Podunk was a small town Arkansas. Back about a hundred years ago Podunk had no sewage plant, everyone just used outdoor toilets. But a problem soon developed, Podunk’s water supply became contaminated. That’s when they decided to build a blibbit* in which they would store their crap. This blibbit was built out of wood and placed on a hill in a convenient location, right in the middle of town.

The blibbit was almost circular, about 100 feet in diameter. Poles, similar to utility poles, were placed in the ground about 10 feet apart and boards were nailed to them to form the sides up to about 10 feet high. Then every few days everyone in town would haul their crap to the blibbit and dump it in. After a few years the blibbit was full so they added a few more boards to raise the sides higher.

But then someone noticed that the bottom boards were bulging out and appeared about to rupture. “She’s gonna burst” the person shouted to everyone in town. “Nah, maybe it will hold a bit more” was what most people said.

Then a few years later the blibbit was full again so they nailed a few more boards a little higher up on the poles and continued to dump in their crap. The bottom boards became even more strained and looked like they would pop this time for sure. “She’s gonna burst” a couple of more people started yelling. Naw, that’s what you said five years ago you were wrong. So we should not listen to you.

Then about five years later the blibbit became full again. More boards were added and more crap was dumped in. “She’s gonna blow this time for sure. The blibbit has reached peak crap for sure.” “Listen stupid”, was the reply, “that’s what you said 10 years ago, then again 5 years ago, and you were dead wrong. “And because you were wrong in the past means you have to be wrong now.”

Now here is my question: Because the peak blibbit crap people were wrong in the past, does that mean it is more likely they are wrong now? Or, is it even more likely they are right now because the situation has deteriorated even more since the early days of peak blippit crap predictions?

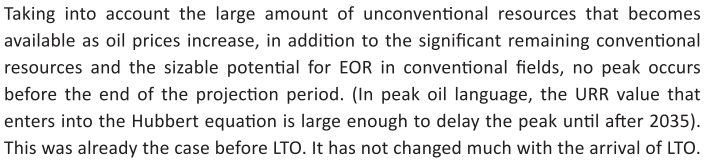

We are all asked, from time to time, what do we think is going to happen to this or that down the road. No one gets asked that question more than peak oilers. And every peak oiler seems to have a slightly different opinion. I have, in the past, reframed from making predictions as to when crude oil extraction will peak. I did so out of fear that I would be wrong and cornucopians would throw it up to me later. But I have now gone out on a limb and now predict that Crude Oil, or rather C+C will peak no later than 2017. I strongly believe the peak will be in 2016 but it could be a year or two earlier but no later than 2017.

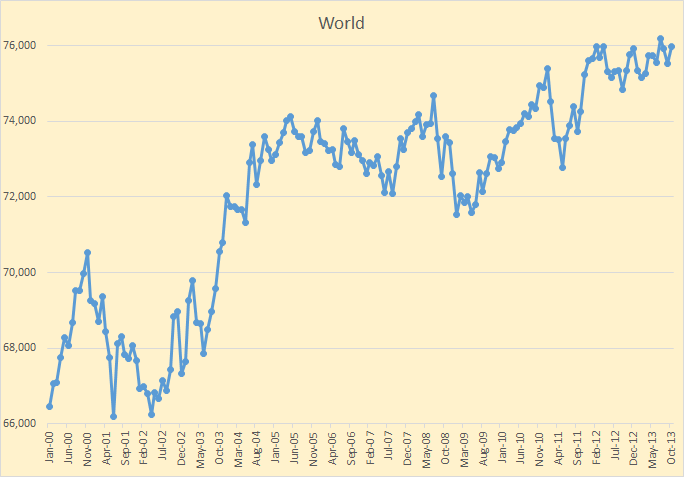

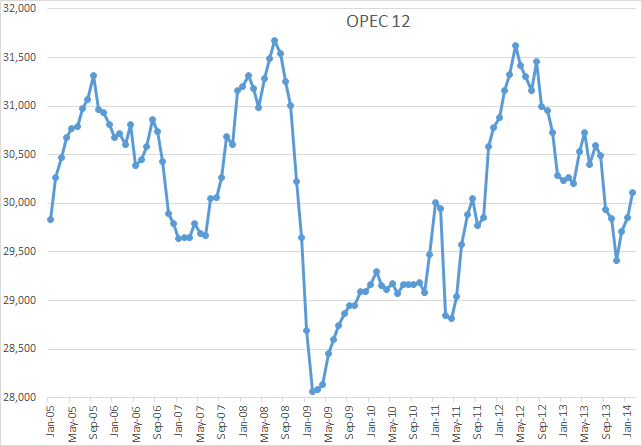

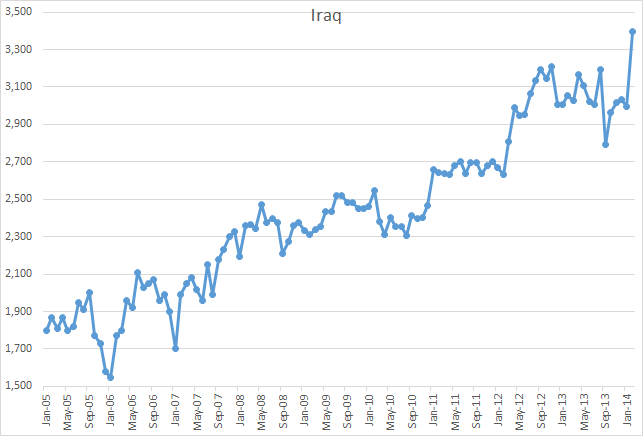

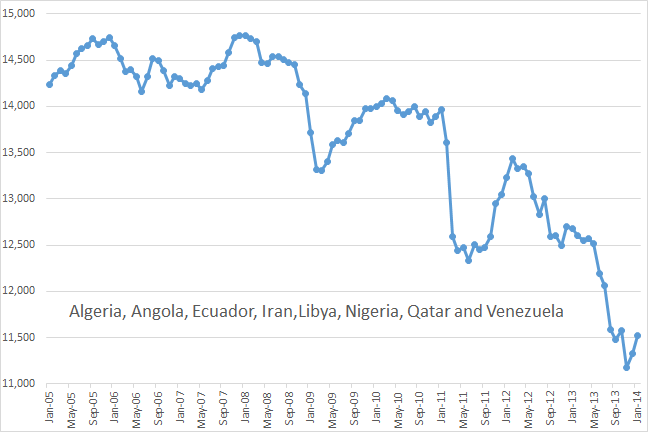

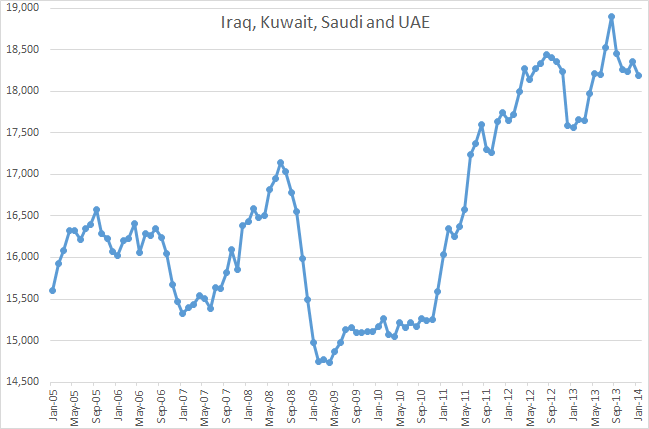

In spite of all the hoopla about the US shale boom world C+C has been relatively flat for two years.