 5% over 50 years. If we see a severe economic downturn that is long term, then oil demand will falter.

I doubt we will see that occur before 2040, but again the future cannot be predicted.

Ken,

I noticed you read my chart wrong, notice how your crash from 2027 to 2032 ends at 2039 on my chart, each minor gridline is 2 years not one. Also you could perhaps show your best guess scenario using the correct scale (make sure your end date matches the chart.)

77.0 79.3 81.0 82.4 83.6 84.7 85.6 86.5 86.5 86.4 86.3 85.6 85.0 84.3 83.5 82.7 81.9 80.6 79.4 78.2 75.2 72.1 68.8 65.8 63.0 60.3 57.9 55.6 53.4 51.4

My best guess data from 2021 to 2050 is above.

Ken geo,

Would you call the yellow dots a Seneca cliff? Does that look realistic to you? Can you paint a scenario that corresponds with your yellow dot scenario?

Cumulative World C plus C output from Jan 1871 to Dec 2021 was about 1437 Gb, I did a scenario roughly similar to your yellow dots with a resulting URR of about 1720 Gb, this is pretty far from reality imho. I modified my unconventional scenarios so they are basically a plateau from 2022 to 2040 at about 12 Mb/d (8 Mb/d tight oil and 4 Mbpd extra heavy oil).

The extraction rate for conventional oil has to be cut in half every year after 2027 to make this scenario a reality. Can you explain why you would expect this to happen?

Dennis – Simple really, if globalization continues to decline, we can envision cuts in oil demand (less trade) as well as cuts in oil supply (less demand and less ability to pay)…

To make this play out, here’s an option:

Russia’s war with Ukraine has only just begun to impact global energy supplies and trade. Russia exports majority of their oil. What happens if all of their supply evaporates from world trade? How do the dominos fall after this?

We can make different groups, the ‘Haves’ (Hs) and ‘Have-nots’ (HNs). Despite all the oil production in North America, we are barely in the Hs club (US is actually a HN). South America is actually just barely in the Hs club, but really should be considered neutral.

Asia Pacific is the biggest HNs by far, they import almost 30 MBOPD, producing only 20% (7/35). Next is Europe (still big), but 3 times smaller than Asia (10 MBOPD imports).

So in a nutshell, disrupting of oil imports/exports results in half of oil production and consumption drop.

There are so many scenarios that could knock out 40 MBOPD…at that point it’s safe to say that knock-on effects will likely drag other producers down.

I think there is a strong possibility that sometime soon we could see a breakdown in trade structure that sends oil prices down to $10-$20…

If globalization fails at a large scale then we can expect major contraction across the board.

If globalization keeps hobbling along then it will require high oil prices, but sooner or later it fails…

Most of us agree Peter Zeihan has some really great insights (but gets oil picture wrong)…he fully expects globalization to fail on a massive scale soon, he sees a future of smaller regional trade partnerships (Canada-US-Mexico)…

So we have four visions of the future (Smooth Energy Transition [SET], Bumpy Energy Transition [BET], Steady Decline [SD], and Seneca Cliff [SC])…I’m split between the SD-SC group…The SET/BET options seems like a pipedream that completely/mostly ignores so many facets (Proven reserve ESTIMATES, hubbert linearization, EV growth outlook vs reality, etc).

It seems like most of us are in the SD group but have a bad feeling that SC is closer to reality…not sure who all is part of the SET/BET EV will save us coalition…even worse I think is a group I will not mention who think shale oil will save us, but they are going extinct like the dinosaurs…

Kengeo,

Russia exported about 8 Mb/d of crude plus petroleum products in 2021 and World net exports of crude plus petroleum products was about 34.7 Mb/d in 2021. It is not very likely that all Russian exports will be removed from the market, likely it will be 1 to 2 mb/d at most. India and China and others will continue to purchase Russian crude and petroleum products. Recently Russian output returned to about 11 Mbpd (july estimate).

The decline in globilization that you foresee may be gradual. Clearly a fall in oil demand would reduce supply, but I doubt this occurs except in response to high oil prices leading to people choosing to consume less oil which will balance demand with limited supply. High oil prices may also lead to more investment and greater supply growth tahn would be the case in a lower oil price environment.

Well, this comment is REALLY stupid.

The US is the 3rd most populated country on the planet, has more internal combustion transportation and consumes more crude oil than any other nation in the world by a wide margin. If our nation’s politicians were to, for instance, overdose on smart pills and restrict crude oil and LNG exports, to increase future supply, including current inventories, want to replenish the SPR for the sake of our nation’s long term energy security, conservate, save, and keep America at a very real economic advantage over the rest of the world with its own secure, inexpensive supply of hydrocarbons…it doesn’t mean the rest of the exporting oil world will cease exports in retaliation. That’s dumb. Who gives a rats ass if they do? Since when does our great nation NOT do what it is suppose to for its citizenship because it’s terrified of the ramifications? Because we’re…scared? Here’s some big news for you, Dennis Coyne; OPEC doesn’t like America already, particularly YOUR current administration, and they are elated that the Permian tight oil industry is on a mission from God to drain our nation’s resources. They’re all holding back exports, plum giddy with being able to re-start those export to the US in a few years for three times the current price.

How many more excuses can you dream up to put America’s economic strength in the world in severe jeopardy with leveraged overproduction of tight oil, 1.5 billion barrels of annual oil exports and closing in on 7 TCF of natural gas exports annually? What do your dislike more, Texas, or your own country?

I can’t believe how hard a left turn this site has made; it’s gotten insane. You, Dennis Coyne, can’t even convince your own readership that EV’s are the answer to all of our energy future problems. You drive a penche EV but then brag about trips to Europe; did you row across the Atlantic in a little boat or spew forth a trail of jet fuel vapor in first class in entitled splendor?

Mike,

I have only ever flown on coach and have been to Europe a couple of times, I imagine it is my “privileged upbringing” at public schools and a state university in the northeast that makes me such radical.

We can choose not to export oil, these exports are something that has been advocated by your industry, don’t complain to me that they were successful. Now if you believe many politicians are likely to support banning crude oil exports you will find them on the left, I think they are stupid to suggest such a policy as it will lead to increased gasoline, diesel, and jet fuel prices.

As I said, I can afford higher fuel prices, I don’t think many in Middle America would favor a policy that leads to increased fuel prices.

As far as a crude export ban, this simply extends the time that we might produce tight oil and perhaps it makes us more secure, I doubt this as I think EVs will replace a lot of oil demand and prices for oil will fall by 2035 (best guess) t that point produceing tight oil will no longer be profitable and there will be a large share of it that remains in the ground forever, if we choose to ban crude oil exports. If we choose to ban natural gas exports as well as you advocate, this will also reduce natural gas prices which is good for consumers, but will lead to lower profits for oil producers (as the associated gas will sell for less).

Hey we could go into full isolationist mode and not import or export anything so that we are secure and are “scared” about our security, but as most conservatives understand this would make everyone worse off.

Note that I like both Texas and the US and also Mike Shellman, but that does not mean that the US political system could not be improved. The founders were scared of too much power in the hands of the government and designed a system were the government would find it difficult to accomplish anything, they accomplished their mission where the US government is paralyzed and has difficulty passing any legislation at all. For that reason the US is behind our friends in Europe on many measures of well being, doubtful that anything will change in my lifetime.

EVs are not the answer to all problems, just a way to get from point a to b without using gasoline or diesel (at least not directly, no doubt diesel was used transporting materials used to produce and to ship the vehicle). Fossil fuels will deplete and we will need to use less of them, EVs, alternative energy (including nuclear power), greater efficiency in the use of energy, and greater conservation of resources in general are some of the ways we can mitigate this problem. Slower population growth and slower economic growth will also help, though this last one is not one most are willing to sign up for.