A Post by Ovi at peakoilbarrel . com

All of the oil production data for the US states comes from the EIAʼs Petroleum Supply Monthly. In addition, information from other EIA offices is provided to project future US output. At the end, an estimate is made for the decline rate in the L48 conventional oil fields and an analysis of a few different EIA reports is undertaken.

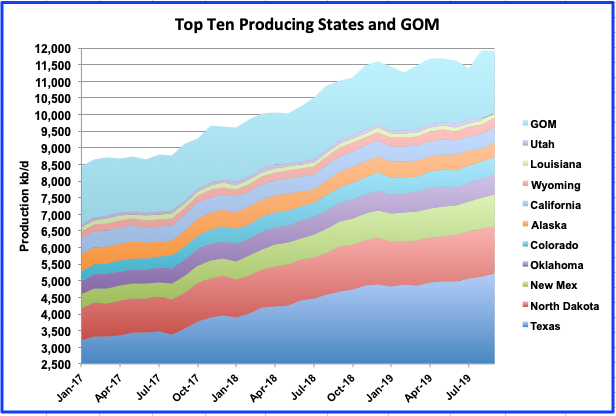

The charts below are updated to October 2019 for the 10 largest US oil producing states (>100 kb/d).

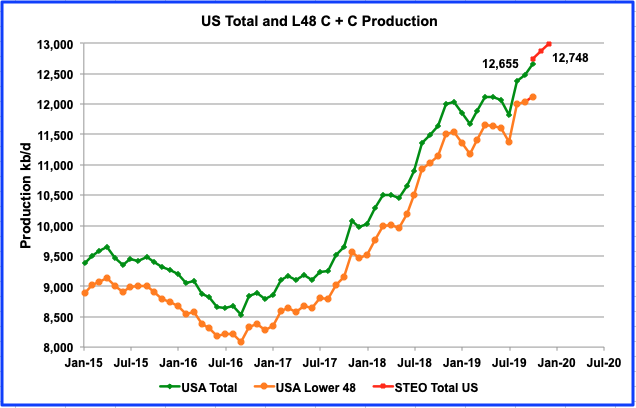

U.S. oil output continued to increase in October 2019. Production reached a new high of 12,655 kb/d, an increase 171 kb/d over September and 55 kb/d higher than estimated by the December Monthly Energy Review (MER). However it is 93 kb/d lower than the 12,748 kb/d estimated in the December STEO report. This could be an indication that the January STEO report will again lower US production estimates for 2020.

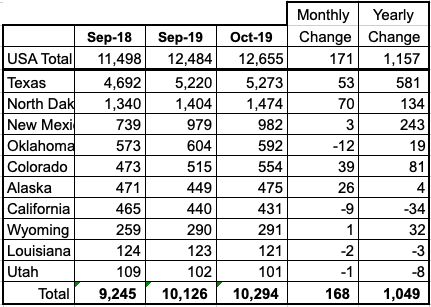

Listed above are the 10 states with production greater than 100 kb/d. These 10 account for 10,294 kb/d (81.3%) of total US production of 12,655 kb/d in October.

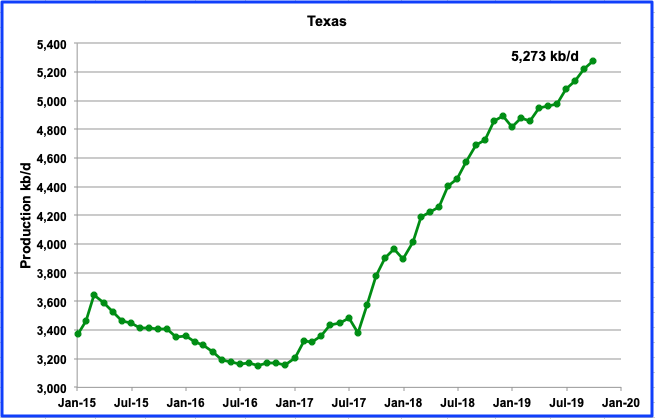

Texas production continued to rise in October and rose by 53 kb/d to 5,273 kb/d. Comparing the initial growth estimate for Texas from January 2019 to October 2019 vs 2018 indicates a slower growth rate for 2019, i.e. 377 kb/d vs 762 kb/d respectively, 49.5% of the 2018 growth. It is worth noting here that the 53 kb/d October increment is close to half of the total 100 kb/d increment shown in the December LTO report and is discussed further down.

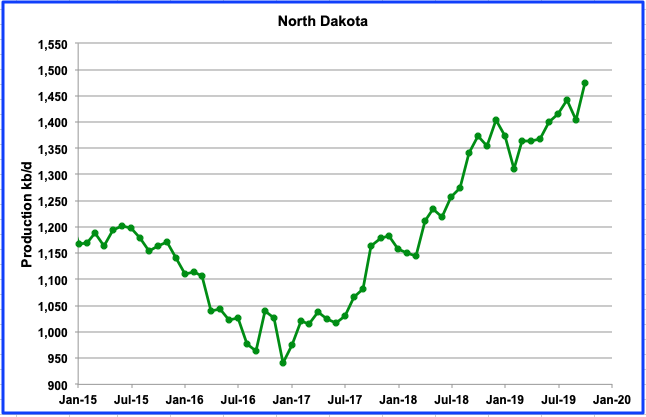

Oil production was up by 70 kb/d in October over September. However September was lower than August due to heavy rains. Regardless October set a new record.

New Mexico output was essentially flat for October at 982 kb/d. However, the September output was revised up from 956 kb/d to 979 kb/d in the October report.

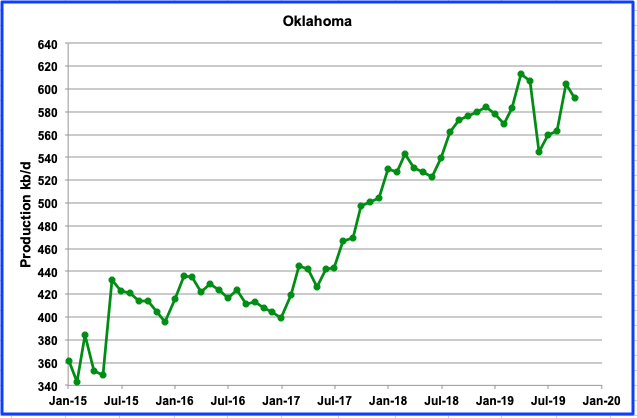

October production was down by 12 kb/d to 592 kb/d. The chart shows indications of peaking or plateauing in Louisiana. There is a loss of drilling interest in Oklahoma due to the complex geology that stymied hopes for a “Permian Jr”, according to this source.

While production is lower than the April high, we will need to wait to see if the down trend continues.

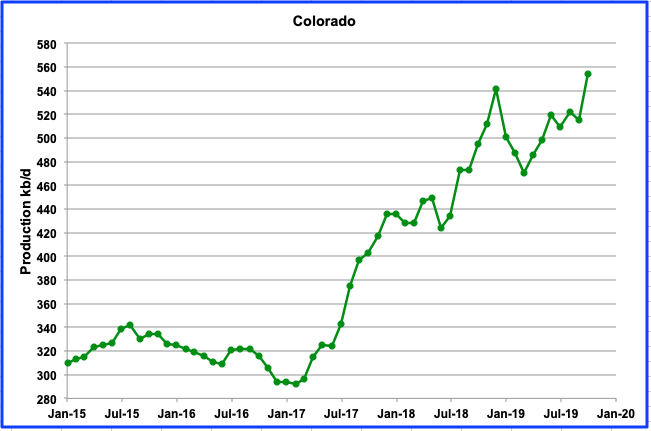

Colorado production was up by 39 kb/d in October to 554 kb/d, an increase of 7%. This is a bit surprising because of all of the concerns with the new drilling regulations and a drop in the rig count. In January, there were 35 rigs operating in Colorado. By October, the number dropped to 24 and a further drop of 2 in December. However according to CPR News, it’s “All Systems Go For Colorado Oil And Gas, Despite Crackdown Efforts.”

“Six months after shouting that new legislative drilling regulations were an existential threat to their industry in Colorado, the state’s oil and gas producers are now whispering a different message to Wall Street:

“We do not foresee significant changes to our development plans, as we have all necessary approvals of more than 550 permits to drill wells over the next several years,” Noble Energy representatives wrote to investors.”

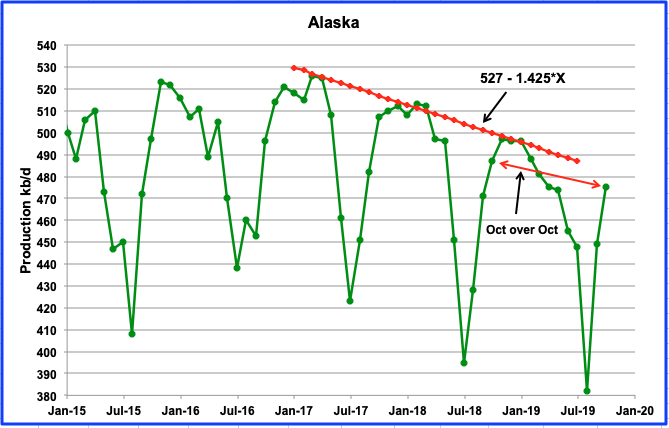

Alaska production was up again in October by 26 kb/d to 475 kb/d after completion of scheduled maintenance. Going forward, two new projects are scheduled for 2020 and 2021 which will add 20 kb/d and 40 kb/d, respectively according to the Frontiersman. Note how the October over October decline is similar to the annual decline.

According to the Frontiersman, in October, with production facilities back online, Prudhoe was up to 270,658 barrels per day but still below October 2018, when Prudhoe averaged 283,754 barrels per day, according to the state revenue data.” Note that the Alaska October over October decline is 12 kb/d compared with with the 13 kb/d from Prudhoe.

In other related Alaska news, Hilcorp Alaska is buying BP’s Alaska oil and pipeline assets according to the Frontiersman.

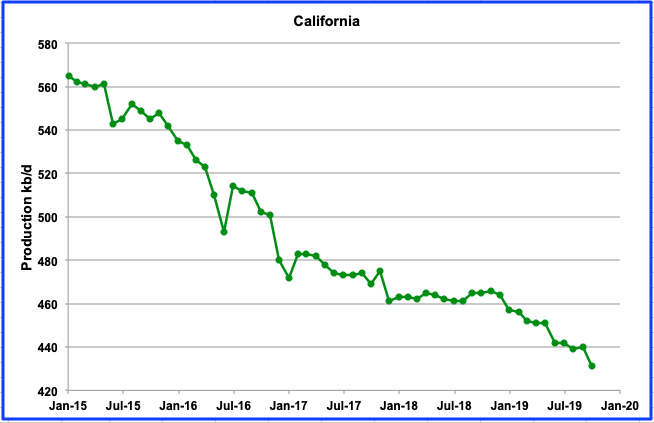

California continues its slow but steady decline and shows no sign of recovery.

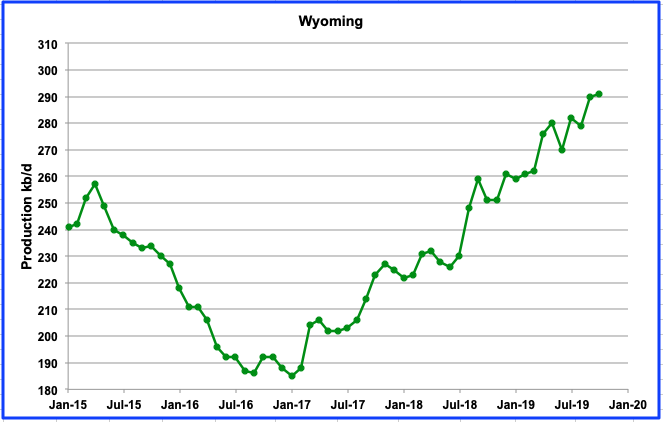

Wyoming continues to increase its output and reached a new high of 291 kb/d in October with a minimal increase of 1 kb/d. It continues to benefit from the northern portion of the Niobrara LTO basin being situated in Wyoming. In October, the Niobrara only added 3.7 kb/d. Last week drillers added two rigs for a total of 29 but the number is still down from 33 in January.

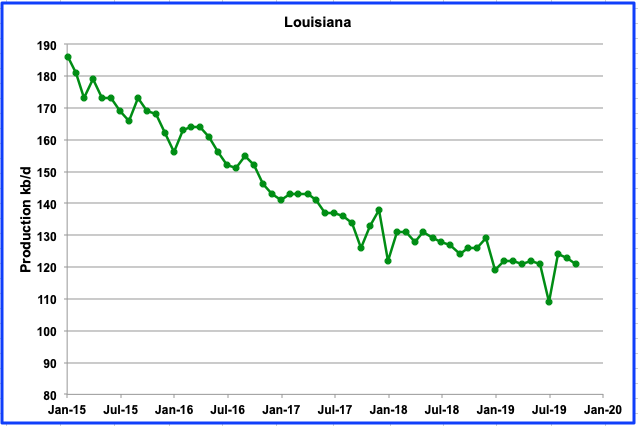

After Louisiana’s output recovery in August 2019, it began another slow decline phase with no indications of a long term recovery. The rig count is down from 63 in January to 55 in October.

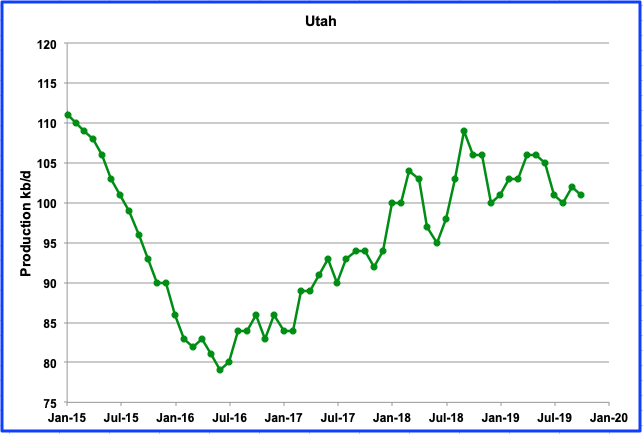

Oil production in Utah reached its peak of 109 kb/d in September 2018 after the discovery of a new conventional oil field. However, Utah’s production now appears to be entering a declining phase.

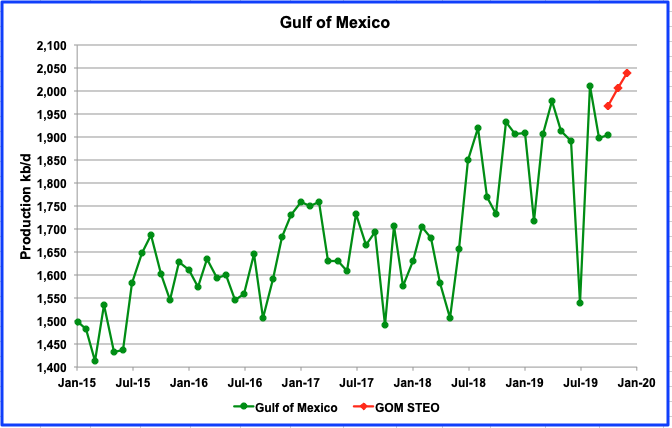

GOM output was essentially flat for October and is 64 kb/d lower than provided in the December STEO report.

According to Rigzone, annual oil production in the GOM is expected to jump to 1.9 million bpd in 2019 and reach 2 million bpd the following year, the agency reported.

“Eight new deepwater projects are expected to come online this year while four should come online in 2020. Majority operators for the 2019 starts include LLOG, Shell, Oxy, Murphy Oil and W&T Offshore. Talos Energy, BP, Murphy Oil and Fieldwood Energy are majority operators for the 2020 starts.

The agency expects these projects in total to add around 44,000 bpd this year and approximately 190,000 bpd in 2020 as their production ramps up.”

Above are the top 10 US oil producing states along with GOM plotted on the same scale to show the relevance of the GOM. Note the chart starts at 2500 kb/d and Texas output is 5,273 kb/d.

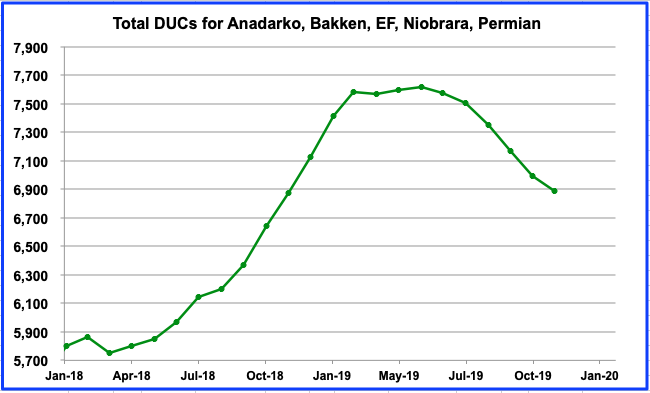

DUCs

This chart shows the number of DUCs in the five major oil producing LTO basins. Much discussion surrounds how production of LTO continues to increase while the number of rigs operating in the LTO basins continues to decrease. Essentially, the higher output rate tier 1 DUCs (Sweet spots) are being used to offset production from lower quality wells. The number of DUCs dropped by 110 from 6,995 in October to 6,885 in November.

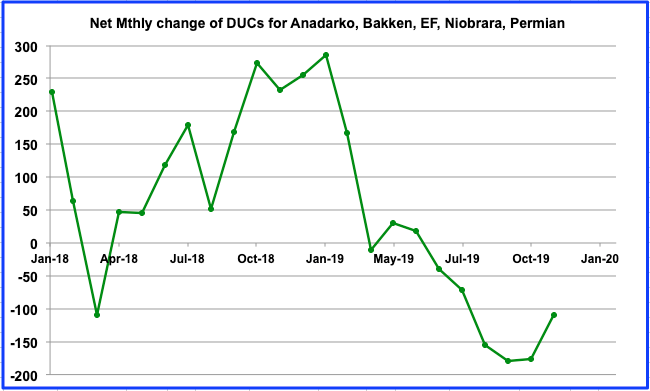

This chart shows the net difference between drilled wells and completions and whether the number of DUCs are increasing or decreasing. A positive number indicates that the DUCs are increasing. From April 2018 to May 2019 more wells were being drilled than completed and the number of DUCs increased, with the peak occurring in January 2019. Commencing in June 2019, completions exceeded drilled wells and the number of uncompleted wells began to decrease. The rate at which DUCs were being completed started to slow after August 2019.

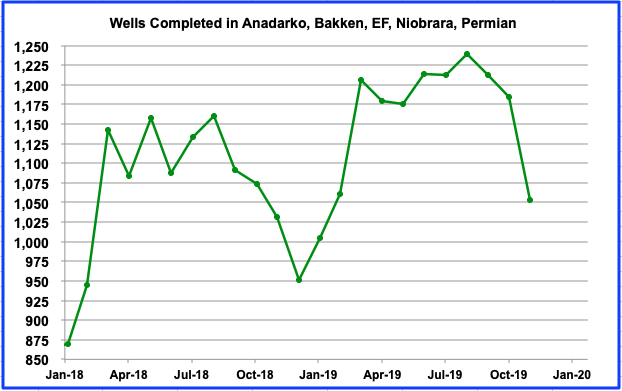

This chart shows the number of wells completed each month. Note that the number of completions from March 2019 to August 2019 slowed relative to the previous few months. However, starting in September 2019, completions began to drop and accelerated in October. The last data point is November. This chart lines up with the recent drop in frac spreads?

EIA’s Differing Oil Growth Perspectives

The EIA has different offices that collect and publish extensive data on the U.S. oil producing industry and uses it to provide forecasts for future production. Three of these perspectives are reviewed and compared below.

1) Drilling Productivity Report (DPR)

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil and natural gas wells to provide estimated changes in oil and natural gas production for seven key tight oil regions.

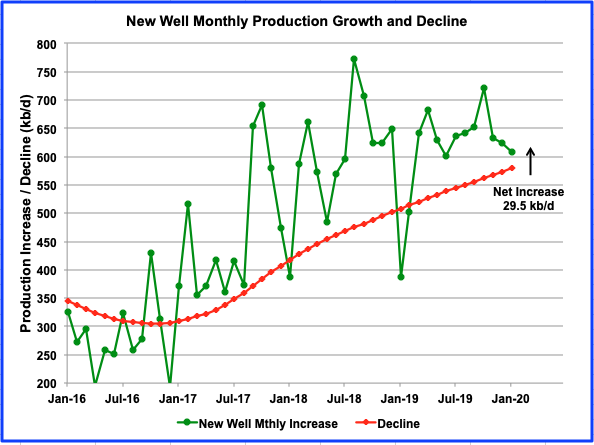

The DPR report looks ahead by one month to provide an estimate for next months output for each of the US tight oil basins. However, it should be noted that the DPR includes both conventional and light tight oil in their projections. It also estimates the month over month decline in the same oil fields to provide a net monthly increase in output. The gap between the green and red lines in the above chart reflects the net monthly production increase.

In the above chart, the projected increase for January 2020 is 29.5 kb/d. Also it can be seen that the EIA’s projected monthly net increase has been getting smaller and less volatile since August 2019. This may be an indication that the DPR has been collecting/obtaining better information for the more recent months.

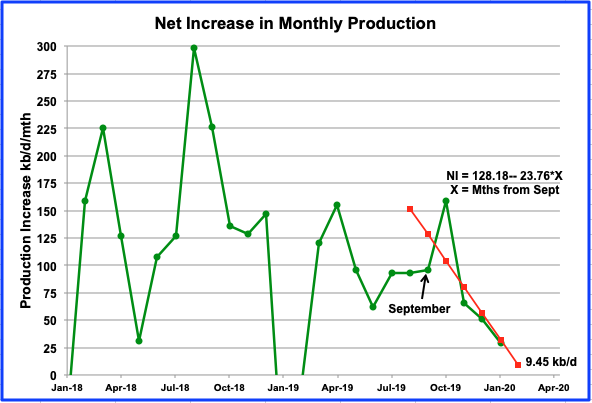

This chart shows the difference between the monthly production growth and the monthly decline in the previous chart. In other words it is the DPR’s projected net monthly production increase for the seven LTO basins starting in January 2018. Last month this chart was shown with data up to December and a straight line fit using the September to December data was added to the chart. Putting a straight line through four data points is a bit risky. Sometimes it is all in the eyes of the beholder. However, when the December DPR was released, their January estimate fell almost on the line. Let’s call it luck for now.

If the decrease were to continue at the rate of 23.76 kb/d/mth, there would be no net increase in production from the LTO basins by mid March 2020. The projected net output for the end of February is 9.45 kb/d.

2) Light Tight Oil (LTO) Report

The LTO database provides information only on tight oil production from the seven main tight oil basins and a few smaller basins. The LTO data differs from the DPR, where both conventional and tight oil are reported. The data is also back corrected each month as updated information is provided to the EIA.

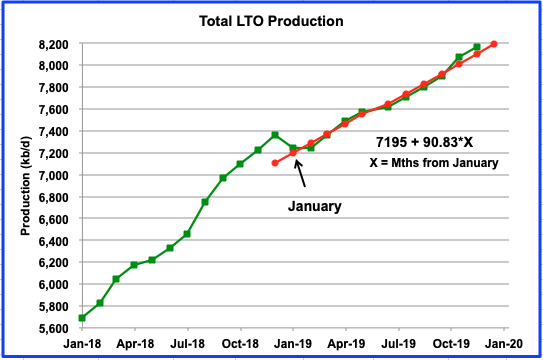

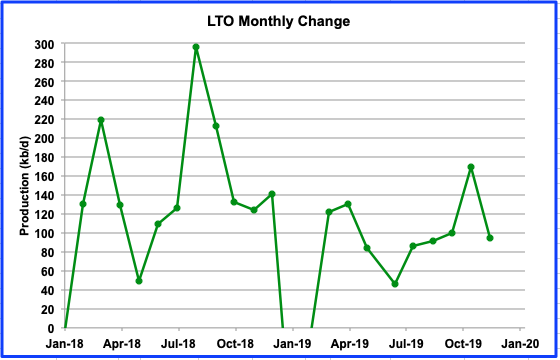

The output of all tight oil basins was 8,165 kb/d in November and increased by 95 kb/d from 8,070 kb/d in October. The average monthly increase from January to November is 90.83 kb/d/mth. The primary contributor to the November increase was the Permian, which provided an additional 100 kb/d and is detailed further down.

Similarly to the DPR report, one can look at the monthly additions to LTO output. By comparing this chart with the similar DPR chart above, the similarity from January 2018 to November 2019 is very close. So while the DPR is projecting a significant slowing in LTO production out to January, the November LTO report can only confirm this trend up to November 2019. A few more months of LTO data will be required to see if the monthly production growth continues to decline and confirms the trend in the DPR data. One indicator that has a trend that is similar to the declining production growth trend shown above is the recent drop in the number of frac spreads.

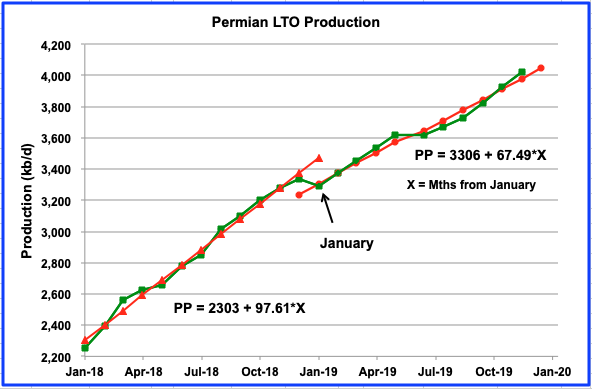

The Permian is the largest contributor to US tight oil growth. The average growth rate in 2018 was 97.61 kb/d, fairly consistent month over month, while the average rate in 2019, up to November, is lower at 67.49 kb/d. However in this case, averages are deceptive because starting in September, the Permian output growth was 100 kb/d/mth for September, October and November. It is difficult to explain this continuing linear increase in output in light of the falling rig counts and plummeting frac spreads.

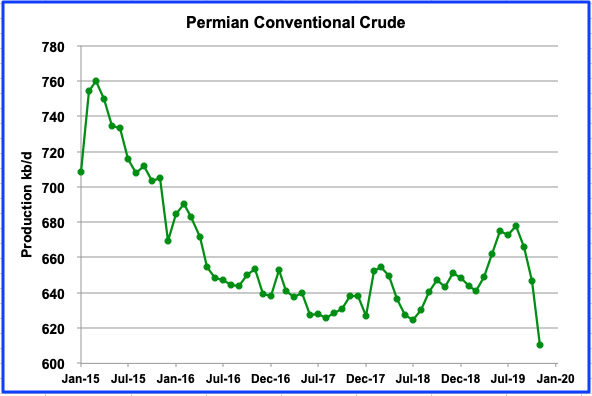

This chart shows the conventional oil component of the Permian output. It was obtained by removing the LTO output from the DPR production. The sharp drop in conventional oil starting in August 2019, may account for the similar drop in the net monthly production shown in the DPR section above. Since this chart represents the difference between total and LTO production, it is not clear if the sharp drop is the result of too high LTO output shown in the previous chart or too low total output. A few more months of data may clarify the situation.

3) Short Term Energy Outlook (STEO) Report

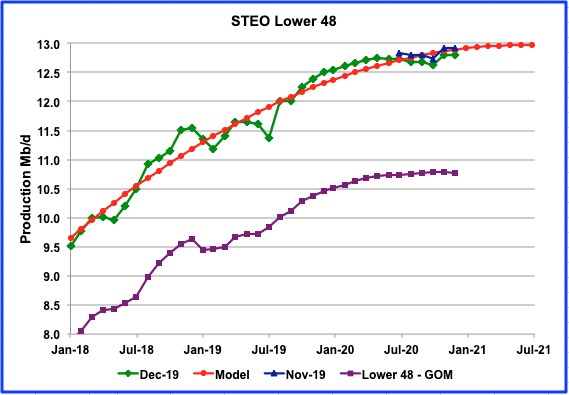

The STEO provides projections for the next 13–24 months for a number of sectors, oil, coal electricity, etc. and is updated monthly. For this post, only their oil production projection is of interest. The upcoming January release will project production out to December 2021

This chart provides the STEO estimate for US oil production out to December 2020. The green graph is the latest December 2019 prediction and is approximately 100 k/d lower than the November 2020 prediction, deep blue, taken from last month’s November 2019 publication. Recently the trend shown in the latest 2019 monthly publications has been successively lower estimates for 2020 output.

The purple graph represents oil output from the onshore L48 states, i.e. it excludes the GOM. Both the green and purple graphs are showing signs of decelerating US production in 2020. Some of the slowing is associated with the reduced number of operating rigs. From January 2019 to December the rig count has fallen by 261 from 1,065 rigs to 804 rigs. Note that while the rig count has been coming down, output has been increasing because the older rigs have been replaced with more efficient and powerful ones.

While the chart is showing signs of US oil production peaking in 2020, we should expect continuing slow growth into 2021 if the price for WTI stays above $60/bbl and heads toward $70/bbl.

Estimating Decline in US Conventional Oil Fields

US output has increased yearly from gains in the LTO basins and the GOM. In order to estimate the average decline rate in US conventional oil fields, two approaches are taken. In one case, the decline rate in states with declining production was estimated. In the other, the decline rate for the onshore L48 conventional fields was estimated by removing the LTO component from the L48 onshore oil output.

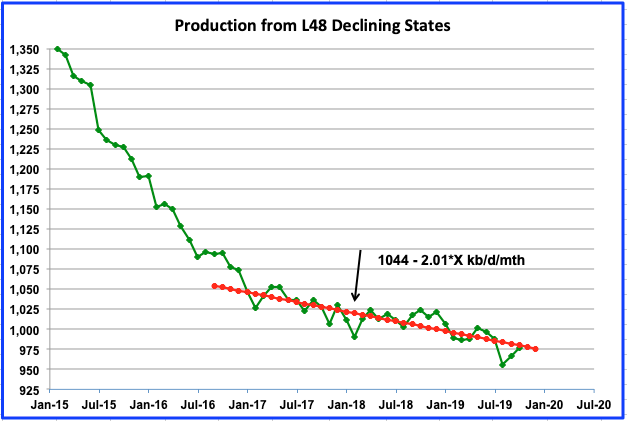

In the above chart, which looks at the L48 states with declining production, we can see a rapid decline in conventional oil output from January 2015 to Dec 2016 at approximately 150 kb/yr. However from January 2017 to the present, it slowed to 2.01 kb/d/mth.

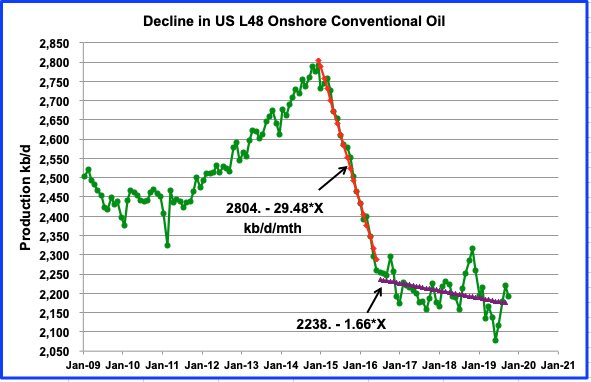

In this chart, the tight oil component was removed from the L48 state’s production using the LTO data. As can be seen, there is a rapid decline in output from January 2015 to June 2016 at an average decline rate of 29.48 kb/d/mth or close to 355 kb/d/yr or approximately 15% using 2,525 kb/d as a mid point reference. The decline rate after June 2016 then falls to 1.66 kb/d/mth and is not that inconsistent with the decline rate estimated using output from declining states above. It is not clear why there is such a sharp change in the decline rate in conventional oil output starting in 2016 to the present.

The above noted decline rate of 15% seems extremely high. However it may give credence to the following statement: “Historically, Permian conventional wells have shown an annual decline of 13%.”, taken from here.

Taking the average decline rate from these two estimates, gives an average rate of 1.84 kb/d/mth. Adding in the decline rate from Alaska of 1.425 kb/d/mth gives an overall average of 3.27 kb/d/mth or 39.2 kb/d/yr which is less than 2% of current conventional output.

In the text portion of the Alaska report above, the following statement is made : “In October, with production facilities back online Prudhoe was up to 270,658 barrels per day but still below October 2018, when Prudhoe averaged 283,754 barrels per day, according to the state revenue data.” If this decline was strictly due to natural decline, then it equates to a decline rate of 1.091 kb/d/mth, which is a significant portion of the overall yearly Alaska decline rate noted above.

On the other hand, a review of the tight oil production data gives a totally different picture for decline in LTO basins. Looking at the production and growth chart in the DPR section above, the expected production increase in January is 609 kb/d while the decline rate is 579 kb/d. In other words 95% of the projected January output is required to offset the decline from all of the earlier wells. It will take a few more months of data to determine whether the monthly decline and production growth will equalize in March, as suggested by the chart in the DPR section above.

World Oil Production

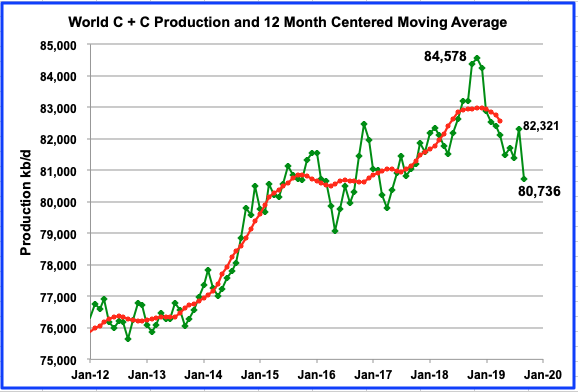

World C + C production fell by 1,585 kb/d to 80,736 kb/d in September 2019. Of the 1,585 kb/d, 1,350 kb/d was due to the attacks on the Saudi Arabia Abqaiq processing plant, one of the world’s most important oil production facilities. The Khurais processing facilities were also attacked.

254 responses to “U.S. Oil Production Is Competing Against Decline”

A fantastic post Ovi, thanks. That last graph, World Oil Production, says it all. Does that look like a peak or what?

Thanks Ron

I was thinking of holding it back for the Non-OPEC update, but when I saw it, I thought to myself, Ron will love this one.

Yeah, I did love it. I am looking forward for the 2020 data to come in. It’s looking more and more like the world is peaking.

I will have a comment on Russia a little later this morning, along with a couple of links. Russia has as much as admitted they are at their peak right now. They say they hope to keep production flat for the next four years but I don’t think that is a feat they can accomplish. Two years perhaps, if that?

?Burn Baby Burn?

“Now, there is simply too much natural gas, and drillers in the American shale patch must face the not-so-pleasant music, with only one question remaining: which shale drillers can hold on until more pipeline capacity comes online?”

https://oilprice.com/Energy/Crude-Oil/Burn-Pay-Or-Shut-It-Down-Three-Evils-For-Permian-Drillers.html

Ron, this must be the 25th year in a row in which you have been predicting the peak in Russian oil production. You are a rival for The Economist in that regard.

I think it’s getting closer.

Ron, this must be the 25th year in a row in which you have been predicting….

Hey asshole, I am not predicting anything. Read my post below on Russia. I am just quoting what the Russian Minister of Energy is saying! The post starts:

Russia has Peaked, according to the Minister of Energy.

Russian oil executives and officials have been making such comments for many, many years. It’s part of the game. They may be after a better tax regime (Russian oil production is heavily taxed) or they may be jawboning the oil price higher (unlike the US, EU, China, Japan etc, Russia prefers a high oil price rather than low oil price) or they may be playing the misinformation game, they don’t want to reveal their strongest card in the public sphere.

Ron,

It’s looking more and more like the world is peaking.

Perhaps Stavros was referring to the sentence above, that sounds a bit like a prediction, though you certainly did not say when that peak would occur in that statement and perhaps you meant soon. Could be that we are on a plateau between 82.5 and 85.5 Mb/d that started in 2018 and will continue until 2030, with a peak near the middle of that plateau, we will know more in 5 years.

Perhaps Stavros was referring to the sentence above,…

Not possible Dennis. The sentence above says “World”, he said “Russian”.

Ron,

Sorry, you are correct, I missed the “Russian” in the comment, you actually have not made that prediction as far as I remember. More focused on World output and perhaps OPEC.

I was thinking of holding it back for the Non-OPEC update, but when I saw it, I thought to myself, Ron will love this one.

Why would somebody who fears the consequences of the downfall of world crude oil production so much, love to see Peakoil happening now or in the rear-view mirror ?

From my own experience I can tell that most people don’t take me serious when I talk or write about Peakoil and the potential destructive consequences. Many don’t even understand the phenomenon Peakoil (“Still crude oil left for many decades”).

So for people not laughing at me and calling me a nutcase or something like that it would be some kind of victory when at last (after a few false declarations in the past) PO or near PO is a fact now.

I am afraid even then people won’t accept peak oil, they will just blame something else, politicians, immigration whatever…

Ron,

Fairly similar to the peak in 2015. When oil prices rise, output is likely to surpass the 12 month centered moving average peak in November 2019, in my opinion. Probably by November 2022, perhaps May 2023 at the latest.

Ovi,

Great post thanks.

As to a possible explanation for conventional decline rates changing consider the chart below.

Data from

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RWTC&f=W

Oil price can make a difference.

DUC completion can compensate for falling drilling rigs to some degree. The completion rates do not correspond very well with frac spreads, but we do not know the breakout between tight oil focused frac spreads and those working the shale gas sector. Keep in mind that both the DPR and LTO estimates get revised monthly, the most recent three months for the DPR are based on the model and tend not to be as variable as real output data, looking back at old DPR reports makes this quite clear.

A drop in completion rates by 10% from the November completion rate level may result in a temporary pause in tight oil output increases, at some point oil price increases, completion rate increases and tight oil output resumes its increase by 2021. It is not clear how much completion rate will drop and perhaps it will simply remain constant. Note that until November the drop in the frac spread count had little effect on the completion rate in tight oil plays, most of the decrease in completion rate through October 2019 occurred in the shale gas plays. From March to Oct 2019 the tight oil plays completion rate decreased by 2% and the shale gas plays completion rate decreased by 16% over the same period with 56% of the total decrease in completions for both tight oil and shale gas due to the shale gas completion decrease (27 fewer vs 21 fewer in tight oil plays).

Dennis,

That google drive excel data and model. Did you do all that ? 25MB of data is a hell of a lot of data to enter in a spreadsheet.

Cheers,

Ovi,

Thanks for the effort, some interesting plots and insights. I still think it’s too early to call peak, but I also tend to agree with what Ron said a while ago, when U.S peaks, the world peaks.

Dennis’s position seems to be when oil prices increase, U.S output will also increase, which as he mentioned happened before already, so could happen again. That could very well be true.

I also have a back of the closet hypothesis that we are possibly entering peak consumerism. Possibly due to the decline of birth rates in the west. If that is the case, oil prices won’t be rising substantially without causing a severe recession.

“we are possibly entering peak consumerism. ”

perhaps, but very slowly. We are adding something like 70-80 million people per year, and will have about 1.5 Billion more alive on the planet within 20 yrs.

GDP is growing at around 3 % in world, which very roughly equates to increase money in the accounts to purchase fuel and items derived from it.

The U.S. Energy Information Administration (EIA) projects that world energy consumption will grow by nearly 50% between 2018 and 2050. Most of this growth comes from countries that are not in the Organization for Economic Cooperation and Development (OECD), and this growth is focused in regions where strong economic growth is driving demand, particularly in Asia.

All in all- it looks to me like this coming decade will see brisk increased demand for energy of all sorts. The scenario of price rise in crude seems highly likely. We’ll see to what extent drilling can keep up.

Hi Hickory,

You may very well be right. I will elaborate why i say we maybe entering peak consumerism. Look at the central banks interest rates of OECD countries. They are all following Japan, nearing or are at negative rates. Why? Because there is very little to no inflation. I assume because people are not buying things as much anymore. The 3% global GDP growth, majority of it is I assume from emergent economies such as India and China. The OECD countries are very close to recession (excluding U.S for the moment). The manufacturing PMI data from Europe and Australia is abysmal. I don’t agree with the EIA’s long term forecast. They are projecting current models and making a huge ASSumption that the current trend will continue. It almost certainly won’t.

Again this is a back of the closet hypothesis. I am very open to being wrong here.

I share your concern about economic growth. It always looks extremely fragile to me. At some point there will be a significant global economic contraction. Will it come in the next 5 years, and take the steam out of exploration and drilling via slack in demand? If so, we are very close to peak oil right now.

Or will an economic contraction come later? If so, there may be persistent demand growth, rising prices, and enough wind in sails of the industry to reach a higher peak in the next few years. Irans production could come back up in the next few years also, depending on policy decisions.

Either way, we are very close to peak. If you define peak as the band between 82-85 mbpd global C + C 12 month average-

we are at Peak Now regardless of price/demand, etc.

Hickory,

Say oil production remains on a plateau from 2016 to 2030 in some “band” of perhaps +/-2% of some average level (maybe 84 Mb/d), when someone says the peak is now, it would be any time over that 15 year period, I tend to pick the midpoint of the plateau as the peak in that case, so 2023/2024 for the example I have given.

My best guess scenario has the peak at 84.51 to 85.49 Mb/d from 2022 to 2027, I would call this a 2024/2025 peak, the average World output from 2022 to 2027 in this scenario is 84.99 Mb/d with output ranging from 84.54 to 85.25 Mb/d over that 6 year period.

I just double checked and the +/-2% plateau actually has a plateau from with an average output of 83.46 Mb/d with a range of output from 2018 to 2030 with a range of output from 82.36 Mb/d to 85.25 Mb/d, midpoint would be 2024.

Its very reasonable Dennis, just longer and higher than my imagination takes me. I am much more interested in the duration of the ‘plateau’, than the peak. The implications for global adaptation to “beyond peak’ times are huge, of course.

Hickory,

In chart form it looks like this.

If this is close, the world has about 10 years supply at current levels, with 800 million additional people by then.

Some countries will be very shorthanded by then, unless they learn to use much less per capita, and total.

Got copper? Got lithium? Got $’s?

Hickory,

I agree the transition will be difficult, higher oil prices will lead to less waste and better fuel efficiency in land tranport, more hybrids, plugin hybrids, and EVs and possibly natural gas or fuel cells used in land transport. In densely populated areas perhaps more light rail and rail as well as rail for long haul goods transport.

There is a lot of waste in the current system, high oil prices will reduce that waste, but it will not be easy.

Iron Mike,

I agree EIA’s long term forecast is likely incorrect. Future is quite difficult to predict, nobody will get it right. The future surely cannot be predicted by a simplistic extrapolation of past trends, the trends will undoubtedly change, but how much they will change and how fast those changes will occur is unknown.

…there is very little to no inflation. I assume because people are not buying things as much anymore.

A more likely explanation is that steadily increasing productivity both in terms of labor and raw materials combined with a vast new workforce coming online in poor countries are keeping prices low.

Found this from some economics dude a few days ago and your 3% comment reminded me of it-

“If the global economy continues to grow at 3% per year, we will consume as much energy and materials in the next 30 years as we did cumulatively in the past 10,000.”

My guess is that’s not actually gonna happen. Something will prevent it, and I don’t mean Tech Daddy’s love.

Errr..Hickory, allow me to slightly modify “We’ll see to what extent drilling can keep up” to “We’ll see to what extent geology can keep up”.

I am of the opinion that all the world’s accessible oil-bearing sedimentary rock formations have been explored, and the economically viable formations already producing.

Peak for all the world’s conventional crude + condensate was November 2005. Peak for all the world’s hydrocarbons is 2019-2020.

Mike,

Consider the following chart with annual output of World C+C minus extra heavy (XH) oil minus tight oil (LTO), the peak was 2016.

Data after 2018 is an oil shock model scenario with conventional URR=2800 Gb.

Iron Mike,

Much of the data is formulas copy and pasted, and much of the data is copied and pasted from other sources. The model has been built gradually starting in 2012, for a very early iteration see

http://oilpeakclimate.blogspot.com/2013/10/exploring-future-bakken-decrease-in.html#more

What oil price would you expect a recession to be caused? $110/bo in 2018 US$ from 2011 to 2014 did not lead to a major Worldwide recession and claims that the high oil price in 2008 lead to the GFC are disputed by many economists, from my perspective it played a minor role relative to lax regulation of the financial industry and poor mortgage lending practices.

Note that my model assumes that oil prices rise to only $90/bo for Brent in 2018 US$ by 2025. That scenario is unlikely to lead to a recession in my opinion. Also note that although you are correct that I expect rising oil prices may lead to increased US output, I also expect that beyond 2027 that even very high oil prices will not be enough to overcome the geophysical characteristics of tight oil plays and that reduced profitability will lead to lower completion rates and falling output regardless of the price of oil.

I also expect that eventually higher oil prices (say $130/bo or more) will lead to demand destruction to keep the market balanced, people will gradually move to alternatives to oil for land transport and by 2040 oil prices may start to fall due to lack of demand for oil.

Dennis,

That’s some dedicated effort, good stuff. Do you by any chance have the annualised U.S tight oil production data or even just the Permian historical production data. I wanted to play around with it.

Nah i don’t believe high oil prices caused the GFC. I think at that time the U.S Fed rates was around 6% or something. So the economy was humming (globally also) in terms of oil consumptions, hence the high oil prices. Now it’s a different ballgame. OECD interest rates are negative or close to record lows. So consumption seems to be a factor in oil prices and why they have been so low, in my opinion. And i don’t see consumption or inflation picking up anytime soon, so oil prices will be contained, assuming no dramas in the middle east, which is almost certain to occur at some point. I think right now oil prices of $80+/barrel will hurt a lot of economies.

Yes i totally understand, you are saying by 2027ish geology will be the key factor in U.S production. Very reasonable.

It’s hard for me to picture that long term as you already know and agree, but i can see oil prices rising dramatically only if there is a war or some third world countries becoming emergent economies.

Iron Mike,

I expect oil prices to rise gradually until the peak becomes apparent, there might be a spike when people realize that the peak has been reached, but that may not be understood until 2030 as there will likely be a plateau for a few years. I think price is determined by both consumption and production and essentially serves to match the two, at some point as production growth slows prices will need to rise to destroy some demand. It is unclear what price will be needed as there are too many unknowns so I just have a straight line increase from $60/b now to $90/b in 2025, quite arbitrary and likely wrong.

The US tight oil data is at link below, Permian is Wolfcamp, Spraberry and Bonespring columns added together. All columns for US tight oil data, data by month.

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

Iron Mike

Oil price was the trigger. The housing mortgage crisis set it up. Something had to trigger the beginnings of mortgage defaults. That’s why oil price was the trigger.

Dennis said “people will gradually move to alternatives to oil for land transport….”

I find that to be quite a supposition, unless you mean that the alternative will be to move by foot. In that regards, you are definitely on to something.

It takes lots and lots of hydrocarbons to mine and refine lithium, steel, cobalt, coal, copper, nickle, chrome, tantalum, titanium, vanadium, niobium, magnesium, etc etc. Even more to transform these into electric cars, windmills, silicon panels, power plants, power lines, transformers etc.

I think the window on this has been largely missed by probably a decade. Unless the world starts a crash construction program for nuclear power plants, I suggest that the putative upcoming optional ‘alternatives’ will be largely limited to ‘by foot’.

Hey Mike,

Thanks for your contributions, I think they are great.

What do you think the feasibility of the USA implementing a Coal to Liquids program are?

thanks!

Mike,

I disagree, I think we will utilize scarce resources efficiently and will find a way, but I agree it will be difficult. Keep in mind that only about 33% of the energy in fossil fuel is transformed to work (as defined in physics Force times distance). Move to a mostly electric economy powered by wind, solar and hydro and there is far less energy wasted as heat. Also utilizing heat pumps where heat is needed is far more efficient than boilers.

There is a huge amount of energy waste in the current system. Higher fossil fuel prices will eliminate much of this waste.

Also utilizing heat pumps where heat is needed is far more efficient than boilers.

Dennis, boilers are primarily used to generate electricity, or power for ocean-going vessels. Heat pumps cannot possibly replace boilers in either of these cases. Boilers to generate heat for heating are seldom used anymore.

Heat pumps for heating homes are great if you live in the southern part of the USA, or in any climate with warm winters. But they are woefully inefficient in super cold weather.

>> Heat pumps … are woefully inefficient in super cold weather. <<

Remember Paul in Halifax from the Oil Drum days? He swore by his heat pumps, even in Nova Scotia.

Will a Heat Pump Work in Cold Weather? Bold theirs.

How heat pumps work in cold weather

An air source heat pump is like a heat sponge: it absorbs heat from the outdoor air and transfers it inside your home.

Because they use outside air, air source heat pumps work especially well in moderate temperatures. But when temperatures drop below 32° F, they lose efficiency, meaning they have to rely on a secondary source of heat to properly heat your home.

Secondary forms of heat come in two forms:

Electric resistance coil heaters (the default)

Gas furnaces (when combined with a heat pump this is called “hybrid heat” or “dual fuel system”)

Air source heat pumps do lose efficiency as temperature declines but many are capable of producing their rated capacity in the -15 degree Fahrenheit range. These units are extremely efficient to zero Fahrenheit. There are actually very few places in the lower 48 where heat pumps aren’t fully competitive. They can also always be augmented by pellet stoves and the like in more trying locations.

Ron,

In cold climates ground source heat pumps work fine.

Many homes, as well as commercial and industrial buildings use boilers for heat and hot water. Heat pumps are more efficient.

I am sure ground source heat pumps work well, as long as there is no permafrost. But I think they are as scarce as hens’ teeth. I never heard of one in the South. And down here there are a lot of heat pumps with electric resistive heat as a backup. Yes, they need a backup, even down here as the temperature often drops below 32 degrees.

I have never heard of a heat pump water heater. Are you sure they exist?

There has been innovation in the heat pump sector. Geothermal works very well, but newer application not requiring the piping of water, is the “Cold Climate heat Pump”, and the RCC [reverse cycle chiller].

The RCC looks very promising (even in cold weather), and also can be used to heat water. All forms serve as efficient air conditioners.

description of RCC near the bottom of the page-

https://www.energy.gov/energysaver/heat-pump-systems/air-source-heat-pumps

Ron, regarding your comment above – heat pump water heaters do indeed exist. I have one in my basement. Its annual electricity cost is less than 1/4 of my old electric resistance unit. It also doubles to dehumidify my basement during summer months. It has a hybrid mode I use in winter that also uses resistance heat.

Ron,

There have been improvements in air source heat pumps see

https://mitsubishicomfort.com/coldsnap/?gclid=CjwKCAiAu9vwBRAEEiwAzvjq-1sryMrwaLIKnNU8VoTstU3eVpQ26xPPO7TbUpeOXAZlm5Qe3MpPvhoCUpYQAvD_BwE

and for a possibly less biased information source

https://www.efficiencymaine.com/heat-pumps/

Cold temperature performance – Because heat pumps extract heat from outside to provide warm air inside during the heating season, as it gets colder outside, the heat pumps work harder to keep up, making them less efficient. For example, a system that delivers four units of heat for every unit of electricity at 50°F, may deliver only two units of heat for every unit of electricity at temperatures below zero. There is evidence of the highest performance units operating and providing heat even below -15 °F in Presque Isle. But if the temperature drops low enough, the system may turn off completely. Be sure to check out the minimum operating temperature listed for your heat pump. If you experience prolonged periods below that temperature, consider a secondary backup heating system to maintain your desired comfort level through the chilliest nights. If you use a backup system, just be sure to switch back to your heat pump once temperatures rise, or you could quickly lose your energy savings.

https://www.energy.gov/energysaver/water-heating/heat-pump-water-heaters

The heat pump water heater probably works best in warmer climates, unless it is tied to a ground source heat pump system.

Ron, you equal heat pump with air as source, that is a useless simplification.

Ground source heat pumps work very well in cold regions. I have no issue to get 4 units heat for one unit electricity, that at -15 °C….

What does DUC stand for? Just asking for a friend…

Drilled But Uncompleted Shale Oil Wells

It means the well has been drilled and the drilling rig removed but the well has not yet been fracked.

Thanks!! That provides a much clearer picture

So, if the drilling rig has been removed, can the fracking take place or does the rig need to be brought back and reattached, etc.?

No, the drilling rig has nothing to do with fracking. The fracking spread is enormous and requires many truckloads of equipment.

https://www.bing.com/images/search?q=Images%20of%20Fracking%20Spread&qs=n&form=QBIR&sp=-1&pq=images%20of%20fracking%20spread&sc=0-25&sk=&cvid=C4D2406AFFCB49808EFAEF8B29114367

Click on any of the images of fracking spreads to enlarge.

So currently Texas is the Second Largest Producer in the World? Do I have that Right? I wonder what their daily consumption is?

Longtimber

Here are the C + C numbers for September (World) and US October.

USA 12,655 kb/d (October)

Russia 10,860

Saudi Arabia 9,895 in August. 8,545 in September

Texas 5,273 (October)

Iraq 4,680

Canada 4,390

Ovi , thanks for a great work. In my eyes to have a compleatly picture I should wish a diagram showing world oil production , world demand and oil price. Perhaps it will show based on your graph that oil growth in US is now 29,5 kb/d and DUCs dropping 100 monthly is seems clear the picture will continue the next 6 months at least. Based on historical data I believe than the oil price should be a lot higher than 55-60 usd wti.. ? As a producer in the shale patch I believe the banks , investors are focus on a future price of the shale oil. 10-15 usd increase wti will change this picture. On the other side Opec might be satisfied as things are as they want to take back market shear. If trade war stops , world growth comes back on track we will see oil growth demand exseed 2% or 2 mill bpd . Saudi might add that for 1 year perhaps 2 but than there will simply be lack off oil in rabge wti 55-65. My guess is than oil price will go to 80-100 usd wti or above. Thiere 2 wells will than be profittable and there will be same situation for some time as with the sweet spots, but first all curves shows a decrease in US oil production. This will make US a significant swing produsent because of the caracteristick of US Shale. First also many Company in US shale patch will go bancorupt as they will not be able to pay their bills with their profit. Investors in thoose Companies normaly loose most of their assets as liability is transfered into stock with values close to cero..

Freddy

I don’t think that I can come up with a chart with all of your variables.

I agree that the price of oil is critical. I also think that production will depend on how many small players are left and the big guys. They will have a much more disciplined approach that would keep the market supplied but not threaten the price.

As for oil price, I think the Saudi’s would like $75 to $80 to meet their social payments obligations. Not quite sure if $80 would slow the US economy. $80 would translate into an average gasoline price of close to $3.00 per gallon. Anything over that starts to worry the US consumer. Probably would unleash a tweet storm from you know who.

Ovi, 3 USD each gallon is not much for gazolin. In Norway that is a oil producing Country where it is also refineries for gazolin cost 1 liter 16,50 nok. Exchange course 8,8 nok/ usd and 1 gallon is 3,785 literes gives it 7,10 usd / gallon and half of that is vat, roadtax to goverment. Just wait to next time.Donald visit here and he will learn how the wall can be built…

Rather than using STEO to project future output, we could fit a quadratic to EIA monthly estimates from Jan 2017 to October 2019. Note that there is no particular reason we would expect future C+C output to be modeled correctly by using a second order polynomial fit to the past 34 months of data, but this is what we would get. I expect this will not reflect future output very well.

I use the STEO data because it shows definite signs of rolling over. Both the total and L48-GOM are rolling over, the later even more so. I have to assume they must have plans from some of the major LTO players. So in essence I am curve fitting some unknown physical/semi-factual data. Interestingly, that quadratic doesn’t peak till mid 2021.

As pointed out above, I think that the next STEO is going to lower the 2020 estimates again. Also it will be interesting to see what it will show for 2021.

On another subject, I find it interesting that the OPEC additional production curbs end in March. Do you think that OPEC is looking at the EIA estimates that are showing a flattening in output in mid 2020. (I was also dreaming if they were checking peakoilbarrel . com). NAH.

Ovi,

My guess is that OPEC is just as skeptical of EIA estimates as I am, they also have access to the earlier estimates. I am skeptical of all models of the future, including my own.

The curve I show (also based on the problematic practice of curve fitting), uses actual output data as its basis. Even this data is often revised, but it tends to be far better than a model of the future.

Dennis

Looking at the STEO chart in the post above, the increment from January to December 2019 is close to 1 Mb/d. The increment from January to December 2020 is approximately 300 kb/d. That is a significant change. The EIA must have some data that makes them predict such a dramatic slow down. Even the quadratic that is shown doesn’t do a very good job. It will be interesting if they will show some kind of a plateau into 2021.

Ovi,

The STEO from Dec 2018 showed the same type of scenario with output flat the second half of 2019. Part of the problem is the oil price scenarios are not very good, the EIA STEO team thought the price of Brent would fall to $51.50/bo by May 2020, then gradually rise to $59.50/bo by Dec 2020. A poor future oil price may be messing up their model results.

https://www.eia.gov/outlooks/steo/data/browser/#/?v=8&f=M&s=0&start=201807&end=202012&linechart=BREPUUS&ctype=linechart&maptype=0&map=

I am far less confident than you that the EIA has learned from past mistakes.

The Jan 2020 STEO will be revised lower for Nov 2019 and they may adjust their oil price assumption and get a model that better reflects the future. My guess is the scenario will become higher rather than lower for the second half of 2020 and 2021 will show continued growth at 400 to 500 kb/d over the Dec 2020 to Dec 2021 period.

Chart below shows Brent oil price scenario for Dec 2019 STEO.

Ovi,

I looked back at STEO versions from Jan 2019 to Dec 2019, the changing scenarios are due to changing oil price assumptions. They also reflect actual output estimates up to two months before the STEO is published. I focused on L48 excluding GOM price assumptions for Brent in Dec 2020 vary from $57/b to $68/b, with low prices corresponding with lower output and higher prices corresponding with higher output (which seems reasonable).

Clearly nobody knows the future price of oil, they may use demand projections based on economic forecasts, OPEC decisions and the futures strip as the basis for their oil price scenarios (or it may be some sophisticated model). If their oil price scenarios are correct their model may be close, I tend to think their higher oil price scenarios (say $65/bo for Brent in Dec 2020) are more reasonable, but I never get future oil prices right. 🙂

Page with STEO archives below

https://www.eia.gov/outlooks/steo/outlook.php#issues2019

Russia has Peaked, according to the Minister of Energy.

Russia’s Interest In Oil Production Cuts Is Waning

Russia is planning level production for the next 4 years.

“As far as the production cuts are concerned, I repeat once again, this is not an indefinite process. A decision on the exit should be gradually taken in order to keep up market share and so that our companies would be able to provide and implement their future projects. I think that we will consider that this year.”(2020)

Meanwhile, Russia’s energy ministry is assuming that the country’s total output is to average around and slightly above 11.2 million barrels per day until 2024. In other words, it is not building any cut into its plan.

Russia’s peak month, so far, was December 2018 at 11,408,000 barrels per day. The average daily production for 2018 was 11,115,000 bpd. Average production for 2019 was 11,211,000 bpd. This is the level they hope to hold for the next 4 years.

Russia’s production increased by an average of 96,000 barrels per day in 2019. They are not expecting any further increase at all. They just hope to hold at 2019 levels for another four years. I think they will be very lucky if they manage that.

Point is, the world’s largest producer, the USA, will likely peak in a few months. The world’s second-largest producer, Russia, is admitting they have peaked. The world’s third-largest producer, Saudi Arabia, has very likely peaked though they do not admit it. OPEC likely peaked in 2016, *Iran and Venezuela notwithstanding.

*Iran peaked in 2005 at 3,938,000 bpd. My Venezuela records only go back to 2001 when they produced 2,961,000 bpd. However, they peaked several years before that. However, neither is producing at maximum capacity today due to political problems. However both are clearly in decline regardless of political problems keeping them from producing flat out.

If we are at peak oil right now we are damn close to it.

The Russian Chart below is C+C through December 2019.

Ron(if you prefer Ronny, let me know),

Agree Russia is probably on a plateau, I disagree on the US reaching peak soon, I expect 2025 or 2026, depending on the price of oil. I agree once US tight oil output peaks in 2025/2026 the World will be at its peak within 2 years (one year before or after the peak in US tight oil), so 2024 to 2027 for the World C+C peak window (12 month centered moving average of World C+C output).

No, I prefer Ron. I just logged in on an older computer and it forced Ronny on me.???

I must emphatically disagree. The US is all that is keeping the world from peak oil right now if it is. But even if the US does not peak in 2020 oil production will dramatically slow down. That will not be enough to keep the peak oil wolf away from the door. Only Brazil and possibly Canada can show any appreciable increase in production while almost every other nation in the world has either plateaued or is in decline.

Ron,

Perhaps. I think there is more output that could come from Iran, high oil prices would probably change Trump’s posture on Iran. Also high oil prices would lead to faster development of tight oil resources, oil sands, and conventional resources,

much changes with higher oil prices, by 2023 we will have surpassed the 2018 peak, probably sooner than that, perhaps 2021.

Ron

Guyana is coming.

Dec 26, 2019, 10:39am

December 20th marks a historic milestone for Guyana, the small South American country that is soon to become the fastest growing economy in the Caribbean. Late in the evening, ExxonMobil and its partners announced that it had produced the first commercial crude from the Liza field, located in Guyana’s offshore Stabroek Block. The output from the first phase is expected to reach capacity of 120,000 gross barrels of oil per day (bdp), utilizing the Liza Destiny floating production storage and offloading (FPSO), and the first cargo is set to be sold within several weeks. Stabroek Block is expected to produce 750,000 bpd by 2025.

Looking at the time scale, this field will add about 150 kb/d/yr up to 2025.

https://www.forbes.com/sites/davidblackmon/2019/12/26/exxonmobil-announces-transformative-first-oil-in-guyana/#9e9e42f6d27e

Ron

I wonder if you saw this article.

https://uawire.org/russia-announces-plans-to-withdraw-from-opec#

I found this statement interesting, in that if they can’t increase production, and are at max, why are they worried about market share.

“We will still need to gradually make a decision to withdraw, in order to preserve our market share, and so that our companies can promote and implement their future projects. I think that we will consider this, even this year,” the minister added.

Another article says they are at a new high. Mind you it is the highest average. Maybe 2020 will be lower.

https://oilprice.com/Energy/Energy-General/Russian-Oil-Production-Hits-New-Records-Despite-OPEC-Deal.html

What message are they trying to send

Ovi, the data in my chart above is from the official Ministry of Energy web site, converting tons to barrels at 7.33 barrels per ton:

MINISTRY OF ENERGY OF RUSSIAN FEDERATION

The site has not updated the December numbers but the Minister has released them. They can be found here:

UPDATE 1-Russian oil, condensate output surges to record-high in 2019

In December, total oil and gas condensate stood at 11.262 million bpd, up from 11.244 million bpd in November, according to the data.

Those are the exact numbers I used in my chart above. And yes, 2019 was a new high, exactly as I stated in the post above. Its yearly average beat the 2018 yearly average by 90,000 bpd.

Concerning 2020 average, it could not be stated any clearer than this:

Russian Energy Minister Alexander Novak expects Russian oil and condensate production of between 555 million tonnes and 565 million tonnes in 2020, or 11.12-11.32 million bpd using a conversion rate of 7.33 barrels per tonne of oil.

Or this from the link:

Russia’s Interest In Oil Production Cuts Is Waning Bold mine:

Russia did not comply with the cuts in 2019.

Got an exemption for condensates at the OPEC meeting, though this was not discussed in the press conference.

Achieving another cut of 70,000 b/d in first quarter appears to be beyond its capability, given past statements.

Russia is planning level production for next 4 years.

And is prepared for oil prices to drop to $25-30 per barrel.

You wrote: I found this statement interesting, in that if they can’t increase production, and are at max, why are they worried about market share.

I really don’t understand that question. If they plan on producing 11.2 million barrels per day for the next four years, then they should be worried about their market share. Whether they can or cannot produce more than that is beside the point.

Ron

My point was if they are at Max production and they can sell it all, I did not understand why they would be concerned with Market share. If the market were over supplied and they couldn’t sell it all, then I could understand their concern with market share.

Hey, And is prepared for oil prices to drop to $25-30 per barrel. at that price, the market would be definitely oversupplied. And they would be extremely concerned with market share.

Ron

I think that you and I, along with a few others on this board, are headed for peak oil soon, so oversupply should not be an issue

Ovi,

When is soon? Do you have a window? Perhaps 2020 to 2022? Soon can cover a lot of ground, I expect a peak soon as well, in the 2024-2026 range. I think you expect a peak sooner, perhaps the March 2020 date you have mentioned.

I think if the slope of the output curve becomes zero, it will be an inflection point rather than a peak, if the second derivative (of output curve) becomes negative, it will be brief, (3 months or less) in my opinion.

Dennis

Yes I meant March, but only as a first one. As prices rise I think we will see an undulating plateau until the supply/demand market direction is clear to OPEC. They are looking for a peak or definite slowing in US production so that they can begin to increase their output and regain control. They also will keep an eye on Brazil and Norway for their upcoming bump up in output along with Guyana. However I do believe that 2020 will provide us with a much better picture of what to expect.

Ovi,

It seems pretty clear that US oil output growth is slowing. I imagine OPEC may continue its cuts to keep oil prices up.

If you play with my model you will see why I think tight oil output will continue to grow.

Ron,

My guess is the market would not be oversupplied for long at $25-30 per barrel unless we are in the middle of Great Depression 2.

In fact I doubt we will see Brent under $50/bo unless there is a major Worldwide economic crisis prior to 2040 (and I expect there may be a major economic crisis around 2030.)

Dennis, I agree. I doubt we will ever see oil prices below $50 again. I think the mid $60s will be the norm for the next couple of years, then perhaps higher.

Of course, we are both just guessing, trying to predict the future. And if I was any good at it I would be filthy rich today. I am not, which means I am a lousy predictor.

Ron,

I am also a poor predictor of the future, but I agree with you on oil prices, so maybe we are right (or more likely both of us are incorrect.)

Dennis.

I do think you are learning! You continue to post that you are more than likely incorrect on your future oil price predictions.

Don’t feel bad, a famous CNBC talking head commodity trader (who recently announced he was hanging it up) predicted less than three years ago that WTI would never be above $44 again in his lifetime.

In the past 20 years we have ranged from $8 to $140. In June, 2014 $99.25. In February, 2016 $25.

The past two years have been somewhat stable. Just a range from $42 to $74. Lol!!

Shallow sand,

Yes I have learned to state the obvious very clearly.

Early on I thought it need not be said that nobody can predict the future, this has always been as clear to me as 1+1=2, my scenarios have always been what might happen under a certain set of assumptions, there are many and any one being incorrect will make the scenario wrong.

Not many get this, though I am sure you and a few others probably do.

I agree that future oil prices cannot be predicted, but I do think a scenario with high consumption of oil and low output of oil is likely to lead to higher prices.

Dennis.

Just being sarcastic.

Heck, who in 2007 would have predicted 13 million BOPD of C + C? Maybe one person in a thousand?

I know you have to plug in something. I don’t equate your oil price predictions to those of CNBC talking heads.

Thanks shallow sand,

I have learned a ton from you, and I appreciate that you have taken the time to teach us about the real world of the oil field.

This is what tight oil output might look like with a low oil price scenario (Brent at no higher than $70/bo in 2018 US$).

I just don’t think oil prices could remain low under this type of scenario, but I certainly was not among those predicting US C+C at 13 Mb/d back in 2007 (or even 2012 when I started blogging), so I do not predict the future very well.

chart kind of small, click on chart for larger view.

Wow . What a great effort and what terrific output . Hats off to you Ovi . I just like to add my two bit . In my opinion the DUC stuff is a red herring . Nobody knows what their output will be . Hell they could be all dry being located in Tier 3 or 4 area^s . Nobody has any information on these ,so count them as a future source of supply is tossing a coin in the air , I will go a little further , I would call the probability of the DUC accounting

being a fraud at more than 50% . Mike Shellman and SS can pitch in ,because they have their ears to the ground .

hole in head

Thanks

I just try to analyse the data I find and try to make some sense of it. Unfortunately I do not have any insight on what it really happening in the fields. I assume the big banks like GS and JPM, who also make predictions send their analysts out to interview some of the bigger drillers to get some further insights.

As for the DUCs, I appreciate your comments regarding the quality of the DUCs. I have been asking myself the question “How do we know all of these DUCs are so good”. Thanks for answering. Like you say, we don’t know.

Ovi,

Excellent work!!!

hole in head, I also think the DUC inventory could be a red herring. The best DUCs would be completed first and some of the remaining DUCs could be dry, or of such low quality, that they are never completed.

I agree with your STEO Lower 48 model fit (red line) predicting production under 13 mbd. We’ll see if the EIA weekly supply estimates for last week of December stay below 13 mbd.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

I know these weekly estimates are just estimates but they are indicating a short peak plateau from Nov 2019 to Dec 2019, as the numbers oscillate between 12.8 and 12.9 mbd.

Tony

I think they will but will cross 13, possibly in January.

Informative post again. Thanks Ovi.

Crude is up over $2.00 as the US apparently killed Iranian General Soleimani. There is speculation this could lead to all out war in the region. This definitely could put peak oil in the rearview mirror, or it might just be a lot of noise. We will see.

A drone strike.

If true, some good intel.

Iran holds the trump card unfortunately.

Another gift to Putin

OPEC probably thinks that US shale oil is peaking about now

“Output from the Organization of Petroleum Exporting Countries fell by 90,000 barrels a day to 29.55 million in December, according to a Bloomberg survey of officials, ship-tracking data and estimates from consultants including Rystad Energy AS and JBC Energy GmbH.”

https://www.msn.com/en-us/money/markets/opec-output-falls-as-gulf-nations-step-up-delivery-of-oil-cuts/ar-BBYyrZh

WTI almost $63 now

Has anyone heard of ESAI Energy which provides energy data services?

https://esaienergy.com/

https://www.bloomberg.com/news/articles/2020-01-02/permian-pipeline-competition-heats-up-as-capacity-outruns-supply

Oil producers are warning that they are preparing to curb spending this year to boost investor returns. “The Permian is definitely slowing down,” said Elisabeth Murphy, an analyst at ESAI Energy Llc. Declines from legacy wells are outstripping the new wells, and there aren’t enough rigs to offset the decline in the legacy wells, she said.

https://esaienergy.com/eia-and-iea-are-too-optimistic-on-shale/

ESAI Energy believes both the EIA and the IEA are overly optimistic in their November projections of US crude oil production in 2020, according to the company’s latest North America Watch. ESAI Energy sees a deceleration in growth to about 650,000 b/d next year, in contrast to the EIA and IEA forecasts of 1.0 million b/d and 900,000 b/d, respectively.

ESAI increase of 0.65 mbd is year on year increase. EIA STEO is 12.25 mbd average for 2019. Add ESAI 0.65 mbd to get 12.9 mbd average for 2020. EIA MER says first estimate US crude oil production 12.847 mbd for Nov 2019, page 57.

https://www.eia.gov/totalenergy/data/monthly/pdf/mer.pdf

Elisabeth Murphy says Permian legacy decline outstripping new wells so US peak oil about now.

Tony

One of the problems that is difficult to sort out is what oil are they talking about. On this board, we mostly think in terms of C + C. IEA and OPEC quote US numbers that include NGPLs, which currently is running at close to 0.5 Mb/d. If we look at C + C, average 2020 over 2019, it will also be close to a 0.5 Mb/d. There is the 1.0 Mb/d. But going forward from today, it looks like the C + C increment will only be about 300 kb/d. So it comes down to trying to clarify we are are discussing apples to apples or apples to apples + oranges.

I am still sticking with March on LTO and the whole US.

You will never get a definition. Lease condensate, plant condensate, NGPLs and pentanes+ overlap — particularly via natural gasoline. The API number for where crude becomes condensate has changed and is changing. Delineation from NGPLs will not define either.

Watcher,

In the US crude plus condensate has always been grouped together so the API gravity that determines the line between crude and condensate does not affect output of C+C. It would make sense for natural gasoline from NG processing plants to be included in the C+C numbers as many nations do, but the US has always done it this way and will not change. The amount of natural gasoline produced in natural gas processing plants in the US is relatively small.

In October 2019 there were 5022 kb/d of NGPL produced and only 591 kb/d of natural gasoline (aka pentanes plus). The rest was LPG (sum of ethane, propane, butane, and isobutane) or what Ron refers to as “bottled gas”. In 2000 the US produced only 2000 kb/d of NGL, output of NGL has increased sharply since 2010. Natural gasoline output was about 300 kb/d in 2000.

https://www.eia.gov/dnav/pet/pet_pnp_gp_dc_nus_mbblpd_m.htm

Ovi,

Consider what a projection using a second order polynomial (quadratic) to the STEO from December 2018 would have looked like had you done so in December 2018 and compare that with a similar projection based on EIA monthly data from Jan 2017 to October 2019. The results are very different, also notice how the Dec 2018 STEO flattens in the second half of 2019, just like the Dec 2019 STEO for the second half of 2020. It might give one pause. I think both of these projections will be incorrect, but the higher of the two will be closer to reality (I think it is a bit too high).

In the chart below the dashed line is EIA monthly data and the solid line is the Dec 2018 STEO, the dotted trendlines are quadratic (or 2nd order polynomials) fit to the underlying data.

Dennis

I agree. Different starting points and different order polynomials are going to give you different answers. The DPR and LTO net production charts started in Jan 2018, along with the STEO. I guess the point I was trying to make was there may be a first peak in LTO production sometime between March 202o and Mid 2021.

Ovi,

The same second order polynomial was used in every case, generally if one is going to curve fit, using more data makes sense, in addition for the fit to the monthly data the R squared is higher for Jan 2017 to Oct 2019 than it is for Jan 2018 to Oct 2019 for the second order polynomial trend line.

Does the Brent Oil price scenario from the December 2019 STEO look reasonable to you? Seems a bit low to me, especially if one believed that World oil output will peak before the end of 2020.

Ovi,

My main point is that if that is correct, the peak is likely to be temporary, there have been many pauses in the past where output growth of World C+C was close to zero. This might be one of those cases, if oil prices remain at $60/b or less for Brent, I think it more likely that Brent will be at $65/b0 or higher and there will be slow growth in US output at an average annual rate of about 430 kb/d from 2020 to 2024 and gradually slowing to zero from 2024 to 2026. The Scenario for US L48 excluding GOM C+C in chart below is my current best guess.

The second order polynomial trend line fit to monthly EIA data (dashed line) shown for comparison, dotted line is trend for quadratic fit.

Dennis

I find it difficult to believe the EIA projection for Brent. It is based on this premise: “EIA expects crude oil prices will be lower on average in 2020 than in 2019 because of forecast rising global oil inventories, particularly in the first half of next year.”

With OPEC cutting another 500 kb/d starting yesterday, I can’t see the inventory build they mention. I think that Brent will be between 65 and 70 after mid year, as summer demand starts to kick in and it is clear that US crude production growth is slowing.

Attached is the futures curve for Brent. While it is showing decline prices out to December, the more important thing to notice is the strong backwardation, i.e. each successive month, the price is lower. Looking at the front month, what this curve is saying is the following. The refiners are saying we want your oil NOW, not 12 months from now. The 89¢ drop from the front month to April is big compared to WTI which is 23¢.

I would be interested on hearing other opinions on the meaning of backwardation

Ovi,

Agree with your price prediction, the July 2019 STEO has Brent at 67 per barrel in 2020 with L48 excl gom at about 11 Mbpd in December 2020.

Not sure about backwardation have never traded in futures market.

Dennis

I have not traded futures either. However I have heard market analysts talking about it. Some say why buy oil stocks when the futures curve is showing the price of oil will be cheaper one or two years from now.

Other analysts say, no no no, that is not what the futures curve is saying. When it is in backwardation, it means that demand is good/high and that is why refiners pay a premium over the next month contract to get their oil now.

The other mode, when the price is higher for each future month, is known as contango. I think the drillers like this. Say Front month oil is $50 and 6 months out it is $53, which was the situation in early 2018. A driller could drill a well, and knowing its potential, cap it and then sell a contract to deliver the oil 6 to 9 months out at a higher price and not have to pay a storage charge for tank usage in Cushing.

I wish that someone on this board with experience would confirm or correct my thoughts on the proper way to interpret the curve and whether it is effecting the rig and frac spread count.

Ovi, I have traded futures, though I never made money doing it.

Backwardation or contango, they both represent nothing but the traders’ consensus of opinion. Traders look mostly at stocks to decide whether or not the price of oil will go up or down. However many look at other price signals also.

The futures price has very little to do with hedging by the actual buyers and sellers of the physical product. Well over 90%, likely closer to 99% of all contracts traded have nothing to do with the physical product. They are paper barrels that are closed out for cash, either before expiration or at expiration.

So the futures price represents nothing but the traders’ hopes and expectations.

At expiration the closing price must represent the spot price, or very nearly so. In other words, the futures price is always a guess at what the spot price will be at expiration.

Many people think the spot price follows the futures price. It does not. It’s the other way around. The spot price represents a negotiated price between the buyer and seller. Only a tiny fraction of all oil bought and sold, are deliveries taken as a result of a futures contract.

Thanks Ron,

Sounds reasonable.

Tony,

The legacy production change becomes smaller in absolute value as fewer new wells are completed (see the numbers from 2015 to 2017 in the DPR), also as oil prices rise the completion rate will increase (see US tight oil output from 2016 to 2018 as completion rate increased.) Perhaps the growth in US tight oil output will fall to zero for a month or two, this is less likely a peak and more likely to be an inflection point as for y=x^3 at (0,0).

Just read a Bloomberg piece claiming that the US has become a net exporter of petroleum.

This is not true for C+C where the US remains a net importer as of October 2019 at 2861 kb/d, I do not trust the weekly estimates they tend to be very inaccurate and shed little light in my opinion.

The US produces significant quantities of NGPL and that is what is exported (and products created from NGL). There is a net export of petroleum and petroleum products, but it is crude oil plus condensate that is used to produce the liquid fuel needed for transport, that is the number to focus on and the US remains a net importer of C+C, though much less is imported than the 10,000 kb/d imported in 2000.

The killing of Irans mastermind behind the Iraninan expansion strategy and proxy attacks, Soleimani will change a lot … it’s like killing Pompeo.

Are you saying Pompeo is a mastermind? I’d say he’s a political hack dreaming of the Rapture. There’s no way he can understand what is happening in the region with those blinders on.

Anyway after a Confederate raid made off with 12 mules and captured a brigadier general, Lincoln said, “How unfortunate! Those mules cost $200 a piece!” On another occasion he remarked he could make a general with the stroke of a pen.

No, but Soleimani was seen as 2nd important person/influencer of iranian foreign policy, which I think is a good match to Pompeo in terms of the ranking.

Not a fan of Pompeo.

Graduated first in his class from West Point, which, like all the US military academies, is far more difficult to be accepted into than other undergraduate universities, like Stanford or Harvard or Duke.

Left the Army after serving the academy time obligation at the rank of O3 (Captain). Went to law school at Harvard. Joined Williams & Conolley, the most selective law firm in the US, located in Washington DC.

Parents not rich. No evidence accomplishments derive from anything but intelligence and merit.

Not pleased with him having a Koch swamp aspect the President hoped to drain, but suggesting he is unable to grasp concepts just cannot make sense given the credentials.

Oh, and he once ran Sentry International, an oil equipment firm. Pretty sure they were non fracking equipment at that time. Conventional well pumps.

Hint:

He is military, not from a educational perspective (or he would not be military)

I don’t know what that means.

His Bachelors degree was in Engineering Management. Most in that discipline seek a Masters but West Point’s program encompasses both. Stanford, Duke and of course Hopkins offer degree programs in Engineering Management. The academies bestow bachelors degrees on graduating cadets and they usually are well beyond any accreditation minimums. These are undergraduate institutions. Military subjects are in addition to what civilian schools would teach. Not instead of. Degrees offered at West Point include all of the sciences and engineering disciplines as well as Philosophy, English, Foreign Languages, Psychology, Sociology and PoliSci.

A graduating cadet this year from West Point has been selected to be a Rhodes Scholar.

A typical 4.0 GPA is required in high school of applicants to the academies. Operative word is typical. There have been 3.95 applicants accepted. It’s very rare because there will be competing applicants with higher GPA. An applicant must have participated in leadership positions at their high school in extracurricular activities of both athletic and non athletic sort. This usually means some kind of debate club plus lettering on some sports team.

Additionally, each member of Congress is allowed to make 2 recommendations from the district (or state if a senator) per year per academy. Without such a recommendation the applicant will not be accepted. If the applicant with a Congressional recommendation does not have a 4.0 or a history of leadership in high school, they will be rejected. Congress staff people know this and they no longer recommend applicants with no chance.

You don’t see anything like this for other universities. They are accepting less qualified candidates. I don’t know where you got the impression that academy grads are uneducated, but it’s essentially absurd. These kids are the cream of the national crop.

You don’t comprehend what I’m saying.

He was going to a Military School– you have subtracted your ability to educate yourself by agreeing to those conditions.

Having “requirements” to enter is just having selective agreement among people wanting those reductions in their “education”.

Look at the result of that “education”.

Reality often brings enlightenment.

50 Universities with the Most Nobel Prize Winners

https://www.bestmastersprograms.org/50-universities-with-the-most-nobel-prize-winners/

West Point is absent–

What a surprise!

West Point is not a research institution. How could there be Nobel Prize winners? None of the academies are research institutions.

There is a Naval Post Graduate Institute in Monterrey, but generally, advanced degrees for academy grads are sought from civilian universities who have research programs. This usually happens after some years of service when it becomes clear senior ranks require an advanced degree.

Graduating cadets who wish to compete for med school will nearly always win that competition because they will have superior qualifications. On graduation from med school they will be expected to serve as military doctors X number of years. Most choose to stay and complete a career. The same is true of JAG oriented cadets, who will apply to law school and generally always be accepted in any competition.

I don’t think you understand these kids are in a different, higher league than elsewhere.

Norman Foster Ramsey’s father went to West Point—

Fill me in– where and who are they?

Berkeley has a parking lot for theirs—

Law is nice (my daughter is a lawyer), and we need doctors, but they are not research scientists, getting Nobel Prizes.

Technicians at best.

Enlighten me– surely a few are able.

Hightrekker, what institution of learning endowed you with your irrefutable reasoning?

Surely you can enlighten me on Nobel Prizes from West Point grads.

There must be hundreds—–

Pompeo is a Jesus freak. That mans he is not mentally capable of understanding what is going on in the Middle East and Central Asia, because he sees everything through the filter of fairy tales and outright lies that make up his world view.

The brainwashing that American military training puts you though is increasingly influenced by crazy Christian ideologies.

He claims to be doing “God’s work” in the Middle East, but that mans trying to foment a nuclear war between Israel and Iran, which nutjobs of his ilk believe will trigger “The Rapture”.

https://www.dailykos.com/stories/2020/1/5/1909619/-Pompeo-Awaiting-the-Rapture-Pushed-Trump-to-Strike-Iranian-General-Soleimani

No, but Soleimani was seen as No2 in Iranian foreign policy, same ranking I would give Pompeo – without weighting his skills…

In think Envision is right. Soleimani was a high ranking figure. While it’s difficult to define an equivalent in another country, Pompeo looks like a good shot (no sarcasm intended here).

This will bring global volatility to new highs, including oil prices and economic development. Now it’s absolutely impossible to predict the developments that will take place in 2020.

From now on it’s not just flipping a coin anymore – it’s rather playing Russian roulette.

it’s like killing Pompeo

Really? Taking that idiot out of the picture would be of no concern.

Lets refrain from talk of killing individuals. Thanks.

Agree, sorry for the post

Gosh, ~20 ignorable posts just because OP compared Soleimani to Pompeo-really folks?

Anyway, Trump is insane. I hope the Iranians will somehow refrain from reacting and wait for the Democrat candidate to (hopefully) win.

Soleimani was much more important to Iran, than Pompeo to USA.

Pompeo is a dime a dozen.

Lets remember- the biggest qualification for being a Trump appointed official is being ‘a yes man’. Thats all that counts with him.