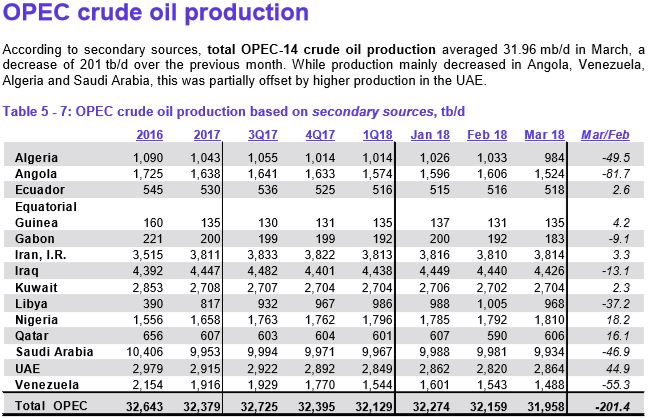

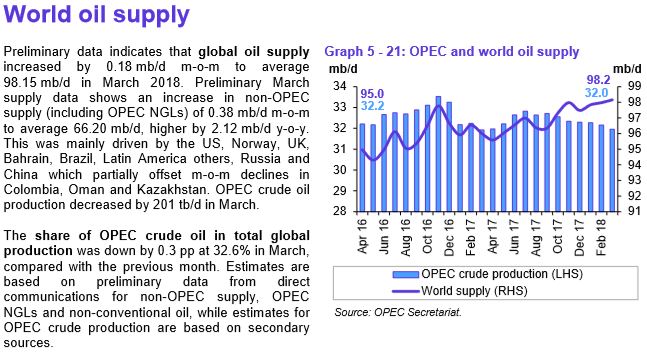

All OPEC data below was taken from the April issue of The OPEC Monthly Oil Market Report. The data is through March 2018 and is thousands of barrels per day.

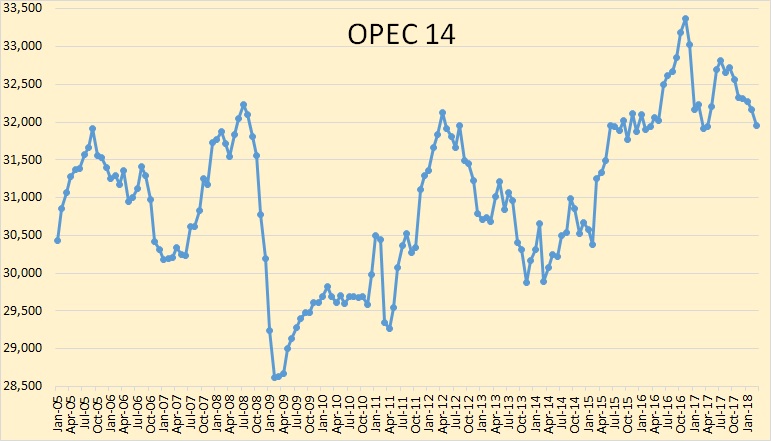

OPEC crude oil production dropped just over 200,000 barrels per day in March. They are now just over one million barrels per day below their fourth-quarter 2016 average.

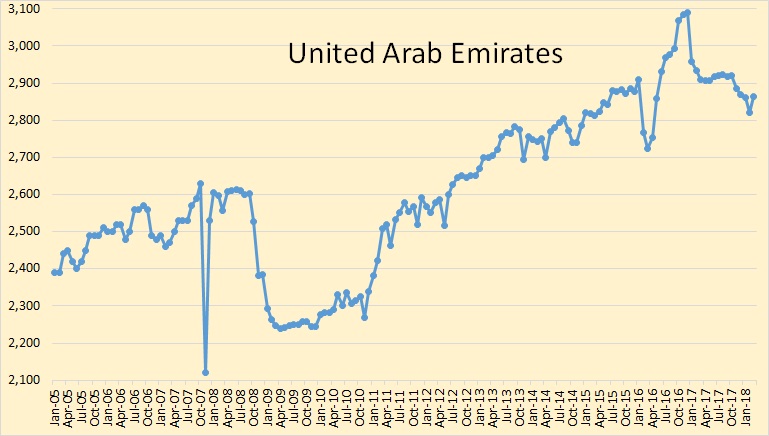

Only the UAE showed any significant gain among OPEC members.

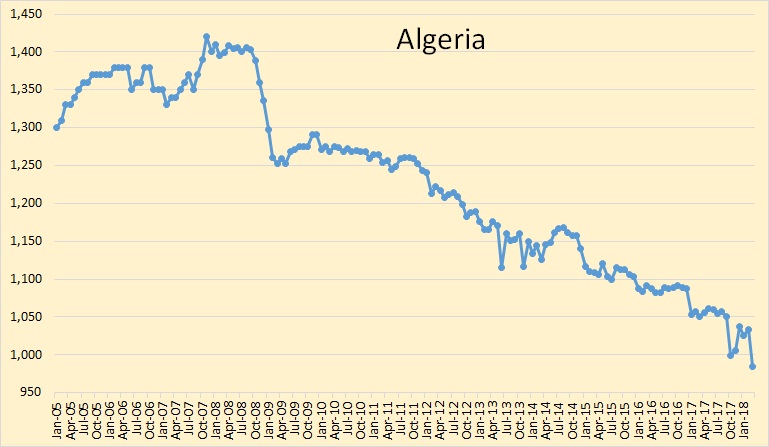

Algeria took a hit in March, down almost 50,000 barrels per day. They reached a new low of under 1,000,000 barrels per day.

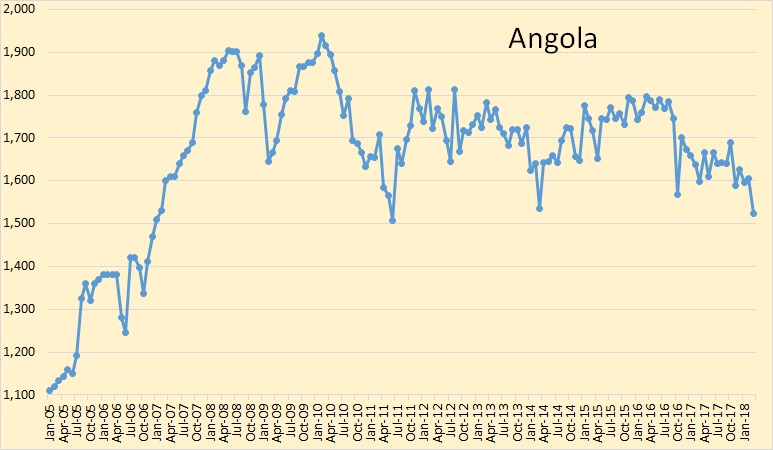

Angola took the biggest his of all OPEC nations in March. They dropped 82,000 barrels per day to reach their lowest level in almost 7 years.

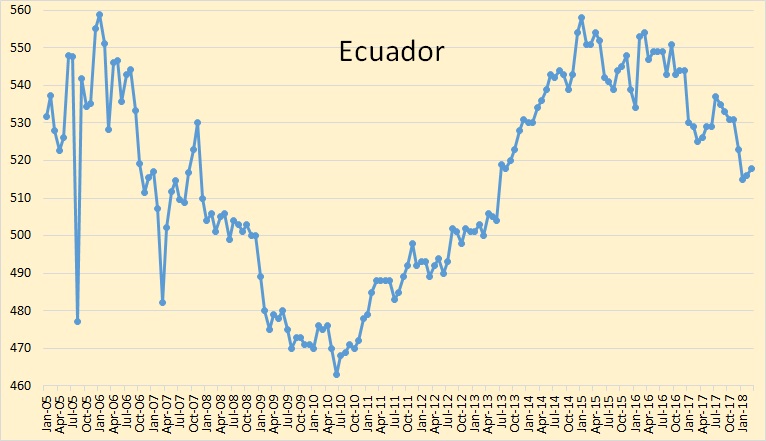

Ecuador has slowed their decline during the last two months.

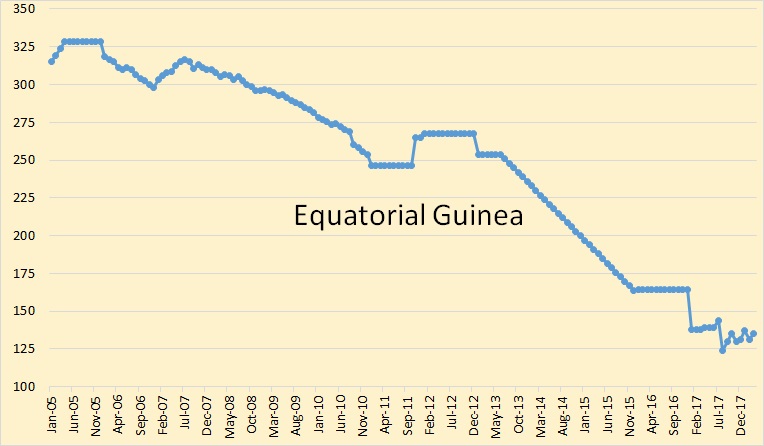

Equatorial Guinea is holding on.

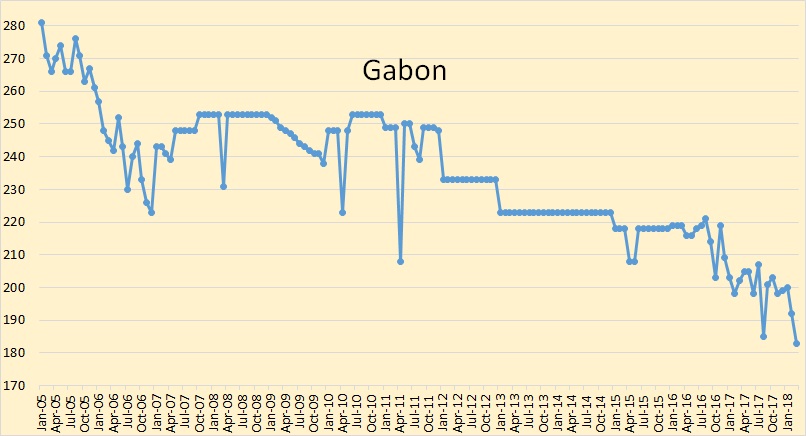

Gabon reached a new low in March.

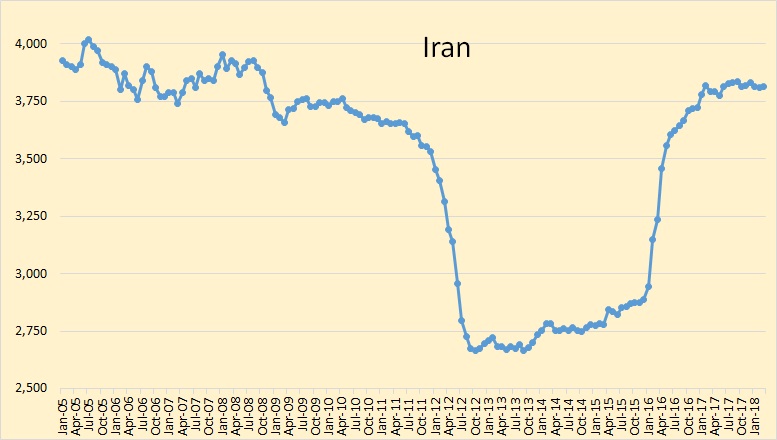

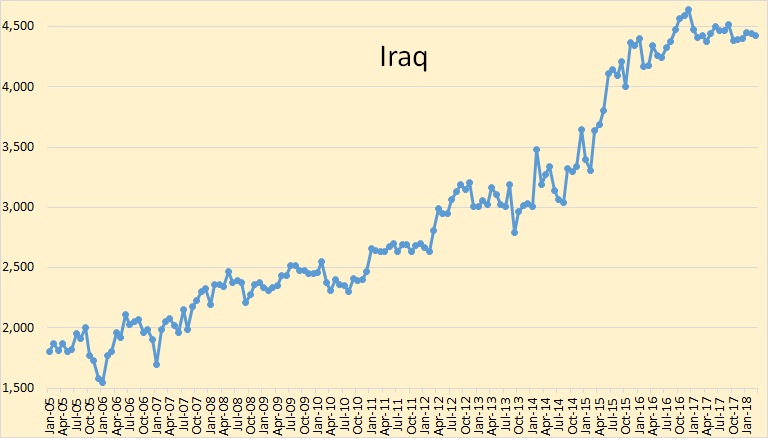

Iraq has fully recovered from sanctions and is now producing flat out.

Iraq is also producing flat out and their production is holding steady.

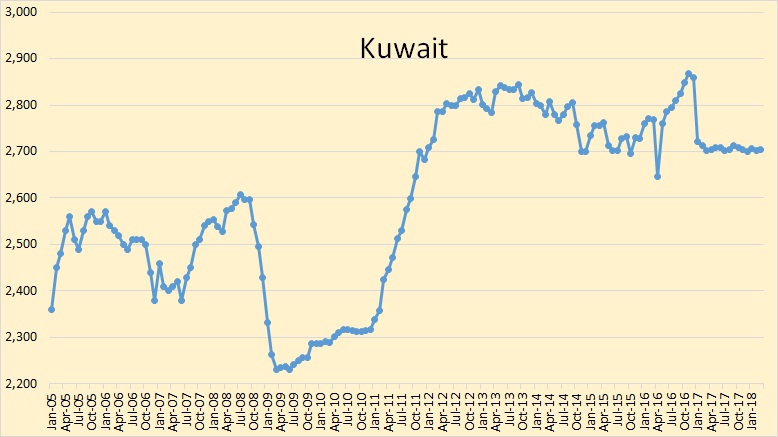

Kuwaiti product has held remarkably steady for the last 15 months.

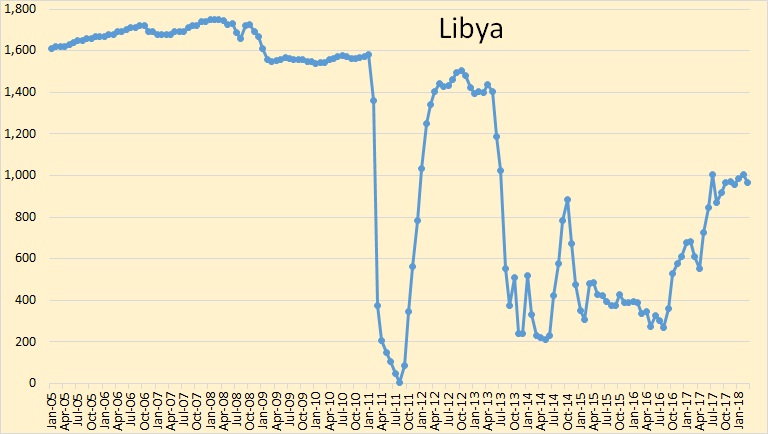

Libya is holding steady at just under 1,000,000 barrels per day. They could likely produce another 200,000 to 400,000 barrels per day if peace ever broke out in that country. But that is unlikely, in the near future anyway.

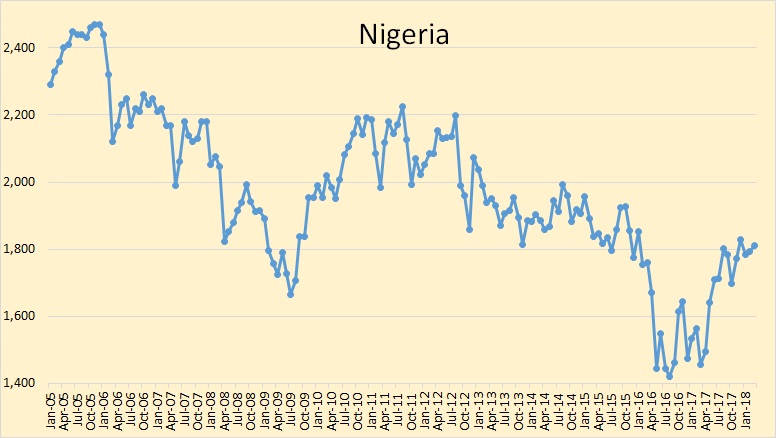

Nigeria is a big question mark. I have no idea how much political strife is hurting production there. Some no doubt but I don’t think they could greatly increase production even if all the rebels laid down their arms, something that is very unlikely to happen any time soon.

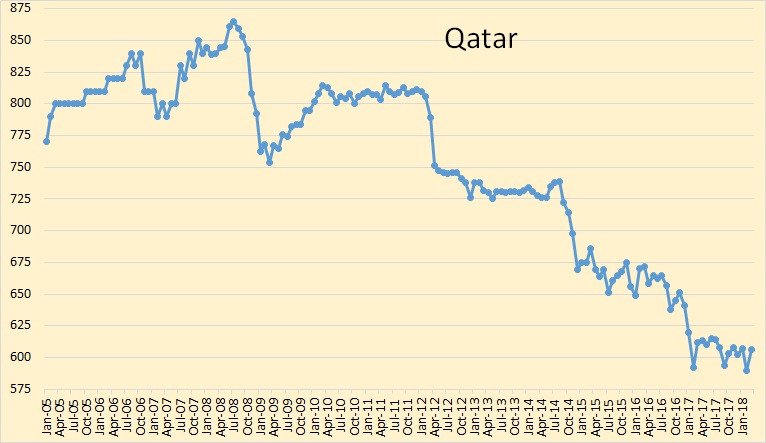

Qatar, after declining for almost a decade has held steady for one year now. But their decline will no doubt begin again soon.

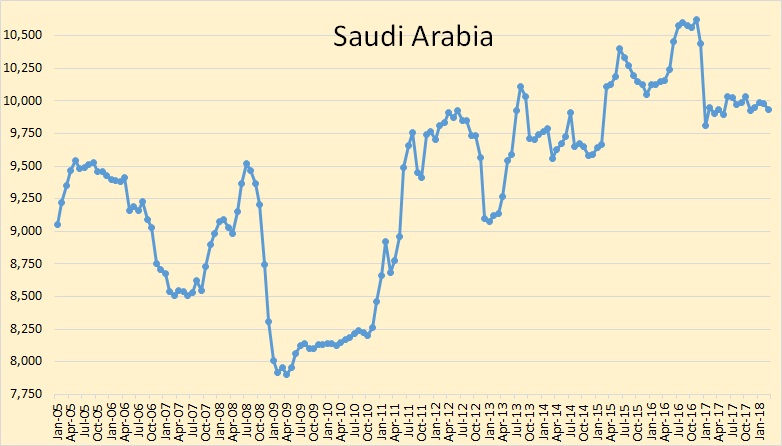

Saudi Arabia, the OPEC giant, has held output steady for 15 months. How much more could they produce? Perhaps half a million barrels per day but likely slightly less than that.

The UAE recovered its losses from last month. However, I still think they are producing flat out.

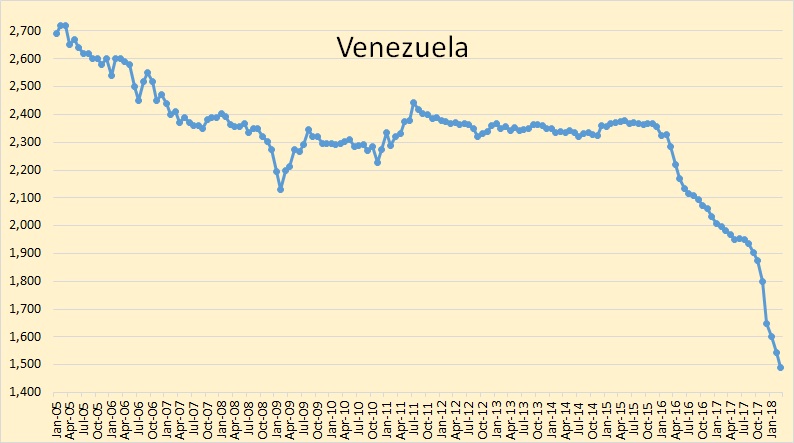

In the last six months, Venezuelan production has dropped 414,000 barrels per day, almost 70,000 barrels per month. They are well on their way to becoming a failed state and the declining income from oil is hastening that process.

OPEC says world oil supply increased by 180,000 barrels per day in March. Since they dropped 201,000 barrels per day, that would mean Non-OPEC would have to have had an increase of 381,000 barrels per day in March. I think that is a bit too high.

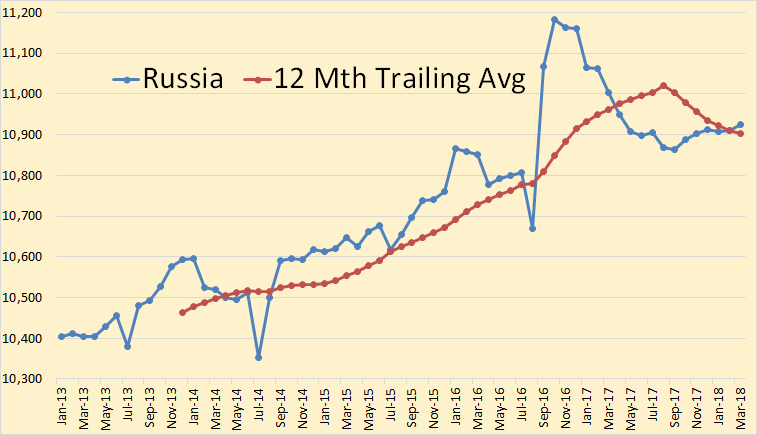

Russia, also through March 2018.

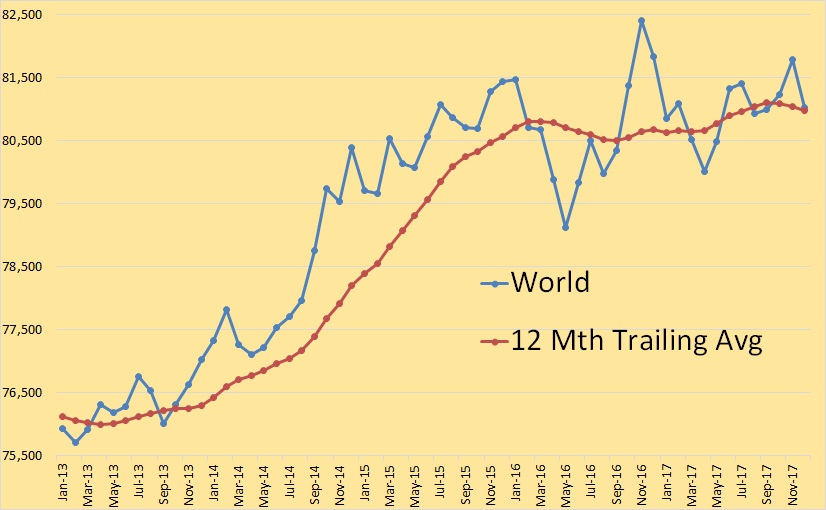

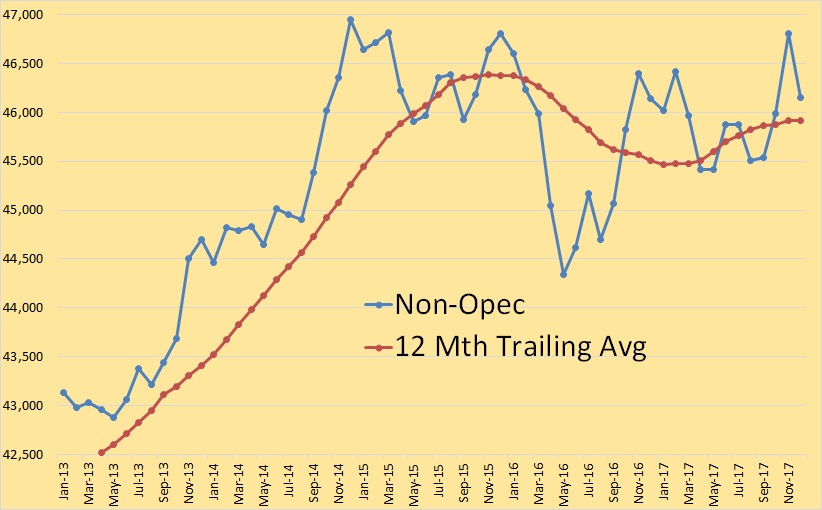

The data for all charts below are from the EIA and is through December 2017.

World oil production, so far, peaked in November 2016 with the 12-month average peaking in September 2017.

Non-OPEC peaked, so far, in December of 2014 with the 12-month average peaking in November of 2015

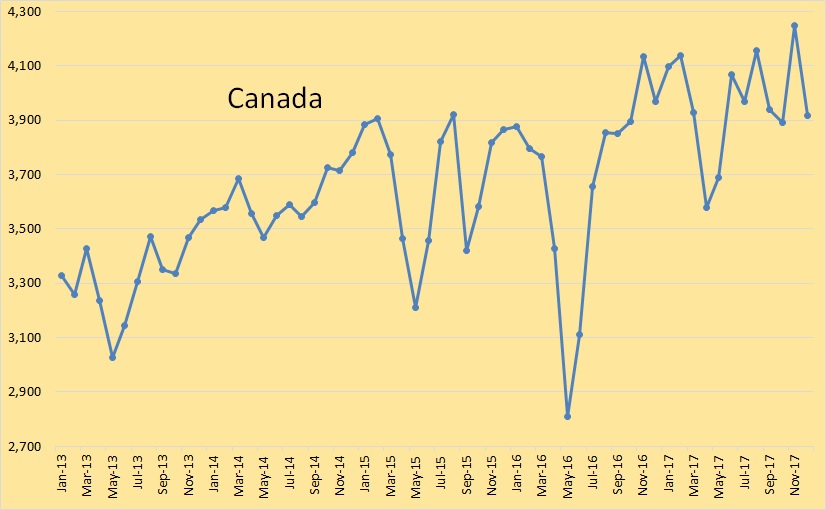

Canada seems to be holding steady.

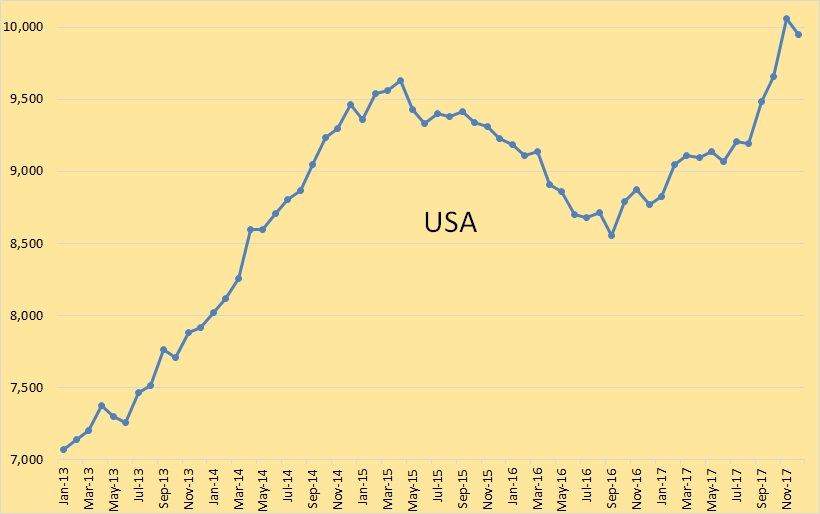

The USA reached a new all-time high in November but slipped a little in December.

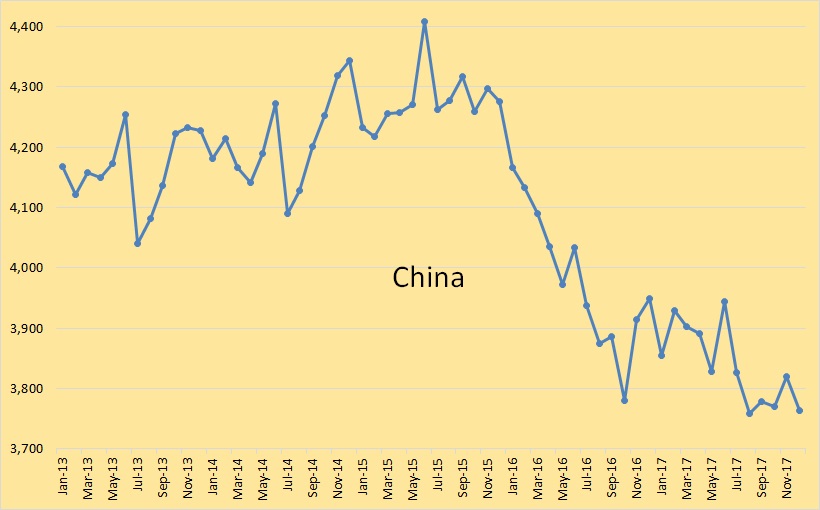

For China, it’s all downhill from here on out. They are consuming more and producing less. This is the Import Land Model as predicted by Jeffrey Brown a few years ago.

Thanks for the update!

Is it safe to say that oil production from this planet Earth, the world as we know it . . . has peaked?

Well, no, it would not be safe to say that. We can guess. And that’s about all we can do.

Thanks for the great presentation Ron. I find the colored background on the graphs makes them much easier to read.

As it looks, there will be a peak only after US shale has peaked. They try to empty their fields at record pace, like in old oil rushs at spindletop where they got the oil price to a few cents / barrel.

Only when Tier 1 claims are empty and the best Tier 2 tapped, things will get a bit more calm.

Eulenspiegel,

There is a possibility that the lack of investment from 2014 to 2017 may lead to a decline in output from oil producers outside of the US and Canada, potentially this could hit about the time that pipeline constraints are overcome in 2019 or 2020 and could lead to an increase in US and Canadian output that barely offsets declining output in the rest of the world. That could set up a plateau scenario at around 81-82 Mb/d of world C+C output from 2018-2023. After that US LTO output will start to decline and I doubt Canadian increases in C+C will be enough to offset the US LTO decline which will be relatively rapid (4% annual decline or more) by 2025.

Possibly high oil prices and more investment (OPEC and ultra deep water) from 2019 to 2025 might help mitigate rapid World decline in oil output, perhaps keeping decline rates at 1% to 2% per year. Eventually the high oil price from 2019 to 2030 (probably an average of $175/b in 2018$ over that period with highly volatile prices) may lead to less oil demand as EVs ramp up (and electric rail for long haul freight and travel.) Eventually that would lead to lower oil prices and more rapid decline in oil output due to lack of profits at lower oil prices.

In this scenario oil use for energy falls to zero by 2056.

Energy reps each claim there’s a future for their resources.

https://www.bloomberg.com/news/articles/2018-04-10/coal-dead-peak-oil-demand-five-takes-on-fossil-fuels-future

some of you here have already made the point in the article. better to be first than last?

https://oilprice.com/Energy/Energy-General/Are-Oil-Markets-Tightening-Too-Fast.html

Per this post, OPEC sees inventories dropping by 1.5 million a day the second half. And they of the many who still sees US production up to an impossible figure, along with EIA, and IEA. Free fall, the second half and into 2019.

https://oilprice.com/Energy/Energy-General/Are-Oil-Markets-Tightening-Too-Fast.html

Sorry TT, posted the same time.

Pretty sure this has been posted before

https://oilprice.com/Energy/Crude-Oil/Permian-Bottleneck-Could-Impact-Global-Oil-Markets.html

Nick Cunningham writes some good posts imo. Some excerpts from the post linked above.

But according to Genscape, and reported on by Reuters, pipeline utilization in the Permian has jumped to 96 percent over the past month. Genscape says the Permian has 3.175 mb/d of pipeline, rail and local refining capacity combined. That’s a problem given that the EIA sees production jumping to 3.156 mb/d in April.

…

But there are broader ramifications for the global oil market. The assumption that the oil market would be well-supplied not only this year, but for years to come, is largely predicated on aggressive growth from U.S. shale generally, but also the Permian in particular. If Permian growth comes to a standstill this year, that will completely upend conventional wisdom about adequate supply.

The first quote suggests my 3.5 Mb/d Permian estimate is too high by over 300 kb/d. My US C+C estimate would drop from an 800 kb/d increase in 2018 to a 600 kb/d increase in 2018. That’s less than half the US C+C increase predicted by the IEA and EIA, adequate oil supply will not be forthcoming.

Canada also having pipeline problems, with Western Canadian select crude futures trading at about $18/b less than WTI on April 12.

http://economicdashboard.alberta.ca/OilPrice

https://oilprice.com/Latest-Energy-News/World-News/Kinder-Morgan-Threatens-To-Suspend-Trans-Mountain-Project.html

https://www.reuters.com/article/us-kindermorgan-cn-pipeline/canada-explores-options-as-kinder-morgan-halts-pipeline-work-idUSKBN1HG21G

It’s not clear if prices will be high enough to spur much growth in Canadian output.

https://www.platts.com/podcasts-detail/spotlight/2018/april/commodities-spotlight-permian-041018

Posting this one because people actually believe a lot of the “news” in this. Platts keeps getting to be a more doubtful source of news for me. As of two days ago, they firmly believe Permian will grow 1.2 million for 2018. Ok, it’s a guess, anyone can guess. Seems rail is an option, because there are 18k of oil on rail in Padd 3. So, 18 railcars will offer a huge solution. They can still ship by truck, as it is only about $24 a barrel. They fail to mention how many 200 barrel trucks that would take. Certainly more than the 18 railcars. They maintain producers will get it out some way, otherwise their 1.2 million estimate will never work. Ok, everyone can guess, it free to everyone. It could happen. Costs go up 15 to 20%, discounts up to $20. Yep, gonna be another killer year for upstream profits, again.

Rowboats! 😉

LOL! And life is but a dream 😉

Guym,

In the podcast they claim rail cost is about $7/b for transport so if the midland Houston spread remains above that level then some of the crude may be moved by rail. Rail capacity is only about 350 kb/d, about the same as local refinery capacity. When pipeline, rail and local refinery capacity are added together the total is about 3.5 Mb/d. That may be the cap on Permian Basin production.

The EIA’s Drilling Productivity Report (DPR) projects Permian output at 3150 kb/d in April, with a 285 kb/d increase in the last 4 months (850 kb/d annual rate, if the increase for the year is linear at the growth of the past 4 months.) If takeaway and local refinery capacity does not increase and the DPR estimates and trend projection proves correct, then capacity limits are reached in September and the Permian basin increase for 2018 would be capped at 630 kb/d.

If we also assumed this was about 60% of the US C+C output increase for the year (% from 2017 for Permian share of US C+C increase in 2017) then US output might increase by about 1000 kb/d in 2018.

Note that I believe this is a high side estimate because the DPR model tends to be optimistic, my guess is that US output may increase in 2018 by 800+/-200 kb/d due to the Permian basin takeaway capacity constraints on both oil and natural gas as well as rising costs and widening Midland/Houston oil price spreads.

Edit:

See comment above, there are different estimates for Permian takeaway capacity, a more recent estimate of local refinery, rail and pipeline capacity in the Permian is 3175 kb/d.

US C+C output increase might be more like 600+/-200 kb/d in 2018 vs IEA/EIA estimate of 1.3-1.4 Mb/d.

Well, not really 3.175. He was quoting Genscape, and incorrectly. The Genscape chart showed pipe plus local refining at 3.175. A separate dotted line above that was for rail, which may be 3.4. I think rail is the real question mark. I believe each tanker is approximately 1k bbls. I am not sure if the rail cars are loaded by truck, which only has a 200 bbl capacity. As demand for railcar goes up, so does the cost.

Guym,

Thanks.

I found another reference to 3.6 Mb/d of capacity, but the picture is rather muddy

https://www.genscape.com/blog/genscape-regulatory-data-provides-full-permian-view-midland-sealy-addition-coming-soon

Towards the end of the piece they mention 3.6 Mb/d of regional capacity.

Not sure exactly what they mean.

Below shows proved developed and undeveloped reserves for the biggest non-NOC E&P companies. Proved (1P) numbers are not as meaningful as proved and probable (2P), which better represent expected actual final production, and for the past couple of years it appears that mostly production is getting replaced by reclassification of probable to proved. However this year ExxonMobil and Chevron added some oil discoveries and BP added some from purchases.

The sell off and write down of oil sand reserves continued, but I think has probably bottomed out. Natural gas declined slightly in total, and for most of the companies.

Without significant new discoveries or acquisitions Marathon, Anadarko and ConocoPhilips are going to be running out of production sometime before 2025. It’s also noticeable that Shell don’t have much in the way of undeveloped proved remaining, and the Appomatox and Prelude FLNG projects are a large chunk of those.

This shows the totals for the companies combined (C&C should be C&C and NGL).

Thanks George.

It is too bad that the 2p data is not required by the SEC.

IHS would fight such rules as they make a lot of money from their propriety 2P reserve data.

Probably need Suncor and CNRL if you are producing a chart on reserves. 4.8 Billion proved and 7.2 Billion P+P for Suncor.

Good info. Would be interesting to see similar info on the next smaller tier of companies.

2025 is about the right time to run out of production. Exploring for oil with a payback period longer than is idiotic; the market will have cratered. Think about the effects of a 25% drop in gasoline demand and a larger drop in diesel demand, which are pretty much guaranteed by then thanks to BEV adoption worldwide.

Has anybody here got an opinion as to if nano surfactant will do what is being claimed. It appears to have been around for quite some time so I suspect it is just another scam.

There is a company currently re opening wells in the texas chalk that have been abandoned for 25 years but they claim will be economic using ERA-3.

nano surfactant!!! now that is creative marketing. All surfactants work in the molecular (nano) level.

Now if they have found a better surfactant, this to be proven. But kudos for creative marketing…. like N2 for tires.

Thanks for the chuckle…

IEA OMR: https://www.iea.org/oilmarketreport/omrpublic/

The projected supply/demand deficit is increasing, again (deficit is widening by each new edition). They still assume US production in 2018 will grow by 1.3mb/d but note that takeaway capacity is becoming a problem.

“OECD commercial stocks declined by 26 mb to 2 841 mb and were just 30 mb above the five-year average at end February. The average could be reached by May, on the assumption of tight balances in 2Q18. Product stocks are already in deficit.”

“Our balances show that if OPEC production were constant this year, and if our outlooks for non-OPEC production and oil demand remain unchanged, in 2Q18-4Q18 global stocks could draw by about 0.6 mb/d. With markets expected to tighten, it is possible that when we publish OECD stocks data in the next month or two they will have reached or even fallen below the five-year average target.”

…if OPEC production were constant this year … – the big question, for 2018 and probably the forthcoming decades. SA +300, Nigeria +200 and Angola +140 new nameplate: is that enough to overcome the declines, which could easily accelerate now as some projects started from 2005 to 2013 will be reaching end of plateau, and unplanned outages seem to be growing across the industry, plus total loss of Venezuela must be on the cards.

And apart from that I still don’t see how non-OPEC conventional supply is not going to decline quite significantly in 2019.

George,

How do you define “conventional” oil? Just asking because there are several different ways that people use that term. Is ultra deepwater offshore (>1500 m) considered conventional? LTO?

Hi George.

The early production project for the fractured basement West of Shetland is coming along.

http://www.hurricaneenergy.com/operations/early-production-system/gallery

Looks like 17 kbpd for 6 years, maybe extendable to 10 if the results look good.

On the other hand it looks like Dana have downgraded the Barra production limit on WIDP from 18 kbpd to 5. They’ve upgraded the Harris production allowance to give a total of 40 still (the facility namplate), but if this reflects a downgrade on the Barra reserves, or even just a major problem with the subsea kit, they are going to lose even more money on the project, unless they can find some good tie back options, and fast.

“And apart from that I still don’t see how non-OPEC conventional supply is not going to decline quite significantly in 2019.”

Agree. Their forecast is unlikely to make it through this summer. 2019 is a different game when reality knocks down the door.

Jeff,

George said “quite significant decline in non-OPEC conventional”.

You seem to agree. Can you explain your understanding of George’s comment?

I don’t know what he defines as “conventional oil”, does it include LTO?

If so, I would not agree that non-OPEC conventional (excluding extra heavy oil with API Gravity>10) will see significant decline in 2019.

I define “significant decline” as more than 2% per year.

What decline rate would you consider “significant”?

Which producers outside OPEC do you expect to increase their output in coming years and by how much? Growth outside OPEC is mainly Canada (heavy), US (LTO), Brazil (deep offshore/pre-salt), Russia (cuts or something). Not even IEA’s Oil 2018: Analysis and forecast to 2023 thinks that this group will increase their output.

I know you like to speculate about oil production and price. Often providing probability estimates too. I’m a bit more hesitant and humble of my ignorance. I just know that about ten years ago the supply was stagnating and speculation got the price all the way to $148/brl. There seems to be a fairly substantial deficit this year, perhaps by as much as 1 mbd. I see an oil price roller coaster ahead.

Yes,

I am very much on your page. I read the Matt Simmons views on SA, and took in the “end of cheap oil” sentiment portraited by the ever so tabloid Economist at the time when oil prices were high. So, I turned out to not acknowledge the wast resources to be exploited nearly 2km beneath the earth surface. The power of horisontal drilling, resovoir mapping of oil left behind and the industrialisation of shale oil that followed. My guess is that the low investment in recent years will lead to lower production and that the price rise will lead to another peak (higher or lower than past peak I dont know), and after that oil production will for certain head down (from 2025). In what way that will influence global economics is also uncertain, other that to ignore a major crisis would most likely be wishful thinking.

So I think the 2025 peak that Dennis C. is talking about makes sense. If that is really above the peak experienced now or if a recession would come before that (well I dare to say 97% likely :)), can just be speculated on right now but will be more clear after a while.

Thanks guys.

I make lots of estimates (aka guesses), but realize they will be wrong about 100% of the time, anything close to correct is probably just a lucky guess.

Note that World C+C is very near a peak right now, been roughly a plateau for about 18 months with small moves above and below 81.5 Mb/d for World C+C output.

Output increases will be from US, Canada, and Brazil mostly and eventually we might see a bit of increase from OPEC and Russia, whether declines elsewhere will be larger than the increases is hard to guess.

Much will depend on oil prices and how increasing oil prices might accelerate the transition to EVs and other types of transport.

I think we will either see an undulating plateau around 82-83 Mb/d or possibly a slow increase to 84-86 Mb/d by 2025. If we see the increase to as much as 86 Mb/d, decline on the backside will be steeper. A plateau scenario might be extended to 2028, but the longer it is extended, the steeper decline will be once it begins.

A severe recession clearly will lead to steeper decline, I am still guessing this happens between 2030 and 2034 (for the start of Great Depression 2), don’t know how long it lasts, depends if policy makers have read Keynes.

If yes, shorter depression (3-5 years), if no, 7-10 years.

What a difference between two months ago. Two months ago, US production increase may create a new glut. Now, it’s come on OPEC, mission is accomplished. Get pumping. We are not ready to admit yet, that our projection of 1.8 million is pure fancy, but we are noticing this slight crack in the dam. Next month it will be, we told you the dam wouldn’t hold. This is April, pretty early in the year, yet.

Add to this, the almost certainty that there will be additional sanctions against Venezuela and Iran. Bound to be a problem for Venezuela, not sure about Iran, but I am sure it will not help them increase output. However, Iran will restart their nuclear projects, and Sauds will be right behind them, though with more resources. Geopolitical risk, who cares, inventories will drop like a rock, anyway.

Guym,

Pipeline issues in both the Permian basin (both oil and natural gas) and Canada (Alberta oil sands) suggest that it might be a struggle to increase World output by 1 million barrels per day as there are likely to be declines from mature fields that will be difficult to offset. I agree the IEA estimate looks quite optimistic, especially if it is assumed there is not a lot of increase from OPEC and Russia.

It will be interesting to see what oil prices look like in Sept and October of 2018, based on current information my guess would be $80-$100/b for the peak monthly price for Brent in 2018.

Yes, the narative is changing fast.

Gone fishing,

You posted a nice chart previously.

http://peakoilbarrel.com/eias-electric-power-monthly-march-2018-edition-with-data-for-january-2018/#comment-636355

Considering only BP data from 1965-2016 for fossil fuels (consumption after 1989 and production earlier where some of the consumption data does not extend back to 1965) in million tonnes of oil equivalent (Mtoe). I took the natural log to look at growth rates and apply trend lines for 1965-1979, 1984-2011, and 2012-2016, slopes are 4%, 2%, and 0.8% respectively, I expect the growth rate will continue to slow to zero by 2025-2030 and then become negative. Coal resource estimates have decreased over time, oil resource estimates may be overstated, natural gas will depend on prices, methane hydrates etc are a little like the kerogen resource and are unlikely to be economically viable on a large scale.

Global biofuel production has been rising fast this decade, putting a dent in demand for oil. Somewhere on the order of 5 million barrels/day lately. Total liquid 0il plus bio demand is getting near 99 million barrels/day.

http://www.mdpi.com/2077-0472/7/4/32/pdf

So basically fossil energy use has increased by 1.7 times since 1984. The slowdown in the last few years is similar to or less than slow downs in previous time periods, so it may or may not be indicative of a coming peak. We will know within a decade how the increasing population/lifestyle/predicament energy problem is being slowed down by new efficiency and alternative energy increases.

Absolutely correct that this may simply be a slow growth period which might be followed by faster growth. Biofuels were removed from the consumption numbers and I use tonnes of oil to account for the lower energy per unit volume of NGL, on a mass basis the energy content is more similar so I prefer mass vs volume. Typically NGL on average has about 70% of the energy content of the average barrel of crude, so barrels are not a great measurement for all liquids unless the barrels of NGL are multiplied by o.7 to adjust.

I prefer to focus on crude plus condensate as that’s what most of the transportation fuel is made from.

Not sure what you are talking about, my original graph was in TWh. The biodiesel (which replaces oil products) can be converted to energy. Not sure why you are talking about NGL’s

Hi Gonefishing,

TWh is a unit of energy, same as Mtoe, or exajoules.

The source of the data in your chart says BP Statistical Review, which has data from 1965 to 2016. I was simply clarifying that I didn’t include biofuels as I was focusing on fossil fuel energy. In your comment you cited liquids output in barrels, my point is simply that barrels of oil equivalent (same energy per barrel) gives a different result from “barrels”.

For example in 2016, BP reports oil consumption in barrels at 96.6 Mb/d, and 4418 Mtoe/year. When the estimate in tonnes is converted to barrels of oil equivalent at 7.33 b/tonne, we get 88.5 Mboe/d.

In 2016, biofuels production was about 1.5 Mboe/d according to BP.

The estimate without biofuels would be about 87 Mboe/d (31.7 Gboe).

The conversion is 1 TWhr=85.98 Mtoe as I am sure you know.

The point was that 99 Mb/d is a volume of liquids (about 36 billion barrels per year) rather than a unit of energy. This is a problem with the way OPEC and the IEA report “oil” output, they don’t use units of energy.

And it gets even more complicated when one considers useful or net energy from a product, since they are often used across a wide variety of systems.

Net or useful energy would be more comparable. That is what is needed to provide the functional work. A lot of energy goes to obtain the fuel, refine the fuel, transport and deliver the fuel to the customer and maintain those systems.

Agreed.

Exergy would be a better measure, pilling together the necessary data is a challenge.

Oil exploration will not be financially viable in 2025, maybe as early as 2023. This isn’t hard to figure out if you understand the substitution effect. In order to get substitution back to oil, the price would have to fall below $20/bbl; no new wells can produce that cheap.

According to EM outlook for energy (2018). Without any further exploration and development, through natural decline, the global liquids production will drop by 78 MBDOE or about 80% of 2016 production. Unless we can replace 78 MBDOE of liquids, or destroy demand for about 80% of 2016 liquids demand some investment will be needed and is going to be economical.

Because anything brought on between now and 2040 would also decline, in fact most new projects, though still not yet most new capacity, recently are short cycle which will be exhausted and decommissioned in 5 to 15 years, there really would need to be about 175 mmbpd added to leave that amount online in 2040. Assuming typical large conventional sized projects it would need about 1.2 to 1.4 trillion barrels of reserves to support that amount of average production (more for XH, maybe a bit less for LTO and small tie backs, but not by much as they deplete so fast and ultimately take more resources and cost more). There isn’t that much undeveloped reserve around (by a long way) and to discover it at current rates would take 300 to 400 years. To develop it at current prices would cost about $12 trillion, plus exploration and operating costs might be the same again, but actually it would be much higher as the developments are getting more difficult and expensive (smaller, heavier, deeper, remoter), and discoveries more difficult. About the same again would be needed for gas, and, assuming Exxon doesn’t think every fossil fuel user suddenly switches to renewables in 2040, the rate of spend would still be going up exponentially, and at quite a high rate, then.

(interesting ExxonMobil haven’t updated that figure since 2016)

From the OPEC report.

Non-OPEC supply in 2018 is forecast to increase by 1.71 mb/d compared with growth of 0.90 mb/d in 2017. Non-OPEC supply for 2018 was revised up by 0.08 mb/d in absolute terms, compared with last month’s assessment, to average 59.61 mb/d, and is now expected to grow at a faster pace.

The key drivers for growth in 2018 are the US (1.50 mb/d), Canada (0.29 mb/d), Brazil (0.21 mb/d), the UK (0.10 mb/d), Kazakhstan (0.08 mb/d) Ghana (0.05 mb/d) and Congo (0.04 mb/d). Production is forecast to decline in Russia (0.15 mb/d), Mexico (0.11 mb/d), China (0.11 mb/d), Norway (0.05 mb/d) and Colombia (0.05 mb/d).

Increases in Brazil, UK, Kazakhstan, Ghana, and Congo are more than offset by declining output in Russia, Mexico, China, Norway, and Colombia. Essentially, the 1.71 Mb/d increase in 2018 for non-OPEC liquids output forecast by OPEC is from the US (1.5 Mb/d) and Canada (0.29 Mb/d).

There have been several stories posted suggesting that both Canada and the US may see output curtailed in 2018 due to lack of pipeline capacity to get the produced oil to market.

My expectation is that US output will fall short of the OPEC estimate by 800 to 1000 kb/d and Canadian output by perhaps 150 kb/d, leaving the non-OPEC increase in liquids output at only 700 kb/d for 2018.

The OPEC forecast for World oil demand in 2018 is for an increase of 1.65 Mb/d, if that estimate is correct, this suggests a stock draw in 2018 of 950 kb/d or about 347 Mb in 2018.

OECD stocks in Jan 2018 were at 2871 Mb, so a 347 Mb draw would take the level to 2524 Mb, this is below the lowest range seen from 2013 to 2017 (about 2570 Mb). Unfortunately we don’t have great data for the non-OECD stock levels.

I wonder what will happen to oil prices.

I predict they will be “volatile”. Isn’t that the term IEA uses?

Hello Dennis,

The price of WTI is at a high since about 12/2014 and on a steady rise going back to 1/2016 with a little pull back in early 2017. Inventories have been declining since 2016 and we are headed into the summer driving season. In the states, refineries will be running at 97% of capacity in a few weeks heading into record world demand.

I’m going to predict we are going to continued an increase in price until sometime into July to September. Reaching a peak between $80 to $85 for WTI. Then a collapse of about $15 to $20 about a month or two before the election. With a final price for the end of the year at about were it is today or a little lower. I also think refineries will not be able to keep up with demand going into the summer with excellent margins and profits. With VLO reaching $120, PBF reaching $45, ANDV reaching $125, XOM reaching $90, CRC reaching $35, OXY reaching $90

https://oilprice.com/commodity-price-charts?1=&page=chart&sym=CL%2A1&name=Crude+Oil+WTI&domain=advancedmedia&sg=true&display_ice=1&enabled_ice_exchanges=&stu

See you in September

Hillary,

I agree with the rise to $85/b maybe by October, perhaps there will be a pull back by $15/b, hard to know how supply and demand will react to $85/b, OECD stocks may be pretty thin by November, but pipeline constraints may ease by early 2019 and that might bring prices down, if stocks start to rise. Remember that an increase of output of 1.4 Mb/d is needed to balance supply and demand, it is far from clear that by November 2018 that supply and demand will be in balance (zero change in oil plus product stocks).

I have been debating for a long time whether there will be one more oil price peak or not. Seems like it’s leaning towards “there will”. This is the last one. I’m not sure when the pirce crash happens after that; it might take until 2019 or even 2020.

Hi Ron or some else

How are you?

When will peak oil of Brazil?

Thank you

Oi Cecília, talvez devêssemos perguntar ao novo Ministro de Minas e Energia do Brasil, o illustre Sr. Wellington Moreira Franco… 😉

I won’t dare presume to speak for Ron, but I’m pretty sure I know what he will say.

George Kaplan had a post on production by: Colombia, Mexico and Brazil not that long ago.

http://peakoilbarrel.com/recent-production-colombia-mexico-and-brazil/

Abç

North Dakota Director’s Cut released. February output about the same as January (1,175,000 bbld).

The 51 completions a very low number.

The February output is about 50 thousand barrels a day less than the all time record.

A new record should be set before summertime.

A new record should be set before summertime.

I’m a novice, so you are probably right——

But—— we shall see

Coffeeguyzz,

If oil prices continue to rise you will be correct, if not due to a large increase in US LTO output (which I am guessing is your expectation), then the Bakken may continue it’s recent plateau in output and may not rise above 1200 kb/d before December 2018 (a new record, but barely so).

Attached is chart of ND Bakken oil production from Jan-12 to Feb-18. Also the number of associated wells is shown, (divided by 10), so that they fit on the same chart. Note the change in slope for well additions that occurs after July-15. There are definitely two distinct slopes and possibly a hint of a lower third one starting in Sept-17. The average well additions are as follows over the following three time frames:

Jan 12 to July-15 158 wells/mth

July -15 to Sept-17 61 wells/mth

Sept-17 to Feb-18 43 wells/mth

It is not clear whether there is a new lower rate of well additions after Sept-15. It will take a few more months to see if the well addition rate has slowed again.

Hi Ovi,

A chart of the natural log of output with trendlines over those three periods would show more clearly how the rate of growth has changed over time.

Hi Dennis

My focus was on well additions and the chart does show how the rate of well additions was virtually linear from Jan-12 till July-15 and then sharply dropped by 61% thereafter. I had also looked at Enno’s Bakken well data and he shows the following increases: Oct-17 105, Nov-17 81 and Dec-17 107. These numbers are more than double the numbers reported for those months and indicated on the chart. I assume that the majority of those new wells were in ND.

We all know that the production decline rate for all of the Bakken increases with time. The wells chart, combined with Enno’s well data, indicates that the number of old wells coming off line is beginning to significantly offset the new well additions in ND. I wonder if Enno’s well data can confirm this. For me, this was a surprise.

Hi Ovi,

When the average number of new wells falls below some level, about 60 to 80 new wells per month, then output will decline. This depends in part on the number of new wells added recently (if this number is higher more new wells are needed and vice versa when fewer new wells have been added in the recent past).

From the shale profile data about 81 new wells per month were added on average from Dec 2016 to Jan 2018 as output increased from 913 kb/d to 1140 kb/d. About 62 wells per month were added on average from Nov 2015 to Dec 2016 as output fell from 1146 kb/d to 913 kb/d.

A higher rate of new wells added (say 80-100 new wells per month) is likely to result in increased ND Bakken/Three Forks output.

Oh the legacy decline rate does not necessarily increase over time, as the rate that new wells are added rises, then the legacy decline increases, the reverse is true as the rate that new wells are added decreases.

https://www.epmag.com/analysts-survey-shows-rise-us-onshore-upstream-budgets-2018-1695476

Reports of capex increases from 9 to 11% doesn’t jive with all the hoopla. Doesn’t seem huge when I think of where last year’s well decline rates are. It may be more active in the Permian, but where one increases another decreases. And note the comment on bottlenecks may decrease that. Those are pretty large samples of E&Ps. I guess they didn’t get the memo that they are suposed to supply the world.

Another article states 9%.

https://www.ogj.com/articles/print/volume-116/issue-3/special-report-capital-spending-update/us-oil-gas-industry-capital-spending-to-increase-in-2018.html

A 9% increase is far from the 40% increase they had in 2017. With this level of budgets for capex, there was no way production increase could be equivalent to last year’s rise to begin with. Shale wells have FAR more than a 9% decine rate.

Most here understand the theory, although I have never seen it work out even close. The theory goes, if your going to drill exactly the same amount of wells in exactly the same producing area, you would get about 35 to 40% more production. That’s because the well you are completing in January 2018 is partially covering the drop in production from that well you completed in January 2017. 60 to 65% of the new production is simply replacing the decline in the first well. So, if you increase capex by 9%, then production may increase by 50% over last year. That varies wildly, though. Not a very good predictor. More unpredictable if costs are increasing.

There was a 40% increase in 2017, but most of that was newly concentrated in the Permian. Hence, the big increase in 2017. But the same, or mostly the same, players increase 9% in the same area, then some of the theory may apply.

RE: Canadian production- pretty sure I remember hearing some oil sands producers holding back production while the pipeline/rail issues persisted.

Yes, although I think they’re still producing around record high levels

2018-03-01 CALGARY — Oilsands giant Canadian Natural Resources Ltd. says it is moving up planned maintenance shutdowns at its heavy oil projects in northern Alberta and will slow down production from new wells to avoid selling the product at current poor prices.

http://calgaryherald.com/pmn/business-pmn/canadian-naturals-fourth-quarter-adjusted-earnings-rise-but-net-profit-down/wcm/03b04c0b-d298-476e-be07-35e2813cc4af

Cenovus

Lots of news from China

2018-04-13 China, record Q1 crude oil imports, also record fuel exports. And the start of refinery maintenance of around 1 million b/day. Those new large refineries will be tough competition for the smaller independent refineries (Teapots). Also a new fuel consumption tax regulation. And next it will be the start of tarrifs?

Reuters imp/exp figs https://www.reuters.com/article/us-china-economy-trade-oil/china-march-crude-oil-imports-second-highest-on-record-fuel-exports-hit-new-high-idUSKBN1HK06X

Natural gas rig count for, Appalachia, US Gulf of Mexico, Canada and Mexico

Production growth is coming from shale areas, such as the Appalachia & Haynesville. But as George mentioned the natural gas rig count in the US GoM is down to zero

Appalachia: https://pbs.twimg.com/media/DavmC_JXkAAHcIV.jpg

US Gulf of Mexico: https://pbs.twimg.com/media/DavmK4AWAAY4-HP.jpg

Canada: https://pbs.twimg.com/media/DavmGUzWAAE-P98.jpg

Mexico: https://pbs.twimg.com/media/Davm4F9X0AA1134.jpg

Pennsylvania just released the most recent – February – production numbers.

Whereas just a few years ago, if a well had an initial 24 hour production rate of 20 to 30 million cubic feet, it was highly touted as hugely productive.

Now, there are dozens and dozens of wells routinely flowing 20 to 30 million cubic feet a day for several months. (Chesapeake’s McGavin 6 has averaged 37.6 MMcfd for 7 months, producing just over 8 Bcf in that time. Every 6 billion cubic feet of gas contains more heat energy than a million barrels of oil).

The length of the laterals is starting to increase dramatically with hundreds of 17,000 footers planned in 2018 alone.

Thanks Coffee,

not sure many here have recognized just how much improvement in drilling and frac control the industry has accomplished in that last 2 years. Likewise Coffee, in Scoop 10,000′ laterals are becoming normal and CLR has drilled one 15,000′ lateral in our local area. The increase in production continues to be to impressive (to me) compared to our earlier wells. 100% increase in comparative time intervals near normal. (~200,000BO in one year) Cost continue to be DOWN 25% per well. If Dennis is right about his $80 oil forecast the wells we are drilling will payout in~6-8 months.

With regard to EUR there is room for doubt as the new completion methods have become standard only in the last year or two but as any engineer will tell you after 2 to 3 years of production you can plot a curve that would be no different than what the industry has done for decades for tight oil and gas wells. take it or leave it as you will.

Best

Hi Coffeguyzz,

Let’s say lateral length increases from 8500 to 17,000 feet. In that case for a given area that is prospective the number of new wells is reduced by a factor of 2. Only if the increase in lateral length results in output that is more than 2 times higher than the shorter laterals is there any increase in output from the field.

Also note that the increased sand and other proppants, surfactants, and water as well as the increased number of frack stages per foot all increase well cost per barrel produced, which will tend to increase time to payout.

What is the total capital cost (including land and all development costs such as storage facilities, water handling, etc) for these 17,000 foot wells and what is the average output of these wells (rather than just the most prolific few) over the first 36 months of output?

It is the payout of the average well that matters as the “best” wells have to pay for the below average performers in order for a company to be profitable.

Sometimes you seem to think profits do not matter, investors (or the smart ones) have a different opinion.

Edit:

Looking more closely at median 36 month cumulative output for Marcellus and Utica and assuming $1.50 per MCF, it looks like the median well easily pays out. The 36 month cumulative is 1800 BCF (billion cubic feet) for the median Marcellus/Utica well. I would need an oil man to see what the payout would be as I do not know the OPEX, etc for a shale natural gas well.

A mistake above (under edit).

The average Marcellus/Utica well in Ohio, Pennsylvania, and W. Virginia which started producing in 2014 (37 months of data) produced about 3.2 BCF of natural gas over the first 37 months of production, using 5800 CF per boe, this is about a 550 kboe EUR. Let’s assume a natural gas price of $3/MCF or about $17/boe and a well cost of $9 million. If we take 17*0.55=$9.35 million over 36 months and the well might payout.

The reality is that natural gas prices in the Appalachia area are much lower than $3/MCF, more like about $1.50/MCF or $8.70/boe, also note that lateral lengths have been increasing in the Appalachian basin, so let’s assume in 36 months cumulative output has doubled to 1000 kboe over 36 months, but that average well cost has increased by 67% to $15 million. So at 1 Mboe cumulative output over 36 months gross revenue is about $8.7 million and the well does not pay out over 36 months (where it is assumed gross revenue should pay for the capital cost of the well for an adequate ROI over the life of the well).

Link below has natural gas price data for Appalachia.

https://www.eia.gov/todayinenergy/detail.php?id=24712

Link below has production data for Appalachia

https://shaleprofile.com/index.php/2018/03/26/marcellus-utica-update-through-december-2017/

Well costs in presentation at link below (slide 36)

https://www.swn.com/investors/lip/latestinvestorpresentation.pdf

Well cost (lean well SW Appalachia) about $7 million, so at $1.50/MCF ($8.70/boe) about 800 kboe cumulative output over 36 months would be needed (or 4.64 BCF cumulative for first 36 months of production).

It looks like 2017 wells will be about 1.2 BCF more than 2015 wells at 36 months, so about 4.5 BCF, not quite enough for payout at low Appalachia natural gas prices, hedging might help and more natural gas pipelines might also reduce the Henry Hub to Appalachia price spread.

I know one of the darling pubco company in the Marcellus sold its gas for $.25/ mcf between 2014-2017.

If there is one company in that position there is likely more.

Did Kinder Morgan Just Kill The Oil Sands Story?

Canada’s Trans Mountain Pipeline project has been delayed due to political infighting between the government of British Columbia and the Canadian national and Albertan governments.

Kinder Morgan has announced that if this political squabbling is not resolved by the end of May, then it will cancel the project.

This is a good move for shareholders on its part despite the fact that Kinder Morgan will sacrifice approximately $873 million a year in adjusted EBITDA.

Producers in the oil sands need the capacity of this pipeline in order to execute on their own forward growth ambition.

Suncor Energy could be especially hard hit as nearly all of its forward growth depends on the oil sands.

On Monday, April 9, 2018, pipeline giant Kinder Morgan, Inc. (KMI) stated that it would cancel work on the Tran Mountain Pipeline Expansion Project if legal issues surrounding it are not resolved by May 31. This could have a deleterious effect on the Canadian oil sands growth story as the pipeline expansion would significantly increase the amount of Albertan oil reaching the west coast of Canada for export. The cancellation of this project could therefore have adverse consequences for the growth ambitions of numerous companies, including Kinder Morgan. This also serves as an example of the potentially major impact that government actions can have on numerous companies in an industry.

Hi Ron

The announcement by KMI has certainly caused a major reaction here in Canada by all interested parties and potentially a constitutional crisis. Our Prime Minister is meeting with the Premiers of BC and Alberta this weekend. The speculation is that the Cdn government and the Alberta govt. will buy into the project and cover costs associated with delays. There are challenges in front of the Federal court regarding the validity of the approvals process. The Cdn. Govt. thinks it will win. Even if it does, BC will then refer it to the Supreme Court and cause more delays.

The biggest impact on the oil sands will be primarily on the smaller players who were planning on increasing their production. The bigger oil companies, XOM, SU, and CNQ have bought space on the current pipeline system as part of their expansion plans.

As for, Suncor, below is a shortened version of an article that appeared in the Financial Post, Jan 29 2018. Note the SU statement at the end of the article.

“Fort Hills is expected to be the last major oilsands mine to be built in Canada for some time given the enormous capital costs. Companies continue to pursue smaller, steam-based oilsands projects to grow their production.

The new production from Fort Hills will be part of the 280,000 bpd of new Canadian oil capacity expected to come on stream this year, according to the International Energy Agency, exacerbating a glut of oil production that currently outstrips total export pipeline capacity. The IEA expects Canadian production to hit a record 5.07 million bpd this year.

“Western Canadian heavy crude production is growing ahead of pipeline capacity,” according to a new report by Morningstar Commodities Research on Monday that showed Canadian oil-by-rail shipments were up 59 per cent in 2017 over the previous year.

Pipeline operators have been rationing space on their export pipelines and TransCanada Corp.’s Keystone system continues to operate at 80 per cent of its stated 590,000 bpd capacity following a spill last year, which is putting further pressure on Canadian oil producers to secure railway cars to move their crude out of Western Canada.

However, Suncor says it has arrangements in place to ensure its barrels reach the market.

“We do have adequate market access for all of our production, including Fort Hills, and it’s mainly by existing pipelines,” Suncor spokesperson Sneh Seetal said. “We do anticipate a very small portion of our production would be moved on rails but that would be on an opportunistic basis.”

BC is looking out for itself—-

Do you want massive oil tankers negotiating tricky waters so a few rich people can extract profit?

Unfortunately for petro interests, Vancouver has a well educated and active populace.

Let the politically conservative populace of Alberta find another route.

They are devastating their ecosystems– let the “challenged” do it to themselves, rather than export it to others.

Yeah, Alberta and Texas are rather challenged on the economic benefits of limited resources. Though I argued with Mike over it, he is probably right. Why should we waste resources that are valuable down the road. Why export it? It doesn’t make sense. In five years, we’ll be smacking our foreheads over being so short sighted. Texas already has the logistical resources of plenty of refineries. Alberta just needs to put some money towards that. Become the Gulf Coast of Canada. If oil or oil products leak out of it, it needs to be paid with excise taxes, or Vat taxes to reimburse Alberta for their loss. In five years, you couldn’t imagine the amount of new business that could attract towards the region. Quit fighting BC, and make a silk purse out of sows’ ears.

BC is rich, and intact.

Why bring the Alberta “rape and scrape” out West?

This is some of the dirtiest oil that exists.

No it’s not. California heavy dirtier. Stop spreading your false information on environment. Trans mtn has been operating safely for 50 years.

Alberta’s Premier in one comment even said that Alberta could buy the whole project and push it through but it wasn’t clear whether that meant the doubling of capacity part or the whole pipeline. I expect it was just the current project of doubling the capacity.

Interesting results of polling on the pipeline issue in BC.

Looks like people have mixed feelings.

The poll questions were well designed to explore to the issue. Better than most.

https://globalnews.ca/news/4091648/b-c-trans-mountain-pipeline-expansion-poll/

Hi,

Here are the Bakken updates. First the production graph. Not so much to say about it except that the decline rates were very low compared to January. 2007 to 2016 together decreased production by only 4300 bopd. Production from new wells were on the other hand also very low, only 164 bopd for the non confidential ones. It was for example 400 bopd in December and 254 bopd in January. Average number of production days for those wells were around 14 days, which is normal as the average well starts production in the middle of the month. So not sure why the number was that low. I should add though that first month production is less reliable in predicting future production. Second month is better to use for that (Also note that I divide monthly production by days in month to get production per day. So twice that number gives a more accurate value for average production for the first month). Average number of production days for legacy wells did not change much compared to January. So the weather did not seem to cause much problems. Number of new wells (all ND) were 70 compared to 61 in January.

Here is the GOR graph. Most years saw an increase compared to previous month.

This graph shows flared gas rates. A bit hard to see but flared gas decreased quite a bit in Mountrail, McKenzie and Williams. Produced gas increased so maybe extra gas capture capacity was added.

And here is the graph.

Thanks!

Correction. The first month average production for non confidential Bakken wells should be 193 bopd for February, 306 bopd for January and 402 bopd for December. The first numbers I wrote includes conventional wells or possibly wells that have not yet been registered as Bakken wells.

Anyway, still very low number. The low producing wells appears to come from McKenzie and Williams. In McKenzie there were 12 non confidential wells with an average production of 180 bopd. It has not been that low since January 2013 if you exclude months where it was because of low number of production days. Williams had 9 non confidential wells and the average production was only 49 bopd! Water cut was very high too at 86%. So doesn´t look like the low production was because they restricted the flow. If I get time maybe I will look into where those bad wells were drilled.

Look at who the operators of the wells are too.

Almost all of the Tier II acreage was divested by the public firms to privately held firms.

With oil prices rising, it appears some of these smaller firms are drilling/completing wells again.

Here are the wells with very low inital production (with operator, shallow sand):

Area: ELLISVILLE, WIL

Operator: CRESCENT POINT ENERGY U.S. CORP.

Wells:

31471

31472

31669

32898

32901

Area: EAST FORK, WIL

Operator: WHITING OIL AND GAS CORPORATION

Wells:

33355

33356

33357

33367

Area: ELIDAH, MCK

Operator: BURLINGTON RESOURCES OIL & GAS COMPANY LP

Wells:

31610

31611

31612

31613

Area: SAND CREEK, MCK

Operator: BURLINGTON RESOURCES OIL & GAS COMPANY LP

Wells:

33553

33554

33555

All above wells are outside the sweetspot areas. EAST FORK is propably the best of the above areas. But it covers a big area and the above wells are in a not so good part of it. The above areas are however not so bad that they can explain the very low initial production numbers. I have however seen cases in the data of very low initial production which after a couple of months suddenly increases a lot. So a bit early to come to any conclusions.

India’s consumption growth of oil products without LPG

March 2018: +6.5% compared to March 2017

Q1 2018: +8.6% compared to Q1 2017

March 2018: approx +278 kb/day (using an overall 8 barrels per ton conversion) compared to March 2017

India – Fuel prices continue to climb aided by strong global demand. Diesel registered record high levels of Rs. 64.96 per litre in Delhi and Rs. 69.17 per litre in Mumbai.

Chart by Edelweiss on Twitter, yearly data from Bloomberg plus the latest daily price for 2018: https://pbs.twimg.com/media/Daz64YbW0AAWLOv.jpg

Edelweiss Investment Research: https://twitter.com/Edelweissonline

Port of Vancouver largest coal exporter in the world, very enlightened, yes those people of Vancouver are.

They are are not just the largest exporter of coal in North America, BC mines that coal.

http://nationalpost.com/news/politics/yes-anti-pipeline-vancouver-really-is-north-americas-largest-exporter-of-coal/amp

And, gasp from tree huggers, timber!

BC does export a large amount of timber.

Wasn’t aware of the coal — thanks for the update.

I fly fish Northern BC for steelhead (Skeena).

But strange– I’ve never seen this in BC:

https://amp.businessinsider.com/images/4fb5280a6bb3f7fe7e00000c-750-563.jpg

https://biv.com/sites/default/files/styles/media_image/public/2017-12/echo_hill_coal_mine.png?itok=1hnheDNV

Yup

That’s coal, and from the image, minor.

You can actually see the vehicle.

If you look closely, the vehicle is going into a cave. So, I guess that is better, unless you have to work in the cave.

Copper mine, not so small

http://img690.imageshack.us/img690/9827/highlandvalleycopper200.jpg

Vancouver is quite proud of the mines:

http://www.mining.com/top-10-british-columbias-biggest-mines-87979/

Strip coal mine, not so minor

http://1qb1ow3qfudf14kwjzalxq61.wpengine.netdna-cdn.com/wp-content/uploads/2015/09/lenz-6743.jpg

But these pictures are prettier than the one you showed, so I can see why they wouldn’t want a pipeline messing up the landscape. Could clog up logging routes too.

http://www.mining.com/worlds-mining-capital/

But, anything is better than an oil spill.

https://amp.theguardian.com/environment/2014/aug/13/mount-polley-mine-spill-british-columbia-canada

The final paragraph exhibits classic altruism.

Nice poost

Guym,

What is your source for “largest coal exporter in North America”?

http://www.nrcan.gc.ca/energy/facts/coal/20071

According to the above link Canada produced 61 million tonnes of coal in 2016 and exported about half.

US coal production was about 660 million metric tonnes. about 55 million metric tonnes of coal was exported in 2016, almost double Canadian exports.

Data from EIA (imports and exports) at link below.

https://www.eia.gov/coal/data.php#imports

Exactly. Also public opinion is for the pipeline or neutral. You are hearing a vocal minority. Paid protestors. Also American oil industry funding protests etc as it’s beneficial to them to keep Canadian oil at a discount

Paid protesters – sure thing buddy.

It is well documented that ads on Craigslist seeking DAPL protesters offerred roundtrip airfare from continental US to Bismarck, $1,500 sign on fee, and $19/hour were online for several weeks that spring.

One of the bigger motivations for the harsh sentencing for arrested trespassers/vandals was to be able to induce plea bargaining so as to ascertain sources of funding.

This is one reason the RICO parameters were invoked by the pipeline builder in their ongoing lawsuit to target the criminal funding of this operation.

Of course, the hundreds of thousands of dollars ‘donated’ to the Standing Rock tribe by wind power companies at the time of the protests (all public knowledge and viewable from online sources) are another matter entirely.

You, Mr. Hren, may be surprised, at the backers of many of these obstructionist movements as they not only include hydrocarbon producing countries (Gasland was partially financed by Qatar, as the early version credits showed), competing industries, and intra-industry factions wanting someone else’s ass gored to protect their own operations.

Should you expand your thinking, read data put forth from an array of sources, be honest in your own as well as the broader body politic’s motivations, you may find a shocking degree of jockeying, manipulation, and self serving that is not limited to any one faction … most especially one’s own, whatever that may be.

Good start is both discovering and sharing the funding sources for the Sea Change organization.

Love to hear your anticipated results.

This comment by “coffeeguyzz” is about the funniest thing I’ve ever read.

… and when one of the self acclaimed high IQ posters responds in thus fashion, what possible hope can be held out that reputable discourse is achieveable in these affairs.

A few minutes (hours?) of googling can verify all that I have posted … and much, much more.

“People believe what they wish to believe” was the quote noted by Mr. Patterson long ago that sparked my active interaction with this site.

Actually, Sir Frankie Porkchops’ quote is but one of several over the ages that highlight how limiting other-than-rational/computational components of humans actually are in real life situations.

Again, we all are immersed in a 24/7, intense information war that is ill served by ideological blinders confirming our most grotesque inaccuracies.

“self acclaimed high IQ posters”

Keep punching down. That’s what you guyzz do.

Ah, from someone never there—

You actually need to have been gassed and clubbed several times, then the delusions start to disappear.

“Paid protesters”. Hah! Keep drinking that Fox Kool-aid.

In the case of British Columbia, a large majority of the citizens do not want to the risk of having a large additional oil transport scheme going through the coastal environment that they cherish. This isn’t some radical notion, just ordinary people.

That’s what I thought. They are ordinary folks and he is projecting as if they are some powerful cabal. Trying to make it look like he is punching up instead of punching down. That’s the typical ploy.

I’ve been tear and cs gassed on three Continents.

Never got paid a dime– what did I do wrong?

It’s not a large majority, your wrong.

What you’re claiming is “well documented” is in fact… outright false, made up from the whole cloth by lying propagandists.

You might want to spend more time doing your homework and looking into the outlandish claims you read on the Internet or hear on Fox News. You’re being lied to. Don’t fall for it.

I live along a route many DAPL protestors took to get to the protest camps and such. I doubt many of these folks were being paid. Most didn’t seem to be the types motivated purely by money. For the most part, they seemed to be radical leftists (a.k.a environmentalists) accustomed to being on the fringes of society but desperate to rally behind a cause and in need of attention/fitting into a group.

I likewise knew and have reputable first-hand accounts of the protests like the Dakota pipeline, how the protesters were sprayed with water hoses when the temperature was well below freezing, living in the snow in tents with no heat. Since most Americans won’t pick produce, clean hotel rooms or any of the other various manual labor jobs for which we require immigrants, I find it difficult to believe that anyone would be paid to put up with such conditions.

I’m willing to believe there is dirty money in such things as documentaries like Gasland, I’ll check that out. But how much money would you have to be paid to be sprayed by a water hose in sub-freezing weather, and then go try to dry off in a tent covered in snow, Mr Guyzz? I’m guessing it would be a damn lot of money. You are impugning the motives of brave men and women who risked death to protest against something they believe in with the core of their being. Consider how insulting that might be.

Well said Stephen.

Mike,

Some of the replies point out that coal that’s shipped out of the port near Vancouver is mined in BC, but that port is also exporting coal from the Powder River Basin in Wyoming. That coal is carried by rail all the way to the Columbia River along the southern border of Washington, barged downriver to near Longview, and then put back on rail to go north across the whole state (Washington) to cross the border into BC. Those are unit trains, and very long. They go right under downtown Seattle through the train tunnel. The coal cars are uncovered, one reason for protests along the route.

Mike,

See

https://www.sourcewatch.org/index.php/Coal_terminals

Biggest existing export terminal for coal is in Australia at 120 million tonnes per year, the BC export terminal may be the largest on the west coast of North America that currently exists and is expanding to 29 million tonnes per year, there are a couple of east coast export terminals in Alabama and Virginia that are larger (68 and 48 million tonnes per year capacity).

Ok Dennis, thanks for the correction. Just trying to point out the hypocricy of some of those living on the lower mainland and the island.

It’s an interesting point. BC does have a lot of resource extraction industries, which makes you wonder. After reading about it, here are a couple of thoughts:

1st, the people who are happy with BC coal are probably not the same people as those objecting to the oil pipeline. I’d bet that if you asked the pipeline protestors, they’d tell you that they’re also not so excited about coal exports.

2nd, even if they were, they might not be hypocritical: part of the objection to the pipeline is that the benefits go to producers in Alberta and consumers outside Canada, while the risks go to BC. That’s not true of the coal, which is mostly mined in BC (and I think there are indeed people protesting the coal which is just passing through BC, which would be a consistent application of the idea that risks and benefits should accrue to the same people – certainly as noted above there are people living next to US coal delivery routes who are objecting to coal passing through).

We always debate the global peak. But there are many other peaks which impact on geopolitics:

14/9/2015

Syria peak oil weakened government’s finances ahead of Arab Spring in 2011

http://crudeoilpeak.info/syria-peak-oil-weakened-governments-finances-ahead-of-arab-spring-in-2011

Its the 2nd shale revolution!

https://www.mrt.com/business/oil/article/Second-shale-revolution-is-on-the-horizon-12832892.php

Or is it the 3rd?

Im so confused.

I have a little experience with EOR. None of these dreamers have any idea of the complexity, cost, and operational issues associated with a successful and economic CO2 flood beginning with the effort to negotiate and implement field wide unitization.

How can a large scale Tertiary LTO project be implemented in Texas without a field wide unitization?

Does that skill set even exist in Texas or anywhere else in the industry today?

With the decline rates of LTO, there simply can’t be enough time to execute a field wide unitization.

They are not as close as advertised, I don’t believe. EOG has it working (not CO2 but gas) in the Eagle Ford. It works, because the shale has some hard boundaries. It doesn’t equate yet to the Bakken, because there are no firm boundries. Permian is much worse for boundries. You can blow gas and it will wind up in the next County. I’m talking about the two large plays with multiple levels, but it could have .a possibility on some of the upper levels

GuyM,

I was told by one the Permian’s tertiary experts that EOG used ethane in its Eagleford Tertiary project because the had so much of it they couldn’t get rid of it otherwise.

I have a lot of respect for EOG because it is,in my opinion, extremely well managed. I have long considered it the Walmart of drilling. Most of the time EOG can drill wells, cheaper, faster, and better than any other operator I am aware of.

But, to my way of thinking a “pilot EOR project” is not the same as a scalable project that delivers a return on investment.

In the Permian, a successful EOR project is preceded by a successful waterflood project. The water flood project is operated on the basis of a previous field wide unitization agreement and operations agreement that is negotiated between many operators and sometimes hundreds of royalty owners. Most of these were negotiated in the 40’s, 50’s and early 60’s when royalty owners where much less litigious and trusting. I don’t think it could be done today without force pooling or “forced leasing” as I view it.

Then, CO2 has unique properties to combine with oil and water and change from a gas to become a miscible fluid that can sweep through a formation. When the miscible fluid of oil water and CO2 is produced then it is separated into its components and the oil is sold, the water is disposed of and the CO2 is re-injected. All of this requires a tremendous investment in wells, gathering systems and procesing plants. And those skills don’t grow on trees.

I haven’t heard or read anything about ethane’s properties to replicate CO2’s performance in a reservoir. If anyone knows anyhing about the ethanes properties, I would like to hear about it.

Generally speaking, it’s takes about 8 years for a “conventional”EOR project to respond to a CO2 flood. The projects are long term, capital intensive and have generally lower rates of return and longer payout terms than conventional wells or waterfloods. I recognize that these factors are attributes shared by all unconventional LTO projects.

However there is one really significant difference between LTO and EOR ….and that is a EOR project is a huge cash flow generator once it responds to a flood and achieves payout. And, the cash flow lasts for years and years.

Ok, that one is way more than anything I have heard of. Waterflood shale? How much water would that take in this size of field(s)? This area does not have much water to speak of. I suppose if you could, that would supply the barrier. Pretty complicated. How much additional percentage are we talking about?

If it takes eight years, then much of the area would no longer be held by production? And if they decide to go unleased, the attorneys will be drooling over that one. In Texas, there is no extra penalty that can be deducted by the operator, only the percentage cost of the well, and no overhead. Pretreating expenses, especially non-authorized, have not gone to court, as far as I know.

GuyM,

Under a field wide unit agreement, operations anywhere in the unit hold acreage.

I’m not suggesting a shale “water flood” as a precursor to a shale EOR. But as far as I know all successful CO2 floods were preceded by a successful water flood. I have no idea what it would take to have successful LTO EOR project on the scale of even an average economic CO2 project.

At least we have many comparable analog projects with CO2 EUR which we can compare EUR projects . LTO EUR? I don’t know.

Are they even comparable on anything except capex requirements?

Typically, a starting CO2 flood has a 98% or so water cut. I’ve also been told that you have to have around 80 mm BO/ left in place to justify a CO2 project. So you can do the math to see how original oil in place existed with primary production. And that is with a God given “real” reservoir.

I suspose time will tell on all of this. “It’s not bragging if you do it” is an oft attributed football quote (was that Don Meridith?)

“ Except I shall see in His hand the print of the nails and put my finger in His side, I will not believe.” Which well characterizes my opinion on LTO EOR.

If only I could be a true believer in LTO; “blessed are they that have not seen and have believed.” John 20. 19-34

Perhaps if EOG or any other LTOcompany-presents presents a project at the next CO2 conference (www. CO2conference .net) for peer review or bragging rights, then we will know. Until then…..

Field wide unit agreement is not a Texas legal term. Are you talking about forced pooling and field unitization? In Texas, they can drill with a certain percentage, but can’t force a lease. If under that, they don’t drill on your property, you have lost out. If they drill on your property, your still unleased.

Crescent Pointe has been pushing a water flood type approach in their Canadian operations for years.

They anticipated adapting this to their North Dakota wells, but said a number of regulatory hurdles would need to be addressed.

They were implementing closeable sleeves in their completion hardware for better pressure/water control.

The folks at the EERC in North Dakota continue to do a great deal of research on LTO EOR with the somewhat surprising finding of the effectiveness of ethane as an injecting medium.

Core Labs had recently been involved in an experimental pilot test in the Bakken using an undisclosed, proprietary gas mix for a huff and puff attempt, but I’ve not read of any results.

90%+ of remaining LTO oil will most definitely not be left behind.

Coffeeguyzz,

And how do you know 90% of OOIP will not be left behind?

If it costs $1000/b (in 2018 $) to produce in 2025, it will be left behind, you can take that to the bank.

Basically the USGS median TRR estimate for the Bakken/Three Forks is about 13 Gb and the median OOIP estimate (Leigh Price) is about 413 Gb.

So recovery is expected to be about 3.4% of the mean OOIP estimate, implying that 96.6% of the oil will indeed be left behind.

Range of OOIP estimates is 271 to 503 Gb and for Bakken TRR 8.5 to 18 Gb (USGS 95% confidence interval) so the recovery factor range (95% confidence interval) is 8.5/503=1.7% to 18/271=6.6%, with a mean of 3.4%.

And “field” gets pretty complicated, here. EOG has its efforts in EOR pretty guarded. They are not exactly the “sharing” type. What they have said about it, is that it works well when there are multiple wells fairly close. Most people assume it’s a huff and puff, but EOG says nothing. For all I know, they may go out in the middle of the night to work on it with their ninja suits.

Field wide unit agreements are most certainly legal recognized legal terms and documents.

I said that new field wide unit agreements would not be possible w/o force pooling which I equate to “forced leasing”. And if you don’t think industry is trying to accomplish this in Texas then you are very uniformed.

I refer you to the dollar hide unit agreement, the Yates field agreement, the Mi vida field unit agreement, the east Texas field unit agreement and many many other.

I don’t know what you are using for a reference agreement but I assure you these agreements have and are commonly used to day because they are still producing. Any company Landman, engineer and geologist should be able to tell you about field wide unit agreements. Likewise any joint interest accountant should be very familiar with these agreements and be able to steal his annual salary via a unit JIB COPAS procedure. Not picking on accountants. Any pumper should be able to steal his salary as well.

Poor choice of words, sorry. And I had to steal back my income with a good attorney from the landman, so I know how that goes. From that point on, any dealings with the oil companies would only be done with an attorney. Trust in the oil business is for those that want to wind up poor.

John

Over the past several years, the Williston Basin Petroleum Conference has several technical papers on LTO EOR.

Steven Hawthorne, from North Dakota’s EERC, has several brief, graphic rich presentations touting their work involving ethane.

I am not a technical person. So maybe someone can explain how water or CO2 would move through solid shale from the injection well to the producing well.

Further, as for water flooding, keep in mind that this makes operations much more expensive.

For example, old (5+ years) Bakken wells tend to produce 10-40 BOPD and a similar amount of water. These wells are rod pumped, and do not pump full time. This makes operations somewhat manageable. Not as much rod wear, not as much stress on the down hole pump, less electricity and down hole chemicals.

OTOH, if water flooding would work, there would need to be a large source of “make up” water. Large injection pumps would be utilized to pump the water down the injection wells into the producing zone. I assume this would need to be at very high PSI given the depths and that the formation is not so pourous shale. The producing wells would pump full time, more strokes per minute as they would now be producing more water. More wear and tear.

Of course, economics would depend on oil recovery rates. I assume those rates would need to be high, given all the infrastructure needed, as well as the increased operating expenses.

I have no experience with CO2 flood, other than I do know the infrastructure, CO2 and operating costs are generally higher than waterflood.

What are some examples of deep onshore CO2 and/or water floods? Thinking deeper than 7,000’ TVD?

SS

The February 2016 AOGR has a brief description of the historical EOR in the Bakken with a highlight on the differences between conventional and LTO.

Crescent Point has a brief description on their waterflooding on page #28 on their recent presentation.

Granite Oil describes their ongoing EOR in the Viewfield Bakken using re-injected field gas.

Best descriptions are Hawthorne’spresentations clearly describing miscibility issues versus flooding through pre-existing fractures by using ethane.

A year or so from now, we may learn whatt Bakken operators are doing with 2017/2018 wells as 2 things are clear …

Initial output now regularly exceeds 50/60 thousand barrels first full month, with high production running 4 to 6 months out.

Second, the produced water over first several months approaches or exceeds 200,000 barrels. This is about 10 times the historical norm which would indicate that operators are maintaining elevated formation pressure via the injected water and are slowly ‘producing’ it along with much higher hydrocarbon recovery.

There has been no detailed discussion on the specifics in this matter.

Coffeeguyzz,

If we consider actual data from shaleprofile.

In 2017 the average North Dakota Bakken/TF well produced about 18,000 barrels in its first full month of production, about 3 times lower than you claim.

First 6 months for average 2017 Bakken new well was 97,000 barrels or about 16,000 barrels per month, by month 11, output of the average 2017 well (6440 b/m)had fallen below the average 2016 well (6930 barrels/month.) By month 20 the level of output of the average 2016 well falls to the 2015 well level, and by month 30 the level of output of the average 2015 well has fallen to the level of the average 2014 well.

From 2014 to 2017 there might have been an increase in EUR of up to 70,000 barrels, though it is possible that after month 20 the newer wells may fall below the output of the older wells in the “tail” months, as was the case for the 2014 wells compared to the 2010 wells after about month 36.

Newer wells may have higher initial production and lower output later.

Dennis

I do not have the time to clarify, not to refute, the points you have made … but your reliance upon averaging via Enno’s fine site can grossly distort specific developments in both North Dakota and the Appalachian Basin.

Not only is there great heterogeneity in geology, different companies employ widely varying operational procedures for a whole host of reasons.

To use averaging can be an accurate, yet wildly misleading metric when one includes short, shallow wells in northwest Pennsylvania by Hilcorp, the shrinking oil window in Ohio, with the prodigious monster wells in Susquehannah, Bradford, and Washington counties.

Likewise, the numbers I quoted above are verifiable from the monthly ND production reports if one chooses to slog through the near 300 page reports.

It is a fact that Oasis, Continental, and Marathon – at least – are now producing wells in excess of 50,000 bbl first full month using 60 to 80 stages and accompanied by a shit ton of produced water.

Again, go to Enno’s site and see what is happening in Susquehannah county, in Greene (with its high NGL content).

Now, glance at recent developments in Armstrong, Westmorland and Allegheny counties.

When one lumps all these numbers to get an average, the disparities – and consequent distortions – should be readily apparent absent a more granular perspective.

Averaging things for analytical and presentation purposes can be very instructive, but interpretingg this view as reality will lead to erroneous conclusions.

what a feakin great reply, Coffee. I think Dennis and others try but they just do not understand why you are so correct. They are always a year or two behind the curve and not KNOWING what is going on “at the front line” so to speak. From my very first post here I tired to understand just why so many people could not or would not grasp the actual facts that are so apparent to those of us who do the detailed work vs relying on as you say “averages” of old data and then trying to make projections in the future based on that. Thanks again for the terrific post.

Coffee,

I think I get your point about “averaging “ outcomes for analylictical and presentation purposes. I think I understand that certain outcomes are indisputable facts. But I have no idea what you mean by a “granular perspective”