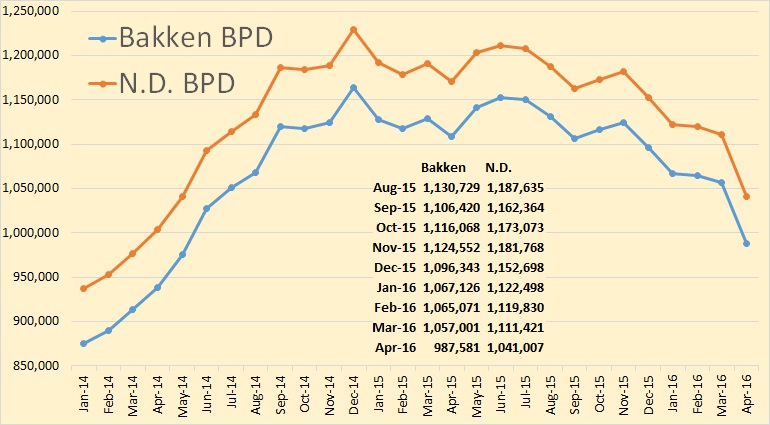

The Bakken and North Dakota production data is out. Big surprise. The Bakken was down 69,420 barrels per day in April while all North Dakota was down 70,414 bpd.

Largest drop ever in North Dakota production. The Bakken is now under one million barrels per day.

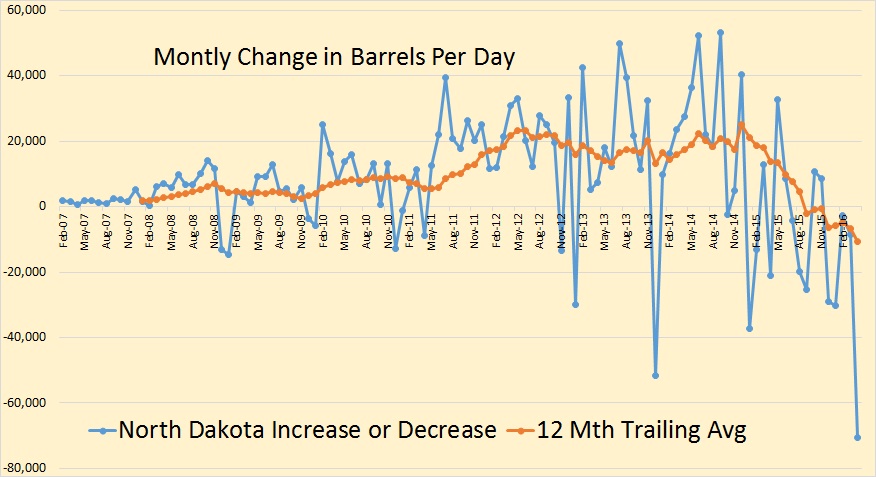

This gives you some idea of the erratic nature of North Dakota production. But as you can see, the decline is accelerating.

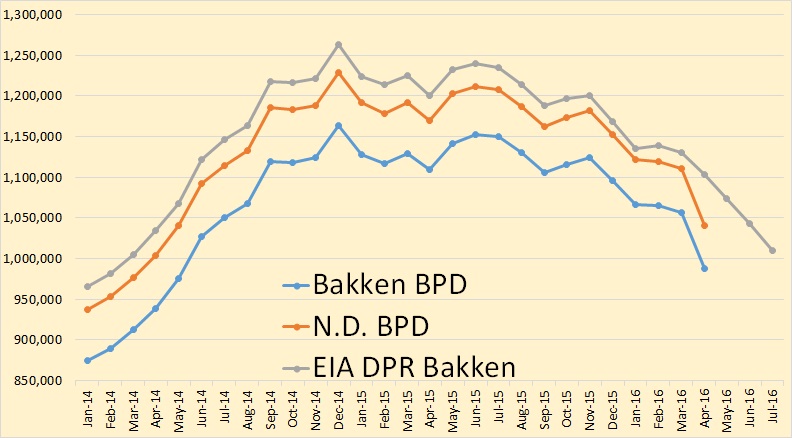

The EIA’s Drilling Productivity Report gives past Bakken production numbers, which includes the Montana portion, and future estimates for the next couple of months. The average difference between North Dakota production and total Bakken production has been about 27,500 bpd. However for April the difference is almost 63,000 barrels. So it looks like for once the DPR estimate is way too conservative. The DPR estimate is through July while the north Dakota data is only through April.

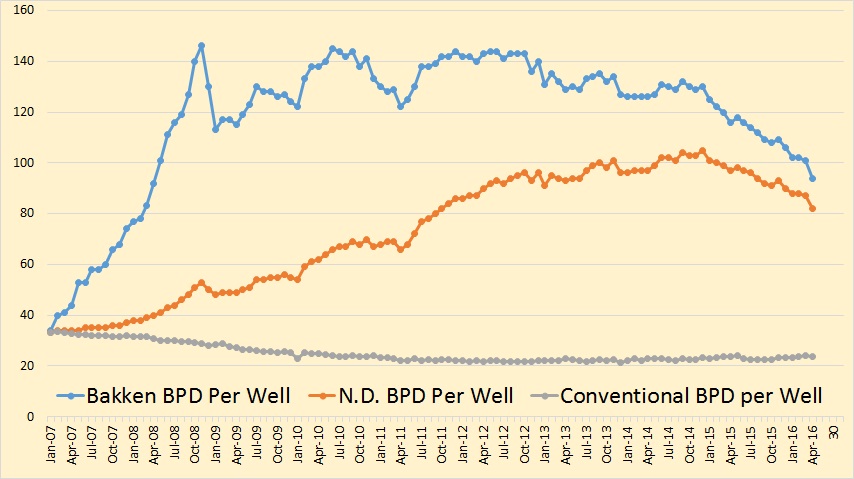

In April Bakken barrels per day per well fell by 7 to 94, North Dakota bpd per well fell by 5 to 82.

From the Director’s Cut

Producing Wells

March 13,052

April 13,050 (preliminary)(all-time high was Oct 2015 13,190)

Permitting

March 56 drilling and 4 seismic

April 66 drilling and 0 seismic

May 42 drilling and 0 seismic (all time high was 370 in 10/2012)

ND Sweet Crude Price

March $26.62/barrel

April $30.75/barrel

May $33.74/barrel

Today $38.25/barrel (all-time high was $136.29 7/3/2008)

Rig Count

March 32

April 29

May 27

Today’s rig count is 28 (lowest since July 2005 when it was 27)(all-time high was 218 on 5/29/2012)

Comments:

The drilling rig count fell 3 from March to April, 2 from April to May, and increased 1 from May to today. Operators remain committed to running the minimum number of rigs while oil prices remain below $60/barrel WTI. The number of well completions fell from 66 (final) in March to 41 (preliminary) in April. Oil price weakness is the primary reason for the slow-down and is now anticipated to last into at least the third quarter of this year and perhaps into the second quarter of 2017. There was 1 significant precipitation event, 15 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

Over 98% of drilling now targets the Bakken and Three Forks formations.

Estimated wells waiting on completion services is 892, down 28 from the end of March to the end of April. Estimated inactive well count is 1,590, up 67 from the end of March to the end of April.

Crude oil take away capacity remains dependent on rail deliveries to coastal refineries to remain adequate.

Low oil price associated with lifting of sanctions on Iran and a weaker economy in China are expected to lead to continued low drilling rig count. Utilization rate for rigs capable of 20,000+ feet is 25-30% and for shallow well rigs (7,000 feet or less) 15-20%.

Drilling permit activity increased from March to April then fell back in May as operators continue to position themselves for low 2016 price scenarios. Operators have a significant permit inventory should a return to the drilling price point occur in the next 12 months.

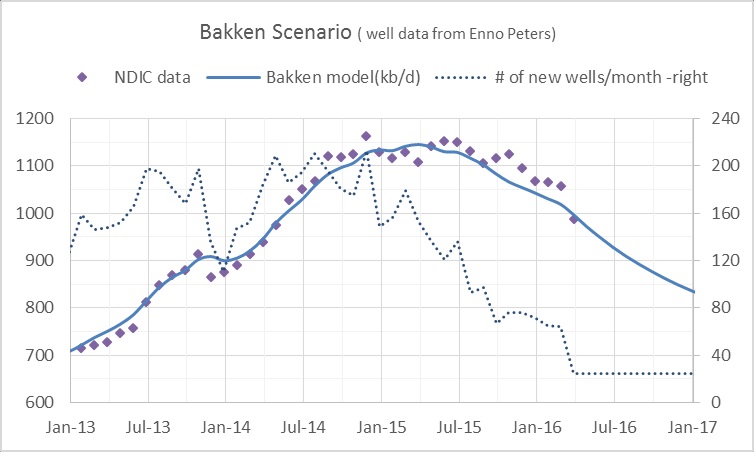

Dennis Coyne posted the above chart. He adds:

New wells added in the Bakken/Three Forks are assumed to drop to 25 new wells in April and remain at that level until Jan 2017. Last month about 64 new wells were added.

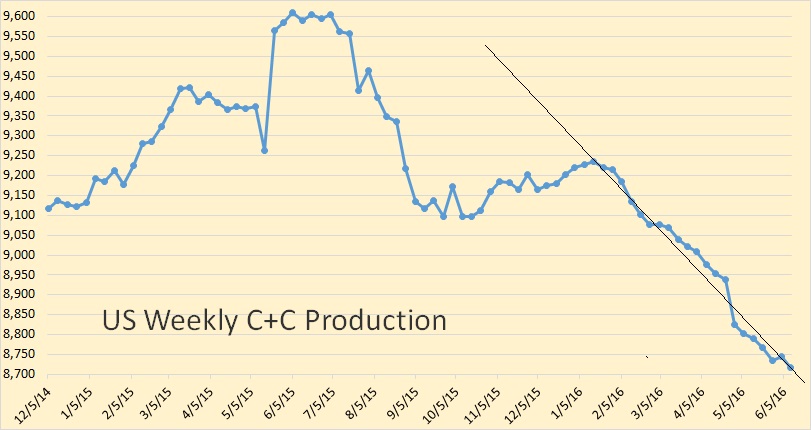

Just one more chart, US weekly C+C production. It looks like US production has been pretty much in free fall since the middle of January.

The last graph indicates domestic production is down close to nine hundred thousand barrels a day. This is free fall sure enough.

I wonder how long it will take the rest of the world’s producers, most of them not nearly so nimble as American businessmen, to shut in another, additional million or two million barrels of high cost production. If they DON’T shut in some production, then the decline of legacy oil will take that much off the market anyway before too long.

At that time, we will find out how high a price the world economy will pay for crude.

In the meantime, the planetary heat wave continues.

https://www.yahoo.com/news/may-goes-down-earths-hottest-record-nasa-183959784.html?ref=gs

We are living in interesting times.

A couple of days ago, Ron said, paraphrased, in response to a question from me, that he thinks it will take at least a year or two of clearly falling oil production before peak oil is back in the news.

I am thinking that it will take maybe another four or five years of steadily increasing average global temperature for the reality of global warming to sink in between the ears of the typical man on the street.

By then even cubicle dwellers will start noticing the difference.

Just a note to correct a popular misconception; production DID NOT drop in Bakken due to SHUT IN wells. The production drop is 100% DEPLETION of existing wells. This is a critical distinction because if wells were shut, they could be turned back on. If wells deplete, generally, new ones must be drilled to replacement them, implying radically different time, service intensity and capital requirements. The popular press is ate up with the concept that when prices rise, all this production will magically reappear, once again swamping the market with excess supplies. The reallity is that the only way this production comes back (or stops decreasing) is the application of massive amounts of new capital, the redeployment of tens of thousands of service workers laid off during the crash, and billions of dollars of equipment. This is even more true internationally. As large mature projects deplete, of which there are thousands in decline, new large projects must be developed to replace them.

“The production drop is 100% DEPLETION of existing wells. This is a critical distinction because if wells were shut, they could be turned back on.”

Brad,

Yes. So essentially oil price does not matter at this point at the end of the game for these marginal and high depletion plays. Price could go even higher but drop in production will just continue.

I think it’s a mix. I’ve been in these circumstances before. The typical approach would be to shut in low rate high water cut producers, and any other wells that have been experiencing high costs. When prices rise and wells have been shut in for months they will have built up some pressure. And some of them will come in at 100 % water due to self injection. It can be a real crap shoot.

Hedge your bets, get a high mpg car now.

https://www.yahoo.com/news/toyota-prius-hybrid-cheapest-car-over-10-years-112500832.html

Old Farmer,

When Miami, New Orleans and Atlantic City are wrecked and Manhattan has been washed over for the third time in storm surges, then global warming will be taken seriously. Before that, it will be only partly paid attention to since there are so many other problems happening at the same time.

It’s hard to fight on all fronts all the time. Some places will be sacrificed.

Mileage is not everything. For example RAV4 hybrid is much more interesting and important then Prius, due to the US population current obsession (should we call it love story?) with SUVs. 2006 model is also heavily discounted. It gets just around 33 miles per gallon (which still beats all compact SUVs). But its AWD drivetrain ( with rear wheels driven electrically ) is really innovative.

Similarly, Prius V is much more interesting, more practical car then the “classic” Prius now, despite worse mileage. Rear visibility of classic Prius is simply horrible.

Both cars do not use lithium batteries which is another huge plus, safetywise.

I have driven an AWD 6 cyl RAV4. Very sporty, hangs turns well and accelerates very well. It had many feature to increase mpg, such as shutting off some cylinders when not needed but still wasn’t that good. Great ride, but the hybrid sounds like a better mpg option. Will attract the northern crowd for snow handling and the outdoor crowd who like to get way out there.

MPG similar to a Camry and a lot more expensive.

now thats what i call a trend line ?

More like a roller coaster ride and gravity just took over.

⛽️ ?

I remember Lynn Helms predicting a sharp drop in production for March.

In fact, in March Bakken output declined only 8 kb/d, but was down 69 kb/d in April.

April number for ND Bakken is down 6.6% vs. March, 10.9% vs. April 2015 and 15.2% (176 kb/d) from the peak reached in December 2014.

Average output for January-April 2016 is 1044 kb/d, down 6.9% year-on-year.

As CLR’s Harold Hamm and several other E&P CEOs are saying, $50 is a trigger for increased completion of the DUCs.

Rig count has also bottomed, but significant increase in drilling activity is unlikely until WTI reaches $60.

Nonetheless, it seems that we will see further declines in LTO output in the next several months due to delayed impact of low oil prices.

Alex,

While oil prices will definitely reach $60 at some point and shale is still doomed at the current price range, there are some contrarian tendencies visible now. If the world economy slows down considerably the rise of oil prices will slow down even more. Let’s hope for the best and prepare for the worst.

likbez,

The world economy may be slowing down, but global oil demand growth is stronger than was expected in the beginning of the year.

From Reuters:

Vehicle sales in China rose 9.8 percent to 2.1 million units in May, the China Association of Automobile Manufacturers said on Monday, in the strongest year-on-year growth since December 2015.

In the first five months of 2016, sales were up 7.0 percent.

“Against the backdrop of low international oil prices, Chinese crude oil demand will remain well supported this year as demand continues to gain traction from stockpiling activities and refining use,” energy consultancy FGE said.

“We expect Chinese crude oil imports to grow by 730,000-760,00 bpd this year,” it said.

http://www.reuters.com/article/us-global-oil-idUSKCN0YW03V

India has become another very important driver of global oil demand.

U.S. gasoline consumption is set to reach a new record this summer (see chart below)

Even in some large European countries demand is increasing this year.

“Britain’s consumption of road fuel is growing at the fastest rate for more than a decade as the impact of economic growth and lower prices more than offsets improvements in vehicle efficiency.

Britain’s motorists consumed 36.0 million tonnes of motor spirit (gasoline) and road diesel in the 12 months ending in March, up from 35.2 million tonnes in the prior 12-month period.

Fuel consumption has been rising since 2013/14 and the increase predates the collapse in oil prices from mid-2014 ”

http://www.reuters.com/article/us-britain-driving-kemp-idUSKCN0YW21Y

The world economy may be slowing down, but global oil demand growth is stronger than expected in the beginning of the year.

Still looks like it all fits within the notion of an undulating plateau to me! I highly doubt these demand growth trends you cite can continue.

Even if we are seeing some current spiking, does anyone seriously believe these are signs that demand growth is in any way shape or form sustainable?

Given recent massive capex reductions by the major oil producers is it realistic to assume that supply can continued to be maintained at current cheap prices without severe damage to producers?

The flip side of the coin should prices spike as demand continues to eventually outstrip supply will almost certainly crash many of these economies and hurt consumption. I see all of this as just a temporary blip in the growth curves.

Maybe we need to revisit the infinite abiotic oil theory…

“New wells added in the Bakken/Three Forks are assumed to drop to 25 new wells in April”

According to NDIC data, the number of producing wells in the Bakken/TF increased by 24 in April vs 61 in March.

Interestinly, NDIC data indicate that the number of producing wells in ND outside Bakken/TF declined by 30.

Thanks for the post Ron & Dennis.

For those who missed the link in the last post, I also updated my presentation on ND production, here.

Hi AlexS,

Based on data from Enno Peters, the new wells added in North Dakota were 63 in March 2016 and 44 in April 2016. Based on the spreadsheet that Enno Peters graciously shared last month, all 63 new wells added in March were Bakken/Three Forks wells, if we assume all the confidential wells3were Bakken Three Forks wells. Helms usually says 98% of drilling targets the Bakken/Three Forks, so if we assume 98% of completed wells are Bakken/Three Forks, it would be 62 new wells in March and 43 new wells in April 2016. The sharp decline was due to fewer wells being completed and perhaps to some older wells being temporarily shut in (a net of roughly 20 wells). The shut in older wells would only amount to 200 to 400 barrels per day, but the 19 fewer new wells this month vs last month would (if they were all average wells) drop output by 6 kb/d.

If 62 wells had been completed in April, we would have expected a drop of only 10 kb/d, with 43 wells in April the model predicts a 17 kb/d drop in Bakken/TF C+C output. Note that the model was 39 kb/d lower than actual output in March 2016. So the errors from previous months got corrected in April, with the model giving a result of 1001 kb/d in April 2016 (or 13 kb/d too high).

The model assumes all wells are average, which is false, some months have better than average wells, other months the wells are worse than average (also wells can be temporarily shut in for mechanical failures and such and this varies month to month).

The chart that Ron posted was before I had gotten information from Enno Peters. The corrected chart below assumes new ND Bakken/TF wells completed falls to 35 wells per month in May and remains at that level until Jan 2017. The model predicts 871 kb/d in Jan 2017 if this guess at completion rate is correct (not very likely).

Paraphrasing the A-Team, I love it when a model comes together.

I think the important lesson learned in all this is that these are not magic wells, but finite reservoirs with very limited lifetimes. Just amazing how well these can be tracked statistically.

Alas, I doubt this will ever be taught in a textbook, because the profs that would teach this would rather not explain to students their own demise.

FED total US production data for May are out, basically confirming the trend for Bakken.

The current cycle lasts roughly two times longer than the cycle in 2008/9. As the oil price recovers much slower this time (green line in below chart), drilling (red line in below chart) responds accordingly much slower. As a consequence the production decline is much steeper than in previous cycles (blue line in below chart) and stands currently at – 8% year over year and -2% per month. Given the slow drilling and price recovery, US total production will very likely not recover until mid 2017. At a monthly decline rate of – 2%, my goal of -30% US total oil production decline looks more and more realistic.

My view is also supported by a recent article:

http://www.naturalgasintel.com/articles/106753-staggering-us-ep-reserve-revisions-in-2015-eliminated-40-tcf-41-billion-bbl

This article suggests in a review of the main US producers a reduction of natgas (-40 Tcf) and oil (-4 bn barrels) reserves at a gigantic proportion. Reserve replacement stands at up to – 200% which results in a significant reserve reduction and reserve life stands at a little bit more than 10 years for gas and oil. As companies have reduced drilling furthermore this year, more reserve and production reductions are likely in 2016.

The good news is that in mid 2017 oil prices are very likely to increase substantially. So, if investors are patient, this patience will be rewarded.

Heinrich Leopold,

Nice chart. However, here is my forecast for U.S. oil production:

2020 = Down 30-40% from PEAK

2025 = Down 70-75% from PEAK

steve

steve,

Thanks for your reply.

US oil production in 2020 to 2025 will depend in my opinion on how much oil prices will recover in 2017/2018. Lower US production in 2016/2017 will result in a lower US dollar and speed up oil demand. This is a catapult effect which can drive oil prices and the USD to extreme levels in 2018.

This could increase US production again in a very short time. However, it will very likely not reach the level of last year.

” This is a catapult effect which can drive oil prices and the USD to extreme levels in 2018″

Oil prices and the USD tend to be negatively correlated.

Oil prices at extremely high levels in 2018 are incompatible with the rise of the USD.

AlexS,

I did not say the dollar will be extremely high. Of course I did mean the dollar will be extremely low in about two years.

I have to imagine that the tails of Bakken wells decline much, much faster than the touted 6%. The hype of the shalies is finally being exposed. Borrowing 2X cash flow to drill covered up a lot. There was an article today on Bloomberg about the SEC taking a harder look at reserves booked by companies. I believe it will take a longer time for the US drillers to recover as I don’t think unsecured (junk bond) lending will come back anytime soon.

John Keller:

Just been looking over Enno’s site

One example of steep decline.

12/14 production from wells with first production in 2014 = 590,483 bopd.

4/16 production from wells with first production in 2014 = 216,671 bopd.

I have a feeling from looking at Enno’s data that 2015 wells will decline more quickly yet.

So more interesting information from April, 2016:

Wells with first production year average bopd:

2007: 20.5 bopd.

2008: 34.21

2009: 38.68

2010: 43.57

2011: 51.77

Wonder if the SEC should take this data and analyze company EUR projections?

It seems 2008 had strong wells. After 100 months, average well has produced 260,210 BO per Enno’s data.

So, if one says such well’s EUR is 750,000 BO, shouldn’t they also be required to disclose that will take around 75 years to achieve?

What is the PV10 of oil produced in years 20-75?

Wonder how much reserves will have to be written down?

This is such a joke.

Hi Shallow sand,

My guess is that the reserves in the 10K are very different from investor presentations where there are disclaimers that say, essentially, that they stretch the truth.

So a “typical well” in an investor presentation is not an “average well”.

In North Dakota at the end of 2014 proved reserves were 6 Gb in the Bakken Three/Forks and 1.2 Gb of C+C had been produced to that date.

A very conservative URR projection would be 7.2 Gb, if probable reserves were included (another 3 Gb would be a conservative estimate), then URR might be as high as 10.2 Gb if oil prices rise to 2014 levels or higher in the future.

I use a well profile with 400 kb of C+C output, 266.6 kb are produced in the first 5 years, output falls to 10 b/d in 19.4 years. I also assume the sweet spots get saturated with wells by June 2018 and EUR starts to decrease. The rate of decrease in new well EUR gradually increases over 12 months reaching a maximum rate of 7% per year by June 2019, by June 2025 the new well EUR falls to 250 kb (166 kb at 5 years), and to 127 kb by August 2036 when wells are no longer added to the ND Bakken/TF (at a total of 36,250 wells). Thus model assumes oil prices rise to $154/b in 2016$ and remain at that level until 2033.

Dennis. You note that you guess the 10K estimates differ from the investor presentation estimates.

Seems like if companies would provide us with the reserves reports themselves, it might help see if your guess is correct?

Also seems claiming roughly double is a little too much to take care of with a mere disclaimer?

I wish the SEC letters to companies requesting them to restate reserves would be made public immediately. We are just now finding out about many of these, after the companies have already BK.

Hi Shallow Sands,

Aren’t the reserves reported in the 10K checked by outside accounting firms? You are no doubt correct that some reserves will no longer be profitable to developed at current oil price levels.

I imagine this will change when oil prices increase.

The oil is there, but it requires higher prices.

Eventually the debt will be paid, or companies will go under.

Hi shallow,

We do a regular chart showing gains in average cumulative production month by month benchmarked to 2010. It clearly shows steeper decline rates for wells with higher early production. 2013 wells were 10% or more above 2010’s cumulative production in month 6 – by month 33 they are just 2.5% above 2010’s cumulative production. 2015 wells were 31% above 2010’s cumulative production in month 7 – they are now in month 17 and are 20% above, and falling.

I’d post the image but it refuses to work.

Hi gwalke,

If you can get the image under 50 kilobytes it will work, sometimes gif format is more compact. If not just post a link to the image. Or you can email it to me.

First initial and last name at gee male (trying to avoid bots).

This is only a little surprise. This decline takes away the surplus that was built up during the last two months (Fabruari and March) compared to the Season Effect Model. I was rather surprised by the modest declines those last two months.

I try to attach the graph once more to this comment (or I will ask Ron for support).

You can clearly see the dataset crosses the modelled line for the sixth time now. The first derivative of the model and the change of the data are still within the same error range as prior to the moment the model was built.

Difference between the model and the data is -2.4% now. The age of the model is 29 months now.

Verwimp,

Excellent chart. Just wanted to let you know that you were one of the few who presented the CORRECT Bakken chart in this blog. There may have been others, but well done. Jean Laherrere and Tad Patzek both have the same Bakken production profile as yours.

By 2025, the United States will be pumping 75% less oil than it is today. It will be interesting to see how we run the LEECH & SPEND SERVICE ECONOMY on that little amount of oil. Americans who think we will be able to exchange worthless paper dollars or Treasuries for oil at that time, better stop sniffing the glue.

steve

Thanks! It’s an honour to find myself in company as good as Tad Patzek and Jean Laherrere.

Hi Verwimp,

As long as the oil price remains low, your chart will be correct, it will be interesting to see what happens to Bakken Production when oil prices rise.

In Jan 2019 your model predicts approximately 420 kb/d, my scenario below suggests about 770 kb/d in Jan 2019, up to that point the models are relatively similar. My model assumes oil prices will reach $88/b by Jan 2019 and that the oil price will rise to $115/b by Oct 2020. ND Bakken/TF output reaches a secondary peak of 1280 kb/d in 2023.

Rolling in the floor, laughing my ass off. 😉

Let’s be honest, you never got out of your chair

Okay, you got me. But I was sitting in my chair laughing my ass off. 😮

…and yet somehow, you thought he will be a wise steward of/for your blog…..

Be well,

Petro

Naw, I knew he had a totally different outlook for the future than I did. It’s just that I did not really give a shit.

I know, full well, that damn few people can fact the actual future that faces humanity. And I understand that… and accept that. Reality is not for the masses, it is only for the tiny few that truly understands reality.

One can only accept reality as it is, not as we would like it to be.

Hell, that is not true, what the hell am I saying? The vast majority can only accept reality as they would like it to be. And that is exactly what they believe, and that is the argument they make.

Sorry, I have had one too many toddies tonight. I am going to bed now. I will be 78 in just a few days. And I am showing my age.

Now, that is my “The Grand Illusion” guy….and that is why I visit this blog….still!

Happy and healthy year to you and yours brother!

Be well,

Petro

Oh my god. That last chart is truly ‘Coynecopian’

Verwimp’s chart, OTOH, is the true situation we face IMO.

I second SRSrocko’s comment and commend Werwimp on his excellent chart!

Hi Mike,

The USGS estimated undiscovered TRR at about 7.4 Gb for the ND Bakken/ Three Forks in April 2013. About 79% of these undiscovered resources were believed to be in North Dakota (the rest are in Montana). So that is roughly 5.8 Gb in the ND Bakken/TF of undiscovered technically recoverable resources.

We would add to this proved plus probable reserves at the end of 2012 which were 4.8 Gb (3.2 Gb proved plus 1.6 Gb probable reserves), there was also about 0.6 Gb of cumulative production at the end of 2012 from the ND Bakken/TF.

So we have 5.8+4.8+0.6=11.2 Gb for the F50 estimate (meaning there is a 50% probability that reserves might be higher). The F95 estimate was about 2.3 Gb lower or 8.9 Gb for the TRR, this means they expect there is only a 5% probability that the technically recoverable resources will be lower than this.

The model I presented has a URR of 8 Gb.

Also not that at the end of 2014 proved plus probable reserves in the ND Bakken/TF were about 8 Gb and cumulative output was 1.2 Gb, suggesting a minimum URR of 9.2 Gb if oil prices return to the 2014 level ($93/b in 2014$).

So we will have to see which model proves correct, if oil prices remain low (under $50/b) forever, my scenario will be incorrect.

My bet is that oil prices will rise to $75/b at minimum by June 2018. If Ron is correct that 2015 is the peak, do you believe that oil prices will remain under $50 /b long term (until 2021)?

The E&P companies stopped drilling wildcats starting in 2013, and haven’t applied for such a permit for months, I’d suggest that means there are no undiscovered reserves, all wells are in known areas now.

Hi Dennis

Thank you for your excellent reply, and as Cracker says the extensive work you’ve done provide a constructive counter to the less optimistic among us, of which I am one.

I am with Cracker in that I think your charts are chronically optimistically lopsided, but held my opinion on this for a long time until now.

The resources amounting to URR 8-9.2GB of oil as you surmise may indeed be there, however I remain highly skeptical of this reported volume for a variety of reasons.

At the end of the day, whether the URR of 8-9.2GB is there or not, I am of the opinion that only a fraction of it will ever be recovered and the true amount never realized. The reason is that the condition of the world economy won’t support anything higher than $50 based on what I’ve seen this year. To wit;

1. Student and consumer debt is at an all-time high, compounded with the problem that most highly paid jobs are disappearing for the middle class. The June 2016 jobs report was pretty lackluster, with a +38,000 nonfarm payroll jobs increase reported. It is to be noted that the civilian long term unemployed has changed little at about 7.4 million.

2. Most driving is of itself for non-productive activities, and includes travel to jobs that are generally non-productive. If fuel gets more expensive, I expect that much of this non-essential travel will drop off. Some commentators have asserted that the 2008 financial crises was due to high fuel costs, and not necessarily due to the cascading collapse of Wall Street financial legerdemain (although this undoubtedly helped fan the flames).

3. The FED has pumped over $4 trillion of cash into the US economy, but the net benefit is estimated to be less than $1 trillion to GDP. It is unknown how the FED is going to unload this pure dreck on its books, and I suspect that it will not comport with higher oil prices in the cogs and wheels of the economy;

4. US debt is at a fantastic level of $19.3 trillion, with another $67 trillion of unfunded liabilities on the books. It’s hard to see how this debt will be reduced to manageable levels with higher oil prices.

5. An Internet 2.0, or some other economically transformative technology, doesn’t appear to be on the horizon. Currently, all we know how to do is burn fuel, heat a working fluid, and use it to drive a piston or turbine. The alternatives, such as solar and wind, will only come on as oil heads into it’s retirement party.

6. Related to point #1; if the current trend to transfer jobs over to automation continues, it’s hard to see how there will be people driving to their (former) employment, and for that matter afford things that are (of course) produced by petroleum;

7. For what it’s worth, I think that the 2008 crises hasn’t gone away despite massive money printing efforts. They’re trying to keep demand artificially supported with easy money and the incurring of unrepayable debt, which is terrifyingly criminal as it is simply passed unto the very young and the unborn. How can we expect them to pay our debts and then go out and buy fuel, when their jobs have been outsourced and/or automated? The whole thing has gone far over the top and is way beyond the point of no return. As mentioned previously, I see no significant industrial (i.e inventive) development or for that matter, improvements in demographics that will turn this around.

So at the end of all this, I think that baring hyperinflation the prospects for oil over $50-$55 for the next couple of years is looking fairly dim. Hence, that claimed 8-9.2 GB UR is not going to be realized in real production.

Hi Mike,

There are many that are very pessimistic about the economy. Unfunded liabilities are not the same as debt, so I don’t count those.

The retirement age can be raised and eventually the US will follow the rest of the advanced economies and reform the health care system to control costs.

(First we need to exhaust all other possibilities, before doing the right thing.)

Note that my scenario has oil prices rising very gradually. Also oil prices were over $100/b for 3 years with the World economy continuing to grow.

All that money printing has had very little positive or negative effect, mostly the velocity of money has slowed because most of that money is just sitting in bank accounts. Inflation is not high, if it were the Fed would simply reduce the money supply.

A debt of $19 trillion for an economy with an income of $18.2 trillion is not really a problem. A debt free consumer with a good credit rating and a 20% down payment in savings can typically borrow up to 3 times their income for a mortgage. The US government debt is at 104% based on fred data.

According to BIS for the US total non-financial sector debt is about 250% of GDP.

For all counties that report to the Bank for International Settlements (BIS) the total non-financial sector debt to GDP was 235% in the fourth quarter of 2015 (most recent data point) at market weighted exchange rates. (220% using PPP weighted exchange rates.) See

https://www.bis.org/statistics/totcredit.htm

Dennis- you say that

“Unfunded liabilities are not the same as debt, so I don’t count those.”

I’d like to point out that both of these things act as a dead weight on a chain that must be carried by those who are working and generating income, as we go forward in time.

And income, or savings derived from it, must then be used to service the debt and pay for the liabilities/entitlements.

This is money that then cannot go towards buying fuel, or funding innovation and transition- things like EV, solar, etc.

A dead weight is a dead weight.

And going into a crisis you have a better chance of surviving it if you are lean and mean, not if you have this ugly balance sheet. It doesn’t help that most of the worlds countries are in poor shape in this regard as well.

I have to agree with Mike Sutherlands view that these factors could very well decrease the URR significantly.

On the other hand, the other 7 Billion people of the world will keep increasing their demand and ,along with depletion, this will leave less cheap oil for the USA to import. This will tend to raise the price here.

These are conflicting forces, and I think we will end up with a scenario with both lower URR of these domestic sources, and yet also higher prices. Good for solar/wind I suppose- if we can afford it.

Very tough on the average family and local businesses.

Hickory,

Social Security is a big part of the “unfunded liabilities”. That’s a transfer. It’s not available to the working person who gets it deducted from their paycheck, but it’s available to the retiree who gets it. And, the retiree is more likely to spend it.

So, SS doesn’t slow down the economy, it helps it.

Nick,

Transferring money from a working family to a retired one doesn’t help the economy, it helps the elderly person, and hurts the working family (in the here and now).

Its overall pretty neutral, but it surely takes resources that could go towards energy infrastructure and development and shifts it towards the pharma industry, for example.

I’m not trying to make a value judgement here, just pointing out that in the scope of our prior discussion, this is fairly neutral and doesn’t change the conclusions.

Currently, all we know how to do is burn fuel, heat a working fluid, and use it to drive a piston or turbine. The alternatives, such as solar and wind, will only come on as oil heads into it’s retirement party.

Well, no, we know a lot more than that. We have superior alternatives for most of the uses for oil, and adequate ones for the rest.

The single biggest use is personal transportation, and EVs will work fine for that. We don’t need turbines for that, electric motors will do just fine.

And…we don’t need wind or solar to get rid off oil. Not at the moment. All we need is electricity, and we have plenty of that, right now.

Mike S and Dennis,

Hilarious! Coynecopian really fits.

My humble apologies, Dennis, just too funny, and appropriate. I do appreciate your charts, but I wish you would occasionally plug is some other values to provide a contrast to your ever-optimistic assumptions. My reaction to your chart was the same as Ron’s.

Make your chart reflect lower and fluctuating oil prices, instead of coynecopian, steady-state high prices and it might make more sense. Add a factor for debt restraining new wells at higher oil prices (see SS’s comment about $75 without debt below). Your assumptions just seem too optimistic to be realistic. Maybe I just underestimate BAU’s ability to fund stupidity and you don’t:-)

It will be interesting to see what really happens.

Thanks to all for your comments. Always educational.

Jim

Hi Jim,

What do you think will happen to oil prices when oil output decreases?

The scenario is optimistic and assumes high oil prices, note that output does not start to increase until 2019 in this scenario, when oil prices have risen to $88/b (2015$).

The high oil price for this model is $116/b in 2016$ which is reached in late 2020, does that seem unreasonable? The number of wells added is 1800 per year starting in 2021 with a gradual ramp up to that level over a 2.5 year period from mid 2018 to the end of 2020.

I think it likely that if oil prices rise and remain over $100/b for a few years that oil output will expand rapidly.

Note that at $90/b at the wellhead, the average 2014-2015 Bakken well pays out in 27 months.

The net discounted cash flow for that well, a 10% annual discount rate is $12.6 million with a well cost of about $8.5 million that leaves $4.1 million for profit or to be used to pay interest and debt.

I doubt we will be seeing more oil surpluses in the near future. Perhaps if people start to move to EVs in 20 years or so we might see demand fall faster than supply, but it will probably be 30 years or more before we get there so 2045, beyond the scope of my scenario.

At some point there could be a financial crisis, but I will leave it to others to predict when that will occur. In that case demand for oil will fall along with oil prices and supply.

Dennis,

You asked “What do you think will happen to oil prices when oil output decreases?”

I agree the initial reaction will be higher oil prices, but I don’t expect the stability in high prices, oil markets, and free money that existed in the last cycle will ever be repeated. And you need those conditions to ramp up shale again to production levels that can overcome the inertia of decline.

I think the stability expected is the root of our separate views. You foresee (and hope) for it while I don’t see it (but hope for it).

I think the only reason the global economy seemed to be able to afford $100 oil is because abundant cheap money (from central banks) reduced interest costs, which were able to help pay for higher energy costs. It bought time, but I’m still seeing its effects, in the form of activities and businesses that just aren’t productive enough to continue, and shut down, without being replaced. The effects of the last round of high oil prices are still slowly but surely creeping around in the US economy.

Sure, oil prices will go back up soon enough. But can they go up and stay stable at high enough levels to overcome the memories of shale ponzi financials? And can the rest of the world avoid instability that affects oil demand and supply for that same period?

Seems unlikely from here.

I’m glad I’m not making your models because I would go nuts trying to figure out how to build in some of my variables of instability. It can’t be easy or you would have done because I (and others) have suggested it in recent past.

Thanks for putting some numbers and graphics on these things. We may not all agree with you, but you sure make us think. Thank you for that.

Jim

Hi Jim,

Thanks.

I don’t expect the price will be stable, I don’t know how the instability will manifest.

When you look at my models just imagine the real values will wiggle above and below the trend line, prices are very hard to predict. Also if we look at the 36 month centered running average of monthly WTI prices since 1986, prices look somewhat less volatile. I expect prices will rise to the 80 to 90 dollar range and perhaps stabilize (if we looked at future 36 month running average). I also don’t predict oil prices well so perhaps it will be $60 to $70/b, in that case there will be less LTO wells drilled, or perhaps none.

There is no reason at all for Dennis to post anything contradictory to his own thinking.

There are plenty of others here to take care of THAT little chore, lol.

He seems to have a much better grasp of the true fundamental nature of debt than just about anybody else commenting.

I am not personally well versed in the intricacies of banking and finance, but I know enough to understand that debt is not the same thing as resources, either physical or human. Debt is merely a bookkeeping device, a score card, used to keep track of ownership.

Hence debt is not intrinsically an unmanageable problem- a problem without any possible solution.

The REAL problem, in a nutshell, is that we are in overshoot, and we will be running critically short of a lot of ESSENTIAL resources within the foreseeable future.

We may be able to innovate and substitute our way out of some resource problems, but I very strongly doubt we will be successful in every case.

Hence we will necessarily have to give up a huge chunk of BAU as we know it today.

But so far as DEBT itself goes?

Well, there IS this thing known as a POLITICAL REVOLUTION, and a political revolution may very well WIPE OUT most or nearly all of the existing debt in this old world.

The thing about such a revolution is that it will most likely wipe out a substantial portion of the people as well. 🙁

It would probably take a generation or longer to recover from such a revolution, but a generation or two is merely a yawn in terms of human history, and NOTHING in terms of biological history.

But except for the portion that gets used up as munitions, or destroyed in the fighting, all the REAL resources remaining to us will still be available when things settle down again.

Debt is a super useful tool, but like any tool it can be and HAS BEEN abused and misused, especially in recent times.

Revolution isn’t necessary to wipe out vast amounts of debt.

Have you read the authoritative book on the subject? It’s “This Time Is Different – 8 centuries of financial folly”.

We see that countries, companies and individuals go insolvent all the time, repeatedly. Greece, for instance has gone bankrupt every 25 years for the last 200 years!

Every country in the world has reneged on it’s debts, except for the US. That’s why US Treasuries are considered so safe.

Wouldn’t it be a lot more prudent to just ration oil and move to EV’s and renewables as fast as possible?

Putting in another 15,000 wells that are mostly not in sweet spots will make most of the players even more vulnerable to a downturn in oil prices than they were the last time.

Hi Gone Fishing,

At high oil prices wells will be drilled. If oil prices stay low because we move quickly to EVs, the scenario will be incorrect. I would love to be wrong, unfortunately this is fairly likely to occur. Note that 10,000 wells were drilled over an 8 year period from 2008 to 2016.

My scenario has another 14,000 wells drilled over 11 years, possibly too optimistic, but similar to past history.

Dennis, I don’t see any way that low oil prices can occur again for any period of time. We are entering the final descent phase of LTO, exports will be falling worldwide and prices will stay high.

Rationing is just around the corner anyway, so why not be sensible about it and start it sooner. People can put up with being transport limited or they can switch to EV’s.

15.000 more wells in the Bakken saturate it and there is no more room. End of story. Probably stop drilling long before that as they will be far off the sweet spots and profits will not be there, even at high oil prices.

‘Rationing’ the remaining affordable oil supply will ONLY work as intended if the entire world does it together and the same time simultaneously and harmoniously.. . Not a snowballs chance of that is there.

So if say UK and USA ration, all it will do is reduce the price (due to reduced demand) which will encourage other unconstrained users to increase their consumption.

In the absence of a One World Govt and its associated Inspired Benevolent Dictator we are screwed either way. The yeast is running our of sugar, we are heading down the back of the resource supply curve, and everybody here knows what a bumpy horrid ride it is going to be.

(That’s my cheerful appreciation of our predicament for today! Carry on!)

When you have a shortfall, rationing what you do have has no effect on world demand or use. It is merely a way of controlling distribution of product in hand and product you can get hold of. If you can’t get more, how does that change anything.

Demand reduction will occur as alternatives and lifestyle changes take over. That is going to happen anyway. Let the ROTFW fight over the last dribbles if they are stupid.

Hi Gonefishing,

Usually rationing causes more problems than it solves, it usually is best to let the market handle it, high prices will reduce the quantity that people are able to purchase and behaviors will change. More efficient vehicles, car pooling, use of public transportation where available, etc.

Most people don’t fully understand the yeast and the sugar.

If there is ENOUGH sugar in the water, then the yeast die of alcohol poisoning as the result of fouling their own environment even though there is still plenty of sugar around.

If we Yankees were to REALLY work at it, we could get by just fine using only our own domestic oil for many decades to come. Of course we AREN’T going to really work at it, until after the shit hits the fan hard and fast.

Once oil is in truly short supply, it is reasonable to expect that it will be hoarded by countries well enough off to get by without the export revenue.

Once he truly understood overshoot, after many long discussions with me, the reddest of my redneck conservative buddies opined that the obvious thing for us Yankees would be to buy every drop we can from any body fool enough to sell it to us on credit, and save our own oil until the last possible minute.

He always understood that most of the debt in the world will NEVER be paid, being a student of history.

He was quite a capable thinker in some respects, but he died of cancer almost for sure as the result of his heavy consumption of tobacco and beer.

On his deathbed, he finally came to understand that the freedom to smoke and drink are also the freedom to kill yourself, and that the nanny state is not all bad. Too late for him, but a great cautionary tale.

The truth of the matter is that we simply do not know how long bankers and financiers working in collusion with central banks and sovereign governments can juggle the debt balls. Maybe they can keep them in the air for a long time yet.

I am reasonably confident my own old age welfare check will make it to the bank for another twenty years if I live that long.

Hi Dennis,

Again: Time will tell.

Still, I stick to my model as I have been doing for 29 months now. Especially because price is not a parameter in the model.

In june 2010 the average well production was 145 barrels per day, with a total of 1663 wells. Now the average well production is 94 barrels per day with a total of ten thousand five hundred and six wells. That’s a lot of wells. All of them declining from day one. There is an enormous amount of inertia built in into the system now. It will take another ten-, twenty- of even fiftythousand wells to make the red queen recover. She will not. In the mean time companies go broke and the whole thing comes to a grinding halt.

That’s my take on it.

Verwimp,

I like your analyses and, subject to unexpected crises, suspect you’ve pretty well nailed it. Of course, expired (and expiring) hedges will serve to exacerbate decline as well.

Hi Doug,

The average Bakken well pays back drilling and completion costs in 60 months at about $75/b. The resources are there, if oil prices are high enough the oil will be recovered. the F50 technically recoverable resources are about 11 Gb based on USGS estimates and the F95 estimate is about 8 Gb.

I will go with the USGS and the likelihood that as oil output decreases oil prices will increase.

We will see who has the last laugh.

“The average Bakken well pays back drilling and completion costs in 60 months at about $75/b.”

That is impossible to happen in short term because business cycle (real economy) has to grow at least the same rate or higher then finance cycle of shale drillers (money that shale borrowed) and that went exponential in the last 8 years.

“Again: Time will tell.”

~Verwimp

-We can say that about your chart, but for Dennis’ there is nothing to tell!

The curbs on that chart cannot coexist together mathematically.

Whether one believes that projections for 2020, 2030 or 2040 and beyond shall materialize, or not is besides the point – we can argue that forever (as we have been).

-Dennis’ chart cannot be, both logically and mathematically.

Unless one believes that they used the wrong narrow pipes from 2010 to 2015 and the large correct ones from 2020-2025 to get the oil out of the ground (I am joking, of course!), for that chart to make sense, either production curb 2020-2025 has to come down below the level of that 2014-2015, or the line representing wells during 2020-2025 has to be way above the level of that representing wells from 2012-2015…or both.

Or, here’s a third ” bright” scenario for you:

one has to believe that some very advanced (not known today) way of fracking will exist by 2020 in order to “squeeze” far more oil than we do today from a, by then – for all practical intents and purposes – totally exhausted oil field (i.e.: Bakken, circa 2025).

I am surprised some of you “well versed on charts guys” did not see that.

Be well,

Petro

No Petro,

The output has decreased because fewer wells have been added each month, if the number of wells completed per month increases, output also increases.

Do you see a logical reason that the number of wells completed per month cannot increase if oil prices increase to a level which makes wells profitable?

Shallow sand has shown very clearly that $75/b is enough to make an average Bakken well profitable.

Also my scenario has 8 Gb from 24,000 wells, and average EUR per well of about 330 kb. The average well from 2008 to 2015 gas a well profile with a URR of about 350 kb.

The model is very straightforward, but could overestimate the well profile for recent wells.

We do not know what the wells will produce in the future,

I have estimated future well output on the performance of past wells, future well could be worse (or better than I have estimated). The scenario below assumes higher oil prices ($154/b) and fewer wells added per month (a maximum of 130 new wells per month), a more conservative well profile for 2015 and later is used (EUR=369 kb), ERR is 8.5 Gb with 33,000 total wells completed. That is fairly close to the USGS F95 estimate.

Dennis. $75 using cash.

How many in the Bakken shale are using cash?

Also, $75 assumes service companies continue to agree to low to no profit from services provided.

Bakken wells were north of $10 million per in 2011-14.

Again, CLR $11 million cash, $7.3 billion debt.

WLL over $5 billion debt.

HRC is bankrupt.

From memory QEP, SM, HES, EOG, MRO, etc. All have billions of debt. PDP PV10 is less than long term debt at current prices.

Hi Shallow sand,

The wells will generate cash at $75/b, if they can be financed at less than the discount rate, net cash flow will be positive.

Dennis.

One thing, it appears that only equity markets are open to shale drillers.

That, of course, is the best approach IMO. Promoters usually make money if investors pay for the well, regardless of whether the well pays out.

Issuing gobs of debt turned out to be a big mistake. Think how much $$ shale could have gotten 2011-14 by just issuing shares.

Break even would certainly be less.

I have estimated future well output on the performance of past wells, future well could be worse (or better than I have estimated).

They could be better? Really? You think perhaps they drilled the worst spots first, saving the sweet spots for last?

No, the sweet spots have already been drilled. Future wells will, almost certainly, produce less oil than those already drilled. Drillers just don’t think that way Dennis. They would never save the sweet spots for last.

Hi Ron,

My projection of future output from recent wells has much steeper decline than older wells, so I could have overestimated or underestimated what the future output will be from a well that was drilled in 2015.

In 2005 to 2007 the EUR of the average well was much lower than 2008 to 2013, so it is possible that improved techniques might increase output, the first 12 months of output was higher in 2013 wells and 2014 wells than the earlier 2008 to 2012 average well. At some point this will reverse and my model has new well EUR decreasing after June 2018, this guess could be too early or too late.

So basically I am not assuming anyone is saving the sweet spots, just that my estimate could be low or high, we won’t know until we have more data.

Dennis, in the early days of Bakken fracking the wells had short laterals and fewer fracking stages. They got better with much longer laterals. They also got better at locating the sweet spots.

But now the laterals and number of stages has maxed out. And the sweet spots are all drilled up.

There is no doubt whatsoever that the very best and most productive wells have already been drilled.

Hi Ron,

I will wait for the data that confirms you are correct. So far the productivity of the average well for the first 12 months of output has been increasing, later months we can only guess at for the wells that were recently drilled (wells starting production after May 2015 we don’t have data for production beyond month 12).

I thought we would see new well EUR decreasing by 2014, so far the data shows little evidence of that.

Dennis, this is just what Lynn Helms says was happening at a news conference back on May 4th.

Next Round Of ND Oil Production Figures ‘going To Be Bad,’ Helms Says

Low oil prices are forcing operators to focus drilling activity only in the core areas of the Bakken where wells have the greatest production. As oil prices recover and drilling expands to other areas of the Bakken, those high-producing wells will be declining, Helms said.

“It’s really kind of doubtful that we’re going to make that (2 million barrels per day) because we’re drilling everything in the core where the best wells are,” he said.

He said he thinks North Dakota production will eventually reach 1.8 million barrels per day. I wonder if he said that with a straight face, especially after just admitting that all the good spots will soon be gone.

Hi Ron,

I repeat, I do not expect the well profile will increase. When I said it may be better or worse than my estimate of the well profile, it simply means that we do not know what the well profile is, we have to estimate and sometimes the “best guess” is too high and other times it is too low, just like any other guess.

When you make an estimate is it always too high? My estimates may be different, about half the time they are too high, and the other half they are too low. 🙂

That is all that I meant.

Also, my “funny model” uses exactly the same well profile that I have been using since Enno suggested I should correct my model because it consistently was under predicting Bakken output.

Maybe new well EUR will start to decrease sooner than I have predicted (June 2018), but with only 980 new wells completed in the model over a 28 month period and that for the past 2 years the well profile has been increasing, I think the June 2018 guess is reasonable.

The eventual number of wells was 150 per month which is 21% less than the high 12 month rate of 186 wells per month, only 80 wells per month are needed for 1000 kb/d with the current well profile.

If i understand Verwimp’s chart correctly, he started it when the price of oil was over 100. So Verwimp, did you know something the rest of us didn’t or was this just a good educated guess.

At any rate your chart has nailed it to date. Congrats.

You do understand correctly. The model was built before the price collapse. It’s a Hubbert analysis basically. The dataset prior to the moment the model was built was a Hubbert poster child and it still is. When linearised according to Hubbert Linearisation, the data is still a straight line. There is no drop in that line. A sudden policy change coinciding with lower prices would have generated a drop in that line. That would also be visible in the change in daily oil shifting away from the first derivative of the model. Both are not occuring. So the only resulting conclusion is: ND Bakken is running out of oil, despite the high USGS EUR estimate.

I may stand corrected in the future. If prices rise and production rises again, I missed something. Until now (today’s WTI prices are almost double the WTI price in Februari ! ) that is not the case, as you can see.

So you’re confirming that it was a guess. Thanks.

Which only makes sense. A simple Hubbert analysis would never have predicted the surge in LTO production of the last 10 years.

A Hubbert analysis only makes sense when a lot of data on the upgoing side of the curve already exists. 10 years ago there was virtually no LTO. So no Hubbert analysis could have been made.

To the contrary, people have been drilling for oil in N. Dakota, and the Bakken, for many decades. Production grew, peaked, and then declined.

Then…prices rose, and LTO became economic. And we’re seeing a second peak.

Hubert Linearization would never, could never have caught that, because it wasn’t designed to take price into account.

Prices matter. Ask any oilman.

No, it wasn’t a guess. It’s just the nature of things that what goes up must come down. The Hubbert analysis provides a tool to calculate the altitude and the timing of the top, as well as the steepness of the decline. These calculations are more accurate when the top is closer by (or past). Apparently 29 months after the calculations were done, the reality is still in line with the modelled curve.

(I also added a seasonal correction to the Hubbert Curve, that as proven to be pretty accurate, but that is a minor feature of the curve compared to the underlying Hybbert Curve.)

The only guess was that ND Bakken would stay being the Hubbert poster child it was prior to the calculations. Apparently it still is. That guess was based on the fact Lower48 and Alaska production are also pretty Hubbert-like curves, just like earlier smaller booms in North Dakota. It’s in the ‘genes’ of Americans, I presume, to go for it as soon as possible, as hard as possible and as fast as possible when it comes to earn money extracting a resource, until the show is over. A Hubbert curve is the result then…

Lower48…also pretty Hubbert-like curves, just like earlier smaller booms in North Dakota

The curve for the lower 48 isn’t at all Hubbert-like, unless you arbitrarily subtract LTO.

Hi Verwimp,

Try a Hubbert curve on US lower 48 output from 1900 to 1940 and see what you get for a URR.

Short answer, far less than the cumulative production to date.

A Hubbert analysis of the ND Bakken/Three Forks is similar in nature.

It will underestimate future URR by a factor of 2 at minimum.

“Naw, I knew he had a totally different outlook for the future than I did.” …… ~ R. Patterson

…oh, if only that was the case….dear Ron.

Dear Dennis,

do you even look (and possibly think) at your charts after you finish them….and before “broadcasting” them to the world (key word: “before”)?

Now:

-I know that you visited this site a few times here and there over the years to know that “first they dig the sweet spots” (…don’t we all?);

-I know that you visited this site a few times here and there over the years to know the average decline rate of a shale well;

-I know that you visited this site a few times here and there over the years to have learned that the amount of investment/leverage shale players received by Wall Street from 2010-2014 is extremely unlikely to be repeated (and I am being generous with “extremely unlikely”)

……and yet, somehow you decided to show us a chart on which Occidental and Chesapeake and… (you put the name here) …. …whatever, that could not get 1.2 mbrl/d out of Bakken when Bakken was an “unspoiled virgin” while digging >200 holes/month financed by virtually unlimited credit – WILL GET >1.3 mbrl/d out of it via 20%-30% less holes/month financed by what is very likely to be non existing “junk bonds” credit by 2020-2025 ………………………………………………………………………………………………….

……and you want me to consider your “model” seriously?

-I know we have vertical and horizontal hole-poking, but did they invent some type of circular and/or “in-out” f***ing ………. errr, sorry I meant fracking, I do not know about?

Please enlighten me!

Be well,

Petro

Well, I’m going to put my wooden nickel down on the Dennis side of things, mainly because I’d rather have his chart be true.

I’m a sucker for gradual change, and really not so eager to hit the brick wall at high speed.

And I do think that if the oil prod #’s are cratering, the oil price will skyrocket and money will flow to the drillers once again- hot and heavy.

Some of us will be around to see.

You have absolutely no idea what my comment to Dennis’s chart is about!

Even if the price per barrel is $1 billion his chart makes no sense.

Price and “…some of us being around to see….” are irrelevant to what we are talking about :

Dennis’ chart.

Be well,

Petro

Slight aside, but just a comment on the public understanding of energy issues-

I engaged with a senate candidate recently regarding a comment she made at a public debate.

She exclaimed that one way the USA should work to contain Putin was to export energy to Europe so they are not hostage to Russian energy supply.

I later pointed put to her that she ought to study up on energy some more, since we are big importers of energy. She said she had been hearing that we are approaching independence on energy.

I was very surprised by her lack of understanding of this critical issue, since in other respects I found her to be very smart and well studied.

Goes to show that people generally hear what they want to hear, or they simply swallow the most convenient truth. And this includes our policy makers, our voters, and ourselves.

[Hi Petro- this also explains my wooden nickel vote, wrong though it may be]

Hi Petro,

When 180 new wells per month were being added output was increasing, when new wells added fell the output flattened. New well EUR has been going up in 2014 and 2015, the current wells have been performing better over the first 12 months of output than earlier wells so fewer wells are needed to increase output. With current average wells about 105 new wells per month is enough to increase output.

Hi Petro,

The EUR of the average well increased from 2013 to 2015, especially over the first 24 months of output, the well profile was adjusted upwards to reflect this (and to get the model to match actual output), it had been running “low” for several months. A steady 150 new wells per month using the 400 kb well profile I had constructed would result in 1300 kb/d.

The well profile could be too high, an alternative scenario uses a 366 kb well profile (which matches pretty well the 12 month increase in output we see with recent wells compared to the 2008 to 2015 average well with EUR of 350 kb). That alternative is up thread. When oil prices go up, financing will be available.

Hi Petro,

The model is very simple see

http://oilpeakclimate.blogspot.com/2014/06/oil-field-models-decline-rates-and.html

The data one would need to develop the model is in the spreadsheet below:

https://drive.google.com/file/d/0B4nArV09d398VzAydU0zN0VKeTg/view?usp=sharing

In a wider spot below I will explain further.

Hi Petro,

The average 12 month completion rate was 177 new wells per month (centered average) in Dec 2014 when ND Bakken/TF output peaked at 1163 kb/d. This was enough to raise output by 300 kb/d from Dec 2013 to Dec 2014, if fewer wells had been completed (for example and average of 150 new wells per month), the rate of increase in output would have been smaller. By July 2015 the centered 12 month average completion rate had fallen to 148 new wells per month, but output had only fallen by 13 kb/d (1150 kb/d).

Only 105 new wells per month after July 2015 would have been enough to keep output rising. A scenario with 105 wells added after 2017 shown below. You won’t believe this, but only 105 wells per month are needed to increase output, at least for a time.

Sweet spots run out and EUR falls after mid 2018.

See, even if I new nothing of what we are talking about, this last chart makes “more” sense than the first one – visually speaking, for the production curb 2020-2025 has come down a bit….

Find my answer at the bottom…

Be well,

Petro

Hi Petro,

The difference is simply the number of wells added per month. There is no a priori reason that the number of new wells will be limited to 105 new wells per month, perhaps there will be no financing available, but I doubt this would be a problem for Statoil or Exxon Mobil, they can do this out of cash flow if needed.

I also doubt that oil prices will remain under $80/b long term (more than 5 years). I expect by 2021, oil at $80/b(2016$) will be considered cheap.

A different view from a Total engineer, looks to be using proprietary modelling software. Seems to capture the possibility of a fatter tail than the logistic curve does, but has already missed the flat peak area:

http://aspofrance.viabloga.com/files/PCharlez%20_ResilienceNon-conv.pdf

Look at the second to last slide “Resilience of the three american gas plays (UFDsim)” decline around 15% durring the first four years for shale gas. We live in interesting times.

Thanks George.

I am affraid those flat tails are engineered according to the engineer’s wishfull thinking.

Goldman Sachs declares end to oil price recovery

Goldman Sachs has dismissed what’s been described by some analysts as a recovery in the global oil markets.

The uber bear said it expects a “modest” deficit in the coming months due to current prices, before the market returns to surplus early next year.

Rising demand, falling US oil output as well as supply disruptions have helped the black stuff recover from below $28 per barrel in January to just under $50 today.

Read more: North Sea to warn MPs subsea sector risks losing world-leading position

But Damien Courvalin, an analyst at Goldman Sachs, said that this was, at best, the first signs of a turnaround.

“Canadian production is finally restarting, production from other Organisation of Petroleum Exporting Countries’ members continues to beat our expectations.”

Courvalin continued: “The recent recovery in prices risks that non-Opec production declines less than we expect, especially in the US.”

What is it they say? A sucker is born every day? This should be illegal!

as to GS public statements relating to oil and gold, the money has been by taking the other side of the trade, I have little doubt that what their trading desk does.

I tried to post this graph in a prior comment, but it did not work. So, here is a link:

https://srsroccoreport.com/wp-content/uploads/2016/05/U.S.-Energy-Sector-Interest-Payments-On-Debt-.png

I find it interesting that the U.S. Energy Sector now has twice as much debt as it did ten years ago at $370 billion… as production declines.

Furthermore, the U.S. Energy Sector is paying at least 50% of its operating profit now to just pay the interest on the debt. Q1 2016, it was 86% of their operation income just to pay the interest on the debt.

Unless Uncle Sam comes in and BAILS OUT the U.S. Energy Sector, it’s in serious trouble.

steve

Has anyone here considered that the reason we are in this energy position is because of the failing of the “free” market system? Instead of doing what we should do, we allow the market and the price to determine what is done.

Maybe we should stop following the market down the tubes and start just doing what works.

What works better?

Getting off the fossil fuel hamster wheel of death.

If you want to see the innovation needed to do that, I would be cheering capitalism on.

It’s not the banking or monetary system that is the problem, it is the choices made by people and businesses down the line. The banks have no power we don’t give them, just make better choices and be prepared to act differently. The businesses won’t make stuff if we refuse to buy it. We control the reigns then blame the system for doing what we tell it to do.

Make better choices.

Fossil fuels are what makes our civilization possible. So getting off fossil fuels isn’t a wise thing to do.

90+% of people posting here in comments are clueless. I visit this site only for oil news, but every time I have to go thru load of bullshit comments. Dennis Coyne is the dumbest here.

Hi ktos,

Very gracious, and highly intelligent. Thanks.

Dennis, between ktos, Ron and others, you take a lot of flak. Thanks for handling it so well, I’m impressed.

let me second that, Dennis you are always gracious and that is hard to do for someone who is frequently wrong?

any body with a opinion will be wrong, perhaps a sign of intelligence is one’s ability to recognize they can be wrong and then learn for it, most progressive do not show that level of intelligence.?

Well, I’m curious.

Do you believe in evolution?

Are you clear that “progressives” are much more likely to be comfortable with the idea of evolution, while “conservatives” are much less likely?

What does that tell us about their respective grounding in reality?

Hi Texas Tea,

There are conservatives and liberals that are not willing to think about things, there are smart people and less smart people and their political views are not a deciding factor.

“any body with a opinion will be wrong”

“perhaps a sign of intelligence is one’s ability to recognize they can be wrong and then learn for it”

So Tex, what were you wrong about the last time here at POB and what did you learn ?

Huntingbeach,

to your question below, let me say I am frequently wrong. I do believe however, if I was proven wrong in over 99% of my beliefs, I would statistically beat out a number of contributors to this blog and 100% of the climate scientist. The reason I started posting was it became apparent that this blog was becoming a goal seeking support group for anti oil, anti free market, anti free speech/thought. I do think all informed opinions enhance debate and provides the necessary intellectual check and balances we ALL need. I have said before, all scientist get it wrong it is the very nature of science, finally someone gets something right, civilization advances, while other scientist begin to build upon the NEW understandings. Climate scientist and their mental midgets in the media and in government are truly the worst case scenario for the advancement of us as a species.

anti oil, anti free market

Nah. We just want free markets that incorporate good accounting.

If you don’t account for something, the markets can’t optimize for it. For instance, you need to account for the cost of executive stock options. You need to account for the cost of pensions.

And…you need to account for the cost of pollution: mercury, NOX, particulates, CO2, etc., etc.

Even the most conservative of libertarian economists agree with that. They may argue about the exact values to place on those “externalities”, but they all agree on the basic concept.

I have said before, all scientist get it wrong it is the very nature of science, finally someone gets something right, civilization advances, while other scientist begin to build upon the NEW understandings.

Sorry Tea, this is the 21st century and while that might have been true even a century ago, we now have a very extensive and solid body of scientific knowledge to work with and therefore all scientists do not in any way shape or form get it wrong ALL THE TIME! That isn’t how science works today.

While great minds like Galileo, Newton, Pasteur, Darwin may have broken into completely new paradigms of scientific thinking leading to great advances and completely revolutionized scientific fields, that isn’t quite the same as suggesting we today don’t know enough physics and chemistry to understand what is happening with our atmosphere. Einstein didn’t make Newton wrong. Calculus still works and we launch spacecraft into orbits on Mars based on that, even though we now understand relativity.

We aren’t talking quantum thermodynamics or cutting edge particle physics here.

Climate science is based on some pretty basic science and the consensus among climate scientists is in. This is not up for debate. To suggest otherwise is simply denial of reality. The MSM’s misunderstandings of basic science notwithstanding.

Only a complete idiot would engage in climate science thinking they would get rich through grant money!

As for being anti oil, you’ll have to submit your complaints to Mother Nature’s ‘Peakoil Department’ and petition for an extension.

The free market is doing just fine ask all the oil companies and governments that are going bankrupt with no help

from anyone in particular.

Well Tex should I assume the fact that you rambled on about climate change denial and didn’t answer my question, that you don’t realize when your wrong and you are not intelligent?

Here is a hint for you of the most recent wrong comment I’ve seen you made before you started rambling on again today.

“Dennis you are always gracious and that is hard to do for someone who is frequently wrong?”

At least you got the “always gracious” part right.

Hi Hickory,

Thanks for the vote of confidence, but I am afraid that Texas Tea is correct, I am often wrong (just ask Ron P, Doug L, Freddy W, Rune L, Enno P, Petro, and many others).

Differences of opinion make life interesting. 🙂

The worst of the climate scientists are Richard Lindzen, Murry Salby, etc who are both AGW deniers and messed up their own research badly.

Fossil fuels aren’t necessary.

EVs get you to work just fine. And, they’re cheaper, cleaner, and have better performance on the road.

“Fossil fuels aren’t necessary.”

That is the most naive statement I’ve ever read.

In this world of 7.3 B, it is absolutely necessary for the sustenance of somewhere north of 80% of all the protein and calories consumed by living people. They are not just numbers, they eat every day.

Inconvenient truth for your your makebelieve Nick.

I don’t like it either, but it is real.

So, you don’t believe EVs can take commuters to work just as well as ICE’s?

Where did EV’s versus ICE’s come from?

Is your agenda showing?

Hickory, if recalled correctly, Nick G admitted hereon some time ago that they own an ICE, take the train in to work and don’t actually own an EV.

Also, if the (un)economy was predominantly built and designed with, and/or to run on, fossil fuels and then it somehow becomes powered by (low EROEI) ‘alternatives’…

(using fossil fuels and of what EROEI qualities [and from where? KSA? Russia? Venezuela? USA?] for build-out as if it’s not already too late)

…how would that affect the uneconomic engine and what jobs– initially formed in a complex, high-energy uneconomy that ran on cheap oil– would we all be going to? Also, that asked, how much of the planet currently ‘enjoying’ this Western lifestyle would manage to build out and at what costs? USA and Canada? Iran? China?

Apparently, according to Jeju-Islander, who comments hereon periodically, Jeju Island– alone– ‘needs’ 400 000 electric vehicles. Multiply that number by how much? Energy requirements? Mining, manufacturing, shipping, maintenance? All’s successfully said and done; places to go with EV’s within a significantly different energy-level society?

Ok, so we have 7+ billion all happily transitioning/building out to a ‘BAU Lite’ lifestyle of EV’s and PV’s and so on… Anyone see any concerns with that? At all?

Nick, I totally agree that we have to get off fossil fuels, as you are wont to write, but of course continue to question and doubt your position and perspectives about that.

And as I’ve previously requested from Javier, I’d feel better if we had your full and real name. That way, it’s less likely you’re trying to hide something, like an agenda, or put one over on us, and can answer to it like a responsible adult. I think it’s part of what is called, ‘transparency’. Otherwise, like many, you’re in the shadows and can say practically whatever you want without the responsibilities or repercussions.

No, I believe fossil fuels do a lot more than just power ICE

HB wrote: “No, I believe fossil fuels do a lot more than just power ICE”

Sorry, that argument is weak: Only a small percentage of oil and NG goes into chemical industry, most is indeed fuel for cars. Therefore, to focus on the exception and ignore the rule is a strange way to make an argument that survies in a serious discussion.

Ulenspiegel, you have a point there. Outside of jurisdictions like my island nation and other islands, the lion’s share oil oil is just being used to move shit (and people) around, from one place to another. The lion’s share of the other fossils fuels, gas and coal, is being used to generate electricity. I am sort of cementing the idea in my mind that, the true value of oil is largely it’s ability to facilitate the movement of large numbers of people and huge amounts of goods.

If other means of generating electricity and moving shit around existed, then in fact, FF would not actually be necessary! 😉

When it comes to moving people around, here’s a somewhat novel idea.

What if some car company decided to build an electric car, a fancy, expensive, 200 plus mile range one at first, in order to finance development of further models and scale up the required technology? What if this company, while scaling it’s manufacturing to say 2,000 plus units per month, started development of a special fast charging network along major interstate routes, sort of like the one shown below? What if this car company was able to develop a more affordable car and make, say half a million in 2018, by which time the fast charging network to which the car has access, has blanketed the entire US?