A post by Ovi at peakoilbarrel.

Here I am again reporting on out of date US February oil production from the EIA April report after the world oil environment has been turned on its head. Fortunately the EIA also has some forward looking reports that make use of more current data to provide projections for a few months out. Also the EIA has a guesstimate for weekly oil output which certainly provides an indication of the direction of production over the next month. Also there are reports on rig counts that indicate activity in oil basins and provide clues on where oil output is going. Down, Down, Down.

All of the oil production data for the US states comes from the EIAʼs Petroleum Supply Monthly. At the end, an analysis of a three different EIA monthly reports is provided. The charts below are updated to February 2020 for the 10 largest US oil producing states (Production > or close to 100 kb/d).

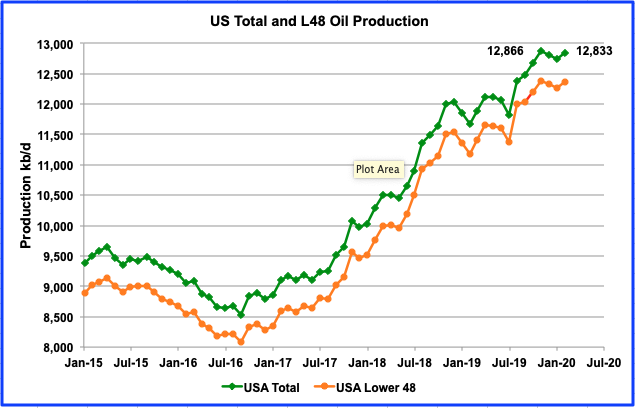

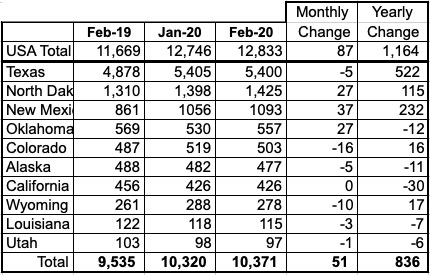

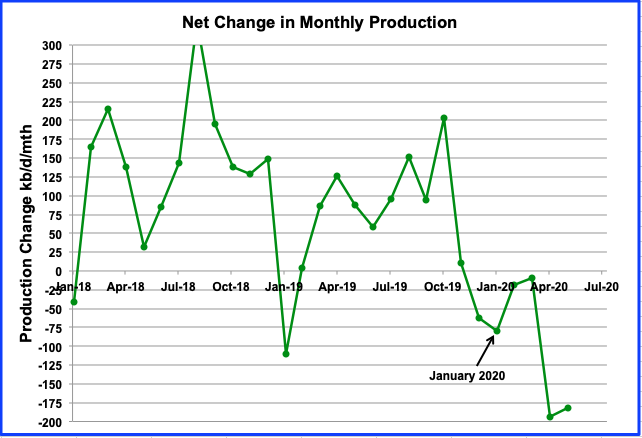

The May EIA report shows US production increased in February by 87 kb/d to 12,833 kb/d from 12,746 kb/d. For the lower 48 states only, production from January to February increased by 92 kb/d. From July 2019 to November 2019, output grew from 11,823 kb/d to 12,866 kb/d, an increase of 1,043 kb/d or an astonishing average rate of 260 kb/d/mth or 3,120 kb/yr. This astonishing rate begs/raises a few questions.

- Is it this stunning production rate of 260 kb/d/mth that lead Saudi Arabia to call for an OPEC + meeting for March that subsequently resulted in the split with Russia which resulted in the launching of Saudi Arabia’s Shock and Awe attack on the world’s oil markets?

- Will the November 2019 output of 12,866 kb/d be recorded as the new US Peak Oil date?

- Will US oil companies again challenge OPEC’s market share in the future or will they be content with taking a portion of the yearly growth, when growth returns? I have often wondered where we would be today if the US had limited their production to 2/3 of the yearly demand growth and let OPEC and Russia compete for the remaining market share. US unlimited production has only led to lower oil prices along with the demise of many US oil companies and less oil in the ground for the future.

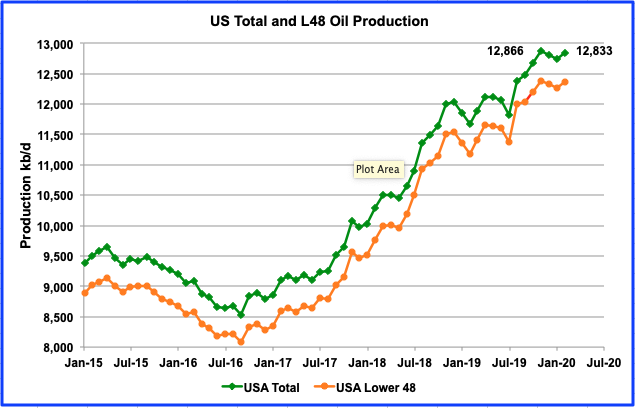

In an attempt to provide the latest production estimates for the US, above is a comparison of the EIA’s weekly and monthly production data. The weekly data is updated to the week ending April 24 and the monthly up to February 2020. While the weekly and monthly numbers are in reasonable agreement from August 2019 to November 2019, there is major divergence after that. Clearly there is some speculative oil production information coming from the EIA’s offices responsible for prediction weekly oil production. Regardless, they got the direction right for February but are 167 kb/d too high. The STEO is predicting output of 11,900 kb/d for May which appears to be where the weekly data is heading.

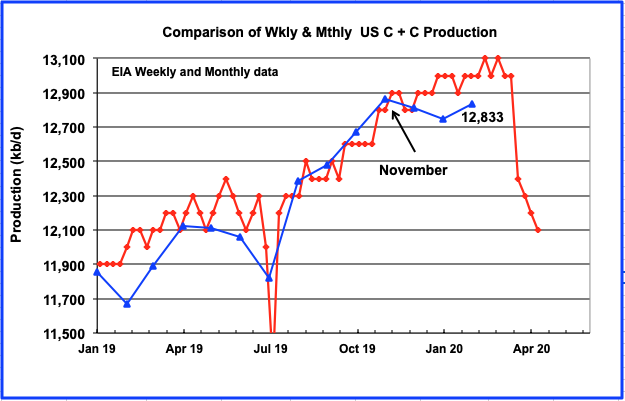

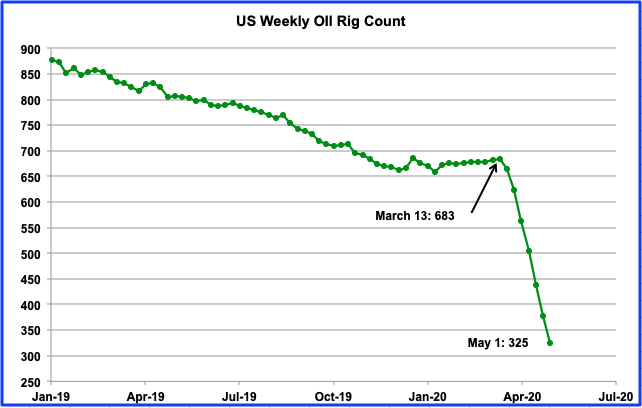

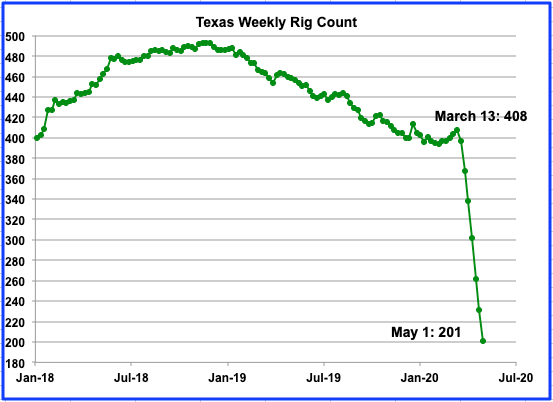

An indication of where US oil production is headed can be gleaned from this chart, showing the US weekly oil rig count. Data is provided by the weekly Baker Hughes rotary rig count report. From March 13 to May 1, 358 rigs were taken out of service, a drop of 52.5%. According to the Drilling Productivity report, each rig was capable of producing 730 bbls/d in April. So as of May 1, 260 kb/d/mth of new production is being shelved which will result in a very steep monthly production drop, as indicated in the previous chart.

Ranking Production from US Oil States

Listed above are the 10 states with production previously greater than 100 kb/d. This month Utah fell below 100 kb/d but will be retained for continuity. These 10 accounted for 10,371 kb/d (81%) of production out of a total US production of 12,833 kb/d in February 2020. US year over year production again exceeded 1,000 kb/d by 164 kb/d. Not shown in the table is the GOM which produced 2,023 kb/d in February and would rank it between Texas and North Dakota.

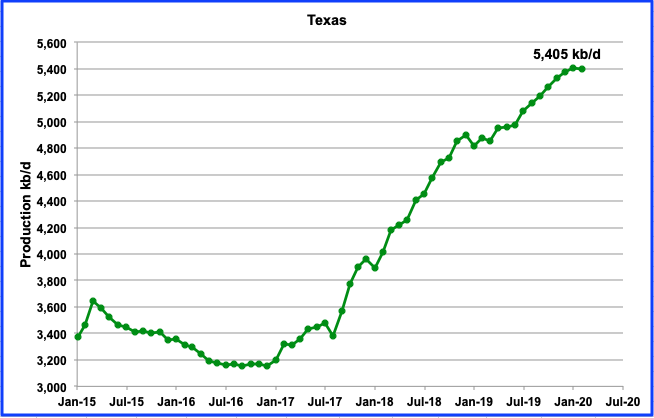

February production in Texas dropped by 5 kb/d to 5,400 kb/d from a revised 5,393 kb/d in January. There is a definite hint of slowing output in Texas.

The rig count in Texas on May 1 was down to 201 rigs, a drop 207, or 50.7%, from 408 in the week of March 18.

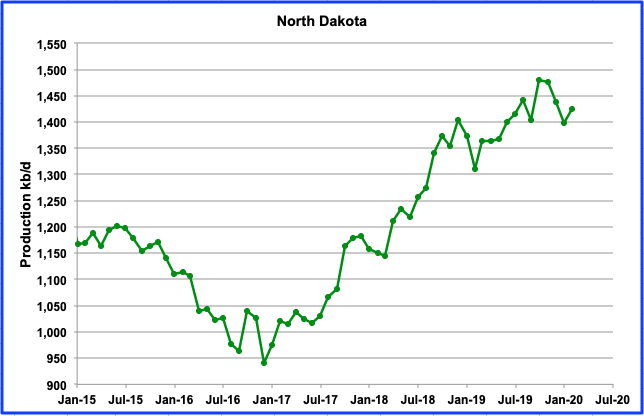

North Dakota’s oil production has been dropping since October 2019 however it increased by 27 kb/d in February to 1,425 kb/d.

According to this report, North Dakota is now drilling wells outside of its core areas. BISMARCK, N.D. (AP) — North Dakota’s oil production may peak within five years as companies finish drilling the most prolific portions of the state’s oil patch, state and industry officials told lawmakers Tuesday.

“Mineral Resources Director Lynn Helms, the state’s top oil regulator, said about 20% of drilling activity is now outside of the “core” areas of the western North Dakota’s oil producing region.”

“The end of (core area-drilling) is on the horizon; we can see it from here,” Helms told the Legislature’s interim Government Finance Committee.

From January to early March the number of rigs operating each week has remained almost constant as it wandered between 51 and 53 but by the week ending May 1, the number had dropped to 26.

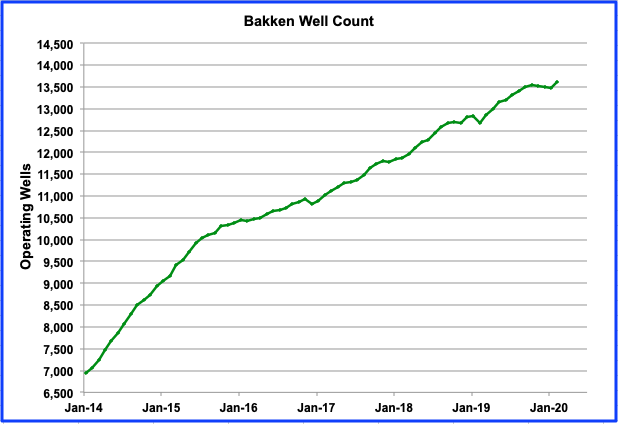

The number of producing wells in the Bakken started to decline in October 2019 from a high of 13,555 to a low of 13,482 in January 2020. However In February there was sharp jump to 13,616. It will be interesting to see what happens in March. We can expect a sharp drop in production and drilling in North Dakota, according to this report.

“Continental Resources Inc, the company controlled by billionaire Harold Hamm, stopped all drilling and shut in most of its wells in the state’s Bakken shale field, three people familiar with production in the state said on Thursday.”

While January was the first month that New Mexico’s output declined, February resumed the upward trend. Output increased by 37 kb/d from 1,056 kb/d to 1,093 kb/d in February. While Texas has been getting all of the attention regarding its production growth, New Mexico has also increased its output and recently has exceeded the critical 1 Mb/d. On a YoY basis, New Mexico has increased its output by 232 kb/d, same as last month.

New Mexico’s production is expected to drop in March according to this report. “New drilling in the Permian Basin in southeastern New Mexico is screeching to a halt, and many producers are starting to shut in existing wells to await better times. That, in turn, foreshadows a double whammy on the state budget, as government revenue tumbles from plummeting oil prices and forthcoming production declines.”

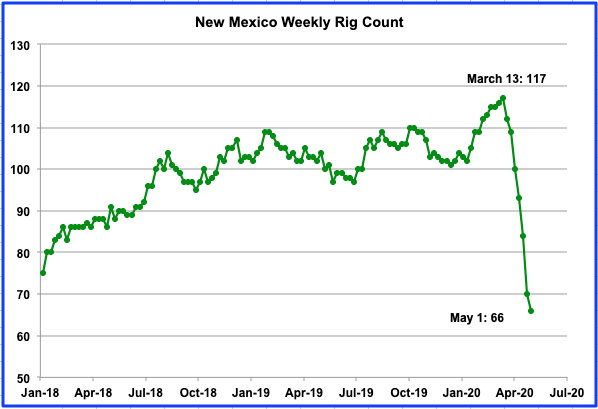

In New Mexico, the rig count fell from 117 to 66 from the week of March 13 to May 1, respectively. This should result in a production drop starting in March.

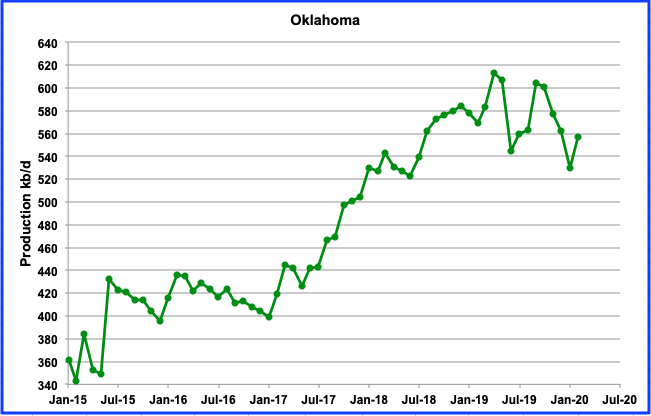

Oklahoma output rebounded in February after declining for four months in a row. Output increased by 27 kb/d to 557 kb/d. In early January, Oklahoma had 50 oil rigs in operation. In the week ending May 1, there were 13, a drop of 37, or 74%, from the beginning of the year.

According to this report, “The Oklahoma Corporation Commission approved an emergency order on April 22 that allows oil producers to stop or reduce production without losing their leases for non-production. One Oklahoma producer who testified that he operates about 600 wells in the state said he is currently losing $200,000 monthly by producing from economically challenged wells.”

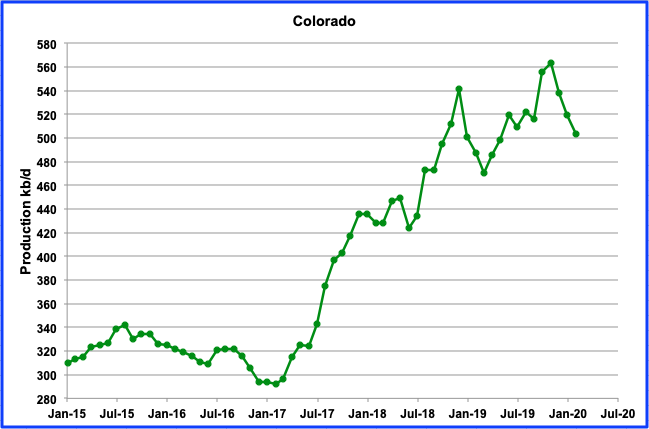

Colorado production declined by 16 kb/d in February to 503 kb/d from 519 kb/d in January. From the peak of 563 kb/d in November, output has dropped by total 60 kb/d. New environmental regulations may be beginning to take their toll on drilling activity and the resulting oil output decline. The current low oil price can only add to the drilling industry’s difficulties. However some operators have hedged their output and will continue to operate according to this report. Regardless, Colorado’s oil producers seem to resemble a tale of two cities.

“The oil and gas industry has been hit hard, including in Colorado. Halliburton and Liberty Oilfield Services have laid off workers in Colorado. Occidental Petroleum, Colorado’s No. 1 oil and gas producer, and Noble Energy, the No. 2 producer, recently announced cuts in spending and employees’ pay and hours. Denver-based Whiting Petroleum said on April 1 that it is filing for bankruptcy.”

On the other hand, “Denver-based Highpoint Resources, which operates exclusively on the northern Front Range, has not shut any of its wells. Bill Crawford, the company’s chief financial officer, said Highpoint has hedged its position in the market, meaning it has contracts locking in the price it receives for future production. About 95% of Highpoint’s production is hedged at $58 a barrel for the rest of this year.” Smart company! ???

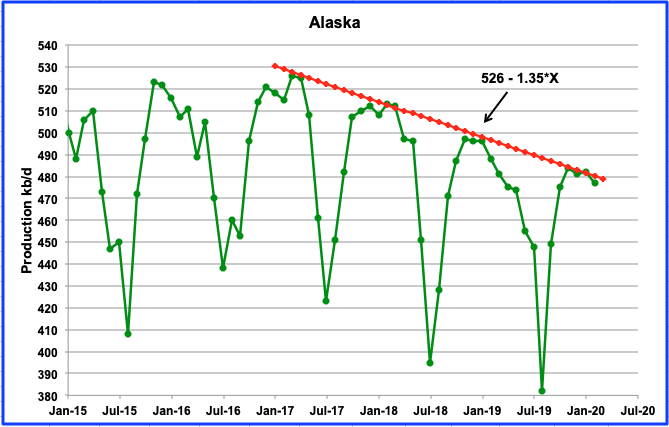

Alaska’s output continues its slow decline as shown by its annual peak production months of November, December and January touching the downtrend line. February was down by 5 kb/d to 477 kb/d. The line continues to show a decline rate of 1.35 kb/d/mth or 16.2 kb/d/yr.

An expected 20 kb/d increment near the end of the year will mostly be offset by the estimated yearly decline of 16.2 kb/d. However, the Corona virus is causing rigs to be shut down according the this report. “ConocoPhillips is demobilizing its rig fleet on Alaska‘s North Slope to try to minimize the risk of workers contracting COVID-19, a spokeswoman said Wednesday”

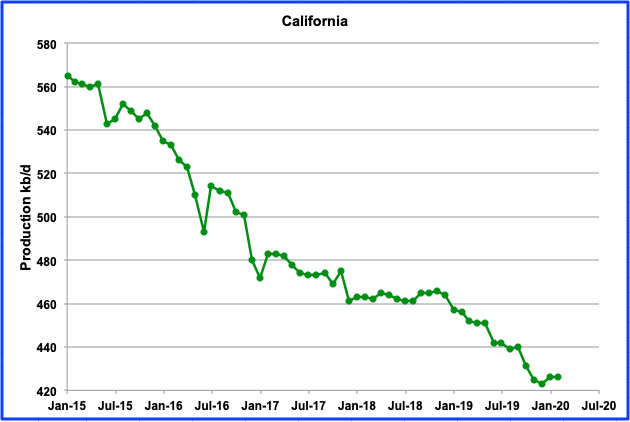

California’s slow decline has taken a pause. February production was flat at 426 kb/d and had an increase of 3 kb/d in January to 426 kb/d.

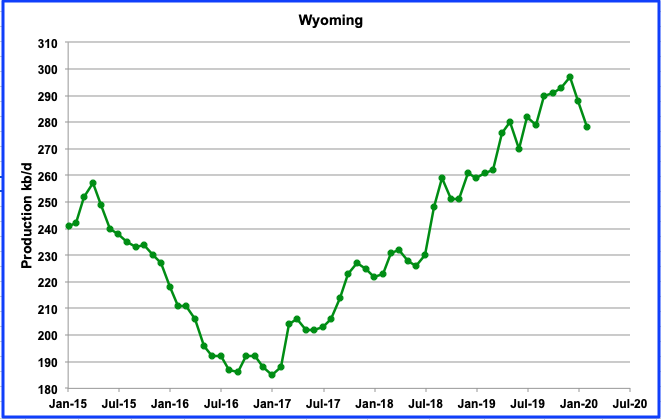

Wyoming increased its output from January 2017 to December 2019 and reached a new high of 297 kb/d in December 2019. However in January and February it had two successive drops. In February 2020 output dropped by 10 kb/d to 278 kb/d. Wyoming, like other states, is being impacted by low oil prices and the virus according to this report.

“Even with an agreement in place, the demand decline has been so sharp, and so deep,” University of Wyoming economist Rob Godby remarked. “The problem is really the coronavirus. There is so much oil on the market right now, and so much to go into storage, that really the only way to slow this down is to actually shut in wells.” Shutting in productive wells can prove costly, and there’s no guarantee activity will return to Wyoming down the road, he added.

Steve Degenfelder, land manager at Kirkwood Oil and Gas, LLC welcomed the decision by OPEC to limit production, but noted the Casper-based company will still be facing challenges in the days ahead. “We have shut in some high cost production and will consider more as time goes on,” he said.

During the week ending May 1, Wyoming had 4 oil rigs in operation, down from a high of 19 during January.

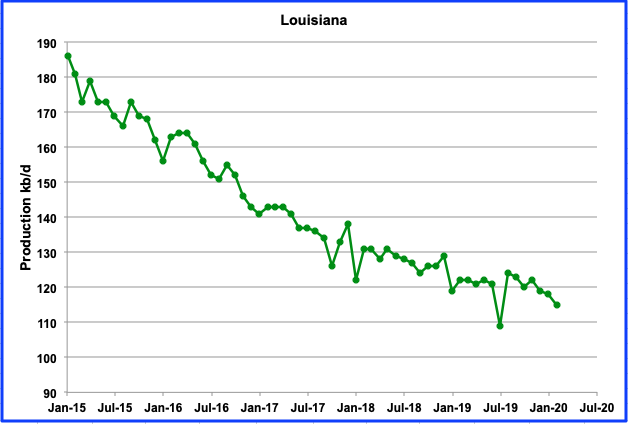

Louisiana continues its slow steady decline. After rebounding from a new low output of 109 kb/d in July 2019, the decline has begun again. February output was down by 3 kb/d from January to 115 kb/d. Louisiana’s oil rig count has had a slow decline from the beginning the year to the week ending May 1. In January, 22 rigs were operating while there were 16 in April/May.

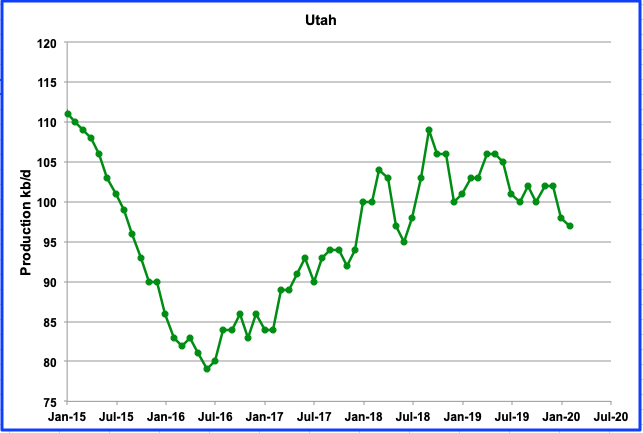

Utah’s output was holding steady since July 2019 at slightly over 100 kb/d due to its new conventional field but is now giving indications of entering a new slow decline phase. February production fell below 100 kb/d to 97 kb/d, a drop of 3 kb/d from January 2020. The last peak occurred on September 2018 at 109 kb/d.

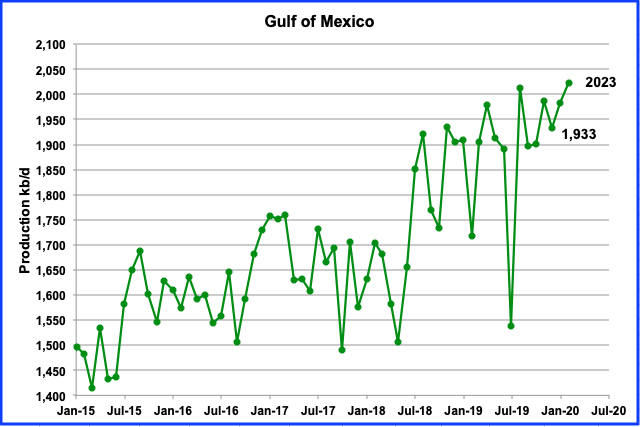

The GOM’s output continued to rise in February and exceeded 2,000 kb/d again. The last time it exceeded 2,000 kb/d was August 2019. February production increased by 41 kb/d to 2,013 kb/d.

UPDATING EIA’S DIFFERENT OIL GROWTH/DECLINE PERSPECTIVES

1) DRILLING PRODUCTIVITY REPORT

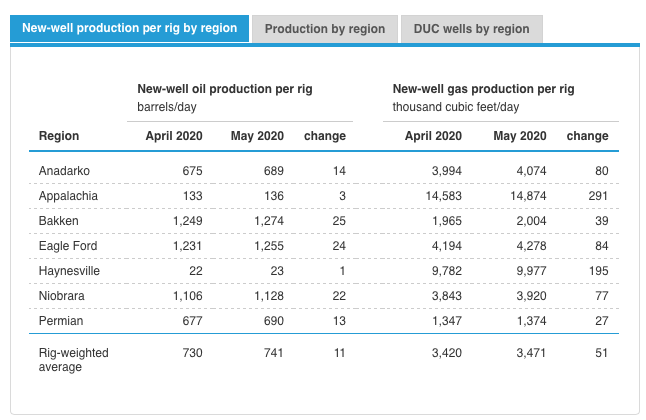

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the five key tight oil regions.

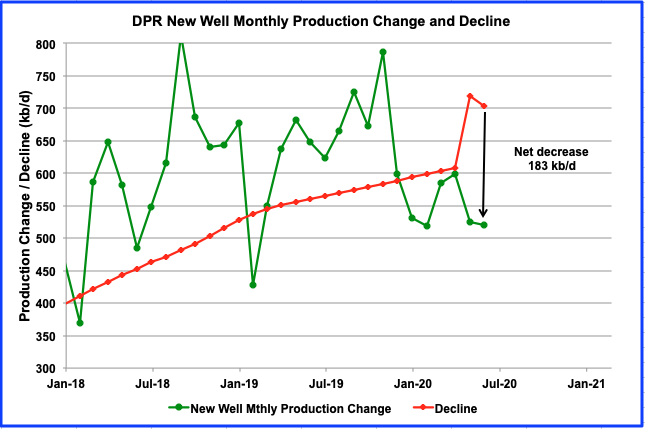

This chart shows the monthly change in new well oil production and the decline from all previous producing wells for the onshore L48 states. The difference between the two gives the projected output increase for all tight oil basins.

There has been a major change in the output projections from the March to April DPR reports. The chart shows the dramatic increase in the decline rate for March and April relative to February. For April 2020, the March report projected an increase of 17.5 kb/d. The new April report has revised the March increase to a decrease of 194 kb/d. For May, the decline rate is projected to be 183 kb/d.

Above is the DPR net growth chart updated to May 2020 and shows the difference between the monthly change in new oil well production and the decline from all previous producing wells for the onshore L48 states. The April report indicates that oil production from the LTO basins and associated conventional wells has been in decline since January 2020. Output came close to no change in March but didn’t quite make it.

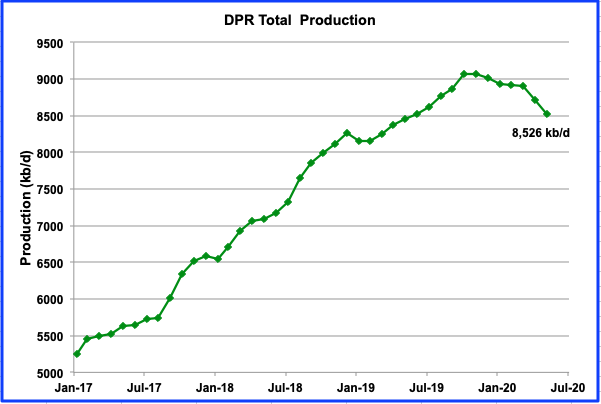

Above is the total oil production from the 7 basins that the DPR tracks. Note that the DPR production includes both LTO oil and oil from conventional wells. LTO oil and conventional oil output peaked in October 2019 at 9,062 kb/d. The projected May output is 8,526 kb/d, a drop of 536 kb/d. Note the increased rate at which production starts to drop in March.

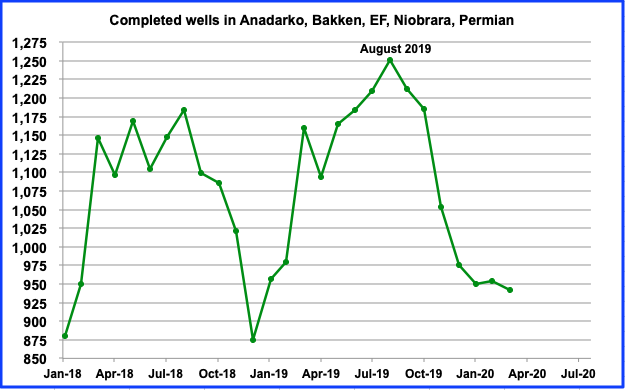

From August 2019 to March 2020 completed wells dropped from 1,251 to 942, a drop of 309. There appears to be a temporary pause in completion from January to March.

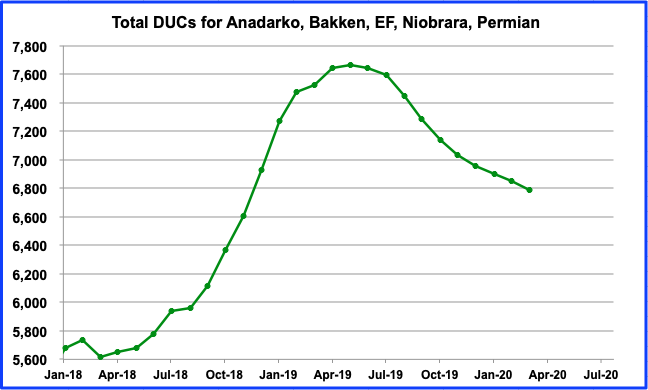

It is interesting to note that the number of DUCs is dropping very slowly. During March, only 62 DUCs were completed. Does this indicate that the majority of them are dead ducs? ????

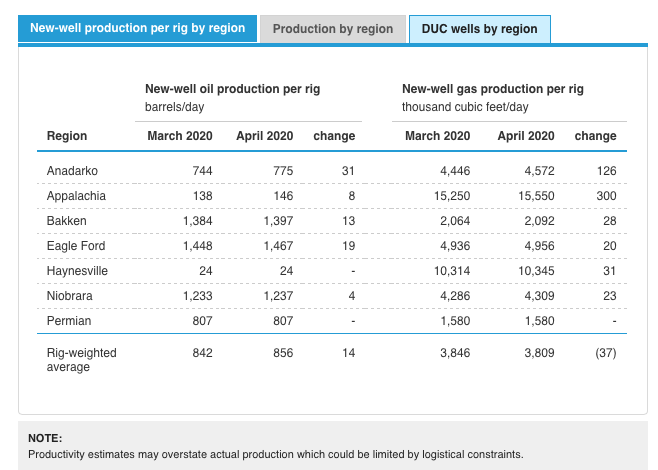

Above are two tables from the March and April DPRs. Compare how the New-well oil production per rig has dropped for each region in going from the March to April reports. The March/April productivity was close to 850 b/d/rig while April/May dropped to 735 b/d/rig. This seems to imply that in April and May, the rigs were moving into lower productive regions. Is there some other explanation?

2) Light Tight Oil (LTO) Report

The LTO database only provides information on LTO production from seven tight oil basins and a few smaller ones.

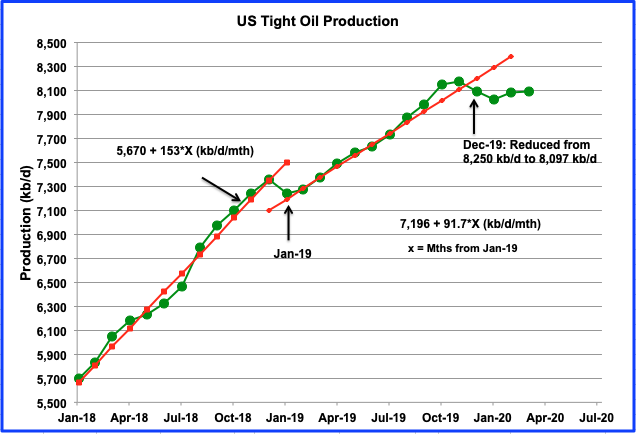

There was a significant downward revision to the LTO data in the April 2020 report. The December 2019 output was reduced from 8,250 kb/d to 8,097 kb/d. March output is 8,096 kb/d up 7 kb/d from 8,089 kb/d in February.

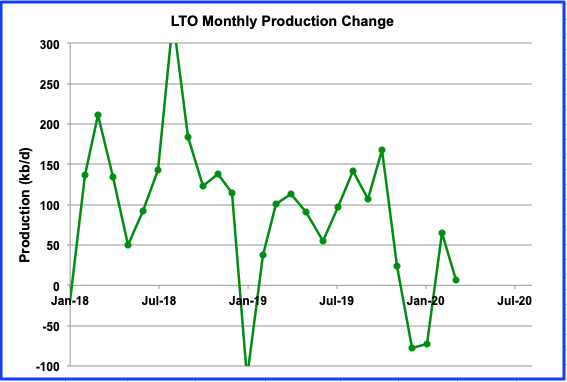

This chart shows the monthly addition to LTO output. It recovered to an output increase in February and March from decreases in December and January. The production increase in March was 7 kb/d.

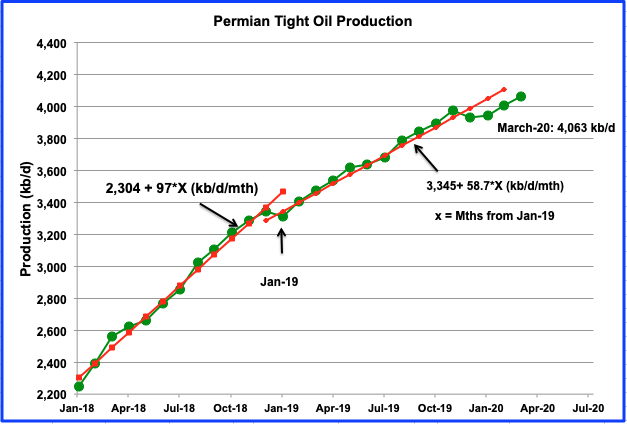

The Permian is the largest contributor to US tight oil growth. The average growth rate for 2019 is 40% lower than 2018. While output may be slowing, output from January to March continued to grow at 59 kb/d/mth, virtually continuing at the average trend of 58.7 kb/d/mth from January 2019. Output in March reached a new high at 4,063 kb/d. Will it slow in April as rigs are retired.

3) Short Term Energy Outlook (STEO)

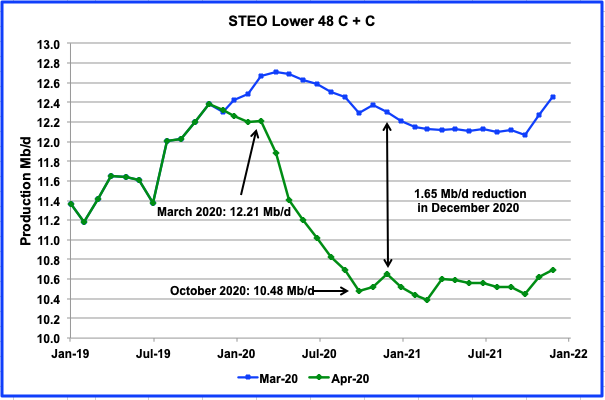

The STEO provides projections for the next 13–24 months for US C + C and NGPLs production. The April 2020 report presents EIA’s oil output projections out to December 2021

The chart compares the April 2020 STEO C + C projections with those in the March 2020 report. In the April STEO report, the estimated output for December 2020 has been reduced by 1,650 kb/d from the March report. From March to October the STEO is estimating that output would fall at an average rate of 250 kb/d with largest drop occurring over the first two months at a rate of 400 kb/d. Also note that the GOM increase in late 2021 is smaller.

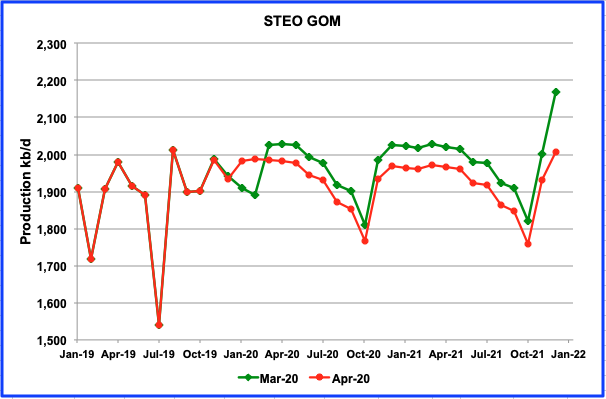

The increase in output from the GOM in December 2021 has been reduced by 167 kb/d. Could this be due to projected lower capex associated with the current low oil price environment?

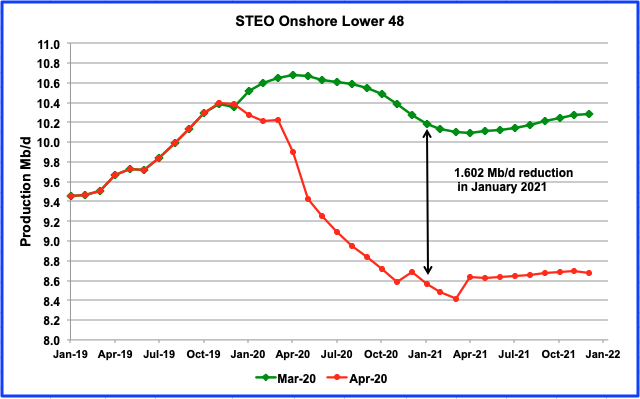

This chart compares the April 2020 STEO projection with the March 2020 report for the Onshore L48. The revisions in April STEO report project that the onshore L48 output will be down by 1,602 kb/d in January 2021 as compared to estimates in the March report. The April report estimates that by December 2020, output is expected to be down from 10,230 kb/d in March to 8,680 kb/d in December, a drop of 1,550 kb/d.

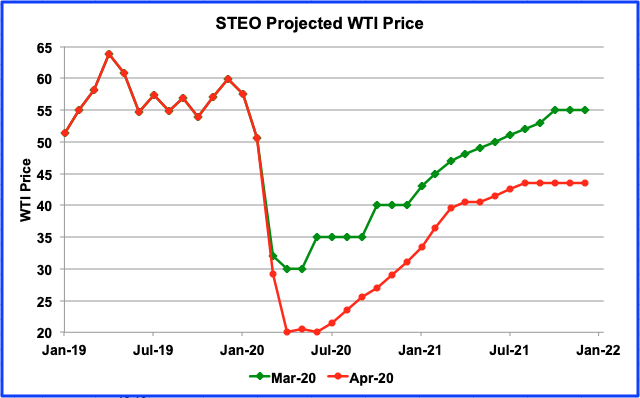

Above is a comparison of the EIA’s March and April projected price environment over the next two years. The settled price for WTI on May 1, 2020 was $19.69 for the June contract and $22.33 for July, close to the EIA estimates. The contango has been reduced to $2.64 today from $5 a few weeks ago.

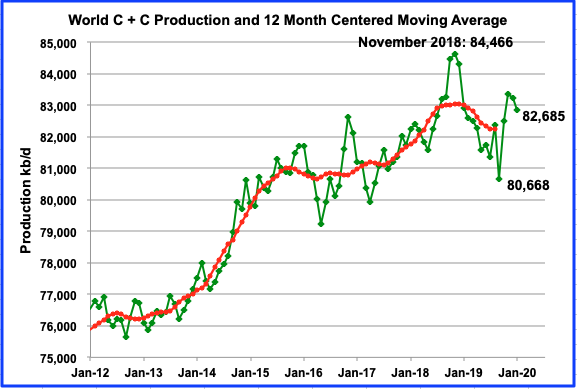

World oil Production

World oil production fell by 850 kb/d from 83,235 kb/d in December to 82,385 kb/d in January. The likely hood that the date November 2018 will be recognized as the date for World Peak Oil is increasing, in light of today’s slowing world economy and the time it will take to recover, possibly up to two or three years. In the mean time, new discoveries are few and small and old fields keep declining 24/7.

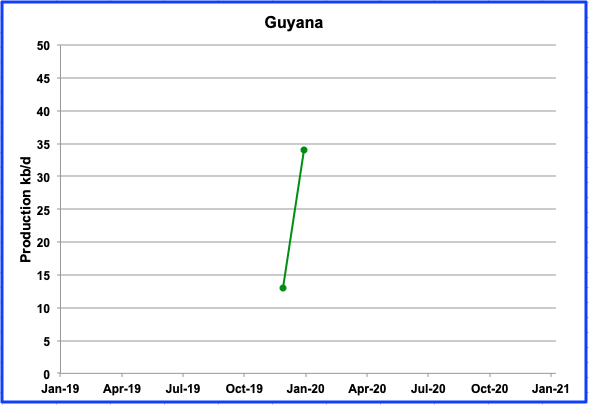

Check how fast Guyana’s production is increasing. Output in January jumped to 34 kb/d. It went from 13 kb/d in December to 34 kb/d in January, an increase of 21 kb/d or 161%. Almost puts the Texas Permian to shame. ????? .

260 responses to “Is November 2019 the New US Peak Oil Date?”

On World Oil I expect there could be a new peak, one such scenario below.

The extraction rate is for conventional C C which excludes tight oil and oil sands resources, the output curve includes separate tight oil and oil sands shock models which are added to the conventional C C shock model to get total World C C output. Peak for this scenario is in 2028 at 85 Mb/d. Arelatively slow recovery from the current economic crisis is assumed with output of World C C not returning to 2018 level until 2026.

Obviously this one of an infinite number of possible future scenarios, odds of it being correct are 1 divided by infinity, or zero.

Despite the lack of new discoveries there are a lot of undeveloped reserves and at higher oil prices a certain level of possible reserves as well as contingent resources that may be reclassified as reserves at higher oil price levels. By 2024 oil prices are likely to be above $70/b and by 2027 likely above $100/bo in 2020 US$ in my opinion.

I think it’s a more political thing:

Can the countries with big reserves develop them (Let’s say oil price > 50$):

– Iraq

– Iran

– Lybia

– Venezuela

If all of them can develope their oil, we’ll see a new peak. Each of them can increase their current production by an important amount, given the right political setting.

All of them failing, and we won’t see a new peak – just not enough reserves in the other countries to counter decline and replace an Iraque / Iran.

Dennis,

You and I will continue debating this issue. I would find your model much more palatable if you can explain by what process and or mechanism the velocity of money and hence inflation would increase to raise the demand for oil to $70-100/b?

Prior to the covid-19 event both M1 and M2 velocities seem to be in terminal decline, with M2V being at the lowest level ever. Oil prices only rose due to geopolitical tension, and not due to demand (especially from 2016 onward if memory serves me correctly).

https://fred.stlouisfed.org/series/M1V

https://fred.stlouisfed.org/series/M2V

In my opinion the velocity of money and inflation have a correlation to oil prices (And other equities/assets). I will quantitatively check this shortly.

So explain how the m1v and m2v can turn around and -> increase inflation and -> increase demand for oil -> cause oil price increase -> oil production to increase ? And then you have to extrapolate that to OECD and emergent economies oil consumption as to why you think it will increase.

I don’t see any particular reason why that would happened. We could have a possible bounce back after covid-19 and just go back to the normal anemic inflationary environment, one that we were accustomed to prior to covid-19. Seems more probable to me currently.

Iron Mike,

Supply will grow less quickly than demand driving the price of oil up. Note that I am talking about real oil prices in constant US$, the level of prices overall does not really matter in this context and the velocity of money is relatively unimportant, all the declining velocity of money tells us is that central banks are pushing on a string in trying to increase economic activity by using monetary policy, increasing money supply simply results in more money sitting in bank accounts and has very little effect on economic activity, that is the reason that the velocity of money has become lower.

As for the reason that oil prices have been low for most of the 2015 to 2020 period is simply a matter of over supply of oil, today oil prices are so low that oil output will decrease and eventually balance the oil market. The lack of investment in the oil industry over the past 5 or 6 years will eventually result in a shortage of oil, in addition tight oil output growth will diminish severely over the next 5 to 10 years (after it recovers to 7 or 8 Mb/d after the recession/depression.) Most of World growth in oil output from 2015 to 2019 was from tight oil output growth (about 85% of all annual output growth). Oil output might recover quickly so that oil is again oversupplied, but I doubt this will be the case, I expect a slow oil output recovery in a high oil price environment (again real oil prices).

Keep in mind that neither of us is clairvoyant. My expectation is the the World economy will recover relatively quickly once a safe vaccine for covid19 is available and widely distributed (18 to 36 months.) This is a matter that will depend on fiscal policy, monetary policy is ineffective when real interest rates are zero or lower.

If the economy never recovers as you seem to believe, then oil output could remain low forever. I would put the odds of that scenario at about 1 in 20.

“all the declining velocity of money tells us is that central banks are pushing on a string in trying to increase economic activity by using monetary policy, increasing money supply simply results in more money sitting in bank accounts and has very little effect on economic activity, that is the reason that the velocity of money has become lower.”

My understanding is different from this- In short, the low velocity of money is due to less spending within the country, for services and goods (including oil, airline tickets, restaurant meals, ect). Demand for most things is down. The central bank adding liquidity is an attempt to reverse the declining velocity of money, but that tactic has become much less effective over time, and can only do so much to reverse a big event like this.

Hickory,

Velocity of money is defined as nominal GDP divided by quantity of money. V=GDP/M or MV=GDP. Monetarists policy assumes V is relatively stable and that and increase in M will lead to an increase in GDP, they are wrong. Often GDP is unchanged and the increase in M simply decreases V. That is what we have seen in general from 1985 to 2019 as V gas continued to fall. This is the Reagan revolution in a nut shell, reduce taxes on the wealthy and increase wealth disparities in the nation, now a larger proportion of income goes to the wealthy. The wealthy spend a smaller proportion of their income, it simply sits in their financial accounts waiting for retirement or death, this decreases the velocity of money, because much of it is sitting idle in the bank accounts (and money market accounts) of the wealthy.

Volcker finally abandoned the right wing delusions, and the velocity of money became reality again.

Secrets of the Temple gives a blow by blow account.

Dennis,

the level of prices overall does not really matter in this context and the velocity of money is relatively unimportant,

This is what i have an issue with. I think it is extremely important.

Firstly oil is denominated in USD. So a strong USD implies lower oil prices. Strong USD->deflationary scenario due to the low velocity of money.

Secondly low economic activity shown by the velocity of money implies low demand.

Again why would that trend change ? Monetary policy has reached it’s limits and M1V has been declining since 2008. And coincidentally we haven’t seen $120/b oil since then. In fact it hasn’t come anywhere near that price for a while now. Yes there has been an oversupply in the market, only because velocity of money is perpetually declining. In other words the market isn’t absorbing all the production. Due to low activity.

Unless that mechanism changes and inflation plagues the USD thereby lowering its purchasing power, oil prices will not rise higher than $65-70/b in my opinion. Barring geopolitical conflict.

I think interest rates will remain low for the foreseeable future. Which has an impact on commodity prices including oil.

I agree with what Hickory said in his last sentence, i’ll rephrase, how would that big event reverse. If central banks have failed….what would cause it to reverse?

Bearing in my this is a worldwide phenomena, not just in the U.S.

Iron Mike,

Velocity of money has little to do with real economic output. The strength of the dollar is determined by international trade, international capital flows and policies of central banks worldwide. Aside from a short period during the GFC, there has not been a deflationary environment, just low inflation rates. Real GWP is what matters and the velocity of money has very little relationship with GWP (Gross World Product, with real GWP in constant dollars).

Your thinking that the velocity of money is important is incorrect.

Since 1981 as Money Velocity has decreased World GDP has increased, the R squared for 1960 to 2018 is about 29%, essentially no correlation. Also over the 1981 to 2018 period World real GDP grew fairly steadily at 2.93% per year.

In any case the price of oil is determined by supply and demand, I expect World real GDP and oil consumption to grow, regardless of the velocity of money. Chart below shows the relationship of Oil production and World GDP from 1983 to 2018. World real GDP determines demand for oil and oil price is determined by the balance of supply and demand for oil on World markets (undersupply results in price increases and oversupply results in oil price decreases, what determines oil supply is complex (geology, technology, politics, weather, war, etc).

Dennis,

Since 1981 as Money Velocity has decreased

Can you show me the data for this please.

Lets look at more recent times. The M1V has been declining since 2008. I think the reason for this is because again all that money is stuck in asset and equity. So world GDP figures are worthless to me if all that money is stuck in the stockmarket/housing/savings or other asset classes. Velocity of money shows real economic activity which requires energy such as oil.

We aren’t going to see eye to eye so we’ll agree to disagree and as usual time will tell.

Iron Mike,

The money supply that modern economics follows most closely is called MZM, as describel below:

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

The frequency of currency exchange can be used to determine the velocity of a given component of the money supply, providing some insight into whether consumers and businesses are saving or spending their money. There are several components of the money supply,: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest. Consider M1, the narrowest component. M1 is the money supply of currency in circulation (notes and coins, traveler’s checks [non-bank issuers], demand deposits, and checkable deposits). A decreasing velocity of M1 might indicate fewer short- term consumption transactions are taking place. We can think of shorter- term transactions as consumption we might make on an everyday basis.

The broader M2 component includes M1 in addition to saving deposits, certificates of deposit (less than $100,000), and money market deposits for individuals. Comparing the velocities of M1 and M2 provides some insight into how quickly the economy is spending and how quickly it is saving.

MZM (money with zero maturity) is the broadest component and consists of the supply of financial assets redeemable at par on demand: notes and coins in circulation, traveler’s checks (non-bank issuers), demand deposits, other checkable deposits, savings deposits, and all money market funds. The velocity of MZM helps determine how often financial assets are switching hands within the economy.

Chart below uses annual average data from link below.

https://fred.stlouisfed.org/series/MZMV

Dennis,

Thanks for the info. As soon as WTI reaches $70 /b barring geopolitical tension, I will admit defeat. Until then, lets see what happens.

Iron Mike

Note that I do not expect a fast recovery just that eventually the economy will recover. It might take 5 to 10 years so I do not expect 70 per barrel in 2020$ before 2025 and perhaps not until 2030. Much depends on the economy and predictions are difficult.

One ramification of of the decline in velocity of money from 3.5 to 1.3, is that you get much less bang for the buck when applying stimulus to the economy in times of crises or contraction. Its a manifestation of gradual, and severe, weakening of the the financial system.

Hickory,

It is simply a matter of who the money goes to. If it is tax breaks for the wealthy or bailouts for big business or banks (which amounts to a similar effect) then the money can just sit in bank accounts and the multiplier will be low.

An alternative is to put money in the hands of low and middle income citizens such as unemployment benefits, welfare and snap benefits, aid to state and local governments, and aid to small businesses (defined by annual revenue of less than 5 million rather than number of employees) then the money goes to people who will spend the money rather than simply save it and it is far more stimulative.

It is much less a weakening of the financial system and much more about unequal distribution of income.

There was a time when there was a progressive tax system to reduce unequal income distribution, that ended with the Reagan revolution and it has been downhill since.

“It is simply a matter of who the money goes to”

Yes Dennis. That simple line says so much about the history of human civilization.

Imagine how the tens of millions of slaves in human history feel about that issue.

In our recent past (since the mid 70’s) the large majority of the wealth growth in the country has gone to top 5-10%. It was a big change trend that was in place after WWll-

https://www.cbpp.org/research/poverty-and-inequality/a-guide-to-statistics-on-historical-trends-in-income-inequality

What I see is the wealthy (measured by net worth, not income) generally sequestering wealth in the form of art, luxury items, gold, off shore accounts, real estate, rocket ships, yachts, sports teams, lobbying to protect their assets, security and such. Much of this does not circulate in the general economy. Most of the spending by the lower 98% of net worth individuals does circulate and results in a healthier velocity of money.

The policy implications of this simple idea are huge, if we focus on them.

Dennis.

I agree there is no good reason that the $400,000 th dollar on the 1040 is taxed at the same rate as the $400 million th dollar.

I think the same should hold true for capital gains.

I also think there could maybe be some kind of capital gain tax differentiation.

Should the farmer who wants to retire and sell out and has a $2 million capital gain pay the same rate as the hedge fund manager who has a $20 billion net worth?

Same deal with the estate tax. The estate tax was attacked because a few years ago, small business owners, farmers etc would hit 55% rate fairly quickly.

Just keep graduating these rates till people like Buffet, Gates, Bezos, etc are paying 60-70% on dollars over $50 million. (Just a suggestion, I am sure there are ways to determine what the actual rate should be).

There is no reason a self employed person with AGI of under $1 million pays the same or more than these multi billionaires.

Huge issue that is always glossed over in the 30 second media sound bytes.

Dennis

What assumptions are behind the drop from 83 to 65? That’s 22% drop. In looking at the BP annual report and checking total reserves vs discoveries, total reserves kept on climbing even though the discoveries were small and appreciating that the world consumes close to 35B barrels each year, I found that over the last five years, the BP World reserves kept on climbing even though discoveries were small and minimal. My only thought was for this to happen, a lot of fields we’d bring reworked with horizons wells so they didn’t suffer the decline associated with vertical wells, however looking at the latest 2019/BP report, it appears that total world reserves are near or at peak.

Considering that the annual decline rate is close to 1 to 1.5% and guessing it will take five years to recover, I find it difficult to see how we will be able to exceed the November 2018 peak.

Just another opinion.

Ovi, BP does not do surveys of world proven reserves, they just ask every country: How much oil do you have left in the ground? That country then declares their proven reserves and BP dutifully reports that number.

The bottom line, BP’s estimate of world proven reserves are not worth a bucket of warm spit.

Let me see?

Mike Pense vs BP’s Estimates

Tough call but I’d have to go with BP.

SW,

Quite a lot of the BP estimate is OPEC reserves, these are not audited, you can believe what you wish, but Ron is correct that the BP reserves are likely overstated, they might match with 3P reserves very roughly. See estimates in Twilight in the Desert.

I don’t doubt for a moment that BP’s estimates are bogus. It is just that when you are comparing degrees of bogosity well, the bucket of warm spit wins. I figured that Ron, like myself is old enough to remember Lyndon Johnson describing the Vice Presidency as “A bucket of warm spit”

Who’s Mike Pense?

Have I misspelled his name? Oh my!

Ron

I would tend to agree with you, if we are talking about the increases in the 80s and 90s. However I think, starting in 2010 when we saw a dramatic fall off in discoveries, (See attached) things must have changed. Even if BP just called and a country tried to increase their reserves, they would have asked for an explanation.

Two basic questions. Have you found new oil? Are you going to recover more from the wells you already have?

Note that from 2012 to 2016 there was hardly any change in the BP world reserves. The bump from 2016 to 2017 was a combination of US (11) and SA (30). I assume the SA increase was related to the work done as part of their IPO.

Also note that double 1,730, puts world reserves in the 3500 range, half way between Dennis’ 3050 for conventional and 4,000 including oil sands.

So I am not inclined to totally ignore the BP estimate. I think there is more than an ounce of truth in their numbers. Let’s see what they come up with this coming June.

Really Ovi? BP’s estimate matches OPEC’s almost exactly.

OPEC Share of world crude oil reserves, 2018

However, that is OPEC’s 2018 estimate. Look for the above estimate of Saudi reserves to be revised upward in the very near future. Obviously BP called Saudi Arabia for their latest estimate and Saudi advised them that their reserves had been revised upward. And BP replied: “OK”. And that was that. Either that or BP is an even greater liar than Saudi Arabia.

BP raises Saudi oil reserves 12% in first big change in 30 years.

BP has raised estimates for Saudi Arabia’s crude oil reserves by 12%, marking the first major change to the country’s estimated reserves since 1989.

In its benchmark 2019 Statistical Review of World Energy, BP recalibrated some Saudi gas reserves as oil, allowing Riyadh to close in on Venezuela’s top spot as the world’s largest reserves holder.

BP said Saudi Arabia’s proved oil reserves were revised to 297.7 billion barrels at the end of 2018 from 266.2 billion a year earlier, only slightly behind 303 billion in Venezuela.

Canada was third with 168 billion barrels, followed by Iran with 156 billion and Iraq with 147 billion.

Ovi, those numbers are laughable. OPEC says the total Non-OPEC proven reserves are 308 billion barrels or 20.6% of the world total. In other words, over 60% of the world’s oil comes from 20% of the world’s oil reserves. Do you believe that Ovi? Do you really believe that?

Ron

In my reply I said “ However I think, starting in 2010 when we saw a dramatic fall off in discoveries, things must have changed. Even if BP just called and a country tried to increase their reserves, they would have asked for an explanation.”

Below is an updated chart with the OPEC reserves added. As you can see from 2011 to 2016, the OPEC reserves hardly changed. (I must admit that is a good trick considering they pump close to 11 Bb/yr)

The only change came in 2016 when SA added 29.8 B barrels. Where did come from. I checked the Saudi Aramco IPO and here are some quotes.

“The Company retained independent petroleum consultants, D&M, to independently evaluate reservoirs the Company believes accounted for approximately 85% of the Company’s proved oil reserves”

“The Company chose this scope because of the overall scale of the Kingdom’s reserves and the concentration of deposits in the major reservoirs that were assessed. Further independent assessment of the Kingdom’s smaller reservoirs would have taken several years to complete. D&M’s reserves estimation of 209.1 billion barrels of oil equivalent reserves for the reservoirs it evaluated was within 1% of the Company’s internal estimation for the same reservoirs for the same Concession time period.

“As at 31 December 2018G, the Kingdom’s reserves in the fields the Company operates consisted of 336.2 billion barrels of oil equivalent, including 261.5 billion barrels of crude oil and condensate, 36.1 billion barrels of NGLs and 233.8 trillion standard cubic feet of natural gas.

So they had an independent petroleum consultant review their reserves before issuing the IPO. I am not prepared to comment on the accuracy of the consultants numbers.

Regardless of whether you or I believe the BP numbers, the OPEC reserves have been essentially constant as are those of the Non-OPEC countries. It’s the trend in the BP numbers that may be more important than the actual numbers.

So I don’t see any significant change in world reserves in the future. I think they are very close to the peak.

All I was trying to say Ovi, was that I do not think BP would have demanded an explanation. In fact, in the vast majority of cases, they would have taken their data from the country’s published reports. There would have been no phone call at all.

Not that BP does not desire accuracy, they most certainly do. It’s just that they are well aware that these numbers have political overtones and simply do not desire to get involved in a public battle over every country’s proven reserves claim.

Ovi,

The 3050 Gb scenario includes conventional oil (2800 Gb), tight oil (90 Gb) and oil sands(aka extra heavy oil) from Canada and Venezuela (150 Gb). The extraction rate is for conventional oil only (separate models are done for tight oil and extra heavy oil and the total is added to the conventional model. Chart below gives total C+C, conventional only and tight oil and extra heavy models (right axis), no extraction rate, this is a revised model (2920 Gb) with an assumed decrease in extraction rate after 2045 (extraction rate decreases from 5.6% in 2045 to 2.35% in 2100 and to 0.1% by 2200.) I assume we transition gradually away from crude oil use over that 155 year period.

I remember doing this calculation a while back:

Non-OPEC reserves = 308 billion barrels

Non-OPEC production = 50.37 million barrels/day

OPEC reserves = 1189 billion barrels

OPEC production = 30.25 million barrels/day

(50.37 million barrels/day / 308 billion barrels) / (30.25 million barrels/day / 1189 billion barrels) = 6.4

In other words, non-OPEC produces 6.4 times more oil per barrel of reserves than OPEC.

So either OPEC is extraordinarily incompetent at producing oil, and/or they have really bad oil fields, and/or their production cuts are very effective, and/or they’re lying about their reserves.

Frugal,

Alternatively, OPEC has a lot of proved undeveloped reserves that they choose not to develop at present because it would result in an oil market that is oversupplied.

Also the extra heavy oil reserves in Venezuela and Canada should be excluded, so at the end of 2018 we have:

OPEC=981 Gb

non-OPEC=325 Gb

I do agree that OPEC reserves are likely overstated, but my guess is by a factor of 2 rather than a factor of 3 as Ron often claims. The difference in R/P ratios is due to a difference in the level of development of reserves in OPEC vs non-OPEC nations.

Alternatively, OPEC has a lot of proved undeveloped reserves that they choose not to develop at present because it would result in an oil market that is oversupplied.

Really now? And just which countries have these proved but undeveloped reserves?

Yes, there are a lot of very tiny undeveloped pockets of oil scattered around the Persian Gulf area. But the reason they are undeveloped has nothing to do with fear of oversupplying the market. They are so small and so remote that it would be uneconomical to develop them. And at any rate, the total reserves in all these tiny pockets would not be significant.

I am sorry to have to keep pointing this out to you Dennis, but you keep insisting that these “proven but undeveloped” fields exist. But there is not one whit of evidence that these massive proven but undeveloped reserves exist.

But the very serious flaw in your logic is that these fields remain undeveloped for fear of oversupplying the market. For the last 80 years or so, every oil-producing nation on earth has tried to maximize its oil production. This includes all OPEC nations.

Saudi Arabia shut down production in Khurais in the 1960s because of low pressure and the remote desert location and the low price of oil made it uneconomical to remedy this problem. But the spike in the price of oil early in this century changed all that and a massive water injection system was installed and the field came back online in 2009.

Manifa had far more serious problems. Its oil is heavy with vanadium and hydrogen sulfide, making it virtually unusable. But the very high price of oil combined with falling production in Ghawar and Saudi’s other super-giant fields made it mandatory that the Manifa be developed. Saudi had to build their own refinery designed to handle the contamination. It was estimated in 2011 that Manifa would cost $17 billion and another $90 billion expanding its refining and petrochemical assets. I have no idea what the final cost was but I would bet it was much higher than their 2011 estimate.

But Saudi Arabia has no more mothballed fields to bring back online. Nor are there any other such giant fields anywhere in the Middle East that can be brought online. No Dennis, I am sorry but those huge proven but undeveloped fields do not exist anywhere in OPEC.

Of course, there is the heavy oil in the Orinoco basin, but that is another story.

Ron,

As I have pointed out before, I said reserves, not fields. Often as a field is developed and knowledge improves along with the development of new technology the estimates of reserves and what can be produced profitably will change. So there may be reserves that will require new wells to be drilled in order to access.

It is also possible that 100% of reserves have been developed (though this is not the case in the US and I doubt it is the case anywhere in the World.

In the US at the end of 2016 there were 17.3 Gb of proved non-producing crude reserves. See

https://www.eia.gov/dnav/pet/PET_CRD_NPROD_DCU_NUS_A.htm

Total crude reserves at the end of 2018 were 43.8 Gb, so 39% of US proved reserves were “non-producing”. for total crude reserves see

https://www.eia.gov/dnav/pet/pet_crd_pres_dcu_NUS_a.htm

I would suggest that for OPEC nations the percentage of non-producing reserves is higher than the US as some OPEC nations seem to limit output to prevent oil prices from crashing.

As neither of us have much data for OPEC, we can only speculate, so we will simply continue to disagree.

US proved reserves estimates have grown over the past 40 years, an assumption that there has been no growth in OPEC reserves seems a bad one from my perspective.

I did a post on this 5 years ago

http://peakoilbarrel.com/us-oil-reserve-growth-2/

little has changed since then.

Often as a field is developed and knowledge improves along with the development of new technology the estimates of reserves and what can be produced profitably will change.

The first Saudi field, Dammam #7, was discovered in 1938. The very last, Shaybah, in 1968.

Dennis, you need to get real. These very old giant fields have already undergone all the technological development they will ever undergo. There is no more “reserve growth” left in any of the very old Saudi giants. Their “reserve” has already undergone all the growth it will ever grow.

Ghawar, for instance, has undergone massive infill drilling with horizontal wells, some of them MRC wells, that skim the top of the reservoir. That is the last “technological development” this old supergiant will ever undergo. It is currently pulling up a lot of water. And that percentage is increasing.

Alternatively, OPEC has a lot of proved undeveloped reserves that they choose not to develop at present because it would result in an oil market that is oversupplied.

Exactly which proved reserves does OPEC have that they’ve decided not to develop at the moment? If these undeveloped reserves actually existed, wouldn’t OPEC nations tell the World about them? Most of them don’t have any compulsions about bragging.

I grant that Orinoco hasn’t seen much development yet, but that’s because Venezuela can’t, not because they chose not to.

Using your numbers that exclude extra heavy oil we get:

(50.37 million barrels/day / 325 billion barrels) / (30.25 million barrels/day / 981 billion barrels) = 5.0

Still way too high of a ratio to be real.

I do agree that OPEC reserves are likely overstated, but my guess is by a factor of 2 rather than a factor of 3 as Ron often claims.

If this is the case, then the OPEC vs non-ratio will be 2.5 instead of 5.0, which is still too high. It really should be close to 1.0 unless those proved but undeveloped reserves make up a much larger share of the total reserves in OPEC countries vs non-OPEC countries. And this claim requires evidence.

If insufficient evidence for this claim exists, then this suggests that OPEC overstates their reserves by a factor of > 4, not 2 or 3.

Frugal,

OPEC limits output, non-OPEC nations mostly doe not (until very recently). An assumption that the R/P ratios must be the same everywhere, is not born out by looking at the numbers for individual non-OPEC nations, it varies from place to place.

You can assume what you want, does not make your assumptions correct.

Lack of data makes it impossible to answer the question.

Ron,

Technology used in oil fields is continually being improved, as far as I know not many fields are still using 1938 technology, so discovery date of the field is unimportant. Lots of US fields were discovered earlier than Saudi fields, US output is higher. Does this mean Saudi reserves must be less than US reserves?

Is that what you are suggesting?

I doubt it, but this suggests then that R/P ratios will be different in different countries.

Also note that the important reserve number is proved plus probable reserves (2P reserves) rather than proved. That is the best estimate. For non-OPEC this is likely about 470 Gb, OPEC Reserves a good 2P estimate is probably about 650 Gb.

There is likely to be reserve growth as technology progresses and as oil prices increase.

An assumption that the R/P ratios must be the same everywhere, is not born out by looking at the numbers for individual non-OPEC nations, it varies from place to place.

We’re not talking about R/P ratios for individual nations, we’re talking about R/P ratios for two large blocks of nations, OPEC and Non-OPEC. Any differences between individual nations are smoothed out by averaging all the nations in each block.

It’s unrealistic to believe that the R/P ratio should be 5 times greater for one block of nations versus another block of nations. Are the two block really that different from each other in how they produce oil?

Technology used in oil fields is continually being improved, as far as I know not many fields are still using 1938 technology, so discovery date of the field is unimportant.

Dennis, below is a drawing of Haradh, the southernmost field in Garwah. Because the rock is so tight, they are using Maximum Reservoir Contact wells. You can see the water injection wells on the periphery of the field. There is no oil beyond this periphery. This is the latest technology. Haradh will never experience any further reservoir growth. Ditto for the rest of Ghawar. Ditto for Saudi’s other very old supergiant fields.

You are simply mistaken, very mistaken, about Saudi having large amounts undeveloped reserves. And anyone who knows anything about Saudi oil reserves will tell you the same thing. I have no idea why you are so fixated on Saudi, or OPEC, having large amounts of undeveloped reserves. All I can say is you are so badly mistaken.

I will have nothing more to say on this subject, (today). 😉

Frugal,

Yes the groups are very different, one group produces all it can, the other group limits production to keep oil prices from crashing.

I agree that the OPEC reserves are inflated,

I use a conventional C+C assumption of 2800 Gb (includes any future discoveries and reserve growth that might occur in the future. This would correspond to 2P, reserves and then some additional quantity of possible reserves and contingent resources that is likely to be produced in the future.

So through the end of 2018 about 1335 of conventional C+C has been produced, that leaves about 1665 Gb to be produced if the 2800 Gb estimate is correct, 2P reserves for non-OPEC are roughly 470 Gb and for OPEC perhaps 650 Gb (both these estimates exclude extra heavy oil from Canada and Venezuela). These three (1335+650+470) add to 2455 Gb, which would imply new discoveries plus reserve growth of 345 Gb over the next 180 years.

Just as two nations will have different R/P ratios, two groups of nations would also be expected to have different R/P ratios, particularly when one group produces as much as possible and the second limits their production in order to keep oil prices high.

Also the World Petroleum Assessment by the USGS in 2000 (20 years old, very much in need of an update) had conventional oil technically recoverable resources plus cumulative output at about 3000 Gb, my mean estimate is 200 Gb less than this and also consistent with Jean Laherrere’s 2018 World URR mean estimate.

Ron,

Nowhere did I say Saudi, I said OPEC, I imagine each OPEC nation has internal 2P estimates that are revised over time as technology, prices, and their level of knowledge of their oil resources changes over time. US reserves have grown, and this has likely happened everywhere in the World, but the data from OPEC is not good, so any estimate is speculative.

Here’s a graph from OPEC’s website:

World Proven Crude Oil Reserves 2009-2018

From 2009 to 2018 non-OPEC added 24.6 billion barrels of reserves while OPEC added 186.2 billion barrels of reserves.

186.2/24.6 = 7.6

So OPEC is 7.6 times better than non-OPEC at finding new reserves and 5.0 times worse at producing oil from these reserves.

Your link was broken Frugal, but I fixed it.

Thanks Ron.

Frugal,

Most of that was Orinoco belt resources. If we exclude oil sands in Canada and Orinoco reserves,

we have for non-OPEC 270 Gb in 2005 and 325 Gb in 2018 (an increase of 55Gb or 20%) and for OPEC 933 Gb in 2005 and 981 in 2018 (an increase of 48 Gb or 5%).

Most of that was Orinoco belt resources.

Naw, that was my first thought. But after doing a bit of research I found that Venezuela increased its reserves to that astronomical number in 2010.

That increase is mostly Iran and Iraq in their race to have the second-highest OPEC reserves. Plus a bit more from other OPEC nations doing their thing to increase their reserves as well of course.

Ron,

The majority of Iran, Iraq, Saudi increases happened before 1990, from 2005 to 2018 the increases (using BP Statistical Review of World Energy) in OPEC conventional reserves (excludes Orinoco) were actually less than the increase in non-OPEC reserves (excluding changes in Canadian oil sands reserves). On a percentage basis, the OPEC reserve increases were 4 times less than the non-OPEC increases.

The Venezuelan Orinoco reserves increased from zero in 2005 to 261 Gb in 2018. Total OPEC reserves increased from 933 Gb in 2005 to 1242 Gb in 2018 an increase of 309 Gb, the Orinoco reserve increase accounts for 84.4% of the OPEC increase in reserves over the 2005 to 2018 period.

Oh well: WORLD’S LARGEST PROVEN CRUDE OIL RESERVES BY COUNTRY (2010)

Last January 20th (2010) Venezuela’s Oil Minister, Rafael Ramirez, said that his country had already surpassed Saudi Arabia to become the nation with the largest proven crude oil reserves in the world, at 297 billion barrels.

Ron,

I use BP data from

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Most of Venezuela’s “proven reserves” for the Orinoco basin are unlikely to ever be produced, probably no more than 75 Gb will be produced, best estimate about 60 Gb total. My recent Oil shock model has extra heavy oil URR of about 150 Gb from 1965 to 2250 (output from Canadian oil sands and Orinoco belt), probably 90 Gb from Canada and 60 Gb from Venezuela. Cumulative extra heavy oil production through the end of 2018 was about 17 Gb, and the model has cumulative extra heavy oil output of 140 Gb through 2100.

My estimate is that much of the proven reserves of extra heavy oil (424 Gb at the end of 2018) will never be extracted, about 291 Gb will be left in the ground.

Ovi,

I assume there will be severe Worldwide economic disruption due to the pandemic, US consumption of C+C fell by over 33% in April. I expect the drop in World output for the year will be somewhat less, the 65 Mb/d is simply a guess. Note that the oil not produced will remain in the ground and can potentially be extracted later, wells not completed now can also be completed later. When oil prices go from $20/bo to $100/bo, there will be many more resources that are profitable to produce.

I expect the new peak between 83 and 87 Mb/d for World C+C will be reached some time between 2025 and 2030, the precise path of output is unknown.

Note that the USGS estimated World C+C URR at about 3000 Gb for conventional resources in 2000, they expect unconventional (they call these continuous resources) to be about 1000 Gb. So about 4000 Gb of C+C for total URR, my estimate is only 75% of this and is quite conservative. For conventional I have 2800 Gb for conventional and for unconventional (tight oil and oil sands) about 250 Gb.

Also note that my current estimate for URR is very close to that of Jean Laherrere, historically his estimates have been quite conservative.

Ovi,

An alternative scenario that matches the 9% decrease in oil consumption for 2020 predicted by the IEA (I have assumed production for the year also falls by 9%). This scenario peaks in 2028 at 84 Mb/d and URR is lower than the previous scenario because I assume in this case extraction rate falls after 2050 as we gradually move to other energy sources for transportation, URR is 2920 Gb, cumulative C+C output through 2019 is about 1400 Gb and cumulative C+C output reaches 1660 Gb at the peak in 2028 (57% of URR). The assumption that the output curve must be symmetrical may not be correct.

Well, the Nov 2018 C+C world peak will stand.

Hightrekker,

Perhaps correct, I only pay attention to annual average output, the 83 Mb/d level of 2018 is likely to be exceeded in the future in my opinion, probably before 2030, I would put the probability at 60%.

The change in productivity per rig is simply to align current tight oil estimates with rig estimates in the DPR, it is simply a model calculation, output per rig (lagged by 2 months) just depends on the output divided by the rigs. The model simply takes total rig count, a better model would look at gas rigs and oil rigs separately and apply each of those counts to a separate oil and gas model, also the counts in the DPR do not seem to match the data from Baker Hughes very well, they also seem to include vertical wells which seems to be a mistake if we are trying to model tight oil.

There are a bunch of problems with the EIA’s DPR model, their “new well oil production per rig” metric is not particularly useful, it can change depending upon the ratio of vertical to horizontal rigs (the horizontal rigs are far more productive) or a change in the ratio of oil rigs to gas rigs (gas rigs don’t lead to much oil output and oil rigs to a lesser extent tend not to increase gas out put by that much (Permian basin may be an exception, but much of the gas produced is flared there).

So bottom line little can be gleaned by changes in rig productivity as reported by the DPR.

The well completions given in the DPR are also problematic, the best data for completion rates is at shaleprofile.com, but they are currently accurate only through about June 2019, after that a model is needed to estimate completion rates, using well profile estimates and tight oil output estimates from the EIA (not from DPR).

Dennis

I don’t understand the first statement in your reply. Attached is a similar table as in the original post above, for February 2017. At that time, average output in the Permian was 664 bbls/rig. In March 2020 it was 807 bbls/rig.

According to previous discussions on this site, productivity increases were related to increases in well length, addition of laterals, number of fracks, sand load, well spacing, etc. Then production per foot appeared to provide additional insight into productivity. So it was these physical improvements that allowed the Permian to go from 664 bbls/rig to 807 bbls/rig. Somewhere along the line I think I read that output per linear well foot had peaked.

As for oil and gas rigs affecting the productivity, the DPR does distinguish between the two.

If I take this statement at face value “output per rig (lagged by 2 months) just depends on the output divided by the rigs, with which I agree. Not sure about the two month lag. Is it the two months associated with the peak LTO output that occurs in the second month of production as shown in the shale profile charts?

So in the post table above, the Permian March number, 807 bbls/rig, reflects what was happening in January 2020. Also the revised April 2020 number, 677 bbls/rig, reflects what was happening in February. From your chart below Frac spreads were still over 300 in February.

Nothing seemed to change in February. So I still don’t understand what could cause such significant drop.

Ovi,

The drop is just a model adjustment, the new well Rig productivity is a calculated number, the DPR gets a bunch of numbers wrong because their model is not very good, well completion numbers are wrong, rig productivity is wrong, output is often wrong and then later revised.

The change from March to April, may be due to a significant revision in output from the March to April report.

Bottom line the drop is not real, it is an artificial drop due to a change in the model. Note that output from the model has been revised significantly in the past few months, the new well productivity per rig had to be revised to match. The change is likely not real, the March model estimate was wrong, April was revised to better reflect reality.

Also keep in mind that new well productivity per rig can change based on what the rigs consist of, the DPR takes total rig count and does not distinguish between oil rigs and gas rigs and between horizontal rigs and vertical rigs. So even if the new well productivity was unchanged, the new well productivity per rig can change if there is a higher proportion of vertical rigs (the vertical wells are lower productivity) or gas rigs (gas rigs tend to produce more gas and less oil) so the amount of new oil produced per rig can change based on the kind of rigs that are running. Assuming the ratios of these various rig types to the total rig count will remain stable seems to be an underlying assumption of the DPR model, it is a very poor assumption as can be seen by simply looking at the Baker Hughes data.

Also if you compare the EIA data for rig counts with Baker Hughes data the numbers don’t match very well, there are just so many problems with the DPR, I simply ignore it, it just is not very useful.

Ovi,

The main point is that new well productivity depends on two factors. Factor one is the average productivity of newly completed wells and factor two is the average number of completions per rig.

You suggest factor one is likely to be the explanation for the change in new well productivity per rig and ask if there could be another explanation. The alternative explanation is a change in factor 2 which can be explained by changing proportions of gas rigs to oil rigs and/or the proportion of horizontal to vertical rigs as well as changing rig efficiency as rigs are added or rigs are stacked, it can also depend on the ratio of frac spreads to drilling rigs.

The data from shaleprofile.com suggests that the actual average well productivity in the Permian basin has been flat to slightly rising over the 2016 to 2019 period, it is too early to evaluate 2020 average well productivity (not enough data), but I suspect any changes in average new well productivity for horizontal oil wells has been minor, if anything I would expect high grading would tend to increase average new well productivity, but the best guess is continued flat average new well productivity.

Frac spread count

https://twitter.com/PrimaryVision/status/1256381399965356035

a snip from 13:43 of video below.

Below I estimate oil focused frac spread count by looking at the relative proportion of horizontal oil rigs (HOR) and horizontal gas rigs to the total horizontal rig (HR) count and dividing up the total frac spread (FS) count between gas frac spreads and oil frac spreads (OFS).

By my estimate the OFS count has fallen by almost a factor of 10 in the past 5 weeks from 205 to 21.

The gas rig count has fallen much less rapidly because we have not seen the same crash in natural gas prices as we have seen in the price of crude oil, so we assume the gas frac spreads have not decreased very much (in comparison to oil frac spreads).

If we consider 4 week average OFS count that has fallen from 243 to 82 in the past 5 weeks, I expect this 4 week average will be under 20 in 4 weeks time and may fall to zero by June 2020.

Frac spread @ 47 down 8

Total US rig count @ 374 down 34

Oil rigs @ 292 down 33.

All numbers are new lows.

WTI @ $24.74

Brent @ $30.97

US Big Oil is losing money during this time, but I can’t imagine that Big Green has stopped advancing its tech. After this pandemic, the market may reboot with the two of them on more even footing and Big Oil won’t have as much political muscle (read: money) to impede them. This whole thing may have a net effect to speed up the adoption of green tech where it can replace oil.

Why do you think there will be an after?

Waah waaahhh.

Ron and shallow.

In the previous thread you were speculating about Alaskan production and TAPS flow.

Alaska has the best data (to my knowledge) in the world and is never more than a few DAYS old.

TAPS flow rates

https://twitter.com/AlyeskaPipeline/status/1254782807835987970?s=20

Production

http://tax.alaska.gov/programs/oil/production/ans.aspx?4/1/2020

The assumptions in this post are on the low side for actual production however if as Shallow says wells are to be shut down it will show in the data within a few days.

Lightsout. Thanks for this info!

Dennis or Ron – I suggest you just ban this chap’s email and ip addresses, then the original log in names should be unaffected.

Concerning BP Reserves. I went and looked at a footnote below their table and Ron’s comment up above about it being a rubber stamp for official sources looks partially and maybe even mostly correct, but not entirely. There’s a lot of wishy-washy words, but the bottom line is they go to secondary sources and what they call third-party sources as well as official sources. They even mentioned the Oil & Gas Journal as a source for their reserves information. Surprising.

George Kaplan wrote:

Dennis or Ron – I suggest you just ban this chap’s email and ip addresses, then the original log in names should be unaffected.

George, when I deleted the post you replied to, your post disappeared also. But this guy uses different email addresses. He is a pro and knows how to get around anything. In this case, he used my email address even though it said “0 approved”.

But the crap he posts are links to stupid right-wing posts. All I can do is delete them. But everyone should know that when I delete them their replies to such posts will be automatically deleted also.

This person is probably using a commercially available VPN (Virtual Private Network)

Like NordVPN (which costs 3 bucks a month)

https://nordvpn.com/

You can dynamically change your IP address at will and block cookies (the way to track people you on internet)

As far as changing email addresses that is trivial as well….just type in whatever one you want.

Not much you can do about it, for free…

Ron,

Perhaps you can use an alternative private email address for your comments (that does not get sent out in bulk emails) and then ban your own email address (the one that is widely known).

Okay, I might try that. I will see if this guy persists in his nonsensual right-wing posts. Such deception is so very typical of a Trumpite. Why are Trumpites so damn dishonest?

“use an alternative private email address for your comments ”

Dennis, do you also think others should change their email address. Its seems as if anyone is vulnerable to this hack.

Hickory,

No need, only Ron and I can see the email you use on POB, this person is using Ron’s email and names that are familiar to fool the system, a few of these may continue to slip through, we will try to delete as we catch them. Mostly we need to be careful about revealing our email addresses on the forum, if it is a concern you could create an email that is never revealed that you only use here, but that might just cause more headaches, let’s try this for now.

Can you deal with the astroturfers that show up too?

NAOM

Not sure what that is.

People are free to disagree or ignore the comments of others.

https://en.wikipedia.org/wiki/Astroturfing

Many just turn up once or twice so ‘Ignore’ won’t help much but they tend to derail discussion which is their intention. Their current target is lifting the lockdown and may well be linked to groups supported to the deVos family who are sponsoring many groups that are driving the open up protests.

NAOM

Too much work to deal with Astroturfers, if we ignore them, maybe they go away.

U.S. Oil Market Setting Up For Another Crash

With the USO ETF (ETP) doing a 1:8 Reverse Split, the BRAINDEAD Retail Investors have come in glorious fashion, buying via a record number of account holders. Furthermore, with the USO ETF now holding about 1/4 of the futures contracts, it will be interesting to see who is left holding the BAG when someone has to take delivery and store the oil.

While 30% of USO ETF holders liquidated positions over the past two days, there are still 145,000 account holders. Will be interesting to see how this plays out.

With the U.S. oil companies selling their oil via the futures, they don’t care who the hell buys the contract, they are covered. So we are going to see a similar MARKET DISASTER when the oil price went to a negative $37. However, it may not take place during the June Contract (May 19th expiration), but most likely during the July Contract (during early June).

As U.S. inventory levels continue to build over the next 2-3 weeks, along with the 40 million barrels of oil heading our way, not including the floating inventory already off the coast of Texas and California, the oil market will destroy the BRAINDEAD Retail USO Investor and Amateur Futures traders.

steve

When will Texas be a Net Oil Importer?

Bakken down 405K/day and falling fast:

Helms said total production curtailed came to 405,000 bpd as of April 24, when the latest data was made available, up from 295,000 bpd reported three days earlier. Producers shut 6,200 of the state’s 16,000 wells, up from 5,000 over the same period.

https://www.reuters.com/article/us-global-oil-shale-north-dakota-insight/like-watching-a-train-wreck-the-coronavirus-effect-on-north-dakota-shale-oilfields-idUSKBN22G1C2

Stephen,

I expect frac spreads in the tight oil plays may fall to zero in May and tight oil completions will be zero.

Based on shaleprofile.com data, if all wells producing less than 100 bo/d were shut in at the end of February, that would have reduced output from 1400 kb/d to about 1000 kb/d. At the end of February there were 10,918 wells producing less than 100 bo/d in North Dakota of 15,780 total wells. Note also that at the end of February only about 14000 of the 15780 wells were producing, so if 6000 of the producing wells were shut in that brings us to about 8000 producing wells, so there are likely about 1100 of the wells that were producing less than 100 bo/d at the end of February, that are still producing if Helms estimates are accurate. Of course the numbers change over time so estimates are rough. In any case a severe drop of 29% in a short period. If the same happens for US tight oil in general, we would see US output drop from 8000 to 5700 kb/d, but note that prices are lowest in the Williston Basin, so we would be likely to see thing shut down there first.

It also depends on how much of output has been hedged, not sure we have a good estimate of that number.

Dennis,

The reason Harold Hamm is shutting in most of his production in the Bakken because NONE OF IT is hedged. Continental Resources is the poster child of what’s wrong with the U.S. Shale Oil Industry.

steve

Steve.

Why wouldn’t companies just cash in the hedges and shut in?

If I was hedged and could do that, I would.

Surprising how once you are shut in, things don’t seem so bad. Employees will be the issue once PPP runs out during June.

However, if the entire US onshore would just not complete a well in May, and shut in the 90+% of wells that can be safely shut in from now till after Memorial Day, this glut would have a large chunk removed.

Shallow,

The situation in the U.S. oil patch is quite a shame. While I realize there are real people behind all these companies, service and etc, no one ever thought about how fragile shale oil production is as an energy source.

And, unfortunately, it’s not just the oil industry that will be in a depression, but also the U.S. economy. With oil being the number one driver of economic growth, most analysts fail to comprehend what is taking place in the United States and world.

steve

“The mass of men lead lives of quiet desperation. What is called resignation is confirmed desperation.”

— Henry David Thoreau, Walden

Dennis.

I suspect the largest drop in percentage terms over 2020 may not be in North Dakota, but instead in Oklahoma.

Enno Peters made his first Oklahoma post, which showed what I expected. Oklahoma shale as an oil producer is a lot of hype, with little to back it up. The wells are expensive, more than other basins, which also doesn’t help.

Rig count has fallen from over 100 one year ago to 15, soon to be near zero.

Also, of the 500K BOPD, around 150K are from stripper wells. After Texas, Oklahoma is the next largest stripper well State both in terms of wells and barrels (although CA might be in the ballpark, I don’t know as much about CA production).

Many stripper wells in OK have been shut in. Add that to a large decline from unconventional wells, it wouldn’t surprise me to see OK hit a low between 100-200K BOPD.

Shallow sand,

Thanks for the heads up, I usually think in terms of the big 4 basins, Permian, Bakken, Eagle Ford and Niobrara. I wasn’t aware Mr Peters had done an Oklahoma blog post, a pretty minor player at only 400 kb/d, though Niobrara is only a bit bigger at a peak of about 600 kb/d.

I agree Oklahoma does not look viable based on well profiles, though I don’t know what the well costs are like there so more analysis would be needed to make a good judgement. The fact that the rig count has dived, suggests it will need high oil prices for further investment. Of course in the present oil price environment there is not any well in the US that makes much sense to produce unless a small amount of production is needed to protect the well. Even in those cases the economics may point to shut in.

Shallow Sand

Out of curiosity, what was so extra revealing in Enno’s Oklahoma post that wasn’t evident in the Oklahoma chart and comments shown in the original post above.

The EIA January/February report shows production in the 530 to 560 kb/d range. Enno is at 384 kb/d from horizontal wells. Add in the 150 from strippers and you get to 534 kb/d. I didn’t know they had so many strippers in Oklahoma.

Ovi,

There is a lot of information in the shaleprofile blog posts, for example the cumulative well profiles as shown in the chart below, maybe 80 kb at 36 months won’t pay for much, at $60/bo at wellhead and assuming 36 month payout we would need a well with full cycle costs of only $2.6 million for a profitable venture, my guess is these wells cost 2 times that amount, so it explains why rig counts have fallen so fast in Oklahoma, you cannot get this level of information from EIA data. The well profiles are under the well quality tab at shale profile, there is also completion data(see well status) and much more, all available for free.

Dennis

I reported on the drop in rigs from January to May 1 and they were down to 13 rigs, a drop of 75%. Also reported on how the Oklahoma Corporation had given the oil companies permission to shut their wells without losing the lease rights. So pretty obvious that output is going to drop precipitously and you could see it starting in the chart.

What tweaked my curiosity was this statement, “Enno Peters made his first Oklahoma post, which showed what I expected”. What was the new piece of information that showed what he expected?

So as I am curious what that extra information was that showed what he expected?

I am not implying that I present all the relevant information. I certainly appreciate information from our participants who are in closer contact with local issues.

I have a vague recollection that SS made a comment, possibly 6 months back that Louisiana was going to drop. I did a bit of digging and found that the Louisiana LTO basin had complex geology that stymied the hopes for a Permian Jr.

As I said, just curious

Ovi,

I am just commenting on what I found interesting, also this is Enno’s first post on Oklahoma so it is new information from a source besides the EIA, some of the EIA data in the DPR does not agree well with Baker-Hughes data and also the completion data is different from the data at shale profile, generally I find the shale profile data to be more accurate.

Another BLOW to Bakken Producers.

North Dakota Light Sweet Crude = NEGATIVE $0.98 a barrel.

steve

Steve:

Plains All American, through its subsidiaries, whacked most everyone onshore lower 48 effective May 1. The same applies for June, although things may get a little better.

This is why you see so many commitments to shut down in May and June, regardless of what happens to WTI in May and June.

Shut ins and complete stoppage of well completion activity will drop US May and June oil production by quite a bit, I predict.

We won’t know the true extent until later in the summer, given reporting lags.

North Dakota will be a good early indicator, as will Alaska. The other states are slower to report.

I guess I should be all doom and gloom, but I guess I just have decided there is no reason to be that way.

I think we hit peak worldwide oil output in 11/18, and it will take a huge amount of CAPEX to get back there.

We can turn our wells on and off, if it weren’t for our employees, this wouldn’t be a big deal to us.

The oil traders (IMO) are going to go way overboard here, as are companies like Plains and their customers, the refiners. The oil price has went way below operating costs, and will stay there too long, creating the possibility of a huge slingshot in the other direction.