A post by Ovi at peakoilbarrel.

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIAʼs International Energy Statistics and updated to February 2021. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

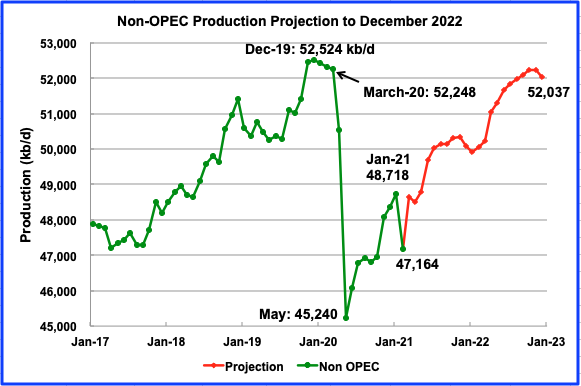

February Non-OPEC production dropped by 1,554 kb/d primarily due to the US winter storm. February’s Non-OPEC drop was primarily driven by output decreases from the US (1,198 kb/d) and Canada (201 kb/d).

Using data from the June 2021 STEO, a projection for Non-OPEC oil output was made for the time period February 2021 to December 2022 (red graph). A significant rebound is expected in March as US production comes back online.

Output is expected to reach 52,037 kb/d in December 2022, which is lower than the previous high of December 2019, by slightly less than 500 kb/d. In the June report, the forecast December 2022 output was revised up from 52,010 by 27 kb/d.

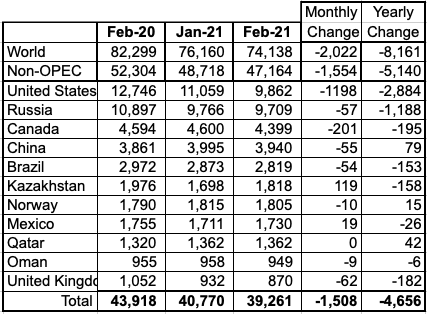

Ranking Production from NON-OPEC Countries

Above are listed the worldʼs 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. Two have currently fallen below 1,000 kb/d.

In February, they produced 83.2% of the Non-OPEC output. On a YoY basis, Non-OPEC production decreased by 5,140 kb/d while on a MoM basis, production decreased by 1,554 kb/d to 47,164 kb/d. World YoY output is down by 8,161 kb/d. As noted above, the MoM February decrease was primarily driven by output decreases from the US and Canada.

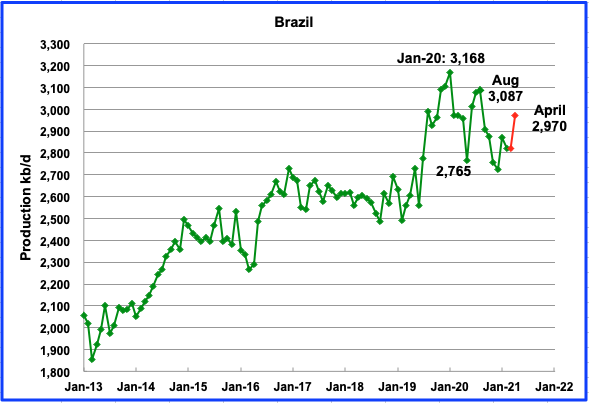

The EIA reported Brazilʼs February production decreased by 53 kb/d to 2,820 kb/d. According to this source, April’s output increased by 4.6% from March to 2,970 kb/d. (Red Markers).

“Oil production in Brazil was up 4.6% in April compared to the previous month, to 2.97 million barrels per day (bpd), in the second consecutive monthly increase, data from the National Agency of Petroleum, Natural Gas and Biofuels pointed out. (ANP), with advances from Petrobras and Shell.“

With regard to future production, Norway’s Equinor ASA (EQNR.OL), Exxon Mobil Corp(XOM.N) and Petrogal Brasil will pour $8 billion into Brazil’s deepwater Bacalhau oil field development. The first oil from Bacalhau is expected in 2024, with output set to reach 220,000 barrels per day, the companies said in the joint statement. The field has a break-even cost below $35 per barrel, Equinor said, or around half the current market price of crude oil, according to this source

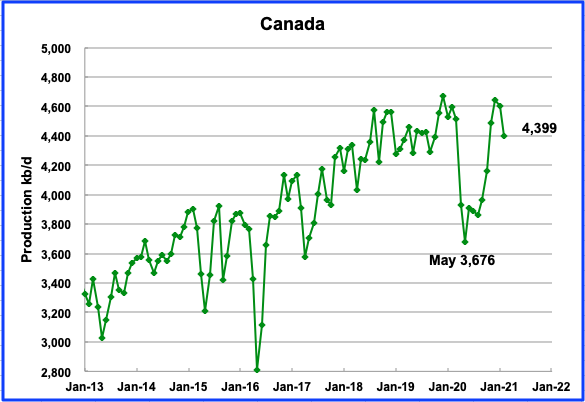

February’s output dropped by 201 kb/d to 4,399 kb/d. Oil exports by rail to the US in March were 175.6 kb/d an increase of to 63.7 kb/d over February.

Two competing consortia have now been formed to buy the Trans Mountain pipeline once it is completed and operational. Even though all of the approvals have been received, opposition still persists. Similarly opposition continues in Minnesota against the Enbridge line 3, source.

On Monday June 14, 2021, the Minnesota appeals court upheld the regulatory approval of Line 3 permits. The court agreed that Enbridge demonstrated a sufficient need to build a replacement line during the permitting process. Source. Other appeals are continuing,

“While reasonable minds may differ on the central question of need for replacement Line 3, substantial evidence supports the commission’s decision to issue a certificate of need,” Judge Lucinda E. Jesson wrote. “Finally, the commission reasonably selected a route for the replacement pipeline based upon respect for tribal sovereignty, while minimizing environmental impacts. Accordingly, we affirm.”

Currently the US imports close to 6,000 kb/d of oil, of which close to 4,000 kb/d is from Canada. The US also exports oil to Canada.

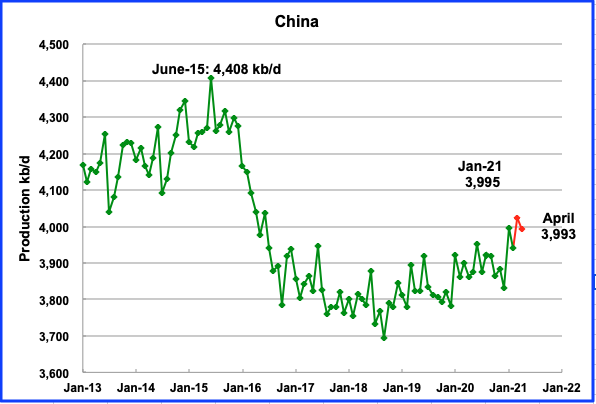

The EIA reported Chinaʼs February output dropped by 55 kb/d from January to 3,940 kb/d. This source reported crude output in April was 16.41 million metric tons. Using 7.3 barrels per ton, April’s output was estimated to be 3,993 kb/d, down 27 kb/d from March.

China continues to be the oil industry’s biggest spending driller because of its fear of dependence on foreign suppliers and its desire to increase its own supply. Source

Mexicoʼs production, as reported by the EIA, in February was 1,710 kb/d. Data from Pemex shows that March production increased to 1,759 kb/d and dropped to 1,752 kb/d in April (Red markers).

According to S & P Global, Mexico’s oil production is expected to remain around 1.7 million b/d for 2021 and 1.75 million b/d for 2022, in spite of the new fields it finds and brings online.

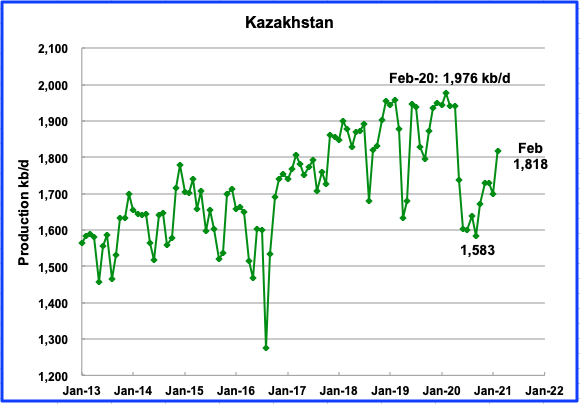

Kazakhstan’s output increased by 120 kb/d in February to 1,818 kb/d. Their OPEC + partners gave Kazakhstan permission to increase their output in April.

Kazakhstan will continue to increase oil production under OPEC+ agreement

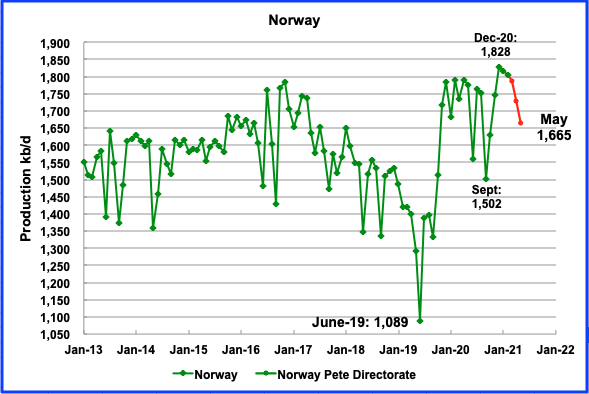

The EIA reported that Norwayʼs February production was 1,805 kb/d, a decrease of 10 kb/d from January. The Norway Petroleum Directorate reported that production in May dropped to 1,665 kb/d after dropping to 1,728 kb/d in April, red markers. The production drop since December is 163 kb/d and is partly due to maintenance.

According to the June OPEC report, production from Johan Sverdrup phase-1, which passed the 500 tb/d level in January 2021, is expected to reach 535 tb/d in July and then continue at this level until the end of year. The output of liquids has been affected by maintenance in 2Q21 and production is expected to be lower by 0.11 mb/d vs 1Q21. However, output is anticipated to be higher in 3Q21 by 0.06 mb/d vs 1Q21 to average 2.17 mb/d. This is due to higher production ramp ups from new projects, more than offsetting outages due to maintenance.

An earlier NPD report noted “State-controlled Equinor said in November Johan Sverdrup output, which has become a major feedstock for Chinese independent refineries, could rise beyond first-phase levels of 500,000 b/d by the middle of this year thanks to increased water injection.“

While not directly related to Norway, Norway’s Equinor ASA (EQNR.OL), Exxon Mobil Corp(XOM.N) and Petrogal Brasil will pour $8 billion into a Brazilian deepwater oil field development that is expected to produce about half of the average carbon emissions of similar projects, the companies said in a joint statement on Tuesday and reported by this source

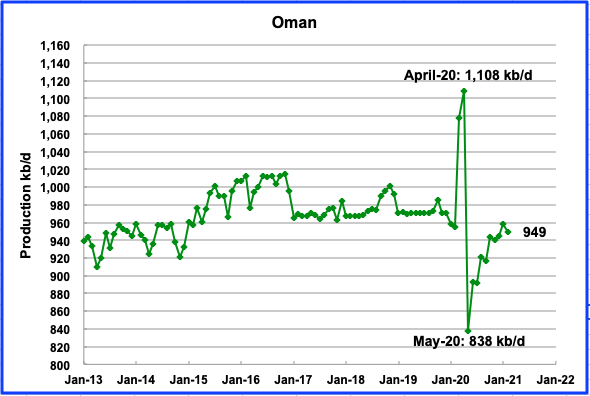

Omanʼs February production decreased by 9 kb/d to 949 kb/d.

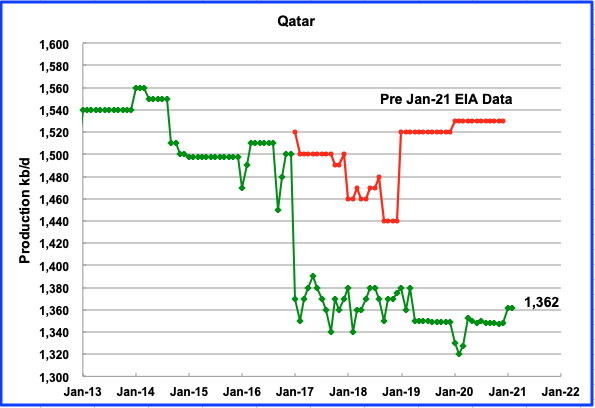

February’s output was unchanged at 1,362 kb/d.

Qatar’s output was drastically revised down by the EIA in its January 2021 report. The red graph represents the EIA’s assessment of Qatar’s production from January 2017 to December 2020 according to its December report. December’s 2020 production of 1,520 kb/d was revised down to 1,348 kb/d in the February report, a decrease of 172 kb/d.

According to the Russian Ministry of Energy, Russian production decreased by 23 kb/d in May to 10,453 kb/d. The difference of close to 400 kb/d between the US and Russian numbers indicates a difference in the definition of Crude plus Condensate.

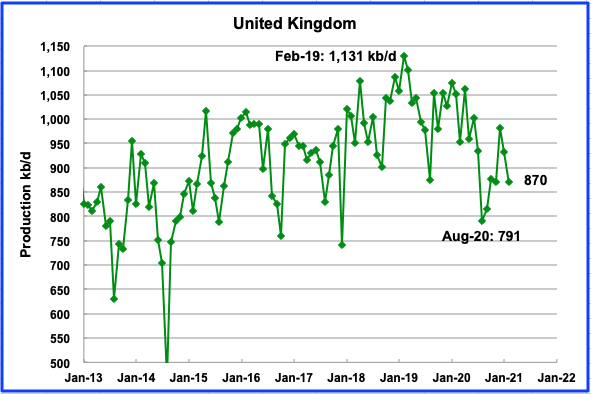

UKʼs production decreased by 62 kb/d in February to 870 kb/d.

According to OPEC, several E&P projects have reportedly been deferred, such as the Seagull project, which was deferred to late 2022. Hence, UK oil supply is expected to decline by 0.05 mb/d y-o-y to average 1.02 mb/d due to a decrease of 32% in investment last year in the oil and gas sector.

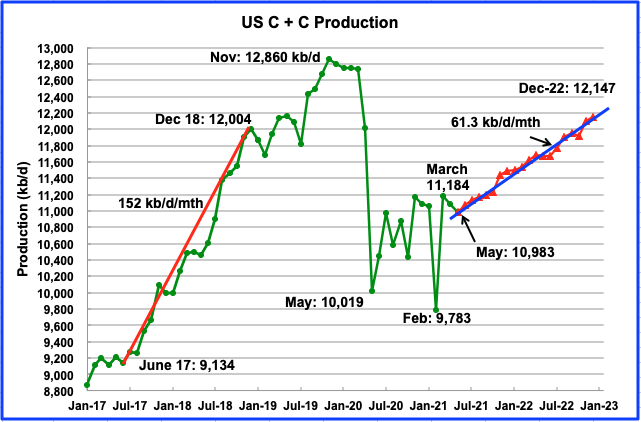

U.S. March production increased by 1,401 kb/d to 11,184 kb/d from Februaryʼs output of 9,783 kb/d and was also 128 kb/d higher than January’s. The increase was due to the rebound from the severe winter storm that hit the four US southern states, Texas, New Mexico, Louisiana and Oklahoma.

The June STEO report forecast US output would drop in April and May to 10,983 kb/d. It would then begin to increase at an average monthly rate of 61.3 kb/d/mth up to December 2022, red markers.

It should be noted that the June STEO lowered the December 2022 production forecast from 12,334 kb/d to 12,147 kb/d, a drop of 187 kb/d. The revised forecast also drops the average monthly US output increase to 61.3 kb/d/mth from last month’s estimate of 75 kb/d/mth.

This should be welcome news to OPEC. If demand growth were to approach 1,000 kb/d in 2022, this would mean that OPEC would have room to increase their production, depending on what the rest of Non OPEC excluding the US does.

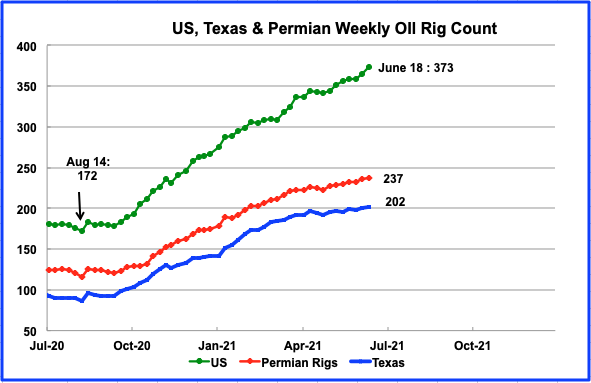

Rig additions continued in the US from the August low of 172 to mid June 2021. For the week of June 18 the rig count increased by 8 to 373. Texas added 2 while the Permian added 1 to 237

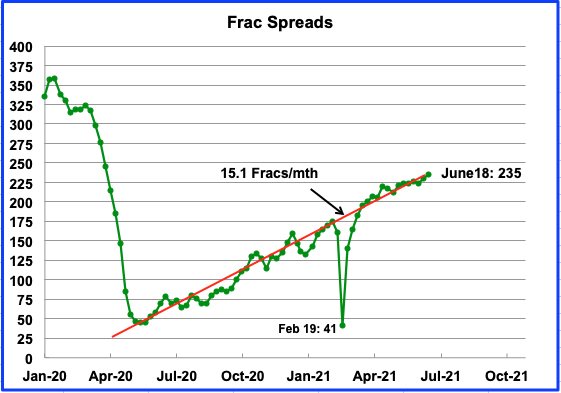

In the week of June 18, 5 frac spreads were added and reached a new recent high of 235. There is no indication of a change or slowing in the rate at which frac spreads are added each month.

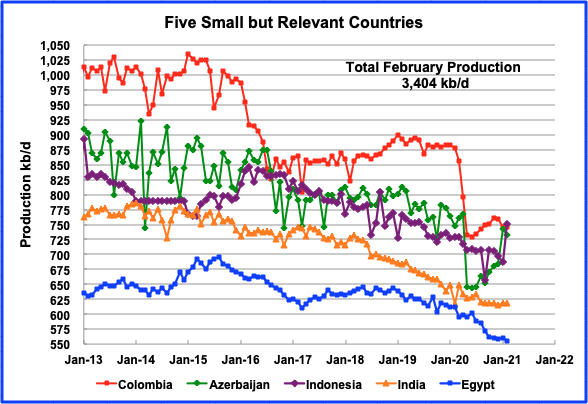

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined February production was 3,404 kb/d, up by 50 kb/d from January’s. Azerbaijan’s and Indonesia’s output appears to be recovering.

World Oil Production Projection

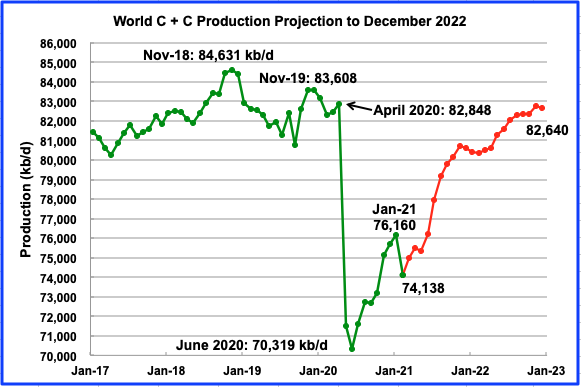

World oil production in February decreased by 2,022 kb/d to 74,138 kb/d according to the EIA. Of the 2,022 kb/d drop, the largest contributors were, US 1,273 kb/d, Saudi Arabia 900 kb/d and 201 kb/d from Canada.

This chart also projects world production out to December 2022. It uses the June STEO report along with the International Energy Statistics to make the projection, red markers. It projects that world crude production in December 2022 will be close to 82,640 kb/d. This is 2,000 kb/d lower than the November 2018 peak of 84,631 kb/d.

An Interesting OPEC Exercise

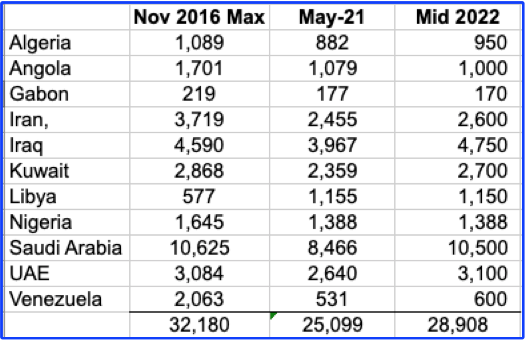

Above are the 11 OPEC countries that were present in OPEC in November 2016 when production reached its maximum output of 33,374 kb/d. Since then Ecuador and Qatar have left. With those two removed the maximum production is reduced to 32,180 kb/d. Production from the remaining 11 countries in May 2021 is in the middle column. The last column is my guesstimate where production will be in mid 2022. These guesses come from looking at the charts in the previous OPEC post by Dennis.

I should note that the EIA STEO is projecting flat output of 28,700 kb/d for OPEC from October 2021 to December 2022. In Q4-19, pre-pandemic, these 11 countries were producing close to 28,700 kb/d.

Essentially I am saying that OPEC output is going from 25,000 kb/d in May 2021 to 29,000 kb/d by Mid 2022, a potential increase of 4,000 kb/d. That still leaves those 11 OPEC countries down by 3,000 kb/d from November 2016.

If by mid 2022 world demand is back to pre pandemic levels and the US is producing close to 11,500 kb/d, we may be seeing a very tight oil market sooner than most expect.

Here is your fun exercise. Put your numbers in column three and give us your best guess.

Thanks Ovi,

My guess is that OPEC output will be 29500 kbpd in July 2022.

Great job as usual.

My best guess is OPEC output will be around 28,500 kbpd or less in July 2022. (Crude Only)

Got any guess for World C+C output in July 2022 Dennis?

Ron

According to the chart above it could be 82,000 kb/d.

Yes, you are correct, according to the chart above it could be 82,000 kb/d. There is just one problem here. The chart above is bullshit. 😉

But what is your prediction? Do you believe the chart above? Hey, this is the turning point. This is the point in time where the peak oiler’s predictions will fail or prevail. This is their last hurrah or last humiliation. Choose your side now or forever hold your peace.

Ovi, in case you haven’t guessed I am on my third toddy tonight and do not really that care about what I say… or think. I just sent the following post to all my friends in North Alabama:

“It’s raining. I love the sound of rain on the roof of my tiny little trailer. I will miss the rain when I get back to the desert of southern New Mexico. It almost never rains there. But, no place is perfect. I am going stir crazy in this tiny living space. I want more space. I want to do things that I cannot do here. And I want to stop living on TV dinners and cereal for breakfast. So I am going back to hot, dry, New Mexico.

But I have no regrets. This six-month trip to rainy North Alabama has been very rewarding for me. I have figured out a lot of things I would not have done otherwise. I am now ready for the next phase, and likely the last phase of my life. I am looking forward to it. I love you all.”

Okay, that’s it for tonight. Take care.

Ron

Enjoy a fourth. I wonder how much production will drop due to Claudette.

I think we are heading for the confirmation of peak oil sometime between mid 2022 and late 2023.

What do you mean by confirmation? Do you mean they will confirm that the peak was 2018-2019? If so, I cannot agree. No, there will be deniers all the way down. There is something about the human psyche that just cannot accept reality. After all, most Republicans still think Trump won the election. The ability to deny the obvious is just built into our nature.

Thanks for continuing to monitor crude oil production. As of now, we are back to 2005 levels!

I have been looking at BP

17/6/2021

BP peak oil (UK decline, asset sales and decommissioning part 2)

https://crudeoilpeak.info/bp-peak-oil-uk-decline-asset-sales-and-decommissioning-part-2

30/4/2021

BP peak oil (UK decline, asset sales and decommissioning part 1)

https://crudeoilpeak.info/bp-peak-oil-uk-decline-asset-sales-and-decommissioning-part-1

Many problems we see are now worse than in any peak oil scenario, especially in the airline industry. So I have been looking at the numbers and found:

22/5/2021

China-Australia passenger traffic has peaked 2018-19 before Covid

https://crudeoilpeak.info/china-australia-passenger-traffic-has-peaked-2018-19-before-covid

It is also generally assumed that electric vehicles will take over.

But in Australia power generation is insufficient to support any number of EVs which would be relevant to reduce oil demand:

14/6/2021

NSW power spot price spikes May 2021 become regular (part 2)

https://crudeoilpeak.info/nsw-power-spot-price-spikes-may-2021-become-regular-part-2

7/6/2021

NSW power spot price spikes May 2021 become regular (part 1)

https://crudeoilpeak.info/nsw-power-spot-price-spikes-may-2021-become-regular-part-1

Too bad Australia has such poor solar reserves, else they’d be able to drive all around without oil.

https://globalsolaratlas.info/map?c=-19.932041,130.078125,4

Ron

Yes. Confirm 2018. Its their choice to believe it or not. In the end they will feel it in their wallets.

When 30% of the GOP believe that T will be reinstated in August, you know that there are people who will believe or not believe anything you tell them.

In 2030, global C+C production will be 74 Mbpd, which will be plenty for the important uses.

Or, it will just have to do.

Hicks , “Or, it will just have to do.” More likely .

On this we agree in full.

Hicks , I think you being very gracious by forecasting 74 mbpd by 2030 . My thought is 74-76 mbpd bracket by 2025 . The reasoning is that we will end 2021 at 80-81mbpd . In the next 4 years shale will easily loose another 3mbpd . It can be ramped up fast and it will also crash fast especially with the headwinds it now faces . Add another 2mbpd on natural decline ( here I am being gracious) and we could loose 5mbpd or more by 2025 . All are requested to give their reasoning and rectify me if I am incorrect .

P.S ; Shale has gone from 8.3mbpd in Nov 2019 to 6.9 mbpd Feb 2021 . Loss of 1.4mbpd in 15 months .

Hole, It was just a wild guess, since that is all you and I are qualified for.

But I stated it with the intent of pointing out that within the decade we may start to see a significant decline in oil availability in parts of the world.

I also think that in the post peak era that money will not be the only director of oil flow on the international market. The idea of preferred customers who support the exporters national interests will rise higher on the determination list.

For example, China will have a lot to say whether Europe gets (as) much oil from the middle east. USA will have an incentive to be a more respectful trading neighbor with Canada. Some places will still get enough oil, and some will start to have shortage- not just the poor.

There will be no choice but to tolerate the decline in petrol available for transportation.

Unless you have other ways to get around.

Hickory,

See

https://peakoilbarrel.com/oil-shock-model-scenarios-2/

Especially chart at link below

http://peakoilbarrel.com/wp-content/uploads/2019/06/blog190607p.png

I think it more likely that output will be about 80 Mbpd in 2030 for World C plus C, only a depression or fast transition to electric transport would lead to 74 Mbpd in 2030, I would put the odds at less than one in 10 that either of those scenarios will occur by 2030, perhaps by 2035.

Well for the sake of stability and gradual transitions, I hope you are correct, Dennis.

I was just throwing out a guess number, wondering what you and others thought.

A coordinated downward adjustment in demand could be orderly, but in reality the oil production beyond peak will be apportioned

-to the producing countries

-to the wealthy (nothing new here)

-to important uses- via government mandates/restrictions of some sort

This will leave big swaths of the worlds population on the very short end of the stick, and will make discretionary use of oil for the common person dramatically more expensive.

Hickory

Also, whoever is President at the time will be issuing a new permit for Keystone Xl

Historical growth and decline rates for world C C.

Lot’s of wiggle room as one can see.

Did the graph show up? It is only 38 kb.

Yea the chart can be seen. Thanks Seppo.

Ron

81 to 82 Mbpd.

Well, the average before the pandemic was about 82.4 Mbpd. Reaching 82 Mbpd would be a miracle. 81 perhaps but not likely. My estimate is 80 Mbpd at best.

The tornado alarm is going off here. If I don’t reply tomorrow you will know I was swept away. Oh, oh, it just stopped, so perhaps I am safe. 😉

Great work Ovi . You never seize to amaze .

In agreement with Ron . 80 Mbpd will be best that they can drag out of the rocks .

Hole in Head

Thanks

What will be World C C output in July 2022?

I guess it will be less than 80mmbpd.

WHY?

Oil supply is a function of both geology/reserves and capex. Only when you put the money in that you can get the oil out, that is self evident. Also obvious is the depletion of assets. If no capex were to be employed, supply will decline naturally. Or in other words, some of the capex is by nature maintenance capex – required to maintain oil flow at a desired level. However, when the reservoir depletion exceeds a point, no amount of capex will be enough to maintain production.

We all have different views of reserves and TRR.

Dennis for example believes in a much higher TRR number than Ron.

But, let’s come to capex. Let’s say that your production now depends on cumulative capex for the last 5 years. Large projects take upto 5 years to come online while smaller capacity increase/maintenance projects with an added well or two can take 9-12 months.

Standing in July 2022, the last 5 year cumulative capex is US$1,850bn. If I am standing in 2018, last 5 year cumulative capex is $2,800. Current capex (2020-21) is around $310bn per year – which is a run rate of $1,550 in a 5 yr period.

So, the question is – if 5yr capex has declined by a third since 2018, why would you expect the same amount of production as in 2018? Production has gotta drop, no? The quantum of drop might be in question but not that it will drop naturally as a result of the drop in capex.

And note, I haven’t brought the geology into the equation here. There is a very good argument that it is getting tougher to extract oil, not much has been found in the last 12 years exploration etc etc. I am just keeping my arguments to capex invested historically.

Ancient Archer,

The cumulative capex through 2018 had World output growing at roughly 1000 kb/d (for C plus C output which is my focus) the reduced capex will lead to lower rates of growth, but not decline, in my opinion, also note that capex can increase, part of the reason for the decrease in capex is oversupply of oil and low oil prices. Higher oil prices will likely lead to an increase in capex, I agree there will be a lag betewwn FID and output increase for some projects (Arctic and deep water) but onshore conventional, tight oil, extensions of existing deepwater projects have shorter lead times of 6 months to 18 months. OPEC has a lot of capacity that is not being utilized and can be brought back online and there is still a lot of capex being spent that can maintain output at the 2018 level. My guess is that by 2023 the World returns to the 2018 peak level (average annual output of C+C) and exceeds that level by 2024, peak expected in 2027/2028.

Update to shock model below, conventional URR=2800 Gb, unconventional=260 Gb which includes tight oil and extra heavy oil (API gravity of 10 degrees or less).

Dennis,

As you mention, extensions of existing projects are short duration and cost less money. But, you need to first invest big money in the project initiations – field developments and such. Once that is done, you can squeeze a bit more (EOR and such) and get by.

Couple of points:

1) You have to invest first in the major project and then EOR it later. If you don’t invest the big money initially, then there will be nothing to squeeze. My point is that a lot of the large capex decisions have been cut or postponed in the last 6-7 years. I can see that the 2014 capex was US$730bn while 2019 (before the pandemic) was already down to US$420bn. This cut through the years affected the large field development projects.

2) There is a limit to which existing assets can be further squeezed. Because the oil world (at least conventional) was short of capex money, they preferred squeezing existing assets – in fact that’s most of what happened. But assets run out of oil eventually, and I am fearing that after years of squeezing, there is not much juice left in the lemon.

Hence, my pessimism. It is not just that 2020/21 capex has fallen off a cliff to around UA$310-320bn but that it had already fallen off a cliff 2015 onwards and we were living on borrowed time. After the latest round of capex cuts, we will face issues in 2022 I reckon.

You also mention 1000kbpd of annual increase in supply that came from the capex before 2018. All of the increase, I mean all of it, came from US Shale. All the capex in conventional was spent just in keeping production flat. I think it can’t be managed now, not with the capex we are left with right now.

Ancient Archer,

I believe you assume capex will not increase, I disagree with such an assumption. I do agree there will be a lag for big projects, but think tight oil, infill drilling, EOR, etc will keep output rising slightly until larger projects can start producing. If not we will see a spike in oil prices in order to balance the market.

Dennis,

How much can you squeeze an already squeezed lemon?

Talking just about conventional here.

Not much more oil is going to flow from EORs, side-tracks, infill drilling and such after you have depended on these primarily for the last few years. At least, definitely less than has flowed in the past and most probably a significant deal lesser.

The big developments will take time, as you say. But where are the newly discovered fields to exploit for these developments? Not much has been discovered since 2002. The big one is Guyana and Hess and Exxon are falling over themselves to develop that. Not a lot of other exploitable resources methinks.

Ancient archer,

There have been resources discovered that were never developed, a fairly big chunk of these, perhaps those will never be developed, but sometimes high oil prices change things. NOCs are a black box, difficult to assess what their potential is.

The short answer, I am guessing based on estimates by USGS and other agencies that have access to information such as the IHS database that I do not have. We will have to wait and see.

USGS estimated 3000 Gb for World conventional oil in 2000. I use 2800 Gb. They have 1000 Gb for unconventional, I have about 220 to 260 Gb in my recent oil shock models.

Despite what many seem to think, my models are quite conservative. This explains why all of my past estimates have been wrong because they have been too low.

Perhaps this will not always be the case, time will tell.

Dennis , “NOCs are a black box, difficult to assess what their potential is. ” The biggest NOC Saudi Aramco is borrowing money hand over fist to stay relevant . They already bought back online the moth balled fields and are working with poison in Manifa . What potential ?

Anyway , what can they do if there is no more ” economical oil” to bring to the market , No wonder they talk about solar .

Dennis

Thanks. Even at 29,500 kb/d, that puts those eleven countries down by 2,500 kb/d. Over roughly 5 1/2 years, that is an overall decline rate of approximately 450 kb/d/yr, after allowing for increases in SA, UAE, Iraq and kuwait.

Ovi and Ron,

Note that I do not necessarily expect this will be as high as OPEC will go in the future.

Several OPEC nations have declined, but I always focus on 12 month peaks. Monthly peaks are not important in my view. OPEC output has indeed fallen mostly due to Venezuela and Angola with some smaller decreases from others. In any case World outlut is the key. My expectation for 2022 midyear is 81 to 82 Mbpd for World C plus C output. I expect World C plus C output to reach 84 Mbpd by 2025. Peak in 2025 to 2030 time frame with peak plateau over that period.

Algeria : I don’t see how they will increase significantly their production. Irak : possible, but the goal of the Iraqi regime is not to produce in order to produce but to produce in order to buy social peace with oil revenues and at the same time save oil reserves. Lybia : forecasting future levels of Lybian oil production is a hazardous task. Nigeria : given the recent past of Nigerian production, it is doubtfull that they will maintain their production. Saudi Arabia : if they feel able to get back to their production level between 2013-2019, roughly, why did they decide to launch a plan to reduce their domestic oil consumption by 1 Mb / day?

They earn money through exports, the subsidized domestic use is a waste. So they will attempt to reduce domestic use.

Best of luck to KSA on reducing consumption with an ever increasing population that has needs air-conditioning and desalinated water 24/7 . Oh forgot to mention the decline rates .

Hole in head,

Solar resource is excellent, would provide plenty of energy and would be cheaper than using oil at 80 per barrel.

Dennis, solar panels in the desert do not work because of the sandstorms and need for cleaning with fresh water in a water stressed region . Has been discussed here before .

HH,

India uses solar panels in their big installations.

Here a source if you don’t believe: https://www.nsenergybusiness.com/features/largest-solar-power-plants-india/

The background looks a lot like desert.

And they use robotic dry cleaners to keep the cells going, they are cleaned once a day.

You won’t install solar installations in a pure sand deserts – but lot’s of deserts are no sand deserts.

Eulenspiegel, in the desert, sand is not the problem, it’s the dust. I lived for almost five years in the desert of Eastern Saudi Arabia. The sand desert of the Rub Al Khali was well to the south. But nevertheless, I lived in the desert, a packed hard dry dirt desert. The wind blew mercilessly and the dust was ever-present. Dust would collect on the power line insulators and then the dew would cause arching. They had water trucks that wash them with pulsating water streams every few days. I can imagine solar panels would have a similar problem.

Hole in head,

Yes I was not convinced. Sand storms happen of course just like snow storms, but not 100% of the time.

Water can be used to clean panels, and collected and recycled, this is far from rocket science. Their solar resource is huge, problems are not difficult to solve.

“solar panels in the desert do not work ”

Haha- Keep believing Hole.

And the world is flat.

Sometimes factual information is useful… even if it clashes with belief?

https://www.eia.gov/todayinenergy/detail.php?id=39832

note- the high Capacity Factor [CF] recorded for the desert region solar installations shows how well they are performing in the real world. CF measures the actual annual output of any electrical generating facility in relation to its theoretically maximum if running 24/7/365. The biggest factors that reduce a solar facility CF are nighttime and clouds. Dust, ash, sand and bird poop also have their effect, but overall- the proof is in the pudding, as the data shows.

@Ron,

If you have solar panels in a desert, you can order a cleaner here:

https://www.indiamart.com/shrijasolarglassshield/solar-panel-cleaning-machine.html

You can buy it already – this problem is solved. No water dust cleaning robots. Normally they run once a day because of the lot of dust in deserts.

Or when you have only a rooftop installation, here the small version:

https://www.pv-magazine.com/2021/05/25/water-free-portable-cleaning-bot-for-rooftop-solar/

You can use a web app to supervise it. No water needed. It has a solar powered loading box you can install on the roof to keep it going.

Putting up solar panels in the desert is not simple . Read about this abandoned project about high speed rail in KSA . When the rubber meets the road then you know how good the tires are .

https://english.elpais.com/elpais/2015/02/04/inenglish/1423052376_326956.html

And then events happen that you have no control over .

https://www.saurenergy.com/solar-energy-news/april-17-killer-storm-hits-bhadla-solar-park-too-as-developers-count-damages

The solar plant in India is built on a dried lake / river basin of old . The ground and surroundings are not sandy but hard like the ground would be after a drought . The best translation from Hindi would be “caked ground ” . In KSA they would have to use cement slabs to put up the panels to prevent them from shifting as the rail project has shown . Most important , not only has electricity to be generated but also transmitted . So get the transformers , wires and towers and the roads etc . Just because it is technically possible does not mean it is economically feasible . Many a slip between the cup and the lip .

JFF

After all of that speculation, I expected to see a prediction tout de suite.

That’s why:

1/10/2019

The Attacks on Abqaiq and Peak Oil in Ghawar

http://crudeoilpeak.info/the-attacks-on-abqaiq-and-peak-oil-in-ghawar

OPEC officials heard from industry experts that US oil output growth will likely remain limited in 2021 despite rising prices,

While there was general agreement on limited US supply growth this year, an industry source said for 2022 forecasts ranged from growth of 500,000 bpd to 1.3 million bpd

The forecasts for 2021 were for average output to be close to 200 kb/d. The 1.3 Mb/d prediction for 2022 is out to lunch. The 500 kb/d has a chance but I think the average will be closer to 350 kb/d.

https://economictimes.indiatimes.com/markets/commodities/news/opec-told-to-expect-limited-us-oil-output-growth-for-now-sources/articleshow/83639450.cms

Ovi,

What is your expectation for oil price in 2022?

Based on what I see now I think an average Brent price of $80/b in 2021$ is likely.

If that is correct I expect US output will increase by 1000 kb/d over 2021 levels, this would be the Dec 2020 to Dec 2021 increase in US C plus C output.

Note that I expect US tight oil output to rise about 300 Kb/d from current level to Dec 2021. So the total rise from April 2021 (last data point) to Dec 2022 for US tight oil may be around 1300 kb/d assuming we see continued rise in Brent oil price to $80/b by Dec 2021 and then average Brent price in 2022 of about $80/b.

Typed incorrectly 2 comments above(638 am), meant to say 1000 kbpd tight oil increase from Dec 2021 to Dec 2022.

Dennis

I think WTI will be $85 plus/minus $5 in mid 2022. This will push the average price of gasoline slightly above $3/gal. As for output, the US will add somewhere close to 300 kb/d average in 2022 over 2021. I am betting on some restraint on the part of the drillers. The Permian is the pivotal basin and I see that the early results for 2021 wells are not as good as 2020.

The big unknown for me is: What is a sustainable price for WTI, $100? At what point does gasoline suck too much money out of the economy. Once the economy starts to slow, oil demand will slow. We can all remember 2008.

If WTI crosses $90, OPEC might start to worry. However will they have the spare capacity to try to control it? Six months from now we can revise our estimates.

Ovi,

Your big question is, is $100 a sustainable price for WTI or what is the sustainable price of WTI?

I have never understood why people behave as if oil ever goes to $100, the United States of America will stop. Absolute dead stop.

A couple of points for your consideration.

1) Historical prices

WTI averaged a bit below $100 from 2011-early 2014, a period of 3 1/2 years. Brent at that time averaged $110. The world didn’t stop as far as I remember.

Take into account the inflation and the increase in personal disposable incomes over the last 10 years. US gdp per capita in 2011 was $50k. It increased 30% to $65k in 2019.

Hence, $100/bbl in 2011 should be equivalent in terms of the customer wallet to $130 currently.

And remember, the world (and the US) was okay with those prices (i.e. the world ran didn’t stop) for 3 1/2 years. If the adjusted level ($130) is reached again – and that is nearly the double of where we are now in terms of the WTI/Brent price, I don’t see why the world will suddenly stop!

2) Current prices comparison across markets

Let’s run a comparison of prices of gasoline in the different markets along with the paying capacity. Gasoline is $3.05 in NY state. It is £1.40 per litre in London and INR 103 in Mumbai. That comes to, in terms of USD/litre: $0.93/lt in the US, $2.10/lt in UK and $1.50/lt in India.

Hence, people in India are paying 50% more at the pump for gasoline and people in the UK are paying more than double.

Now let’s compare the ability to pay by comparing the GDP per capita: $65k in the US, $42k in the UK and $2k in India.

So, people in the UK are paying more than double for gas while simultaneously having 35% less income. If I adopt that ratio of price of gasoline to GDP per capita, WTI price can go to: $72*1.35*2.1 = $204. Let’s round it down to $200. This means that if WTI went to $200/bbl, the avg American will pay the same at the pump as a proportion of income as does the average Briton NOW.

I won’t perform the same calculation for India vs the US because that will lead to a ridiculous result. A country that has 3% of the GDP per capita of the US is paying 50% more than the US at the pump.

These two countries (UK and India) are just examples of how much the rest of the world pays for oil. And how, even at those elevated prices, there is still demand for oil and the economies still run. The US has one of the highest per capita GDPs in the world and one of the lowest prices of gasoline at the pump. They can pay a lot more, the evidence shows.

How did you come to the conclusion that WTI price won’t be sustainable at $100?

In order to equal the $/mile of electric vehicle in the USA gasoline would have to be about 1$/gallon.

What price of crude could give gasoline at $1?

On oil price, there hasn’t been a time until just recently where major oil companies have announced they will be producing less oil in the future as a goal going forward. That hasn’t happened in the industry’s 150 plus years.

Likewise, there hasn’t been a time until recently where future demand projections have been for demand to decline over time.

These facts result in tremendous uncertainty and volatility. I argue these facts will have a major impact on the world economy.

I really do think we could see prices above $200. I also believe we could see prices as low as $25. Both WTI prices. Could even happen in the same calendar year.

shallow sand,

doubt we see it the same year unless there is a severe shock like WW3, Great Depression2, another pandemic, or other catastophe.

If oil producers choose to produce less because of high risk, then oil prices will rise, this will tend to accelerate the transition to alternatives to oil, difficult to guess how rapidly that might occur.

I still think higher prices through 2030 are likely (though I doubt $200/bo, perhaps $150 ), by 2030 to 2035 I expect demand may begin to fall fater than supply and prices might fall pretty rapidly. This is where it is possible we could see prices go from high to low rapidly, especially if there is also a supply or demand shock, depression or major war.

Difficult to know how it plays out, probably not a smooth ride.

ANCIENTARCHER

My basic question was “What is a sustainable price for WTI?” Unfortunately I added in the $100 as an example. I was looking for someone to bring together some economic info to get some idea of what sustainable price would be.

So thanks for the info and comparisons. We just might see if the US and world can sustain $200/bbl.

It is not clear to me that one can compare the price of gasoline between countries. Do the Brits travel 100 km to 150 km from the suburbs into London. More than likely they have access to a an excellent regional transit system and paid medicare. Not clear to me how much of their income goes to gasoline relative to a US consumer. Same for the other countries.

Thanks Ovi!

The average Brit here in the UK doesn’t travel as much as the American – I can say that having lived in both countries, though in the US I lived in NYC where I didn’t need to drive at all and drive a little bit in London.

However, consider that the average Brit is earning 1/3rd less than the avg American at a gross income level. Yes, (s)he gets (apparently) free healthcare from NHS but that is not entirely true. We pay it through taxes here which are higher in the UK than in the US. House prices also tend to be a bit higher in the UK as are basic utilities and necessities like food.

If you consider net disposable income that is available after taxes, rent/mortgage, food etc, the American should be substantially better off – maybe having close to 2x the disposable income of a Brit.

We can perform the same calculations for the rest of the developed world and we will be at a level closer to the UK than the US, in terms of disposable income vs the US and actual price of petrol at the pump.

There is no doubt that Americans are paying far less than anywhere else in the developed world in terms of the absolute price of gasoline. If you take the higher disposable income of Americans in general (gross income for Americans is substantially higher and taxes are lower than almost any other large developed market though for the others healthcare is covered from a part of the higher taxes) then the gap between what the Americans are paying and what the rest of DM is paying widens even more.

I believe $150-200 should be sustainable in the US, though at the higher end of the range, it will begin to depress demand.

$150-200 is what I am predicting a couple of years down the line i.e. 2023

Ovi,

2008 was a credit crisis due to poor regulation of financial industry, oil prices had very little to do with GFC, see “The Big Short”.

I also remember 2011 to 2014 with average Brent price of about $110/b over that period in 2019 US$, The World real GDP growth rate over that period (using market exchange rates) was about 3% per year.

Basically $100/bo for Brent (say $95/bo for WTI) is unlikley to be a problem, note also that as a percentage of current average World real income (essentially equal to real GDP) that $100/bo will be less today because real GDP has grown by much more than oil use over the 2014 to 2019 period. (I assume oil use will return to at least the 2019 level by 2022).

I see your 300 kb/d growth in US output as a minimum, something that would be achieved at $60/bo for WTI, currently WTI is close to $70/bo and likely to be $78/bo by the end of 2021 ( the Brent/WTI spread had dropped to $2/bo from a typical $5/bo when tight oil was booming).

I expect the average completion rate in the Permian basin will return to over 450 completions per month by mid 2022. Permian output would increase by about 600 kb/d in this scenario, I expect other tight oil basins may remain at flat output at these prices as well as GOM, conventional might also be flat at these higher prices in the US so overall a more reasonable guess would be 600 kb/d increase from April 2021 to Dec 2022, less than I had previously guessed over the weekend (I didn’t have access to my models so it was more of a guess than usual).

Scenario below for Permian basin assumes Brent goes to $80/b by Dec 2021 and remains at that level until 2032 and then oil price gradually declines to $25/b in 2075. No wells completed after 2041 in scenario, peak about 5500 kb/d in 2030, URR=45 Gb with TRR assumption of 75 Gb and 125 thousand total horizontal tight oil wells completed from 2008 to 2042, about 32000 horizontal tight oil wells have been completed in the Permian basin through April 2021 based on current well profiles and output estimates. The average Permian well is assumed to have an estimated ultimate recovery of 370 thousand barrels over an 18 year well life as of Dec 2019, well productivity is assumed to decrease after dec 2019.

this scenario assumes no more than 500 wells per month are completed after 2020 which assumes tight oil producers remain disciplined on their capital spending, to me this seems like a minimum output if the USGS mean TRR estimate of 75 Gb for the Permian basin is correct (oil pros doubt this is a reasonable estimate). A scenario using the low end USGS estimate of 44 Gb for TRR would yield perhaps a URR of 30 Gb (a guess as I have not run that scenario recently).

I have run the Permian scenario with lower TRR of 44 Gb, similar assumptions to earlier “mean TRR scenario” see below, URR of 27 Gb, I expect this is the minimum output we would see from the Permian basin, but I think the URR=45 Gb is more reasonable.

Dennis

Regarding the 2008 GFC, the banks through their mortgage policies literally created a house of cards. Something had to trigger the collapse of that house.

I think the high price of oil did it because too much was spent buying gasoline at $4/gal to $5/gal. I recall seeing pickup truck owners on TV complaining about paying $250 to $300 to fill up their truck. I think this lead to mortgage defaults, which then brought down a small bank and then Lehman Brothers and the other banks followed.

I just did a search and found this. Did the Oil Price Boom of 2008 Cause Crisis?

https://www.wsj.com/articles/BL-REB-4141

My 300 kb/d was an average for the year so it implies a 600 kb/d increase from January 2022 to December.

I think the projections made by Dennis are very useful.

He is the first to acknowledge that they are looking into the future, and thus will not be what specifically happens when we get there.

However, they give a sense for what may be possible given the various assumptions.

I think of it as what could happen if all the stars were aligned for optimal (desperate) LTO production.

If the country was desperate for transportation fuel (for example there was very little electric vehicle deployment- like the current status), then the price will be very high before long and even McCombs Bar B Que House in Rankin will be busy serving it up.

Credit (from thin air) will be extended to drillers by somebody.

Wont happen Dennis unless the New consolidated companies double the rig count. The new average well which is a child well IPs are roughly 60% of the parent wells. You may even see production decline. The Shale’s best days are behind us.

Also companies who pay dividends will have trouble growing organically. Look for more consolidation.

The future development of HZ tight oil in the US is only remotely dependent on product prices; credit/debt will continue to play a paramount role. As will regulatory matters, public sentiment and groundwater, groundwater and groundwater. Wells that decline 85% in the first 32 months of production and that can only dribble out 35%-40% rates of return over 15 year periods do not generate sufficient cash flow, fast enough, to NOT require credit/debt, particularly now in the face of $300B of public and private legacy debt. The Permian Basin is still adding debt, not paying it back.

THEN there is the matter of Mother Nature. In the end, She ALWAYS gets Her way:

https://www.oilystuffblog.com/forum/forum-stuff/the-heart-s-of-the-permian-watermelon

LTO survivor,

So far there is little evidence that average new wells are lower in productivity by looking at the data. See

https://shaleprofile.com/blog/permian/permian-update-through-march-2021/

Chart below has average cumulative output from Permian basin tight oil wells that started producing in 2018, 2019, 2020, and 2021.

The important factor is the frack spread count, rig count will increase as needed, perhaps it will need to double.

I suppose you believe the 27 Gb scenario based on USGS F95 TRR of 44 Gb is also too optimistic?

Cumulative output plus proved reserves for Permian basin tight oil is about 17 Gb, what is your expectation for Permian basin tight oil URR?

Dennis , “The important factor is the frack spread count, rig count will increase as needed, perhaps it will need to double. ”

Do you believe this will be done ? Maybe the “oilmen” will interject ?

Not true, as this person actually operating HZ tight oil wells in the Permian would know, of course. When normalized for lateral lengths and proppant loading per perforated foot well productivity in the Permian has been falling since 2016.

Dennis, from your link

“As is visible in the chart on the right, wells completed in recent years are trending towards somewhat lower ultimate recoveries per 1,000 ft of lateral length”

Permian well productivity does appear to be past its prime, as is Bakken and to a much greater extent Eagle Ford. Seems unlikely they will be able to flog this dying horse much harder…

Stephen Hren,

I agree that it has been decreasing, but not by 60% as indicated by LTO survivor. I do not have access to lateral length data, I take the output data reported by shaleprofile and estimate well profiles for 2010-2012 wells (single well profile estimate) then one for each year from 2013 to 2019. From 2020 tnto the future I assume well productivity decreases in my model.

Chart below shows the assumed decrease for average new well EUR for the 45 Gb Permian scenario I presented somewhere in the thread. The rate of decrease varies depending on number of wells completed per month.

Mike,

It has been falling when normalized by lateral foot, but not by 60% as LTO survivor suggests above. I do not have access to the normalized data.

The post I linked from shaleprofile shows a slight decrease in cumulative production in chart below, perhaps as much as a 12% decrease, all wells are still well above the 2015 average well, and I expect we will see continued decrease in productivity per 1000 feet of lateral length.

I assume in my models that productivity starts to decrease in Jan 2020. I use actual output data for wells that started producing in 2019 and assume an average lateral length of 10,000 feet (which overestimates actual length) so the acres per well I use is also an overestimate for the average well (10000 by 500 feet) roughly 250 acres per well. My well profile (estimated on limited well data last year) has output ay 16 months at 179 kb cumuative vs actual average output of 188 kb (based on shaleprofile data). Despite what you believe my estimates are relatively conservative the 2019 average well has an EUR in my model of 375 kbo and pays out at 35 months for a 10 million dollar well at a wellhead price of $60/b for crude, and $1.50/ Mcf for NG. Cost per barrel of oil(OPEX) over life of well is $13/bo, EUR for NG is about 300 kboe (5800 cf/b) and cumulative NGL is 122 kb sold at 25% of price of oil.

forgot chart, sorry

LTO Survivor,

Anything is possible, it will depend on frack spreads and horizontal oil rigs operating. Based on rig count alone and assuming it does not increase or decrease in the future, Enno Peters model has Permian supply increasing.

What has been happening to rig count in the Permian basin?

Seems the horizontal rig count from Sept 2020 to June 2021 has been increasing at a rate of about 150 per year in Permian basin. Currently about 228 rigs are running and in Sept 2019 about 380 rigs were running so we need about 150 more rigs to get back to Sept 2020 levels when drilling was near its maximum in the Permian basin. If the rate of the past 9 months continues for another year we will be back to 380 rigs, the frack spread count may approach its March 2020 level (when output was at a peak in the Permian basin) sooner, perhaps by late December 2021.

The completion rate is more closely correlated with frack spread count, the problem is that I don’t have the break down of number of frack spreads by basin as is the case for rig count.

typo above, I wrote maximum in Sept 2020, should have been Sept 2019 and assuming 6 month lag between drilling and first flow, the max output ends up being March 2021.

Mike

If you are around I would appreciate your thoughts on this P&A blowout.

https://twitter.com/sand_frac/status/1405312730282840070?s=19

As a matter of fact, there will be less of this due to the financial discipline of oil shale producers. But this is one the reason why fracking has been forbidden in France. By seeing what was happening in USA, people prefered to forbid this instead of experimenting it themselves.

To avoid drama amongst the anti-oil crowd here, I have answered your question the best I can, here:

https://www.oilystuffblog.com/forum/forum-stuff/red-bucket-well-control

Mike, please don’t worry about upsetting the anti-oil crowd. I do that almost every day. Don’t get me wrong, I know climate change is a very serious problem but those who believe that problem will be solved by renewables are living in a dreamland.

The climate change problem is just not solvable. I know, every little bit helps but we are headed for a much warmer world in the next few decades. And we will never get rid of oil until it is all gone.

Perhaps not for those who have 85% of their electricity produced by nuclear power.

JFF , yes , but they have another problem . How to dispose of the used nuclear fuel rods ? Life is full of unintended consequences and how to dismantle the past of expiry date reactors . 😉

No problem–

In 24,000 years they will reach a half life.

How were things 24,000 years ago?

Well, we have a specialized factory for the retreatment of the used nuclear fuel rods in La Hague in Normandy. Ideally, we should build a fast neutron reactor in order to significantly reduce the half-life of minor actinides by transmutation. This would facilitate the management of these nuclear waste because their storage time would be of the order of a century. Therefore, the people won’t have any difficulties to understand the instructions to manage the storage facility. About the dismantling of the nuclear power plants : that’s not so difficult. What is the main challenge is the dismantling of the reactor vessel. The rest has already been done for a few facilities such as superphenix. Simply, it will cost money. So, I imagine that the retirement plan is going to be planified carefully.

JFF , not all fuel rods are handled by the Normandy facility . Many are sent to a unit in the UK , I think it is called Hinckly point or Hincky Point . Dismantling of power plants is no kid stuff . I have been witnessing the dismantling of a small thermal power plant 20Kms away from my place . It is ongoing since the last 5 years . As to dismantling nuclear plants ,you have answered the question ” it is costly ” and the power industry is broke . They have been kicking the can down the road for the dismantling of the Doel and Tihange power plants in Belgium since the last 10 years . Both the plants have cracks in the cement casing verified by IAEA and have ongoing breakdowns which is leading to a capacity utilisation of about 65-70 % . By the way they are operated by the French power corporation . They keep on changing the name as they go thru M&A to keep solvent . Black hole for the government . It was called Electrabel, then GDF Suez , then Aviva , now Fluvius . Heck ,not much can be done . There are hundreds of nuclear installations around the world , how many can the system take care off . Chernobyl and Fukushima were close calls . Keep the fingers crossed and pray nothing bad happens .

The US had the integral fast reactor program, a superb bit of engineering that burned (as fast reactors do) the long lived problematic transuranic waste products that thermal reactors produce. It was demonstrated to be walk away blackout safe. Reprocessing was done on site (hence ‘integral’).

Fission products decay in 500 years or so to some quite valuable metals. 500 years of containment isnt a huge problem.

https://issuu.com/johna.shanahan/docs/110101_plentiful_energy_by_charles_

The program was shut down by John Kerry.

All those skills dissipated and perhaps lost.

IanH , you said ” Fission products decay in 500 years or so to some quite valuable metals. 500 years of containment isnt a huge problem. ” Valuable metals are not fission products .

I seriously hope you are not serious .

Thanks Mike.

Thanks Mike I will head over.

Currently some countries import more energy than others.

Net energy (including all sources, not only oil) import by country is shown here in the link

The value listed is % of the total energy use of the country, with Ireland importing 86% for example.

This table is from 2014 data.

Wonder what has significantly changed since then

https://www.indexmundi.com/facts/indicators/EG.IMP.CONS.ZS/rankings

As oil price stays above $70/barrel, most shale will come back. However the max reached by USA was 13,100 million b/d. So whether World will hit 75 million b/d is doubtful. But NGL keeps increasing because of increase in natgas output. Besides nearly 6 million b/d that comes from CTL, GTL and bio-fuels will keep overall oil consumption above 100 million b/d.

Despite rapid increase in electric vehicles, oil will hold above 100 minion b/d mark.

Ted , demand is governed by price and availability . Demand of 100 mbpd is immaterial if the supply is only 80mbpd . Shale is not coming back . USA has peaked . Period . The peak in shale was (is) the peak of oil production in USA . I have commented earlier that ” all liquids ” is BS . The 6mbpd of NGPL ,CTL , GTL etc. are just ” fill in the blanks ” . These are not transportation fuels and have 65% of the BTU of crude .

Hole- Hydrocarbon Gas Liquids are nothing to belittle. It is a lot of energy-

“HGLs accounted for over a quarter of total U.S. petroleum products output in 2018”

https://www.kindermorgan.com/getAttachment/babe6db9-ba7a-4f51-a100-5fd46b944540/White_Natural_Gas_Liquids.pdf

Hickory,

NGL has about 70% of the energy content of a barrel of crude. In addition most uses for HGLs are not for transportation which is the the main use for crude plus condensate.

As Ron has said we don’t count bottled gas. I would say NGL should be put in a basket with natural gas.

Or we could define liquid petroleum as that which is a liquid at 1 atmosphere pressure and 25C aka STP.

By that standard only pentanes plus would qualify, which makes sense as it is essentially condensate, the proportion of pentanes plus in the US NGL mix is less than 12% by volume, 2020 data (582

kbpd).

Might not count it, but it is far from trivial. If all you had was wood and coal, and then came upon some NGL’s you would feel extremely fortunate. Its only because of the incredible energy abundance of oil that we don’t get all excited about NGL’s.

Ted,

When world peaked at about 83 Mbpd in 2018, US output was about the same as it is now, about 11 Mbpd. Iran, Iraq. Canada, Brazil and Norway can all produceore in the future than they produced in 2018, and US can likely pruduce 12 Mbpd, though I think the US may be past peak for crude plus condensate output. We ignore th NGL output here because most of that is not used for transportation which is the bulk of liquid petroleum liquids use.

Propane , butane, and ethane are mostly used for heat. Lighters, plastics, and other chemical industry inputs.

Dennis , 2021 is not 2018 . In between we had a black swan they call Covid 19 . You discount that and presume it is BAU .

Hole in head,

I take that into account in more recent projections. The oil not produced remains in the ground and can be produced at a later date.

Now if your prediction of 25 dollar per barrel WTI in 2022 proves accurate then your output prediction would also be correct.

I think you will miss the mark on oil price.

Pretty sure 75 per barrel will be a bit closer to the mark. 😉

Dennis, my year for $ 25 is 2025 . You can check . I had already said that before we reach the price there will be spikes but these spikes will not be sustained . Still 4 years to go .

Ok.

If you make it 2035, we will definitely forget. 🙂

We will see what it looks like in 2025. So I do agree prices will be volatile, the average for the year is really what pays the bills. My guess for 2022 is $75/bo for the average WTI price, what’s yours?

I am expecting prices a lot higher in 2022. An average of $85 would not shock me at all. They will be higher because oil production will not fully recover to the 2019 level as everyone expects it to.

The EIA Short Term Outlook has production fully recovered by the end of 2022 and total liquids about one million barrels per day higher for non-OPEC.

Dennis 2025 is 2025 . In my view 3 years forecasting is an informed guess ,5 years is stretching your luck and beyond that is shooting arrows in the dark .

This year the average will be $75 . In agreement with you .

hole in head,

I just need to remember 25 in 25. 🙂

Ron,

I agree on your guess for price, I think of $75/b as a minimum I would expect, 75 to 85 per barrel seems a reasonable range for an average annual WTI price in 2022, at least to me.

China will be in outright contraction demographically speaking within 3 years. Oil demand will be headed lower as old people don’t do as much as 20-35 year old’s. I’d have to check again but average age in China is about 43 currently. Chinese economy is based on a pile of leverage/debt that looks like a 110 story building. In comparison US would be like a 20 story building. Whatever people are taught to believe about US having a debt problem it’s far worse in most places you look. I’m talking total debt to GDP. Europe, China, Japan, India, Turkey, Brazil, Canada pretty much everywhere you look is worse off than the US.

The credit market makes everything go. Be it your talking about stock prices or oil production. Largest single source of credit in the USA is the pension funds. And they have to have a 7% return on capital to meet obligations. Which is why pension were at one time heavily invested in US shale oil debt.

Right now this is how the capital structure in the US works. Pension funds buys corporate bonds. CEO of company uses those funds to repurchase his or her companies stock so he or she can get paid via stock options. Does matter one bit if it makes economic sense or not. Valuations are distorted beyond belief.

Capital structure can and will change in the future as benefits paid out to retires takes capital away from corporate debt. There is going to be a draw down at some point.

Inflation is already a problem. Can the FED really step in a do whatever it takes including buying stocks and corporate debt to make everybody whole and not make the current inflationary problems worse?

We get another oil spike that goes above $120 maybe above $147 and the asset bubble that was created by low interest rates and QE pops.

I don’t think congress can pass anymore spending until price inflation comes down a good bit. So no Green New Deal or any other spending is likely anytime soon. They’ll keep talking about it but it just won’t happen.

We got a pullback in the stock market last week. What i expect to happen is. Maybe it last for another week maybe not. And CEO’s will use it as a buying opportunity to ramp stocks higher. And oil will go higher right long with it.

Because everybody know as long as the stock market goes up it means all is well and the economy can handle higher price oil and everything else. 🙂

HHH , a gem of a post . An absolute out of the way all of us think . Not all is supply /demand , currency etc . A new angle of demographics . I have in an earlier post said that we are facing a confluence of 3 E ( Energy, Economy, Ecology ) and 3D (Debt ,Deficits ,Demographics) problems which are insurmountable as their cumulative effect is more than what the current system can adjust to. Keep commenting . Greatly appreciated .

Yes, the chinese population will shrink.

Western population will grow, with accelerating speed. Woke culture in all old industrial western countries leads to an open border policy growing population – with random immigration. Social benefits will feed these not able to get a job. That’s a growth industry here in Germany already, leading to an real estate boom and state driven boom (The state must give the rent for an apartment to anyone here being able to spell the word “Asyl”).

I still don’t see this market crash. Even when the FED talks about tapering in 2 years as last weeks, stocks are warning. They even didn’t anounce DOING something.

This will crash, as every bubble crashes – but the crash will get up. The FED can’t taper. People will lose confidence in money and (try to) sell these bonds and (try to) buy anything valuable. 1922 was an extreme busy year for the German stock exchange, after 1923 they had to print new money. And since all big currencies are coupled and intertied, all big countries will have this the same time.

After this, the debt is gone – together with pension fund money and insurance money.

I know this mood with colleagues already. Everybody owning a house goes for the big repairs or improvements, other try to buy one or at least start buying gold and real estate funds. Younger buy stock and bitcoins. The money starts moving.

In fact, China’s population is probably already shrinking.

https://www.ft.com/content/008ea78a-8bc1-4954-b283-700608d3dc6c

What matters for oil is not a miniscule drop in China’s population, but the ongoing rise in Chinese

living standards, car ownership, air conditioning, and petrochemical use. Also air travel. All of these

are booming and leading to a million b/d rise in Chinese oil consumption every year. Same for India. Another several

hundred thousand b/d increase every year.

What is important is rising living standards for 1.5 billion inhabitants. Between China and India nearly

3 billion. The rest of the Asian countries like Indonesia, Phillipines, Vietnam, Thailand, add many more

hundreds of millions whose living standards are also rising. And they all want more convenient oil

energy for their cars, motorbikes, rototillers and tractors. That is what will collide with peak oil.

And electric vehicles will not make much impact.

In the end, the gas tanks of Europe and America may

shrink to supply the hunger for oil in Asia. Their marginal value product from oil consumption is much higher than in the OECD. Just how steep is Seneca’s cliff. We may

soon find out. jmho pilot

One tends to overlook that population is rising by 80m (sic) souls per year.

Question: is the number of FF-powered vehicles still increasing? Are EVs even keeping up with demand from the 80m reaching driving age each year?

Ok – many in poorer countries, with low vehicle ownership. Perhaps motorcycle sales are booming?

And on a similar theme, giving internet access to everyone via these new satellite constellations will cause a big increase in supporting infrastructure – phones, computers, batteries, solar panels, etc. – along with the desire to travel and to buy all those goods on Amazon, from the remotest areas of the shrinking Amazon.

I do not see this ending well.

https://www.businesstoday.in/current/economy-politics/pandemic-perils-push-32-million-indians-out-of-middle-class-pew-research/story/434235.html

Pilot , you said “What matters for oil is not a miniscule drop in China’s population, but the ongoing rise in Chinese

living standards, car ownership, air conditioning, and petrochemical use. Also air travel. All of these

are booming and leading to a million b/d rise in Chinese oil consumption every year. Same for India.”

Get the info correct . India is now 60% below or at poverty line which is $ 2 per day .

Hole in head–

India has one of the largest middle classes in the world–some 300 million people– who

all want cars and other modern conveniences. This is more middle class people than

either Europe or North America, and is exceeded only by China. Yes there are a lot of

very poor people in India. But even they has rising living standards. But the middle class

is using more and more energy, especially oil.

Pilot , I have provided this info earlier but maybe you missed out so once again for your rethinking and coming to an appropriate conclusion .

India ; Total population 1300 million (1.3 billion )

50 million rich and ultra rich : Own the house + vacation home in the hills for summer . Vacation in Europe /USA or any other exotic place to talk about . Kids in Yale, MIIT, Oxford . Cars for each family member with chauffer . Brands BMW , Mercedese , Lexus .Clothing Armani/ Versace . For health problems prefer to go to USA . Drinks only Scotch or Fosters beer (Aussie) . They cannot create demand like the 1% in USA . Saturated .

100 million upper middle class : Own the house but no vacation home . Vacation in Singapore , Bangkok, Dubai, Maldives . Kids in the best college of India . Cars for the parents and mobike for the kids . Car brands Hyundai, Suzuki . Clothing high end local brands . Health care in private hospitals . Drink best high end Indian brands . Comfortable . Not much aspirations and so no additional demand . House Full .

200 million lower middle class : Own house but mortgaged . Car but with a car loan . Vacation domestic only . Kids in medium level college but aspire to be in the best college . Clothing local . Skinch on health care to save for the future . This is the aspirational class . They want a better lifestyle and a better future for the kids . They want a car for their kid , an A/C in each bedroom and other goodies . Unfortunately the 35 million (add 20 million of the first wave , total 55 million) who got downgraded from the “lower middle ” to the ” upper poor” . The rest of the 150 million have gone into absolute saving mode fearing that the same future awaits them . Zero demand creation .

150 million migrants with no fixed address . They keep moving from village to city and city to city . These are vegetable vendors , food stall vendors, daily labourers . Only survival mode .

800 million (60%) already explained above .

Yes as you said “all want cars and other modern conveniences. ” , the problem is the aspirational class is dying . The living standards are falling and not rising . Increased inequality .

That is why energy(oil ) demand will remain flat ( cars/trucks already on the road will burn gas/diesel) or decrease in the future . Growth in energy demand is a no .no .

Some info off the point . Capacity utilisation of industry is at 65 % since 2018 . No demand indicating lower living standards . The poor cannot even buy kerosene for cooking and now scavenge for wood or use cowdung cakes .

The truth ,nothing but the truth .

BP releasing bible 8 July

Exxon is on the back foot .

https://www.zerohedge.com/markets/exxon-fire-10-white-collar-workers-next-3-5-years

Hickory, to answer your question above, the last time gas was at $1 per gallon was 1976 with WTI at about $13 per barrel. At least, according to the chart at this link.

https://inflationdata.com/articles/charts/gasoline-crude-oil-prices-chart/

Also, US average fuel cost per mile is $0.12 for gas ($3.07 / 24.9 mpg).

For EVs it’s about $0.03 per mile using US average of $0.13 per kWh). Or $0.06 using CA’s $0.26 per kWh). This assumes 4.0+ miles per kWh. Here’s a list of 14 (mainly EU available) cars at or above that efficiency…

https://www.carwow.co.uk/blog/most-efficient-electric-cars#gref

PS Here in the UK my car costs $0.23 per mile in fuel; coincidentally my electricity is also $0.23 per kWh.

@John Norris:

UK annual subsidy for an EV doing, say, 10,000 miles per year, amounts to some £2,000.

This is made up of just 5% tax on electricity, compared to £0.80 per litre for petrol/diesel. I.e about 60% at a pump price of £1.30 per litre.

Then there’s zero vehicle excise duty for a battery EV, and a new vehicle subsidy of £2,500 for cars less than £35,000, down from £3,000 last year.

You can add things like reduced or zero congestion charges, and low emission zero charges. Also reduced parking costs in some places.

It all adds up to EVs being subsidy-soaked. This will have to change.

Will have to change when the number of EVs increase. Look at China and see what happened to the EVs sold when they removed some of the subsidies.

Why will the subsidies have to go?

Hey because someone has to pay for the roads and replace the tax that the petrol users were paying. That tax goes somewhere, mostly for the upkeep of the transport infra. The EV users use the infra but don’t pay for it. Can’t go on for ever. someone has to pay, rather those who use it have to pay. eventually.

And on top of it, when EV sales increase beyond a certain number, subsidizing EV purchase will lead to a higher burden on the govt.

Eventually, EVs will be taxed (probably on miles driven to pay for the usage of the transport infra) not subsidized.

Chinese EV sales are going through the roof, so I’m not sure what event you are referring to.

Shale oil and gas fraud: A sign of a peak in oil supplies? Bold mine.

Those of us who watched incredulously as investors shoveled more and more money into what we were sure were money-losing shale oil and gas drillers do not find the current spate of fraud lawsuits against these drillers surprising.

The gargantuan claims about shale hydrocarbon reserves—which were compared more than once to those in Saudi Arabia—were clearly designed to woo investors into bidding up the stock price and/or hoovering up the constant stream of junk bonds emitted by the shale oil and gas drillers. The hype succeeded for a long time, even during the crash in oil prices in 2015 and beyond when investors convinced themselves that they were picking up “bargains.”

It wasn’t until the pandemic-induced plunge in oil prices that the reality of those outlandish claims was revealed, and many companies disappeared.

But this story of fraud and exaggerated claims is much more than a legal story. The large production gains that did take place in American oil fields had people believing America would be or already was “energy-independent,” a phrase that meant the country would not be a net importer of energy resources. Though U.S. dependence on imported energy resources did decline, it didn’t reach zero until the pandemic dramatically crashed U.S. oil demand below U.S. production. But as the world and U.S. economies rebound, that dependence is almost certain to return as the so-called “shale miracle” turns out to be something less than miraculous, bankruptcies continue and reserve estimates come back into line with reality.

But the fallout extends even further. The U.S. oil boom was the principal source of increased world production for most of the last 15 years. Without that boom and the boom in the Canadian tar sands, world oil production would have grown little or even declined. Now that U.S. shale oil production is receding—from an estimated 8.3 million barrels per day (mbpd) in November 2019 to 6.9 mbpd as of February 2021—it is unlikely that U.S. producers could pull off a similar feat again.

The recent rise in oil prices against a backdrop of a still recovering economy suggests that the shale miracle is not returning any time soon, if ever. For those who scoffed at the idea that world oil production would peak in the near term, the test is just ahead. World production of crude oil including lease condensate (which is the definition of oil) peaked at 84.6 mbpd in November 2018 (well before the pandemic) and has yet to touch that peak again. In fact, the latest monthly production figures available from the U.S. Energy Information Administration show oil production in February still more than 10 million barrels below its November 2018 peak.

No one can say for certain whether we have seen the all-time high in world production. But I am personally on “peak watch” and have been since the middle of 2019. The implications for the world will be even greater than those of the pandemic if it turns out we are now past the peak in world oil production.

US May LTO production is out and it ain’t going anywhere.

Ovi thanks.

I looked at Permian vs the rest of US tight oil over the last 10 months (dropping the Feb data point as an anomaly) basically the rest of US LTO has dropped by slightly more than the increase in the Permian with US tight oil as a whole trending down by about an annual rate of 30 kb/d over the past 10 months. I imagine Permian output may pick up as more frac spreads and rigs are added. Probably very little increase this year in US tight oil perhaps we get to 7200 or 7300 kb/d by Dec 2021. Despite Mike Shellman’s comment above about prices having little influence, I think as oil prices approach $80/b, tight oil output may move a bit.

Dennis

According to the STEO chart in the post above, it claims that starting in June output will begin to increase at an average monthly rate of 61.3 kb/d/mth up to December 2022. Sounds a bit ambitious looking at LTO production from August to May.

Ovi,

I agree, the STEO is too optimistic, though 360 kb/d is not a huge increase, probably 250 kb/d is a more reasonable guess for the June to Dec 2021 period, imho.

Dennis Coyne, since you have likely never even SEEN a shale oil well before, I suggest before you lecture and argue with someone who has actually drilled over a hundred of them, you GET all that data you think you might need before opening your lobster intake.

Well productivity in the Permian (based on the definition of IP24 months), normalized for lateral length and proppant loading, is declining. Has been for the past 5 years. You missed that, badly. You are never going to be the analyst you want to be until you “get” that past results in the oil business are NOT indicative of future performance. Some people may define “productivity” as EUR, and none of us know that answer to that entirely, yet; you in particular. If THATS the definition, problematic children may indeed be 60% less productive than their mamas.

I wish only to debate this stuff with people who write checks to be IN the oil business, who respect my industry. You don’t respect my industry at all. I am pretty sure that everybody remotely interested in the future of oil in our great nation can see right thru your stuff, like cellophane.

I did not say “prices have little influence;” I implied, clearly, that in spite of $70 oil, the shale oil sector still needs credit/debt to function, to maintain current production levels and have a RRR of 100%, not go backwards.

Here we are 2H21 and Ovi says “LTO is going nowhere.” Why is it that almost every large independent in the LTO sector is still adding debt if this is the year of big free cash flow? Its now adding debt just to stay even. Not to grow, but just to “go nowhere.”

Get a grip, man. We’re trying to help people prepare for some difficult oil times ahead. I am, anyway. Your message of abundance, and a debt free shale oil sector able to stand on its own two financial feet and serve America’s long term energy needs, is dog dookey.

I’ll add that a big impediment also is oil price volatility. It is only going to get worse. A kid on Reddit can now trade .4 of a barrel of WTI.

How can a business plan when the experts are predicting an oil price range of $35-$130? I think that is tame, my range is $25-$250. I should probably go with a negative number on the low end, but think a monthly average of $25 is about right, given how far below that is many well’s LOE around the world.

Add in that anyone who is responsible is trying to build the P&A fund, given all the governmental talk about ending oil. We have to prepare for a far left President and Congress ordering us to cease operations.