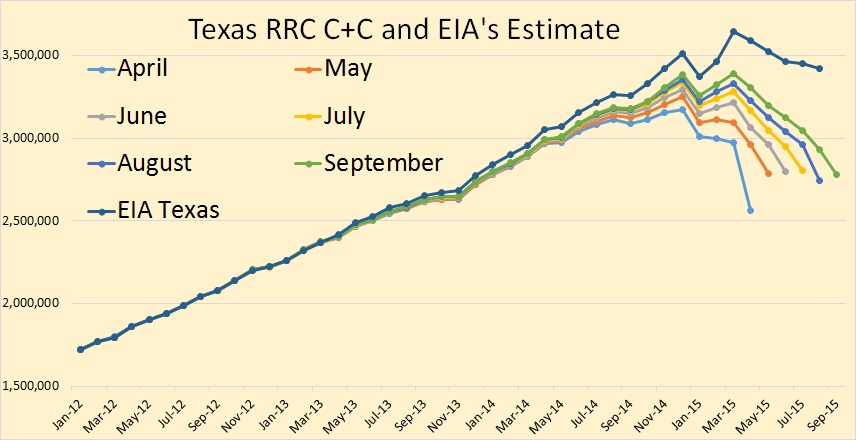

The Texas RRC Production Data is out. There appear to be no big surprises this month. All RRC data is through September but the EIA data is only through August.

Note: For all those not familiar with the Texas Railroad Commission data it is always incomplete. That is the reason for the drooping data lines you see in the charts. The EIA data is what they believe the final estimate will be.

Final month production was just a little higher in September than August. That usually indicates a small uptick in production. But the data is so incomplete it is hard to tell.

Dr. Dean Fantazzini has Texas C+C with a slight uptick in September but still well below the March 2015 peak.

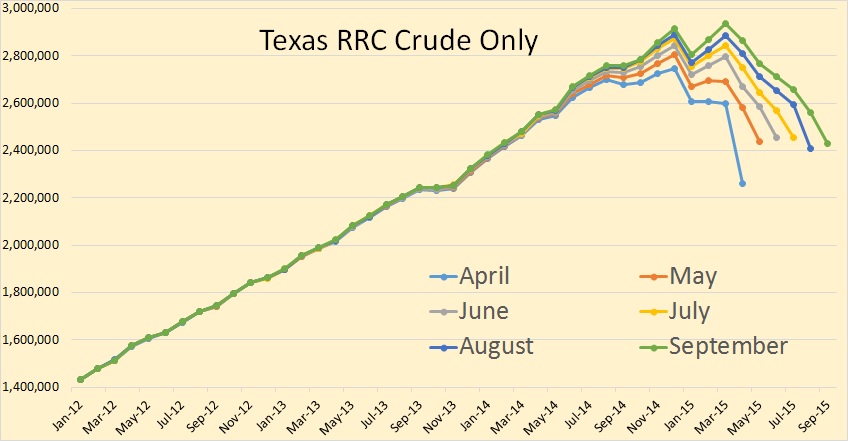

Texas crude only reflects basically the same pattern as Texas C+C.

Dean has Texas crude only also with a slight uptick in September.

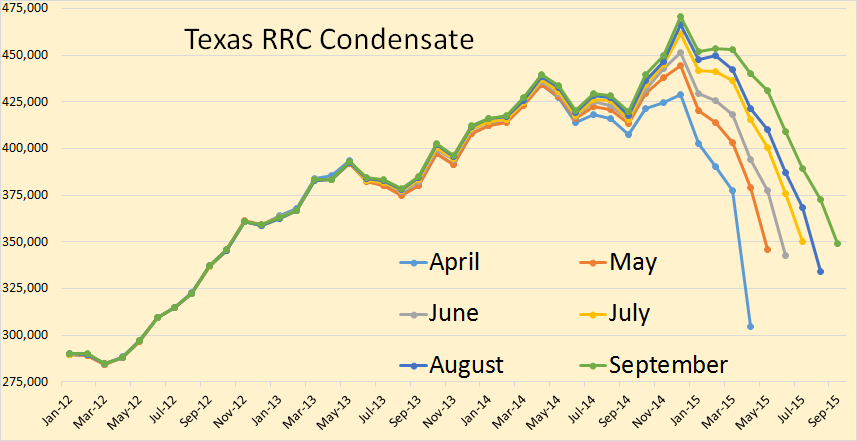

Texas condensate should show a slight uptick in September when the final data comes in.

Dean has condensate almost flat since December.

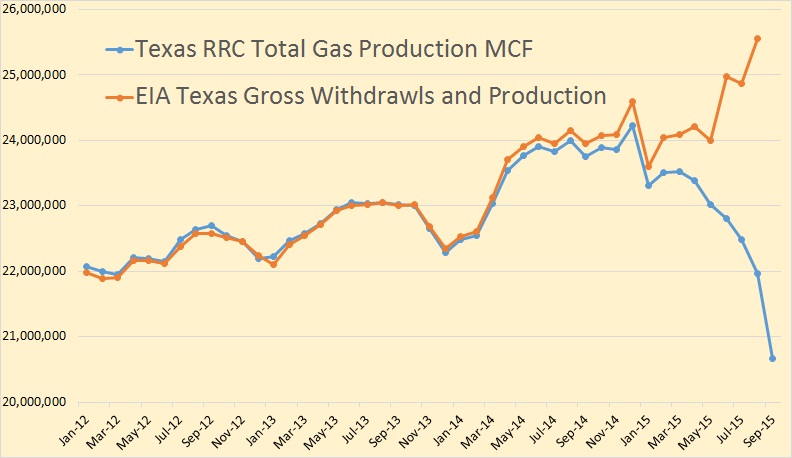

Texas total gas production also showed a slight uptick in September. All gas data is in MCF per day.

Dean has Texas total gas with a slight uptick in September. Other than that big drop in January Texas gas production has been basically flat since December.

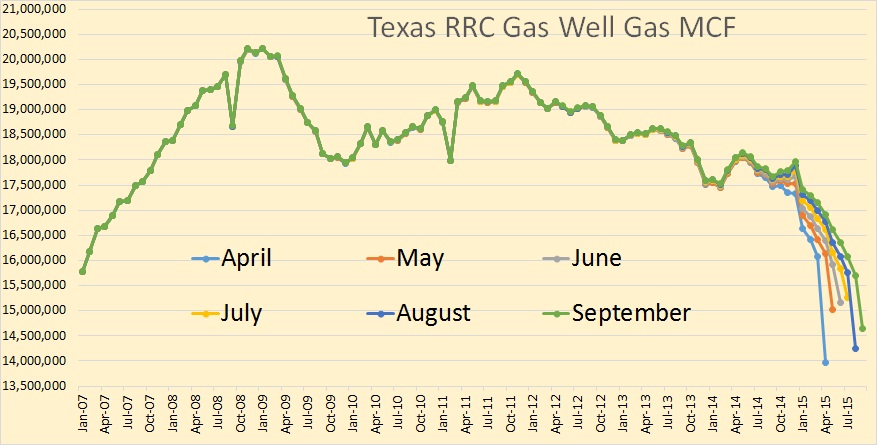

The incomplete data shows a slight uptick in gas well gas but it don’t look like much is really happening here.

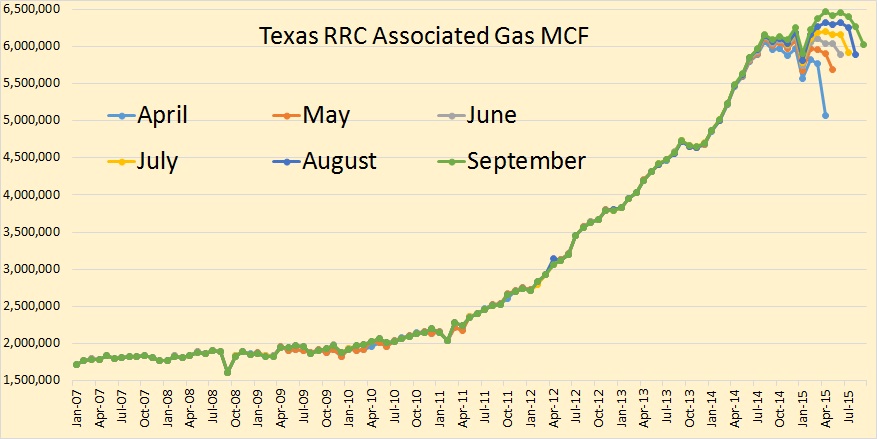

Texas associated gas, which has been responsible for all the increase in Texas gas production since 2011, seems to have leveled out.

The EIA publishes state by state natural gas prduction as well as state by state oil production. That data can be found here: EIA Natural Gas Their current data, like their oil data, is through August.

Here is the EIA Texas natural gas production data compared with the RRC total gas data. All gas data is in MCF. that the EIA sees. The EIA has Texas total natural gas spiking upward in June and August.

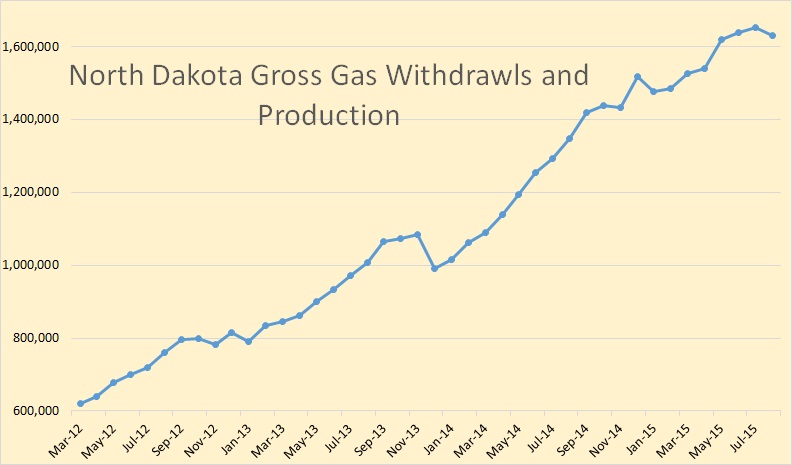

And just in case you were wondering this is what the EIA says North Dakota’s gas production has been doing. The last data point is August, 2015.

I have, so far, reframed from giving much of an opinion on the Islamic Terrorist attacks in Paris. But I received, in my email box this morning, a link to a short podcast that reflects my opinions exactly.

Still Sleepwalking Toward Armageddon

Listened to the first six minutes or so, no argument from me.

A direct link to a pretty amazing monologue, on the Islamic State/ISIS/ISIL strategy, from the 2015 season premiere of the TV series “Homeland.” Total segment is about three minutes long.

https://www.youtube.com/watch?v=R8AldurlGKg

It’s hard to figure out what’s going on with all the lies and players. But you will find the heart of the problem based around religion, power and resources.

I suspect ISIS is mostly rejected Sunni’s after the US invasion in 2003 when the Shiites were handed control over Iraq. A barbaric army of men without much to live for but raping and killing with terror. Using religion to justify it and trying to reclaim territory and power.

I see little chance at all of resolving the problem without killing or capturing all of ISIS and than holding the country by military force for decades. We are talking millions of troops. Something on the scale of WWII to do it right.

I think Obama’s hope is to supply the air power and intelligence with the bulk of the troops mostly being supplied from the surrounding countries. It took a couple of years to ramp up the American military before D-day and than another year to control the territory. The allies also spent a year degrading the Germans with airpower first. Maybe Fridays acts will unit the powers to be and the public for what seems to be required.

Oh how I miss the good old days of Saddam and a Iraq no fly zone. Dick Cheney swatted the hornets nest and the world is living with the consequences.

American hands are not exactly clean to this whole mess.

http://www.brasschecktv.com/page/29145.html

That’s my best guess today and I’m sticking with it until tomorrow

In general I agree with you. But Assad and the Russians can be the Western Front, the Iraqi Shiites the eastern front backed by Iran. The Kurds can take care of their own territory. Unfortunately the USA doesn’t make its own foreign policy. It has to get Israel Lobby blessing.

What you are saying makes perfect military sense as well as counter-terrorist sense. But it will also mean total victory for the Russia-led coalition, and total defeat for the NATO-GCC coalition, or US-led coalition if you will.

Hence, NATO will do everything/anything in its power to prevent that, or at least very significantly raise the cost for such a potential Russo-Iranian victory.

The US military is finally trying to shut down ISIL’s oilfields

http://qz.com/548820/the-us-military-is-finally-trying-to-shut-down-isils-oilfields/

November, 13.

More than a year since the US started attacking ISIL’s oil-led financial network, American bombers are finally being used in an attempt to entirely shut down the fields.

As early as last September, oil experts from the region said that the best way to stop ISIL’s estimated $40 million a month in oil revenue was to destroy any equipment with rotating machinery or electric supply.

Instead, though, US bombers appeared to attack mostly small refineries and some trucks. As a result, the flow of money to ISIL persisted.

Now, though, put under pressure by Russian president Vladimir Putin’s foray into Syria and Iran’s more aggressive posture there, the US has begun to bomb the oilfields aggressively, according to a Nov. 13 report in the New York Times. Among the targets, the report says, are fuel-oil equipment and pumping stations.

The Pentagon has dubbed the mission Tidal Wave II, after a World War II campaign called Operation Tidal Wave, which persistently attacked Hitler’s oil infrastructure in Romania and significantly reduced his oil supply.

U.S. Warplanes Strike ISIS Oil Trucks in Syria

http://www.nytimes.com/2015/11/17/world/middleeast/us-strikes-syria-oil.html?_r=0

November, 16.

ISTANBUL — Intensifying pressure on the Islamic State, United States warplanes for the first time attacked hundreds of trucks on Monday that the extremist group has been using to smuggle the crude oil it has been producing in Syria, American officials said.

According to an initial assessment, 116 trucks were destroyed in the attack, which took place near Deir al-Zour, an area in eastern Syria that is controlled by the Islamic State.

The airstrikes were carried out by four A-10 attack planes and two AC-130 gunships based in Turkey.

Plans for the strike were developed well before the terrorist attacks in and around Paris on Friday, officials familiar with the operation said, part of a broader operation to disrupt the ability of the Islamic State, also known as ISIS or ISIL, to generate revenue to support its military operations and govern its territory.

American officials have long been frustrated by ability of ISIS to generate tens of million of dollars a month by producing and exporting oil.

To disrupt that source of revenue, American officials said last week that the United States had sharply stepped up its airstrikes against infrastructure that allows ISIS to pump oil in Syria.

Until Monday, the United States had refrained from striking the fleet used to transport oil, believed to include more than 1,000 tanker trucks, because of concerns about causing civilian casualties. As a result, the Islamic State’s distribution system for exporting oil had remained largely intact.

The new campaign is called Tidal Wave II. It is named after the World War II effort to counter Nazi Germany by striking Romania’s oil industry. Lt. Gen. Sean B. MacFarland, who in September assumed command of the international coalition’s campaign in Iraq and Syria, suggested the name.

To reduce the risk of harming civilians, two F-15 warplanes dropped leaflets about an hour before the attack warning drivers to abandon their vehicles, and strafing runs were conducted to reinforce the message.

The area where the trucks assemble in Syria has been closely monitored by reconnaissance drones. As many as 1,000 trucks have been observed there, waiting to receive their cargo of illicit oil.

On Monday, 295 trucks were in the area, and more than a third of them were destroyed, United States officials said. The A-10s dropped two dozen 500-pound bombs and conducted strafing runs with 30-millimeter Gatling guns. The AC-130s attacked with 30-millimeter Gatling guns and 105-millimeter cannons.

The pilots saw several drivers running to a nearby tent and did not attack them, an American official said, and there were no immediate reports of civilian casualties.

Col. Steven H. Warren, a Baghdad-based spokesman for the American-led coalition, confirmed that A-10s and AC-130s had been used in the attack and that 116 tanker trucks had been destroyed.

“This part of Tidal Wave II is designed to attack the distribution component of ISIL’s oil smuggling operation and degrade their capacity to fund their military operations,” Colonel Warren said.

The strike comes just days after Kurdish and Yazidi fighters, backed by American airstrikes, cut an important road, Highway 47, that ISIS has used to move supplies and fighters between Syria and Mosul, Iraq’s second largest city, which was captured by the militant group last year.

That road was cut on Thursday, and Kurdish and Yazidi fighters retook the Iraqi city of Sinjar the next day.

The American operation against the oil trucks followed a French on raid Sunday on two Islamic State targets in Raqqa, Syria, which allied officials identified as a headquarters building and a training camp.

More than 20 bombs were dropped by French planes in the attack, an allied official said. It is not clear how much damage was caused, and no secondary explosions were observed.

As always, oil is behind many of the important events that we watch taking place.

Pardon me but if this reporting is real then the US government is even more incompetent than I ever imagined. We’ve avoided destroying over 1,000 trucks because we feared injuring civilians? then all of a sudden we have a totally simplistic way to destroy the trucks and avoid hurting any innocents? Then we brag about destroying 116 trucks out of 295?

C’mon. If we were serious we wouldn’t stop until there wasn’t a single truck, truck driver or road for them to move that oil.

Don’t get me started about a French “furious retaliation” where they dropped 20 bombs from 10 airplanes.

Tens of millions of dollars a month. Call it 30 and $360 million/yr.

1) Then why interdict, which the supply and demand apostles would suggest raises the price, getting them more money for whatever gets through.

2) $360 million a year is pocket change to any of the countries there with a Central Bank, who can print that in a quiet morning and electronically recharge ISIS debit cards.

Hi Watcher,

The high prices can effect the economy and it is the total revenue that matters. For example if the supply is cut in half and prices double, the policy would have no effect on revenue, but prices might not double, maybe people would use fuel more efficiently and prices would only rise by 25%, in that case oil revenue is reduced and the policy works.

You do not seem to understand basic economics.

After reading Watcher’s comments for months, I can only conclude that he has only one basic insight the rest of us ought to keep in mind.

That insight is that various governments, including our own, will spend a lot of money, either collected tax money, or printed money, to ensure that oil remains available in sufficient quantity, without a shortage causing a panic.

Now when it comes to printed money, most people do not seem to understand that in the last analysis, it is a tax on EVERYBODY,excepting the recipients thereof.

In economics there are win lose games, breakeven games, and win win games to be played.

Printing money is a way to take a little from a lot of people and giving it to who ever the government wants to have it, whether an oil company or a drug company or schools or grand scale scam artists, such as for profit universities.

Saying which sort of game it is, when it comes to oil, is not easy.

We sure as hell MUST have oil, in the short to medium term, at affordable prices and in sufficient quantity to prevent an economic heart attack.

Longer term, we should be able to deal with expensive oil in limited quantities, so long as the price doesn’t go up TOO FAST and the quantity down TOO FAST.

A big subsidy to producers, IF it prevented changes in price and supply from coming too fast, would be a good deal for everybody, short term.

Long term it would be a bad deal, because it would prevent us from adapting by using less oil and using it more efficiently.

Completely agree, OFM,

A subsidy to oil producers even in the form of credit means a tax or credit reduction to oil consumers and a market distortion. Oil consumers will be less capable of affording oil so it will reduce demand increasing current imbalance instead of reducing it.

Oil industry needs consolidation and our economy needs to use less oil and more rationally. When oil production falls enough we could have a very severe oil crunch and we should prepare for that. In any case we are moving towards a world with less oil.

Hello Mac,

“Printing money is a way to take a little from a lot of people and giving it to who ever the government wants to have it”

This statement really doesn’t give justice as to how the system works. It’s true that expanding the money supply can devalue the purchasing power of a currency by to much money chasing to few goods(inflation). Currently the Fed has a target of 2% inflation and the country is running less that that. For almost 10 years now the Fed has had an easy money policy to stimulate demand and hasn’t reaching it 2% inflation goal and/or full employment. The Fed talks monthly about tightening money policy as to not over shoot their 2% goal and is prepared to do so. The Fed doesn’t have a secret plan to take a little away from everyone and give it away to who it wants.

I believe your statement misleads a lot of people who don’t understand this complex system of money supply and currency stabilization.

The US likely has been indirectly aiding ISIS, as a means to remove Assad from Syria. Much of the arms supplied from the US for the war in Syria ended up in ISIS’s hands. The US had no intention of engaging ISIS to disarm them. Recall when the Roman empire began to decline, they turn to mercenary armies to fight in proxy wars because the emperors could no longer obtain public support to send Roman troops to engage in overseas wars.

Some say the French Terror was part of the plan to continue to distract nations from economic problems and to increase gov’t control (more state control of the economy, and to relieve civilians of their liberties).

In my opinion the gov’t had to know that permitting radical muslims into their borders would have terrible outcome. There are only two possibilities: Gov’t are run by clueless idiots, or they have a nefarious agenda.

For years I suggested that sooner or later their would be another rise of fascism in Europe. At the time, and probably still, most people dismissed this and thought I was crazy. Its coming.

I continue to discuss that the world is marching towards another global war. Yet, everyone still thinks I am crazy. War is coming. If you don’t believe it, your going down a path of self or collective delusion.

I still don’t believe that this oil they produce is the primary source of their funding. Who is buying this illicit oil? Turks? Iranians? You would think they would need a substantial amount of it (crudely refined) to be used in trucks, APCs, generators, etc.

I think they are being directly funded by wealthy donors in KSA and Qatar and perhaps even covertly funded by those governments.

And I don’t think $30 million per month (with no other funding) is really going to get you that far in funding a standing army large enough to fight the Iraqi army, the Peshmerga in Iraq, Kurds in Syria, Syrian govt forces, Hezbollah, and Nusra. And police the populace in their territory. But maybe they pinch pennies better than I do…

So as is said, ISIS’ sources of funding grow curious and curiouser the more one knows. Those seeking to destroy ISIS might well wish to look into where the money comes from, and ask why, after a year and three months of war, no one has bothered to follow the money.

http://www.commondreams.org/views/2015/11/18/stopping-isis-follow-money

Anonymous is on it:

http://www.nbcnews.com/storyline/paris-terror-attacks/anonymous-hackers-declare-war-isis-video-message-n464116

http://www.esquire.com/news-politics/news/a39736/john-oliver-paris-attacks/

He speaks for me.

I listened to it all. Best post from Ron since I have been here.

The day after the Paris “events,” I remembered something from over 60 years ago, when I was 10 or 12 years old. Learning that Lemmings en-mass ran over cliffs into the oceans and drowned. I remember thinking, “how stupid can mammals be?” Well, it turns out that humans are no different than Lemmings.

Clueless,

I learned about Norwegian lemming migrations at about the same time, from an Uncle Scrooge comic book. I wish I still had it.

They were great: introduced me to the Seven Cities of Cibola, cenotes in Yucatan, course changes of the Mississippi River, the lake lands of northern Minnesota and rare-earth metals, Whitehorse, the effect of oversupply on prices…

I know of nothing better for the Young Inquiring Mind. Or for mine, either.

That’s a pretty good link Ron. There’s definitely grist for the thought mill there.

It is likely true that we will be dealing with Paris like attacks for the rest of our lives (I’m 40, so I’ve got a bit more “rest of my life” than you, if I’ve understood things correctly). Some honesty about the problem we face and a focus on the ideas that give rise to those who employ the terror tactic will be useful. I don’t know if that honesty will be enough.

Time shall tell.

Thanks Ron for the link.

While safely ensconced here on the BC west coast, I have family in Paris. Last years Charlie Hebdo attack took place in the same block where a niece lives. The final shootout took place a mile from another niece’s home. For this one we have enquired as to the situation and have yet to hear back. As I told my sister, a city of 12 million people….it’s all about odds. 4 family members in Paris:12 million. Still haven’t heard back. As James Bond might say; “shaken, not stirred”.

Anyway, thoughtful podcast. Wondering now how CNN will extricate themselves from non-stop talking head coverage? Maybe this Charlie Sheen Aids thing…..(and yes, that was intended to be a snide commentary on the state of our collective coverage on this onslaught against almost everything.) What’s next, destruction of antiquities and book burnings? Hospital bombings? Oh yeah…..

Suerte.

NAOM

PS Any way to send a PM on this blog?

I listened to the fifteenth minute, all they have to do is stop what they are doing. It is that simple. Just do the one thing that will work, stop. It is going to be easy, better than what is being done now. There is the answer, stop.

It has all happened before, the crusades were something of the same kind of thing, a parallel. Constantinople was sacked in 1204 by Crusaders which caused the schism between the Eastern Orthodox Church and the Roman Catholic Church to be more or less permanent.

https://graceuniversity.edu/iip/2011/08/11-08-20-2/

“It was the crusades which made the schism definitive with the worst of it occurring in 1204 when the Crusaders from the west who were originally bound for Egypt, ended up sacking Constantinople. The Crusaders looted, terrorized and vandalized Constantinople for three days. many ancient and medieval Roman and Greek works were either taken or destroyed. Many priceless artworks made of bronze, including the statue of Hercules created by the legendary Lysippos, court sculptor to Alexander the Great, were melted down for their content by the Crusaders. The famous bronze horses from the Hippodrome were sent back to adorn the facade of St Mark’s Basilica in Venice. They are still in Venice in a museum. The Library of Constantinople was destroyed. The Crusaders violated the city’s holy sanctuaries, destroying or stealing all they could lay hands on. Thousands of civilians were killed in cold blood. Women, even nuns, were raped by the Crusader army. The very altars of these churches were smashed and torn to pieces for their gold and marble by the warriors who had sworn to fight in service of Christendom without question.

The sack weakened the Byzantine Empire, which allowed the Ottoman Turks, to conquer the area and enslave the Greek Christian population for 400 years of terror.”

https://graceuniversity.edu/iip/2011/08/11-08-20-2/

That’s the way it goes moving west.

Ain’t nothin’ new under the sun.

You are wrong in both accounts.

What Islamic fanatics want is that we do not exist. There have been millions of Christians living in Muslim lands for centuries. They belong to different Oriental denominations and they are disappearing very fast in almost every Muslim country. Even in Turkey, a NATO member since 1952, Christians, that were 20% of the population only 100 years ago, are facing extinction now. In Irak and Syria they are simply exterminated.

Every Muslim in the world believes that lands that belonged to Islam once should become part of Islam again. It is part of their religious core beliefs. This means that they think that Spain should be part of Islam again.

You cannot appease the people that want your destruction. While we can come to terms with Muslims that are unwilling to attack Christians as their faith demands, we must combat every Muslim that acts upon his beliefs and attacks Christians.

Regarding the attack on Constantinople by Frankish crusaders led by Venetians in 1204 as being responsible for today’s separation of Orthodox Church, it is a beautiful theory, but nothing supports it. The basis of the separation of Eastern and Western Churches is the division of the Roman Empire that made the Pope of Rome and the Patriarch of Constantinople equals in power and thus not willing to accept the other’s authority. The divisions became profound over the fourth council of Constantinople in 870, not recognized as ecumenical by the Eastern Church over the issue of Patriarch Photius, a layman that could not be a Patriarch to Rome and a saint to Constantinople. The division became irreconcilable after the Norman conquest of Sicily in 1054 when the isle’s Greek population was forced to adopt the Western rite, and Constantinople forbade the Western rite leading to the excommunion of the Patriarch. But it was actually after the fall of Constantinople in 1453 when under Sultan’s pressure all Eastern Churches were forced to repudiate any authority by Rome that the Eastern Church became completely separated from the Western.

Once religions become separated not only in authority, but also in beliefs and rites, it is almost impossible for them to reunite. To think that the crusaders pillage of Constantinople was decisive in the Eastern-Western Christian split is to entertain a fantasy.

Ok, I am wrong, you don’t have to get so mad.

Anyhow, the French are on a crusade right now to apprehend the perpetrators, the culprits have been detected today.

I suppose the Statue of Liberty is a target, that was made in France. The giant statue of Jesus, Christ the Redeemer, in Rio de Janeiro is probably another target. Every continent must sacrifice its fair share. Can’t rule out the Lincoln Memorial as a prime target, or the US Capitol as target numero uno.

The Three Gorges Dam would be another prime target.

By that time, it won’t be good for anybody.

If it won’t stop and it all continues as such, there won’t be much left. At some point, the Waterloo will happen.

Spain has a very long experience with terrorism. Between 1975 and 2011 a separatist Basque terrorist group killed 829 people. From the beginning and during the presidencies of Giscard d’Estaign and Mitterrand, France offered sanctuary to the terrorists and refused to prosecute and extradite terrorists in their country. As a result of this decades long pro-terrorist policy of France hundreds of Spaniards died. They even used this policy as a political tool to extract political and economical concessions from the Spanish government and for example our high-speed trains had to be bought from France over Germany in exchange for an improvement in anti-terrorist cooperation.

This French pro-terrorist stance diminished with Chirac and finally came to an end with Sarkozy. The end of the French sanctuary after almost four decades was instrumental in ending the terrorism. The French are lucky that the Spaniards are not a rancourous people.

The Spanish experience with terrorism demonstrates that you don’t have to reduce your liberties to fight terrorism. It is instrumental to reinforce justice tools to prosecute anybody affiliated in any way with the terrorists and specially to attack their sources of finance. That is what finally made them in. Despite that, one has to be prepared to accept that we are going to pay a very dear price.

Responding to terrorist attacks with the bombing of cities only breeds more terrorists.

Hollande is making mistake after mistake. You don’t change your constitution because of a terrorist attack. You don’t order the bombing of a city. You don’t invoke an European clause of self-defense to force your allies to go beyond what they offer because of a terrorist attack. The French presidency has not been up to the occasion. We live in times of lack of enlightened leadership.

Javier,

it is a pity that most people do not get it what you wrote in your last paragrah, instead they give the terrorists what they want.

It’s scary what Hollande is doing with his “emergency measures.” Here’s what CBS had to say about it last night:

https://youtu.be/VLdzdcrDtDc?t=125

The means of defence against foreign danger have been always the instruments of tyranny at home. Among the Romans it was a standing maxim to excite a war, whenever a revolt was apprehended. Throughout all Europe, the armies kept up under the pretext of defending, have enslaved the people.

― James Madison, Notes of Debates in the Federal Convention of 1787

Javier,

Hollande is not making mistake. You are making mistake on how you perceive whom he represent. He represents Lois Vutton and Tiffany crowd, so 1% crowd. Holland is doing the same thing that all politicians in France have been doing for centuries. Arm and divide the natives and then come as cavalry on aircraft carrier as peacekeepers. If you read the history on how countries in the North Africa were formed you will know how the French, as they were retreating from their colonies, were “poisoning the wells” by creating fake countries from several different ethnic and religious groups. Divide and Conquer. There is no better and low cost way to pull the strings in the far lands from Versailles.

Hollande is a pin head.

I suppose the Statue of Liberty is a target, that was made in France.

Yep, there used to be a watering hole within walking distance of my home in Hollywood Florida where I would occasionally stop for a beer. One day I noticed a sign in the window with the inscription: “Boycott French Products”. So I casually asked the owner if he would sign a petition to have the Statue of Liberty dismantled and returned to France? He seemed to be at a loss for an answer. Ironically they are no longer in business and there is now a restaurant in that space, called Exotic Bites, the owner is an Egyptian…

I always enjoy watching the fur fly when Sam Harris and Scott Atran debate radical Islam.

Atran has worked decades interviewing and counseling young people who have converted to radical Islam, so speaks with a great deal of firsthand knowledge when it comes to the ideology.

Ralph linked to an article by Atran on the last thread, which can be found here:

http://peakoilbarrel.com/bakken-big-decline-in-september/comment-page-1/#comment-546566

Atran stakes out the exact opposite position that Harris does. He asserts that Isis’ popularity has very little to do with its theology or religious teachings.

Instead, Atran argues, its appeal is due to its secular, non-religious aspects.

Atran states that radical Islam “conscientiously exploits the disheartening dynamic…in Europe in ways reminiscent of the hatchet job that the communists and fascists did on European democracy in the 1920s and 30s.”

“As I testified to the US Senate armed service committee and before the United Nations security council,” Atran adds, “what inspires the most uncompromisingly lethal actors in the world today is not so much the Qur’an or religious teachings. It’s a thrilling cause that promises glory and esteem.”

“It’s communal,” he continues. “They join a ‘band of brothers (and sisters)’ ready to sacrifice for significance.”

Atran is not the first to argue that radical Islam has its origins in the revolutionary secular ideologies which engulfed Russia and Germany in the first half of the 20th century.

Malise Ruthven, for instance, writes in A Fury for God, The Islamic attack on America that “the revolutionary vanguard Qutb advocates does not have an Islamic pedigree… The vanguard is a concept imported from Europe, through a lineage that also stretches back to the Jacobins, through the Bolsheviks and latter-day Marxist guerillas such as the Baader-Meinhof gang.”

“Qutb’s ideas about revolutionary struggle were of recent European vintage,” John Gray asserts in Al Qaeda and What It Means to Be Modern.

Or as Leonard Binder puts it in Islamic Liberation: A Critique of Development Ideologies, Qutb “seems to have adopted the post Kantian aesthetic.”

“The intellectual roots of radical islam are in the Eurpean Counter-Enlightenment,” Gray concludes. “It is the fact that radical Ialam rejects reason that shows it is a modern movement. The medieval world may have been unified by faith, but it did not scorn reason.”

Atran is not the first to argue that radical Islam has its origins in the revolutionary secular ideologies which engulfed Russia and Germany in the first half of the 20th century.

Are you sure that’s his argument? He seemed to be drawing a parallel between their tactics, not a causal line.

The medieval world may have been unified by faith, but it did not scorn reason.

I agree that much of the energy of today’s fundamentalism comes from a rejection of modern ideas, which makes it far more rigid than earlier religious practice. But, the idea that faith is entirely compatible with reason seems puzzling.

Isn’t faith dependent on reliance on authority, rather than thinking things through on one’s own?

Nick G,

I have been following the debate between Sam Harris and Scott Atran since their showdown at The Science Network’s “Beyond Belief” conference in 2006. You can watch it here:

https://www.youtube.com/watch?v=8VWO6U6248c

https://www.youtube.com/watch?v=Wu6qQDphSGU

https://www.youtube.com/watch?v=BRKbBsl6KaQ

Atran states that he believes radical Islam is like all the other messianic secular “isms” which emerged during the 20th century — communism, anarchism, etc. — which he calls “secular versions of Christianity.”

Atran presents as evidence a massive empirical survey, with more than 10,000 respondents, which shows that the ideological adherents with the greatest “tendency to scapegoating” and who are the most “violent and inflexible in their beliefs” are Catholics, atheists, and Orthodox Christians. Those who exhibit the least of these traits are Buddhists, Hindus and Muslims.

Atran cites more evidence in his recent testimony before the Security Council of the United Nations, which can be heard (or the transcript read) here:

http://blogs.plos.org/neuroanthropology/2015/04/25/scott-atran-on-youth-violent-extremism-and-promoting-peace/

Following are some of the things Atran had to say about the youth that has taken “the path of violent extremism” in his UN presentation:

Atran goes on to conclude that

It was known at the time of the 2006 “Beyond Belief” conference that the New Atheists (Harris is one of the “Four Horsemen of New Atheism”), along with their fellow travelers some very promient neoclassical economists, were the high priests of the cult of the self. (See, for instance, Moral Sentiments and Material Interests by Herbert Gintis eta al, published in 2005.)

It would not be fully revealed, however, until 2013 that the New Atheists are hardline, card-carrying members of the U.S. war party, for which they were duly called out by Glenn Greenwald, Nathan Lean, and many others:

http://www.theguardian.com/commentisfree/2013/apr/03/sam-harris-muslim-animus

http://www.salon.com/2013/03/30/dawkins_harris_hitchens_new_atheists_flirt_with_islamophobia/

It would not be fully revealed, however, until 2013 that the New Atheists are hardline, card-carrying members of the U.S. war party

This seems to argue that M.E. war is not about religion, but rather US intervention:

“Indeed, even a Pentagon-commissioned study back in 2004 – hardly a bastion of PC liberalism – obliterated Harris’ self-justifying stereotype that anti-American sentiment among Muslims is religious and tribal rather than political and rational. That study concluded that “Muslims do not ‘hate our freedom,’ but rather, they hate our policies”: specifically “American direct intervention in the Muslim world” — through the US’s “one sided support in favor of Israel”; support for Islamic tyrannies in places like Egypt and Saudi Arabia; and, most of all, “the American occupation of Iraq and Afghanistan”.”

http://www.theguardian.com/commentisfree/2013/apr/03/sam-harris-muslim-animus

Which seems to support the argument that indeed…war in the M.E. is all about oil, and that the US would prevent the loss of a lot of blood and wealth by transitioning away from oil ASAP.

Nick,

I don’t know if the “war in the M.E. is all about oil,” but the narrative that Harris and Murray are peddling — that it’s all about irrational religious passions — is certainly incorrect.

As Michael Allen Gillespie said of the “religious wars” that ravaged Europe during the 16th and 17th centuries:

It would be great if Glenn stopped posting his absurd attempts to keep us from seeing the stark evil of religious dogma. Much of the religious warfare in European history was framed specifically in religious terms. Almost all of the battle lines that either now exist or are likely to exist in the Middle East will be precisely determined by religious differences. There are a great many mothers of dead terrorists who celebrate what their sons have done and express the hope that their remaining progeny will pursue the same religious obligation.

Don,

The grotesquely reductionist explanation of highly complex phenomena which you offer up, in defiance of all the evidence to the contrary, is what has largely discredited New Atheism.

The bottom line, at least for anyone with even the most rudimentary knowledge of history, is this: There is no singlular cause which can explain the evils perpetrated by mankind, and thus there is no silver bullet to slay those evils.

The French Revolution, with its extravagant claims for the rule of reason and its abysmal realization of these clams in the Terror, should have made the limitations of the modern project abundantly apparent

Scott Atran, in his closing remarks at the “Beyond Belief” debate with Sam Harris, summed up the problem as follows:

I agree there’s lots of nonsense in the world, and that science may or may not, even though I see no historical evidence of what science has done for morals yet, or ethics or politics or anything else – in fact I’ve seen the contrary – but, let’s suppose there is. And let’s suppose it’s a good mission to get rid of the nonsense in the world. This is the problem which you are not facing: how to advance science and reason in a fundamentally irrational world. Not to wish it go go away. Not to believe that by rational argument it will go away. But how to deal with that problem. It is a very, very hard problem.

Hi Glenn,

Lots of people prefer simple explanations. It is often a problem even in very sophisticated analyses.

For some the focus is power, for others it is religion, for others it is energy, and for some it is debt.

Many people have their pet “essentialisms” as Resnick and Wolff like to call them. An analysis that doesn’t boil everything down to a single essential concept from which everything else flows, is hard to find. The world is a complex place and particularly for social science there are many different ways of looking at things.

I agree with your main point that very simple explanations are inadequate. Keep in mind that on a blog most people are trying to be concise [not me 🙂 ]

Dennis,

I agree that people have what seems to be an almost instinctive drive to over-simplify. But these simplifications should not be confused with factual reality. Leo Tolstoy put it this way in War and Peace:

The human mind cannot grasp the causes of phenomena in the aggregate. But the need to find these causes is inherent in man’s soul. And the human intellect, without investigating the multiplicity and complexity of the conditions of the phenomena, any one of which taken separately may seem to be the cause, snatches at the first, the most intelligible approximation to a cause, and says: “This is the cause!”

The grotesquely reductionist explanation of highly complex phenomena which you offer up, in defiance of all the evidence to the contrary, is what has largely discredited New Atheism.

The idea that highly complex phenomena can only be explained by the hand of God is obviously what you are driving at. Such belief is based on ignorance, ignorance of science and the worst kind of ignorance of all, the belief that the answers can be found in religion.

There is no such thing as New Atheism! Atheism is as old as religion itself. Well, perhaps almost as old as religion. There has always been superstition in the world and religion sprang from ignorance and superstition.

Religion is still battling science and that is all you are doing Glenn. Pretending that there is some organization or group of people that go by the name of “New Atheism” is just your stupid attempt to create a straw man so you can slay him in the name of ignorance and superstition. (i.e. religion).

°°°°Ron Patterson says:

The idea that highly complex phenomena can only be explained by the hand of God is obviously what you are driving at.

No, that’s not at all what I’m driving at.

What I’m driving at is that many of the criticisms, and for me what are the most interesting criticisms, leveled at the New Atheists come from other atheists, or from other scientists (whether they be atheist or not).

What I’m driving at is that there should be no atheist ‘acid test’ required before someone’s evidence, or the hypotheses which they draw from that evidence, are deemed to be valid.

Here’s how Stephen Jay Gould described the “Darwinian fundamentalists,” or “ultras,” as he called them:

Since the ultras are fundamentalists at heart, and since fundamentalists generally try to stigmatize their opponents by depicting them as apostates from the one true way, may I state for the record that I (along with all other Darwinian pluralists) do not deny either the existence and central importance of adaptation, or the production of adaptation by natural selection….

“Straight is the gate, and narrow is the way.” Fundamentalists of all stripes live by this venerable motto, and must therefore wield their unsleeping swords in constant mental fight against contrary opinions of apostates and opponents… [T]he basic ideological weapon of fundamentalism rarely departs much from the tried and true techniques of anathematization.

Unfortunately, at least for the ideals of intellectual discourse, anathematization rarely follows the dictates of logic or evidence, and nearly always scores distressingly high in heat/light ratio.

http://www.nybooks.com/articles/archives/1997/jun/12/darwinian-fundamentalism/

°°°°Ron Patterson says:

There is no such thing as New Atheism!

Well, I suggest telling that to Victor J. Stenger, an author and physicist and one of seminal, leading lights of New Atheism. He published a book titled The New Atheism: Taking a Stand for Science and Reason in 2009.

This is from the Amazon webpage for the book:

The authors of these books—Richard Dawkins, Daniel Dennett, Sam Harris, Christopher Hitchens, and Victor J. Stenger—have come to be known as the “New Atheists.” ….

The New Atheism is a well-argued defense of the atheist position and a strong rebuttal of its critics.

http://www.amazon.com/The-New-Atheism-Taking-Science/dp/1591027519

Glenn, I will not get into the Gould debate. Gould has gone and can no longer defend himself. That is why Dawkins quit pointing out the very stupid things that Gould wrote. He just wanted to let Gould rest in peace.

But I did follow that debate while Gould was alive. And Dawkins made Gould look like an idiot at every turn. Now Gould was a very smart man, he just had a blind spot, he was an ideologist. Gould wrote high praises about the Stephen Rose et. al. book “Not In Our Genes” which tried to argue that intelligence was not inherited. And Dawkins took him to the woodshed for it. That and other things.

Glenn, just because someone writes a book about a group of people and calls them “The New Atheist” does not mean that such an organization actually exist. It does not. The men exist but such an organization does not. Therefore you cannot ascribe to them qualities that can only be ascribed to an organization. They don’t have a “membership” roll so you cannot say Blacks or Hispanic are not included since no one is included. And you cannot say they mistreat women or whatever since there is no organization to mistreat anyone. You cannot ascribe qualities to a group when there is no such group.

Glenn,

I agree that religion is not the sole cause of evil.

On the other hand, that doesn’t mean that supernatural explanations of the world are helpful. On the contrary, they push us in the direction of irrationality and deference to authority, and support authoritarian relations and violence.

Just because people reject religion doesn’t mean that they’ve become rational – irrational culture and psychology is very persistent. But, religion gets in the way of becoming rational.

°°°°Nick said:

…that doesn’t mean that supernatural explanations of the world are helpful. On the contrary, they push us in the direction of irrationality and deference to authority, and support authoritarian relations and violence.

Is that what the Rev. Martin Luther King’s religion did?

Mahatma Gandhi’s?

Albert Einstein’s?

Nick said:

…religion gets in the way of becoming rational.

No denying that, if by being rational what you mean is not departing from factual reality.

But why single out religion?

Some people, including myself, are very skeptical about man’s ability to reason. And James Madison and John Adams certainly didn’t buy into Thomas Jefferson’s naive empiricism. Here, for instance, is what Adams had to say about man’s very limited ability to reason:

Our passions, ambitions, avarice, love and resentment, etc., possess so much metaphysical subtlety and so much overpowering eloquence that they insinuate themselves into the understanding and the conscience and convert both to their party.

This is the thinking which informed our constitutional and its separation of powers. As Adams continues:

Power must be opposed to power, force to force, strength to strength, interest to interest, as well as reason to reason, eloquence to eloquence, and passion to passion.

The idea is to try to keep any one group from gaining a monopoly of these things.

Is that what the Rev. Martin Luther King’s religion did?

Yes. Fortunately, he rose above that.

Note my language: I said religion “pushes” and “supports” certain things. That doesn’t mean that religious organizations can’t behave better than that. It just means that the underlying ideas promote certain things.

if by being rational what you mean is not departing from factual reality.

Factual reality is important. But what I’m referring to is a process: the process of thinking for one’s self, rather than relying on authority.

But why single out religion?

I’m talking about any organized movement that promotes reliance on authority for one’s ideas, and belief in the supernatural. I don’t like psychics, either.

Some people, including myself, are very skeptical about man’s ability to reason.

Sure. I agree. But…what’s the alternative? Relying on the reasoning of someone else, who tells us that they got their authority from a vision??

Now, I’d agree that religious organizations have much accrued cultural wisdom, including “mystical” wisdom that deserves more attention. But, we can’t accept it uncritically.

I have been following the debate between Sam Harris and Scott Atran …You can watch it here:

I hate watching videos. Have you come across any transcripts for these?

Nick,

I don’t know of any transcript that is available.

Amazing please do tell more. I had no idea that islamic fundamentalism was a product of the 20th century. What true enlightenment you represent.

@Glenn

Amazing please do tell more. I had no idea that islamic fundamentalism was a product of the 20th century. What true enlightenment you represent.

It’s instructive to see what’s going on in Turkey, an overwhelmingly Muslim country, and an ally of the US, and a member of NATO. A Reuters reporter noted that following a request for a minute of silence in honor of the Paris victims at the Turkey/Greece soccer game in Istanbul, the audience responded with boos, and chants of “Allah Akbar,” echoing the chants from the Islamic terrorists in Paris, as they shot hundreds of people.

Incidentally, the largest charter school operation in Texas is the Harmony Public School system, which is run by followers of a secretive Turkish Islamic cleric, Fethullah Gulen*. Harmony is just one of several Gulen school systems in the US and around the world.

The Gulen schools have brought in thousands of Islamic trained teachers from Turkey to teach in US schools, on H1-B Visas.

What could possibly go wrong?

*After years of denying any connection between Gulen and the Gulen schools, Gulen himself “came out of the closet” in a recent New York Times column and admitted that his followers have set up schools all over the world. Gulen is fighting an arrest warrant issued for him in Turkey, and he is apparently trying to convince Americans that he is a good guy who runs great schools, presumably in an attempt to fight a possible extradition request from Turkey. Apparently, Gulen has had a falling out with the Turkish president, after previously being closely allied with him. In prior years, there were reports that anyone in Turkey who criticized Gulen ran the risk of being arrested on trumped up charges.

WikiLeaks files detail U.S. unease over Turks and charter schools (April, 2011)

http://articles.philly.com/2011-04-04/news/29380536_1_charter-schools-fethullah-gulen-truebright-science-academy

In Male Homosexuality: A Contemporary Psychoanalytic Perspective, Richard C. Friedman notes that,

More concretely, Amitai Etzioni in The Moral Dimension speaks of the tactics that political and economic entrepreneurs use in their “Us” vs. “Them” group-making, placing “Us” and “Them” in their neat little boxes, as well as what motivates this behavior:

Alan Gilchrist, professor of psychology at Rutgers University, called out Sam Harris and Richard Dawkins on their one-eyed view of the world at the “Beyond Belief” conference in 2006:

Islamophilia:

https://www.youtube.com/watch?v=dprjKb8yiSY

This fellow Douglas Murray is a new one on me, that is until you and Sam Harris brought him up.

But I must confess that those news outlets which Murray is a darling of (e.g., Fox News, The Spectator, The American Spectaror) are not the places I ususally go to for news and political commentary.

“29 August: Douglas Murray on Fox News discussing the US’ lack of strategy”

https://www.youtube.com/watch?v=KV-ra7XRfGI

“Douglas Murray – Tracking Terror [Fox News]”

https://www.youtube.com/watch?v=3S-d2gU62PM

“Douglas Murray – Intelligence Agencies and Terror [Fox News]”

https://www.youtube.com/watch?v=0yD9l68TXCE

“10 January: Douglas Murray on Fox discussing the war with Radical Islam”

https://www.youtube.com/watch?v=EBA_aysA63U

Donald Trump, not to be outdone by Murray in the war on Islam, or in the macho-male chest pounding contest, fired back yesterday: “I will quickly and decisively bomb the hell out of ISIS. We’ll rebuild our military and make it so strong no one, and I mean no one, will mess with us.”

http://www.cbsnews.com/videos/republicans-to-president-obama-no-syrian-refugees-here/

To which President Obama responded: “These are the same folks oftentimes who suggest that they’re so tough that just talking to Putin or staring down ISIS or using some additional rhetoric is somehow going to solve the problems out there, but apparently they’re scared of widows and orphans coming into the United States of America as part of our tradition of compassion.”

“They’ve been playing on fear in order to try to score political points, or to advance their campaigns,” Obama added, “and it’s irresponsible. And it’s contrary to what we are. And it needs to stop, because the world is watching.”

http://www.cbsnews.com/videos/kerry-confident-isis-will-ultimately-be-destroyed/

But Sam Harris and Douglas Murray have many more fellow travelers than just Donald Trump. As the Southern Poverty Law Center reported,

Regarding Bush 43’s invasion of Iraq, it was Ralph Nader and his Green Party supporters in Florida who provided the swing votes against Gore in the year 2000 and delivered the US and the world into the arms of the Neocons. A combination of some of my comments on the prior thread:

It’s interesting how one man can change world events, e.g., Gavrilo Princip, who assassinated Archduke Ferdinand, triggering the First World War, and indirectly the Second World War.

If it weren’t for Ralph Nader, in my opinion it’s a virtual certainty that Gore would have won Florida in 2000*, and thus the presidency. And I can’t imagine that Al Gore would have launched an invasion of Iraq.

My point is that just as Princip’s assassination of Archduke Ferdinand directly triggered the First World War and indirectly led to the Second World war, Nader’s political assassination of Al Gore in the year 2000 allowed a person, Bush 43, to be elected president–when a majority of voters in Florida and nationwide voted against Bush.

And 9/11 gave Bush/Cheney/Rumsfeld and the Neocon crowd the excuse for invading Iraq–which arguably may have led to what may be decades of unrest, instability, terrorism and war, plus hundreds of thousands to perhaps millions of casualties.

In any case, what’s bizarre about the 2000 election is that Nader ran as a third party (Green Party) candidate and therefore contributed directly to defeating a person, Al Gore, who was in my opinion the most pro-environment major party candidate that we have ever seen or perhaps that we will ever see.

And in regard to current US politics, I’m beginning to wonder if the terrorist attack in Paris–and Obama’s tone-deaf response to concerns about Middle Eastern/North African refugees/migrants–may have made it possible that we may, God help us, see Donald Trump become the 45th President of the United States. Obama’s response has been characterized as arrogant, dismissive or petulant, even by some of his allies.

*About 100,000 people in Florida voted for Nader and Bush won Florida by about 500 votes

of course if Gore could have won his home state……

Well there’s no better defense than to blame the victim.

“Well, she didn’t fight me off.”

Glenn,

Two hundred years ago in the South where I have lived all my life, there was “us” white folks and a lot of slave owners. Then there was “them”, black folks who were all slaves. My point is Glenn, that sometimes it is completely legitimate to divide folks into “us” and “them”.

I lived in Saudi Arabia for five years back in the early 80s. There was “us” non Muslims and there was “them”, the Muslims. Then there were “them” women whom we never saw. Well there hands were exposed and sometimes their eyes. But other times their eyes were covered also with a veil. These women were not allowed out except when accompanied by a family member.

There were exceptions to this law, or religious rule. Beggar women were allowed out alone… to beg. These women were widows who’s husbands had died and left them penniless. So if they had no other family member to support them they either died or begged. They never had any life insurance on their husbands because that was against the law in Saudi. It was considered placing a wager against the will of Allah.

The women were not allowed to drive, not allowed to work and had no life whatsoever outside their home. It is the same in many other Islamic countries, to varying degrees. But in all Islamic countries women are second class citizens. That is simply a tenant of the Islamic religion even though most Islamist would deny it. And that is what assholes like Alan Gilchrist say we are not allowed to criticize. Well my sentiments are entirely with Sam Harris, Richard Dawkins and Bill Maher when they criticize the such stupid practices in the name of religion.

Edit: During my five years in Saudi Arabia I made several flights between the US and Saudi. On many of these trips, especially those between Houston and Dhahran, there would be several Saudi women on board, accompanied by their husbands of course. The women would be decked out is high heels or cowboy boots, jeans and colorful blouses. But about half an hour out f Dhahran they would make their way to the bathroom… and in a few minutes exit… a black lump.

Had they dared to exit the aircraft in their Texas attire, they would have been carted off to jail as soon as the customs agent saw their Saudi passport. In Saudi Arabia women don’t have rights.

Isn’t that precious…

BTW:

So Ron, we’re to believe that the New Atheists, who Victoria Bekiempis blasted as being a “showboating boys’ club,” are now all of a sudden concerned about women?

http://www.theguardian.com/commentisfree/cifamerica/2011/sep/26/new-atheism-boys-club

After pointing to a number of promient female atheists – Madalyn Murray O’Hair (founder of American Atheist), Sergeant Kathleen Johnson (founder of an organisation for atheists in the United States military), Debbie Goddard (founder of African Americans for Humanism), and writers Jennifer Michael Hecht and Susan Jacoby – Bekiempis asks: “If all these smart, clearly respected women are in the mix of loud-and-proud atheists, why does the face of New Atheism still look like that of a curmudgeonly, sixtysomething white guy?”

Annie Laurie Gaylor, who founded the Freedom From Religion Foundation with her mother, Anne Nicol Gaylor, in 1978, sums up the problem with our little “band of intellectual brothers” bluntly: “One word – sexism.”

Bekiempis acknowledges that Harris hasn’t made the overtly misogynist statements like other members of the all male club have, such as Christopher Hitchens and Stephen Fry. Nevertheless, Harris doesn’t seem to have any qualms about keeping women hidden safely away at the back of the bus.

So I’m wondering, given the New Atheists’ history of keeping women quarantined and marginalized, why the epiphany?

Glenn, there is no group that calls themselves the “New Atheists”. That is just a made up term by atheist haters. And there is no “New Atheists” movement. These guys, Dawkins, Harris and others, are just individual atheists who now choose to speak out about the hypocrisy of a lot of Bible thumpers.

Quoting what individual atheists have said or did in the past is also a stupid rhetorical trick. I could give you instances of what religious people have done in the past, rape, murder and so on, and say this is an example of “The New Religious Order” or some shit like that. But I would not do that because that would be just as stupid as what you are doing.

Harris doesn’t seem to have any qualms about keeping women hidden safely away at the back of the bus.

That is absolute fucking bullshit! Harris speaks out for women’s rights at every opportunity. If all you can do is make up lies then it would be better if you just keep silent.

Well Joan Roughgarden (born Jonathan Roughgarden), an evolutionary biologist who teaches at Stamford University, certainly didn’t have any problem calling Dawins and Harris out.

Being an academic and not a political activist, she wasn’t quite as blunt as Gaylor and Bekiempis, but she nevertheless managed to get her point across at the 2006 “Beyond Belief” conference. On a panel she served on with Richard Dawkins, she charged that:

It’s hard to tell what that quote is referring to, without a transcript.

It’s not clear that it’s about sexism on the part of athiests.

Nick,

The link is there to the video of the panel discussion.

If you can’t be bothered to go listen to the panel discussion between Dawkins and Roughgarden, what else can I say?

You can say that we all have better things to do with our time than listen to videos.

If it’s not worth transcribing…

Nick,

Even if what you say is true, then is it not incumbent upon the New Atheists to make an effort to be more inclusive, so as to counter the media perception?

But they have not done this, have they?

For instance, can you point to one leading woman New Atheist?

Can you point to one leading black New Atheist?

Can you point to one leading hispanic New Atheist?

The reality, of course, is that the New Atheists have not gone out of their way to be inclusive. And in fact, they have done just the opposite, as Bekiempis documents in her article. (I tried to include her specific citation, the paragraph which begins with “Nevertheless” and ends with “but the ‘New Atheists’ referred to in his book’s promotional materials include none of these women.”)

All of this exclusionary behavior by the New Atheists, of course, comes in defiance of the factual reality: decades of literary works published by strident, out and proud women atheists.

Glenn, once again, atheists are not new atheist, they are just atheist. There is no organization called “The New Atheist”. One cannot be included in an organization that does not exist.

Can you point to one leading black New Atheist?

One that you might call a new atheist is Neil deGrasse Tyson. But he is definitely not a new atheist, he has been an atheist all his adult life.

But Neil deGrasse Tyson is not a member of any group that calls themselves “New Atheist” and neither is Bill Maher, Richard Dawkins or Sam Harris. They cannot be because such an organization does not exist. They all have been atheist all their life, or at least since they figured out that religion is nothing but stupid superstition.

And such people number in the hundreds of millions. To label them all as “New Atheist” is just ignorance coming from those that hope to prop up their superstition by slandering scientific and rational people.

Ron Patterson says:

So these women atheists who are raising these issues about the exclusion and mysogeny of the New Atheists — a term they use — are all self-hating atheists?

So these women atheists who are raising these issues about the exclusion and mysogeny of the New Atheists — a term they use — are all self-hating atheists?

For the record, Joan Roughgarden is a proponent of Theistic Evolution. Which hardly qualifies her as an Atheist… Furthermore I highly doubt Dawkins could be characterized as a mysogenist.

I would venture that both Dawkins and Harris have more of an issue with Roughgarden’s views on God having a hand in evolution than with the fact that she is a woman.

As for mysogeny in academia, that is very much a separate issue from Atheism!

Fred,

So what about Gaylor and Bikiempis? Are they not atheists?

Are their charges of sexism not specific enough?

Let me assure you, they’ve spent many decades fighting in the trenches, and they very well know how to take names and kick ass. What kind of “ludicrous,” “idiotic,” and “data-free” narrative, to paraphrase Roughgarden, do you imagine the New Atheists can cook up to disqualify them?

The bottom line is that the little piece of ground the New Atheists stand on is slowly eroding away. Many people, including many atheists and many scientists, just don’t buy into their “secular stealth religion,” as David Sloan Wilson called it, or their “Darwinian fundamentalism,” as Stephen Jay Gould called it. And that’s even before we get around to talking about their sexism, militarism, Islamophobia, and anti-religious bigotry.

Are their charges of sexism not specific enough?

No, they’re not. Again, read the article more closely, and you’ll see that Bekiempis and Gaylor said that it was the media that was engaging in sexism.

As to the larger question: yes, religion based on a personal god tends to foster a dependence on authority, which can be associated with authoritarianism in all of it’s aggressive, rigid forms.

And, people who are raised in an authoritarian culture will tend to be authoritarian, regardless of the intellectual ideas they hold as adults. So, some atheists will be rigid and aggressive, even if their ideas ideally would point them in a different direction.

Nick,

Even if what you say is true, then is it not incumbent upon the New Atheists to make an effort to be more inclusive in order to counter the media perception?

But they have not done this, have they?

For instance, can you point to one leading woman New Atheist?

Can you point to one leading black New Atheist?

Can you point to one leading hispanic New Atheist?

The reality, of course, is that the New Atheists have not gone out of their way to be inclusive. And in fact, they have done just the opposite. As Bekiempis explains in her article:

Nevertheless, a statement on Stenger’s website identifies Harris’s book as the bellwether of contemporary atheist thought. On a page promoting his own book, The New Atheism: Taking a Stand for Science and Reason, Stenger writes that The End of Faith “marked the first of a series of bestsellers that took a harder line against religion than has been the custom among secularists.” In an email interview, Stenger acknowledged that female atheists do exist – name-checking Ayaan Hirsi Ali, Wendy Kaminer, Rebecca Goldstein and Michelle Goldberg, as well as Jacoby – but the “New Athiests” referred to in his book’s promotional materials include none of these women.

This outrageously false statement of Stenger’s comes in defiance of the factual reality: decades of literary works published by strident, out and proud women atheists.

Nick,

The complaint, and the sad reality, is that the New Atheists have made no effort to be inclusive. And in fact, they have done just the opposite. As Bekiempis explains in her article:

Nevertheless, a statement on Stenger’s website identifies Harris’s book as the bellwether of contemporary atheist thought. On a page promoting his own book, The New Atheism: Taking a Stand for Science and Reason, Stenger writes that The End of Faith “marked the first of a series of bestsellers that took a harder line against religion than has been the custom among secularists.” In an email interview, Stenger acknowledged that female atheists do exist – name-checking Ayaan Hirsi Ali, Wendy Kaminer, Rebecca Goldstein and Michelle Goldberg, as well as Jacoby – but the “New Athiests” referred to in his book’s promotional materials include none of these women.

This outrageously false statement of Stenger’s comes in defiance of the factual reality: decades of literary works published by strident, out and proud women atheists.

Glen, as Ron mentioned, there is NO organization know as the ‘New Atheists’.

Are there individuals in academia who are also atheists and perhaps happened to be mysogenistic old white men? I’m sure there are but one has nothing to do with the other.

Fred,

So atheists like Bekiempis, Stenger, Gaylor, and Monica Shores just made up the entire New Atheism thing from whole cloth?

Again, Bekiempis and Gaylor were talking about the Media making it up.

I’d guess Stenger went along for the ride – remember, his promotional materials talked about “best sellers”, not the atheism “community” as a whole.

given the New Atheists’ history of keeping women quarantined and marginalized

That’s not what Bekiempis or Gaylor said.

They said that it was the Media that was quarantining and marginalizing female atheist writers.

More lying BS from Glenn. My friend Melody Hensley organized a number of Women In Secularism Conferences. This was with solid support from the Center for Inquiry, which is one of the largest national secular organizations. The videos from them are almost all available on the web and are highly recommended.

given the New Atheists’ history of keeping women quarantined and marginalized.

That is about the stupidest thing I have read in a long time. Glenn you don’t have a fucking clue as to what the hell you are talking about. There is no group that calls themselves the “New Atheist”. Atheist sometimes do organize, like “The Freedom From Religion Foundation”. But none of those atheist are new and the organization is decades old.

And claiming that any of them keep women marginalize is just plain ignorant. I am shocked that anyone on this list would be so damn dumb as to make such a claim.

Ron,

So atheists like Bekiempis, Stenger, Gaylor, and Monica Shores just made up the entire New Atheism thing from whole cloth?

See my comment above.

Syrian Conflict a Battle in Fourth Generation Warfare Unleashed by West

What goes around, comes around.

Addendum:

Assad Condemns ‘Savage’ Paris Attacks, Blames French Foreign Policy

“New evidence emerging from the investigation into the Paris attacks

Hey, Steven Pinker, wait for it…

If Y is the total number of Muslims and if X is the number of violent Islamic extremists, it stands to reason that as Y (total number) increases so does X (violent extremists). Of course, X (violent extremists) would be the sum of recent (extremist) immigrants plus home grown violent Islamic extremists, i.e, the children of previous immigrants, which is what apparently happened recently in France.

So, it would stand to reason that if one wants to increase X (total number of violent extremists), we should allow greater immigration from predominantly Muslim countries.

Probably the more important thing to focus on is finding productive employment for all those young males.

France would do well to make the children of immigrants automatic citizens, and promote assimilation, rather than keeping them unemployed in ghettos.

And, countries like Saudi Arabia would do well to expand their economy beyond oil, and find things to do for their young people. It might help if the US stopped supporting a rigid monarchy, which resists opening up the economy and government to new things.

Of course, the US is terrified of any change at all in countries like KSA, because that might endanger oil supplies. But, the longer change is delayed, the more violent it will be when it comes. After all, look how violent the change was in Iran in 1979, after 25 years of US imposed authoritarian rule.

The US may have to kick the oil habit before it can dump it’s counter-productive foreign policies.

For peak oil we sure do seem to have a lot of it. /SMH

Really? Texas produces about 4% of the world’s crude oil production. And you can tell from looking at that 4% that we sure do seem to have a lot of oil?

I recall hearing that Texas was a Net Energy Importer. Jeff, Is that still the case. Florida imports 99.9+ % of it’s Energy.

With the production increase, Texas is almost certainly a net energy exporter now.

http://www.marketwatch.com/story/minister-says-russia-oil-output-increasing-report-2015-11-16

“Russia’s oil output is increasing and will reach 533 million metric tons this year, Energy Minister Alexander Novak said Monday, Interfax news agency reported.

Russia’s oil production has already exceeded levels of the Soviet Union and now the world’s second-largest oil producer pumps an average of 10.74 million barrels a day, according to government data.

Earlier this year, Mr. Novak said that Russia’s oil production in 2016 will be close to this year’s levels.”

I still believe 2015 will be the peak for Russia. Their web site, CDU TEK showed a huge drop the last few days. They are at 1446.9 thousand tons per day. They were around 1470 just a few days ago. I expect to see Russian production lower in November and December.

Ron, do you really think that daily, weekly of monthly fluctuations in production volumes are a sign of a permanent peak? They can be a result of maintenance, weather conditions or other temporary factors.

There were days in recent months when production dropped below 1440 thousand tons per day. And there were sharp monthly declines. For example, production in July 2014 dropped to 1418 th. tons from 1440 th tons in previous month (by 158 kb/d).

Oh for God’s sake Alex, give me a little fucking credit. I have been following Russian oil production for 10 years and I know a bit about what might indicate whether a country is peaking or not.

The below chart is from the EIA’s Short Term Energy Outlook, Russia Total Liquids. The EIA has Russia peaking in 2015. That is my estimate also. But that is based on one hell of a lot more than just the below chart.

Ron,

I have been following Russian oil industry for 35 years.

I am regularly reading local sources, including company reports, etc.

The EIA is certainly not the most reliable source of information on Russian oil.

They have been revising up their forecast for 2015-16, but with significant delays. It’s amazing that they have Russian production peaking in June 15, followed by a six-month decline.

In fact, production declined in July, but has been recovering in August-October, having reached a new post-Soviet record.

The IEA has also been pessimistic on Russian oil production since end-2014, but they finally recognized that output remains surprisingly resilient and now project it to “remain robust in 2016 as well” (IEA OMR November 2015).

Their updated C+C+NGL production forecast for 2016 is 11.05 mb/d, up from 10.93 mb/d in October OMR and 10.86 mb/d in July OMR.

The IEA is more closely following monthly oil production numbers, as it works with local agencies, and is revising estimates with only one-month delay.

Russian total liquids (C+C+NGLs) production estimates and forecasts from different issues of EIA STEO

Alex, do you have production data for the Nenetsky AO? I did a study in the area, to prepare the development due east of Naryan Mar.

Fernando,

When have you been there? Did you work with Total?

Oil production in the NAO was rapidly rising until 2009; then it was equally rapidly dropping due to unexpectedly high declines at Lukoil’s South Khylchuyuskoe oil field. Production stabilized and started to rise again last year due to the start-up of the Trebs and Titov field and several smaller fields. Growth is continuing this year and is projected for for 2016 due to ramp-up of Trebs and Titov and several new field start-ups by Lukoil and Rosneft

Oil production in the Nenets autonomous district (kb/d)

Sources: Arhangelskstat; NAO government forecast

Nice. So YK didn’t have a continuous reservoir? I always thought it was the field that a super alien deity created (I’m agnostic).

Are they moving the oil by tanker from the Pechora terminal?

Oh, and no, I didn’t work for Total.

AlexS,

The fall in oil production is not a sign, indication, or confirmation of peak oil. It is the fulfillment of a prediction based on the end of cheap to produce oil.

One can just look at the graph and think that there is nothing new in this fall and that prices will eventually recover and production will surpass this peak, or one can study the causes of the fall, the effect that it will have on production and the economy, and understand that this time it is for real.

The predictions that are going to fail are those that claim that this is a temporary situation and that a recovery of prices and production will take place in a few months or 1-2 years, because they are baseless.

Javier,

Ron’s chart uses EIA’s estimated that are wrong and outdated.

In fact Russian oil production reached a new record in October.

Here is the chart with real numbers of crude + condensate production from the Russian Energy Ministry (unlike the EIA and the IEA, it does not include NGLs, but NGLs production is also rising due to increasing share of wet gas in total natural gas output):

Ok, you convinced me regarding Russia.

They are the main ones gaining market share through 2015, then.

Javier,

The main winner in terms of market share this year is Saudi Arabia. In 2014 and the previous 2 years, it was U.S.

Crude and condensate production in Russia, Saudi Arabia and U.S. (mb/d)

Sources: Russian Energy Ministry, JODI, OPEC, EIA

Alex,

I think there are no winners if we just look from the oil industry perspective. All oil producers at this moment are losers with just with different degree of loss.

Ves, I totally agree with you. There are no winners, as all oil producers are suffering from low oil prices.

But Javier mentioned one particular aspect – the market share

Hi AlexS,

I typically look at market share in the following way: Who has the biggest share?

In this rare instance, I agree with Javier, Russia is winning the market share battle for C+C output from Jan 2014 to Sept 2015, based on your chart.

I am not at all sure that the EIA data is wrong. It matches the JODI data pretty close. And both report Russian C+C production at from 400,000 to 500,000 bpd below what CDU TEK reports.

I do not believe any country knows what their daily production was the day after it was produce. I think they just make a wild ass guess and that guess is just naturally very optimistic.

I believe 2015 will be the peak year for Russian oil production. Time will tell.

Ron,

Oil producers were reporting to the Oil ministry in Soviet times on a daily basis, and these rules were kept since then. The combined numbers for the last month are preliminary, and they are revised in the beginning of the next month, usually not by much.

The monthly numbers, re-published by several Russian oil journals and by the Energy Intelligence are very detailed.

They include not only all companies, but also regional units and subsidiaries of the large vertically-integrated companies.

The numbers can easily be checked as oil is transported by large pipelines, not by trains and trucks. There are also check-points at the refineries and at the customs.

As regards differencies between the Russian Energy Ministry’s, the IEA’s, the EIA’s and JODI’s data, we have already discussed them before (probably, in early October). They mainly reflect different classification of condensates. The EIA and JODI account large part of Russia’s condensate production as NGLs

I had posted this table before. If you want, I can update it

Russian liquids production estimates from different sources

Until January 2012, JODI’s statistics were more in line with Russia’s Energy Ministry. Since then, they are accounting a large part of Russian condensates as NGLs:

Here are JODI’s numbers for Russia (as of 2 month ago):

The IEA Oil Market Report shows monthly estimates of C+C+NGL output by country, but does not disclose its monthly forecasts.

The November OMR with data for October is not yet available for non-subscribers, but the numbers from previous issues show significant discrepancy with the EIA.

Russian C+C+NGL production estimates for end-2014 – 2015 from IEA OMR and EIA STEO

Ron,

Yesterday’s Russian C+C production was 1466.4 thousand tons, up 19.5% from previous day. I was right that a drop in the past few days was just temporary.

http://www.riatec.ru/en/

On November 17, Russian C+C production increased to 1472.4 thousand tons (10,749 kb/d). This is above October monthly average of 1470.0 thousand tons (10,731 kb/d)

(barrels/ton ratio = 7.3)

These are normal fluctuations in daily output

http://www.riatec.ru/en/

This is a post-Soviet record. In 1987, Russian Federation (part of the Soviet Union) produced 570 million tons, or about 11.4 mb/d of crude and condensate.

For instance, the IEA in the November oil market report, increased its estimate of Russia’s C+C+NGL production in 2016 by 120 kb/d, to 11.05 mb/d from 10.93 mb/d in last month’s report.

From IEA OMR: “…resilient non-OPEC supply – with Russian output at a post-Soviet record and likely to remain robust in 2016 as well. “

Hi AlexS,