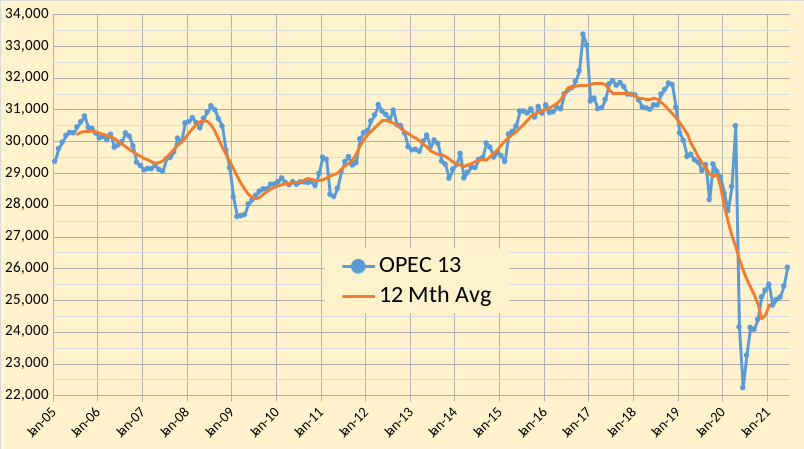

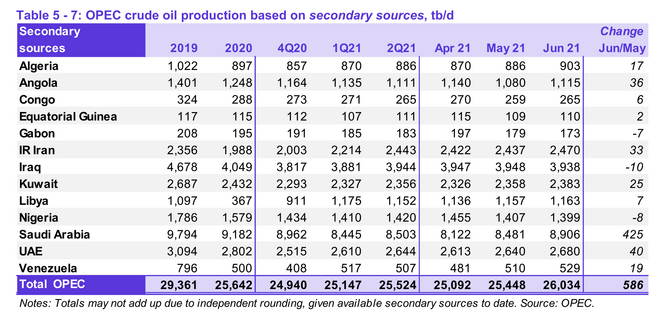

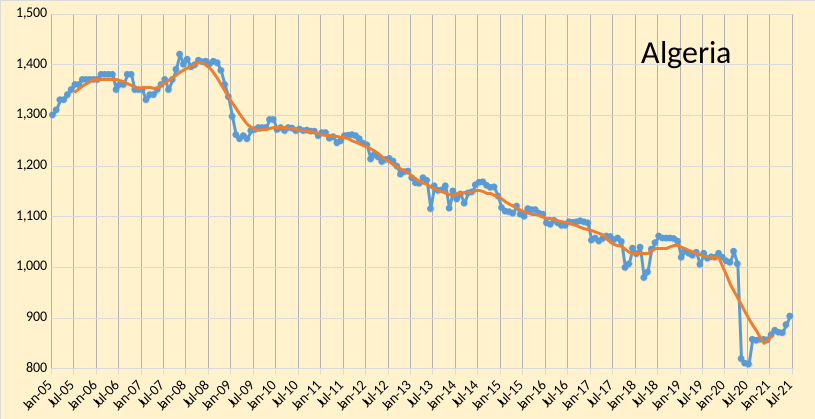

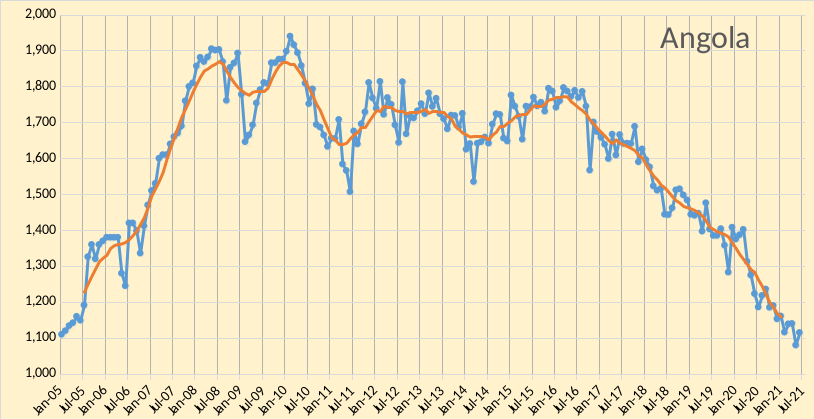

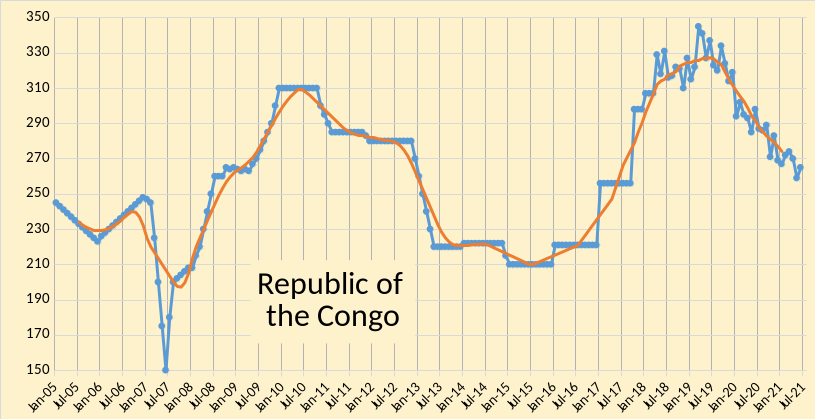

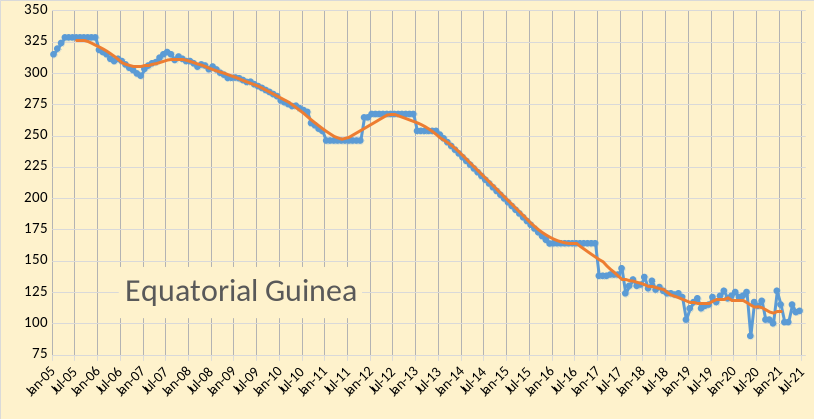

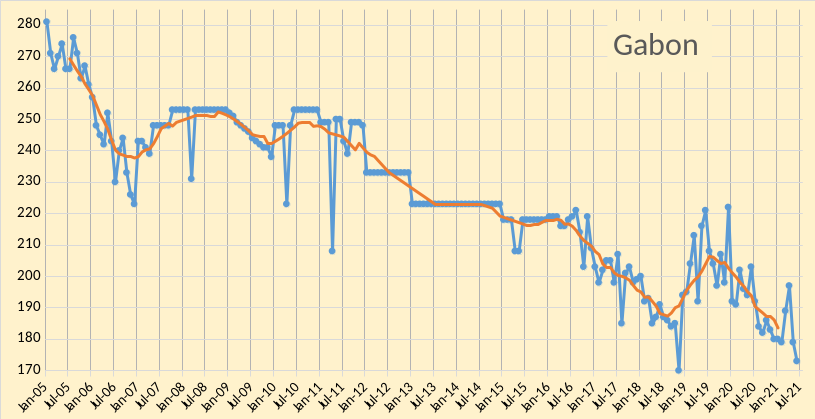

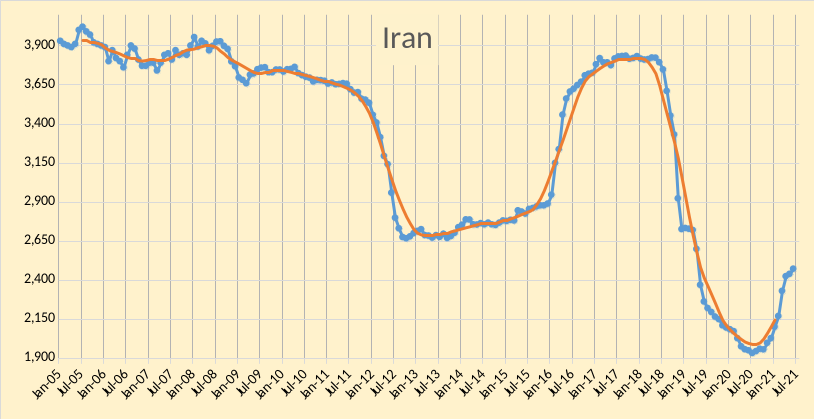

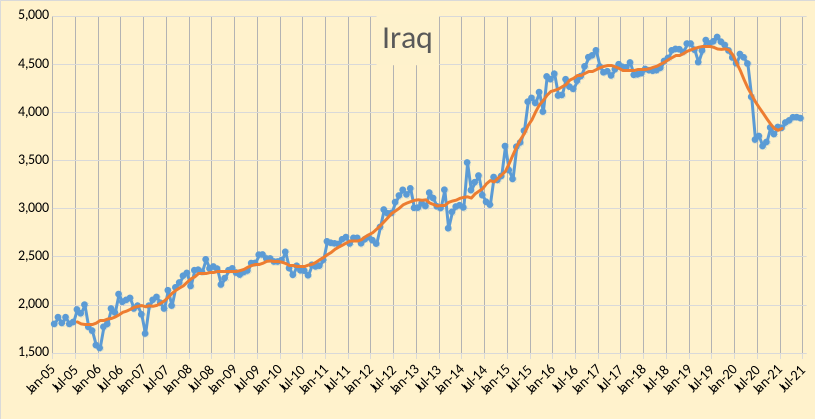

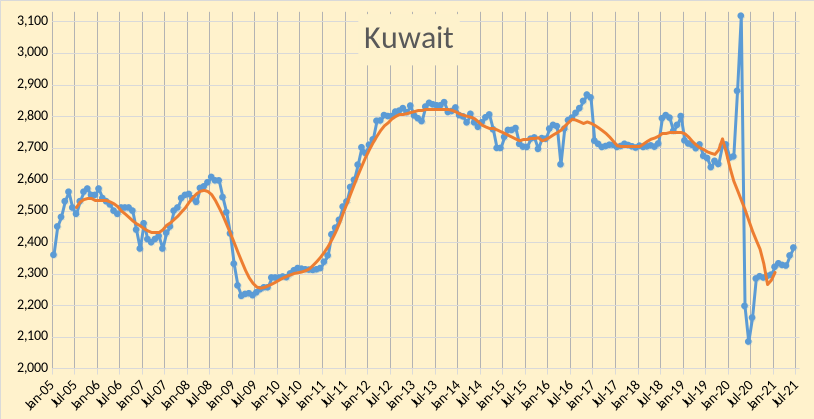

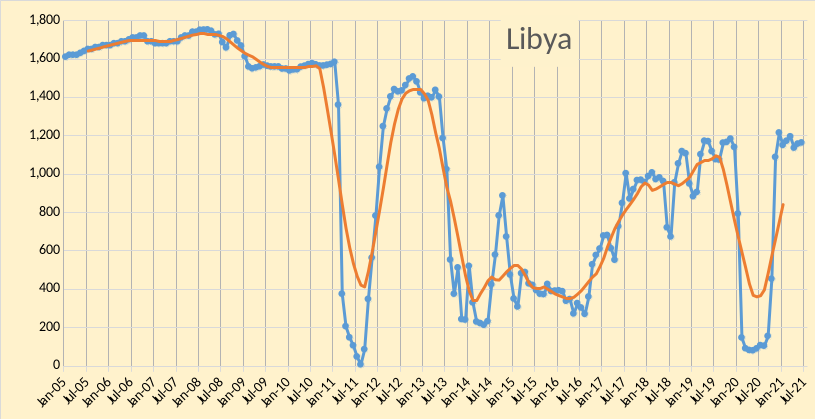

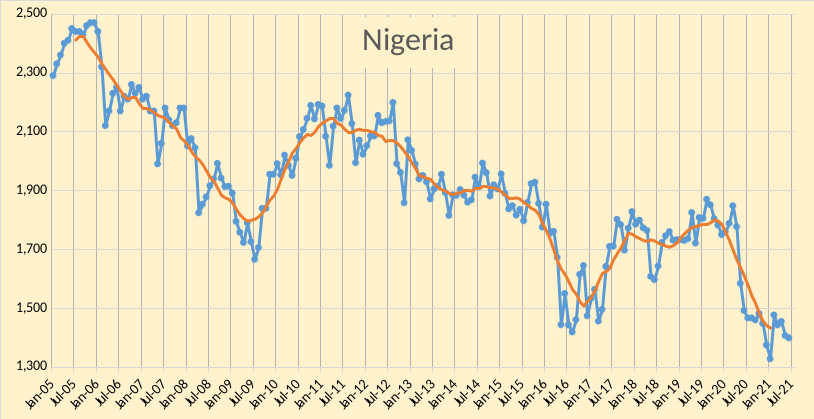

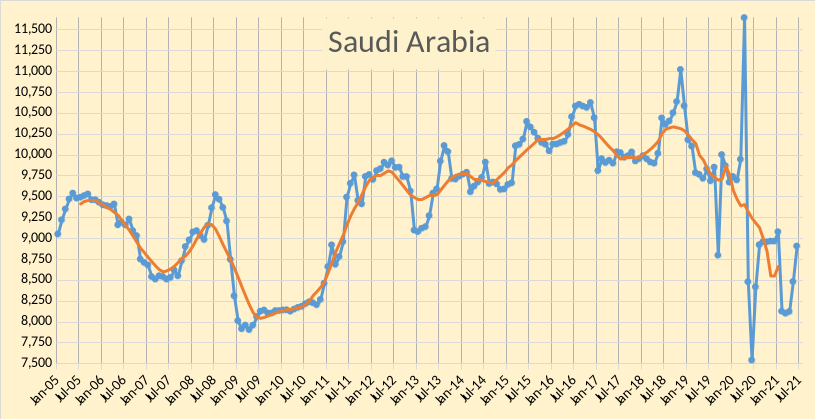

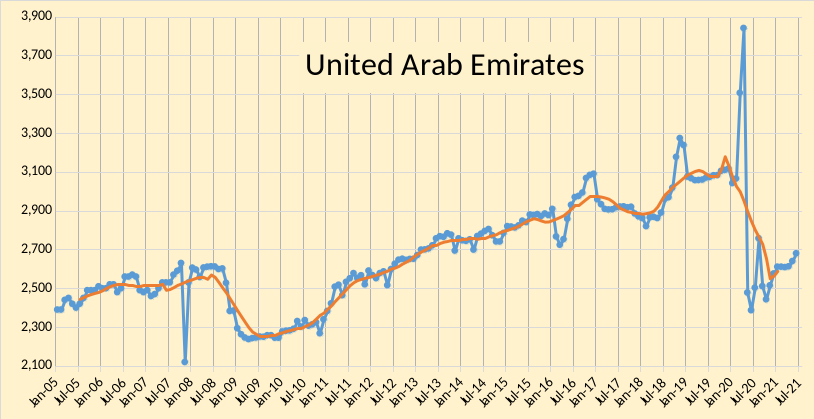

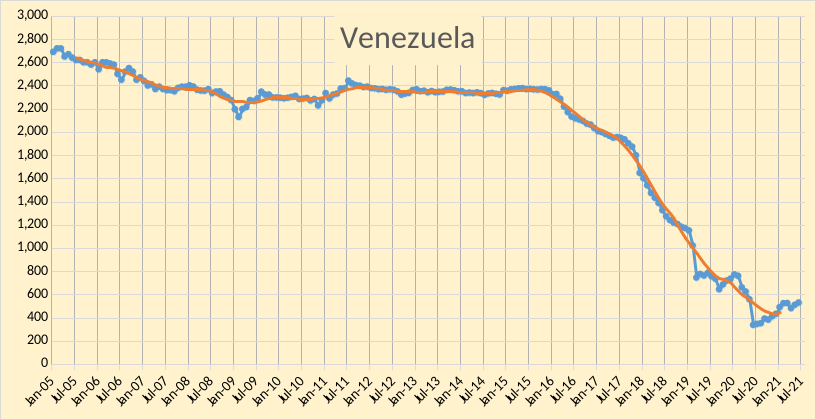

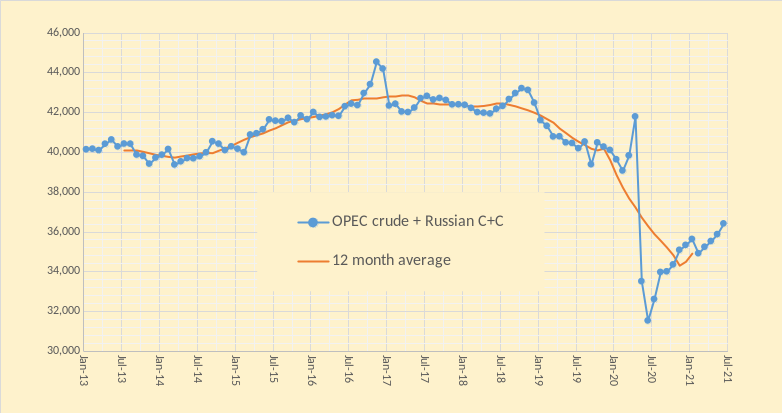

The OPEC Monthly Oil Market Report for July 2021 was published this past week. The last month reported in each of the charts that follow is June 2021 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the charts that follow the blue line with markers is monthly average output and the red line without markers is the centered twelve month average (CTMA) output.

April OPEC output was revised up by 19 kb/d from last month’s report and May was revised up by 15 kb/d. OPEC output increased by 586 kb/d in June with most of that increase (425 kb/d) from Saudi Arabia.

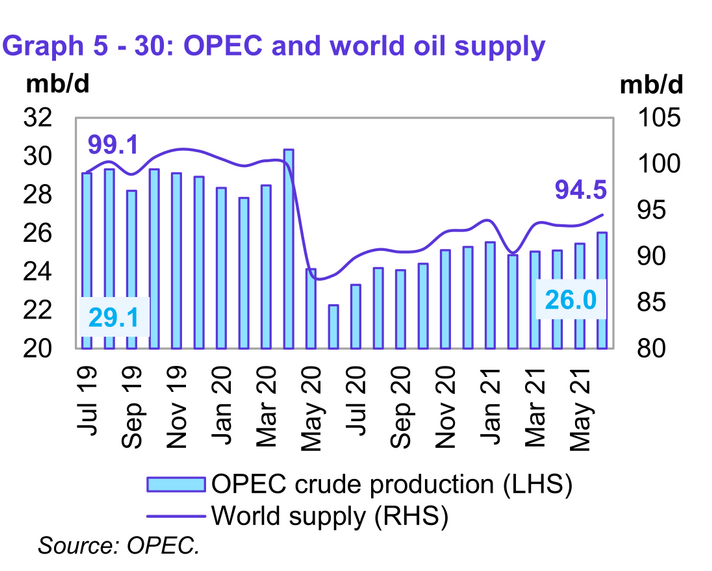

World liquids supply remains about 5% below the level of 2 years ago (94.5 vs 99.1 Mb/d, OPEC crude output is about 10% below the level of 2 years ago (down 3.1 Mb/d from 29.1 Mb/d in July 2019).

The chart above uses data from the Russian Energy Ministry and converts from metric tonnes to barrels at 7.3 barrels per tonne, the combination is OPEC crude plus Russian C+C output. Russian output decreased by 48 kb/d in June 2021 to 10376 kb/d. OPEC13 crude + Russian C+C output increased by 538 kb/d in June 2021 to 36410 kb/d. The centered 12 month average OPEC crude plus Russian C+C output in Jan 2021 (most recent data point) was 34912 kb/d an increase of 406 kb/d from the Dec 2020 level.

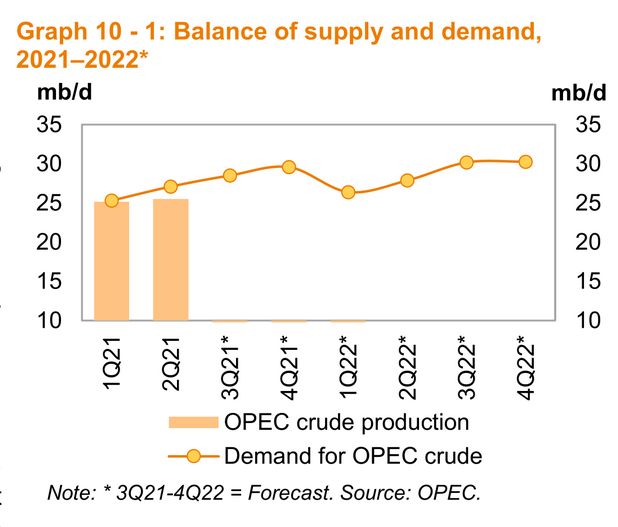

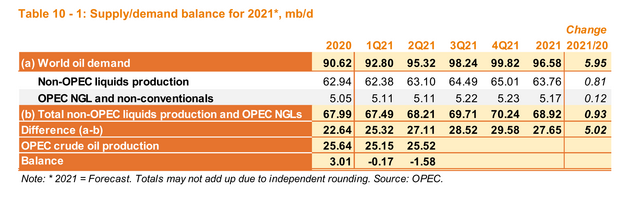

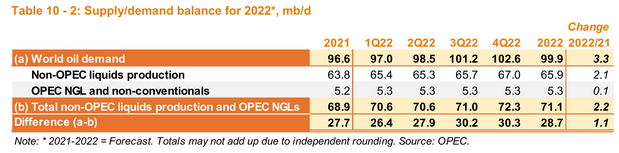

Figure 19 shows the difference between World liquids demand and non-OPEC output plus OPEC non-crude output, the so-called “call on OPEC”, which is forecast to increase from 26 Mb/d in 2Q21 to 30 Mb/d in 4Q2022, an increase of 4 Mb/d.

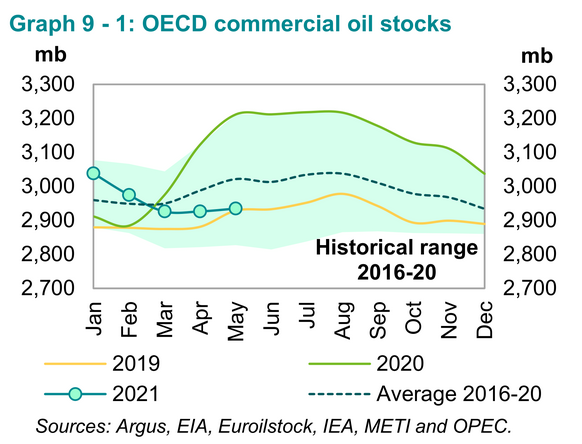

April OECD commercial oil stocks were 86,600 kbo below the 5 year average (see figure 19 above). OPEC crude output for the 2Q21 period was was about 25,520 kb/d. OPEC estimates demand for OPEC crude in the third quarter of 2021 will average about 28,520 kb/d. If the OPEC demand estimate for OPEC crude is correct and OECD oil stocks roughly reflect the level of World oil stocks and OPEC output remains at 26,000 kb/d, then for the third quarter of 2021, we would expect OECD oil stocks to continue to decrease. For OPEC to balance the World oil market at their expected levels for non-OPEC output and world Demand for the third quarter of 2021 would require an increase in OPEC output of about 2.5 Mb/d to and fourth quarter output would need to rise by another 1020 kb/d to meet world demand for oil. I think it is possible that OPEC might meet these levels of output. Note that the OPEC demand estimates might be lower than is likely, if 2021 world real economic growth is 5.5% in constant international dollars as OPEC forecasts. Seems likely we will continue to see oil prices rise for the rest of 2021.

Nice hubbert curves. Also, this may be the last opec post Dennis makes if they start cutting and peak oil past.

Nice Hubbert curves are…nice…but them never having worked before, it seems that their “niceness” might not be relevant to projecting future oil production. As far as peak oil past, we’ve had some 3-4-5 just this century, isn’t it a bit more important to talk about how many more peaks there might be, before we achieve THE peak?

isn’t it a bit more important to talk about how many more peaks there might be, before we achieve THE peak?

No, not at all. We now know, that because all predictions have been wrong, that there will never be “THE peak”. If it has never happened in the past, that automatically means it will never happen in the future. Right?

Hubbert’s mathematical explanation of a peak of finite resources was spot on, axiomatic, and true to this day. 3 points along the path of finite resource extraction, a beginning at zero, an ending at zero, and a maxima somewhere along the way. So of course there will be THE peak. Other peaks HAVE happened in the past, more than once, so of course they can happen again. Hence my point. When Colin Campbell proclaimed global peak oil circa 1990 or so, he didn’t caveat it with “well gee, this is the most recent, but don’t worry, I’ll proclaim more in the future when I get this wrong”. He didn’t say a word about his 1990 call when he did the Scientific America paper most are familiar with, where he declared another global peak oil in 2002 or, including “unconventionals”. So, knowing in advance that this has closely resembled the broken clock being right twice a day problem, how many more rotations are out there before the clock battery runs out seems to be a completely valid observation.

THE peak was November 2018, with the average peaking in 2019. That is an observation, not a prediction. That is called “hindsight”.

To be more accurate (based on the sheer number of peaks come and gone in the modern era….since 1990), the most recent peak is November of 2018. Prior hindsights included 1979 (that one lasted for 15 years before the clock ran out on it), 2005 (Deffeyes was validating his date years afterwards), 2006 (called by the IEA in 2010), 2008 (called in hindsight by TOD in 2009) and didn’t someone on this website call for yet another one in 2015 or so? When peak oils can be invalidated half a century AFTER one was in hindsight (the US and Ohio being two examples) or 16 years if you want to discuss global peak oils (1979), how MUCH hindsight is required? Certainly the most recent, at less than 2 years, is insignificant.

Long time since hearing from Rulz — so long that have had a book published, etc

As always the thing to remember is that the reason for fracking shale oil in the first place is that conventional sources of crude oil are all but depleted. And shale is no panacea — see George Kaplan’s informative comment elsewhere in the comments

https://peakoilbarrel.com/opec-update-june-2021-2/#comment-721756

The concept of Peak Oil is now nothing more than a band-aid to keep the patient from hemorrhaging

David Rutledge’s book Energy, Supply and Demand was published last year.

He was a dean of Engineering at Caltech (now retired) and taught a course on energy for a number of years. Amazon let’s you see the Table of Contents.

https://www.amazon.com/Energy-Supply-David-B-Rutledge/dp/1107031079/ref=sr_1_1?dchild=1&keywords=david+rutledge+energy&qid=1627101616&sr=8-1

On page 212 is a table from which the peak dates can be calculated to be:

—

oil + gas -> 2029.5

—-

coal -> 2006.0

—–

Fossil Fuels -> 2023.5

I replied to this comment Paul, but it doesn’t seem to show up. My apologies at a delayed response. I disagree with your comment that a 70+ year old completion technique has something to do with “conventional oil” (oil and gas produced via wells drilled into hydrocarbon bearing strata) being “all but depleted”. With more than a trillion barrels on the books (let alone future reserves flowing into the category via reserve growth), “all but depleted” isn’t only an exaggeration but borders on “pretty amusing”.

“Nice Hubbert curves are…nice…but them never having worked before,” What a ridiculous statement.

It is the statement I was making back around 2005 when I first bumped into peak oil. Turns out I knew it didn’t work back then, and I am surprised that folks still buy into it, when they’ve had time to learn better. Feel free to demonstrate a Hubbert curve on historical US production nowadays, and let me know how it goes. Extrapolate that obvious “why it didn’t work” into the rest of the world, when the same sort of modern drilling and completion designs are applied to other countries around the world. I mean really, no one seriously thinks the US is the only country on this planet to have SHALE rock with oil and gas in it, do they?

There are other prospects for shale oil and gas all over the place but none with the advantages of the USA. There is gas in France but is directly under Paris so nobody is going to get at it. China geology means the rok is too pliable to be easily fractured. UK has bits and pieces but so far poor results from driling and much environmental opposition. Russia and Argentine deposits have not really proved very attractive yet – they are spread over large areas which do not have any infrastructure in place to allow easy access and in Rusia especially the climate makes adding the necessary facilitis really difficult (I thik there are geological issues there too). Saudi has shale gas but for all there resources its exploitation has gone very slowly (again ther are infrastructure and geology issues). Texas fields are unique in the world – theres not really anywhere with quite such a hsitory with a huge and long lasting inland sea that allowed such large quantaties of source rock to be laid down. And yet for all its advantages of geology and in-place infrastructure makig actual profit from shale gas and LTO has proved rather difficult so what chance do the poorer prospects have, maybe the final EROIs there are so low that the resources can never be exploited at any price level.

Thanks George well said.

I agree.

I think Rulz was most recently lording over one of those awful Reddit groups. He has little chance to make any headway here — too many insightful commenters and loads of data-driven analysis. Let’s see how it goes.

“And yet for all its advantages of geology and in-place infrastructure makig actual profit from shale gas and LTO has proved rather difficult so what chance do the poorer prospects have, maybe the final EROIs there are so low that the resources can never be exploited at any price level.”

Currently, Canada, Argentina and China appear to be the only players outside the US. But they are players. Your comments on international development of LTO and shale gas is quite apropos, but can also be easily answered not using eroi, but resource cost curves. Sure, things are more expensive, oil and gas wise, everywhere when compared to the Permian. But that doesn’t make them impossible, or even unlikely. Just not cost competitive. And there is no “never” when it comes to a price level when viewed only from the supply side, the USGS has published a perspective that all known oil and gas resources can be developed. Without regard for economics. So, of course there is a price to develop…everything. $1,000,000/bbl anyone? That isn’t where the problem resides. Folks will not DEMAND oil and gas at that near-infinite price. Peak oilers who want to discuss scarcity don’t like that answer, because it undercuts the entire peak oil via scarcity argument, when there is another mechanism that can just as easier bring about The Blessed Event. No one wants the stuff for the price necessary to develop it.

Dennis

Well done.

In an article in oilprice the quote below was stated. The article was posted in an earlier POB post, link below. Comparing the official OPEC number above, 26,034 kb/d, with the oilprice number below, it looks like the preliminary number was tooo high. I have noticed before that the early numbers are not that reliable.

“The 13-member organization raised its production to 26.47 million bpd last month, up by 855,000 bpd compared to May, according to the survey based on ship-tracking data, information from officials, and estimates from energy consultancies.”

https://peakoilbarrel.com/us-april-oil-production-flat/#comment-720464

Thanks Ovi,

Lots of different estimates out there, some of them are C plus C instead of crude only.

Thanks Dennis.

Adds to my knowledge, as limited as it is.

Dennis

In my previous US post, it shows that the number of remaining DUCs is 5,560 in May.

In the latest OPEC report, the following is stated

“As a result, it is estimated that there are 1,930 economically feasible DUCs (wells which have been drilled over the past two years) which have remained in inventory by 1 July, according to the latest Rystad Energy data.”

A number of our participants say they are Dead DUCs. Maybe there is a grain of truth in what they say.

“Economically feasible” can mean a 5 boe stripper well for a tax credit.

Ovi,

I like the numbers by DUCs reported by Enno Peters at shaleprofile.com, those are the best freely available numbers that I know of. For March 2021 Shale profile has 6747 DUCs for the US for the most recent datapoint (published July 7, 2021, link below) down from recent peak of 9506 in July 2019 with all time peak at 10120 in Jan 2015. That is likely the best estimate imo.

Ovi,

There is no doubt some of the DUCs won’t be feasible, It is not clear how many that will be.

If we focus on big 4 tight oil basins (Bakken, Permian, Eagle Ford, and Niobrara) the total DUCs are 4358. For Permian alone the DUC count for March 2021 was 2233, data from shaleprofile.com.

Based on those “economically feasible” the DUCs will be gone by September. Permian is falling 100+ a month.

Criterion Research estimates at the current rate of drilling DUC depletion will occur in May 2023.

There are 2,400 permain ducs, 25% feasible in June, some are spudders so we get 3-6 months.

Mark

Forgive my ignorance but are the spudders that you refer to the same as the old practice of spudding the well and setting conductor pipe with a rat hole rig to fulfil the terms of commencement of operations in their leases?

More or less. https://www.spglobal.com/platts/en/market-insights/latest-news/oil/092719-us-producers-criticize-eia-estimates-of-ducs-clouding-production-outlook

EIA to count smaller “spudder” wells and overestimate DUCs

It’s not specific. The point is that companies drill wells for a tax credit and economics has nothing to do with reality. Companies decide on the mindless behavior they want and lobby for it, the resulting cost is arbitrary.

I got two things on my radar that will absolutely have an impact on oil price over next 18 months. Dollar shortage looming in China is the first.

The way that China’s monetary system work is like this. Corporate China gets paid in US dollars via the export of goods. Corporate China then exchanges those US dollar at their central bank for their local currency. So as long as US dollars are flowing into China they can expand their local currency at a rate of about 6 local currency units for every 1 US dollar they have. Keep in mind they have to spend a lot of US dollars importing everything they import. So they have US dollars leaving all the time.

When they do a RRR rate cut it’s means financial conditions are tight. Meaning they don’t have enough US dollars to expand their monetary base in local currency. There is a potential hard landing there. They just did a RRR rate cut.

Eurodollar futures curve which kind of give us a glimpse into what the offshore dollars market is thinking is the other thing I’m watching. The yield curve has inverted. Usually means there is trouble ahead in the global dollar market were absolutely everything happens. There is a big collateral shortage currently. Which is what is used to make these dollar loans in the global Eurodollar market. There is a potential blow up in Eurodollar funding.

FED has no control or oversight whatsoever with what happens in the Eurodollar market.

Both of these could put price of oil back to $40 or less.

I guarantee you will be wrong and they will just do some paperwork to fix it.

Also American trade deficit is growing extremely rapidly so there is no shortage of dollars.

You do realize China’s trade deficit with the rest of the world pretty much equals their trade surplus with the US right? Dollars are leave just as fast as they a coming in. China doesn’t have a swap line at the FED either. And on top of that it’s not physical cash that is needed. China has to borrow via Eurodollar market just to do business. They have to post collateral for dollar based loans just to do do business with rest of the world. Dollar funding is what is needed.

If price oil keeps going up China is screwed beyond belief btw. They will be going the Argentina route of running twin deficits. Both current account and fiscal deficits. The fact that you believe some paperwork can fix it. Just shows that you don’t get it. And even if I were to go into deep explanation on the plumbing of the system and why there is a looming dollar shortage you’d still say it isn’t so.

There is a collateral shortage due to central banks buying up all the collateral that private banks use to create loans. US has to run much bigger deficits otherwise loans made in Eurodollar market start contracting in a big way. Dollar shortage outside of US. Do you get it now?

I don’t see your math, if they are exporting more. Now once oil reaches $150 or whatever there will be a recession and everyone will die, and it will fall to a low price. But that would happen anyway.

HHH, no one doubts there is a dollar shortage at the moment. But if China agreed to appreciate their currency, resume U.S. treasury purchases and buy the item list set out in the U.S. China trade deal. Then everything can be made nice.

What neither power can do is print oil. The supply of oil can’t keep abreast of demand which is why the powers that be are shutting down the world economy. Millions are unemployed and hundreds of thousands of businesses no longer exist. The resources those entities were consuming is being repurposed to satisfy demand in creditor nations.

If you doubt me look at the oil and gas inventories for the U.S. and Europe. North America will be back at the 2010 – 2014 average by the end of the month.

According to forecasters at OPEC-

“OPEC forecast on Thursday that world oil demand would rise in 2022 to reach a level similar to before the pandemic, led by growth in the United States, China and India. The Organization of the Petroleum Exporting Countries said in its monthly report that demand next year would rise by 3.4% to 99.86 million barrels per day (bpd), and would average more than 100 million bpd in the second half of 2022. “Solid expectations exist for global economic growth in 2022,” OPEC said. “These include improved containment of COVID-19, particularly in emerging and developing countries, which are forecast to spur oil demand to reach pre-pandemic levels in 2022.”

We’ll see tomorrow if they raise production.

They did raise production, we will see in august if it actually happens.

https://www.worldoil.com/news/2021/7/16/opec-agrees-to-boost-oil-output-in-august-on-saudi-uae-compromise

The agreement means the cartel will boost output by 400,000 barrels a day each month from August, continuing until all of its halted output has been revived. The deal will also give the UAE and several other countries higher baselines against which their production cuts are measured, starting in May 2022, according to a statement from the group.

Angolan June crude output slides to 17-year low of 1.07 million b/d: ANPG

Angola’s crude output plunged to a 17-year low of 1.073 million b/d in June, the country’s energy regulator, Agência Nacional de Petróleo, Gás e Biocombustíveis, or ANPG, said July 15.

For June, Angola had committed to keep production at 1.298 million b/d under the recent OPEC deal.

Dennis, you wrote on June 2:

…I imagine if output is deemed too low on July 1, the targets will be adjusted. Angola produced about 1.1 Mb/d in April, the extra 200 kb/d can come from KSA, Iran, Iraq, UAE, Kuwait, or Russia,…

I don’t think any adjustments have been done (what I have heard of).

Most importantly Russia reported “technical problems” maintaining production and Aramco is losing cash.

If you look at the graph Dennis posted from about 2017, OPEC product appears to be declining between 5% and 6% annually. I think this trend will continue for many years ahead.

Techguy,

The decline started to steepen in 2019 to 2021, this was simply OPEC cutting output to balance the market. Output will return clse to the 2018 level and may surpass it as UAE. Iran, Iraq, and KSA expand capacity in response to higher oil prices.

In short, I strongly disagree.

Angola: URR=21Gb, Depletion level 71.8 percent, depletion rate =yearly production (q)/current reserve(Q_R) = q/(Q_0-Q)= 11.8 percent, decline rate = 12.7 percent.

Impressive graph.

Angola is definitely in the top five of NOCs most likely to go bankrupt in the next few years. While underlying resource base is important, mismanagement can also doom production. As individual counties’ production peaks, corruption and mismanagement are likely to increase due to dwindling resources and rising expectations. Discussed KSA’s massive $75B/yr dividend requirements last thread. Mexico, Brazil, Angola, and Nigeria also make great candidates for bankruptcy/collapse:

https://oilprice.com/Energy/Energy-General/Mexicos-Drug-Cartels-Are-Stealing-Oil-Again.html

https://www.aljazeera.com/economy/2021/6/30/angolas-debts-to-western-oil-companies-reach-1b-report

Thanks to George + Kaplan (both of them) for the heads up on the 2021 Rystad assessment of global oil supply-

https://www.rystadenergy.com/newsevents/news/press-releases/worlds-recoverable-oil-now-seen-9pct-slimmer-commercial-volumes-can-keep-global-warming-below-1p8c/

“In this scenario, global production of oil and natural gas liquids will fall below 50 million barrels per day by 2050”

In the downgrade of recoverable oil, the countries that have the biggest loss are USA, China, Mexico, in that order.

https://www.google.com/amp/s/www.cnbc.com/amp/2021/07/18/opec-meets-to-agree-oil-supply-boost-as-prices-surge.html

OPEC looking to ease cuts by 2 million barrels per day

Unclear if new supply will be added in August or September

Supply management likely to last until end-2022

UAE, others may get higher production quotas

//

If opec leaves 3m capacity hanging, does that mean capacity is falling by 1.5m per year?

Also, these raises barely cover population growth. Exports will continue to fall.

The CNBC article above seems to suggest that the increases will begin in September.

Africa is growing something like 2% a year so it won’t clear its growth if everything is perfect. China and India have their own peaks. So whether they increase or not the market will stay in deficit.

What’s the meaning of the decision of ADNOC to decrease by 15% the oil exports in September if they get a higher quota production?

The quota is symbolic, it’s “what we could produce”. The goal of OPEC is to limit supply while members try to defect so countries can always produce less voluntarily.

Furthemore population growth and EROI rot is faster than production growth in some countries so exports are decoupled from production.

In reality UAE peaked years ago and its quota demands are mere grandstanding.

Mark, thanks for confirming a suspicion of mine concerning the UAE and it’s recent baseline demands.

United Arab Emirates

URR = Q_0 = 127 Gb

Q now = 45.6 Gb

Peak year = 2031

Depletion Level = 36 %

Depletion rate = 1.6% per year

Forgot the graph

Thanks Seppo.

I am surprised the usual crowd did not push back with, “no way they can increase output, output will decline 6% (or 10%) per year from now forward”.

What is the difference between the 2020 annual average output and your estimate for annual output in 2031 and 2032? Also you did not specify if this chart is for crude only or C plus C.

Sorry Seppo, but I do not get the same slope or the same data as you. My data only goes back to 2005 and is crude only. But you have their production going from around 2,500 Kb/d in 2005 to 4,000 Kb/d in 2019.

My chart, with data which was furnished by the OPEC MOMR, going from the same level of 2,500 Kb/d in 2005 to 3,100 kb/d in 2019.

I have UAE production increasing by just under an average of 43,000 barrels per day per year between 2005 and 2019 while your chart shows UAE production increasing by about 107,000 barrels per day per year between 2005 and 2019.

Your chart shows two years, 2016 and 2019, at above 4,000 Kb/d. I get an average of 2,927 kb/d for 2016 and an average of 3,080 Kb/d for 2019. What is the source of your data?

The two-month spike in March and April 2020 is them preparing for quotas, producing by every possible short-term way, including draining their storage tanks. Kuwait and Saudi Arabia had similar spikes.

Stop deleting my replies, I can simply post them below. You can politely ask me to leave instead of being childish.

The data was from BP so it is all but refinery gain and biofuels and synthetic derivatives. When using data from EIA, I get the following chart. The last few years of data are for cc and all liquids. The output for cc is 3500 kbpd in 2030.

—-

2016 3243 3773

—–

2017 3174 3728

—–

2018 3216 3790

—–

2019 3487 4134

—–

2020 3138 3785

—–

The two emerging leaders for OPEC are UAE and Iraq, as Saudi Arabia might be struggling, judging by anecdotal evidence.

Seppo, those curves are inconsistent, they are also inconsistent with reserves.

I dunno why you’re so convinced UAE will keep growing. The production decline since 2016, the tertiary and the reserves point to it declining.

They are actually deleting my reply to the uae post. Amusing.

Here’s the correct curve.

https://i.ibb.co/4MZLZRk/1-C76-D61-A-DC4-A-4560-9347-F8-CB558487-D8.jpg

Even starting in 1998 it’s within 30% same. The curve varies year to year but almost all results are a peak by now.

https://i.ibb.co/Y3ZZgZv/20585092-0-DDC-4-FD7-A565-4-BD7-F5-F68-D6-B.jpg

The actual situation was

https://i.ibb.co/RbHBS3d/BE4-D26-E3-4-B1-C-4-FA0-9293-7-FA97-C198241.jpg

Which sums to

https://i.ibb.co/X7Z1rFV/B9-B5-BB5-A-5-D0-F-44-F7-B553-27-ABF1-EF23-A2.jpg

So since we know tertiary recovery is the end UAE is dead. The UAE has 100b reserves at 30-50% recovery so it is not getting to 127.

Table from OPEC with new limits.

“Adjust upward their overall production by 0.4 mb/d on a monthly basis starting August 2021 until phasing out the 5.8 mb/d production adjustment, and in December 2021 assess market developments and Participating Countries’ performance.”

Thank you for the graph. At this point I think OPEC reference production is some political dickwaving because it shouldn’t require “negotiation”.

The level of production of Russia (C+C, I suppose) and its evolution are ratherly funny. They are below the level of April by something like 500 kb/d or 1Mb/d, given the way the production is calculated and their production has even decreased by a few tens of thousands b/d recently. Not mentioning the ”technical problems”.

JFF

The numbers in the table are crude not C+C. So Russia allotment seems really bizarre.

Ovi, that chart makes no sense whatsoever. That is over 6 million barrels per day than they are producing right now.

It might be a typo but I thought they intended to raise 400k monthly for over a year.

OPECs plans are pretty extreme and only work if capacity hasn’t declined at all.

Ron

That is straight from OPEC. The table is in the upper right hand corner for download.

https://www.opec.org/opec_web/en/press_room/6512.htm

Ron

The 26,683 is their permissible target for April 22. Note the SA is at 11,000 Mb/d. I don’t think they will be there by April. It gives all them a lot of margin and SA will get bragging rights for only producing 10 Mb/d and helping all of their brothers keep the oil price at a reasonable level.

Ovi ,KSA cannot do above 9.5 mbpd . Rest is talk .

There’s a lot of good blogs from 2000s analyzing google maps and news and guessing what ghawars capacity was. They got everything right and the expensive consultants with high numbers were wrong.

Ovi. Thanks.

Interesting how many on this list are in decline. Add to that the majors are pulling out of most of these places, which will make maintaining production tougher.

Delta variant is an issue with demand, but it seems it isn’t killing as many as the previous strains. If vaccinations continue, the world will eventually get past this.

Thanks for speaking the truth Shallow Sand-

It bears repeating- “If vaccinations continue, the world will eventually get past this.”

Its either get vaccinated , or get immunity the hard way.

Or die…

Like the other 4 Coronaviruses affecting humans, this will eventually become benign.

How long that will take is another matter. It is not going away, but we can get our numbers way down.

Vaccination Identities:

Rationalizing Each Slippery Slope Toward Authoritarianism

It’s already benign for those who’ve already caught it, dealt with it easily, and have become naturally immune. Many have already done so and not even noticed.

One could be forgiven in thinking that those, often aggressively and ignorantly, pushing policy and technology on people, such as in the form of vaccines, and describing natural immunization as ‘the hard way’, understand, or care little, about the value of natural immunity and of being naturally asymptomatic, nor of people’s natural rights and freedoms for that matter.

Pushing things on people, whether by physical/psychological coercion and/or other forms of manipulation, and physically-invasive ones at that, (and essentially across the board), seems rather unethical, malevolent, suspect, and ultimately harmful and, as such, to ultimately run counter to the Hippocratic Oath or a fundamentally-healthy, free and functional society.

Hickory and Lloyd, for two examples, could be as much victims of an unhealthy, dysfunctional society as its potential perpetrators.

Careful what you wish for (or support).

Addendum:

Doing Harm: The Contradiction Between The State & The Hippocratic Oath

And we haven’t even touched on questionable State-funded virus research (gain-of-function?), nor their possble lab-leaks nor with the application of a kind of personal precautionary principle in response to and in light of these, and these kinds of, things.

The tyrannical impulses of world governments means this episode won’t end well for all concerned. The socialists who see the state as the arbiter for all and can’t resist their own perchant for state interference will know the error of their ways soon enough.

Watch for a time when they talk of unity and putting aside differences for a common cause. That is when we libertarians and conservatives must resist and see them crushed under foot.

SS , “Delta variant is an issue with demand, but it seems it isn’t killing as many as the previous strains. If vaccinations continue, the world will eventually get past this. ”

Maybe , but the economic and financial system damage is now permanent .

I am not too sure about this. Mass vaccinations of this scale has never been attempted before. The effects of it are unknown. This is an article from 2018, vaccines could invoke more deadlier strains of this virus.

Vaccines Are Pushing Pathogens to Evolve

https://www.quantamagazine.org/how-vaccines-can-drive-pathogens-to-evolve-20180510/

Also another article from 2015 mentioning a study done, which is very similar to the current covid vaccines.

Evolutionary science suggests that many pathogens aren’t deadly, or not even very virulent, because if they kill their host too quickly they can’t spread to other victims. Now enter vaccination. Some vaccines don’t prevent infection, but they do reduce how sick patients become. As Read first argued in a Nature paper 14 years ago, by keeping their hosts alive, such “imperfect” or “leaky” vaccines could give deadlier pathogens an edge, allowing them to spread when they would normally burn out quickly.

Now, Read has published a paper showing that this seems to have happened with Marek’s disease, a viral infection in chickens. Marek’s disease spreads when infected birds shed the virus from their feather follicles, which is then inhaled with dust by other chickens. Poultry farmers routinely vaccinate against the disease, which keeps their flocks healthy but does not stop chickens from becoming infected and spreading the virus. Over the past few decades, Marek’s disease has become much more virulent—which some researchers believe is the result of vaccination.

https://www.sciencemag.org/news/2015/07/could-some-vaccines-make-diseases-more-deadly

We will find out soon how this plays out as the U.K has opened up completely with ~40k new cases a day and i believe ~50% of the population vaccinated.

Iron Mike. Think of it in terms of relative risk.

Risk of a new Covid 19 virus emerging that not covered by the current vaccinations.

That can happen via the current virus having more and more generations circulating among the unvaccinated- as happened already with the Delta variant for example.

Or it could theoretically happen via evolution of the virus among those who have already been vaccinated, as the articles describe.

No one knows the relative risk of theses two scenarios, but the later one is entirely theoretical and has not been seen with any prior illness in human beings, and the other one has already happened multiple times with this particular virus. A virus that happens to have a mortality rate of somewhere in the 1-2% range among known cases.

It is an easy decision for public health experts to select the pathway with the lowest relative risk- and in this case one of the easiest decisions someone in their profession can make.

Vaccination.

Btw- there have been global viral vaccination efforts with heavy penetration previously, including polio and small pox. With incredible success.

Vaccines will fail spectacularly and everyone will die. That’s what we’re waiting to see.

Hickory,

I agree it could also happened among the unvaccinated, but if history is any guide, for e.g. the Spanish flu, it had a high death rate relative to the population at the time but the pandemic lasted 1.5 year- 2 years. Now bear in mind the covid-19 pandemic could end by 2022 too, it is possible, so i am not going to attempt to predict the future.

In any case i am not suggesting we shouldn’t vaccinate. I am lucky I am not in a position of authority to decide. According to the data i’ve seen around 51% of the deaths caused by covid-19 is due to pneumonia which one would expect with all respiratory diseases. Maybe the pneumonia shot will decrease the death rate further. Anyways all i am saying is we don’t know how this will play out. And what leaky vaccines could lead to.

I think it is fallacious to compare the current mass vaccination programs to polio or smallpox. Smallpox vaccination program started in ~ 1958-1977 according to wikipedia. And the population was ~ 3 billion. I think polio would have been similar. This is a completely different beast, and we aren’t using traditional vaccines.

To reiterate, i think the U.K right now is the perfect experiment to see how it will play out. (No offense to any British people)

We should know in a few months if the data shows a spike in unvaccinated young people with no comorbidity getting hospitalised or dying. And also a new strain of the virus.

Spanish flu was aspirin overdose.

Mark,

There are credible sources saying aspirin overdose exacerbated the deaths, with similar symptoms of death with regards to aspirin overdose and pneumonia (filling up of the lungs with fluid).

However i think there was an actual pandemic which was lethal for a lot of people at the time.

Iron Mike,

I’ll just say that it amazing (I was going to say amusing, but considering the subject matter it would be inappropriate) to observe the level of general populace confusion over this very straightforward science and public health issue.

Very few issues we will ever confront are as clearcut as the vaccination case with covid-19, and yet a significant chunk of humanity is walking around in circles scratching their head.

It is a case of mass confusion, or misunderstanding of the basic facts, that has been intentionally propagated for a political purpose.

And many people are so eager to accept the false narratives.

That is nothing new, of course. Social media is just making the spread of confusion faster and more sophisticated.

As an example of human behavior, this is not a good sign.

In fact it is a very poor sign, and people are/will suffer badly for it.

Both directly through illness, and indirectly through big damage to the global economy.

Vaccination works.That’s why we aren’t all dying of smallpox, a horrible disease for which there is no cure. The United Nations wiped it out decades ago. How soon we forget.

Quit spreading FUD, and treating humans like firewood to “burn diseases out”.

Alimbiquated,

Spare me your knee jerk responses and go away while adults have respectable discussions.

Woohoo tough guy “Iron” Mike lol. Spoken like the drunk uncle that ruined Thanksgiving dinner for everyone.

You might be able to intimidate you niece that way, but typing it out in chat just makes you look incontinent.

The System That Cried Wolf

It is not so much whether ‘vaccines’ work or not per se but, rather, whether/how people’s trust in the system works or not.

This is key.

Trust is a keystone of any healthy relationship– personal, sociocultural or otherwise.

IOW, if you keep being corrupt, untruthful, irresponsible, shifty, deceptive, deliberately-convoluted and otherwise questionable, Alimbiquated, over time your truths won’t count for as much, if at all, as trust in you has eroded over time.

Eroding trust in and for a sociocultural system that is failing seems part and parcel of decline/collapse.

Increasing mistrust probably helps accelerate the decline which, in turn, helps increase the mistrust, in a bit of a classic self-reinforcing feedback-loop.

Perhaps that somewhat undergirds why the system has been squawking so loudly and bizarrely for the past year and a half: It is less about the disease/vax and more about an attempt, conscious or unconscious, to gauge and/or reassert control in the face of increasing distrust/dissent.

According to Figure 20 in the post, crude demand from OPEC is forecast to be 29.58 Mb/d in Q4.

If OPEC adds another 0.5 Mb/d in July, they will be at 26.5 Mb/d. Add in anther 2 Mb/d of new supply from August to December and that gets OPEC + supply to 28.5 Mb/d. If their economic recovery forecast is correct, that still leaves the world short by 1 Mb/d.

That would be a tight market and inventory would be dropping all along the way. While OPEC has made an estimate for the US, it will be interesting to see what the supply demand situation looks like then.

A very interesting article by Curt Cobb: Has OPEC finally won the war against shale oil? Bold mine

I have maintained for the past six years that a key goal of OPEC has been to so demoralize investors in shale oil that they stop sending money to the companies that drill for it. As I’ve written previously, I believe that OPEC’s contest with the shale oil industry is “part of a broader strategy meant to maximize Saudi revenues as production in the kingdom hovers at an all-time high over the next decade before beginning a decline.” It now appears that OPEC may have finally won its war against shale.

Investment in shale oil companies has finally collapsed—even as oil prices levitate. It has been a long time coming. The industry would like you to believe that it is now showing “restraint” in its capital spending. But, to use a dieting analogy, there is a big difference between watching what you eat and having your jaw wired shut. The industry has experienced the equivalent of the latter in the capital markets.

SNIP

The problem from here forward is that most of the sweet spots in U.S. shale plays have been exploited. As the industry runs out of them and increasingly moves toward developing more difficult shale deposits, costs will rise—thus making it even more difficult to turn a profit on shale oil.

There is an oil price that would certainly make shale deposits profitable. But that price is likely too high for the economy and consumers to bear without falling into a recession. That, it turns out, is the conundrum for the oil industry as a whole. The price band that is affordable to consumers in the long run no longer overlaps with the price band that will allow oil companies to exploit increasingly difficult-to-extract deposits.

There is a lot more to this article but much too long to quote here.

Ron,” The price band that is affordable to consumers in the long run no longer overlaps with the price band that will allow oil companies to exploit increasingly difficult-to-extract deposits.”

Does that mean that the price of oil is now ” al a carte ” . No limits .????

I really don’t think so. I believe it means the exact opposite, there is a definite limit to oil prices, a price that people can afford. And that price is not high enough to allow very difficult and expensive oil deposits to be exploited.

Ron,

If oil was $100/barrel how much consumption do you think would be cut due to lack of affordability?

Not much. I think it would have to get to $125 ir $150 before you would see serious demand shrinkage.

I just spent eight days on the road and covered about 3,000 miles. The traffic was horrible. The number of heavy trucks on the road was unbelievable. And cars everywhere. In every large city it was bumper to bumper for hours on end. Demand is not about to drop any way soon, not at $75 dollar oil anyway.

Ron,

At $125/bo, the tier 2 acres in the Permian basin and Bakken are likely to be profitable. There will be a lot of projects that will get FID at $125/bo, so it will be interesting to see how much. In addition there will be a gradual adjustment in the transportation fleet as EVs become very competitive at a gasoline price of $3.50/gallon or higher. We might see a big move over the next few years in the OECD to electric land transport which will reduce growth in oil demand.

I agree with both of your (Ron and Dennis) observations and projections.

If oil price gets too high, the first thing to get scaled back will be leisure travel I suspect. The higher transport costs for labor to get to and from work will show up in the form of increased labor costs.

A somewhat related issue is the shortage of computer chips and lumber. Auto manufacturing is being scaled back due to shortage of chips, and lumber prices have doubled and tripled if you haven’t seen. Many people are just cancelling projects requiring lumber.

Energy availability may look like this in a few years.

Economies with weak growth, like most countries, will not absorb these price increases well, on the macro level. Hard to see how the Fed will get a window of opportunity to raise interest rates without big negative effects.

We may find ourselves in a place where there is demand, but a shortage of credit to fund projects of all sorts- including E & P.

Hickory.

The worst shortage of all in the USA is labor.

We got two days of a crew on the rig that has been sitting on our workover well for 6 weeks. Then they left to put out another “fire.”

The service company that owns the rig has 9 workover rigs. The company only has three crews. Six rigs are rigged up on wells. Three are stacked. The crews just kind of go wherever the state is threatening fines the hardest. We aren’t in a fine situation with this well, so we only get a crew here and there.

What we wonder is this. When the state and or feds succumb to the leave it in the ground movement, and we are ordered to plug all of our wells, what happens if there isn’t anyone to do the work?

We have over 4,000 well bores in our field. There are less than ten rig crews. It won’t get better, likely will get worse.

I know some here will think I am exaggerating. I am not.

Ron

What was the price range on the gasoline?

I don’t think it’s the direct oil consumption which falls in this scenario. It is the consumption of other discretionary purchasing which is forced out which contracts, causing recession, and indirectly reducing oil consumption.

Ovi, understand that everything is just a wild-ass guess. I really have no idea what the gasoline range would be. But I would guess that around $4.00 gasoline would see serious headwinds. At that price, people would start to driving less and less. And at around $5.00 things would get to be really serious. But that is just my wild-ass guess. Others might have a different opinion.

Carbon credits are suppressing oil price. Oil is already $100 without carbon. It might stay flat while credits boom and then collapse.

In my opinion, gasoline prices would have to be higher than $4.00/gallon to drastically decrease consumption. Over the last month here in Vancouver, I have seen posted prices as high as 1.739 CA$/litre x 0.785 US$/CA$ x 3.785412 litre/gallon = US$5.33/gallon with no apparent reduction in traffic or vehicle composition.

Maybe sustained $10/gallon gasoline would do the trick?

Prices will not increase. Stations will go bankrupt from credits and it will be impossible to obtain gas.

Some areas are without gas already, Las Vegas for example.

Here in India price of petrol is $1.40-1.45 per litre =$ 5.60 per gallon . A friend of mine who owns a gas station says the term ” fill it up ” is rare . Most of the customers buy in round figures say 10 litres, 15 litres etc or in rounded currency say 100 rupees , 200 rupees . His second observation was that many of his regular clients who were using a car on a daily basis now are riding a scooter or motor bike . A shift in the driving pattern . Apparently driving single in a car is now not affordable . Companies have also limited the amount of gasoline the employee can consume per month for corporate cars .

I suppose it is $4 for 1 gallon? If it is so, your are paying your gazoline at a very low level : the liter of gazoline in France is at 1 euro and 55 centimes or so. Or in dollars, that would make $6,89 for 1 gallon. That would make your people mad, if I follow your way of thinking. The economy is fonctioning in France, more or less, with this level of price.

Roughly a third of gasoline price may be hidden by carbon credits. In the US gas might already be $4 and in Europe $9.

Europe is already in recession, Germany never even recovered car production from the GFC.

JFF, India income per capita $1900 , France $38625 . Yes , the public is going mad at $ 1.45 per litre .

As I see it, if there is a cheap and abundant energy source in the global energy mix, the economic metabolism generates surpluses that allow the system to exploit less accessible sources, even those technologies which have a net negative energetic return, if the resultant energy product is useful for the society. Of course, the issue is not that simple, as there are other factors involved, but the point is that in the long run what ultimately limits the affordability of a source is the global energetic balance.

Imagine a hypothetic future society who has developed nuclear fusion reactors. That technology could become the main energy source, but that society could still find liquid fuels more useful than electricity for some selected activities. In that situation it could make sense to exploit Mars oil, with a price of say 100M per barrel.

Returning to present, some authors suggest that, sweet spots aside, tight oil has net negative energy returns, so I wonder if such an energy product, useful as it is now, could have been exploited for more than a decade if there hasn’t been other cheap sources feeding the mega-machine, for instance Asian coal.

In that way, and if the argument exposed is right, in the absence of cheap alternatives we cannot expect oil prices to grow too high, even if it is getting scarcer and scarcer. It would be rather possible to see price volatility as the mega-machine begins squeaking, or even oil getting cheaper as unemployment soars.

As oil, coal, gas and uranium approach their limits, and as renewable transition jumps from paper and pencil to face the reality of large scale development, we can get a more precise idea.

Sir , I like to be polite but the whole of your comment is as per your words “Imagine a hypothetic future society who has developed nuclear fusion reactors. ”

The lesser said the better .

Sir, I don’t understand your point. May be my english understanding is worse than bad, may be my expression too. May be my words have suggested that I find possible or even desirable the fusion fantasy -I’m far from it. May be heterodox economic arguments are not of your taste.

Quim is saying that beyond FF peak, with no really cheap renewable substitute at scale, the remains of LTO will rest in the ground like “Mars oil”. That makes sense.

Quim’s comment is more connected to reality, than 90% of comments here.

Luca , but that is what we all know, at least on this blog . Most of the oil will not be harvested as it will be too expensive or in other words ” unaffordable ” . For reference checkout the graph posted by Seppo regarding Angola and the following comment by Stephen Hiren regarding Mexico, Brazil, Nigeria . I am not running down Quim but just correcting his viewpoint specially because he thinks we have time to transition and I know that the train has left the station .

@Quim

Interesting thoughts. Can you please name the sources/authors who suggest that LTO has negative energy returns ?

Last time i checked it, the joules per dollar for coal a buyer gets were five times the joules per dollar for crude oil. More bang for the bucks.

I am quite sure, that energy from coal subsidies the oil production.

Because China produces half of the coal of the world, (https://en.wikipedia.org/wiki/List_of_countries_by_coal_production), China must be the most important oil production subsidizer. Sounds crazy ?

Mr Quim ,sir . First your English is good but your understanding of the issue “peak oil ” is not good ( to be mild good enough ) . You are mixing oil with electricity and whatsoever you may be thinking . Heck , lets go to Mars to get oil . You said that , not me . All your comment is ” if ” and “but ” and events that will never occur because we do not have the time . We have run out of road . Simple .

Berndt , you have it correct . It was cheap coal ( plus top down govt etc ) that made the Chinese miracle . China is now past ” peak coal ” and that is why growth has stalled . Of course there is the Covid , HK , environmental degradation etc ( we could go on ) but you have the issue in the correct docket . No , it does not sound crazy , at least to me .

Mr Berndt, I cannot bring rhe reffrences, but I remember some papers talking about LTO eroei 1.5:1. Considering that most analysis don’t segregate types of shale wells in their results, and taking into account that analysis bountaries are also rather restrictive, I think it is reasonable to assume that, sweet spots aside, most LTO cannot be considered an energy source but just a vector -carrier.

Mr Hole, I don’t expect a large scale renewable transition, we have no way to keep moving our 17TW machine. My words don’t say what you say I’m stating. I was precisely trying to suggest that there is no miracle in the horizon, and that soon we will have clear clues of it.

Shallow Sand

I have the utmost empathy for your labor situation, particularly regarding pulling units. Here’s a couple of ideas that we have tried with success over the years. If you’ve already considered them or tried them at least you know that I’m not an idiot.

First, purchase your own rig(s) and staff them with your own, multitalented and cross-trained employees. As an incentive, give a portion of the net revenue from the field to those employees as long as the y stay around. This is sort of a profit sharing scenario. While I realize the facts that you’ve related over age, drug use and reliability, you might be able to build a more cohesive and beneficial production increasing workforce. We did this over many years with pumpers and rig crews. When they have skin in the game and create their own bonuses the results are positive most of the time.

Most companies contract out because legal risk. If you have 100 people working a rig then one of them will file a lawsuit every few years potentially costing millions of dollars. Maybe the oil industry is different but I’m guessing it would be greater risk of injury.

Rasputin.

We have owned rigs. We could never keep an operator around long enough to make it worthwhile. We had a double drum and a single drum. Mud pump. Power swivel. Power tongs on both. Testing truck. The whole enchilada.

We sold them all to a man who had worked for someone else and then went out on his own. We gave him a good deal, and he did a lot of work for us. He still does work for us, but he can’t find help that will stay.

We also owned a tank truck. Sold it also. It is currently parked, the man we sold it to cannot find a driver. He is a one horse tank truck driver. He turns down work all the time. We had to shut down a lease we haul water on for a few days when he got COVID. Thankfully he recovered.

All of us around here just cannot quite believe what is going on with the oilfield labor force. It is a perfect storm.

Meanwhile, most recently we paid $5.63 per foot for 2 3/8” steel tubing, which was under $3 a year ago. We priced a 115 fiberglass tank for $6,800, would have been $3,900 a year ago.

We had a couple wells down for a few weeks because we could neither get new nor rewound motors for them.

The man who owns the backhoes, trackhoes and cranes that does contract work for us is in his 70’s and has great grandkids. He works in the field daily beside his son and grandson.

One of the last rig hands we had broke into our shop last winter. He got out of jail after a few weeks and immediately got a job in a local factory. Hope he stays clean. He was a good hand when he was, and had learned to operate a single drum also.

The prosecutor in our county announced the first six months of 2021 that 162 felony cases had been filed in our small county, that in 2019 the total for the year was 204 felonies, and that 33 of the 34 jail inmates were addicted to meth.

We do have one pumper now under 50. The rest are from 51 to 63.

How much land do you have left? At one well per section how many can you drill and how long it takes? That’s when your business wraps up.

Holy Moly SS

I guess the days of vertical doing things in house are gone. That labor mess is unreal. However, here in nowhere USA it is hard to find good help but you can usually find help. I was so surprised at some of the job turnover even during peak covid when some businesses were restricted and some essential. How are people living that have no jobs? Over the years I hired relatives that never got it, didn’t stay sober and didn’t see the long term upside. Maybe it’s all about today for the younger generation.

Over the past year and a half I’ve been following your posts including labor issues. Were they so dreadful before covid and helicopter money? It might appear to the uninformed that training rig help. pumpers and the like is easy, but it’s not. One small oops for man is one huge oops for you.

Perhaps, as we move away from the false narrative that you must have a college degree to get a good or high paying job, things will improve in the trades and the oilfield.

About 20 years ago I was visiting with a substantial independent stimulation company that was having labor issues. The head honcho lamented that they had already poached all of the young guys that grew up on farms and knew machinery, getting up early and how to work. Having known a few guys and what they earned they most likely didn’t point their kids at basket weaving degrees.

Sure wish I had an answer for you. Personally, I’m shrinking down to a few wells close to the house/shop/yard, one of which I could walk to for daily exercise. However, I’ll run my equipment myself as long as possible.

The best to you.

Rasputin.

The number of basically “homeless” people living here in my part of very rural USA is startling. People aren’t generally sleeping in the parks. They have duffle bags and backpacks and crash place to place.

We have the tremendous labor shortage, yet the public defender and conflicts public defender have over 400 clients combined. This in a county of a little less than 20K people. That right there is the labor force for a decent sized factory around here.

To qualify for the PD you must have income below 125% of federal poverty guidelines, which is very low. During the height of COVID, nothing got done with their cases because the PD’s couldn’t get ahold of them. Few have cell phones that are permanent (track phones) and few have permanent addresses. The jail is full so there aren’t a lot of warrants being issued for the lower level crimes. So people haven’t been showing up for their court cases for months/ over a year. Our county is going to send close to 100 people to prison this year, almost all for meth delivery. This is the situation all over rural USA. People who live here and aren’t in the court system are oblivious to it until they get broken into or robbed (or have an addicted relative, which many do).

The primary reason for the labor shortage here is a combination of young people moving to larger towns/cities, a very large percentage of the working age population being addicted to meth (which is now being cut with heroin, fentanyl, etc) and the significant benefits that have been paid to not work. I hate to think of how many billions of borrowed money stimulus our future generations are now indebted with that went directly into the pockets of the foreign drug cartels.

As for the oilfield, add to that the hard work, not the greatest pay in the world at the bottom end (rig hands) the need to find people who can work unsupervised outdoors, and the young people being told the industry is dead and a job in that field will soon be gone. Finally, a ton of “old timers” simply retired during COVID.

Our country has no idea how dependent we are on labor from Mexico and Central America that keeps us alive. The only farm workers are Hispanic. However, most don’t want to work in the oilfield either, it seems. We just harvested green beans, and all the crew were Hispanic. The same will be the case here shortly as we harvest watermelons and cabbage. If Trump were successful and closed the borders and sent everyone back, we would starve.

The largest oil company here shut in everything it owned when oil went negative. Unfortunately for them they laid off a lot of people. Many of their wells are still idle.

Maybe we are an outlier. But I doubt it. A decent amount people at the lower end of the labor force seem to have decided they aren’t going to work, and offering a lot more $$ won’t bring them back. Maybe they will come back when the government benefits end.

Even the prisons can’t find employees. They pay $70K+ plus great benefits. Mentally difficult work though. Also, can’t have a criminal record and cannot use drugs, even pot.

Keep in mind a large percentage of the USA population now smokes or ingests pot. That doesn’t work well in a lot of industries where sobriety is mandatory.

The gas station I fill up at is offering a $300 signing bonus which is paid after 30 days of no unexcused absences. $13 and hour to start at the cash register. They can’t find people to take that.

I’m rambling now, and I’ll stop.

Surely there are some shale basin people reading this. Could any of you comment about whether there is a labor shortage in your shale basin? If there isn’t, maybe we could persuade a few of them to come to our neck of the woods and work on the simple, shallow wells. Not a lot of traveling, no weekends unless you pump, and work is daytime only.

Shallow sand,

You have given me an idea. Shoot me an email, if you are interested.

Thanks for the comment.

It’s the jungle. There are obviously no territorial schemes of economic development and management. The territories are abandoned. Would you be pleased that we export parts of our legislation about decentralization and territorial organization and a few elected members of local authorities or wannabes who failed to be elected and who have (had) already in the pocket a poste of responsability in a local authority? We can be not in agreement with their choices but at least, they know what they have to do.

Apparently this current labor shortage issue is both international, and affecting numerous sectors-

https://www.cnn.com/2021/06/29/economy/global-worker-shortage-pandemic-brexit/index.html

We may have to shift from demonizing immigrants to a stance of actively recruiting them- especially with attributes that are most useful.

This will require a big shift in the attitude of many Americans- they will need to learn to respect people from other cultures, even if they don’t speak much English.

I was talking to a general contractor who had a very hardworking crew. He pointed out one strong and clear eyed 20 year old. That kid was from Guatemala and did not know Spanish. His people all still spoke their indigenous language. He was studying English and Spanish eagerly in his spare time, and of course learning the languages quickly in the course of work.

As a general contractor I can tell you that the average price of a new home would probably be about twice what it is now without labor from Mexico and Guatemala. I’m sure the same thing can be said for food as well.

If the border truly were closed home completions would plummet probably 90%.

You would just have other homes.

Here there are factories that produce preconstructed homes that only tke a few days to be assembled. This is the cheap way to build here, with full isolation standard.

Cheap labor often hinders progression – thats the reason the romans never pushed machines because they had slaves.

They even have already found the coal.

A friend of mine owns a pretty large orchard and vineyard in Canada, and he also had labor problems. He used to import workers from Haiti, Dominican Republic, and Cuba for the picking season.

Now he has Cuban workers imported to not only do the picking but to operate the equipment and do the maintenance, and some are year-round emplyees. Some he had to train, but found that it wasn’t the nightmare he worried about. Some work three months on, one month off. Some work six months on, six months off. Almost all are repeat workers that he’s come to rely on.

He’s pretty happy with how it all worked out.

Pavel Zavalny: There is a reserve of ready-made fields in Yugra that can increase oil production by 80 million tons per year

July 20 / 09:59

Kogalym, KhMAO. More than 2 billion tons of oil reserves in Yugra are ready for development, but are not being commissioned due to economic inefficiency. This was announced by Pavel Zavalny, Chairman of the State Duma Committee on Energy.

“If this reserve were used now, then additional oil production would amount to 80 million tons per year, and additional tax revenues to the consolidated budget of the country – about 1 trillion rubles annually,” the deputy stressed during a meeting on the results of work in Kogalym and Fedorovskoye.

According to him, in order to increase the profitability and efficiency of oil production, constant adjustment of the taxation system is needed. In May, within the framework of a meeting in Surgut, a working group was created to promptly develop proposals for adjusting the tax burden, including for depleted fields, before the start of a new budget cycle.

“This work will give companies the opportunity to include in the development of unprofitable reserves today, will give the district additional budget revenues, which means opportunities for the development of municipalities, construction of municipal housing, social facilities, and so on,” explained Pavel Zavalny.

It should be noted that since the beginning of the exploitation of the fields in Yugra, more than 12 billion tons of oil have been produced, while 23 billion tons still remain in the bowels.

Shallow Sand –

I echo all of your sentiments. We are a small operator in Kansas, producing about 300 bbl/day in 13 various counties. We have approximately 50-60 bbl/day offline pushing 3 weeks. We’re talking 8/8ths approximately $75,000 in revenue. Pre-Covid you could count on getting a pulling unit sometimes next day if you had a mechanical failure. Now it’s 3-4 weeks. $20/hour for green rig hands evidently isn’t enough to move the needle, whether it’s because the work is too difficult, or it’s easier to keep cashing the government checks. And by my count we are in a similar situation with oil field pumpers. We have 13 of them. 2 are 50s, and the rest are all over 60. I’m in my early 40s and my field superintendent is 56. He loves to work and will probably do so until he’s 70-75. When he checks out will probably be when I check out.

Kansas Oil.

Great to hear from you.

Thanks for confirming what we are experiencing.

The big question is whether this is also going on in the shale basins, primarily Permian. If it is, don’t see how USA production grows much.

I drive across Kansas on both I 70 and the South Route through Wichita to the OK panhandle quite a bit. Always keep my eyes open for whether pumping units are moving or not.

I worry about whether the huge feed lots, hog facilities and packing plants out there can find enough help. People have no clue how much of the USA is fed from the TX, OK panhandles on up through Western KS and NE.

Hang in there!

Shallow Sand and Kansas Oil

Thanks for your comments. When a bunch of the shale is petered out, the effects of the labor wreck in the stripper or even the oilfield in general will be more pronounced. It is important that analysts and thinkers on this site are aware of this issue.

Thinking back to the first time that I saw rod tongs it should have told me where the oilfield was headed.

As for drugs and alcohol, legal or not, their abuse or misuse is a plague that is consuming our society. It’s ironic that we push the covid vaccine for our good and the good of those we encounter/affect but we really don’t promote abstinence for the same reasons. I have no solutions.

It will be interesting to see what Dennis has to say. It would be wonderful if a magic bullet existed.

SS , Kansas oil , Rasputin and all other oilmen who post or lurk here . I am not an oilman and I do not live in the US . I have never ever seen an oil rig in my whole life (69 yrs) . Your comments make me weep . If I was you , I would quit in a jiffy . I have long opined that the most underrated occupations in the world are farming and oil men . They will remain so till your breakfast is not ready tomorrow morning .

Disclaimer : I am biased towards farming as members of my family are involved in the farmers agitation currently (7 mths ) in India . I don’t know what to do, empathize or sympathize , but yes , thanks for arranging that I have strawberries , asparagus etc 24/7/365 . All you guys be well .

Rasputin,

I agree with you all. I have no answers, perhaps legalizing drugs and offering treatment to addicts would be better than the War on Drugs which has been a dismal failure. Also extra income for unemployed will end soon, that might change things in US.

In 1973 Saudi Arabia declared economic warfare on the USA in the form of an oil embargo, as some of you remember, and in 1979 a brisk oil shortage recurred with the Iranian overthrow of their US supported dictator.

The episodes of rapid oil shortfall prompted early steps and plan development for oil rationing.

The link below is interesting quick reading about what the government was working towards in 1979.

And the coupon is from 1973, printed in the hundreds of millions, but never issued.

We may soon have to revisit this topic in great detail.

https://www.gao.gov/assets/108914.pdf

Of course, they reduced abruptly their production because of the Kippour war but, before, American officials asked them to reduce their production because USA had just passed its first oil peak and the American administration wanted higher oil prices to encourage US oil companies to invest more money in researching more oil fields in USA.

False history narrative,

but regardless the issue raised relates to what rationing of limited oil supplies may look like.

I am pretty sure of what I wrote. What is written above is historical. US administration really asked this.

Austria was an gas exporter until 1969. That’s where opec began.

Labor. I now run a small hotel and pub in southeast BC. For years it has been a seven day a week operation.

Now we struggle to stay open 5 days a week. Need at least two cooks and 4 servers. Beautiful place, lakes,

mountains, skiing, fishing, hiking, etc. Anyone know anyone who wants a job. Top wages and tips being paid.

No workers to be found. Where did they go? Canada pays $500/week to anyone who had earned $5000 in 2019.

No questions asked. Could be that is why. Business is booming, but no help. Shallow, I feel your pain. Pilot

People cannot even get jobs and cars. They’re just going to get worse until they die of failaids.

The situation in America is literal communism, there is a wait list for cars and homes.

Steak For Stake

Where’s that? Cranbrook? Apparently, the general area is one of the hottest places in Canada in the summer.

Assuming this is not the case, then how about changing at least some of your business model to something of a co-op/co-ownership where those who wish are on relatively-equitable footing and have a stake in the business, and no one is being pimped/wage-slaved who doesn’t want to be?

No one is motivated by exactly the same things. For example, some are more motivated by work-equity than wages.

Offer a sweat-equity stake in the business. You might even enjoy it more.

Cops will be annihlated, the time will come soon.

What has that got to do with my comment?

The minute Canada stops paying everybody $500/week Canada’s economy falls off a cliff. Well it’s actually about a 8-12 month lag. But none the less it falls off a cliff. Everybody is sitting in this same boat. Covid response was globally lets say $10 trillion in deficit spending. So there is a deficit cliff so to speak waiting on everybody. Where money being pushed by governments into economy contracts in a massive way. And private banks aren’t going to step in an fill the void. You can’t spend $10 trillion then follow it up by only spending say $3-4 trillion. Economy collapses if you do that.

Global credit impulse is already contracting that is why you see US dollar strengthen now. Oil is never going to make back to$100 When you realize the recovery has already happened and is over. Right now it’s just a matter of how far do things have to fall before governments step back in an deficit spend like never before. And if they collectively do $20 trillion maybe oil price goes over $100. But realize anything they do they have to follow it up with something just as big if not bigger to keep the illusion going.

HHH

Canada does not pay 500/wk to everybody. I can guarantee you that those deposits don’t show up in my account. I think it is for people laid off due to CV.

North Dakota was almost flat in May. Up 4,351 barrels per day.

North Dakota Rig Count

April 15

May 19

June 20

Today 23

All-time high 218 (5/29/2012)

Worth noting, North Dakota, in May, had 16,241 wells producing. That is an all-time high. Production per well is 69 barrels per day. That is the lowest since 2011. The all-time high was 105 barrels per day in December 2014. Note however that this data is for all North Dakota. The figures would be a bit higher for the Bakken only.

Red Queen in action .

hole in head,

Red queen is running faster and faster to stay in place. North Dakota has slowed its completion rate by a large measure, from 180 wells completed per month in the April 2014 to March 2015 period to about 35 wells completed per month in the most recent 12 months.

Dennis , I am glad that at least on this we are on the same page . 🙂

Bakken is having a “worker shortage” meaning it’s depleted and about to collapse.

Yes , it would collapse any way , worker shortage or not . Good excuse . Ron has already posted on this , I think . Shale is a pile of shit , the question is how high and how smelly?.

Very!

“OPEC could double its control over the oil market, to between 70% and 80%, according to Lukoil’s Vice President.”

Likely it seems to me, this decade.

note- He indicates ‘market’, rather than absolute production levels.

https://oilprice.com/Energy/Energy-General/OPEC-Could-Double-Its-Control-Over-Oil-Market.html

Hickory, from your link:

As climate policies continue to weigh on the oil markets, the oil market is expected to contract—a situation that will increase OPEC countries’ share of the global oil market from 30% today to nearly 70-80%.

That is about the stupidest thing I have ever read on OilPrice.com. Even if demand is reduced by 30%, which I seriously doubt, but even so there is no reason that OPEC will grab the lion’s share of the remaining 70%. Why would that happen?

If civilization survives at all it will be dominated by heavy oil production of which the Mideast has little.

IM7 , what the Achilles heel is the mismatch between the configuration of the refineries and the oil that will be available to them from the producers . US exports circa 3.5 mbpd of LTO and imports circa 8 mbpd of heavy because there is a mismatch . This is flying below the radar . You are on the pulse. It is going to be not only a quantity issue but also a quality issue .

P.S : Apologies for using IM 7 but no offense intended . I believe in the KISS ( Keep It Simple Stupid ) formulae .

Yeh, agree that statement seems poorly thought out Ron.

And its a lot less about climate policy and a lot more about depletion and lack finding big new fields over the past decade plus.

But the notion that Russia plus the other top OPEC producers will rapidly increase their share of the dwindling export market seems inevitable, and may come about rapidly.

Geopolitical implications are very big.

China has their eye on this like a laser beam.

On a related topic, it seems bizarre to me that Trump and Biden admin (and the ones before) would try to lecture Germany and others in Europe about getting Nat Gas from Russia. Not just lecture, but try to interfere with the new pipeline. Easy to lecture others when you have huge domestic supplies in your pocket. I wonder how that goes down in Europe.

This is concerning only Germany. Indeed, they decided to shut down their nuclear power stations. So, to compensate, they are burning coal and lignite to produce electricity. That’s not climatic agenda friendly. Thus, they have decided to shift to gas to produce electricity and hydrogen (dumbest idea). But this at the expanse of their foreign policy with Russia. With their decision to shut down their nuclear power plant, they are now walking on the head.

Any thoughts on the new baselines for OPEC members?

Now, baseline is not the same as quota and member countries are not expected to produce upto the baselines but that does tend to give an indication, whether warranted or not, of the supply CAPACITIES of member countries.

Looking at the new baseline numbers for Russia and Saudi Arabia, I doubt they will be able to produce so much. This topic has been discussed previously, but isn’t it strange that they are allotting themselves baselines that are so far above their supply capacities? Views?

It’s been discussed. The baselines are obviously political in nature.

UAE seems to be in tertiary production and peaked a few years ago. It’s also produced about half its reserves. It’s not likely to grow.

Russia is reporting problems producing already.

Saudi, it will be interesting if the ARAMCO data is leaked showing disaster. Both Saudi and Kuwait have declining drilling activity since 2015 and might be near peak.

Iraq and Iran are not plausible ways to grow exports.

Ancient Archer,

Probably correct that they would not be able to maintain the “baseline capacity” for a 12 month period. They are the levels of output that might be maintained for a month or two in order to have the highest possible output quota during “cuts” in output. The actual level for OPEC+ for a the current sustained output level might be 90% of “baseline”, perhaps even 85%, we will find out in the next couple of years.

More bad press for the fracking industry. Use of toxic chemicals that never break down:

https://www.theguardian.com/commentisfree/2021/jul/21/toxic-forever-chemicals-pfas-fracking

Belated:

Oil consumption from the Regional tab:

US diesel down 8.3% vs -14% gasoline.

The trucks have to carry food.

China, who had an increase in 2020, only country thus

Light distillate naphtha +8.7% Diesel +2% Fuel oil +14%

India diesel -14.5% naphtha +11% gasoline -11%

Most places minimized diesel consumption decline vs other API liquids. People have to eat, regardless of virus.

Now that we are at the oil peak plateau phase, for how long nobody knows,

its better late than never to start making plans for when petrol is too expensive or simply unavailable for

the common man and woman.

What are the alternatives, other than walking of course.

-Starting simply- bikes. Cargo or commute, manual, electric assist or electric complete, so many good choices.

-Moving up in weight , there is horses. If you don’t have pasture now, what are you waiting for?

Consider that horses need to eat, and grazing is by far the cheapest way to supply them.

In general, the approximate pasture needs per average-sized mature horse, with pasture providing most, if not all, of the nutrition is:

1 – 2 acres with an excellent, dense sod, permanent pasture

2 – 2.5 acres with an average permanent pasture (spring growth will be OK but summer forage is average)

3- 3 acres with a thin, poor sod that is unmanaged (supplemental forage will likely be needed)