This is a guest post by Rune Likvern

Who’s Website is: Fractional Flowa

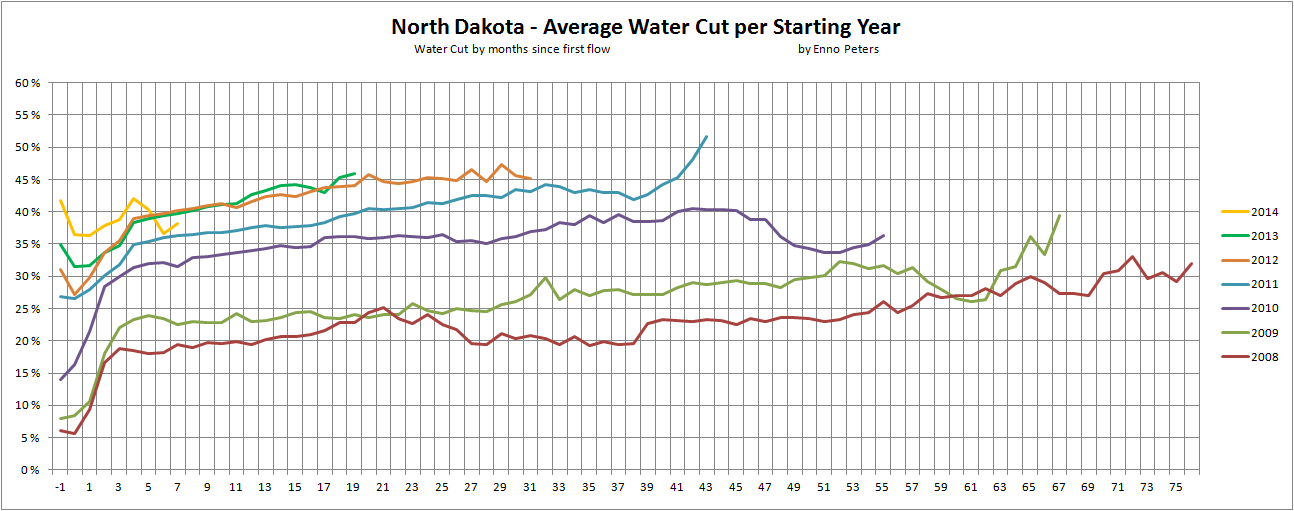

This post presents a closer examination of actual data on Light Tight Oil (LTO) extraction, developments in water cut and Gas Oil Ratio (GOR) for some pools and individual wells in the Middle Bakken and Three Forks formations in North Dakota.

LTO extraction’s primary drive mechanism is (differential) pressure and there are some noticeable trends for LTO extraction from Bakken:

- LTO productivity (measured as average totals by vintage) in 2014 have increased, most notably from the Middle Bakken formation which has better well productivity than Three Forks.

There are differences to LTO productivity developments amongst the pools.

- Water cut; generally increases as the wells ages.

An indicator for depletion.

- Water cut; generally increases for newer wells.

This suggests that the areas with the highest oil saturation has been developed.

- Gas Oil Ratio (GOR, produced and expressed as Mcf/Bbl); generally increases as the well ages.

- What appears to characterize a Bakken sweet spot is the presence of natural fractures (favorable geology), high oil saturation and a pressure above hydrostatic pressure.

Further, this post also has a brief look into well economics and describes how well manufacturing is likely to be affected by the decline in the oil price and what this may entail if a lower oil price ($70/Bbl, WTI) is sustained.

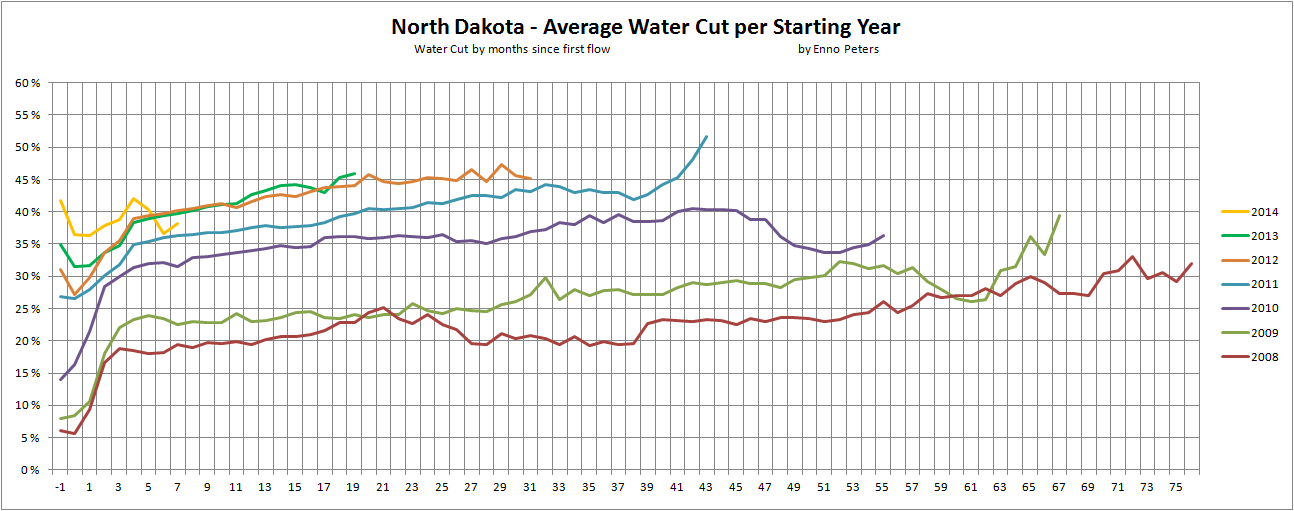

Figure 01: The chart above shows development in the water cut [water cut = [water/(water + LTO)] for the “average” wells by vintage in North Dakota. Produced water (brine) is transported to dedicated disposal sites.

Figure 01: The chart above shows development in the water cut [water cut = [water/(water + LTO)] for the “average” wells by vintage in North Dakota. Produced water (brine) is transported to dedicated disposal sites.

Chart by Enno Peters.

What is fascinating about LTO wells in Bakken is that the individual wells appear to have their own “personality” when it comes to productivity, surrounding rock properties, water/oil saturation and GOR which makes well management (of close to 9,000 “personalities”) a paramount task.

This post contains in total 30 charts that hopefully are self explanatory.

Acknowledgements

This post was made possible by contributions, comments and suggestions from several professionals within the oil industry and the academia.

The invaluable talents and expertise of Enno Peters made it possible to transform the NDIC monthly production data with the formation data into spreadsheet format.

The spreadsheet format allows to sort well data by formation, pool, vintage, company and much more.

NOTE: Actual data used for this analysis are all from North Dakota Industrial Commission (NDIC). Some data are missing for some wells and after discussions, the consensus was that the presented average LTO numbers after the first 12 months should have around 5% added to account for missing data from some wells as well as adjusting for the effects from assuming all wells starts at day one of its reported first month of operation (on average each well flows for half a month during its first month of reported operation).

For wells on confidential list, data on runs was used as a proxy for production.

By adding around 5% of the presented average flows for the first 12 months and around 4% after 36 months numbers should come close to actual.

Production data for Bakken, North Dakota: Monthly Production Report Index

Formation data from: Bakken Horizontal Wells By Producing Zone

Water cut is the ratio of [produced water/(produced water + produced oil)] and expressed as a percentage.

Water cuts for individual wells may swing from 0% to 100%, suggesting a shut in well or data not reported. For the early months of a well’s life the water cut may be influenced from water used for fracking.

The important messages from this analysis are the trends in well productivity, water cut and GOR on an aggregate level and by vintage.

For this presentation wells from two pools in Mountrail (Alger and Van Hook), McKenzie (Banks, Camp) and Williams (Squires, Todd) are presented. Hopefully these pools constitutes a good representation of developments for similar pools.

A growing portion of wells have been/are being targeted the Three Forks formation which may suggest something about remaining attractive targets to drill in the Middle Bakken.

Read More