This is a guest post from Jean Laherrere. There are 12 graphs in this post. I have added a “continue reading” break in this post after the first three. I will do this for all long posts.

Tag: Peak Oil

US Crude Storage, Production and Other Peak Oil News

There has been a dearth of oil production data lately so I have been scratching to find something to post. So I have gathered this and that in hopes of making it interesting.

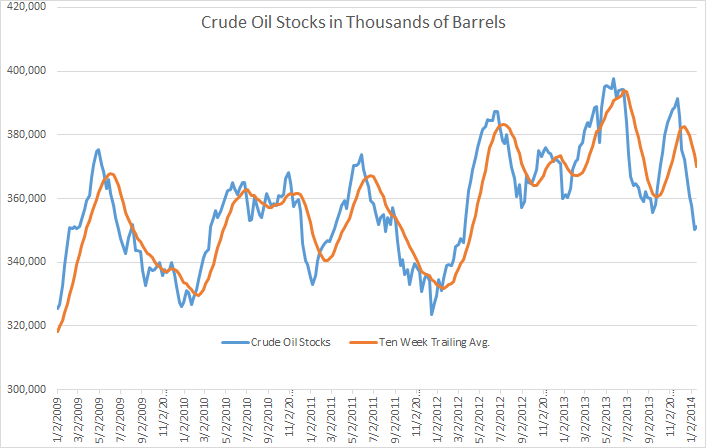

US stocks had the first uptick in nine weeks, gaining 990 kb. (See the slight uptick in the blue line.) But they still stand at their lowest point in 21 months.

Incidentally the EIA’s Weekly Petroleum Status Report had US crude oil production down last week. Their estimate of production went from 8,159 kb/d to 8,052 kb/d. That was the first decline in nine weeks. Of course that is really just a guess by the EIA.

Based on the weekly US production data I have charted US production through Januay 2014. The data through November 2013 is from the EIA’s Monthly Energy Review. The data for December and January is from the Weekly Petroleum Status Report, link above. That data is through January 17th. I have estimated the rest of the month.

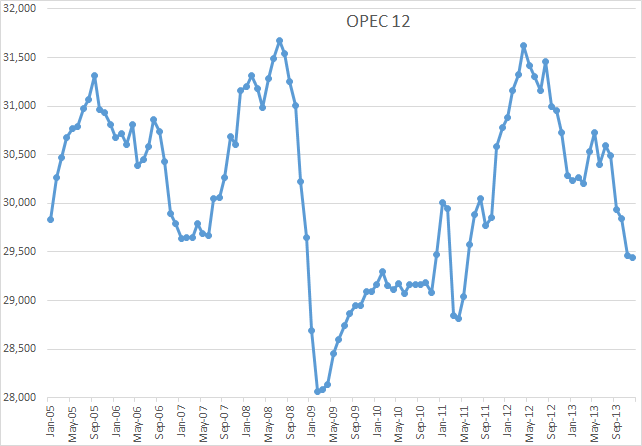

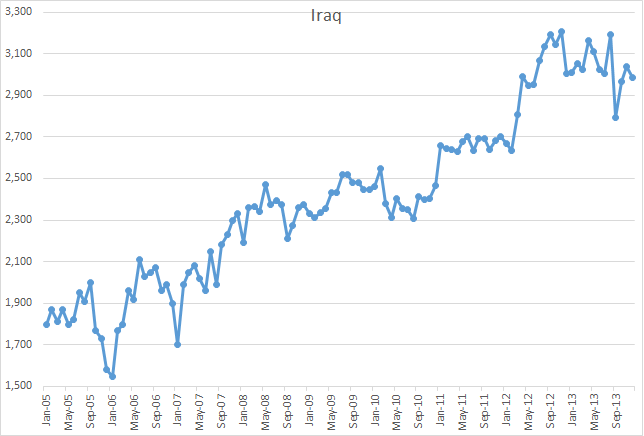

Update: OPEC January MOMR with December Production Data

The OPEC January Monthly Oil Market Report is out with crude only production data through December 2012. Total OPEC crude only was 29,223,000 barrels per day, down 20,000 barrels per day. But that was after November production was revised down by 170,000 bp/d. So December production was down 190,000 bp/d from what they originally reported last month.

Big movers were Iraq and Libya. Iraqi November production was revised down by 132,000 bp/d and their December production was down another 55,000 bp/d meaning they were down 187,000 from what was originally reported last month.

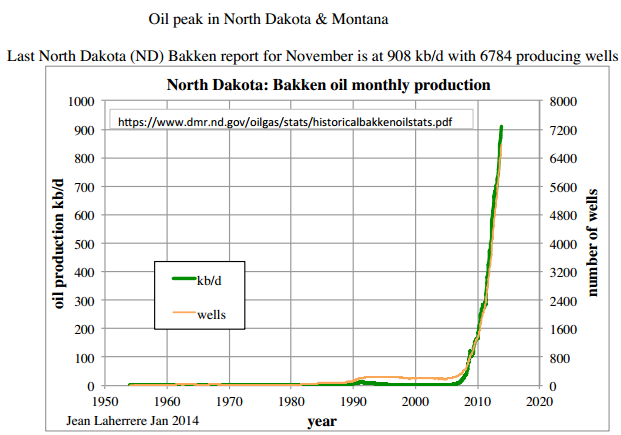

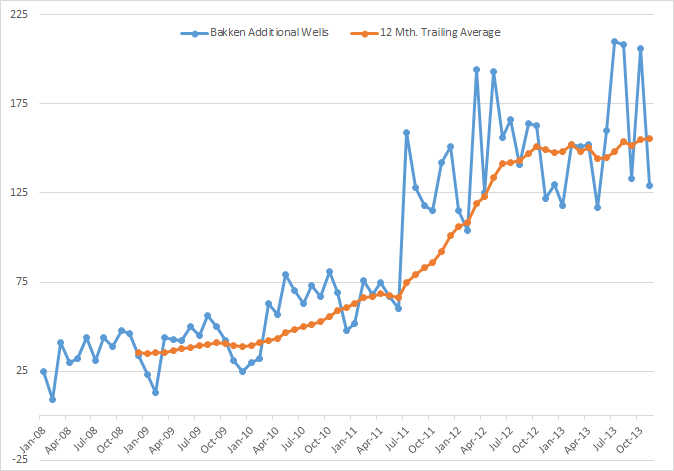

Update: North Dakota Bakken Data

North Dakota published their monthly report on Bakken Production and All North Dakota Prouction. Nothing to get excited about. Bakken production was up 28,285 barrels per day while all north Dakota was up 27,864 barrels per day. This means that North Dakota production outside the Bakken was down 421 bp/d.

The Director’s Cut comments on the price they are getting for Bakken Oil:

Oct Sweet Crude Price = $85.16/barrel

Nov Sweet Crude Price = $71.42/barrel

Dec Sweet Crude Price = $73.47/barrel

Today Sweet Crude Price = $71.25/barrel (all-time high was $136.29 7/3/2008)

Interesting that they are selling their oil at about a $21 discount to WTI about a $35 discount to Brent. More of the Director’s comments:

The drilling rig count was unchanged from Oct to Nov, but the number of well

completions dropped from 166 to 138. Days from spud to initial production remained

steady at 114. Investors remain concerned about the uncertainty surrounding federal

policies on taxation and hydraulic fracturing regulation.

We estimate that at the end of Nov there were about 510 wells waiting on completion

services, an increase of 50.

This plot is “Bakken Additional Wells” and the 12 month trailing average. As you can see the average for the last 15 months or so has been pretty flat, around 150 additional wells per month.

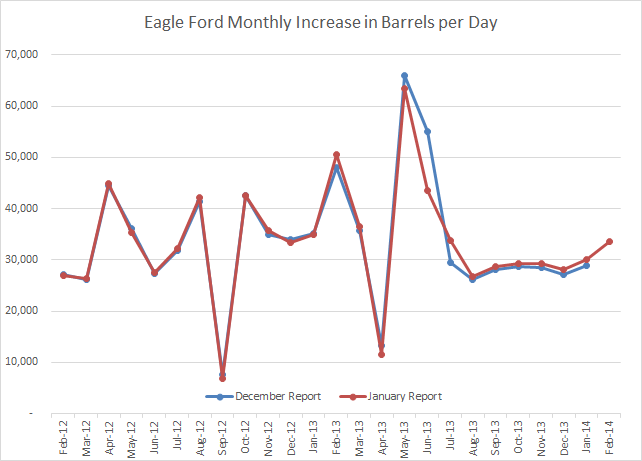

The EIA’s Latest Drilling Productivity Report

The EIA’s latest Drilling Productivity Report is out. Not a lot of changes since we now know that the EIA just guesses at the production for the last five months, August through December, then plugs in their estimate for the next two months, January and February. In the case of the Bakken they say December production was 1,003,578 bp/d and January and February will be 1,025,634 and 1,050,521 bp/d respectively. For Eagle Ford December production, they say, was 1,221,576 bp/d and they expect January and February production to be 1,251,617 and 1,285,224 bp/d respectively.

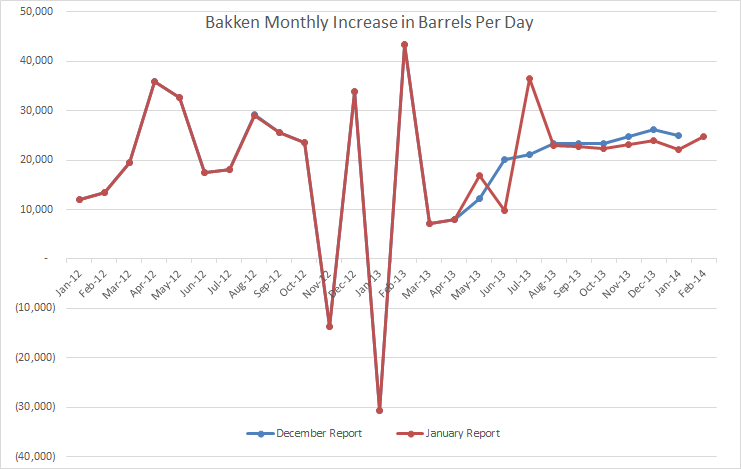

The below chart shows the Bakken production change from month to month. I have shortened the time displayed in order to better show the month to month change.

Notice the dramatic change in the January report for May, June and July. Obviously they looked at the real data and saw how different it was from what they had previously just plugged in, and made the necessary changes. They are saying that the Bakken had a really good December, slightly better than January, then things turn up again in February.

Here is the same chart for Eagle Ford.

Not such dramatic changes in the Eagle Ford production data. But notice they are expecting an upturn in January and December. We shall see.