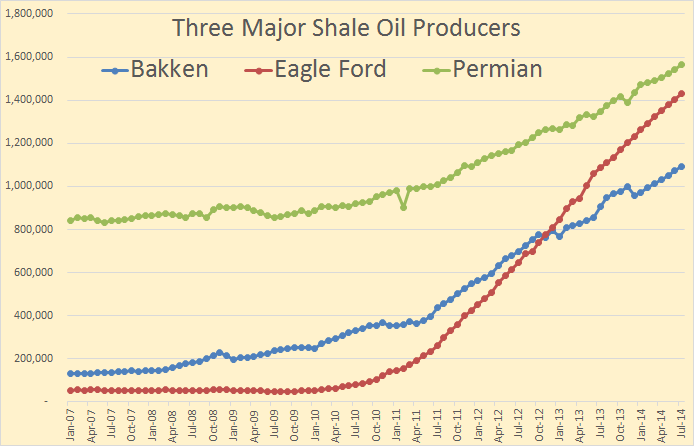

The EIA’s latest Drilling Productivity Report is out. Not a lot of changes since we now know that the EIA just guesses at the production for the last five months, August through December, then plugs in their estimate for the next two months, January and February. In the case of the Bakken they say December production was 1,003,578 bp/d and January and February will be 1,025,634 and 1,050,521 bp/d respectively. For Eagle Ford December production, they say, was 1,221,576 bp/d and they expect January and February production to be 1,251,617 and 1,285,224 bp/d respectively.

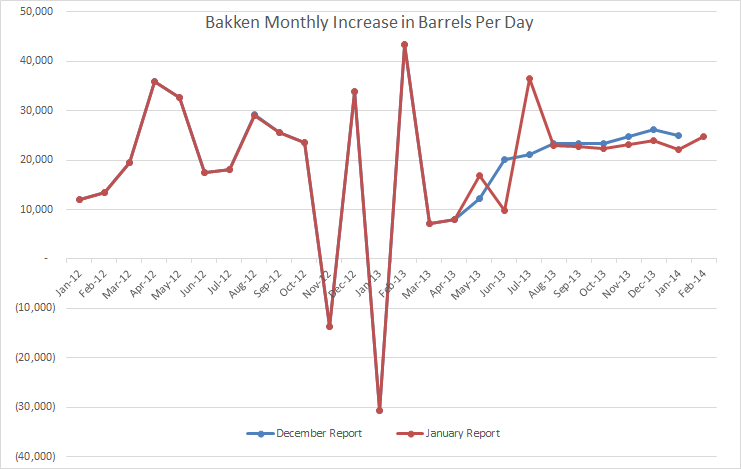

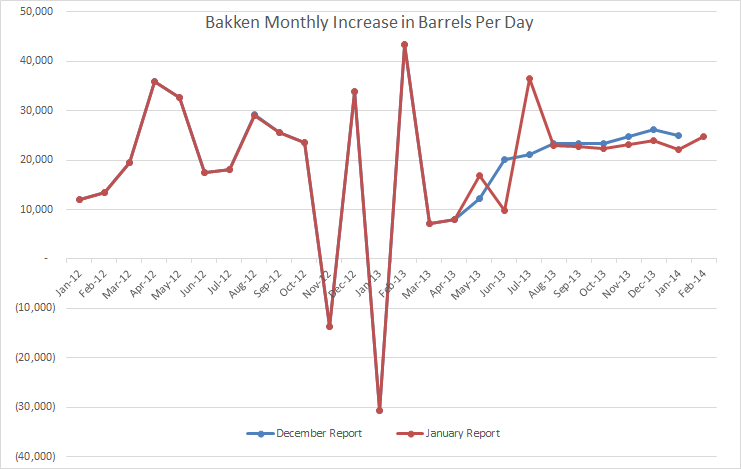

The below chart shows the Bakken production change from month to month. I have shortened the time displayed in order to better show the month to month change.

Notice the dramatic change in the January report for May, June and July. Obviously they looked at the real data and saw how different it was from what they had previously just plugged in, and made the necessary changes. They are saying that the Bakken had a really good December, slightly better than January, then things turn up again in February.

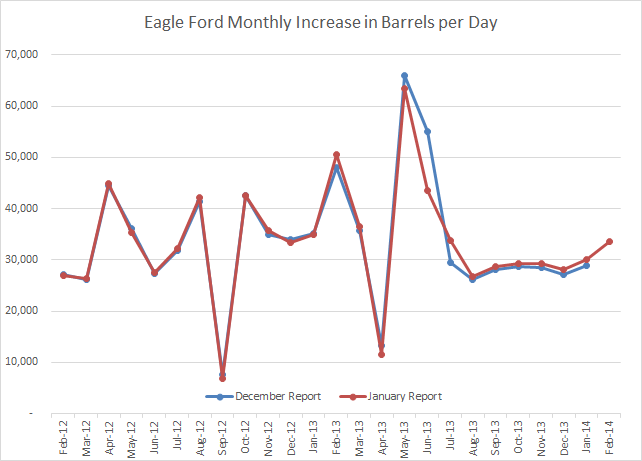

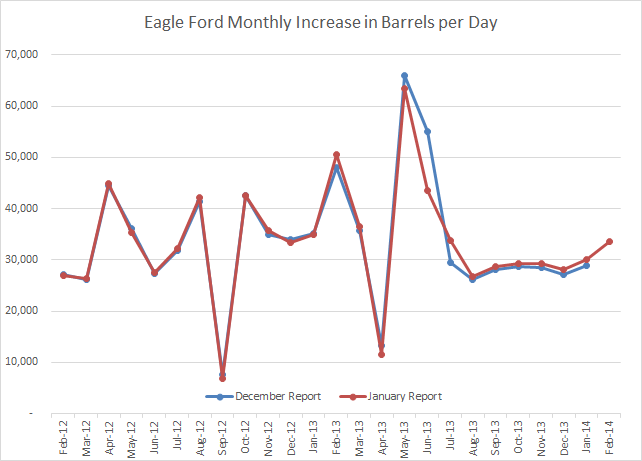

Here is the same chart for Eagle Ford.

Not such dramatic changes in the Eagle Ford production data. But notice they are expecting an upturn in January and December. We shall see.

Read More