A guest post by George Kaplan

Over this century the oil sands business has consolidated into three main players: CNRL, Suncor and Cenovus, all of which have shown considerable organic and total growth in reserves and production (and presumably debt). After this growth period it looks like things are plateauing at the moment. Oil sands projects have longer life cycles than conventional (e.g. 50 versus 20) and hence slower decline and depletion rates and longer plateaus. Most of the other companies have pulled out in the last five years, Shell has downsized and ExxonMobil’s assets are susceptible to price swings and it has put new developments on hold

Husky was a fourth Canadian company with significant interests, though less than the others, but the data and some news stories don’t show it to have been a particularly well-run company and it was taken over by Cenovus last year.

Canadian companies present annual data on SEC form 40-f (and a Canadian equivalent) and it is extremely detailed, in particular it is the only remaining readily accessible source for a Company’s probable reserve data that I know of. All SEC filings can be difficult to follow before 2009, especially Canadian ones as Bitumen mining could not be listed as part of oil and gas operations, in-situ SAGD could, but companies chose to list the product either grouped in with heavy oil or as separate entities (raw bitumen or synthetic oil). As further examples NGL was originally listed separately then it wasn’t and then it was again; reserves were listed as net only then net and gross and then gross alone and the layout of the forms changed every year until 2011.

Cenovus

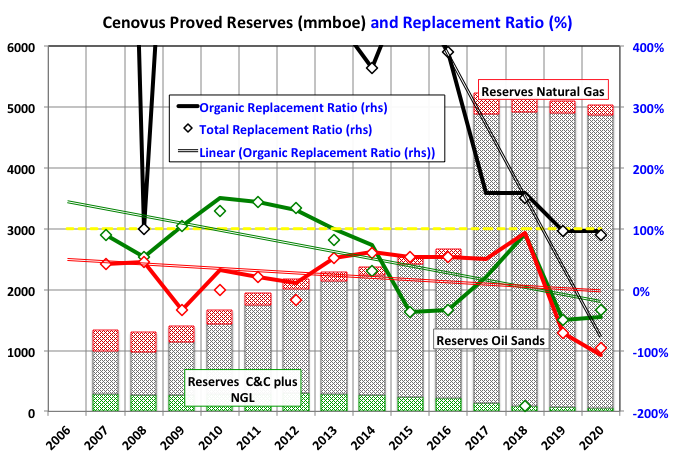

Cenovus was created in 2009 when it was split off from Encana taking the oil assets, while the gas business remained with the original company, which has since been renamed Ovintiv. I couldn’t find data for 2006 but it is probably somewhere in the Ovintiv filings. It grew significantly in 2017 when it acquired ConocoPhillips’ assets in Western Canada. It is now exclusively an Oil Sands company. Its debt load must be quite high.

The oil sands replacement ratio has plummeted in the last decade but may be stabilizing at around 100%.