The EIA has just published their Petroleum Supply Monthly with July production data for the USA and all states and territories. There were really no big surprises.

US C+C production was up 94,000 barrels per day in July to 9,358,000 bpd.

The EIA has just published their Petroleum Supply Monthly with July production data for the USA and all states and territories. There were really no big surprises.

US C+C production was up 94,000 barrels per day in July to 9,358,000 bpd.

EIA begins monthly survey-based reporting of U.S. crude oil production

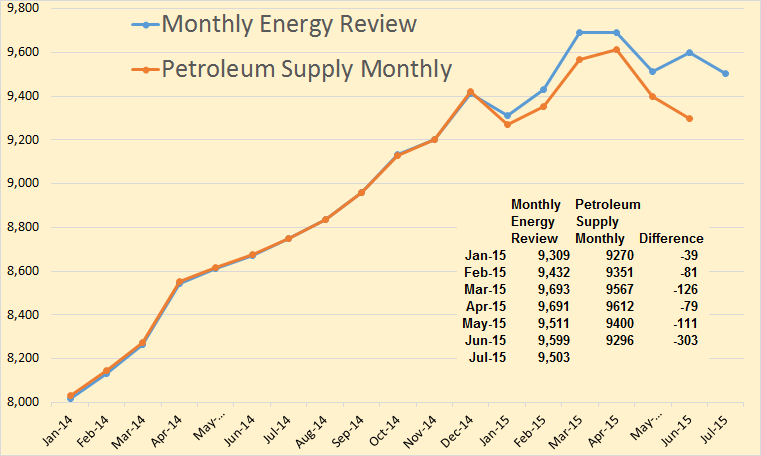

With the release of today’s Petroleum Supply Monthly, EIA is incorporating the first survey-based reporting of monthly U.S. crude oil production statistics. Today’s Petroleum Supply Monthly includes estimates for June 2015 crude oil production using new survey data for 13 states and the federal Gulf of Mexico, and revises figures previously reported for January through May 2015.

From the EIA’s Monthly Crude Oil and Natural Gas Production webpage.

Beginning with the June 2015 data, EIA is providing estimates for crude oil production (including lease condensate) based on data from the EIA-914 survey. Survey-based monthly production estimates starting with January 2015 are provided for Arkansas, California, Colorado, Kansas, Louisiana, Montana, New Mexico, North Dakota, Ohio, Pennsylvania, Texas, Utah, Wyoming, and the Federal Gulf of Mexico. For two states covered by the EIA-914—Oklahoma and West Virginia—and all remaining oil-producing states and areas not individually covered by the EIA-914, production estimates are based on the previous methodology (using lagged state data). When EIA completes its validation of Oklahoma and West Virginia data, estimates for these states will also be based on EIA-914 data. For all states and areas, production data prior to 2015 are estimates published in the Petroleum Supply Monthly. Later in 2015, EIA will report monthly crude oil production by API gravity category for the individually-surveyed EIA-914 states.

This is great news for those of us who have been complaining for years about the EIA’s poor and misleading data collection methods.

June C+C production, according to the Monthly Energy Review, was almost 9.6 million barrels per day. But the Petroleum Supply Monthly cuts that by 303,000 bpd. And they have production dropping by 316,000 barrels per day in the last two months, May and June.

The EIA’s, on June 30th, published its Petroleum Supply Monthly. I Think their numbers are just way too high. I compared them with the EIA’s Weekly Petroleum Status Report. The chart below shows the Results.

I averaged the weekly numbers and converted them to monthly data. They were pretty close for the first three months of 2014 but then they begin to diverge. Of course they were much closer earlier but in the Petroleum Supply Monthly has, over several months, been revised upward. The Weekly Petroleum Status Report is never revised.

In April, the Petroleum Supply Monthly shows US C+C production 322,000 barrels per day above the weekly average of the Weekly Petroleum Status Report.

The latest Petroleum Supply Monthly is out with the USA production numbers for January 2015. The data is thousand barrels per day with the last data point January 2015.

US C+C production was down 135,000 barrels per day in January. That is the biggest monthly decline since July of 2011.

I have shortened the states data to 25 months in order to give more emphasis on the January 2015 data.

North Dakota was down 37,000 barrels per day, exactly what the NDIC reported. That is because the EIA gets their data from the states.

The EIA has published their Petroleum Supply Monthly with all US production numbers through December 2014. The chart below shows the largest changes in December and Yearly production. Almost every state had a production increase. The largest decliner was Wyoming, down 7,000 bpd. Below are the biggest gainers and the amount of their production increase in thousand barrels per day for December and the whole year.

| December | 2014 | |

| US | 187 | 1366 |

| Texas | 49 | 684 |

| North Dakota | 39 | 297 |

| GOM | 68 | 157 |

The Gulf of Mexico was up 68,000 bpd in December but was down 56,000 bpd in November. The EIA had great hopes for the GOM expecting it to hit 2 million barrels per day in 2016. I don’t think that is going to happen. GOM production now stands at 1,441,000 bpd

Alaska’s decline seems to be slowing down slightly. They are now at 520,000 bpd.