Much of the information for this post comes from data at shaleprofile , and assessments by the USGS. In addition a paper published in Jan 2022 by Wardana Saputra et al was an excellent resource.

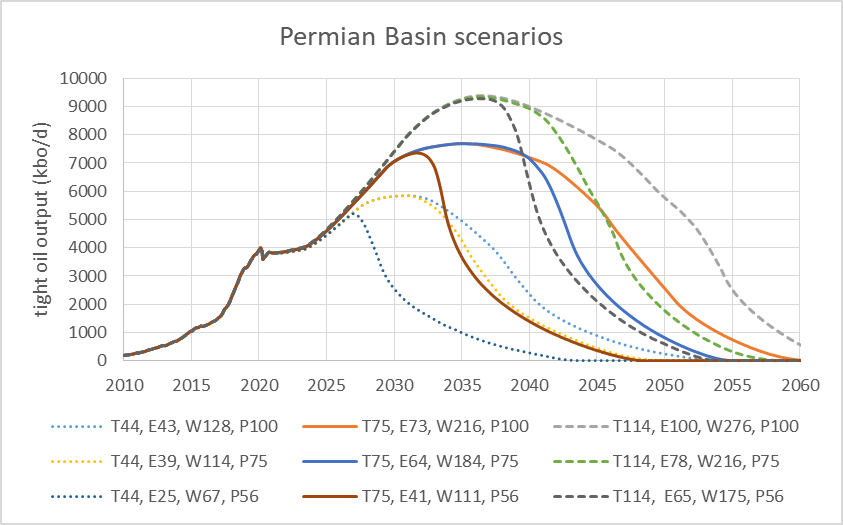

The basic method used in the is analysis is covered in an earlier post, essentially the convolution of average well profiles with the monthly completion rate over time is used to model future output. I focus on the period starting in Jan 2010 and consider only horizontal tight oil wells in the analysis. Future well profiles are estimated and several future scenarios for completion rate are used, clearly the future is unknown so future completion rates and estimated ultimate recovery (EUR) for wells completed in the future can only be guessed at.

In order to make such a guess I start with the USGS assessments for the Permian basin where the mean estimate for prospective net acres as of mid 2017 was about 50 million acres. I use an estimate for average acres per well of 300 acres (about 9500 feet lateral length with spacing of 1320 feet between laterals) which gives an estimate of about 167 thousand wells. There were about 14 thousand wells already completed in the Permian basin by June 2017 so total completions would be about 181 thousand wells, if oil prices were high enough to make every potential well location profitable. Using the mean UTRR estimate (70 Gb) and number of potential drilling locations (about 160 thousand as of Dec 21, 2021 based on the data at shale profile where about 21 thousand wells were completed from July 2017 to Dec 2021), I find and estimate for the future decrease in EUR per well that will result in a UTRR of 70 Gb if all potential wells were completed.

After that step a discounted cash flow analysis using guesses of future costs and prices is used to determine whether a well will be profitable to complete to arrive at an ERR for a given scenario, typically ERR is less than TRR, but in rare high oil price scenarios they could be nearly equal.

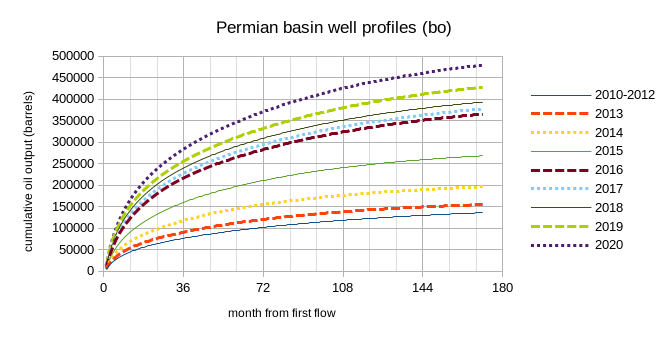

Average well profiles have been developed by fitting an Arps hyperbolic function to the data from shaleprofile.com for the average 2010 to 2012 well and then for each individual year from 2013 to 2020. In my scenarios I assume EUR starts to decrease after Dec 2020 and assume no further increase in lateral length or change in average well spacing.