The North American Baker Hughes Rig Count came out Friday. The decline continues. Baker Hughes gives an oil and gas breakout for every basin and state with five years of historical data.

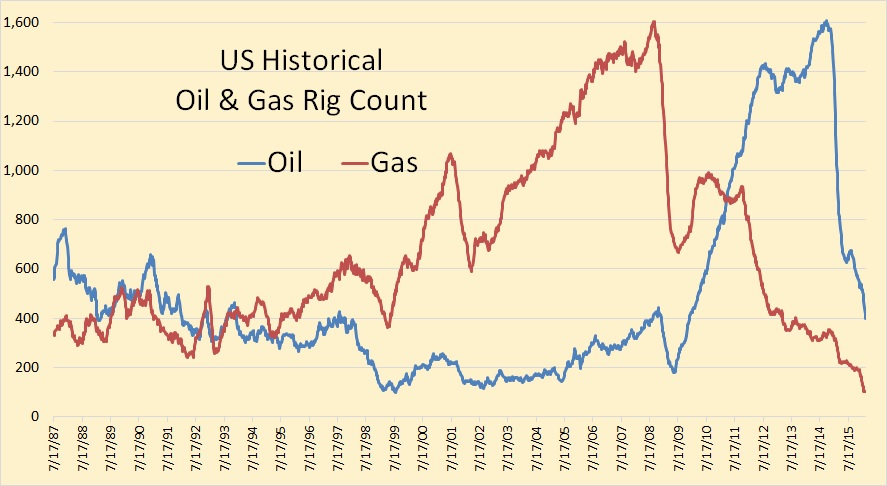

Baker Hughes has twenty eight and one half years of historical data for total US rigs but only five years for individual basins. Gas rigs peaked in August 2008 at 1,606 rigs, over six years before the peak in Oil rigs. On February, 26, gas total US gas rig count stood at 102, a decline of over over 93%.

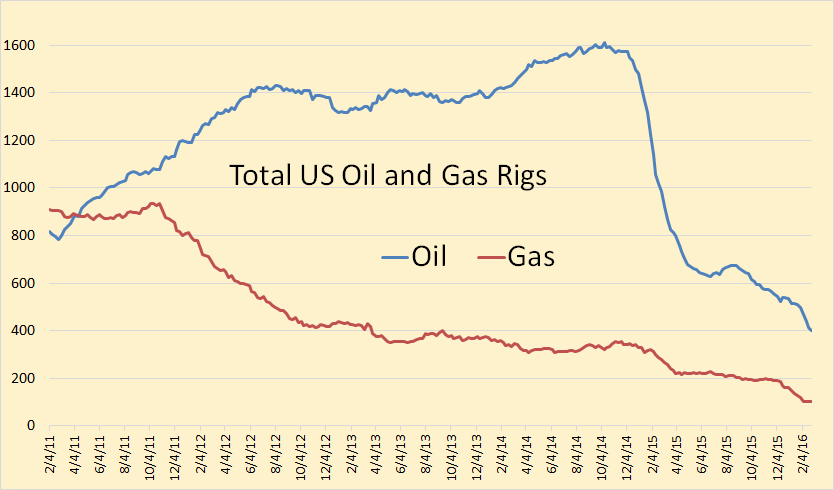

A closer look at the total US total rig count.

October 10, 2014 1,609 rigs

February 26, 2016 400 rigs

Percent decline 75%

In figuring the percent decline for each basin I have use October 10 as peak, the week US rigs peaked even though all basins did not peak on that week.

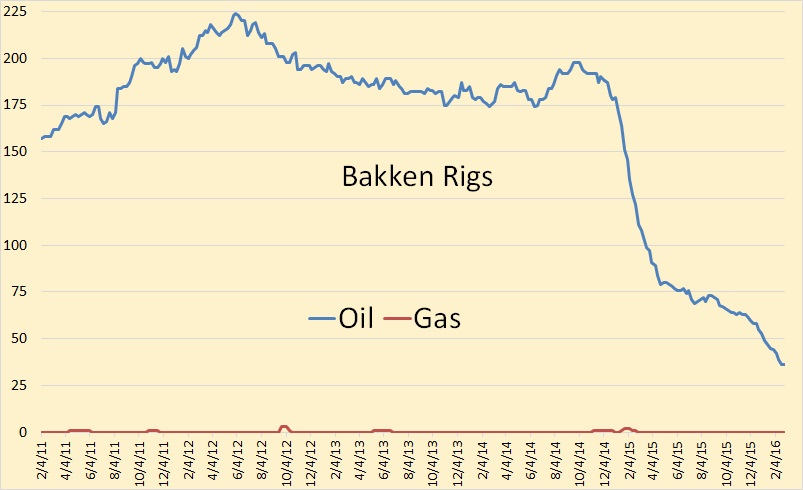

Bakken

October 10, 2014 198 rigs

February 26, 2016 36 rigs

Percent decline 82%

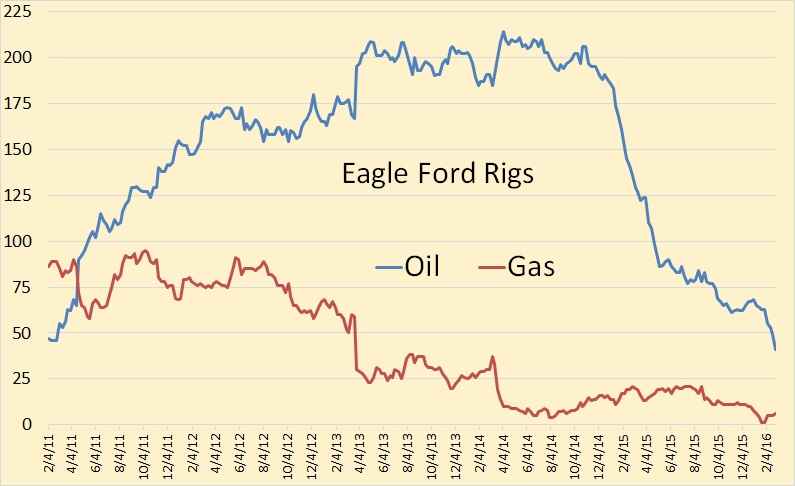

Eagle Ford

October 10, 2014 202 rigs

February 26, 2016 41 rigs

Percent decline 80%

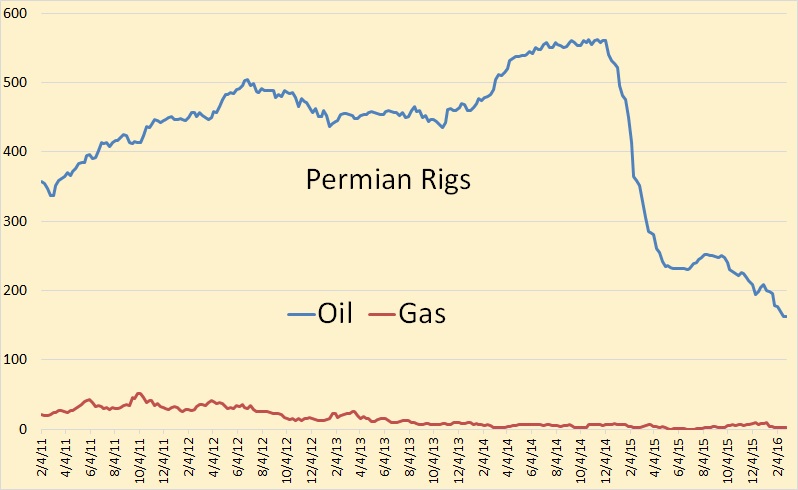

Permian

October 10, 2014 554 rigs

February 26, 2016 162 rigs

Percent decline 71%

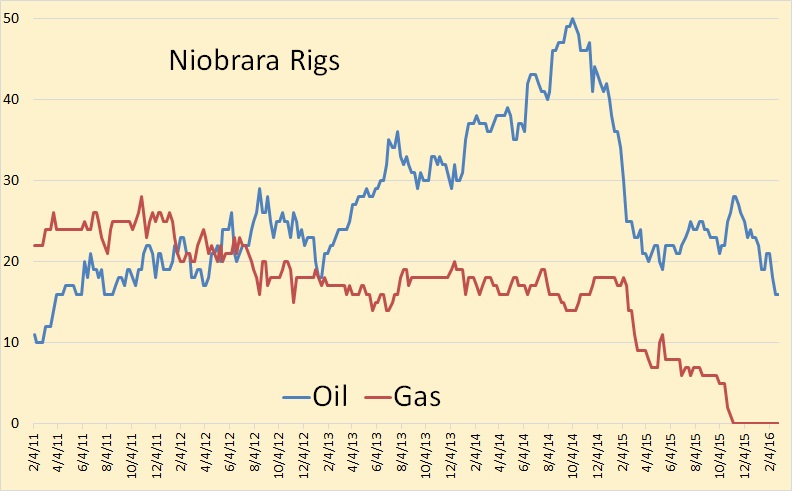

Niobrara

October 10, 2014 50 rigs

February 26, 2016 16 rigs

Percent decline 68%

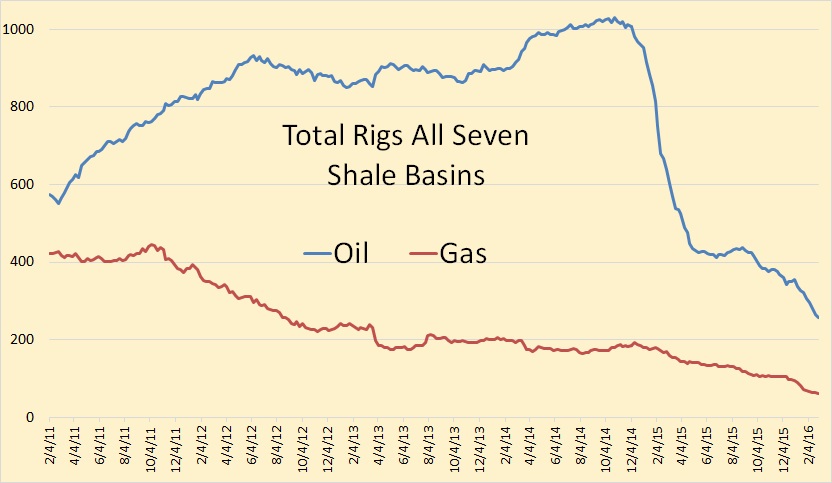

Total rigs all seven shale basins

October 10, 2014 1,028 rigs

February 26, 2016 257 rigs

Percent decline 75%

Note: There are shale (LTO) wells outside the seven shale basins and there are conventional wells inside the shale basins. So the above chart and the one below should in no way be taken to represent shale versus conventional. But they are somewhat of a guide. Wells drilled in the shale basins are, by a wide margin, light tight oil wells, except for the Permian that is. But outside the shale basins it is not so clear. I have no idea what percentage of wells drilled outside the shale basins are LTO wells, but the percentage is not small.

One more point to note. This past week horizontal rigs declined by 19 while vertical rigs increased by 8… whatever that means.

Total rigs outside shale basins

October 10, 2014 581 rigs

February 26, 2016 143 rigs

Percent decline 75%

In the shale plays a drop in the rig count does not mean a drop in well completions. And except for the Bakken, we have only a vague idea how many wells are being completed each month. We know that the inventory of DUCs, (drilled but uncompleted wells), is quite high. But if so, why are any shale wells being drilled at all? Well here is one reason:

DUCs in a Row for 2016: It’s Anybody’s Guess

Jeb Armstrong, Vice President of Energy Research for the Marwood Group, doesn’t expect most producers to have a large inventory of DUCs. Instead, he sees the backlog as a matter of circumstance rather than a way of loading up on potential volumes. “The only reason why I can see a company willingly drilling DUCs is because they have a rig contract that’s too expensive to cancel,” he said in an email to Oil & Gas 360®. “Might as well keep the rig operating and plow the capital into the ground than pay a penalty to the rig owner.”

Raymond James analysts shared a similar viewpoint, noting a certain dynamic on the oilservice industry. “Lower returns and crimped cash flow lead operators to slow activity and conserve cash in any way possible,” the note said. “Since many of the land rigs had longer-term contracts and the frac crews didn’t, the quickest way to conserve cash is to drill but not complete.”

But wells are obviously being completed. In fact more wells are being completed than being drilled but we obviously don’t know just how many. And…

DUCs to Prolong Shale Boom Hangover

Many prognosticators of oil and gas markets have found themselves on the wrong side of US production calls throughout the shale era after failing to understand and model the risks associated with operational momentum. Increases in well productivity brought higher potential returns, and every company in the oil patch scrambled to gain the assets, people, and infrastructure to grow production (and hopefully cash) in the future. As supply growth outpaced demand, prices sank, but production hasn’t responded with an equal intensity. Why doesn’t production respond accordingly? The same reason you can’t turn around an aircraft carrier on a dime, momentum.

The momentum of the shale boom can be seen in the large overhang of drilled but uncompleted wells (DUCs) sitting out in the field today, looming over the market and weighing on any potential oil price recovery…

Until the number of DUCs returns to levels more aligned with historical working inventory levels (3-6 months of drilling), we expect their threat to loom large over the market and have a dampening effect on any near-term price recovery. But their longer term impact could loom just as large. If producers steer too much capital away from drilling, and instead harvest DUCs to maintain production and cash flow in 2016, the human capital behind the rig fleet could be lost to other industries, making service cost inflation all but guaranteed when US supply growth is again needed. It looks like this hangover will be felt for years to come.

Conclusion

The decline in the oil rig count cannot, in the near term, be directly linked to a decline in oil production due to so many DUCs. But eventually it must. Steep declines in oil production must eventually follow steep declines in the rig count. And as we see a drop in production we will see a corresponding rise in prices. This, in turn, will cause an increase in well completions, knocking the price back down again.

So don’t expect any quick recovery of either oil prices or production. Yes, it looks like the hangover will be felt for years to come. And in the meantime peak oil will be in the rear view mirror. But no one will notice for years to come.

Why would they have DUCs? Because, they are maybe profitable wells at a higher price. How is that going to affect this lower for longer nonsense?

There are always DUCs. There have always been DUCs, even when the price was well above $100 a barrel. In fact the inventory of DUCs grew every year that the price of oil was in the $100 range. And the number of DUCs reached their peak while prices were still high. There are DUCs because there is always a delay between when the drillers finish their work and when the frackers start their work. And the number of DUCs grew, during high prices, because there were more wells being drilled than wells fracked.

Higher prices will bring on more completions, bringing on more production, knocking prices back down again, keeping prices lower for longer. Right or wrong, that is simple logic. It is not nonsense.

Though higher prices will only bring on more completions if there is money to pay for them, which is not a given.

That interrupts the logic, and is not to be considered. It is not important that upstream companies are out of bucks, and nobody will lend them any. Drilling will continue to be done with cash available until which time, the coffers start filling. May take some time to put into completing those wells that are only profitable at 80. Be quacking for quite a while. However, that interrupts the logic of lower for longer, so it is not to be considered.

You don’t have to be an economist or a CPA to figure out how difficult it will be for oil companies to again be growing at this point. It is mostly going to be funded by internal cash flow. Let’s assume that EIA’S estimate of the average Eagle Ford’s EUR to be 168,000 bbls, and somewhat meaningful. So, maybe the average first year’s production to be 75,000 bbls. At 100 a barrel, they recover the cost of the capex, plus a little more. They can drill another well with positive cash flow. Probably describes the average DUC. At 80 a barrel, they are in negative cash flow. Probably, a profitable well, but negative cash flow. They did not make back enough money to drill a new well the first year. Later, next year, but not by the end of the year. So amount available for capex goes down. At 40, they may, or may not recover the cost of the well. If the DUC is an average Eagle Ford EUR, then it could sit for quite a while if lower for longer is the logic.

That is the main reason you won’t see large scale ramp ups on production until it stays over 70 for a while. A large percentage of the area is average, or less than average.

Oil Production Vital Statistics February 2016

Thanks for the article and charts Euan. I find the Middle East OPEC rig count data going back to 1995 very interesting. It looks like 2011 saw a surge in the Saudi, Kuwait, UAE, Qatar rig count (from roughly 60 to 150). Crude oil production from those four doesn’t seem to show much increase over the time period that the rig count has more than doubled. Kuwait is flat to down, KSA is flat to up, Qatar is down and UAE is flat. I assume that all of that drilling activity is infill drilling and that this perhaps might contribute to some steeper decline curves in the future than if the infill drilling had not taken place. It seems OPEC Middle East is drilling like mad to stay flat.

Anybody know the OPEC Middle East rig count split between oil and gas rigs?

Anybody have any historical data on how infill drilling contributes to steeper future decline rates in conventional fields?

Thanks for the post Ron.

Couple of comments:

– I think the rig count is an important metric to follow. However, some adjustment is needed to correct for the fact that rigs are more efficient now in drilling wells. Probably several reasons for this (better rigs, crews, methods, pad drilling, drilling in a closer area, etc). E.g., in ND in 2012 every rig on average drilled 0.8 well per month. In 2014 this was 1.1, and in the last few months it was 1.4. I agree with you that the rig count eventually has to impact production (it will be with some delay, and corrected with the above factor).

– Shallow showed a comment from the Hess CEO that another reason to keep drilling was to keep at least some experienced production staff in the company.

– Another reason why production hasn’t fallen as rapidly as some expected was that newer wells produce a bit more in the first couple of months, followed by a steeper decline. This can be seen from the production profiles from the different shale areas. This is more like a one-time gain however.

– Some companies apparently do intend to drill more wells than complete them in 2016. Continental Resources plans to drill 73 wells, and complete 26 (net) wells in 2016. Note that in 2015 they actually reduced the number of wells waiting for completion by 35. Completion is about 2/3 of the total well cost.

Completion is about 2/3 of the total well cost.

Thanks Enno, I did not know that.

Imagine the production profile if they could complete every single well in the fracklog on the same day, vs if they complete one a day for the next 11 years.

These are obviously absurd examples, but just to make the point that really what we would like in order to accurately predict production is a ‘frac crew count’ rather than a rig count, and to agree with what you say above.

Re: Survivor Bias in Calculating Decline Rates

Enno,

Following is a link to, an excerpt from, a question I posed on a prior thread. It’s my understanding that you are attempting to correct for survivor bias, in regard to decline rates, by dividing annual production by the original number of producing wells. I constructed a simple model which seems to show that this makes no difference. It seems to me that one is calculating rates of change in total production in both cases (total production or total production divided by original number of wells).

http://peakoilbarrel.com/texas-oil-production-still-on-a-plateau/#comment-560963

Jeffrey,

I don’t use the well count. For each vintage group, for each exact year on production, I sum the latest 12 months production, and compare it with the total (again over all relevant wells) 12 months production of the prior year on production.

For example, to calculate the decline rate of the 2008 vintage group, in year 4, I calculate the total production these wells had in their 4th year of production, and compared it to the total production from the same wells in year 3 on production.

I have excluded wells that appear to have been refracked from the whole set, to try to establish the natural rate of decline.

As I noted in my comment, I agree that this works for volumes, but not for rates of decline, i.e., there is no difference between rates of change for total production by vintage year versus total production by vintage year, divided by the original number of wells.

Following is an excerpt from my comment linked above:

The exponential year over year rate of decline in total production from 2012 to 2013 was 22%/year (natural log of 336/420).

If we divide the 2012 and 2013 production by 10, i.e., the original number of wells completed in 2010, the exponential year over year rate of decline in production was also 22%/year (natural log of 33.6/42.0)–as the number of producing wells on the lease fell by 75%.

So, again, unless I am missing something, it seems to me that the rates of decline chart you showed reflects the rates of decline in total production by year, without any weight given to survivor bias.

Are you disputing this?

The only way I see to address the survivor bias issue is to show the number or percentage of plugged/inactive wells by year, on the same chart as the year over year rates of decline chart. On the example I showed, the plugged/inactive percentage would be 0% in 2010, rising to 90% in 2013.

Jeffrey,

I understand your example, but I don’t see an issue regarding survivor bias. The 22% is the decline number I am interested in, as it reflects the total decline that can be expected for that group, for that year.

In any case, it’s a non-issue for now, as not many wells are dropping out yet (about 1% of wells a year). Let’s leave it at this.

I agree that the 22% decline number reflects the decline from the wells still producing, and the percentage of plugged/inactive wells may or may not be material in regard to survivor bias. But that is not the issue. It doesn’t matter whether 1% of the original producing wells or 50% of the original producing wells are plugged/abandoned at a given point in time.

This is a math question.

If production for a group of wells (not my model wells) completed in 2010 declines by 80% from 2010 to 2015, while the percentage of plugged/inactive wells (completed in 2010) increases from 0% in 2010 to 50% in 2015, are you seriously asserting that there is not a survivor bias issue? Or for that matter, if the percentage of plugged/inactive wells increases from 0% in 2010 to 1% in 2015.

In any case, why not include a chart showing the percentage, by year, for the plugged/inactive wells along with the chart showing decline rates by year? For example, 100% of the wells completed as oil wells in 2010 had some level of production, and what percentage of those 2010 wells were plugged/inactive by year, as time goes on?

Probably the best way to show a survivor bias chart is to show the number of wells showing some level of production as time goes on, expressed as a percentage of total number of wells with reported production in the reference year. That way, the slope of the curve would be in the same direction as the slopes of the decline rates. For my example, the survivor percentage by year for my 10 well model would be:

2010: 100%

2011: 70%

2012: 40%

2013: 10%*

*2013 and subsequent years until last producing well is plugged.

Of course, when the survivor percentage hits 0%, production = zero.

An interesting question would be projected half-life, to-wit, how many years would it take for the survivors among a group of wells completed in a given year, e.g., 2010, to be reduced to 50% of the original number?

As noted above, the observed half-life for the 2007 vintage wells completed on the DFW Airport Lease in the Barnett Shale Play–the wells that Chesapeake asserted would produce “for at least 50 years–was about five years.

Hi Jeffrey,

As Enno points out for the Bakken/Three Forks after 8 years about 1% of 2007 wells that were not refracked have been permanently abandoned. The average 2008 to 2012 well will be shut in at about year 15 if they are profitable to produce at up to 7 b/d of output. This will depend on oil prices in 2023, which are hard to predict.

Dennis,

Are you now arguing that the survivor bias is not material, whereas you previously, and repeatedly, asserted that there was no survivor bias in regard to rates of change calculations? Following is a link to the original question, followed by three of your comments:

http://peakoilbarrel.com/texas-oil-production-still-on-a-plateau/#comment-560612

*In regard to my model

Hi Jeffrey,

As I said before get the spreadsheet and present whatever you think is important.

I am arguing that there is no survivorship bias, and even if there were it is not important because there is so little of it.

Or in short, I agree with Enno Peters, and will also try to leave it there.

Following is my original question, followed by Enno’s response. My point was and is that Enno’s approach is a pointless exercise in regard to rates of change, since he is, in both cases (with or without attempted survivor bias adjustments) simply calculating rates of change in total production.

And here is the question that Enno has still refused to address:

“the percentage of plugged/inactive wells (completed in 2010) increases from 0% in 2010 to 50% in 2015”

This is a hypothetical assumption. The real number of plugged wells is low and therefore it can be ignored

The 50% abandonment number in five years was based on a real life case history in the Barnett Shale Play, the 2007 vintage wells on the DFW Airport Lease that Chesapeake asserted would produce “for at least 50 years.”

As I said, it doesn’t matter whether one assumes a 50% or a 1% abandonment percentage in five years, this is a math question.

Are you guys incapable of answering a math question?

Enno and Dennis have repeatedly asserted that that there is NO survivor bias.

In any case, at least for people who do not reject fundamental mathematical principles, it’s when, not if, that survivor bias becomes a factor in regard to year over year rates of change calculations.

Hi Jeffrey,

Lets say output was 500 kb/d in 2010 from 500 wells and in 2015 these same 500 wells were producing 100 kb/d, but only 250 of the wells were producing. If I use 500 wells in the denominator for both 2010 and 2015 to find the output of the “average” well then in 2010 the average well produced 1000 b/d and in 2015 the average well produced 200 b/d.

There would be survivorship bias if I claimed the “average” well produced 400 b/d in 2015 and that is not what I do.

So I don’t see any survivorship bias. As long as we include all the wells in the data (including those abandoned) survivorship bias is eliminated.

Hi Jeffrey,

Could you define survivorship bias?

Perhaps Enno and I understand this term differently from you.

Enno and I consider output from the entire play or in my case I will often construct a hypothetical “average well” where the average well profile is equal to total output divided by the total wells completed.

You are correct that this is a question of arithmetic.

Let’s say 50% of the wells were abandoned and initially there were 100 wells completed. If we take total output and divide by 100 to find the average well profile, then for this hypothetical average well there is no survivorship bias.

There would be survivorship bias if I divided output by the number of producing wells to find the average well profile, but that is not what is done, I use 100 in the denominator even if there are only 50 wells producing (in the example above.)

Survivorship bias is only an issue of one uses producing wells rather than the initial number of wells completed when calculating average well output. The denominator is held fixed regardless of the number of wells plugged.

Dennis,

I am not sure what JB’s beef is.

Included in your model is that the wells have declined to the extent that they aren’t contributing much to the total.

It is possible that he is not including in his math a hyperbolic or diffusional decline per well?

That’s what’s great about having access to all the Bakken oil data. For once, we can actually do accurate depletion modelling and book-keeping. Using convolution techniques, one can keep track of wells coming on-line and generate cumulative production curves that match the actuals — just by using an empirical per-well decline model.

The painful truth may be that this approach is sophisticated enough that it is not taught in any petroleum engineering or reserve engineering textbooks. But then again, why would they teach this, since it has nothing to do with maximizing production efficiency. It’s simply something that needs to be done by oil patch outsiders interpreting how fossil fuel reserves decline.

Hi WHUT,

If there is someone that gets the math, it would be you, yes the output of the wells at the end of their lives is low.

Mr Brown seems to think when a well profile is presented for wells completed in 2010, that we take output and divide by the number of producing wells.

If that is what we did there would be survivorship bias, but we don’t do that.

If there were 1000 wells completed in 2010 we take output an each year (or month) and divide by 1000 wells, no matter how many wells are actually producing.

That eliminates survivorship bias when an average well profile is calculated, unless I am missing something.

Hi Jeffrey,

You said:

I agree that the 22% decline number reflects the decline from the wells still producing, and the percentage of plugged/inactive wells may or may not be material in regard to survivor bias.

The 22% decline rate reflects the decline rate of all wells completed not only the wells still producing.

Let’s say 1000 wells were completed and output was

100 kb/d (example chosen for simple arithmetic rather than realism) in the first year, let’s also assume that 1 year later output fell to 80 kb/d from the initial 1000 wells, but that 100 wells were plugged and abandoned.

No survivorship bias

year 1 output is 100 b/d for average well

year 2 output is 80 b/d for average well

a decline of 20% for first year

Survivorship bias

year 1 100 b/d for avg well

year 2 89 b/d for avg well (80,000b/900 producing wells)

a decline of 11% for first year

I don’t use the number of producing wells, I use the total wells completed in the denominator no matter how many wells are producing, that eliminates any survivorship bias.

The answer to your question in bold is yes that is exactly what I am asserting.

Hi Jeffrey,

As long as one uses 10 wells in the denominator for all years to construct an “average” well profile there is no survivorship bias, if one used the number of producing wells in the denominator there would be survivorship bias.

I use your model above to find a NSB (no survivorship bias) average well profile and an SB (survivorship bias) average well profile. Chart below.

Price is too low to allow wells to live long. It’s as if the ground moved up.

As noted up the thread, I showed that dividing annual production by the original number of producing wells (10 wells in the model I showed) to correct for survivor bias has no effect on rates of change calculations. In both cases, one is simply calculating the year over year rates of change in total production from surviving wells, and as noted, it’s when, not if that it becomes a material factor.

Dennis had the following response in one of his previous comments:

How does one respond to people who reject fundamental mathematical principles? More importantly perhaps, why should one waste one’s time responding to people who reject fundamental mathematical principles?

I think it’s time for another grizzled oil patch veteran to bid you guys adieu. Good luck with your continuing efforts to, in effect, to assert that 1 + 1 = 3, because it feels like a better answer.

Hi Jeffrey,

No we are not using surviving wells in the denominator, this is what you fail to see. We use the total number of wells completed in the denominator.

Hi Jeffrey,

Which mathematical principles are being ignored?

We complete 10 wells and track output of those 10 wells over time.

Average output for those 10 wells is total output divided by 10. It doesn’t matter if 9 of the wells have zero output, the average output is still the total output divided by 10. Please point out the mathematical error in this reasoning.

Hi Enno,

Please keep up the good work and please keep providing us with great data on the LTO plays. I am convinced that it is you that understands the basic arithmetic here. There is no survivorship bias as long as all completed wells are included in the denominator of any average well calculation. If we reduced the magnitude of the denominator so that it matched the “producing wells” rather than keeping the total wells completed number constant (regardless of how many wells had been abandoned), then there would be survivorship bias.

There are those that fail to understand this fairly basic point.

Jean Laherrere had a post on POB that indicated a 20 to 30 month lag between rig count and production, during the expansion phase. Empirically the curves seemed to match but I don’t get why the delay is that high or the correlation so close. However if true it would suggest production is going to fall off of a cliff over the next 2 to 6 months.

http://peakoilbarrel.com/bakken-oil-peak-jean-laherrere/

“Another reason why production hasn’t fallen as rapidly as some expected”

Rats can chew thru a PV Source circuit and you have barbecue but Future Energy Production is not Jeopardized. With an unconventional well It’s my understanding that the Resource may be affected if shut in or altered. Perhaps in the environment, E&P’s “can not afford” to take this risk (??)

Enno,

Thanks for your comment.

Baker Bughes in 2012-2014 issued well count for key U.S. oil and gas basins.

Using the well count and rig count, they have calculated the number of wells drilled per 1 rig per 1 quarter and year.

Unfortunately, this product was discontinued in 2015.

Below are their numbers for the Williston basin:

Debt swaps become a tough sell for cash-strapped U.S. energy firms

The deepening slump also means that producers need to offer more attractive terms – higher interest payments and more collateral – to win over investors and avoid the brutal equity wipeout that happens in most bankruptcies.

The two biggest operators in the Bakken, WLL and CLR has said that they will not complete any wells that they are drilling in the Bakken until oil prices are in the mid $40s.

Both companies have a few rigs drilling there.

Sharp decline in oil demand predicted according to Oilprice.com article.

“But BNEF sees EVs displacing 2 million barrels per day (mb/d) of oil demand as early as 2023. That is just the start. The real pain will come after that point as EV sales start to skyrocket. BNEF estimates that EVs could capture 35 percent of the market by 2040, which would displace 13 mb/d. For an oil market currently in tatters because supply is exceeding demand by a meager 1 to 2 mb/d, the destruction of 13 mb/d of demand should be unsettling, to say the least. EVs present an existential threat.”

http://oilprice.com/Energy/Energy-General/Electric-Vehicles-Could-Soon-Reduce-Oil-Demand-By-13-Million-Barrels-Per-Day.html

I don’t think that Bloomberg New Energy Finance or OilPrice has a good handle on the peak oil problem, but this is landmark prediction from mainstream corporate America as to the potential of EV’s . Imagine if they added in the high mpg ICE’s that are bound to be produced in competition (or through necessity) to EV’s, the projected demand would be even less. Add a carbon tax system and the demand for oil will drop further.

Rough and ready arithmetic without even a napkin indicates that in order for electrified cars to displace a couple of million barrels of oil per day, somewhere in the general neighborhood of ten million will have to be on the road and in regular use, depending on assumptions about how much they are used.

If the price of batteries declines sharply, as expected, and as soon as expected, I can see that many pure electrics and plug in hybrids on the road in 2023. Some countries will continue to subsidize them directly , and others will subsidize them indirectly via higher fuel taxes or import taxes. A few localities may simply mandate electrics only for new car sales.

Here in the Land o the Free and the Home of the Brave, we tend to forget that most other countries tax the hell out of gasoline and diesel fuel, and the cost of charging in those countries is small, compared to the cost of a tank of gas. So the incentive to save on fuel costs is still there in many places .

Most of us don’t believe it will ever happen, but the social fabric of this country is changing at such a fast rate that a number of formerly unthinkable things have come to pass over the last few decades.

An increase in oil taxes is no longer entirely out of the question in the USA.

Urban folks who don’t drive much will not kick much about a higher gasoline tax if the money is earmarked for mass transit, so as to reduce the traffic they have to deal with.

More and more people are giving up driving altogether, and will be ready to vote a higher tax on gasoline since they are not going to be paying it.

I wouldn’t kick at all if my state doubled the state tax, so long as the revenue are spent on road maintenance, or on mass transit. The savings in vehicle wear and tear and time would be a bargain for me, even though I don’t drive much any more.

And even though I never take a bus or subway these days, the more people that do, the cheaper gasoline will be.

With more and more non driving poor people, politicians may eventually find it expedient to use some fuel tax money to subsidize general revenues, rather than the other way around, using general revenues to maintain and build roads. Give it ten more years, and you may see it happening, in some states and some localities.

The price of Lithium Carbonate needed for batteries has gone from 6,000 per ton to $14,000 per ton in the last year. Any increase in demand will send the price of batteries up not down.

This guy says $6,000/ton in 2016 for “big 3”.

http://investingnews.com/daily/resource-investing/energy-investing/lithium-investing/lithium-price-2016-joe-lowry/

Also, we’re dealing with about the same situation as the LTO-patch,

hype and boom leading to excess supply soon enough.

The same has happened with silicon for pv cells.

Once manufacturers realized that there was continued demand, they ramped up production.

The exact same will happen with raw materials for batteries.

Anecdotal evidence to be sure, but when I got home today there was a young woman on an electric bicycle standing by my parking spot talking on her cell phone. So I said hello and chatted a bit. She has no intention or need to buy an ICE vehicle. More interesting was that her battery pack was homemade from recycled laptop batteries. She charges her batteries at home but she talked about getting a charger with foldable solar panels that she could take with her to both charge her bike battery and smart phone. I have a hunch that there are a lot more of her generation who are not going to be using a lot of gasoline to get around in the near future. That means more and more demand destruction for oil.

Fred, bicycles are good for some areas, but deadly in the icy weather that lasts up to 5 months in my region.

Considering that a Toyota Camry uses only 7 horsepower to drive at 60 mph on a level road, I think that four wheeled low horsepower vehicles may become all the rage in the future. 20 to 30 horsepower is all that is needed for a personal vehicle if properly designed and not overloaded. I can see 10 horsepower electrics being practical for personal and local transport.

They will certainly not need nearly as much material or build energy, while being highly conservative on fuel or electricity.

Fishin’

They have to simplify the cars and lighten them up, big time. Right now, our 2009 Yaris is, (in my opinion) at least twice as heavy as it should be. We had to order hand crank windows, beilieve it or not, but air bags are mandatory.

Jeez, I woke up today and got going with life by 5:30. It was 7 deg and raining. Supposed to be a high of 11 deg. It is now 3 deg and sleeting blowing 45 kts. I just lit the woodstove in the shop and am waiting for our spring to arrive. Not biking weather at all!!

https://goo.gl/56s3I1

Cycling to work in winter (Oslo, Norway)

More anecdotal…12 years ago I worked with the #1 bike trailer company in the world, which was a Co-op by the way, and we made more recumbents than anyone. Bought out and dismantled by a huge private equity firm now none of it is happening.

Opened a small restaurant across from the University and got heavily involved with localization, transition, sustainability, local food production, etc. We set up a bike exchange and maintenance center where I helped people electrify bikes with hub motor retrofits. University started an ev challenge project with national races. The excited young folks made it all so worthwhile.

Turns out the whole thing was simply a fad, I doubt there is more than 2 or three ebikes still on the road, 90% of the localization efforts are dissolved, sustainability group still meets regularly but the only thing sustained is their group meetings. We have gotten a few more local farmers to plant more food crops but only when they can get a reasonable contract for there crop which is tough as the same bean or grain can usually be shipped in for much less.

Due to the economic vibrance of the University and the fact that Oregon is the #1 state in the nation where people are moving into we now have massive building boom, cost of living increase, 5 times the traffic of 10 years ago, and more monster trucks and suvs than you could imagine. We used to be a biker friendly community now you take your life in your hands.

I am not just countering your cheeriness with doom, I am simply reporting what is happening everywhere I go here on the west coast. My daughter is in the Tempe Arizona area and it is very much the same except that no one rides a bike. I brought her bike out to her when we moved her and she said she was literally laughed at when people saw it. Granted it is too hot to ride most of the time but still. Her boyfriend has dropped out and partnered with some friends to flip properties as real estate is booming.

I don’t doubt what you observed but I estimate it represents about one tenth of one percent or less.

Thanks for the post, Ron

This chart from Rystad Energy indeed shows that the number of DUCs was rapidly increasing during the shale boom, when oil prices were around $100. It has peaked in late 2014 and was decreasing since then

If the number of DUCs is almost unchanged for the last 9 months it implies the number of completions is falling in lock step with the number of wells being drilled. Drill rigs are becoming more efficient on average, but it still implies a very rapid fall-off in production in the coming months.

If no wells are completed in 2016, output in the Bakken drops by roughly 40%per year in the first year. Not a very realistic scenario, though. If an average of 35 wells per month are completed, the drop is about 25%/year. If 60 wells per month are completed, output drops about 20%/year and 70 wells completed per month results in about a 15% drop in Bakken/Three Forks output.

I have no guess about how many wells will be completed, but somewhere between 0 and 70 new wells per month on average for 2016 will probably cover it.

Bakken rigs down to 35, with one to lay down/stack.

McKenzie county, makes up 19 of those 35 rigs.

Mountrail and Williams are at 5 and 4 respectively,with Williams about to go to 3!

Dunn Co at 6.

I have to agree with Ron, This sharp downward trend has to have a direct effect on the Bakken oil production, in the shorter time frame,rather than the longer term,

From Reuters:

U.S. shale’s message for OPEC: above $40, we are coming back

Mon Feb 29, 2016

http://www.reuters.com/article/us-usa-oil-shale-idUSKCN0W20JH

For leading U.S. shale oil producers, $40 is the new $70.

Less than a year ago major shale firms were saying they needed oil above $60 a barrel to produce more; now some say they will settle for far less in deciding whether to crank up output after the worst oil price crash in a generation.

Their latest comments highlight the industry’s remarkable resilience, but also serve as a warning to rivals and traders: a retreat in U.S. oil production that would help ease global oversupply and let prices recover may prove shorter than some may have expected.

Continental Resources is prepared to increase capital spending if U.S. crude reaches the low- to mid-$40s range, allowing it to boost 2017 production by more than 10 percent, chief financial official John Hart said last week.

Rival Whiting Petroleum, the biggest producer in North Dakota’s Bakken formation, will stop fracking new wells by the end of March, but would “consider completing some of these wells” if oil reached $40 to $45 a barrel, Chairman and CEO Jim Volker told analysts. Less than a year ago, when the company was still in spending mode, Volker said it might deploy more rigs if U.S. crude hit $70.

While the comments were couched with caution, they serve as a reminder of how a dramatic decline in costs and rapid efficiency gains have turned U.S. shale, initially seen by rivals as a marginal, high cost sector, into a major player – and a thorn in the side of big OPEC producers.

Nimble shale drillers are now helping mitigate the nearly 70-percent slide crude price rout by cutting back output, but may also limit any rally by quickly turning up the spigots once prices start recovering from current levels just above $30.

The threat of a shale rebound is “putting a cap on oil prices,” said John Kilduff, partner at Again Capital LLC. “If there’s some bullish outlook for demand or the economy, they will try to get ahead of the curve and increase production even sooner.”

Some producers have already began hedging future production, with prices for 2017 oil trading at near $45 a barrel, which could put a floor under any future production cuts.

While the worst oil downturn since the 1980s sounds the death knell for scores of debt-laden shale producers, it has also hastened the decline in costs of hydraulic fracturing and improvements of the still-developing technology.

For example, Hess Corp., which pumps one of every 15 barrels of North Dakota crude, cut the cost of a new Bakken oil well by 28 percent last year.

What once helped fatten margins is now key to survival in what Saudi Oil Minister Ali al-Naimi described last week as the “harsh” reality of a global market in which the Organization of Oil Exporting Countries is no longer willing to curb its supplies to bolster prices.

While Deloitte auditing and consulting warns that a third of U.S. oil producers may face bankruptcy, leading shale producers say their ambitions go beyond just outrunning domestic rivals.

“It’s no longer enough to be the low cost producer in U.S. horizontal shale,” Bill Thomas, chairman of EOG Resources Inc, said on Friday. “EOG’s goal is to be competitive, low-cost oil producer in the global market.”

Thomas did not say what price would spur EOG to boost output this year, but said it had a “premium inventory” of 3,200 well locations that can yield returns of 30 percent or more with oil at $40.

Apache Corp, forecasts its output will drop by as much as 11 percent this year, but said it would probably manage to match 2015 North American production if oil averaged $45 this year.

One reason shale producers can be so fleet-footed is the record backlog of wells that have already been drilled but wait to get fractured to keep oil trapped in shale rocks flowing.

There were 945 such wells in North Dakota, birthplace of the U.S. shale boom in December, compared to 585 in mid-2014, when prices peaked, according to the latest available data from the Department of Mineral Resources. Their numbers are growing as firms like Whiting keep drilling, but hold off with fracking.

Some warn that fracking the uncompleted wells can offer only a short-term supply boost and a sustained increase would require costly drilling of new wells and therefore higher prices.

“It’s going to take a move up to $55 before we see anyone plan new production,” says Carl Larry, director of business development for oil and gas at Frost & Sullivan.

To be sure, it is far from certain whether oil prices will even reach $40 any time soon. Morgan Stanley and ANZ expect average prices in the low $30s for the full year.

Some analysts also warn resuming drilling quickly may prove hard after firms laid off thousands of workers and idled more than three-quarters of their rigs since late 2014.

In fact, John Hess, chief executive of Hess Corp last week took issue with labeling U.S. shale oil as a “swing producer.” Hess told Reuters in an interview that U.S. shale firms should be rather considered as “short-cycle” producers, which might need up to a year to stop or restart production.

And even scarred veterans of past boom-bust oil cycles are not sure what will happen once prices start to recover – during the last big upswing a decade ago, shale oil did not even exist.

“We are a little concerned that this time there is one dynamic we’ve never had previously,” said Darrell Hollek, vice president of U.S. onshore at Anadarko Petroleum Corp.

—————————————-

Some analysts also believe that drilling/completion activity in the U.S. will rebound in the second half of the year, as oil prices reach $40-45. See, for example, US rig count forecast by Raymond James (chart below). BTW, their energy analyst expect WTI to reach $50 by the end of 2016.

AlexS. This talk is pure desparate talk, and nothing more.

A group of us have been analyzing the Statements of Future Cash Flows in the 10K’s recently released by some of the large shale players, including EOG, CLR, WLL, PXD and CHK.

The assumptions made in the reduction of future production costs are questionable. Here are the revisions from 12/31/14 to 12/31/15 for these companies:

EOG

2014 $51.533 billion

2015 $32.061 billion

CLR

2014 $25.799 billion

2015 $10.869 billion

WLL

2014 $20.772 billion

2015 $12.344 billion

PXD

2014 $18.223 billion

2015 $11.475 billion

CHK

2014 $17.036 billion

2015 $7.391 billion

The only thing I have been unable to determine is whether any drilling and completion costs are included by these companies in “future production costs”

I would note all break out “future development costs” and all have greatly reduced numbers from 2014 to 2015, which makes sense given large budget cuts.

In any event, it is worth noting the future estimates of these companies in the 10K and how radically they have changed from 12/31/14 to 12/31/15.

Further, it is noteworthy that if current oil and gas prices are plugged into the 12/31/15 future cash inflows, there is little positive to negative future net cash flows.

In summary, the claims are not backed up by the company SEC filings, IMO. Also, the large long term debt incurred in prior years cannot be ignored either, IMO.

Here is a repost of CLR’s snake oil sale press release and calculations for PDP reserve adds for CLR and what that implies about EUR’s in the Bakken. If correct, breakevens for the Bakken is much higher than $55.

Sorry, 850K. From CLR’s Q4 press release:

“Given its plans to defer most Bakken completions in 2016, Continental expects to increase its Bakken DUC inventory to approximately 195 gross operated DUCs at year-end 2016. The year-end 2016 DUC inventory represents a high-graded inventory with an average EUR per well of approximately 850,000 Boe. At year-end 2015, the Company’s Bakken DUC inventory was approximately 135 gross operated DUCs.”

From an analyst named Frank, who posts on Yahoo. His calcs look right to me.

“Look at the 10-k reserve and production data – proved developed only of course.

In the Bakken

They added 180 net wells in 2015

They produced 38 mm BO and 47 mmcf ng or 46 mm boe

Reserves declined 15.5 mm BO and ng reserves increased by 16.2 mmcf or 2.7 boe

Therefore reserves declined by 13 mm boe

So adds from new wells was 46-13 = 33 boe from 180 wells. That is 185k boe per well. A little shy of 800k.”

EUR is total expected production from a well during its lyfe cycle, not annual production, especially as these wells were producing less than a year in 2015.

But 850,000 boe EUR still looks overoptimistic

AlexS. Shaleprofile.com is a good place to test the EUR claims, IMO.

See also

http://seekingalpha.com/instablog/121744-mark-anthony/1354531-the-real-bakken-shale-well-decline

I know. The EUR sabove are calculated from the change of PDP reserves adjusted by a year’s production, divided by wells completed. That should give you the amount of reserves added per completed well.

But 850,000 boe EUR still looks overoptimistic

It’s not overoptimistic. It is simply a wild dream that is achievable in 8 years on very few wells. 450,000 gross bbl EUR is more probable overall in the Bakken outside of sweet spots ( or around half of this estimate. )

Some people use 300,000 for their models: three year total 150 kbbl times two)

From an old post

http://peakoilbarrel.com/bakken-1st-24-hour-prod-validity-verified/#comment-475905

The EIA in its Annual Energy Outlook 2015 has a much more conservative estimate of the Bakken wells average EUR: only 203,000 bbls. But this includes a lot of potential (marginal) wells in the periphery of the play that may never be drilled.

Alex,

The EIA in its Annual Energy Outlook 2015 has a much more conservative estimate of the Bakken wells average EUR: only 203,000 bbls.

This is not an estimate. This is a death sentence.

$30* 200,000 = $6 million.

Or in academic language EROEI close to one.

Or, if you wish, EIA certification that Bakken is a Ponzi scheme producing “subprime oil”…

This is how they calculate technically recoverable resources, not economically recoverable.

shallow sand,

Thanks for your analysis. I read all your posts.

I totally agree with you that shale companies’ financials do not justify a rebound in activity even if oil prices rise to $40, $45 or $50.

Hi AlexS,

I agree we will need somewhere from $60 to $80/b. Perhaps costs for the core areas are even lower than this, for the average Bakken/ Three Forks well n North Dakota before the price crash breakeven was between $70 and $80 per barrel, I do not know how much this has fallen over the past 12 to 18 months. Shallow sand would have a much better idea about current break even in LTO plays.

Dennis,

I think shale companies need between $60 and $80 to increase production volumes, while being cash-positive. This implies a moderate growth, not 30% p.a., like in 2013-14

Individual wells in the sweet spots may have much lower breakevens, but cash breakeven at corporate level is always higher.

That said, some companies may start increasing drilling / completion activity at $45-50, even though that would mean burning more cash

Hi AlexS,

I am not sure what would be gained by increasing completions if it is going to increase cash burn.

However I do not understand why the completion rate has remained as high as it has since prices first crashed in late 2014.

One potential explanation is that in core areas the breakeven oil price might be lower, but I doubt it is as low as $30/b except perhaps for the best 1% of the wells.

It seems to me that the smart oil companies will wait for oil prices to reach at least $65/b before increasing their well completion rate, but there don’t seem to be many smart companies in the LTO plays (except perhaps XTO and Statoil).

Dennis,

For many years investors in US E&P companies had rewarded growth over capital discipline. Investment banks’ analysts were ignoring financial risks associated with the shale sector’s growth model. The MSM was cheering the shale boom.

This has created a corporate culture, which is very difficult to transform even in a sharply deteriorated oil market environment.

Therefore, I expect many shale companies to return to growth as soon as oil prices reach $45-50.

This contradicts a normal logic, but this is how these companies are used to work.

Hi AlexS,

Maybe so. I wonder if all the bankruptcies might change the culture a bit. It sure will make finding money to burn more difficult and investors may look beyond the investor presentations to the 10k and the bottom line and reward fiscal discipline.

Hard to know for sure. The banks may pull back and the bond investors may require very high interest rates and industry behavior might change as a result.

Dennis,

a quote from and article:

“once the entire U.S. shale space goes bankrupt, it will emerge debtless only to start drilling and pumping anew prompting the Saudis to continue to ratchet up the pressure in an endless deflationary merry-go-round.”

http://oilprice.com/Latest-Energy-News/World-News/BP-Claims-That-Oil-Storage-Limit-Is-Far-Nearer-Than-We-Realize.html

Hi AlexS,

If the entire Shale industry goes bankrupt, they will have trouble with financing new wells in my opinion. So increasing output will be difficult without financing.

If the assets are bought by companies using there own cash (no bank or bond financing), they will not throw money away on wells that will never break even.

Wouldn’t they solve the financing problem by hedging output?

If future prices are high, you can guarantee a profit for most of the well’s output.

Hi Nick,

Hedging only gets the job done if you can hedge at a price higher than breakeven. If the spot price is $50/b. You would need to be able to hedge at $75/b or more for the average well to break even, in practice this is not likely to happen.

Currently the futures price in Dec 2018 is $10/b above the April 2016 futures price.

So possibly if oil prices reach $65/b hedging might be an option, below this maybe not. (I have ignored transaction costs in this example.)

That makes sense, but I was talking about financing: whether banks or investors would finance new drilling. Wouldn’t hedging solve that problem?

Many oil producers failed to hedge in the last several years, due to overconfidence. They won’t repeat that mistake soon…

Hi NickG,

I am no expert on hedging (very far from it).

I would think the extreme price volatility makes it more difficult to hedge.

In any case all problems could easily be solved by hedging then the price of oil wouldn’t matter, I am fairly certain that is not the case. Hedging reduces risk, but there are costs involved. Oil prices under $50/b as currently forecast by many public agencies and private firms out to 2017 are going to sink the LTO industry leading to many defaults on loans and bonds.

How do you think this affects the availability of financing for LTO firms in the future? Would you expect financing might be more difficult in such a scenario?

You don’t think a hedge means you are paid in advance for output, I hope. It is either a futures contract, a swap, or a set of puts and calls (costless collars). Essentially a contract to sell oil at a certain price at a future date.

It does not help a company that needs cash to drill a well now with the needed cash, this money you either have or you borrow.

This is probably a stupid question, but don’t you need a rig to complete those duc? Or do they have their completion already run and only await the frac-job?

No, you don’t need a drilling rig to complete a DUC. They are awaiting fracking and then the installation of a pump and other hook ups.

Pretty sure 6 million pounds of sand took quite a while to get to the site. And huge swimming pool quantities of water ditto.

Completion is not a wave of the hand. Probably have to compete with others waiting for fewer and fewer trucks.

I beg to disagree, from experience as a rolling stone with time wearing a hard hat. There are almost for sure more fracking crews and more equipment available than there is work.

The ones that work cheap enough are no doubt busy as hell. If the price of a frack job goes up a little, assuming such jobs have been cheaper than usual recently, then folks who recently parked their equipment and laid off their men will go back to work on a week’s notice.

Jobs in the oil fields are scarce as hell now, and most of the people who have been laid off in the last year no doubt have not found new jobs in their industry. You can bet most of them are ready to go back to work asap, and quite a few of them are probably willing to start a few bucks cheaper than they were getting a year ago.

Being a rolling stone, I could usually find SOMETHING that paid ok,when I wanted to work, because I could work in three or four different trades as a journeyman, master of only two, but passable at the other two, and ok in a pinch in a couple more. Most trades people can’t do that, and when they have to go outside their specialty, they have to take second class pay for a year or two while getting up to speed.

I have no idea how flexible fracking crew workers are. The truck drivers could go to work anywhere. Ditto any pipefitters, welders,industrial electricians.

Ditto laborers, but most likely at much lower pay rates for the laborers, because back home, there is usually a lot more competition than on the road living out of the suit case.

In any case the odds are high that most of the laid off people are making less on any new job than they were before, and ready to go back to fracking.

EIA’s Petroleum Supply Monthly:

U.S. oil production in December 2015 was 9,262 kb/d,

65 kb/d higher than the EIA’s forecast in the February Short-Term Energy Outlook (9,197 kb/d)

The EIA continues to underestimate US oil production in its forecasts.

AlexS,

adjustment was -200k/day

stocks change -195k/day

US production in December was 9.062kb/day when adjustment for unaccounted for oil is factored.

Moreover, stocks actually declined in the month of December at a rate of 195k/day.

Dan,

Adjustments refer to the balance of supply (production + imports), consumption, exports and stock change.

Adjustments do nor refer to oil production.

Oil production was 9,262 kb/d, 65 kb/d higher than forecast in the EIA’s February STEO (9,197 kb/d)

AlexS,

if consumption, exports, imports, and stock change are held constant than production had to be lower. Of the five parameters that go into the formula, the most difficult in terms of estimating is production. Thus, holding others constant production had to be lower to have a negative adjustment.

Dan,

The EIA apparently calculates oil production, using data for consuption, imports, exports and stock change only in they weekly estimates.

Their methodology for monthly numbers is completely different.

The EIA uses surveys of key producers for 15 states and statistics from state oil regulators for other states. Then the EIA adjusts these numbers according to their methodology.

But this is not the adjustments you can see in PS Monthly.

Besides, consumption, exports, imports, and stock change are NOT held constant; they are also constantly revised.

Alex,

One percent (probably the most charitable estimate of error margin for EIA STEO ) for 9,262 kb/d will be 93 kb/d

From this point of view your statement does not make any sense. Those two values are equal within the margin or error +-93.

likbez,

The 65 kb/d difference between the most recent estimate for December 2015 published on Feb 29 and previous estimate issued on Feb 12 is a fact

How can a fact make no sense?

My statement is that the EIA has been constantly underestimating US oil production volumes and therefore had to revise upwards its previous forecasts.

Thus, the estimate for September 2015 has been revised by 480 kb/d between September STEO and today’s Monthly Production Report (MPR).

Compared to 480 kb/d, 65 kb/d is not much, but there might be further revisions.

EIA’s US monthly oil production estimates for 2015: from STEO Sep.15 to MPR Feb.16

Alex,

I’ve seen a couple of articles about how Oklahoma’s production statistics were understated for some time due to reliance on an old computer system and manual adjustments which never made the released data. This data was incorporated into the EIA production data until recently when they switched to reliance on surveys of producers and discovered the differences.

Generally there was said to be an understatement of Oklahoma production by around 100 kbopd for a lengthy period. This may be part of the reason for the understatement you noted.

An article on the EIA production change.

http://www.upi.com/Business_News/Energy-Industry/2016/02/12/EIA-revises-Oklahoma-oil-production-higher/8641455284577/

Article from Daily Oklahoman about the understatement

http://newsok.com/article/5478761

dclonghorn,

Yes, the most recent revision was for Oklahoma. Earlier, there were also revisions for Texas and some other states.

These are revisions of historical numbers. They may be more modest in the future, as the EIA new methodology (based on producers’ surveys) appears to be more accurate than that based on the data obtained from state-level agencies.

What’s important, the EIA has also been very conservative in its forecasts.

The chart below shows that over the past 5 years the actual US total liquids production was almost always higher than initial forecasts.

This may change in 2016, as the EIA forecast for this year from the January 2015 STEO was higher than in most recent STEO. But this is due to much lower prices: In January 2015 the EIA was projecting the average WTI price for 2016 at $71, and current forecast is only $37.6

U.S. total liquids production estimates and forecasts:

from STEO January 2012 to STEO February 2016

While revisions in US production numbers reflect the unexpected high growth in LTO production, the EIA has also been extremely conservative in its forecasts for some other non-OPEC countries.

Russia’s total liquids production estimates and forecasts:

from EIA STEO January 2012 to STEO February 2016

I bet the EIA has yet to revise its numbers for Russia for the last several months.

Two other sources, IEA and JODI, show a growth trend.

(JODI apparently uses a different barrels/ton conversion rate)

Russia C+C+NGLs production estimates:

EIA STEO February 2016, IEA OMR February 2016, JODI

Hi AlexS,

I believe you have shown in the past that JODI is reporting crude only for Russia and leaving out condensate and NGL, or the numbers would match up if that is what they are doing (based on my recollection). I also believe you have shown that the IEA data matches the Russian Energy Ministry data.

This suggests that the Oct 2015 EIA World estimate might be low by 200 kb/d. The EIA data is 10.14 Mb/d of C+C for Russia in Oct 2015, what did the Russian Energy Ministry report for C+C output in Oct 2015?

I found a report suggesting November output was 10.8 MMb/d in November, October might have been about 10.7.

So World C+C output might have been about 600 kb/d higher in October than reported by the EIA, roughly 80.7 Mb/d

In fact if all of the difference in the EIA and IEA liquids estimate was due to different estimates of Russian C+C, then all but 100 kb/d of the decline in World C+C from July 2015 to Oct 2015 would be eliminated and there would be roughly a plateau in World output over that period.

I agree with Ron and AlexS that we can expect a decline in US output, possibly on the order of 1000 kb/d from December 2015 levels for US L48 onshore by December 2016. This may be offset by increases in OPEC output (about 500 kb/d). Overall World C+C may fall between 500 and 1000 kb/d in 2016.

Dennis,

For Russia, JODI separately reports crude production (which excludes condensate) and NGL production, which includes condensate.

The EIA also classifies most of Russia’s condensate production as NGLs.

The IEA’s estimates for both C+C and NGLs are very close to Russian statistics.

The chart above shows C+C+NGLs numbers from the 3 sources, so their estimates can be compared.

And this comparison shows that since mid-2015 the EIA’s data did not match other sources. This was also the case in the past, and the EIA ultimately had to revise its estimates for Russia. The revisions are simply delayed by several months.

If we look at C+C only, the most recent numbers from the Russian Energy Ministry are:

Thanks. Interesting that JODI’s numbers are different (are they reporting NGL in barrels of oil equivalent maybe)?

Alex,

My statement is that the EIA has been constantly underestimating US oil production

IMHO you are missing possible correlation of “misunderestimation” of US oil production with “cheerleading” of oil price slump. Please note that this is not about some “wild” conspiracy theory 🙂

As unforgettable Bush II said:

and

The same is true about EIA estimates of the USA oil production. May be there is such a specialty “misunderestimator” for government employees 🙂

If we assume error margin 1% for EIA data that means that EIA data should be rounded to two meaningful digits before making any conclusions.

That makes minimum meaningful difference 100,000 bbl. Everything below that should be considered to be statistical noise.

In other words EIA operating with four meaningful digit on the data with error margin at or above 1% is just a sophisticated form of deception of (mathematically challenged) public creating an impression of precision were it does not exists.

And if the addition is below the error margin it can’t be considered statistically meaningful because the value 9,262 is in reality an interval from 9.162 to 9.362 within which the precise value lies.

I generally try to use two significant figures, e.g., global C+C production increased from 74 million bpd in 2005 to 78 million bpd in 2014.

Per EIA Petroleum Supply Monthly, GOM production increased from 1521 kbopd in Nov. to 1633 kbopd in Dec. An increase of 112 kbopd. US production excluding GOM was 7784 kbopd in Nov. and 7629 kbopd in Dec. a decrease of 155 kbopd, approximately 2 percent of Nov. production.

GOM production continues to have long lead time production coming in. US ex GOM is dropping.

Lower 48 states onshore: a decrease of 157 kb/d,

including North Dakota: -27 kb/d; Texas: -65 kb/d; other states: -65 kb/d

Even though there could be upward revisions, December was likely a turning point.

I expect declines to accelerate in 1Q16

Even though there could be upward revisions, December was likely a turning point. I expect declines to accelerate in 1Q16.

I concur.

Alex, DCLonghorn,

Nice charts, and good points, thanks.

Thank you, Enno

“The EIA continues to underestimate US oil production in its forecasts.”

I think they have a tendency to underestimate in rising conditions, but will overestimate in falling conditions.

http://cdn.oilprice.com/images/tinymce/2016/ThisSC2.jpg

from this article:

http://oilprice.com/Energy/Energy-General/Is-The-EIA-Too-Optimistic-On-US-Oil-Output.html

Their weekly estimates appear to lag actual inflections by 2-3 months.

Pemex lost $32 billion last year. That is more than the GDP of Latvia, Cameroon, Paraguay and 89 other countries. It is 2.5% of Mexican GDP.

The CEO has issued a statement slashing costs:

http://www.pemex.com/en/investors/investor-tools/Presentaciones%20Archivos/Message%20CEO_i_160229.pdf

I’d interpret that to mean we should expect 4 to 8% decline rates in their production from here on.

http://www.zerohedge.com/news/2016-02-29/mexicos-oil-giant-posts-record-32-billion-loss-cuts-crude-price-forecast-25

The global economy seems to be tottering on the edge even with cheap oil. If the price had stayed at $110 and these losses had been covered by OECD consumers where would we be (or well will we be if the price does recover eventually) – I guess even more debt until the bubble really does pop.

The rig count is getting clipped at a fairly fast rate in the Bakken. It’s starting to look like the Black Knight in Monty Python’s Holy Grail. Just a flesh wound.

Rig count graphs have/are close to sharkfin shape.

*https://www.youtube.com/watch?v=WHE1dM4hYCw

Mercenary Song by Steve Earle, a great song.

Copy and paste after the asterisk.

R Walter

The rig count graph shows a highly inefficient approach, quadruple the rig count gets less than double the production gain. Then it falls off due to unsustainable economics.

Unless government and the laws get involved, the market will tend to weed out the less efficient producers in the long run. That old game of competitive edge.

But what happens when the big game starts to fall apart, all the stuff that people want which requires the use of oil? What happens when the sales, production, and shipping drops out?

When people are keeping cars for 20 years, not driving so far and not buying a whole lot of unnecessary junk?

A deck of cards can last decades for a family at no cost. An ipod, iphone, iwhatever for each member of the family has to be replaced every few years at large cost along with the big monthly bills to feed the info/entertainment/communication machines. What happens when this virtual house of cards and cars starts to fall apart? What would happen if people and families started playing board and yard games together again with no need for power or high tech manufacturing facilities?

Could civilization be transformed by the simple use of a checker board or Monopoly game? Or maybe the kids will start playing outside again and there will be one car per family (or less).

Didn’t that family or group horseshoe or wiffle ball game have a greater importance because it did not happen every day, 24/7? It was special, something one might remember. People getting together rather than sitting alone watching their TV or video. Putting the fun back into sports might ruin a whole business machine, but it might make for a better life, instead of militarized school sports. Might make for a lot less depressed and anxious people too.

I know, it’s a recipe for economic disaster, using less and getting more out of life in an economic world that demands MORE, MORE, MORE, RIGHT NOW.

More is not more, when it comes too easily. My old Grandpa told me that he got just as excited at the sight of an ankle and calf when he was a young man as I ever did at the sight of an equally attractive girl in a micro mini skirt, and I have no doubt he was dead on correct.

STUFF is good, up to a certain quantity. But it does not buy happiness, so long as you have about as much as your peers. Having less tends to lead to unhappiness due to our being so status conscious.

Haha, that is funny about your Grandpa!

“Stuff” has a real, objective value, up to a certain point.

Outhouses are miserable, even if you have the best one in the ‘hood. Running water makes life easier, regardless of it’s status value. A washing machine makes life much easier, even if it’s a Sears and everyone else has a German expensive model.

I agree that after a certain point you don’t get more satisfaction from stuff. A lot of people are on a consumption trap. See Maslow’s hierarchy of needs…

R Walter,

Bakken. It’s starting to look like the Black Knight in Monty Python’s Holy Grail.

Brilliant comparison !!! Simply brilliant.

And the KILLER Rabbit is:

A: HAL. B: KSA C: CITI. D: 350.ORG

http://www.forbes.com/sites/arthurberman/2016/02/29/what-really-controls-oil-prices/#3aca881b71e4

Here is a short excerpt from this article, in which Berman basically argues that the price of oil is controlled by the level of storage at Cushing. I agree at least to the extent than the price correlates closely with storage at Cushing.

xxxx

For oil prices to increase, Cushing inventories must fall. That means that both U.S. tight oil production, chiefly from the Bakken play, and Canadian light oil production brought by pipeline to Cushing must decline.

Bakken production was consistent in 2015 at about 1.2 million barrels per day. Canadian oil imports to the U.S. decreased from April through July 2015 and may have contributed to the fall in Cushing inventories that lead to a $15 per barrel increase in WTI prices. At the same time, decreased production from the Eagle Ford and Permian basin tight oil plays would free up storage in the Gulf Coast that might allow more oil to flow out of Cushing.

xxxx

Now here are a couple of points. Just how is it that so called traders can control the amount of oil that goes to Cushing, or leaves ? The traders can control NEITHER PRODUCTION NOR CONSUMPTION. The end user, the overall economy buys and pays for as much oil as it WANTS, at any given price. The lower the price, the more the economy will buy, everything else held equal, but changes in consumption just don’t happen overnight. Of course the end users buy as cheap as they can, and so does every middle man in the industry, from the truckers, railroaders, and pipeline operators to the independent retailer.

Ron nailed it. Producers do not determine price, but their PRODUCTION determines price. Nobody is going to pay any more for crude than he has to, and there is just too much crude arriving on the market for it to sell at a higher price. Ron understands. Berman understands. He says too much oil on hand means a low price, and he is certainly smart enough to know where crude oil comes from, lol.

The price will go up, when deliveries to refineries and tank farms goes down, or when the economy picks up enough to buy more oil at a higher price.

I am waiting for somebody to explain to me precisely how great white shark companies such as Exon and Saudi Aramco are duped into allowing middlemen to make big profits on their sales to refineries, or how they get a big cut out of refineries sales to wholesalers, or wholesalers sales to retailers, or retailers sales to end users. How are these traders supposed to be able to dictate prices to truckers or railroads or pipeline companies that transport oil?

Now there IS a diamond cartel that controls the supply of diamonds, and thus the price, on the market by buying up excess supply. There are farm commodities that are sold under the control of marketing organizations that control supply, and thus control price. THAT sort of price control WORKS. Such organizations are invariably dependent on the long arm of government for their very existence. Otherwise, they wouldn’t last very long at all.

OPEC at one time was a creditable, capable organization that could control the price of oil, by controlling ENOUGH production to put the supply at the level that fetched the desired price.

Saudi Arabia at one time could produce enough EXTRA ,at least temporarily, to flood the market,and drive the price of oil DOWN. I am not sure they have that much spare capacity any more, but the Saudis could sure as hell drive the price UP by cutting production a few million barrels a day, assuming the rest of the producers don’t have spare capacity enough to replace such a hypothetical Saudi cut.

CONTROL, CONTROL , CONTROL.

You simply cannot control the price of a commodity unless you control the supply and distribution of that commodity. You can maybe force the price up or down a little,for a while, but in the end, supply and demand determine price.

OFM,

From the previous Ron’s post discussion:

http://peakoilbarrel.com/oil-price-and-its-effect-on-production/#comment-561326

http://peakoilbarrel.com/oil-price-and-its-effect-on-production/#comment-561368

This article is a little on the long side, for those of us who are into sound bites, but folks with more patience will find it illuminating, and maybe even find a little something in it to improve their personal morale, if they are feeling really down about the future.

http://www.scientificamerican.com/article/world-s-richest-man-picks-energy-miracles/

A note on “OMG Cushing is filling up hysteria” or negative correlation of oil price with Cushing recently discovered by Art Berman:

That’s what happens when good people get into bad company due to lack of employment opportunities caused by shale oil price crush 🙂

I wonder whether this is Erik “know everything” Townsend (a retired software entrepreneur turned hedge fund manager; see http://www.macrovoices.com/podcasts/MacroVoices-2016-02-25-Art-Berman.mp3) or somebody else 😉

Compare with

http://peakoil.com/consumption/httpwww-zerohedge-comnews2016-02-26theres-feeling-bits-ice-cracking-all-once-big-new-threat-oil-prices

rockman on Sat, 27th Feb 2016 7:56 am

rockman on Sat, 27th Feb 2016 9:39 am

I forgot to insert the word “inversely” between cushing storage and oil price, in my comment, but the correlation is perfectly obvious.. The correlation between Brent and WTI is also close and obvious, not inverse.

Now it is ancient and undisputed day to day common place knowledge that commodity prices are generally quoted in terms of some “benchmark ” or another, which is used in day to day communications about the market to indicate prices.

When local farmers in my neighborhood sell their corn, the price is virtually always a little higher than the price you see quoted on the commodities market news for corn. This is because my area is a net corn importing area, and shipping is not free. So local growers get a premium- which is REMARKABLY CONSTANT, on average in relation to the going market price. Oil prices are reported, and understood, to be much the same. Oil is “benchmarked” at Cushing, and the price will be up or down elsewhere from that price, due to day to day commercial realities.

Shortages and surpluses can happen in given areas, so prices do not necessarily track the benchmark consistently as a result. Oil can be bottlenecked in some places, and due to lack of transportation capacity, sell for a LOT less than it ought to, locally. It can be in short supply in another place, and sell for more than it ought to, due to transportation bottlenecks.

But as a general thing, the price at any given location usually follows the benchmark up, or down, consistently, as the price changes. This is because there is a relatively free market in oil, and in most places the transportation infrastructure is adequate.

It is not necesary that most of the storage capacity actually be in Cushing. The industry could use the price of the same grades of oil at Houston just as easily, where they would be a little higher, due to more transportation expense getting the oil there.

Prices of a given commodity track together all over the world, so long as trade in that commodity is relatively free, and transportation is readily available.

Now the QUESTION is not whether Cushing is the main and most important storage site for crude, but rather WHAT THE SELLERS OF CRUDE ARE WILLING TO ACCEPT. If they will accept the price at Cushing, then they know just about to the dime how much MORE they could get at a refinery which needs their oil, if that refinery is four hundred miles farther away, assuming crude moves from the Cushing area towards that refinery. A refinery CLOSER that Cushing to producers who would otherwise ship to Cushing ought to be able to negotiate a discount about equal to the saved costs of shipping ,and thus buy a little cheaper than the Cushing price.

Now the fact that we still import oil is well known to us all, and Rockman has forgotten more about oil I could ever hope to learn, but the fact remains- BUYERS DON’T pay any more than they have to, and so long as producers are willing to sell for thirty bucks quoted at Cushing, the price won’t go up. A lot of those producers might be getting only twenty five, after paying five bucks shipping costs.Some others, closer to the refineries than Cushing, ought to be getting a little more than the quoted Cushing price.

Whatever the price may be, it will go up if and when , and only if and when, producers stop delivering all the oil buyers want oil at that price .

I believe Rockman will agree with this bold (pun intended ) statement.

The fact that overseas producers are willing to deliver at this price doesn’t change the calculus.The fact that we are net oil importers does not change the calculus.

And so far as the word “glut” is concerned, it is an emotionally loaded code word, which has no place in a serious discussion of economic theory . The word does not appear in any of my standard economic texts in the chapters devoted to production, consumption, and price in competitive commodity markets. A professional economist writing a text says something along these lines.