By Ovi

The focus of this post is an overview of World oil production along with a more detailed review of the top 11 Non-OPEC oil producing countries. OPEC production is covered in a separate post.

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for the oil producing countries. The charts are created from data provided by the EIA’s International Energy Statistics and are updated to September 2025. This is the latest and most detailed/complete World oil production information available. Information from other sources such as OPEC, IEA, STEO and country specific sites such as Brazil, Norway, Mexico, Argentina and China is reported to provide a one or two month outlook.

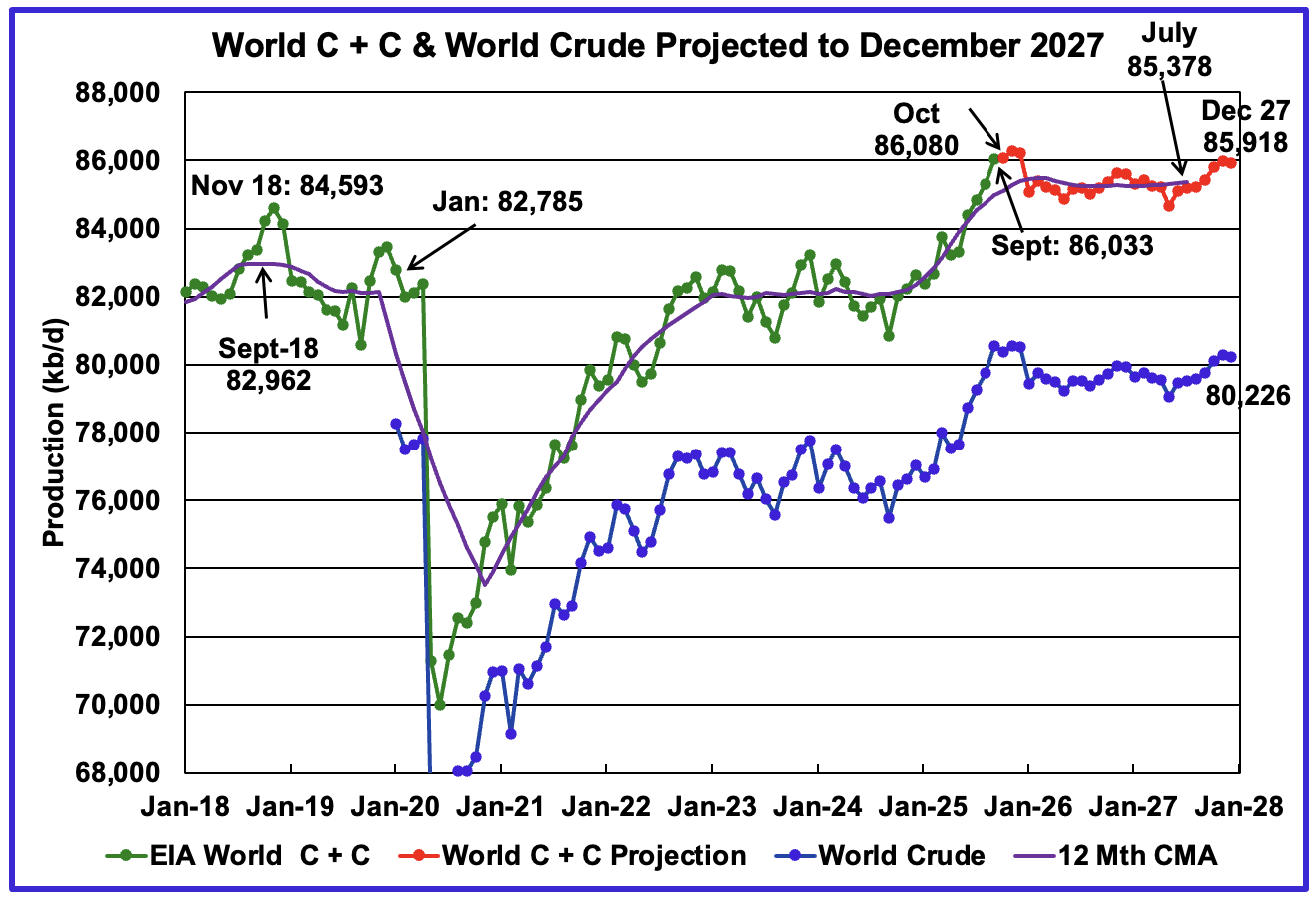

The World’s September oil production increased by 737 kb/d to 86,033 kb/d, a new World Peak Oil All Time High. The large September C + C increase is due to the 792 kb/d increase in crude production shown in the crude graph. That increase then drops in January 2026. The large January drop is just as surprising as the September increase.

The January 2026 STEO was released today and it projects oil production out to December 2027.

This chart has been updated to project World C + C production out to December 2027. It uses the January 2026 STEO report along with the International Energy Statistics to make the projection. Production in October 2025 is projected to increase by 47 kb/d to 86,080 kb/d, if correct, another new World Peak Oil next month.

The 12 month Centred Moving Average shown at July 2027 is 85,378 kb/d vs the September 2018 12 month CMA of 82,962 kb/d.

For December 2027, production is projected to be 85,918 b/d.

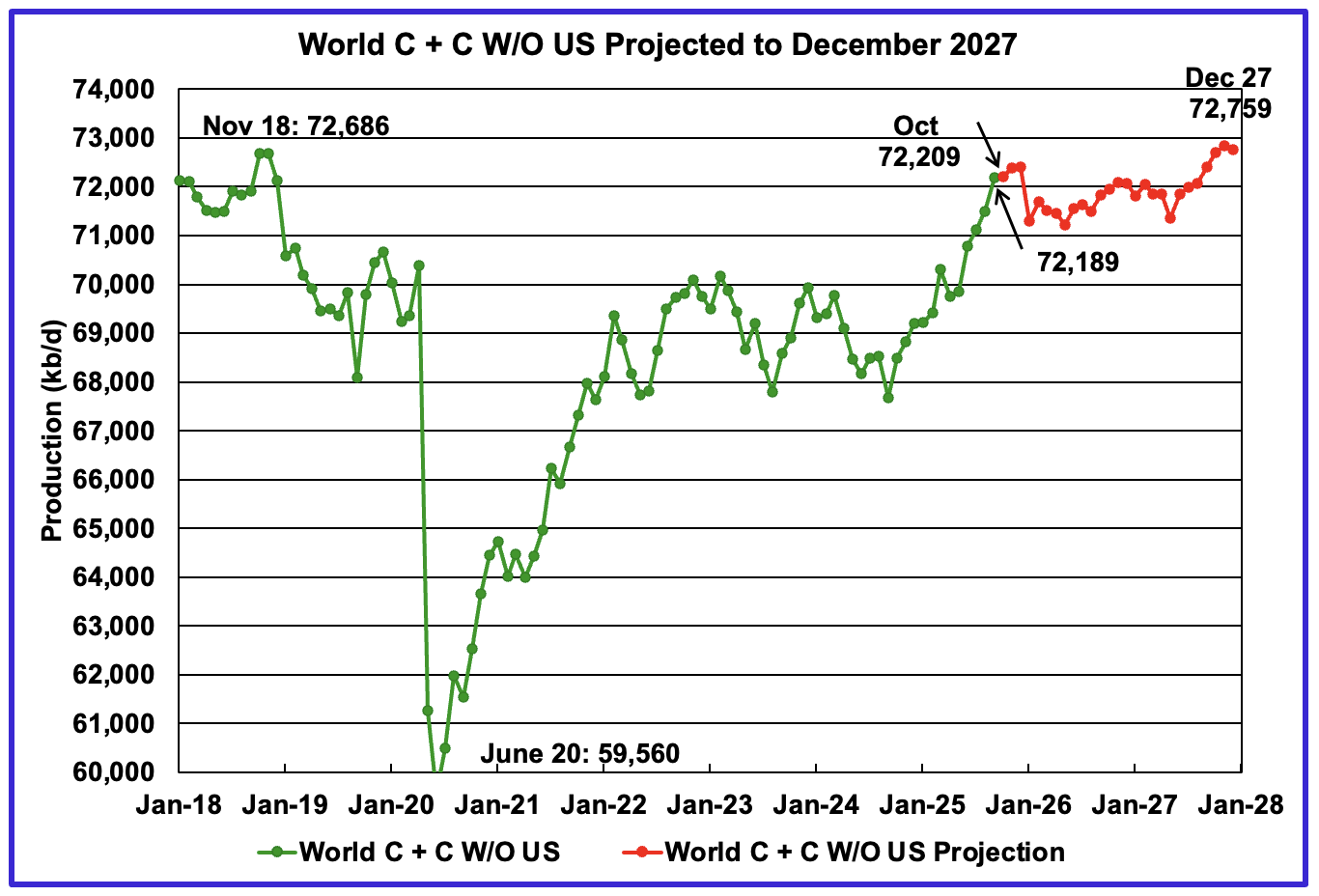

September’s World oil output W/O the US increased by 692 kb/d to 72,189 kb/d. October’s production is expected to increase by 20 kb/d to 72,209 kb/d.

The projection is forecasting that December 2027 World W/O US oil production will be 72,759 kb/d, an increase of 570 kb/d from September 2025.

A Different Perspective on World Oil Production

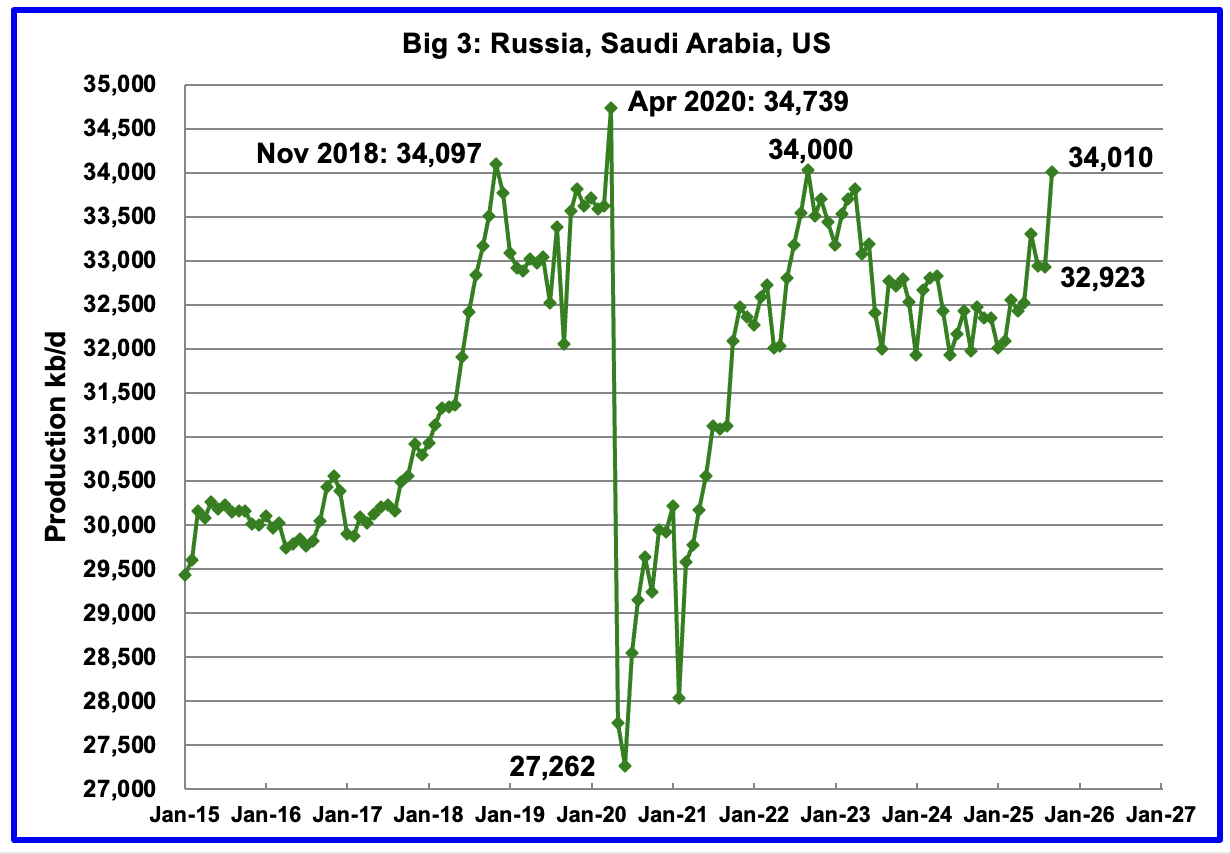

September’s Big 3 oil production increased by 1,087 kb/d to 34,010 kb/d. Saudi Arabia contributed 900 kb/d to the increase while Russia added 143 kb/d.

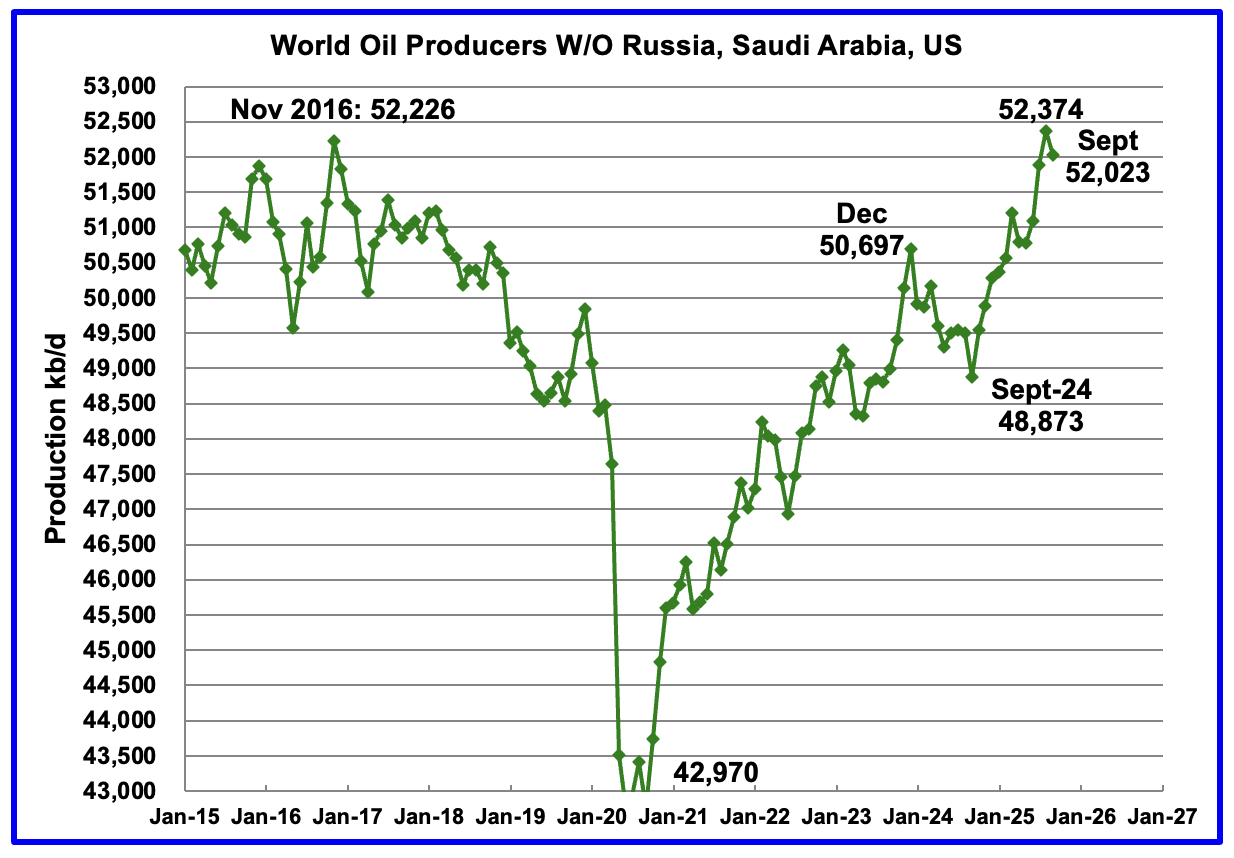

Production in the remaining countries has been slowly increasing since the September 2020 low of 42,970 kb/d. However production dropped in September 2025 by 351 kb/d to 52,023 kb/d.

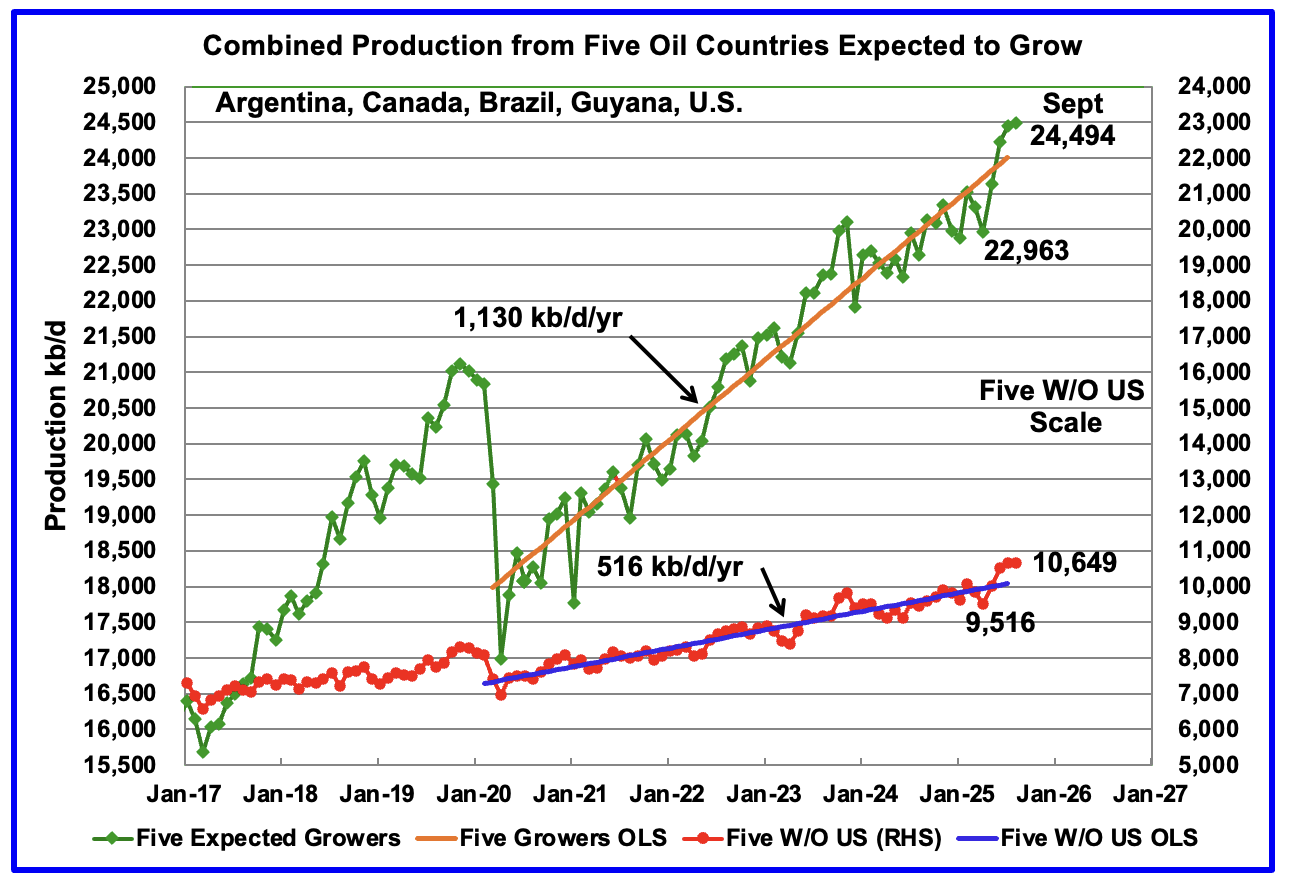

Countries Expected to Grow Oil Production

This chart was first posted a number of months back and shows the combined oil production from five Non-OPEC countries, Argentina, Brazil, Canada, Guyana and the U.S., whose oil production is expected to grow. These five countries are often cited by OPEC and the IEA for being capable of meeting the increasing World oil demand for next year. For these five countries, production from April 2020 to July 2025 rose at an average rate of 1,130 kb/d/year as shown by the orange OLS line.

To show the impact of US growth over the past 5 years, U.S. production was removed from the five countries and that graph is shown in red. The production growth slope for the remaining four countries has been reduced by 614 kb/d/yr to 516 kb/d/yr.

September production has been added to the five growers chart, up by 41 kb/d to 24,494 kb/d. September’s small production increase was a mix of small gains and declines. For the Five growers W/O U.S., September production declined by 4 kb/d to 10,649 kb/d.

October production is expected to grow again due to the large October Brazilian production increase.

Note: The OLS lines are updated to July. 2025

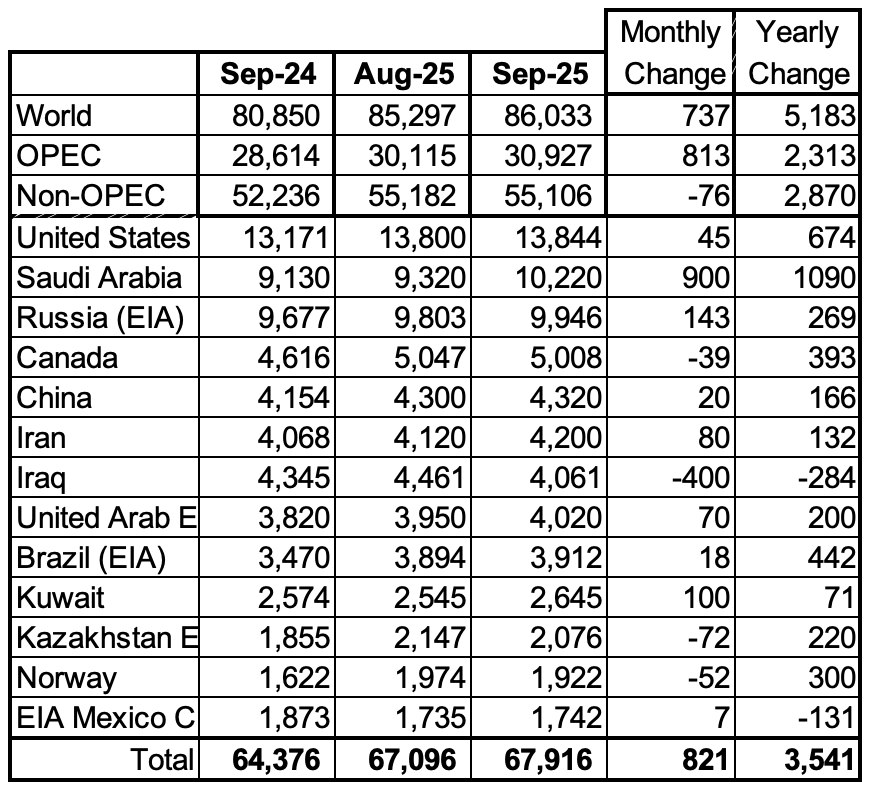

World Oil Countries Ranked by Production

Above are listed the World’s 13th largest oil producing countries. In August 2025 these 13 countries produced 78.6% of the World’s oil. On a MoM basis, production increased by 821 kb/d in these 13 countries while on a YOY basis production rose by 3,541 kb/d. Note the YoY increases from Saudi Arabia, U.S. and Brazil

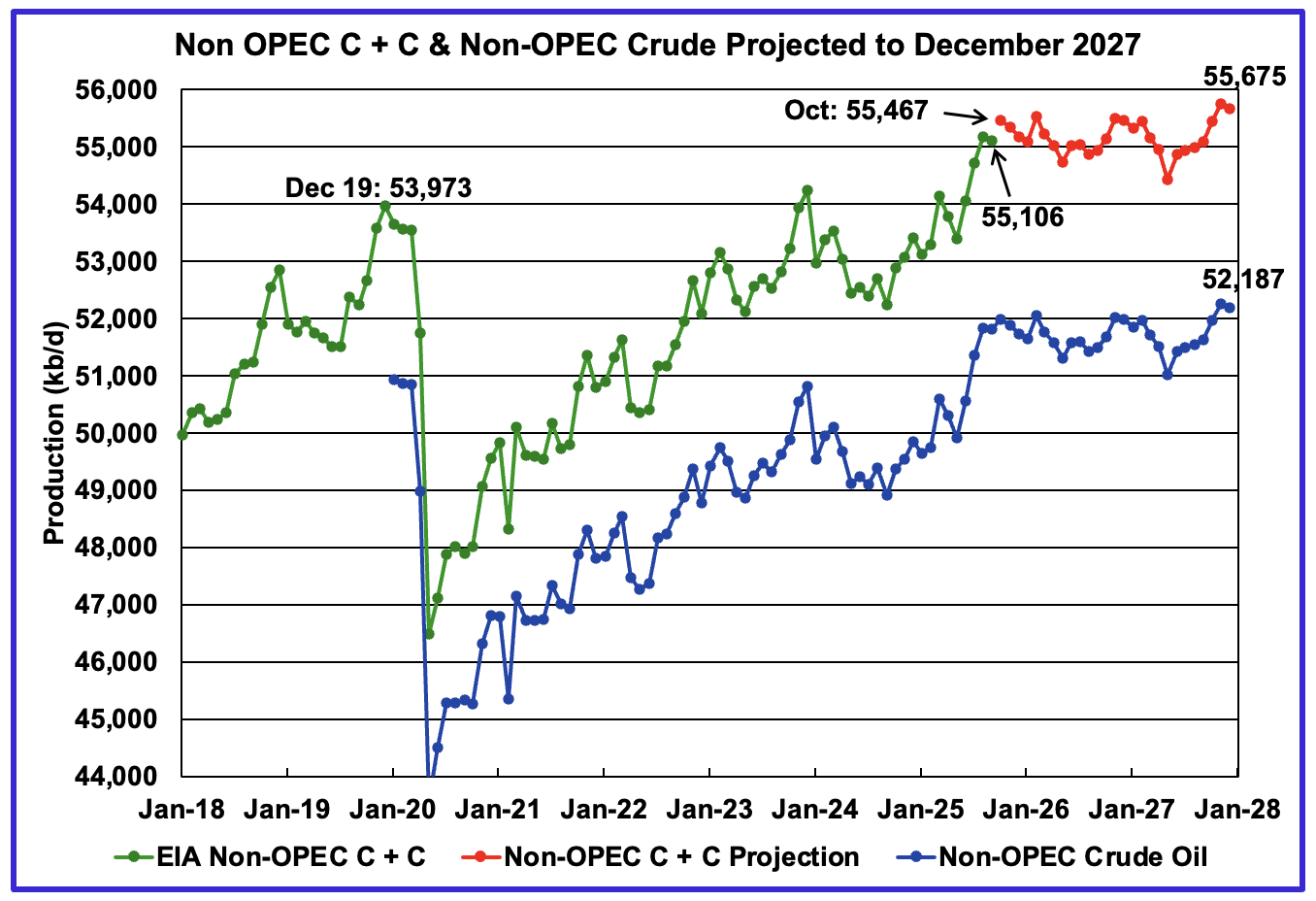

September Non-OPEC Oil Production Charts

September’s Non-OPEC oil production decreased by 76 kb/d to 55,106 kb/d. October is expected to add an additional 361 kb/d to 55,467 kb/d.

Using data from the January 2026 STEO, a projection for Non-OPEC oil output was made for the period October 2025 to December 2027. (Red graph). Output is expected to grow by 569 kb/d from September 2025 to reach 55,675 kb/d in December 2027.

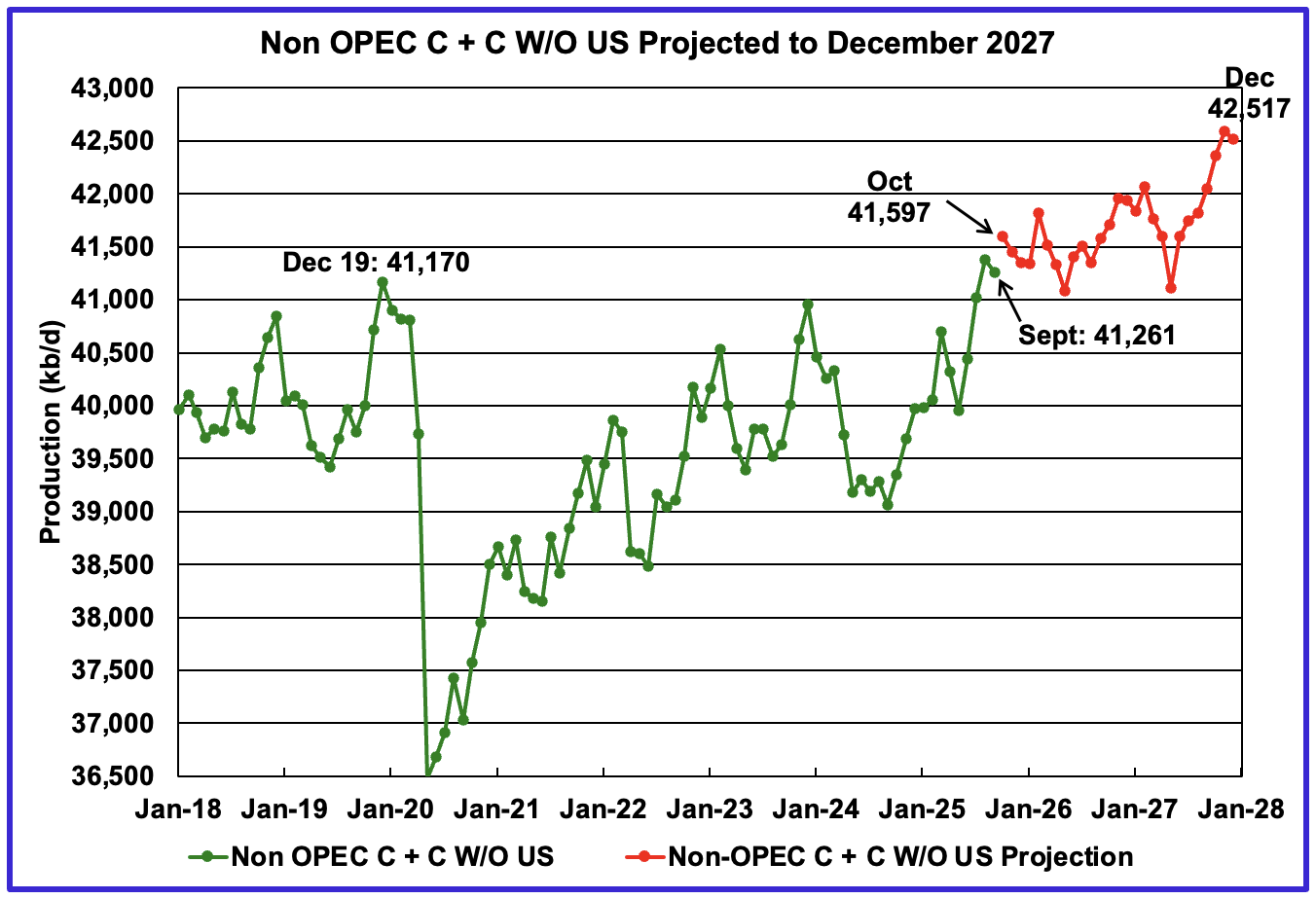

September’s Non-OPEC W/O US oil production decreased by 121 kb/d to 41,261 kb/d. October’s production is projected to add 336 kb/d to 41,597 kb/d.

From September 2025 to December 2027, production in Non-OPEC countries W/O the U.S. is expected to increase by 1,256 to 42,517 kb/d.

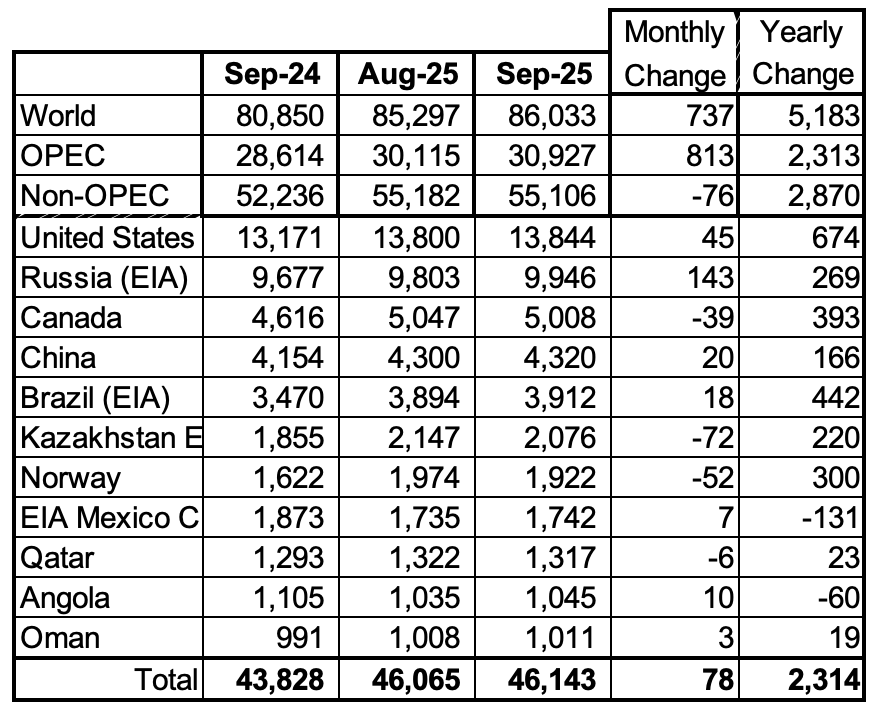

Non-OPEC Oil Countries Ranked by Production

Listed above are the World’s 11 largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. Both Oman and Angola were below 1,000 kb/d for a few months but have rebounded to above 1,000 kb/d.

September’s MoM production increased by 78 kb/d to 46,143 kb/d for these eleven Non-OPEC countries while as a whole the Non-OPEC countries saw a yearly production increase of 2,870 kb/d to 55,106 kb/d. Major yearly gains came from Brazil, Canada and the U.S.

In September 2025, these 11 countries produced 83.7% of all Non-OPEC oil.

Non-OPEC Country’s Oil Production Charts

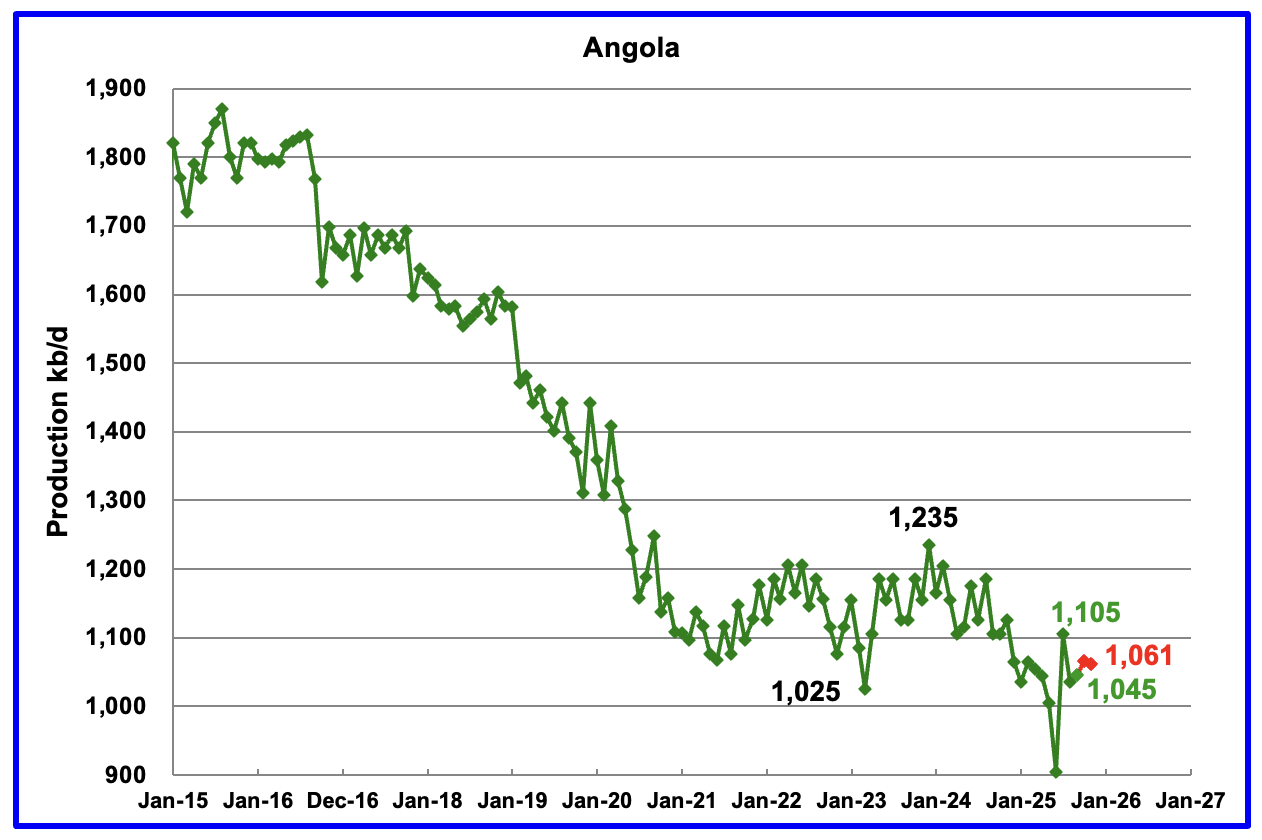

Angola’s September oil production rose by 10 kb/d to 1,045 kb/d.

According to the National Agency for Petroleum, November’s production was 1,061 kb/d, red markers.

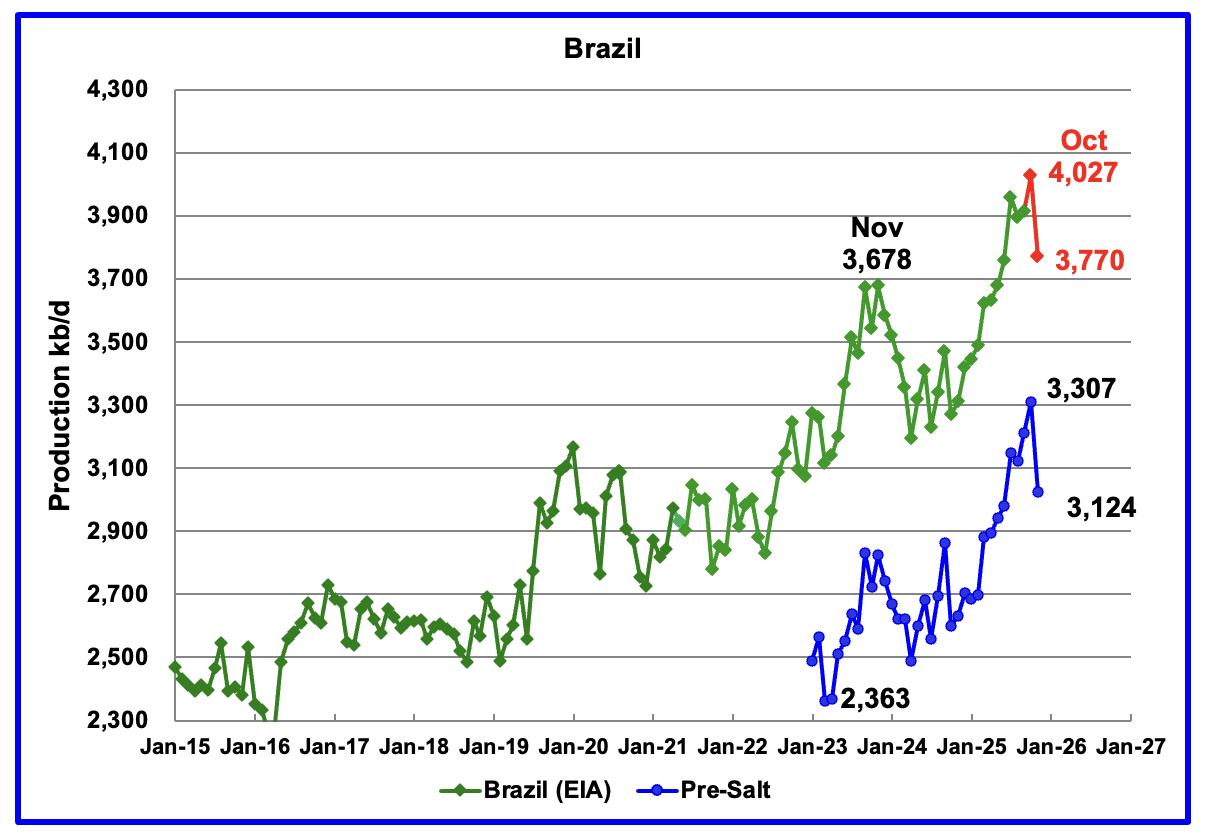

The EIA reported that Brazil’s September’s production rose by 18 kb/d to 3,912 kb/d.

Brazil’s National Petroleum Association (BNPA) reported that production rose in October to a new high of 4,027 kb/d and then dropped by 257 kb/d in November to 3,770 kb/d. The pre-salt blue graph tracks Brazil’s trend. Pre-salt production decreased by 283 kb/d in November to 3,124 kb/d.

According to this article, the Production drop was due to platform outages at offshore fields.

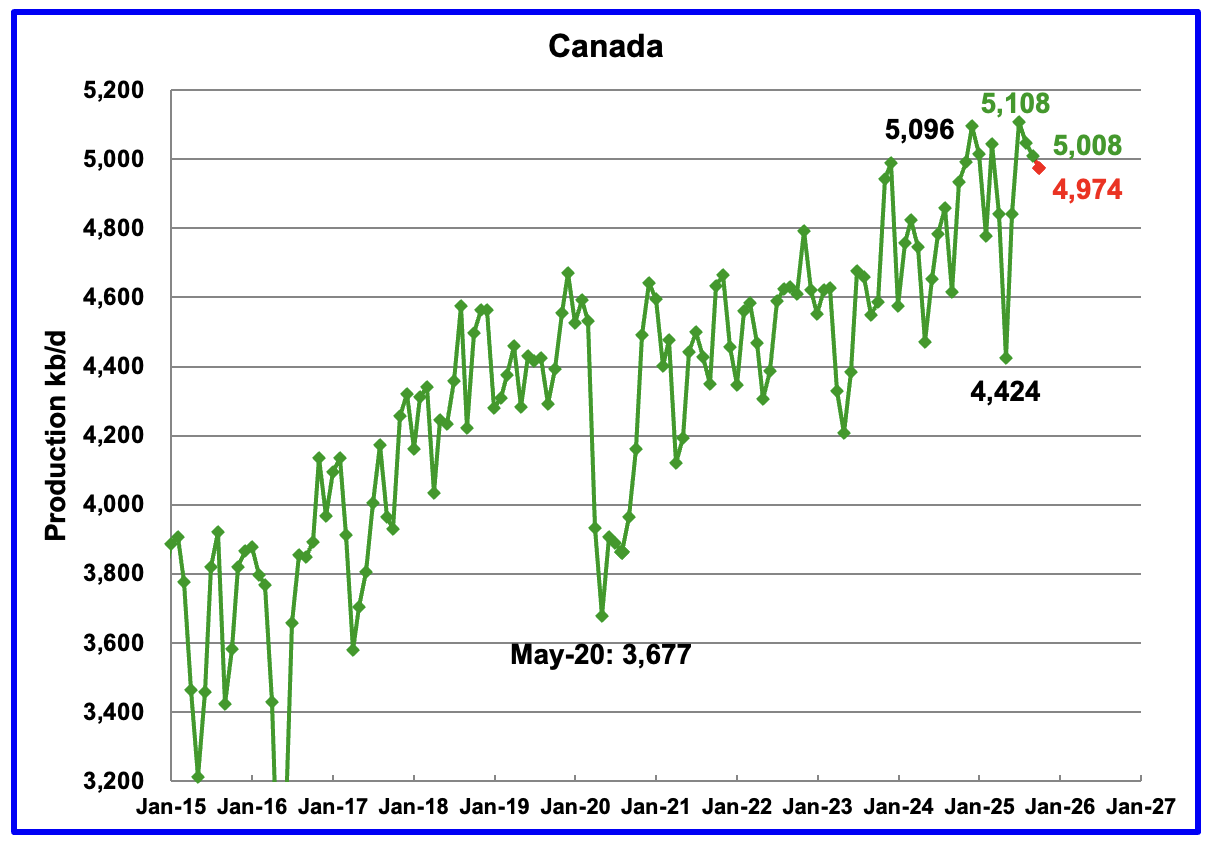

Canada’s oil production decreased by 39 kb/d in September to 5,008 kb/d.

A projection has been made for October production based on preliminary production provided by the Canada Energy Regulator (CER). October’s projected production dropped to 4,974 kb/d. The CER estimate contains some NGLs which have been removed from the projection. On average the EIA reduces the CER’s monthly production by 375 kb/d.

The EIA reported China’s September oil output rose by 20 kb/d to 4,320 kb/d.

The China National Bureau of Statistics reported October production dropped by 80 kb/d to 4,240 kb/d and then in November rose by 49 kb/d to 4,289 kb/d.

On a YoY basis, China’s August production increased by 166 kb/d from 4,154 kb/d.

According to the OPEC December MOMR: Offshore developments, particularly in Bohai Bay in northern China and the South China Sea, are projected to lead overall production growth following recent exploration investment.

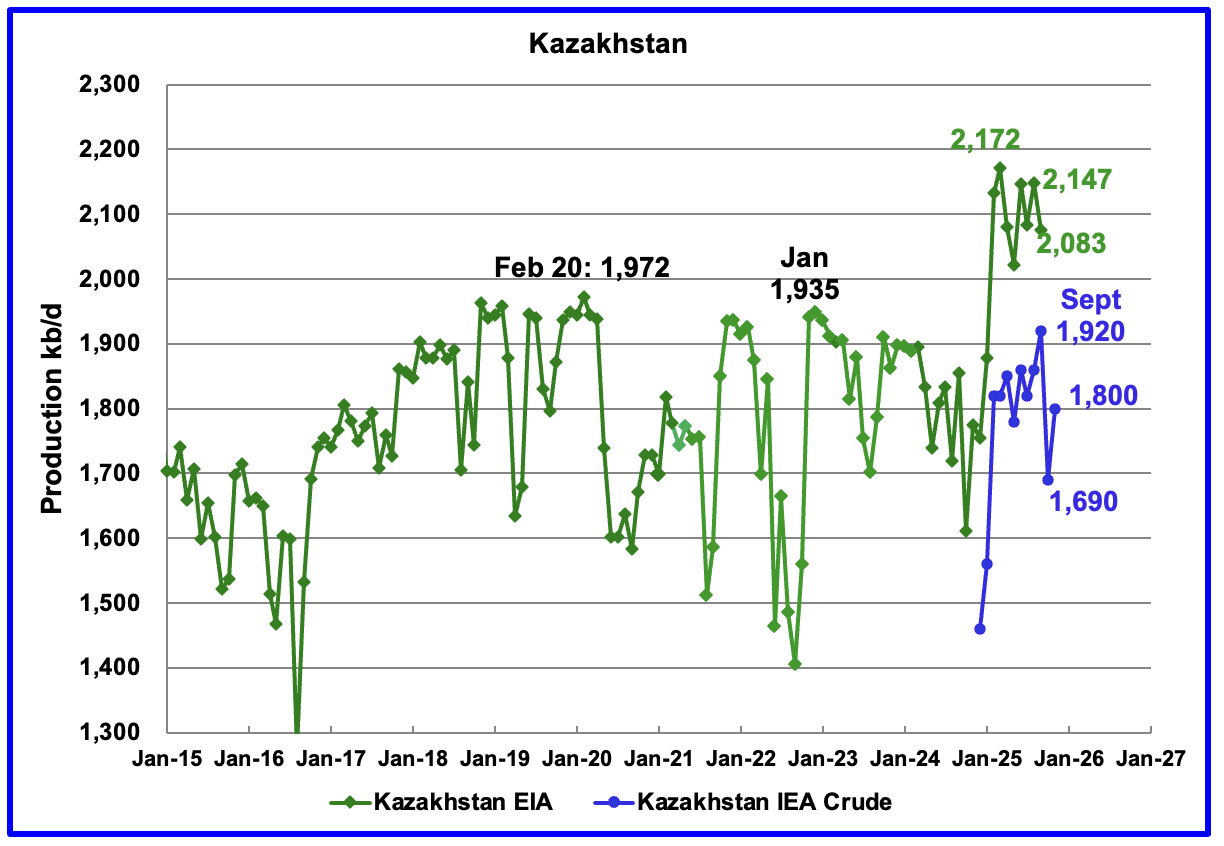

According to the EIA, Kazakhstan’s September oil output decreased by 72 kb/d to 2,076 kb/d.

Since Argus no longer reports OPEC + crude production, production data for Kazakhstan will now be taken from the monthly IEA reports. In September 2025 pre-salt crude production rose to 1,920 kb/d. In the IEA’s December report, they reported October’s production dropped by 230 kb/d to 1,690 kb/d and then rose to 1,800 kb/d in November.

The November oil production is 320 kb/d above the OPEC + target set for Kazakhstan.

According to this Article: Four Opec+ producers plan to triple compensation cuts by June. Kazakhstan will make the deepest cuts.

“Kazakhstan will account for the largest share of the increase, with its cutbacks totalling 669,000 bpd by June, from 131,000 bpd in December. Baghdad, which frequently overproduces its quota within Opec+, will maintain cuts at a 100,000 bpd level by midyear.”

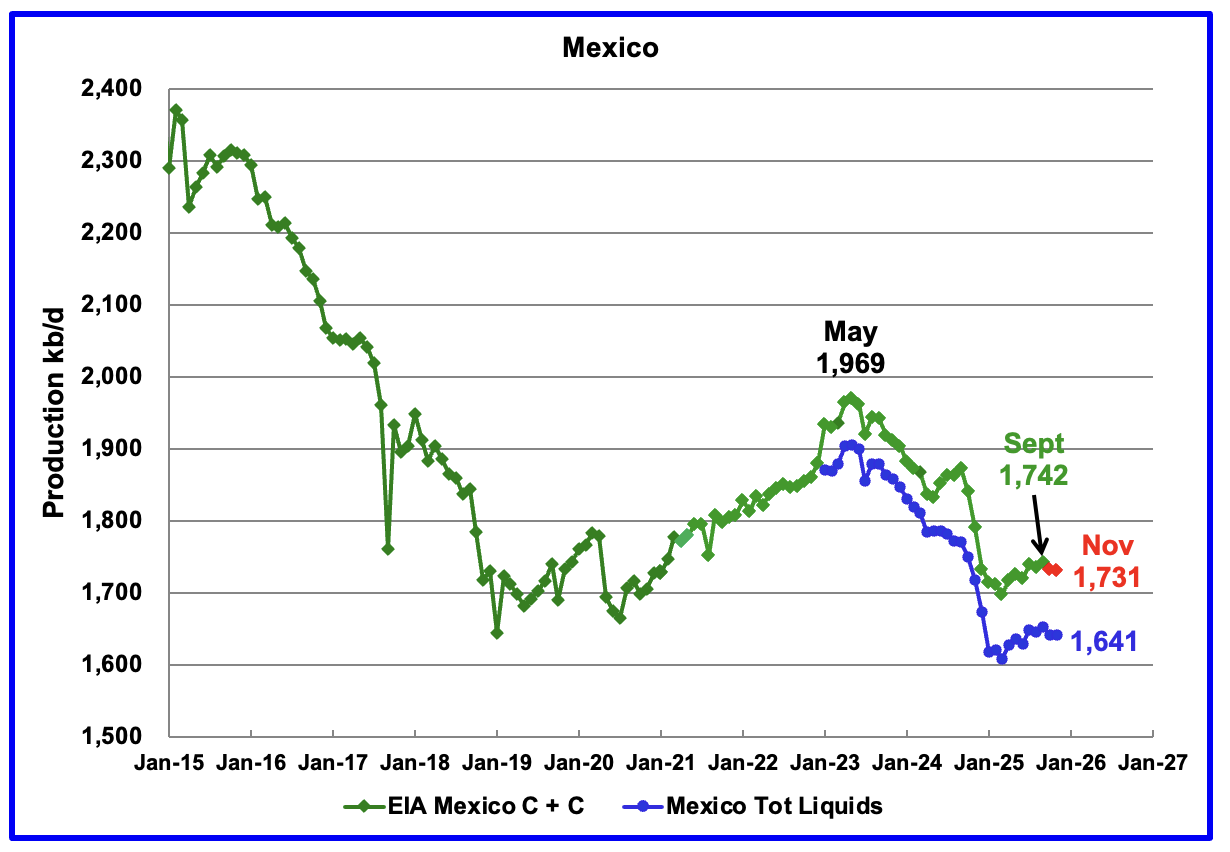

According to the EIA, Mexico’s September output rose by 7 kb/d to 1,742 kb/d.

In June 2024, Pemex issued a new and modified oil production report for Heavy, Light and Extra Light oil. It is shown in blue in the chart and it appears that Mexico is not reporting condensate production when compared to the EIA report.

In earlier EIA reports, they would add close to 55 kb/d of condensate to the Pemex’s “Total Liquids” report. More recently the EIA has been adding 90 kb/d of condensate to Mexican production. For October and November production, 90 kb/d have been added to the Pemex report. November’s production is estimated to be close to 1,731 kb/d and was unchanged from October. Note that Mexico’s production, as reported by Pemex for the last four months has stabilized around 1,650 kb/d.

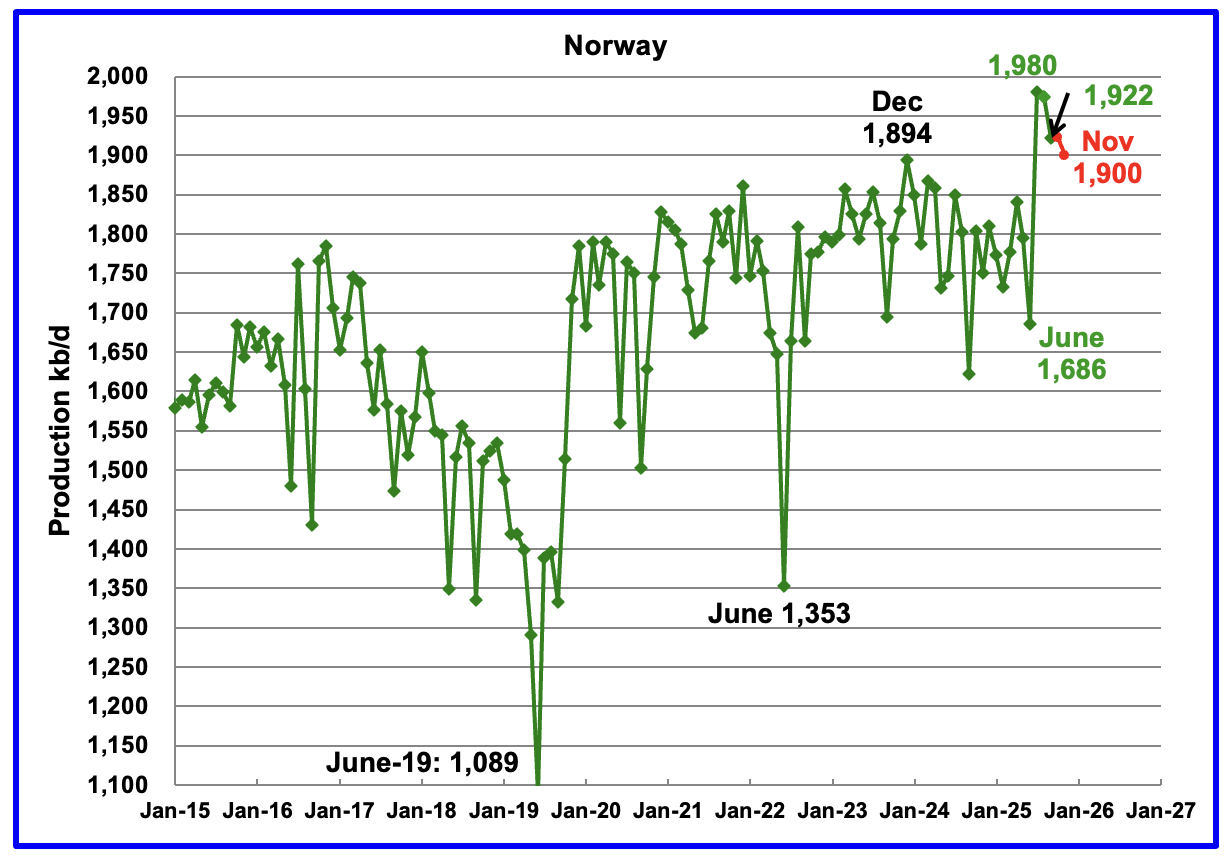

The EIA reported Norway’s September’s production dropped by 52 kb/d to 1,922 kb/d.

Separately, the Norway Petroleum Directorate (NPD) reported that October’s production was flat and November’s production dropped to 1,900 kb/d, red markers.

The Norway Petroleum Directorship also reported that November’s oil production was 4.3 % above forecast.

According to the OPEC December MOMR: “For the remainder of the year, output is expected to be underpinned by the Johan Castberg and Jotun FPSOs, complemented by strong contributions from Johan Sverdrup”

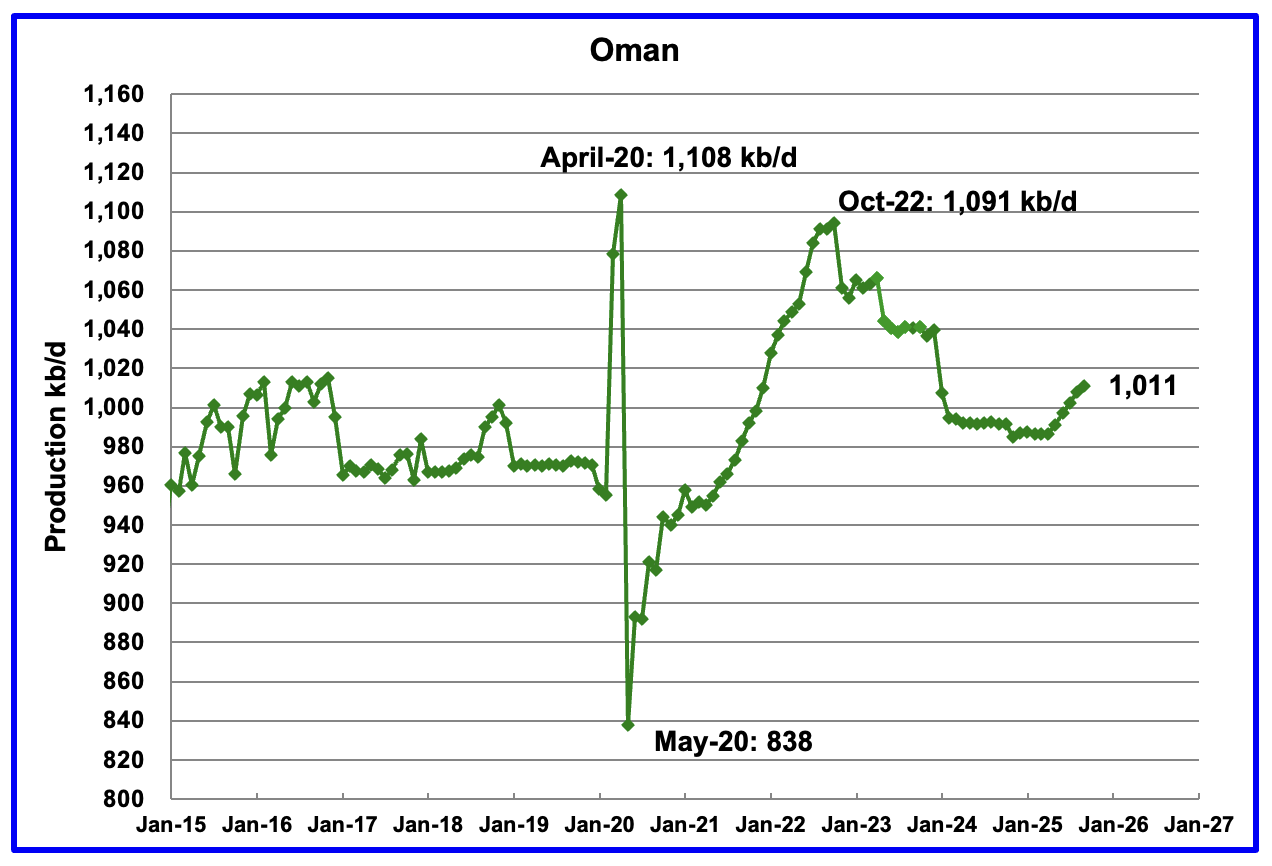

According to the EIA, September’s output rose by 3 kb/d to 1,011 kb/d and appears to have begun a budding growth phase. Previous production peaked in October 2022.

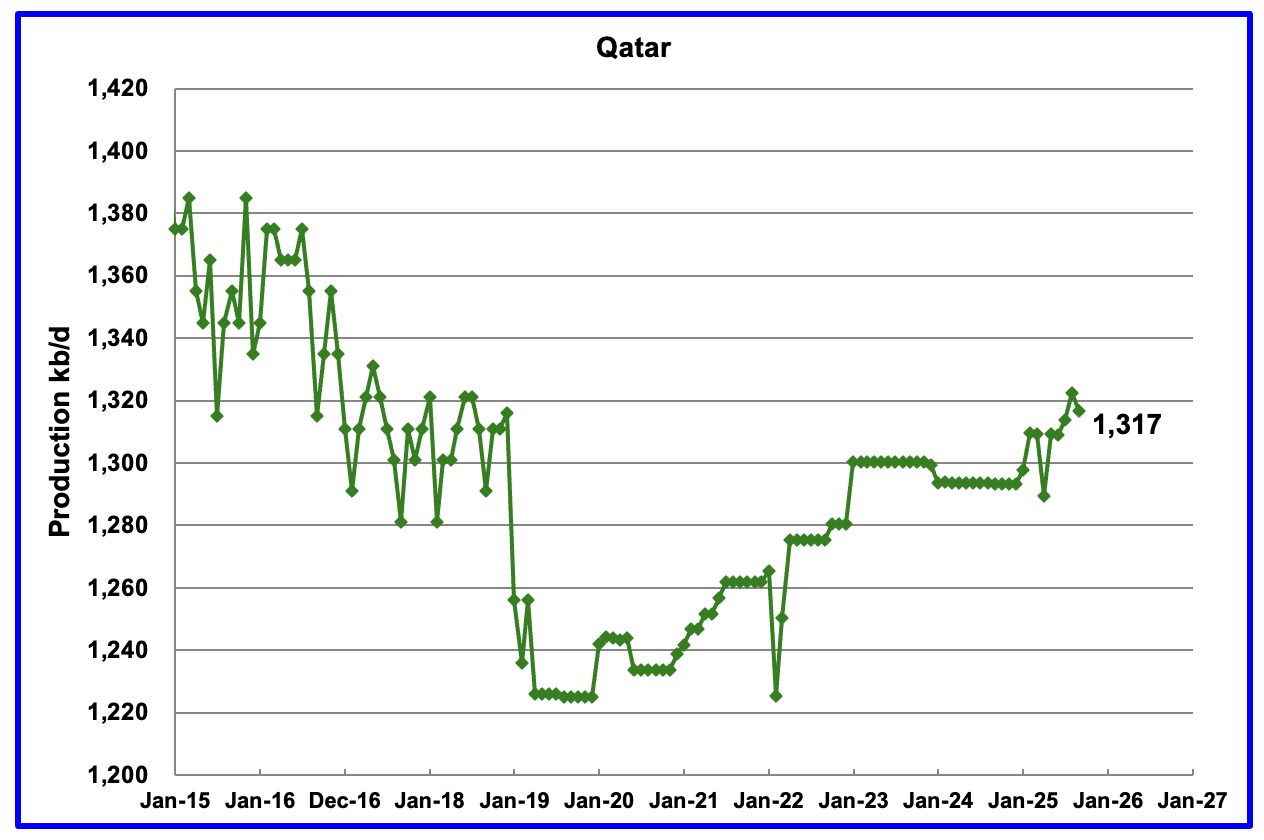

Qatar is now providing the EIA with monthly updated oil production back to January 2025. Qatar’s September’s output was reported to be 1,317 kb/d down 5 kb/d from August

The EIA reported Russia’s September C + C production increased by 143 kb/d to 9,946 kb/d and was up by 269 kb/d from September 2024.

Up to August 2025 Argus Media used to report OPEC + crude production. That monthly report has now been discontinued. The above chart now also shows Russian production as reported by the IEA. It is difficult to assess the accuracy of the IEA report but over the last few months the IEA’s Russian production has been around 100 kb/d to 150 kb/d higher than Argus’ Media. The best that can be done at this time will be to compare the production trends between the EIA and the IEA. I think that Russian oil production continues to be a major state secret at this time because of the damage being caused by the heavy bombing to its related crude oil processing facilities.

According to the IEA’s December report, October crude production was 9,240 kb/d and then November production dropped by 210 kb/d to 9,030 kb/d. November production was 500 kb/d lower than the OPEC + target set for Russia and is the first month that may be showing the effects of Ukrainian bombing.

According to this Article: Russia’s Crude Output in December Made Deep Plunge due to Ukrainian drone attacks.

“Russia’s crude oil production plunged by the most in 18 months in December, pincered by western sanctions that are causing the nation’s barrels to pile up at sea and a surge of Ukrainian drone attacks on its energy infrastructure.

The nation pumped an average 9.326 million barrels a day of crude oil last month, according to people with knowledge of government data, who asked not to be identified discussing classified information. The figure — which doesn’t include output of condensate — is more than 100,000 barrels a day below November, and almost 250,000 barrels a day lower than Russia is allowed to pump under agreement with the Organization of the Petroleum Exporting Countries and allies.”

Note there is huge discrepancy between the bold statement regarding Russia’s November production and the production reported by the IEA. A likely explanation could be the IEA picked up the big drop in November a month before Bloomberg picked it up.

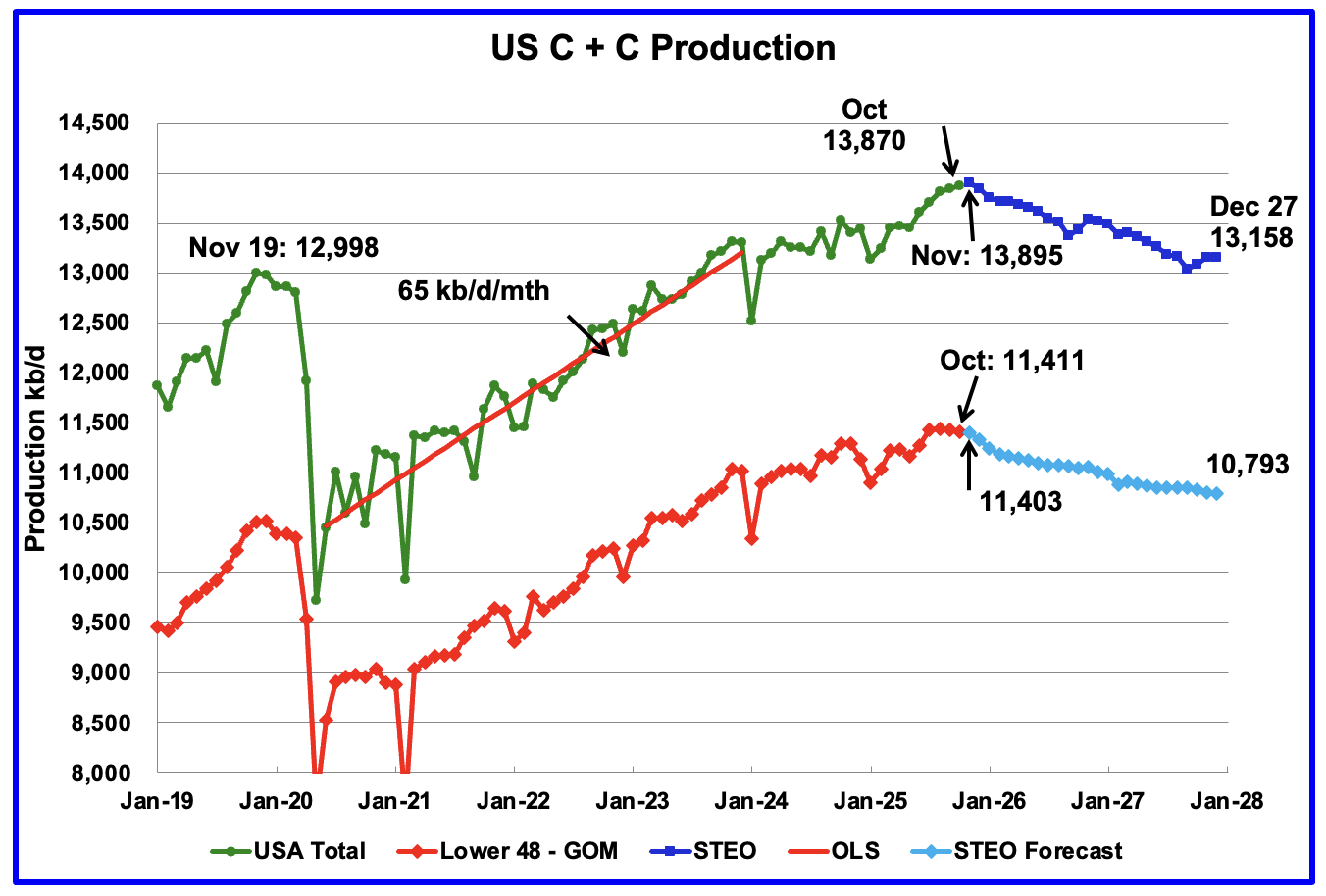

This US production chart up to October 2025 is the same as the one published last week in the US update. However the projected portions of the two production graphs have been updated and extended to December 2027 using the January 2026 STEO.

U.S. November projected production has been revised up by 34 kb/d to 13,895 kb/d from the last report.

Production in December 2027 is expected to be 13,158 kb/d. Production peaks in November 2025 and then begins its slow steady decline.

Note production in the Onshore L48 essentially peaked in August 2025 at 11,440 kb/d. Production decline steepens starting in December 2025.

Leave a Reply