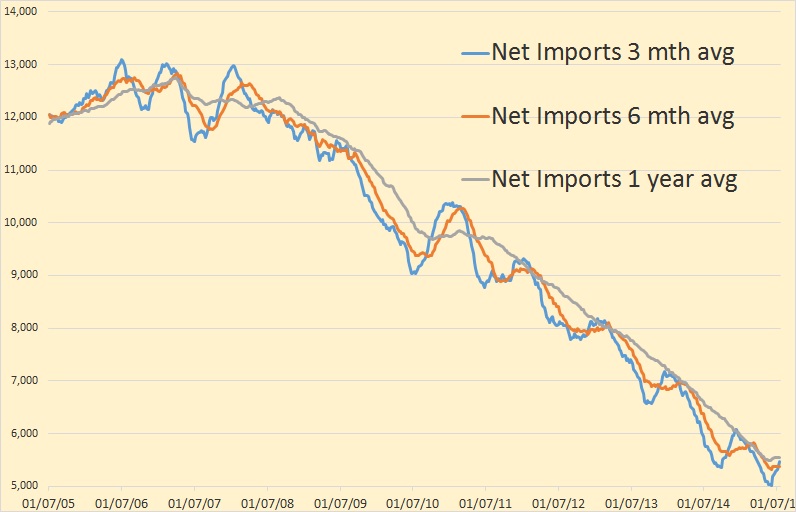

Even before the shale revolution got underway, US net imports were falling. The data below is from the Weekly Petroleum Status Report and is in thousand barrels per day.

This chart shows net crude oil and petroleum products imports. Net imports peaked in 2006 and started to fall in earnest in 2008. They continued to fall until 2010 when the three month average increased sharply and the annual average leveled out for about a year. Then as the Light Tight Oil revolution got underway in 2011, net imports started to fall again.

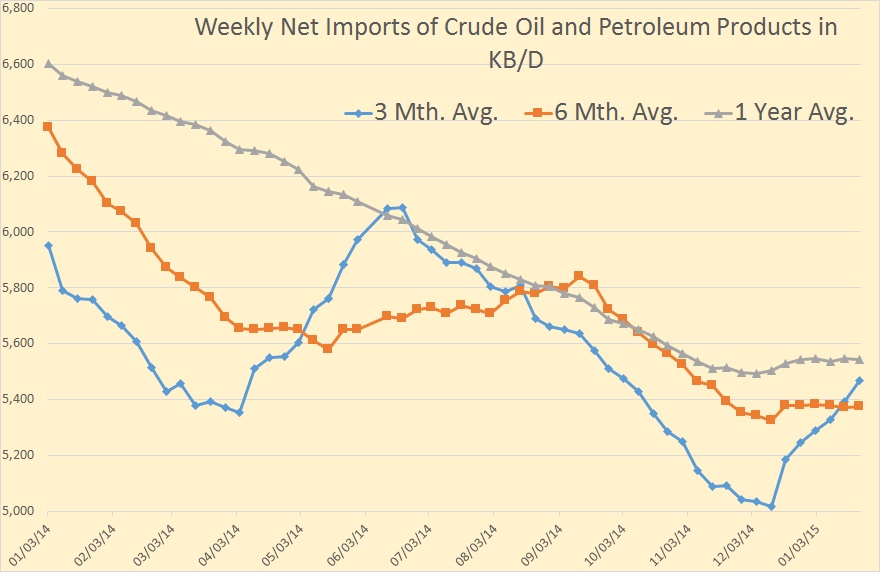

The chart above shows net imports bottom out in late spring, March and April and heads back down again in June. Below is the last year of that chart amplified.

But in December of 2014 net imports broke their trend and headed sharply up, about four months earlier than normal. Much of this increase in imports had to be caused by declining US production though part of it could be caused by increased consumption because of low prices.

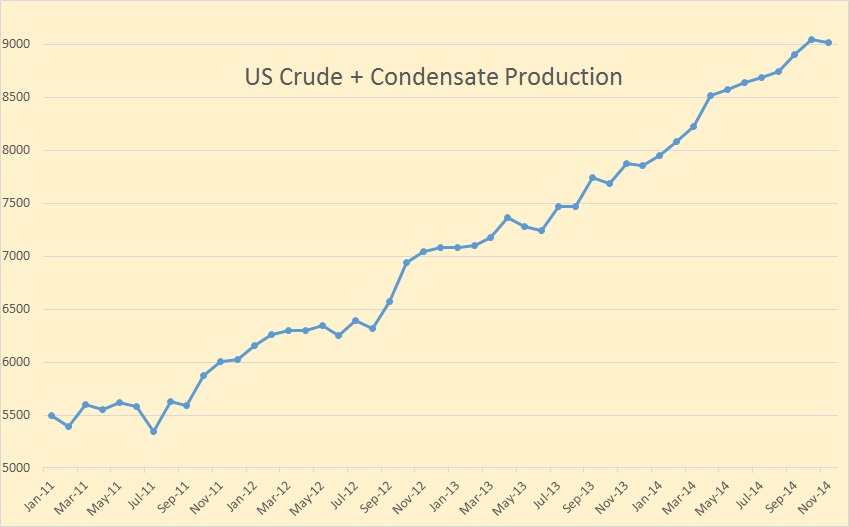

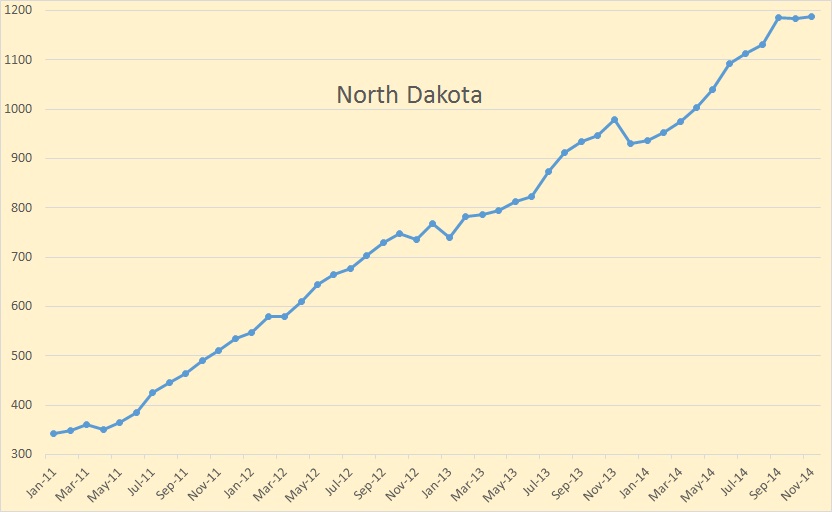

The EIA’s Petroleum Supply Monthly is out with US and individual states production numbers for November 2014. Below are some charts from that data. The data is in thousand barrels per day with the last data point November 2014.

US, down 31 kbd to 9,020,000 bpd. This is the first time the US has had a monthly decline that wasn’t blamed on a weather event in quite a while.

Texas, up 48 kbd to 3,403,000 bpd. Because of Texas’s reporting procedures the EIA has to guess at their oil and gas production. And their guess is that Texas oil production is behaving as if oil were still $100 a barrel. I believe there will be some big revisions in this data in a few months.

North Dakota, up 3 kbd to 1,187,000 bpd. At least they get North Dakota right.

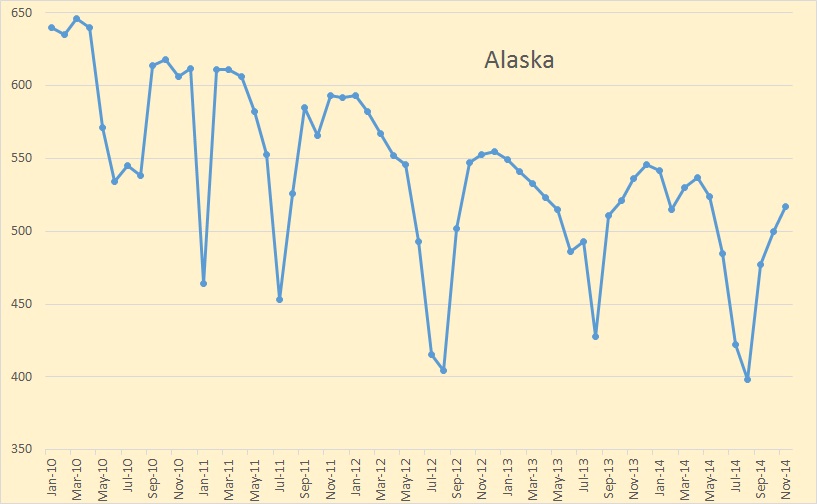

Alaska, up 17 kbd to 517,000 bpd. Alaska always bottoms out in August, for summer maintenance, and peaks in December. The spike down in January 2011 was due to the pipeline leak and had to shut down for several days

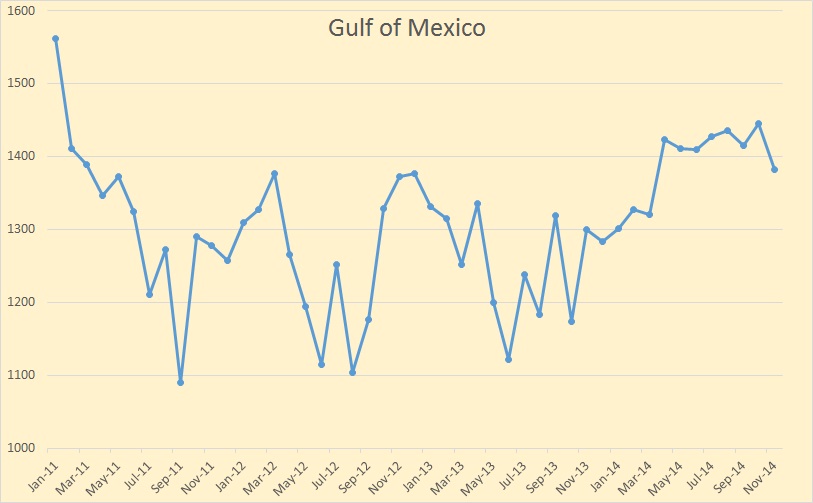

GOM, down 62 kbd to 1,383,000 bpd. They had expected a lot more out of the Gulf of Mexico by now. The EIA predicted 2 million barrels per day from the GOM by 2016. I just don’t think that is going to happen

Below is a short essay by Tom Giesen a Natural Resource Policy instructor at the University of Oregon. He calls it: A Primer on the Oil Situation

Oil has been relatively inexpensive, energy intensive, portable, relatively safe, convertible to myriad uses – an incredibly useful substance, especially in regard to transportation. In the US, and globally, oil powers virtually all movement of people and goods, and is the source of many products. It appears to many people to be essential.

Oil comes in at least these categories:

- Conventional oil: vertically drilled wells on land or shallow continental shelf. Conventional oil, worldwide, is past its peak of production (it peaked in 2005-8 per the International Energy Agency), and oil production is declining at an average rate of 5.8% per year (Whall and Nelson. Investec. “Global oil supply: the decline rate problem” 2/2014, page 11).

- Unconventional oil comes from oil-laden shale, requiring vertical and horizontal drilling, and also requiring hydraulic fracturing, or “fracking”. It is more expensive to produce than conventional oil. Unconventional oil appears to be in a state of transition. Oil prices were high (~ $100/barrel) from about 2011 to mid-2014. Those high prices supported rapidly expanding new shale oil production, adding nearly 5 million barrels/day of unconventional shale oil to American production, and more than off-setting the worldwide decline in conventional oil.

However, the price of all oil has been dramatically declining (today it is about $45/barrel) – more than a 55% decline – and, in most cases, the price is insufficient to cover shale oil production costs plus profit. Some shale wells are shut in; only very productive shale oil wells will continue to be operated. Conway Mackenzie Inc., a liquidator, predicts large losses in shale oil production-related businesses in the next quarter, especially if prices continue to fall.

Shale oil production has slowed due to low prices. Shale oil operators are cutting the numbers of operating drilling rigs and laying off employees as losses accumulate. Reservations for rail tank cars are off by 30%. Shale wells have a short economically productive life, with the first year typically good, and production then diminishing dramatically by the end of year 2 or 3.

- Tar sands are a mixture of sand and bitumen. Heat is used to separate the bitumen from the sand, and the bitumen is then cut with lighter hydrocarbons and refined to be similar to crude oil. It is generally more expensive than shale oil to produce, but much of the cost is related to building the initial plant. It seems likely that on-going production will be continued for a time as all but operating costs were covered in the initial investment. Production is relatively small.

- Ultra-deep oceanic wells are expensive and high risk. For example, the Macondo well in the Gulf of Mexico, which blew out, was a major ecological/financial disaster for BP. However, some deep drilling is continuing. Arctic drilling has not been successful and instead has caused huge losses for Shell.

The long decline in oil prices from July 2014 to the present has several causes. Due to faltering major economies (e.g., EU, Japan, Russia, and a slowing of growth in China), the demand for oil diminished. At the same time, American shale oil production was booming. The result was abundant oil in a depressed market for oil, and those circumstances led to a long tumble in oil prices, which may continue. Many enterprises, profitable at $100/bbl., were unable to continue at substantially lower oil prices.

The extent of fracking is declining for economic reasons. However, the only because Richard Cheney, VP under President George W. Bush, pushed through laws in 2005 which exempted oil and gas production from these existing laws:

Clean Air Act, Clean Water Act, Safe Drinking Water Act,

National Environmental Policy Act, Resource Conservation and

Recovery Act, Emergency Planning and Community Right-to-Know

Act, the Superfund act, and from various toxic reporting requirements

(Source Exemptions for hydraulic fracturing under United States federal law

Without those exemptions, fracking would not have been possible.

Fracking is horribly polluting via many carcinogenic agents (e.g., benzene and formaldehyde) and a laundry list of other toxics. Fracking sites are not monitored for environmental degradation, as they are exempt from regulation.

Fracking is also water-intensive, using an average of about 20 million gallons of water (plus as many as 50 different chemical additives) per well. The water – now more toxic – must be removed from the well and disposed of safely – though there are no known purification processes.

People who live and work near fracking sites are often chronically ill from the fumes, and families are often unable to sell and move – most people these days won’t buy a home near a fracked well because of toxics, so families essentially become prisoners in their homes.

That we permit fracking is testimony that, as a nation, we value using shale oil more than we value protecting our families from living and working in extremely toxic/carcinogenic conditions.

—

To summarize, production of conventional oil is declining at 5.8%/year (about 5.3 million barrels a day). Unconventional oil is declining because the current price of oil is too low in most cases to make fracking profitable. Tar sands oil may continue for a time – but future projects are on hold. Ultra-deep wells and Arctic sources are risky and expensive relative to current prices.

The global production of oil is declining.

—

Oil, unlike sunlight, is available only in finite quantities, and the flow of oil is diminishing. Oil, like coal and natural gas, produces carbon dioxide when burned; CO2 is a greenhouse gas, and is the major cause of global warming. The decline in oil production is a clarion call for renewable energy. We need the remaining oil to create the infrastructure for a base flow of renewable energy.

Our future is in renewable energy sources, not fossil fuels.

Tom Giesen is an Adjunct Instructor in Planning Public Policy and Management at the University of Oregon, teaching Natural Resource Policy.

Tom Giesen

212 Pearl #8 97401

giesentom@gmail.com

541-554-4162

Note: I post an email notice to a couple of hundred people when I put up a new post. If you would like to be added to that list, or removed from it, please post me at DarwinianOne at Gmail.com

My apologies if this was posted in the last thread, but I thought the price discussion was interesting.

http://www.cnbc.com/id/102377233

Best,

Tom

Good article but I think that the comparison of the current price of oil to the 25 year average price was particularly clueless. Who cares that the average price over 25 years was $48.00? A rational investor would compare today’s costs for a specific well against today’s expected revenues to determine if drilling the well made sense.

Well the average price, adjusted for inflation, over the past 25 years was $48 a barrel. What that tells me is that, if drillers cannot make a profit at $48 then it is costing a lot more than it used to to produce a barrel of oil. After all, the oil companies used to make huge profits at that price. It means oil is just a lot harder to produce these days.

That is my take away also Ron. It was also interesting to listen to the discussion regarding those plays that they felt were >$60-$70/ barrel.

Best,

Tom

Oleg Malentyev has the right idea but his analysis is backwards: credit market problems have caused the oil prices to crash. Right now the fuel price says the world’s economies have lost half of their borrowing capacity over the past 9 months.

The customers for oil products must borrow to bid … when they cannot borrow for any reason there is no bid = prices collapse. Customers must borrow because they cannot pay for the fuel generally by burning it.

A consequence of long-term monetary easing (Quantitative Easing or QE) is the shifting of purchasing power away from customers toward lenders and their big business clients. Businesses use the borrowed funds to buy shares and bid the price higher. This pauperization process leaves customers unable to borrow … they are as a consequence unable to take on the loan exposure of oil drillers (who are observed as being heavy borrowers at very high cost).

Indeed, some American customers are doing well enough to buy a new SUV and fuel it with cheaper gasoline, but the marginal customer is not necessarily an American; he is likely to be Japanese or European, whose purchasing power has been cut by currency depreciation by 15% or more. When the marginal customer loses his job there is little or no fuel buying at all; this feeds on itself.

Right now it is too early to feel the effects of reduced drilling and shortages. However, if last summer’s price action is indicative, shutting in of supply and accelerated depletion will adversely affect customers = more price declines.

The price will fall ultimately to the level that can be supported by actual, remunerative use of the fuel rather than loans = about $8/barrel or less. It will be interesting to see how much economy we have w/ $8 fuel.

A consequence of long-term monetary easing (Quantitative Easing or QE) is the shifting of purchasing power away from customers toward lenders

Reducing interest rates shifts purchasing power from borrowers to lenders? Could you describe the mechanism?

I struggle mightily to follow Steve’s reasoning and occasionally I get it in part. But I am coming to the conclusion that he is a WHOLE lot smarter than I am or else ….. just maybe he has his credit cart in front of the more fundamental supply and demand horse.

His insisting that you cannot pay for a car by driving it is on the surface just not going to wash with me across the board. I know tons of people who own a car than is used exclusively to get back and forth to work. Having that car is part of the de facto qualifications for that particular person holding that particular job just as much as the ability to read and write or follow instructions.

Now I do realize there is a great deal of truth in what he says about credit propping up demand.An enormous amount of truth.

I also concluded long ago that barring collapse of the business as usual economy coming very suddenly due to a violent black swan event that financial troubles would be the first unmistakable sign that things are falling apart.

Now let us look at the elephant from the other end. Maybe there is a problem with credit because there is a more fundamental problem with resources and productivity and spending on people and things that contribute little or nothing to productivity.

Without that productivity —- borrowers are not looking like good credit risks.

I am not making this comment and claiming it is a BETTER explanation or theory but rather that it is ONE MORE valid way of throwing some light on the overall problem.

We have outsourced the jobs that used to make us rich leaving our working people stuck flipping hamburgers and peddling dope and thus also putting our selves in the position of having to have a vastly expanded welfare state with a law enforcement/ judicial/ legal / prison sector that is getting so big it shows some indication of perhaps growing from the seedling ( the acorn stage is history now) it is into a mighty Big Brother oak.

But while the little folks tighten their belts the big companies are now few enough in any given industry and able to shed employees enough – what with being able to scarf up the printed money that mostly winds up as corporate welfare- I am with Steve on this point- WELL, big biz is sitting pretty and doesn’t really have any problem at all taking market share from smaller outfits or just swallowing them whole while also raising prices, exporting more real industry, getting rid of employees etc etc etc.

This general scenario has come to pass as the result of the nature of competition between individuals and businesses when political conditions are such that it CAN happen. The ” can happen” conditions are in place and have been in place for a good while now.

Now let’s see how this can play out in a given industry such as the furniture industry which is not a really hard one to get into and uses a lot of semiskilled or unskilled labor.

A manufacturer with a couple of thousand employees scattered thru a few towns in the Carolinas even though he is not paying very much in terms of wages or benefits bites the bullet and moves his production overseas.

It is necessary and proper to note that as a general thing this hypothetical manufacturer is either compelled to do so or exit the business altogether given the cutthroat competition.

He will wind up firing seventeen hundred and keeping three hundred in warehousing shipping sales bookkeeping and various other marketing types of jobs.

From his pov he has lost one thousand seven hundred potential customers out of the three hundred million population of this country.He is in the black again- perhaps deep dark rich black for a while.

But when one company after another off shores work that used to pay Americans a livable wage – well after a while that handful of lost potential customers morphs into several tens of millions of lost customers. It also means that the people at the very bottom of the employment totem pole – burger flippers – are in competition with millions more potential burger flippers. Wages crash or stagnate across the board.

In the meantime the professional and managerial and entrepreneurial and bureaucratic classes keep right on raking it in just about as fast as ever. In my neighborhood two supposedly underpaid teachers can easily become millionaires in ten to fifteen years if they choose to live on one’s salary and invest the other salary. Most families around here live on less than one teachers salary and somehow yet manage to live respectable dignified lives.

It is very hard indeed for somebody like me to compete with my cousin the mail carrier who has an orchard too and hires three people in the field for every hour he drives his car- and only a fool would consider delivering the mail to be more than semiskilled work. The place to be in my part of the world is on a government payroll if you can manage it.

(I am not bitching about this as much as simply pointing out realities. My dentist seems to average about two hundred bucks an hour gross out of which he pays his assistant and maintains a small rural office building that didn’t cost more than fifty grand when he bought it twenty years ago.He is in fact a very decent guy and charges only half as much as a lot of other local dentists. I once had an opportunity to stay in a classroom for forty years but made other choices after a while. )

Cousin mail carrier will collect at least half a million bucks in retirement bennies while the post office recedes farther and farther into irrelevance.

I see our troubles as being mostly due to resource shortages and government mismanagement on the grand scale. Politicians get elected and stay elected by promising stuff that will not have to be delivered except in small part while they are still around.

Please be advised that this is NOT an antigovernment rant but merely an observation of what I perceive as reality. I fully recognize that government is more necessary than ever and that we are facing numerous problems that can ONLY be solved at the government level – if they can be solved at all.

I fully support just about all environmental legislation for instance and while I see it as the biggest political fumble and bumble in my lifetime I support the IDEA behind OCARE – getting control of the cost of health care and making sure everybody has access. Etc

Please be advised that this is NOT an antigovernment rant but merely an observation of what I perceive as reality. I fully recognize that government is more necessary than ever and that we are facing numerous problems that can ONLY be solved at the government level – if they can be solved at all.

The reason I get so frustrated with the political discussions against government entitlements is that I know the politicians who campaign against them will never cut them. Look, in the interest of energy conservation and saving the planet, severe austerity might be a good thing. It will force a great more people into poverty, but it would stop a lot of consumption.

However, consider what would happen if the government stopped government payouts, stopped government jobs, and stopped government contracts. The US would collapse and even the most rabid anti-government people know that. They wouldn’t dare do it. They support government money just as much as the rest of the politicians. What I see is just a difference in who they want the money to go to: military contractors, prison operators, border patrols, and so on. Politicians on the right have long supported money going to those folks. A few Libertarians have supported drastically cutting back on our military budget, but you won’t find many conservative politicians to embrace that. Cutting veterans benefits, yes. Cutting military hardware purchases, no.

Well said and right on Boomer!!!

On the other hand, my grandfather was a lumberman who went broke in the 20s when his specialist wood business in Chicago died with the custom furniture business — it was replaced by furniture factories in the Southeast with cheap labor.

Reducing interest rates are symptoms that capacity to pay interest has been falling for decades. A declining rate of profit goes hand-in-hand with a falling rate of interest. When you have burger doing IPO like today than you know that we are even running out of illusionary businesses that can pretend you can still make a profit in this debt based economy. Time wasting businesses like FB, Twitter did for a while create illusion of sustainable business but now you cannot even create illusion so you resort to damn burger 🙂

The big change came in the mid seventies with the invention of the container. Container ships radically reduced the cost of transporting manufactured goods across borders. That widened the labor market beyond imagination.

Asia is a giant deflation machine. The amazing developments of recent decades are just the beginning.

”The customers for oil products must borrow to bid … when they cannot borrow for any reason there is no bid = prices collapse. ”

Steve,

Don’t we borrow for the most of the things in order to bid?

Why just Oil in just 6 months and at 62% decline and not car sales(they are back at pre 2008 17 mil), or house sales or smartphones?

It isn’t just the oil markets: retail sales and revenue are being hammered. So are leading indicator commodities such as lumber, copper and iron ore. The Baltic Dry Index has fallen to its 2008 level; home ownership is at a multi-decade low. There are alarms going off in China and Japan, also Latin America including oil producer Venezuela; also Russia, Zimbabwe, Nigeria, Libya, Ukraine … The world’s customers are broke; it only looks like a glut in the oil patch because drillers are stuck with unsold inventory and the media is willing to lie about it.

The marginal customer — whose purchase sets the price for all the others — is not necessarily an American, he is most likely Japanese or Chinese.

Constrained supply will cause prices to increase as an outcome of competitive bidding … provided the bidders are solvent. There is no universal law that requires prices to rise in the event of a shortage: when customers are unable or unwilling to borrow prices will decline, even as the ability to meet the price declines faster. This occurs during deflationary recessions as the result of deleveraging.

Again, deleveraging does not have to occur in the US, it is occurring elsewhere right now. Many Americans are not feeling any pain, they appreciate the low price for fuel but the effect of low prices on drilling have not emerged, that’s all.

This comment is clear as a new washed window and there is hardly anything in it that I would dispute. Dead on in the bullseye.

But I don’t know if the marginal oil customer is located mostly in any particular country.

steve from virginia, this is the first coherent explanation or attempt at explanation I’ve seen of the actual causes of the overall drop in commodity prices globally.

“…. shutting in of supply and accelerated depletion will adversely affect customers = more price declines. ” I always thought that shutting in supplies will slow down depletion. I also though shutting in supplies or accelerated depletion will increase the oil price rather decrease it as Steve says.

Steve is spot-on with this analysis, but I can see that many people find the idea that prices can fall in times of shortage hard to understand, so here’s my take on it. At the beginning of the 20th century, the EROEI (Energy Return on Energy Invested) was around 100:1 or more. The 100 there was mostly waste, but that didn’t matter: there was plenty of capacity to pay for the cost of extraction. It is generally accepted that EROEI is falling as oil becomes harder to extract. It’s when EROEI falls to 2:1 that things start to get interesting. At that point, the non-oil oil economy starts to struggle to pay for the oil economy: the non-oil economy has to be able to generate an increase in GDP in order to pay for the oil, and as that becomes increasingly difficult, the price starts to fall. Demand destruction between 2:1 and 1:1 is in reality the destruction of waste – “conservation by other means”. At 1:1, all oil producers can do is to create the product in the refinery: there’s not even enough resources to shift it to the gas stations. At that point, oil becomes an energy carrier: still useful (like a battery), but economically irrelevant in anything other than a command-and-control economy – which is what we are likely to get, because modern agriculture is almost literally a process that turns oil into food.

My understanding is that we passed 2:1 in 2012, we are currently at around 1.7:1, and will reach 1:1 in 2021. Meaning: in 2021, even $8 a barrel looks optimistic.

I got lost. Do you believe the oil price will rise or drop from the price prevailing at this point?

Hey guys, let’s us not get too complicated. Sure prices can fall during times of shortage but only if people do not have money to buy. That is if we are in a recession. And since oil is fungible and traded on a world market, if enough countries are in a recession, world oil prices can fall, even during a shortage.

That is a simply a demand driven price fall. Both supply and demand determine the price of oil.

But let us not get ridiculous, oil is not going to fall to $8 a barrel. Well, not before a worldwide economic collapse anyway.

Very short term: no idea

Medium term : rise

Long term (2-3 years) : fall

Very long term (10 years): oil ceases to be fungible, so “price” becomes meaningless.

What do you mean by “ceases to be fungible”? Do you have an opinion or thesis about oil prices in 20 years?

Very long term (10 years): oil ceases to be fungible, so “price” becomes meaningless.

Oil will continue to be sold on world markets and so long as commerce exists oil will be fungible to a major extent.

To the extent that fungible means anything as ordinarily defined the lack of it can only be the result of a big enough shortage of oil to mean it is no longer freely bought and sold.

The price of it will go thru the roof when that happens and price will certainly mean something although I understand your point.

Price will vary wildly from one country to the next depending on politics and who has domestic oil and who doesn’t.

My interpretation of Gerry’s comments were that when the energy or the value used to get oil is the same or more than the energy/value created, then there becomes no reason to get it.

Yes, we have talked about how when oil becomes scarce, there will still be consumers of oil because it will add value to whatever it is purchased for. However, it isn’t totally inconceivable for there to be a time when oil doesn’t add value to anything because there are alternative energy and chemical compositions that are either cheaper or work better.

Great explanation.

I don’t know where you got the 2 to 1 eroei number, I’ve never seen anyone give a number that low, I think that’s a pure fiction.

My understanding was that tarsands, the worst by far in terms of energy required, ran at around 6 to 1, which from my readings on TOD over the years, was frequently cited as being quite close to the minimum energy return for that type of resource if you used EROEI as your metric.

Since those days however, I’ve come to completely ignore the academic notion of EROEI because I think it’s a hopeless abstraction, now I prefer to use money, which is far more reliable. For example, a society doesn’t seem able to pay ongoing 100 a barrel for oil, that pulls too much away from other areas, ie, too many resource chits are being used to aquire one resource, but if it costs greater than the price that society will pay over time, then new oil simply will not get developed.

This allows you to bypass the hopelessly synthetic EROEI which nobody but academics have ever used, guys like ROCKMAN have always noted that it’s money/capital costs, always, that determines when something gets drilled. Money is more reliable in my opinion, though it won’t get you as many published papers as an academic and doesn’t sound as fancy, but I really think it is a better metric than something that is virtually impossible actually create like EROEI. No modern drilling happens without the entirety of the modern industrial/extractive infrastructure, capital allocation, etc, and that system uses money/capital as its metric, and I think it’s right to do so, it’s already built in that is how the entirety of resource flows, not an artificially separated and isolated component like energy alone, are allocated. It’s useful to consider money as a claim on the totality of the social resource flows. So if it takes say, 70 dollar units per barrel to justify a certain tight oil or super deep water project, the entirety of resource/capital costs is already included in that calculation, which is of course why that is how drillers decide to drill or not drill.

Oil / Coal / Natural gas fossil fuels are the primary energy source for a totality built out of cement, steel, copper, and all the other resources we are sustainably using. You can’t just pick one element and say that is key when it can’t really exist without all the others as a social resource, maybe the problem is poor system thinking skills now that I think about it?…

we are UNsustainably using, oops.

steve from virginia, to expand slightly, I would suggest that the process you are describing is a direct result of actual cessation of real expansion of economies globally, which indicates a basic maxing out of resource extraction rates globally. What you’re talking about here is the process of sending resources/money to the elites to allow them to keep trying to ‘grow’ their various enterprises, which can only happen using things like stock buy backs, buying other companies, etc, since actual growth has pretty much stopped. Then as you note, there is no longer debt available for other pursuits, like buying oil at the prices required to produce new resources of oil, or copper, or whatever other commodity that everyone has been ignoring when looking at the overall decline in price of almost all key industrial resources globally.

Nothing else I’ve seen actually explained how all primary resources decided to drop globally, just because the US produced a few million more barrels of one resource, all domestically consumed. But your observation about debt being held back does in fact explain how they could all be dropping at the same time, at similar rates. I forgot completely that when you buy resources globally, you have to have that loan in place before it’s shipped, that was one of the details that seems irrelevant until you realize it’s not.

Once the globalized system starts to see, as I think it has for a while now, that growth per se only is happening by expanding individual enterprises at the cost of legions of smaller ones, it’s easy to see why that’s where capital would go, since capital always seeks out areas that can provide return on investment.

If you look at the four week running average data, total US net imports are up by one mbpd from early November, from 4.7 mbpd in early November, 2014 to 5.7 mbpd, for the four week period ending on 1/13/15.

. . . four week period ending on 1/23/15.

Jef,

The other thing about the US net imports of oil and oil products, is the decrease in the net export of petroleum product exports. In the last 12 months they have dropped 900mmbpd, nearly half of what they were last year.

http://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf

Net Imports (Thousand Barrels per Day)

Four Weeks Ending

……………………………..1/23/15……1/16/15…. 1/24/14

Crude Oil……………….. 6,831 ……..6,769 ……..7,552

Petroleum Products.. -1,142…….. -1,171 …….-2,021

Total……………………… 5,689……. 5,598……… 5,531

And what is getting counted as export is quite a laugh. Nearly 500mbpd of those highly refined exports is Petroleum Coke!!

http://www.eia.gov/dnav/pet/pet_move_exp_a_EPPC_EEX_mbblpd_m.htm

It was a surprise to me to see how they measure Petcoke, a solid in barrels, but seemingly that is what they do. So close on half of the US export of refined oil, consists of black powder, literally scrapped out of the bottom of the refinery.

I can only assume that the pollution regulations in the US restrict the burning of this Petcoke in power stations.

http://en.wikipedia.org/wiki/Petroleum_coke

Large stockpiles of petcoke also existed in Canada as of 2013. China and Mexico were markets for petcoke exported from California to be used as fuel. As of 2013 the EPA was declining permits to use petcoke as fuel in the United States but markets existed in India and Latin America where it was used to fuel cement manufacture.

So that is something I have learnt today. Half of the current US refined oil exports consist of a waste product too polluting to be consumed in the US. I don’t think we will hear too much of that on MSN when the talking heads are raving about US oil exports?

It is also great to see how the EPA is saving the world from all that CO2. They won’t allow it to be burnt in the US, where it may be counted, but put it in a ship, send it around the world, burning more heavy fuel, and burn it is Asia, where it will not be counted. I see a major victory against CO2 generation has just been won, sarc.

Maybe somebody who knows more about the oil refining process and the design of large boilers and so forth will explain why pet coke is dirtier than plain old coal if burnt in a well designed power plant.

I am guessing that the problem is mostly that pet coke contains high levels of metals or maybe a lot of sulphur. But generally speaking it sure ought to burn just fine and have plenty of energy per ton.

It would also be interesting to hear something about just what the differences are between pet coke, asphalt, and heavy fuel oils or bunker oils and how much of each of these products are produced on average from a barrel of crude.

Petroleum coke is mostly carbon but contains numerous volatile compounds. It also can have high levels of sulfur compounds and has vanadium.

Here are some analyses. http://docs.housedems.com/district/006/CokeAggregrateCombined.pdf

http://education.afpm.org/refining/petroleum-coke/

http://www.epa.gov/hpv/pubs/summaries/ptrlcoke/c12563rr2.pdf

And from the environmentally astute:

http://planetsave.com/2013/12/04/pet-coke-4-top-10-toxic-ingredients-used-fossil-fuel-industries-series/

Old farmer, quite often crude oil contains asphaltines. These are extremely heavy molecules. Resins are A slightly lighter class of heavy molecule. These mole percent of asphaltines and resins increases as oil gets heavier.

Refineries separate the heavy oil fraction and eventually the really heavy molecules are fed to a coker unit. This unit uses a batch process, cooks the heavy oil and turns some of it into a solid material (coke). The vapours from the coker are mixed with hydrogen, this stabilizes the molecules, and builds lighter refinery products.

Asphalt is the extra heavy components, but they are mixed to make the gooey mess which turns solid.

Bunker oils are heavy, but not as heavy. My impression is that bunkers were developed because refiners lacked the economic incentive to destroy those molecules, hydrogenate them, and make lighter fuels.

Today we have technologies to take almost 100 % of the oil and turn it into a lighter product. Somewhere in the process the sulfur and the metals do have to be removed. A Coker does that pretty good.

By the way, the coke is taken out of the Coker drum using a small drilling rig which sits on top of the drum. The process is fairly simple, but coke drum construction is a very delicate process.

Ron i think you should see this Ali al-Naimi of Saudi Aramco acknowledges peak oil

http://money.cnn.com/video/news/2014/12/22/saudi-arabia-oil-minister.cnnmoney/

No, he is saying that “Peak Oil is a theory now that is dead.” At least that is what I think I heard.

Hmm could be English is not my first language

I think the important quote there is he said the KSA will never cut production.

Probably a veiled admission that they’ve got no spare capacity and will continue producing all out forever. Now’s the time to watch the Saudi production curve — it should start declining soon.

I think it’s more of a jab at Iran. Iran controls 4 Arab countries now, BTW.

Parts of four anyway. Try still aren’t making much progress in their old stamping grounds, central Asia. Looks like China will beat them to it. But looking back over the past 5,000 years, it’s a mistake to underestimate the Persians.

There was an interesting admission about oil exports.

The following item was posted in the prior thread, and Watcher noticed the key quote:

Saudi Aramco CEO (Khalid al-Falih): “Our exports are gradually declining”

http://www.reuters.com/article/2015/01/27/saudi-oil-aramco-idUSL6N0V60Z320150127

I’m going to call November-December as the peak of US production. For a variety of reasons I don’t believe that North Dakota production will be able to (a) overcome the winter decline before no-drilling decline takes its toll, or (b) overcome the enormous hit it will take from no-drilling decline followed by 15-16 winter decline.

US as a whole is flat even with the estimated Texas production (not right) so I strongly suspect the US is down as of this moment and about to go real far down.

“To summarize, production of conventional oil is declining at 5.8%/year (about 5.3 million barrels a day).”

I am asking all you experts out there, is this true? It sounds unlikely to me because on the one hand Giesen is stating that peak of conventional oil took place between 2005-8, on the other hand we are now in 2015 at least 6-7 years from the peak and we haven`t seen those declines yet as far as I know. Or is he talking about gross declines from existing wells and not counting new (conventional) production coming online?

It’s hard to tell. The discussion is a bit sketchy. I would lump crude oil and gas condensate in a single class because the statistics separating them are hard to come by.

It also depends on how one defines conventional oil. For the sake of argument let’s say we limit ourselves to crude oil, exclude offshore deeper than 1000 meters, anything above the Arctic circle, any oil heavier than 10 degrees API or viscosity higher than 1000 cp, syncrudes from gas to liquids, and so on…then it’s true this “conventional” class hit peak in the recent past.

But there’s no way to be sure unless you get access to the full IHS data base. I wouldn’t put decimals or imply much accuracy in such projections using public data. Lets say it’s like a slowly disappearing shrinking woman.

People – human beings- are animals and for the most part we act like the animals we are- although we can display an amazing degree of flexibility in our behavior when necessary.

” Like a slowly shrinking disappearing woman” is an apt analogy and as likely as not may prove out as an accurate description of oil depletion.

But we are also much like a bunch of rats protected from predators inside a well constructed grain silo.THe rats all eat until there comes a day when there is almost nothing left for any of of them to eat. Then things get hairy very quickly.

Unless we manage some sort of miracle and free ourselves from oil dependency there may well come a day when the available daily production is such that personal or national survival depends on actually shedding blood for a portion of it.

Whether this comes to pass depends mostly on how fast production declines, how fast we adopt effective conservation measures, how fast we adopt non oil based transportation, and how fast the population and world economy grow.

Let’s hope we move quickly towards electrified transportation and that somebody really does get the ball rolling on such alternatives as fueling heavy trucks with natural gas. If we had just ten percent of the cars on the road running on electricity this would reduce domestic oil demand substantially.

We are going to HAVE to get used to using noticeably less oil per capita per year year after year over the next couple of decades.

But it is also possible for us to change our habits and life styles substantially within that time frame.

I believe we will build a LOT of high voltage long distance transmission lines and that electric cars and light trucks will be the norm in twenty years. We will learn to live with range problems- if they persist- the same way we learned to live with all the other problems we deal with on a daily basis.

Just about every body in my community used to own a full sized pickup truck and a full sized car. Maybe half the better off guys are still buying new full sized trucks but the other three quarters are buying smaller trucks- and so far as full sized cars are concerned- well they hardly even sell what used to be a full sized car anymore. Even the well off folks are mostly driving what would have been a mid sized car twenty five years ago.We got used to smaller cars and trucks and we will get used to smaller ones yet that don’t go as far as we might like without having to charge the battery.

The REAL transition to electrics will probably start with people with money enough to buy one to save on fuel and maintenance while also still owning a conventional car.

There is no real reason not to keep a conventional car at least ten to fifteen years these days and drive it at least a couple of hundred thousand miles- assuming you maintain it well and select a make and model with a reputation for dependability.

A person who owns such a car that is fairly new can keep it more or less for the rest of his life if he also owns an electric and uses it for nearly all his day to day driving.

Today C+C is around 77 million barrel/day so 5.8% is 4.5 million barrel/day. Maybe he’s counting all liquids.

If the rate of decline is 5.8%/year (I think this is incorrect), that would be 4.2 million barrels per day (mbpd) for the next 12 months from the roughly 72 mbpd of “conventional” C+C being produced as of Sept 2014 (12 month trailing average C+C output based on EIA data). I have assumed the 5 mbpd estimate of unconventional C+C in the essay is correct.

The 5.8%/year must assume that there would be no further investment in conventional C+C production, which is not a good assumption. If that is not the assumption and if overall C+C output had been flat (rather than slowly rising), it would imply that unconventional output must have been increasing by 4.2 mbpd each year since conventional peaked in 2006/2007, that is pretty amazing, it’s been 7 years so that would be an increase to 28 mbpd of unconventional oil over the past 7 years.

Clearly that is not the case, so the 5.8% decline in conventional output must assume no investment in conventional oil output, a highly unlikely scenario. The investment needed to keep oil output flat is huge and is the reason that oil is expensive and will become more so. We will likely be back to $75/b by June or July, then price increases will moderate to a 10% annual rate for 3 years and the rate will slow to 4 % when we get back to $100/b in 2018, by 2028 we will be at $150/b, at that point the rate of increase in prices slows to 2% per year and real oil prices reach $182/b in 2038. All oil prices are in 2014$ and these are general oil price trends, the oil price will be volatile and will oscillate ramdomly above and below these trendlines depending on above ground factors such as recessions, wars, etc.

The scenario you describe above in which prices will gradually increase from $75 next year to $182 in 2038 seems quite optimistic (I’m not necessarily disagreeing with it).

If the price of oil is $180 in 23 years from now then surely this suggests that it will likely be a rather gentle decline down the back slope rather than a shark-fin. This raises the possibility that we could mitigate it somewhat by basic energy saving measures like more fuel efficient cars.

I had always anticipated that the decline would cause more price volatility than the above. I know none of us have a crystal ball and can predict the economic future, but do you really expect price to increase that slowly?

The material by Giesen could use some editing. There are small mistakes, confused terminology, in a couple of items the statements are wrong, and there’s also quite of bit of propaganda. If this is being taught to college students they will come out a bit misinformed.

Adjunct instructing is a tough racket.

This is also typical of the quality of science instruction in classes out side the ones that are core courses for science majors.

The author seems to be somewhat lacking in composition and grammar skills but he is at least in the ballpark in terms of the subject matter considering that he is necessarily painting very fast with a very small brush and that oil is only one aspect of the general subject he is teaching.My own composition and grammar are not what they could be. No disrespect intended. Top flight writing is a time consuming specialty.

The instructor and the institution are faced with the just about impossible problem of teaching what necessarily takes years to learn in days to students who are mostly just barely motivated by necessity to get their ONE science survey course finished so as to meet the institutions requirements for graduation.

The entire idea of educating everybody well is about as big a pipe dream as controlling co2 emissions world wide. It just ain’t gonna happen because under our clothes every last one of us is a NEKKID APE, a monkey with hypertrophied brain hard wired to compete for food sex territory status etc etc.

Evolution did not provide brakes as part of this hard wired programming because brakes have never been needed.Overshoot has served perfectly well in solving any problems associated with EXCESS SUCCESS. Overshoot extinguishes excess very efficiently indeed.

We are in overshoot and we are going to pay the usual price – a massive die off.

You can fix things so every kid gets a high school diploma but you can’t fix them so that every kid gets one and the diploma is still worth something.

A hell of a lot of kids understand that when a teacher insists on performance – the teacher will not be around next year because teachers are subject to being fired and laid off. The law compels the school to keep the student enrolled. The choice is no choice at all when the principal and the school board meet in closed session.

Assigning homework in a vocational school setting in this country is an exercise in futility.

Assigning homework to students in the middle track is possible and sometimes a teacher with great persuasive skills can persuade her students to actually do it.

If you want to assign homework and see it done you must be teaching the academic track kids – the ones sorted out as potential real students at real universities. School systems often deny the existence of tracking but it is just about universally practiced.

”We don’t need no education. We don’t need yer discipline. ” Pink Floyd understands.

Teacher!!! Leave them kids alone.!!!!!

You can use a whip to drive a mule to water but there is no known way to make it drink unless it is thirsty.

With all due respect to Tom Giesen’s editorial [from the Oil Capital of the USA – Oregon], with respect to fracking: fracking disclosures are required by some states and are voluntarily provided by some oil companies in every instance. What has actually been published that shows “families are prisoners in their homes,” “carcinogenic agents,” “toxins” and “no known purification processes?” Do the oil companies “create” carcinogenic agents” that they then inject? Or do they use ordinary materials that are present everywhere and then are described that way? By the way, I believe that sea water is toxic. You drink it you die. Well that is 70% of the Earth. Be wary of the use of the word “toxic.” It is inflammatory and does not convey useful information. I also believe that oil itself contains “toxins” and “carcinogenic agents.” So, in his mind, everyone in the oil industry is trying to kill everyone else because (we/you) “value oil” “more than we value protecting our families from living and working in extremely toxic/carcinogenic conditions.”

Since I am in my 70’s, I plan on dying before his ilk takes over.

Ron – I hope that you are not a member of his cult.

Give the guy a break. It’s better to use constructive criticism.

This from the guy who reels out negative generalities like “confused,” “wrong,” “propaganda,” “mistakes” without offering a single example? LMAO

That was my introductory paragraph. I spent all night editing it and making corrections out of habit. Then I realized I was retired and this wasn’t a paper draft, and went to sleep for two hours.

Clueless, I have seen these things in fracking documentaries. They have found illegal dump sites in North Dakota where radioactive filters have been dumped by the ton. Are you a member of that cult?

Really, there are two sides to every story.

Why do the frackers put radioactive materials in? Is it because it is like sunlight – radioactive??

PS: A truckload of bananas will set off a Geiger counter.

pps: http://www.epa.gov/radiation/tenorm/oilandgas.html

The radiation is from the subsurface rock. It is called NORM Naturally Occurring Radioactive Material. Like the bananas, it is not normally a problem unless it is concentrated. Like Ron says, in filters and the like. Completion strings that have been in the hole many years can also build NORM to high levels that require special treatment.

Much focus is placed on the BTEX and NORM, with frac fluids, but the simple salt content, is probably should be the greater concern.

http://en.wikipedia.org/wiki/BTEX

http://en.wikipedia.org/wiki/Naturally_occurring_radioactive_material

And there is the other major component of frac fluids nobody want to talk about.

Warning, Please only read this reference while smiling!

http://www.dhmo.org/facts.html

What is Dihydrogen Monoxide?

Dihydrogen Monoxide (DHMO) is a colorless and odorless chemical compound, also referred to by some as Dihydrogen Oxide, Hydrogen Hydroxide, Hydronium Hydroxide, or simply Hydric acid. Its basis is the highly reactive hydroxyl radical, a species shown to mutate DNA, denature proteins, disrupt cell membranes, and chemically alter critical neurotransmitters. The atomic components of DHMO are found in a number of caustic, explosive and poisonous compounds such as Sulfuric Acid, Nitroglycerine and Ethyl Alcohol.

Don’t drink that stuff it rusts your innards. 🙂

Stick with beer and moonshine.

When I was working in containments at nukes the health sciences guys made a point of telling us to be sure to avoid eating a number of foods for couple of days previous to getting a whole body check out scan.

One of my very favorite foraged foods – we call it KRESSY salad – a green that grows wild here and is simply beyond compare in terms of it’s intense flavor – grabs just about every natural and man made radioactive atom or molecule within reach of it’s roots.

Some guys about to get laid off figured out that eating some would sometimes get you an extra couple of days work so the contractor could run another PASSING scan after you passed the greens. Most likely though you had to wait around on your own time in order to get cleared. If you didn’t pass it meant all sorts of bureaucratic work for everybody and that you would not be hired next time around.

Push, I realize you are knowledgeable about the All Bidnezz, but revealing info about frac ingredients such as Dihydrogen Monoxide (known to cause fatalities if 100% contact is maintained to the human body for as brief a time as ten minutes, causing an annual fatality rate measured in the thousands per year), is jes gonna cause more problems.

The silicon dioxide – also commonly used in the fracturing process – is likewise harmful if a human is covered in an abundance of this compound. (Curiously, some cultures reverentially place their deceased’s remains under a layer of this suspect frac’ing component).

Yeah Coffee,

It sure is a dangerous world out there. But it does show how so many people are willingly to go along with the latest disaster, with no knowledge of what they are talking about. The Snopes link below has some wonderful examples.

http://www.snopes.com/science/dhmo.asp

Greed generally trumps decency, morality and good sense, at least in the business world. Good thing law suits have kept some of them in check. Human life has very little value to many in industry. Of course they would never admit that directly but one only has to look at their actions.

The sad part is that science and engineering has put very dangerous tools in the hands of sociopaths, madmen and infantile self-centered minds.

Human life has very little value to many in industry. Of course they would never admit that directly but one only has to look at their actions.

Yes, I would agree that human life is expendable to many people. They may not frame it that way, but they are willing to cut back on support to big chunks of the human population and let economics and nature take its course.

Businesses in general feel no obligation to create jobs to give people work. If a machine can do it as well as a human and is less hassle, the machine is a better option in their eyes.

Handing more money to the rich and to companies on the assumption that they will goose the economy hasn’t proven to be the case. The rich will invest in art and property rather than in growing companies if they believe the returns will be better for them. Companies have been buying back their own stock rather than expanding their businesses.

What keeps me from being more distressed by the growing income inequality is my belief that recession is probably better for the environment. Wipe out the middle class and you eliminate a lot of consumption. When people say how much we’ll have to downsize in order to conserve energy and use less of it, I see the lack of economic growth throughout the world as a unpleasant, unequal part of the process. We may not be able to convince the American middle class to cut back their lifestyles, but if we take away their jobs and we take away their government entitlements, we are accomplishing the same thing. It doesn’t have to be this way, but it may end up being this way.

Much of modern society was due to the foresight of the rich and well off and their charity. Hospitals, schools, colleges, libraries and much more can be directly linked to the wealthy trying to improve society in general. Our conservation of forests and national parks is the result of the wealthy taking up the banner.

The middle class of long ago made sure services such as fire departments were in place. Industry built schools to educate the young.

Sure, some of it was a little self serving but on the whole they did what was needed to improve the lot of the general population. So what has happened now? Are we so improved that further improvements can’t be made? I think not. Why did new generations of benefactors not rise up and push society forward toward a grander more sustainable life? Do they think a bank account is going to protect their descendants?

Much of modern society was due to the foresight of the rich and well off and their charity. Hospitals, schools, colleges, libraries and much more can be directly linked to the wealthy trying to improve society in general.

I think what may have been changed is that we need fewer people to work for us now. In the past, if you ran a business, manufacturing plant, or a farm, a lot of the work was provided by people or animals. So it made sense to take care of your “investment” in them. Now so many jobs don’t need people that I don’t think the very wealthy think in terms of “their people.”

You still do see some of the very wealthy setting up charities and non-profits and I think they become aware of their legacies at about the same age as philanthropists in the past (i.e., as they get on the other side of middle age), but in terms of what the wealthy do to provide jobs and take care of their employees, not so much.

So because sea water is “toxic” any sort of environmental regulations are useless? Clueless, there is some very cheap property along Love Canal, you could sell your house in South Florida or maybe Phoenix, and move there. You make John McCain sound like friendly, and the two of you are equally harebrained.

Regarding Gulf of Mexico oil production – I have to agree with Ron in that I don’t think it will ever reach 2 mmbpd, and it may be challenged to even reach 1.5 mmbpd. A good year ago or so I challenged Ron on the 1.5 mark – I thought it would exceed that amount of production, but I am starting to have 2nd thoughts. A couple new fields have come on since November – Tubular Bells, Jack-St.Malo and Lucius, but will those new fields offset existing decline rates and push total production over the 1.5 mark?

Jack-St.Malo is the 2nd complex of fields to produce from the Lower Tertiary (Petrobras’s Cascade-Chinook complex is the 1st). Is the Lower Tertiary going to be the savior of the GOM? A lot of Lower Tertiary discoveries have been made (most recently are Chevron’s Anchor and Guadalupe discoveries) and a lot of projects are in the queue. These are long term projects that, while they may be delayed a bit by near term low oil prices, will still probably go forward, I think!

That should read Lower Tertiary in the Gulf of Mexico. This section is Paleocene-Eocene-Oligocene.

The age itself isn’t that important, what counts is the rock fabric, burial history, and what it looks like today. And the fluids. But if we are going to use the age to name them, there are very large Lower Tertiary fields in Colombia and Venezuela. And their properties can vary a lot.

I think the best way to lump them is to say they are very deep and high pressure reservoirs located in very deep water? I hope I’m wrong but I suspect those fields will be much harder to produce than they expect.

Correct, sometimes also called the Wilcox. Very thick gross reservoir sections, often over 1000′, but not-so-great rock properties because of the great burial depths of 25,000′ and deeper. The concern to me is the long term producibility of these reservoirs – they may start out at reasonable rates (for deepwater wells) of 10-15000 bopd, but one year later they are producing half that amount. Somewhat similar to the LTO plays, in my opinion.

Hi SouthLaGeo,

I assume you have seen the BOEM estimates for undiscovered technically recoverable resources (UTRR) for the Gulf of Mexico. I think their F95 estimate is about 30 Gb, what is a reasonable guess in your view for GOM URR (US only), so far cumulative production and 2P reserves are about 25 Gb, so a 30 Gb UTRR would suggest a URR of about 55 Gb?

Dennis, that comment sure confused me. I used to work in the GOM many years ago, but I’ve been asked to look over some of the really deep discoveries (just an eyeball so I could make some general remarks). They seem to be very large accumulations, but the long term performance is hard to define.

In BOEM’s 2011 assessment for the US Gulf of Mexico the F95 UTRR estimate is 39 Gb (+ 194 tcf gas). (That is, they have a 95% certainty that at least 39 Gb of technically recoverable oil is yet to be discovered) Their F50 UTRR estimate is 48 Gb.

In that same assessment, they state that 16 Gb have been produced and that there are 19 Gb of what they call “reserves” and “reserve appreciation” in existing producing fields and sanctioned projects.

So, 39 + 16 + 19 = 74 Gb high confidence URR. Do I believe that? That is saying the Gulf is going to produce more than 4 times more oil that is has already produced. I think that is very unlikely.

Even your estimate, Dennis, of 55 Gb, seems a stretch, but certainly more reasonable than 74 Gb.

In my opinion, if there is any hope of a US GOM URR over 50 Gb, industry is going to have to be able to achieve more than 10-15% recoveries from the Wilcox, and that is going to mean massive EOR projects (water floods, gas injection, polymer floods, you have it).

Now, what may end up being the ultimate savior of the GOM is offshore Mexico – now that is an entirely different story. There we have an extremely underexplored basin with a few deepwater discoveries, and a government that is finally looking to take advantage of the technical expertise of the international oil companies.

the Mexican legislation and contract terms aren’t that good. I wouldn’t touch those blocks they are going to offer. I think we are about to see a lot of winner’s curse.

Solageo,

Thanks! I thought 55 might be too high. What seems reasonable to you? 40 Gb does the 25 Gb sound right for cumulative plus 2P reserves?

40 to 50 might be a good range. One of my concerns is – how long of a time frame is reasonable? For example, if you assume the cum oil from the GOM right now is about 17 Gb, which is probably about right, and assume another 45 years of activity, going until 2060, at an average of 1.5 mmbpd for that entire 45 years, you get a cum of 42 Gb. Is that reasonable?

If you add another 20 years to that, going out to 2080, at an average of 1.2 mmbpd for that entire 20 years, you get a cum of about 50 Gb. Does anyone really think we will be producing over a million barrels a day from the GOM in 2075?

assume another 45 years of activity, going until 2060, at an average of 1.5 mmbpd for that entire 45 years, you get a cum of 42 Gb. Is that reasonable?

Good Lord no! 1.5 million bpd for another 45 years is totally unreasonable. Only a Dennis Coyne would think that reasonable. 😉

The smiley face is for Dennis. I am totally serious about the unreasonableness. The GOM is not producing 1.5 Mbd today, (M is for Million), and will not be producing that in five years, not to mention 45 years.

Hi SouthLaGeo,

You would have a better idea what is reasonable. An average of 1 mmbopd for 45 years on average, say starting at 1.5 mmbopd and decreasing to 0.75 mmbopd over 45 years would give a URR of 33 Gb, you would know better than I what may be possible.

I have done now 4 posts with stacked graphs on the US crude and product import/export history. Agreed that imports dropped long before the tight oil boom started.

27/1/2015

40% of US petroleum exports didn’t grow since 2011

http://crudeoilpeak.info/40-of-us-petroleum-product-exports-didnt-grow-since-2011

13/1/2015

Tight oil boom can explain only part of drop in US oil product imports

http://crudeoilpeak.info/tight-oil-boom-can-explain-only-part-of-drop-in-us-oil-product-imports

3/12/2014

US crude imports from Non-OPEC countries peaked 10 years before tight oil boom

http://crudeoilpeak.info/us-crude-imports-from-non-opec-countries-peaked-10-years-before-tight-oil-boom

6/11/2014

US oil dependency on Middle East has hardly changed since 2007

http://crudeoilpeak.info/us-oil-dependency-on-middle-east-has-hardly-changed-since-2007

Matt, At your first link, figure 6 there is mentioned a fuel type called petroleum coke. I was until now unaware of this substance. Could you or anyone else explain this to me?

http://en.wikipedia.org/wiki/Petroleum_coke

Thanks Push, After I wrote that I scrolled farther down and got an explanation. When I would ask such in school I would invariably be told to…LOOK IT UP!

Re families becoming prisoners in their own homes near fracking sites due to environmental problems

Question: when the acreage is leased do the owners of the land not agree to all this? Or are these families renting and their landlord has made decisions they don’t like. Or are these conflicts between neighbors where some would lease and some won’t?

Matt, there are fracking sites in some very highly populated areas. There are thousands of homes in these areas occupied by people who get nothing from the drillers or oil companies. They don’t have to rent, most of them own their homes, sitting on quarter acre sites in the burbs.

Look at the chart below. Pick out a place in the Marcellus or Utica where people don’t live unless they own land leased to frackers. Way over 99% don’t own any fracked land.

In places like Colorado the land rights and the mineral rights are split. Most land owners don’t own the mineral rights and get nothing when the land upon which they live and farm is fracked. Aside from whatever environmental issues there might be, they are subjected to noise, traffic, etc. Since they get no money from the fracking, but they do get inconvenience, there is little incentive for them to support it.

Also a problem is that in places like Colorado fracking is moving closer and closer to populated areas. There has been fracking across the street from schools and parks. It’s one thing when then drilling occurs out in areas where no one lives. It is another when it is done in a suburb.

I am wondering if the current low prices will discourage companies from moving into areas where they aren’t wanted anyway.

I own land in Texas on top of a shale field. The price has been increasing because taxes are collected from oil company facilities. There are people objecting to the industry, but I find their objections are mostly driven by ignorance and watching those propaganda films like “Gasland”. I work with them to show them where to aim their complaints, because there are areas which can be improved, but the radical greens with the tin foil hats take over meetings and mouth off the same endless bs. How do I know? Because I have two sons who live in that area and go to those meetings.

We’ve had gas wells on our land for generations now. Receive royalty checks. Rather not. Noisy smelly things that freak out the horses. Just a fact of life I guess.

SW, my advice to the people my sons are dealing with is to focus on the noise and the smell. THAT is something you can deal with. Record the sound, AND have the air sampled. Then talk to a lawyer.

The exact same thing is true for North Dakota and Montana as well. A majority of the farmers and ranchers whose fields are being used to drill Bakken wells don’t own the mineral rights on their land and so can do little to stop the wells from going in. The rights were quite often sold to interested parties many states away (oftentimes Texas) during the Great Depression to get some desperately needed cash. Plus, oil had not yet been discovered in the region at that time, so the true value of the mineral rights wasn’t fully known.

What I have been concerned about is having fracking going into places like the Colorado suburbs, disrupting life there, and then going bust, with the communities left with the mess.

That’s why I started to follow this forum. And as things play out with oil prices, it will be interesting to see what happens to communities which haven’t asked oil companies to pay enough for damage and which haven’t budgeted themselves for life post-oil boom.

Also, along those lines, I spotted this article. Lots of oil-industry related earthquakes in Oklahoma and discussions about what to do about them.

http://www.washingtonpost.com/business/economy/oklahoma-worries-over-swarm-of-earthquakes-and-connection-to-oil-industry/2015/01/28/eca21234-a71a-11e4-a2b2-776095f393b2_story.html

A. You CAN have local regulations to make the drill sites unobstrusive. And the earthquake issue arises due to water disposal. What they need is improved water disposal well regulations.

I don’t want to get people riled at me, but it seems the American states have a very cowboy approach towards regulation. There’s no need to kill the industry, nor do they have to behave like Bulls in the China shop.

I think this is a very good point.

A very, very good point.

Yes, I agree with you. Some of the push back from local communities against fracking is that the industry hasn’t done a good job of working with the communities.

If you are lax about how you treat the areas where you drill, and you start drilling in areas with affluent, college-educated homeowners who have cameras and know how to post photos and complaints online, you’ve got a PR problem.

And when Colorado communities can read about the living environments in the Bakken, some of them don’t want to go down that same route.

I am as bullish towards the E & P gys as can be, and I also agree 100% to all the above few comments. Industrialization/ heavy-duty commercial activities have been, should be zoned, moderated so as not to cause unwanted intrusion to the surrounding populace. Nobody retiring to the bucolic hills of rural Pennsylvania would be thrilled to see thousands of big trucks constantly rumbling by. Whereas business establishments can be placed in designated areas, minerals are where they are, and that can cause problems, greatly exacerbated if there is little to no financial reward/incentive to endure that stuff.

To approach these issues with as fair and open-minded perspective as can reasonably be hoped for could go a long way to reduce the acrimony.

I have always thought it makes a difference if the homeowner moved to the nuisance or if the nuisance came after the home was built.

Have a couple of situations where people built closer to an existing well than they should have. My opinion is they don’t have a complaint in that situation.

I have heard good lawyers say homeowners should always have the mineral title checked, but almost none do because of the cost. However, I know in some areas almost all the minerals were severed long ago, so it is not easy to find a home where you own the minerals underneath also. Also, that doesn’t take care of effects from activity in the neighborhood.

There are usually laws or ordinances that protect homeowners in these situations, but I’m aware of horror stories. We have leased our own land for others to drill on, and made sure the lease was very strict on change of operator, given we wanted to avoid a big headache. Ended up with the lease after they produced the cream off the top, so it all worked out.

I personally would never drill in someone’s back yard. Too many headaches, even for guys like us that make tiny footprints.

I have heard good lawyers say homeowners should always have the mineral title checked, but almost none do because of the cost. However, I know in some areas almost all the minerals were severed long ago, so it is not easy to find a home where you own the minerals underneath also. Also, that doesn’t take care of effects from activity in the neighborhood.

In Colorado, before fracking moved closer to the suburbs, most home buyers weren’t aware of mineral rights. They didn’t ask about them and realtors didn’t bother to mention them.

With the new focus on fracking I suspect people are more aware of mineral rights. Homes still don’t usually come with them, but now home purchasers are more likely to know in advance how much at risk they might be of living next to a future drilling site.

“It comes amid a growing body of research suggesting that the country’s ballooning oil and gas production — cheek-by-jowl with homes and schools — could be endangering the health of people nearby.”

http://www.publicintegrity.org/2014/10/07/15890/new-five-state-study-finds-high-levels-toxic-chemicals-air-near-oil-and-gas-sites

“The Eagle Ford Shale region of South Texas is in the midst of a massive drilling boom that’s generating billions of dollars for oil companies. But a months-long investigation in partnership with InsideClimate News and The Weather Channel finds some residents saying emissions of dangerous chemicals are making them sick, and state regulators have offered little help.”

http://www.publicintegrity.org/environment/big-oil-bad-air

I was talking to some land owners north of Scranton Pa a few years back. These were basically large acreages, mostly farmers. They had been approached with gas drilling offers and were deciding whether they would accept or not. One said his neighbor was going to accept so that put pressure on him (downsides and no money). Since the drillers can go under unleased lots, they only have to get a few landowners in an area to run their wells.

The area was about as quiet and rural as one could get in that region. I wonder what it was like during and after the drilling.

Infinite sunlight? Alas poor Yorick, I knew this claim well. From only like every thread here, ever. This week, we shall assign Monarch-brand butterfly nets to help collect on that infinity. Go, go, quick! All the sunshine is getting away! Oh, what, the nets won’t do? Maybe this job calls for Heroic Materialism Man, whose talents—besides the ability to poop out unprecedented amounts of concrete and steel, and to look somewhat good in tights, or at least stun his enemies with the muffin top—include staying one step ahead of the credit card company, owning several cars, a hinterlands home (or two? They’re so like Pokémon cards…), maintaining storage for durable goods from China, et cetera.

Solar optimist narrative control in 3, 2, … hey! If we’re entertaining a collapse back to the new, improved! electric car, we could then also have Carbon fibre hansoms, and the blinkers can go back on the horse? Nay! Onwards, as futurist Brin says.

Ya get more power from orbit. Ya get about 1360 watts/sq meter but that’s non spectral specific so you throttle back power in the budget somewhat on day 1.

It depletes. The gallium arsenide junctions start getting hit by gamma particles and die. So the same surface area gives you less power over time. Worse for high equatorial inclination orbits than purely equatorial because other particles can do some damage at the unshielded poles and also the south atlantic anomaly. It’s like barrels/day decline. Relentless stuff.

Those particles . . . some of ’em . . . reach the surface, too. They hit keyboards hard and cause typos.

Singapore says $44.59, up a few pennies. Dollar flattish to up a tad. Quiet over there.

Maybe the traders are adding together all the CAPEX cuts and wondering when the short squeeze will hit?

shallow guy, this stuff really isn’t about trading. This is about death. Coming. Soon.

The destruction of the narratives is going to do ugly things. Permanence to the end of shale does even worse things.

what are you short?

Lifetime.

Shallow,

Looks like the rig count got the shorts burning. I said a couple of weeks ago we needed a 100 rig drop to get peoples attention. It seems 94 may have been enough, but as the 4th results get released, and we have yet to see any of the highly concentrated shale plays report, I feel the real message is going to get through to the market. Then we can start to see what is going to be left and if anyone can put all the pieces back together again.

Maybe a few shallow stripper will be able to make a wind fall and save the day, lol.

Ha ha. Not going to be able to save the day toolpush. Just hoping for enough of a rebound to stop the sleepless nights. It seems to me maybe if we get back in the 70s the small conventional producers can make a decent return without the shale guys drilling like crazy again.

However, its just one day. Big inventory build will knock it back down in a hurry. But at least its Friday and we ended on a positive note. Now if we have no operational problems tomorrow or Sunday morning will be in even a better mood! Our guys have been great through this so far. Most of them started out in the 80s boom and so they’ve been through this before. Worried about when they want to retire, hard to find young ones who will stick with it.

Canadian Oil Sands to Further Slash Dividend and Spending

Syncrude has struggled to cope with a series of unplanned outages at its surface-mining operations, the largest oil-sands project in the world. Its average cost per barrel is about C$47.75, which is higher than every other major oil sands mine in Canada, according to TD Securities Inc.

The tar sands carnage continues ….. and it’s taking the whole Canadian economy down with it, just like in Russia.

with exception that CAD$ unfortunately did not depreciated as much as Ruble.

Who else has a major surface mining project?

Suncor, Shell, ExxonMobil

Plus: Imperial Oil, Statoil, Sinopec, Total S.A., Nexen, CNRL, Petro Canada, Tsck-Cominco

Are they all using SURFACE mining? I’m trying to see if we can clarify the different types of project.

No, about 80% is in situ extraction owing to overburden thickness so only 20 percent of bitumen can be extracted by open pit mining methods. In situ extraction uses a steam-assisted gravity drainage (SAGD or “Sag-D”) process.

And, although Anonymous above claimed ExxonMobil is a player in the Alberta Athabasca oil sands play I don’t think this is correct.

That’s what I thought. There seems to be some confusion about this topic.

We also have an “untouchable” resource in the intermediate depths between the surface mining and the deeper steam recovery projects. I’ve worked a bit on this technical problem. I’m hoping the ConocoPhillips experiment in Alaska will give us some leads.

check out the official oil sands project map at:

http://www.energy.alberta.ca/LandAccess/pdfs/OilSands_Projects.pdf

You will have to enlarge it a bit to see the names and “thermal” or “mining”. Surprised to find many are listed as “primary”, e.g. “These projects utilize the natural energy available in the reservoirs (in some cases supplemented by non-thermal EOR processes) to produce bitumen.”

All kinds of good info at:

http://www.energy.alberta.ca/OurBusiness/oilsands.asp

the DMR of far northern north dakota 😉

BTW – I find no double cross company (eXXon) listed in the tar^H^H^Hoil sands projects.

The latest quarterly update:

http://www.albertacanada.com/files/albertacanada/AOSID_QuarterlyUpdate_Winter2015.pdf

has mining numbers to Jun 2014, other numbers to Dec 2014.

Mined = 600,000 bpd (but was a million bpd in March – ?weather?).

Primary = about 240,000 bpd

In situ thermal = a million bpd.

So roughly half mined, a bit more than half primary or in-situ.

Detailed list of projects follows that, with company, site, capacity, technology, status. Past quarterlies at:

http://www.albertacanada.com/business/statistics/oil-sands-quarterly.aspx