The JODI Oil World Database came out a few days ago. The data is through December 2015. The JODI C+C production numbers differs somewhat from the EIA numbers. The JODI OPEC numbers are crude. Also there are a few very small producers that do not report to JODI so their numbers will be slightly less than the EIA. But otherwise they are pretty accurate.

Also, JODI, for some reason, does not count all of Canada’s oil sands production. So for Canada I use Canada’s National Energy Board numbers instead.

The JODI C+C numbers, for Non-OPEC, will average about 2.4 million barrels per day less than the EIA. This is largely due to some countries not reporting to JODI. But these countries only have small changes in their overall production so would have little effect on any of my charts or calculations.

According to JODI, world crude oil production peaked, so far, in July and has declined by 339,000 barrels per day.

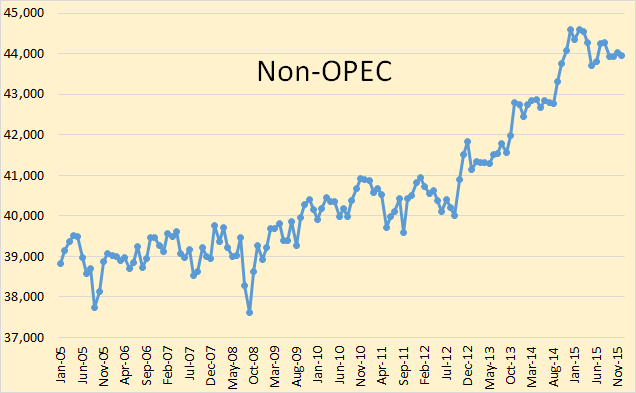

The recent price collapse has had a greater effect on Non-OPEC production than OPEC production. Non-OPEC production peaked, so far, in December 2014 and in December 2015 stood at 650,000 bpd below that peak.

No discussion of Non-OPEC production would be complete without Russia, Non-OPEC’s largest producer. I would never claim, just by looking at the chart, that Russia is peaking, or has peaked. But there have been reports coming out of Russia for over two years now that Russia is peaking. Some of those reports like this one Global and Russian Energy Outlook to 2040 have been reported on this blog. I think the charts lend strong credence to those reports.

Note: Russian data, prior to 2012, is from the EIA. Beginning January 2012, JODI changed its Russian reporting methods but did not change its historical data, showing a huge decline in production beginning in 2012. So for more accurate historical data prior to 2012, EIA data is used.

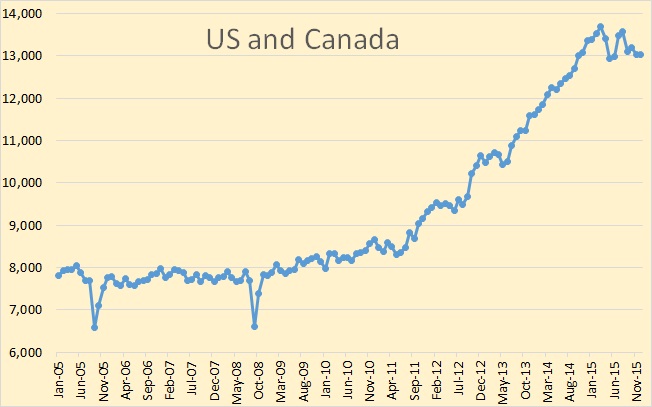

But, by far the largest gains in Non-OPEC production has come from the USA and Canada.

Notice how close a chart of US and Canadian production resembles a chart of Non-OPEC production itself. In fact….

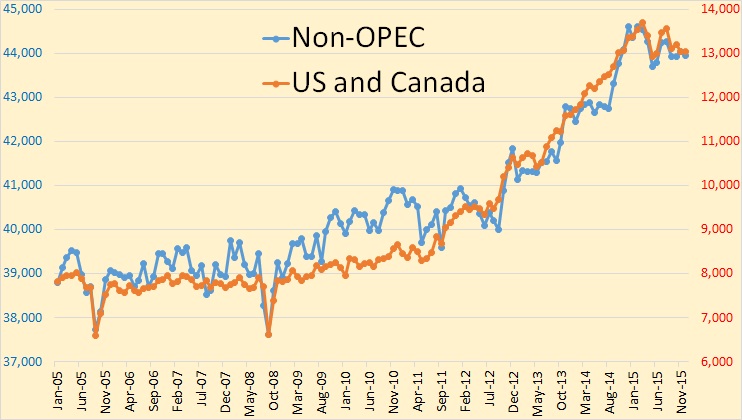

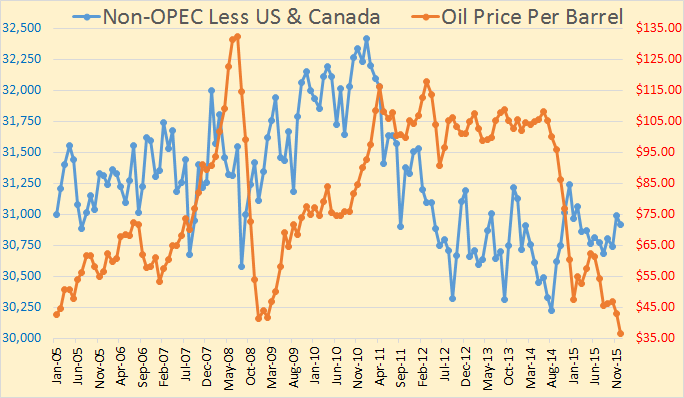

I think this chart is amazing. Non-OPEC, left axis and US + Canada, right axis. There is 31,000,000 bpd difference in the scale but the difference in the scale lines for both axis is exactly the same, 1,000,000 bpd per line. From January 2005 until December 2015, all Non-OPEC was up 5,144,000 barrels per day. During that same period US + Canada was up 5,222,000 bpd, meaning during that 11 year period, Non-OPEC less US and Canada, actually declined 78,000 bpd.

That number, -78,000 bpd, is even more remarkable due to the fact that this includes Russia, who’s production during those 11 years was up 1,192,000 barrels per day.

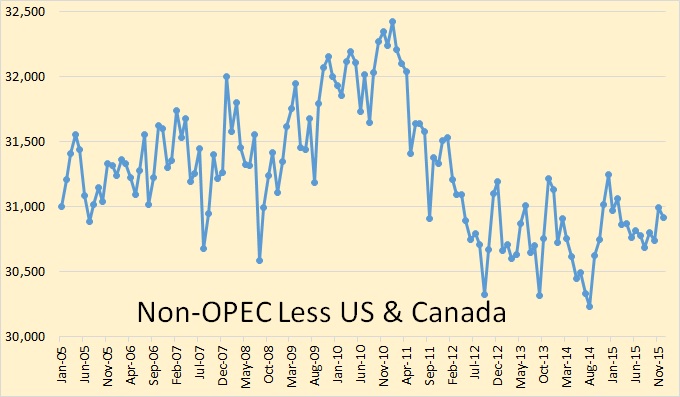

Here is a chart of Non-OPEC less US and Canada. Notice that the first point on the chart, January 2005, sits right on the 31,000,000 bpd line and ends up, on December 2015, at just below that point.

Non-OPEC less US and Canada peaked in January 2011 and in December 2015 had declined almost exactly 1.5 million barrels per day from that point.

Non-OPEC production did not drop because of the price, it dropped despite the fact that world oil prices averaged $105 per barrel for most of that period. That is not to say that the price of oil played no part in production levels during that time. They almost certainly did. It is likely that production would have fallen much further had not oil prices been so high.

There is no question that Non-OPEC, less US and Canada, peaked in January 2011. Rising prices brought with it rising production. Production, during that six year period from January 2005 to January 2011 rose just under 1.5 million barrels per day among Non-OPEC nations less US and Canada. And just where did that increase come from?

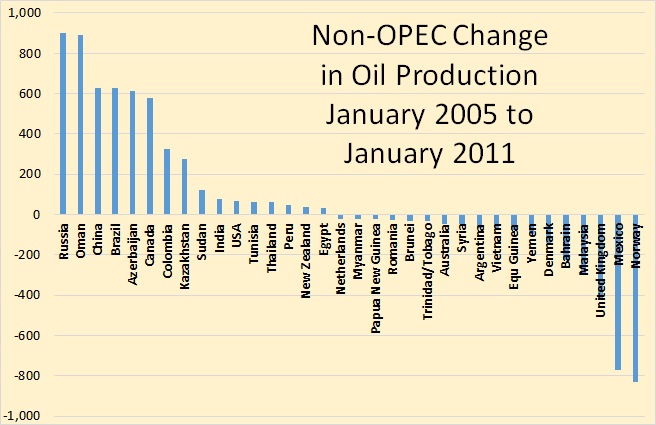

The two charts below show production change. Countries with little or no change are not shown.

During that six year period Non-OPEC production increase came primarily from Russia, Oman, China, Brazil, Azerbaijan and Canada. USA was just one of the also rans during this period. The big declines in Non-OPEC production, during this period, came primarily from the North Sea and Mexico.

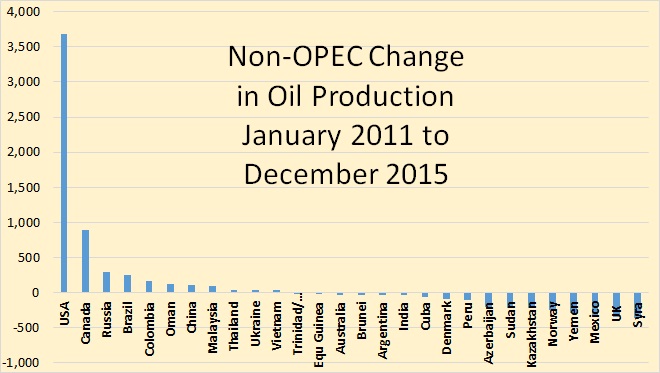

The above chart shows what happened to Non-OPEC production during the longest period of very high oil prices in history.

This chart shows the change from the peak in January 2011 to December 2015 of Non-OPEC countries less USA and Canada. Notice the minor roles Russia, Brazil, Colombia, Oman and China played in the last five years. Their increase in production is outweighed by those on the declining side of production.

$105 oil was not able to sustain their growth but it was, very likely, able to slow the decline of some of those nations.

Conclusion

Non-OPEC oil production, less US and Canada, will continue to decline. That decline will now be accelerated due to cancelled projects brought on by very low oil prices. The oil production from US and Canada will also now begin to decline. The decline from Canada will be slight, if any, but there will definitely be much slower growth in Canadian oil production. The decline US crude oil production will be significant.

The decline in total Non-OPEC crude plus condensate production, that begun in mid 2015, will continue at a slightly accelerated pace. Prices, high enough to make a significant difference, will not likely return until at least mid 2017. Then, beginning in 2018, growth in US production will likely return but at a much slower rate than in previous years.

OPEC is a different story. Iran will, very likely, increase production by about 600,000 barrels per day over the next 12 to 18 months. Iraq may increase production slightly but not nearly as much as Iran. And any increase in Iraqi production will be erratic. And Iraq still has a strong potential for political disruption. The rest of OPEC will show a decline in crude oil production. And any total increase in OPEC production will not be nearly enough to offset the decline in Non-OPEC production.

2015 will be the year world production of crude oil peaked. The return of higher oil prices, whether later this year or further in the future, will not bring production back to the 2015 level.

Thanks for the post, Ron.

Below is an article from Bloomberg:

Biggest Wave Yet of U.S. Oil Defaults Looms as Bust Intensifies

http://www.bloomberg.com/news/articles/2016-02-25/biggest-wave-yet-of-u-s-oil-defaults-looms-as-bust-intensifies

• SandRidge, Energy XXI missed interest payments due Feb. 16

• Face $7.6 billion default if interest isn’t paid by mid-March

In less than a month, the U.S. oil bust could claim two of its biggest victims yet.

Energy XXI Ltd. and SandRidge Energy Inc., oil and gas drillers with a combined $7.6 billion of debt, didn’t pay interest on their bonds last week. They have until the middle of next month to either pay the interest, work out a deal with their creditors or face a default that could tip them into bankruptcy.

If the two companies fail in March, it would be the biggest cluster of oil and gas defaults in a month since energy prices plunged in early 2015.

“We’re just beginning to see how bad 2016 is going to be,” said Becky Roof, managing director for turnaround and restructuring with consulting firm AlixPartners.

The U.S. shale boom was fueled by junk debt. Companies spent more on drilling than they earned selling oil and gas, plugging the difference with other peoples’ money. Drillers piled up a staggering $237 billion of borrowings at the end of September, according to data compiled on the 61 companies in the Bloomberg Intelligence index of North American independent oil and gas producers. Oil prices have now fallen more than 70 percent from a 2014 peak, and banks and bondholders are fighting for scraps. U.S. high yield energy debt lost 24 percent last year, the biggest fall since 2008, according to Bank of America Merrill Lynch U.S. High Yield Indexes.

Both Energy XXI and SandRidge could still reach an agreement with creditors that will give them time to turn their businesses around. SandRidge said last week that it missed a $21.7 million interest payment. The company owes $4.2 billion, including a fully-drawn $500 million credit line. Energy XXI, which owes $3.4 billion, said in a filing last week that it missed an $8.8 million interest payment.

David Kimmel, a spokesman for SandRidge, said it has the money to make interest payments due in February, March and April. He wouldn’t comment on SandRidge’s options if it doesn’t make the interest payments by the end of the grace period.

The companies’ failing to pay interest on their bonds may be a way to help motivate creditors to renegotiate debt, said Jason Wangler, an energy analyst with Wunderlich Securities in Houston.

“It’s a negotiating tool,” Wangler said. “They say, ’I’m not going to pay you. Now what are you going to do?’”

Energy XXI owes $150 million to banks including Royal Bank of Scotland Group Plc, UBS Group AG and BNP Paribas SA, among others. SandRidge has fully drawn its credit line with banks including Barclays Plc, Royal Bank of Canada and Morgan Stanley, according to data compiled by Bloomberg.

SandRidge is likely to file for bankruptcy, analysts at junk bond research firm KDP Investment Advisors Inc. wrote in a report last week. S&P wrote in a separate report that Energy XXI is probably going to file. Since the start of 2015, 48 North American oil and gas producers have gone bankrupt with a total of $17.3 billion in debt, according to law firm Haynes and Boone. The largest was Samson Resources Corp., which entered Chapter 11 in September owing more than $4 billion.

Others are probably coming. The number of U.S. companies that have the highest risk of defaulting on their debt is nearing a peak not seen since the height of the financial crisis, according to a report by Moody’s Investors Service earlier this month. The oil and gas sector took up the biggest share, accounting for 28 percent, or 74 borrowers.

Most of the shale industry’s debt is in the form of bonds, according to data compiled for the Bloomberg Intelligence index. Of those $197 billion of securities, $101 billion is junk-rated.

Bond investors aren’t likely to recover much money from oil and gas companies that default. Standard & Poor’s estimates, for example, that Energy XXI’s and SandRidge’s unsecured noteholders will receive, at most, 10 cents on the dollar.

Banks are setting aside more money to cover potential losses on souring energy loans. S&P estimates that credit lines to these companies could be cut by 30 percent by April, when banks conduct one of their twice-yearly evaluations of their loans.

“We are at the very beginning of the next wave of energy defaults,” said Paul Halpern, chief investment officer at Versa Capital Management, which manages about $1.5 billion of distressed debt.

Also from Bloomberg:

Oil Slump May Hit U.S. Investment Banks’ Capital Market Revenue

http://www.bloomberg.com/news/articles/2016-02-25/oil-slump-may-hit-u-s-investment-banks-capital-market-revenue

Revenue generated by U.S. investment banks through their capital markets businesses may “suffer” if oil and commodity prices stay low and the global economy slows further, Moody’s Investors Service has warned.

While direct energy loan exposures for the largest U.S. banks look “manageable relative to earnings” and most of their exposures are to investment-grade borrowers, additional loss provisions will be necessary in some cases should oil remain subdued for an extended period, the credit assessor said in a report dated Feb. 24. Moody’s also warned that “lower-for-longer” oil prices presented a rising threat for lenders around the world.

JPMorgan Chase & Co. said this week its reserves for impaired energy loans would increase by about $500 million in the first quarter and it would have to add an additional $1.5 billion to the set-aside if oil prices held at $25 a barrel for about 18 months. Wells Fargo & Co., the world’s largest bank by market value, said Wednesday in a filing soured energy loans climbed 49 percent in the last three months of 2015, while higher oil-and-gas provisions at Royal Bank of Canada crimped quarterly earnings.

“Oil price volatility has contributed to increased market volatility, which could help boost trading activity and returns,” Moody’s said. “However, current weak sentiment in global equity and credit markets could work in the opposite direction, reducing trading volumes and banks’ related revenues.”

For U.S. global investment banks such as Bank of America Corp., Citigroup Inc. and JPMorgan Chase, funded exposures to the oil and gas industry range from 1.5 percent to 5 percent and average 2.3 percent of total loans, according to Moody’s. The ratings company also underscored risks for banks in energy-exporting regions from the Middle East and Russia to Africa and Latin America.

“Banks’ direct and indirect exposures to the drop in oil prices pose the potential for deterioration in asset quality, particularly in net oil-exporting countries,” Moody’s said. “While direct exposures appear broadly manageable from both a solvency and earnings perspective, low oil prices could still test the credit profiles of banks across our global rated portfolio.”

Another article from Bloomberg:

Goldman Sachs Says 40% of Its Oil, Gas Lending to Junk Firms

http://www.bloomberg.com/news/articles/2016-02-22/goldman-sachs-says-40-of-lending-to-oil-and-gas-firms-is-junk

Goldman Sachs Group Inc. said about 40 percent of its oil and gas loans and lending commitments are to junk-rated firms.

The figure, which counts both loans made and future promises to lend, accounted for $4.2 billion of a total $10.6 billion as of the end of December, the New York-based bank said Monday in its annual regulatory filing. Goldman Sachs has $1.5 billion in loans to energy companies rated below investment grade and $2.7 billion in unfunded commitments.

The total exposure jumps $1.9 billion counting derivatives and other receivables, which were “primarily” to investment-grade firms, Goldman Sachs said. The bank’s market exposure to oil and gas firms was negative $677 million compared with $805 million a year earlier.

Goldman Sachs’s total is less than of its biggest competitors. Citigroup Inc.’s funded and unfunded commitments amounted to $58 billion, analysts at Susquehanna Financial Group LLP wrote in a note last week. Most of Wells Fargo & Co.’s $17 billion in outstanding energy loans is for companies that aren’t investment grade, Chief Financial Officer John Shrewsberry said last month.

Those bonds must be cumulative mustn’t they – i.e. rolled over each year. Otherwise that is about $1.3 trillion total. At (say) 5,000,000 bpd for 7 years at as high as $100 per barrel the companies would only be getting $1.25 trillion total. Or am I missing something.

Yes, I also think this is cumulative. Total amount of junk oil & gas bonds seems to be around $260 bn

Even so at current prices that is probably over 70% of all the money those companies are going to be able to take in from oil production.

I’m going to predict a lot of bankruptcies in late 2017 as oil prices start to rise because the lender’s will suddenly see a lot more money in taking over the resource base than by keeping the bond’s rolling over.

George,

The total debt due over the next year is not cumulative, but the above numbers come due each year. The cumulative debt stands at around 1.2 trillion. See:

http://www.wallstreetdaily.com/2015/06/13/u-s-shale-producers-debt/

In this article it states:

….Credit analysts at UBS say there are $1.2 trillion outstanding in loans to the U.S. oil industry! A third of this debt is owed by exploration and production companies. And UBS predicts the default rate on these loans could end up being in the low-teens…..

The oil industry also includes pipelines and infrastructure, refineries ……

In the above diagram it is also clearly stated:

The amount of bonds US energy companies below investment grade need to pay back each year….

So, it is clear that the total amount of debt maturing over the next 7 years stands at 1.2 trillion.

“Credit analysts at UBS say there are $1.2 trillion outstanding in loans to the U.S. oil industry! A third of this debt is owed by exploration and production companies”

I think $1.2 trillion is total debt owed by the US oil and gas industry, not just loans.

1/3 of $1.2 trillion = $400 billion owed by the E&P companies.

This includes bonds and bank loans.

Bonds include junk bonds and investment grade bonds.

So $260 billion in junk bonds is the right number.

Besides, I have seen in various sources a similar number

Heinrich – I think I agree with Alex. The caption is wrong in the “per year” bit, but correct in “below investment grade” – that is junk, which is not the total debt to the oil industry by a long way (let’s hope).

If I were a betting man I would bet with Ron on 2015 being the year of peak crude.

But gas production seems likely to increase for some time yet.

Does anybody have a good estimate of the percentage of all gas produced which is produced from oil wells?

Declining production of oil from legacy oil fields is going to drag down gas production to some extent.

AKA as Peak Crude + Condensate (C+C).

As I have noted about a zillion times, when we ask for the price of oil, we get the price of actual crude oil, most frequently WTI or Brent with average API Gravities in the high 30’s (and the maximum API Gravity for WTI crude is 42 API Gravity), but when we ask for the volume of oil, we get some combination of actual crude oil + partial substitutes–condensate, natural gas liquids (NGL) and biofuels. And of course, condensate and NGL are byproducts of natural gas production.

Mr. Brown – Do you understand how this works specifically in Iran (e.g. ratio of crude to condensate in their production and exports)? I think their biggest ‘oil’ field is actually South Pars condensate, and they were looking for western investment to complete the development of this – not for new crude oil fields. I think a lot of their cars run on LPG as they have so much light liquids available. They use all the gas they produce, so the condensate and NGLs are in some respects zero cost for export, if they have excess.

I’m afraid I’m not anywhere close to being an expert on Iranian consumption and production, but according to Iranian sources I believe that they claimed that the bulk of their floating offshore storage was condensate and fuel oil, not crude oil.

I’m concerned bout all this Carnage of The Big Easy. Oil Rush like a Gold Rush ?? Significant amounts of North American mind-boggling current flowrates are from concentrated Sweetspots “nuggets”. As these pockets of Shallow/Easy/Lower cost resource tap out , Sections of North American HC production landscape may be like well well .. Oil City, Pa. HISTORY BABY.

Yes, OFM, I also shared Ron’s opinion by late 2014 that 2015 was going to be the year of Peak Oil.

But this is now a fact. Summer of 2015 (July for C+C, August for all liquids) is a peak oil for everybody for as long as production doesn’t start increasing again. Since nobody is predicting an increase in production for 2016, the most fundamental issue in the oil world right now is how fast is production going to fall and for how long.

My level of knowledge in the oil world is too low, but from what I have seen in this blog we might be seeing a loss of 1 to 1.5 mbpd in 2016, depending on how much Iran is able to increase production.

On the other hand people usually talk about a level of annual depletion of around 6%. That’s about 4.5 mbpd for the entire world, so if only half of the world depletes at those rates we are talking upwards of a fall of 2 mbpd.

I guess then between 1 and 2 mbpd defines the possible loss of oil production in 2016. Is this a reasonable estimate?

Hi Javier,

At one point that seemed reasonable to me.

What I was missing was the various projects that are coming online over the next few years, these are large projects that have recently started production and are in the process of ramping up or projects that have been sanctioned by major IOCs or NOCs and will start producing in 2016 or 2017. This has been repeatedly pointed out to me by AlexS and it has now started to sink in. So from now until late 2017 the declines will be offset to some degree by these new projects that have not been deferred.

My guess is that decline in 2016 will be 500 kb/d and this will moderate as the oil market begins to balance in 2017 and oil prices start to rise. The various projects that have been cancelled will start to affect output in 2018, whether prices rise enough (to $80/b) by then so that LTO investment restarts to keep supply up remains to be seen, but if the supply shortfall causes a rapid drop in oil in storage we will quickly see oil prices rise to $100/b and LTO will ramp up output and the long term projects will be sanctioned (those that were earlier deferred) and that output will hit 2 or 3 years later (2020 to 2021). After that it is hard to see what happens, it will depend on oil prices and consumer demand for oil, both of which are hard to predict 5 years in the future.

Dennis, you talk about:

“the various projects that are coming online over the next few years, these are large projects that have recently started production and are in the process of ramping up or projects that have been sanctioned by major IOCs or NOCs and will start producing in 2016 or 2017.”

Hasn’t this always been the case? The new decline should be on top of the new exploits as these are built into the increasing rate of production for the last decades, that without new exploits being brought on line every year would have not taken place.

I do not think that the existence of new developments should affect the rate of decline (only the lack of new developments). We have seen 0.6 mbpd lost since last summer and the situation is getting worse, not better. I find it hard to believe that we are going to lose less than 1 mbpd in 2016, although obviously I could be wrong on this.

If “we” is global C+C+NGLs production, you are certainly wrong.

I think that even non-OPEC production will drop by slightly less than 1 mb/d. And OPEC will increase thanks to Iran.

I was thinking C+C, but yes, I might be wrong. I will be watching first quarter production data, although it is possible that the decline is front loaded with the gains coming later in the year.

Thanks for your opinion.

Hi Javier,

To take account of seasonal changes I think it best to look at centered 12 month averages to see the true trend.

Chart below shows EIA World C+C monthly data and centered 12 month average. I am not too concerned with month to month fluctuations. The chart shows the start of a plateau.

Dennis, your chart ends halfway through 2015. We are two months into 2016. Have you any idea what has happened to production since mid 2015? Hint: It is not a plateau.

Hi Ron,

Monthly data goes to Oct 2015, the centered 12 month average (the center of the most recent 12 months) is May 2015, where the blue line ends.

The 12 month average of World C+C is on a plateau, based on EIA data.

Dennis,

Averages are always behind changes. A 12 month average is 6 months behind the data (10 months behind present).

To say that an average is plateauing with only 5 points for 2015 all of which are higher than the previous means you are not using the average data for that conclusion. You are projecting your preconceptions.

You can only see a decline on monthly data. A plateau on quarterly data. And growth on yearly data or 12 month average.

Any other conclusion is not based on data.

The best way to see what is happening on real time is year on year rate of change.

Hi Javier,

You are correct. It does look like the growth in output has slowed for 12 month data and may be the start of a plateau. The monthly decline may just be noise. YOY monthly data is also noisy, yes trend changes cannot be determined in real time IMO. Monthly data fluctuates a lot so basing predictions on the last 3 or 6 months of data will lead to many false predictions.

“But gas production seems likely to increase for some time yet. ”

Yes, it does. I’ve been trying to predict the natgas market for a while with no luck. It’s quite… complicated. The coal and oil markets are much, much simpler and as a result much easier to predict.

I’d love to see a solid natgas model. There are three main uses for natgas: industrial feedstock, electrical generation, and residential heating & cooking, plus a transportation niche.

— For industrial feedstock natgas competes with petroleum and biological feedstocks

— For elecrtrical generation natgas competes with coal and renewables

— For residential natgas competes with electricity

— For transportation natgas competes with petroleum and electricity

There are four main classes of sources: side effects of oil wells, independent “normal” gas wells, shale and other tight gas, and biogas.

— The side effect of oil wells — wells where the main profit comes from oil, or condensates, or other liquids, and the gas is a “bonus” — has always been the main source, and the cheapest.

— Independent “normal” gas wells such as the North Sea wells exist on their own with the main profit coming from the sale of gas

— Tight gas (without oil) has never been profitable, and requires very high gas prices to be truly profitable, but was produced in large quantities anyway as part of land-flipping scams by the fracking companies.

— Biogas is always converted to power for some reason (avoiding purification I suppose) and doesn’t affect the other markets.

Anyway, that is four potential sources of demand-side moves and four potential sources of supply-side moves. I’ve been unable to figure out the result of them all interacting; it’s hard to figure out which effects dominate.

If Oil prices remain low 2015 will be the peak.

I doubt oil prices will remain low after 2018.

When the oil price rises we will return to 2015 output levels or higher by 2022 to 2025.

Final peak between 2020 and 2030.

”When the oil price rises we will return to 2015 output levels or higher by 2022 to 2025.”

What oil price will that require?

”Final peak between 2020 and 2030.”

And where are the discoveries that will allow for that?

I think this is just Dennis’s gut feeling. 😉

Hi Ron,

No it is based on my estimate of available resources using Hubbert linearization for World C+C less extra heavy and the mean estimate by the USGS and then adding 600 Gb from Canadian and Venezuelan Oil sands (modelled separately because these resources are developed more slowly). The demand model is based on about 2%/year real GDP growth for the World and a correlation of oil demand with real GDP from 1997 to 2014. The supply model which will satisfy that demand (taking account of inventory drawdown) is shown in the model below.

Models work better on simulated worlds.

I can’t help but notice that your predicted annual decline rate for 2015-2018 is the lowest on record.

Hi Javier,

No, look at the chart, the decline has been negative (an increase) over many periods in the past (all the spaces where I don’t show the negative data from 1970 to 2014.)

Look at 2009 to 2015, that is real data not a model, what are you talking about? The annual decline rate is this year’s output divided by last year’s output minus one (then presented as a percentage). It is different from the average decline rate of an individual well.

Dennis,

I am talking about the annual decline rate (red dots) between 2016 and 2019 showing a peak that is lower than any previous peak of decline rate (red dots) shown in your graph.

I interpret that as you thinking that the decline rate for 2016-2019 being lower than those at 1975, 1980-83, 1999, 2001 and 2009. That looks not very credible.

I think that the decline rate for 2016-19 could be as big or bigger than that at 1980-83. Your model is a very best scenario with almost no decline in production.

Hi Javier,

The temporary ups and downs are difficult to predict, the very big declines were due to the Arab oil embargo in 1974 and the Iran/Iraq War and Iranian revolution from 1979 to 1984.

Perhaps you can predict such events in advance?

The future scenario can be thought of as a trendline, there will be events that will cause output to bump above and below this trendline.

The chart below shows the annual decline rate of the 3 year centered average which smooths out some of the noise. A sharp temporary decline could occur from a major war in the Middle East (between Sunni and Shia nations perhaps), but I cannot predict if or when such an event might occur. Tell me when it will happen and I can model it. 🙂

Well, Dennis,

I can predict that the decline rate between 2016-2018 is going to be bigger than any previous decline since 1985. The reason is clear, the situation of the producers is a lot worse than anytime since the big glut of the early 80’s. Much worse than at any economical crisis of 1985-2015 that affected production through reduced consumption.

Therefore I can predict that your model does not predict what is going to happen.

Hi Javier,

As I said, events such as the GFC(2009), US Iraq war(2001-2002), the Asian financial crisis in 1999, or the S+L crisis in the US in 1985 are difficult to predict in advance. Those are the instances where the decline was temporarily (one year in almost every case) higher than my scenario for 2016 to 2018. In fact it would be very easy to adjust the model so there was a one year decline that was a little higher, see chart below.

Note that the last big oil glut was in 1998 to 1999 when the real price of oil dropped to $17.65/b for the year in 1998. I will let Shallow sand comment as to whether that was worse than the recent price down turn, probably yes because prices started at $30/b in that case.

I am less confident than you about my ability to foresee the future, time wil tell us how clairvoyant you are.

The decline in 2016 is in the middle of the level of the 6 previous small decline episodes from 1983 to 2015.

I don’t claim to be able to precisely know what output will be in the future, I expect the decline in 2016 to be relatively minor.

Hi Javier,

Below is a model that has extraction rates decrease in a similar proportion t0 1979 to 1983 and then level off for a time and then increase as they did from 1984 to 2015. Note that the only plausible scenario for that big a decline is a major war between Shia and Sunni nations in the middle east.

I don’t think that is very likely, your view may differ. The global financial crisis resulted in a very minor change in output in comparison.

Not just discovery shortages, but the oil industry will have a severally compromised development capacity. It could barely overcome decline rates for conventional oil over the past 10 years, the LTO got developed at a loss, and about 30 to 40% of the industry is currently being laid off or shut down. There is no way it will be able to ramp up to about 150% of the capacity it had say in 2013 to overcome accelerating decline rates and add production on what will be ever more complex new fields (i.e. small,heavy, deep water etc.)

George,

Not just discovery shortages, but the oil industry will have a severally compromised development capacity. It could barely overcome decline rates for conventional oil over the past 10 years

And please note the growing share of condensate in the total volume of produced C+C. That’s only around 88% of energy of traditional oil. Volume based accounting just masks the deteriorating quality of production.

The last card that can be played is probably Arctic oil. Everything else is already on the table.

As Art Berman aptly said “Shale is not a revolution, it’s a retirement party”.

http://www.energypost.eu/interview-arthur-berman-shale-revolution-retirement-party/

So it was mainly about “free money” and the government (and EIA) dubious role of a cheerleader, which created incentives for the companies to drill at a loss while racking up debt, enriching the management and E&P subcontractors. All of which is depressingly similar to the subprime boom. In both cases the expectations were that the price will rise indefinitely. And the role of the financial industry is identical, but on somewhat smaller scale.

Also it looks like mankind is now close or past “peak energy” which is a larger problem then “peak oil”. I wonder what is the current EROEI of shale oil at wellhead. Some sources claim that “The EROEI for tar-sands oil is ~5. The EROEI for shale oil is ~3.” http://www.roperld.com/science/minerals/EROEIFossilFuels.htm

If so that’s explain the current level of debt of shale companies.

In any case, the US shale revolution more and more looks like the “The Last Hurrah.”

The Arctic is 15 years away at least from any real oil production. What’s been found so far is mostly gas/condensate. To be develop each area needs a giant anchor field – none of which has so far been found. The most likely geology for oil is under the permanent thick ice north of Greenland and nobody really knows if its there. The continual squeezing and release of the rock from ice ages might have fractured everything beyond what is normally seen.

I dont know much about Greenland geólogy, but I have studied rocks which underwent periodic ice loading, they don’t fracture, the rock simply loses porosity a bit. My teacher in this area was Dr Maurice Dussault, check with him if you ever have questions about this subject.

Should have said faulted. Too much thinking about shale oil.

I think the roperld site means “oil from kerogen containing rock commonly called `oil shale'” when they say “shale oil”,

not “light tight oil from a shale-ish source rock”.

Kerogen shale must be cooked into oil, so I can believe the EROEI of about 3 or so.

LTO (light tight oil) would seem to be better than that, no cooking needed (only fracking and pumping).

https://www.eia.gov/dnav/pet/pet_cons_821dsta_dcu_nus_a.htm

gives annual distillate fuel oil by end use through 2014.

62 billion gallons in 2014 total, 2.1 billion “oil company”.

Though one wonders how much “on-highway” is used for drilling, etc.

https://www.eia.gov/dnav/pet/pet_cons_821dsta_dcu_SND_a.htm

gives data just for North Dakota.

2009 total 422 million gals, 2014 1.11 billion gals

2009 oil company 24 million gals, 2014 337 million gals – big jump

2009 on-highway 195 million gals, 2014 418 million gals

2009 off-highway 29 million gals, 2014 54 million gals

2009 railroad 15 million gals, 2014 73 million gals.

So for 2014, 300 + 200 + 20 + 60 = 580 million I assume went to LTO drilling/pad prep/pipeline construction/hauling.

In round numbers, say a million bpd of LTO (ignoring conventional in ND) x 365 days/year x 42 gals/barrel is 15.3 billion gallons of LTO, divided by 580 million is EROEI of (very roughly) 26.

Refining, use of natural gas in GOSP (gas/oil separation plants), pipeline stations, etc. etc. not included, so maybe the real EROEI is mid-to-high teens or very low 20’s.

Way better than 3, but hardly comforting.

An Art Berman video on shale plays is at:

http://www.artberman.com/art-berman-shale-plays-have-years-not-decades-of-reserves-february-23-2015/

He also has the PDF of the slides at:

http://www.artberman.com/wp-content/uploads/HGS-NA-Presentation-23-Feb-2015.pdf

Well worth the view/read, as is the rest of the stuff on his site.

Hi Rune,

Most of the oil will come from resources already discovered as higher prices move probable and possible reserves to the proved category and as contingent resources move into the reserves category.

An oil price (all prices in 2015$) of $100/b in 2018 increasing to $125/b by 2024 should be enough to get oil supply higher.

Dennis,

This shows GoM fields bought on line last year:

https://www.eia.gov/todayinenergy/detail.cfm?id=25012

All but one discovered 2009 to 2013. Then check what other discoveries have been made since 2010 that might be waiting in the wings. The only places there are significant known discoveries waiting to go are Canada and, who knows, Venezuela. Tar sands are very long term projects and would need two years stable high prices before being considered and quite likely some guarantees about new pipelines. The expensive offshore oil that might suddenly be profitable as prices rise will mostly be in small pockets, and therefore of limited impact.

Hi George,

My model assumes very little discovery, there is a lot of oil that has been discovered but not developed, high oil prices will lead to development.

I agree not a lot more oil will be discovered, perhaps 200 Gb after 2010 (Jean Laherrere’s estimate). There will be reserve growth (or an increase in the estimates of proved plus probable reserves) over time.

In the US from 1980 to 2005 reserve growth was about 63% of 1980 2P reserves, based on EIA data and assuming probable reserves are about 70% of proven reserves ( an estimate based on UK North sea data ).

Dennis – Reserve growth has happened mostly on large conventional fields. There aren’t any more of these. It also happens mostly in the early years after discovery. You can’t apply the same growth expectations to any new field. A lot of deep water finds haven’t lived up to expectations. Growth also mostly happens because of drilling in the area around the earlier discovery (e.g. in neighbouring fault blocks or possible traps in similar geology) – i.e. it doesn’t look much different to wildcat exploration. It doesn’t just happen that a any producing field suddenly makes more oil than was originally expected.

Hi George,

The US lower 48 onshore was pretty mature in 1980, there are plenty of places around the World at the same level of maturity today as the US was in 1980, there will be reserve growth in these areas. Russia and the Middle East and perhaps China will see some reserve growth. Do you expect there will be no reserve growth? That seems unrealistic in my opinion.

There will be reserve growth, but not as much as on old, large reservoirs and at greater risk and cost. Imagine you had a 1 billion reservoir on shore, you think there is probable oil around it. You understand the geology quite well. Drilling around a bit and you get another 200 million and it takes a few more wells to tie back to your production system. Now you have a new deep water reservoir. There is only 300 million barrels. There might be another 50 around it or under it. But drilling wells costs 20 times as much as onshore, the risk of not finding anything is triple, to develop the field will cost a few more wells (all 20 times as expensive as on shore) plus a new subsea template, risers and umbilical; and the final reward is only a quarter. Do you go ahead and look, and if not now how high does the price have to be before you do and how certain do you have to be that the price will stay high. And suppose it’s not 50 in one place but two 25s – not far short of twice the cost to find and develop – what then.

Hi George,

I am not proposing that reserve growth will be as big as in the US. Consider the following scenario, there were about 850 Gb of 2P reserves at the end of 2010 in the world based on the work of Jean Laherrere. He also estimates there will be about 250 Gb of discoveries added in the future. At the end of 2010 there were about 1100 Gb of C+C less extra heavy oil produced. Let’s assume for the World reserves also grow by 63%,but it takes 90 years for reserves to grow this much (rather than 25 years as was the case for the US). That would be about 535 Gb of reserve growth and total URR would be 2700 Gb, we would need to assume 70% reserve growth over 100 years (to 2110) to get the medium URR I use of 2800 Gb if we assume only 250 Gb of discoveries after 2010.

Note that the 2800 Gb estimate is the average of a Hubbert Linearization (2500 Gb) and the USGS estimate of 3100 Gb.

Dennis maybe I´m nitpicking, but higher prices will not move probable and possible reserves to proven reserves. They only represent uncertainties in the geology. Contingent resources can be moved to reserves though.

Also the amount of oil discovered has decreased this decade even with record high oil price as you know. Low oil price will make it worse for the years to come. As it takes about 10 years for discoveries to come into production the worst problems will not be seen until next decade. Most of the so-called reserve growth comes during the first years of an oil fields life. So if discoveries drop, then reserve growth should drop soon thereafter too. Regarding enhanced oil recovery. As usual they of course take the low hanging fruits first. So it will be more costly and difficult as time goes. The next decade will be very difficult as I see it.

Hi FreddyW,

Maybe I have it wrong, my impression was that as fields get developed and more is known about the field that reserves that were probable or possible get moved to the proven category over time. The higher porices tend to speed up the amount of drilling and the knowledge gained from this drilling would also be greater and tend to speed the process of reserves moving to the proven category.

I have seen that companies sometimes talk about possible reserves being moved to proven plus probable. But it really makes no sence if you read the definition. It may look like it is whats happening as the reserves increase and the span decrease as you know more and more about the field. So they are probably just simplifying it. The opposite can also happen. The reserves shrink as you learn more about the field. But I don´t think anyone talk about proven reserves being moved to probable and possible.

the estimate of proven reserves also depends on the price of oil

Yes but possible reserves will not move to 2p reserves because of the price.

Hi Freddy W,

The reserves are classified and over time the statistical evaluation changes as more knowledge is gained.

Lets say 100 Gb were discovered and the initial estimate was 40 Gb was proved, 30 Gb probable, and 30 Gb possible.

Ten years after production starts maybe 50 Gb has been produced and the improved knowledge gained leads to

30 Gb of proved, 20 Gb of probable and 20 Gb of possible reserves. So the initial 2P reserves (70 Gb) has grown to 100 Gb (50 Gb produced plus 50 Gb 2P reserves).

It is true that reserves sometimes are less than the initial 2P estimate, but at least for the US from 1980 to 2005 (chosen so LTO is not included) 1980 2P reserves grew by 63% in that 25 year period. So the overall average is growth.

So you are right the reserves are not “moved”, but estimates change over time as knowledge is gained.

In your example it´s not 100 Gb that was discovered. It was 70 Gb with a 80% certainty that it´s within +- 30 Gb. Later when 2P has been increased it´s not because the possible has moved to probable. It´s because the old assessment is obsolete and there is a new better one. If you think that all possible reserves eventually will turn into 2p reserves, then you are way too optimistic.

I should also add that 2P reserves are actually allways too low and that is one reason there is reserve growth. There is 50% chance it´s higher and 50% chance it´s lower. But the probablity curve has a long tail. So if it turns out to be higher then there is a possibility it can be much higher. To get a correct value you should calculate the average for the curve instead,

US has probably the highest reserve growth in the world. So you should really not use that as a model for how the world will behave.

HI FreddyW,

I assume the World will have much lower reserve growth than the US.

HL gives a 2500 Gb estimate, those estimates tend to be low USGS estimates 3100 Gb WHICH I believe too high. I take the average., 2800 Gb for C+C-XH.

I agree the discovery estimate should be 70 Gb in my example and agree the estimate changes that’s the reserve growth.

If one estimates 2P reserves as roughly 1.7 times proved and consider growth of 2P reserves the US is probably similar to the rest of the World.

I only have data for US.

”Most of the oil will come from resources already discovered as higher prices move probable and possible reserves to the proved category and as contingent resources move into the reserves category.”

WHERE are these discoveries (resources)? [Split/grouped on type of oil, regions, basins, size or other].

To allow for transparency and third party verification these reserves should be listed by sizes, region/country/basin.

Will the financial and physical (development) capacities be there to allow for the growth assumed in your scenario?

”An oil price (all prices in 2015$) of $100/b in 2018 increasing to $125/b by 2024 should be enough to get oil supply higher.”

The above is an assumption.

Hi Rune,

Have you ever seen a scenario of the future that did not involve assumptions?

The following type analysis from Wood MacKenzie is the basis for my assumption that there are projects and potential projects which can keep oil output increasing until 2020. I do not have access to enough data to provide specific projects, my guess is that Wood MacKenzie and Rystad Energy.

Rystad has a cost curve at link below:

http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases/global-liquids-supply-cost-curve

Based on that Curve $120/b should get us about 1200 Gb and $120/b should be enough to do it. This is consistent with a URR of at least 2500 Gb, my scenario is about 2200 Gb through 2050. Wood Mac scenario below.

Have you ever seen a scenario of the future that did not involve assumptions?

Of course not. But assumptions can be realistic, or in some cases totally unrealistic. I think your assumptions are unrealistic, though not totally unrealistic. That is in the neighborhood of the 5% probability range.

I would give it a probability way below 1%.

It takes some time to explain the rationale for this, but key words are total global debt levels, strength of the oilco’s balance sheets, consumers affordability (as their access to/ability to take on more debt diminishes), the US dollar appreciation to name a few.

Hi Rune,

Interesting. Why is debt such a problem? There have been some who have argued that the very low interest rates in major economies are a market signal that more should be borrowed rather than less.

Oil company balance sheets will improve with higher oil prices.

US dollar appreciation makes US exports less competitive and will stimulate demand for US imports, improving the economies of nations that produce the exports to the US because they will be producing more goods both exported and due to fewer imports from the US. The US dollar appreciation mostly hurts US manufacturers. The US economy is doing relatively well compared to many other OECD nations so I don’t see the problem.

On consumer affordability, inflation is very low, interest rates are very low, oil prices are very low. Do you think affording oil is more of a problem now than in July 2014?

In any case a more pessimistic scenario is below, but many will still find it much too optimistic.

Has the interest rate in recent years been set by the market?

If interest rates now went up several would face bankruptcy and have their debt carrying capacities impaired.

”US dollar appreciation makes US exports less competitive and will stimulate demand for US imports, improving the economies of nations that produce the exports to the US because they will be producing more goods both exported and due to fewer imports from the US. The US dollar appreciation mostly hurts US manufacturers. The US economy is doing relatively well compared to many other OECD nations so I don’t see the problem.”

In short, what you are saying is that eroding the industrial base of the US is a good thing…for US.

”Oil company balance sheets will improve with higher oil prices.”

Oil price is one variable. The other one is reserves. Several years with low oil price while producing will lower the reserves of the companies.

”On consumer affordability, inflation is very low, interest rates are very low, oil prices are very low. Do you think affording oil is more of a problem now than in July 2014?”

You should post that question to someone who lost their job in the oil fields and now (if lucky) has to do with a lower paid job.

Your scenarios are of little value.

Hi Rune,

Why would interest rates rise?

Yes reduced reserves are a problem, as far as I understand this is nothing new, depletion has been a constant problem for the oil industry as has volatile oil prices.

I believe that most oil companies would prefer higher oil prices (and higher reserves).

Higher oil prices will certainly improve the situation for many oil companies and will also help the laid off workers in the industry get their jobs back.

And no I did not say the eroding industrial base in the US is a good thing. Please don’t put words in my mouth.

Market exchange rates influence international trade, so a stronger dollar helps other nations, pretty basic stuff.

And yes the central bank controls one interest rate, all other rates are determined by supply and demand for credit and are market based in advanced economies.

”Market exchange rates influence international trade, so a stronger dollar helps other nations, pretty basic stuff.”

Which erodes the US industrial base.

”And yes the central bank controls one interest rate, all other rates are determined by supply and demand for credit and are market based in advanced economies.”

Are you saying that the feds funds rate [or other central banks similar rate] does not influence the interest rates in the market?

No I am saying it does not determine them. Are the interest rate spreads always the same?

Hi Dennis & George & Rune & Ron

Please forgive me if I oversimplify and hark back and take much too long. I’m remembering back to TOD discussions of Hubbert’s linearization and the relationship between oil stocks and rates of extraction. The HL (which WHT used to describe as merely a heuristic) did define a rate in terms of a stock (having inferred an imagined total stock).

It had already been shown that US oil industry could not invest enough in US domestic extraction to keep up with the US rate of demand, even though there was a lot of conventional oil demonstrably still in the ground in the USA. Thus the US necessarily imported oil from other investment in world oil reservoirs. But, it seemed possible, circa 2007, given the relationship that had governed the rise and fall of US domestic oil production and given a notional world stock (reasonably quantified) of the same type of conventional oil reservoirs as the original US oil production, one could guesstimate the rate at which world industry might recover oil out of the ground over any particular coming decade. Which exercise assumed, (1) there was a growing use for the magic stuff, and (2) the oil industry was profitable along the lines of the known US model.

Given that perhaps only half the world stock of recoverable oil round about 2007 (guesstimate) was assumed to be still in the ground it could be argued back then on TOD that the rate of world extraction could not be expected to increase much further, if at all. If we assumed both a global economy similar to the US economy back in Hubbert’s day, and that we could rely on his heuristic for determining a relationship between ‘stock’ and ‘rate’, then the world already had reached ‘Peak Oil’. Some others argued on the basis of other guesstimates, but similar arguments, that the world could expect for another decade or so to increase the rate of extraction, but would soon enough approach PO. Indeed by 2007 it seemed there remained not too many places where profitable investment could lift the overall rate of world oil extraction above its already high maximum rate.

The same arguments continue for conventional oil to this day a decade later. Rune Likvern in comments has pointed out, if I have understood correctly, that only an examination ‘place-by-place’ can determine the relationship between investment in extraction (which determines the rate) and the existing ‘stock in-place’ (including notional estimates of ‘new stock’) if we are to have the information needed to estimate a future ‘rate’ of extraction . Hubbert’s linearization USA-style it seems cannot be simply applied to the future rate of extraction of world stocks. Where will the investment be made? There are still some profitable looking places, but not too many.

I think I am aware that a distinction needs to be made between ‘conventional’ and ‘unconventional’ oil, and attention needs to be given to the different types of oil. Refining, mixing and fungibility tend to disguise the likely very different relationships between ‘stocks’ and ‘rate’ for the different sources of different oil types. I would make a plea in particular for a distinction between LTO (which will perhaps remain a US phenomenon and only marginal to world oil production) and conventional oil. An oil reservoir is different from an oil source rock. The latter resembles more perhaps a stock of coal in vast beds that can be mined by increasing the forces (investment) needed to strip off the top burden and collect the stuff over a vast area, which does not seem sufficiently like assumptions about Hubbert’s oil.

I am still wondering – and I still hang around here – about the ratios that govern the Red Queen.

best

Phil

Dennis thanks.

Yes, all scenarios are based upon assumptions, but some assumptions are more probable than others.

WTI and 2016YTD is around $31/b.

So what should make it move to a sustained $100/b in 2 years while the market have been struggling with and likely for some time to come will continue to struggle with a supply overhang?

And how would the economies react to such a shock?

The Wood MacKenzie chart includes NGLs, while your scenario appears to cover C + C.

Further, Wood MacKenzie (in their chart) makes several important reservations.

It is not about the stock, it is about the flow.

Hi Rune,

I agree it is the flow that matters. Note that NGLs in my scenarios are about 350 Gb total (when the scenario is extended to 2300). I included NGL in my output totals to 2050. The output in the scenario is less than demand and oil in storage is reduced so that by 2018 oil prices start to rise. The World economy did just fine overall (World real GDP) from 2011 to July 2014 and the increased oil prices will help oil exporting nations like Norway, Russia, Canada, and OPEC. The price level I suggested keeps total oil spending at less than 2011 levels (4.5% of World GDP) and may be needed to keep flow rates high enough.

Also note that the World extraction rates(% of producing reserves for C+C less extra heavy producing reserves) might not be able to reach 12%, the US level is about 14% and I estimate the current World extraction rate at 8.4% (it was about 7.4% in 2005) and the model has this rate increase to 10.4% in 2025 in order to try to match demand. This may be unrealistic, the model is intended to be optimistic and is easily modified. A more conservative scenario below where extraction rates are somewhat lower.

Hi Rune,

The chart below attempt to explain the oil price rise.

I show supply and demand for the “optimistic” scenario.

The Storage level is shown on the right axis in Gb and it is relative to the “normal” 5 year average storage level. I have assumed in 2013 the storage level was normal and set that to zero. In 2018 the storage level starts to decrease and oil prices gradually rise reaching $75/b that year. By 2019 it is apparent that storage is dropping fast and supply is not keeping up with demand and oil prices rise to $100/b, by 2020 storage levels have dropped to normal levels but supply is still not keeping up with demand and prices rise to $125/b. After that the model is not realistic because storage runs out (not really possible) so either supply rises or demand falls (probably both) above and below the levels in the model. It may be that prices spike to $150/b which might reduce demand and increase supply, but I expect supply cannot rise above this scenario so it will mostly be reduced demand and maybe slower GDP or a lot of substitution for liquid fuel (better energy efficiency, more use of public transport, rural to urban migration, etc).

Total C+C+NGL output is about 2200 Gb from 1870 to 2050 with about 200 Gb from NGL and 2000 Gb from C+C. Biofuels are also included in the scenario below with the assumption that biofuels output remains at 2014 levels (using BP data) until 2025.

Forgot chart sorry.

Note that the green line is storage level from normal level (5 year average) in Gb and is read on the right axis.

”The World economy did just fine overall (World real GDP) from 2011 to July 2014 and….

That is a statement that is not backed by anything up to say why it was so.

According to BIS data the 4 big economies (EU, USA, China and Japan) which has about two thirds of the world GDP increased their total public and private debt with more than $16 Trillion from Q1 2011 to Q2 2014 while their total growth in GDP for the same period was about $4.6 Trillion [all figures are market value, $].

This is akin to saying the households did really good for some years because they each year borrowed 200% more than their annual income.

To keep pounding a message about oil spending as a portion of GDP [to derive some price the economies can sustain] is at best meaningless if not the effects of growth in debt is considered.

What is the definition of this extraction rate?

So far I have seen only one way to build a model that with some confidence may project future production and that is by splitting the world into regions/countries/basins with their respective oil reserves and looking at how R/P (Reserves over Production), discoveries [with due consideration to the distribution of their sizes and location {synergies, time critical discoveries, market access}].

The above method will also help identify what regions/countries/basins are in terminal decline and identify the realism in growth from those that may have the potential for future growth.

Then do a second loop involving amongst others the health of the companies’ balance sheets.

Lumping it all together and trying to apply some parameters to fit some supply profile are very likely not going to produce a realistic scenario/outlook.

As prices rise, demand will decline. Rinse and repeat. This time (as in now and the near future) the consumers will have almost exhausted their abilities to take on more debt to pay for higher priced oil.

NGLs both have lower volumetric energy content than crude oil and are not as useful as crude oil.

So why include NGLs, as the most important and valuable one is crude oil?

Substitution away from liquid fuel takes time and requires huge investments. Is there anywhere in the world where this is happening in a meaningful scale?

And how should these investments realistically be financed?

The scenarios you present Dennis all says there is ten years or more before this happens.

What if it turns out your scenarios are wrong? [I hold the probability for that to be higher than 99%.]

Hi Rune,

If we look at the entire World then for every borrower their is a creditor, so all assets and liabilities balance on a World basis as long as we don’t do any extra terrestrial borrowing 🙂

When governments can borrow at near zero interest rates, they should borrow and invest in public infrastructure. This tends to reduce unemployment rates.

Of course my scenarios could be wrong, most scenarios of the future are. I agree that there is likely to be a 100% chance that my scenarios could be wrong. As it is highly unlikely, in fact virtually certain that anyone could precisely forecast the future.

I use C+C+NGL because that is the data I have from the IEA and BP for consumption estimates.

I agree NGL is less useful, but I adjust for the lower energy content by using metric tonnes and then convert to barrels of oil equivalent using 7.3 barrels per metric tonne.

If one is going to look at supply and demand, most demand data I have seen lumps C+C+NGL togethefr

Is borrowing a neutral process?

”Of course my scenarios could be wrong, most scenarios of the future are.”

There is a difference between a realistic scenario and something that is way off.

”As it is highly unlikely, in fact virtually certain that anyone could precisely forecast the future.”

It is about being realistic and what is probable.

And what is the conversion you apply going from metric tons of [NGL] to barrels of oil equivalent?

Dough Leighton’so niece suggested that NGL would be similar to crude in energy content on a mass basis. Sour when using BP data I use 7.3 be perfect tonne.

In my model for supply I find NGL using a natural gas shock model and multiply by 0.7 to convert b of NGL to boe.

Ok, How many barrels NGL are there in one metric tonne?

7.3

Liquid Fuel Measurements and Conversions

Refined petroleum products

1 metric ton motor gasoline = 8.53 barrels

1 metric ton LP-gas (liquefied petroleum gas) (propane) = 11.6 barrels

1 metric ton natural gas = 10 barrels

1 metric ton NGL (natural gas liquids) = 10.4 barrels

HI Ron,

Correct I forgot to divide by 0.7.

I use 7.3/0.7= 10.4 b/tonne for NGL.

Forecasters like Wood-Mac can do zeroth hold, first order linear growth or exponential growth. They don’t do second order changes and definitely not tipping points. Having used some like them (not WM) the important thing is you can go to your boss and with open arms and say “we’ve used the best we could, unfortunately they were wrong”. There is a book called Supeforecasters out – I haven’t read it but seen some reviews. The best forecasters are not too invested in the result of the forecast, have a wide field of vision, and are prepared to admit and learn from their mistakes. The expensive consultants don’t tick those boxes. Can you imagine WM going to one of their major customers and saying “You’re toast in a few years, tough shit, suck it up. That will be $350 per hour thanks very much. Oh and by the way we’re toast as well maybe a bit earlier, but hoh hum, so be it.”

From reading the world around me I believe we are headed for non linear developments.

Some forecasts are in my opinion very simplistic and lacks important feedback loops.

I agree – 90 to 99% of the time just extending the trend works out fine. But it is the other times that really determine what the future looks like.

“Can you imagine WM going to one of their major customers and saying “You’re toast in a few years, tough shit, suck it up. That will be $350 per hour thanks very much. Oh and by the way we’re toast as well maybe a bit earlier, but hoh hum, so be it.””

Ha ha! I know someone who does consulting in another area who is well known for giving brutally honest advice like that — “Your program is doomed and a waste of money. Here’s precisely why. Shut it down now and use the money for something else.”

His reports get thrown in a drawer and ignored. He still gets paid so no skin of his back.

Hi Rune,

The global Cost curve from the Rystad link below, it includes C+C+NGL.

http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases/global-liquids-supply-cost-curve

Looks like the cost of the marginal barrel is roughly $95/b so if the reserves are developed quickly enough prices might remain about $100/b, I expect by 2018 it will be clear that storage is falling and output is falling short of demand so prices will rise quickly to $75/b and then more slowly to $125/b as it becomes clear by 2020 that the pace of reserve development is too slow. After 2020 we might see an oil price spike and a slowdown in global growth and oil demand, hard to know how it will play out, maybe another GFC as it becomes clear the peak is either behind us(2015) or will soon be upon us (2021-2025).

Just a short reply for now (likely more to follow which takes it a step further).

Most projections appear by default to assume that the consumers (in the future) will afford the costlier oil. I am not convinced that this will be the case and there are now some developments in US consumption that supports this view.

Remember the US dollar has appreciated significantly versus most currencies offsetting some of the decline in the oil price for consumers outside US.

High oil prices usually mean a weaker dollar, so the current dollar appreciation will reverse if oil prices rise again to $80-100 levels or above

Hi AlexS,

Can you remind me of your expectation for when that might occur ($90/b oil price for Brent in 2015$), are you thinking 2018 or do you believe it will be later like 2020 or beyond?

Dennis,

certainly not in 2016-17, unlikely in 2018.

Possible by 2020

Hi Rune,

There are some places such as China where the currency is pegged to the dollar, so a pretty major economy will not be affected by the dollar appreciation. For other nations the exchange rate favors their economy as there will tend to be more exports to the US and fewer US imports.

The oil price may not be as low as in the US, but unless the dollar has appreciated by 300% against your currency, oil will still be cheaper than in July 2014.

In the future there will be substitution away from oil as people buy more efficient cars and drive less as oil prices increase, some of the reduced vehicle miles travelled in the US is due to an aging population which tends to drive less. In addition more teleconferencing and younger people being less enthusiastic about the automobile may also be an important dynamic.

It seems this would be somewhat of a peak demand argument. That is a possibility, but I see that happening around 2030 as oil prices rise, to think that it will happen sooner seems too optimistic (even to me.)

In OECD nations in general oil consumption has been growing more slowly than in the past, my guess is that increased demand from developing nations will more than make up for this slower demand growth in the OECD.

And how much longer will the Yuan remain pegged to the US dollar?

”In the future there will be substitution away from oil..”

And what will substitute for oil? (Less driving using gas/diesel is not substitution.)

”It seems this would be somewhat of a peak demand argument. That is a possibility, but I see that happening around 2030 as oil prices rise, to think that it will happen sooner seems too optimistic (even to me.)”

I think me and several others would like to see documentation on how that is probable.

”In OECD nations in general oil consumption has been growing more slowly than in the past, my guess is that increased demand from developing nations will more than make up for this slower demand growth in the OECD.”

Key phrase here is: my guess.

Back it up with some documentation that supports it, then there will be less guessing.

Electricity will substitute for oil for electric trains and light rail, EVs, and plug in hybrids. As oil prices rise and the price of batteries falls demand for oil will be reduced.

OK. I’m going to do a major analysis here. Feel free to promote it to a guest post, Dennis — I see that you also believe demand destruction will happen. I attempted to quantify how it will happen based on the upcoming price signals.

I don’t know how accurate this site is:

http://gascalc.appspot.com/

But I’ve been trying to work out the relationship between the oil price and the gas price.

Here’s the thing. In a few years (2018) battery-electric cars will have comparable purchase costs to gasoline cars with similar size and features in the $35K+ price bracket, which is about half of all new cars sold in the US. (This is from promises made by GM and Tesla; BYD is matching this for China.) Electric cars are simply nicer to drive, so if all else is equal, they will be preferred. Their efficiency is well known, about .333 kwh/mile or better.

So I’ve been trying to figure out under what circumstances gasoline cars would still be cheaper to operate. This depends on the price of electricity, but we can assume that that will be 14 cents/kwh or less since that’s the solar LCOE in cloudy areas — more typical electricity price would be 11 cents/kwh, with 6 cents/kwh at the low end. This gives a range of operations costs for the electric car of 4.6 cents/mile (high end) down to 2.4 cents/mile (low end).

The difference of course depends more on the fuel efficiency of the gasoline cars. If I assume 30 mpg (which is optimistic for higher-end all-gas cars), I can calculate possible “break even gas prices” — prices where if gas is cheaper than that, a gas car is cheaper to operate than an electric car — from 72 cents/gallon to $1.38/gallon. If I assume 55 mpg (which requires a hybrid), I get a range from $1.32/gallon to $2.53/gallon.

Now, that website I found for guessing the relationship between oil prices and gasoline prices? It tells me that at $40/bbl, we should have gas prices around $1.31/gallon. At $77/bbl we should have gas prices around $2.53/gallon. (To get to 77 cents/gallon, we’d need $23/bbl oil.) Gas taxes should make the “breakeven” oil price a bit lower than these numbers, actually.

With the upfront purchase price equalized, gasoline cars become completely uncompetitive at these oil prices. As of 2018, the upfront purchase price will be equalized for the top half of the car market in the US (probably similar in Europe). So somewhere between $40/bbl and $77/bbl (or somewhat lower, considering gas taxes), *half of the automobile gasoline market starts to disappear*. That’s a lot of demand destruction.

I’m betting on the demand destruction being closer to $40/bbl. This is because hybrid cars require all the tech of battery-electric cars *plus* all the gasoline-engine tech; they’re more expensive to maintain and more expensive to manufacture, all else equal, so I think they’ll be less popular. Furthermore, once you are manufacturing a hybrid, there’s no reason not to add a plug to it; if it runs on wall electricity most of the time and gasoline occasionally (as most Volt drivers are documented to do) that still causes massive demand destruction for oil.

Any field with an $80 production cost is doomed. Any field with a production cost over $40 is very risky economically, and is basically a bet against electric cars.

When I compare that to your graph, Dennis, I see that Onshore Middle East is the only category which can be profitably added to production (with the exception of a few of the very cheapest of the other fields). All the others — if they’re added to production, they simply set fire to stockholder money and add to oil company losses.

Oil prices *may* temporarily spike above the “demand destruction limit” due to production capacity constraints on the manufacturing volume for electric cars — but this won’t last long, as the electric car manufactures will be practically coining money by expanding, so they’ll do so ASAP.

Even if it takes longer for electric cars to reach purchase price parity with gas cars in the low-end market, the destruction of *half* the gasoline demand will bring the price right down. 63% of oil is used in transportation, and of that 80% is used in road transportation, so about half of oil is used in road vehicles. Destroying half of gasoline demand is equivalent to destroying 1/4 of total oil demand.

When you look at *this* picture — where the onshore middle east is the LAST set of fields which can be profitably produced — you see a hard limit of less than 800 billion bbl. I am quite sure that this is, in fact, the hard limit. Due to the destruction of 1/4 of global oil demand within the next few years (probably in the early 2020s), we will actually recover even less than that.

Disclaimer: This is not investment advice; I am not your investment advisor.

–Nathanael N.

There’s the issue of rate as well. Getting rate up in the extra heavy áreas requires years. And Venezuela is a basket case. The situation has just worsened day by day. This week bakeries cut back on the bread they make, and there seems to be no way out, the communists simply insist on destroying everything. It’s going to be like Cambodia under pol pot if this keeps going. I never thought it could get this bad.

Those of you who speak Spanish can watch the drama day by day on “La Patilla Video” YouTube. Or read “Caracas Chronicles” in English. The English media simply fails to report the horror of what’s going on.

Hi Fernando,

Yes I am aware that flow rate is important so I model extra heavy oil separately. The model for extra heavy (XH) oil is pretty conservative, through 2040 we could get this done with Canadian oil sands alone based on CAPP forecasts, after that we might need some Orinoco Belt oil, hopefully the political situation in Venezuela will be resolved by then.

Also note that the Rystad cost curve does not include much “extra heavy” oil (which I believe is Orinoco belt oil), only about 10 Gb and “oil sands” (which I believe is Canadian) is only about 50 Gb on the cost curve. It also looks like they over estimate the North American Shale recoverable resource by a factor of at least 2.

At an oil price of $100/barrel in 2018, everyone stops using oil. The alternatives are well-developed now. $100/barrel == $4/gallon gasoline, at which point the electric cars which will be availalbe in 2018 are significantly cheaper. So if the price goes that high? Demand collapses, and supply collapses along with it.

When the oil price rises we will return to 2015 output levels or higher by 2022 to 2025.

I would love to see your rational for this. Who will return to 2015 output levels or higher? Obviously not everyone because so many nations have already peaked and are in decline. So for production to return to 2015 levels, and higher since you are not predicting peak oil until a decade or so from now, who will increase their production to well above 2015 levels? We know this will have to happen, for your scenario to be correct, because post peak nations will continue to decline regardless of price.

So who will it be Dennis? Where will all this new production come from?

Hi Ron,

Canada, US, Russia, Iran, Iraq, and Saudi Arabia. A number of projects that have already started to be developed or that have recently started production and are ramping up will reduce the overall decline from 2016 to 2018, by 2019 the current project deferrals will lead to a short oil supply and oil prices will rise, this will lead to a restart (probably beginning in 2018) in oil investment with new projects beginning to hit in 2020 and a gradual ramp up in output from there.

So an increase in price will increase demand? How do you figure?

Hi Jef,

The increase in price will affect demand very little based on the 1997 to 2014 data, demand depends mostly on real GDP not oil price.

The increased price will increase the oil supply needed to match oil demand.

But there are secular reasons to expect a drop in oil demand in the near future, *particularly* at high prices. Alternatives are now more attractive when oil prices get high (electric cars are just plain better than gasoline cars, for example). Government efficiency and anti-pollution laws will encourage lower usage as well.

I have to say, Dennis, that I believe this to be very unlikely. Quality of oil yet to be produced is falling – LTO in the States, sour, heavy crude from Saudia Arabia, oil sands in Canada and Venezuela. It will take great future political stability in the face of what presently most people would describe as a crisis in several of the major producing nations to compensate for, say, 10mm bbl/d fall in the next ten years. Iran, Iraq and Russia are unlikely candidates, imo, to step up to the plate.

Hi Jonathan,

Possibly you will be correct, so far Iraq, Russia, and Saudi Arabia have provided a lot of the increase in output.

I doubt we will see much decline in Russian output, I expect a plateau at minimum. Perhaps Iraq will not be able to increase output further, but they have been increasing output in a very unstable situation so far which may or may not continue, the potential is there. Iran can increase output with some investment, the country is stable relative to Iraq.

I expect demand to overtake supply in the next few years, oil prices will increase and supply may be more resilient than many expect.

The more realistic scenario would be a plateau in output, but very high prices would be needed to keep demand for oil in check and I expect C+C supply will increase to at least 82 Mb/d in response to high oil prices. Not sure where you get the 10 MMb/d decline, if average well decline rates for all producing wells was 6% and output is 80 MMb/d that would be a 5 MMb/d decline in a year. Clearly we have been able to match that plus another 2 MMb/d in 2015, for a total of 7 MMb/d of new oil output added (2 MMb/d net increase).

I expect output will fall somewhat in 2016, by about 600 kb/d, prices will gradually increase and output will level off for a few years and then increase as oil prices rise to $100/b or more. the reserves are there, the high oil prices will lead to their development.

Hi Jonathan,

I misread, you said 10 MMb/d in 10 years, and that is very conservative if you are talking about legacy decline. If you mean that actual future output will fall by 1 MMb each year for 10 years, I doubt that will happen because demand will drive oil prices higher and the decline in 2016 will level off as investment restarts due to higher oil prices.