The EIA updated the Short Term Energy Outlook (STEO) in March and also released the 2023 version of the Annual Energy Outlook in March. This post will take a brief look at both of these reports with a focus on Crude plus Condensate (C+C) Output for the World, OPEC and Non-OPEC in the case of the STEO through the fourth quarter of 2024 and US C+C output for three oil price cases from 2022 to 2050, reference (medium oil price), high and low oil price cases.

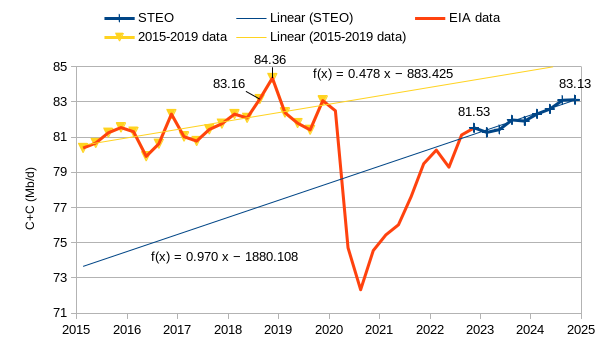

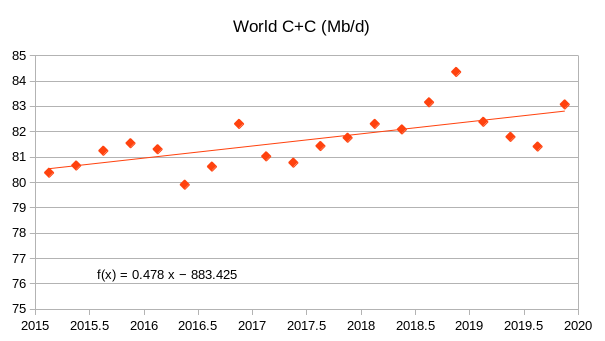

Figure 1 above shows World C+C output from 2015Q1 to 2024Q4. The red line shows quarterly output using International data from the EIA. The yellow line is the Ordinary Least Squares (OLS) trend before the pandemic from 2015Q1 to 2019Q4, the annual rate of increase was about 478 kb/d over that period. The blue line is a projection based on the OPEC, non-OPEC liquids projection in the STEO and US C+C projection in the STEO from 2022Q4 to 2024Q4. The OLS trend for this EIA projection is an annual rate of increase of 970 kb/d. The quarterly peak in World C+C output was 84.36 Mb/d in 2018Q4, which was 1.2 Mb/d higher than the next highest quarter over the 2015 to 2019 period one quarter earlier, the highest 4 quarter average was 83 Mb/d from 1870 to 2023. The EIA projection has World C+C output rising from 81.53 Mb/d in 2022Q4 to 83.13 Mb/d for 2024Q4.

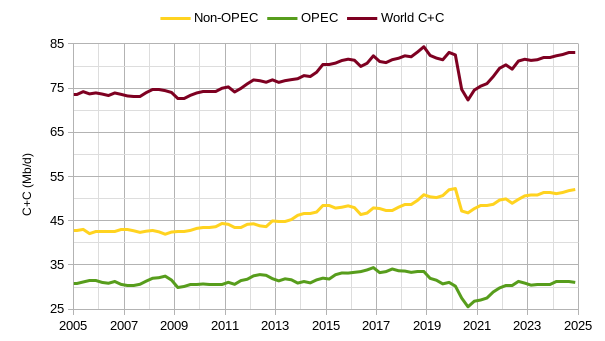

Figure 2 shows World, OPEC and Non-OPEC output from 2005 to 2024 with STEO projections shown for 2022Q4 to 2024Q4. Output was relatively flat from 2005 to 2009, with a noticeable rise in output from 2009 to 2018, followed by OPEC cuts, pandemic and then recovery. Of the 10 Mb/d increase in World output from 2010Q1 to 2018Q4, about 70% of the increase was from Non-OPEC nations.

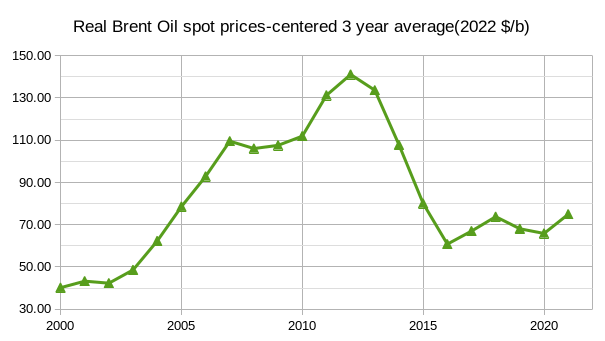

Figure 3 above considers the centered 3 year average annual Real Brent Oil Price in 2022 US$/b. The centered 3 year average real Brent oil price remained above $90/b in 2022$ for the period from 2006 to 2014, and was above $100/b from 2007 to 2014. World output increased very rapidly from 2002 to 2005 in a response to a doubling of the real price of oil (from $40 to $80/b over 3 years for centered 3 year average real oil price), the annual rate of increase in World C+C output was 2625 kb/d over the 2002 to 2005 period (OLS trend on quarterly output). There was then a pause in World C+C output increases from 2005 to 2009, the World may have reached capacity limits and it took some time for capacity to be added, in addition the high oil price environment from 2006 to 2009 allowed the development of tight oil in the US to take off.

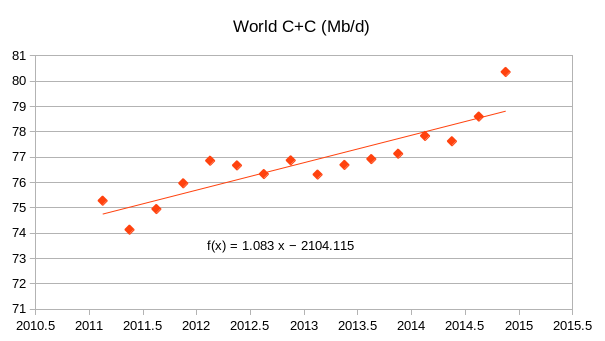

For the period covered in figure 4 above (2011-2014), for 3 years (2011-2013) the centered 3 year average real Brent price was over $130/bo in 2022$, World output increased at an average rate of 1083 kb/d with much of this increase coming from US tight oil.

The rate of increase in World C+C output dropped to 478 kb/d over the 2015 to 2019 period, less than half of the preceding 4 years. Centered 3 year average real oil prices had dropped to under $80/b over this later period which may have reduced the rate of oil field investment in resource development and thus reduced the rate of increase in output.

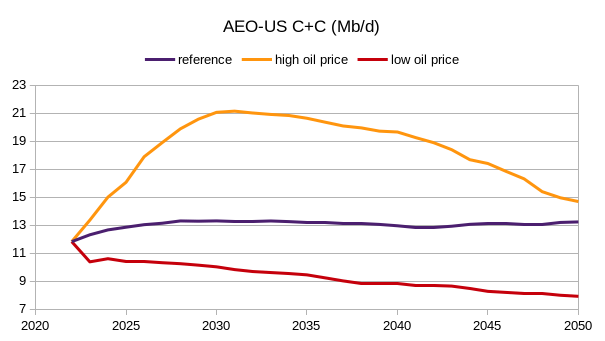

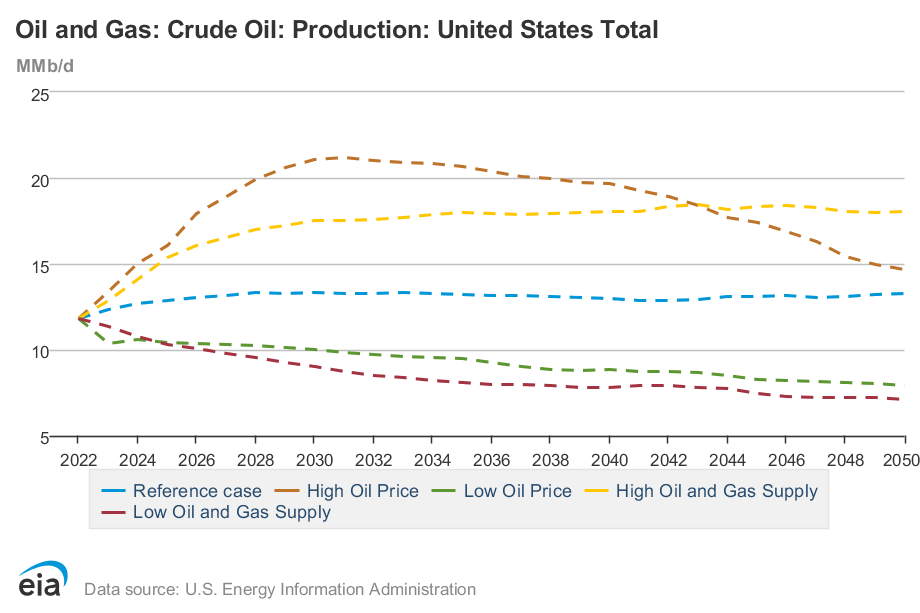

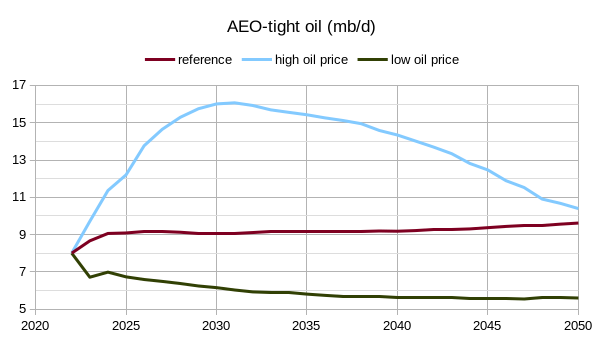

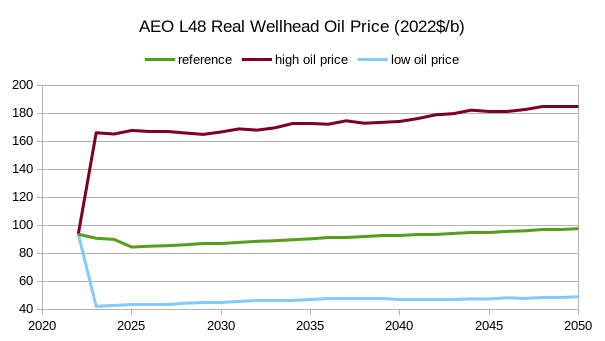

Figure 6 shows the 2023 Annual Energy Outlook scenarios for 3 cases of many (15 total cases) different scenarios, many of the other cases are not that different from the reference case, the only exception is the high and low oil and gas supply cases and I chose the high and low oil price cases to keep the analysis simple.

Basically I chose the high and low oil price cases because the range from high and low US output for those cases was larger than the High and Low Oil and Gas Supply cases.

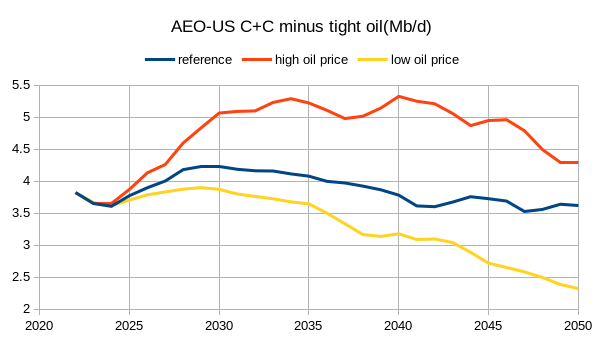

If we consider US C+C output minus tight oil output for the three cases from figure 6, we find that the difference beween the high and low oil price cases is much smaller than for US C+C output in figure 6. See figure 8 below.

In 2030 the difference between the high an low oil price cases for conventional oil is only about 1.2 Mb/d vs. roughly 11 Mb/d for total US C+C output.

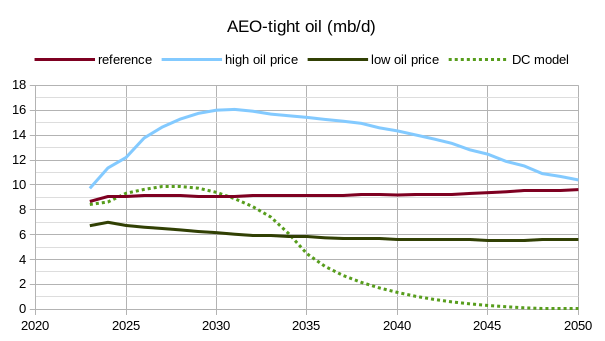

We can see clearly in figure 9 that there is a 10 Mb/d difference between the high and low oil pri ce cases in 2030 for tight oil and about a 7 Mb/d difference between the high oil price case and the reference case (16 Mb/d vs 9 Mb/d in 2030.) Note that if we assume tight oil output falls linearly to zero by 2055 in all three cases in figure 9, then the URR is 90 Gb, 127 Gb, and 173 Gb for each of the three cases in figure 9.

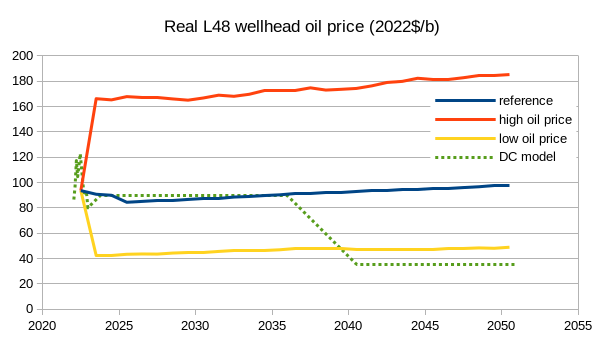

I doubt the low oil price scenario will be correct from 2022 to 2040, but potentially oil prices might fall between 2035 and 2040 as the transition to electric land transport occurs and oil demand may fall below oil supply at the World level. My expectation is that between 2024 and 2035 real oil prices (in 2022$) will be in the $100 to $120/bo range at the wellhead in the US L48. For my tight oil scenario I use a more conservative oil price scenario with maximum L48 average real wellhead oil prices of $90/bo in 2022$ (see figure 11 below.)

The AEO 2023 scenarios for US C+C output are highly unrealistic in my opinion, particularly the tight oil output scenarios. The low oil price tight oil scenario is most realistic in terms of URR at 90 Gb(though at the assumed real oil prices output would be half that level at most). My best guess US tight oil scenario with the oil prices shown as the DC model in figure 11, has a URR of about 70 Gb. My scenario is compared with the AEO scenarios in the chart below.

Thanks for breaking these reports down for us Dennis. Great work.

+1 . Dennis this is terrific work . Microanalysis — that is like splitting a hair in two . Hats off to you .

P.S : But still the world peak (C+C) was 2018 and US peak was 2019 . You can’t split that . Depletion and decline rates are a one way street . 🙂

Thx Schinzy and Hole in head.

Hole in Head,

As far as the US peak, I focus on the centered 12 month average rather than single monthly records (which are of little importance in my view). For the US the current CTMA C plus C peak is October 2019 at 12.565 Mb/d. If the EIA’s March 2023 STEO forecast is correct for 2023 and 2024 there will be a new CTMA C plus C peak in March 2024 and the CTMA then continues to rise until July 2024 (end of forecast). We will know in roughly November 2024, if the forecast proves correct.

Here’s the big picture, without permian basin, US total product supplied is at 40-50 year lows…

Dennis,

Thanks for the report. I agree with figure 12 AEO being extremely unrealistic. Are EIA abiotic oil advocates ? Because that scenario looks like something out of the abiotic oil handbook.

Dennis your tight oil model and world C+C model seem to peak around a similar time. Is that correct ?

Iron Mike,

You’re welcome. Yes the World Model peaks at about the same time at US tight oil in my best guess scenario, as I like to point out it is certain that my best guess will be wrong, but I would put the odds at about 50/50 that the World centered 12 month peak will be either before or after June 2028. Also note that if oil prices are $100 to $120 per barrel in 2022$ from 2024 to 2035 as I expect, the tight oil scenario may prove too low, URR could be 80 Gb in that case, but I expect the peak won’t change much, just a fatter tail after 2028.

Thanks Dennis. Interesting, it seems in the current global economic climate with debt levels being so high, the world cannot handle high energy prices in other words high inflation. So the only way the world can sustain a high oil price scenario is first through a great deleveraging or severe recession where global debt levels fall, and asset prices return to some form of normality based on fundamentals. That’s just my opinion of course.

Iron Mike,

The World did fine from 2011 to 2013 with oil prices over $130/bo in 2022$, much of the inflation has been due to supply disruptions and changes in demand from more people working at home and increasing demand for home office space and various durable goods for their home (workout equipment, home theaters etc), the growth was exceptional as the World rebounded from the pandemic, also there were chip shortages affecting auto output and raising new and used vehicle prices. Much of this has or will be sorted out in my opinion. The “debt problem” is less of an issue than many believe, much of that at the World level is from middle income economies that have gotten better access to credit, more in line with OECD levels. In any case predicting what will happen with the World economy is difficult, but it usually muddles through, odds are low we will see a depression in the near term (next 10 to 15 years) imho.

Dennis,

I agree the factors you mentioned which have added fuel to inflation.

However what you fail to mention the elephant in the room which is that the world has been awash with cheap money for about the last 15 years thanks to the central banks monetary policy and QE programs, during covid the easy access to credit went up exponential both through monetary and fiscal policy. Easy credit is a drug, everyone wants to live beyond their means. The world is hooked on this drug now.

Now asset lobbyists have hissy fits through the mainstream media everytime the Fed increases rates. Alot of “experts” want the Fed to stop raising rates even though inflation is at 6%. Powell will probably be remembered as Arthur Burns, he ain’t no Paul Volcker.

There might come a time when it will be time for rehab and deleveraging. The world needs a depression without taxpayer bailouts or the Fed debt buying programs. Shitty business/corporation practices need to be punished and allowed to fail. There has to be a reset.

This has direct consequences for oil prices.

Again all this is just my opinion.

Iron Mike,

Interesting opinion, yes interest rates have been low, but in my opinion things are not as bad as you seem to believe, lots of businesses still fail, we could have the government take over large businesses that fail to avoid systemic collapse, most Western nations do not like that approach and instead choose to coddle wealthy investors, I don’t particularly like that approach, but prefer it to a Great Depression, YMMV.

Dennis , you presume that the government or TPTB ( whosoever ) are omnipotent and can pull a lever here and there and bingo things will be stable . Look at the Covid debacle and the economic debacle brought about by loose monetary and fiscal policy . Here is the Secretary of Treasury Janet Yellen (fumble , stumble and mumble ) saying $ 50 trillion debt and Debt/GDP ratio of 110% is sustainable . Pathetic . You are allowing too much leeway . Geniuses or Bozos ? Probably monkey’s throwing darts .

https://www.youtube.com/watch?v=vy5A55YAZ7E

Hole in head,

The Covid pandemic was a major unforeseen event, lots of adjustments needed, we have muddled through. Ms Yellen is correct in my opinion. Current levels of debt/GDP are sustainable. No omnipotence or omniscience is assumed.

Dennis , if you concur with Ms Yellen then I am not going to argue . This is your opinion and I respect that . Parting note –It couldn’t be more obvious, but Socrates was spot on when he called amathia (willful ignorance) the one and only evil.

QED .

From Bank for International Settlements

https://www.bis.org/statistics/totcredit.htm?m=2669

US Debt to GDP, last data point is 2022Q3, note that this is similar to Euro Area, but far less than Japan and Luxembourg at about 416% or Hong Kong at 454%, several European nations are between 300 and 350% (France, Switzerland, Belgium). Japan has been at 296% debt to GDP or higher since 1997. The average for advanced economies is 256%, for G20 it is 239%, for all nations reporting data to the BIS the average is 237% and for emerging economies it is 211% at market exchange rates for 2022Q3.

Total Public Debt as percentage of GDP is currently high, last time it was this high was 1945.

From mid 1980s to 2008 the Debt/GDP % ratio was ~50-60%. Quickly climbing to 100% by the end of 2012. Slowly creeping up to 108% right before covid hit which launched it to 135%, since then it’s stabilized to 120%. Now I guess you could make an argument that 100% is fine, or even 120%.

70’s-80s was ~30%, 90s-00s was ~60%, 00s-10s was 90%, 20s-? are 120%.

The only drop on record since 1980 is the period of 1995-2000 (from 65% down to 55%).

To lower the ratio, GDP has to increase relative to debt (or Debt has to decrease more than GDP decreases).

So there in lies the problem, how do we grow out of the pile of debt when growth is no longer an option?

That leaves one option, austerity measures…

Kengeo,

As long as the debt can be serviced it is not a problem. Japan has had total debt to GDP of over 296% since 1997. As to growth stopping, so far little evidence of this. We will see. Recently US debt to GDP decreased by 37%, back to the 2010 to 2019 level.

Nice post from Rapier, I think Dennis would agree with his points. I think politically Biden and his administration are really in a difficult spot. If HHH is right, even if oil prices remain low its curtains for the Dems in 24. If HHH is wrong and oil prices rise, there will be NO cushion when they need it the most. I think, this in part played a roll in the North Slope Project approval. They did not want to run against the backdrop of high energy prices and such a visible and easy to understand, hard to explain its denial, in the face of high prices project. Just my opinion.

https://oilprice.com/Energy/Energy-General/Is-It-Time-To-Refill-The-Strategic-Petroleum-Reserve.html

a bit more color on the alaska willow project

https://oilprice.com/Energy/Energy-General/The-Only-Oil-Major-Betting-Big-On-Alaska.html

Texas tea,

Mr Rapier has a very reasonable point of view which I tend to agree with 99% of the time, this is indeed one of those cases.

Thanks Dennis, great post.

The EIA is pretty much useless as far as predicting Russian future production is concerned.

Ron,

That is all liquids for Russia in the STEO, it doesn’t look like a bad guess to me, if anything it looks too low. For 2023, OPEC has a similar estimate for Russia in its most recent MOMR. For 2023Q2 to Q4 Russia total liquids output at 10.00, 10.10, and 10.15 Mb/d according the March MOMR, same ballpark.

I was pretty much talking about their past predictions of Russian output. They have missed it by a country mile. The MOMR is just as useless. But they admit it. They say Russian future production is volitile and unclear.

The EIA has no idea what Russian production will be.

The OPEC MOMR has no idea and they admit it

I have no idea and I admit it.

Ron,

I don’t have a clear idea either, but analyses from those who know more than me have suggested a plateau in output, I think if anything the MOMR and STEO might be a bit on the low side as Russia may find ways around the sanctions. I think for all liquids a 10.5 Mb/d plateau might be a better guess than 10 Mb/d.

Ron

You might find this interesting insight in to Russia.

“Strengthening technological sovereignty. Together with the Ministry of Industry and Trade of the Russian Federation, a coordinating council for import substitution will be created. The focus will be on technology in the field of hard-to-recover oil deposits, because there is a decline in conventional production.”

https://www.business-gazeta.ru/article/588291

Thanks Dennis always interesting. I do not find the stranded oil argument very compelling. After witnessing how the energy markets reacted and more importantly how the governments reacted to the war, I think the most likely outcome, barring a long term deflationary depression, is higher over all energy cost and a higher priority on energy security for the short and near term say out 20 years. Looking at the “most hated” energy source, which is still in great demand(coal) as a model I think higher oil demand and higher oil prices are in the future.

While I do not want to get into the weeds of climate change, there is NO industrial country, NO government be it a democracy or theocracy, or dictatorship that will stand in the face of starvation or stagnation or stagflation due to the willful and purposeful refusal to use what ever resources are available to keep the power on, the industrial base productive, the agricultural base up and running. It is just not going to happen. Put me down for one of the higher price scenario’s.

https://www.iea.org/data-and-statistics/charts/global-coal-consumption-2020-2023

https://www.bloomberg.com/opinion/articles/2023-03-27/saudi-aramco-s-deal-will-cement-china-s-oil-demand-and-push-its-peak-higher?utm_medium=email&utm_source=newsletter&utm_term=230327&utm_campaign=author_19016770#xj4y7vzkg

Texastea,

I agree oil prices will likely be higher than the EIA’s reference case, but think 120 to 130 per barrel in 2022$ will be about as high as the annual average WTI price will go. A couple of things to keep in mind is that a lot more people are working from home which reduces oil demand and EV sales have been growing at 45% per year for about 5 years. When Tesla comes out with its next generation platform in a few years they expect the price will be about 50% of current vehicles, say 20 to 25k in 2022$, other car companies will try to match this and the transition to EVs will accelerate. By 2030 we may see demand for oil falling below supply and may see prices decrease to reduce supply to match demand. At some point lots of tight and extra heavy oil will no longer be able to compete with cheaper onshore conventional oil and is likely to be stranded due to lack of profitability.

In short, I disagree just based on simple neoclassical microeconomic reasoning and how I see land transportation developing over time. There is also the potential for self driving vehicles which when approved could have each self driving EV replacing 4 ICEVs (as a self driving vehicle can run almost constantly with occasional stops for level 3 charging). Once self driving cars are approved the transition to EVs makes a step change and proceeds 4 times faster than before.

“there is NO industrial country, NO government be it a democracy or theocracy, or dictatorship that will stand in the face of starvation or stagnation or stagflation due to the willful and purposeful refusal to use what ever resources are available”

You might call that the “Donner party theory of community well being”

Correct JJHMAN , there are no volunteers for starvation . You might call that the “Donner party theory of community well being” . Interesting a new theory .

Nobody is suggesting as much, As fossil fuel depletes it will no longer be the cheapest energy resource and will be replaced with cheaper energy resources.

That’s magical thinking. It’s cheap energy or collapse for our civilization. See https://youtu.be/5WPB2u8EzL8?t=363

Required,

Magical thinking is believing something will always be cheap when it is not the case for depleting resources. Wind, solar, and batteries are cheaper than fossil fuel especially in areas with good resources of wind or solar energy.

See

https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf

Energy storage will be critical. My latest analysis for Australia:

21/3/2023

NSW power supply on 16 March 2023 so tight that AEMO had to issue emergency response direction

http://crudeoilpeak.info/nsw-power-supply-on-16-march-2023-so-tight-that-aemo-had-to-issue-emergency-response-directions

13/3/2023

Lack of reserve on hot day in NSW as Liddell power plant is scheduled to close

http://crudeoilpeak.info/lack-of-reserve-on-hot-day-in-nsw-as-liddell-power-plant-is-scheduled-to-close

8 Mar 2023

Can NSW replace Liddell? (part 1)

http://crudeoilpeak.info/can-nsw-replace-liddell-part-1

30 Jan 2023

When the sun sets in Queensland, energy guzzler NSW is on its own

http://crudeoilpeak.info/when-the-sun-sets-in-queensland-energy-guzzler-nsw-is-on-its-own

stand in the face of starvation or stagnation or stagflation

If things get tough, the quickest way to save money is to stop wasting it on cars. The average American car costs its owner about $12,000 a year to own and operate. Public transportation typically costs about a twentieth of that.

Alimbiquated,

The UK is ~80,000 square miles in size with a population over 67 million people.

(Sparsely populated Scotland is over one third the UK landmass with about 5 1/2 million residents).

Just one state – Oregon – is almost 100,000 square miles with a little over 4 million people … way larger than the UK with 1/15 the number of people.

There are reasons why the US needs so many vehicles for transportation.

In Bend, because of a limited public transit, I use a car almost daily.

Portland?

Not needed, if you are a conscious human.

HT,

Italy is the same size as New Mexico, yet has 30 times the population.

Germany is smaller than Montana, yet has 80 times more people.

Different circumstances prompt varying responses with vast distances in the US giving rise to widespread adoption of vehicular travel.

Coffee,

That’s a ultra-lazy argument based on looking at the wrong numbers. You aren’t even trying.

The whole population density argument is a canard. Sweden is less densely populated that the US, but has much better public transportation.

If Alaska were to leave the union, would that change traffic planning in Florida? No. That is why average population density is irrelevant. Not really, most people are packed into small areas. You need to consider medians, which reduce the differences between

Density is measured in people per square mile, but nobody ever drove a square mile, so it’s the wrong number. You need to take the square root of the denominator, which gets rid of the exaggerated differences. When we talk about how much oil is in the ground, we don’t talk about the square of how much oil is there. why is the square of the distance we drive even mentioned?

I suggest you go back to the drawing board and consider the median distance between households. You may come up with halfway viable arguments.

Dennis

A lot of good work. However I think that you and I will continue to disagree on what is the right data set to use to estimate future growth. In particular I would like to present a different view of your first chart.

Not quite sure what the 81.53 Mb/d is. Could it be a quarterly average? In the chart below at the bottom is the latest C + C data from the EIA. The Q3 average is 81.1 Mb/d. The Q4 average is 81.9 Mb/d, using the December estimate in the attached chart, posted at the end here, https://peakoilbarrel.com/non-opecs-november-oil-production-increase-offsets-opecs-cutback/#more-42008.

The production increase in the attached chart from December 2022 to December 2024 is 930 kb/d. Using a simple average, that would be 465 kb/d/yr. I am using a simple average because the drop from December to April is due the Russian production drop, which may not have started till March. Regardless the average is less than 1/2 of the posted estimate of 970 kb/d/yr in the chart.

Ovi,

I used quarterly data for World liquids and World C plus C for both OPEC and non-OPEC minus US. I found the ratio of C plus C and total liquids from 2019Q4 to 2022Q3 for each of the two groups and then found the average ratio over that 3 year period. For OPEC it was 0.8974 and for non-OPEC minus US it was 0.8343. The STEO quarterly liquids estimate was multiplied by these ratios for each group to find a C plus C estimate, then the C C estimate for the US from the STEO was added to the OPEC and non-OPEC minus US estimate. Here is the chart, data is quarterly which I believe I mentioned in the post, but perhaps forgot. The trend line is an OLS from Excel. We are estimating future output differently, so we will get different results, I rarely use two endpoints to estimate a trend, I always use OLS.

Dennis

I use a similar process for my chart but use monthly data.

Let’s keep things simple. The EIA has hard C + C data for October and November 2022, 81.8 Mb/d and 81.9 Mb/d. I can’t see how Q4-22 average can up at 81.53 Mb/d.

Ovi,

Just used the quarterly data as I explained. Chart doing it monthly below with OLS on STEO monthly projection from Dec 2022 to Dec 2024.

Dennis

There is something wrong. The November C plus C production is 81.92 Mb/d and the above chart is plotted at 81.29 Mb/d, looks like December. On my chart December is 82.0 Mb/d.

Ovi,

We are not estimating the same way.

What is the slope of and OLS on your Dec 2022 to Dec 2024 estimate? To me that’s the important number. Using just two data points rather than 25 data points is not the best way.

Dennis

One step at a time. I am not interested in the slope in this discussion. My question is related to trying to understand the discrepancy between my 82.0 Mb/d estimate for December vs the 81.29 Mb/d in your chart. That is a difference of 700 kb/d. Something is amiss.

Note the actual October November C C average is 81.87 Mb/d. What causes the big drop 81.29 in December.

Ovi,

38.32057

30.87932

12.1

81.299898

From top to bottom for December 2023 from STEO (March 2023):

Non-OPEC minus US C plus C

OPEC C plus C

US C plus C

World C plus C

45.92

34.03

Data above for total liquids in December 2023 from March 2023 STEO

top number is Non-OPEC minus US

bottom number is OPEC

I multiply the top number by 0.8345 to estimate C plus C.

I multiply the bottom number by 0.89739 to estimate C plus C.

As to what causes the big drop in December, not known, simply using a consistent methodology on STEO data. The method I use suggests non-OPEC minus US C plus C output falls by 404 kb/d from Nov to Dec 2022 and US C plus C output falls by 275 kb/d and OPEC C plus C output increases by 56 kb/d from Nov to Dec 2022. The net decrease in World C plus C output in Dec 2022 using my method is 622 kb/d.

A slight change to the ratios below

0.834507270045957

0.897393908899655

first is non-OPEC minus US and second is OPEC, using sum of output from Dec 2019 to Nov 2022 (monthly international EIA data) for C plus C and total liquids and then taking the ratio of the sums (a weighted average).

Earlier you said:

The production increase in the attached chart from December 2022 to December 2024 is 930 kb/d. Using a simple average, that would be 465 kb/d/yr. I am using a simple average because the drop from December to April is due the Russian production drop, which may not have started till March. Regardless the average is less than 1/2 of the posted estimate of 970 kb/d/yr in the chart.

Based on that it seemed you were interested in the slope, does it seem to you that the best way to estimate the trend for a set of data points is to choose the end points and find the slope based on that? If so, I would disagree.

Ovi,

modified spreadsheet new link below should work

https://drive.google.com/file/d/1T10C_ej_wYbENgnOgmbcxYyr2_BTcBBb/view?usp=sharing

Ovi,

Perhaps you could explain in detail how you arrive at your estimate (as I have done). Then perhaps we can find what is causing the difference in our estimates, when I use the monthly data for International and STEO data we still reach different conclusions. I would note that US output decreased in December 2022 and by my estimate so did the rest of non-OPEC, OPEC rose a bit (60 kb/d), but based on the STEO output should be lower in December than November.

Dennis

I think I have sent you my calc sheet in the past. This is what I do, using the STEO and EIA World data.

Historical Info/Ratio

– World Liquids W/O US

– World C + C W/O US

– Monthly Historical Ratio (MHR) (World C + C W/O US / World liquids W/O US)

– Calculate 12 month moving average and use latest value. Not trailing.

Future

– MHR Average x World Liquids W/O US

– Future US C + C

– Add them

Attached is a chart which shows the MHR and the moving average. Note how the two have been getting closer over the past year and a half now that world production is getting back to normal.

Ovi,

I think your average might be a trailing average rather than a “centered average”. In other words, the moving average for November 2022 on your chart should use the average of data for 12 months from Dec 2021 to Nov 2022. I refer to this as a trailing average, you may have another name. Excellent method, I would use a weighted average which would take the sum of output for C C for the past 12 months and divide by the sum of total liquids output for the past 12 months and take that ratio.

Thanks. I didn’t know if your method had been changed over time.

Note that the convergence of the two numbers on your chart looks suspicious, my guess is that this has to do with models being used to estimate the most recent three months of data.

Ovi,

Using your method I get an MHR of 0.862833272079908 and using that with STEO data for World liquids minus US and adding back the US C plus C estimate I get the following chart.

I would add that your estimation method is better than mine, simpler and more straightforward, but you may want to check your spreadsheet.

Mine at link below

https://docs.google.com/spreadsheets/d/17cj5ERncioKy98fVT13NULQTlSYPk3obnJwKL-o4gV4/edit?usp=sharing

First data point on chart below is the first estimated point from the STEO (December 2022) the last point on the right is December 2024 (25 data points on chart).

Dennis

I have checked the model and see nothing wrong with it. The sheet you linked seems to work with Non-OPEC. I start with World data.

I have emailed you my work sheet so you can compare it with your model.

In this case I prefer to work with the trailing 12 month average since I want the latest data to project future production.

Ovi,

Look at the second spreadsheet linked below

https://docs.google.com/spreadsheets/d/17cj5ERncioKy98fVT13NULQTlSYPk3obnJwKL-o4gV4/edit?usp=sharing

this spreadsheet uses the exact method you outlined in your comment, but leads to a different result. I will look at your spreadsheet. Thanks.

Responded to your email with updated US C plus C from PSM and World liquids from March STEO (both downloaded 3/30/3023).

version 2 spreadsheet attached to email.

Ovi,

Chart using your spreadsheet with updated US C+C and updated World liquids data from STEO, corrected slope is 934 kb/d/year (earlier version 2 forgot to update using international data up to Nov 2022 (used STEO data by mistake).

If we drop July 2022 and do the OLS on Aug 2022 to Dec 2024 we get

“I fundamentally believe in the role of oil and gas for a long, long time to come,” he said in a recent interview with The Wall Street Journal.

What’s more, he said, he doesn’t believe renewable- and low-carbon energy projects should be subsidized by Shell’s fossil-fuel profits, but should deliver returns that merit continued investment on their own. “We’re definitely taking a hard look at the portfolio,” Mr. Sawan said.

https://www.wsj.com/articles/new-shell-ceo-faces-big-dilemma-should-the-company-pump-more-oil-9fa35497?st=v3zy1g50xh61jb4

i guess we got another “mexican cartel” member😂

Another way to look at World C+C, this includes the STEO March 2023 forecast from Dec 2022 to Dec 2024.

Dennis

Attached is my OLS from July 2022 to December 2024. It has a slope of 761 kb/d/yr. It all depends on the starting date. IMO, I don’t think that rate is realistic beyond January 2025. I think that production will start to plateau around 83 Mb/d, which reflects today’s current capacity plus 1,000 kb/d of OPEC reserve capacity. After 83 Mb/d, production increases will be difficult.

Ovi,

I agree growth will likely slow down after Dec 2024, though I believe Permian output will continue to grow beyond that, there may be some growth in Canada, Guyana, Norway, and Brazil and potentially some growth over time from Saudi Arabia, UAE, Iraq, and Kuwait, potentially there could be growth in Venezuela and Iran if there is sanction relief. To me it seems doubtful that growth stops at 83 Mb/d in Dec 2024, the STEO forecast is more optimistic than my own which has average annual output at about 83.5 Mb/d in 2028.

I am simply doing an estimate of the C plus C output implied by the STEO. There are many different ways this could be done.

Chart below shows the OLS from July 2022 to Dec 2024 for my estimate, the annual increase is 902 kb/d. Generally not including full years of data leads to distortions due to seasonality in the data. That’s why I chose Jan 2022 to Dec 2024 to give three full years of data, alternatively we could do two years from July 2022 to June 2024 which has a slope of 773 kb/d, similar to your estimate (but for a different time period).

Hunting Beach

it looks like Warren Buffett continues to aid and abet the “mexican cartels”. maybe you should protest his next investor meeting and explain your theories. better yet use all those insurance royalties and do a hostile takeover😜

https://finance.yahoo.com/video/berkshire-hathaway-buys-additional-3-134157848.html

The EIA Monthly Energy Review is out. The data is through February 2023. However, the months of January and February are subject to heavy revisions. The more accurate data will be in the EIA Petroleum Supply Monthly, due out Friday. However, that data will be only through January.

I have inserted the data for the last seven months.

US Gasoline consumption (Finished gasoline production minus net exports of finished gasoline) 4 week average data. Note the downward trend since 2021.

Dennis,

I suppose we will get a clearer picture of the cause of the “downtrend” in the next 4 months. If it was due to price “shock” or EV competition. Following gas buddy data I think it may be the former rather than the later but we will have the actual data later this year, and that will be the tell. However the chart period covers a low oil (gasoline) price period since it starts 2016, the only year we have had high oil prices in your chart is 2022. Do you see that differently?

Texas tea,

Would have to check high price periods, pretty sure the trend was up or flat during the high price period. My guess is that this has little to do with EVs and probably due to more people working from home.

Dennis, “My guess is that this has little to do with EVs and probably due to more people working from home.” I agree, I thought about that after my post, great point. 👍

Texasteastwo,

Chart below considers US consumption of finished motor gasoline (product supplied minus net exports) and uses the trailing twelve month (TTM) average to smooth out seaonal fluctuations in demand. I think that you are correct that high gasoline prices had an affect on demand, there might also be a demographic effect where the baby boomers reached retirement age and started driving less. Let’s take the height of baby boom as 1950 and add 60 years, that would be about 2010, the peak for gasoline demand was 2006 and the down slope after that might be due to a combination of high oil prices and demographics. In addition, population growth in the US has been slowing down which has an affect on demand along with an aging population.

Don’t forget that the nations fleet of ICE vehicles has been gradually achieving higher mpg efficiency, which could be a factor here.

https://www.energy.gov/eere/vehicles/articles/fotw-1195-july-19-2021-small-suv-segment-has-seen-greatest-improvement-fuel

Hickory,

Great point, thanks. Note that the decline in my chart occurs after 2020 so the timing does not align that well with your chart, so there may be a different affect lately, also we don’t know if fuel economy has continued to increase (as the data ends in 2020 in your chart), it might have or it may have plateaued as in the earlier 1985 to 2000 period.

The rapid recent increase in average mpg began roughly 2008, which does align pretty well with the gasoline peak consumption.

Its a big factor.

Consider how much higher the consumption would be if the battle over CAFE mandates hadn’t been gradually won. It began when the Saudis embargoed the US.

Hickory,

Yes I agree, consumption declined after 2008 so it does line up well, I stand corrected. Thanks.

Prices might also play a role as texastea2 suggested earlier. Also more telecommuting and changes in demography might play some role as well, no doubt there’s other stuff I am not accounting for.

Now if we could just put a hard limit on nationwide speed at 60 mph, we could save another roughly 10%.

If people don’t want 60, then we could 50.

That change would not collapse the world,

and think of all the money that could be collected from violators.

We would have enough money for universal preschool.

Win Win.

Hickory,

I also like the 60 MPH (or perhaps 65 MPH) national speed limit idea, but I think we are probably in the minority. High gasoline and diesel prices might change things, but my experience driving in Europe suggests this is probably not true (they seem to drive as fast or faster there and fuel prices are roughly double in the US).

Yes.

Its an example of how people who are swimming in cheap energy (gas under $20/g)

have no intention of taking the issue of pending scarcity seriously.

👍

Big Draw Across the Board

API

Crude -6.076mm (+300k exp) – biggest draw since 11/25/22

Cushing -2.388mm – biggest draw since Feb 2022

Gasoline -5.891mm (-1.6mm exp)

Distillates +548k (-1.1mm exp)

https://www.zerohedge.com/energy/wti-extends-gains-after-unexpected-large-crude-draw

The Main Factor For CPI – Consumer Price Inflation For DUMMIES…

KISS – KEEP IT SIMPLE STUPID.

steve

Here’s a better chart of US total petroleum product supplied (~50 year low excluding Permian contribution).

WTI price added for comparison…

US Refinery Input

Kengeo,

If we look at transport fuel consumption (gasoline, distillate fuel, jet fuel, and residual fuel consumption) by taking product supplied and deducting net exports of these fuels (this is the amount consumed in the US) we have the following.

Note that this has little to do with supply of oil (as we simply import what is needed over the amount produced locally), it is about demand for transport fuel, which has fallen by roughly 4000 kb/d since 2005 (about 23.5% over 17 years or about 1.6% per year on average if constant exponential decline is assumed).

Dennis –

I disagree, I’m also not sure about your assumptions related to the economic side. High prices curbed demand…high prices are a result of imbalance between supply (low) and demand (high).

The additional analysis is that current trends for past three years indicate annual loss in US conventional production of ~0.5 MBpD (note that while permian rebounded, conventional did not). If Permian production stalls (which it appears it has) then we can expect annual drop in production of almost 1 MBpD (this is significant).

It’s important to use multiple lines of evidence and not focus too much on one single factor/line.

Most here would agree that US and world supply of high quality oil has been on plateau for almost 20 years. There is limited evidence to suggest that this will change (the tight oil revolution muddy the waters and it took time to separate fact from fiction).

The trends you continue to model haven’t materialized and do not appear to be remotely possible.

While you’ve tempered your expectations very slightly in response to the data, at some point soon you will need to rethink the numerous assumptions being made to forecast future production.

But thank you Dennis for the posts and charts, it provides a valuable source of debate…

Kengeo,

I agree consumption may have dropped in part due to high oil prices, but note that consumption continued to rise while oil prices doubled from 2002 to 2006. Oil prices were at a relatively low level from 2015 to 2020, but oil consumption did not return to the high point of 2005 when oil prices were at a high level. As to a plateau in oil output for 20 years, I disagree, just look at data for World C plus C output and don’t arbitrarily exclude certain types of crude oil, 20 years ago World output of C plus C was about 67 Mb/d.

I look at multiple lines of evidence an focus on facts. My forecasts of future World output are quite conservative and if incorrect are more likely to be too low than too high, particularly through 2035.

Keep in mind the oil men are saying tight oil output will not grow at low oil and natural gas prices, I agree with them. I do not expect oil and natural gas prices will remain low, I expect we will see them rise to over $100/bo in 2022$ and over $3/MCF (2022$) by 2025 at the latest.

Can you remind me of your expectation for future oil and natural gas prices? Maybe we have different points of view on that.

As to whether the future output I have guessed at proves correct, we will see.

Starting in 2021 World average annual C plus C output 2021-2035 (Mb/d):

77.1

80.0

81.0

82.0

82.8

83.4

83.9

83.6

82.7

81.4

78.4

75.5

73.3

71.4

69.6

A scenario from December 2022.

November 2022 output was 81.9 Mb/d. Peak annual output was about 83 Mb/d in 2018. In a few years we may look back and wonder why my projections were so conservative, but I have always said just that.

I don’t believe high oil prices are sustainable. I also don’t believe continued oil growth is sustainable. We are reaching a growing number of limits and the entire system is at risk of failure. As others point out almost daily, the system in place which allows tight oil to be harvested is expensive, extremely complex, and relies on cheap labor to be profitable. High oil prices create feedback and compounding headwinds that result in demand destruction. Whether we like it or not the world economy is now running in reverse, we can expect simplification and reduction, all of which points to lower world oil production. The world growth model has now turned the corner and now is the shrink model.

Kengeo,

Can you define a high oil price please? Oil prices averaged about $128 per barrel (2022$) for imported crude oil for the US from 2011 to 2013. World Real GDP grew at about 3% per year over that period. Oil prices dropped after July 2014 due to oversupply of oil.

https://www.eia.gov/outlooks/steo/realprices/

Eventually oil prices will drop and I agree they will not be sustained at a high level indefinitely. My expectation is that oil prices will drop gradually from 2030 to 2040 due to lack of demand as the World transitions to electric land tansport, supply will drop as well as lower prices will lead to low profits for more expensive oil resources (tight oil, deep water offshore, Arctic oil, and oil sands).

As far as “shrink model” perhaps after 2021? See

https://data.worldbank.org/indicator/NY.GDP.MKTP.KD

From 1982 to 2021 (40 years) it looks like World real GDP in 2015$ has grown at an average annual rate of about 3% per year, perhaps it will be lower in the future, we will see.

Dennis Sure –

First of all though, for your chart above you should recognize/realize that global debt creation was 2x GDP between 2005-2015…if that’s not a symptom of an ailing world economy then I don’t know what is… what role will inflation play in growing debt and or shrinking GDP?

For oil price, it depends on the time period you look at. But in a nutshell the following are the ranges:

– Low Range is $50 and below ($25 in the case of ~1990s)

– Medium Range is $50-75, call it ~$63 (about 25% above the low price)

– High Range is $75-100, call it ~$87 (about 75% above the low price)

– Very High Range is >$100 – 125 (about 100% above the low price)

– Extremely High Range are the oil shocks of $150-$200 (200-300% above the low prices.

Looking at recent prices, 2021 was Medium priced but trending towards High. For 2022, prices quickly moved from High to Very High and stayed there for ~6 months. The second half of 2022 saw decreases in demand due to the Very High prices and corresponding drop in prices due to slightly lower demand. Remember that due to inelasticity of oil supply, price and demand have to respond in order to balance supply.

Since September 2022, prices have remained in the Medium / High range.

General expectation is that prices will move higher, but it’s unclear if the economy is going to face a serious recession (or not).

Kengeo,

I guess this is where we differ, I would call high oil prices as above $110/bo and those prices might not be sustained for very long. because we would see a fairly rapid transition to electric transport over 5 to 10 years which would kill demand and reduce oil prices. Any price below $90/bo could probably be sustained for a longer period, 10 to 15 years in my opinion, but much depends on the speed of the transition to electric transport which most people underestimate. If self driving cars gain widespread approval, the transition to electric transport accelerates by a factor of 3 or 4.

“Whether we like it or not the world economy is now running in reverse, we can expect simplification and reduction”

We are close to agreeing on this KenGeo,

although I don’t think we are there quite yet.

And I’d call it contraction. Semantic choice.

Despite that, I think the price of oil will generally be high and higher.

8 (soon to be 9) billion people will work hard to buy energy.

Kengeo,

Expanding credit is a property of an economy that is doing well, this is something that many get backwards. During a boom, credit expands and during a depression it contracts, generally the World economy has been growing at roughly 3% per year in real terms for about 40 years, that is just a brute fact that cannot be denied.

As to future rates of growth, they will probably be lower as World popultion growth continues to slow due to falling total fertility ratios as women get better access to education and healthcare and more equal rights.

From World bank

https://data.worldbank.org/indicator/NY.GDP.PCAP.KD

From 1975 to 2021 World real GDP per capita grew at an average annual rate of 1.6%.

As World population growth approaches zero and assuming no change in the annual rate of growth in real GDP per capita (likely incorrect), the annual growth rate in World real GDP would fall toward 1.6%.

Dennis,

Expanding credit is a property of an economy that is doing well, this is something that many get backwards.

Yes if it can pay back the debt via the creation of credit. While keeping inflation in check. You should attach a plot of world (private and public) debt to gdp to see how it correlates with real gdp growth. I think you will find they correlate well, which could imply pure expansion of credit is gdp positive which is why all governments and banks do it.

High oil prices are not sustainable in a debt ridden world. A depression is needed to reset the global economy in my opinion.

“As to future rates of growth, they will probably be lower as World population growth continues to slow due to falling total fertility”

There are other factors tilting towards slower growth trend as well

-higher cost of inputs of energy and materials

-gradual aging of the global population (1/2 now over age 30)

-higher debt load diverts capital from productive investment…

On this last point, according to S&P Global-

Global Debt Leverage: Is a Global reset Coming?

“Global debt has hit a record $300 trillion, or 349% leverage on gross domestic product. This translates to $37,500 of average debt for each person in the world versus GDP per capita of just $12,000.”

https://www.spglobal.com/en/research-insights/featured/special-editorial/look-forward/global-debt-leverage-is-a-great-reset-coming

Credit tightening is a healthy (or necessary?) thing in the current environment, it appears. This will contribute to lower growth. We are seeing this play out with the Fed tightening in the US currently, for example.

Lastly, it will be very interesting to see how automation in transport, and how AI being deployed globally will affect all white collar employment/incomes, between now and 2035. These factors could shake up the economic system quite a lot.

Iron Mike,

That is very old school thinking prior to Keynes seminal work.

https://www.amazon.com/General-Theory-Employment-Interest-Money/dp/0156347113/ref=sr_1_2?keywords=John Maynard Keynes&qid=1680187357&s=books&sr=1-2

The book costs 39 cents on Kindle, if you haven’t read it. You could also try Krugman’s, “End This Depression Now”.

In short, I strongly disagree that a depression solves much, unless one likes a lot of suffering for no good reason, I am not a fan.

On inflation, it has mostly been in check from 2009 to 2021, recent inflation has been due to a combination of supply chain problems due to the pandemic and aggressive fiscal stimulus in response to the pandemic downturn.

Hickory,

Much of the increase in Debt to GDP comes from emerging economies that had difficulty accessing credit in the past and have now been able to do so. As to what is “productive investment”, that is up to markets (in the case of private investment) and voters (in the case of government investment in democratic societies) to decide. Perhaps credit will grow more slowly in the future so that debt to GDP decreases, some governments may have overspent in response to pandemic and that fiscal stimulus will subside, higher interest rates will reduce private investment and short term growth will slow.

Will this be a permanent slow down in the rate of real GDP growth? I see a gradual decrease (over decades) as population growth slows. Of course business cycles will continue as before.

In the piece you linked, they argue for a “reset” that entails slower growth in credit so that debt to GDP ratio stops growing or is reduced, they don’t seem to be talking about a depression.

Agree.

I see the risk of depression, or sustained contraction, as not just an issue of debt/credit, but of a combination of factors including the cost of energy (old and new systems simultaneous), aging of many countries, gradual increase in cost of raw materials, food, and climate instability (food), for example.

The credit tightening/over-indebtedness factor just makes handling all those big issues harder.

I am skeptical that there will be a soft landing from population Overshoot.

One of these decades we are in for an avalanche of bricks.

Hickory,

Difficult to predict, energy costs could decrease (in real terms) as solar, wind, hydro, and batteries take on more of the energy load, better farming practices could improve the soil situation, and a more rapid transition to lower total fertility ratios worldwide as women become more educated, have better access to healthcare, and gain more equal rights to men which reduces the need for food, and other goods as population starts to decline at the World level.

Reality might fall somewhere between this admittedly optimistic view and your somewhat pessimistic view of the future, better policy may lead to better outcomes.

Global debt is only possible if there are global savings to match. It’s very one-sided to wring your hands about debt and ignore the fact that it is some else’s investment.

So you should say savers have lent record amounts of money, reflecting their growing wealth and strong confidence in the bright future of the economy. Investments have reached an all-time high.

Alimbiquated,

This is not how debt works. Debt does not come from the pockets of savers. When a bank issues a loan, they create two accounting entries. One on the assets side, one on the liabilities side. Their books now balance, and an amount of money equal to the loan enters the economy. No money was removed from an account anywhere else. From “insvestopedia”:

“In today’s modern economy most money takes the form of deposits, but rather than being created by a group of savers entrusting the bank withholding their money, deposits are actually created when banks extend credit (i.e., create new loans). As Joseph Schumpeter once wrote, “It is much more realistic to say that the banks ‘create credit,’ that is, that they create deposits in their act of lending than to say that they lend the deposits that have been entrusted to them.”

2

When a bank makes a loan, there are two corresponding entries that are made on its balance sheet, one on the assets side and one on the liabilities side. The loan counts as an asset to the bank and it is simultaneously offset by a newly created deposit, which is a liability of the bank to the depositor holder. Contrary to the story described above, loans actually create deposits.

Now, this may seem a bit shocking since, if loans create deposits, private banks are creators of money. But you might be asking, “Isn’t the creation of money the central banks’ sole right and responsibility?” Well, if you believe that the reserve requirement is a binding constraint on banks’ ability to lend then yes, in a certain way banks cannot create money without the central bank either relaxing the reserve requirement or increasing the number of reserves in the banking system.

The truth, however, is that the reserve requirement does not act as a binding constraint on banks’ ability to lend and consequently their ability to create money. The reality is that banks first extend loans and then look for the required reserves later.”

The idea that all debt is loaned from some other account is outdated, and in our modern financial system it is completely false.

Niko,

Facts. 1

Niko,

Let’s do a thought experiment and keep things very simple. A bank with two customers A and B.

The bank has a million in deposits from person A decides to grant a loan of one million to person B.

Now the Bank has two million in deposits (but only one million in reserves) for customers A and B and an asset ( the note on the loan) for one million. Customer B withdraws one million from his account to buy a boat and customer A decides to move his money to another bank (which he believes is more stable) one day later.

The bank is now insolvent as it has no cash reserves to pay customer A.

One can write any numbers they please on a ledger (or type them into a computer). The bank has a problem with the Fed when their reserves are less than zero as I understand it.

Yes banks create money (again macro 101), but bank runs are still possible as we have witnessed with SVB (second largest bank failure in US history).

It still remains true that the bank does not hold all of the deposits and bank runs are possible when customers lose faith in the bank.

I caught by accident Mike’s and GUNGAGALONGA continued debate regarding oil business history on the open forum. I will add, Mike’s is certainly entitled to his point of view, but I think it is clear he stands largely in the corner by himself screaming at the room. There is nothing new under the sun, in broad terms it’s the same business as it always has been.

I think it might help, based on some of Ron’s comments, as to why it seems to be so much disagreement within the oil community. There isn’t by the way but the appearance does exist on the board.

For those who made a living in the conventional oil business, and that includes me, all my partners, most of my friends and all of their families, the horizontal play increased the cost of business to us while at the same time deceased the price we can get for our products. That is to say, we (our ideas) could not compete with multi thousand dollar per acre lease bonuses, we could not compete with higher royalties burdens paid to mineral owners. I get exactly why Mike has a thorn in his backside. Like I stated before I no longer make a living doing what I love to do, that is mapping and selling my ideas. I did not have access to PE, not that my ideas needed it, but I could not compete with the lower risk and perceived returns of the horizontal plays. Back in the late 1990’s I could get a 8000′ well drilled for $150,000, last years I got an a AFE prepared for a similar well in the same area and it was $1,200,000, for a wildcat well. That is if you could get a rig and there is no guarantee of that before your lease expired. You would also have to buy your completion casing BEFORE drilling a well, because if you did not have it you could not case your well IF successful. So I do get it.

But it is the same ole story, look what walmart did to small-town main-street. While I get being mad, what I don’t get is not getting over it, moving on and or learning to participate. I was taught you leave the complaining to the woman and children.

TTT,

Expanding upon your observations concerning the ‘assing out’ of many conventional operators by the more costly/revenue producing unconventional realm, this is continuing apace within the ‘shale’ industry as well.

Smaller operators are struggling to keep up with newer innovations that strongly advantage the bigger players.

Today’s 10,000 foot laterals are quickly becoming yesterday’s 5,000 footers as both technology and economics strongly favor the increasingly common 15,000 foot laterals. (Even the Bakken – home to the 10,000 footers – is adopting 3 mile laterals. Ascent just drilled two 24,000 foot+ wells in the Ohio Utica).

So called simul fracs fracture 4 or more wells simultaneously, saving a claimed quarter million bucks per well.

Big capital challenge for ‘one at a time’ folks.

EQT is implementing (since paused) a program they label ‘combo development’ wherein 4 pads – each containing 4 to 5 wells and close to one another – are drilled/frac’d virtually at the same time. The shared logistics and operations reduce the overall cost per well. That said, it is still a capital outlay of ~$250 million before a penny of revenue is realized.

Consolidation is a given in the coming years.

Coffee, “Today’s 10,000 foot laterals are quickly becoming yesterday’s 5,000 footers as both technology and economics strongly favor the increasingly common 15,000 foot laterals.”

Don’t I know it. Our first well with Continental in Grady County Okla, was Woodford well with a 10,000 foot lateral which kicked off at 11,000′. AFE was for $11,500,000, we leased most of our minerals but kept a 1% WI. Four months after spud they reached their lateral length and exceeded the AFE by 50%. OUCH ! We came out ok as we HBP the 1200 acres, waited as the new formation called the Springer was developed and still have yet to drill out the Woodford Density Wells.

They are now routinely drilling those type wells in 30 days or less. Cost based on the wells we drilled with Ovintiv late last summer was about the same. Consolidation would be great for prices but hard on the consumer, but like you, I think it is coming. Thanks for the input, I always learn a thing or two when you contribute.

“Perceived returns of horizontal plays.”

5 words say so much.

This is a stoopid comment designed to be insulting, by someone who likes to belittle people behind the safety of a keyboard. For the record I have asked this person to stop, to come see me, man to man, and he hasn’t.

I am not a sheep, don’t run with the flock, have lots and lots of followers, and am not alone in my concern for my country’s hydrocarbon situation. I am only “mad” or angry, at the way these amazing shale resources are being so grossly mismanaged. You’ll see what I mean soon enough.

These guys that cannot address the specific issues that I raise, the ‘message’ regarding the future of tight oil in our country… instead like to attack the messenger. That’s all they’ve got. Ignore it and try to remember that not all Texans are like this and certainly not all oilmen in the US are NOTHING like this.

AGAIN MIKE, ‘I am only “mad” or angry, at the way these amazing shale resources are being so grossly mismanaged”. That is an opinion, which you are entitled to. But it is contrary to the opinion of most oil and gas professionals, regulators and politicians. So how many people are employed in the Oil Drilling & Gas Extraction industry in the US in 2023? There are 148,610 people employed in the Oil Drilling & Gas Extraction industry in the US as of 2023. When I got into the business in the mid 1980’s there were 800,000 and 4500 rigs running. By the late 1980’s it was closer to 300,000 with the collapse of the oil price. Today with half that number and 824 rigs running we are producing a record amount of oil and gas. SO mismanagement is in the eye of the beholder. Getting more from fewer people is the definition of efficiency. Some might call that a technological miracle. I know it’s painful but that is the way it is. It aint going to stop. In fact these exact practices will be adopted around the world where suitable rock is located. There is NOTHING THAT WILL STOP IT. Certainly not complaining about it.

Now for some basic math, there are let’s say 200,000 people in the in the oil and gas business. There are 331 million Americans, everyone of them benefits from what you call “mismanagement” , to them it means lower prices for necessary products, diving, heating and cooling the house, all products derived from petroleum. Do you see why NO ONE but you is UP IN ARMS about this “mismanagement”. Now let’s talk about our European allies who take the majority of our exported Oil. Do you hear them complaining about mismanagement? No you don’t, and again it was the FREAKIN DEMOCRAT PRESIDENT calling on us to produce more. CAN you see the picture NOW?

There are a number of people here who I don’t know, but I know I would enjoy having a personal conversation with over a beer because of their critical thinking abilities, even when I disagree with them, that includes Dennis. I have watched his thinking evolve. Coffee, I know I could learn a thing or two. There are many here whose life or professional experience is broader than mine. I can see that right away. There are many here who are much more intelligent than me, I can recognize that right way, it’s why I read the blog, I want to learn more, I want to have my assumptions challenged, it’s how we grow.

You on the other hand, I have read nothing from you that leads me to conclude I could learn anything of value. To the contrary It’s like a friend who got divorced 10 years ago and still can’t stop talking about it,(tilting at windmills) no one wants to be around that. It is my opinion, it is a close call between you and Steve, which one delivers less value per digital word spoken, good news for you is I think Steve has got you by a nose and I am sure he has lots of “followers” too🖖

I will admit that I sometimes have a bit of fun at other peoples expense, kind of like playing with a cat with a laser light. The cat can’t figure out what’s happening, people should be able too. It’s not personal, but I “usually” don’t want to be intentionally offensive. I don’t go over to read or post on Mikes blog so I don’t go out of my to challenge him.

I ask for the forbearance of the board, I have gone back and forth on if I should address this or not, and decided it is best that I do.

Mike says “For the record I have asked this person to stop, to come see me, man to man, and he hasn’t.” Mike here is my response. You constantly attack people, not their ideas, but the people themselves. Second with your farm animals reference and constant invitations to “Man to man meeting” I am not sure if you are looking for a lonely farm boy fantasy experience or a fist fight. But resorting to physical threats is the tell you are losing the debate. that’s a pro tip by the way or as Scott Adams post today.

@ScottAdamsSays

·

6h

Dumb people argue without using data.

Smart people argue with data.

Smarter people know you can torture data until it tells you what you want to hear, so don’t trust it.

Smartest people know the data is not real and neither are you

Now let’s talk risk/reward. I stand 6 foot about 205lbs. I am 64 years old. Today like most days I start my workout doing 100 pull-ups. ON back day i do half of those with a 45lb plate. I have 17” biceps and do dips with two 45lb plates. To say you would be outclassed would be an understatement. While I know that does not intimidate you, to the contrary you are probably getting excited, who could blame you, I would get ZERO benefit or joy from a man to man “meeting” with you. So perhaps Mike let’s just stick to ideas.

Texastea2,

From your comment it sounds like you are losing the debate.

Your comment above adds very little to the discussion.

More comments along those lines and you will be gone.

Plus 1 – I’m starting to wonder if this site should be renamed, maybe angryoldoilmen.com?

Maybe add a third thread/topic:

Oil, Open, and Gloves-off…

while I think it’s generally great to give some leeway to the topics, not sure threats and insults add any real value here…

Kengeo,

Yes the insults are of no value. Unfortunately people feel insulted and return the insults, I do it myself, when someone insults me (sometimes by using the words of others).

Dennis that is fair enough and I agree it does not in any way add to the discussion. But so we are clear, posters can challenge people to a physical confrontations and routinely attack others like Mike does all the time and that is OK by you? I think that is a bit of hypocrisy but it is your blog. I think you understand this, but there are several posters here that routinely attack people personally for their ideas. Would you care to address that at this time? Do you think it is proper, do you think that adds anything to the discussion?

Texastea,

No I do not. Your thinking that Mike wants a physical fight I think might be incorrect. He is aggravated that people like you hide their identity, and can claim they are tough when they might be a 10 year old at a computer. He may have been saying that people are less likely to be impolite when they are face to face with someone. That is likely correct.

You do have a knack for ad hominems. There are others that do the same. None of it adds anything to the discussion, but I don’t really want to play hall monitor here.

My preference is that people behave like adults.

I’ve never “threatened” this guy; that is ridiculous. If you wish to insult someone, or call him/her names, or ridicule 60 years of work and family heritage, simply because you don’t agree with that person, in Texas you ought to have the huevos to do that to his face. Man to man. That is, of course, all I meant, all I asked. Hell, he is way younger than I am and certainly has bigger biceps.

I have not done well at ignoring the insults and I apologize to the community for making people feel uncomfortable. I am sorry. I will do my best not to look, or contribute anymore to the forum in spite of what people wish to say.

Good luck to all; think past next week and always think for yourself. The future is NOT now, it’s in the future.

Mike,

No apology is necessary. Although some like to insult you perhaps because you have a strong point of view, I agree the ad hominems add little to the discussion.

Sometimes people become offended by a comment when some one offers a conflicting point of view and in the process ridicules the opposing view point (calling something flat earth and such, which I am guilty of myself).

We should all try to refrain from these tactics, especially the personal insults.

It is too much work to either edit comments to remove offenses or to delete comments which contain them, note that all responses to the deleted comments get deleted as well (just the way the software was written and I don’t have the programming chops to modify that).

In any case, Mr Shellman will be missed and I am sorry that he wants to leave, his comments are wonderful and we all are wiser when we listen to what he has to say.

Hey Shellman,

I think it would be a mistake for you to stop reading and posting here at POB. For no other reason, if you really are apologizing to the community. Then you owe it to Dennis to stick around for the guy who gets a 10 for tolerance, accepts you for who you are and has always had your back.

You and I may have our differences, but I know your a well intentioned good person who loves his country. I’m pretty sure most others here believe the same. Personally, I can enjoy someone like yourself who pushes back. There’s a lot here for all of us to learn including socialization and writing skills. We could all learn more from Dennis about letting comments roll off our shoulders and being more tolerant. Remember, it’s called the United States and divided we fall. We all make mistakes.

Sticks and stones will break my bones, but names will never hurt me. Now get back up on that horse and be who you want to be. You have earned it. The future is ours to leave a better mankind.

Let it go

Mike , I will add to Dennis’s comments below, It should be recognized by the numbers of people who are still in the business, after the many price shocks, evolving technology, F’ing government shut down, those who still are a making living in this business (800,000 down to 150,000) are very unique individuals. I liken it to being an olympic competitor or pro athlete. Many started out… few got to the finish line. Mike and Shallow are still in the game, their business savvy and hard work demonstrates how a high level personal commitment achievement where many others failed. So with the understanding that a disagreement about ideas is not a personal attack on those recognized achievements, all input especially from those that actually know a thing or two should be welcome.

On a positive note, My base case is a replay of the 1970’s. Higher oil prices because of much higher inputs cost combined with restricted cap ex over the last 6 years will fuel an inflationary cycle. Those with a reserve base that is paid for should be rewarded. Price solves a lot of issue in the oil patch. But don’t borrow money on that, I have been wrong before🖖

HB comment +1

Crude Stocks Down by 7.5 M barrels

Attached is the weekly balance sheet for March 24. Net imports were down by 500 kb/d and crude input to refineries up by 450 kb/d. Combined those two account for a draw of 6.65 M barrel of the total draw of 7.5 M barrels.

Total product supplied was up by 449 kb/d to 20,476 kb/d while Gasoline supplied was 9,145 kb/d up by 185 kb/d.

https://mobile.twitter.com/JKempEnergy

U.S. PETROLEUM INVENTORIES including the strategic reserve fell -11 million bbl in the seven days to March 24, after declining -10 million in the week to March 17:

World Consumption of transport fuel 1983-2021 (gasoline, distillate fuel, jet fuel, and fuel oil) fro BP Stats 2022. Trend line is based on 1983-2019 only and uses OLS average annual increase of 585 kb/d per year.

Natural gas below $2, any thoughts on what’s going on there? Didn’t think we’d see that ever again

Stephen

Two thoughts. Are the gas fields wet so the producers get a good price for the liquids, Ethane, Propane, Butane and Pentane. The other possibllity is that many of the drillers have contracted a higher price with the LNG liquifiers and the low price is the price they get for the excess they can’t sell to anybody else.

Just speculating

Stephen Hren,

Much of the demand for natural gas is weather dependent, this past winter was unusually warm reducing demand for natural gas in North America and Europe where most US gas is being utilized for the past 12 months or so. Simply an oversupply situation which may result in lower completion rates in shale gas plays in the US (particularly Haynesville, Marcellus, and Utica plays) at this price level. Supply will decrease until prices rise to a level where completing new wells becomes profitable again, date unknown.

Also see

https://www.eia.gov/naturalgas/weekly/

From the report linked above (from EIA)

The price at the Waha Hub in West Texas, which is located near Permian Basin production activities, fell 36 cents this report week, from $1.27/MMBtu last Wednesday to $0.91/MMBtu yesterday.

This reduces profits for Permian producers that have chosen not to hedge. As LTO Survivor and Mr Shellman have been saying for a while, current prices for oil and natural gas may lead to fewer wells being completed in Texas and New Mexico because there is very little profit to incentivize greater output.

Hint:

Daily CO2

Mar. 29, 2023 = 421.60 ppm

Mar. 29, 2022 = 420.49 ppm

You lucky human!

You have levels no other human has experienced.

Stephen, I will take a crack at your question. ON a macro level there is a sh!T ton of natural gas available. Relatively small surpluses or tightness leads to over size price volatility, same as we see in the oil markets.

This is just an opinion but it looks to me the traders feel free to trade these commodities up or down until something breaks. For oil it means getting OPEC to make a move one way or the other. For nat gas it might be a public announcements where producers are shutting their gas in.

The Freeport plant is now back to full operation: https://oilprice.com/Energy/Energy-General/Freeport-LNG-Returns-To-Full-Power.html

Once we get past shoulder season I expect prices to tick back up, but that is just a guess. We are only 6 months away from significant new export capacity coming online and that will continue for serveral years. I posted before the EPD report showing a doubling of export capacity over the next 3-4 years. That should help prices significantly. It should also help with price volatility. I don’t have any use for Steve’s “Analysis” below as it is nothing more than panic porn, it takes two data points and paints an over simplistic picture. Since the commodity has fallen from $9 to $2 jumping in now seems like piling on rather than thoughtful analysis.

I appreciate the thoughtful responses. My natural gas bill was less than half in February. I work more in construction than energy and I feel like since the pandemic I am getting a taste of what energy folks have to deal with all the time with the price of their products zinging back and forth all of the place. It makes multi year investments incredibly stressful.

Stephen,

Maybe you might consider the chart below. 🙂

steve

Are you calling Stephen a Dummy?

Stephan here is a bit more color on the nat gas situation. I think it a bit under appreciated the impact the close of the freeport plant had on available domestic supplies and therefor storage levels. It really is a unique time in our business. I did a back of the napkin calculation on how much proved nat gas reserves we have an interest, its off the charts. The point is there has never been a time before where those reserves would not have been developed. Now to be fair most of those reserves would not be available without the much improved hydraulic factoring technology. So we sit and wait for higher prices. Consumers should count their blessing, if the consolidation Coffee and many others predict, with tighter control and discipline, these low prices will not last.

https://oilprice.com/Latest-Energy-News/World-News/US-South-Central-Natural-Gas-Withdrawals-Set-A-Record-Low-This-Winter.html

Randomly noticed that Comstock Resources sold off their entire oil stake in 2019-2020 timeframe and primarily has a natural gas portfolio now…interesting and wonder what their thinking was for selling 15 Bbls…

Super-Low Natgas Prices & Why The Price Is Heading Even Lower For DUMMIES

I thought I’d mentioned this, but I gather it wasn’t understood. The problem with the Natgas Market is that Europe Natgas Storage is 112% higher than where it was last year, and at current projected trend, it will be COMPLETELY FULL by Aug-Sep, something it has never done before.

Also, the United States Natgas Storage Levels are at 5- Year highs, regardless that Freeport is getting back up to Full Export Capacity.

NOTE: I just took the Last Year Gas Inventory Trend Line Chart (BLUE LINE) and added it to the current trend to give a FORECAST for 2023. If true… Europe won’t need anymore gas in Late Summer. This is certainly very BEARISH for the Natgas Price and for the U.S. Shale Industry… which a large percentage of profits came from high natgas and NGL prices.

steve

Steve,

It was a very warm winter, which reduced demand below normal levels, fewer natural gas wells will be completed in pure natural gas plays (Haynesville, Marcellus, Utica) and supply is likely to decrease. This is something that most dummies understand, freshman microeconomics.

One might guess that Europe will import less this summer than last summer as generally storage cannot be filled to more than 100% (assuming no new storage is being commissioned).

Collateral damage .

https://oilprice.com/Latest-Energy-News/World-News/Americas-LNG-Problems-Hit-Banking-Crisis-Snags.html

I wonder how far storage gets them through next winter if it happens to be a frigid, brutal one.

John,

Relevant question.

Quick number crunching …

About 100 billion cubic meters in storage as of end of January, 2023.

2021 saw ~400 billion Cubic meter consumption.

There should be an additional 150 Cbm LNG import capacity by the end of this year via new FSRUs (Floating Storage and Regasification Units) and ~60 Bcm more by the end of 2024.

(Current LNG import capacity is ~200 Bcm per year).

There are still natgas supplies coming in from at least one Russia-sourced pipe, I believe, as well as Netherlands, UK and Norwegian, Algeria, et al supply.

The above data was compiled quickly, but should be accurate.

A long, cold winter could prove to be daunting.