This is a guest post by Steve St. Angelo of SRSroccoReport.Com. All opinions expressed in this post are his and do not necessarily reflect those of Ron Patterson.

The U.S. Empire is in serious trouble as the collapse of its domestic shale gas production has begun. This is just another nail in a series of nails that have been driven into the U.S. Empire coffin.

Unfortunately, most investors don’t pay attention to what is taking place in the U.S. Energy Industry. Without energy, the U.S. economy would grind to a halt. All the trillions of Dollars in financial assets mean nothing without oil, natural gas or coal. Energy drives the economy and finance steers it. As I stated several times before, the financial industry is driving us over the cliff.

The Great U.S. Shale Gas Boom Is Likely Over For Good

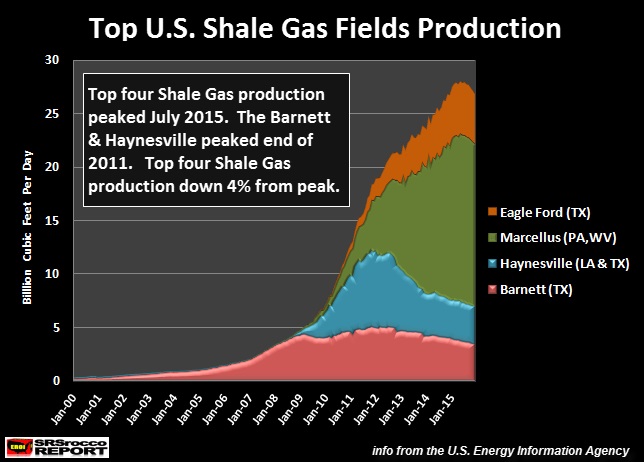

Very few Americans noticed that the top four shale gas fields combined production peaked back in July 2015. Total shale gas production from the Barnett, Eagle Ford, Haynesville and Marcellus peaked at 27.9 billion cubic feet per day (Bcf/d) in July and fell to 26.7 Bcf/d by December 2015:

As we can see from the chart, the Barnett and Haynesville peaked four years ago at the end of 2011. Here are the production profiles for each shale gas field:

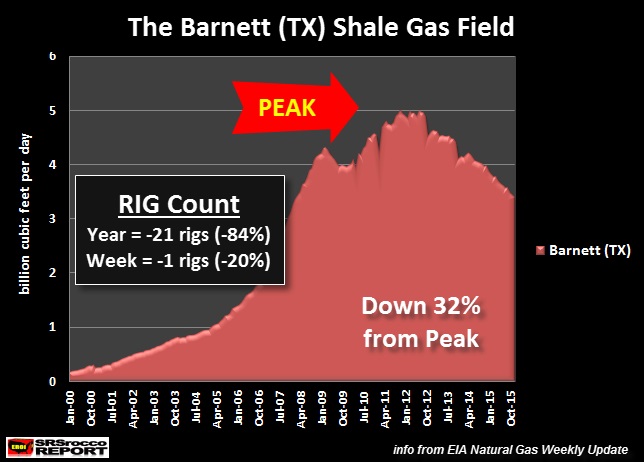

According to the U.S. Energy Information Agency (EIA), the Barnett shale gas production peaked on November 2011 and is down 32% from its high. The Barnett produced a record 5 Bcf/d of shale gas in 2011 and is currently producing only 3.4 Bcf/d. Furthermore, the drilling rig count in the Barnett is down a stunning 84% in over the past year.

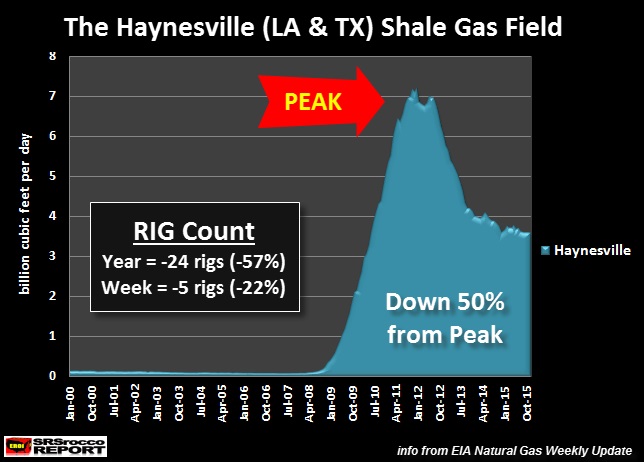

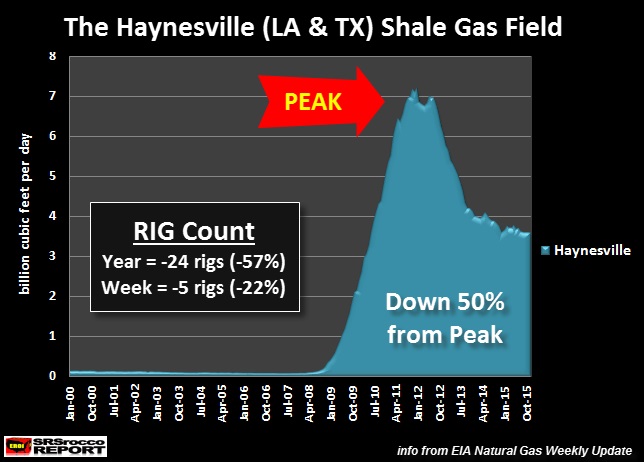

The Haynesville was the second to peak on Jan 2012 at 7.2 Bcf/d per day and is currently producing 3.6 Bcf/d. This was a huge 50% decline from its peak. Not only is the drilling rig count in the Haynesville down 57% in a year, it fell another five rigs this past week. There are only 18 drilling rigs currently working in the Haynesville.

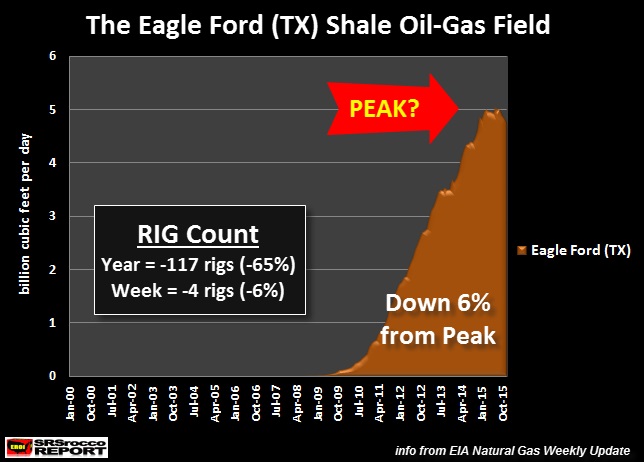

The EIA reports that shale gas production from the Eagle ford peaked in July 2015 at 5 Bcf/d and is now down 6% at 4.7 Bcf/d. As we can see, total drilling rigs at the Eagle Ford declined the most at 117 since last year. The reason the falling drilling rig count is so high is due to the fact that the Eagle Ford is the largest shale oil-producing field in the United States.

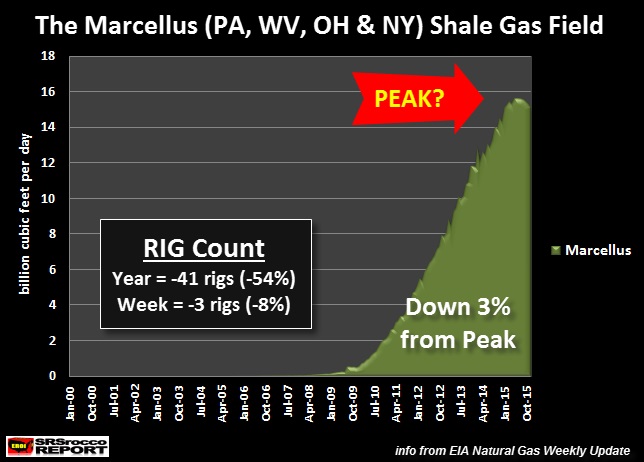

Lastly, the Mighty Marcellus also peaked in July 2015 at a staggering 15.5 Bcf/d and is now down 3% producing 15.0 Bcf/d currently. The Marcellus is producing more gas (15 Bcf/d) than the other top three shale gas fields combined (12.1 Bcf/d).

I have posted the Haynesville shale gas production chart below to discuss why U.S. Shale Gas production will likely collapse going forward:

What is interesting about the Haynesville shale gas field, located in Louisiana and Texas, is the steep decline of production from its peak. On the other hand, the Barnett (chart above in red) had a much different profile as its production peak was more rounded and slow. Not so with the Haynesville. The decline of shale gas production at the Haynesville was more rapid and sudden. I believe the Eagle Ford and Marcellus shale gas production declines will resemble what took place in the Haynesville.

All you have to do is look at how the Eagle Ford and Marcellus ramped up production. Their production profiles are more similar to the Haynesville than the Barnett. Thus, the declines will likely behave in the same fashion. Furthermore drilling and extracting shale gas from the Haynesville was a “Commercial Failure” as stated by energy analyst Art Berman in his Forbes article on Nov 22 2015:

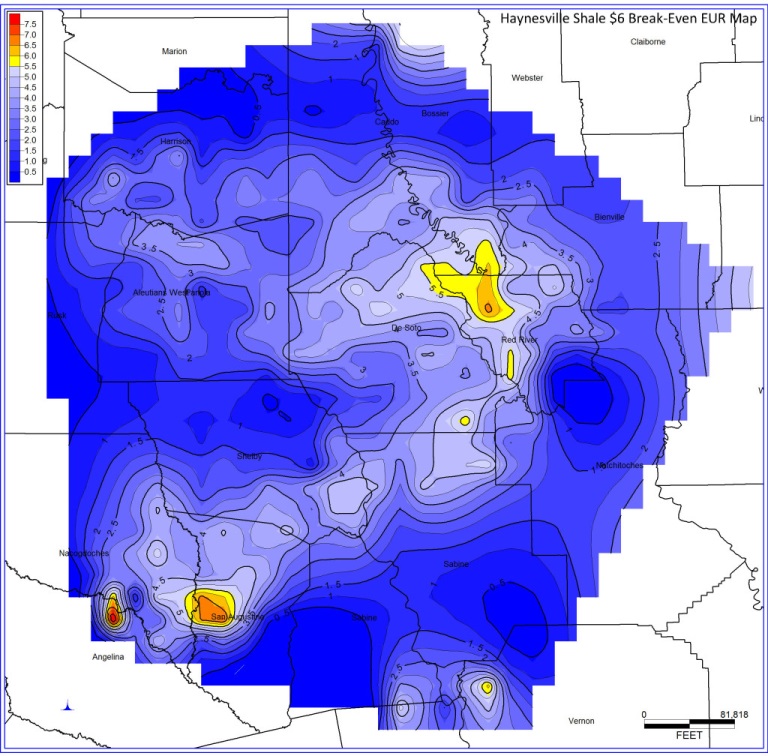

The Haynesville Shale play needs $6.50 gas prices to break even. With natural gas prices just above $2/Mcf (thousand cubic feet), we question the shale gas business model that has 31 rigs drilling wells in that play that cost $8-10 million apiece to sell gas at a loss into a over-supplied market.

At $6 gas prices, only 17% of Haynesville wells break even (Table 3) and approximately 115,000 acres are commercial (Figure 2) out the approximately 3.8 million acres that comprise the drilled area of the play.

The Haynesville Shale play is a commercial failure. Encana exited the play in late August. Chesapeake and Exco, the two leading producers in the play, both announced significant write-downs in the 3rd quarter of 2015.

Basically, the overwhelming majority of the shale gas extracted at the Haynesville was done so at a complete loss. So, why do they continue drilling and producing gas in the Haynesville?

The reason Art Berman states is this:

What we see in the Haynesville Shale play are companies that blindly seek production volumes rather than value, and that care nothing for the interests of their shareholders. The business model is broken. It is time for investors to finally start asking serious questions.

Chesapeake is one of the larger shale gas producers in the Haynesville as well as in the United States. According to its recent financial reports, Chesapeake received $1.05 billion in operating cash in the first three-quarters of 2015, but spent $3.2 on capital expenditures to continue drilling. Thus, its free cash flow was a negative $2.1 billion in the first nine months of 2015. And this doesn’t include what it paid out in dividends.

The same phenomenon is taking place in other companies drilling for shale gas in the other fields in the U.S. This insanity has Berman perplexed as he states this in another article from his site:

This has puzzled me because the shale gas plays are not commercial at less than about $6/mmBtu except in small parts of the Marcellus core areas where $4 prices break even. Natural gas prices have averaged less than $3/mmBtu for the first quarter of 2015 and are currently at their lowest levels in more than 2 years.

The reason these companies continue to produce shale gas at a loss is to keep generating revenue and cash flow to service their debt. If they cut back significantly on drilling activity, their production would plummet. This would cause cash flow to drop like a rock, including their stock price, and they would go bankrupt as they couldn’t continue servicing their debt.

Basically, the U.S. Shale Gas Industry is nothing more than a Ponzi Scheme.

The Collapse Of U.S. Shale Gas Production Even At Higher Prices

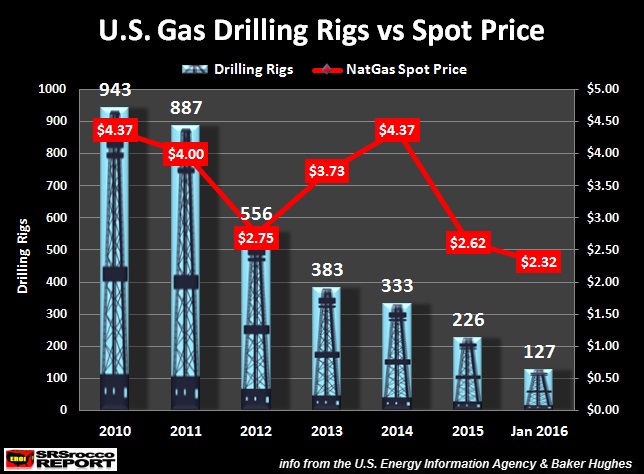

I believe the collapse of U.S. shale gas production will occur even at higher prices Why? Because the price of natural gas increased from $2.75 mmBtu in 2012 to $4.37 mmBtu in 2014, but the drilling rig count continued to fall:

As the price of natural gas increased from 2012 to 2014, gas drilling rigs fell 40% from 556 to 333. Furthermore, drilling rigs continued to decline and now are at a record low of 127. Just as Art Berman stated, the average break-even for most shale gas plays are $6 mmBtu, while only a small percentage of the Marcellus is profitable at $4 mmBtu.

Looking at the chart again, we can see that the price of natural gas never got close to $6 mmtu.. the highest was $4.37 mmBtu. Thus, the U.S. Shale Gas Industry has been a commercial failure.

Now that the major shale gas producers are saddled with debt and many of the sweet spots in these shale gas fields have already been drilled, I believe U.S. shale gas production will collapse going forward. If we look at the Haynesville Shale Gas Field production profile, a 50% decline in 4 years represents a collapse in my book.

The Two Nails In The U.S. Empire Coffin

As I stated in several articles and interviews, ENERGY DRIVES THE ECONOMY, not finance. So, energy is the key to economic activity. Which means, energy output and the control of energy are the keys to economic prosperity.

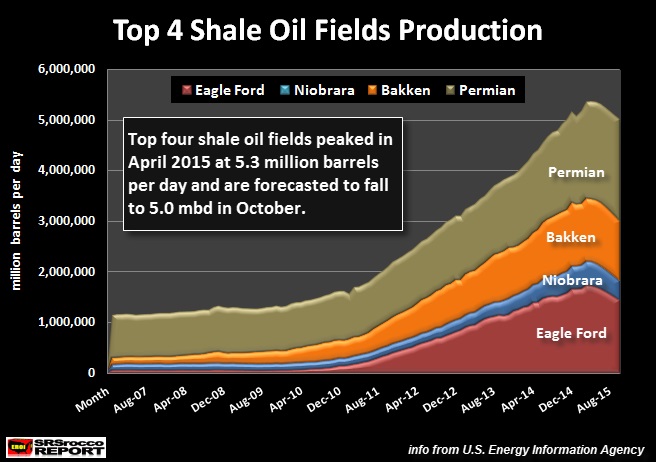

While the collapse of U.S. shale gas production is one nail in the U.S. Empire Coffin, the other is Shale Oil. U.S. shale oil production peaked before shale gas production:

This chart is a few months out of date, but according to the EIA’s Productivity Reports,domestic oil production from the top four shale oil fields peaked in April of 2015… three months before the major shale gas fields (July 2015).

Unfortunately for the United States, it was never going to become energy independent. The notion of U.S. energy independence was built on hype, hope and cow excrement. Instead, we are now going to witness the collapse of U.S. shale oil and gas production.

The collapse of U.S. shale oil and gas production are two nails in the U.S. Empire coffin. Why? Because U.S. will have to rely on growing oil and gas imports in the future as the strength and faith of the Dollar weakens. I see a time when oil exporting countries will no longer take Dollars or U.S. Treasuries for oil. Which means… we are going to have to actually trade something of real value other than paper promises.

I believe U.S. oil production will decline 30-40% from its peak (9.6 million barrels per day July 2015) by 2020 and 60-75% by 2025. The U.S. Empire is a suburban sprawl economy that needs a lot of oil to keep trains, trucks and cars moving. A collapse in oil production will also mean a collapse of economic activity.

Thus, a collapse of economic activity means skyrocketing debt defaults, massive bankruptcies and plunging tax revenue. This will be a disaster for the U.S. Empire.

Lastly, it is hard to forecast how this unfolds, but the best plan of action is to be more self-sufficient in the country with wealth held in physical gold and silver.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

Good read but really just a recap of what we already know.

Steve has come up with a damned impressive set of arguments.

About the only thing missing is some discussion of how long it will take to get the drill rigs and men back into the gas fields, and how high the price will have to go, to get production back up again.

So far as I can see, he is not arguing that the gas is not there, but rather that the MONEY is not there.

Maybe the economy will not support the prices necessary to make domestic gas profitable next year and the year after that, and on down the road.

I believe the gas IS there, based on Rockman’s comments about it being there IF the price is right.

For what it is worth, my opinion is that reduced upstream capex, in combination with depletion, will result in an oil and gas short supply situation which in turn will result in price spikes UP as sharp as the recent free fall down .

I have no way of estimating how long this might be in coming about, but my guess is that it won’t be a whole lot longer, in historical terms, probably not over a couple of years.

I am of the opinion that taken all around, the low prices of oil and gas have been EXTREMELY GOOD for the American economy, and the economy of all developed countries that import a lot of oil and gas. The return of higher prices is going to have a hell of a bad impact on the economy.

OldFarmerMac,

Been a while since I responded to one of your comments. That being said, we must remember, MONEY = ENERGY. However, it’s not that we need more money to get more drilling, we need MORE DEBT. As Gail Tverberg implies in her recent articles, we are now at a conundrum. We can’t afford to service the debt we have right now, so it’s impossible to add even more debt to bring on more energy.

This is the reason why we have Zero & Negative Interest Rates. The U.S. will never again have a normal interest rate, unless it gets rid of all its debt. And if the debt is forgiven, then collapse happens because the other side of that debt was assets in the public and wealthy hands.

Thus, we are now facing the COLLAPSE of DEBT… which means we can’t really afford to bring on more expensive energy. Even when the price of NatGas increased from 2012-2014, the drilling rig count fell considerably.

To really turn the Shale Gas Industry around, I would imagine a price of $7-$8 is needed. Don’t know if we ever get there again due to the massive debt already in the system.

There lies the Rub.

Steve

Hi Steve,

Don’t defaults on private debt happen all the time? That is the price one pays for buying junk debt, high risk in exchange for high interest payments.

There is a simple solution to low interest rates. More debt. If people are willing to lend to a government at zero or negative interest rates, then roll over old debt and replace it with low (or no) interest debt.

In fact economic theory would suggest in an economy at less than full employment more government borrowing at low interest rates is very sensible. Increase aggregate demand by investing in water systems, roads, bridges, rail, grid improvements, and anything else deemed useful by society (education maybe). The increased demand leads to higher income and more profitable businesses that demand more loans.

The increased borrowing drives up interest rates to normal levels at which point the government stops borrowing and gradually reduces the level of public investment (cutting spending) while gradually raising taxes if necessary to balance the budget.

All that is needed is a functioning government (rather than what currently exists in the US). I imagine a parliamentary government with enlightened leadership (Canada might be a good example) could implement such a plan.

Dennis,

I believe the debt defaults that are coming are much bigger than we have ever experienced. The day the U.S. Treasury Market defaults will be the BIG ONE. And it’s coming. I am not saying it’s coming this year or next… but probably by 2020.

Regardless, Japan stunned the markets on Friday by announcing Negative Interest Rates. This was why we saw a surge in World Indices on Friday. However, this is not a long-term solution.

When you hit Negative Interest Rates, it’s hard to go too negative. So, there is very little room to continue dropping interest rates. All that remains is QE to infinity. But, again… this next QE that is done will likely cause serious inflation.

The U.S. Financial System will likely collapse more suddenly than most realize.

Hence… Seneca’s Cliff.

steve

Hi Steve,

QE will only cause inflation if the economy is doing well.

Very unlikely that the US would default on debt, at low interest rates the US government should try to spur investment through tax breaks or public private partnerships, or borrow to offer low interest refinancing of student loans, there are many possibilities for productive investments that can be undertaken when private business is unwilling to invest.

The debt situation in the US is really not as bad as you think.

I respectfully disagree about the debt not being a problem.

It can be defaulted on, but the consequences for that are generally severe especially for the huge debts we have.

Our chances of outgrowing our debt is very slim (equivalent of this generation robbing future generations of funds).

Unless we learn to live within our means (really too late for that),

we are in for a bad lesson.

BTW- I suggest seeing the movie The Big Short.

Hi Hickory,

US assets about $200 billion and total debt about $45 billion. A 25% debt to assets ratio is not a big problem.

Debt to GDP around 250%, also not a problem in my view.

I agree lower would be better, if the economy continues to improve debt will decrease at the federal level as tax revenue will increase and spending on unemployment benefits and welfare will decrease.

“US assets about $200 billion…” 90% of which are blue sky/finance/bankster generated.

Please list those assets you claim and site refs.

For every slice of pie there are at least 100 claims on it.

You coyne are a nonentity…re. a computer generated response algorithm. You spew absolute nonsense.

Please everyone, stop allowing his posts.

Jef you have your head up your own backside so far you will never see daylight.

Dennis has FORGOTTEN more than you can ever hope to learn.

He is a mainstay of this forum, and when Ron retires, which must happen before too long, considering his age, if ANYBODY keeps it going, perhaps with a new name, you can bet your ass Dennis will be one of the most important people involved.

Hi Jef,

Read the following

http://rutledgecapital.com/2009/05/24/total-assets-of-the-us-economy-188-trillion-134xgdp/

You can’t liquidate the entire US economy.

There would be no one who could buy it, among other preposterous implausibilities.

Therefore those assets can’t be worth 200 trillion marked-to-market.

An asset is only worth what someones pays for it at purchase time. Otherwise, it is an estimate of what it is worth.

I don’t question that you can estimate that usa total assets are 200 trillion.

Unless Jesus multiplies the loaves, fishes and gold nuggets those assets cannot be exchanged for 200 trillion dollars.

Maybe we can sell the US military to China! They would be possibly the only country that could afford it based on what those assets are being valuated at.

Debt is accurate to the penny. It is a legal obligation. And interest rates will go up due to the laws of thermodynamcs. There is no such thing as a free lunch .

thanks!

Hi Satan’s Best Friend,

On selling the entire US economy, usually it would be done a piece at a time.

The 200 trillion dollar estimate was from 2009, it is probably more now, I kept it at $200 trillion to be conservative.

We could be even more conservative and cut it in half, we would still be at better than a 50% loan to value.

Did you read the Rutledge piece?

Dennis- the student loan debt alone in this country is up to 1.4 Trillion$!

http://www.bloombergview.com/quicktake/student-debt

I wasn’t just talking about government debt. There is corporate debt, household debt, farmer debt, pension fund debt, etc.

Lets not even get into the groundwater debt.

Maybe you are comfortable with living far out on the edge of the thin ice, but I’m just not.

Private debt is a huge problem. The best way to deal with it is… for the government to convert it into government debt and then inflate it away. Money problems are simple if you have a government willing to deal with them.

Real resource problems like global warming and peak oil are another matter entirely and much harder.

Nathanael,

Do you live on planet earth?

The best way to deal with private debt is to convert it to public debt and then inflate it away?

That is the way children deal with money.

The laws of thermodynamics prevent a free lunch.

There is no escape from the laws of mathematics.

Hi Hickory,

I used the following:

https://research.stlouisfed.org/fred2/series/GFDEBTN

and

https://research.stlouisfed.org/fred2/series/CRDQUSAPABIS

US Debt 45 billion, US assets 200 billion

http://rutledgecapital.com/2009/05/24/total-assets-of-the-us-economy-188-trillion-134xgdp/

not a problem.

Billion or trillion?

Thanks AlexS,

My mistake it should be trillion.

Hi Satan’s Best Friend,

If there is secular stagnation due to low labor productivity growth, interest rates will never rise and it may be that deflation is more of a problem than inflation.

If there is deflation then many private debts will be defaulted on. Yes debts are a legal obligation, bankruptcy is how the defaults are dealt with legally.

If we assume the debts are held mostly by the wealthy and liabilities belong mostly to poorer folks, the defaults redistribute wealth from rich to poor.

Now in a more normal economy there is at least some inflation so that the real value of debt in inflation adjusted money is reduced over time, this has been true since fiat money has been used.

Keep in mind there is a distinction between the real economy and the monetary economy. Thermodynamics applies to the real economy, but not so much to the monetary part.

Think of the price assigned to a good at an auction, how does thermodynamics apply there? Price is an arbitrary number assigned to an object based on the supply of and demand for that object, thermodynamics and physics have very little to do with it. Price discovery is a social interaction.

Hey Dennis,

I can’t tell if I’m responding to the right thread on my iPhone.

I have a sneaky suspicion u r actually smarter than me, so I better cut my losses. Lol!

Remember the economy is a balance sheet.

For every entity that is henefitting from low interest rates there is an entity that is getting killed by them.

Any entity engaged in bond laddering (like insurance companies and pension funds), is getting killed.

At some point the fed will have to back off or they will detonate half of the economy.

There is no escape from the laws of math and there is no free lunch.

Hi Dennis,

The end of American growth is here. See economist Robert Gordon’s magisterial 768 page new book. Total factor productivity has been falling since the 70’s.

http://www.prospectmagazine.co.uk/features/growing-pains-united-states-end-of-economic-growth-productivity

Hi VK,

His opinions are not shared by many economists, I agree that growth in advanced economies will be slower, that is a good thing.

The unequal wealth distribution will need to be addressed, at some point the poorer members of society may get behind a populist that advocates real change to address the problem. The internet could potentially link many people together to form such a movement.

Using data from FRED:

https://research.stlouisfed.org/fred2/series/USPRIV

and

https://research.stlouisfed.org/fred2/series/GDPC1

I was able to look at US labor productivity from 1955 to 2015.

On average the rate of increase was 1.3%, but from 1976 to 1982 and from 2010 to 2015 there was no increase in labor productivity.

The hypothesis that this may be permanent is interesting, but as yet unproven.

Mistake on my part billion should have been trillion.

You and the Keynesian shamans you read have forgotten one very important part of the system, without which it will collapse: CONFIDENCE. Billions or trillions, it doesn’t matter. What matters is confidence. When high-powered institutions realize the only remaining collateral is the kind of ad hoc idiocy that you are spewing, the system will collapse into something more manageable.

Hi grs,

Perhaps you have never read Keynes.

Confidence was central to his analysis in The General Theory, published in 1936.

It is the non-Keynesians that think the economic system is self regulating and requires little or no government interference.

Most mainstream economists are not Keynesians (there are a few, but they are no longer the clear majority, as was the case before 1980).

So you think that the value of the real assets in society do not matter?

Note when I talk about assets, I don’t mean stocks and bonds. I am talking about land, buildings, equipment, and other physical capital. I am not talking about financial assets, perhaps you should read the piece by Rutledge.

http://rutledgecapital.com/2009/05/24/total-assets-of-the-us-economy-188-trillion-134xgdp/

In the piece by Rutledge he notes that many sectors do not have data for tangible assets, such physical assets as farmland, and federal and local government assets(roads, bridges, buildings, water systems, public transport networks.)

http://www.federalreserve.gov/releases/z1/current/z1.pdf

Page 20 of the document above gives 2014 US net worth as $78 trillion, and $54 trillion is tangible assets, this excludes the market value of US corporations, if the tangible assets of those businesses were added we would be back up to $70 trillion in tangible assets.

Note that the value of federal, state, and local government land and the mineral rights associated with that land are not included (this might add another $3 trillion or so) so maybe $73 trillion in tangible (or real) assets. Total debt is about $50 trillion (government and private debt) so for the entire US economy the loan to value is about 70%, if we ignore the value of US corporations (their net present value is assumed to equal only their tangible assets).

If debt continues to grow faster than the economy, this may become a problem.

Note that this analysis has set all US corporations to half their market value in 2014 so it is fairly conservative.

It’s not possible for the US Treasuries to default, unless a deranged President (Trump?) *decides* to make them default.

What is possible is that the US will simply print money to pay interest on the Treasuries. This could cause inflation, but if the economy is in bad shape, it won’t.

The private banks could all go bankrupt though.

Hi Nathaneal,

Some banks might be closed, all banks is very unlikely barring an asteroid strike or World War 3.

Nathaneal,

Not could cause inflation. Printing money, to increase the money supply, is by definition, inflation.

You are talking about rising prices ( which is sometimes a consequence of increasing the money supply)

If printing money and going into massive debt worked, we would all be sitting on the beach drinking coconut smoothies and laughing our arses off.

It doesn’t work, that is why people have to go to work.

It doesn’t work, specifically because the laws of physics won’t allow it.

Hi Satan’s Best Friend,

When the economy is doing poorly. More money supply does not lead to inflation. The money just circulates more slowly if more money is created.

Think of it in the following way. You print a trillion dollars and give it to the 10 wealthiest people in the country.

Does spending increase? Hint, not very much.

Does inflation increase by much? Again no, the rich just let it sit in their investment accounts, there is very little effect on the real economy.

That is why the quantitative easing has not led to inflation.

Money supply has increased a lot, inflation has been modest.

Dennis,

But at the slightest hint that that money is going to lose part of its value, those rich people are going to unpark it and use it to buy assets. At that point you are going to have an asset inflation like none before. Then inflation goes to the roof, and then money dies.

It is very easy to print money as it has been done. It is very difficult to unprint that money and recall it to be destroyed so it doesn’t hang like Damocles sword on us. Monetary expansion beyond economic growth is a fools game. It has always been, it will always be.

Hi Javier,

Potentially there could be some inflation of financial assets such as stocks and bonds.

Much of the excess money supply has not resulted in increased lending. Much of the bond buying has been the central bank buying bonds from big banks. If the banks don’t lend most of this money to private businesses (the money received in exchange for bonds), then there is little asset appreciation.

The point of the policy is to stimulate the economy, any lending which does occur tends to increase aggregate demand, which is the point.

Many worry about inflation from these policies, it doesn’t occur unless the economy starts doing well.

I agree the policy does not work very well, fiscal policy is much more effective.

Dennis,

The money created out of thin air constitutes a claim on the same amount of riches (economic wealth) that support the monetary base. Therefore, used or not, it dilutes the claim from previously existing money.

Inflation is simply a measure of two things, the increase in monetary base in circulation beyond the increase in economic wealth and the increase in money velocity.

But you got it backwards. The problem is if the economy starts contracting, not if it starts doing well. If the economy contracts, and there is an excess of money, the claim of the monetary base on the economic wealth starts to go down and so money velocity starts going up as people try to exchange a money that is losing value for goods. The situation is described as “too much money chasing too few goods” and can easily lead to stagflation. Then there is no good choice. If allowed to reign, it can lead to hyperinflation, if checked by reduction of the monetary base it worsens the economic contraction.

Javier,

although not entirely accurate (technically and theoretically speaking), for terms and sentences such as: “…too much money chasing too few goods…” and “…the increase in monetary base in circulation beyond the increase in economic wealth…” are Classical Economic Theory terms which do NOT reflect accurately the financialized, notional and interconnected global economy we have today (but more so the old “goods and services” based economy we used to have) – you have a far better understanding of these things than the overwhelming majority of economists and finance experts (some of whom are in decision making positions nowadays … unfortunately!).

I am impressed.

Be well,

Petro

Hi Javier,

If the excess reserves remain in the bank, the money supply will contract over time as loans are paid back. What you are forgetting is that as the economy contracts, the money supply contracts as well because the debt being repaid will exceed the money being borrowed.

Stagflation was a result of poor monetary policy in the US in response to the oil shock of 1979 to 1981.

We should be concerned more with deflation, the inflation fears are without much basis in economic theory, if the economy contracts, deflation is the problem and monetary policy is not a solution. Only fiscal policy will help.

Hey Dennis,

Inflation is an increase in the money supply.

Deflation is a decrease in the money supply.

Sometimes inflation and deflation affect the prices of things, depending on other factors.

QE hasn’t produced as much price increase as expected because the amount of money printed by the fed is relatively small to the entire money supply.

Credit and bank loans dwarf what the fed has done.

Inflation and deflation are terms reflecting generally increasing or decreasing prices for things and services in the marketplace. The money supply MAY influence those prices but it is not the definition of of inflation or deflation.

Donald,

You must not be an Austrian economist.

I can only hope that Murray Rothbard and Ludwig von mises log in and give you a spanking.

Lol. Thanks for your input!

Obviously I am categorically opposed to the stupidities of the Austrians.

Hi Steve,

Read my comment, http://peakoilbarrel.com/collapse-of-shale-gas-production-has-begun/#comment-558059 , down thread, and tell me what you think.

I believe actual future history is apt to play out somewhere between a hard uncontrolled collapse and Sky Daddy only knows how bad times, and my top down controlled collapse and winding down without collapse scenario, as described in my comment.

Part of a controlled descent from current day business as usual WILL INVOLVE some new drilling for oil and gas, and some coal to liquid capacity being built.

There is no doubt in my mind that the entire house of cards that is modern industrial civilization COULD collapse , and might collapse. Whether it does, or dose not, in my estimation, is mostly a matter of luck, such as which political parties and which special interests prevail in determining future policies at national levels. A few countries at least are sure to wage aggressive war on their neighbors near, and perhaps far, hoping to seize any remaining depleting assets such as oil, gas, metal ores, even farmland.

Back atcha.

I have a little gold and silver, and an equal amount of cash tied up in sealed containers of ammo, which will in my estimation be as easy or easier to trade in a doomer scenario as gold coins.

My personal opinion is that any end of life as we know it scenario is very likely at least two or three decades down the road, barring very bad luck bringing on WWIII or something of that nature.

Debts can and will be repudiated, when necessary. The consequences will be awful, but they need not include more than a very small percentage of the people in a rich western country dieing violently or of starvation and exposure.

A lot can happen in two or three decades, and a lot of what happens will be VERY positive, such as substantially improved recycling of depleting resources, falling birthrates, enormously improved energy efficiency, draconian MANDATED conservation measures, substantially cheaper renewable energy, etc.

With peaking and falling populations, most countries THAT MATTER will not need much at all in the way of new highways, electrical transmission lines, water treatment and sewage plants, or housing. Maintaining old stuff is expensive, true , but maintenance is dirt cheap compared to building new from scratch.

The renewable energy naysayers never quit harping about the need for fossil fuel back up for wind and solar power, but they very CONVENIENTLY ignore the perfectly obvious fact that the necessary backup capacity ALREADY EXISTS, and must be maintained in any case, whether we run it around the clock around the calender on fossil fuel, or intermittently as necessary to supplement renewables.

It is true that oil, coal , and metal ores were not in short supply in the thirties when the nazis came to power in Germany, but it is also true that Germany was a country economically prostrated, with many millions of her best men dead or crippled, and nevertheless, Germany built the most impressive war machine ever even imagined up until that time in less than a decade.

MONEY didn’t build that war machine, PEOPLE built it, using what material resources were at hand, or could be begged, bought , borrowed or stolen.

Folks such as MARX and LENIN were not complete idiots, they knew a few things.

When the shit hits the fan, world wide, there will still be plenty of material resources and skilled manpower that can be diverted to doing something about energy troubles.

The bigger and stronger the renewables industries at that time, the faster they will be able to expand. Hopefully they will be big enough to allow some of us to continue to live a life at least superficially similar to life as we know it today.

Success is NOT assured.

But neither is outright failure.

“Maintaining old stuff is expensive, true , but maintenance is dirt cheap compared to building new from scratch. ”

True, but maintenance does not win elections; neither does it generate the profits needed to adequately bribe (“fund”) the political parties. At least in NJ, which is the most paved state in the union.

HI Stu,

I imagine that when and if the shit hits the fan, really hard, damned few residential streets and side roads will be repaved, or even patched, anywhere at all.

All the four by four vehicles that have never been off pavement will finally actually be USEFUL to somebody other than a farmer, or a Vermonter in winter- if gasoline enough to drive them more than a few miles a week can be had.

Folks will be amazed at what they can GET BY WITH when necessity forces them to get by. Traffic will fall off eighty percent or more, on most streets. Potato chips will OUT, potatoes will be in, one load of potatoes in the place of ten loads of chips, and in reusable bags and boxes, rather than throwaway packaging.

The places hardest to maintain, with the least reason for people to hang around, will simply be abandoned. Population will be falling, and there will be plenty of vacant housing in places where life is easier than a New Jersey industrial and commercial dead zone.

Of course SOME New Jersey industry will survive.

A good half of everything we do has little or nothing to do with people living a dignified if spartan life. When the shit hits the fan, we won’t be spending much on advertising, or high status restaurants, or fancy clothes, or luxury automobiles.

But ” personal servant” will be a growth industry. I might get lucky and find a young pretty one for myself who will cook and clean for me and hoe the garden and pick beans and dig potatoes, for room and board and a few things to trade at the flea market, such as some of the potatoes and beans.

Now if things get REALLY bad, my servant(s) might just murder me, and take possession of the farm. 🙁

In that case, my worries will be over ANYWAY. 😉

Sorry guys, money is not energy even if it seems like it is on the oil patch.

P.S. Concerning all this “American Empire” stuff, is the name SRSrocco a joke? It looks a lot like SRs Россия, where SRs is a common abbreviation for the Socialist Revolutionaries.

Commenter,

While you can come up with all the socialist propaganda to your heart’s desire, my screen name is quite harmless. It’s my initials followed by my middle name.

LOL…. Steve

Commenter,

I am not sure about Steve’s, for he can explain that himself, but (judging by what you wrote) you presented us with only your last name.

You forgot to write your first and middle names:

Dumb F******

Therefore your full name – so we know exactly where such wise and thoughtful comments akin to yours are coming from, would be:

Dumb F****** Commenter

Be well,

Petro

Hi Steve,

The debt situation in the US is really not that dire.

Total assets of the US were about 200 trillion in 2009. Total federal and private non-financial debt was about $43 trillion in 2014 ($36 trillion in 2009) so debt to assets is only about 25%.

See http://rutledgecapital.com/2009/05/24/total-assets-of-the-us-economy-188-trillion-134xgdp/

Chart below shows federal plus non-financial private debt to GDP for the US.

I don’t agree with that.

There is no way you could liquidate all those 200 trillion of “assets”. Therefore their value is not 200 trillion.

The debt is accurate to the penny and a legal obligation.

An asset is only worth what someone can pay for it. Who has 200 trillion laying around?

Interest rates have hit rock bottom. There is no where to go but up.

When they start going up, all the governments, companies, entities that have been playing the “roll your debt over to lower interest rates” games will be in deep shit.

It will be “roll your debt over to higher interest rates that you haven’t budgeted for” game.

And there are ALOT of those out there.

thanks!

Hi SBF,

When interest rates increase it will be because the economy is improving.

Government revenues will be higher so some debt can be retired, and corporate profits will be higher so higher interest rates can be paid. Higher interest rates are the sign of a more robust economy. So we disagree and asset values matter. That is why the house is appraised.

Thanks for the response Dennis.

Aren’t interest rates low because at treasury bond auctions the bidders are buying them at low rates?

The Federal Reserve (who has a gargantuan and unsustainable balance sheet) is in there buying them to prevent the rates from going up.

I don’t believe that can be gracefully controlled forever.

When has the Federal Gov’t ever retired debt?

thanks for your input, I have learned much from your posts.

HI SBF,

Probably very little debt has been retired, it mostly gets rolled over. The debt grows more slowly than the economy so debt to GDP decreases. After World War 2 government debt was high (as a percentage of GDP) and has fallen until 1973 and then began to rise again. See

https://research.stlouisfed.org/fred2/series/FYPUGDA188S

Dennis,

One more brilliant point! LOL!

Housing prices increased because interest rates have been on the decline for the last 30 years.

Housing prices rise, because some other idiot can borrow more money than the last guy did.

When interest rates are going down, you can afford more with the same monthly payment.

When interest rates go up. That is no longer true.

Asset values do matter. But they are only worth what someoe who wants them can afford to pay.

In the case of houses, in a rising interest rate environment, that will be lower and lower asset values.

thanks!

Hi SBF,

I agree that interest rates will influence the price of the asset for the reason you say.

Consider the following thought experiment, how low would the price go due to higher interest rates? It would depend on the condition of the house and the cost to build something like it plus land cost in a similar neighborhood in the vicinity.

Interest rates will influence the asset value, but they will not determine it, it will be mostly a matter of supply and demand in the housing market.

Also keep in mind the interest rates will affect the value of all houses and the price of a house is a relative thing, how much is house A relative to house B.

Dennis, the problem is the distribution of wealth. A few billionaires have all the assets; everyone else has all the debt.

Hi Nathanael,

I agree wealth distribution is a big problem. The simple solution is elimination of tax loopholes and tax shelters, higher estate taxes (on inherited assets over 1 million adjusted for inflation), and more progressive income tax (similar to pre-1965 US tax code adjusted for inflation).

If the private debts are defaulted on, that would accomplish a lot of wealth redistribution right there.

Steve, enjoyed the article and an investor in LT (2019) natgas futures, I hope your are correct about the following statement:

“To really turn the Shale Gas Industry around, I would imagine a price of $7-$8 is needed. Don’t know if we ever get there again due to the massive debt already in the system.$6

I see that you quoted Arthur Berman in reference to $6 breakeven. Only recent work i have seen from him was on the Haynesville shale – and he had a $6.50 breakeven number.

Obviously, every play (even well) has a number. Not sure where you are getting $7 or $8 from….and the use of the word turnaround is a bit confusing given certain areas will “turnaround” at $3, then another set at…

So, where do assume the marginal MCF will come from? And can you share more about how you arrive at your projection?

(as an aside, was very excited to see this topic and looking forward to a discussion of natgas pricing – given all the focus on oil here…and just about every where else. It seems most here want to discuss inflation, debt, gold, silver, etc. While interested in that, was hoping to have a more focused discussion…then we can each apply all our theories on the end of the US, world, money, etc. Just a suggestion0

There is currently a world LNG glut which is going to grow over the next two years – at $6 it might be cheaper to import LNG than develop the shale, especially where there are pipeline bottlenecks in some areas.

Steve/SRS,

Disappearing act when questioned about the data supporting your natgas price projection?

Anyway, thanks for pointing out production falls when the prices low enough for long enough. 😉

@oldfarmermac

You are 100% correct.

The march towards doom continues unabated. Forward comrades!

I agree with Steve on all the shale gas stuff but I am not at all sure about all that “U.S. Empire” stuff.

The U.S. Empire is a suburban sprawl economy that needs a lot of oil to keep trains, trucks and cars moving.

Yes we need all that but that is definitely not the definition of an empire that I have ever read anywhere. The economy is not an empire. I think Steve uses the term “U.S. Empire” for its dramatic effects. It just sounds so damn impressive to call it an empire.

The U.S. Empire consist of Puerto Rico, The U.S. Virgin Islands, Guam and American Samoa. That’s a pip squeak empire if you ask me. 😉

I would understand the US empire as an economic domination as reflected in the dollar’s role in the world’s economy.

From the Spanish empire that was all about land dominance to the British empire that was built on commerce and the US empire on economic dominance, there has been an evolution of the empire concept as the world changed. The only constant is that the empire has always been backed by military supremacy.

The only constant is that the empire has always been backed by military supremacy.

The dollar’s role in the world’s economy is not backed by military supremacy. Though the US does have somewhat of a military supremacy throughout the world, no country has guns pointed at them telling them: “You will use the dollar as your reserve currency or get shot.”

The dollar is used as the world’s reserve currency purely for convince. Oil, and other world traded goods needs a common currency throughout the world. Otherwise no one would know what anything cost if everything was priced in local currencies.

Any country however, is free to trade any commodity in their local currency. Japan already does that. Oil is priced in yen per kl on the Tokyo exchange. Other countries routinely ask that their oil be traded in some other currency than the US dollar. And some people think this is a big deal. It is not. It makes no difference whatsoever other than the inconvenience of having to exchange currencies on the FOREX. And the US Army never comes around to bother them about it.

It seems I did not explain myself. The dollar’s role in the world economy is a reflection of the US economic dominance, not its basis. Quite a few countries have had their currencies pegged to the dollar or their economies directly dollarized.

Military dominance is not required to enforce the role of the dollar, but to command the respect that makes it difficult to be challenged. US has used its military dominance to enforce its oil policy through several oil wars and interventions.

US has used its military dominance to enforce its oil policy through several oil wars and interventions.

No it has not. The Iraq war may or man not have been about oil. But it was not to enforce its oil policy. The US has no official oil policy. All US oil companies and oil holdings are held by private companies or private people, not the US government.

The first Iraq war was to kick Saddam out of Kuwait and all the ramifications that would have had had he kept it. The second Iraq war was just a very stupid US President wanting to have his own glory. He wanted to say he saved us from weapons of mass destruction. Or perhaps because they tried to kill his daddy. Neither was to enforce our oil policy because there is no such thing as a US oil policy.

“According to academics from the Universities of Portsmouth, Warwick and Essex, foreign intervention in a civil war is 100 times more likely when the afflicted country has high oil reserves than if it has none. The research is the first to confirm the role of oil as a dominant motivating factor in conflict, suggesting hydrocarbons were a major reason for the military intervention in Libya, by a coalition which included the UK, and the current US campaign against Isis in northern Iraq.”

Intervention in civil wars ‘far more likely in oil-rich nations’

Fueling Conflict: The Role of Oil in Foreign Interventions

“Oil Above Water”: Economic Interdependence and Third-Party Intervention

Journal of Conflict Resolution January 27, 2015 V. Bove et al.

US Oil policy has been to guarantee an adequate supply of oil from the Middle East at a stable affordable price. That has always been the motivation behind interventions, and alliances policy with the Middle East countries. All the rest is just lies for public consumption.

Javier says he is smart – “foreign intervention in a civil war is 100 times more likely when the afflicted country has high oil reserves.”

Right with respect to the US? Let’s see – Korea in 1950; Vietnam in 1965; Nicaragua in 1980’s; all “civil wars” but, NO OIL. Grenada in 1980’s – not a “civil war” and NO OIL.

Iraq/Kuwait – Not a “civil war.” Iraq in 2003 – not a “civil war.” Afghanistan 2002 – “maybe” a civil war, but NO OIL.

Clueless, to have a clue about someone’s position perhaps you should at least glance at the information provided on which it is based.

From the third link (scientific article):

“The US for most of the period studied here provides an example at the high end of the oil dependence spectrum (i.e., high reserves, high demand for oil). Consistent with this we see recurrent US involvements in the civil wars and internal affairs of Angola from 1975 until the end of the cold war. The US was the country with the highest demand for oil during this period, and it was known from the 1970s that Angola had oil reserves. Oil in Angola was first discovered in 1955, and many US corporations, like Chevron, have been operating in the oil-rich Cabinda region for more than fifty years. The US has also intervened in a number of other countries with proven large oil reserves, such as in Guatemala, Indonesia and the Philippines over the period covered by our dataset (1945-1999).”

And no, I do not claim to be smart. That is something that it is either recognized by others or it isn’t. Instead of claiming to be smart you should start acting likewise.

Javier,

Thanks a lot for your links.

As Colonel Bacevich noted the USA did not fundamentally change its foreign policy after the Cold War, and remains focused on an effort to expand its control and propagate neoliberalism all over the world, crushing any regime that offers resistance.

Skeptics of your position should read his book AMERICAN EMPIRE

http://www.amazon.com/American-Empire-Realities-Consequences-Diplomacy/dp/0674013751

It’s only $1 + shipping (used) on amazon.

As the only surviving superpower at the end of the Cold War, the U.S. should focus on world dominance according to former Under Secretary of Defense for Policy Paul Wolfowitz in 1991. His so called “Wolfowitz doctrine” was a blueprint for Iraq, Libya and Syria invasions and a set of neoliberal color revolutions accomplished by the USA since 1991.

See http://www.softpanorama.org/Skeptics/Political_skeptic/Neocons/wolfowitz_doctrine.shtml

May be neoliberal hegemony is a better term then empire.

The influential set of US politicians are called neoconservatives (that includes Jeb!, Hillary, Rubio and Cruz, but not Trump).

Foreign policy of all administrations since Clinton was based on the recommendations of the Project for the New American Century https://en.wikipedia.org/wiki/Project_for_the_New_American_Century

Compared with traditionalist conservatism and libertarianism, which are non-interventionist, neoconservatism emphasizes confrontation, and regime change in countries hostile to the interests of the United States. It is extremely jingoistic creed. The unspoken assumptions of neocons ideology have led the United States into a senseless, wasteful, and counter-productive posture of perpetual war. It is a foreign policy equivalent to Al Capone idea that “You can get much farther with a kind word and a gun than you can with a kind word alone”. It is very close to the idea that “War is a natural state, and peace is a utopian dream that induces softness, decadence and pacifism.” The problem here is that it’s the person who promotes this creed can be shot. Of course neocons are chickenhawks and prefer other people die for their misguided adventures.

John McGowan, professor of humanities at the University of North Carolina, states, after an extensive review of neoconservative literature and theory, that neoconservatives are attempting to build an American Empire, seen as successor to the British Empire, its goal being to perpetuate a Pax Americana. As imperialism is largely considered unacceptable by the American media, neoconservatives do not articulate their ideas and goals in a frank manner in public discourse but use “noble lie” approach.

== quote ==

Frank neoconservatives like Robert Kaplan and Niall Ferguson recognize that they are proposing imperialism as the alternative to liberal internationalism. Yet both Kaplan and Ferguson also understand that imperialism runs so counter to American’s liberal tradition that it must… remain a foreign policy that dare not speak its name… While Ferguson, the Brit, laments that Americans cannot just openly shoulder the white man’s burden, Kaplan the American, tells us that “only through stealth and anxious foresight” can the United States continue to pursue the “imperial reality [that] already dominates our foreign policy”, but must be disavowed in light of “our anti-imperial traditions, and… the fact that imperialism is delegitimized in public discourse”… The Bush administration, justifying all of its actions by an appeal to “national security”, has kept as many of those actions as it can secret and has scorned all limitations to executive power by other branches of government or international law.

Guatemala and phillipines dont have large oil reserves. They never had.

Clueless, you forgot Somalia, no oil. All those places shoots the hell out of that “100 times more likely” bullshit.

US Oil policy has been to guarantee an adequate supply of oil from the Middle East at a stable affordable price. That has always been the motivation behind interventions, and alliances policy with the Middle East countries.

Yeah right. That’s the reason we went to war with Iraq when they tried to confiscate Kuwait? That being said, even if it was, just who the hell was the beneficiary of keeping Saddam from invading Saudi Arabia and eventually taking over the entire Middle East oil supply?

Was it only the US? Or perhaps every importing nation on earth was just as much the beneficiary as was the US. We footed the bill and sacrificed the lives but Germany, Spain, Brazil, Japan, South Korea, and all of Europe got the benefit.

If the US has a policy of trying to stabilize the world, then all the rest of the civilized world outside the Middle East is the beneficiary including your home country Javier. Or perhaps you would rather we let Saddam have Kuwait… then Saudi Arabia, then then the UAE, then Oman, then…..

You know, sometimes this “knock America” bullshit just starts to wear thin.

Ron,

“All those places shoots the hell out of that “100 times more likely” bullshit.”

If you are going to contradict a published scientific study you should do it on something more than your opinion, don’t you think? The article analyzes hundreds of civil wars between 1945-1999 for third party interventions. Military interventions are very expensive. Being a country with significant oil reserves and oil exports makes a foreign military intervention a lot more likely. Had Kuwait not have any oil I doubt a lot of countries would have bothered.

Regarding “knock America” I do not espouse any of that. I have not criticized US policy. I just have stated what it is. I am a realist, but pardon me for not thinking that America’s main interest is to improve the world. Any country is primarily interested in defending its interests and USA is no different. My country being in the same alliance both benefits and pays a price, and stays in that alliance because it suits its interests.

If you are going to contradict a published scientific study you should do it on something more than your opinion, don’t you think?

I did, there were 5 civil wars listed that had nothing to do with oil. 100 to 1 would mean there had to be 495 that did deal with oil.

The article analyzes hundreds of civil wars between 1945-1999 for third party interventions.

Welllllll, I have a problem here Javier. A quote from the article:

The report’s starkest finding is that a third party is 100 times more likely to intervene when the country at war is a big producer and exporter of oil than when it has no reserves.

That is pure bullshit. Of the top 28 countries, other than the US, all those that produce more than half a million barrels per day, only two, Iraq and Libya, did the US have any interface with.

But the article goes on to say:

The study, published in the Journal of Conflict Resolution, analysed 69 civil wars between 1945 and 1999,

69 ain’t hundreds Javier. And of all the countries in the world, only 29, counting the USA, that produced more than half a million barrels per day. And only two had American intervention. They are listed below along with the oil they produced in June 2015. The numbers are thousand barrels per day.

10,240 Saudi Arabia

10,234 Russia

9,296 United States

4,409 China

4,325 Iraq

3,608 Canada

3,300 Iran

2,820 UAE

2,550 Kuwait

2,500 Venezuela

2,396 Brazil

2,283 Mexico

2,220 Nigeria

1,850 Angola

1,595 Norway

1,567 Kazakhstan

1,537 Qatar

1,370 Algeria

1,010 Colombia

993 Oman

880 United Kingdom

867 Azerbaijan

822 Indonesia

771 India

620 Malaysia

541 Ecuador

534 Argentina

511 Egypt

410 Libya

I am a realist, but pardon me for not thinking that America’s main interest is to improve the world.

Javier, get real. Our interest is your interest. If you don’t know that then I really don’t have anymore to say.

Ron,

“That is pure bullshit. … , only two, Iraq and Libya, did the US have any interface with.”

The study is about every country, not about the US.

“69 ain’t hundreds Javier”

My mistake. It is hundreds of military interventions. As it says in:

Fueling Conflict: The Role of Oil in Foreign Interventions:

“In the 344 armed interventions in civil wars that took place from 1945 to 1999”

There can be military interventions from multiple countries in a single war as we have seen.

The data they have used is from other independent studies. Perhaps their study or their model is wrong, but I don’t see much reason to doubt their result. We all know about resource wars, and oil is the main resource. I don’t see that their result is controversial.

Mostly yes, but I oppose military interventions in foreign countries as a question of principle. I did oppose the second Gulf war, and I did oppose the intervention in Libya. My country participated in both in a supporting role. I guess my position has been vindicated by developments.

He can quote me. Ron is right.

Ron, the USA does have an oil policy. It’s called The Carter Doctrine. I can think of only one reason why the USA cares about the Persian Gulf. Unless there’s something other than oil behind the Carter Doctrine then I’d say it’s an oil policy within foreign policy.

Israel lobby. They are the boss. The USA is more like a colony.

Yeh, and I suppose you think the world is flat too.

The USA policy regarding the mid-east and oil is to attempt to safeguard the export of oil from the sellers to all the buyers- including itself and places like Japan, Korea, Taiwan, Germany, France, India, China, Spain etc. The dependable supply of oil flowing from the gulf allows international trade and the prosperity that results. Simple as that.

American políticians pledge unconditional support for Israel, a foreign power ruled by an extreme right wing ethno/theocratic regime whose population is crawling with racist Russians. As far as I’m concerned this implies the USA has become a quasi colony, with a brainwashed public and a cowardly suicidal elite.

Come on, Ron. The issue in the first Iraq war was Kuwait doing horizontal drilling under the border. Iraq felt that this was tantamount to stealing its oil

When Saddam complained to the Bush administration, he was told that the U.S. regarded this as purely an inter-Arab affair. The fact that Bush immediately jumped on the invasion as an excuse for war strongly suggests that Iraq was being “set up”.

Or, Kuwait was being “set up” in order to agree to a big U.S. military presence. Either interpretation suggests a conscious extension of “empire”.

The fact that Bush immediately jumped on the invasion as an excuse for war strongly suggests that Iraq was being “set up”.

Or, Kuwait was being “set up” in order to agree to a big U.S. military presence. Either interpretation suggests a conscious extension of “empire”.

Yeah right! It was all one big conspiracy so Bush could extend the empire.

I have never heard such a line of bullshit in all my life.

Actually, the simplest approach (“Occams Razor”) is to assume that the diplomat was following instructions.

Not such a huge conspiracy – just the type of thing that governments do all the time.

Very simple compared to FDR’s strategy of goading Japan to attack so he could enter the war against Germany. Or do you think that the majority of historians who interpret things that way are all conspiracy theorists?

Stu, you are trying to justify a very stupid conspiracy theory by citing an event of WW2, which was not remotely related to the situation we are discussing. That is almost as dumb as your conspiracy theory.

I have never heard of any historian who thinks that the Iraqi ambassador was instructed to tell Saddam that he had free rein to invade Kuwait just to give Bush an excuse to start a war with him. But I am sure there may be one or two somewhere in the world. After all there are thousands of historians and all of them are not immune to very stupid conspiracy theories.

And Occam’s Razor does not support wild hare brained conspiracy theories. The simplest approach is not to assume Bush 41 hatched a plan to lure Saddam into invading Kuwait. Bush likely had no idea that Saddam and his associates would pay a visit to the ambassador and try to glean from her what the US might do if he invaded Kuwait. After all, she did not go to him, he went to her with his queries.

The “Empire” dissolved after the neocons got their war on in Iraq. This exposed the limits of military power in the 21st century and although we spend more than every other nation on Earth combined on conventional weaponry we demonstrated for all to see that this is insufficient to impose your will on a recalcitrant population. A lesson that the right wing in this country has yet to fully absorb.

“that this is insufficient to impose your will on a recalcitrant population. A lesson that the right wing in this country has yet to fully absorb.”

I would not be so sure and smug about that conclusion. The oil is still flowing, to anybody with the wherewithal to pay for it.

Do you think it would be flowing freely if Saddam Hussein had been left in power? Do you think it will flow freely if ISIS is allowed to come to undisputed power in two or three major oil exporting countries?

There is no good evidence, so far as I can see, to indicate that Uncle Sam, along with a few friends, will not send as many troops as necessary back to Sand Country to KEEP it flowing, if necessary.

Those of us who are opposed to right wing type thinking and policies generally fail to recognize what CAN be accomplished with military power.

It is true that we might have to go back to Iraq, etc, once in a while, but given the choice of paying that price, and paying the price of doing without a world market in oil, freely traded.

HRC, or Bernie Sanders, or the Trump Chump, or whoever winds up in the White House, pay the price, again, if necessary, and send the troops. The opposition will go along, as it has gone along in the past.

Fighting an unpopular war is less of a political problem than dealing with a deep economic depression,and the inability to import oil would certainly bring on a very deep depression very quickly indeed. ( And for what it is worth, the msm know which side their bread is buttered on, and that their existence is based mostly on advertising revenues. No bau, DAMNED LITTLE AD REVENUE! )

The doves will make a lot of hay about five or ten thousand dead young Americans, but the truth is we kill that many in automobile accidents alone, as fast or faster than we have gotten them killed in combat in recent times.

We will finally quit mucking around in Sand Country when there is no longer enough oil left there to make the mucking around profitable to us, or until oil becomes obsolete. I personally think the oil will run out sooner than we will learn how to get by with out it.

I may come across as redneck warmonger, but that is not my intent. My intent is to be realistic. I am a hard core advocate of building renewables , pedal to the metal, from here on out, in large part to reduce the likelihood of more hot resource wars.

We can’t prevent them all, but we can certainly reduce the number THAT MIGHT OTHERWISE HAPPEN.

Yes, such wars are ruinously expensive, but they are still a hell of a lot cheaper than full blown economic depressions or outright economic collapse.

Those of us who are opposed to right wing type thinking and policies generally fail to recognize what CAN be accomplished with military power.

Mac, driving Saddam out of Kuwait is something any US President would have ordered. It was our idiot right wing ambassador to Iraq who told Saddam we would not intervene if he invaded. Any goddamn fool should have known we would kick him back out, no matter who was in the White House.

Our invasion of Iraq in 2002 was an entire different matter however. That was the work of an idiot right wing nut case president.

“Mac, driving Saddam out of Kuwait is something any US President would have ordered.”

Likewise any future president will most likely put the military boot the the ass of ISIS or any other outfit that actually threatens to cut off the flow of oil.

One application of the boot will probably be enough to keep the oil flowing anywhere from a couple of years to four or five years, maybe longer.

Repeated boot treatments will be administered if the doctor orders them, lol.

Nobody really gives a shit about Sand Country, once the oil is gone, all of us with a brain understand this much.

Saddam had to be kicked out of Kuwait, dead on.

HRC in my estimation has the morals of an alley cat and the judgement of a fool, but if she is elected, she is mean enough to go to war in heartbeat, if it suits her agenda, or becomes necessary. ( Self declared conservative or no, I hope to vote for Bernie. ) Trump and Cruz are imo worse than HRC.

IF it comes down to HRC versus trump, I will stay home and get dog drunk, and start posting about moving to New Zealand, lol.

WHOEVER winds up in power, the ships will sail, and the planes will take off, and bullets will fly, to whatever extent is necessary to keep the oil flowing.

Yes , invading Iraq later was a mistake. But WHO WHO WHO supported that invasion?

Shall I look up the votes, and speeches made, and post them?

Saddam Hussein as the boogie man was a creation of media hype. He was a garden variety psycho-dictator who was completely ruthless in his attempts to hold onto power. But he was our boy. And on one was more shocked than he was when we turned on him. You say you are interested in keeping the oil flowing from Iraq? What was Saddam going to do with it? Drink it? The falling out between Saddam and the Bushes was a personal issue. Stemming from the first Gulf war. He thought that Bush I had his back because of his fight with Iran and the fact that the Kuwaitis were stealing Iraqi oil via horizontal drilling. Of course he was an idiot, but there is little doubt that this is what he thought. Given our support of his regime in their struggle with Iran he had every reason to consider us his ally. THe fact that otherwise intelligent people buy into the revisionist history of this period still amazes me after all these years. Cast your mind back to the early 80’s when Iran was the devil that took our hostages and plucky little Iraq was fighting the good fight against these heathens. I remember a 60 Minutes segment with Leslie freakin Stahl in the trenches with Saddam damn near worshipping the fool. Even after he invaded Kuwait Bush wasn’t going to do a damn thing about it until Maggie Thatcher shamed him into it by questioning his manhood. Christ the whole thing is just a sick joke.

But you’re not running the numbers:

What is your estimate of the additional cost to the U.S. if there was less of an export market in petroleum?

… and …

How much do you think we could save by not trying to project military power around the globe?

For instance, the F-35 program alone might pay the extra cost of the oil. And why would a U.S. in a basically defensive posture require an F-35 (or least one that actually worked)?

HI Stu,

Is your objection about running numbers is pointed in my direction ?

I have consistently advocated the fastest possible build out of renewables, etc, in large part because this will reduce our exposure to international oil markets, and reduce our chances of being involved in more hot resource wars.

This applies globally as well as nationally.

But IN THE MEANTIME, WE YANKEES MUST HAVE THAT IMPORTED OIL.

There is simply no way around this as a factual practical matter. It might be TECHNICALLY possible for us to get by without importing oil, but it is a political impossibility, for now, to even attempt doing so.

So for now, and for the easily foreseeable future, we will go to war, as necessary, to keep oil flowing.

But we get most of our imports from Canada and Mexico.

Besides, the exporters will continue to *sell*, just at a higher price. And if we could shave a few hundred billion off the security budget, it would probably be more than enough to offset.

Might not even hurt our balance of payments that much, considering how much money is spent with foreign contractors in this age of “privatization”

“expensive, but hellofallot cheaper than”—going solar real fast?

don’t think so, neither do lotsa heavy hitters in money world.

SW,

“A lesson that the right wing in this country has yet to fully absorb.”

I do not think this process even started. May be with a new POTUS in 2017. And as for foreign policy Dems are not that different from the right wing. Obama administration actions were from the playbook of Bush II administration almost 100%. See also

http://peakoilbarrel.com/collapse-of-shale-gas-production-has-begun/#comment-558230

The US Dollar is the worlds reserve currency as a simple function of math.

The US is running the biggest trade deficit in the world. Therefore there are more dollars out there than any other currency.

The US also has the largest capital markets.

That is it. There is no master plan.

The baton hand-off from the British Empire (sun never sets, etc) to the ________ Empire is quite distinctive, what with the joint rolling of that democracy in the middle east–the one where the Shah was installed. Also, note the habit of Empires (Russian, British, Soviet, ________) to roll around in Afghanistan. A map of military bases and carrier groups might also be indicative, or military spending, as mentioned elsewhere in this thread. Calls for walls to be built also have something of a history for Empires (Toynbee, a limey, terms this limen).

thrig

Yes, I know an old guy who describes the British hand-over sometime in 1946, I think, of the key British naval base at Bahrein (think of the longstanding supply/trade route to Indian sub-continent and etc.). They simply pulled down the flag and handed over the keys to the ______ fleet waiting outside. First job of incoming Prime Minister was to get rid of the British Empire; it had gone from a paying to an unaffordable asset. Perhaps there is some level of comparison with any of us in our individual micro economy when we feel the strain and can’t sell our assets, but still owe the other fellow an arm and a leg?

Edit PS – I could not resist this – I just read the quote on coal below. I know that apples and oranges are not the same thing but I keep reading stuff about “non-performing loans”, which term I think I understand. And then coal?

Quote: “[Last] week we saw Alpha Natural Resources cancel an auction of 35 coal mines at the last minute due to a lack of interest, illustrating the fact that some mining assets burdened with outstanding liabilities and negative margins are left without any residual value,” Goldman [Sachs] notes.

Not only is the US an Empire, but it is an Empire that puts to shame all preceding ones.

After 1945, the US acquired at least partial dominance over all other Empires (British, French, German, Japanese, etc) I must note, that in a capitalist world, the countries most rich in capital, dominate those that are poor in capital. This is not a value-judgement, it is merely reality. If Africa were capital rich and Europe & North America were poor, it would have been the other way round.

The US Empire, is different than let’s say the British Empire, in that it requires little if any direct political control. It is also less severe in comparison with preceding ones, as leverage can be exercised without permanent use of force. This benign character of the US Empire, is of course reserved for its core members, which are themselves extensions of this Empire. This would include Canada, Western Europe, Australia, Israel, as well as the GCC countries. Other members of the Empire are less privileged, especially those that were ex-European colonies to begin with, e.g. Colombia, Philippines, Indonesia, Kosovo etc etc. Those that are outside the Imperial embrace, are either Third World backwaters that can only obey orders (especially after the Soviet collapse and until the very recent rise of China) or are “strategic enemies” and have to face the consequences. China and Russia make up the strategic rivals of the Empire. Iran and a few others are lesser examples. The reason why Russia and China are targets for the Empire, is not remotely ideological (as some people naively still believe) but because they both have the potential to directly challenge US supremacy if they are left in peace, let alone incorporated into the US-designed-and-controlled global system on equal terms.

NATO is the primary political/military mechanism through which the US manages its imperial affairs. As any random student of IR can tell you, NATO was specifically designed with three imperatives in mind:

a) Keep the Russians out. (of Europe)

b) Keep the Americans in. (Europe)

c) Keep the Germans down. (as part of the Empire)

Israel as well as the GCC countries are a further geographical and economic extension of NATO. The GCC countries have been provided with the US/UK/French security guarantee in exchange of massive recycling of capital in Western financial markets etc. In the case of the relation between the US/EU and the GCC countries, we see the classic operation of Empire, with money flowing into the metropolises.

Control of Europe and Japan is maintained through the fact that the US is far bigger in any metric than the rest of the members, but even more crucially, because the US can always utilize the rest of the alliance against any recalcitrant member. Moreover, former foes such as Germany or Japan, despite being practically as advanced as the US, are incapable of acting independently not only due to the aforementioned reasons, but also due to their lack of access to hydrocarbons.

This lack of direct access to hydrocarbons, is what allowed for the post-war magnanimity of the USA in relation to both Germany and Japan. The US strategists knew that both could not only be incorporated into a US-led global system, but that they could additionally act as useful proxies in the unfolding Cold War.

Russia is the flip-side of Germany/Japan. Since Russia has direct access to massive hydrocarbon reserves, as well as other essential raw materials, she cannot be given a good deal or be incorporated into the US-led global system with anything remotely resembling tolerable terms. For Russia’s geographical characteristics will allow it to defy all and any US wishes. This has been demonstrated in recent years, with Russia openly defying the entire North-American-EU-Turkey-GCC-Israel complex despite a relative balance of forces that is on paper nothing less than catastrophic (for Russia) Now, imagine how Russia would be able to behave (in relation to Imperial interests) had it been a member of the global system on equal terms.

All of Russia, China or Iran, attempt to navigate NATO-GCC pressure by utilizing the contradiction between the short-term (and even long-term) financial interests of western corporations and those of long-term strategic interests. If it was up to Western corporations, there would never have been any sanctions against Russia, it was 100% a deep-state decision. In this endeavor, China has succeeded to an astonishing degree. It also helped that western “experts” have kept forecasting a more or less imminent Chinese collapse for decades. Russia and Iran have been far less successful in this. Russia due to the disastrous “liberalizing” reforms of the 90s, and Iran due to its relative weakness. Iran is however now poised to enjoy significant investment inflows from all over the world and especially from European firms.

Now, what is it that allowed the US to become the imperial center of the planet:

a) The security afforded by two oceans. Bordering weak states.

b) Competition and wars across Eurasia (the two World Wars being the apex of this process) relatively weakened all other major powers.

c) Vast natural resources at home, excellent and plentiful farmland.

d) European immigration. No pre-capitalist forms to retard economic progress. Well, one can point to the natives, but they were summarily dealt with.

Foundations of the US Empire:

a) Number one economy on the planet since the 1870s. By 1945 (the apex of its power) the US approached almost 50% of global output.

b) By far the strongest Navy.

c) Safe geographical location, hence, “freedom to roam”.

d) Military presence around the globe, to a large degree surrounding its main rivals with military assets (containment)

e) Significant influence (if not outright control) over all other highly advanced countries.

f) Pre-eminent military presence in the Middle East.

g) Unrivaled propaganda infrastructure, or “soft power”. Movies, TV, news networks, music, fashion norms, NGOs, English language, famous universities etc etc.