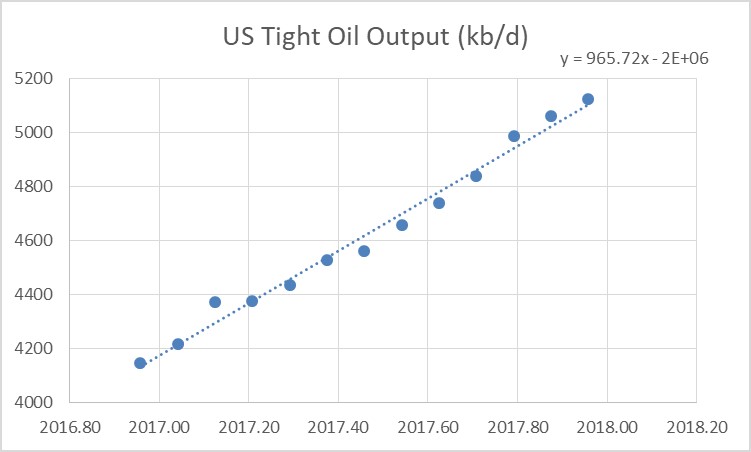

From Dec 2016 to Dec 2017 US Tight oil output has increased by 975 kb/d based on US tight oil output data from the EIA.

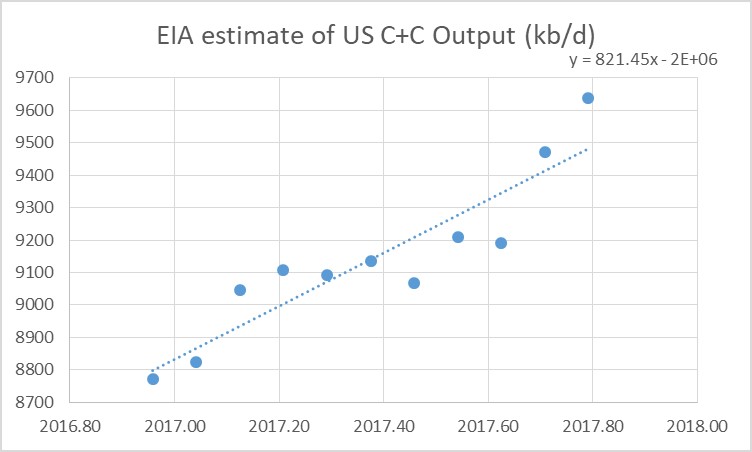

For the entire US we only have EIA monthly output estimates through Oct 2017. Over the Dec 2016 to Oct 2017 period US output has increased by 866 kb/d and the OLS trend has a slope of 821 kb/d.

Note that the 866 kb/d increase in US output over 10 months would be a 1040 kb/d increase over a 12 month period.

Most of the increase in US output has been from increased LTO output. The forecasts by several agencies (EIA, IEA, and OPEC) of more than a 1000 kb/d increase in US output in 2018 may assume that the recently increased oil price level will lead to increased investment in the oil sector.

Much of the increase in LTO output has been in the Permian basin and several factors may slow down the recent rapid growth. Among these are limited fracking crews, inadequate pipeline capacity for natural gas, which will limit output as flaring limits are reached, and potential water shortages.

Longer term the various LTO plays will run out of space to drill more wells in the tier one areas (the so-called sweet-spots) and this will limit the rate of increase within 2 or 3 years. It is likely that the Eagle Ford is close to this point, the Bakken might reach that point by 2019, and the Permian basin perhaps by 2021.

For US C+C output, I expect about a 600+/-100 kb/d increase in 2018.

I think you have it pegged.

thx Guym.

The Dark Side of America’s Rise to Oil Superpower

By Javier Blas

https://www.bloomberg.com/news/articles/2018-01-25/the-dark-side-of-america-s-rise-to-oil-superpower

The last time U.S. drillers pumped 10 million barrels of crude a day, Richard Nixon was in the White House. The first oil crisis hadn’t yet scared Americans into buying Toyotas, and fracking was an experimental technique a handful of engineers were trying, with meager success, to popularize. It was 1970, and oil sold for $1.80 a barrel.

Almost five decades later, with oil hovering near $65 a barrel, daily U.S. crude output is about to hit the eight-digit mark again. It’s a significant milestone on the way to fulfilling a dream that a generation ago seemed far-fetched: By the end of the year, the U.S. may well be the world’s biggest oil producer. With that, America takes a big step toward energy independence.

The U.S. crowing from the top of a hill long occupied by Saudi Arabia or Russia would scramble geopolitics. A new world energy order could emerge. That shuffling will be good for America but not so much for the planet.

For now, though, the petroleum train is chugging. And you can thank the resilience of the U.S. shale industry for it.

What didn’t kill shale drillers made them stronger. The survivors have transformed themselves into leaner, faster versions that can thrive even at lower oil prices. Shale isn’t any longer just about grit, sweat, and luck. Technology is key. Geologists use smartphones to direct drilling, and companies are putting in longer and longer wells. At current prices, drillers can walk and chew gum at the same time—lifting production and profits simultaneously.

Fracking—blasting water and sand deep underground to free oil from shale rock—has improved, too. It’s what many call Shale 2.0. And it’s not just the risk-taking pioneers who dominated the first phase of the revolution, such as Trump friend Harold Hamm of Continental Resources Inc., who are benefiting from the surge. Exxon Mobil Corp., Chevron Corp., and other major oil groups are joining the rush. U.S. shale is “seemingly on steroids,” says Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. in London. “The market remains enchanted by the ability of shale producers to adapt to lower prices and to continue to grow.”

To infinity, and beyond.

This feller used ‘hype’ because there is likely no word for bullshit in Farsi: https://oilprice.com/Energy/Energy-General/Saudi-Oil-Minister-Tired-Of-Shale-Hype.html.

https://www.oilystuffblog.com/single-post/2018/01/25/Cartoon-Of-the-Week

Geez Mike, your link to the oilprice.com story will surely bring Texas Tea back. Upsetting the oil minister of KSA is the ultimate sign of victory to the shale/political types.

These shale guys are bound and determined to kill the oil price rally, and IEA and EIA (which BTW in my opinion are both very political organizations) are really boosting it too.

I know you feel you have a short window, but hang in there. The current price is pretty good for “us types” and maybe it will hold between here and $55 WTI for the downside, while we blow through 10 million and 11 million, all the while thinking, just like 1970, that USA has unlimited supplies of oil.

I am starting to think the dollar is the key anyway. It was weak in 2011-2014, and oil was sky high. Might be headed that way again, who knows.

Really enjoying all of the history on Oilystuff. Keep it coming!

It’s curious that the fool shale guys are trying to kill the oil price rally, since they cannot make a profit without high oil prices.

In about 5 years, they wll ram headlong into the end of oil demand. Oil demand doesn’t actually really decline massively for about 12 years, but within 5 years it’s going to be shaky enough to be bad for oil pricing.

Let’s do some simple math. Almost all oil is used for cars. Elecrric cars are reaching purchase price parity with gasoline cars now and will be there within two years. Current bids for solar power are under $0.02/kwh. Add $0.05/kwh for batteries, or less for transmission. (These are current prices.) You get $0.07/kwh. A typical low-efficiency electric car gets 0.333 kwh/mile (3 miles / kwh), so that’s roughly $.023/mile. The best non-hybrid gasoline cars get 40 mpg, so this is equivalent to a gasoline price of roughly $0.94/gallon. At any gasoline price above that, it’s financially advisable for people to switch to electric cars.

A friend of mine did a long term regression between average US gasoline prices and WTI crude prices. He came up with gasoline price = $0.922 + $0.0261 * WTI price. It’s believed to cost $1 minimum to pull a barrel of Saudi oil out of an existing well. So there’s basically no way to keep gasoline below $0.94/gallon.

This is *it*. There will be bumps during the transition — it takes a while for wholesale solar prices to translate to retail, it takes a while for battery production to ramp up, it takes a while for electric car production to ramp up — but financially speaking, it’s already all over.

I guess if you can literally pu

Show me the money. Stop counting barrels and start counting profits.

“shale firms are on an unparalleled money-losing streak”

https://www.economist.com/news/business-and-finance/21719436-exploration-and-production-companies-are-poised-go-another-investment-spree-americas

It’s a Ponzi scheme.

Saudis speak Arabic, not Farsi; I knew that; sorry.

Thank you, Shallow. I appreciate that, mate. I am fast becoming fascinated with the history of the Illinois Basin.

Survivalist, as a lot of us expected, as soon as prices broke a $60 threshold the rhetoric about profits over growth would get thrown out the window. Lenders OWN the shale oil industry now; whatever they want, the get, and they continue to want yields on cheap stimulus money. Money is a drug to the shale industry and they are addicted, Wall Street and private equity the pushers.

How do you predict the future of an industry, the growth of the product it produces, under those circumstances?

@Mike,

‘How do you predict the future of an industry, the growth of the product it produces, under those circumstances?’

I think the expression you are after goes something like this:

https://en.wiktionary.org/wiki/rip,_shit_or_bust

It is kind of funny that there is talk of “energy independence”.

Looking at energy from oil only, we input about 16-17 Mb/d into refineries on average (for past 2 years), so if we assume we continue at that rate in 2018 and 2019 and reach 10 or 11 Mb/d of C+C output by 2019 we still need to import 5 or 6 Mb/d of oil.

Also note that the EIA’s Annual Energy Outlook (AEO) 2017 (released in Jan 2017) reference case has a 2029 US peak at 10.55 Mb/d, certainly not “oil independence” for the US, net oil imports are expected to be about 6.62 Mb/d at the peak in 2029.

Energy independence maybe not. But with a growing renewal industry, still a lot of coal in the ground and Tesla finally ramping up production, 2029 could be a sweetspot-year rather than a doomsday. I’m wondering if “America first” is in fact helping the survival of the United States in times of global collapse. Who knows? Parameters are changing that fast, I’m throwing away my civilization models as fast as Elon Musk announces new projects 😉

And I’m saying this as a European who must be very nice to Russia if he wants a similar outcome in his region …

WestTXFan,

I agree EVs, wind, solar, hydro, battery backup, and maybe some nuclear will go a long way towards helping as fossil fuel peaks and declines.

Hopefully entrepreneurs will see the opportunity this presents and will make it happen.

There is a ton of money to be made by those with the capital and foresight to see that an energy transition will need to happen over the next 20-40 years.

I’m reading about Davos and how things are booming.

But other than a growing global population, I see nothing in the global economy to suggest things are going to keep getting better. The last major economic transformation came with the commercialization of the Internet.

I can see renewable energy transforming the world, but we aren’t there yet.

Most of us here see fossil fuels in decline. Maybe not this minute, but the easy oil is gone and coal will be replaced as soon as possible.

Are the Davis types not aware of what we talk about here, are they ignoring it, or do they know and are just taking in the money as they can?

I know there is a disconnect from reality in the Trump administration. What about the rest of the world?

I realize that some people think the Peak Oil folks have cried wolf too often, but other than the relatively temporary boost from LTO, US resources are in decline.

I think things will really heat up when electric vehicles start making an impact. The oil industry will notice they can’t compete with electricity except in a few niches, and the niches are disappearing.

A rising oil price affects a very wide spectrum of produced goods, tending to increase costs and prices with a delay of a year to 18 months. EVs and their batteries will not be immune so expect them to become less affordable. Will gov’t subsidies make up the shortfall?, manufacturers take a hit?, or Jo public stump up the difference?

A rising oil price affects a very wide spectrum of produced goods, tending to increase costs and prices with a delay of a year to 18 months.

Do you have any evidence for that? Sources?

Here’s one:

http://www.coppolacomment.com/2017/02/uk-inflation-and-oil-price.html?m=1

Obviously there is a delay for oil price change to feed through the supply chain. In my experience this seems to be a year or so before the inflation appears at retail level

He seems to be saying the exact opposite:

“However, the rising oil price is evidently not being significantly passed through to consumer prices. A producer price rise of 20% is resulting in CPI of less than 2%. In fact the chart above shows that none of the swings in producer price inflation this century have been fully passed through to consumer prices – including the extraordinary speculative oil price spike just prior to the financial crisis and the QE-driven oil and commodity price bubble of 2010-14.”

The argument that rising oil prices will cause the price of EVs to rise is unrealistic: EVs are a manufactured product, and oil is not a significant input to manufacturing costs for things like vehicles. Oil products will obviously be affected. Food products will be affected a bit, in part due to co-correlation of commodities, in part due to the US linking corn prices to fuel prices through ethanol. But EVs? Not so much.

Oil is involved in the mining and transportation of goods.

Heavy duty machines and trucks are said to be not replaceable by electrics without major battery improvements.

Producers may be able to amortize oil price effects for a while, but it is doubtful that a sustained price increase won’t propagate through the chain. Minerals have to be mined, and transported, these are used to create the robotics, the roads, the facilities, the energy generation machinery, everything. The chain goes further and further, deeper and deeper, as robot parts are made by robots whose parts are also made by other robots.

Heavy duty mining machines are ALREADY being replaced with electric equipment. You’re way out of date. The biggest electric dump truck in the world was deployed in a quarry in Switzerland recently.

https://electrek.co/2017/09/17/electric-dumper-truck-worlds-largest-ev-battery-pack/

I think you might realize that all the equipment used in fully underground mines has been electric for years — those mines are now putting up solar farms and batteries to generate their electricity.

New Nissan leaf £26,490

New Nissan Pulsar £13,275

The £13,215 difference would pay insurance, servicing, parts, petrol and road tax for 8 years. With the leaf, you still need insurance and servicing.

Also battery car values plummet, some one who paid £30,000 for a leaf 3 years ago could only get £6,000 for it.

Electric vehicles (EVs) reached purchase cost parity at the top of the automotive market about 10 years ago. Due to lower running costs they had to have reached total cost of ownership parity years earlier (the CEOs of Rolls, etc. were totally asleep at the wheel).

Today’s EVs are significantly superior to internal combustion engine (ICE) vehicles in every aspect except for refill speed and the cost of each additional mile of range. While EVs enjoy significant superiority in every day use, to compete with ICE vehicles they must to provide long range travel on a reasonably close level to ICE vehicles.

Mass market acceptance of ICE vehicles showed a rough minimum range for those products of 300 miles. EVs must be near that minimum level to compete fully with ICE vehicles (only near since they are so much better in every other aspect). EVs therefore had to achieve roughly 3 hours of highway travel to compete successfully with ICE vehicles. Since 200+ miles of EV range is expensive (since each additional cell must be purchased versus just making the tank bigger), EVs reached purchase cost parity first at the top of the automotive market.

All of the major incumbent vehicle manufacturers have significant investments in current technologies that must be written off in a transition to EVs. Because engines were the key technology for ICE vehicles, they were one of the key technologies vehicle manufacturers kept in house. Roughly 70 percent of what incumbent firms are doing must be written off during the current transition to EVs. To manage the transition they have been gimping their plug-in products to reduce demand and pretend the results are a product of demand for the drivetrain. Most current EVs are overpriced (particularly for the vehicle class), have poor visibility, inadequate seating, dorky looks, inadequate range. Despite the fact that purchase cost parity occurred first at the high end of the market, incumbent firms have concentrated production on mid- to low-end products. Nissan is an incumbent firm with little incentive to greatly speed this transition. The Leaf has a name that restricts buyers (due to the “green” association), a short range, and it is over priced for its class.

All of this said, with the high gasoline prices in England, how many miles per year does it take before even the overpriced, gimped Leaf is cheaper to own than the Pulsar? How does the Tesla Model 3 stack up versus the Audi A4?

In the uk 2/3rds of petrol price is tax. Add the same to EV charging and they’re not so cheap to run after all.

And you need some 200 charging points to replace one fuel station, on a rate of energy transfer basis. Include EV depreciation and they are a non-starter for me.

Add the same to EV charging and they’re not so cheap to run after all.

Why would you tax electricity like that? Petrol is taxed heavily in the UK because it’s history as an imported item. The tax was a response to the fact that imported oil has very large external costs in the form of supply insecurity and transfer of income and wealth the oil exporters. Now, we recognize that oil has even larger external costs due to ME war, and serious pollution.

The principal reason to increase UK tax on EV charging would be to substitute lost revenue from petroleum retail sales. However a possible alternative is to introduce road pricing, based on distance driven and type of roads used.

The UK has produced a substantial proportion of its oil consumption from the North Sea, UK sector. Although production has declined in recent years, we still only net import less than half our oil. In the 80s and 90s we were net exporters. Petrol sales tax has nevertheless always been an important source of gov’t revenue.

EVs charged from the UK grid are deriving about half their power from FFs, 40% gas, 10% coal. In China it’s 64% coal.

possible alternative is to introduce road pricing, based on distance driven and type of roads used.

Is there any reason why substitute revenue needs to come from vehicles? Again, petrol is heavily taxed to reduce reliance on imports (while electricity is domestic) and there’s no particular reason I can see to tax EVs in a similar fashion. It’s true that there was a relatively brief period when that reliance was low, but it was a very wise decision for the long term to keep taxes high, and reduce the purchase of inefficient vehicles.

EVs charged from the UK grid are deriving about half their power from FFs

That’s an average. EVs are heavily computerized and connected – it’s pretty trivial to have them charge during periods when wind, solar and nuclear power are more important, such as during the early morning and early afternoon.

Nick

Why should someone who can afford a Tesla at over £100,000 get electricity subsidized by care worker driving from one elderly client to another.

https://visual.ons.gov.uk/uk-energy-how-much-what-type-and-where-from/

Despite UK having 18GW of installed wind capacity, wind often produces as little as 1GW.

Electricity is produced from gas and we now import over half and that is increasing.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/632523/Chapter_4.pdf

So natural gas should be taxed at the same rate as petrol according to your reasoning.

At the moment the government can subsidize electric cars because there are so few of them.

However with the country is so much debt the government could never lose the £28 billion it gets from petrol and diesel tax.

It will at some point have to tax electric cars just the same as ICE ones.

Why should someone who can afford a Tesla at over £100,000 get electricity subsidized by care worker driving from one elderly client to another.

How is the care worker subsidizing electricity?

And, why should a working class soldier lose his life or limbs to protect oil used by Range Rover drivers? Why should working class children get asthma, to allow people to drive Jaguars?

natural gas should be taxed at the same rate as petrol according to your reasoning.

Well, UK oil historically came from Iran. Overall world oil exports still come from OPEC, the center of oil subsidized terrorism. OTOH, yes, gas probably should be taxed heavily based on it’s import status and it’s pollution.

You agree that fossil fuels produce very substantial pollution, with very real costs, right?

Hi Peter,

A tax on all fossil fuels would make sense, taxing electricity separately does not make sense. Eventually as fossil fuel use falls, the government may need to raise revenue in other ways. Possibly a road tax, based on mileage travelled per year and the gross vehicle weight of the vehicle.

That make sense, but it needs more detail:

Currently fuel taxes are being used as a user fee and funding mechanism for transportation capex and opex. This is a real mistake. Fuel taxes don’t line up with road wear & tear: trucks (both freight and SUVS) badly underpay, while passenger vehicles overpay. This subsidizes truck freight, and hurts rail.

Fuel taxes aren’t nearly as high in the US as they should be to provide the funds that transportation needs. They also aren’t nearly high enough to account for all of the pollution and security costs they create. Fuel taxes should be much higher. Coincidentally, that would provide more funds for transportation.

In the long run we need to separate pigovian fuel taxes (for pollution and security) from user fees – then we could stop these unproductive arguments about taxing EVs. In the meantime, we should raise fuel taxes and give EVs subidies to properly account for real costs and benefits.

Hi Nick,

I agree road taxes based on fuel use are not ideal. A carbon tax on all fossil fuel would make sense, no subsidy for EVs would really be needed as they would only pay carbon taxes on any electricity they use that is produced with fossil fuel.

I agree. Subsidies for EVs (and renewables) are only needed in the absence of proper carbon/fuel taxes.

It’s worth mentioning that carbon isn’t the only external cost. Coal has very high non-CO2 pollution costs, as well as large mine-site and occupational costs (totaling around 14 cents per kWh vs 4 cents for CO2). Oil has much higher costs than gas – for both security and pollution. Diesel probably has specific particulate costs that don’t apply to gasoline.

Fossil fuel has given us large benefits, but we’re now realizing that it has large costs as well – its time to switch. And, if we simply properly account for those costs in consumer pricing, that transition will happen pretty quickly.

And, of course, there’s another benefit: we’d save fossil fuels for the future, as Mike is proposing. With luck we’d never need to burn them, but we might want them for chemical feedstocks, or something like that.

Stan is right – the Leaf and the Pulsar aren’t comparable.

Heck, if the price per km is the only important metric, why not ride a scooter?

More importantly, this comparison doesn’t include pollution, military costs or the risk of inadequate supplies.

stan1

The first leaf cost around £30,000, they have lost £25,000 in value in 5/6 years. For £25,000 you can buy 2 petrol cars of the same size and have money left over. So your idea of parity is some what different to mine.

It also had a range of around 110 miles, this is fine for most commuters there and back. However very impractical for a weekend trip to see friends or go on holiday.

In my car I drive 250 miles without having to worry about running out of diesel.

The new leaf is still very expensive.

http://offers.nissan.co.uk/GB/en/car-deals/electric-vehicles/new-leaf/offer-1.html

After 6 years the leaf is hardly any more affordable. most people that I know can afford £12,000 -£14,000 on a finance deal. The £13,000 difference pays for all their fuel, insurance, servicing for over 7 years.

You can buy a Yaris for £13,000, petrol would cost about £1,000 per year. Servicing and parts £500, insurance £300 road tax £150. In effect if you don’t buy to leaf and buy the Yaris you get 7 years of motoring for free! Also in 7 years time the leaf would have lost £20,000.

You can talk about parity all you like, most people know how to add up.

When an electric costs the same as a petrol car, then I will buy one.

Hi Peter,

The Leaf is a much nicer car than the Pulsar, for a fair comparison you have to compare with a similar car.

A Toyota Yaris is a POS car, there are no EVs available in Europe or North America that are such low quality, the minimum trim level is similar to a top of the line Toyota Corolla or Nissan Versa, and the Leaf is about the same size car.

Try to make apples to apples comparisons, if you want to make a better argument.

I have a Subaru, Camry, and a Yaris.

I drive the Yaris 90% of the time, even though the Subaru is a 2017.

Hi Hightrekker,

To each his own. A scooter or bicycle might be more efficient than a Yaris. I drove a 1980 Tercel from 1984 to 1990, but it was my only car, drove a 1984 Tercel that got totaled and have driven an Accord, 2 Camrys (one is a hybrid) and 3 Prii since (latest a plugin).

Have never driven a Yaris, if it’s like the Tercel not a very good car in my opinion.

The point of my previous post was that there is no EV as poor quality as a Yaris (except perhaps in China), so comparing the price of a better car with a cheaper car is like comparing a Camry with a Yaris. The Camry or a car like it will cost more.

If one likes a cheaper car, then buy it. Not everyone wants to drive an econobox.

I always chose the Yaris over the Camry.

I’ll take the Subaru if off road is a issue (living in Bend Oregon, off road is a issue).

But I must confess, I am a minimalist.

The Yaris is bullet prof.

Hi Dennis.

You are doing the Yaris a disservice, especially when you decide that Toyota has learned nothing about small cars in the last 40 years, and that you drive a smallish car made by the same company.

I own a 2007 Yaris with a standard transmission. I have never owned a more reliable car. A battery, two sets of tires, front brake pads, an exhaust pipe and gasket (still the original muffler), regular oil changes. That’s all. Never had a breakdown of any kind. Drove it 150 miles today: still surprised at how smooth it is and how you can find yourself cruising at 80mph if you don’t pay attention.

My explanation to people when I bought the car was that I wanted the best 1.5 litre motor I could find; it just happened to have a Yaris wrapped around it.

The only change* I would make is the seating position: the headrest kicks your neck forward, and you get a cramp in your right leg after 2 hours of driving.

-Lloyd

*Edit: Almost true…I would give it a longer first gear, too.

Dennis

The Tercel production stopped in 1999. Production quality is much better today. Anyway if you have never driven a Yaris you cannot say how good it is. Also a camry is a good sized car, a leaf is small, so I think you need to compare like with like.

https://www.toyota.com/camry/

As I said, buying a leaf is ridiculously expensive. I could buy a 5 door ford fiesta which is the same size and put the £14,000 saved into a 7 year bond.

Then in seven year buy another brand new car.

In seven years time the Nissan leaf would have lost £20,000 of it’s value.

For myself £20,000 is 10 years of tax, insurance, servicing and petrol.

It really is no contest financially.

Peter,

Do you have a source for your cost comparison?

In the US, Edmunds.com is an authoritative source which tells us that both the Nissan Versa and the Leaf are very close competitors to be the very cheapest cars on the road to own and drive over a 5 year period, taking into account all costs including maintenance and depreciation.

If you add in external costs for oil like pollution and security, the Leaf would be significantly cheaper.

You agree that oil wars, oil supply shocks and pollution have real and serious costs, right??

Hi Lloyd,

Correct, I have never driven a Yaris.

The main point is that the Leaf is a nicer car than the Pulsar. Kind of like comparing a Camry to a Yaris. I have driven various econoboxes as rentals, they are not very nice cars, perhaps the Yaris is a nicer car than a Camry, but I doubt it.

‘When an electric costs the same as a petrol car, then I will buy one.’

To which I would add a whole list of other things, of which are two:

Steel, not aluminium, body panels. Alu crumples like tissue paper and is expensive to repair:

https://jpwhitenissanleaf.com/2011/12/10/leafless-in-nashville/

Secondly, an expected durability of 250,000 miles without major maintenance.

A tall order, I suspect

an expected durability of 250,000 miles without major maintenance.

EVs are substantially more reliable than ICEs. But, you seem to want even better than that. Why?

Nick,

I am of course going on my own experience. The car I have has done 300k miles with no major repairs. (2004 Honda CRV, auto.) It costs about £2,500 p.a. all in, for 10,000 miles, of which £1,000 is petrol tax. The car is worthless, so I am not too bothered if it gets dented, and it is good on poorly maintained roads. There is very little aluminium in it so parts, which are cheap and easy to replace, do not corrode and seize. It has no rattles and is comfortable and quiet.

I am hoping for another 100k-150k miles before it goes to the crusher.

While it probably doesn’t make very much difference environmentally, I do like to make goods last as long as possible. E.g.: Electric cooker: 35yrs; fridge 35yrs; washing machine 30yrs; central heating boiler 37yrs (overall efficiency about 82%, b.t.w.); microwave oven 30yrs. I have a surprising number of friends and acquaintances who run old (30yrs+) Massey Ferguson and Ford tractors. These chug away year in, year out towing everything from wood to boats. One of them goes into the sea daily. They look as if they should not work, yet the engines sound like new. It is the electrics that tend to fail, not the mechanicals.

There’s talk these days about plastic waste in the oceans, which anyone could have seen coming. The book ‘Moby Duck’, by Donovan Hohn, highlighted the problem in 2011. So I suppose I do my bit by minimising plastic waste, as well as keeping costs down.

At least in the US a 30 year old fridge uses considerably more electricity than a new one, so keeping the old probably doesn’t save you money and may not be better for the environment. The same is true of washing machines with newer models being far more water efficient and clothes dry faster because more water is removed in the spin cycle.

I agree that using many things as long as possible makes sense.

Everyone is different, the EVs may last a million miles, though they might require battery replacement.

Wow

300k, I have heard the Honda CRV is good. Our of interest what make is your washing machine?

Peter,

Washing machine is a Miele. It hasn’t had a single fault in over 30 years. It probably does use more water than a new one, however.

The fridge is Electrolux. It’s pretty efficient, and fairly small, (certainly by US standards.) The motor/compressor hasn’t deteriorated. It clicks to ‘on’ about 1/4 of the time for 5C in a 21C room.

Jon Madden,

The fridge from 30 years ago is the same efficiency as one that could be purchased today?

In the US, efficiency has improved quite a bit for refrigerators over the past 30 years, though mine is also pretty old (roughly 20 years) and Europe may have been more aggressive with efficiency. Big changes here from 1985-2000.

Refrigerators could be made much more efficient. A 1947 fridge used about 400 kwh per year and even in the 1950’s with full freezer and refrigerator combo they used about what our modern fridges use today.

Better insulation, less frills and a better heat exchanger system would make for a fridge with all the capacity and half the power use or less.

Dennis,

I think my fridge, which dates from 1982 or so, uses about 350kWh/yr. It is well constructed and insulated, with the heat exchanger cooled by convection. Owing to under-counter space constraints one can be tempted towards fan-cooled exchangers, which may be noisier and use more power. I have thus far resisted the request from my wife to use the space for a larger fridge!

Thanks Jon,

How many cubic feet? For about a 17.5 cu ft fridge +freezer the best today (mainstream brands) use about 360 kWhr per year, a small 5 cu ft frig uses about 200 kWhr per year, for brands sold in US.

Dennis,

It is 7 cu ft capacity.

I haven’t actually checked the compressor power recently. I seem to remember 135W. Next time I pull it out I’ll take a look. But I think it’s safe to assume it’s using something approaching 1kWh/day – rather more than a new model. This does include it being opened frequently of course.

Nick has made the most important point. The externalized costs of oil fueled vehicles are so great that we should implement tax regulations that reflect these costs.

If and when this happens, and in my opinion it WILL happen, at least in more enlightened countries within a decade or so, electric cars won’t cost any more than conventional cars, all costs of owning and driving them taken into account.

But Peter is dead on about the higher upfront cost of a comparable electric car being a killer. There’s no way in hell a person who is seriously economically literate, in terms of managing and investing his money, would pay the extra money for a Leaf. The odds are at least fair to good that he could invest that much and get another new car, eight years down the road, with his investment income plus his trade in.

Or if you are in a position to put ten grand down on a house worth fifty to a hundred, and live in it with a fixed P and I loan, with rents going up, and houses going up, well, spending the extra on the electric would be as dumb as dumb can get, in terms of money management.

It’s this little bit of simple arithmetic that convinced me back when I was a freshman in the Dark Ages that new cars are about the worst possible of all significant purchases.

In my neighborhood, you can own three old cars in a one good condition- for an old car….. taxes and insurance included….. for less than the depreciation alone on a new car, on an annual basis. So when I was driving a lot, I had an Escort for fuel economy and ease of parking and so forth to run errands to town, a land yacht Buick for special occasions, and a four by four truck for when a truck was NEEDED.

There might have been one or two days when I was down to one vehicle ready to go, due to needed repairs, but no more than that, over the last twenty years.

The guys who laughed at my old cars and my old truck aren’t laughing now. They have memories, I have property….. bought with the money I saved by avoiding buying expensive cars.

Some of them are still renting, lol.

My own personal wild assed guess is that it will be between five and ten years before you can buy an electric car that is comparable in every respect to a conventional car for the same money, without electric car subsides.

I don’t think it’s range that’s slowing up sales of electrics any more, it’s price.

There are tens of millions of people in this country that have two, three, or more cars in their household, and they are smart enough to understand that they can drive the hell out of a two hundred mile range electric commuting to work, shopping, taking the kids to a ball game, etc, while keeping the nicer larger more impressive conventional car out of the road salt and shopping center parking lots where it gets dinged, and reserve it for going out to eat or visit or the occasional weekend and vacation trip.

Electric cars will sell like ice water in hell once they reach true price parity, meaning the same price as a comparable conventional car WITHOUT any tax break or subsidy involved.

The owners of stores, restaurants, hospitals, apartment houses, single family homes, etc, can easily afford a charging station. Hell, they won’t be able to NOT afford charging stations a decade from now. A restaurant owner will find it NECESSARY to have a charging station or two, pretty soon, so as to keep his customers from eating elsewhere because they can charge up ELSEWHERE while dining out.

Electrical work is relatively cheap where I live, and as the owner, I am legally entitled to do my own in Virginia, and do it. I can add a six kilowatt charging outlet beside the parking space at a rental, doing it myself, for no more than a couple of hundred bucks. Hiring it done would cost less than a thousand.

Charging stations are dirt cheap, unless you buy something dedicated specifically to a certain arbitrary standard. Hell, all you really need is a thirty amp 240 volt circuit with a weather proof outside fixture with a receptacle that will accept the plug on the end of your car’s charging cord. That’s capacity enough to keep damned near anybody charged up beyond his day to day needs if he plugs in before bed time.

Ofm, I am pretty much with you on that. Had three paid of trucks and autos, had to get a new one, because the 500 mile trips to our coastal property were pretty much questionable with a two hundred thousand mile vehicle. Got one with 6500 miles on it for $9. Thirty five to forty per gallon is not too steep for something we don’t have to find a charging station for. To me, autos are just transportation, not something I compare to others with.

Mac, two thoughts.

1st, it’s worth specifically acknowledging that a Leaf’s Total Cost of Ownership (cost of buying and operating) is very low – roughly the same as a Versa/Pulsar, which is, as Dennis says, a POS. It’s true that their upfront price is higher, and that most people pay more attention to purchase price than operating cost. They’re making a mistake to do so. Of course, we do have to work with that particular common cognitive failure, but…let’s acknowledge the economic fundamentals.

2nd, if as Peter says a Leaf can be bought in the UK for an 80% discount after several years…that makes a used Leaf incredibly cheap to own and operate. I realize you like to buy cars after they’re 90% depreciated, but most people are content to buy cars after less depreciation than that.

Hi Nick,

Also worth noting that with a rapidly evolving technology like EVs, the newer cars are far better (more so than conventional cars) so depreciation is much steeper.

That’s the risk for early adopters for any new technology, one which most early adopters are well aware of.

Yeah, I think a lot of plug-ins get leased for that reason.

Yea, I’ve spent quite a bit of time in a Prius, as a housemate had one (I actually drove it from St. Louis to Marin). I don’t mind driving it, but it has visibility problems, and the Yaris is a better option.

The Camry (I like it, but why take a car that is harder to park, and less efficient?) is a option for long trips, boring and efficient, but works.

Tercel? Had a housemate with one– agree, a sacrifice.

The 90% Yaris comes out on top.

I have spent time in a Fiat 500e, as a friend has one.

Works great around town, but you are not going to be traveling a long distance.

For Sonoma, it works as long as the City is not necessary — Bend- no way.

Hi Nick,

It’s also worth pointing out that money has enormous TIME VALUE, if you have brains and ambition enough to think for yourself, and MANAGE money, rather than money managing you.

I know you are very intelligent, but bottom line, from the pov of an INDIVIDUAL, rather than society, you are talking about BUYING NEW CARS.

I will post some more over in the non petroleum thread, and mention the time of this post and yours to help anybody who cares to understand the context.

.

Well, keep in mind that this cost analysis is the same for new or used. In fact, Peter is suggesting that used EVs in the UK are an incredible bargain.

See you on the flip side!

I continue to read about the coverage of Davos.

Most stories say everything is doing great and the CEOs are happy.

But when I follow stories about individual industries, I see lots of concern about the future.

The one organization at Davos warning about 2019 and beyond is the IMF.

Also, there is this.

“And while the short-term growth picture looks rosy, the prognosis for the long term—as defined by the prospects for potential growth—is sobering.”

https://www.brookings.edu/blog/up-front/2018/01/22/davos-attendees-should-beware-the-slowing-of-potential-growth/

“Many economists are skeptical that the benefits of growth will reach beyond the educated, affluent, politically connected class that has captured most of the spoils in many countries and left behind working people whose wages have stagnated even as jobless rates have plunged.”

“As the World Economic Forum this past week released an assessment of risk factors featuring a survey of 1,000 experts, it found that 93 percent of respondents saw increased threat of political or economic confrontations. Some 79 percent fretted about heightened likelihood of military conflict and 73 percent saw rising risks of an erosion of world trading rules.”

https://www.nytimes.com/2018/01/27/business/its-not-a-roar-but-the-global-economy-is-finally-making-noise.html

More about the possible risks in 2018.

https://www.cnbc.com/2018/01/17/world-entering-critical-period-of-intensified-risks-in-2018-wef-says.html

This has a good chart showing how global indebtedness has been rising when comparing 1997 to 2007 to 2017.

I understand the argument that debt is not a problem if you can pay it back, but I fear that debt has been used to further consumption rather than to improve productivity and fund new scientific and technological advancements. In other words, the world has been borrowing to finance a sugar high that won’t serve us well.

I am also not concerned that world civilization will collapse if debt isn’t paid back. What does concern me, however, is that the current cheery global growth figures might be masking an unsustainable global economy.

http://www.independent.co.uk/news/business/analysis-and-features/global-debt-crisis-explained-all-time-high-world-economy-causes-solutions-definition-a8143516.html

Below is the World Bank numbers for GDP growth – ten year trailing average. The World Bank uses dollars and I realise there are lots of arguments about per capita, local currencies, GDP being meaningless for many real life purposes, etc. but the overall trend is really unremittingly down except for the jump in the early 80s and the China pump earlier this century, with the OECD hitting zero somewhere in the mid twenties, possibly earlier if there is a big energy price spike on the way. Debt has gone from about one for one to six for one in terms of debt to growth (I think since about when Reagan and Thatcher took over). At zero growth it will be infinity and then negative, at which point, or a bit earlier, some different sort of economic theory surely has to take over. Maybe it already has, currently it doesn’t seem like proper capitalism to me as markets are being set by government and central bank policy for the benefit of the rentiers, not by intrinsic asset value.

There’s different sort of debt – financial institution debt doesn’t seem a big deal as they just owe each other the money, government debt not so much either as they can just create what they want, but private debt seems the thing that can just destroy a country if it goes wrong.

I don’t know much about it though – I’ve tried reading some macro economic books and most seem to start with an implicit economic framework which has almost nothing to do with the world I see that is driven primarily from extraction of resources (including space to dump waste), and secondarily by individual equality and property rights. All those things are gradually going from most countries, assuming they originally existed, so it doesn’t really surprise me that GDP growth is declining.

Government and financial institution debt is not a problem as long as everyone is doing it. If one single country goes on a debt binge like this they would be punished by international currency and bond markets. If they all do it – where can you go to escape it? Might help explain cryptocurrency rise and (still going!) australia and canada housing bubbles. probably the only two mildly worrying things for the global masters – dollar weakness could create unforeseen currency disruptions; oil price rise could make flow of payments difficult even with infinite money creation.

twocats wrote: “Government and financial institution debt is not a problem as long as everyone is doing it. ”

Consider an analogy: “Recreational Drug abuse is not a problem as long as everyone is doing it!” You statement is no less appropriate than mine. There is little difference between using debt for self indulgence than using recreational drugs.

Clearly debt is a problem when global interest rates are at historic lows and have remained there for nearly 10 years. Interest rates must remain low so that companies and people can service their debt. The issue is that rather than paying down debt, borrowers, are doubling down on their debt, when interest rates were dropped. Sooner or later they will once again have trouble servicing their debt even when rates are at extreme lows. At some point we will hit a another debt wall and we’ll face the same problems faced in 2008, but without the option to drop interest rates.

Nothing has been fixed, They just managed to kick the can down the road.

twocats wrote: “Might help explain cryptocurrency rise and (still going!) ”

Not really Cryptos crashed about 2 weeks ago and remain in a bear market. They may have crashed all the way to zero if there wasn’t a large buy propping them up. Not sure if these buyer(s) are hedge funds or even central banks, but its clearly that someone stepped in to catch the falling knife.

trust me, I would like to think the debt bubble has consequences dear enough that it would force them to stop, but no one has given me an argument other than “it can’t go on forever” as the reason. I read Doug Noland regularly – and occasionally he highlight a small ripple in the smooth sailing waters, but that’s about it.

with peak oil dynamic so strong right now one might ask – “what alternative do they have?” global capitalism has been untenable since 2009, what makes anyone think it would be more feasible AFTER the popping of the largest bubble ever created in the history of humanity (and that is not at all an exaggeration)?

smaller points:

1) to think cryptocurrencies haven’t had a massive, accelerated drive is to be blind.

2) the still going was referring to housing bubbles, not cryptos. though I believe many believe that cryptos are a put on global CB debt

3) your recreational drug use analogy is not convincing. if everyone agreed that using drugs was ok, then, well, ok. it might result in increased fatalities and mistakes, just as global debt binge is resulting in misallocation of resources and hot-spot inflation flare-ups. but if you are drug manufacturer for these recreational drugs then I fail to see the incentive to stop. just look at oxycontin. everyone was doing it, everyone in the supply chain was making money, now we’ve got an opioid crises. Do you think anyone from the Sackler family will ever go to jail or suffer consequences for their massive crime against the US? Ha, I say! Ha!

twocats wrote:

“global capitalism has been untenable since 2009, what makes anyone think it would be more feasible AFTER the popping of the largest bubble ever created in the history of humanity (and that is not at all an exaggeration)?”

The current bubble is much much bigger than the 2008 bubble. You think after creating two bubbles: 2000 dot-com and the 2008 housing bubble that people would have learned about consequences. Nope: Let’s shoot for an even bigger bubble!

Quote: “Insanity: doing the same thing over and over again and expecting different results.”

twocats wrote:

“I would like to think the debt bubble has consequences dear enough that it would force them to stop, but no one has given me an argument other than”

Considering that the previous two bubbles (2000 & 2008) had dramatic consequences, I would think it would be self evident by now. But it appears you & most of the world, haven’t connected the dots yet. Perhaps the third crisis will provide enlightment?

In the end, its going to lead to another World War, just as it did in the 1930’s. This time won’t be different.

twocats wrote:

“to think cryptocurrencies haven’t had a massive, accelerated drive is to be blind.”

Tulip mania! When people start taking out second mortgages to buy BTC, there is a problem. Ditto for Stocks with Margin debt at an all time high. Cryptos will are the digital version of Ponzi/Pyramid schemes. A few people will become very wealthy while leaving millions of speculators impoverished. Most people are speculating in Cryptos hoping to become wealthy (ie Get Rich quick without doing anything)

twocats wrote:

“3) your recreational drug use analogy is not convincing….”

re-read your own #3 reponse entirely & carefully. You self answered why the analogy is a perfect fit.

Tech Guy –

Well said. And if Reality ever gets a say in the matter you will be proven correct.

Viagra is recreational drug use. Not everyone is doing it. Only problem I can detect is increased STI’s in old men.

Another article about how the global economy is debt driven now.

https://www.ft.com/content/5d6ca2d6-de81-11e7-a8a4-0a1e63a52f9c

Cashed out leaps, pocketed the initial investment, and put the winnings into USO leaps Jan 2010 strike 14. Its over $13 now, so not much of a risk. Guess you don’t need to be a rocket scientist to figure this out. But I was in the same position in 2015, and lost the winnings when it went down, way down.

EIA Webinar for Weekly Crude Oil Production Estimates – Mon Jan 29 1pm (EST)

Register: https://t.co/JEdCssYOk3

It will be available after: https://www.eia.gov/pressroom/events/more_webinars.php

Who are these numbers actually for? No other country produces anything like this, most are monthly numbers 2 or 3 months late. No business or political decisions are going to be made on them so I can only assume they are for speculators and hedge funds, and therefore just another wall street trick to make money.

It also gives journalists something to write about, the fact that it’s just a model isn’t exciting and so they always seem to forget to mention that part.

A reminder for people measuring oil in profits or even revenue. I know you guys in the business have to because that’s how you support your families, but try not to get so deeply immersed in it that you forget this:

Japan 10 year bond interest rate — equivalent to a US Treasury note — 0.07%

You lend Japan money for 10 yrs, they will pay your 0.07% interest each year. BTW this has been celebrated of late. It was negative most of last year.

Think Japan is a basket case and worthy of dismissal?

Germany 10 year bund interest rate — 0.62%

Switzerland 10 year bond interest rate 0.01%

The US 10 yr rate today is 2.65%. That’s down from 8% in 1990.

This is NOT mind boggling. Understand what it all means. Why should it be mind boggling when the substance can be created by decree? There Are No Limits On This. There is only pretense. People want to think there is some rational logic behind it all. The entire financial industry NEEDS people to think that or there would be nothing for them to do.

I could, last year, point at some of those major countries having negative interest rates and evoke many more puzzled looks. Now the numbers have moved to a tiny bit above zero, so human nature can find reassurance that there is no violation of logic and it’s just awkward — rather than impossible — as it was for multiple years the last few.

So. For oil, stop thinking money is decisive. It can’t be. It doesn’t mean anything.

Oh, btw, I didn’t mention those are nominal numbers, not inflation adjusted.

Switzerland pays you 0.01% for lending them 10 yrs of money. That 0.01% they pay you each year erodes 1.5% or so from inflation. So you are paying them to lend them money.

So what? It’s Doesn’t Have To Make Sense.

That’s good, because it doesn’t.

The odds are pretty damned high that the inflation rate that really matters to any actual person will be far higher than one and a half percent, unless the economy goes to hell in a hand basket.

Rents, medical care, groceries, and most of the things we need to spend money on to live from day to day go up faster than that, on average, to the best of my knowledge.

If inflation is higher, it means you pay the Swiss government even more to lend them money.

If only oil companies could mine something, like bitcoin does, to create value.

Money is still decisive in the oil biz. It has to be spent in order for gasoline and diesel fuel to magically arrive at your nearest service station.

It’s just a question of WHO provides it, and why, and how. It still counts more than any other one factor, excepting possibly geology.

Baker Hughes U.S. oil rig count +12 to 759

Permian +18 to 427

BH: http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-reportsother

Venezuela Crude Oil Production. I don’t know why there’s a difference between Secondary Sources and Direct Communications.

Direct communication just means a guy on a phone. Another human being. Human beings often lie.

For many years, after the oil workers strike and their firing by Chavez, Venezuela reported over half a million barrels per day above what OPEC’s “secondary sources” reported. That was before the MOMR started reporting “direct communication”. Their motive for lying was that they wanted to show that the strike and hiring of mostly unqualified oil workers had no effect on their oil production. In fact, it was because Venezuela was always complaining about their production being underreported by the MOMR, that they finally decided to start reporting “direct communication” production in order to shut them up.

This way or that way, they held roughly steady for about a decade and had certainly significant support from China and Russia. The low oil prices of the last years were their kill.

While I had certain sympathies for Chavez, todays Venezuela seems to be a madhouse. It’s easy to play opposition with such a hardboiled marxist like Maduro leading the country – But I don’t trust neither side. The middle ground is lost and that’s where modern societies use to function. Sad story.

The figures were faked after the 2002-3 strike because new management had to show they could function after firing 18000 strikers. This trend continued until late 2017, when pdvsa managers were arrested for corruption and replaced with military personnel.

The new military management decided to under report production to be able to claim a recovery in January and thereafter thanks to their efforts. The problem they face is that arresting so many managers has two effects: 1. The new managers tend to be even worse, and 2. Any managers who haven’t been arrested are now terrified of making decisions.

There’s also an ongoing erosion of know how as more educated Venezuelans join the exodus out of the country, and what’s called a “silent strike”, which involves taking as much vacation as possible, calling in sick, or simply reducing the amount of work being done.

The opposition appears to be divided into a faction that’s clearly bought, such as Manuel Rosales and his party UN Nuevo Tiempo, a faction that’s accommodating the dicttatirship out of fear, such as Henry Ramos Allup and his party Accion Democratica (which happens to be socialist). I have doubts about Sakharov Prize winner Julio Borges, who looks like a coward (he has been beaten badly by Chavez thugs twice), and then there’s the Voluntad Popular leaders Lopez (house arrest, blackmailed by the regime, which has forbidden his wife and children from leaving the country), and Guevara (got political asylum in the Chilean embassy). Ledezma, former Caracas mayor, and Vecchio, a López lieutenant, are in exile after escaping from jail. They are working hard to get governments to sanction individual chavista leaders.

The problem I see is that the Castro dictatorship continues to have a very strong presence in Venezuela. This includes a large spy network which is partially embedded in the regime’s secret police and brown shirt organizations, as well as military personnel which is openly placed as “advisers” to the Venezuelan military. This network props up the regime, and will continue to do so until outside parties demand their withdrawal. Given the large number of commies within the USA and Europe who want the Castro dictatorship to survive (including Obama, Bernie Sanders, Maxine Waters, Mogherini, and the Pope), I don’t see much action against the Castro Mafia. This means we will have to emphasize forming guerrillas and the destruction of the Venezuelan oil industry infrastructure.

Floating storage – Malaysia, Sungai Linggi

It’s only a small sample size but it’s still worth knowing that there are less barrels than last year.

Free TankerTrackers –> http://tankertrackers.com

Chart on Twitter: https://pbs.twimg.com/media/DUkwCDuXcAA5ikL.jpg

FEDCom/Platts Fujairah Distillates Inventory Data (An onshore fuel hub in the UAE)

https://fujairah.platts.com/fujairah/#analyst

Energy News:

Thank you for all of your data posts.

Would you happen to have any data on US conventional oil production, onshore, lower 48, from say 2005-2017?

I was just browsing some large conventional fields in this area and find many have declined considerably, especially since the end of 2014.

I realize this is difficult data to compile because no one is interested in it, and because in some areas (San Andres, for example) conventional areas have had quite of few horizontal wells drilled.

It took from Colonel Drake to 1970 to hit the peak on US conventional. I doubt it takes 100 years to hit the peak on US unconventional.

Think I am glad I did not try to buy North Ward Estes from Whiting (LOL – I could not have swung that if I wanted to, $300 million). The buyer, Four Corners, is experiencing what I would consider a significant decline in production after buying that from Whiting in 2016.

On similar note, there are leases we offered on in 2012-2014 that I am still very glad we were outbid on. Timing sure as heck is important in oil production.

Further complicating that is the Permian. They are still drilling verticals. Still more cost effective for some to try to chase it with one million dollar costs, rather than a Christmas tree of 14 wells costing 85 million.

Hi Shallow sand,

You can use tight oil output and deduct that from US output minus Alaska and GOM output (I assume you mean L48 onshore) to estimate US conventional.

Use tight oil production estimates at page below

https://www.eia.gov/petroleum/data.php#crude

and page below

https://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

Chart for US L48 onshore conventional C+C from Jan 2000 to Oct 2017.

Thanks Dennis. Recent uptick is interesting. Wonder how accurate and what field or fields are responsible.

Primarily the Permian. And a large part of that is from Loving County. Mostly condensate, see my post below. To confirm, go to RRC reasearch queries for completions for the past several months for Loving County. Select a completion and pull the W2. It has completion data.

Ignore my post above, I did not notice it was referring to conventional. Sorry, shallow.

No problem Guym.

I have been doing some reading recently on hz San Andres. Seems like they are having some success, probably over 250 hz wells now in this formation, which, started production since 2016. The wells make water only for several months before oil commences, so possibly if these wells are mistakenly being included by EIA as conventional, or are intended to be classified as such, maybe this is part of the growth?

For example, look at the wells of Steward Energy II in Lea Co., NM and Yoakum Co., TX. TVD 5,000 ish, TD 9-12,000 ish. Make a lot of water, but many 12 month cumulatives will be north of 100K BO.

Also, I suspect a fair amount of production was shut in in early 2016 and returned to production. I know we did that.

Dennis. It will be interesting if WTI doesn’t remain in $55-65 trading range. Has only been there for three months and now looks poised to go higher, although it could do anything, I have no clue.

$55-65 is not some magic range, just what I think is “fair” for producers and consumers.

Hi Shallow sand,

I suspect there will not be adequate oil supply at $55-65/b, but could be wrong (as usual).

Your guess or Mike’s would be better than mine.

Fernando thinks $63/b.

My guess for 2018 is an average annual oil price of $75+/-5 per barrel (average of the 12 monthly prices for Brent spot price.

There has not been a similar uptick in the vertical rig count. I assume vertical rigs drill conventional wells.

I guess they can drill conventional wells horizontally but I don’t know if they do?

I don’t know why, the only thing that I can think of is that some small producers have switched their electric pumps back on due to the $WTI price rise?

I think there have been quite a few horizontal San Andres wells drilled in the Permian Basin. OXY has drilled many and some others have also. I wonder if these are counted as horizontal? They are located in water flood areas and are not the typical “light tight” oil wells.

Note that my “conventional” output subtracts tight oil output from US L48 onshore C+C. I don’t know if those wells are part of the LTO output estimate by the EIA.

HZ san Andres are classified horizontal by RRC, drillinginfo, etc.

Ever notice that none of these gushy oil industry stories ever mention the factor, “global climate change.” It’s as if, to the authors, this is “settled science,” and the story that’s been settled-on is the Rush Limbaugh story:

“Climate change is a hoax perpetrated by China.”

(The other story is, the gushy stories have concluded that petroleum-limits to growth also is a hoax, perpetrated by Club of Rome. But that’s another comment…)

https://oilprice.com/Energy/Crude-Oil/US-Condensate-Output-Set-To-Increase-In-2018.html

Headline and story are disconnected. That is very possibly a reality, but not developed within the article. Too bad, as it was the closest thing to reality posted in awhile. Assume it is a problem with Oiprice, as garbage info is what interests them the most.

Permian growth. The Permian basin is huge, and extends across four districts of the RRC. However, the Permian increase can be mostly isolated in District 8. The pending lease file has a majority in District 8, also. The other districts show a little growth, but the vast majority is the District 8. District 8 can be Delaware Basin, or Midland Basin.

The Counties west of Midland look like pincushions with wolf berries, probably. Loving is the likely candidate for the increase, and they have some excellent production on some leases. A lot of permitted areas are still pending, some are zombie permits, along with some probably zombie wells. Inter spaced in all of these are some verticals, but not nearly like the Midland Basin. Just a lot of uncompleted wolfcamps far too close together, in my opinion. 2018 could be the hurry up, or slow down year for the Permian, or Loving County. May be wrong, but I think this Permian thing is vastly overstated.

They have been drilling in the Midland Basin, FOREVER, with verticals. Many were combined spray berry and wolfcamp. As wolfcamp pressure drops after you drill in an area, I’m sure that’s why they are not concentrating in that area. Unless, I am missing something, the are of concentration, now, is mainly in the Delaware Basin, or Loving County. What I see them pulling out of there is close to condensate. They will have to export it, as it is no use to most refineries.

Looks like this info needs to be attached to the wording in the headlines to your most recent post, Dennis.

The oil they pull out of our wells in the Eagle Ford is about 32-34, this oil is 44 to 50 something. The great Permian is going to turn out to be a bust.

They are going to have major problems transporting this, too.

http://mobile.reuters.com/article/amp/idUSL1N0UV1YB20150116

Blending it will become a problem:

http://www.argusmedia.com/pages/NewsBody.aspx?id=1254610&menu=yes

Do you really think we are going to increase production by one million barrels with primarily condensate?

On second thought, if they could get to Canada, they could make a killing on condensate:

http://business.financialpost.com/commodities/energy/encana-pivots-to-78-per-barrel-condensates-from-prolific-montney-basin/amp

The average eagle Ford is 45-50. Most operators won’t consider anything under 40 from shale as it’s too heavy.

Again with the misinformation.

Its possible to create isopach maps for gravity of oil throughout the Eagle Ford trend; it varies. Higher initial GOR and higher gravity liquids leads to higher EURs; the best EF wells are generally in the very volatile, liquids rich gas leg in Dewitt County, for instance. Higher gravity stuff also can mean lower prices at the WH and market difficulties.

I don’t see any blatant misinformation here. I see people trying to understand what is going on. I suggest Berman’s twitter feed for some good poop on oil and condensate quality. Light tight oil IS getting lighter and it is a very serious problem with end users. We will never become hydrocarbon independent in America simply because of the quality of the stuff we now produce.

So what’s the plan in America? Send LTO to Corpus and ship it to China or anyone else that will take the stuff. We can’t use anymore of it in America. Instead of developing heavy markets to blend LTO with, so America can use America’s oil and not export it, we have developed this stupid

“isolationistic, energy dominance” plan that is shortsighted and pissing the rest of the oil producing world off. We’re trying to ‘prove’ something to the rest of the world. In another decade or so when we have exported all of our LTO away and OPEC and others have us entirely by the ying-yang again, we’ll look back and ask, “who in the hell was in charge?”

Exporting America’s oil away is stupid. But then again, less than 20% of America’s population has a savings account… so no sweat. Let the kids fend for themselves.

Ok, in support of T’s comment, Eagle Ford was much lighter back in 2014. But they were doing a lot of drilling in the gas/condensate window at that time. It has decreased to less than 45, probably, on average. Even the massive Austin Chalk wells, that EOG are drilling are close to 45. They are primarily in the oil window, now. Burlington, and some that don’t have oil window properties are still coming in at around 50.

I understand what you are saying on exporting oil, instead of using it, and I agree that is a problem. But how is it solved? Keep it in the ground, until the US needs it, because of potential actions by our supposed “friends”? Then, we will be in a major problems gearing up drilling, to feed refineries who can’t use it. Wouldn’t a better option be to increase our SPR, now, like China is doing? I have no idea why the morons are intent on selling off our SPR.

Guy, slow the rate of shale oil development in the US with existing statutory laws in Texas regarding spacing between wells and/or well densities per acre. The TRRC has abandoned conservation principles in the name of tax dollars; its easily re-implemented, however. And quite legal. So, yes, keep ‘some’ of it in the ground. That is the beauty of shale oil and its short investment cycle; each well is in itself a SPR that can be brought to market within 5 months, spud to flowing in the tanks.

Create a separate State entity that answers to both the TRRC and the State Comptroller, or a new executive committee in the legislature and that monitors inventory levels, production trends, prices, costs, and worldwide geo-political issues whereby shale oil drilling permits can be issued that would allow “in between” wells to be drilled, or to increase well densities within a unit that is commensurate with market fundamentals. This would stabilize prices, costs, and oil and gas employment.

In the mean time re-tool refineries and develop a secure source of heavy oils for blending with LTO. That would mean finishing Keystone and trying to improve relations with Venezuela, where its heavy oil in the Orinoco Delta is a perfect fit for LTO and better refinery yields. Columbia has some heavy oil, as does Mexico. Quit pissing the world off with nationalistic arrogance about our oil “dominance.” We do not have the resources and the only thing that has made the shale oil industry “resilient” the past four years is low interest stimulus money. We have no “dominance” over OPEC or Russia’s massive conventional resources; that is ridiculous.

You are mineral owner and I understand why you would not like that plan. I am as well, with interest in shale wells. But I am thinking about our near long term future. Exporting LTO because we can’t use it fast enough is dumb.

Short of water, hydrocarbons are our life blood. We have to be able to think past next week and manage those resources for the long haul, even if it appears to be a threat to free enterprise and free trade. We better get past that BS. Quick. The TRRC regulated the oil and gas industry for 40 years, successfully. In the industry, we lived with it just fine.

Relax, however; it will never happen. We are being led by the short sighted and the greedy in America; we don’t believe in savings accounts and we deal with problems after its too late.

I don’t think you need additional regulations or new administrations when you have existing laws that could be used. That is using the “allowables” law that is already on the books. The only time it was used is when drilling got so bad that oil prices were in the pennies. Each producer, based upon what they had would be assigned an amount that they were allowed to produce. Still on the books, and each producer does have an allowable amount, it just they would never reach it based upon the amount that is currently set. I don’t think that would be a bad thing to use from the royalty owner standpoint. Make the producer seriously think about how to get the maximum out of a well, possibly. Choke size, well spacing, or enhanced production of any kind could be considered more. Right now, the producers could really give a damn.

Don’t know that that would solve some other important parts of the equations, like managing refinery inputs, getting oil sands from Canada, or playing patty cake with a tyrant. Whose oil production is circling the drain, anyway.

You could introduce allowables based on API gravity, too. That one, I would have no problem with, personally.

But you are right, because it would require an intelligent thought process, it will never happen.

Until the shale well goes on artificial lift it is detrimental to frac’ed wells to be shut in (allowables for the month, met) due to proppant embedment and fracture closure, among other reasons. Since they typically make 75% of what they are ever going to make in the first 4 years of their life, in my opinion it is better to leave it in the ground entirely, some of it anyway, until its needed. As I said, no new rules are regulations are required, only old ones implemented and enforced. Conservation laws are set forth in the Texas Natural Resource Code and were the precursor to Statewide Rule 37: http://burlesonllp.com/D6B628/assets/files/Documents/Durrett_Pub-NA.pdf

Keep up the good work here on POB.

Hi Mike,

I agree with your plan, not sure you will be able to convince a majority of Texans.

One thought is that it would be good for the oil industry and tax revenue.

For example let’s say Texas oil production is reduced by 50% (to 1.75 Mb/d from 3.5 Mb/d) and oil prices go from $60/b to $120/b. Assume taxes are 10% (I am not sure what the actual taxes are). At 3.5 Mb/d and $60/b, tax revenue would be $21 Million per day at a 10% tax rate. At 1.75 Mb/d and $120/b and the same 10% tax rate the revenue would be exactly the same $21 Million per day.

In addition, oil producers would see much higher profits at $120/b vs $60/b and one might argue that in Texas what is good for the oil industry is good for Texas.

Maybe you should run for Governor. 🙂

Indeed what is good for the long term health of my industry is good for the long term health of Texas and the rest of the country.

What causes this, http://www.chron.com/business/energy/article/Even-with-oil-record-in-sight-Texas-energy-12533523.php ? Price instability caused by short sighted, greedy people.

I think your points are excellent, Dennis. But far too rational in the me-first, I want it and I want it NOW world we live in today. Putting America first by draining its oil reserves to plum empty is putting our children last.

Mike,

Also the country has moved very far to the point of view that no government regulation or interference in the economy is best.

Any regulation of oil output by a government agency would be considered socialism by many on the right.

I think regulation of output by the RRC and other state agencies would be a good idea, but my political views are a bit to the left of most Texas and Oklahoma citizens.

I might be a centrist in Austin. 🙂

In Austin you would be considered a right wing fanatic, Dennis. Holler if you want to buy it; most of the rest of Texas would love to simply get rid of it.

I am a conservative Republican who has worked under the confines of allowables and conservation laws set forth by the TRRC in the past. I never then thought it was socialism, nor do I now. I thought it was forward thinking and good for the long term energy security of my country.

Hi Mike,

Well to many republicans, government regulation of any kind is a bad idea, or so it seems. For those who are more to the right of you, they might claim you’re a liberal.

To me you make sense, but I think you might have trouble convincing many Texans that restricting oil output (as was done in the 60s, as far as I know) is a good idea.

I am all for it. It would help with stability in the oil industry.

Mike,

Ship LTO to China? Piffle. Canada needs it and pays well.

Canada is set to have its own shale oil revolution it appears and will no longer need US LTO; all of Asia, including China, will be the big recipient of US exports in another year or so: https://www.reuters.com/article/us-usa-oil-summit-exports/u-s-crude-exports-expected-to-strengthen-in-2018-amid-robust-demand-idUSKBN1F7046

Exporting America’s shale oil is good for America, keeps prices low and all that, just google it. We must have decades of the stuff; my bad. I am clearly out of the loop. So, I better water my mule and get back to my cable tool rig before dark.

Hi Mike.

In Canada the Montney, and parts of the Duvernay, are getting a lot of attention for condensate production, yep. I started watching them a couple of years ago, and kept looking for any connection in written sources between their future production, and supply to the oil sands for diluent. I don’t think I ever saw such mention. Seems odd.

I’m sure the oil sands will be a big market, as you say.

T- Then why are they producing it? Under 40 is too heavy?? That’s what the frigging refiners buy. Average Eagle Ford produced now, is probably 40 to 45. I am constantly looking at completion reports, and not just re-quoting some expert. Yes, mine at 33, would be exceptional, and I didn’t mean to confuse. Over 45 causes problems. Misinformation is caused by listening to experts, and not doing your own research with primary data.

If all of the Eagle Ford or tight oil was at an API gravity of 33, we probably would not be importing as much oil. Nor, would we ever have had the huge inventory build.

Over 45, you have a smaller number of options. There are a few refineries in W Texas set up for this, there are a few more refineries set up, but they are small in number and production, and are hard to transport to. Blending becomes difficult, per my post. Bigger option is to export it.

Correction, not a bust. While, it was hard to find with all the dots, there are just as many additional horizontals being completed in the Midland Basin area, based on searches by County. API looks decent there, so it’s a combination of over 45 ApI in the Delaware Basin, and around 40 out of the Midland Basin. Jumped the gun.

Little tidbit of info for Loving County, with only a population of around 113, the County had more oil wells than people.

I think there has been a psychological change since 2014-16. At that time, tight oil surprised to the upside. Now everyone has expectations of 1M/d output growth from LTO for the next 2-3 years as the foundation for future supply gains as world demand continues to increase. Will that pan out? And if it does, how much investment will it require and how long can it be kept that high? Because it’s beginning to look like when LTO in the US starts to fall, that could peak oil.

Hi Stephen Hren,

My friend Chris sent a link to a McKinsey report

https://www.mckinseyenergyinsights.com/services/market-intelligence/reports/north-american-shale-oil-outlook

Chart below is from the report, a peak at 8 Mb/d in 2025, my guess is 2025 but 7.5 Mb/d and I expect steeper decline than the McKinsey scenario.

For the next 3 years McKinsey expects about a 700 kb/d increase in LTO output each year. From 2021 to 2025 (peak output) the rate of increase in LTO output falls to 300 kb/d each year on average.

Reuters – January 29th – Canadian Tight Oil

Together, the Duvernay and Montney formations in Canada hold marketable resources estimated at 500 trillion cubic feet of natural gas, 20 billion barrels of natural gas liquids and 4.5 billion barrels of oil, according to the National Energy Board, a Canadian regulator.