OPEC December Crude Output Falls to 2-Year Low: Survey

Venezuelan Policies

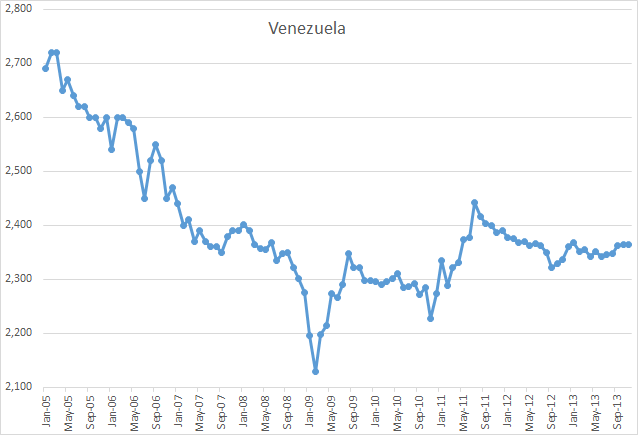

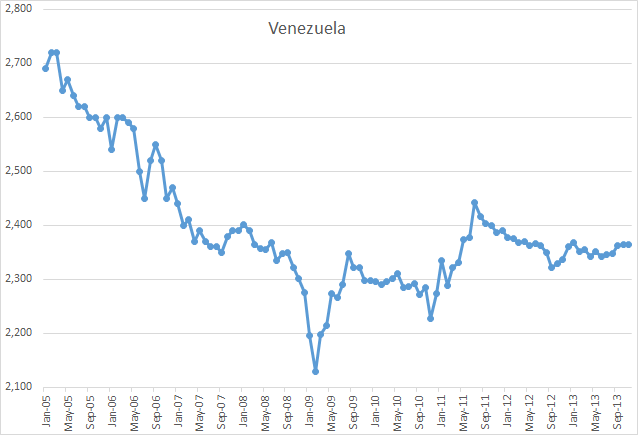

Venezuelan production dropped 235,000 barrels a day to 2.45 million this month, the survey showed. The South American country pumped the least crude since October 2011. Resources have been diverted from energy sector into social welfare programs, sending production lower.

Petroleos de Venezuela SA, the state oil company, was purged after a two-month oil strike intended to oust President Hugo Chavez from power in 2003. Nicolas Maduro, who became president in March when Chavez died, has continued his predecessor’s policies.

“It’s hard to see how the situation in Venezuela gets any better,” said Bill O’Grady, chief market strategist at Confluence Investment Management in St. Louis, which oversees $1.4 billion. “Funds have been used to prop up the government instead of maintaining the oil industry since the PDVSA strike in 2003. It’s clear the country is on an unsustainable path.”

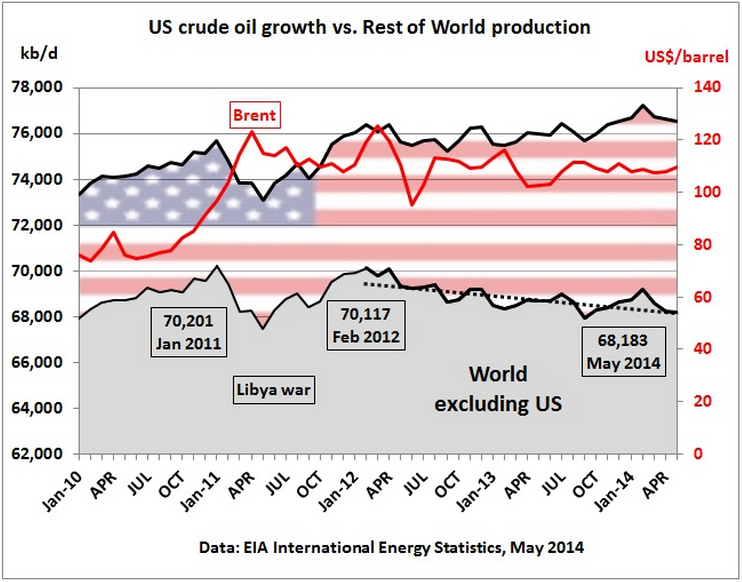

Data for the above graph is from the latest OPEC MOMR published last month and includes data through November 2012. It has Venezuela crude only production at 2,364,000 bp/d in November so it differs considerably from the Bloomberg report above. That report may be using production reported by Venezuela themselves which they reported as 2,854,000 bp/d for November or 490,000 kb/d above what the OPEC MOMR’s “secondary sources” said they produced.

Read More