A Guest Post by George Kaplan

UK C&C

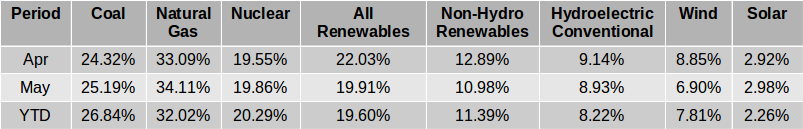

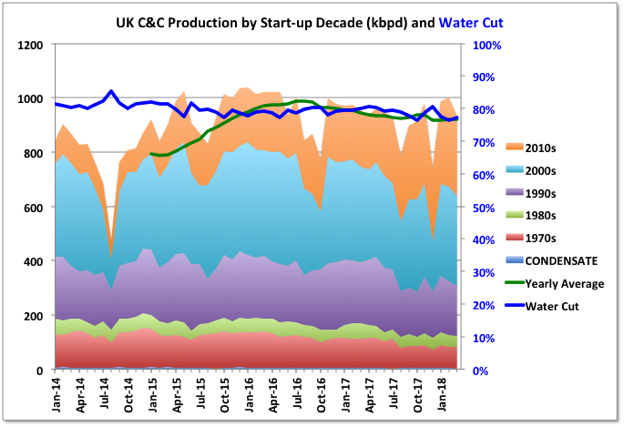

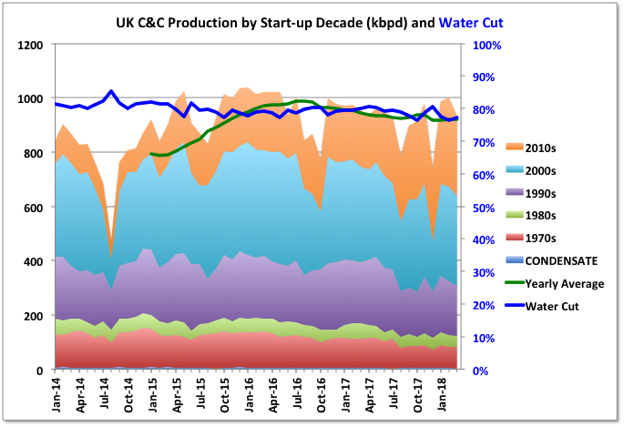

It was expected by many, me included but more importantly UKOGA and a couple of the bigger oil and gas consultancies, that UK offshore oil production would increase significantly from 2017 to exceed 1000 kbpd for the yearly average in 2018. So far this is proving a bit of a challenge. March production was 934 kbpd, down 7% m-o-m and 2% y-o-y (but up 0.8% for the first quarter compared with 2017). It’s possible that some fields have not reported but those showing zero for the month are not big producers. The biggest single field drop came from Clair but most fields saw declines, even the newer ones. Jodi data indicates there will be a rise shown for April to slightly above 1000 kbpd and then a fall back to around March numbers in May (note edit based on July Jodi data); there is usually a summer dip because of maintenance shutdowns (plus this year some strikes at Total platforms will impact).

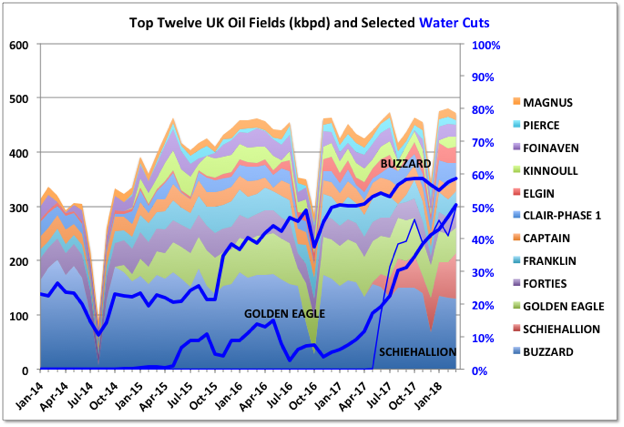

Two of the largest oil producers, Buzzard and the Golden Eagle Area Development, both operated by Nexen, have started accelerated decline following increasing water breakthrough (especially noticeable in GEAD over the past year). The newest large field is Scheihallion. This is a redevelopment with its neighbouring field, Loyal, through the Glen Lyon FPSO (also called the Quad 204 project), which was started last year. So far the combined decline in Buzzard and GEAD is almost matching growth in Scheihallion.

The Clair Ridge platforms, which will also exploit the remaining heavy oil in the Clair field, were installed last year but there have been multiple delays and production is not now expected until later this year. Once it is ramped up, which could take three or four years despite it having some predrilled wells, the project will be the largest producer at 100 to 120 mmbpd and has an eight year plateau, while Scheihallion/Loyal will plateau and decline quickly.

Read More