There has been plenty of hoopla lately concerning the boom in shale (LTO) oil production. From the New York Times: Surge Seen in U.S. Oil Output, Lowering Gasoline Prices

Domestic oil production will continue to soar for years to come, the Energy Department predicted on Monday, scaling to levels not seen in nearly half a century by 2016.

The annual outlook by the department’s Energy Information Administration was cited by experts as confirmation that the United States was well on its way — far faster than anticipated even a year ago — to achieving virtual energy independence.

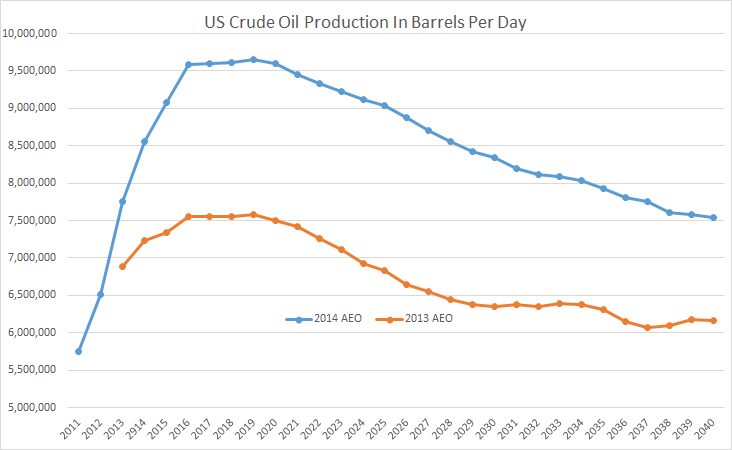

What the EIA is actually predicting: AEO2014 EARLY RELEASE OVERVIEW. The data is C+C.

The first two points were what was actually produced in 2011 and 2012 and the rest of the blue line is what they are predicting for the future. The orange line is what they predicted last year. The predicted numbers this year are a lot higher but the shape of the curve looks the same. They predict US Crude + Condensate will plateau in 2016, actually peak in 2019 and by 2021 be headed for a permanent decline.

Note the difference between AEO 2013 and AEO 2014. The difference rises to just over 2 mb/d and holds that difference util 2030 when it slowly closes down to 1.37 mb/d in 2040. And everything above about 5 mb/d is all Shale, or Light Tight Oil. They expect LTO to rise to about 4.5 mb/d by 2016, hold that level for almost 5 years and for LTO to still be above 2.5 mb/d by 2040.