This is a guest post by Jean Laherrère

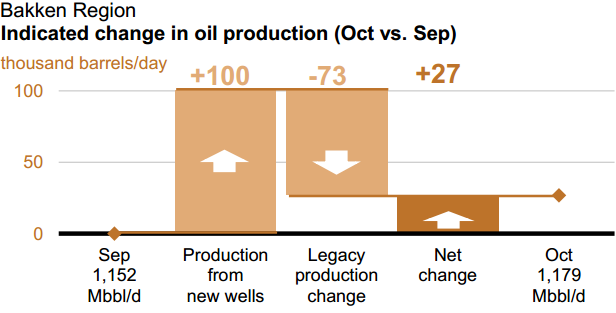

The problem of forecasting future Bakken production is that estimating reserves of shale oil is harder than for conventional oil and is very unreliable because many confuse reserves and resources, and shale oil reserves depend more from economy than from technology. Many estimate the amount of hydrocarbons generated by the source-rock and believe that a significant percentage could be recovered: the study of the main Petroleum Systems in the world estimate than only about 1% will recovered in conventional fields, no more could be expected in unconventional fields.

US Shale gas production started in 1821 in Fredonia for lighting when whale oil price was about 2000 $2014/b, but was replaced by conventional oil in 1859 because a largely lower price.

How to estimate future production?

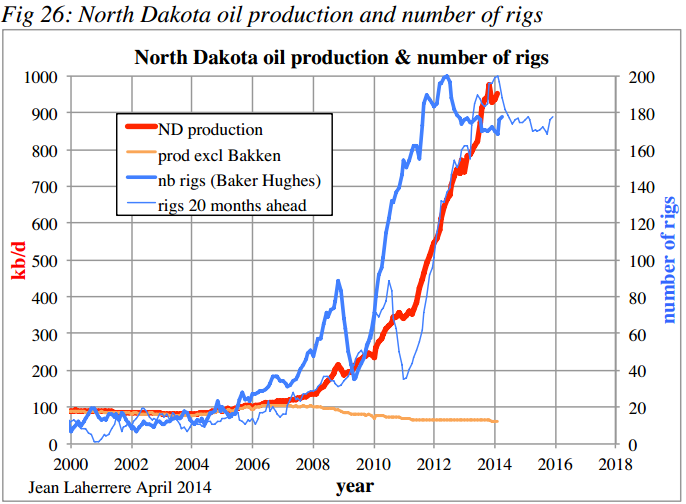

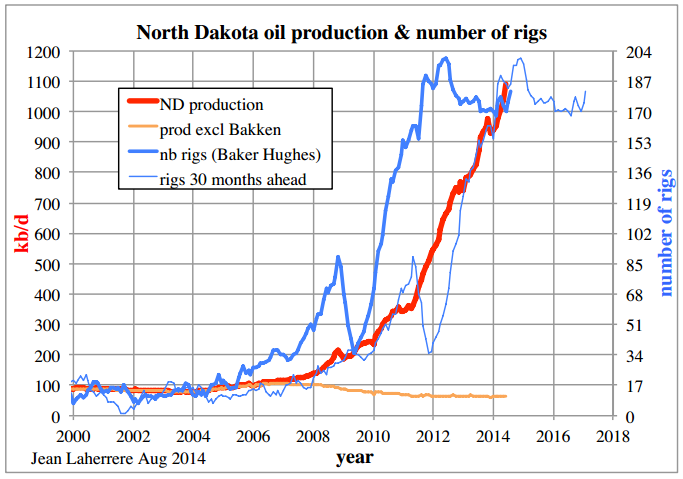

Drilling activity is a good way to model production with a shift.

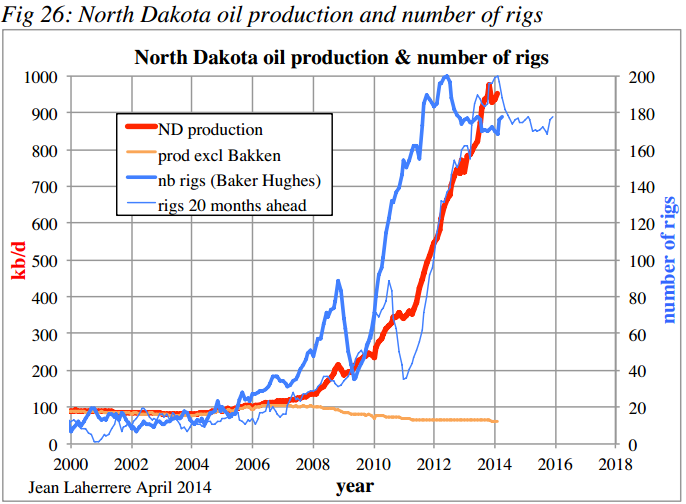

In my MIT Paris paper «The end of the peak oil myth» MIT club de France- Paris 28 April 2014, I was convinced that North Dakota oil production will peak within 2014 using a correlation between oil production and shifted number of rigs, guessing the value of the shift and the relationship between rigs and production.

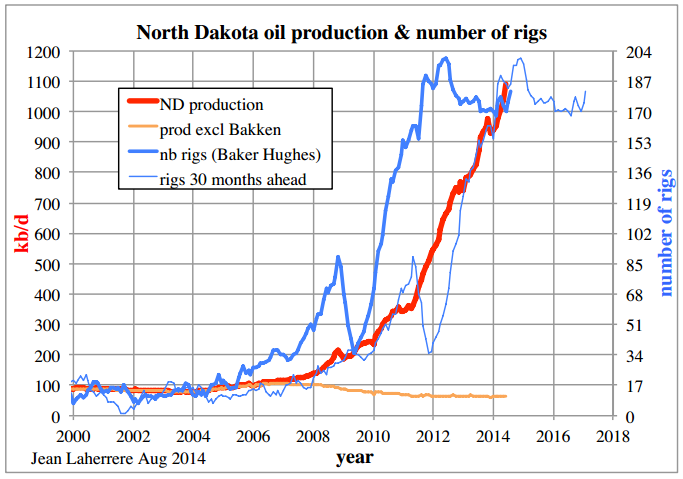

This April 2014 graph is wrong when adding present data at July 2014 (still rising after a minor peak in November 2013) and I have changed the shift from 20 months to 30 months and the correlation oil/rig, but I feel uncertain about the reliability of such graph.

When active in exploration I was used to drill 9 dry holes out of 10 wildcats: I am used to be wrong and I am not afraid of that. To make discovery you have to take risks.

My new model forecasts ND oil production peak in 2015 at less than 1.2 Mb/d, but again this new model could be wrong as the old one.

My modeling was based on the Montana oil peaks, which fit well with the number of rigs shifted by 12 months since 2000.

Read More