A guest post by Ovi

Below are a number of oil, crude plus condensate (C + C ), production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to November 2021. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

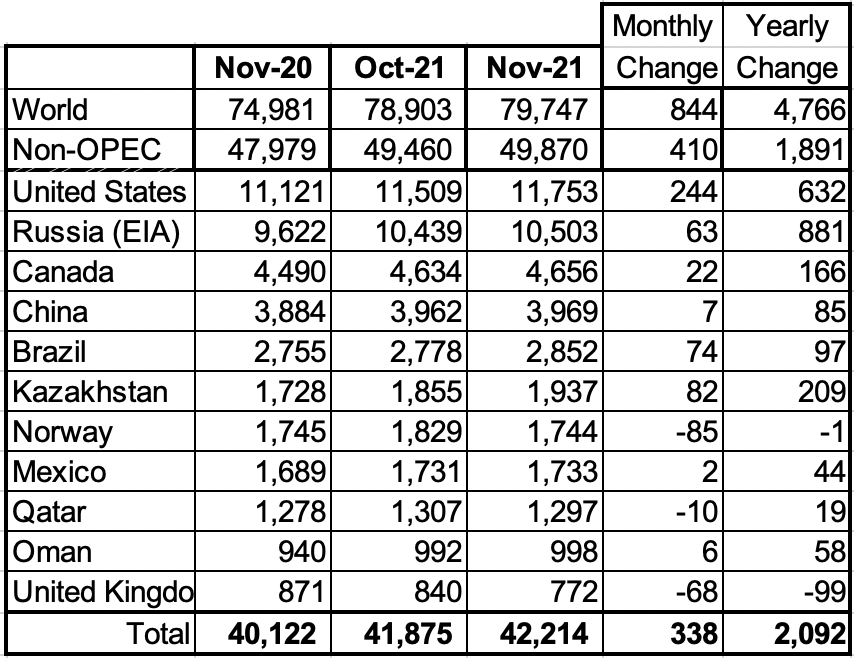

November Non-OPEC production increased by 410 kb/d to 49,870 kb/d. Of the 410 kb/d increase, the biggest increase came from the US with 244 kb/d along with a number of smaller increases. The other increasing countries were Brazil 74 kb/d, Kazakhstan 82 kb/d and Russia, 63 kb/d for a total of 463 kb/d. The biggest declines occurred in Guyana 86 kb/d and Norway 85 kb/d.

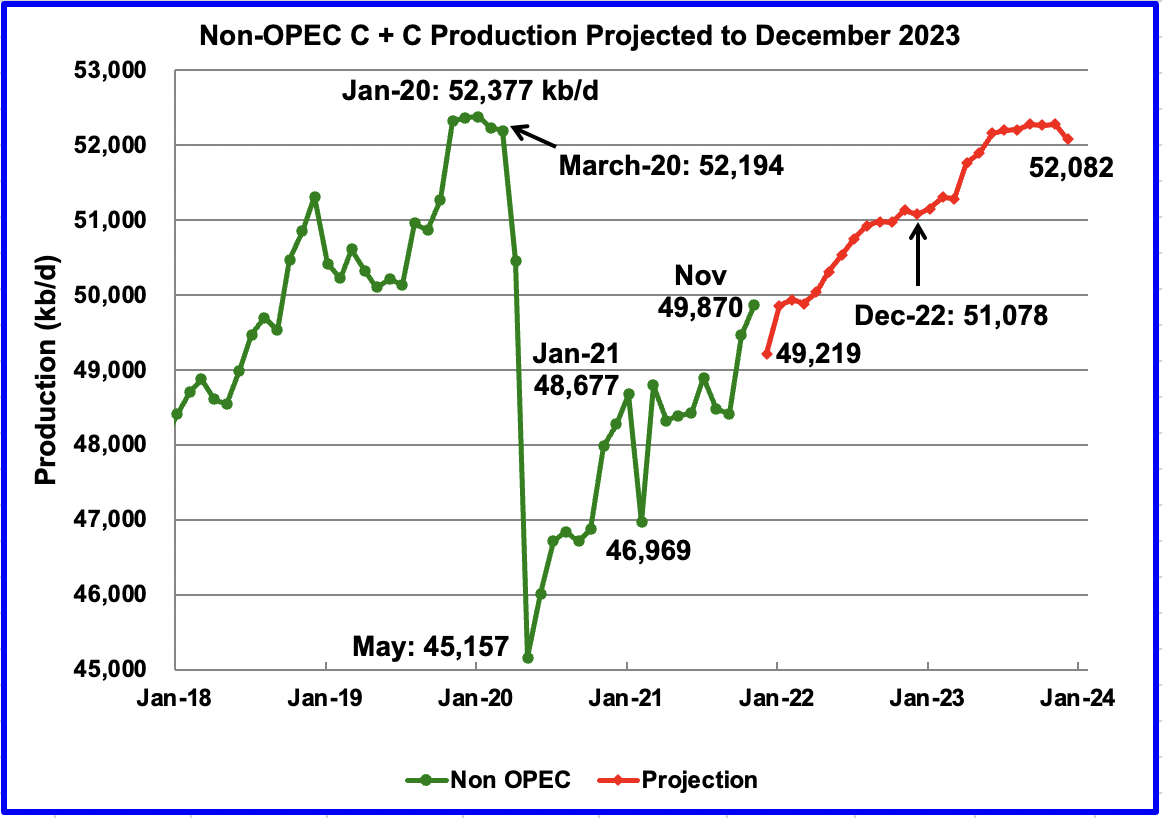

Using data from the March 2022 STEO, a projection for Non-OPEC oil output was made for the time period December 2021 to December 2023 (Red graph). Output is expected to reach 52,082 kb/d in December 2023, which is 295 kb/d lower than the January pre-covid peak of 52,377 kb/d. Note the projected drop for December 2021.

The current December 2023 output of 52,082 was revised down by 474 kb/d from the previous February report. The downward revision is primarily related to the STEO’s downward projection of close to 500 kb/d for Russian output, relative to February 2022. The revision is due to sanctions imposed by the US and its allies and the difficulty Russia is having in finding buyers for its oil. See Russia chart below for further details.

Above are listed the world’s 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The last two have currently fallen below 1,000 kb/d.

In November, these 11 countries produced 84.6% of the Non-OPEC output. On a YoY basis, Non-OPEC production increased by 1,891 kb/d while on a MoM basis production increased by 410 kb/d to 49,870 kb/d. World YoY November output increased by 4,766 kb/d.

Production by Country

The EIA reported Brazil’s November production increased by 74 kb/d to 2,852 kb/d. The national petroleum association reported that January output rebounded to 3,032 kb/d. (Red Markers).

Brazil production is expected to increase in 2022. According to OPEC: “Crude oil production is expected to rise through two new project start-ups: Mero-1 (Guanabara), which was initially planned to start in 2021, and Peregrino-Phase 2. Moreover, in Buzios, a fifth unit, the Almirante Barroso FPSO — to be supplied by Japan’s Modec — is due to begin operations in 2022.

Peak production was reached in Brazil in January 2020, followed by two subsequent lower peaks. The Brazilian pre-salt reserves are being developed by Petrobras, as well as multinational oil companies such as Royal Dutch Shell, British Petroleum, Chevron, and ExxonMobil. These companies are spending hundreds of millions of dollars to produce the oil. One has to wonder if these companies are cutting their production expenditures, leading to the decline in production that started in January 2020 or is it related to geology?

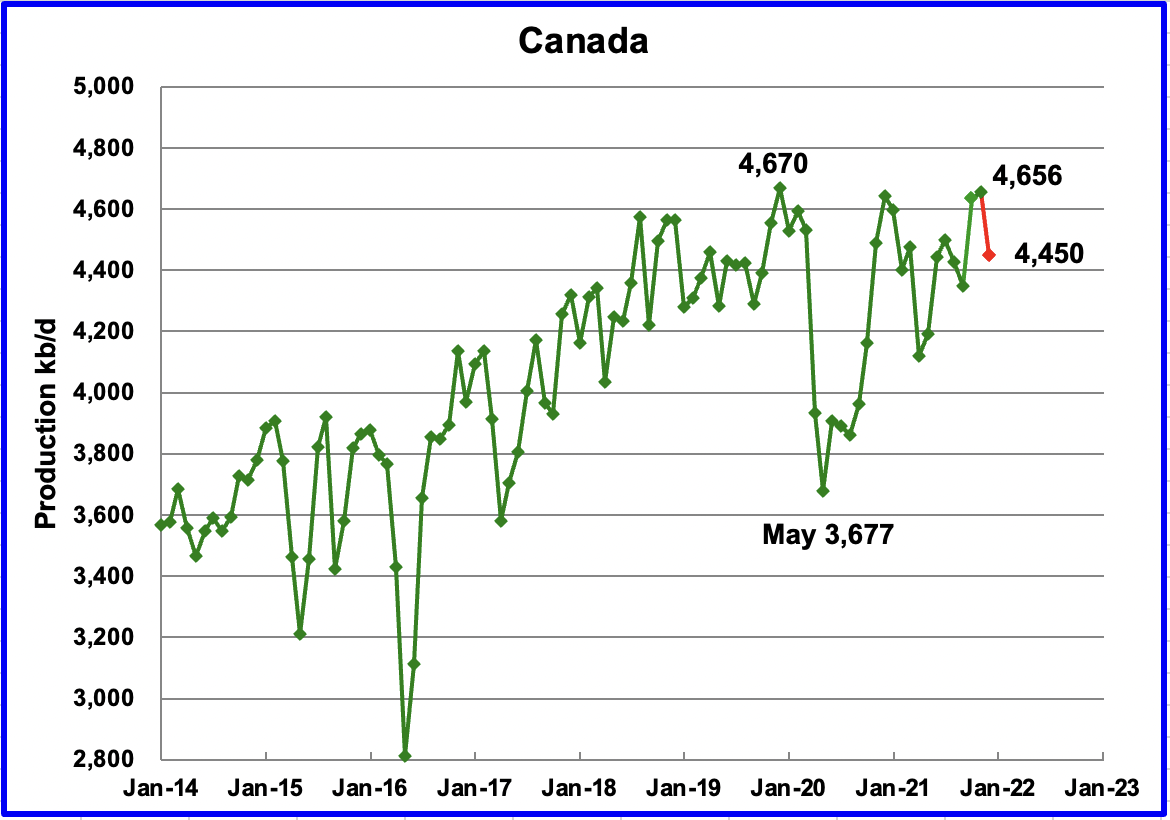

According to the EIA, November’s output increased by 22 kb/d to 4,656 kb/d.

The Canada Energy Regulator published partial production information for Canada’s December output. Filling in some of the blanks using info from the previous months, it appears that December production will drop by approximately 200 kb/d to 4,450 kb/d.

Suncor, one of Canada’s major oil producer, expects to increase its crude oil production in 2022 and reduce its oil sands operating costs.

Suncor’s Oil Sands operations production of 395,000 to 435,000 barrels per day (bbls/d) and cash operating costs(1) per barrel of $25.00 – $28.00 reflects a larger proportion of production being higher margin SCO as well as planned maintenance at Firebag – its first major turnaround in 10 years.

“Fort Hills production of 85,000 to 100,000 bbls/d, net to Suncor, represents a two-train operation for the year and expected utilization of 90%. This production increase and focus on costs is expected to result in an approximately 40% reduction of Fort Hills cash operating costs(1) per barrel to $23.00 – $27.00 compared to the midpoint of 2021 guidance. Fort Hills will ramp up imminently in late December 2021 to a stable two train operation.”

I think the operating costs are strictly labour, fuel and maintenance. Administration and interest charges are not included.

In December Canada shipped 131.2 kb/d by rail to the US, essentially unchanged from November which was 132.3 kb/d.

Canada looking at boosting oil pipeline flows to U.S.

According to this report the Minister of Natural Resources is working with Enbridge to increase the capacity of its pipeline system to flow more crude to the U.S. and Europe. Both Enbridge and Trans Canada Pipeline have used friction reducing additives to increase pipeline flow.

“Even if Canada is able to increase pipeline export capacity, many producers have been reluctant to adjust spending plans to significantly boost output.

However, Suncor Energy’s (SU.TO) chief executive, Mark Little, said earlier this week he expects Canadian production to climb by a “few hundred thousand” barrels this year as prices soar.

Canadian oil companies exported a record amount of crude out of the U.S. Gulf Coast at the end of 2021, most of which went to big importers India, China and South Korea. read more”

Note that in Q2-22, many of the oil sands plants have scheduled maintenance which will reduce Canadian oil supply.

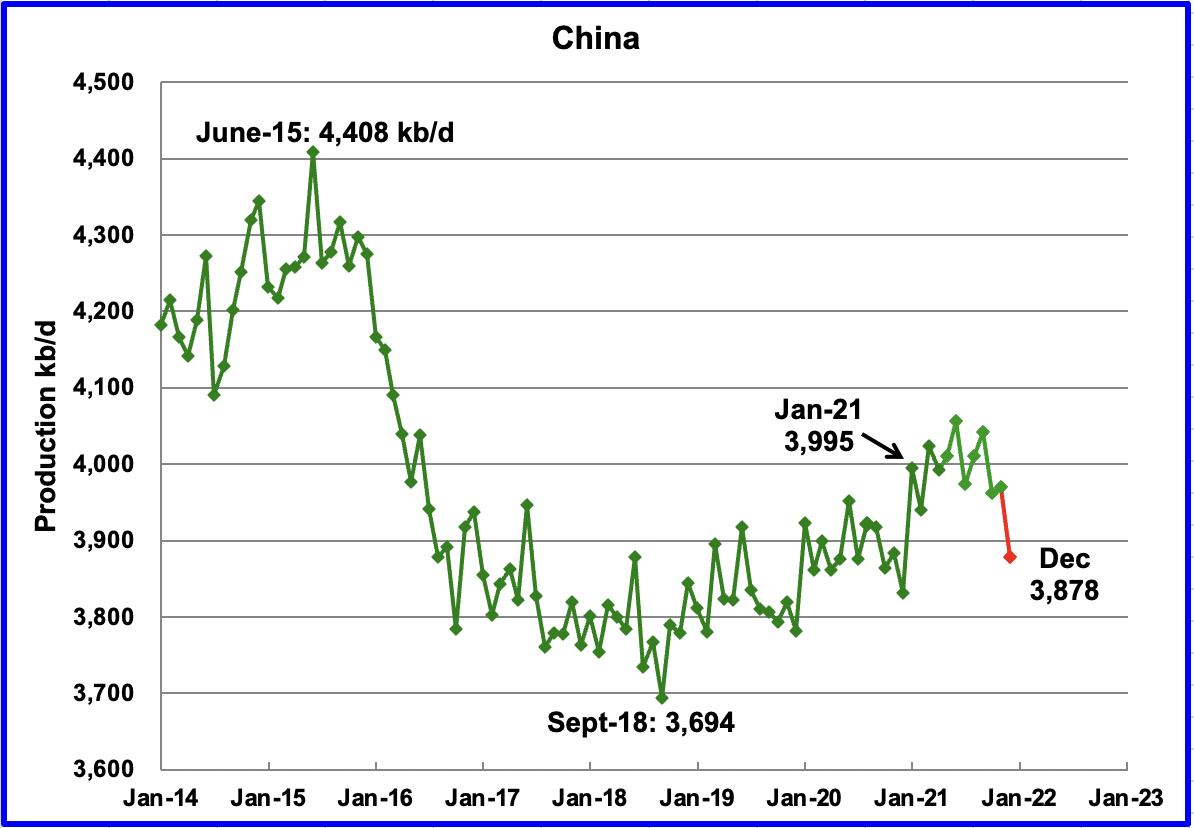

The EIA reported China’s output increased by 7 kb/d from 3,962 kb/d in October to 3,962 kb/d in November. December’s output declined according to this source to 3,878 kb/d. (Red marker).

A sidebar: Close to the 22nd of every month I access the Chinese National Bureau of Statistics to get their crude production for the previous month. The information is no longer available. December was the last month when the information was provided. Will China’s oil production information now become a state secret?

Mexico’s production as reported by the EIA for November increased by 2 kb/d to 1,733 kb/d.

Data from Pemex showed that November’s output climbed to 1,771 kb/d and was essentially unchanged for December and January at 1,783 kb/d. (Red markers). For some unknown reason, it appears that the EIA reduced Mexico’s official November C + C number by 38 kb/d. The January output of 1,783 kb/d may again be reduced by the EIA.

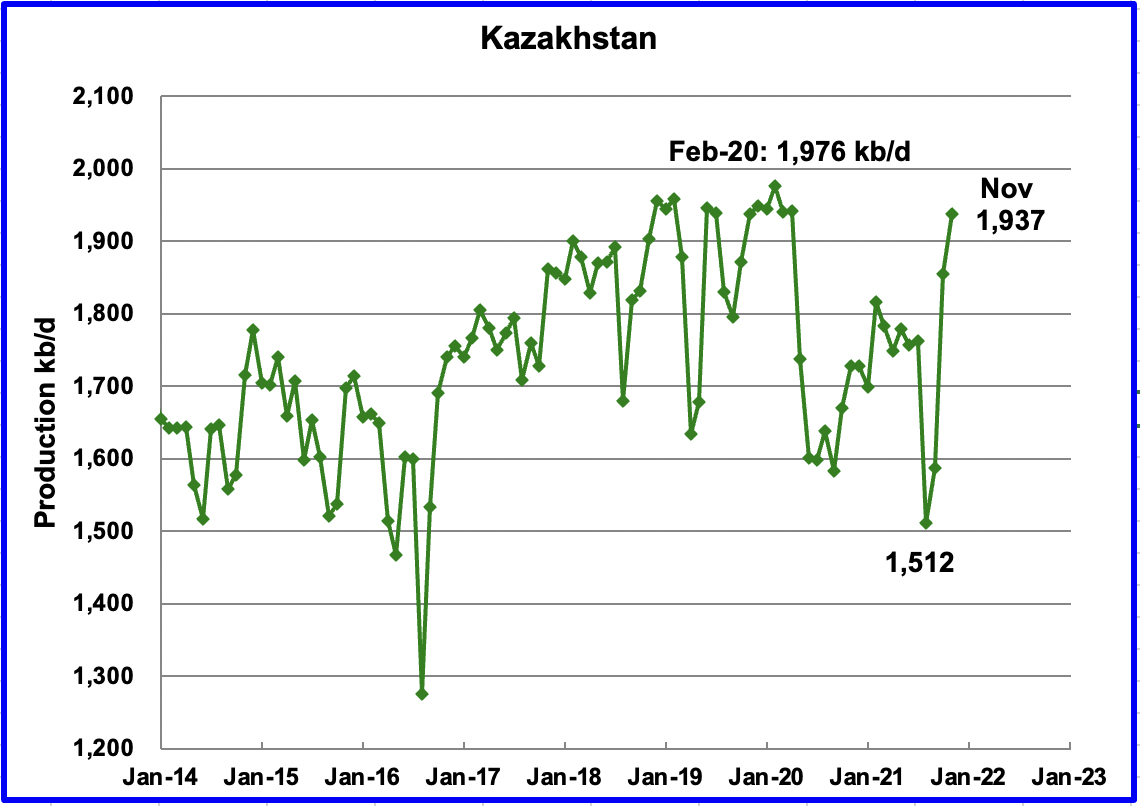

Kazakhstan’s output increased by 82 kb/d in November to 1,937 kb/d following the end of maintenance in the Tengiz field. November was the highest output since May 2020. OPEC expects a small increase, possibly 10 kb/d, in December.

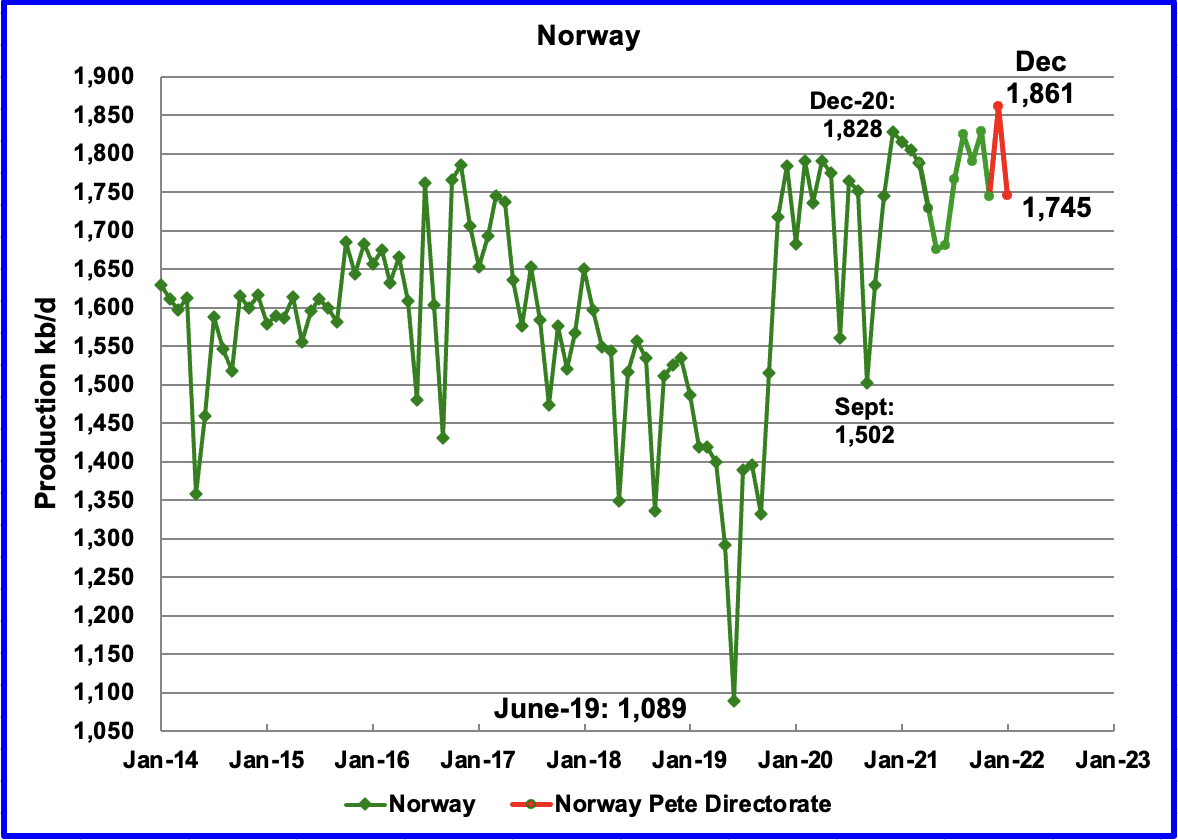

The EIA reported that Norway’s November production declined by 85 kb/d to 1,744 kb/d. The Norway Petroleum Directorate (NPD) reported that production in December increased to 1,861 kb/d and then dropped to 1,745 kb/d in January. (Red markers.)

According to the NPD, November production dropped due to technical problems. The production level was 5% lower than the Directorate had forecast.

Earlier this year, the NPD implied that Norway’s production would exceed the December 2020 output in the latter half of 2021. Their prediction was validated in December 2021 with a recent production record of 1,851 kb/d, which was much lower than its previous peak.

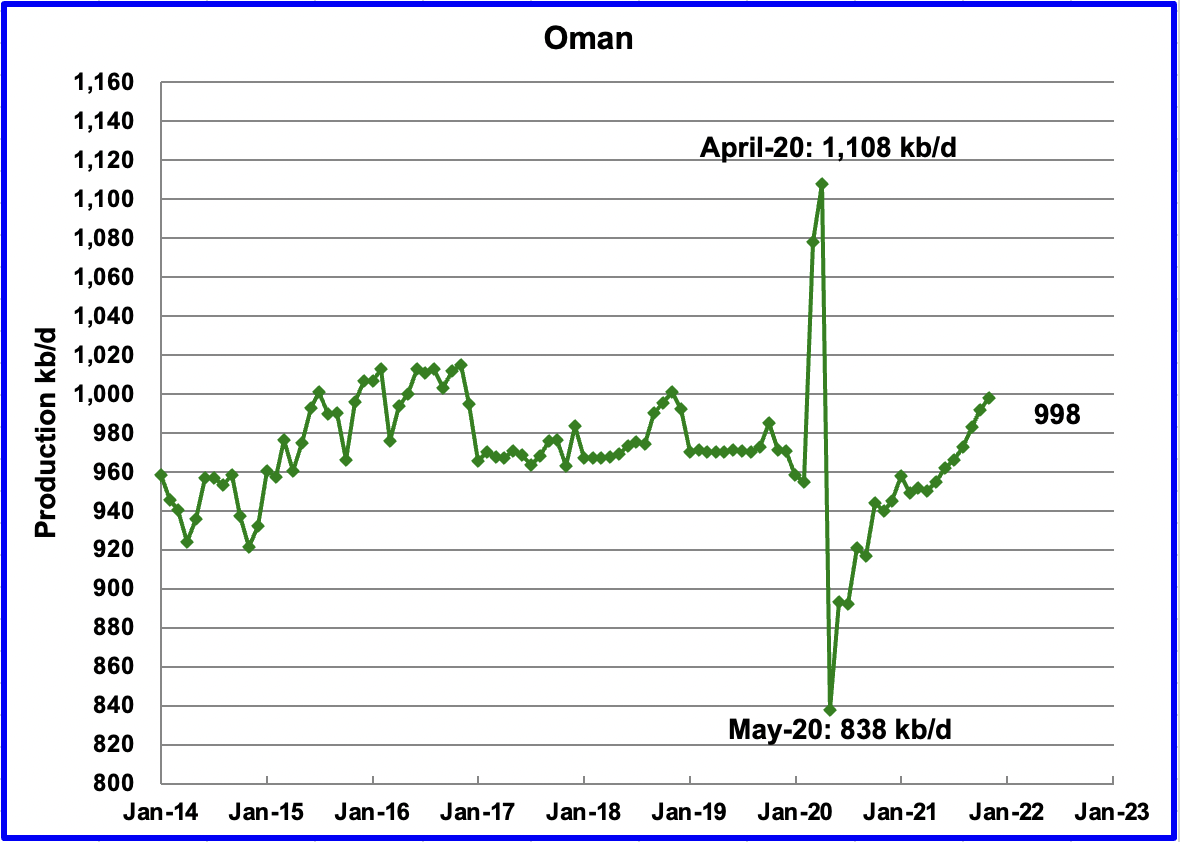

Oman’s November production increased by 6 kb/d to 998 kb/d.

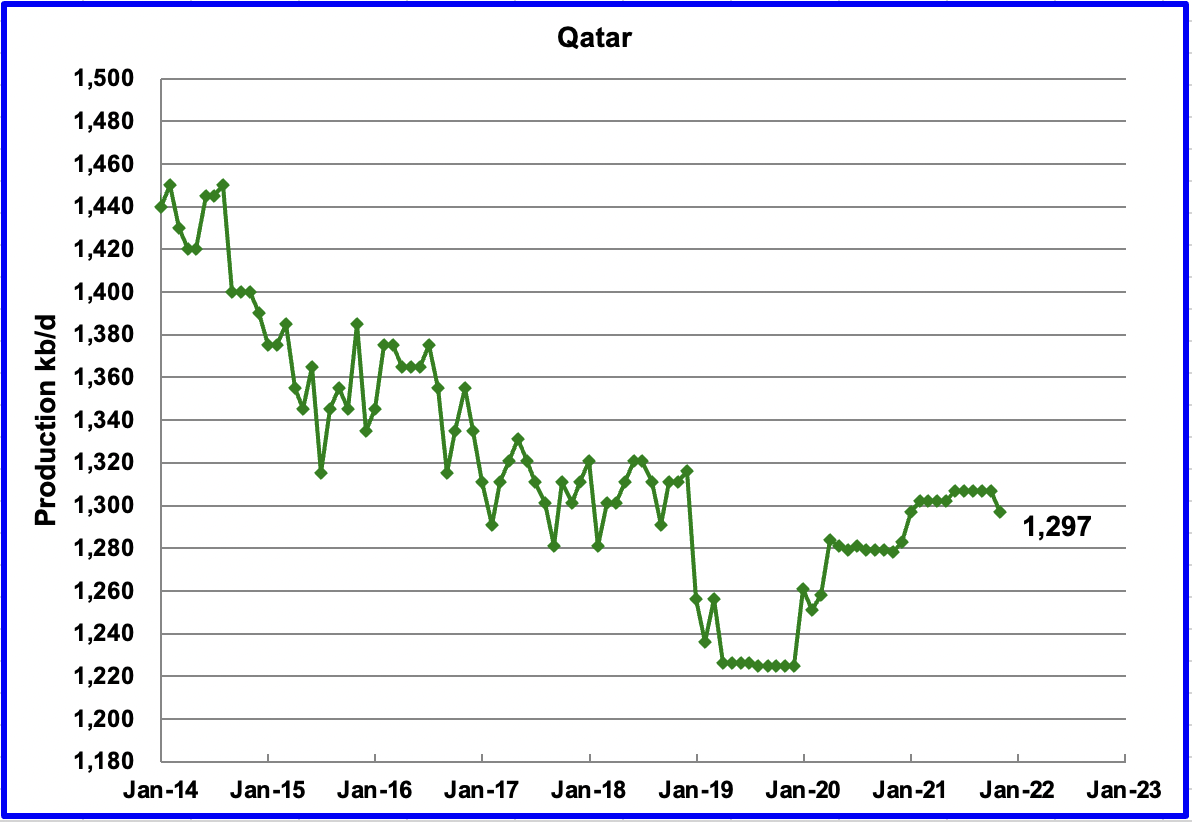

November’s output dropped by 10 kb/d to 1,297 kb/d.

The EIA reported that Russian output increased by 63 kb/d in November to 10,503 kb/d. According to this source, February’s production increased by 50 kb/d over January to 11,050 kb/d. The blue graph represents the STEO’s forecast for Russian production up to October 2022 and beyond due to the imposition of economic sanctions by the U.S. and many other countries.

The C + C forecast was made by comparing the ratio of the STEO’s all liquids output with the Russian Ministry C + C output over the period October 2021 to February 2022. Russian C + C was close to 97.5% of the STEO all liquids data. That percentage was used to generate the Blue graph.

It is difficult to fully assess Russia’s compliance with the OPEC+ deal as the CDU-TEK data doesn’t provide a breakdown between crude and condensate, a lighter type of oil that’s excluded from the agreement. If Russia’s condensate output for February was close to December’s level of 950 kb/d, source, crude-only daily production was around 10,100 kb/d, some 127 kb/d below its February quota of 10,227 kb/d. Note that both Russia’s and Saudi Arabia’s commitments increase each month by 105 kb/d.

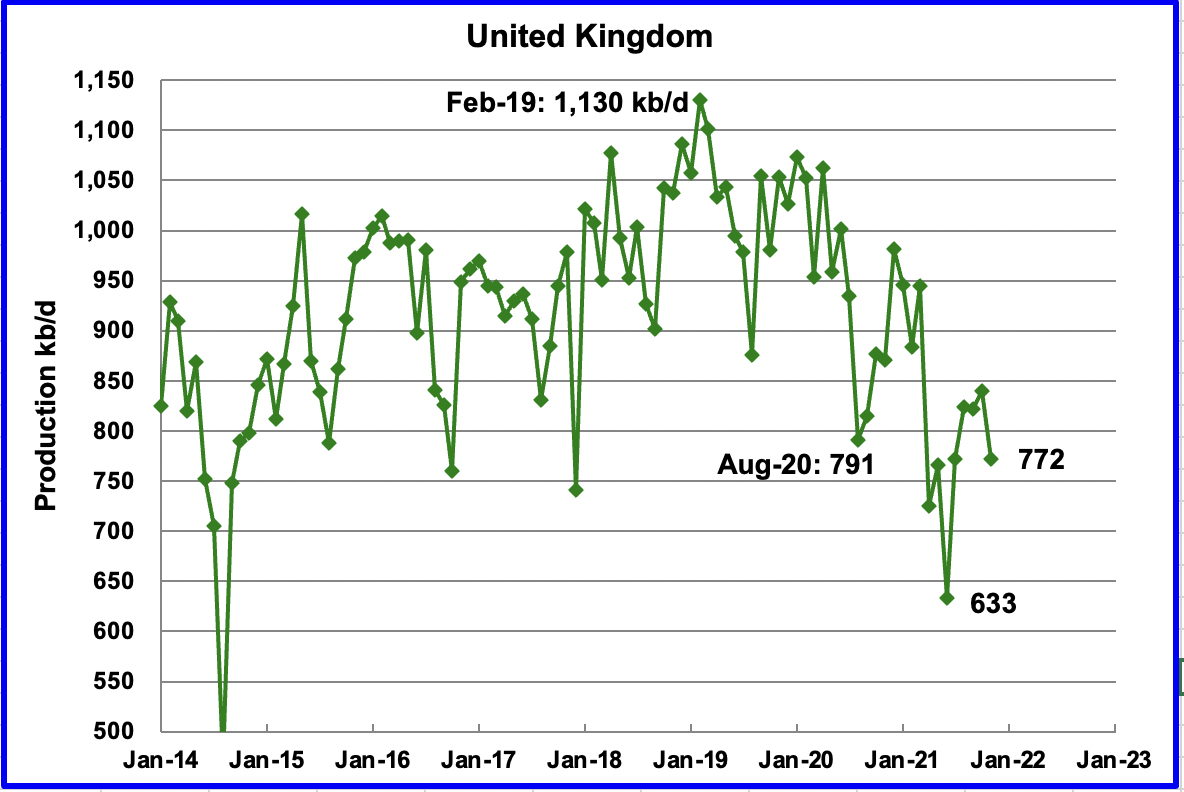

UK’s production decreased by 68 kb/d in November to 772 kb/d. The chart indicates that the UK may have entered a steep decline phase.

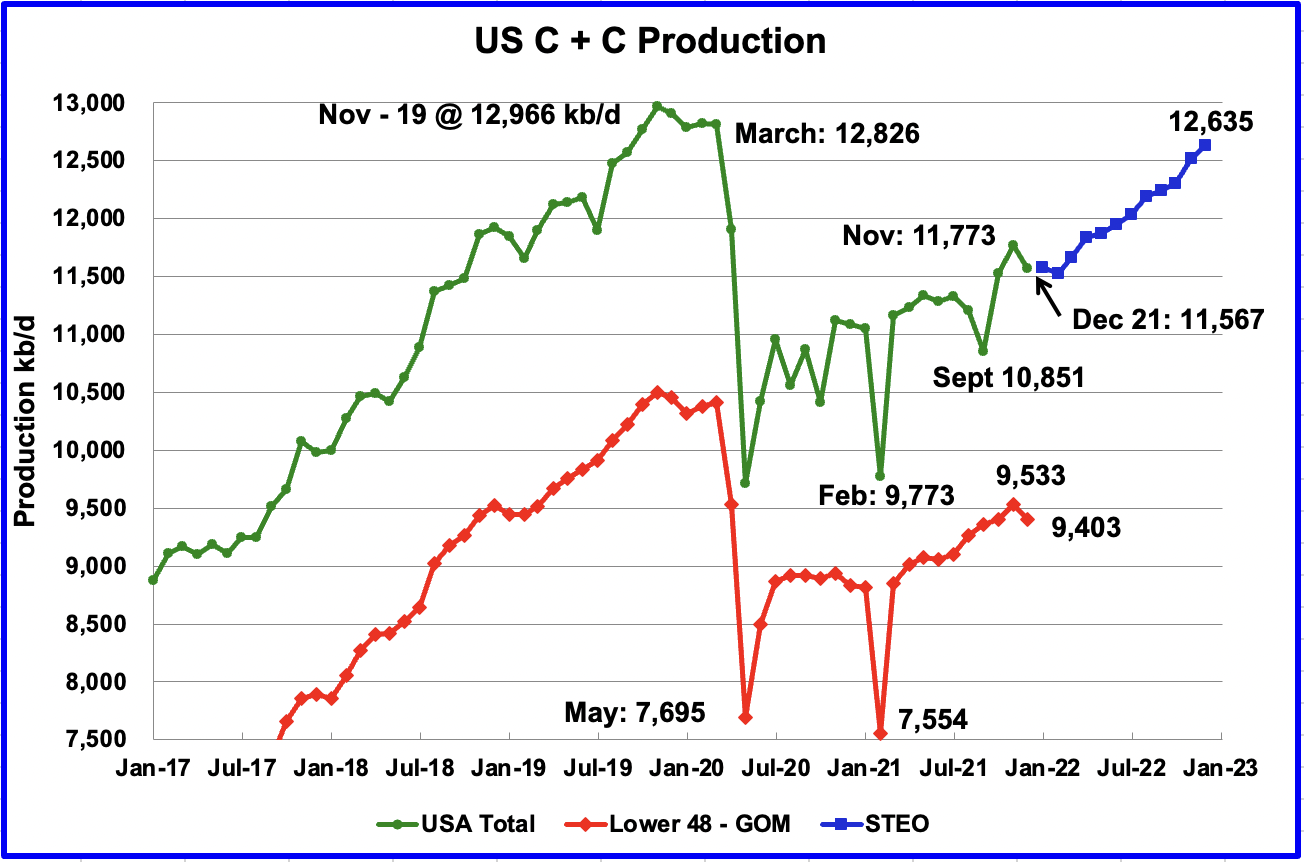

U.S. December production decreased by a surprising 206 kb/d to 11,567 kb/d. The main declining contributors were New Mexico 61 kb/d, ND 25 kb/d, GOM 81 kb/d and Texas 16 kb/d.

The blue markers, obtained from the March 2022 STEO, are the production forecast for the U.S. from January 2022 to December 2022. Output for December 2022 is expected to be 12,635 kb/d an increase/revision of 245 kb/d higher than was forecast in the February STEO report. Note the blue markers have been updated from those posted last Thursday in the previous US update. That is why December 2022 was revised up by 245 kb/d.

From February 2022 to December 2022 output is forecast to increase by 1,108 kb/d or an average of 110.8 kb/d/mth. Almost unbelievable.

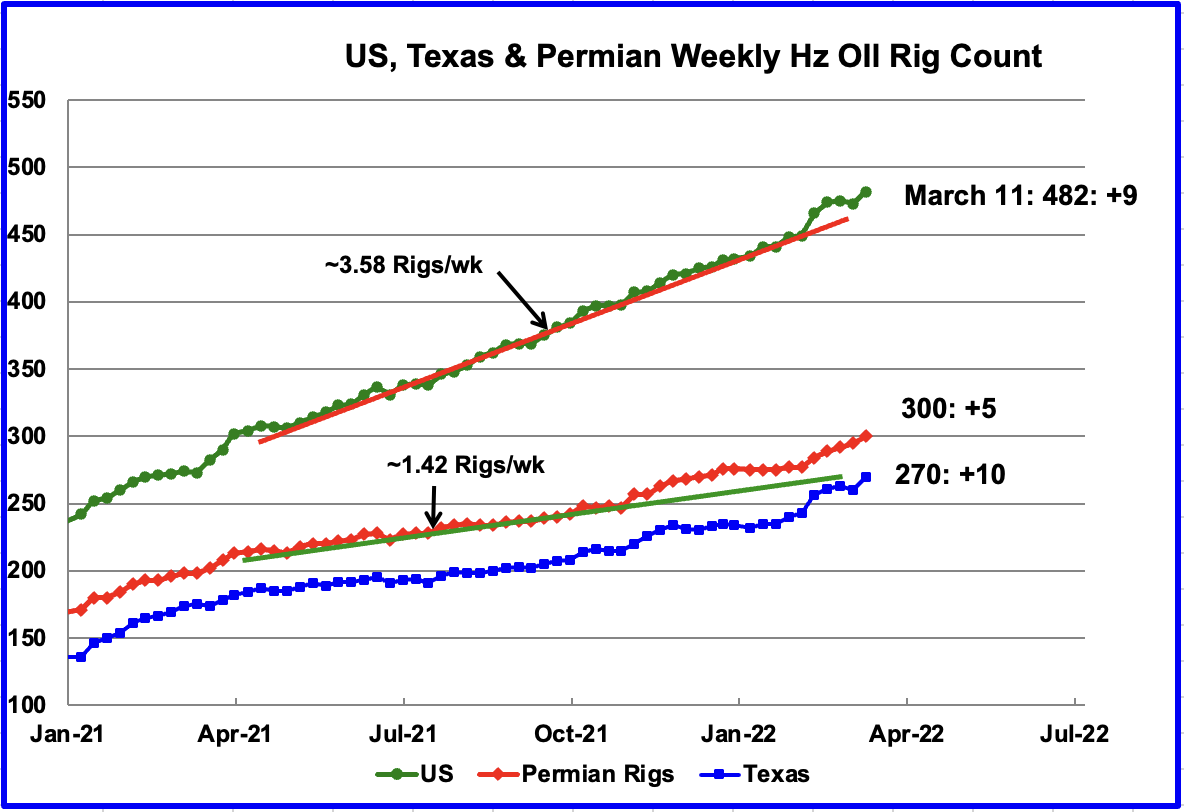

From the beginning of April 2021 to the end of January 2022, the US has been adding horizontal oil rigs at an average rate of close to 3.58 rigs/wk. However since the beginning of February, rig additions have accelerated in the US and particularly in the Texas Permian.

Over the last five weeks, an additional 32 rigs, or 6.4 rigs/wk, have been placed into operation in the U.S. Over the same period, 23 rigs have been added to the Permian, 4 in NM and 19 in Texas.

For the week ending March 11, 9 horizontal oil rigs were added for a total of 482. Permian rigs increased by 5. In Texas, the rig count increased by 10 while New Mexico dropped by 1.

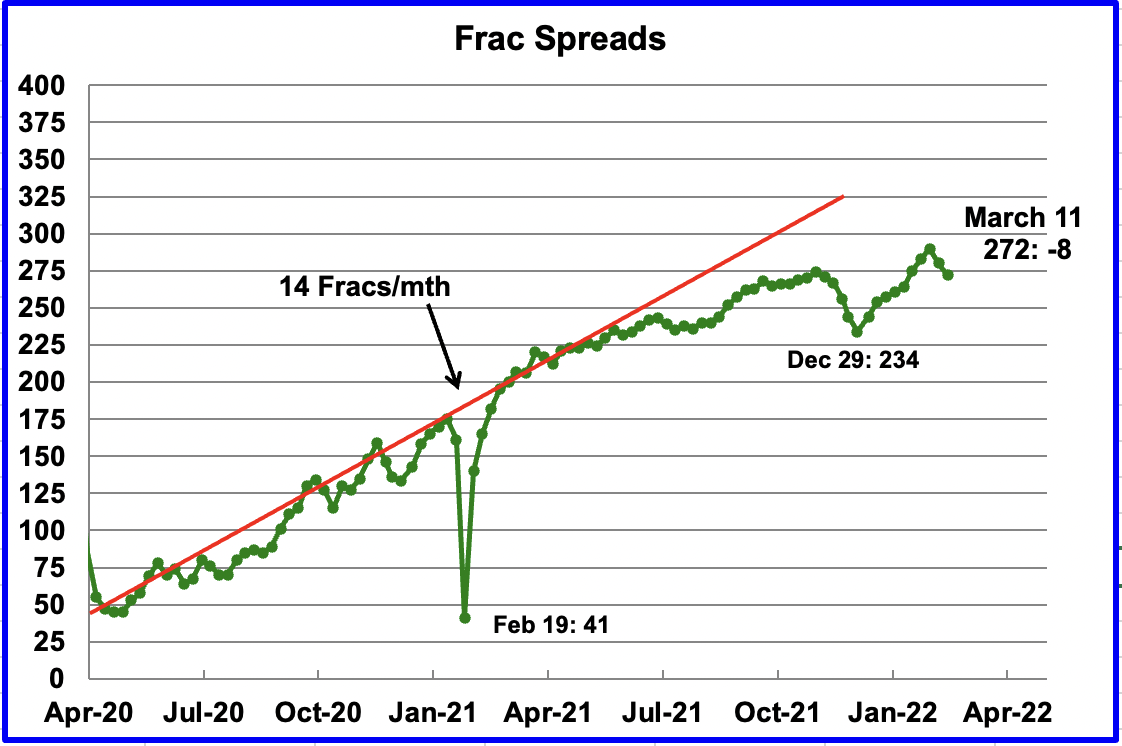

During December 2021, 37 frac spreads were decommissioned primarily due to the holidays and dropped to a low of 234 on December 29. Starting in early January up to the end of February, frac spreads were added at an average rate of 7 per week and peaked at 290 in the week ending February 25. However, since then the frac count has dropped by 18 over the first two weeks of March, 10 last week and 8 for the week ending March 11.

Note that these 272 frac spreads include both gas and oil spreads, whereas the rigs information is strictly oil rigs.

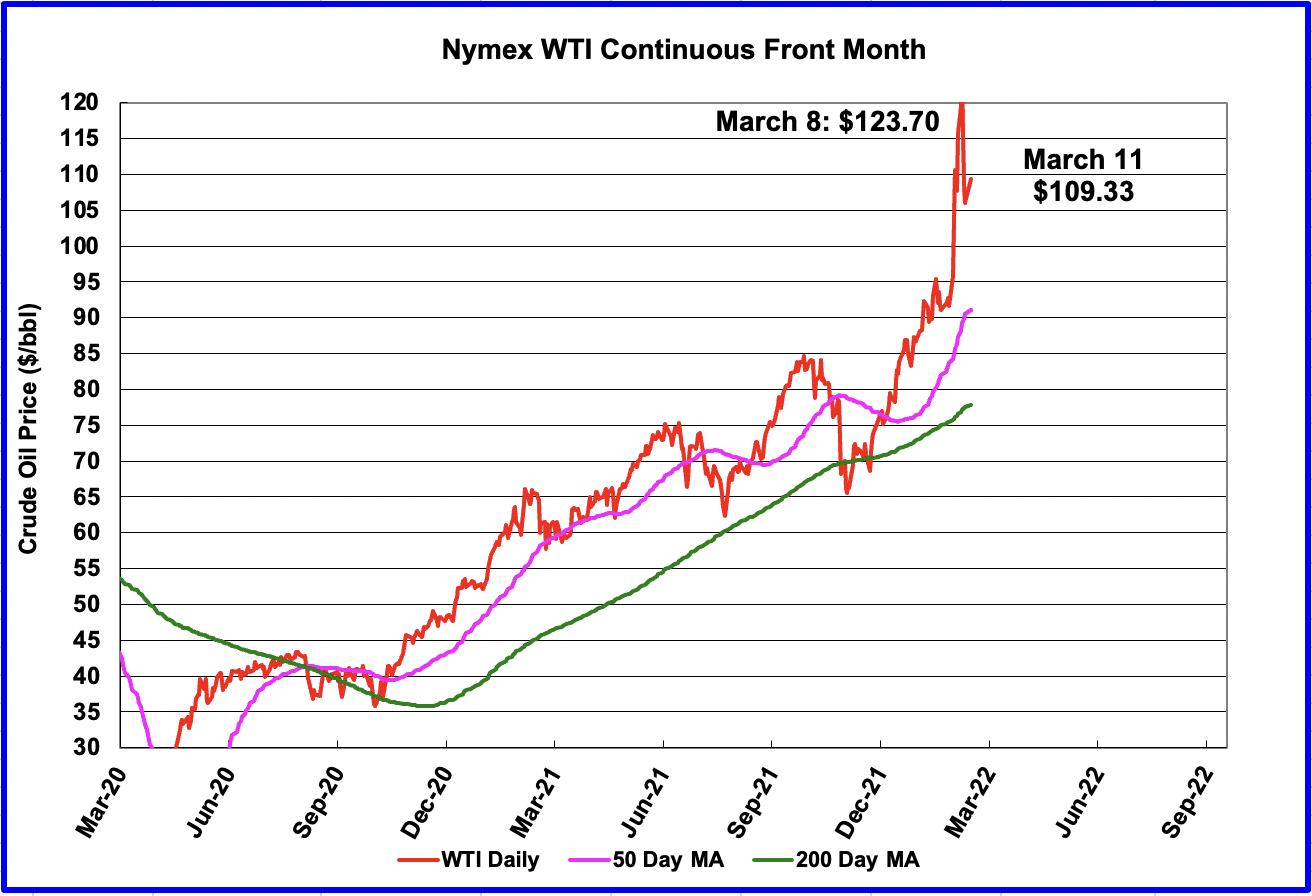

The Ukrainian crisis caused the price of WTI to increase from $95.72/b on Feb 28 to a recent high of $123.70/b on March 8. Over the last few days the price has settled back to $109.33/b.

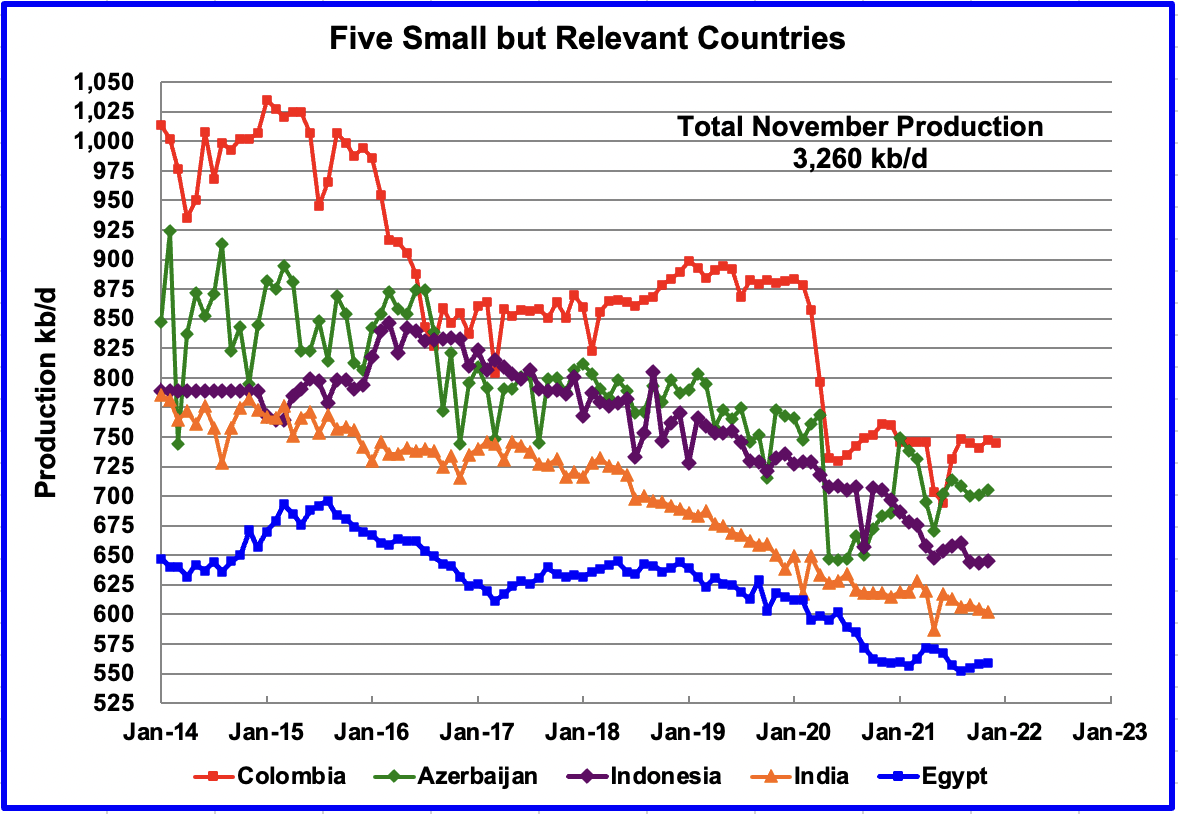

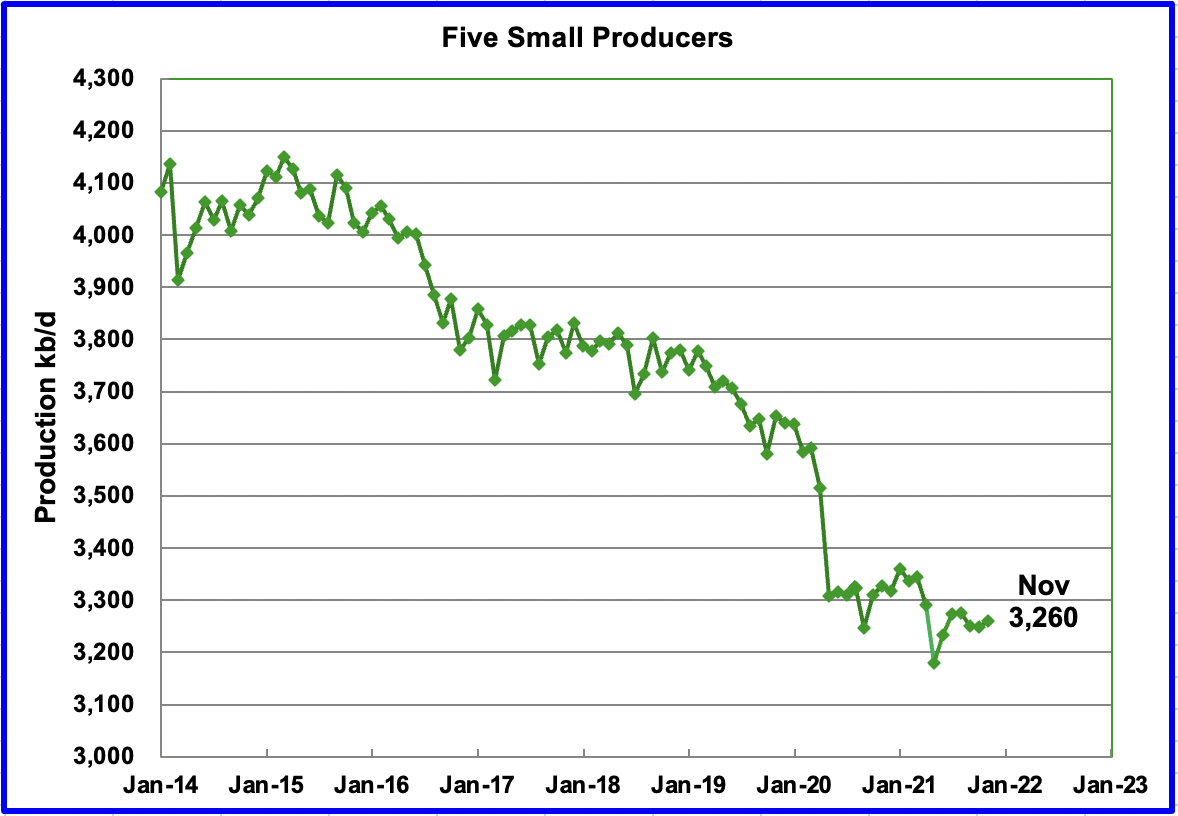

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined November production was 3,260 kb/d, up by 12 kb/d from October.

The overall output from the above five countries has been in a slow decline since 2015. The drop in May 2020 from 3,500 kb/d to 3,300 kb/d was primarily from Azerbaijan, 125 kb/d, which is a member of OPEC + and Colombia.

World Oil Production

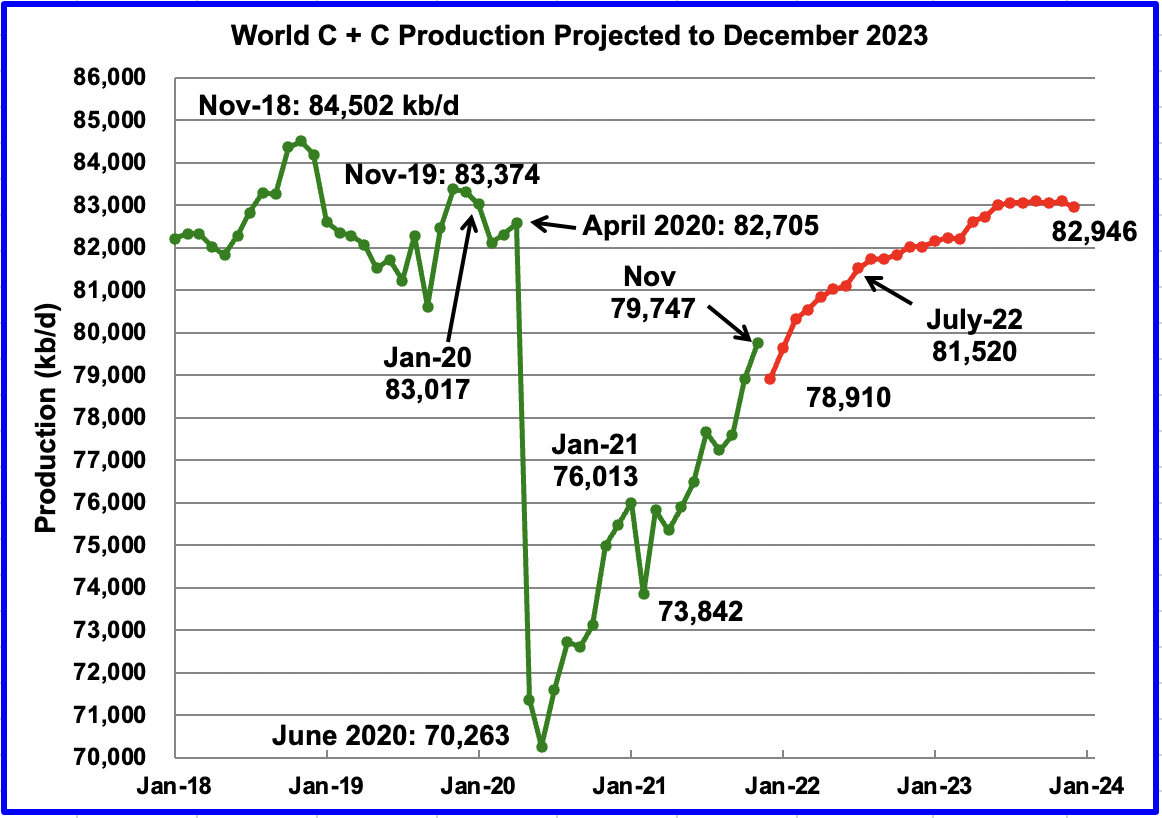

November’s world oil production increased by 844 kb/d to 79,747 kb/d according to the EIA. Of the 844 kb/d increase, the biggest production increase occurred in the US, 244 kb/d, followed by Saudi Arabia 102 kb/d, Kazakhstan 82 kb/d, Venezuela 80 kb/d, Brazil 74 kb/d and Russia 63 kb/d. The biggest declines occurred in Guyana 86 kb/d, Norway 85 kb/d and the UK 68 kb/d.

This chart also projects world production out to December 2023. It uses the March 2022 STEO report along with the International Energy Statistics to make the projection. (Red markers).

It projects that world crude production in December 2023 will be 82,946 kb/d, 278 kb/d lower than projected in the February report. It is also 71 kb/d lower than the January pre-covid rate of 83,017 kb/d and 1,556 kb/d lower than the November 2018 peak.

More Permian problems!

https://twitter.com/ShaleUnikitty/status/1502444290055753728?t=6bB9fZmIJbRqG3B37a1XGg&s=19

Another fantastic post. Thanks for the work Ovi!

Schinzy

Thanks. Much Appreciated.

I love your blog. but can you correct the name of columbia for colombia? Thank you.

Miguel

Sorry for the error.

Thank you for pointing that out. Fortunately the charts use the correct spelling. In Canada, we have a province that is called British Columbia and a retailer called Columbia. I think that is the source of my error.

If perchance you are from Colombia or close by, could you provide a comment on where oil production in Colombia is headed.

Ovi , no error . I am bailing you out . You owe me one . 🙂

https://www.youtube.com/watch?v=G2wkO0DhpEY&ab_channel=EllaFitzgerald-Topic

https://www.bloomberg.com/news/articles/2022-03-10/world-s-oil-giant-adds-to-diesel-strain-with-rare-buy-tender

“Oil kingpin Saudi Arabia is seeking to purchase an unusually large amount of diesel in a surprise move for the net exporter, adding strain when diesel markets already are in short supply.

“Aramco Trading sought 1.2 million to 4.6 million barrels of low sulfur diesel for delivery to several ports in Saudi Arabia by mid-March to April via a tender, said traders close to the matter…

John Kemp .

https://www.reuters.com/business/energy/global-diesel-shortage-raises-risk-oil-price-spike-kemp-2022-03-11/

Running down inventory .

Caps on diesel sales in Hungary . Shortages of diesel also reported in Germany, France, Sweden and Poland .

https://financialpost.com/pmn/business-pmn/austrias-omv-restricts-hungary-fuel-sales-as-supply-fears-grip-europe#:~:text=OMV%20has%20capped%20refueling%20at,the%20company%20said%20on%20Friday.

Diesel demand is inelastic, gasoline less so.

Life without Lorries

https://www.alanmckinnon.co.uk/uploaded/PDFs/Papers/Life-without-Lorries-(Report-for-Commercial-Motor–Dec-2004).pdf

Heating oil is now 1.8€ / Liter in Germany. Delivery in May!

Nat gas for heating is even more expensive.

How does STEO project oil production out to 2 years with such precise granularity? It must be based on the assumed completion of DUC’s? I imagine?

Peter

Their projections change every month.

Your work is very much appreciated Ovi.

It seems that the next 3-5 years will be the last great hurray for global oil production, stimulated by high prices and then winding down by depletion. The production ‘action’ as shown in many projections will now be compressed, giving the world less time to adjust to the reality of peak oil.

Repercussions of the Russian economic isolation discussed in this brief article,

highlighting three big impacts

-The Green-Energy Revolution Goes Into Warp Speed (I would not characterize this as ‘green’ as it will include coal, wood, and anything with energy content)

-A New Chinese Empire (more on that below)

-A Global Food Fight

https://www.theatlantic.com/newsletters/archive/2022/03/russia-economic-sanctions-wheat-oil/627004/?utm_source=pocket-newtab

A lot hinges on China. They must tread carefully since their trade with Russia is dwarfed by trade with the ‘west’. Likely they will find a way to benefit longterm from the rearrangement of the global cards on the table, such as an ownership stake in Russian oil and mineral production.

China has lots of issues. They are also trending down the path of authoritarian aggressor like Russia. And Omicron has finally arrived making this a year of lockdowns, and just might prick their debt bubble. China could be the catalyst for a huge lurch downwards in oil prices in the second quarter.

https://www.reuters.com/business/healthcare-pharmaceuticals/china-daily-local-covid-infections-exceed-1000-symptomless-cases-spike-2022-03-11/

Stephen , just dusted my book by Tainter ” Collapse of complex societies ” . I am having an eerie (gut) feeling we are headed for what David Korowitz called a ” Synchronized System Failure ” . This would be the absolute collapse of the financial system . USA , EU and China collapse simultaneously . I am not the only one calling this . I have long said ” Complexity and connectivity are the Achilles heel of IC ” . When Martin Armstrong speaks you better start tying your shoelaces . Complexity kills and complexity without sufficient energy will lead to a collapse .

https://www.armstrongeconomics.com/products_services/socrates/the-great-economic-destruction-complexity/

Omicron is pretty mild especially with vaccination rate almost 60% in China. Debt bubbles have become impossible to gauge when they are the primary engines of growth in this Super-Late Capitalist stage where natural profits are anemic. There is no real evidence China’s in any real danger, despite what Kyle Bass’ of the world would like to believe (and have believed for years now). If Peak Oil has taught us anything it’s that no financial (i.e. artificial) collapse will really hold things down for long. These rules are completely arbitrary and just made up out of thin air. Only real physical limits: climate change, peak oil, pandemic will ever stop this train a-rolling.

Most cases are asymptomatic. But if you shut down your financial capital with a population of 26 million over a handful of cases, it will have consequences.

Hint:

In the USA it has killed, in 2 years, about the same as all wars combined, from the revolutionary war to the present.

1 out of every 330 people in the USA.

Very hard to believe that China escaped covid19 by spraying disinfectant around city center.

I’m a bit sceptical about the timing….

I think the high prices are a wake up call – at least here in Europe.

Who likes windmills and despices nuclear plants, now builds windmills in double speed.

And who like nuklear plants speeds up construction, too. And perhaps even a few solar cells and a hand full wind mills.

From this side this is better than a few more years with enough oil and low prices – no incentive to do much.

Eulen , too little too late . The problem is transportation fuel and not electricity . See my several posts on diesel above . Diesel is king and oil is the master resource . Read Alice Friedman’s ” When the trucks stop running ” .

Still luxury problems – there are some easy to get sollutions, and there is still Diesel.

Some very low hanging fruits.

Bring more on rail and ship (there is still some spare capacity) – and drive slower. In container shipping they made this step a few years ago, saving a lot of fuel by going 30% slower. Perhaps you need more drivers – but that’s a money and burocracy problem mostly. Redirect the billion incentives from electric cars to truck drivers.

Yes there will be more logistic chaos, but adaption is fast here (I work on logistics).

Some harder thing would be reserve electric transportation battery capacity to busses and short range trucks with priority – cars are more inefficient.

A single electric bus or short range truck saves 0.5-1 barrel Diesel / day. You really need Diesel with current tech only for the long haul trucks, which is only a part of all truckage.

So a nice brand new Tesla is nice to look on – but a bumpy 7.5 ton truck delivering stuff in urban enviroment, going 100 miles a day, will get much more oil avoidence out of the battery pack. And can be electric with today tech.

Eulen “Yes there will be more logistic chaos, but adaption is fast here (I work on logistics). ” .

So do I my dear friend but I cater to the JIT category . Life saving medicines , human organs , parts for Volvo/ Scania trucks stranded on the road carrying live animals , refrigeration gases and components for food stores(Aldi, lidl etc) . Been there done that . The system has run out of road . Time we went from denial , anger, bargaining , depression to acceptance .

I could definitely see Nuclear making a come-back. Sure Fukushima was only about 10 years ago and that accident will carry-on for a little while longer (try finding THAT number amidst the propaganda!!) . But hey, gotta stay warm. And interestingly, the Fukushima incident happened in 2011, and that masked the eye-popper that was oil prices north of $80/barrel for five years. I know Dennis likes to cite that as the reason oil prices could go and stay much higher without tea-bagging the economy, but I believe that should have been setting off alarm bells and that the global economy will NEVER be able to sustain anything like that again.

Twocats , nuclear is not coming back . As ESG is driving the nails in the coffin of the FF industry , similarly NIMBY will not permit the building of nuclear plants . Second ,have earlier informed that their is only a division of Nippon Steel, Japan that makes the special steel for the dome . Their capacity is for 2-3 domes per year .Third technical manpower . Laplander has informed of the problem propping up in a nuclear plant being setup in Finland/Sweden with untrained Romanians and Bulgarians on the work site . Now we have a new one . The plants use uranium, U235 . The processing facilities for this ( more than 50% of the world’s capacity) is in the Russian sphere of influence . Russia has all energy sources oil, gas, coal and nuclear under its control .I am not even talking about the cost to put one up as it is prohibitive . Nuclear Fission and molten salt etc are experimental and will remain so .

I guess I should be checking out the non-oil side of POB more. I’ll take your word for it, though if you have any reliable articles summing up these situations I’d appreciate it. I’ll try to read them before they are banned for being on the wrong thread 😉

Two cats , here is link to worldwide Uranium production . Kazakhstan is 41% . Add all others that are in Russia’s sphere of influence . Probably about 60 % .

https://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production.aspx

As to other 3 points you have to take them at face value . Maybe Laplander will confirm about the Romanians and Bulgarian issue .

Short comment, regarding foreign workers at Olkiluoto 3, Finland see:

https://yle.fi/news/3-6323719

For reactor build times and costs, plenty more to find about Olkiluoto 3 on the net, but also check out Hinkley point C, UK and Flamanville 3, France.

Tks , laplander for the assistance .

Olkiluoto 3 started to produce electricity yesterday. Will produce 14% of Finland’s electricity next summer

https://yle.fi/news/3-12356596

HiH & Laplander – much appreciated. I would agree. We’ve seen an inability to engage in projects on a national / international level as society has begun to break down (covid response is exhibit A), and considering the complexity of building nuclear reactors they would probably fall into that category.

It’s much easier to let people freeze to death and just higher a public relations firm to manage the fall out and make people feel “heard”

Hicks , the action of the FED to nullify Russian USD reserves and assets is having a ripple effect with all the Sovereign Wealth funds mostly in the Middle East . Countries are now going to choose . Food security or border security . Financial security is now under threat for the ROW with actions of Washington . Suggested reading Zoltan Pozsar who says a new currency backed by commodities will be Bretton Woods 2.0 . Powell has now admitted ” There can be more than one reserve currency ” Get ready . Putin now received a second call from Macron the midget and he told him to ” FO ” . This is a fight to the finish .

A new order is in formation , . When did anyone in ME had the guts NOT to take a call from POTUS ? MBS said in an interview when asked ” Don’t you worry about what Biden thinks of you ? ” . His answer was ” I don’t care ” . The world is changing .

As we have known for a long time, poor choices for everyone.

Thats what happens when overshoot realities take effect.

Luke Gormen thinks the attack against the Russian Central Bank will be a huge new steps in the direction that makes everything more unstable (the last part is my interpretation)

https://www.podbean.com/media/share/pb-y2e9u-11ccab3?utm_campaign=w_share_ep&utm_medium=dlink&utm_source=w_share

Right-wingers (and initially Left-Wingers) have been worried and warning against the New World Order for a couple decades now. But the reality is the NWO has existed quite comfortably for a while, and only now is being seriously threatened. Connections are being broken and some or many of these connections may never resuscitate in the wake of Peak Everything.

I’m give my two cents on the topic of the rest of the world or part of the world moving away from the dollar or petrodollars or Eurodollars.

Let’s just say that it happens. Is it a big negative for the dollar? Hell no! It’s the opposite. Supply of dollars falls fast as they aren’t being borrowed into existence. Value of the dollar goes through the roof. Which will absolutely crush the value of other currencies.

Think of all the borrowed dollars that are invested globally and that are used in finance. Think about how big of an unwind that could be. I don’t see there being an alternative to the dollar because if you try it your currency will be plummeted into oblivion.

You’re saying the dollar will be more valuable if less functional?

Less supply of dollars equals greater value. If less dollars are borrowed into existence inevitably more dollars will be destroyed than are created.

Dollars are created through the process of making a loan and are destroyed when a loan is paid back or default on. If dollars aren’t borrowed at all. Way more money gets destroyed than gets created. Equals more valuable dollar.

Oil, natural gas, and coal are all priced in dollars. The Chinese yuan and Russian ruble are also priced in dollars. India rupee is priced in dollars.

If dollars aren’t borrowed that’s ok. Because the dollar gains purchasing power pushing down the value of other currencies

I’m well aware of the narrative that the dollar is going to crash. I’m also well aware that those pushing that narrative either don’t understand money or are trying to sell you something.

Hickory

Thanks. Much appreciated.

Hickory,

By 2030 to 2035, demand for oil will be falling faster than supply is falling iif oil prices remain around $100 per barrel.

The problem will be too much oil and prices will be falling to balance the oil market.

In the mean time high oil prices will accelerate the transition to electric transport, much needed to reduce the chance of a climate catastrophe.

Unfortunately the latest science suggests this may be too little too late. We will likely need efforts to remove excess carbon from the atmosphere, an expensive proposition.

Also those that want to reduce human suffering will choose to have one child rather than two.

Dennis

“The problem will be too much oil ”

I have trouble digesting this possibility.

I can’t see it.

I’m trying to imagine it.

I agree Hickory. I am having a hard time imagining that also.

Hickory and Iron Mike,

Note there is only too much oil in a high price environment (say $100/bo or more) after 2032 when much of light transport is done with electricity rather than petroleum products.

In chart below we have a conservative oil supply scenario (where demand is high enough to keep oil prices high so that oil is profitable to produce at this level). The demand curves (low, high and average demand for oil) is based on higher and lower EV transition, dependent on prices, policy, and technology, with the average scenario being the average of the low and high scenarios.

The “too much oil” scenario would start between 2028 and 2032, this does not even consider middle east OPEC nations ramping up development of resources in a battle for market share, in that case the supply curve might be on plateau from 2030 to 2037, with oil prices falling steeply as more expensive deep water, tight oil, and extra heavy oil are driven from the market.

Just think back to 2015 or 2020 when there was a glut of oil on the World market and oil prices crashed. This is what will occur some time around 2030+/-2, if my EV scenarios and oil supply scenarios prove correct. Note that the supply scenario has a URR of about 3000 Gb, fairly close to a 2018 estimate by Jean Laherrere.

Thank you for putting thought to this.

I’m trying to picture the EV transition over the next ten years, as it goes from infancy to dominant.

[I have said 90% of new light vehicle sales in 2030 will have a plug, but I am still trying to digest what that will look like]

Of course the transition is going to happen, but how fast…

Some big variables to all this

-does the vehicle battery cost/power/weight scenario improve

-what does global prosperity (or lack thereof) do these trends

“I am still trying to digest what that will look like] ” .

Don’t try you are going to suffer from indigestion . Get some laxatives .

With due respect Dennis, I reject your analysis. It’s too simple and linear. The world is complex and non-linear.

Your assumptions are based on induction, which is itself not a logical phenomena but a psychological one as Hume showed many centuries ago.

Iron Mike,

You are free to provide your own analysis, but any analysis of the future requires induction and every model is less complex than reality which would require an infinite set of variables and an infinite set of assumptions. I will get back to you when I have finished such a model (requiring an infinite amount of time).

I agree the EV transition scenario is both too simple and likely incorrect, just like every other scenario of the future ever created.

Hickory,

I have focused on oil demand for land transport and made the simplifying assumption that demand for all other uses of crude plus condensate remains constant after 2021.

The chart below has the plugin annual sales growth and annual plugin fleet growth rates that I have assumed for the low oil demand EV transition scenario. Note that the average annual growth rate for plugin sales worldwide was about 39% from 2014 to 2021.

Click on chart for larger view.

I don’t have any particular suggestions for changes to assumptions.

My inclination is that new vehicles sales will be less than the past decade despite a growing population (about 80 million/yr). This due to

-lower purchasing power in the face of stagflation, and

-the tendency to delay a big capital purchase when a better product is just over the horizon, and

-supply chain disruptions of various components

Hickory,

Not so sure about that, smart phone sales have been pretty good over the years and they are constantly improving. Many buy the newer models due to improvements, perhaps the same will be true of vehicles. In addition EVs may last longer than ICEVs due to fewer complex moving parts and the used vehicle market may eventually be dominated by EVs as sales expand and ICEVs get junked. I assume sales stop growing when light vehicle sales reach about 100 million per year, and I also assume self driving vehicles never get regulatory approval (or not befor 2050). A change in that assumption might make TaaS very economical using self driving vehicles and only the very rich would own a light duty vehicle (except perhaps trades people) and sales of light duty vehicles would plummet in that case. It would also cuae the total vehicle miles travelled by light duty vehicles increase as each self driving EV might travel 55k per year rather than 11 k per year, thus increasing the market penetration of EVs by a factor of 5.

“Also those that want to reduce human suffering will choose to have one child rather than two.” – D Coyne

Goodnight!

Sean,

Not clear what you mean by good night. Note that I say this is a choice people can make, not all will do so, but it would help with the overshoot problem and limited resources.

Dennis, only a tiny fraction of the world’s population knows we are in overshoot. Africa is where the world’s population is really exploding. Do you think the average citizen of Sub-Saharan Africa is really concerned about world overshoot?

Obviously, you, along with just about everyone else in the world, have no idea what caused overshoot or what is causing the current destruction of the world’s environment. What happened, and what is continually happening, is nothing more than human nature.

Resource scarcity, thoughts by Charles Hugh Smith

http://charleshughsmith.blogspot.com/2022/03/the-only-non-totalitarian-solution-to.html

Ovi,

Can you create your final chart on global oil production, but going back to 2012 or so? I want to see the impact that the late 2014 price crash had on global oil production.

thanks

Bob

Production and WTI on two charts.

WTI Price

Thanks Ovi,

The interesting things to me are that the big price drops in 2008 and late 2014 were not accompanied by big production drops, but that did happen in 2020. In fact the price drop in 2014 is hardly reflected in the production – maybe not til early 2016. Is that the difference between a supply driven price drop (2014) vs a demand drive price drop (2020)? Was 2008 more of a supply driven or demand driven price drop? Just speculating here,,

-note that my posts are taking a long time to appear, I get a prompt that are they waiting on moderation. I have access to the admin site, but am not able to approve the posts myself. thanks

Bob

I think the March 2020 drop set a different and exaggerated benchmark. Big is Big until something Bigger comes along.

The 2008 drop of 3,000 kb/d occurred very rapidly between July 2008 and January 2009 and was unprecedented at the time. The drop seems small today relative to 2020, but at the time it was Big. The demand destruction that followed the price spike in early 2008 was absorbed by OPEC. Saudi Arabia cut 1,587 kb/d, Iraq 293 kb/d, UAE 290 kb/d and Kuwait 264 kb/d. The rest of the world just kept on producing. Appreciate that OPEC at the time said that their job was to moderate prices and prices did recover fairly quickly in 2009. I would classify 2008 as a demand driven price drop.

2014 was arm wrestling between the US and OPEC. In 2014, the US increased production by 1,300 kb/d (Unheard of production growth. See chart) and OPEC cut production to offset US production to try to stabilize prices. Didn’t work and prices crashed to the mid 20s which also resulted in a US drop in production. 2014 was a supply driven price drop.

2020 is not your typical economic scenario. 2020 was a pandemic driven event that did follow standard economic theory after the fact. Businesses and travel shutdown, oil demand dropped but production didn’t drop initially because Russia wouldn’t agree to cut production. SA said to Russia, so you won’t cut, so I and a few other countries will go to Max production. As prices dropped, P then understood real power and meekly agreed that Russia would cut, but it was too late and the oil price collapsed to below zero. The first super over supply induced super price crash.

Now we are in a demand driven price rise that may not be correctable because supply may not be capable to keep up with demand at this time.

Thanks Ovi, and thanks for all the work on the site, along with Dennis.

My anecdotal comment is we shut in for about 4 weeks in April, 2020.

Recall the price didn’t go just a little negative, our price that day was -$39. We discussed this with the crude purchasers. Nobody had ever seen anything like this. They both told us if the average price at month end was negative, we would have to pay them for the barrels we had “sold” them that month. We had already “sold” about 3,500 barrels that month.

Both crude purchasers were predicting at best single digit pricing for the next couple of months at least, maybe negative for May. They didn’t know. Nobody did.

So we shut in, as many did in the USA and around the world. Had we been able to predict the actual prices for May and June, we wouldn’t have shut in. There were a few wells we kept going, but not many. We sold 0 tanks of oil May, 2020.

In conjunction with the very negative settle on 4/20/20, we saw a tremendous layoff of employees in the field, from which we still haven’t recovered, and probably never will. Many employees decided this was it for them, they’d already ridden the volatility of the previous 10-15 years and had enough. Wages exploded at factories, which was a big deal.

There is a guy that does some well pulling on his days off from a factory job. He worked in the oilfield for about 15 years. He says he’s making $28 per hour plus good benefits. So why would he want to come back full time? Even if it’s in his blood so much he comes out on days off?

Shallow sand,

How much do these guys make in the oil field (say the guy you are referring to). Typically when there is a shortage, the price goes up.

They can make more but the work is harder, benefits are less and chances of getting laid off due to a bust are high.

Not that factory work around here is the greatest, but it pays a lot more and has better benefits than it used to. Wasn’t too many years ago $10 an hour was a starting wage in most factories.

Now it’s closer to $20. Benefits kick in much quicker too.

Shallow sand,

At $110/bo, I would think operators would raise wages to make it worthwhile for the qualified workers to come back, otherwise they are leaving money on the table as it were.

Dennis.

If this price holds, they will. It’s early and most think this price won’t last long.

Right now, or at 8:30 AM EDT, Monday, WTI was at $104.74.

Shallow sand,

I would think those in the oil industry that are paying attention would realize that oil will be in short supply for a while. The high prices will not last forever, the sweet spot is now until 2030 (when oil prices will be high). After that the World may have moved on from needing so much oil (due to a transition to EVs, rail, and possibly natural gas for transport) and at that point there may be a chronic oversupply of oil as middle east producers vie for market share.

Waiting may be a mistake, but your business is a risky one and oil prices are indeed volatile, that is not likely to change.

Ron,

The question is will prices rise or fall from $104/bo in the future. My guess is that oil prices are likely to rise because demand is likely to rise faster than any increase in the supply of oil over the next 6 to 8 years.

There is a much higher probability that oil prices will stay elevated/go up vs dropping in the coming weeks (based on signals), but is that any reason to radically change your short-term business model? I mean, we banned Russian exports, but what about a deal with Iran? It doesn’t LOOK like Venezuela gives two f&*%s about US proposal, but who knows. What if the war ends within the next month? Hey, why don’t you turn on the news, there’s a super-reliable source of information (/sarc).

If I were an oil field operator I wouldn’t necessarily see this price action as a good thing since its occurred with a huge increase in volatility. Might it just be easier to buy hedges when those prices are high as opposed to actually pumping more oil?

Two cats,

Whether someone changes their behavior depends on their expectations of the future.

I am not talking about what happens in the next couple of weeks but the long term trajectory of oil prices. Buying hedges only makes money if one can accurately predict short term oil price movements (a suckers bet). Short term business decisions are closely tied with long term expectations. The decisions made by an oil producer who expects long term oil prices between $100 and $120/b will be different from the decisions of a producer who expects future oil prices in the $50 to $60/bo range. The first will expand output and the second will not.

Two cats,

Whether someone changes their behavior depends on their expectations of the future.

I am not talking about what happens in the next couple of weeks but the long term trajectory of oil prices. Buying hedges only makes money if one can accurately predict short term oil price movements (a suckers bet). Short term business decisions are closely tied with long term expectations. The decisions made by an oil producer who expects long term oil prices between $100 and $120/b will be different from the decisions of a producer who expects future oil prices in the $50 to $60/bo range. The first will expand output and the second will not.

D. Coyne – exactly my point. Even if oil stays above $100 for six months, it’s still born out of crises. No legit business would make decisions based on that potential scenario. So you could have an interesting set up where NO surplus country/company turns on the spigot (based entirely on self-interest and flagging economics) and oil goes incredibly high. We will find out soon enough.

Two cats,

My guess is that some operators will be tempted by the high oil prices, different people have different tolerances for risk. If suppy is inadequate prices continue to rise until demand is destroyed in the absence of any supply increase.

It will be interesting to see how it plays out. There will be a narrow window of 7 to 9 years or so that oil prices will be high, waiting a year to drill new wells leaves money on the table, but only if I am correct (which is not very likely). No doubt Shallow sand is correct and he has been in this business for a long time and obviously it would be his money on the line. His business is high risk/high reward by nature.

Sorry Bob.

I will adjust that.

Bob Meltz,

I think the difference in 2020 was that the price dropped to below lease operating expense, there is a thresh hold that was reached that had rarely(or maybe never) been seen. Certainly a negative price for WTI is rare.

In 2008 real oil prices dropped to $47/bo (2021$), in 2016 oil prices dropped to $32/b (2021$) and in 2020 they dropped to $18.50/bo (2021 $). These are average monthly prices for the lowest monthly price in those 3 years.

Chart below has the monthly percentage change in the real oil price (adjusted for inflation), the biggest monthly drop since January 1974 was in April 2020 at 41%, in 2008 the biggest monthly drop in real oil price was 30% and in 1886 there was a 27% monthly decrease in real oil price.

Chart with US real imported crude oil prices in 2021 US$/bo.

Data from EIA at link below

https://www.eia.gov/outlooks/steo/realprices/

Bob,

I think you may now be able to approve your comments. Note that you may have more than one user name in the system, so the dumb software doesn’t know you under both names.

A longer term chart of World C plus C from Jan 1973 to November 2021, there have been many big drops in the past, the biggest in 1979 to 1982 (Iranian revolution and Iran-Iraq war) a severe supply shock.

Thanks Dennis,

Great chart above. Quite enlightening to see how much global oil production has been able to increase over the last 40+ years. I know we’ve had alot of informed discussion about whether the peak in late 2018 is “The peak” or will we ever exceed that. I give it about a 70% chance that we will never exceed it.

Bob Meltz,

You’re welcome. If oil prices remain near current levels (say $100 to 120 per barrel in 2021$ for Brent Crude) my odds for 2018 (12 month centered average) being the ultimate peak for World C plus C output would be more like 3 in 10, I expect that by 2025 we will see a new peak and that the ultimate peak will be 2027/2028 at around 87 Mbpd (say +/-1 Mbpd).

World chart for centered 12 month average of C plus C output, if output were to continue to increase at the rate of the past 12 months until July 2022 and then revert to long term rate of increase of 800 kb/d per year in August 2022, we would see a new World peak in the centered 12 month output for C plus C in November 2022. Note that I doubt output will rise this fast, I expect the rate will slow after November 2021 and we will not see a new centered 12 month peak until 2024 or 2025.

The oil will flow .

https://www.zerohedge.com/markets/biggest-commodity-trading-houses-west-continue-buy-russian-oil-and-gas

https://www.pehalnews.in/oil-supertanker-from-russian-port-to-dock-in-southampton/1749175/

Hole in Head

Your comments on this. The longer article is behind the paywall of Zero Hedge

https://remarkboard.com/m/wall-street-stunned-by-zoltan-pozsar-s-latest-prediction-of/1ghgr5npz7eph?fbclid=IwAR2xdVbvBr8eIv2XskE8NHcacDyh3KYki_DJKW_4AzzYmDmmn9bVE7EzdmQ

More than a week ago, when looking at the latest price dynamics in the commodity sector in general and oil in particular, where Russian-produced oil was suddenly toxic and could not find a willing buyer anywhere in the Western world despite record discounts while non-Russian oil hit the highest price since 2008, we summarized this dynamic as “Russian oil bidless, non-Russian oil offerless”

One day later, one of Wall Street’s most respected voices, Credit Suisse repo guru (formerly the NY Fed’s most erudite expert on market plumbing) Zoltan Pozsar took this analogy and extended it into a lengthy explanation why the disconnect in the commodity world between “Russian” commodities (and as a reminder Russia is one of the world’s biggest exporters of raw commodities) and “non-Russian” commodities has set the stage for a “classic liquidity crisis” as the world suddenly finds itself locked out of trillions in commodities that serve as collateral in subsequent monetary transformations which are critical in keeping the existing financial system well-oiled (so to speak) and whose absence could lead to unprecedented shocks across virtually all asset classes (that is a rough summary, for a much more detailed explanation see here) .

Seppo etc , This post by Tom Luongo goes deeper into the subject . Interesting his is take on the crisis if the nickel market . How many here know that LME is Chinese owned ? Not me , till I read this article . OFM etc , yes the Chinese are playing the long game .

https://tomluongo.me/2022/03/13/ins-outs-whose-money-is-it-anyway/

Zero Hedge is a Russian propaganda outlet. It isn’t surprising that they are claiming the sky will fall if Russian exports are boycotted.

ZH is a news aggregator just like Naked Capitalism and The Drudge Report . It does not make the news or have an opinion , just reports it . Yes , maybe what it reports is not to your liking but “Tyler Durden ” does not care .

Tks , Seppo for bailing me out . Some here say my identity is appropriate for my comments . Who said this ? ” It is a tragedy to be ahead of your time ” . I think it was my Guru Matt Simmons but I could be wrong . Be well .

Looking beyond the situation in Ukraine. And where to next for global economy. The US treasury yield curve is extremely flat and starting to invert at the long end.

FED hasn’t even done the first rate hike yet an yield curve is about to invert. And only 26 basis points between the 2’s and 10’s

We going to get a credit event and the high yielding nongovernment bonds like shale oil uses. Yields are going to blow out and cause carnage in the financing of shale oil and gas.

HHH,

At current oil prices, tight oil can self finance out of operating cash flow and still would have plenty of excess cash to pay down debt quickly.

Well prices won’t stick around in a recession Dennis. I implied that when I said credit event. Yields are going to blowout in HY corporate bonds equals credit squeeze or money cut off and it also means much lower oil and other commodity prices.

So no they won’t be able to self finance out of cash flow.

HHH,

If demand falls the oil won’t really be needed, in the unlikely event that your predictions are correct.

It’s always a severe credit crash right around the corner from you, as long as you say this every day for 20 years or so, you might one day be correct.

Just look at a 15 year chart of HYG (High Yield bond) and you will see that HHH is not making this up. It’s in the process of happening. Great Recession, Covid collapse. Will this be a bigger unwind than the end of the First Shale Boom? That remains to be seen, but its already gotten very serious in High Yield / Shale Oil Financing space. The mistake people make is that this is somehow going to “end the world”. Sorry, this bullshit is going to just keep getting worse day after day, but only slightly.

FED’s interest rate hikes are going to invert yield curve. And bring on recession. As banks can’t make money borrowing on short end and lending on the long end.

And it’s going to happen rather quick. And only solution they will have is to take nominal interest rates negative. To un-invert the yield curve. Otherwise a whole lot of debt is going to be defaulted on.

They will get the cover to take interest rate negative when prices have crashed to much lower levels. This is going to be messy.

Absolutely agreed HHH. Interest inversion is definitely in the cards. About a month ago I was expecting it within the next year, but now… 2s and 10s is within 0.2%! Whenever it inverts a recession is almost always to follow.

Expect Long-Dated Bonds to be the winners in this environment. Anyone still Long Equities, High-Yield, Tech, Discretionary is either not paying attention or is just a HODLer. Btw finally got the correction you were looking for in Energy. Probably not going to $80 at this point, but the sentiment was correct (if not the price action – which is why I never make price predictions).

Interest rate spread 10 year to 2 year maturity from link below

https://fred.stlouisfed.org/series/T10Y2Y

Note that this has been happening from time to time since 1976, when the spread becomes negative a recession usually follows.

Click on chart for larger view.

Russia seeks military equipment from China after Ukraine invasion

This may not be the right place for this headline. Just hoping it may be a hint that there could be a peace agreement shortly. Difficult to believe that P miscalculated so much. Did the generals lie to him or just didn’t know what their capabilities really were?

https://www.reuters.com/world/russia-seeks-military-equipment-china-after-ukraine-invasion-reports-2022-03-13/

Ovi,

It is unclear that China would want to piss off the West. Russia is a tiny market by comparison to the west and sales of arms to Russia might result in sanctions imposed on China as well, from the Chinese perspective it might not be a risk worth taking.

Dennis

I agree. My point is that this huge country takes on this small neighbour and after two weeks of fighting starts to run out of armaments and supplies.

The downside of this is that maybe they thought building up their nuclear arsenal was enough.

Just trying to understand the full significance of that request. Imagine how embarrassed Russia would be if the Ukrainian forces could rout the Russians.

Ovi,

Difficult to predict how this will go.

I think it’s pretty safe to predict that it won’t end quickly. So in that sense, to replay to Ovi, Putin either miscalculated, or he decided that now was the best chance he had, because the odds of victory were getting worse. Or Both.

Iraq invasion should be considered the model for how these wars are going to go. Countries are perpetually getting hemmed in by narrowing rates of return – the world is just too globalized and interconnected for countries to gain any sort of “competitive advantage”. For many countries, their bloated militaries are the only button they have left to push. So why not “Push the Button” and see what happens? Russia is seeing the same results as the US – failure to seriously reorder the board. For the US victory was only important for the NeoConLibs. For the military manufacturers chaos is the preferred outcome. Maybe Russia could turn Ukraine into THAT for the Chinese – trade oil for arms and (otherwise sanctioned) goods and you have a virtuous cycle bathed in blood.

There’s a very real possibility, according to some very real intelligence experts, that Putin is living in a bubble surrounded entirely by yes men, including generals, who are afraid for their careers if not their very lives, to tell him anything he doesn’t want to know.

And if he really is on high doses of steroids to control a medical issue such as some cancers…… well, ‘ roid rage is a very real thing too.

I wouldn’t be at all surprised if Putin’s advisers are in the same position as people reporting bad news to Hitler during WWII…… doing so was a fast way to find yourself out of the warm, well fed, and ( most safe until near the end) inner circle and out someplace in the cold, hungry, getting shot at……. if not just shot out of hand.

Perhaps true, but it also entirely possible that Putin is not on steroids and that as the authoritarian leader of ‘his’ country,

he is proceeding with his big goal of re-establishing the Russian empire regardless of borders, treaties or the wishes of other countries.

And to him it is entirely rational, reasonable, within his established powers, and with the belief that he has taken other positions into account.

As you say, the inner circle to authoritarians must be above all else loyal to the whims of the leader regardless of truth, laws or ethics.

Goes for Putin, just as it did for Trump.

Not everyone is a savvy operator like Shoigu. I’d say the pre-invasion dressing down of the foreign intel. director for the FSB which was recorded and deliberately broadcast, indicates the issues with Putin’s inner circle. He even shouted down the PM twice when discussing potential sanction threats if going through with the invasion.

Putin is no fool, yet he seems to have bought into his own propaganda which may have been enforced by surrounding himself with yes men. On top of the decrepit way they run the military like some mafia protection racket, it’s not really surprising we’re seeing some hard limits on force projection come about after the blitzkrieg idea totally failed to garner a quick surrender by Zelensky. Ukraine just needs to prolong this and let sanctions bite and whittle away at ever more Russian material and troops with NATO support. There is no permutation of this that delivers a win for Putin. If he takes Ukraine, he can’t hold it. If he’s really lucky, he gets The Troubles: Slavic Edition. But more than likely he gets mass insurrection and civil war for his new annexed property.

Medical steroids are the opposite of body builder steroids. But they can result in excessive optimism about one’s own abilities (look up hypomania rather than ‘roid rage) . That is, he may have wildly overestimated the likelihood of rapid success. He sure doesn’t look well.

It is very unlikely that steroids explain the behavior/decisions of Putin.

Much more likely he is just acting in accordance with his belief system. It may seem ludicrous or nutty to us, but to him the decisions are entirely coherent with his ideas on how history and the world is structured.

Look no further than the US for bizarre examples of such a thing.

In 2016 the republican voters en masse looked at the slate of republican candidates onstage and made an absolutely bizarre selection for president- Least qualified, least dignified, least trustworthy, least ‘tested’, and least respectful of US traditions of democracy and international relations.

Don’t tell me all those voters were on steroids too.

Not sure about that, one thing for sure, China will be happy to get gas and oil from Russia at a great discounted price, and even wheat. And in the process it can continue pushing manufactured products to the west.

Hi Dennis,

If there’s one continuous thread in Chinese culture, it’s probably that they think long term.

The Chinese used to mind their own business……. due to a desire to be peaceful according to naive but well intentioned idealists in the West…… but because they lacked the capacity to play the empire game……. until recently.

The Chinese economic model, in the fewest possible words, is to import damned near anything and everything, in the largest possible quantities, and keep the people happy, working and living better over time, exporting damned near anything and every thing in the way of manufactured goods.

Now they have the opportunity to get the Russians by the balls, and cut deals enabling them to have dibs on just about everything that REALLY matters, in exchange for supplying Russian needs.

Russia has more minerals, more oil, more farmland, etc, than just about any other country in the world…… and China wants to control that supply.

And these days…. they have both the opportunity and quite possibly the power to do so.

The Hill is a lousy messenger, but you should always listen to messengers before you dismiss the message out of hand.

https://thehill.com/opinion/international/597943-putin-and-xi-look-to-beijing-for-the-real-reason-behind-the-ukraine

OFM,

China needs to balance the need for imported raw materials with a very large export market (US and European Union) that they may alienate. There are plenty of places that China can get their raw materials besides Russia, but there are not many export markets as large as North America and Europe.

Ovi , PSCYHOPS . The sources is as usual leaked reports ( who leaked) and the media involved is WaPo and NYT . In the meanwhile the Chinese ambassador in Washington says ” Never heard of that ” . Trash .

https://www.zerohedge.com/geopolitical/russia-urging-chinas-military-help-ukraine-biden-admin-says-sunday-afternoon-media

I wonder if the request for military equipment is related to the stories about improper maintenance of vehicles (and particularly tires), resulting in a large number of sidewall failures. I actually have experience with Chinese tires. I purchased my Yaris used from a Toyota dealer, and the tires had just been replaced with Chinese ones. I didn’t give it any thought at the time. 3 years later, there was plenty of tread left but there were cracks between the treads and in the sidewalls, and I had to replace them.

If this is typical of Chinese rubber chemistry, it explains the tire failures, and to some extent, the logistical/ maintenance problem, in that they expected the tires to last longer (though of course they should have tested the tires).

Perhaps it’s not a purchase order at all….maybe it’s a giant warranty claim.

Still have my original tires on Yaris (I do put winter tires on) after 165,000 miles.

Dealership did say the fronts needed replacement soon.

It’s possible it’s more to do with precision guided munitions. The use of Iskanders that suddenly hit residential blocks hundreds of metres from anything potentially to be targeted means their ability to project accurate strikes is severely limited. Some would say that’s a feature not a bug now, if you want to just raze everything and terrorise the populace.

Of course, if giving up on taking Ukraine and moving to scorched earth is the game now, that’s even dumber. The West will simply replace all that is lost with newer equipment, and NATO is already seeing the limits of Russian equipment and training in this current war post-massive doctrine changes. Syria and Chechnya and Georgia were nothing like a true war with a peer power as we see here, so it’d be like the US going into WWIII with only the tactics and lessons learned from asymmetric MOUT ops. in Fallujah or Kabul, rather than true modern warfare.

Ovi , clearing the fog of war . China is the second biggest importer of arms and ammunition from Russia . India is number one . So now Russia seeks military equipment from China ??? . Trash .

https://www.statista.com/statistics/1102702/countries-where-russia-is-a-major-arms-supplier/

https://www.statista.com/statistics/1102701/russia-main-destinations-of-arms-exports/

HIH

Could be, but I think there is some truth in this one. Don’t forget, Russia is asking for Syrian fighters to come and help him.

Also, this was supposed to be a walk in the park for P. We will have to look for more clues to see what the real story is.

Syrian fighters ? Another piece of trash . Just like 16,000 fighters coming from Syria to fight for Zelensky . Disinformation wars . He doesn’t need Syrians. He has the Chechen brigade still on standby . 10,000 strong and bloodthirsty, boy they do know how to clean up a mess . Mr Putin reads SunTsu .

Putin ordered to bring in mercenaries from Syria. That’s a fact. https://www.reuters.com/world/europe/putin-says-volunteers-welcome-help-fight-against-ukrainian-forces-2022-03-11/

Hole in head is particularly vulnerable to PhsyOps by authoritarian sources, given his preference.

Ovi , the West has no strategy and no tactics . The interests of USA , Europe and NATO are conflicting that is why poor decision making .

So markets have decided the ukrainian and oil crisis is over. Peace everywhere, supply chains work again and oil is plentiful available.

Wallstreet…

I used to refer to myself as the token conservative here, as best I can remember, and on some other sites as well.

My values and my votes generally belong to the left liberal establishment, but this does NOT mean traditional conservatism ( NOT the same thing as t RUMP and present day American Republican Party style conservatism, which is mostly just plain old fascism) is all bullshit…… a critical fact that most liberals somehow conveniently manage to forget these days.

One thing old time Democrats up until a few decades back, and Republicans, up until fairly recently, understood and acted upon is the fact that history isn’t over, and that countries such as Russia ( former USSR) and China will use their economic and military power to get what they want, assuming they HAVE sufficient power to do so.

Sometimes publications such as The Hill run pieces that make one hell of a lot of scary sense.

This is one of them…….

It’s about the long term economic and political interests of China, and how China can take advantage of the current political and economic landscape.

It absolutely applies to any informed understanding of the oil market, medium and long term. Ditto other natural resource markets as well.

https://thehill.com/opinion/international/597943-putin-and-xi-look-to-beijing-for-the-real-reason-behind-the-ukraine

I wonder to what degree the Russian invasion is a resource grab. Russia and China entered into a long term supply contract just a few days ago:

https://www.reuters.com/world/asia-pacific/exclusive-russia-china-agree-30-year-gas-deal-using-new-pipeline-source-2022-02-04/

So it would make sense to send gas in from the east to China.

https://www.naturalgasintel.com/could-russia-look-to-china-to-export-more-oil-and-natural-gas/

Ukraine has tons of resources:

https://en.wikipedia.org/wiki/Natural_gas_in_Ukraine

and already has the pipeline structure in place so it would make sense to grab them and sell them to Europe.

https://www.businesstoday.in/latest/world/story/are-ukraines-vast-natural-resources-a-real-reason-behind-russias-invasion-323894-2022-02-25

It is unlikely that this is 100% of the reason for Russia’s adventure but it very well may play a part.

Rgds

WP

I have also wondered about the resource grab and it works both ways. We know that the Iraq war was about oil. It did not matter that the West did not occupy the country permanently, as long as the oil began to flow and with petrodollars at play USA would still manage the world financial system. That is what the discussion between Grant Williams and Luke Gormen to which I provided a link above was about. So, the western powers wanted to bring Ukraine into its orbit and later try a regime change in Russia. That would have opened up the resources of Russia to the world even more than now. At the same time they would have eliminated Putin and liberated the Russian people from the oligarchs. Of course this would have introduced them to a new kind of kleptocracy such as we have in the west where income inequality has grown greatly. That is, the west is great at stealing the future from ordinary folks. It is not done at a gunpoint but in a very sophisticated way, and ordinary people are not in the position to connect the dots. “You own nothing and you are happy”, as Klaus Schwab and the Devon crowd is propagating. We are heading to a new feudalism.

Oil on water.

Tks Seppo . I was going to post a request to you and Pollux for this info . Looks like we are using 3 mbpd per day from inventory so 85/3 = 28 days and then what ?

This guy basically thinks Russia is dying from within. First I’ve heard of him, anyone here?

https://www.youtube.com/watch?v=gj7irIrmN0Q&ab_channel=ZeihanonGeopolitics

From frequent reports of Ukraine needing gas from Russia in the past, it would seem that Ukraine is not self-sufficient in energy from its own reserves. Thus Ukraine would appear to be a net sink of energy resources and thus not a helpful contributor to Russia’s reserves if ‘captured.’. I understand that Russia has actually increased gas transith through Ukraine to supply Europe during the crisis, and presumably Russia is still paying the transit fees and Europe is paying for the gas delivered. Interesting times.

Agree but it is not clear why that is the case. It does not seem to be a case of lack of resources, but more one of a lack of resource development.

rgds

WP

I think the tide is turning on prices. Dollar funding is coming under pressure. It’s starting to get scarce. Rate hikes will amplify dollar scarcity.

Hong Kong is a dollar based goods center. And you can visually see dollar’s becoming a problem in the exchange rate. I believe that peg brakes within a year or so as they don’t have the FX reserves to defend it. Mainland China might not be too far behind them.

A lot of dollars that make their way to China come via Japanese banks. Something I’m also keeping an eye on.

As the dollar tide turns a lot of people will be caught on the wrong side of the inflation trade. A lot of oil bulls will be left scratching their heads.

Oil volatility.

The only thing regarding oil prices that I am willing to bet on.

Shallow sand,

A safe bet indeed.

Option and future games at work – lot’s of traders bought short term calls, when the first too much sells a stampede is triggered.

Stampede up, stampede down, stampede …

There’s normal oil volatility, and then there’s this – which is double normal oil volatility. Real volatility is still above market perception which is usually dangerous waters. Still, the bullish bets are beginning to pile up with such a huge correction (technically it just crashed!). Glad that’s not my job. But oil companies should definitely definitely hire dozens of workers and drill tons of wells – I want to fill my tank up for free!

https://www.wsj.com/articles/saudi-arabia-considers-accepting-yuan-instead-of-dollars-for-chinese-oil-sales-11647351541?mod=lead_feature_below_a_pos1

“Saudi Arabia is in active talks with Beijing to price its some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia.

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

The Saudis are angry over the U.S.’s lack of support for their intervention in the Yemen civil war, and over the Biden administration’s attempt to strike a deal with Iran over its nuclear program. Saudi officials have said they were shocked by the precipitous U.S. withdrawal from Afghanistan last year.

China buys more than 25% of the oil that Saudi Arabia exports. If priced in yuan, those sales would boost the standing of China’s currency.”

Rgds

WP

Straws in the wind.

https://www.huffingtonpost.co.uk/entry/nazanin-iran-prisoner-boris-johnson_uk_62306a82e4b0d1329e8a7a62

Rumours are that the UK government has paid the debt for those cancelled tanks. I can’t believe they would do that without getting approval from the US first.

My money is on a new deal with Iran fairly soon. And it looks to me that the markets are pricing that in with recent falls in the oil price.

The Saudi’s, Iran and any potential Venezuelan oil can’t cover the expected shortage of Russian oil even if they tried. Yet WTI is under $95 again.

Just read financial press: They just need to “pump some more” and the problems are solved.

That’s priced in in the markets.

HHH,

Unclear at this point. Russian oil may be sold to China reducing imports to Chimne from elsewhere. Also Europe is still importing Russian oil at present, the amount imported by the US is relatively small in comparison. Iranian increase in output, plus increased tight oil output and perhaps some increased Venezuelan output along with Canadian, Brazilian, and Norwegian, may keep World oil prices in the $90 to $110 per barrel range, as long as central banks have modest rate increases, inflation may be kept under control without a severe recession.

My concern is prices don’t react to the first couple of hikes. Then they keep going and at around the 4th rate hike the yield curve inverts.

And prices react to the inverted yield curve.

Yes, it’s the old Coyotee problem (from roadrunner): He always manage to stay in the air too long, to ensure the most painful fall.

That’s what the stock market always manages, too – the central banks are increasing, stocks have all “priced in” and keep rising – and then everything crashes very fast.

Hikes are “priced in”, Ukraine is “priced in”, sanctions and counter sanctions are “priced in”, global supply chain chaos is “priced in”, commodities chaos is “priced in” – until it isn’t, and money for plunge protection runs out.

Then the central banks have to slash to zero and start a new, even bigger, QE. Or even first time intervention on stock market – the last time they only got until junk bonds.

I don’t rule out another spike in oil prices depending on news coming out of Ukraine.

But central banks are playing with fire raising interest rates.

My guess is 4 rate hikes this year brings 10 year under 1% flipping entire curve.

At first the 10 year will steepen a bit before it rolls over.

Hey, here is something maybe we agree on. The war and new geopolitics is going to cause more supply constraints. Demand is hot. Unemployment low. Inflation hot and interest rates very low at the bottom of the scale. Analysist calling for 4 to 7 rate increases by year end and the Fed behind the curve.

The Fed in my opinion should go half a percent this week and make a statement inflation is not going to be ignored. I expect the Fed to only go a quarter percent.

I don’t think we agree. FED is raising interest rates for all the wrong reasons. I’m mean really how do you cure supply side shocks with interest rate hikes?

You can’t bring more oil to the market by hiking rates. You can’t bring more natural gas to the market by hiking rates.

You can crash prices by inverting yield curve though. Going to be a lot of damage in credit markets though.

HHH,

I tend to agree on this point, though politically high inflation is all that is mentioned on the news about domestic politics, the Fed will likely take some action, though probably only a quarter point at a time and see how the economy reacts. You are correct that there is a good chance the rate hikes will be overdone and probably will lead to a recession, but maybe Powell will be smart enough to avoid this pitfall and wait for supply disruptions to ease. Going slow is probably the best approach.

HHH,

The Fed’s mandate is full employment and stable prices. It’s tools are interest rates and money supply. They can’t drill for oil, mine for gold or grow wheat. All resources are limited and none of them are free. Even the air you breath. Bringing more gas and oil to market is not their responsibility. That balance is for the free market to figure out and it will in time. Higher prices and lack of supply will bring more substitutes and production.

Cathie Woods believes long term rates are low because of new efficient technology. That has been driving costs down and will continue in the future. There is always financial pain out there for someone. Two years ago it was oil producers. If we are at peak oil or near, it’s time to face it and not paper over what it means. The credit markets don’t get a free pass.

The Fed manages the currency of the United States. By rising rates it will strengthen the dollar and make oil that is traded in dollars more expensive for other countries and currencies. Which then those users will use less of it. Which then in return makes more oil available at a lower cost in the states. Basic Macro Economics 102 for someone with an education on the subject.

HB – But what does Bernie Madoff think? That’s what I want to know.

Good chance dollar sinks after today rate hike. Sell the news. In short term traders view it as the FED not supporting USD asset prices.

Only later on when credit start to unwind as yield curve inverts does dollar really start to take off and strengthen.

Won’t be surprised to see oil bounce in meantime as a little dollar weakness shows up and things are relatively ok as credit markets haven’t yet taken a big tumble.

Bernie Madoff died a year ago after spending years in jail

Guys , the FED is pussy . Raising 0.25 % . My bet was nothing and they would give the Ukraine crisis as an excuse . Anyway sticking a finger in a hole of the dyke isn’t going to stop the collapse of the dyke with all the margin calls , liquidity problems etc . The FED blinked . Powell is no Volcker . Who said this ” After me , the deluge ” ?

Hair on Fire, the delivery guy,

knows best.

So he thinks.

Nothing new on that.

Hicks , nothing bad happens until it happens to you .

HB – Madoff’s opinion would still be worth more than Cathie Woods.

I figured that was your point

Iran ready to supply required oil for the world market: Official

Tehran: Mohsen Khojasteh Mehr, head of the National Iranian Oil Company (NIOC), ..

Read more at:

https://energy.economictimes.indiatimes.com/news/oil-and-gas/iran-ready-to-supply-required-oil-for-the-world-market-official/901836599

Help! Am I losing my mind or is it just mass ignorance?

The USA is a net oil exporter! The USA exports more oil than it consumes! I keep hearing versions of this from folks who should know better.

Does the USA not produce in the neighborhood of 11.3 millions barrels per day??

Does the USA not consume somewhere in the neighborhood of 18 – 20 million barrels per day??

I get that folks mix ‘energy independent’ with ‘oil independent’. They seldom mention ‘self-sufficient’. Has anyone added up the BTU’s from coal oil gas exports vs. coal oil gas BTU’s consumed? Are we net positive?

I also get that we export some USA-produced oil, which simply means imports are larger than ‘net imports’, right?

Is the USA the world’s 2nd largest importer of oil behind China?

I have to ask because I have looked these numbers up through time. They confirm what I think, we use more than we produce. But energy experts and serious-sounding journalists keep saying the opposite. The discussion out there is non-sensical. After talking about how much we export, they mention we import Russian oil. Why?

The discussion is all about opening the spigots, and ‘turning on’ production. Climate be damned.

Got2surf, what’s wrong with you?

Don’t you know 11.3 million is a larger number than 18 million?

Gottosurf

Here is a partial explanation. A number of reporters/analysts look at what is called all liquids and are ill informed. All liquids includes Crude plus Condensate plus NGLs and ethanol.

In the accompanying table from today’s EIA’s inventory report, you can see that C plus C is 11,600 kb/d (1). In the NGL part there are 5,733 kb/d of NGLs (16), 1,221 kb/d ethanol (17) (which contains 66% of the energy in a gallon of gasoline) and 984 kb/d (20) of refinery gains due to the addition of hydrogen in the refining process.

Adding it all up, US all liquids production last week was 19,538 kb/d. Product supplied to the market was 20,652 kb/d, close to 1,000 kb/d more than all liquids. Note that input to refineries was 15,601 kb/d. Gasoline is imported to make up part of that 5,000 kbd difference between refinery input and supplied to the market. Part of the 5,000 kb/d is the refinery gain.

So as you indicate “opening the spigots, and ‘turning on’ production” is a lot of nonsense. A lot of the liquids are exported since they are not suitable for making gasoline or diesel.

This just confirms your thinking and possibly explains some of the gobbledygook you are hearing.

Thank you Ovi! I’m not insane!

I appreciate your clear and thorough reply. I thought C C ethanol, etc. had something to do with it. I listened to 2 podcasts last week that brought in ‘energy experts’ to inform the hosts, and us all. We’re being so misinformed! Youtube is a cesspool of intentional misinformation, but these earnest-sounding folks with good acoustics are doing even greater damage to an informed electorate, IMO.

Speaking of electorate, when we throw out our leaders, and the new leaders can’t ‘open the spigots’, what does the USA do after that? Scary thought for the day.

“Speaking of electorate, when we throw out our leaders, and the new leaders can’t ‘open the spigots’”