Rystad Energy, an independent oil and gas consulting services and business intelligence data firm in Oslo, Norway, has online, a wealth of information concerning upstream oil production projects and costs. Some of it is a bit dated but some of their charts date from late 2015.

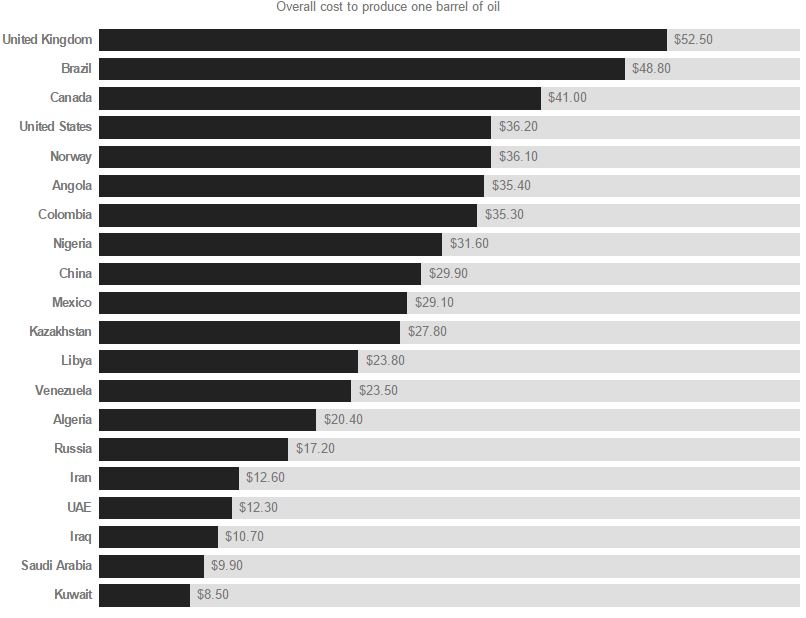

The two below Rystad charts were published by CNN Money on November 23, 2015.

This is overall or average cost, not marginal cost. It cost Canada $41 to produce a barrel of oil but only cost Russia $17.20. I guess that is why Canada is cutting back but Russia is not.

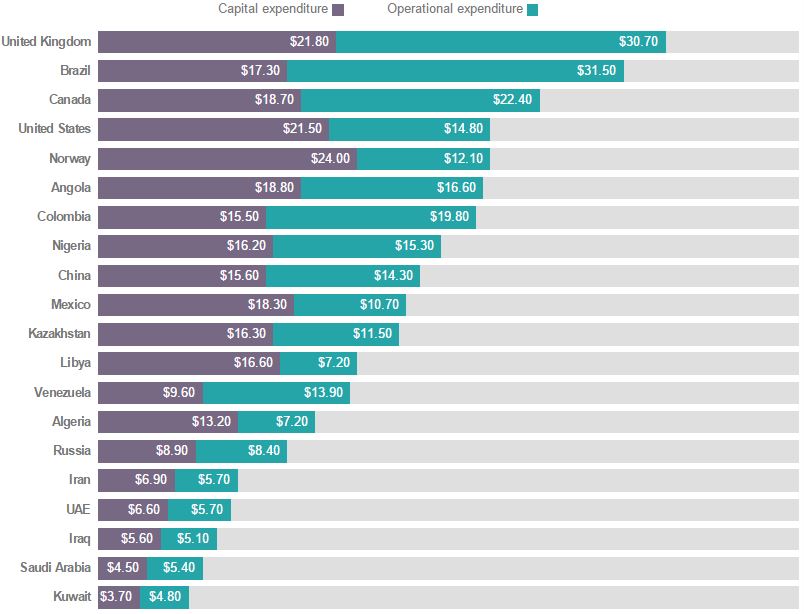

Here is the breakdown between capital expenditures and operational expenditures. Why would the United Kingdom’s operational expenditures be two and one half times those of Norway? After all, they are both drilling basically the same oil field.

Here is the breakdown between capital expenditures and operational expenditures. Why would the United Kingdom’s operational expenditures be two and one half times those of Norway? After all, they are both drilling basically the same oil field.

So why is not the price of oil having a more dramatic effect on production? Well it is, it just takes a while. Here are some plans from about a year and a half ago, when the price of oil was much higher.

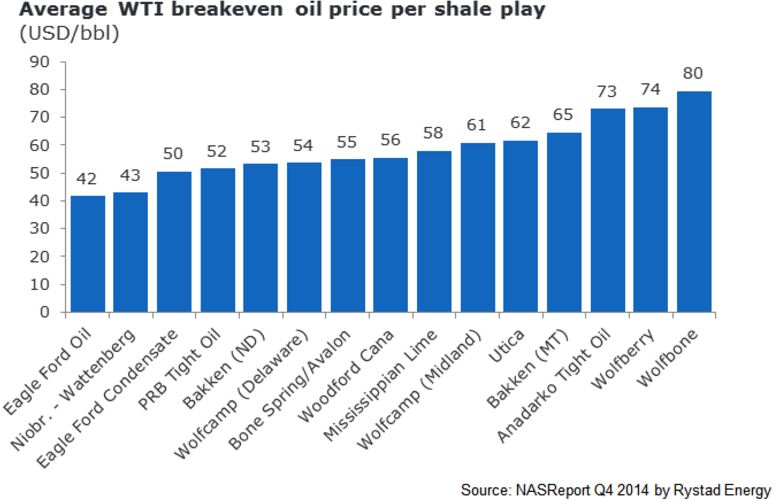

Rystad published the two below charts in their US Shale Newsletter in January 2015 but the data dates from the 4th quarter of 2014, just as the price of oil had started to drop.

At that time Bakken (ND) had a break even price of $53 while Eagle Ford oil had a break even price of $42 and Eagle ford condensate a break even price of $50.

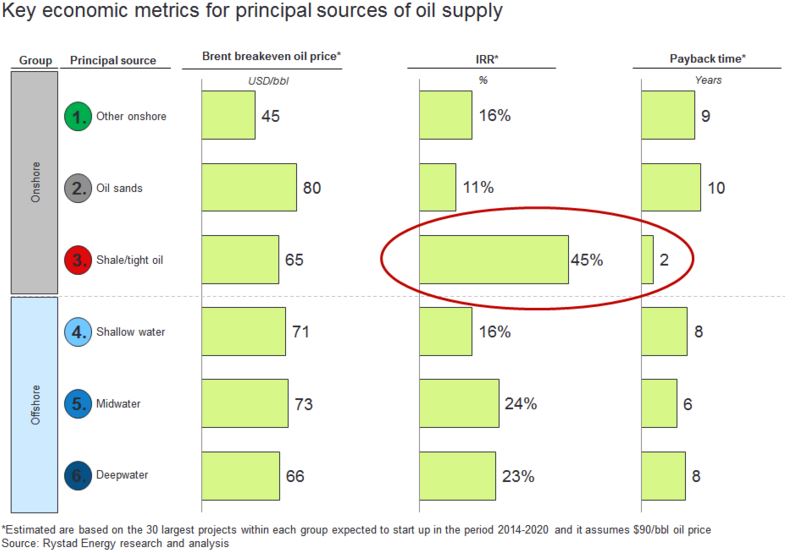

The below chart, from the same newsletter, assumes $90 a barrel oil.

Shale oil, at the time, had an average break even price of $65 a barrel, which would have given them a 45% internal rate of return and a payback time of only 2 years. It is amazing how much things have changed in just a little over a year.

But by October 2015 things had changed dramatically.

Exclusive: Offshore oil output to plunge as producers scrap field upgrades

Global offshore oil production in aging fields will fall by 10 percent next year as producers abandon field upgrades at the fastest rate in 30 years, in the first clear sign of output cuts outside the U.S. shale industry, exclusive data shows.

A drop in oil prices to half the level of a year ago has forced producers to slash spending and scrap mega projects that can take up to a decade to develop, but they are also taking less visible steps to cut investment in existing fields that will have an immediate impact on global supplies.

There have been few signs of how cost cuts of around $180 billion will impact near-term production until now. They could erode the glut that has forced down prices, and help balance global production and demand by the middle of next year or earlier, Oslo-based oil consultancy Rystad Energy said.

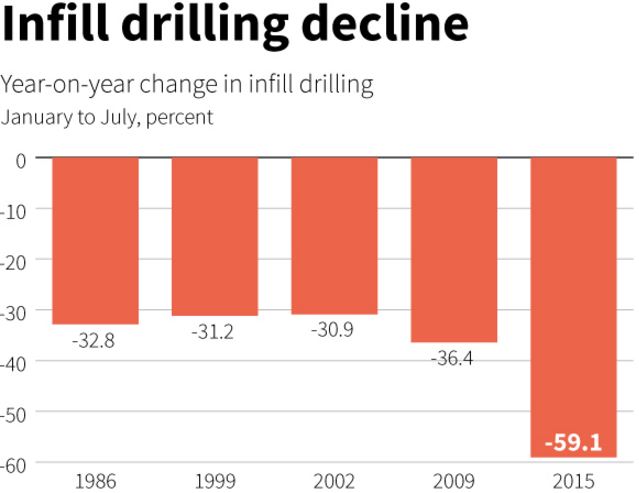

Data provided exclusively to Reuters by Rystad show a sharp decline in investment to upgrade mature offshore oil fields in order to arrest their natural decline, in what is known as infill drilling.(Graphic: link.reuters.com/xaz75w)

The above chart shows the decline in infill drilling due to previous drops in the price of oil. The data is from the Gulf of Mexico, Southeast Asia and Brazil. The decline in infill drilling in 2009 was the largest… until now. The first half of 2015 saw the largest decline in offshore infill drilling in history.

In three major offshore basins — the Gulf of Mexico, Southeast Asia and Brazil — infill drilling dropped by 60 percent between January and July this year compared with the same period last year, according to the Rystad Oil Market Trend Report, whose data is based on company data and regulatory filings.

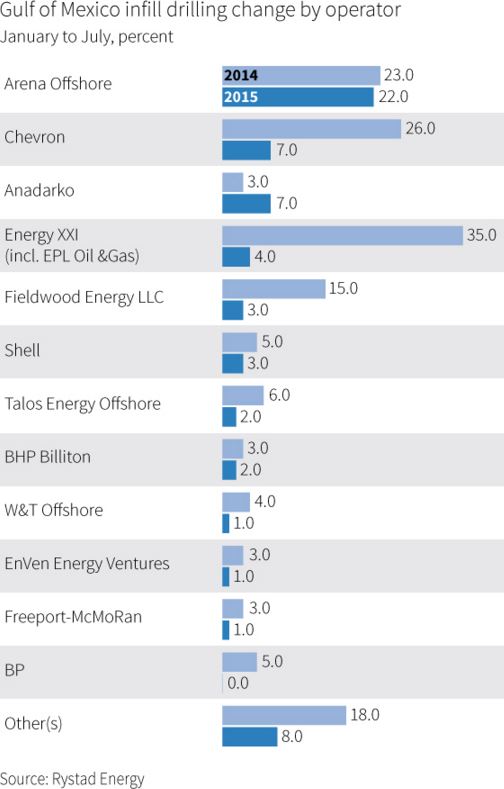

For example, according to the data, in the Gulf of Mexico, infill drilling on mature wells dropped from 149 wells between January and July 2014 to a total of 61 wells during the same period this year.

Based on this trend, Rystad Energy estimates that global offshore oil production in mature field will decline next year by 1.5 million barrels per day (bpd), or 10 percent, to 13.5 million bpd from 15 million bpd in 2015.

The above chart is change per operator, just in the GOM. And this was just in the first half of 2015 when the price of oil averaged about $56 a barrel. What is it now when the price of oil is over $20 a barrel lower?

Well, just since June Wood Mackenzie says the latest figures show that the amount of deferred capital spending on projects awaiting approval has almost doubled from $200bn to $380bn, with 2.9m barrels a day of liquids production now not due to come on stream until early in the next decade.

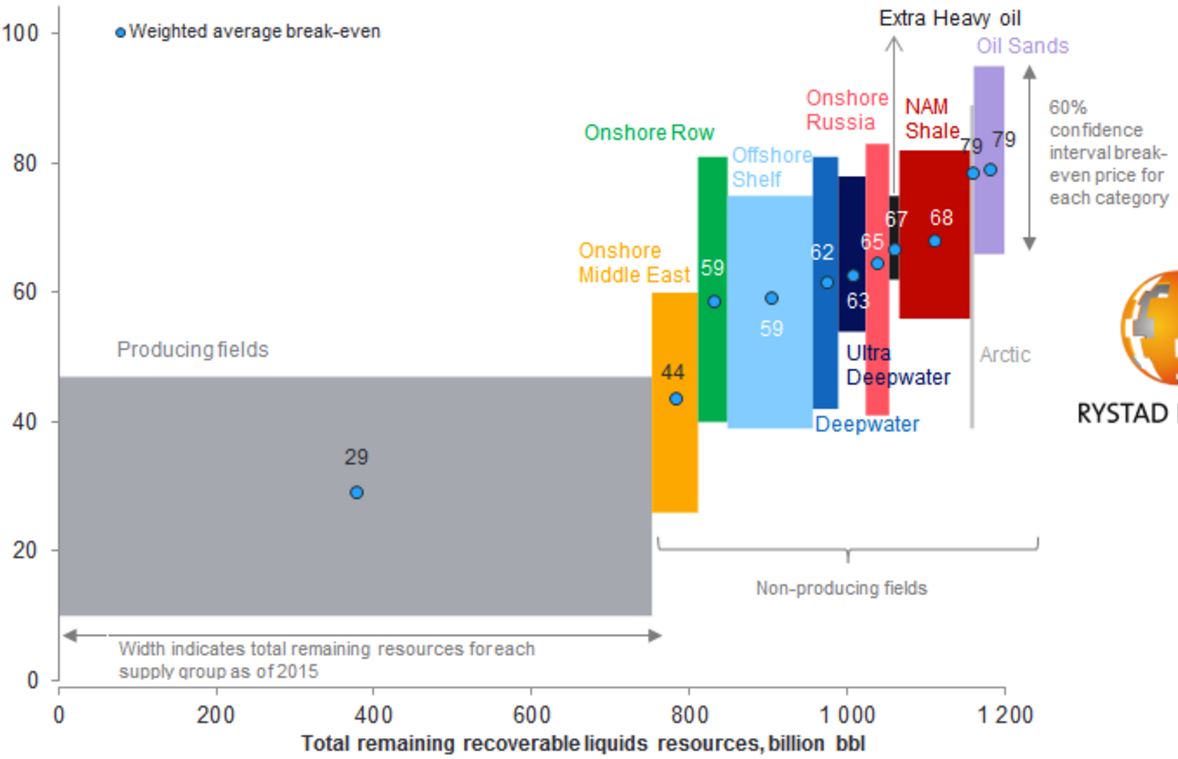

Global liquids cost curve (October 2015)

*The break-even price is the Brent oil price at which NPV equals zero using a real discount rate of 7.5%. Resources are split into two life cycle categories: producing and non-producing (under development and discoveries). the latter is further split into several supply segment groups. The curve is made up of more than 20,000 unique assets based on each asset’s break-even price and remaining liquids resources in 2015.

Source: Rystad Energy UCube September 2015

What the above chart tells me is that it now costs a lot more to produce a barrel than it once did. And… unless crude oil hits at least $60 a barrel soon a lot more projects will have to be cancelled. But… all that being said, I think it is now obvious that oil production will drop, rather dramatically, beginning sometime in 2016. And that drop will lead to a rise in the price of oil, at least to $60 a barrel and likely higher.

That is unless some black swan event happens. That could be a collapse in several economies of the world… or a collapse of the economy in one country, China. In other words, it is a given that production is going to decline. So if demand stays constant, or rises, then the price of oil will definitely rise. We know what is going to happen to supply. We have no idea what is going to happen to demand. But if BAU continues as normal, the price of oil is going up.

Good info.

Generally breakeven cost should be

Where BEP is ( https://en.wikipedia.org/wiki/Break-even_%28economics%29 )

But this is rarely the case as breakeven price has tremendous propaganda value. Typically only a fraction of those expenses is included and due to this there are multiple definitions. See for example several listed in:

https://cdn2.hubspot.net/hub/312313/file-2262672865-pdf/breakevencosts-evaluateenergy2.pdf

It would be interesting to know what expenses “average breakeven price” that Rystad Energy uses include.

For example, is return on capital included?

likbez,

You hit the nail on the head. Breaking even on a point forward basis is nice if an individual is stupid, however most smart investors (if they knew the real facts) wouldn’t put their money in that sort of Ponzi scheme. Unfortunately, many investors don’t realize they are dumping money into a black hole called the U.S. Shale Oil & Gas Industry.

This has to be one of the biggest CANNARDS I know of. I wrote about BHP Billiton purchasing shale assets back in 2005. Said it was a stupid thing for them to do. Maybe, I should have put together some professional presentation and called myself a OIL GURU and if they listened, they could have saved $10 billion in write-downs. Maybe that info would have be worth a cool few million.

However, big corporations will continue to do stupid things… so will the small fry investors.

I am just waiting for the next shoe to drop. While 2016 will turn out to be an interesting year, 2017 will be a real BARN BURNER.

steve

SRS wrote:

“Maybe, I should have put together some professional presentation and called myself a OIL GURU and if they listened, they could have saved $10 billion in write-downs”

They would never have listened. Its pretty simply: No Project, No paycheck. The people that drive these grand expansions profit from them regardless of the outcome. Consultants and employees collect paychecks and bonuses implementing project. If there is no work to do, then they don’t get paid.

The entire business model of Cheseapeake under Aubrey McClendon was based on selling these no-good unprofitable shale fields to big integrated oil companies for much, much more than they were worth. Whole damn thing was a land scam. It’s amazing how many of the big integrated oil companies fell for it.

I think it’s a psychological thing: they want to believe their industry has a future, so they fall for any scam artist who tells them that it does. The “oilmen” aren’t psychologically able to do what Warren Buffett did with Berkshire Hathaway (he abandoned its original industry completely and put the money into another industry).

The US is dead broke, $210 Trillion in liabilities.

http://www.nytimes.com/2014/08/01/opinion/laurence-kotlikoff-on-fiscal-gap-accounting.html?_r=0

“Even worse, the budget office raised what’s called the alternative fiscal scenario, the most realistic projection of fiscal outcomes absent major policy changes. Based on these estimates, I calculate that the “fiscal gap” — a yardstick of total government indebtedness that I’ve worked on with the economists Alan J. Auerbach and Jagadeesh Gokhale — was $210 trillion last year, up from $205 trillion the previous year. Thus $5 trillion was the true deficit.

The fiscal gap — the difference between our government’s projected financial obligations and the present value of all projected future tax and other receipts — is, effectively, our nation’s credit card bill. Eliminating it, would require an immediate, permanent 59 percent increase in federal tax revenue. An immediate, permanent 38 percent cut in federal spending would also suffice. The longer we wait, the worse the pain. If, for example, we do nothing for 20 years, the requisite federal tax increase would be 70 percent, or the requisite spending cut, 43 percent.”

The US Congress knows America is broke,

http://www.cnsnews.com/news/article/barbara-hollingsworth/economist-tells-congress-us-may-be-worse-fiscal-shape-greece

“The U.S. has a $210 trillion “fiscal gap” and “may well be in worse fiscal shape than any developed country, including Greece,” Boston University economist Laurence Kotlikoff told members of the Senate Budget Committee in written and oral testimony on Feb. 25.

“The first point I want to get across is that our nation is broke,” Kotlikoff testified. “Our nation’s broke, and it’s not broke in 75 years or 50 years or 25 years or 10 years. It’s broke today.”

The US may have “200 Trillion” in over priced and over valued assets like suburban sprawl McMansions and a FED sponsored stock boom for the elite, which looks like it has popped. But the fiscal gap liabilities far outweighs any assets the US has.

17 Nobel Laureates and 1200+ Economists Agree with Ben Carson re U.S. Fiscal Gap : http://www.forbes.com/sites/kotlikoff/2015/05/13/17-nobel-laureates-and-1200-economists-agree-with-ben-carson-re-u-s-fiscal-gap/#1fc16de35931

“The fiscal gap is the present value of all projected future expenditures less the present value of all projected future taxes. The fiscal gap is calculated over the infinite horizon. But since future expenditures and taxes far off in the future are being discounted, their contribution to the fiscal gap is smaller the farther out one goes. The $210 trillion figure is based on the Congressional Budget Office’s July 2014 Alternative Fiscal Scenario projections, which I extended beyond their 75-year horizon.

Dr. Carson referenced $211 trillion as the size of “unfunded mandates.” Michelle Lee correctly points out that Dr. Carson was referencing the U.S. fiscal gap, not the present value of mandatory spending. What she knew (because I told her), but failed to say, is that the present value of mandatory spending is far larger than $210 trillion because the fiscal gap is a net, not a gross number.”

Anyway in the long run none of this is really relevant and important, we are all living in a hall of doom that entropy will have her way with. Human existence is just about biding the time with socio-cultural games till we pass on, either to a bleak coldness or maybe the pearly gates of a communist Santa Claus.

“What are we to make of creation in which routine activity is for organisms to be tearing others apart with teeth of all types – biting, grinding flesh, plant stalks, bones between molars, pushing the pulp greedily down the gullet with delight, incorporating its essence into one’s own organization, and then excreting with foul stench and gasses residue. Everyone reaching out to incorporate others who are edible to him. The mosquitoes bloating themselves on blood, the maggots, the killer-bees attacking with a fury and a demonism, sharks continuing to tear and swallow while their own innards are being torn out – not to mention the daily dismemberment and slaughter in “natural” accidents of all types: an earthquake buries alive 70 thousand bodies in Peru, a tidal wave washes over a quarter of a million in the Indian Ocean. Creation is a nightmare spectacular taking place on a planet that has been soaked for hundreds of millions of years in the blood of all creatures. The soberest conclusion that we could make about what has actually been taking place on the planet about three billion years is that it is being turned into a vast pit of fertilizer. But the sun distracts our attention, always baking the blood dry, making things grow over it, and with its warmth giving the hope that comes with the organism’s comfort and expansiveness.” Ernest Becker.

Is it any wonder we humans are collectively destroying the biosphere of the earth? It is a cold, systematic revenge against creation.

VK – “The US is dead broke, $210 Trillion in liabilities.”

Didn’t you get the memo ? Superpowers can print as much money as they wish. Now loosen up your underwear. You sound like a conservative on FM radio.

Dr. Carson needs to go get his cloths cleaned.

The 200 trillion in “liabilities” is the present value of future social security and medicare payments. You see different estimates on this because different people use a different rate to calculate the payments. The rate is obviously just an estimate.

These are political promises. Not debt.

Read your social security statement (If you are a yank). You are not guaranteed to get the money.

The bigger problem is that medical expenses are compounding at 9% per annum due to medical monopoly pricing ( I got this from Karl Denninger if you are interested, read him).

This will bankrupt the entire country and the only way to fix it is to destroy the medical industry (20% of GDP). If you rip out the legislation that allows these monopolistic practices (which would land you in jail in any other industry) the costs would drop by 80% (Japan levels).

going bankrupt or destroying the medical industry is guaranteed to happen. Pick your poison.

There is no escape.

I used to read Denninger until he lost his mind and full Birther. How can anyone trust his judgement on anything?

His birther stuff is stupid. He is a climate change and peak oil denier, which is stupid.

If u eliminated everyone that fell into that category, u couldn’t trust 97% of the planet.

The truth is that otherwise talented people can have very foolish views of the universe we live in.

Darwin figured out evolution by natural selection in the 19th century. Humans with the same brains as denninger and fuser had been on the planet for 100,000 years before that (biologists I am just making a point, not accurate numbers). Most humans can’t understand the world from a scientific perspective.

He founded one of the first Internet companies and a political party that is still significant (I am not a tea partier, I like science), which is an accomplishment that I doubt fuser has achieved.

Do u disagree that medical monopolies are destroying the U.S. health care system?

If u do, u aren’t very smart.

This is arrant nonsense from Kotlikoff, who is a moron. The US prints the money. We could eliminate the “fiscal gap” overnight with no effect on anything. US Treasury bonds are basically the same as money — they are not really debt at all.

Learn some real economics, not this fake economics. The sovereign issuer of money can generate wealth through “seignorage”. As much money as is necessary can be printed until inflation starts going up, and we are a looooong way from inflation.

(If we have high inflation, THEN we have to raise taxes or cut spending. We’re not even close.)

Ron, very interesting, thank you. Reading your conclusion, we then can expect that markets will do all possible to cause the collapse of one or more countries. So, Oil production will peak, while our economies (US and Europe) could not to.

How does the shale irr of 45% and paybakc of 2 years line up with the mountain of dede and other info (aka bertman). Does not seem to make sense??

Daniel, I think you missed the point. That was a year and a half ago, when it was expected that the future price of oil, 2014 to 2020, would average about $90 a barrel. I thought I made that clear. Things are totally different today. In fact, that chart was meant to show just how much things have changed in a year and a half.

Thanks ron. I get that things are much worse now. But your shale oil players were accumulating massive amounys of debt even before 2015. Which seems hard to understand with such economics.

Daniel. LTO production was growing very aggressively, therefore even with high oil prices, producers were outspending cash flow. This is how the mountain of debt was built, despite 2010-2014 strong oil prices.

I think we get caught up in the idea that production in US is not falling as fast as expected, I know I do. However, if we look at the year over year change, it will likely approach 2 million bopd. Production grew 1.4 million bopd in 2014, and may have fallen as much as .6 million bopd in 2015. (Numbers off the top of my head, and 2015 is still yet to be determined).

Also, the current price is extremely low, much lower than 2015. If this price holds for several months, look for continued decreases in production from many parts of the world. $10s and $20s is what most oil is selling for in the world at present. That is simply not economic is the majority of the producing areas of the world, and definitely not in North America, where the 2010-2014 production growth predominantly came from.

Daniel, Ron, shallow sand,

In my view shale economics have significantly changed over the last two years. The monthly decline rate (see below chart) reached in the Eagle Ford oil basin nearly 12%.

Although Marcellus has somewhat stabilized and Utica, which is still in its infancy, even improved, it is in my opinion just a matter of time when decline rates increase for all shale plays.

This trend has not been baked into many economic and forecasting models – quietly assuming constant decline rates – and comes now as a surprise for many analysts and investors.

Heinrich, what’s the source of your Eagle Ford data?

Ron,

It comes from the EIA drilling report. Legacy decline is close to 150 kb/d and month since a few months now and production is declining and currently stands at around 1.2 mill b/d. The above decline rate is legacy decline divided by actual production.

Of course the actual decline is lower as there is also production from new wells, yet my chart shows the internal decline which has to be replaced by companies and is just an indicator how fast the ‘Red Queen’ has to run.

It is in my view exactly the increasing demand for capital to keep oil and gas production stable, which weakens the bond market, which then spills over to the economy and stock market. As companies did not want to curb production voluntarily, they are forced now to do so over a collapsing bond market.

As Eagle Ford is one of the most mature plays, it serves in my opinion as a blueprint for more recently started basins such as Marcellus and Utica.

Interested in this, as North Dakota’s decline rate stalled (i.e. many years stopped declining all together, or even grew) in October and November as operators opened the chokes on their old wells.

That can’t be right. Got a link for that bit of information?

That’s from the NDIC data. If you split the wells into year of completion, 2006-2009 and 2014 year wells increased production month on month in Nov vs Oct, while 2009-2012 years increased in Oct vs Sept.

Lynn Helms suggested that operators re-opened shut-in older wells, but that doesn’t seem to be the full story after comparing the monthly PDF reports to one another – a load of old wells didn’t just appear in the data. Also producing wells fell in November.

After we noticed this, Schlumberger’s CEO said in their conference call that recent slower declines were down to operators “opening all the taps” on their old wells, so after this initial surge he expected higher decline rates in future. Search for “taps” in this transcript: http://seekingalpha.com/article/3828566-schlumbergers-slb-ceo-paal-kibsgaard-q4-2015-results-earnings-call-transcript?part=single

North Dakota’s decline rate stalled (i.e. many years stopped declining all together, or even grew) in October and November as operators opened the chokes on their old wells.

Naw, you are reading that all wrong. The decline rate has not stopped. The decline numbers are slowing down, but only because production is declining. The Bakken legacy decline was 62,385 barrels per day in October and 61,702 barrels per day in November. But the decline rate held steady at 5.26 percent per month.

The EIA is finally getting their act together with their Drilling Productivity report. For months they had the legacy decline still increasing while production was declining. Now they have corrected that mistake and corrected the historical data. The legacy decline is now decreasing right along with production, just as it should.

I’m not sure I am misreading, Ron. As I said, it’s North Dakota Industrial Commission data I’m using, not EIA. And it is actual empirical well data, aggregated by year of completion – it is simply the sum of oil production from wells completed in a specific year, divided by days in the month.

Use Enno’s excel file, split the wells up by year, and you will see the same thing – output actually increased for some vintages in these months. I was as surprised as you are to find this.

Edit: Even if you do it just by looking at wells completed thru 2014 – those wells decline 31,000 bpd August to Sept, but only declined 1,000 bpd in Oct compared to Sept! Decline rates don’t just drop 97% month to month – and then increase again the next month!

“But your shale oil players were accumulating massive amounys of debt even before 2015. Which seems hard to understand with such economics.”

The business model worked this way:

(1) borrow money

(2) wheedle leases by any means necessary

(3) drill, frack, do a sloppy job, get poisons in the groundwater

(4) announce extremely high first-year production numbers

(5) SELL SELL SELL the entire operation to an integrated oil company (or another sucker), at a high price. Hoping the integrated oil company won’t notice that the well runs out of oil in two years.

(6) Use the proceeds to pay off the debt and make a tidy profit — leaving the integrated oil company with the losses

This was the business model. Now does it make sense? They were all doing this. They ran out of suckers to resell the fields to.

Ron

The reason for the greatly different OE for the UK and Norway is simply due to geology. Although they share the same basin and the reserves for each nation are very similar UK oil sits in many fields and Norway’s oil is concentrated in fewer large fields.

One thing is for damned sure. The oil biz must have been generating UNGODLY UNIMAGINABLE PROFITS up until a year ago, if the figures Ron just posted are even ball park accurate.

Have they really been making that much money,as a percentage of revenues, even before taxes, royalties, etc?

It has been my belief , as the result of reading this site, and the old TOD, etc, that it costs a hell of a lot more than the figures listed, to produce oil, as a general thing.

We all know that tax lawyers and accountants can work miracles, and that the oil industry can afford the best, but ………….?????

If the oil industry has TRULY been making this kind of money, how is it that oil stocks weren’t going up FAST?

My seat of the pants impression is that the production cost figures given are highly slanted so as to make the industry look better during this downturn, and keep people for selling oil stocks, etc.

The drillers haven’t been making money, they have all be losing/underwater.

Even the bigs and nationals have been losing: they have been throwing away value for some useless ‘numbers’ … numbers which are all borrowed.

Don’t forget Jeffrey Brown: when you ask the price, you get the price of top sirloin, when you ask the quantity you get the amount of meat. Not all oil sells for the price of Brent or WTI.

“he oil biz must have been generating UNGODLY UNIMAGINABLE PROFITS up until a year ago,”

How do you think the backwards, medieval, theocratic Saudi Arabian *aristocracy*, with no skills whatsoever, managed to become so rich? Yes, they were making ludicrous amounts of money on oil. And still are actually.

Oil companies were insanely profitable in the US until the mid-1970s, too.

How are prices going to increase? Everyone is broke (except for a handful of Richie-Riches).

How will oil shortages make anyone richer? Even the Richie-Riches are getting hammered by the ongoing bloodletting as driller defaults spill into credit markets and banking. The (only) outcome is some will be less poor than others, those who are less poor will be those who do not waste their ‘wealth’ on petroleum consumption.

Oil industry has lost $100 trillion dollars. How are the poor, hapless customers going to fix that? Where are they going to get that kind of cash? (They aren’t, they never will get it.)

http://www.mauldineconomics.com/frontlinethoughts/100-trillion-up-in-smoke

Peeps need to understand the reason why prices have declined, not put lipstick on the decline and call it a pig.

Maybe I ought to be sitting in a corner, wearing a clown suit and a dunce hat, BUT I have been buying and selling in commodity markets, as a small business person, for over half a century, and I THINK I know a couple of things.

ONE thing I know is that graded products, manufactured and marketed to reasonably well defined standards, compete on price. When I buy two by fours, or diesel fuel, I buy by grade and price. I am not about to pay the lumber guy closest to me more for a load of two by fours, if the next guy down the road has them in the same grade a little cheaper. I buy diesel fuel and gasoline, wholesale and retail, the same way.

I don’t know more than a couple of fools who will pay significantly more for gasoline , because of the brand name on the pump.

You can pay double for your car, so as to impress other fools, but you just don’t hang around it front of the gas pump impressing people with the brand of gasoline you use.

People in general, the whole world full of people, are buying MORE OIL THAN EVER BEFORE, at least up until the last few months, when production might have started to decline. ( I personally think production has been declining recently but not by much, not yet .)

In some ways people are awesomely stupid, but this stupidity does not extent to paying more for gasoline , diesel fuel, fertilizer, heating oil , gas for heating the home, etc, than necessary. Even rich people pay attention to prices, which is in large part why they get rich and stay rich.

BUSINESS MEN are ESPECIALLY quick to buy what they need to run their businesses at the best price they can, because a penny saved is worth ten pennies in new gross revenue, as likely as not. The penny saved goes directly on the bottom line.

The fucking price of oil is low because oil producers are bringing enough to market that people can and DO HAVE MORE THAN EVER, basically as much as they can USE, at the current low price.

WHY SHOULD anybody pay more, when they can get it for less?

I have a bottle of premium sipping whiskey for anybody who can provide me with a RATIONAL answer to this question.

Times may be tough, but tough times do not explain the low price of oil. Production in excess of the collective end users’ DESIRE for oil at HIGHER prices explains the current low price.

It is a very common thing for commodity producers to have a string of good years, and increase production to a point that the price of their product falls significantly, until somebody or everybody producing cuts back production.

The real question is why it is taking so long for the industry to cut back production. THAT’s what we ought to be talking about.

It is obvious the world oil industry necessarily moves at a glacial pace, which explains a lot.

But I am coming around to the pov that economic warfare has as much or more to do with the industry reacting so slowly. A privately owned business, owned by individuals, or share holders, may be UNABLE to respond any faster, for many reasons.

But a country such as Saudi Arabia, or Russia, could cut production in VERY short order, thereby getting MORE revenue for LESS product, with the double bonus of having the product still in the ground for later sale AND spending less on current operations. Laid off men and stacked machines are cheaper than working men and running machines.

Question? What is the difference between the “f–king” price of oil and the price of oil? I don’t see how the adjective “f–king” relates to price at all.

{The fucking price of oil is low because oil producers are bringing enough to market that people can and DO HAVE MORE THAN EVER, basically as much as they can USE, at the current low price.}

It’s one of Rat’s favorite words.

https://en.wikipedia.org/wiki/Ratfucking

I should point out that the fucking price of oil is usually a lot lower than the price of fucking oil.

https://www.google.com/?gws_rd=ssl#q=kama+sutra+oil

Excellent response, Rat. And you are so right about the relative prices!

My opinion is that there is no global oil glut. The US and the Saudis are playing economic warfare on Iran and Russia. A study in 2014 by the IEA claimed that 1,600 oil fields that product 70% of global oil had an average yearly decline rate of 6.2%. If true, (90 mpd)x(0.7)x(0.062) = 3.9 million bpd. Global demand usually increases about 1 million or more a year. So the world needs about 5 million bpd of new prod per year to stay even. Where is the data to support this ?

“But a country such as Saudi Arabia, or Russia, could cut production in VERY short order, thereby getting MORE revenue for LESS product, with the double bonus of having the product still in the ground for later sale AND spending less on current operations. ”

Saudi Arabia’s oil minister specifically said that the end of the age of oil was coming. (Why? Electric cars are superior to gasoline cars and cheaper to operate, industry is already switching away from oil as a feedstock, heating with electricity or NG is cheaper than heating with oil, etc.) He wants to sell Saudi Arabia’s oil *while people still want the damn stuff*. He figures that it’ll be worthless in 20 years.

And he’s right. How’s the coal market doing these days? Owning huge coal reserves is worthless now. Anyone sitting on that stuff should’ve sold it while it was still worth something (economically speaking, I mean — environmentally it’s good if they’re sitting on it).

OFM- it’s a world market, not just a USA market.

It’s a flyover USA market isn’t just NYC, LA or DC (or Silicon Valley) market.

Price of anything speaks for itself. If a price is low it is because there is no bid to drive it higher.

The f word is for emphasis.

There is NO reason to go around like a bunch of Monty Python characters wondering about why oil is cheap.

Oil is cheap BECAUSE there are people in the production business who are willing to sell it cheap, and it will STAY cheap until producers quit selling at current prices.

Witch doctors and astrologers talk about spirits and stars making people sick or well. Folks who know better talk about germs and poisons.

People who actually took and passed an elementary econ course do not find it necessary to invoke spirits and stars, and international conspiracies, etc, to explain the price of oil.

The price of oil is determined by the willingness of the collective customer to buy and consume the collective amount produced.

Nobody pays more for a commodity than necessary. WHY should they?

The collective producer is bringing enough oil to market that the collective user will buy the full quantity only at the current low price.

It’s as SIMPLE as falling off a log.

The real question is why producers are not cutting back.

Part of the answer is that some producers ARE cutting back as fast as they can.

But other producers are apparently determined to sell all they can produce, for reasons not well understood, at least not well understood by outsiders.

We can’t know specifically why some producers are willing to sell at a loss, or at least at a price that severely reduces their profit margin, when they could cut back deliveries and get more money for less oil.

But we CAN be fairly sure we know the GENERAL answer. It’s a combination of desire to maintain market share, national pride, domestic politics in producing countries, economic warfare between countries such as Russia and Iran versus Saudi Arabia, desperation sales to generate SOME cash so as to keep the company in business, etc etc.

Some producers may believe they can run some of the competition out of business.

Other folks can add more possible reasons, I am sure I missed some.

For Steve,

“Price of anything speaks for itself. If a price is low it is because there is no bid to drive it higher.”

I agree absolutely.

BUT you don’t need to bid higher when you can get ALL YOU WANT at the CURRENT price.

Is there anybody in this forum fool enough to argue that the collective consumer is not getting all the gasoline and diesel fuel,heating oil, etc, he WANTS at the CURRENT PRICE?

IF the neighborhood store where I buy gasoline starts rationing my purchase at the current buck seventy per gallon, or runs OUT, I will go on down the road and buy at a store that is not out, and not rationing my purchase, at a buck eighty or however much MORE I have to pay, to get as much as I want at “their” price, whatever their price might be.

There really is such a thing as a market, and in a market, the price of a good is determined by the quantity sellers will supply at a given price, and the quantity customers will buy at a given price.

There really is an oil market. It is a COMPETITIVE market.

Anybody who believes otherwise has his head up his butt, unless he can offer a reasonable explanation as to who has the power to control the supply coming to market.

Right now there is no cartel able to control oil supply, and no single individual company big enough to have pricing power, with the possible exception of Saudi Aramco. That company is government property or more accurately the property of the Saudi royal family and for reasons uncertain, they are not cutting back production.

Well said, OFM!

Iran is hoping to get paid mostly with Euros rather than dollars or other currencies, and the Iranians appear to have a good shot at getting what they want.

In any case, it appears to me that two countries as big and diversified gegraphically and economically as Iran and India ought to be able to work out a deal strictly between themselves, bartering let us say so many barrels of oil for so much by way of industrial equipment or food etc. Relatively small amounts of any well accepted currency ought to suffice to grease the wheels of such potential barter deals.

http://www.cnbc.com/2016/02/07/iran-wants-euro-payment-for-new-outstanding-oil-sales.html

I would like to know how much oversupply or undersupply causes how much price change. Is a 5% oversupply enough to get a price drop like this or is it 10%? And looking forward, how much would a short supply of 10% mean in price hike?

We know that our civilization needs oil to function, in fact it exists because of oil. Much of our consumption is inelastic. I think the current oversupply is relatively small. Producing nations are pumping like mad because they need the cashflow. They cannot make long term decisions to wait out a higher price.

We are adding some 40-50 Million motor vehicles to the world’s fleet every year. There is a finite amount in the ground with ever increasing cost and decreasing Energy Return on Energy Invested. We also have declining net exports.

The current fool’s paradise cannot last long.

Sydney Mike,

You asked a very difficult question. Oil oversupply/undersupply are not only economic but also political categories as oil is a strategic product. Almost everybody in 2014 and 2015 underestimated the severity and the length of the current drop of oil prices. Despite the fact that oversupply was minor (2 Mb/d or less) and partially fictional (see condensate vs oil issue below). So there might well be no any solid correlation between those two in view of “casino capitalism” effects on oil price.

Here some general “cause-effect” considerations:

1. There is no way to detect “oil glut” or deficit less then 1Mb/d based on accuracy of world oil production/consumption data. So any deficit or glut less then 1Mb/d reported by MSM or agencies is pure propaganda. The four meaningful digits reported by EIA (aka “Energy Disinformation Agency”) is also pure propaganda. Their data does not allow more then two meaningful digits.

2. Price of oil in “casino capitalism” is detached from producers and is determined via “paper oil” bought and sold in financial casino. See http://peakoilbarrel.com/the-ieas-oil-production-predictions-for-2016/#comment-558670

So tail is wagging the dog. That means that price is detached from the situation on the ground and only shortages of “physical oil” that can’t be hidden can move the prices either way. So the regime of “suppressed price” might well last longer then most of us expect, and definitely longer then some hypothetical point in time at which balance of world supply and demand is achieved. You need shortage not a balance to move the price. So oil price moves probably overshoot as they will be accompanied by “short squeeze”.

3. There is a strong institutional bias of all major Western agencies including EIA and IEA as well as mass media toward low oil prices as it is plausible that high oil prices cause “secular stagnation” in world and, especially, Western economies. That’s why “Fuser law” of predicting breakeven price of oil (BEPO) reported by MSM (BEPO=0.8 * current_WIT_price ) works so amazingly well.

4. Recent oil glut was by-and-large “condensate glut” (aka “Great condensate con”, the effect discovered by Jeffrey Brown http://www.resilience.org/stories/2016-01-17/the-great-condensate-con-is-the-oil-glut-just-about-oil ) caused by tremendous increase of gas production and extraction of associated liquids and “false equivalence” reporting by major agencies which overstated the real supply picture.

As condensate processing facilities were insufficient and some refineries refused shipping of blended oils that caused growth of condensate storage which was interpreted as oversupply of oil.

5. Dropping of the price of oil was probably a political decision. A join decision of USA and Saudis governments among other things. Also it looks like that the point of lifting sanction from Iran also was chosen strategically.

Obama explicitly stated that he intends to crush Russian economy via low oil prices. ( https://www.rt.com/usa/218731-obama-npr-interview-russia/ )

That suggest that low oil price regime might well last for the duration of Obama administration unless Russia folds.

6. It might well be that the decision to crush oil prices was also in part caused by the desire to save Western economies from the new recession as there were sign that they started sliding into recession earlier and that bought the USA and G7 almost two years of relative prosperity.

In any case shale oil boom was one of the main factor of lifting the USA from the Great Recession and it probably served the same role as subprime mortgage boom in lifting the USA economy from dot com crisis of 200-2002. It also improved exports/imports ration and all produced oil (by virtue of decreasing imports) and most equipment used can be counted as manufactured in the USA product creating a short-lasted revival in the USA heavy machinery manufacturing.

7. Depletion of world oil deposits is now an undeniable fact and the impression that we entered “post peak oil” period (true or false) creates pressure to move oil price up (as Ron explained in his recent post)

Sydney Mike – I will give my illustration again. The problem is that almost nobody understands commodity pricing. So here is my analogy, again.

A group of very wealthy individuals are playing a game of musical chairs. With unusual rules. There are 20 people playing and only 19 chairs. The rule: when the music stops, the person without a chair is executed. However, there is one chair for sale, so if you buy it in an auction, you will not have to worry. The price of the guaranteed chair – probably pretty high, especially if some are billionaires.

Next game, same rules, 20 players, only difference is that there are also 20 chairs. The auction for one guaranteed chair gets a high bid of ZERO. It has no value. 20 players, 20 chairs. So, a 5+% increase in the number of chairs causes the value of a guaranteed chair to drop from millions of $’s to zero.

If there is a shortage of a commodity, the price can skyrocket. Take oil. Do you want the fire department to say that they will not buy gas because it is too expensive? How about ambulances? How about police? How about people that have to get to work? How about an offshore drilling rig that costs $500,000/day to lease without considering the cost of diesel fuel. Are you going to shut it down because the fuel costs $5000/day more and you still have to pay the daily lease? Well, hopefully, you get the picture.

Very well put Mr. Clueless. That is exactly what I am thinking. A relatively small change in supply can cause a major change in price.

You could also look at it from the other direction – between 2005 and 2014 prices increased four fold but supply went up not at all in the short term and only slowly longer term, and this might have as much to do with low interest rates as price. Now prices have crashed supply is declining equally slowly short term. There is an intrinsic time lag in the supply balance of at least one year to eighteen months for companies making investment decisions and about five years for most project development cycles. Any system with pure time lags is inherently unstable, and for oil the financial system seems to act as a positive (enhancing) feedback in the short term rather than helping to smooth things out.

What does price mean when it is measured in printed pieces of paper the value of which is defined only by agreement between counterparties and no innate, inherent integrity for the paper itself?

When the yardstick itself has no integrity, how can you explore the validity of a mere theory like supply and demand with it.

Our currency is based on the full faith and trust of the US Government.

Watcher, that’s just the way the world works. And I do mean world because every national currency in the world is based exactly the same thing. We keep harping on our “fiat currency”. But there is no such thing as a “non-fiat currency”.

Again. That’s just how the world works. And if the fiat currency collapses then the world’s economies crash. So your only hope is to put your full faith and trust in our fiat currency. There is no alternative other than total collapse.

It is a form of Ludittism. In the evolution of primitive exchange systems you had direct barter, then an advance when a valuable exchange medium like wampum was used and in modern technological societies we have money which is issued by a government. The transition from wampum to money was done gradually, with the money initially being backed by wampum so that it would be accepted by the more primitive backward members of the species.

The problem with money is that it is a symbol. It is therefore decoupled from reality by its very nature as a symbol.

When something like money is subject to the ‘human imagination’ (LOL) all kinds of effects can happen with it and many of these effects are far from funny.

Did you type that with a straight face, Ron? I can’t even read it with a straight face. ‘u^

(I might be tempted, if I could, to edit your passage to add the word, ‘force’, after ‘full’.)

Money is *inherently* a matter of trust and faith. Basically, I trust that other people will give me real goods and service in exchange for the money. *And that is why I accept the money in exchange for my goods and services*.

Money is a social convention. ALL money is.

It looks like we have our answer:

The surplus of supply over demand at the start of the year is “even greater” than initially expected, the International Energy Agency said in its latest monthly report.”With the market already awash in oil, it is very hard to see how oil prices can rise significantly in the short term.”Supply may exceed consumption by an average of 1.75M bpd in the first half of 2016, compared with an estimate of 1.5M last month, and the excess could swell if OPEC members bolster production.

A miserly 2% or so of excess supply can tank the price of oil. Imagine what a 10% shortfall can do.

In our world all governments have a tool called the printing press (or its electronic equivalent) than can conjure unlimited amounts of fiat currency out of nothing. This currency can then be lent to banks at 0% who can then lend out into the economy at any percent greater than 0, and make profit from the spread. Alternatively, the fiat currency itself can be used to pay back loans denominated in that currency. The central banks can just create currency and transfer the loans onto their own balance sheet. In effect, the public pays back the loans by inflation.

Yes, that is correct. All loans in existence worldwide, every last one, can be paid back by the issuance of more currency.

Doesn’t mean we won’t face a shortage of all sorts of things. But currency is not one of them. By definition, there is never a shortage of currency. Therefore, if you make the claim that everybody is broke and doesn’t have currency, that is incorrect. Currency is infinite, and infinitely substitutable. At last resort, they can just start crediting your accounts directly.

Think this is incorrect, or perhaps unfair? Think long and hard before you reply to this post and say I’m wrong. What do you guys use to buy stuff? Gold and silver coins?

Not only that, but simultaneous with that governments could declare price freeze. And then require production of whatever, the refusal of which would be a criminal offense.

Economics is not physics. It is a whimsical “science” at the mercy of all government decrees.

Economics isn’t physics. But it can’t violate the laws of physics or math ( which might be the same thing).

You can print money all day long and all u do is dillute the value of the currency in existence.

That may fool the markets for awhile, but not forever.

No such thing as a free lunch.

Incorrect. When the government prints money, it is usually actually *creating economic activity*. Activity which would not have happened without the money, because it was too hard to arrange all the barter transactions.

Most of the time there is a *shortage of money* in the economy and the government needs to print more in order to keep trade happening. Not enough money and people have to try to barter instead, which is hard and doesn’t work and causes trades to not happen.

If you print *too much* money then you get inflation, which means “diluting the value of the currency”. But as long as you don’t have significant inflation, you CAN and SHOULD print more money.

Basically, money is used as a sort of “lubricant” to make trading possible. If there isn’t enough money in circulation, the economy freezes up. The government’s job is to print and inject enough money so that people can make trades.

(Incidentally this specifically means the government needs to hand that money to *poor people* so that they can make trades like buying food. Rich people already generally have enough money to make trades. When the economy freezes up, it’s the poor people who drop out of the economy and can’t make any trades except barter — money needs to go back to them in order to get the economy moving. Stupid Puritan morality prevents us in the US from doing this, although it is correct by the cold calculating laws of economics.)

The shortage is not currency or reserves but lack of growth of after-tax and -debt service income and purchasing power of the bottom 90%+. We have been seeing this manifest in demand for commodities, contracting profits, investment per employee, industrial production, and final sales less the fiscal deficit, which is decelerating below stall speed and toward recession-like conditions.

Peak Boomer demographic drag effects, extreme inequality, and health care, education, gov’t spending, and net flows to the financial sector exceeding 50% equivalent of GDP are exacerbating the decline in velocity and contraction of the acceleration of velocity. The more central banks print, the worse asset bubbles become and inequality encourages hoarding by the top 0.001-1% of overvalued financial assets at no acceleration of velocity in the productive economy.

Negative interest rates are an effect, or response to, deflation, which is caused by excessive private debt to wages and GDP, which results in slower GDP per capita, which in turn causes deficits and public debt to rise thereafter to prevent nominal GDP per capita from contracting.

We’re in the early phase of a debt-deflationary regime against which central banks and gov’ts are desperately leaning to prevent outright debt and price deflation.

Typical hyperinflation ignorance.

First off all money is LOANED into existence not printed with a press or a keyboard.

No loans – no new money. Pay off loans – money disappears

This is what is happening right now.

Does the future look so bright that everyone is going to start taking out trillions in loans? NO!

Does the future look so bright that banks is going to start loaning out trillions to everyone who asks? NO!

Thanks Jef…

If all debt were retired all money would disappear.

You also have the interest on that debt that has to be paid by someone else taking out a loan to create the interest.

It’s exponential as they say.

Money can be printed into existence. Just ask the Bureau of Engraving and Printing, which does so.

Money can also be “loaned” into existence but *that’s a choice*. If we pay off loans with *newly printed Greenbacks*, we are replacing one form of money with another.

You actually can have a shortage of currency — that is in a very real sense what causes a “Great Depression”.

However, such a shortage of currency is a *choice made by the government* who issues the currency. A functioning government can always produce enough currency if it wants to.

Other people can produce currency too. But it can be hard to get people to accept it, so it can be hard to make it work. For instance, banks produced “money market funds”, and people accepted them as equivalent to currency *until 2008* when suddenly they weren’t currency any more. The sudden “demonetization” caused an economic crash.

Ron,

Your analysis is perfect. 2016 is going to see a bigger reduction in oil production than the second half of 2015. That is the effect of oil price reductions that have already taken place, so not even a recovery in oil prices could prevent it. Now we should take the analysis a little bit further in the two possible scenarios:

1. Oil demand does not decrease. This means that the global economy is stable. Oil price will increase. As long as oil price doesn’t get too high, the decline in oil production will be slowed and with luck halted or even reversed. We buy some more time.

2. Oil demand also decreases. This means that the global economy enters recession. Oil price will remain low and the decline in oil production will continue and probably accelerate. We might enter a tail spin oil/economy situation that could produce a hard crash getting us much closer to civilization decline.

Peak oil in 2015. We will have to watch the global economy as we already know what the oil production is going to be doing. Thanks for sharing your knowledge and view.

I expect #2, which I suspect is already beginning.

Javier says: “could produce a hard crash getting us much closer to civilization decline.”

When in doubt, bring out the chicken little (the sky is falling) again.

When in doubt, bring out the chicken little (the sky is falling) again.

Clueless, bullshit! It is not a danger that civilization will decline, it is a lead pipe cinch.

I am a little shocked. Such a silly cornucopian remark is not usually expressed by on of the regulars on this site. What I mean is, the regulars, when they disagree, usually try to make some kind of logical argument, not just through out a silly cliche that is without any logical argument whatsoever.

Please feel free to refute my claim that the eventual decline of civilization is a lead pipe cinch. But please don’t try to do it with some silly one line cliche.

Of course civilization is toast. Entropy always wins. Fossil fuels just accelerated the demise while misleading us into thinking we were entering some sort of a techno utopia.

http://gizmodo.com/this-timeline-shows-the-entire-history-and-potential-fu-1745431371

It’s been very hard for me to predict oil demand. But I can predict a lot of related stuff. There are a number of interlocking features.

(1) Demand for oil for heating is down permanently, on the death spiral to zero, and pretty close to zero already.

(2) Demand for oil for industrial feedstock is down permanently, on the death spiral to zero.

(3) Demand for oil for lubricants and plastics is insignificant.

(4) Demand for oil for airplanes will probably rise with the economy and drop with the economy.

Which gets us to the key one, which dominates all others in terms of volume:

(5) Demand for oil for land vehicles is on a *permanent* decline due to the rise of battery-electric vehicles, but I couldn’t tell you the *timing* on this.

Low oil prices mean it takes longer for the demand destruction to take place. High oil prices mean it happens quicker. Battery price declines are the main determining factor. Electricity prices are another.

(Electricity prices will remain roughly flat in most areas, but areas with high prices will see electricity prices drop to 14 cents/kwh and eventually 11 cents/kwh retail, and half that wholesale. That I’ve figured out.)

How soon?

How high?

Price volatility and thermoeconomic issues (lower price glass ceiling?) to help it along?

In any case, China, international shipping and Nick G comments on POB all seem to be in decline, if not outright collapse…

How soon?

This year, by September or October.

How high?

$70 dollars or so.

Hell, nothing is certain here. Anything could happen. All I am doing is just making a wild ass guess, a guess that is just as likely to be wrong as right.

Nick G is out driving around the country in his new Tesla with free lifetime solar charging. What are you doing doomer ? Growing potatoes and raising rabbits

Speaking of cars, your ‘buddy’ posted this down-thread.

Potatoes grow, and rabbits raise, themselves, respectively, which frees up valuable time for real community living, rather than working in some relatively-useless mind-numbing capacity in some vertical hierarchy neofeudal social disorder for some slavemaster. This is pretty much where this culture is at this point.

Agreed and fair enough. We’ll see what happens and how close you get.

Interesting article about the slowdown of the oil biz in North Dakota:

http://www.nytimes.com/2016/02/08/us/built-up-by-oil-boom-north-dakota-now-has-an-emptier-feeling.html?action=click&contentCollection=Opinion&module=MostPopularFB&version=Full®ion=Marginalia&src=me&pgtype=article

This was completely predictable; I just didn’t think it would slow down by 2015/2016…I thought the head of steam might have lasted till ~ 2018-2021 or so.

Will the boom times come roaring back, bigger and crazier than ever?

None of us know.

What we do know: The Earth is finite, the amount of FFs in the ground is finite, and depletion never sleeps, and the distribution of FF deposits (size, frequency) seems to follow the power law…and the cost to raise each bbl of oil and mcf of methane and ton of coal will continue to rise.

Barring a breakthrough which produces inexpensive, compact, ubiquitous ‘Mr. Fusion’ power reactors, the outlook looks bleak. Even with a ‘Mr. Fusion’ breakthrough, other source and sink limits would end up eating humanity’s lunch if population increase was no slowed, stopped, and reversed at some point, and the seemingly endless increase in per capita consumption slowed and then reversed as well. But a ‘Mr. Fusion’ breakthrough would sure give us some breathing room to mature as a species and figure out how to bring our existence into some kind longer-term sustainable future, one in which we do not exterminate many of the other species on Earth.

I would bet that Ron’s “lead pipe cinch” prognosis will turn out to be correct.

We already have a “Mr Fusion” reactor. It’s called the sun. So isn’t that convenient?

It’s ubiquitous — it shines on the whole earth; solar panels are inexpensive and getting cheaper (and are becoming ubiquitous); and solar panels are about as compact as you get for power generation.

Our major problem is CO2 emissions, which will kill us all if we don’t stop it, thanks to ocean acidification and global warming.

Does anyone here buy into the idea that both N. and S.America could both be energy independent for the next 20-30 years- if managed carefully?

Here is a case for that. In N. America we have plenty of coal, nat gas, oil sands and various oils to keep us rolling, warm, powered and fed, if we cut back something like 30% on transport, and keep rolling out things like LED’s, transit, solar, wind, electrification of the car fleet, and a big HVDC electric infrastructure. Oil at $100 a barrel would keep the drillers busy. I seriously believe we could keep the GDP at close to par while cutting back on oil for transport by something like 30%.

In S.America, they too could make due with the production from the continents oil sands, other oils, sugar cane ethanol, hydro, solar, etc.

The key is effective management. But I fear we are a combination of too short-sighted, ignorant, greedy, and stuck in our ways to pull it off.

Hickory,

I admire your can-do attitude…I still think those dreams sometimes.

But…no, I don’t see your scenario happening.

Politicians won’t tell the truth…we won’t elect ones who would tell the truth, because we can’t handle the truth and want to hear the reassurances that the BAU party will roll on, and that the majik will happen. It someone in power told us the truth, that person/those people would not be in power much longer…voted out, recall elections, impeached, marginalized. It is in our nature to be so.

Volvo740 (below) has the right of it…declining EROEI…tick tock.

I would love to be proven wrong…for my kids’ sake…

I guess what I’m saying is that it is theoretically feasible to achieve this (the 30% liquids reduction goal is just a wild guess), kind of like safe nuclear energy.

But the human element of poor decision making, poor foresight, partisanship, lack of discipline, and outright contempt for others- makes achieving these these energy security goals highly unlikely.

Also, a side effect of the trillions of paper wealth that has evaporated in past 6 months [multiple $70/barrel x’s the proved reserves of companies, countries, stockholders]

is the unfortunate inevitable resultant drop in funds available to flow towards solar/wind deployment- ie the negative wealth effect.

As grim as the depletion curves from Campbell et al looked like, those were best case scenarios.

The real wall is when it takes 1 unit of energy to get 1 unit of energy out. Ehh – no – that can’t be. What equipment would they use to get that out? So we need a functioning steel industry. We actually need a bit more than that. An oil platform incorporates pretty much everything modern in this world, engines and motors of all kinds. Computers. And we might want to get to the platform. So we need some helicopters. A complicated machine.

And even if we have all of that, we still done have any energy left for the rest of the conomy.

Depletion never sleeps.

Civilizational decline is starting to feel palpable now.

Sorry to hear your view of the world is so blue. Ask your doctor if you could try serotonin. It is popularly thought to be a contributor to feelings of well-being and happiness. Also, once your able to hold down a job. Your self esteem will increase for the better.

Don’t give up buddy !

You sure? (*kiss*) Try harder. ^u’

Just give that free Canadian big government health care a try. If not for you, everybody else.

Don’t you just hate it when someone quotes one of your lame older edits?

…Ok, here, let’s get rid of it once and for all:

“Sorry to hear you can’t get it up. It’s just you.” ~ Trump 2.0There. All gone. ^u^

LOL

Also, once your able to hold down a job. Your self esteem will increase for the better.

Like all the lazy slackers in the oil industry who got canned in the Dakotas recently? Yeah, some happy pills will solve all their problems. Maybe therapy will help them. Sooner or later they will wish they had some health care a la Canada as opposed to no health care a la USA. (Trump 2.5)

Of course they always have the option of suicide, that helps solve the problem by reducing the population. I would have suggested a minimum wage job as a greeter at Wallmart but they have been closing stores.

The US has 40% real unemployment!

Donald Trump is right: America’s real unemployment rate is 40%

http://fortune.com/2015/09/14/donald-trump-unemployment-rate-jobs/

For Trump 2.0

To add to Fred’s statement re Canadian healthcare: (Single Payer)

“In 2015, total health expenditure in Canada is expected to reach $219.1 billion, or $6,105 per person. It is anticipated that, overall, health spending will represent 10.9% of Canada’s gross domestic product (GDP).”

https://www.cihi.ca/en/spending-and-health-workforce/spending

And in USA:

“No other advanced country even comes close to the United States in annual spending on health care, but plenty of those other countries see much better outcomes in their citizens’ actual health overall.

A new Commonwealth Fund report released Thursday underscored that point — yet again — with an analysis that ranks 13 high-income nations on their overall health spending, use of medical services, prices and health outcomes.

The study data, which is from 2013, predates the full implementation of Obamacare, which took place in 2014. Obamacare is designed to increase health coverage for Americans and stem the rise in health-care costs.

150666783

Jason Butcher | Getty Images

The findings indicate that despite spending well in excess of the rate of any other of those countries in 2013, the United States achieved worse outcomes when it comes to rates of chronic conditions, obesity and infant mortality.

One rare bright spot for the U.S., however, is that its mortality rate for cancer is among the lowest out of the 13 countries, and that cancer rates fell faster between 1995 and 2007 than in other countries.

“Time and again, we see evidence that the amount of money we spend on health care in this country is not gaining us comparable health benefits,” said Dr. David Blumenthal, president of the Commonwealth Fund. “We have to look at the root causes of this disconnect and invest our health-care dollars in ways that will allow us to live longer while enjoying better health and greater productivity.”

Heart surgery

How’s your heart doing? You may want to read this

The U.S. spent an average of $9,086 per person on health care in 2013, which translated to more than 17 percent of gross domestic product, the fund noted.

That level of health spending relative to GDP is about 50 percent more than any of the countries studied for the report, which are Australia, Canada, Denmark, France, Germany, Japan, the Netherlands, New Zealand, Norway, Sweden, Switzerland and the United Kingdom.

http://www.cnbc.com/2015/10/08/us-health-care-spending-is-high-results-arenot-so-good.html

The kickers are as follows:

*Health Outcomes in Canada higher

*Some Provinces no premiums….mine (BC $136/month) highest family rate based on income…reduced for low income families

*No co-pays or deductibles.

*My pension health plan (Private) pays for 1/2 premium and 80% pharm

For example….5 years ago I was diagnosed with cancer. It required surgery and rehab. No bill for me and I missed just 5 weeks work. Regular follow-ups and I am cut loose from the surveillance regime this October to be declared cancer free.

My wife was diagnosed type 1 diabetic at age 13. She is now 56. She has led a robust work and personal life and is in excellent health. In the States her diabetic supplies would cost us about $500/month, plus extras. Until the sub-standard Obama care was introduced, she would never have qualified for coverage. I would assume she would have died young in poverty having to pay for her supplies and for missing work due to complications.

In this time of diminishing returns, the only constant is the intrusion of the Coropocracy in all facets of American life, plus the propaganda protecting the insider staus quo. My sister, who lives in WA is now old enough for Medicare. Nevertheless, she and her husband purchase a private insurance policy to ensure proper care. For her supposedly free Medicare, they still pay an extra $600/month to ensure they are covered by necessary procedures.

Vote Bernie, imho. Apologies as it is none of my business who you vote for. However, Good luck.

For the second time in one month, I am fearful of a contract being put out on me.

Paulo notes: “That level of health spending relative to GDP is about 50 percent more than any of the countries studied for the report, which are Australia, Canada, Denmark, France, Germany, Japan, the Netherlands, New Zealand, Norway, Sweden, Switzerland and the United Kingdom.”

Which of those countries have a minority population of 50% like the US? If you combine the results from Idaho, Wyoming, Montana, South Dakota, North Dakota, Minnesota, Maine, Vermont, New Hampshire, Kansas, and Nebraska, you get results like those countries.

He further notes: “Until the sub-standard Obama care was introduced” Well, it covers EVERYTHING – even a pregnant male. And it is FREE, if your income is low.

He further notes: “Nevertheless, she and her husband purchase a private insurance policy to ensure proper care.” No!! Since medicare is not TOTALLY free, [there are small deductibles plus Medicare only pays 80%] most people purchase a Medicare supplement policy [which I do – My cost for my wife & me is $385/mo] which pays for the deductible and the Medicare co-pay of 20%. She and her husband are NOT paying for “proper care.” As Ron would say: I am calling Bullshit on that. PS. I have been on Medicare for 10 years. MRI [for anything, back, shoulder, etc] – one day wait. Surgery – usually scheduled within 3 days. See a doctor – one day. Need lab tests – can you go to the lab NOW?

Hello Clueless,

I’m an independent insurance broker in the state of California that specializes in health coverage. What I’ve learned over the last 20 years is that most people(maybe 98%) don’t understand their coverage. Also most brokers bad mouth the ACA and the reason is because it has forced insurance companies to cut overhead expenses. The largest portion of that overhead are commissions to brokers. Over the last few years, commissions under the ACA have been cut from about 30% to 60% from prior years. I’m one of the few brokers that supports the ACA because a lot of the good things it does to fix the broken medical system.

You are correct by calling a Ron Bullshit here. The ACA is not “sub-standard coverage”. In fact, it make better coverage available than what an individual could purchase prior and helps medium income people with financial help. Also, here in California there is no primary carrier available that sell to 65+ seniors except Medicare. The private carriers only offer Supplements like the “F” plan you describe for yourself and wife. Medicare isn’t free except for very low income individuals which get help from Medicaid. Most people have to pay $104 per month for their Medicare part B coverage in addition to deductibles and co-insurance(20%).

Here is what I see as the biggest problem with the ACA currently and it is self inflicted by “Red” state governors who refuse to accept Medicaid for low income individuals(example: single people with less than about 15k annual income). During the first 3 years of the ACA(years 2014,2015,2016) the Federal Government pays 100% of the Medicaid expense to the state. After 2016, the Fed’s will pay the state 90% of the expense. There are about 6 to 8 million low income people in Red states that governors have refused to cover. Besides the fact of not getting coverage for these people. The emergency rooms still have to cover the expenses for these people and the states are missing billions of dollars that could stimulate their economy. All because of politics, ideology and 10% cost starting in 2017. Also, keep in mind that Medicaid is the lowest cost system to cover health care because it uses the lowest cost doctors, hospitals and drugs.

If I were Hillary Clinton, I would “Trump” Bernie Sanders by offering to cover 100% of all future Medicaid costs to the states to get everyone covered. The “Red” state governors would not have any “Ron Bullshit” excuse to not cover the poor. This would be a lot cheaper than Medicare for all and do we really need the cost of a premium plan for the low achievers ?

If I had sold you your supplement plan. My commission would be somewhere between $38.50 to $50.05 per month depending on which company covers you. This is a commission that didn’t get reduced by the ACA.

Thank you and others like you

THANK YOU

All I know is my American niece and nephew pay over $6000/yr premiums and $8,000 year deductible. When they had a rabid bat in the house they had to pay $7,000 per injection.

’nuff said.

I call your bullshit and raise you reality.

Commision of $50.00/month for selling a policy? Priceless. What’s in your wallet?

Of course Medicaid is poor coverage. Most hospitals/nurses/doc’s will avoid taking medicaid patients if they can control the doors to their facility because the reimbursement rate for service doesn’t pay well enough to pay the wages, let alone keep the facilities up.

I know because I work primarily emergency medicine and the ER gets all the medicaid patients that can’t find others places to get their care.

A medicaid based system would work if the reimbursements were at Medicare rates, but as Hillary keeps asking Bernie, where you going to get the money for that?

If “Medicaid is poor coverage” meant your doctor drives around in a Buick and doesn’t own a Porsche Panamera or BMW 750Li. You might get me to feel sorry for him.

There is no reason anyone should be turned away at an ER in this country. Period !

No, our expenditures in states like Vermont and New Hampshire are WAY WAY WAY WAY out of line — much higher — than expenditures in Canada and Europe. For worse results.

Medicaid is actually pretty good coverage. The nasty expensive coverage is what people who are stuck buying insurance on the “individual market” who aren’t poor enough to be on Medicaid get.

If we had Medicaid-for-all we’d probably have outcomes as good — and as cheap — as Canada has.

Volvo740 –

“As grim as the depletion curves from Campbell et al looked like, those were best case scenarios.”

That was pretty much my thought as well. This is one of the more depressing posts here. I’ve been thinking we’d muddle through for a good few more years even as oil depleted but if these figures are born out I’m not so sure.

The 10% decline rate without continuous infill drilling is particularly worrying. Mostly infill drilling accelerates production but does little for overall capture (sometimes a bit of increase in recovery, but sometimes it can have the opposite effect) so the more they are used the more the decline rate will increase after the peak. I know the 10% figure is for offshore fields but a) this is not encouraging for the prospects of deepwater development b) there have been recent large infill drilling programs in Russia and ME – if the result is that their declines tend towards 10% rather than 2 or 3 in the near term then look out.

In addition for the ME – I cannot see how the ruling regimes can be maintained once serious decline sets in and is recognised as such by the populace (i.e. that there will be no recovery). As the cradle to grave social programs have to be continuously cut then there must be some kind of uprising, which you’d expect would lead to significant, and maybe permanent, disruption of production (and therefore less overall recovery).

The export issue is also relevant to consider. Say a 10% reduction in production would likely be a 20% reduction in export availability (maybe a bit more because of EROI issues and growing domestic use, especially if wars and social unrest escalate) – which would crush most European and a good few developing countries’ economies even if they were looking reasonably healthy, which they obviously aren’t, and without the ever increasing waves of refugees coming their way.

For offshore I do not worry so much about decline rates as I do about the fact that there are no offshore stripper wells. If the platform cost 50 000 $ a day to rent and run, then they need to make those 50 K every day. In other words, offshore wells run their decline rate of say 10% a day, and then one day there are a 100% decline in one single day. There are fields from 1900 still producing, but I doubt any producing offshore field of today will survive me.

Ron, I appreciate your thoughts of $60 oil later this year. My concern is what happens to North American producers if that doesn’t occur.

I looked closely at ConocoPhillips earnings release over the weekend. Remember they produce as much oil per day as some of the small OPEC nations.

They are in serious trouble at $30 WTI and $2 gas. The one thing which somewhat helps them is they do sell a decent amount of gas internationally. On the other hand, they also sell a decent amount of condensate and bitumen, and sub $10 per barrel really hurts them.

This got me to thinking about the transition from oil. The $10 per barrel tax proposal stunned me. I understand it wont pass a Republican congress. However, it was proposed by a two term President elected by a majority of those citizens who chose to vote. The proposal has to be taken seriously.

I look at the state of the US coal industry. Is oil next? I have no answers. I do think this transition is going to be very messy, and those, such as President Obama, do not understand the ramifications of the failure of both the US coal industry and US oil industry within a fairly short period of time.

I am not trying to start another fossil v alternative discussion with this comment. I just don’t think transitioning away from coal and oil will occur without a large amount of economic pain.

If prices do not go up, ConocoPhillips will fail. I don’t know when, but they will. So will almost all others in the industry. So will the exporting countries. Again, don’t know when, but they will.

I am just looking at this based upon the financials I am reviewing. The losses are truly staggering for 2015, and we are now so much lower in early 2016. We are relying on 15-20K foot wells with huge fracks, and selling the product at inflation adjusted prices which are at or lower than in the 1940s and 1950s. During that era, oil was coming from shallow, vertical wells.

People in the industry are either scared to death or in complete denial. Our politicians are neither, they appear to be without a clue. I am not an Obama hater. He is a very intelligent man. I just don’t think he understands the economic upheaval if the US oil industry goes BK. Maybe it is necessary for the world’s long term, I’m not commenting to debate that. I commenting because his successor needs to understand that the US economy will be in bad shape if the entire industry goes under.

One small example. The quick end of US oil refineries will mean a huge loss of very high paying, stable jobs. It will also mean billions of dollars of remediation and clean up, all that will be paid for by the US taxpayer. The BK refiners wont pay that bill. What is the plan? Again, not arguing good or bad, just pointing out reality.

How about the hundreds of thousands of US gas stations? What is the plan to deal with them?