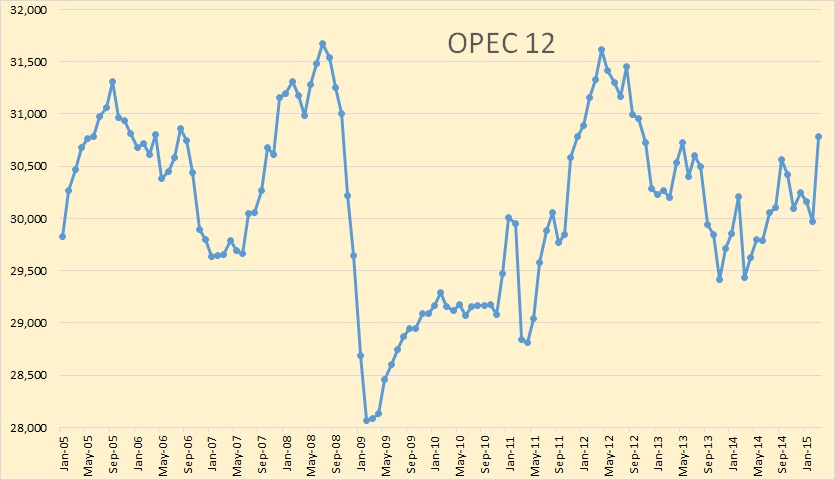

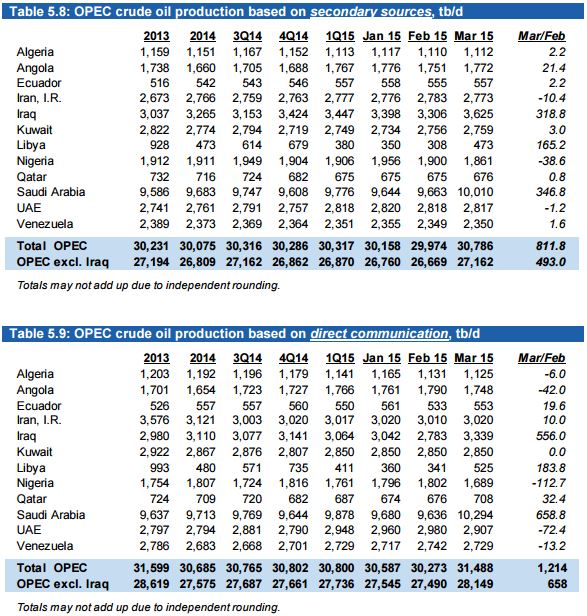

The OPEC Monthly Oil Market Report is out with OPEC crude only production numbers for March 2015.

OPEC production was up 812,000 barrels per day. The increase came primarily from three countries:

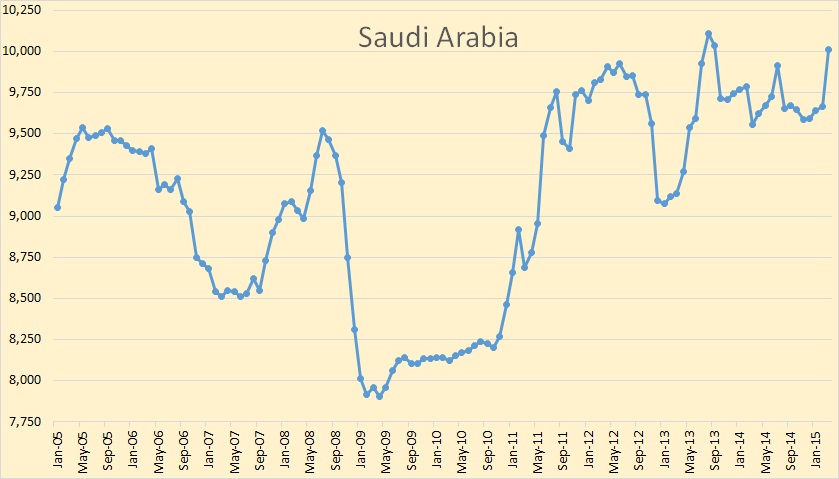

Saudi Arabia was up 347,000 barrels per day to 10,010,000 bpd.

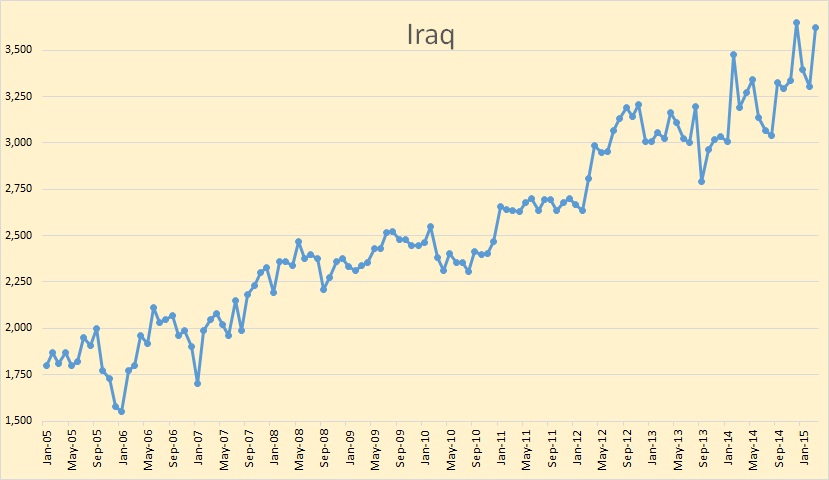

Iraq was up 319,000 bpd to 3,625,000 barrels per day.

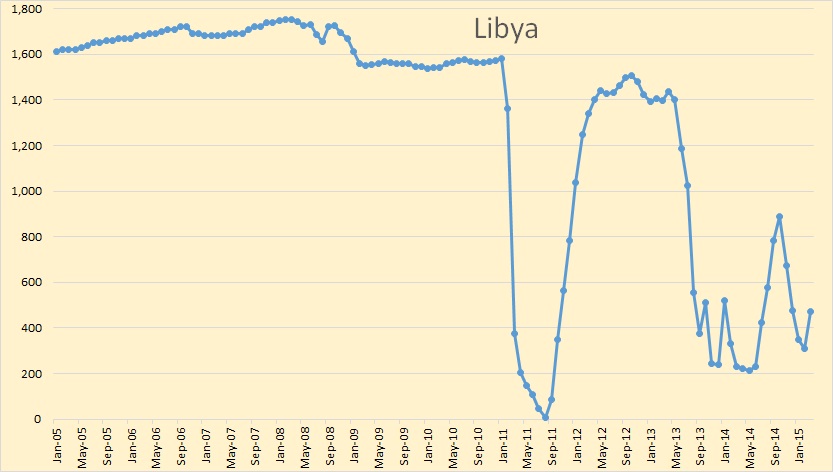

And Libya was up 165,000 bpd to 473,000 bpd.

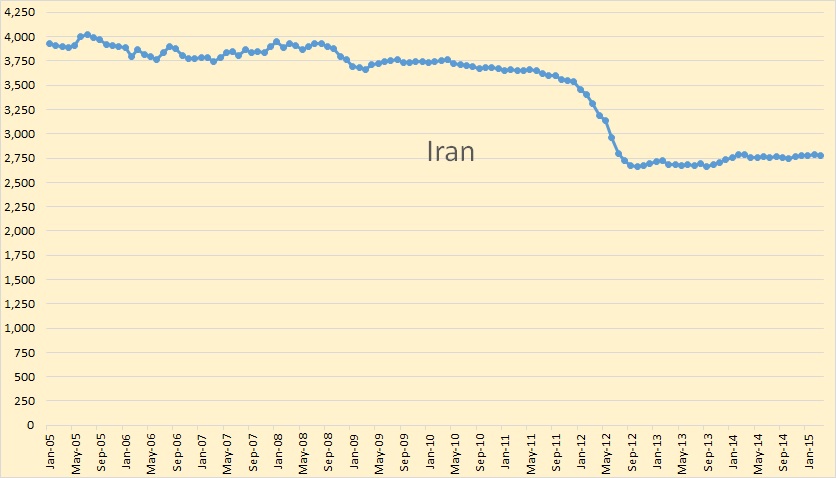

This is Iran zero based in order to show exactly how much sanctions have affected them. Iran was producing about 3.75 million bpd before sanctions. Then when sanctions the UN resolution for sanctions was passed in 2010, but before they were enforced, production began to drop, but very slightly. It was not until late 2011 and early 2012 before production began to fall rather steeply. Iranian crude only production is now around 2.75 million bpd, down about 1 million bpd, or 27 percent from their production level before sanctions.

Here is how all 12 OPEC nations fared in March. Notice Saudi Arabia says they were up a lot more than the “secondary sources” claimed they were. Iraq also claimed more increase than the secondary sources’ estimated. But Iraq is still claiming almost 300,000 bpd less than the secondary sources says they are producing.

Charts for all 12 OPEC countries can be found at on my OPEC Charts web page.

Art Berman says Saudi Arabia’s Oil-Price War Is With Stupid Money

Saudi Arabia is not trying to crush U.S. shale plays. Its oil-price war is with the investment banks and the stupid money they directed to fund the plays. It is also with the zero-interest rate economic conditions that made this possible.

Art’s point is that stupid money is funding the so called Tight Oil Revolution. This is a great article that everyone should read. Art has a chart showing that most tight oil companies were losing money even when prices were in the $90 to $100 range. And CLR, Continental Resources, seems to be the biggest loser of all.

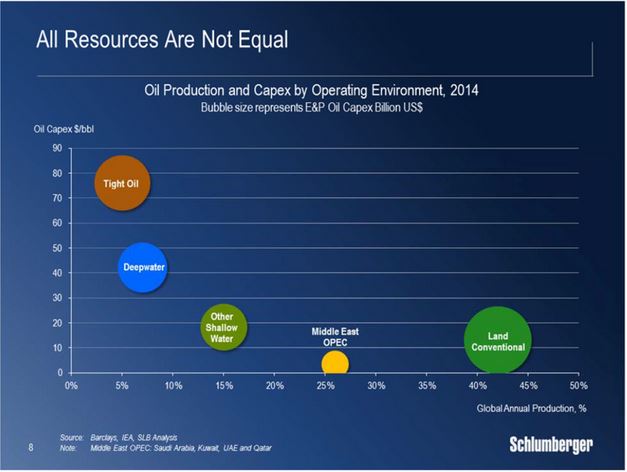

The next two charts are from Art’s Stupid Money article.

What does it cost to produce a barrel of light tight oil? Schlumberger says it cost around $75. The size of the bubble here represents the Exploration and Production capex spent. Tight oil is second only to the amount spent on land conventional. But land conventional produced about 42 percent of all oil produced while tight oil was about 4 percent.

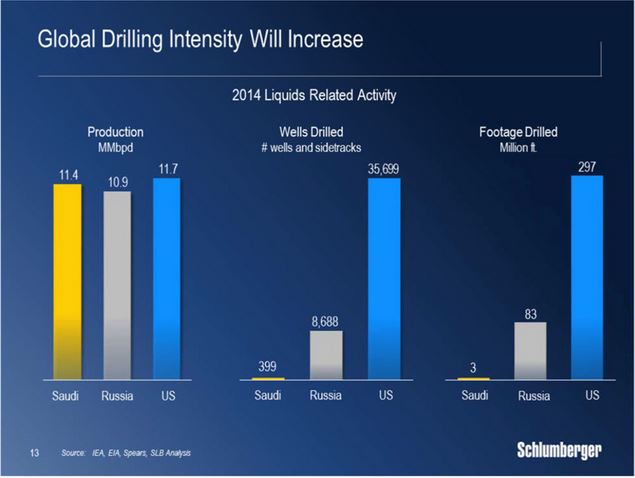

U.S. companies drilled almost 100 times more wells to reach the same daily production as Saudi Aramco. Strident claims of increased efficiency by tight oil producers sound absurd in this context.

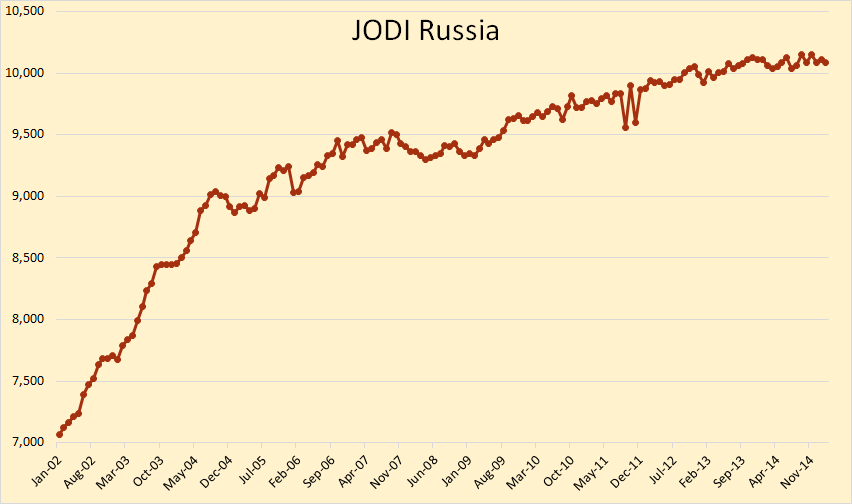

But the Russian part of the above chart is what I wish to emphasize here. In 2014 Russia drilled 8,688 wells.

In 2009 Renaissance Capital oil and gas analyst Alex Burgansky said:

If you exclude all the drilling activity taking place every year, then Russian organic decline in production is close to 19%. To compensate for that organic decline, Russia drills somewhere between 5,000 and 6,000 wells every year.

5 to 6 thousand in 2009, 8 to 9 thousand in 2014. They are now drilling 3,000 more wells than they did five years ago and production has been flat for about a year and a half. Russia has their own version of the Red Queen.

The last data point in this chart is February 2015.

Looks like the Bakken is beginning to produce more oil as time goes on. The Bakken keeps on truckin’.

These wells are producing in the neighborhood of 30,000 bpd.

PRODUCING WELL COMPLETED:

#25082 – STATOIL OIL & GAS LP, FIELD TRUST 7-6 6H, SWSE 7-154N-101W, WILLIAMS CO., 2212 BOPD, 5106 BWPD – BAKKEN

#26387 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, CCU NORTH COAST 31-25MBH, NENE 25-147N-95W, DUNN CO., 2112 BOPD, 2208 BWPD – BAKKEN

#26389 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, CCU NORTH COAST 41-25MBH, NENE 25-147N-95W, DUNN CO., 1920 BOPD, 1728 BWPD – BAKKEN

#26685 – ZAVANNA, LLC, ANGUS 3-10 5H, LOT4 3-153N-99W, WILLIAMS CO., 1543 BOPD, 1071 BWPD – BAKKEN

#26687 – ZAVANNA, LLC, ANGUS 3-10 7H, LOT4 3-153N-99W, WILLIAMS CO., 686 BOPD, 278 BWPD – BAKKEN

#26954 – CONTINENTAL RESOURCES, INC., RYDEN 2-24AH1, NENE 24-146N-96W, DUNN CO., BOPD, BWPD –

#28347 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, LILLIBRIDGE 41-27MBH, NENE 27- 150N-96W, MCKENZIE CO., 1656 BOPD, 432 BWPD – BAKKEN

#28348 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, COPPER DRAW 41-27TFH, NENE 27-150N-96W, MCKENZIE CO., 1920 BOPD, 432 BWPD -BAKKEN

#28354 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, CCU PULLMAN 3-8-7TFH, SESW 18-147N-95W, DUNN CO., 2445 BOPD, 2164 BWPD – BAKKEN

#28363 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, CCU PULLMAN 5-8-7TFH, SWSE

18-147N-95W, DUNN CO., 2160 BOPD, 2808 BWPD – BAKKEN

#28369 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, CCU PULLMAN 6-8-7MBH, SESE

18-147N-95W, DUNN CO., 2766 BOPD, 2004 BWPD – BAKKEN

#28413 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, SHENANDOAH 44-36TFH, SESE 36- 153N-96W, MCKENZIE CO., 2544 BOPD, 888 BWPD – BAKKEN/THREE FORKS

#28414 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, SHENANDOAH 44-36MBH ULW, SESE 36-153N-96W, MCKENZIE CO., 2204 BOPD, 521 BWPD – BAKKEN/THREE FORKS

#28623 – STATOIL OIL & GAS LP, FIELD TRUST 7-6 #8TFH, SWSE 7-154N-101W, WILLIAMS CO., 1857 BOPD, 4398 BWPD – BAKKEN

#29217 – BURLINGTON RESOURCES OIL & GAS COMPANY LP, CCU NORTH COAST 4-8-23MBH, SESE 23-147N-95W, DUNN CO., 2244 BOPD, 2363 BWPD – BAKKEN

Did you verify which of those are not new and merely coming off the confidential list, or not?

Nope, those are not confidential, strike that.

Watcher, these were all producing wells completed and none were released from “tight hole” status.

However there were just nine producing wells completed all of last week, so I think things are just averaging out.

Nod, odd density in Dunn rather than MacK and Mountrail.

Watcher, of more significance, perhaps, than Dunn county producing good wells (the northwest corner is actually pretty prolific), is the fact that at least five of the above wells are NOT from the Bakken play … they are in the Three Forks formation.

The designation ‘TF’ denotes the origin, although some operators target the Three Forks without signifying such in the wells’ name.

For those possibly not knowing, the USGS has claimed the Three Forks play has more recoverable oil than the Bakken, which is both smaller in areal extent as well as NOT having four ‘benches/layers’ as does the Three Forks.

Operators have been targeting the TF more frequently in the past 12/18 months or so as there is a growing ‘comfort’ level now that several thousands of wells have been drilled in the area.

The term ‘delineated’ is used to describe a hydrocarbon bearing field that is pretty well defined as to its placement and size. The Three Forks has NOT yet been delineated, and may be a few years out before it is.

Ronald, those wells are not producing those rates. The initial rates are for very short time periods. A fractured horizontal well is similar to a bottle of coke dropped from a second story window. Open that bottle and you’ll get a gushing geyser of coke, but it lasts a short time, and after a while you got to pump that bottle at ever decreasing rates.

A production decrease will be what it is going to happen within a year’s time. I won’t argue, I see what happens to the numbers on a piece of paper. What begins at 400 bpd is now at 40 bpd, even less, going into the fourth year of production.

My guess is that the wells that have initial production of 2000 bpd will be at a thousand barrels or less after one year, then after two years of production, the production will be at 500 bpd.

Going into the fourth year of production, the well that produced 2000 bpd initially will be producing 200 bpd or less, a 90 percent reduction.

Maybe even more. What begins at x will end up at 1/10th of x.

The first hundred days of production will be what counts the most. A steep decline rate after that is what can be expected.

It does happen and will happen time after time.

The Three Forks is under the lower Bakken shale and is Bakken oil that leaks out of the the source rock. That is why the Bakken/Three Forks is together in monthly reports from the NDIC.

The Three Forks is under the lower Bakken shale and is Bakken oil that leaks out of the the source rock. That is why the Bakken/Three Forks is together in monthly reports from the NDIC.

That statement makes no sense whatsoever. Could you explain in detail how this works? Or rather how you think this works?

It makes sense if lower layers are more permeable than cap rock. As oil forms, pressure builds and flow take path of least resistance, which is sometimes down.

Baloney! Source rock is always below the reservoir rock. All light oil is lighter than water and flows only upward if it flows at all. But the whole point in fracking is the oil is in the source rock and flows nowhere. Light tight oil is in tight rock and only fracking can free it from the source rock.

Three forks was formed before the Bakken and that is why it is below the Bakken. They are unrelated except that they are in the same general area, separated by layers of strata.

In conventional fields the pores, in porous rock, are always filled with something, they are never empty. Oil formed below is lighter than the water above therefore migrates upward, very slowly, until it reaches the cap rock and can flow no further. Oil could not possibly flow down because all the pores below are filled with water. After all, all oil is aquatic and formed at the bottom of a shallow sea. All pores at the bottom of a sea are filled with seawater, never air.

That is not always the case. The East Texas field, one of the largest fields in the United States, produces out of the Woodbine formation that is sourced from the overlying Eagle Ford Shale. Now, it is sourced from the overlying formation because of an exposure derived unconformity during the Sabine uplift, but situations do exist where source rocks can overlie the formations they charge.

MBP,

Yes things do get complicated. In Vietnam they produce oil from fractured granite, and it is not abotic. lol

The geologists claim they can explain how the oil got from the sedimentary source rock above to the granite basement below. It must have been quite a jig saw puzzle?

I have heard of some fractured granite producing fields, but I have never worked one myself. Id think that the granite could have been tectonically thrown, like in a thrust fault, over the sedimentary source, and thus allowing it to become charged. I have no idea if this is the model that they use, but was simply the first thing that came to mind when I read that.

When I googled looking for additional answers, the book “Hydrocarbons in Crystaline Rocks” came up. maybe it has some answers? I’m a carbonates guy, so this is way outside my area of knowledge.

http://books.google.com/books?id=9i435-1X0QIC&printsec=frontcover&dq=Hydrocarbons+in+crystalline+rocks&hl=en&ei=Dw7lTbSzCofQsAOq8sUW&sa=X&oi=book_result&ct=result&resnum=1&ved=0CCoQ6AEwAA#v=onepage&q&f=false

I have worked in fields with the source located above the reservoir. A couple were weathered granite wash, or fractured basement. Sometimes the source is offset by faulting.

A source can flow down via fractures into a lower pressure permeable layer, from over pressured source beds. But that requires a pore pressure break back. It’s kind of rare.

Read pages 40 through 120.

Bakken Source System

I asked you to give a simple explanation of this statement.

The Three Forks is under the lower Bakken shale and is Bakken oil that leaks out of the the source rock. That is why the Bakken/Three Forks is together in monthly reports from the NDIC.

You respond by asking me to read 80 pages of a 15 year old PDF file. No, I will not. Just explain how Bakken oil leaked out of the Bakken very tight source rock and migrated downward to supply the Three Forks, (very tight source rock), with the oil currently being fracked from that strata.

The lower Bakken shale was a seal, the upper Bakken shale was a seal.

Heat and pressure inside the middle Bakken which has the generated oil from the kerogen, the heat and pressure caused the volume in the middle Bakken shale to increase to a greater amount than the total volume of the middle Bakken shale.

When the heat and pressure became too great, the lower Bakken and the upper Bakken shales cracked and fissures formed.

The generated oil migrated to the Lodgepole above the upper Bakken shale and deposited, the generated oil migrated through the fissures of the lower Bakken shale and formed deposits in the Three Forks.

Hence the words ‘Bakken Source System’.

Some Bakken oil did migrate upward to a trap where conventional wells were drilled and recovered the oil. Most of the conventional oil has already been recovered from the Bakken and very little is left.

However no oil migrated from the upper Bakken to the lower Three Forks. Both the Bakken and Three Forks are very tight source rock. Oil never migrates downward from one source rock to another source rock.

Probably Schlumberger is correct in that if oil was not at $75, then it would not be profitable to drill in most areas. Certainly not the price per barrel for any given well, but overall a good ballpark. As usual, a very good article.

I have a question which does not seem to be addressed much, especially as to the future price of WTI. As you know, companies and refineries are gearing up to transition from full refinery to a “tower” with a much reduced condensate distillation process for export. One article I read stated that production capacity might exceed 3.3 million barrels a day by the end of 2016. In addition to that, I think that shale production will have a hard time getting back to the level it was in 2014 any time within the next two years. Considering these major factors, can’t you imagine WTI having a premium to Brent in the next year, or so?

Cue Jeffrey and the quote from Pemex about there being no need for condensate.

Guy, I don’t get your comment. Could you expand? What is this tower about?

Hey, Fernando, maybe Guy can expand upon his comments, or provide some links, but there are numerous stories out these past several weeks describing some type of minimal processing (aka cheap) of LTO that would qualify it for export, amongst other consequences.

If I understood the gist of this, one upshot could be a much vaster market for LTO than currently exists.

He means “column”, as in “distillation column”.

IMHO, the only “towers” in an oil refinery are “cooling towers” (most are more like boxes) and the water jet towers on top of coking units.

This EIA study talks about the whole thing of splitting or stabilizing LTO (Light Tight Oil) from the Bakken or Eagle Ford to make intermediates (i.e. napthas or other blendstocks) that can be sold, e.g. exported to foreign refineries/blenders.

The domestic LTO has essentially replaced light crude imports,

and trying to blend more in with heavy streams just starves the middle output streams from the ADU (Atmospheric Distillation Unit – the first step in crude oil refining),

resulting in throughput loss/bad economics for a refinery.

So people have built/are building simplified distillation columns to split or stabilize LTO in an attempt to make a buck by exporting. (who/size/status in table in report,

as are cost numbers for the various possible refinery processes – good stuff).

n.b. figure 1 is a version of the “fraction yield vs. API gravity picture” for 20.5 API Maya, 42.3 Bakken, and 55.6 Eagle Ford.

full report:

http://www.eia.gov/analysis/studies/petroleum/lto/pdf/lightightoil.pdf

HTML executive summary:

http://www.eia.gov/analysis/studies/petroleum/lto/

Today In Energy page that got me to the report:

http://www.eia.gov/todayinenergy/detail.cfm?id=20672

coffeeguyzz – the gist is just that, to encourage a bigger/more profitable market for LTO, since “products” and “intermediates” don’t require presidential blessing/licenses/hassle to export like crude does. Also, maybe to put a bit of pressure on heavier crude prices by threatening to split out some heavies from LTO to replace some heavy crude unless youse guys cut yer prices even lower. Ahhh, competition. But wait, you say LTO production is falling? Hmmm, how many of these LTO stabilizer/splitter projects are now uneconomic?

Got it. I’m a trained process engineer (but I barely practiced it, so don’t ask me really hard questions). I’ve discussed process alternatives for the problem caused by the extra light ends in the U.S. Mix. If I were a large producer (and I mean really large, say Angola), I would study whether to strip light ends from the oil using a cut to match my crude to the Eagle Ford condensate. This would allow me to market the crude to refineries which have access to Eagle Ford and can blend the two to make an optimized feed. By splitting my crude I could ship a lighter blend to say Europe, and sell the heavier material to the USA gulf coast.

Fern Wrote:

“By splitting my crude I could ship a lighter blend to say Europe, and sell the heavier material to the USA gulf coast.”

I am not sure that will help much. If I recall correct, Europe mostly uses diesel and not gasoline. The heavier crudes are best for diesel distillation, and the lighter crudes are better for gasoline distillation.

Yes, but this doesn’t mean an European refinery won’t take light ends.

Consider this: if it’s possible to split light ends in the USA and export them elsewhere, then there’s a market for such light ends. Europe happens to import a lot of light expensive crudes and exports gasoline. Thus all I do is avoid competing with my light ends in the oversupplied USA market. I ship what they need, and ship my light ends to the same end market the Americans would ship theirs.

Eventually this shakes down by changing prices. And I’m still for investigating if taking lights away from USA bound loads may not make sense. The least I would to is consider driving up my heater treater temperatures a bit, and taking more C4 to C8 from the overhead gas away from USA bound loads.

sunnnv,

Thanks for these links.

sunnnv,

Yes, thanks big time for the info.

So, there are plans and/or proposals, and actual construction for about 800,000 bpd additional US refinery capacity for LTO … with much in place within two years time.

According to that fig. 1, using an el cheapo Atmospheric Distillation Unit, both Bakken 42 and Eagle Ford 56 produce as much or more diesel types than Maya 20.

Hmmmm …

Who’s gonna tell Watcher he can soon fire up a diesel-fueled pickup and head south to spread the news?

Coffee,

Where did you get the 800mbpd number from? I do not see any estimates of new capacity in the EIA report.

Push,

I quickly added the numbers regarding processing plants in figures #2  in the EIA report cited by sunnnv above. Just double checked and I believe it’s accurate.

Thanks Coffee,

I missed that on my first time through.

Good presentation on LTO use and future use.

http://www.bakerobrien.com/bakerobrien2/assets/File/B&OB%20LTO%20Capacity%20Study.pdf

This is Iran zero based in order to show exactly how much sanctions have affected them.

And yet in their role as the Great Satan, and amid these supposed crushing sanctions, there seems to be no video of starvation in Tehran and they seem to still have plenty of money to be the evil funders of Yemen government overthrow. How odd.

Big Oil’s Latest Fear

http://www.bloomberg.com/news/articles/2015-04-22/big-oil-s-latest-fear-a-price-shock-after-spending-cuts

Good article. But those large companies are still working on long term projects. The problem will be caused by lack of people when they want to restart.

I second the thanks.

Also found this:

http://www.bloomberg.com/news/articles/2015-04-22/half-of-u-s-fracking-companies-will-be-dead-or-sold-this-year

“Half of the 41 fracking companies operating in the U.S. will be dead or sold by year-end because of slashed spending by oil companies, an executive with Weatherford International Plc said.

… Demand for fracking, … has declined as customers leave wells uncompleted because of low prices.

There were 61 fracking service providers in the U.S., the world’s largest market, at the start of last year. … ”

What Fernando said about the people who will go away, and not come back… bummer.

For what it is worth (not very much), the latest EIA US weekly oil production data shows a second week on week fall (down 56,000 bpd) from the mid-March ‘peak’.

Slowly, the EIA is coming to accept the fact that US production is actually in decline. Last week’s production is exactly the same as it was week ending March 6th.

Look back at the production numbers six months ago, on October 10, 2014. It is over 200 bpd above the 10 week moving average. I think it very likely that in six months from today, production will be over 200 bpd below the 10 week moving average.

Since we are trying to see what is happening in Texas and the Bakken. it would be more informative if production in the lower 48 states was tracked. The Alaska data is very volatile and drops significantly going into the summer. Currently, the lower 48 states are down 50 kb/d below the peak. Over the last two weeks there has been no change in the lower 48.

While the difference is only 6 kb/d now, it will get bigger as Alaska shuts down for summer maintenance.

I don’t quite follow this 10 week average curve – how can an average be lower than all the numbers that go in to it?

Edit – ignore this I think I’ve got it now – the average lags the data so on a continuously rising curve the average will always appear low.

If Saudi Arabia is behind the halving of the oil price and they have only produce say 300,000 barrels per day more than they did in Sep 14, what small shortage of oil supply would it take to send the price through the roof? When the tight oil producers fall over like dominoes, we could have interesting times in the oil markets and hence in our just-in-time oil based world economy.

Not everyone worships at the altar of supply and demand as a determinant of price. I could add “when Central Banks can define more or less anything”, but S&D was a law of nature . . . never.

Don’t presume the price fall had anything to do with supply and demand. Money was created out of imagination. It’s not like gravity or E=Mc^2. It’s not a provable law of nature.

Not everyone worships at the altar of supply and demand as a determinant of price.

Not every one does, it is only those who know anything about economics who understand that supply and demand dictate the long term price of oil. Changing the money supply affects demand. Therefore, of course, the money supply can affect the price of oil.

Lots of things can cause short term swings in the price of oil but only supply and demand can possibly affect the long term price of oil.

Money supply? What’s that? Did that mean M1, M2, M3 and all other currencies? Why should that affect the price of oil? Do we have a measure of this thing called global money supply and what is its correlation?

Oh for goodness sake, you can’t be serious with that question. The money supply affects everything. That is what Quantitative Easing is all about, increasing the money supply, boosting the economy, enabling people to buy more stuff, including gasoline and other oil products.

DEFINITION of ‘Quantitative Easing’

An unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity. Quantitative easing is considered when short-term interest rates are at or approaching zero, and does not involve the printing of new banknotes.

Watcher, I really cannot believe that you do not understand that the more money you have the more stuff you can buy, including gasoline for your car.

Ron,

QE is an asset swap, as the link you highlighted points out, in which the FED buys a T-Bill with central bank reserves. The T-Bill is effectively unprinted, and plays no further part in the economy, so at no point does private sector wealth increase. This is why there has been no inflation post QE, as many feared. Secondly, central bank reserves are not immediately ‘lent out’ when given to a bank, this view is based on the faulty “money multiplier” view. Banks create loans first, and then seek reserves later as needed. Increasing the amount of reserves that a bank has will not increase the demand for loans, nor make the bank more likely to create loans. Banks lend to credit worthy individuals, they do not lend because they have a surplus of reserves.

If QE did indeed work in the manner most people think, there where on earth is the inflation that all the newly created money should have caused?

As for supply and demand, it’s a good mind sized model, but as always the world is much more complex in reality. There’s a few economists (Brian Arthur and Ken Arrow are people who I’m aware of in this area) who’ve done work showing that lots of the conditions needed for the equilibirum assumptions behind supply and demand don’t really stand up to any realistic conditions. At best supply and demand, as taught in textbooks, is very special case which only exists under certain conditions. It’s not a law on a par with gravity. I mean, ultimately markets are just human creations. Change the markets and you’ll change the response.

This is a very accurate response.

I’d also add that Daniel Kahnemann, a psychologist, won the Nobel Prize for Economics in 2001 because markets are not rational information processing entities; they are composed of millions of irrational people, each with their own idiosyncratic biases.

The hope in economics has always been that if you accumulate enough irrational monkeys interpreting data that it’ll all average out and the end result is a rational market. In the long run this is generally true, but on a daily, weekly, monthly, and even yearly basis there is a significant skew in market pricing based on inherent emotional and experiential biases.

Richard Dawkins would refer to these cultural biases as being “memes” – the original definition of a meme before the internet turned it into its current definition.

You can make healthy sums of money by stepping out of the cultural preferences that swing markets away from “true” value. This is the basis of Warren Buffet’s quote that we should “Be fearful when others are greedy and greedy when others are fearful”.

My cow college instructor back in the sixties was perfectly straight forward in explaining that the so called law of supply and demand is an ABSTRACTION that explains behavior of markets in a generally accurate and useful way.

IN THE ABSTRACT.

First he says, you need to understand this as what would happen IF the abstraction held true – that everybody was well informed etc.

He made it clear than in the real world economists even back then took into account the market distorting effects of advertising , religions, monetary and fiscal policies. etc etc etc when ACTUALLY WORKING.

It could be that he was a few decades ahead of the curve since he also taught a principles of advertising class.

I had to take a basic business series and chose econ- and I needed one more free elective in business and took the advertising. I learned more useful stuff in these two classes than anywhere else except chemistry biology and math.

Micro markets where supply and demand such as Watchers example of dickering the price of a soft drink – maybe the last one available at that spot and minute – do still exist even in the USA.

I go to a flea market often and dicker the last dime because the old women selling tomatoes and cantaloupes there enjoy the process. Telling them they are still good looking and mean hearted as ever gets the dime off plus even gets me propositioned sometimes. ( I still get around without a cane and can wipe my own butt which is the primary criteria these vintage girls use in checking out guys.)

Yes, QE did not cause a significant increase in the money supply circulating outside the Fed, TBTE banks (including foreign banks’ US subsidiaries), and the US Treasury. Less the accumulated bank reserves/bank cash assets of ~$3 trillion, money supply has grown very little since 2007-08, primarily because bank lending growth has been subdued (until 2012-13, driven largely by C&I loans to the energy sector).

QE did result in a decline in interest rates and the flattening of the yield curve, which (1) further discouraged bank lending by reducing the spread and net margin for banks; and (2) it lowered the cost of borrowing for large corporations to borrow at a record to GDP to buyback shares and to pay interest, dividends, and HUGE compensation to executives.

Therefore, even the massive corporate borrowing at lower interest rates did not result in an acceleration of growth of revenues (averaging 2-3% since 2007), bank lending, money supply, and employment since 2007-08.

Finally, QE also provided the necessary liquidity for the US gov’t to run average deficits of ~$1 trillion since fiscal 2009, increasing the US public debt by $8 trillion; otherwise, the US economy would be at least 20% smaller today.

Now the US economy appears to be decelerating again to historical “stall speed” as of Q4 ’14 and Q1 ’15, suggesting that the Fed will not raise the funds rate this year but rather more likely resume QEternity later this year to fund the increasing fiscal deficit to GDP as GDP decelerates.

“QE did result in a decline in interest rates and the flattening of the yield curve, which (1) further discouraged bank lending by reducing the spread and net margin for banks;”

QE fueled the Shale bubble, by lowering borrowing costs and making easy credit available to shale drillers. The Stock market bubble is also largely driving by QE. Corporations have borrow hundreds of billions for stock buyback programs using ZIRP to finance buybacks.

There is significant inflation, its just not even distributed or symetrical. Stocks, and bonds are at all time highs. Without QE the valuation of these investments would be a fraction of their current valuations.

On the consumer side, without QE prices for may items would have been much lower, such as home prices and rent. QE has escewed the real estate properties and preventing from normalizing to real-long term affordabilty. It also also having an impact of savers, most people no longer save money because there is no return, and those living on fixed income are no longer paid interest on their retirement savings.

For every quick fix, there are problems. Once an nation begins QE, they can never exit without a major correction. QE distorts markets and prevent any hope of normalization. This week BoJ said it never going to end QE because it can’t without collapsing the Japanese economy. The US did QE after blowing too bubbles as a quick fix to 2+ decades of deferred market corrections. Each bubble is larger than the previous one. The current bubble (driven by QE) will even be much bigger than the first two. perhaps the mother of all bubbles depending on how this plays out.

Techguy,

QE didn’t lower the interest rates, the federal reserve did. It’s hard to tell if QE accomplished much of anything to be honest. Now I don’t disagree that high oil price and low interest rates are major factors in the takeoff of shale, I expect that even without QE shale would still have exploded.

Stock market might or might not be a bubble. Corporate profits are high, and private equity is scarce due to buybacks, which would obviously mean higher prices. Could just be that stocks stick around their current level and underperform for a few years.

Sam Wrote:

“QE didn’t lower the interest rates, the federal reserve did. It’s hard to tell if QE accomplished much of anything to be honest.”

It sure did lower rates. QE financed gov’t debt by gobbling up treasuries, lowering the yield on the 10yr, which is the metric used to establish US commercial and consumer loans. It also freed up liquidity at the too big to fail banks, by purchasing worthless assets. With out the asset purchases the Banks would have too much capital tied up on failing\non-performing loans which would prevented them from further lending.

The question of how to measure the supply of money doesn’t really have much to do with the question of whether money supply influences price.

Supply and demand is a simple law of nature: if three kids want to use the swing and there is only one swing in the playground, either war or rationing ensues. Perhaps an entrepreneur will start a business charging for the usage of swings. You’re not really disputing this very simple principle?

Oh but I think he is. Watcher has always disputed the fact tat supply and demand governs the price of anything.

When you go to Walmart to buy a bottle of Pepsi, do you pay a price based on how many bottles are on that shelf, or do you pay the price labeled on the shelf $/bottle?

Ever go to Burger King and order some item on the menu and have them tell you . . . “Sorry, we’re out of those.” Well, the previous customer who bought that last one, did he pay the menu price or did he pay a price higher than what is listed?

Planet-wide, of all transactions that take place buying and selling items in commerce, the overwhelming majority of those transactions take place at a published price and not at a price defined by how much supply the seller has on hand. Billions of transactions at the supermarket take place day to day at a listed price without regard to how many are in the store’s inventory that moment.

Billions upon billions. There might be a few hundred transactions day to day where someone tries to charge more for something he has few of. The buyer may walk away. In which case there would be even fewer of such transactions, since it did not complete.

Contrast all of the above with gravity. Billions and billions of times you can drop an object in a vacuum from a certain height and d = 1/2 g*t^2 every single time, for every circumstance, no matter how many objects or how few objects you drop.

If you are snake bit by a water moccasin cobra rattler coral and the anti-venom is immediately available, the supply, will the demand be there, it’ll save your life, do you demand it or say ‘no thanks, I’d rather die’?

You’ll pay the price, no matter what the supply is, just so there is enough to matter, a matter of life and death. The neurotoxic effects are taking hold, everything is getting dark, the efficacious anti-venom is here now.

Last one on the shelf, how much will you be willing to pay?

Will there be any demand for the only anti-venom that is there here and now?

No anti-venom, you’ll die. Is there a demand or not?

At what price?

If you live, you’ll pay the price.

It is a law of nature.

What’dya thunk, is it a law of nature or knot?

Watcher, you are not going to get many converts with such very silly examples. You are trying to make supply and demand at the micro level wen it is obviously at the macro level. McDonald’s has 35,000 restaurants, they know what price they can get for a hamburger before people start going to Burger King or someone else.

Pepsi knows what they can get for a two liter bottle. But individual stores figure they can get a higher price, or offer a lower price to get customers in for a sale. And if the price is cheaper at Dollar General than Kroger, then people will go to Dollar General for their Pepsi. That is supply and demand mitigated by price.

Bye now, this debate is so damn silly that I refuse to engage in it further.

Why did you engage it at all?

”Why did you engage it at all?”

Because as the host Ron has an obligation to himself to not let bullshit comments go unchallenged.

Serious people who happen across this forum and read your comments might take the whole forum as bullshit otherwise.

Now as for why I respond-I am stuck in the house too many hours playing nurse with nothing more interesting to do at this particular minute.

“Because as the host Ron has an obligation to himself to not let bullshit comments go unchallenged.”

Or even delete it. Better challenge it though, to show the foolishness of it.

Yet if a billion cattle die because of an epidemic, the published prices of burgers will go up and the number of burgers eaten will go down, and this is exactly how supply and demand works.

Are there a billion cattle? That’s a lot.

Far more transactions take place day to day at a price unrelated to the supply available than take place with the price negotiated for that transaction based on anything other than the price sticker.

Oh and btw if your competitor charges a lower price than you, regardless of your supply, that’s what you have to charge — unless you can pretend you aren’t selling the same thing. Which is why the burger king vs mcd’s issue is invalid and pepsi/coke ditto.

Another example is rent. You have rental property . . . say 2000 sq feet of it. There are several other such properties around of that size. You charge $1200/mo for it. So do they. You also have rental property of 3000 sq feet. There are several other properties of that size around. You charge $1400/mo for that. You have another that is 4000 sq ft. There are very few other such properties that size around you. But you still charge $1400/mo for it, just like your 3000 sq ft property. Why?

Because that’s the limit of local income. They can’t pay more. Demand is constant, supply is lower. But the price didn’t change.

The only reason you folks worship at this altar is you were told it’s true, despite all the evidence to the contrary. It’s just not gravity. It’s not a law of nature.

Here’s some statistics on cattle.

http://www.statista.com/statistics/263979/global-cattle-population-since-1990/

About supply, demand and price, Ron is basically right, but the devil is in the detail. There are several issues:

Market mechanisms are aggregate, and don’t pretend to predict individual transactions any more than the temperature of a liquid can predict the heat content of a given molecule.

Supply and demand determine price when markets “clear” but no economics book can tell you how long that will take.

For example “sticky” labor costs are usually seen as the root cause of unemployment (which cannot exist according to “classical” economics). That’s one of the main arguments of 20th century economics in a nutshell. Real estate is another market where long term contracts muddy the waters.

Competing products that aren’t identical make things even more cloudy. And as you point out, so does incomplete information and bad choices (“irrationality”), which market theory assumes does not exist.

Other distortions are caused by externalities and transaction costs. In both cases the price does not cover the whole cost. Again, market theory assumes this does not exist.

Once you start adding all that in, it is hard to see the signal for the noise.

THere is a drought in Texas and Oklahoma. Ranchers can’t afford to buy feed for their cattle. They send not just their yearling steers to slaughter but a good deal of their breeding cows. That reduces the size of their herds. Within a couple of years there is a shortage of yearling steers. The price of beef goes way up. Ranchers wish they had their breeding cows back to satisfy this increased demand (as a consequence of the reduced supply of steers).

Watcher wrote:

“Another example is rent. You have rental property . . . say 2000 sq feet of it. There are several other such properties around of that size. You charge $1200/mo for it. So do they. You also have rental property of 3000 sq feet…”

Not quite. In that case, the homeowner simply splits the home into multifamily building. rates stay the same, but the space per unit declines. No owner is going to keep a 3K sq foot home as a single family rental, especially as property taxes rise.

Other Examples: 5 Pound Bag of sugar now sold as 4 Pound bag at the same price. Orange juice sold in 64 ounce (half gallon) now sold as 54-56 ounces (same price) as well adding in High Fruitose corn syrup, adding water and artificial flavoring (fake OJ)

As far as hamburgers at McDonalds, they are no longer real beef. only about 15% of a McDonalds burger is real beef, the rest is filler and junk. I could go on, but you get the idea. The prices haven’t changed, but the the quality and amount of the product has declined to mask rising input costs.

The Price of Oil is falling because the global economy is falling into a recession and the US Fed talking about future rate hikes has temporarily strengthen the dollar. The Euro was about at about $1.30 a year ago. today its about $1.08 as the ECB started using QE. QE solved nothing, it just deferred the day of reckoning. ZIRP is about done and Central banks are working on NIRP.

” No owner is going to keep a 3K sq foot home as a single family rental, especially as property taxes rise.”

There are probably well into the millions of three thousand square foot rental homes in the USA.

Splitting them into duplexes or triplexes etc is forbidden by law in most cases.. In places where it can be done it often is.

But by the time the market for rentals starts justifying this practice , and it starts happening, most cities pass ordinances against it. There are usually a few grandfathered duplexes and triplexes around.

And in some cities there are lots of houses that have been converted illegally.Most of the time one complaint from a neighbor is enough to get you hauled into court if you pull this trick.

I realize things are different in other countries.

Watcher you are getting to be an incredible bore with your constant insistence that supply and demand do not matter.

You are sounding like a preacher. Even worse than a preacher. Just believe what preacher tells you no matter how unlikely it is to be true and live like a king forever and ever and ever.( After you are dead of course..)

You are attributing god like powers to government – powers that government does not have.

Now it is true to some extent that government can institute a policy that allows businesses to produce goods or services at prices that would ordinarily be impossibly low.

There is a name for this sort of thing. It is called SUBSIDY.

If UNCLE pours money into a given industry, that industry produces more. But we ALL OF US pay the price in terms of the subsidy not being spent on US as individuals rather than the individual or business that collects it.If UNCLE prints three hundred million and gives it to a particular business then that costs each of the rest of us yankees about a dollar apiece.

There are some corn pone sayings in trade work that apply to your soap box pronouncements. One of them is that if you can’t dazzle them with your brilliance you can baffle them with your bullshit.

Now I can get rid of all sorts of worries and aches and pain with a pint of bourbon. It takes away the backache and the worries about the bills. For a little while. The more you use it the worse the problems really get.

The problem with your sort of preaching is that a hell of a lot of less than brilliant or uninformed people are apt to fall for your variety of bullshit and start believing the impossible because your BULLSHIT sure does SMELL LIKE ROSES to somebody who wants to believe it. And most people want to believe in free lunches. I would LIKE to believe in them myself but I know better.

Yes Uncle and other governments can temporarily TEMPORARILY make supply of some certain service or good grow as if by magic by robbing the COLLECTIVE PETER, meaning everybody, to pay the Paul who supplies that good or service. TEMPORARILY.

And given that the collective Peter generally does not even understand he IS BEING ROBBED by such schemes he does not even protest- if he is listening to somebody preaching your sort of shooting cannons at the sky to make it rain.

Peter doesn’t realize because he is being bled to death by the death of ten thousand cuts and one more cut is trivial.

Another saying is that a man’s professional qualifications are proportional to his distance from home. This actually makes a good deal of rule of thumb sense. You don’t find welders working a couple of thousand miles from home unless they are GOOD welders. If a contractor is willing to bring in electricians from a couple of thousand miles away – or even farther – you can BET they will be good ones.

On the other hand any half assed welder or electrician can get some local work when times are good.

In a forum such as this one we are all a long way from home in a metaphorical sense. People who are not economists are apt to believe your bullshit but those of us who know some basic economics understand that you are DELUDED in the same sense that a drunk is when he thinks another drink solves his problems.

If it were possible to just fucking magically conjure up goods and services from a vacuum then we would all have quit work before now.

Only a person who has NEVER taken a basic course in economics would run his mouth the way you do about supply and demand. You understand about as much about it as I do about reading Chinese script- which is to say NEXT TO NOTHING.

I think Twain is one of the people credited with the quote that you should never argue with a fool in public-BECAUSE THE PUBLIC WILL NOT KNOW WHICH IS THE FOOL.

”Ever go to Burger King and order some item on the menu and have them tell you . . . “Sorry, we’re out of those.” Well, the previous customer who bought that last one, did he pay the menu price or did he pay a price higher than what is listed?”

If I have ever heard a fools argument in respect to supply and demand this is it.

Now I better shut up because most of the membership has probably already likely concluded that BOTH of us are fools. You for saying supply and demand don’t matter and me for even dignifying such twaddle with a reply.

Watcher said:When you go to Walmart to buy a bottle of Pepsi, do you pay a price based on how many bottles are on that shelf, or do you pay the price labeled on the shelf $/bottle?

I agree with Ron that this is a bad example; but in thinking about it, I have come up with some grounds on which Watcher’s ideas can be supported.

I think that Supply and Demand, as an ideal, is being debased by inequality in the marketplace. The effects of advantages in time and scale are twisting markets in ways that make them ineffective.

Supply and Demand has never functioned as a platonic ideal. For the system to operate perfectly, you would need perfect information: cost to produce, cost to transport, number who desire the product, etc., and a level playing field. This is not the case: food is produced in the hope that the eventual price will cover it’s costs, cars are designed and tooled based on assumed production volumes that may or may not be met, and we drill oil wells not knowing what the total production will be or what price the oil will bring. There is an element of chance involved. Gambles on the future price of apples are time-based with roughly equal information for both sides of the deal.

Michael Lewis’ excellent “Flash Boys” discusses the use of high speed trading algorithms to front run the stock market: using a tiny sliver of time, they were able to gain an information advantage. How many other areas of the economy are affected by this kind of unequal information? This throws any idea of Supply and Demand being a fair, platonic system out the window.

I also think that unequal size of participants causes Supply and Demand to function in ways that are not in accordance with the ideal. A buyer for Ikea has advantages over smaller suppliers: they don’t actually care if the smaller company has to agree to terms that may result in the demise of the smaller company. They may be removed from the social costs of their choices because of internationalization. They may have cash reserves that allow them to make decisions that are more strategic than economic: they may, in fact, be playing a different game entirely.

So we have a system where people have unequal information, unequal size and influence, and where people may be using markets to accomplish goals other than a good price on the immediate deal. And throw in the speed of modern technology as an unknown leaning towards the bad.

While it may not mean, as Watcher claims, that Supply and Demand don’t work anymore, it does suggest that it no longer even pretends to function as we expect it to, and behaves in ways which cannot be controlled or predicted (which, come to think of it, is pretty close to what Watcher says…).

-Lloyd

Money was created out of imagination. It’s not like gravity or E=Mc^2. It’s not a provable law of nature.

More to the point, there are no conservation laws in economics that restrict the money supply. This is the real difference to physics (where things like charge, energy, spin, hadron number etc are conserved).

That does not mean that increasing the money supply has no consequences. It’s just not impossible.

Correct me if I am wrong, but lower interest rates pull forward future demand – units at the margin can’t afford a house or new car at 7% interest, but can at 2% thus purchasing earlier and increasing demand. Basically the same with business purchases although the need for more, newer, or more efficient equipment must also exist, which conveniently tends to happen due to the consumer impact of lower rates.

Interest rates are lowered through reducing the prime rate or, more recently, through QE. These policies are enacted when the Central Bank believes there is “slack” in the economy. This is determined by inflation, unemployment, labor participation, and a combo of other measures that indicate if growth is running at its maximum potential.

To me this is identical to how biology and physiology work – organisms raise/lower various hormone levels to change behavior. The end result is changes in behavior that maximize growth and reproduction.

The ultimate “goal” for both an organisms metabolism and an economies interest rates is to maximize the speed of growth/reproduction while keeping enough reserve capital/resources for a potential shock to the system (like a period of food scarcity or a negative economic event).

I feel that both economics and biology are at nascent stages of development into true hard sciences because they are the complex, dynamic accumulation of physics and chemistry interacting. Defining gravity or ideal gases through immutable equations is easy compared to the dynamism of a complex system.

Whether it is a biological system, a human industrial economy, or a weather pattern, we currently only have the mathematical fortitude to predict outcomes statistically by using a normal curve of distribution.

With the ideal gas law we can say, for certain, 100% of the time, what temperature a system will end at when we change pressure, moles, or volume. For complex systems we must revert to statistics and say “24% of the time this will happen” without having a solid conclusion of how any specific event will conclude.

To me this means that Calculus (the mathematical basis for our incredibly precise physics and chemistry) is but a stepping stone to a more rigorous mathematical system; just as Calculus simplified Algebra.

Perhaps AI can invent this new mathematical system that turns a 1,000,000 variable system into a simplified equation, but with that thought I’d be leaping faithfully into extraordinary conjecture without a shred of evidence. AI is the holy frail of possibility, but I feel that genuine AI on the level I am speaking (inventing entirely novel mathematical doctrines) is more myth than foresight.

Re: Russia

Domestic consumption about 3.5 mbpd. They can fall from 10 to 3.5 before anyone there starves.

OTOH if they take 6.5 mbpd off the market, some non Russian is likely to starve somewhere.

Interesting item — they seem to have 5.4 mbpd of refining capacity.

If only those supply and demand numbers (and especially those pesky M1, M2, M3… numbers ) were easy to understand, we would all be joining the kinds of Irving Fisher and Ludwig von Mises.

If only…

-Russia is a $2.2 trillion economy. Russia is also a commodity producing/exporting country (akin to Australia, SArabia, etc). The “commodity producing/exporting” part constitutes 60%-70% of that $2.2 trillion.

-The reason Russia consumes 3.5 mbd ( as you say) is BECAUSE of those 10 mbd it produces/sells (among other things like: CH4, grains, tanks, pplutonium, etc) .

If Russia were to drop from 10 mbd to 3.5 mbd (as per your hypothesis) it would not be consuming those 3.5 mbd (no need to do so!) and it would be already starving!

That is called collapse and they had one from 1991-2000. Especially bad during 1997-1998-1999.

You know what happened then?

Their population dropped 10%-20% (depends on who or what you read); a large portion of their beautiful XX chromosomed population (and believe me: they are beautiful!) filled whore houses and intersections of Europe; the largest land mass on Earth with 11 time zones (12 if Kaliningrad is included and almost twice the size of US) and more nukes than ALL the other nations combined, was headed by a fat, disgusting drunkard called Yeltsin and NATO expanded from Germany to Ukraine.

They defaulted on their debt as a nation and experienced hyperinflation and starvation.

-Those supply and demand numbers are indeed tricky, but to help a little understanding them consider this:

if Russia were to drop from 10 mbd to 3.5 mbd immediately (as you say), it would be unlikely that you and I would have the electricity and/or the internet connection to write these silly verses…

I suspect we would be concerned with finding our next meal…

And by the way, there are roughly 1.5 Billion cattle roaming (or confined) on planet Earth.

Be well,

Petro

Saudi Arabia / Iraq

Do you think either/both of these countries are buying ISIS production at a discount but reporting it as their own, then selling on the world market and just pocketing the difference? Gives the SA, U.S. cabal a back channel to profit off Iraq oil where they’ve been edged out for official purposes.

Certainly seems likely SA would do this, not as clear Iraq would.

ISIS is not a country. If they have any production it is oil they stole. Of course they sell this stolen oil, usually through Turkey. I seriously doubt that they would try to sell Iraq their own oil. And I doubt they would try to sell it to Saudi either.

Last count was about $3 million/day.

http://www.newsweek.com/isis-islamic-state-baiji-iraq-syria-oil-283524

The Islamic State – yes this really did happen.

https://www.youtube.com/watch?v=oZVRYQa73W8

In case you are wondering why the shale oil industry has not gone global (supposidly):

http://fuelfix.com/blog/2015/04/22/ceraweek-oil-chiefs-explain-why-u-s-shale-boom-hasnt-gone-global/

No mention of the fact that free money has been the prime enabler in the US…..

But this guy is on to it:

”Mark Lewis from Kepler Cheuvreux said on Monday that the boom in U.S. shale gas production over the last few years that had helped push down oil prices was partly driven by the Fed’s “very, very low interest rates.”

“The financial dimension to the shale story is hugely important,” he told CNBC. “I think it’s questionable whether we would ever have had the increase in oil production we’ve had out of the shale plays over the last three or four years if we hadn’t been in this environment.”

http://www.cnbc.com/id/102600440

Mark Lewis is a very sharp energy analyst. Incidentally he gave a presentation at the ASPO-USA conference in Austin, Texas, in 2012.

His more recent work is on the challenges facing the fossil fuel industry, in an era of falling costs for renewable energy.

I fully concur. Fed QEternity was a kind of financialization of the US energy/commodity sector at a discount of 0% at an infinite term.

How much future demand can we bring forward at a 0% discount at an infinite term?

Clearly far more than the economy has the capacity to demand at anywhere near the rate of growth of “unprofitable” and “unaffordable” supply.

Of course, the problem is that the value-added real output capacity per capita since the onset of Peak Oil and ZIRP and QEternity is well below 1% and near 0%.

This is what we get when economists are “educated”, socialized, credentialed, and allocated to ignore the limits of debt to wages and GDP, as well as have little or no understanding of thermodynamics, net energy, entropy, and exergy.

Andy, I don’t agree with one point in the article. Private ownership isn’t required in countries where the oil fields are located in rural areas and the laws allow eminent domain. I’ve worked in those countries and we reach a balance, pay the landowner a cash bonus and sometimes a rental for the use of the surface, and eventually can take them to court using eminent domain. The key is for the government to have a slightly lower tax rate so we can afford to pay landowners, and the courts working properly so that if necessary we take them to court. Another practice which really helps is to have the central government allocate a percentage of the tax proceeds to the state/province/county/municipal budgets. When everybody gets cash the industry can work out these minor problems.

Yes, because it’s not like Europe has lower interest rates…

Interest rates impact shale extraction at the margin. Prices are the primary driver in the U.S.

If it costs $75 barrel to produce shale oil and prices are $100 barrel I will produce regardless of interest rates. Let’s not forget that oil first hit $75 in 2007.

After this checkpoint is law and policy. In Europe it is simply illegal. In the U.S. Dick Cheney exempted fracking from the Clean Water Act. Had this policy change not occured fracking would still be unprofitable.

This move helped make Dick Cheney a very wealthy man considering his monetary interests, but it also made the fracking boom possible (given first and foremost high oil prices).

It’s weird to say, but Dick Cheney seems to have single handedly postponed peak oil by declaring that everyone except fossil fuel extractors have to obey the Clean Water Act. Frankly, looking at global production data, the world economy would be hell in a hand basket were it not for this seemingly minute executive action.

Yet no one. anywhere, mentions this. Whenever I mention this incredibly important fact I am ostracized because people take it politically, and instead of understanding it neutrally as data and information they transform it into a position driven by emotion and political affiliation.

Science and data don’t have positions. My family is Republican and they think I mention this is an assault (even though it concludes that Dick Cheney prevented a global economic catastrophe) and my Democrat friends… Well, if I say that anything Dick Cheney did is even remotely beneficial, I have clearly gone insane.

Then, there is reality. Where potentially, bit not definitely, someone’s actions were guided by self interest and by chance happened to postpone economic mayhem by radically increasing oil and nat gas production in the U.S.

I would have opposed the policy change when it happened, had it been reported on at all. Almost a decade later I’ve found an odd peace with it as I see that such a self serving, seemingly shortsighted executive action had given the world valuable years of breathing room to develop renewables and EVs.

I highly doubt that Dick Cheney’s intention was to but time for renewables to become affordable, but all that matters is the end result.

It’s weird to say, but Dick Cheney seems to have single handedly postponed peak oil by declaring that everyone except fossil fuel detractors have to obey the Clean Water Act. Frankly, looking at global production data, the world economy would be hell in a hand basket were it not for this seemingly minute executive action.

…

I highly doubt that Dick Cheney’s intention was to but time for renewables to become affordable, but all that matters is the end result.

That’s an interesting take on it. I’m in a place where a number of communities have been fighting fracking. Water pollution is one of the issues.

The bad economics of fracking have slowed things down, and perhaps there won’t be fracking now in communities that don’t want it.

I’m inclined to think that the breathing room that fracking provided renewables wasn’t needed, but I suppose if one believes that fracking was necessary to prop up economies and without it there would have been no advance in renewables, then fracking was a good thing.

Basically, where I live, it’s a a matter of “not in my backyard.” Let them frack somewhere else.

I am very glad to see that at least one other person appreciates the paradox and the irony involved in the renewables versus fossil fuels debate and actually SAYS SO in so many words. Most of us understand it of course but there seems to be a reluctance to talk about it.

Our only real hope of ever having a viable industrial economy based on renewables is that fossil fuels will remain plentiful enough and affordable enough for the renewables industries to grow like kudzu on steroids for a couple of decades at least. Just throwing money at renewables deployment is not going to be enough.

Part of the solution is going to have to be found in advances in the basic sciences. Any particular field or industry depends on advances in other fields as well as the basic sciences. Doctors for instance did not invent the microscopes that allowed physicians (biologists ? todays terminology does not fit well) to come up with germ theory. People who manufacture wind turbines owe a hell of a lot to materials researchers who invented composites used in turbine blades.

Pouring money into basic research is an exceptionally good use of it but it takes a good while for new discoveries to make it from the lab to the construction site or retail store. Decades in most cases. Centuries sometimes.

A few more decades of business as usual with luck will provide us with renewables technologies that are cheap enough to deploy them at the necessary level.

I mean a LOT of luck.

Guys there is no natural price signal. Why is the price of gold and silver hitting multiyear lows with explosive demand from China, Russia etc.? It is because the HFT (high frequency trading) and spoofing and all the corruption coming from the banks who have become wards of the deep state. The NY Fed has an Army of 75 traders that show up at 4:30 AM and coordinate (collusion) with the banks how the day will go. There is no longer a free market in the U.S. but a cesspool of collusion, front running, insider information, HFT, spoofing, etc. Supply demand died with the repeal of Glass Steagall.

Dr. Don, well said. What you describe is what I refer to as the Anglo-American and European rentier-socialist corporate-state in which an equivalent of all growth of annual value-added output is pledged, and thus flows to, the financial and gov’t sectors (and its top 0.001-1% owners), precluding any growth or real value-added output net of the financial sector and gov’t.

Then add the net energy constraint per capita from Peak Oil and the constraint is structurally permanent.

Not a good idea to fling out too very much detail about such things. One such might be wrong, and then the rest of it is dismissed.

Better one thinks about systemic forces than agreement among too very many people, any one of whom might decide to write a book.

The price of gold and silver are determined mostly by FEAR. When things seem to be really iffy for the financial systems in place in large countries the price of gold shoots up. When the people as a whole get over being afraid of cash and bonds and the stock market etc the price of gold drifts back down.

Of course the price of gold can be manipulated to some extent. The price of anything can be manipulated to some extent if enough people with enough clout blow enough smoke and erect enough mirrors.

But so long as people in the west think things are stable and their money is safe in stocks or bonds or cash then they don’t want to hold gold. Gold doesn’t pay any interest. Everything else pays at least a little interest or profit in normal times, even a few bucks in a savings account.

People in the east keep on buying it because they believe it will always be accepted by just about anybody anytime when paper or electronic money loses its value.

What few will say at this point, i.e., they won’t be paid if they do, is that an increasing majority share of US “oil” extraction since 2012 was consumed in order to extract the unprofitable incremental supply at $75-$100/bbl that is not affordable to the rest of the economy to burn and grow real GDP per capita AND sustain unprofitable “oil” extraction at today’s $45-$55/bbl.

What some call a “glut” of “oil” is actually an unprofitable supply at which neither the shale “oil” sector can afford to produce and consume to produce “growth” of supply that the economy can afford to consume and “grow” real GDP per capita.

In the meantime, the “reality” of our situation is that we are at, or near, the log-limit bound of maximum systemic entropy, near zero exergy, and thus at the net energy equilibrium per capita, i.e., “Limits to Growth” (LTG).

The central banks, including the Fed, increasing bank reserves at a 0% discount and at an effective infinite term will not increase profitable supply of “oil” at a price we can afford to burn to grow, or even maintain, real GDP per capita.

But all of the trillions in bank reserve printing to avoid a global debt-deflationary wipeout larger than 2008-10 has provided gross distortions to market price signals of all kinds, encouraging MASSIVE MISALLOCATION of resources, savings, credit, and labor, including unprofitable production of shale and tar sands “oil” at an average price we can’t afford to burn and grow the economy.

Until this is understood and internalized, the disinformation, misinformation, and confusion will persist and serve as a novel topic of discussion and debate.

Hi BC,

Are you seriously arguing that the entire world economic system is operating at near zero exergy?

I think you would need to substantiate such a bold claim. I do agree exergy is falling as fossil fuel resources deplete.

There is a fair amount of solar input into the system (at least 110 million TW-h), as the price of fossil fuels increases more of this energy (both as wind and solar) will be utilized, there is also nuclear power (though this would not be my first choice), which will undoubtedly be needed.

I agree that there are limits to growth, but it is not clear that we are as close to those limits as some believe. Higher prices will lead to more efficient allocation of energy resources (less waste.)

I suspect you’re quite clear on this point, but it’s worth clarifying for other readers that total Fossil Fuel resources amount to perhaps 3 months of the Earth’s solar insolation.

So, depletion of Fossil Fuel reduces the total exergy available by a very small percentage.

Nick,

For completeness why not list the energy of the total neutrino flux through the planet as well?

Well, heck, show me a neutrino collector at Radio Shack or Home Depot, and I will. PV has been available at Radio Shack for 40 years, though of course the cost per watt has dropped dramatically in that time.

What is the neutrino energy level, by the way?

Well they are massive particles moving at great speed, so surely they must have a lot of energy!

Thus concludes this weeks edition of The Armchair Scientist.

*A program intended for those among us who are just educated enough to fall for such dribble*

Total available, usable, affordable per capita at necessary scale.

Yup, wind and solar are all of those.

Scalable, available, usable, affordable.

Heck, wind is cheaper than coal in the US. Solar is much cheaper than oil for power generation everywhere.

Both are cheaper than FF, when you include all the costs.

http://questioneverything.typepad.com/question_everything/2010/10/work-exergy-the-economy-money-and-wealth.html

Yes, available, usable, affordable exergy capacity per capita to permit further real growth per capita of value-added output.

To scale the seemingly infinite energy from the Sun, the economy has to grow per capita to service the unprecedented debt, replenish the physical capital stock, sustain the fossil fuel infrastructure indefinitely at existing scale and rate per capita, and then provide the necessary funding to build out and maintain the renewable infrastructure.

Ain’t gonna happen.

The hyper-financialization of the western economies and gov’t, financial services, health care, education, and household debt service being equivalent to ~56% of GDP is masking the underlying lack of growth of real GDP per capita, capital formation, real household income. These sectors are now a net cost to the rest of the economy, with the Fed printing and gov’t programs such as Obamacare exacerbating the drag from financial services, gov’t, and health care.

Add peak Boomer demographic drag effects and Peak Oil, and LTG and the maximum entropy limit bound per capita is becoming well established and decelerating to equilibrium or stasis around the ~0% rate of real GDP per capita and trade since 2007-08.

Growth is done. Today. Now.

The IMF real GDP statistics and UN population statistics do not really confirm your story, real GDP per capita growth has not slowed to zero, money invested in solar and wind will be exergy positive especially as technology improves and economies of scale make solar, wind, and the HVDC grid upgrades that will help support it take place. Do you have good data on exergy values? People throw this term around a lot with very little data to back it up.

The piece by George Mobus was pretty good. It is not clear that the exergy of non-fossil fuel energy will not continue to grow as the price of fossil fuel increases and the economy substitutes these forms of energy for fossil fuels over time. This is simply assumed.

There are other studies that have suggested solar has very low exergy, but these studies are flawed by including long lived assets such as roads and fences in the cost of solar at their full cost over a 25 year life of the solar panels, not really a proper way to do the analysis.

Right on Dennis,

When a solar farm is supposedly at the end of its usefulness at twenty five or thirty years the panels will still be worth half what they were the day they were NEW.

And a few guys with a pickup truck will go in and start taking out bad components as they find them without ever shutting down the solar farm. It will continue to produce even as it is refurbished with the latest generation of new panels and auxiliary equipment.

This is not your grandfathers coal fired plant that will have to haul the coal an ADDITIONAL thousand miles because the sun is worked out and no longer shines in the local area. It won’t take three or four or ten years to tear it down and rebuild it. And except for a little diesel for the maintenance trucks it will run basically oil free more or less FOREVER so long as panels and converters etc can be manufactured.

The naysayers just don’t want to face up to the basic facts which are as obvious as the sun at noon. We CAN adjust to energy that is double or triple todays energy costs GIVEN TIME.

When I was a little kid we used three times as much firewood as we do now to keep a much smaller house warm.

As Alan used to point out at TOD railroad tunnels dug well over a hundred years ago are just as useful today as they were then.

Resources diverted from mindless current consumption to long term durable goods are not wasted except in the minds of people who refuse to think.

Folks who think renewables are a boondoggle never seem to think the same thing about another football stadium or ski resort or shopping mall or another ten million cars. They have no problem with destroying a billion dollars worth of capital flying to the sun and snow. A week later only the memory of such a trip still exists.

Money spent on renewables is still circulating in the economy. It is still providing jobs and the renewables that get built supply local tax revenues.

“Resources diverted from mindless current consumption to long term durable goods are not wasted except in the minds of people who refuse to think.”

This one sentence says it all OFM. Brilliant in its simplicity.

We’ll extract as many barrels of oil as fast as we possibly can; the only question is what we do with them. Burn it frivolously for immediate gratification, or constructively building a future; burn it for this moments pleasure, or tomorrows comfort. The barrel is burnt in both instances, but how that energy is directed dictates the comforts and sufferings of every generation that proceeds us.

That being said, who can’t wait to get the $10,000 Gold Apple Watch!?

I’ll be back after locking up my snowmobile for the year, and getting my jet ski ready for some fun. I work so hard; better spend my extra cash buying toys that make me forget about how dreadful work is. Afterall, my home has increased in value o much that I can just finance it all with a HELOC. Rates are so low nothing could ever go wrong! Right?

Is Russian oil production primarily secondary and tertiary recovery? It is my understanding they have primarily mature onshore fields. Is this accurate?

A lot of talk about Russia’s big shale.

They simply have all that surface area. They are going to go dry last. And before that happens they are going to assert dominance to ensure maximum comfort and pride for their own citizens.

The price for their oil will become more than monetary. It will involve disarmament, and maybe slave labor of those who imposed sanctions or inflicted any other slight. They thus have every incentive to keep all conflict non military and let the wheels of time grind their enemies to beggars. Hard to see how this isn’t inevitable.

Золотые слова 🙂

Россия является большое место. Это и хаос трудно управлять. И золото плавится. ^u^

Or, you could drive a Chevy Volt, which costs less to own than the average car.

I don’t think Russia really has much leverage, after “the wheels of time” grind away oil demand.

Shallow, it’s mostly secondary recovery, water floods. But it’s important to realize that most countries require water injection at an early date, this means reservoirs aren’t allowed to reach bubble point as they were in the USA.

The new areas (Timan Pechora, Vankor, Eastern Siberia) are developed using fairly modern techniques. I don’t think they are using “tertiary” methods at large scale, , but I don’t follow Russia closely anymore.

Russia’s oil industry is an odd creature, it has a mix of soviet and modern methods.

I read somewhere about Russia trying plasma-pulse EOR on some wells, but I don’t know where or to what effectiveness. But most Russian fields are mature waterfloods, I don’t know of any CO2 floods that they currently run.

I would rather call it pressure pulsing. I have seen the lab and field test results, and it works. Don’t keep up with the science anymore, but the last time I read about it or discussed it in a meeting nobody had a sound theoretical basis to explain it. Dr Dussault showed me a draft paper he had, and it didn’t convince me. But I think I know why it works.

The Russians try just about everything. Nowadays there’s a pretty decent technology flow into Russia. And they love to copy our ideas when we are dumb enough to expose them for free.

I am somewhat of an independent scholar in that I have spent at least a couple of hours almost every day just reading anything that interested me for half a century plus.

At one time I was burning with desire to prove to lefty liberals that communism WAS a real threat to us .

– Nobody on the left I ever met back then ever seemed to take into account the reality of COMMIE empires. They were all focused exclusively on their mostly imaginary AMERICAN empire even though we generally brought our troops home and left things in the countries we occupied at the end of WWII mostly to the local people in very short order.

The Russians did not.They erected the IRON CURTAIN.. I have basically ever since had nothing but contempt for academic liberals the way liberals have contempt for pious Christians . Nobody can ever be as blind as those who REFUSE to see.

One thing that I learned was that both the Russian and the Chinese maintained ( and most likely still maintain) a MASSIVE intelligence operation targeted at NONCLASSIFIED information. This meant obtaining copies of just about every technical publication printed and having somebody read and summarize just about every piece of technical news.

The intent of course was to save their own country the expense of doing research domestically.Reverse engineering a machine such as a pump is a hell of a lot faster and easier than designing one from scratch.

Having an actual pump is best but just having the service manual with diagrams and exploded views is enough to get you ninety nine percent of the way to setting up to manufacture.